Abstract

The financial industry can play a significant role in reaching the sustainability goals. But there is a lack of attention to the part financial advisors can or should play. By advising SMEs on sustainability, financial advisors are in the position to make a large impact. To do that, financial advisors must not only advise on creating financial value but also on social and ecological value. By advising on creating multiple value and applying integrated thinking, financial advisors can provide sustainable financial advice to SMEs. And because of the large and diverse number of financial advisors for SMEs, they can make a difference in helping SMEs to become more sustainable. This article focuses on the role financial advisors can play and the impact they can make for SMEs in their challenge to become more sustainable. By combining theory on the value of advice, multiple value creation, and integrated thinking, specifically related to the challenges of SMEs on sustainability, the result is a definition of sustainable financial advice to stimulate the debate on the specific role of financial advisors in reaching the sustainability goals worldwide. Sustainable financial advice is financial advice with integrated thinking about multiple value creation with the aim to reach the sustainability goals.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Fred de Jong is Associate Professor Sustainable Finance & Tax at the HAN University of Applied Sciences in The Netherlands. He has a PhD from the University of Amsterdam for his research on market failure and financial intermediaries (2010). At the HAN University, he is working on research about the multiple value of financial advice, the role and impact of financial advisors on sustainability, and sustainable business models of financial advice.

Koos Wagensveld is Professor Future Proof Control at the HAN University of Applied Sciences. He is also assistant professor of Accounting & Control at Radboud University Nijmegen. His expertise focuses on modern and sustainable forms of performance management and risk management in the business services, healthcare, and construction sectors.

Introduction

In reaching the Sustainable Development Goals (SDGs) set by the United Nations, financials play an important role. The SDGs serve as a global compass which the financial community of banks, insurers, and investors can use to guide their core business towards achieving economic, social, and environmental sustainability (SDG Industry Matrix, Financial ServicesFootnote 1). But what about the role of financial advisors? There is a lack of attention for the impact financial advice can have on sustainability, even in the recent paper about social sustainability of the Geneva Association [1]. In this article, the possible impact of financial advice on reaching sustainability goals by small- and medium-sized enterprises (SMEs) is described, based upon the theory of financial intermediation and the value of financial advice. This leads to a definition of sustainable financial advice. We want to contribute to the field of sustainable finance and financial advice by focusing on the specific role of financial advisors in relation to multiple value creation, which is lacking until now.

The Value of Financial Advice

The value of financial advice, as described by Montmarquette and Prud’homme [2], Montmarquette and Viennot-Briot [2, 3], Association of Financial Advisors [4], Brancati et al. [5], Beach [6], and Winchester and Huston [7], is that financial advisors have a positive influence on people’s financial behavior and financial outcomes. Recent studies during the COVID-19 pandemic find that clients in long-term advice relationships were better prepared financially to deal with the financial consequences of the pandemic [8]. Also, several authors [9,10,11] connect financial growth of SMEs with the impact of financial advisors. These findings built upon the theory of financial intermediation, where Williamson [12] established that intermediaries have added value as the clients’ feeling of uncertainty and complexity increases. Cummins and Doherty [13] point to the intermediary’s role in simplifying the complexity of products and providing information and transferring this to the client. This does not only concern products and services that are considered complex or impactful by the government, such as investment products, mortgages, pensions, and income insurance, but also products and services that are considered complex or impactful by the clients’ experience. For an entrepreneur, being properly insured is extremely impactful. A mix of well-coordinated non-life insurance policies can mean the difference between going bankrupt or not. Taking out a simple loan can have a major impact if a consumer subsequently wants to buy a house and cannot get a mortgage because of that simple loan. For SMEs, there is no distinction between simple and complex financial products, like policymakers tend to do.

Within the theory of financial intermediation [14, 15], the added value of the financial advisor as an intermediary is attributed to two primary aspects: reducing transaction costs and reducing information asymmetry. Coase [16] introduced transaction cost theory to explain that there are costs involved when exchanging products and services. And that organizations, like financial intermediaries, can reduce these transaction costs. Getting insurance, tax return, or a loan is an activity that a business owner is not familiar with. Therefore, finding out what kind of financial products or services you need and where to get them can be a costly procedure. Contracting a financial advisor can reduce these transaction costs, because they have the experience of monitoring and screening for financial products. The concept of reducing information asymmetry is based on the advantage a financial advisor, the agent, has by having more information than their principals. Financial advisors can have more knowledge than insurers and banks about what kind of financial services a business owner needs, and more knowledge than clients about what the best product in the market is. Aristei and Gallo [17], Fan [18], and Alyyousif and Kalenkoski [19] all showed a positive relationship between financial knowledge, financial literacy, and seeking financial advice. And a negative correlation between financial stress and seeking advice. Fan states that “financial advice-seeking behavior is positively associated with short- and long-term responsible financial behaviors, which ties well with previous studies showing positive value provided by financial professionals to clients’ overall financial wellness (e.g., [20]; [21]; [22]; [23]).” Moreland [24] shows a significant positive association between obtaining financial advice and financial behaviors as measured by an index of desirable financial behaviors (avoiding bank overdrafts, paying credit card balances on time and in full, establishing a retirement account, and checking credit scores/reports).

Montmarquette and Viennot-Briot [25] establish a link between financial advice and financial prosperity. As clients receive more financial advice, they are better protected against risks and have less debt on average and more prosperity. The demonstrable wealth accumulation is in the saving behavior. In addition, Montmarquette and Viennot-Briot [25] conclude that advice also ensures the selection of appropriate financial products, the optimization of the asset mix, and the increase of financial self-confidence and peace of mind with the customer. “The presence of a financial advisor increases confidence that there is enough money to retire comfortably. Those who have advice are more likely to rely on financial advisors, associate satisfaction with financial advisors, and have confidence in financial advisors.” In their 2016 and 2020 studies, Montmarquette and Viennot-Briot confirm these values of financial advice, noting that advised individuals have better discipline in financial behavior than non-advised individuals.

Brancati, Franklin, and Beach [5] also conclude, based on of their statistical research, that clients who have received financial advice build up significantly more (retirement) wealth, in the form of more savings and share ownership. This applies to both wealthy and non-wealthy clients. As a follow-up to this research, Beach [6] concludes that an ongoing relationship with a financial advisor leads to better financial results (more pension assets) for clients and that especially clients who are just getting by, benefit most from financial advice. Winchester and Huston [7] find that middle-income households who have the help of an advisor are financially better prepared for retirement, make better use of their employee benefits, and provide a good buffer compared to households that do not receive advice. De Jong [26] concludes based on Spulber [27] and Williamson [12] that financial advisors create more prosperity by reducing uncertainty and complexity about the right financial transactions. Financial advice has tangible (material) and intangible (immaterial) value. Intangible value can also be considered as subjective well-being, an advice that benefits the experienced quality of life. Schepen and Burger [28] found that professional financial advice is positively associated with subjective well-being, compared to advice from friends, families, or acquaintances or self-study, as the most important source when making important financial decisions.

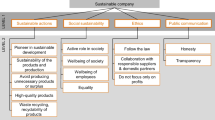

Based on a literature review of the value of financial advice [29], the following model was created to help financial advisors and policymakers to become more aware of the concrete impact and value of financial advice.

In the model as shown in Fig. 1, a distinction is made between the material value of advice, which can be expressed in financial value, and immaterial value, which can be expressed in, for example, feeling, emotion, or increased well-being. MacDonald et al. [30] also concluded that financial advisors deliver a valuable service, and several of the benefits are intangible and therefore difficult to measure, such as peace of mind. In addition, a distinction is made between individual value, the value for a specific person, and collective value, the value of advice for society. The theory of the value of financial advice has parallels with the theory of sustainable finance, which will be discussed later. First the theory on the value of financial advice is narrowed to SMEs specifically.

The value of financial advice [29]

Value of Financial Advice on SMEs

Most research on value of financial advice is done with consumers. But the results are also transferable to businesses, specifically SMEs. For SMEs, the value of advice is twofold [11]. There is the objective economic value by means of more profit and jobs and there is the subjective value by confidence building and the psychological benefits of advice. Carey [10] found that financial advice has a positive impact on SME performance, in particular that of small (5–49 employees) businesses. Berry et al. [9] also found that specifically external advisors like auditors lead to higher growth for SMEs. Mole et al. [31] signals the propensity to use formal external advice is the threshold of around ten employees. He suggests that about this size businesses become more complex, requiring a greater range of expertise and management skills, yet are still too small to justify employing staff with the required knowledge and expertise internally. Berry et al. [9] found that SMEs whose owner managers were high users of a range of business advice were also those that were growing most quickly; hence, the effect of business advisors’ contribution did make a positive contribution to SME growth. These findings were in concert with and extend those of Bennett and Robson [32] and Wren and Storey [33]. Empirical results from Carey [10] support the value of advice to SMEs. Carey found that firms buying business advice exhibit superior performance. “SME performance is perceived to be further enhanced when business advice and auditing are jointly purchased, which suggests that auditors’ depth of knowledge is beneficial to SME management.”

So where there is evidence that financial advice is beneficial to SMEs, the main findings on the value of financial advice for consumers can also be valid for SMEs. As owners of SMEs are individuals themselves, it is likely to conclude that the results of the studies on the value of advice can be applied to SMEs. The raison d'être of financial advisors can therefore be explained by the fact that they improve SMEs’ financial situation, increase efficiency, reduce the information gap, and/or reduce complexity for the client.

Sustainable Finance and Multiple Value Creation

The value of financial advice for SMEs can potentially be higher when the nature of the context is complex and uncertainty with SMEs increases. We argue that the challenges SMEs are facing with becoming more sustainable will boost the demand for advice by financial advisors. Salzmann et al. [34] argue for instance that corporate decision-making becomes more complex when a firm tries to balance acting responsibly with financial performance.

The Dutch Committee for Entrepreneurship [35] indicates that long-term investments are needed for SMEs, especially in the field of sustainability and digitization. The Committee writes: “Future-proof companies respond in a timely manner to technological developments and new revenue models. Moving along in time prevents high costs when governments are forced to take compelling measures. That is why it is important that companies now think and invest in sustainability.” The circular economy requires additional investments from SMEs, the digital revolution is putting traditional revenue models under pressure, and attracting and retaining employees requires a good employment conditions policy. Profitability is a precondition for the continuity of SMEs, but this should not be at the expense of the social and environmental responsibility that entrepreneurs have and on which they are increasingly held accountable. Researchers at the Rotterdam School of Management [36] use the concept of healthy growth, but this is mainly aimed at wealth growth expressed in gross domestic product (GDP). Growth aimed at broad prosperity, which ensures long-term value creation for a broad group of stakeholders, goes beyond healthy growth. This is sustainable growth. This can increase the social value of SMEs, according to the Dutch Committee for Entrepreneurship [35].

Sustainability has been around for decades, in various guises. As early as 1972, the Club of Rome [37] concluded that the earth’s capacity cannot keep up with economic and population growth, even with advanced technology. In 1987, the UN published a report (Our Common Future), better known as the Brundtland report, in which sustainable development and sustainability were first identified as strategic goals. “Sustainable development is development in which the present world population meets its needs without limiting future generations to meet their needs.” Sustainable development is linked to the concepts corporate social responsibility (CSR), stakeholder theory, and corporate accountability [38].

In the European Union (EU), ambitious objectives have been formulated at both European and national level in relation to sustainable development linked to the SDGs, and a European Green Deal has been developed as a roadmap to make the European economy more sustainable. Furthermore, a EU action plan (CEAP) to reach a circular economy by 2050 was launched in 2020. A Sustainable Finance Action Plan (SFAP) was launched in 2018, with a focus on actively stimulating investments in sustainable development. One of the goals of which is to integrate ESG impact indicators into financial advice. The broader focus on sustainability in relation to financing and reporting on sustainability impact indicators is also reflected in new legislation and standards, including the Corporate Sustainability Reporting Directive (CSRD) and Sustainable Finance Disclosure Regulation (SFDR), which are decisive for legislation within the EU in this area.

Sustainable finance is mainly referring to the impact to be made by banks, insurers, asset, and investment managers, with financing, investments, insurance, and payments. Schoenmaker and Schramade [39], based on Levine [40], indicate three main functions of the financial system for sustainability: (1) Produce information ex ante about possible investments and allocate capital, (2) monitor investments and exert corporate governance after providing finance, and (3) facilitate the trading, diversification, and management of risk. In this article, we introduce a fourth main function of the financial system for sustainability: sustainable financial advice. By combining theory about the value of financial advice with sustainable finance, the potential impact of financial advisors on sustainable development is identified.

Sustainable finance is defined as “the process of taking due account of environmental, social and governance (ESG) considerations when making investment decisions in the financial sector, leading to increased longer-term investments into sustainable economic activities and projects” [41]. Sustainability and ESG are linked more together also in academic literature lately [42]. Several authors describe sustainability as a multiple value issue. According to Mondini [43], sustainability is to achieve a balanced development of the economic, social, and ecological system. Scholtens [44] describes sustainable finance as the interaction between economic, social, and ecological issues. Edmans and Kacperczyk [45] mention the contribution of sustainable finance to non-financial objectives. And Schoenmaker and Schramade [39] build their framework on sustainable finance on the combination of financial, social, and environmental aspects. Also, Willekes, Jonker, and Wagensveld [46] describe sustainable finance based on the foundations of multiple value creation, which is “to move from mere economic value creation, to simultaneously and in a balanced way creating ecological and social value.”

Multiple value creation is a combination of quantitative and qualitative performance, based on the Triple-P philosophy of Elkington [47] with a focus on economic (Profit), social (People), and ecological (Planet) value creation [48]. Profit is therefore not only expressed in money, but also in social utility [49]. Multiple value creation is not only about creating financial value, but also about creating ecological and social value.

Sustainability is now becoming more meaningful because it has been given international priority through the UN SDGs, EU action plans for a circular economy and the Green Deal. Concrete goals have been drawn up that governments must achieve, which is why there is extra pressure on the financial sector, among others, to shape the sustainability transition. Sustainability is no longer optional, not even for the financial advisor. One of the objectives of the Sustainable Finance Action Plan by the European Commission [50] is incorporating sustainability in financial advice. But until now the only real step that has been taken is the introduction of the SFDR. As of March 2021, financial advisors must be transparent about the consideration of adverse effects on sustainability in the investment or insurance advice, and the integration of sustainability risks, the sustainability risk policies, and the remuneration policy regarding the integration of sustainability risks. From 2 August 2022, insurers and advisers in unit-linked insurance policies must consider the sustainability preferences of customers in the product approval and review process (PARP), product features for products with an investment component must be geared to the sustainability wishes of the target group, and advisers must obtain information from the customer about those wishes during a suitability test and explicitly take this into account to be able to give good advice [51].

Value of Financial Advice and Sustainable Finance

The sustainability challenges have a major impact on the future of SMEs, the clients of the financial advisor, and cause important financial issues. Sustainability in business is based on four key elements according to Esty and Winston [52]: revenues, intangibles, costs, and risks. They classify revenues and intangibles (like brand value, reputation, patents, copyrights, and trademarks) as components that have the potential to create value, while costs and risks can potentially destroy value if not managed adequately. The scale and complexity of these sustainability challenges create (financial) uncertainty for SMEs. The value of advice increases as the complexity and uncertainty for SMEs increase. Financial advisors are ideally suited to reduce this uncertainty and help SMEs towards a financially healthy future in a responsible manner for society and the environment. Almost all SME entrepreneurs already use a financial advisor, such as an accountant, auditor, bookkeeper, tax advisor, financing advisor, or insurance advisor. When advising on annual accounts and tax returns, the past of the company is mainly looked at. But the challenges for SMEs focus on the future, like a circular economy and the Sustainable Development Goals. Therefore, the financial professional should advise more about the future instead of the past of a company.

Research by the Chamber of Commerce [53] in The Netherlands shows that self-employed professionals and SMEs want to become more sustainable, but that in practice they encounter (mostly financial) barriers. The Dutch Committee for Entrepreneurship [35] concludes that it is necessary for SMEs to have better access to capital in the form of both debt and equity. “A robust and diverse financing market is needed, where alternative forms of financing are also accessible in addition to bank financing.”

Godos-Diez et al. [54] link external advice seeking by SMEs to sustainability initiatives. Building on McDonald et al. [55] and Yaniv [56], they state that “seeking for advice provides regular access to non-redundant information and alternative points of view, exposing directors to different perspectives and interpretations. Thus, advice from external sources is likely to offer several interpretations to the extent that it entails different cognitive schemas processing specific information, allowing for the framing of issues and answers from a broader perspective [57].” Executives who consider external advice in their decision-making processes are more likely to acquire new knowledge on environmental changes and on opportunities according to Alexiev et al. [58]. Menon and Pfeffer [59] mention that external advice is often considered more impartial and therefore may also assist board members to reach consensuses thanks to the provision of independent analyses and evaluations of proposals [58]. When sustainability initiatives are voluntary, it is important for each project proposed by a director to be supported by an external opinion to convince the other directors. So, resources and insights provided by financial advisors might be particularly important for the board to adopt new perspectives and make decisions on sustainability.

From Integrated Thinking to Sustainable Financial Advice

Financial advisors often work in a fragmented way: the tax advisor with returns, the auditor with the reporting, the accountant with the annual accounts, the insurance intermediary with the insurance policies, and the financing advisor with the loan. This fragmented approach does not fit the sustainability challenges SMEs face. To integrate sustainability into the financial system, the accounting sector introduced integrated reporting based on integrated thinking. Integrated thinking is the active consideration by an organization of the relationships between its various operating and functional units and the capitals that the organization uses or affects. Integrated thinking leads to integrated (“holistic”) decision-making and actions that consider the creation of value over the short, medium, and long term [60,61,62]. In other words, it involves organizational change to require everyone in the organization to increase their contribution to a much broader, and longer term, concept of value creation through a better understanding of how value is created.

On 9 December 2013, the International Integrated Reporting Council (IIRC) published the International Integrated Reporting Framework. It was adapted in 2021. With this comprehensive (“holistic”) framework, companies report about their business by addressing six different capitals [63] or stores of value they can use to produce goods or services. These are financial, manufactured, intellectual, human, social and relationship, and natural capital. Integrated thinking unites the constituent parts of an organization. It focuses the whole organization on the mutually reinforcing endeavor of value creation for the organization and value creation for key stakeholders. The business model, as the core of the organization’s value creation, sits at the center. It transforms input resources through business activities into outputs and outcomes (impacts), achieving an organization’s purpose and delivering its strategy. Integrated thinking also helps align these outcomes with the distinct contribution an organization can make to the delivery of the SDGs. In November 2022, the Council of the European Union gave its final approval to the CSRD. CompaniesFootnote 2 will have to report on how their business model affects their sustainability, and on how external sustainability factors (such as climate change or human right issues) influence their activities. The new sustainability reporting rules will apply to all large companies and to all companies listed on regulated markets except listed micro undertakings. These companies are also responsible for assessing the information applicable to their subsidiaries. The rules also apply to listed SMEs, considering their specific characteristics. For non-European companies, the requirement to provide a sustainability report applies to all companies generating a net turnover of EUR 150 million in the EU and which have at least one subsidiary or branch in the EU exceeding certain thresholds. These companies must provide a report on their environmental, social, and governance (ESG) impacts, as defined in this directive.

Siegrist et al. [64] also propose an integrated conceptual framework, which highlights how firms could embed environment and sustainability into their long-term financial decision-making framework. They advise firms to adopt (1) longer-term executive compensation plans, (2) longer-term financial reporting, and (3) flexible financial decision-making models which embed intangibles. All components correspond with the value of financial advice.

The transitions SMEs face affect the entrepreneur and the company as well as the employees. And these transitions have an impact on the tax dynamics, the (insurable) risks, the cash flow, the investments, the return, and, for example, the employment conditions. To be able to give sustainable financial advice to SMEs, an advisor must have a multidisciplinary approach and combine several financial specialties. This view is consistent with Gibson [65] who states that sustainability assessment would be best designed as an integrative process. Adger et al. [66] also advocate a multidisciplinary approach “using a decision-making framework where outcomes are based on a thick understanding, spanning across various disciplines to gain legitimacy and eventually produce solutions that are equitable, efficient and effective.” Also, SMEs are often part of a supply chain and interact with several stakeholders like (local) government, residents, and clients.

The developments described in this article lead to a new insight into the role of the financial professional of the future. There is a need for financial professionals who can think and act in an integrated way, but especially for financial professionals who actively advise SMEs based on this integrated approach. The challenges faced by SMEs require more integrated advice from a financial professional [67]. Leaning on the definition of integrated thinking, integrated (financial) advice can be considered as multidisciplinary advice on financially facilitating an organization to create multiple value. Integrated (financial) advice is a new field of research and is conditional to achieving sustainable financial advice.

Integrated thinking as a financial advisor means being able to think in multiple forms of value, thinking from multiple perspectives, thinking from systems and subsystems, and thinking from multiple disciplines. To then convert this into integral advice for the SME. The integral SME advisor maintains a long-term relationship with his SME client who oversees the relationship between the issues and can advise and guide SMEs at a strategic level. The financial advisor who can advise SMEs broadly and integrally can create a future-proof business model for himself in this way. To do so, this integrated financial advisor should have knowledge and capabilities on four dimensions:

-

1.

Multiple value creation;

-

2.

The cohesion between entrepreneur, enterprise, and employees;

-

3.

Stakeholder and supply chain approach;

-

4.

A multidisciplinary approach.

Sustainable financial advice is advice that helps SMEs to become more sustainable. For the short and long term. Sustainable financial advice is about integrated advice with the aim to reach the Sustainable Development Goals. In order to help SMEs become more sustainable, the financial advisor will have to adjust his/her value proposition. From simple, especially advising for financial, value creation to advising for the creation of multiple (financial, ecological, and social) value. In doing so, we apply the principles of multiple value creation and integrated thinking. Multiple value creation is an organizational strategy in which an organization not only creates financial-economic value with its activities, but also explicitly aims to realize social and ecological value. In practice, such a strategy leads to a “triple win”: profit for the shareholders, profit for the other stakeholders, and profit for the natural ecosystem.

Conclusion

Financial advice is valuable and can potentially be of great impact on achieving the sustainability challenges for SMEs. By not only advising on economic value but also on social and ecological value. This requires integrated thinking skills by financial advisors. The combination of integrated thinking and multiple value creation by financial advisors for SMEs is what is defined in this article as sustainable financial advice. Sustainable financial advice is financial advice with integrated thinking about multiple value creation with the aim to reach the sustainability goals. With this article, the specific role and potential added value of financial advisors for SMEs in reaching their sustainability challenges are emphasized. This was lacking until now, as the literature on sustainable finance is mainly focusing on corporates and the role of accountants, banks, insurers, and asset managers. The multiple value of financial advice for SMEs should be taken more into account by policymakers and SME representatives and further research to support this is conditional. More research is necessary about how integrated thinking can be observed and gauged in practice and about the accessibility of financial advisors for SMEs and their capabilities of providing sustainable and integrated advice. This article did not address the issue of the degree of independence of financial advisors and their remuneration but this should also be part of further discussion.

Data Availability

Not applicable

Notes

SDG Industry Matrix: Financial Services (2016), United Nations Global Impact and KPMG International

References

The Geneva Association (2022) The role of insurance in promoting social sustainability. Author: Kai-Uwe Schanz. November

Montmarquette, C and A. Prud’homme (2020) More on the value of financial advisors. Montreal

Montmarquette, C and N. Viennot-Briot (2016) The gamma factor and the value of financial advice. Montreal

Association of Financial Advisors (2018) Value of advice, 2018 AFA report

Brancati, C.U., B. Franklin and B. Beach (2017) The value of financial advice, a research report from ILC-UK, Londen

Beach, B. (2019) What it’s worth, revisiting the value of financial advice, a research report from ILC-UK, London

Winchester DD, Huston SJ (2015) All financial advice for the middle class is not equal. J Consum Policy 38:247–264

Loy E, MacDonald KL, Brimble M, Wildman KL (2021) The value of professional financial advice for consumers in a crisis: experiences of financial advisers during the COVID-19 pandemic. Working paper. Griffith Business School, Griffith University, Brisbane

Berry AJ, Sweeting R, Goto J (2006) The effect of business advisers on the performance of SMEs. J Small Bus Enterp Dev 13(1):33–47. https://doi.org/10.1108/14626000610645298

Carey PJ (2015) External accountants’ business advice and SME performance. Pac Account Rev 27(2):166–188. https://doi.org/10.1108/PAR-04-2013-0020

Mole, K. (2016) (Seeking, acting on and appreciating) the value of business advice. ERC Research Paper No.44 May 2016

Williamson OE (1975) Markets and hierarchies, analysis and antitrust implications: a study in the economics of internal organization. Free Press, New York

Cummins JD, Doherty NA (2006) The economics of insurance intermediaries. J Risk Insur 73(3):359–396

Bhattacharya S, Thakor A (1993) Contemporary banking theory. J Financ Intermed 3:2–50

Santomero AM (1984) Modelling the banking firm. J Money Credit Bank 16(4):576–602

Coase R (1937) The nature of the firm. Economics 4:386–405

Aristei D, Gallo M (2021) Financial knowledge, confidence, and sustainable financial behavior. Sustainability 13:10926. https://doi.org/10.3390/su131910926

Fan L (2020) A conceptual framework of financial advice-seeking and short- and long-term financial behaviors: an age comparison. J Fam Econ Issues 42(2021):90–112. https://doi.org/10.1007/s10834-020-09727-3

Alyousif MH, Kalenkoski CM (2017) Who seeks financial advice? Financ Serv Rev 26(2017):405–432

Brenner L (1998) When you need a financial expert. New Choices 38(8):81–82

Hilgert MA, Hogarth JM, Beverly SG (2003) Household financial management: the connection between knowledge and behavior. Fed Reserv Bull 89:309–322

Hira TK, Mugenda OM (1999) The relationships between self-worth and financial beliefs, behavior, and satisfaction. J Fam Consum Sci 91(4):76–82

Staten ME, Elliehausen G, Lundquist EC (2002) The impact of credit counseling on subsequent borrower credit usage and payment behavior. Credit Res Center Monog 36:1–38

Moreland K (2018) Seeking financial advice and other desirable financial behaviors. J Financ Couns Plan 29(2):198–206. https://doi.org/10.1891/1052-3073.29.2.198

Montmarquette, C. and N. Viennot-Briot (2012) Econometric models on the value of advice of a financial advisor. Montréal

De Jong F (2010) Marktfalen bij tussenpersonen”. PhD diss. University of Amsterdam

Spulber DF (1999) Market microstructure, intermediairies and the theory of the firm. Cambridge University Press, Cambridge

Schepen A, Burger MJ (2022) Professional financial advice and subjective well-being. Appl Res Qual Life 17:2967–3004. https://doi.org/10.1007/s11482-022-10049-9

De Jong F (2021) Naar meervoudige waarde van financieel en fiscaal advies. HAN University of Applied Sciences, Arnhem

MacDonald KL, Loy E, Brimble M, Wildman K (2023) The value of personal professional financial advice to clients: a systematic quantitative literature review. Account Financ 00:1–31. https://doi.org/10.1111/acfi.13099

Mole KDN, Baldock R (2017) Which SMEs seek external support? Business characteristics, management behaviour and external influences in a contingency approach. Environ Plan C Politics Space 35(3):476–499. https://doi.org/10.1177/0263774X16665362

Bennett RJ, Robson PJA (1999) Intensity of interaction in supply of business advice and client impact: a comparison of consultancy, business associations and government support initiatives for SMEs. Br J Manag 10(4):351–369

Wren C, Storey DJ (2002) Evaluating the effect of soft business support upon small firm performance. Oxf Econ Pap 54(2):334–365

Salzmann O, Ionescu-Somers A, Steger U (2005) The business case for corporate sustainability: literature review and research options. Eur Manag J 23:27–36

Dutch Committee for Entrepeneurship (2021) State of SME’s annual report 2021.

Haans, R.G. Criaco and J. Jansen (2020) Groeidynamiek van het Nederlandse MKB. Rotterdam School of Management, Erasmus University. 13 November 2020

Meadows DH, Meadows DL, Randers J, Behrens WW III (1972) The limits to growth, a report for the club of Rome’s project on the predicament of mankind. Universe Books, New York

Wilson M (2003) Corporate sustainability: what is it and where does it come from? Ivey Business Journal (March/April)

Schoenmaker D, Schramade W (2019) Principles of sustainable finance. Oxford University Press

Levine R (2005) Finance and growth: theory, mechanisms and evidence. In: Aghion P, Durlauf SN (eds) Handbook of economic growth. Elsevier, Amsterdam, pp 865–923

Worldbank (2021) Sustainable finance brief. https://www.worldbank.org/en/topic/financialsector/brief/sustainable-finance, August 5, 2021

Chang XKF, Jin Y, Liem PF (2022) Sustainable finance: ESG/CSR, firm value, and investment returns. Asia-Pac J Financ Stud 51:325–371. https://doi.org/10.1111/ajfs.12379

Mondini G (2019) Sustainability assessment: from Brundtland Report to Sustainable Development Goals. J valori e valutazioni 23:129–137

Scholtens B (2006) Finance as a driver of corporate social responsibility. J Bus Ethics 68(1):19–33

Edmans A, Kacperczyk M (2022) Sustainable finance. Rev Financ 2022:1309–1313. https://doi.org/10.1093/rof/rfac069

Willekes, E., J. Jonker & K. Wagensveld (2020) The impact of multiple value creation on management control systems: an explorative case study. Contribution to the 5th online conference on new business models. 1-2 July 2020 Radboud University Nijmegen

Elkington J (1998) Cannibals with forks: the triple bottom line of 21st century business. Capstone Publishing, Chichester

Jonker, J. (2015) Nieuwe Business Modellen, Amersfoort, Wilco

Wagensveld K. and R. Westerdijk (2018) Future proof sturen op meervoudige waarde en de rol van HR. Chapter 2 in: Fit for the future : handvatten voor toekomstbestendig HRM-beleid, Edited by Sara Detaille and Annet de Lange. Alphen aan de Rijn. Vakmedianet

European Commission (2018) Action plan: financing sustainable growth. Brussels. 8.3.2018 COM 97 final

European Union (2021) Commission delegated regulation (EU) 2021/1253 of 21 April 2021

Esty DC, Winston AS (2009) Green to gold: how smart companies use environmental strategy to innovate, create value, and build competitive advantage. Wiley, Hoboken, NJ

Chamber of Commerce The Netherlands (2018) Duurzaam ondernemen Report. Utrecht

Godos-Diez J, Cabeza-Garcia L, Alonso-Martinez D, Ferdandez-Gago R (2016) Factors influencing board of directors’ decision-making process as determinants of CSR engagement. Rev Manag Sci 12(2018):229–253. https://doi.org/10.1007/s11846-016-0220-1

McDonald ML, Westphal JD, Graebner ME (2008) What do they know? The effects of outside director acquisition experience on firm acquisition performance. Strateg Manag J 29(11):1155–1177

Yaniv I (2004) Receiving other people’s advice: influence and benefit. Organ Behav Hum Dec 93(1):1–13

Heyden M, Van Doorn S, Reimer M, Van Den Bosch F, Volberda H (2013) Perceived environmental dynamism, relative competitive performance, and top management team heterogeneity: examining correlates of upper echelons’ advice–seeking. Organ Stud 34(9):1327–1356

Alexiev AS, Jansen JJP, Van den Bosch FAJ, Volberda HW (2010) Top management team advice seeking and exploratory innovation: the moderating role of TMT heterogeneity. J Manag Stud 47(7):1343–1364

Menon T, Pfeffer J (2003) Valuing internal vs. external knowledge: explaining the preference for outsiders. Manag Sci 49(4):497–513

International Integrated Reporting Council. (2013) The International <IR> Framework, December 2013

International Integrated Reporting Council (2021) The International <IR> Framework, January 2021

Maroun WE, Cerbone D (2023) Refining integrated thinking. Sustain Account Manag Policy J 14(7):1–25

Gleeson-White J (2015) Six capitals or can accountants save the planet? Rethinking capitalism for the twenty-first century. Norton & Company, Incorporated, W. W.

Siegrist M, Bowman G, Mervine E, Southam C (2020) Embedding environment and sustainability into corporate financial decision-making. Account Financ 60(2020):129–147

Gibson RB (2006) Beyond the pillars: sustainability assessment as a framework for effective integration of social, economic and ecological considerations in significant decision-making. JEAPM 8:259–280

Adger WN, Brown K, Fairbrass J, Jordan A, Paavola J, Rosendo S, Seyfang G (2003) Governance for sustainability: towards a ‘thick’ analysis of environmental decisionmaking. Environ Plan 35:1095–1110

Jong, F. De M. Van Kooten (2019) Financieel Gezond MKB vereist een integrale en multidisciplinaire adviesbenadering. Het Verzekeringsarchief jaargang 96, 3e kwartaal

Carey PJ, Simnett R, Tanewski GA (2005) Providing business advice for small to medium enterprises. CPA Australia

European Commission (2020) New circular economy action plan (CEAP). Brussels. 11.3.2020 COM 98 final

Schot, van der (2016) Van Macht naar Kracht. De Veranderende Overheidsrol in de Economie van de Toekomst. Innovatiepartners/ Het Groene Brein

United Nations (1987) Report of the World Commission on Environment and Development: our common future. Transmitted to the General Assembly as an Annex to document A/42/427 - Development and International Co-operation: Environment

United Nations (2015) Resolution approved by the General Assembly on 25 September 2015, Transforming our world: the 2030 Agenda for Sustainable Development

Value Reporting Foundation (2021) Integrated thinking, a virtuous loop, London

Author information

Authors and Affiliations

Contributions

All authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Ethics Approval and Consent to Participate

This manuscript has no studies involving human participants, human data, or human tissue.

Consent for Publication

Not applicable

Competing Interests

The authors declare no competing interests.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

de Jong, F., Wagensveld, K. Sustainable Financial Advice for SMEs. Circ.Econ.Sust. 4, 777–789 (2024). https://doi.org/10.1007/s43615-023-00309-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s43615-023-00309-7