Abstract

Rare earth elements (REEs) are often referred to as the industrial vitamins and the key drivers of the industry 4.0 revolution. The current global supply chain of REEs for green and high-tech applications with more than 220 metric kilotons per year involves a huge environmental impact (backpack) as well as the piling up of radioactive by-products to about 1.5 times the amount of REEs produced. E-wastes and municipal solid waste streams are attractive secondary resources. The current opinion paper discusses the recycling of rare earth metals along the value chain with the opportunities and challenges associated with it. The way to mitigate the economic constraints has been pointed out in terms of competitive quality and recovery of the REEs when compared with the mineral exploration options in the market. It is also emphasised that the technical complexity, capital expenditures and operating expenses need to fit the economic boundary conditions to make the recycling viable. In future, the appropriate REE-rich feedstocks such as fluorescent lamp e-waste powders and magnets can be potential secondary sources of the critical raw materials necessary for the green transition. The success of the viable recycling approaches and technologies will largely depend on the public–private partnerships based on hybrid financing models and local know-how generation to compete with quasi-monopoly in the REE supply chains. However, to break the monopolies, it will not be sufficient to only recycle the REEs; it will also be relevant to diversify the industries that produce REE-containing goods from recycled waste streams.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

The green energy transition, electric vehicles (EV) adoption in society, and smart and hybrid high-tech gadgets developments are the new age megatrends [1,2,3]. However, the success of these sustainability technologies largely depends on the key, essential and critical raw materials called rare earth elements (REEs). These are a group of 17 metals (15 lanthanides, La-Lu, together with Sc and Y). REEs are identified as the green technology relevant critical raw materials with great supply risks due to their difficult separations, and non-transparent and quasi-monopolistic supply chains [4,5,6,7,8,9,10].

To protect the large societal, industrial and climate interests, production of these materials from mining or alternative resources is necessary. But, mining resources cause great harm to human and environmental health due to the generation of toxic and radioactive by-products [11,12,13]. However, alternative resources such as urban mining of e-waste by recycling (and in a greater sense by the circular economy) can be viable solutions to fulfil the partial demand for these materials [2, 6].

The current opinion paper discusses and asserts that there is a need for interventions on different levels, such as know-how and technology development, targeting of selected wastes and residues for recycling feeds with appropriate approaches and financing via public–private and hybrid financing models. In addition to this, public and industrial awareness of the collection of the e-wastes in the reverse supply chain and the off-take and reuse of the recycled materials in the manufacturing of new products is essential. Increased manufacturing of new products in industries which circumvent their reuse in existing monopolies is also necessary. This will be essential to ensure the viability of the targeted circular economy and recycling ecosystem, and moreover, it will allow the development of a less monopolistic REE market.

Rare Earths as Technological and Economic Growth Drivers

There are different megatrends one can witness in the recent decade:

-

1.

There is unprecedented awareness of climate change and its socio-economic and ecological impacts. It is one of the most urgent threats mankind is facing [1, 8].

-

2.

There are huge technological advancements in software and hardware technologies that change the modus operandi in every technical, engineering, and operation field. All the processes are becoming faster, greener, and cheaper [2].

-

3.

There is a large increase in the urbanisation and the penetration of personalised gadgets and technology; hence, the demand for energy and electronics and the generation of the waste stockpile are increasing in double digits every year [3].

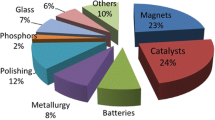

However, these transitions are being propelled by critical rare metals. They comprise 15 lanthanides (La-Lu) along with Y and Sc. The amount of attention and geopolitical and economic importance they have received over the last decade is unparalleled by that received by any other commodity humans have ever traded [4, 5]. The rare earth elements are divided into two different categories, i.e., light (LREEs (La-Gd)) and heavy (HREEs (Tb-Lu and Y)). Depending on their optical, electronic and magnetic properties, they find applications in different high-tech industries like chemicals, optics, telecommunication, energy and medical diagnostics. They are used in relatively small quantities; however, they have a very large impact on the performance of the different appliances. On the other hand, they will have a very big ecological impact due to their dilute concentrations in ores and their nature when co-existing along with other chemical and radioactive impurities. Their advances in energy technology require larger amounts of REEs and will cause more environmental issues in terms of mining residues and generating larger amounts of secondary processing wastes [6, 7].

Their current market demands reached more than 220,000 metric tons (t) in 2020 as compared to only about 65,000 t in 1994 [11]. The current global supply chain of REEs involves a huge environmental impact (backpack) as well as the piling up of radioactive by-products to about 1.5 times the amount of REEs produced [14]. For example, every e-car includes a total of nearly 1.1 kg of REE-based (permanent) magnets [6]. A wind turbine involves about 200 kg of neodymium per megawatt of electricity generated [8]. Such applications imply a huge demand for REEs as they are the key drivers of the high-tech and clean-energy world. In a 100%-electric-vehicle (EV) world, the need for REEs is about 6.5 times larger than the demand for metals from the platinum group, which will already have shrunk by − 53% when compared to present-day scenarios [9]. Therefore, utmost attention has been given to these raw materials and they are identified as key critical raw materials with potential economic significance and supply risk by leading economies globally [10,11,12].

Opportunities in Different Sectors to Increase the Circular Economic Contributions

Given the enormous awareness about climate impact and achievable alternative energy strategy, mobility, and technological prospects, more companies are moving to circular economic value chains. In earlier decades, waste material flows were perceived as negative costs and liability. Nowadays, it is emerging as the potential business opportunity to make the value chain and businesses more sustainable and meaningful for the big societal and environmental aspects. For the mining industry, it is particularly propelled by the increasing interest in environmental, social and governance (ESG) criteria at the management level. More attention is being given to the circular practices in the commodity sector. The collective impact of the circular economic approaches will reduce virgin raw material requirements and improve climate friendliness, and economic and local value chains. Nowadays, recycling not only is a sustainable and holistic approach but also serves as a new way of defining business processes, services and products (Fig. 1).

Recycling as an opportunity in the raw materials sector [12]

Therefore, collective efforts are being taken in academia, industry and governance. On different national, European and global levels, recycling is being promoted. Traditional recycling sectors, e.g. plastics, metal scraps, etc., show high recycling shares. This has the potential to revive the economic prospects as well as to create new jobs in the future. Different initiatives, such as the Circular Economy Transition (CET) in Switzerland, the European Institute of Innovation and Technology Climate-Knowledge and Innovation Community (EIT Climate-KIC) and the Critical Raw Materials (CRMs) initiative for the EU, are already in place to promote such technologies [10, 11].

Waste as a Resource

On the other side of the anthropogenic value chain, there lies one more issue needing appropriate attention given the increasing human population and urbanisation. It is expected that the current 7.8 billion-large human population will be nearly 9.8 billion people by 2050 and will increase further to 11.2 billion by 2100 [13, 15].

This also implies that more and more people will move to the cities in search of better resources, western lifestyle and economic opportunities. This will eventually give rise to a tremendous amount of waste generation due to anthropogenic activities. Global municipal solid waste amounted to 2.01 billion metric tons (Bt) in 2018, and it is expected to reach the astonishing level of 3.4 Bt by the year 2050 [16]. It also gives a disparity in the amount of waste generated by different countries. For example, in 2018, the three most populous countries on earth, i.e. China, India and the USA, have produced nearly 15.55%, 11.95% and 11.65% the global solid waste fraction for their global population portion of 18.45%, 18.05% and 4.4%, respectively [17]. These data suggest that, per capita, the waste generation rates are very high in high-income countries. However, there is good news as well, that in high-income countries the collection rates of solid waste are close to 96% as compared to 39% in low-income and 51% in low- to middle-income countries [16].

Without appropriate management strategies, the amount of greenhouse gas impact by the anthropogenic waste from municipal sources is expected to reach 2.38 Bt by 2050 as compared to the 1.6 Bt of CO2-equivalent in 2016. In 2018, only 13.5% of the global municipal waste was recycled and nearly 70% of the waste ended up in landfills of different types. Only 16.5% of the waste was used for the harvesting of energy either by incineration or fermentation [16, 17]. In economic terms, the waste is seen as a liability with a negative value and mostly ends up with landfilling with huge surveillance, transport, and environmental costs.

A sustainable alternative to this conventional dealing could be that waste should be exploited as a resource with a recycling and urban mining approach. Waste could be used to recover energy either by incineration or fermentation. The second way is to recover raw materials and use them in front-end manufacturing again (Fig. 2). The third approach is to isolate/immobilise toxic materials so that the environmental impact could be avoided. The fourth approach is to recover the valuable and critical materials so that they can be introduced again into the economy, thereby saving an equivalent amount from natural exploitation. The latter type of approach can also help in covering the costs for this kind of sustainable waste management by generating incentives and revenues in terms of the greenhouse gas impact saved by the recovered materials, and by using decentralised supply chains. In this holistic approach, the critical REEs can also be circulated in an anthropogenic ecosystem.

Waste as a resource as an alternative strategy to landfilling [18]

Recent trends in the implementation of the circular economy approach in materials recycling underscore the importance of artificial intelligence (AI)–based materials flow tracking and analysis [19]. It can help in understanding the contents, risks and feed volumes of different feedstock to geographic, technology and accessibility matrices. Such approaches could also help in the rational process developments and also in increasing the lifespan of the gadgets and appliances, hereby, making sure that raw materials stay within the economy for a longer time. This will certainly help to reduce the burden of virgin resources extraction [20].

Opportunities and Recycling Challenges in REE Value Chains

Alternative (secondary) resources for the REEs could be the e-wastes and the industrial wastes in the municipal streams. Since the last decade, e-waste is the fastest-growing waste type in the world and its amount is increasing by more than 10% each year. In 2019, the amount of e-waste generated globally was nearly 54 million metric tons (Mt) with a documented collection rate of nearly 17% [17, 18, 21, 22]. Especially e-waste could be exploited as an alternative resource for critical REEs, i.e. the heavy rare earth elements (HREEs (Tb-Lu and Y)), having relatively lower concentrations in ores. The quest for their production also results in unwanted co-production of the relatively more abundant light rare earth elements (LREEs (La-Gd)), causing disturbed economics and pricing in the market due to the “balance problem” [6, 21]. This is particularly evident from the low abundance of the most sought heavy REEs, such as Dy and Tb. It is to be expected that electronic gadgets, EVs and appliances are bound to have more and higher amounts of REEs in the future, and they could also end up in waste streams after the end of their use. Therefore, there are trends towards increasing amounts of e-wastes reaching critical masses required for economically viable industrial recycling processes. Also, there is a clear advantage with appropriate waste management aspects. This will help to achieve a positive environmental impact and to mitigate the consequences of the balance problem.

However, along with these opportunities and other, mostly technological, advantages, there still also lie challenges ahead for recycling. However, nowadays, recycling is foremost concentrated on other waste targets, such as paper, plastic, glass and ferrous metals. Therefore, recovering speciality chemicals and REEs from waste is not yet technologically advanced to be recycled efficiently. A technological challenge is to separate the different REEs from each other and to remove other impurities contained in the waste streams, i.e. e-wastes are highly heterogeneous. The reverse supply chain with materials deeply embedded in end-of-life waste gadgets with very few per-unit quantities of REEs is very complex and expensive. Also, because of higher transport, dismantling and recovery costs, the low output qualities (i.e. low purity and recovery rates) can hardly find good economy and reuse prospects without economically more viable treatments/enrichments. Because of achieving the tough balance between circular economy–related opportunities and challenges, there is an urgent need to develop new technologies for solid waste treatment that can fulfil these stringent criteria (Fig. 3). However, solid waste treatment research seems still on a growing trajectory [18].

Technologies to Be Exploited and an Own Model Process for the Implementation

The only way to realise the recycling and urban mining in the REE value chain is in the development of an REE-specific recycling technology going beyond the state of the art as established nowadays, e.g. for transition metals or those adapted from mining practices. Current approaches only focus on shredding, mechanical segregation and sometimes pyrolysis techniques. These are suitable given today’s practised waste management strategy, but they fail to deliver high-quality or concentrated REE contents that can compete in quality and quantity with the primary sourcing mechanism. Therefore, we enriched individual REEs selectively from end-of-life lamp phosphors or NdPr magnets to their commercially acceptable purity by using specialised chemistry and chemical engineering approaches [21, 23].

The process development for the end-of-life lamp phosphors and magnets can be different in the pre-processing stages, such as demagnetisation with magnets, and mercury removal and shredding stages with the lamps. However, we have developed hydrometallurgy and solution chemistry–based processes with individual rare earth metal–selective approaches [21, 23]. Our process helped to deal with the bottlenecks of the recycling such as the handling of the complex feedstock with dilute REE concentrations and the element separations to high purities within economic viability boundary conditions [21]. The process is directly scalable and is being piloted on the kilogram scale at the moment.

In the case of magnets, also the dry reduction processes such as hydrogen decrepitation and solid sintering are being developed by some groups, which, however, do not reach an individual high purity for REEs [24,25,26].

Our technology with end-of-life lamps (or magnets) relies on the processing of mechanically pre-shredded (or segregated) materials. These materials are digested into the solution so that we can do the required selective solution chemistry with it. We are then separating the REEs from the impurities using hydrometallurgy and a well-established liquid–liquid extraction approach. The entire process is done with the help of advanced elemental analysis techniques for impurity profiling and quality testing purposes. This enables us to reach commercially acceptable purity of > 99% REEs [27, 28]. The purified REEs can then be utilised in different front-end manufacturing of energy, lighting, EV motors, magnets or wearable appliances. After their end of use, they can again arrive in the reverse supply chain and can be processed as described above. Therefore, it may facilitate an entirely viable recycling activity for the REEs. But, such approaches should also fit within the operational and economic boundary conditions so that they can be implemented successfully (Fig. 4). Such sustainable value chains can spontaneously feed the front and back ends of the supply chains. The growing demands and uses can thus increase the feed influx and result in more recycling throughput. Therefore, developing and implementing such technologies in circular approaches are very important.

It is also important to note that the recycling of the REEs should yield high-value purified materials and not below the commercially acceptable purities. Even though some approaches propose to use mixed feeds of primary and secondary origin, e.g. in the case of NdPr magnets, the incentives can be substantially increased by producing highly pure REE compounds (or elemental REEs), which can be used in different configurations and applications in the future [2]. Our model processes are always focused on the generation of high-purity materials (> 99% individual REE content) as described above.

In the case of lamp phosphors, the transition to LEDs will certainly affect the economic viabilities. However, the high-scale penetration of LED technology is expected to keep the phosphors requirements at a high level. And the reverse supply chain will still have a considerable amount of the REEs-containing phosphors until 2040, requiring viable recycling and treatment solutions to harness the REEs in it [29]. An element like Tb can be a part of high-performance magnets, and it is one of the most expensive REEs with limited resource availability and quasi-supply monopolies. Such recycled streams could go to the manufacturing of new lamps/LEDs or magnet applications. Versatile reuse of recycled Tb in different applications is only possible when high-purity elemental Tb or Tb-containing compounds do result from the recycling process.

Geopolitical and Socio-economic Issues Associated with Value Chains

It is well documented that a 100% EV world strategy is an important aspect of the global energy transition. It is also affecting the market dynamics with the fact that EV sales have more than doubled in 2021 alone to reach 6.6 million vehicles [30]. Examples like in Norway already showed that EV sales are more than those of conventional fossil fuel vehicles. Moreover, during the review process of this paper, the European Parliament has just approved the phasing out of fossil fuel cars.

This trend has already affected the required underlying commodity and raw materials, and thus, the REE magnets have recently doubled in price. The pricing is also affected given the fact that the REE supply is concentrated with few companies and countries (e.g. > 90% of the HREE supply comes from China alone). Also, their ore supply chains are affected due to pandemics and political instability in mining locations [30]. Therefore, REEs have featured in the global headlines regularly over the last few years. The global technology and energy transition and thus sustainable development goals have direct relevance to the supply and value chain of these critical raw materials. Therefore, the focus must be on the sustainable and reliable supply of these raw materials within the socio-economic boundary conditions so that the “Industry 4.0” revolution would result in a world focused on sustainable development goals (SDGs) with equal and fair opportunities for both humans and the environment.

For a fair dialogue and detailed considerations, reporting of the mining impact and inclusive governance, as well as guidelines, are needed on the legislative fronts. This is highlighted repeatedly by the International Resource Panel in their global resources outlook [31]. Concerning the REEs, such needs are even more pronounced given the fact that REEs are part of all the critical raw materials lists published by the European Commission since 2011 [12].

Another issue is that of the socio-economic factors. Mainly in the mining location, often the environmental and occupational safety of the workers, the impact on indigenous and local communities, the environmental impact during operations and the post-closure of operation such as tailing management are very important and often subjected to the debate between different jurisdictions and regulations. Therefore, common and rational approaches need to be established to implement and report the necessary efforts to tackle such issues [32]. In this regard, the REE supply chain can emerge as a good example with better sustainability and a holistic approach from governments, businesses and other stakeholders. And, a collaborative approach between them can help in the appropriate mitigation of geopolitical and socio-economic concerns. Recycling will then have a better perspective by the deserved inclusion in such value chains.

Need for New Business Models and Financing Strategies

So far, many efforts have been initiated on the mining and recycling front in the western world. However, they ended up being expensive and non-competitive [6, 21]. In any case, due to being a side product of iron mining activities, concentrated supply monopoly and balance problems, the REE pricing always remained undervalued [30]. Therefore, the reduced pricing of the REEs coming from the front-end mining resources kept the recycling and thus the circular economic boundary conditions very stringent. Therefore, new technologies and implementation approaches need the impetus from the market for viable recycling of REE raw materials [6]. The pricing of the REEs has to be higher than the operational recycling costs at a given recycling scale to ensure economic viability [21, 33].

In the recent past, very good examples of circular value chains have emerged in the precious metal industry. The recycling costs are covered with fair and competitive service fees. However, the end-user companies for these precious metals are keeping the ownership of the recycled materials. This helps them to use recycling as a service and protects them from the multifold increase in metal pricing that could be detrimental to their business prospects. This business model is functioning quite smoothly now for processing targets such as autocatalysts and chemical catalysts that are based on platinum group metals. This value chain is circular and also helps relevant stakeholders to keep track of the metal inventory and the reliable, specialised and cooperative relationships between different stakeholders [34].

Similar business models can help to cover the costs of REE recycling and help protect potential investments (e.g. in EV R&D) against critical raw materials supply bottlenecks. The end customers can keep ownership of their REE inventory by covering the recycling costs regulated by law. At the moment, the costs for collecting, storing and managing the anthropogenic waste for recycling purposes of REEs may seem very high as compared to those for mining new ore deposits. But, when mining would also include costs from socio-economic impacts, environmental impact, tailings management and potential economic losses due to interrupted primary REEs supply chains, it would more realistically show the real costs with the primary mining products. Therefore, appropriate interventions on business models and legislative fronts can help such business models succeed.

However, considering that monopolistic REE-intensive industries tend to develop a vertical economic integration [35], it can be assumed that the market price for secondary REEs is fluctuating considerably as the producers will buy secondary REEs on the margin. Examples of such a mechanism are given by Worrell et al. for the paper recycling industry [18]. There may be different factors leading to strong fluctuations in prices for recycled materials, but we assume that production industries that aim to only use secondary REEs will help to stabilise the market prices for recycled materials.

One more idea getting lots of traction nowadays is the cooperative model between different stakeholders in the supply chain. This was inspired by the leading market players in the REE sector. This implies that private capital will hardly make a breakthrough in the critical raw materials market. Stringent environmental and labour laws make the costs higher in the northern hemisphere than in the global south. Companies operating in the global south have this cost advantage, making other businesses and value chains more viable. This often results in a supply monopoly or non-transparent supply chains. But, initial investments in newly established and properly managed recycling businesses could still come through public–private partnerships when involving the state authorities and companies involved up- and downstream of the supply chain. Such a business model could already be seen with the Japanese and the USA governments by promoting and supporting the Lynas corporation to ensure the uninterrupted supply of REEs [6]. This gives the opportunity and assurance for the required capital, feedstock and off-take of the purified metal products. This can further be linked with the compulsory requirements for recycled REE use in the new front-end products. Also, in a concerted manner, it is needed to retain the waste inventory of products, gadgets and the appropriate reverse supply chain establishment for the end-of-life products. Such an ecosystem can then have a fair distribution of costs, information, inventory, compliance and responsibilities along the value chains [32, 33, 36].

Know-How and Further Technological Developments Are the Keys

During the era of the expansion of nuclear energy, substantial know-how was created on f-elements chemistry in the western world. However, after the Chernobyl and Fukushima incidents, the majority of the nuclear programmes have been abandoned and most of the engineering and chemistry know-how related to the f-elements was relocated (adopted) to the mining and mineral-processing activities related to the REEs. Since 2010, the REEs found their relevance in the high-tech industry once again. Moreover, these critical raw materials are now sought after for energy and other high-tech mobility developments. The raw materials processing and upstream technologies are entirely outsourced, and major economies are only importing either the products or machinery parts from the mineral-exporting countries.

This import reliance resulted in concentrated mining and processing activities and bottom-up manufacturing capabilities only in limited countries (e.g. in China and Malaysia). Via capital and human resources investments, R&D allows for know-how for new, better or cheaper processes and products. New processes or products are resulting in new businesses. These businesses are resulting in revenues and wealth. Such wealth can then put the communities in a position to invest more, either to develop or attract know-how or to invest more in the R&D of the processes and products involved (Fig. 5). Therefore, retaining the fundamental and processing know-how is very important in the critical REE sector so that these most-sought raw materials with the associated and in the future emerging businesses can benefit the community and humanity [10, 33, 37].

Conclusion and Perspectives

Given the key commodity ‘raw materials’ in sustainability and societal relevant technologies, the REEs will have continued demand and impact with a market of nearly 13 billion USD by 2027, and a growth rate of 10% per year. There is a huge opportunity to implement recycling in such value chains because these value chains are in their emerging phase and the forecasted demands will be tenfold higher than today. In a real sense, this approach may combine the municipal e-waste issue with secondary resources of critical raw materials to give a sustainable and circular economic solution.

To harness these alternative resources, one also has to develop robust and competitive process technologies that can handle the complex feeds within economically viable boundary conditions. New hydrometallurgy-based processes can reach high-purity levels for individual REEs and direct scalability to address such complex feeds and recycling process needs.

These opportunities can generate new business models and value chains; however, such business generations and financing will need to be based on mutual consensus and partnership between the stakeholders operating at or between the front or back ends of the product value chains. Such growth in new businesses and thus strategies for REE recycling, however, will be largely dependent on the appropriate availability of the hybrid financing models, advanced waste feedstock supply and purified metals purchase guarantees. This can be complemented by regulatory measures on the back-end processing of the REE-containing wastes within state boundaries and by enforcing the use of recycled materials in the production of new products or gadgets. And such measures have to be implemented strictly. The potential tracing of REE flows in materials along the value chain using AI-based technology can also offer new opportunities to increase recovery efficiencies.

In conclusion, implementing recycling and sustainability in REE value chains can be achieved only through cooperative systems addressing the entire value chain. Immediate initiatives needed to compete with quasi-monopoly are robust technology and know-how developments, public–private partnerships and hybrid financing mechanisms. Industries that will strictly use secondary REEs for their products may help to reduce the high variations in the market price of secondary REEs and by this help to develop a robust recycling system for REEs. For western countries, it is advised not to only support the recycling technology development but also consider supporting their industries that can produce independently REE-containing goods. Else, the recycled REEs will remain under the market control of the quasi-monopolists, today.

Also, for the recycling of REE-containing e-wastes in general, on the short- to mid-terms, it is therefore advised to support the development of new recycling technologies that can produce materials for different applications and sell their products to many different industries and markets. This is the case for compounds or elemental REEs which have a high purity, i.e. not containing a mixture of different REEs. These efforts are needed in the western world to increase independency, despite the fact that lower-quality recycled REEs could possibly also be sold to some of the known monopolists as per requirement to initiate the development of new and alternative value chains. On the long term, it is to hope that recycling will be better integrated in the production processes of goods which could make recycling overall more cost-effective as not for all cases a complete separation of the different REEs may be necessary.

References

Net Zero by 2050; (2021). https://doi.org/10.1787/c8328405-en

Binnemans K, McGuiness P, Jones P (2021) Rare-earth recycling needs market intervention. Nat Rev Mater 6:459–461. https://doi.org/10.1038/s41578-021-00308-w

Zepf V, Reller A, Rennie C, Ashfield M, Simmons J (2014) Universität Augsburg, & British Petroleum Company. Materials critical to the energy industry. An introduction. 2nd edition

Golev A, Scott M, Erskine P, Ali S, Ballantyne G (2014) Rare earths supply chains: current status, constraints and opportunities. Resour Policy 41:52–59

Massari S, Ruberti M (2013) Rare earth elements as critical raw materials: focus on international markets and future strategies. Resour Policy 38:36–43

Binnemans K, Jones P, Blanpain B (2013) Recycling of rare earths: a critical review. J Clean Prod 51:1–22. https://doi.org/10.1016/j.jclepro.2012.12.037

Schwarzer S (2020) Challenges for the growth of the electric vehicle market. UNEP Foresight Brief 17: pp 1–7. https://wedocs.unep.org/bitstream/handle/20.500.11822/33111/FB17.pdf?sequence=7&isAllowed=y

Cho R. Rare earth metals: will we have enough? (2012). Retrieved on February 25, 2022. https://news.climate.columbia.edu/2012/09/19/rare-earth-metals-will-we-have-enough/

The massive impact of EVs on commodities. (2017). Retrieved on February 25, 2022. https://kirillklip.blogspot.com/2017/10/ubs-joins-lithium-race-and-energy.html

European Commission (2020) Critical materials for strategic technologies and sectors in the EU - a foresight study. https://fileservices.ad.jyu.fi/homes/patilab/Downloads/Critical%20Raw%20Materials%20in%20Technologies%20and%20Sectors_foresight.pdf

Gauß R, Burkhardt C, Carencotte F, Gasparon M, Gutfleisch O, Higgins I, Karajić M, Klossek A, Mäkinen M, Schäfer B, Schindler R, Veluri B (2021) Rare earth magnets and motors: a European call for action. A report by the Rare Earth Magnets and Motors Cluster of the European Raw Materials Alliance. Berlin. https://eitrawmaterials.eu/wp-content/uploads/2021/09/ERMA-Action-Plan-2021-A-European-Call-for-Action.pdf

European Commission, (2020) Critical raw materials resilience: charting a path towards greater security and sustainability, fourth critical raw materials list. https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:52020DC0474&from=EN

Time for global action, UNEP “Our planet” report (2015). https://sustainabledevelopment.un.org/content/documents/1624Our_Planet__time_for_global_action.pdf

De Lima IB (2016) Rare earths industry and eco-management. Rare Earths Ind 8:293–304

Boyle D (2015) World population is set to hit 9.7 billion by 2050 with India overtaking China as the world’s most populous country within seven years. Daily Mail. Retrieved on February 25, 2022. https://www.dailymail.co.uk/news/article-3178933/World-population-set-hit-9-7billion-2050-India-overtaking-China-world-s-populous-country-seven-years.html

Silpa K, Yao L, Bhada-Tata P, Van Woerden F (2018) What a Waste 2.0: a global snapshot of solid waste management to 2050. Urban Development Series. Washington, DC: World Bank. https://doi.org/10.1596/978-1-4648-1329-0

Tiseo I (2020) Global population and municipal solid waste generation shares in 2018, by select country. Retrieved on February 25, 2022. https://www.statista.com/statistics/1026652/population-share-msw-generation-by-select-country/

Worrell W, Vesilind P, Ludwig Chr (2017) Solid waste engineering - a global perspective, 3rd edition, CENGAGE Learning. 499pp (ISBN: 978–1–305–67465–3)

Schwartz M, Lenzini G, Geng Y, Rønne P, Ryan P, Lagerwall J (2018) Cholesteric liquid crystal shells as enabling material for information-rich design and architecture. Adv Mater 30:1707382

Lu W, Chen J (2022) Computer vision for solid waste sorting: a critical review of academic research. Waste Manage 142:29–43

Patil A, Tarik M, Struis R, Ludwig C (2021) Exploiting end-of-life lamps fluorescent powder e-waste as a secondary resource for critical rare earth metals. Resour Conserv Recycl 164:105153. https://doi.org/10.1016/j.resconrec.2020.105153

Balde C (2014). E-waste monitor. https://doi.org/10.1007/s00705-012-1479-4

Patil A, Struis R, Testino A, Ludwig C (2021) Extraction of rare earth metals: the new thermodynamic considerations toward process hydrometallurgy. The Minerals, Metals & Minerals Society. G. Azimi et al. (eds.), Rare metal technology, the minerals, metals & materials series. https://doi.org/10.1007/978-3-030-65489-4_19

Yang Y, Walton A, Sheridan R et al (2017) REE Recovery from end-of-life NdFeB permanent magnet scrap: a critical review. J Sustain Metall 3:122–149. https://doi.org/10.1007/s40831-016-0090-4

Jowitt SM, Werner TT, Weng Z, Mudd GM (2018) Recycling of the rare earth elements, Current Opinion in Green and Sustainable. Chemistry 13:1–7. https://doi.org/10.1016/j.cogsc.2018.02.008

Schulze R, Buchert M (2016) Estimates of global REE recycling potentials from NdFeB magnet material. Resour Conserv Recycl 113:12–27. https://doi.org/10.1016/j.resconrec.2016.05.004

Patil A, Struis R, Schuler A, Ludwig C (2019) Method for individual rare earth metals recycling from fluorescent powder e-wastes. Patent application: WO2019201582A1. https://worldwide.espacenet.com/patent/search/family/062027866/publication/WO2019201582A1?q=pn%3DWO2019201582A1

Patil A, Struis R, Schuler A, Tarik M, Krebs A, Larsen W, Ludwig C (2019) Rare earth metals recycling from e-wastes: strategy and perspective. In Sonia Valdivia; Christian Ludwig (Eds), Progress Towards the Resource Revolution. World Resources Forum, Switzerland, Villigen PSI, pp. 162–164.

Qiu Y, Suh S (2019) Economic feasibility of recycling rare earth oxides from end-of-life lighting technologies. Resour Conserv Recycl 150:104432

Onstad E (2022) GRAPHIC-Rare earth prices set to keep on the boil after sharp rally. Retrieved on February 25, 2022. https://www.reuters.com/article/rareearths-prices/graphic-rare-earth-prices-set-to-keep-on-the-boil-after-sharp-rally-idUKL8N2UE6S1

Oberle B, Bringezu S, Hatfield-Dodds S, Hellweg S, Schandl H, Clement J, Cabernard L, Che N, Chen D, Droz-Georget H, Ekins P, Fischer-Kowalski M, Flörke M, Frank S, Froemelt A, Geschke A, Haupt M, Havlik P, Hüfner R, Lenzen M, Lieber M, Liu B, Lu Y, Lutter S, Mehr J, Miatto A, Newth D, Oberschelp C, Obersteiner M, Pfister S, Piccoli E, Schaldach R, Schüngel J, Sonderegger T, Sudheshwar A, Tanikawa H, van der Voet E, Walker C, West J, Wang Z, Zhu B (2019) Global Resources Outlook 2019: natural resources for the future we want. A Report of the International Resource Panel. United Nations Environment Programme. Nairobi, Kenya. IRP. https://www.resourcepanel.org/reports/global-resources-outlook

Responsible Mining Foundation (RMF) (2020) RMI Report 2020. https://2020.responsibleminingindex.org/resources/RMI_Report_2020-Summary_EN.pdf

Lifton J (2021) Before we can climb out from the Chinese control of rare earths and battery materials – we must understand our past. Retrieved on February 25, 2022, from https://investorintel.com/markets/technology-metals/technology-metals-intel/before-we-can-climb-out-from-the-chinese-control-of-rare-earths-and-battery-materials-we-must-understand-the-past/

https://catalysts.basf.com/files/pdf/BF-10655_Materials-Matrix-100220.pdf. Retrieved on February 25, 2022

Hana A, Gea J, Lei Y (2016) Vertical vs. horizontal integration: game analysis for the rare earth industrial integration in China. Resour Policy 50:149–159

Curtis N (2010) Rare earths, we can touch them everyday. In: Lynas Presentation at the JP Morgan Australia Corporate Access Days, New York, 27–28 September 2010. Retrieved on February 25, 2022, from https://www.asx.com.au/asxpdf/20100927/pdf/31sqqzmv0ng1tb.pdf

Hool A, Schrijvers D, van Nielen S, Clifton A, Ganzeboom S, Hagelueken C, Harada Y, Kim H, Ku A, Meese‑Marktschefel J, Nemoto T (2022) How companies improve critical raw material circularity: 5 use cases Findings from the International Round Table on Materials Criticality. Miner Econ 35:325–335. https://doi.org/10.1007/s13563-022-00315-5

Acknowledgements

The authors acknowledge the Swiss Federal Office for the Environment (FOEN) for having co-financed the present work (project no.: UTF-1011-05300).

Funding

Open Access funding provided by Lib4RI – Library for the Research Institutes within the ETH Domain: Eawag, Empa, PSI & WSL.

Author information

Authors and Affiliations

Contributions

The authors have equally contributed to all the aspects of this opinion paper.

Corresponding authors

Ethics declarations

Conflict of Interest

The authors declare no competing interests.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Patil, A.B., Struis, R.P.W.J. & Ludwig, C. Opportunities in Critical Rare Earth Metal Recycling Value Chains for Economic Growth with Sustainable Technological Innovations. Circ.Econ.Sust. 3, 1127–1140 (2023). https://doi.org/10.1007/s43615-022-00204-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s43615-022-00204-7