Abstract

This study investigates the spillover effects of the U.S. monetary policy to monetary policy in inflation-targeting (IT) countries. We used the PVAR model of a panel consisting of 80 countries, with different income levels, from January 1990 to December 2019. The main finding is that the level of economic development matters for the transmission of U.S. monetary policy shocks. The shocks are transmitted to high-income countries, whereas the results for other countries are either inconclusive (middle-income countries) or not available (low-income countries). For high-income countries, following the interest rates of major global financial centers can be a way to reduce volatility and uncertainty. Unlike less developed countries, which need to adopt stricter monetary policies and have a greater need for the interest rate to act on domestic conditions in order to convince economic agents of meeting the inflation target.

Similar content being viewed by others

Data availability

The data that supports the findings of this study are available from the corresponding author upon request. The data used in this research can also be found in International Financial Statistics (https://data.imf.org/?sk=4c514d48-b6ba-49ed-8ab9-52b0c1a0179b&sid=1390030341854) and Cboe Global Markets (https://www.cboe.com/).

Notes

The main financial centers include the United States, Euro Area, Japan and United Kingdom.

In this paper, we utilize the Treasury Bill’s interest rate.

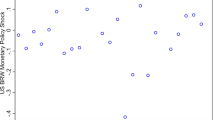

The correlation coefficients presented were calculated by the authors.

This classification is used to encompass countries with a floating exchange rate regime, but some of them will probably not have a pure floating exchange rate regime; Obstfeld (2015) also used this classification.

Informally, among the Latin American countries, Chile was the first to adopt the IT, in 1990 (Fonseca et al. 2016).

See Table A4 in the Online Appendix.

Edwards (2015).

For further details, see Table A6 in the Online Appendix.

Chile, Colombia, Dominican Republic, Guatemala, Indonesia, India, Korea, Norway, Paraguay, Peru and Uruguay. Japan and the United Kingdom are also countries that adopt IT, but they were removed from the calculation, given that they are large financial centers, and therefore were used in the calculation of the average of the main financial centers worldwide.

The global monetary shock (average interest rate of the main financial centers: USA, Japan, Euro Area and UK) was also calculated—see results in Figs. 1a and 2a, in the appendix. In order to analyze the response to the global monetary shock, the group of countries with fixed exchange rates totaled twenty countries.

US interest rate increase.

There were not enough data to estimate the results for different low-income groups and countries.

References

Abrigo MRM, Love I (2016) Estimation of vector autoregression panel in Stata. Stand Genomic Sci 16:778–804. https://doi.org/10.1177/1536867X1601600314

Adrian T, Shin HS (2014) Procyclical leverage and value-at-risk. Rev Financ Stud 27:373–440. https://doi.org/10.1093/rfs/hht068

Ahmed S, Zlate A (2014) Capital flows to emerging market economies: A brave new world? J Int Money Finance 48:221–248. https://doi.org/10.1016/j.jimonfin.2014.05.015

Aizenman J, Chinn MD, Ito H (2013) The “Impossible trinity” hypothesis in an era of global imbalances: measurement and testing. Rev Int Econ 21:447–458. https://doi.org/10.1111/roie.12047

Aizenman J, Chinn MD, Ito H (2016) Monetary policy spillovers and the trilemma in the new normal: periphery country sensitivity to core country conditions. J Int Money Finance 68:298–330. https://doi.org/10.1016/j.jimonfin.2016.02.008

Andrews DWK, Lu B (2001) Consistent model and moment selection procedures for GMM estimation with application to dynamic panel data models. J Econom 101:123–164. https://doi.org/10.1016/S0304-4076(00)00077-4

Arbatli-Saxegaard EC, Davide Furceri P, Domínguez JDO, Shanaka P (2024) Spillovers from US monetary policy: role of policy drivers and cyclical conditions. J Int Money Finance. https://doi.org/10.1016/j.jimonfin.2024.103053

Arellano M, Bover O (1995) Another look at the instrumental variable estimation of error-components models. J Econom 68:29–51. https://doi.org/10.1016/0304-4076(94)01642-D

BACEN. Available at: https://www.bcb.gov.br/controleinflacao/metainflacao. Access date: 10/03/2020

Bergant K, Grigoli F, Hansen N, Sandri D (2023) Dampening global financial shocks: Can macroprudential regulation help (more than capital controls)? J Money Credit Bank. https://doi.org/10.1111/jmcb.13089

Borio C, Zhu H (2012) Capital regulation, risk-taking, and monetary policy: A missing link in the transmission mechanism? J Financ Stabil 8:236–251. https://doi.org/10.1016/j.jfs.2011.12.003

Breitenlechner M, Georgiadis G, Schumann B (2022) What goes around comes around: How large are spillbacks from US monetary policy? J Monet Econ 131:45–60. https://doi.org/10.1016/j.jmoneco.2022.07.001

Bruno V, Shin HS (2015) Capital flows and the risk-taking channel of monetary policy. J Monetary Econ 71:119–132. https://doi.org/10.1016/j.jmoneco.2014.11.011

Chinn MD, Hiro I (2006) What matters for financial development? Capital controls, institutions, and interactions. J Dev Econ 81:163–192. https://doi.org/10.1016/j.jdeveco.2005.05.010

Devereux MB, Young ER, Yu C (2013) Capital controls and monetary policy in sudden-stop economies. J Monetary Econ 103:52–74. https://doi.org/10.1016/j.jmoneco.2018.07.016

Edwards S (2015) Monetary policy independence under flexible Exchange rates: An illusion? World Econ. https://doi.org/10.1111/twec.12262

Fonseca MR, Peres SC, Araújo EC (2016) Inflation targeting regime: comparative analysis and empirical evidence. Rev Econ Contemp 20:113–143. https://doi.org/10.1590/198055272015

Frankel J, Schmukler SL, Servén L (2004) Global transmission of interest rates: monetary independence and currency regime. J Int Money Finance 23:701–733. https://doi.org/10.1016/j.jimonfin.2004.03.006

Gülsen E, Ozmen E (2020) Monetary policy trilemma, inflation targeting, and global financial crisis. Int J Financ Econ 25:286–296. https://doi.org/10.1002/ijfe.1752

Ha J, Kose MA, Otrok C, Prasad ES (2020) Global macro-financial cycles and spillovers. NBER working paper no. 26798

Hammond G (2012) State of the art of inflation targeting, edn 4, no 29. Handbooks, Centre for Central Banking Studies, Bank of England

Iacoviello M, Navarro G (2019) Foreign effects of higher US interest rates. J. Int. Money Finance 95:232–250. https://doi.org/10.1016/j.jimonfin.2018.06.012

Ilzetzki E, Reinhart CM, Rogoff KS (2019) Exchange arrangements entering the twenty-first century: Which anchor will hold? Q J Econ 134:599–646. https://doi.org/10.1093/qje/qjy033

Kalemli-Özcan Ṣ (2019) US Monetary policy and international risk spillovers. NBER working paper 26297. http://www.nber.org/papers/w26297

Klein MW, Shambaugh JC (2015) Rounding the corners of the policy trilemma: sources of monetary policy autonomy. Am Econ J Macroecon 7(4):33–66. https://doi.org/10.1257/mac.20130237

Kliem M, Meyer-Gohde A (2021) (Un)expected monetary policy shocks and term awards. J Appl Econom 37:1–23. https://doi.org/10.1002/jae.2872

Love I, Zicchino L (2006) Financial development and dynamic investment behavior: evidence from panel VAR. Q Rev Econ Finance 46:190–210. https://doi.org/10.1016/j.qref.2005.11.007

Miniane J, Rogers JH (2007) Capital controls and the international transmission of U.S. money shocks. J Money Credit Bank 39:1003–1035. https://doi.org/10.1111/j.1538-4616.2007.00056.x

Modenesi AM (2005) Monetary regimes: theory and real experience. Editora Manole Ltda, Barueri, SP

Nave JM, Ruiz J (2015) Risk aversion and monetary policy in a global context. J Financ Stabil 20:14–35. https://doi.org/10.1016/j.jfs.2015.06.001

Nelson E (2020) The continuing validity of monetary policy autonomy under floating exchanges rates. Int J Cent Bank. https://doi.org/10.17016/FEDS.2017.112

Obstfeld M (2015) Trilemmas and trade-offs: living with financial globalization. Bis working paper, no 480. Available at SSRN: https://ssrn.com/abstract=2552572

Pang K (2013) Financial integration, nominal rigidity and monetary policy. Int Rev Econ Financ 25:75–90. https://doi.org/10.1016/j.iref.2012.05.005

Rey H (2015) Dilemma, not trilemma: the global financial cycle and monetary policy independence. National Bureau of Economic Research, Cambridge, Working paper 21162

Roger S (2010) Inflation targeting turns 20. Finance Dev 47

Rohit AK, Dash P (2019) Dynamics of monetary policy spillover: the role of exchange rate regimes. Econ Model 77:276–288. https://doi.org/10.1016/j.econmod.2018.09.007

Shambaugh JC (2004) The effect of fixed exchange rates on monetary policy. Q J Econ 119:301–352. https://doi.org/10.1162/003355304772839605

Sims CA (1980) Macroeconomics and reality. Econometrics 48:1–48. https://doi.org/10.2307/1912017

Vindondoa A (2019) Monetary news in the United States and business cycles in emerging economies. J Int Econ 117:79–90. https://doi.org/10.1016/j.jinteco.2018.12.002

Funding

This work was supported by the Minas Gerais State Research Support Foundation (FAPEMIG) and the National Council for Scientific and Technological Development (CNPQ).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors have no relevant financial or non-financial interests to disclose.

Supplementary Information

Below is the link to the electronic supplementary material.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

de Sá Farias, E., de Mattos, L.B. & Ferreira, D.M. Spillover effects: Does the inflation targeting system matter?. SN Bus Econ 4, 66 (2024). https://doi.org/10.1007/s43546-024-00662-1

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s43546-024-00662-1