Abstract

Various studies have shown that green buildings trade at a premium, with estimates of it ranging widely from low single-digits up to 26% for sales values and up to 21% for rents. There is, however, little quantified evidence of why people are willing to pay more for sustainable housing. We investigate the green premium for MINERGIE-certified residential properties in the Canton and City of Zurich, which have among the highest densities of certified green buildings worldwide. Using a comprehensive data set of 17,743 condominiums for sale and 50,075 apartments for rent, we show that the premium can be decomposed and associated with various benefits for owners and tenants. The overall green premia in the canton amount to 2.45% and in the city to 4.91%. From these total premia, 6% (city: insignificant) are attributed to energy savings, 71% (city: 70%) to increased comfort, and 23% (city: 33%) to making the building future proof against regulators and market participants.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

The trend toward green buildings in Switzerland started more than 20 years ago and has accelerated recently, as people have become more aware of the benefits associated with green buildings. In addition, the topic of energy efficiency has moved to the top of the priority list on the political agenda (Swiss Federal Council 2016). This development raises the questions of whether people attach a financial value to green buildings, and if so, what benefits buyers or renters are willing to pay for. Several studies in Europe and the US identify a price premium—let us call it the green premium—for green buildings over conventional buildings.Footnote 1 Further studies examine the determinants of green premia, that is, why tenants and landlords pay extra for sustainable housing. Most obviously, homeowners value the expected future cost savings generated by energy efficiency. Several authors have documented the incentive effects of higher energy prices on the demand for energy-efficient technologies; see, for example, Hausman (1979), Klier and Linn (2008), and Beresteanu and Li (2011). However, we argue that more moderate utility bills alone do not explain the demand for green properties and the premia paid. Thus, our research focuses on the question of how the green premium of the residential property market in the Canton of Zurich decomposes into further value-driving parts. Based on the existing literature and surveys on the topic, we state the hypothesis that besides the reduction in energy cost, people value mainly the increase in living comfort and the general expectation that green buildings are future proof against increasing regulatory requirements and the sensible market demand for quality.

As it is our main goal in this study to understand and quantify the principal value-driving parts that contribute to the green premium, we build on the following take-aways from the existing literature. In summary, the existing literature observes a significant price premium for green buildings and follows various interpretations to justify this premium. The interpretations comprise three general benefits that seem to influence the willingness to pay (WTP) of renters and buyers. In line with the findings of the existing literature, MINERGIE (2019a) promises the following three green benefits to customers:

-

(i)

higher energy efficiency: Expected future energy savings (more generally, lower running costs) are an apparent reason for a price premium. However, the literature finds that energy savings alone do not justify the entire premium observed in the market.

-

(ii)

better quality and comfort: Living quality including an improved indoor climate seems to have a considerable impact on tenants’ and owner-occupiers’ perception and WTP for green apartments.

-

(iii)

enhanced conservation of value: Future-proofing a building is an important source of a green premium. In an environment in which building codes are getting stricter and tenants more demanding, a green building certification enhances the chance of the property remaining in the market for longer. For investors, this implies better resale ability and slower debasement, or generally lower financial risk.

The price effects of each of these three aspects are not found directly in the data per se. Hence, we use proxies to measure them. First, we take “rent extras” as a measurable proxy for energy efficiency, as they consist mainly of costs for heating and warm water. Second, we assume that both a tenant and an owner-occupier are willing to pay extra for higher quality and comfort, as offered by a MINERGIE apartment, and for the positive feeling of living green. We interpret the premium in rents, adjusted for the energy cost saving effect, as a proxy for tenants’ and owner-occupiers’ environmental awareness and higher quality and comfort of living. Third, enhanced conservation of value is connected to longer building life cycles with more stable cash flows. This increased conservation of value is reflected in lower cap rates and, thus, higher sales prices.

To isolate green premia into these three main value-driving parts, we analyze the rent and sales market separately in our data; in the last step, we then combine both markets.

Methodologywise, this study employs hedonic pricing models (revealed preferences method) to break down the green premium. This allows us to investigate and quantify the main green building benefits that contribute to the green premium as described above. Up to now, no study has decomposed the green premium into quantifiable parts by using hedonic pricing models to explain the premia observed in the market.

Our empirical analysis, for the first time, looks at a differentiated rationale for renters’ and owners’ WTP for certified green properties, drawing on a set of comprehensive data collected from the property market of the Canton of Zurich. This market is a practical playground to examine the premia for green properties. Zurich has the largest number of certified green buildings in Switzerland and one of the highest densities of energy-efficient buildings in the world. In 2017, roughly 40% of newly constructed residential buildings (single- and multi-family houses) in the canton received certification of the Swiss green building standard MINERGIEFootnote 2 (MNG).

We use data from 17,743 condominiums and 50,075 apartments for rent from the leading internet platform in Switzerland, namely homegate.ch,Footnote 3 which together represent a market share of over 10% of the total existing dwellings stock (without single-family homes) in the Canton of Zurich in 2017 (FSO 2019c). We complement the set of nine property-specific attributes with two locational variables based on individual addresses, as well as a dummy variable for the MINERGIE certification. Using a hedonic model, we estimate the green premium for rental apartments and condominiums for the period from 2010 to 2017. The analysis of these two distinct residential property types allows us to estimate the market-implied value for the various benefits of green buildings. Alongside the Canton of Zurich, we also analyze the subsample for the City of Zurich, with its even more homogenous data.

Looking at our findings, we see an overall MINERGIE price premium for the Canton (and City) of Zurich of 2.45% (city: 4.91%) and divide it into three value-driving parts. First, we find that (i) lower energy costs through fewer extras account for \(6.5\%\) (city: insignificant) of the whole premium. Second, our analysis shows that residents are willing to pay more for (ii) higher quality and comfort. This markup explains 70.41% (city: 69.53%) of the total premium. Investors receive higher net rents resulting from tenants’ willingness to pay extra for better comfort and out of the awareness for living sustainably. Finally, there is an additional owners’ WTP of about 23.3% (city: 32.78%) of the total green premium, which we associate with the conservation of value. Better building materials and longer life cycles of MINERGIE buildings decrease lessors’ cap rates and hence increase their property value.

The study is structured as follows: The literature section reviews and summarizes studies related to this work, followed by a description of the MINERGIE standard. Within this section the MINERGIE standard is compared to two of the most popular international green building labels, namely, LEED and BREEAM, to place it in an international context. The next sections outline the theoretical arguments, premises and methodology (hedonic regressions) to decompose the green premium. After a description of the data set, we discuss the variables used in the analysis and some descriptive statistics. Finally, we present the estimation results, and conclude by discussing our findings.

Literature

The national and international literature on green price and rent premiums show statistically significant positive premiums on rents and prices of around 2% to 26% in the residential and commercial sector. Although there is a consensus of statistically significant positive mark-ups for certified buildings in the literature, the magnitude of the identified premiums varies considerably. Additionally, according to the reviewed literature, the premium for sales prices is larger than that for rents.

A review of the current Swiss literature regarding financial implications of MINERGIE buildings reveals the following. Several studiesFootnote 4 show positive and statistically significant price and rent premia of up to 10% of that of conventional residential buildings. Moreover, these green premia seem to shrink over time, as conventional building standards are raised and continue to converge to MINERGIE requirements. Salvi et al. (2010) conclude that an up to 10% higher net rent for a MINERGIE certification, ceteris paribus, would partially compensate for the cost surplus of the construction, according to the MINERGIE standard, such as that from higher material costs and certification costs. According to MINERGIE the additional costs of implementing the basic MINERGIE standard should not exceed a 10% markup on conventional buildings.

The Center for Corporate Responsibility and Sustainability (CCRS) of the University of Zurich analyzes the economics of green buildings in Switzerland. Based on a sample of 9,000 real property transactions in the Canton of Zurich from 1998 to 2008, of which 250 are certified green buildings, a hedonic regression reveals a price premium of 7% for single-family houses and 3.5% for apartments (Salvi et al. 2008). A further study by CCRS published 2 years later focuses on rent premia for green buildings (Salvi et al. 2010). The authors find that the net rent of MINERGIE-certified apartments is 6% higher for Switzerland and 6.2% higher for the Canton of Zurich compared to conventional buildings.

A more recent Swiss study by Kempf et al. (2016) shows that commercial buildings in Switzerland exhibit, on average, 24% higher sales prices than non-certified office spaces, a 17% markup on rents paid, and about 2% increased occupancy. In the commercial sector, Kempf et al. (2016) and Schuster and Füss (2016) find sales and rent premia of well above 10% in Switzerland. Apparently, the commercial sector rewards building green more than the residential sector does, and these results confirm those of earlier international studies.

Most international studies focus on the green premium of office buildings, since LEED and BREEAM rarely apply to residential housing.

Miller et al. (2008) estimate the green premium of US office buildings based on LEED and Energy Star certifications up to early 2008. They find an average premium of 5.8% and 9.9% for Energy Star- and LEED-certified offices, respectively. Referring to the study of Kats et al. (2003), they find that corresponding additional construction costs are only between 0.6% and 6.8%, depending on the level of certification. The comparison of these ranges shows there is a considerable net premium in favor of green buildings. However, the results need to be treated with care, as the market premia may include other benefits, such as contemporary architecture for the typically new green buildings that attract investors and tenants.

Deng et al. (2012) estimate the green premium of Singaporean residential properties that are Green Mark-certified during 2000–2010 and find a statistically significant green transaction price premium of 4%, based on a regression analysis that adjusts for quality and isolates the green certification.

Chegut et al. (2011) investigate BREEAM-rated office buildings in London and find a price premium of 21% for rental and 26% for sales transaction prices. The authors note that controlling for building quality should moderate the premium.

Holtermans and Kok (2017) track panel rent data over time. They show that certified office buildings have, on average, moderately higher rental, occupancy, and pricing levels than non-certified buildings do. The authors find up to about 15% higher transaction prices and 5% higher effective rents for labeled offices. In addition, the authors report that water efficiency, materials and resources, and sustainable sites have the largest effects on effective rent levels in LEED-certified office buildings.

A meta-analysis by Fuerst and Dalton (2019) examines 42 international studies that look at the relationship between environmental sustainability and property rents and prices in commercial and residential markets. The average rental premium is estimated at 6.02%, and the sales premium at 7.61%. Although both estimates are highly significant, the analyses show considerable statistical heterogeneity among the studies considered.

I.e., international studies observe a significant green premium for certified buildings, but the extent of the premium varies considerably. Typically, the premium for sales prices is higher than that for rents. Table 2 provides an overview.

The variation of the estimated green premium between the studies can be explained in part by different climatic conditions of the region under investigation, but also by different methods and controls for other quality attributes. Hence, it is not meaningful to compare green premia internationally, and this conclusion is supported by the vast difference between the applied certification standards in various countries. However, all studies find that green buildings trade at a statistically significant premium.

Apart from claiming existence, the reviewed literature commonly indicates that a green premium generally exceeds the energy savings of green buildings. For instance, Eichholtz et al. (2013) analyze green office buildings in the US during 2007–2009. The sample includes 1,943 and 744 rental and sales values of green buildings, respectively. Energy Star- or LEED-rated buildings yield an estimated 11% to 13% higher sales prices and 5% to 7% higher effective rents. Moreover, Eichholtz et al. (2013) find that rental and asset value premia vary with the different measures and scores of LEED and Energy Star labels. The authors also note that energy efficiency is fully capitalized into rents and asset values, and that other sustainability scores add complementary value.

Besides energy efficiency, the market rewards further dimensions of sustainable buildings. In Switzerland, Marty et al. (2016), Marty and Meins (2017), and Feige et al. (2013), for instance, examine whether and to what extent the valuation of real estate depends on different sustainability attributes, besides classical value-driving characteristics, such as location, size, and age. Marty et al. (2016) analyze rental rates based on the following five so-called Economic Sustainability Indicators (ESIs): 1. flexibility and polyvalence, 2. resource consumption and greenhouse gases, 3. location and mobility, 4. safety and security, and 5. health and comfort. Their analysis shows that all criteria except flexibility and polyvalence have a positive impact on rental rates. Furthermore, they find that MINERGIE-label requirements in the proper sense (i.e., high energy efficiency and comfort ventilation) impact rental rates, albeit not significantly. Their findings contradict the existence of rent premia, as found in earlier studies, which, however, do not distinguish between different dimensions of sustainability.

In a more recent study, Marty and Meins (2017) find a significant positive effect of health and comfort (i.e., inside air quality, low noise exposure, and sufficient natural light). By contrast, thermal heat usage shows a significant negative impact on net rental income.

Feige et al. (2013) studied sustainability dimensions of rental prices in Switzerland based on a similar framework to that of Marty et al. (2016) and Marty and Meins (2017), finding statistically significant positive price effects for building characteristics that enhance water efficiency, health and comfort level, and the building’s safety and security. Surprisingly, Feige et al. (2013) find a negative association between energy efficiency ratings and rental prices, which again contradicts the undifferentiated rent premia found in the studies listed in Table 2.

Therefore, the Swiss studies of Marty et al. (2016), Marty and Meins (2017), and Feige et al. (2013) show that sustainability dimensions can impact rents differently. Our study aims to reveal how and to what extent measurable sustainability dimensions affect rents and sale prices. For this purpose, we do not define or evaluate sustainability dimensions by a rating system, as in the work of Marty et al. (2016), Marty and Meins (2017), and Feige et al. (2013). Instead, we determine sustainability dimensions by employing a theoretical and empirical framework, directly out of the data at hand.

Besides energy savings, some studies conjecture that the premium potentially is related to making the building future proof, and to the increased comfort including the appreciation of living green. Some studies also compare the premium to the additional construction costs of green buildings. For instance, a study by Wegner et al. (2010) at the University of Applied Sciences Northwestern Switzerland finds that energy savings do not fully compensate for the additional construction costs of a green building; only about one-third of the additional costs can be recovered. However, energy savings represent just a fraction of the market premium paid for green properties. Moreover, the construction costs are sunk costs that are not compensated for in the market. Only the actual benefits of a green building increase the WTP, regardless of how much was paid for construction.

Another stream of research investigates the benefits of green buildings with regard to a better indoor climate. The studies refer to indoor climate in terms of temperature, air quality and ventilation, pollutants and contaminants, illumination and daylight, and noise. An improved indoor climate is generally associated with lower sickness rates and higher productivity in office buildings and better living quality in residential properties.

Fisk (2000) and Fisk and Rosenfeld (1998) find evidence in the US office sector that technology and design of green buildings can improve indoor environments in a manner that increases health and productivity. Seppanen and Fisk (2006) develop models to quantify the effects of indoor environmental quality based on available studies and evidence. They find that air ventilation, air quality, and temperature have significant impacts on health and productivity. Miller et al. (2009) show that improved indoor climate increases productivity on average, based on a survey of over 500 tenants that moved to LEED- or Energy Star-rated buildings.

Based on a further survey, Brown et al. (2010) explore the relationship between green buildings, occupants’ improved comfort, health, and productivity. They find that, on average, respondents perceive comfort to be 36% higher in green buildings, mainly because of improved lighting and air quality. Furthermore, health, wellbeing, and productivity are rated considerably higher in green buildings.

Kats et al. (2003) provide a comprehensive report that small increases in upfront costs of about 2% to support green design result in life cycle savings of 20% of total construction costs, which is equal to more than 10 times the initial investment. The study emphasizes that health and productivity improvements owing to better indoor climate, alongside energy savings, are the main benefits of green buildings. Similarly, MINERGIE emphasizes the improved comfort of users living or working in certified buildings, made possible by high-grade building envelopes and the continuous renewal of air. However, while energy savings are measurable and hence, fairly predictable, comfort, health, environmental consciousness and productivity gains are much less precisely understood and far more difficult to predict with accuracy. For example, Xie et al. (2017) and Mandell and Wilhelmsson (2011) show that residents’ environmental awareness impacts the premium they are willing to pay for sustainable housing.

Besides higher rents, Miller et al. (2008), Fuerst and McAllister (2011a), McGrath (2013), and LaSalle (2017) state that green buildings may exhibit a lower risk premium because of, for instance, lower vacancies and better protection against regulatory risks compared to conventional buildings. These lower risk premia increase the valuation of green buildings through lower cap rates and lead to enhanced conservation of value (iii). For instance, Fuerst and McAllister (2011b) suggest that for commercial buildings in the US, additional occupier benefits, lower holding costs for investors, and a lower risk premium are the main drivers of a green premium. They find that LEED- and Energy Star-certified buildings achieve an average rental premium of 4% to 5% and a price premium of 25% to 26%. The authors note that the level of certification corresponds to the level of the premium.

Further studies explore the determinants of green premia to answer the question why and for what parts tenants and landlords pay for green buildings. They do this by using questionnaires or experiments, that is, stated preferences methods. The studies of He et al. (2019) and Zhang et al. (2018) use questionnaires to reveal potential owners’ and construction practitioners’ WTP for green housing attributes. Robinson et al. (2016) conduct an online survey to reveal the stated WTP of office tenants, and Jang et al. (2018) examine the potential tenants’ willingness to rent for commercial and residential space by a vignette-based experiment. A study by Robinson et al. (2017) analyzes the bundle of attributes contained in LEED and Energy Star buildings using semi-univariate and multivariate regressions.

Building on the findings of the cited papers our study assembles a new data set and employs a theoretical framework together with quantitative methods, specifically hedonic pricing models (revealed preferences) to break down the green premium. To the best of the authors’ knowledge, this is the first study that decomposes the green premium by this theoretical and quantitative methodology, breaking it into three dimensions: (i) energy savings, (ii) comfort and quality, and (iii) conservation of value (cf. Table 2).

MINERGIE

Internationally, energy-efficient construction and green building certification are on the rise. In Switzerland, the sustainability brand MINERGIE is the predominant standard for energy-efficient buildings. The MINERGIE certification body verifies that the standards’ criteria are met.

According to MINERGIE (2014), prerequisites for basic certification include a well-insulated building envelope, a controlled air ventilation system (MINERGIEs comfort ventilation), reduced energy consumption compared to conventional buildings of at least 25%, reduced fossil energy consumption of at least 50% compared to conventional buildings, and additional construction cost limited to 10% of that of an average conventional building. In addition, built estates should be at least as disposable as their non-labeled counterparts. Congruent to our proposed decomposition of the green premium, stemming from findings in the literature, MINERGIE (2019b) emphasizes that its benefits comprise three main parts: more comfort, lower running costs, and better protection of value than a conventional building.

First, an advantage of a MINERGIE-certified building is the living and working comfort of its dwellers, including both indoor comfort and awareness and appreciation of living green. The high-quality building envelope and systematic ventilation enable this convenience. Second, reduced energy consumption benefits the owners’ or tenants’ pockets; through energy-savings over time it is possible to compensate for additional costs of better construction quality. Third, the use of higher-quality materials influences the medium- to long-term value of a property and its lifespan.

Since its launch, the MINERGIEFootnote 5 label has been successful. Most certified properties belong to residential owner-occupiers and private owners of residential multi-family buildings. As of April 2019, there were 51,058 certified buildings, of which 83% were residential properties. Of the 17% non-residential units, about 38% were administration offices, 17% retail outlets, and 16% schools. For a detailed overview, see Appendix I. Because of the dominating share of residential buildings, our analysis focuses on this segment.

The Canton of Zurich experiences an over-proportional number of MINERGIE certifications and hence, an even higher green building density than Switzerland as a whole. Salvi and Syz (2011) describe the heterogeneous spatial distribution of green buildings in Switzerland as varying considerably between Swiss municipalities for various reasons, such as differences in income levels and cultural factors. Within Switzerland, the Canton of Zurich, being a highly homogeneous property market, stands out by boasting 9,989 or one out of four certified buildings in Switzerland, including 5,220 apartment buildings and 3,268 single-family homes. Hence, it offers a rare natural experiment to examine the variations of the green premium based on a consistent sample.

Figure 1 shows the rapid growth of the number of MINERGIE-certified residential (and other) buildings in the Canton of Zurich since 2010. However, only about 4.5% of the existing building stock has been certified so far (FSO 2019b; Statistical Office Kanton Zurich 2018). Nevertheless, the density of green buildings in the Canton of Zurich is arguably among the highest in the world.

The two most common and internationally leading labels are LEED, from the US, and BREEAM, from the UK. There are many other labels, such as that of the German Association for Sustainable Construction, Green Star from Australia, Green Mark from Singapore, and CASBEE from Japan. Most of the labels are exclusively applied domestically.

LEED was founded in 1998, the same year as MINERGIE. According to USGBC (2020), there were roughly 30,690 LEED certifications in the US by the end of 2017. LEED is mainly applied to commercial buildings. Comparing the certifications to an estimated stock of 5.6 million commercial buildings in the US in 2012 gives a green building share of about 0.55%. Fuerst et al. (2014) conclude that despite high growth rates, LEED-certified buildings make up a small portion (on average less than 1%) of total commercial stock. LEED bases its certification on a credit point system for various attributes of buildings, such as efficient use of resources, green design, and green building material. The US Green Building Council emphasizes the financial benefits of green buildings owing to higher occupancy and lower holding costs than conventional buildings.

Similarly, the BREEAM certification system is based on credit points for various aspects of a property. BREEAM was founded in 1990 and has more than 500,000 certified buildings in more than 80 countries by now (BREEAM 2020). BREEAM applies to both residential and commercial buildings. In the UK, 4,188 buildings (renovations and new constructions) were BREEAM certified in 2017 (RICS 2017). The certified buildings correspond to a tiny fraction of less than 0.02% of buildings in the UK, which by itself had more than 23 million homes in 2017 (National Statistics 2019).

Comparing the density of MINERGIE-certified buildings in the Canton of Zurich with those of LEED and BREEAM in their respective home countries reveals that the Swiss label exhibits roughly an 8 to 250 times higher density. For an overview see Table 1. In our view, MINERGIE is a role model for how a green building label penetrates an industrialized country successfully. Therefore, MINERGIE, represents an optimal research object to study and understand green dimensions for the future of the built environment.

The green premium decomposed

The following theoretical arguments and premises set the stage for the upcoming empirical analysis. We start by the decomposition of total rent into net rent and extras. In a next step, the price premium in the sales market is identified. Finally, we link the two markets through the capitalization rate (cap rate).

Decomposition of Total Rent into Net Rent and Extras

We start by examining the composition of rents in the rental market. Total rents (gross rents) are split into net rents and rent extras (gross rent = net rent + extras). KUB (2017) defines extras as costs that are paid for contractually agreed services of the lessor and are not included in the net rent yet. Examples of extras are, inter alia, costs for heating, warm water, elevator maintenance, sewage, cleaning, and gardening. According to Swiss law (Art. 257b OR), extras have to correspond to actual expenditure. In our study we use extras as a proxy for how efficiently a building is maintained and uses its resources. We can differentiate between extras, net, and gross rent within the data set at hand, as homegate.ch reports them separately. However, it should be noted that this is a simplification; in Switzerland, not all extras accrue to energy and heating costs but also include the aforementioned services and expenses. The economic and social situation of the population from the household budget surveyFootnote 6 shows that, on average, between 2010 and 2017, half of the total extras accrue to total energy costs (FSO 2019a). We assume non-energy extras, such as cleaning and gardening, do not differ on average for green and conventional buildings. This assumption is reasonable, because some of the cost-intense non-energy part of the extras are controlled for in the model: For instance, the existence of an elevator, which impacts extras significantly. Moreover, extras strongly correlate with the amount of living space and are typically higher in more luxurious flats–for example an attic apartment, which we also control for. Additionally, extras are highest in the more favorable micro-locations (see Public Transport Quality A–D in Appendix IV).

Thus, the whole variability between green and conventional extras is associated with energy costs.

We use the division of net rent and extras to analyze who benefits and to what extent from the green rental premium. Tenants, lessors, or both benefit from the fewer extras (i). In addition, tenants directly benefit from higher quality and comfort of living (ii) in a green apartment. Consequently, lessors benefit indirectly from this aspect through the tenants’ higher WTP (higher gross rents).

To ascribe the financial impact of the rent analysis to either the tenant or lessor, the following premises are adopted.

Premise a: We are in a lessors’ market, that is, housing demand exceeds housing supply. Therefore, a possible discount on MINERGIE extras (compared to conventional apartments) favors the lessor by increased net rents. The reason is that in a market with housing scarcity (i.e., there are more parties on the demand side than those on the supply side), the marginal tenant is willing to pay the same as or even more than the market rent for either MINERGIE- or non-labeled apartments, as he or she has no other choice, as lessors may increase the net rent by the amount of extras saved.Footnote 7 The Canton of Zurich has been a lessors’ market over the period under investigation, with vacancy rates between 0.56% and 0.90% (Statistical Office Canton of Zurich 2020).

Premise b: Besides savings through fewer extras, that is, lower energy consumption, tenants and owner-occupier have a higher WTP for the quality and comfort of living in a MINERGIE apartment. Therefore, the total net rent premium for MINERGIE is split into fewer (i) extras, which correspond to lower energy costs and higher (ii) total rent that embodies the enhanced quality and comfort of MINERGIE.

Following the line of argument under Premises a and b, the following holds. In a lessors’ market, lessors claim the total financial benefit of MINERGIE by means of increased net rents. The increased net rent is split into a surplus in gross rent owing to tenants’ higher WTP plus savings on extras. While investors gain financially in the lessors’ market, tenants do not benefit monetarily from living in a MINERGIE apartment. They are willing to pay higher gross rents out of appreciation for living green and for the additional comforts.

Estimating Price Premium in the Sales Market

We compare data of MINERGIE-certified condominiums with their non-certified counterpart in the sales market. This allows us to estimate a sales price premium for green housing that capitalizes the direct and indirect benefits to the lessor. The condominiums constitute a different real estate market to rental apartments, which we analyze for energy savings and the rent premium in (i) and (ii). Buyers of condominiums that they want to live in are often willing to pay extra for better materials and higher quality of the apartment’s equipment. In an ideal world, our methodology would be best applied to rents and selling prices of the same objects. However, with the data at hand and the peculiarities of real estate market structures, this is not feasible, because the same apartment is either used as a rental dwelling or sold as a condominium; identical objects are not rented out and sold at the same time.

Thus, we compare prices of labeled and non-labeled condominiums to estimate the green markup of buying a MINERGIE-certified condominium and eventually compare this price premium with what a tenant in a rental apartment pays. We assume that condominiums could also be rented out on market terms. According to Aydin et al. (2020) and Brounen and Kok (2011) an often mentioned methodological caveat in the literature on housing price and rent premia is omitted variable bias (OVB), that is, the potential bias from omitting, in our case, unobserved dwelling characteristics, which are correlated with green attributes. A typical remedy to ease OVB is to incorporate a detailed set of observable characteristics into the hedonic regression model. Our set of structural attributes of dwellings is what potential renters and buyers observe on homegate.ch, complemented with locational and time variables. Moreover, we only compare certified and non-certified buildings from the same construction era (see Discussion of Variables), to ensure that certification according to MINERGIE, with its prescribed heating systems, comfort ventilation, and building materials, is what distinguishes the treated from the control group in the sample regarding architectural aspects.

To bridge the gap between rents and sales prices, we use the cap rates approach. According to Fuerst and McAllister (2011a)Footnote 8 and RICS (2017), the value of an apartment can be expressed as the discounted sum of future net operating income (NOI) \(R_{t}-C_{t}\) or rental income (Gross Yield) \(R_{t}\), written as follows:

\(\Leftrightarrow\)

with

V is the current earnings value, which can be derived by discounting NOI or \(R_{t}-C_{t}\) by the net capitalization rate \(i_{net}\), or equivalently by discounting rental income or Gross Yield \(R_{t}\) by the gross capitalization rate \(i_{gross}\). Thus, operating costs and accruals \(C_{t}\) are either subtracted from rental income \(R_{t}\) in the numerator or considered in the denominator by an increased capitalization rate \(i_{gross}\) compared to \(i_{net}\). Furthermore, NOI or \(R_{t}\) is multiplied by a constant growth rate g. Here, Gross Yield corresponds to net rents or total rents minus extras. Thus, it is the cash flow that accrues to investors before the deduction of operating costs and accruals \(C_{t}\). These cash flow streams are discounted with \(i_{gross}\), which corrects for \(C_{t}\), and is called the gross target rate of return, which consists of the risk-free rate (r f) and a risk premium (RP). As the right to own a property is unlimited in time t, we can rewrite equation (3), where the Gross Yield is simply divided by Cap Rate:

Fuerst and McAllister (2011a) argue that green buildings may affect this valuation through different channels. As the analysis of rents shows, the owners of MINERGIE apartments seek higher net rents, which corresponds to \(R_{t}\) or Gross Yield, via fewer extra costs (i) and higher quality and comfort for its inhabitants (ii). Besides higher cash flows (or Gross Yield), Miller et al. (2008), Fuerst and McAllister (2011a), McGrath (2013), and LaSalle (2017) state that green buildings may exhibit a lower risk premium. McGrath (2013), Miller et al. (2008), and LaSalle (2017) find lower cap rates for green buildings of 36 bps, 55 bps, and 65 bps, respectively. The reasoning is that income streams are more stable (less volatile) owing to lower vacancy risks than those of conventional buildings. From a valuation perspective, additional risk-mitigating factors, such as higher conservation of value and protection against regulatory risks, may lower the risk premium of a green apartment and therefore, may explain higher prices through lower cap rates.

Following this line of argument, we assume the following in our cap rates approach:

Premise c: We assume lower cap rates for MINERGIE (MNG) apartments. The reason is that the risk premium (as part of the cap rate) is lower than that of conventional apartments. Our explanation of the lower risk premium is an enhanced conservation of value of MINERGIE apartments, that is, lower risks in general.

Under Premise c, we can derive the sales premium as follows:

where \(\frac{Gross~Yield_{MNG}}{Gross~Yield_{conv}}\) corresponds to the net rent premium and \(\frac{V_{MNG}}{V_{conv}}\) to the sales price premium found in our hedonic regressions for rent and sale in section Regression Results.

Finally, the delta in sales and net rents constitutes the residual component of the premia—the conservation of value—which benefits only the apartment owner.

Combining results

In a third step, we combine the findings from the rental and sales markets. When buyers choose to buy and live in a condominium, they take advantage of the same benefits as tenants in the rental market, that is, possible lower energy costs (i) and higher quality and comfort of living (ii). These marginal buyers—as residual claimants of properties—not only benefit from living in (greener) apartments, they also take further advantage of higher-quality building materials, and longer life cycles, that is, (iii) enhanced conservation of value. Therefore, we conjecture that buyers are willing to pay even more for MINERGIE-certified condominiums than renters are willing to pay for their rental apartments.

Hedonic regressions and signaling sustainability

In this section, we briefly discuss the economic implications of green building labels based on Meier (2008) and Kempf et al. (2016). Merrian-Webster (2019) defines the term label or certificate (which we use interchangeably in this study) as a conveyor of information, signaling that a product, or more specifically in this study a building, is officially proofed to meet certain requirements. Thus, in our case, a label signals the presence of specific attributes of a building. This idea refers to signaling in information economics. The label helps to reduce asymmetric information in the market, as it transmits information about sustainability, such as energy efficiency or other sustainability dimensions of the building, from the seller to the potential buyer. In general, a green building label is particularly valuable if the verification of individual buildings’ characteristics entails considerable expenses or if it is difficult or impossible for the potential buyers or tenants to verify the information on their own. This is often the case in real estate markets, where information is asymmetrically distributed among the parties involved. Buyers are able to screen the building only based on the existence of sustainability standards and with additional costs. Therefore, sustainability labels act as a signal, confirmed by a third-party institution, to facilitate the transaction. Thus, as long as certifying a building is less costly than screening sustainability dimensions self-reliantly, labels help to make the transaction more efficient. Besides increased transparency and decreased transaction costs through signaling, green building labels may have further economic implications, such as standardization and comparability, facilitation of awarding subsidies, and market segmentation. For further discussion of these aspects, we refer to Meier (2008) and Kempf et al. (2016).

In this study, we use MINERGIE as a signal for sustainability, or more precisely a “green building”. As mentioned in “General Approach”, MINERGIE claims to exhibit (i) higher energy efficiency as well as (ii) better comfort and quality, and (iii) enhanced conservation of value.

Rosen (1974) introduces the hedonic model to derive quality-adjusted house prices. According to Fuerst and McAllister (2011a), the model still constitutes the standard method for examining the price determinants in real estate research. To address our research question, we adapt and expand the general hedonic model. The model is supposed to show possible differences in prices and rents across labeled and conventional buildings. As higher average rents and transaction prices may simply arise because certified buildings are newer, bigger, or even located in more favorable locations or markets, the regression has to control for these attributes (Fuerst and McAllister 2011a). The basic log-log hedonic regression model, which is adapted and expanded to the needs (i.e., needed parameter specifications) of this research, is written as follows:

where \(p_{i}\) is the natural logarithm of net rent or selling price for a given apartment. \(z_{i}\) is a vector of the natural log of different physical and locational characteristics, such as living space in square meters, age of the dwelling, and centrality. Among these physical characteristics, the dummy variable MINERGIE indicates whether the building is certified or not. Thus, a positive MINERGIE coefficient corresponds to a green rental or price premium expressed in approximately \(\beta _{MINERGIE}*100\%\).Footnote 9\(t_{i}\) is a vector of time-related variables and controls for time-specific fixed effects, such as the economic situation within a given year. \(\beta\) and \(\phi\) are the corresponding vectors of coefficients to be estimated. The random error term \(\epsilon _{i}\) is expected to be normally distributed with zero mean and variance of \(\sigma ^2_{e}\). The regression model weights these buildings characteristics \(z_{i}\) and time variables \(t_{i}\) by their implicit hedonic prices \(p_{i}\), which are equal to the regression coefficients \(\beta\) and \(\phi\). Thus, the hedonic weights ascribed to each variable are equivalent to the attributes’ overall contribution to the rental or selling price \(p_{i}\). Finally, their weighted sum leads to the overall net rent or property price \(p_{i}\) (Rosen 1974; Fuerst and McAllister 2011a).

Data set

The Canton of Zurich provides a homogeneous property market and a highly consistent data set that optimally allows the analysis of the green premium. The City of Zurich is even more homogeneous and allows for the control of detailed location criteria. Therefore, we analyze, in addition to the Canton of Zurich, a subsample of the City of Zurich, which consists of apartments for rent and sale within the same political community, “Zurich City.” The City of Zurich is one of the most desirable residential areas in the Canton of Zurich. Between 2010 and 2017, the vacancy rate in the municipality was between 0.07% and 0.22% and therefore, was even lower than in the whole canton, which shows vacancy rates between 0.56% and 0.90% for that time period (Stadt Zürich 2020; Statistical Office Canton of Zurich 2020). The high demand for residential space contrasts with the relatively slow expansion of supply, leading to continuously rising prices. Therefore, the characteristics of a lessors’ market are even more pronounced in the City of Zurich than in the Canton of Zurich. The yearly increases in rent and sale prices for the Canton and the City of Zurich are reflected in the time fixed effects in the regression results in the appendix. Moreover, the regressions for the Canton of Zurich reveal that the City of Zurich, which corresponds to Mobilité Spatiale (MS) Region 1 and serves as the reference category, is the second-highest priced MS Region in the canton. Only on the left and right sides of Lake Zurich are rents (and sales for MS Region 6) higher. For various reasons, the City of Zurich can be considered an even more homogeneous sample than the canton: The entire municipality “City of Zurich” represents a political unit, namely, the same rate of local taxes is applied within the city. In addition, the City of Zurich presents itself as relatively homogeneous in terms of centrality and urbanness compared to the rest of the canton.

The data set used mainly is based on data of properties offered to purchase or rent on the real estate internet platform homegate.ch. Besides rents and prices, further structural (building) attributes, such as living space, number of rooms, and year of renovation or construction, are given in the homegate.ch data set. In addition, we add locational variables and time fixed effects to the hedonic regressions. A more detailed discussion of variables can be found in the next paragraph and Appendix II. A visualization of the spatial distribution of the rent and sales sample from the Canton and City of Zurich is depicted in Appendices VII to X.

Discussion of variables

The dependent variables in our analysis are extras, net rent, gross rent, and selling price. The literature reviewed generally logarithmizes the dependent variables as well as the explanatory variables in hedonic pricing models. Here, we run lin-log as well as log-log models to derive the decomposition of the net rent premium from gross rents and extras in CHF units as well as percentage points. We report both specifications in our regression results, as we use the lin-log model to calculate the percentage share of the premia within the rental market (see Table 6). For further information on the model specifications, see section Regression Results.

Structural variables describe the physical characteristics of the buildings, such as size, age, or the existence of, for example, an elevator or view, and are included in the Homegate (2018) data set. Since the green building label MINERGIE was established only in 1998, in our sample, we include buildings that were built after that point in time. This restriction ensures that only buildings of the same architectural and technological era are analyzed in the sample. Data over 8 years, from 2010 to 2017, are analyzed.

In addition, we include locational variables in the model. For this, we use five classes of access by public transport categorized as A, B, C, D, and none, modeled as a categorical variable with base category none. The dummies represent varying degrees of location quality and are added manually to the corresponding addresses from the Homegate (2018) data set using geocoding.

Furthermore, we divide the Canton of Zurich data into 10 MS regions. Each MS region in Switzerland represents a homogeneous spatial area regarding employment. For instance, the City of Zurich corresponds to MS region 1, whereas the wealthy communities on the “left” and “right” side of Lake Zurich are defined as MS regions 5 and 6, respectively (FSO 2016a).

In our city subsample, we distinguish between seven different micro-location classes. The most attractive location in the City of Zurich is indicated by Location Class 1, whereas the least favorable locations are labeled as Location Class 7 (ARE 2021).

Moreover, to consider time fixed effects, we include dummies for the specific year when the apartment or condominium was first put on the internet. This date allows accounting for yearly time-related fixed effects, such as the general economic situation, level of mortgage reference rate, vacancies, and others.

A more comprehensive description of variables is found in Appendix II.

Descriptive statistics

In total, we analyze over 50,000 apartments for rent to determine a rental premium and discount on extras for MINERGIE-certified buildings. Not surprisingly, the MINERGIE rent apartments are, on average, younger than their non-labeled counterparts. In our data, we measure age as the difference between the year when the apartment was first put on the internet and the construction year. Based on this definition, MINERGIE apartments in the Canton of Zurich are, on average, 4 years younger than their conventional counterparts. In the City of Zurich subsample, the difference is smaller for rents and even reversed for apartments on sale.

MINERGIE apartments in the Canton of Zurich show, on average, a 7% (CHF 2,559/ CHF 2,382) markup over net rents per month, without controlling for size and other covariates. MINERGIE apartments not only seek higher net rents but also higher extras. However, this markup is only 2% (CHF 252 / CHF 247) on average. A MINERGIE apartment has, on average, 108 square meters of living space and 3.5 rooms, which is similar in size and floor plans to non-labeled apartments. These descriptive statistics show that we analyze certified and non-certified apartments using comparable characteristics, that is, size, structure, and age. Moreover, in Switzerland, the construction materials, processes, and standards are strongly regulated by authorities for the whole real estate industry. Therefore, we regard non-labeled and labeled buildings of the same construction era as of comparable quality. Hence, a comparison of MINERGIE-certified and non-certified apartments filters out the labels claimed sustainability dimensions of energy efficiency, comfort, and conservation of value.

We study over 17,000 condominiums for sale to assess a possible sale premium for MINERGIE. MINERGIE apartments are placed on homegate.ch with an average price of CHF 1.158 million, whereas the average non-labeled apartment is offered at CHF 1.043 million, without considering any covariates. This comparison leads to an unadjusted markup for MINERGIE of about 11%. Surprisingly, this markup persists even on the basis of per square meter living space, as MINERGIE and non-labeled apartments are of about the same size of 126 meters2 to 129 meters2 on average in the sample. Again, MINERGIE condominiums are of about the same size, structure, and age as their non-labeled counterparts, which ensures comparability between them.

Turning to the City of Zurich, city living space is considerably more expensive than that in the canton as a whole. The average price per square meter for living space is over 37% (CHF 11,525/CHF 8,384) higher than the canton average price. Monthly rents are also, on average, 31% higher in the city than in the canton, although the size of apartments is almost 7 square meters smaller at around 100 square meters. Table 3 summarizes the aforementioned descriptive statistics for the Canton as well as the City of Zurich.

Apart from these descriptive statistics, we consider further building attributes, locational variables, and time fixed effects to adequately estimate the rent and price premia as well as a discount on extras for MINERGIE-certified apartments. We do this by running hedonic regressions.

Estimation results

In the upcoming paragraphs, we outline the regression results for the overall sample of the Canton of Zurich and our subsample—the City of Zurich—in more detail. Table 5 comprises the regression results. The full regression results, including further covariates, are found in Appendices III–VI.

Investors Benefit from Fewer Extras in a Lessors’ Market

As mentioned in the beginning, we use extras as a proxy for resource or energy efficiency. To determine the extras discount of MINERGIE, we regress extras on a MINERGIE dummy, signaling whether an object is certified according to the MINERGIE standard (MINERGIE, MINERGIE-P, or MINERGIE-A) or not. In addition, we use the same set of control variables as for the sales, gross, and net rent regressions. This leads to the following regression model:

where: \(c_{0}\) is a constant, \(\beta\) a vector of regression coefficients or implicit hedonic prices, and \(z_{i}=\) buildings’ characteristics, such as our variable of interest MINERGIE and covariates, including living space, number of rooms, age, and access by public transport. \(\phi t_{i}\) controls for time fixed effects, and \(\epsilon _{i}\) is a random error term.

Regressing extras, net rents, gross rents, and sales prices (response variables) on the building attributes by using data from homegate.ch and enriching them with locational and time trend variables, this study obtains the following full-blown regression equation:

The model tells us how many fewer (or more) extras a MINERGIE-certified apartment has than a conventional apartment. Therefore, this analysis reveals the energy or resource-saving component of the green net rent premium. Our analysis for the Canton of Zurich shows that MINERGIE-certified apartments exhibit on average [\(e^{-0.0181}-1]*100\%=-1.79\%\) (or CHF -2.55) fewer extras than conventional dwellings, ceteris paribus. Although extras are statistically significant negative at the canton level, they are not different from zero in our subsample in the City of Zurich.

Lessors ask for higher net and gross rents

In the second step, an ex-ante presumed rent premium is to be determined by hedonic regression analysis. We analyze the same data as used for extras (from the real estate platform homegate.ch) to examine how much more the market expects from green rentals. Here, we regress net rent and gross rent, instead of extras, on the same classical attributes of the apartments, such as structural, locational, and time fixed effects as well as our dummy of interest, MINERGIE.

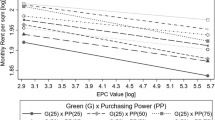

The above described regressions for the Canton of Zurich show, that MINERGIE-certified apartments exhibit on average [\(e^{0.0187}-1]*100\%=1.88\%\) (or CHF 30.19 per month) higher net rents and [\(e^{0.0154}-1]*100\%=1.55\%\) (or CHF 27.64 per month) higher gross rents than their conventional counterparts, holding all other variables constant. The difference between the net and gross premium constitutes, by definition, the discount on extras, that is, \(CHF~30.19 - CHF~27.64 = CHF~2.55~(8.4\%)\) per month. The model estimates that energy savings explain about 8.4% of the MINERGIE rent premium. However, tenants are willing to pay CHF 27.64 or \(1.55\%\) more gross rent per month for living in a MINERGIE apartment. These results show that other factors than fewer extras explain 91.6% (CHF 27.64/CHF 30.19) of the rental premium, such as higher comfort, quality of living, prestige, and awareness and ideological effects of living green.Footnote 10 Looking at the City of Zurich sample, the rent extras premium even becomes insignificant. This result is in line with the findings of Marty and Meins (2017) and Marty et al. (2016), where energy efficiency also does not affect rental rates significantly. Figure 2 graphically summarizes this line of argument and lists the corresponding results.

Again, looking at the canton, lessors benefit from fewer extras by CHF 2.55 per month on average, which corresponds to \(8.4\%\) of the total (net) rent premium (CHF 2.55/CHF 30.19 per month). In turn, \(91.6\%\) (CHF 27.64/CHF 30.19 per month) of tenants’ WTP cannot be explained by fewer extras and therefore, are accounted for by higher quality and comfort, and an awareness for sustainability, which is reflected in higher gross rents. As we are in a lessors’ market, the whole net rent premium of \(1.88\%\) or CHF 30.19 financially benefits the investor. In the City of Zurich, the net rent markup for the investor is even higher and corresponds to 3.3% or 43.05 CHF per month. Because tenants benefit only from lower energy costs and higher comfort and quality of living, the rent market analysis does not include proprietary advantages, namely, the conservation of value in the premium yet.

Sellers seek even higher sales revenues

In the last step, an ex-ante assumed green sales price premium is evaluated. This price premium embodies all advantages of a green building over a conventional construction: lower energy consumption, higher comfort of living, and better conservation of value, which means longer life cycles from higher quality of building and hedging against future risks. We regress the selling price on the same attributes as those used in the rent sample. Therefore, the only elements that change are the response variable and the data sample.

Also in the sales sample, the dummy for MINERGIE-certified buildings shows a significant positive coefficient. Thus, lessors, real estate agents, and professionals selling condominiums do so with an even higher markup of \(e^{0.0242} - 1 = 2.45\%\) (canton) or \(e^{0.0479}- 1 = 4.91\%\) (city) for green buildings than in the case of rental apartments.

Combining results

Plugging in the net rent premium for the canton \(\frac{Gross~Yield_{MNG}}{Gross~Yield_{conv}}\) (1.88%) and the cantonwide sales price premium \(\frac{V_{MNG}}{V_{conv}}\) (2.45%) into equation (5) and solving for the cap rates leads to the following:

The ratio of the cap rates in equation (10) shows that a MINERGIE-certified apartment in the Canton of Zurich has, on average, a 0.56% lower cap rate than a conventional apartment. In other words, based on the simple relation that value equals net rental income divided by the cap rate, a 0.56% lower cap rate translates into a 0.57% higher sales price. Therefore, 0.57% of the green premium can be associated with the cap rate or value conservation, respectively. This explains about a quarter (0.57% / 2.45% = 23.26%) of the total premium.

For the sample of the city of Zurich, repeating the steps above, we find a 1.53% lower cap rate for MINERGIE-certified apartments, which translates into a conservation of value of 1.61%. This corresponds to about one-third (1.61% / 4.91% = 32.78%) of the total premium. As the conservation of value benefits only the lessor, it can be regarded as the residual claim that is reflected by the difference in the green sales price premia over the rental premia. Table 4 exemplifies how the differences in cap rates of MINERGIE-certified and conventional apartments translate into higher sales prices and form part of the total green premium. Based on CSL Immobilien AG (2017), we assume a cap rate of 3.00% for the Canton and 2.50% for the City of Zurich. For the regression results, see Table 5.

Conclusion and discussion

Following the reasoning in this study, Table 5 presents the empirical findings of our theoretical model. Analyzing the rental market of the Canton of Zurich shows that tenants are offered 1.88% higher net rents if built according to the MINERGIE standard. At the city level, this markup is 3.3% and shows that MINERGIE-certified apartments trade at a considerably higher premium in the City of Zurich than in the rest of the canton. Possible reasons for this are manifold, and include the socio-economic situation or a generally sharpened perception of sustainable issues in the city, that is, a greener attitude and a resulting higher willingness and capacity to pay for green housing. Furthermore, the analysis shows that in a lessors’ market, investors benefit from more efficient green construction through fewer extra costs incurred, which allow investors to raise net rents accordingly. In the Canton of Zurich, extras for MINERGIE-certified apartments cost on average 1.79% less than for non-labeled buildings. In addition, tenants benefit from living in apartments with (ii) higher comfort and quality, and are willing to pay a markup for this in the form of higher gross rents of 1.55%. The results of the regression for the City of Zurich are largely consistent with the findings for the canton. However, in our subsample for the City of Zurich, we do not find a significant cost-mitigating effect through (i) fewer extras. Instead, higher gross rents explain the whole green rental premium in the city, whereas energy efficiency becomes insignificant. We assume that the observation of insignificant extra costs in the city may be partly explained by the fact that according to Gehrig et al. (2018), the City of Zurich has on average 0 to 4–5 degrees Celsius higher daily minimum temperatures than its rural surroundings during winter (heat island effect). Thus, apartments in the city require less heating during winter, which lowers their extra costs. Considering the sales market, our analysis shows that MINERGIE apartments trade at a price premium of 2.45% cantonwide. Therefore, buyers of such apartments are willing to pay a markup for their ownership, which is 0.57% above tenants’ additional WTP for living green of 1.88%. Thus, this residual corresponds to the (iii) conservation of value, which benefits only the owner of the apartment. In our city sample, the WTP for a MINERGIE apartment has an even more pronounced markup of 4.91%. The green premium is 1.61% above the net rent premium of 3.3%. Therefore, the conservation of value comprises almost one-third of the overall premia in the City of Zurich.

In summary, we split the overall MINERGIE price premium for the Canton (and City) of Zurich of 2.45% (city: 4.91%) into three value-driving parts (cf. Table 6). First, we find that (i) lower energy costs through fewer extras accounts for \(6.5\%\) (city: insignificant) of the total premium. Second, our analysis shows that residents are willing to pay more for (ii) higher quality and comfort. This markup explains 70.41% (city: 69.53%) of the total premium in our data and shows that MINERGIE pays off for investors. Certified flats receive higher net rents resulting from tenants’ willingness to pay extra for better comfort and out of the awareness for living sustainably. In addition, in a lessors’ market, MINERGIE enables investors to increase net rents at the expense of fewer extras, whereas in a tenants’ market, fewer extras serve as a cushion against vacancy risks for investors, allowing them to lower the marginal rent and assure rentability. In this setting, tenants accordingly benefit from lower gross rents. Finally, there is an additional owners’ WTP of about 23.3% (city: 32.78%) of the whole green premium, which we associate with retention of value, that is, making the building future-proof. MINERGIE assets show higher conservation of value owing to better building materials and longer life cycles, which lowers lessors’ cap rates and increases their (green) property value. Table 6 presents a synopsis that reflects the effects and findings of our study schematically. Our key findings show that comfort is the most financially beneficial aspect of green buildings, followed by conservation of value, while energy savings have a minimal impact. Table 7 summarizes qualitatively the value drivers of the examined sustainability dimensions of this study.

Data availability statement: Data subject to third party restrictions

The data that support the findings of this study are available from Homegate AG but restrictions apply to the availability of these data, which were used under license for the current study, and so are not publicly available. Data are, however, available from the authors upon reasonable request and with permission of Homegate AG.

Notes

We define conventional buildings or apartments as non-labeled objects throughout the study.

Since the introduction of the MINERGIE standard in 1998, 8,488 residential buildings in the Canton of Zurich have been certified. This is equivalent to 4.5% of the current residential building stock. About 85% of the total certifications in the Canton of Zurich are attributed to the residential sector, consisting of 5,220 multi-family houses and 3,268 single-family homes (Statistical Office Kanton Zurich 2018; FSO 2019b). Other buildings, such as administration offices, retail outlets, and schools, account for 15% or 1,501 buildings of a total MINERGIE building stock in the Canton of Zurich of 9,989 in December 2017 (including planned buildings).

The object category for the listed dwellings for sale and rent is either apartment, duplex, attic flat, or roof flat (Homegate 2018).

The complete list of certified buildings is available at https://www.minergie.ch/de/gebaeude/ (MINERGIE 2019a).

The household budget survey is based on a random survey of 3,000 households across the seven major regions of Switzerland. The survey is conducted through telephone interviews and written questionnaires (FSO 2016b).

In contrast, however, in a tenants’ market, if supply exceeds demand, the tenant can choose between different apartments and the market rent decreases to find the marginal renter. In this situation, a cost advantage through lower energy expenses would enable the lessor to decrease total rent in order to rent out the apartment to the marginal renter. Therefore, the MINERGIE advantage might not allow increasing net rents to the same extent as in the lessors’ market but serves as a cushion against vacancy risks. Hence, in a tenants’ market, if a MINERGIE and a non-labeled apartment are offered at the same price, tenants can be expected to choose MINERGIE over the non-labeled apartment owing to higher quality and comfort, ceteris paribus.

Fuerst and McAllister (2011a) consider the net capitalization rate perspective of equation (2), whereas our study applies the gross capitalization in equation (3).

The exact semi-elasticity is calculated as \([e^{\beta _{MINERGIE}}-1]*100\%\) (Wooldridge 2016).

If we assume that there is no WTP for MINERGIE at all, that is, the gross rent premium would be zero (from the perspective of a tenant), an increase in net rents would be possible only to the extent of the fewer extras. In this case, the lessor would benefit financially only from fewer extras.

References

ARE (2020) ÖV-Güteklassen ARE. Retrieved June 30, 2020, from https://opendata.swiss/de/dataset/ov-guteklassen-are1

ARE (2021) Geodatensatz grundstücks-lageklassen. Retrieved October 6, 2022, from https://www.geolion.zh.ch/geodatensatz/show?gdsid=147

Aydin E, Brounen D, Kok N (2020) The capitalization of energy efficiency: Evidence from the housing market. J Urban Econ 117:103243

Beresteanu A, Li S (2011) Gasoline prices, government support, and the demand for hybrid vehicles in the united states. Int Econ Rev 52:161–182

BFS (2021) Ms-regionen. Steckbrief - Nomenklatur. Retrieved October 6, 2022, from https://www.bfs.admin.ch/bfs/de/home/statistiken/raum-umwelt/nomenklaturen/msreg.assetdetail.415729.html

Breeam (2020) BREEAM. Retrieved June 30, 2020, from https://www.breeam.com/

Brounen D, Kok N (2011) On the economics of energy labels in the housing market. J Environ Econ Manag 62:166–179

Brown Z, Cole RJ, Robinson J, Dowlatabadi H (2010) Evaluating user experience in green buildings in relation to workplace culture and context. Facilities 28:225–238

Chegut A, Eichholtz P, Kok N, Quigley JM (2011) The value of green buildings: new evidence from the United Kingdom. ERES 2010 proceedings

CSL Immobilien AG (2017) Immobilienmarktbericht 2017. Retrieved June 30, 2020, from https://csl-immobilien.ch/de/Immobilienmarktbericht

Deng Y, Li Z, Quigley JM (2012) Economic returns to energy-efficient investments in the housing market: Evidence from Singapore. Reg Sci Urban Econ 42:506–515

Eichholtz P, Kok N, Quigley JM (2013) The economics of green building. Rev Econ Stat 95:50–63

Feige A, McAllister P, Wallbaum H (2013) Rental price and sustainability ratings: Which sustainability criteria are really paying back? Constr Manag Econ 31:322–334

Fisk WJ (2000) Health and productivity gains from better indoor environments and their implications for the US Department of Energy. Technical Report Lawrence Berkeley National Lab, CA (US)

Fisk WJ, Rosenfeld AH (1998) Potential nationwide improvements in productivity and health from better indoor environments

FSO (2016a) MS-Regionen. Retrieved June 30, 2020, from https://www.bfs.admin.ch/bfs/de/home/statistiken/raum-umwelt/nomenklaturen/msreg.assetdetail.415729.html

FSO (2016b) Household budget survey (HBS). Retrieved June 30, 2020, from https://www.bfs.admin.ch/bfs/en/home/statistics/economic-social-situation-population/surveys/hbs.assetdetail.8153.html

FSO (2018) Die Raumgliederungen der Schweiz 2018 - Excel Version - Typologie der MS-Regionen. Retrieved June 30, 2020, from https://www.bfs.admin.ch/bfs/de/home/grundlagen/raumgliederungen.html

FSO (2019a) Economic and social situation of the population. Retrieved June 30, 2020, from https://www.bfs.admin.ch/bfs/de/home/aktuell/neue-veroeffentlichungen.assetdetail.10867225.html

FSO (2019b) Gebäude nach Gebäudekategorie, Kantonen und Bauperiode. Retrieved June 30, 2020, from https://www.bfs.admin.ch/bfs/en/home/statistics/catalogues-databases.assetdetail.je-d-09.02.01.03.html

FSO (2019c) Wohnungen nach Gebäudekategorie und Kantonen. Retrieved June 30, 2020, from https://www.bfs.admin.ch/bfs/en/home/statistics/construction-housing/dwellings.assetdetail.9767648.html

Fuerst F, Dalton B (2019) Gibt es einen wissenschaftlichen Konsens zur Wirtschaftlichkeit nachhaltiger Immobilien? Zeitschrift für Immobilienökonomie 5:173–191

Fuerst F, Kontokosta C, McAllister P (2014) Determinants of green building adoption. Environ Plann B Plann Des 41:551–570

Fuerst F, McAllister P (2011) Eco-labeling in commercial office markets: Do leed and energy star offices obtain multiple premiums? Ecol Econ 70:1220–1230

Fuerst F, McAllister P (2011) Green noise or green value? Measuring the effects of environmental certification on office values. Real Estate Economics 39:45–69

Gehrig R, König N, Scherrer S (2018) Städtische Wärmeinseln in der Schweiz - Klimatologische Studie mit Messdaten in fünf Städten. MeteoSchweiz

Hausman JA (1979) Individual discount rates and the purchase and utilization of energy-using durables. The Bell Journal of Economics 10:33

He C, Yu S, Han Q, de Vries B (2019) How to attract customers to buy green housing? their heterogeneous willingness to pay for different attributes. J Clean Prod 230:709–719

Holtermans R, Kok N (2017) On the value of environmental certification in the commercial real estate market. Real Estate Economics 47:685–722

Homegate AG (2018) homegate.ch listings data, 2010-2017

Jang D-C, Kim B, Kim SH (2018) The effect of green building certification on potential tenants’ willingness to rent space in a building. J Clean Prod 194:645–655

Kats G, Alevantis L, Berman A, Mills E, Perlman J (2003) The costs and financial benefits of green buildings: a report to California’s sustainable building task force

Kempf C, Hens T, Syz J (2016) How Green Buildings Mitigate Risk. Master’s thesis University of Zurich

Klier T, Linn J (2008) The price of gasoline and the demand for fuel efficiency: Evidence from monthly new vehicles sales data. University of Illinois at Chicago

KUB (2017) Immobilienmanagement: Handbuch für Immobilienentwicklung, Bauherrenberatung, Immobilienbewirtschaftung. (2nd ed.). Zürich: Schulthess. Kammer Unabhängiger Bauherrenberater and Institut für Finanzdienstleistungen Zug and Schweizerischer Verband der Immobilienwirtschaft and Zürcher Hochschule für Angewandte Wissenschaften. Institut für Facility Management

LaSalle (2017) Umweltfaktoren beeinflussen Nachfrage nach Immobilien Weißbuch „Nachhaltigkeit“ von LaSalle, LaSalle Investment Management. Retrieved April 8, 2021, from https://www.lasalle.com/company/news/umweltfaktoren-beeinflussen-nachfrage-nach-immobilien-weissbuch-nachhaltigk

Mandell S, Wilhelmsson M (2011) Willingness to pay for sustainable housing. J Hous Res 20:35–51

Marty R (2017) The impact of mortgage rates on expected real estate returns and rent growth in Switzerland: A dynamic discounted cashflow approach. In: 64th annual North American Meetings of the Regional Science Association International (RSAI)

Marty R, Meins E (2017) Der Schweizer Mietimmobilienmarkt belohnt andere Nachhaltigkeitsmerkmale als Energieeffizienz. Swiss Real Estate Journal 15:47–54

Marty R, Meins E, Bächinger C (2016) Sustainability and real estate rental rates: Empirical evidence for Switzerland Universität Zürich. CCRS Working Paper Series

McGrath KM (2013) The effects of eco-certification on office properties: a cap rates-based analysis. J Prop Res 30:345–365

Meier S (2008) Die Rolle von Gebäudelabeln bei der Vermarktung von Büroimmobilien in der Schweiz und in Deutschland. Master’s thesis CUREM - Center for Urban Real Estate Managament

Merrian-Webster (2019) certificate. Retrieved June 30, 2020, from https://www.merriam-webster.com/dictionary/certificate

Miller N, Pogue D, Gough Q, Davis S (2009) Green buildings and productivity. Journal of Sustainable Real Estate 1:65–89

Miller N, Spivey J, Florance A (2008) Does green pay off? Journal of Real Estate Portfolio Management 14:385–400

MINERGIE (2014) Reglement zur Nutzung der Qualitätsmarke MINERGIE. Retrieved June 30, 2020, from https://www.minergie.ch/media/nutzungsreglement_minergie_2014-dt_1.pdf

MINERGIE (2019a) Gebäudeliste. Retrieved June 30, 2020, from https://www.minergie.ch/de/gebaeude/

MINERGIE (2019b) Was ist Minergie? Retrieved June 30, 2020, from https://www.minergie.ch/de/verstehen/uebersicht/

National Statistics (2019) English housing survey 2017: Stock condition. Retrieved June 30, 2020, from https://www.gov.uk/government/statistics/english-housing-survey-2017-stock-condition

RICS (2017) Swiss valuation standards (SVS): Best Practice of Real Estate Valuation in Switzerland volume 3., überarbeitete und ergänzte Auflage. vdf Hochschulverlag

Robinson S, Simons R, Lee E (2017) Which green office building features do tenants pay for? a study of observed rental effects. Journal of Real Estate Research 39:467–492

Robinson S, Simons R, Lee E, Kern A (2016) Demand for green buildings: Office tenants’ stated willingness-to-pay for green features. Journal of Real Estate Research 38:423–452

Rosen S (1974) Hedonic prices and implicit markets: Product differentiation in pure competition. J Polit Econ 82:34–55

Salvi M, Horehájová A, Müri R (2008) Der Nachhaltigkeit von Immobilien einen finanziellen Wert geben-Minergie macht sich bezahlt. Center for Corporate Responsibility and Sustainability, Universität Zürich, Zürich

Salvi M, Horehájová A, Neeser J (2010) Der Nachhaltigkeit von Immobilien einen finanziellen Wert geben–der Minergie-Boom unter der Lupe. Center for Corporate Responsibility and Sustainability, Universität Zürich, Zürich

Salvi M, Syz J (2011) What drives “green housing’’ construction? Evidence from Switzerland. Journal of Financial Economic Policy 3:86–102

Schuster T, Füss R (2016) Mietprämien von MINERGIE-Gebäuden im Immobilienmarkt Schweiz. Master’s thesis Universität St. Gallen

Seppanen O, Fisk W (2006) Some quantitative relations between indoor environmental quality and work performance or health. HVAC &R Research 12:957–973

Stadt Zürich (2020) Leerwohnungszählung. Retrieved June 30, 2020, from https://www.stadt-zuerich.ch/prd/de/index/statistik/themen/bauen-wohnen/leerwohnungen-leerflaechen/leerwohnungszaehlung.html#daten

Statistical Office Canton of Zurich (2020) Gemeindeporträt Kanton Zürich. Retrieved June 30, 2020, from https://statistik.zh.ch/internet/justiz_inneres/statistik/de/daten/gemeindeportraet_kanton_zuerich.html?tab=indikatoren\&jahr=0\&indikatoren=381,373\&gebietstyp=8\&gebiet=195

Statistical Office Kanton Zurich (2016) Statistisches Jahrbuch des Kantons Zürich 2016

Statistical Office Kanton Zurich (2017) Statistisches Jahrbuch des Kantons Zürich 2017

Statistical Office Kanton Zurich (2018) Statistisches Jahrbuch des Kantons Zürich 2018

Swiss Federal Council (2016) Sustainable development strategy 2016-2019. Retrieved October 7, 2022, from https://www.are.admin.ch/are/en/home/media/publications/sustainable-development/strategie-nachhaltige-entwicklung-2016---2019.html

USGBC (2020). Country market briefs. Retrieved June 30, 2020, from https://www.usgbc.org/resources/country-market-brief

Wegner J, Stokar M, Hoffmann C, Binz A, Bürgi P (2010) Studie zur Untersuchung von Mehrkosten von MINERGIE-P®-Bauten

Wooldridge JM (2016) Introductory econometrics: A modern approach. (5th ed.). South-Western Cengage Learning

Xie X, Lu Y, Gou Z (2017) Green building pro-environment behaviors: Are green users also green buyers? Sustainability 2017:1703

Zhang L, Chen L, Wu Z, Xue H, Dong W (2018) Key factors affecting informed consumers’ willingness to pay for green housing: A case study of jinan, china. Sustainability 10:1711

Funding

Open access funding provided by University of Basel.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

On behalf of all authors, the corresponding author states that there is no conflict of interest.

Supplementary Information

Below is the link to the electronic supplementary material.

Rights and permissions