Abstract

In this study, we predict the future trends of consumption expenditure in disaggregated age groups in both the within-sample and out-of-sample periods. In addition, we incorporate the estimation of a dynamic panel model with cross-sectional dependence into our forecasting methodology. As a whole, our dynamic panel model generates accurate forecasts for within sample. In particular, the accuracy is better in the 40–49 age group, while it is the most inaccurate for the over-70 age group. The out-of-sample period forecast results show that the dynamic panel model generates more accurate than the AR model in almost all age groups. Further, the impact of the COVID-19 shock in 2020 will be retained in many age groups for some time, leading to a decline in consumption. However, after a while, this impact will gradually disappear, and consumption will increase for most age groups. On the other hand, the out-of-sample period forecast results show that the older age group drags out the COVID-19 shock longer than the younger age group and will take longer to recover its consumption levels. In addition, aging of the heads of Japanese households will make it difficult for these households to maintain their current consumption levels unless some measures are taken to deal with the older age group.

Similar content being viewed by others

Introduction

Japanese households are facing a change in demographic factors, such as a decline in the number of people aged under 18 years due to the declining birthrate, increase in the age of household heads due to population aging, and increase in the number of people aged over 65 years. In fact, the aging rate has risen from 17.4% in 2000 to 28.9% in 2020 (Annual Report on the Aging Society 2020).Footnote 1 Further, the rate of people under the age of 18 to the total population has declined from 19.3% in 2000 to 16.4% in 2020.Footnote 2 Changes in age and family structure within households affect current and future consumption trends. In addition to these factors, exogenous macro shocks such as the Lehman shock in 2008 and the coronavirus disease of 2019 (COVID-19) shock in 2020 have caused an additional problem of long-term stagnation in consumption expenditure, which underpins domestic demand in the Japanese economy. On the other hand, susceptibility to these exogenous shocks differs by age group. For instance, older groups of those aged over 70 years are the most susceptible to the effects of changes in household income due to exogenous shocks, because their average propensity to consume (APC) is higher than that of the other age groups.Footnote 3 In addition, the weight of households with heads aged over 70 years among the total households is the highest in all age groups, and the influence of the over-70 age group on consumption trends is high (Fujimura and Sato 2017).Footnote 4 On the other hand, the 30–39 age group had the lowest APC among all age groups, although their consumption was the same as that of the over-70 age group. In addition, because the 30–39 age group accounts for a smaller weight among total households, their impact on overall consumption is relatively low. In other words, it is more effective to approach targeted age groups than to have a unified policy for all age groups to recover consumption in the future.

This study aims to predict future consumption in disaggregated age groups using a dynamic panel model. The advantage of introducing dynamic panel analysis is that it allows us to predict future trends in consumption by capturing the dynamic optimal behavior in consumption by age groups based on the data to date. Based on the results of the projections, we discuss which policies need to be introduced in which age group to increase consumption in the future. On the other hand, we face various estimation problems when performing dynamic panel analysis. For example, the occurrence of correlations between the lagged explained variable and the error term, and the nonstationarity of the variables. In addition to addressing these, we incorporate the cross-sectional dependence methods into our forecast analysis. As a theoretical contribution, we aim to use a model that considers the cross-sectional correlation between age groups to obtain a consistent estimator of the parameters. Therefore, we use a dynamic panel model that introduces correlations between cross-sections in a factor model (Sarafidis et al. 2009). We also incorporate the method of performing the panel unit root test on a series after removing the factors, because ignoring the correlations between the cross-sections would lead to size distortions (Pesaran 2007). The dynamic panel model can be estimated by the generalized method of moments (GMM) using instrumental variables that take the deviation from the cross-sectional average; this is because the bias becomes smaller than the GMM estimator without considering the correlation between cross sections.

A variety of studies have been published on the theoretical aspects of panel analysis of forecasts. For example, Baltagi (2008) proposed the basis of forecasting methods in static and dynamic panel analysis, and later introduced the method applied to the case of spatial correlation in Baltagi et al. (2012). In the literature focusing on cross-sectional dependence, Phillips and Sul (2003, 2007) discussed the issues of homogeneity restrictions and small sample bias in dynamic panel estimation under cross-sectional dependence. Moreover, although there are many studies on the empirical aspects of panel analysis of forecasts, such as Ince (2014) and Kim et al. (2016), few have incorporated cross-sectional dependence methods into their analysis. This is one of the main contributions of this study.

The remainder of this paper proceeds as follows. The next section explains the data used in this study. The subsequent section presents the dynamic panel model with cross-sectional dependence between age groups followed by which the estimation results by the GMM are shown. Then the forecasting results for the within sample and out-of-sample are presented. Finally, the conclusions of this study are given.

Data

The household survey data employed in this study comprise monthly data for six age groups. We sourced data on consumption expenditures, disposable income, and household demographics from the Family Income and Expenditure Survey (Kakei Chosa in Japanese) conducted between January 2000 and November 2020 by the Japanese Statistics Bureau. The demographic data indicate the number of household members, age of the household heads, number of people under 18, and number of people aged over 65 years. We also obtain price data from the consumer price index (CPI) for 2015 as the standard. The CPI used was identical across the six age groups because of data limitations.

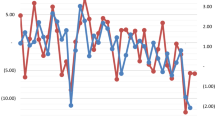

The age group in this study was divided into six groups: under 29, 30–39, 40–49, 50–59, 60–69, and over 70 years. Figure 1 shows the annual average of logarithm consumption expenditure by age group. Overall, there has been a gradual decline in consumption expenditure for most age groups since 2000. In Japan, the consumption of the under-29 age group is the lowest, and that of the 50–59 and 60–69 age groups are the highest. In particular, the 60–69 age group consumed the most since 2012, surpassing the 50–59 age group. In other words, consumption in Japan is supported by the 50–59 and 60–69 age groups. On the other hand, consumption of the under-29 and over-70 age groups has time-series fluctuations, and the decline due to the Lehman shock in 2008 is particularly noticeable compared with other age groups. This is because both age groups were immediately affected by the shock through a decrease in their disposable incomes. In all groups, a decrease in consumption was observed due to the impact of the COVID-19 shock in 2020. Further, data movements in consumption for the groups aged 30–60 years were similar. These age groups must have different lifestyles and family structures, but their time-series consumption trends appear to be similar. Therefore, we expect that there is a correlation between age groups in consumption trends.

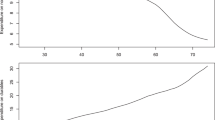

On the other hand, as shown in Fig. 2, the logarithm disposable income has been on a gradual upward trend, except for the over-70 age group. In particular, since the latter half of the 2010s, consumption has not been on an upward trend, even though disposable incomes have increased. This is due to an increase in the savings rate among Japanese households. By experiencing macro shocks, such as the Lehman shock in 2008, Japanese households may be preparing for future shocks by increasing their savings.Footnote 5 However, this trend does not hold for the over-70 age group.

Table 1 shows the group-averaged statistics used in this study. There is a large difference in the values of consumption expenditure and disposable income between age groups, and this tendency is particularly noticeable for disposable income. The minimum value of disposable income is smaller than that of consumption expenditure, and the difference in disposable income between age groups is remarkable. In other words, it is clear that the low-income age group cannot expect higher consumption expenditure than the high-income age groups. In Japan, age of the household heads is increasing, and the antilogarithm of the average value is 44.3 years old. On the contrary, the number of household members is decreasing, and the antilogarithm of the average value is 3.28 per household. In addition, due to the declining birthrate, the number of people aged under 18 years is 0.55 per household. On the contrary, due to population aging, the number of people aged over 65 years is increasing by 0.14 per household.

In this study, to produce out-of-sample forecasts, we split the forecasts into two components: within sample and out-of-sample. For the first step, using data from January 2000 to December 2017, we estimate the dynamic panel model and calculate the within-sample forecast. For the second step, the out-of-sample forecast can be calculated from January 2018 to November 2020 based on the GMM estimates. For the final step, we calculate the out-of-sample forecast for 10 years.

The model

We first define the dynamic panel model of consumption expenditure as follows.

where \(\mathrm{ln}{C}_{it}\) is the logarithm of consumption expenditure in the \(i\) th age group of period \(t\), \(\mathrm{ln}{Y}_{it}\) is the logarithm of real disposable income in the \(i\) th age group of period \(t\), \(\mathrm{ln}{P}_{t}\) is the logarithm of the CPI in period \(t\), and \(\mathrm{ln}{\mathbf{D}}_{it}=(\mathrm{ln}{Age}_{it}, \mathrm{ln}{Num}_{it}, \mathrm{ln}{Under18}_{it}, \mathrm{ln}{Over65}_{it}{)}^{^{\prime}}\) denotes the logarithm of the demographic variables of the age of the household head, number of households, number of people aged under 18 years, and number of people aged over 65 years. \(\mathrm{ln}{P}_{t}\) is common throughout cross-section \(i\) owing to data limitations. The stationarity assumption requires \(\left|\alpha \right|<1\). Further, we assume homogeneous coefficients, where \({\alpha }_{i}=\alpha\), \({\beta }_{i}=\beta\), \({\gamma }_{i}=\gamma\), and \({{\varvec{\delta}}}_{i}={\varvec{\delta}}\) for all \(i\).

As discussed in “Introduction” and “Data”, the error term in (1) can be correlated between the cross-sections. Therefore, we assume that the unobserved common factor error structure is

where \({\mu }_{i}\) is an individual effect that is assumed to be \(iid\left(0,{\sigma }_{\mu }^{2}\right)\), and \({v}_{it}\) is the remainder effect that is assumed to be \(iid\left(0,{\sigma }_{v}^{2}\right)\). \({{\varvec{\lambda}}}_{i}=({\lambda }_{i1},{\lambda }_{i2},\dots ,{\lambda }_{im}{)}^{^{\prime}}\) is an \(m\times 1\) vector of factor loadings and a non-random variable, and \({\mathbf{f}}_{t}=({f}_{1t},{f}_{2t},\dots ,{f}_{mt}{)}^{^{\prime}}\) is an \(m\)-dimensional vector of unobservable common factors and a random variable with \({E(\mathbf{f}}_{t})=0\) and \({V(\mathbf{f}}_{t})={{\varvec{\Sigma}}}_{f}\). In addition, because \({E({{\varvec{\lambda}}}_{i}^{^{\prime}}\mathbf{f}}_{t}{\mathbf{f}}_{t}^{^{\prime}}{{\varvec{\lambda}}}_{j})={{\varvec{\lambda}}}_{i}^{^{\prime}}{{{\varvec{\Sigma}}}_{f}{\varvec{\lambda}}}_{j}\ne 0\) for a different cross-sectional unit \(i\ne j\), the dependent variable \(\mathrm{ln}{C}_{it}\) is correlated between cross sections. In this case, the GMM estimators of (1) are not consistent, but the bias can be reduced by including the time effect in the model (Sarafidis et al. 2009). That is, we calculated the deviation from the cross-sectional average.

Second, we apply the time effect to (1) as follows:

where

Because the deviation from the cross-sectional average of \(\mathrm{ln}{P}_{t}\) is zero, it disappears from (3).

Furthermore, the first difference of (3) is given by

We eliminate the individual effect \({\mu }_{i}\) in (3), which is correlated with the lagged dependent variable. The first-difference GMM estimator of (4) uses the instrumental variable \({\overline{\mathrm{ln}C} }_{is}\) (\(s=0,\dots ,t-2)\), which takes the deviation from the cross-sectional average because the bias becomes smaller than the GMM estimator without considering the correlation between the cross-section (Sarafidis et al. 2009). Originally, the dynamic panel model often uses its own past values as instrumental variables, and the same applies in this case. That is, under the assumption that \({\overline{v} }_{it}\) has no serial correlation, \({\overline{\mathrm{ln}C} }_{is}\) (\(s=0,\dots ,t-2\)) is orthogonal condition to \({\Delta \overline{v} }_{it}\) is satisfied.

In addition, \({\overline{\mathrm{ln}C} }_{is}\) (\(s=0,\dots ,t-2\)) is also correlated with the endogenous variable \(\Delta {\overline{\mathrm{ln}C} }_{i,t-1}\). If the instrumental variables are close to or follow the nonstationary process, the correlation between \({\overline{\mathrm{ln}C} }_{is} (s=0,\dots ,t-2)\) and \(\Delta {\overline{\mathrm{ln}C} }_{i,t-1}\) becomes small or uncorrelated, which is a weak moment condition problems arise. This will be confirmed in the next section by a panel unit root test for stationarity of the variables.

Empirical results

Pre-test results for cross-sectional dependence

We expect there to be a correlation between the cross-sections because consumption trends are similar when the age groups are close. First, we investigate the presence of error cross-sectional dependence. It is well known that ignoring the panel cross-sectional dependence in estimation can have serious consequences, with unaccounted for residual dependence resulting in estimator efficiency loss and invalid test statistics. We assume that \({\rho }_{ij}\) is the correlation between the error terms in different cross-sectional units \(i,j\). The null hypothesis is commonly represented as \({H}_{0}:{\rho }_{ij}=0\) for all \(t\) and \(i\ne j\). In other words, there is no cross-sectional dependence in terms of the correlations between the error terms in different cross-sectional units. Table 2 shows that the null hypothesis of no cross-sectional dependence is rejected at the 5% level. That is, we find that there is a cross-sectional correlation between \(i\) and \(j\). As described above, when the error term is correlated between cross sections, the GMM estimators of (1) are not consistent. Therefore, we use (3) or (4), including the common factor error structure, to obtain consistent estimators.

Second, we carry out the following panel unit root tests with cross-sectional dependence: the cross-sectionally augmented Im, Pesaran, and Shin (CIPS) and truncated CIPS tests by Pesaran (2007), which extended the Im et al. (2003) test to the correlation between cross-sections. Table 3 shows that the null hypothesis of the panel unit root is rejected at the 5% level for both cases. In other words, the CIPS and truncated CIPS test results show that all variables are stationary, \(I(0)\). Therefore, we use the stationary panel dynamic model in (4) in the next subsection.

Estimation results

As a result, we perform a stationary dynamic panel estimation of (4). We select lag order 6 as the autoregressive (AR) model for (1) according to the Akaike information criterion. In the GMM estimation of (4), the instruments \({\overline{\mathrm{ln}C} }_{is}\) (\(s=0,\dots ,6)\) are used to reduce the bias rather than the GMM estimator without considering the cross-sectional correlation.Footnote 6 Table 4 shows that the estimated coefficients are all significant at the 5% level. The increase in the lagged first-difference term of consumption \(\Delta {\overline{\mathrm{ln}C} }_{i,t-s}\) decreases the first difference in consumption expenditure, but the negative effect gradually decreases as the lag increases. Further, the increase in the first-difference terms of real disposable income, age of the household heads, and number of households increases the first difference in consumption expenditure. In particular, we find that the first difference in household heads’ age rather than real disposable income increases the first difference in consumption expenditure. On the other hand, the increase in first-difference terms of the number of those aged under 18 and over 65 years decreases the first difference in consumption expenditure.

Furthermore, the GMM estimators in Table 4 use instrumental variables that deviates from the cross-sectional average, which improves the bias compared to GMM estimators that do not account for correlation across cross-sections. In addition, the instrumental variable uses its own past values as in the general dynamic panel model, and thus satisfies the orthogonality between the instrumental variable and the error term, i.e., the moment condition, and the correlation with the endogenous variables. As a result, the consistent estimators of parameters are obtained.

Forecasting the consumption expenditure in disaggregate age groups

Within-sample forecasting performance

We first predict the within-sample based on the GMM estimates in Table 4, from August 2000 to December 2017. For example, for the one-step ahead forecast at time T, we consider the following equation:

where \(\Delta {\overline{\mathrm{ln}C} }_{it+1}\) is the first difference in \({\overline{\mathrm{ln}C} }_{it+1}\). From \(\Delta {\overline{\mathrm{ln}C} }_{it+1}\) at the \(T=t+1\) period, we recalculate levels \({\mathrm{ln}\widehat{C}}_{i,t+1|T}\) of the \(t+1\) period ahead by returning the difference and the deviation from the cross-sectional average. Further, by repeating this step, we calculate \({\mathrm{ln}\widehat{C}}_{i,t+S|T}\) of the S-period ahead.

We present the accuracy of the sample forecasts using two forecast evaluation criteria. First, the S-period-ahead root mean squared prediction error (RMSPE) is defined as

where \({\mathrm{ln}\widehat{C}}_{i,t+S|T}\) is the S-period-ahead forecast of \({\mathrm{ln}C}_{i,t+S}\) using the observations available at time t.

For within-sample forecasting, \(S=0\) and the sample forecast are conducted within the available observations. Second, we calculated an alternative forecast evaluation using the mean absolute prediction error (MAPE):

Table 5 shows the simulation result for within-sample periods based on the GMM estimates from August 2000 to December 2017. The RMSE and MAPE of each age group are calculated using (6) and (7). The average of the simulations is similar to the observed average, but the 95% confidence interval differs from the observed values as the age increases. In particular, the difference of the 95% confidence interval in the over-70 age group is remarkable. Further, both the RMSE and MAPE calculated the increase in the accuracy of prediction between the under-29 and over-70 age groups. In particular, the prediction is inaccurate for the over-70 age group. On the contrary, the accuracy is better in the 40–49 age group, which represents the average age of the household head. As a whole, we find that our dynamic panel model generates accurate forecasts for within-sample.

Out-of-sample forecasting performance

We first introduce the forecasting performance of the dynamic panel model for the out-of-sample period, compared with the AR model. Both models are estimated based on Table 4 using the data up to December 2017, and the out-of-sample observations from January 2018 to November 2020 are used to measure the 1–3 years-ahead forecasting accuracy. Table 6 shows the comparison of the out-of-sample forecasting performance between the dynamic panel model and AR model. The upper half of the table refers to the forecasts of the dynamic panel model. In the RMSPE and MAPE, the 1–3-year-ahead forecasting accuracy improves as the years pass in many age groups. However, in 60–69 age group, the forecasting accuracy worsens as the years pass. In both forecast evaluations, the dynamic panel model generates relatively accurate out-of-sample forecasts. The lower half of the table refers to the forecasts of the AR model. In both the RMSPE and MAPE, the one-to-three-years-ahead forecasting accuracy worsens as the years pass in almost all age groups. In other words, when the AR model measures long-run forecasts, the accuracy of the forecasting worsens. The forecast results suggest that the dynamic panel model generates more accurate forecasts than the AR model. In particular, the difference in accuracy between the dynamic panel model and AR model is remarkable in the under-29, 50–59, and 60–69 age groups.

Next, we calculate the long-run forecast for the out-of-sample using the simulation model based on (5). It is assumed that no exogenous macro shocks occur during the forecast period. In (5), \(\Delta {\overline{\mathrm{ln}Y} }_{it+1}\) denotes the first difference of \({\overline{\mathrm{ln}Y} }_{it+1}\), and \(\Delta {\overline{\mathrm{ln}\mathbf{D}} }_{it+1}\) denotes the first difference of \({\overline{\mathrm{ln}\mathbf{D}} }_{it+1}\). For the one-step ahead forecast, the series of \({\overline{\mathrm{ln}Y} }_{it+1}\) and \({\overline{\mathrm{ln}\mathbf{D}} }_{it+1}\) are calculated using the AR(p) model.

For example, to calculate the first-difference \(\Delta {\overline{\mathrm{ln}Y} }_{it+1}\), the level variable \({\overline{\mathrm{ln}\widehat{Y}} }_{it+1|T}\) can be estimated using the AR(6) model as follows:

Moreover, the one-step ahead forecast at time T is

where \({\overline{\mathrm{ln}\widehat{Y}} }_{it+1|T}\) denotes the estimated value of \({\overline{\mathrm{ln}Y} }_{it+1}\) based on results of \({\overline{\mathrm{ln}Y} }_{it}\) at time T.

For the two-step ahead forecast at time T, we obtain

Further, to obtain \({\Delta \overline{\mathrm{ln}\widehat{Y}} }_{it+S}\), we extend (10) to the S-step ahead and repeat the calculations (8) through (10). By applying the same method, we can also obtain \(\Delta {\overline{\mathrm{ln}\mathbf{D}} }_{it+S}\) for the S-step ahead.

The left half of Table 7 shows the observed and simulated results from December 2018 to November 2020. For younger age groups below 50 years, the simulated results have lower average values than the observed results. For age groups over 50 years, the simulated results have higher average values. In Japan, which has a large number of households with heads aged over 60 years, the results of the older age groups are highly weighted. Therefore, the final average values are skewed toward the middle-aged and older age groups. As in the case of the within-sample in Table 5, the accuracy of forecasting for the under-29 and over-70 age groups is relatively poor. The right half of Table 7 shows the out-of-sample forecasting based on the dynamic panel model for two periods: December 2020 to December 2025 and January 2026 to December 2030. From December 2020 to December 2025, logarithm consumption is expected to increase among younger and early middle-aged groups, that is, the under-29, 30–39, and 40–49 age groups. On the other hand, consumption expenditure will decrease in age groups of over 50 years. In particular, consumption in the over-70 age group will decline significantly. As a result, consumption of the over-70 age group will be lower than that of the under-29 age group. From January 2026 to December 2030, consumption is expected to increase not only among the younger age groups of under 29 and 30–39 years, but also the middle-aged groups of those 40–49, 50–59, and 60–69 years old. Only the over-70 age group is on the decline. On average, among the age groups, consumption is expected to increase in the near future after decreasing once. In addition, the 50–59 age group will remain the most consumptive in the future, similar to the observed and simulated results until November 2020.

From December 2020 to December 2025, the impact of the COVID-19 shock in 2020 will be retained in many age groups, leading to a decline in consumption. The impact will be felt especially in middle-aged and older age groups of over 50 years. However, from January 2026 to December 2030, this impact will gradually disappear, and consumption will increase for most age groups. However, for younger age groups of under 29 and 30–39 years, the impact of the COVID-19 shock is not retained, and consumption increases immediately. On the other hand, in the over-70 age group, once consumption begins to decline, there is no sign of recovery, and the effects of the COVID-19 shock remain with them. As can be observed in Fig. 1, this age group experienced large fluctuations in consumption and was the most affected by the COVID-19 shock. The main difference between this and the younger age groups is that they have higher APCs and lower savings rates, which means that the effects of macro shocks are longer lasting. A generous policy for this older generation is necessary to encourage consumption.

As a whole, consumption by the middle-aged and older age groups of 50 years and over, which has underpinned Japan’s consumption to date, has declined. However, the consumption of young people of the under-29, 30–39, and 40–49 age groups is predicted to increase in the future. However, Japanese households, whose heads are generally aged 60 years and over, account for a high weight of the total, and their average consumption is likely to decline compared with the past. Furthermore, if we assume that the population will continue to age, a further decline in consumption is inevitable. In other words, policies to promote consumption among households whose heads are aged 60 years and above are necessary.

Conclusion

In Japan, consumption expenditure gradually decreased among most age groups. In addition, the recent COVID-19 shock caused another temporary decline. In this study, therefore, by forecasting the trends of future consumption expenditure in disaggregated age groups, we aimed to determine what policies are necessary for which age groups to increase consumption in the future. We account for correlations between age groups by incorporating the estimates of a dynamic panel model with cross-sectional dependence into our forecasting methodology. We obtained the following results from our forecasts. First, from December 2020 to December 2025, the impact of the COVID-19 shock in 2020 will be retained in many age groups, which will experience a decline in consumption. The impact will be especially felt in middle-aged and older age groups of over 50 years. However, from January 2026 to December 2030, this impact will gradually disappear, and consumption will increase for most age groups. On the other hand, in the over-70 age group, once consumption begins to decline, there will be no sign of recovery, and the effects of the COVID-19 shock will remain with them for a long time. Second, Japanese households with a high weight of total household heads aged 60 years or older are likely to experience a decline in average consumption due to this effect. Furthermore, as the population continues to age, a further decline in consumption is inevitable if no measures are taken to deal with older age groups. In other words, factors in two directions—temporary macro shocks and demographic factors—cause consumption fluctuations in forecasts.

Based on these results, we suggest that it is necessary to maintain disposable income by extending the retirement age system for the age groups of 60 years and over. Maintaining disposable income has the effect not decreasing consumption. In addition, when macro shocks occur, the effects tend to drag on for a long time for the age groups of 60 years and above. Therefore, providing income compensation for a certain period, such as lump-sum benefits, would be effective. In addition, this study does not assume that further macro shocks will occur during the forecast period. Our forecasting model will require improvements if we must account for such future macro shocks. On the other hand, in such an event, a further decline in consumption by older age groups will be inevitable.

In future research, we aim to use cohort data to predict changes in each current age group 10 or 20 years from now. In other words, it will be possible to confirm whether the results of this forecasting of consumption are a trend specific to a certain age group or whether they are due to an age effect.

Data availability

The data that support the findings of this study are available from the author upon reasonable request.

Notes

The aging rate is the ratio of people aged 65 years and over to the total population. The rate is expected to rise to 32.8% in 2035. These data are based on the results of the Population Census conducted by the Statistics Bureau of Japan until 2015, and on the midpoint of births and deaths in the National Institute of Population and Social Security Research’s “Future Population Projections for Japan” since 2020.

The rate is expected to decline to 14.1% in 2035. The data sources are the same as in Footnote 1.

The average APC from January 2000 to November 2020 is highest in the over-70 age group at 0.82 and lowest in the 30–39 age group at 0.67. The higher the APC, the higher the ratio of consumption expenditure to disposable income.

As Japan’s population ages, the number of household heads aged 60 years or older are increasing. In Japan’s household survey, more than 50% of the surveyed household heads are 60 years old or older. In addition, there is a growing body of research focusing on the consumption trends of senior households.

From January 2000 to November 2020, the average savings rate for the 30–39 age group was the highest at 22.4%, while that for the over-70 age group was the lowest at -1.9%. In other words, we find that the 30–39 age group is reducing consumption and increasing savings.

On the other hand, the weak moment condition problem, which occurs when the instrumental variables are close to or follow the nonstationary process, is also confirmed in Table 3 by the stationarity of the original variable \(\mathrm{ln}{C}_{it}\).

References

Annual Report on the Aging Society (2020) Cabinet Office Web. https://www8.cao.go.jp/kourei/english/annualreport/2020/pdf/2020.pdf. Accessed 8 April 2021

Baltagi BH (2008) Forecasting with panel data. J Forecast 27:153–173

Baltagi BH, Bresson G, Pirotte A (2012) Forecasting with spatial panel data. Comput Stat Data Anal 56:3381–3397

Fujimura T, Sato M (2017) Shinia setai no shohi to shotoku no genjo (in Japanese). Ministry of Finance Web. https://www.mof.go.jp/public_relations/finance/201712/201712l.pdf. Accessed 30 March 2021

Im KS, Pesaran HM, Shin Y (2003) Testing for unit roots in heterogeneous panels. J Econ 115(1):53–74

Ince O (2014) Forecasting exchange rates out-of-sample with panel methods and real-time data. J Int Money Financ 43:1–18

Kim K, Hewings GJD, Kratena K (2016) Household disaggregation and forecasting in a regional econometric input-output model. Lett Spat Resour Sci 9:73–91

Pesaran MH (2007) A simple panel unit root test in the presence of cross-sectional dependence. J Appl Economet 22:265–312

Phillips PCB, Sul D (2003) Dynamic panel estimation and homogeneity testing under cross section dependence. Econ J 6:217–259

Phillips PCB, Sul D (2007) Bias in dynamic panel estimation with fixed effects, incidental trends and cross section dependence. J Econ 137:162–188

Sarafidis V, Yamagata T, Robertson D (2009) A test of cross section dependence for a linear dynamic panel model with regressors. J Econ 148(2):149–161

Funding

This study was funded by Otemon Gakuin University.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The author declares to have no conflicts of interests/competing interests.

Ethical approval

This article does not contain any studies with human participants or animals performed by the author.

Rights and permissions

Springer Nature or its licensor holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Ogura, M. Forecasting consumption expenditure using a dynamic panel model with cross-sectional dependence: the case of Japan. SN Bus Econ 2, 140 (2022). https://doi.org/10.1007/s43546-022-00311-5

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s43546-022-00311-5