Abstract

This study argues that the spatiotemporal geostatistical model for real estate prices, which accounts for and incorporates spatial autocorrelation, can be estimated successfully using the Bayesian Markov Chain Monte Carlo (MCMC) estimation. While this procedure often encounters difficulty in calculating probabilistic densities in the Metropolis–Hastings (MH) algorithm, this study introduces a feasible and practical estimation method, providing useful estimated parameters for the model. Using single-family house transaction data, we show that ordinary estimations of real estate prices, with respect to certain explanatory variables, may lead to the underestimation of standard errors of coefficients for explanatory variables with spatial effects unless spatial autocorrelation is controlled for. Our model also makes it possible to obtain accurate in-sample predictions and moderately improved out-of-sample predictions for real estate prices. This study further estimates a “decay rate:” a diminishing correlation between real estate prices and increasing distance, showing that geographical proximities are likely to have an important impact on real estate prices, especially at a range under 600 m.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Based on the theoretical foundation of the hedonic model formulated by Rosen (1974), Freeman (1974), and others, many works, including those of Muth (1969) and Polinsky and Ellwood (1979), have used hedonic estimation to explain real estate prices, with respect to some explanatory variables. As Kanemoto (1988) describes the nature of such a hedonic approach in that period as “particularly attractive,” this approach can be applied to nonmarket interactions such as existence of externalities and public goods, even though there are many potential theoretical and empirical biases that need to be cautioned against. Hedonic analysis and regression, ranging from ordinary linear regression to sophisticated non-linear models and other estimation techniques, have attempted to retrieve certain effects from explanatory variables, including infrastructure provision, environmental changes, and other elements that affect real estate prices. In doing so, they assume that such changes in a particular location or city will eventually be reflected in real estate prices, through revealed preferences for certain properties.

This type of analysis has been conducted in many different fields, including regional studies and transportation economics, where researchers are interested in the effect of particular environmental characteristics and the provision of infrastructure or facilities. While the present study provides valuable insights into the estimation of coefficients for explanatory variables and spatiotemporal variance–covariance matrices, one of its focuses is on the prediction performance of the dependent variable (real estate price) in the estimated hedonic model. The strategy for improving the prediction performance of the model involves incorporating “spatial effects” in the estimation model, where the unexplained effects of explanatory variables maybe correlated with spatial proximity.

Between the late 1960s and the 1970s, several researchers used statistics to explore such spatial interactions. For example, Ord (1975) uses the maximum likelihood estimator to estimate a certain output via the spatial weight matrix, assuming the existence of spatial autocorrelation. Prof. Jean Paelinck coined the term "spatial econometrics,” pointing out the principles used to specify spatial econometric models (Paelinck (1978)). In a textbook, he published a specification estimation that incorporated spatial autocorrelation and included some empirical results (Paelinck and Klaassen 1979). Given the rapid advances in the analysis of spatial autocorrelation in recent decades (see e.g., Anselin and Bera (1998), LeSage and Pace (2009), and Anselin (2010)), analytical methods that consider spatial autocorrelation have emerged and accumulated in many strands of research.

These studies take similar approaches, employing a spatial weight matrix to capture the geographical distance between datasets. Naturally, this technique has been applied to hedonic real estate price analyses, reflecting the fact that real estate prices always incur a decent level of spatial autocorrelation, while location has a significant impact on real estate prices. Such studies apply the spatial weight matrix, estimated using GLS, maximum likelihood, or other methods that should be appropriate for statistical assumptions about explanatory variables and error terms.

Since real estate prices have many implications for our daily lives and the economy, capturing the effect of the surrounding environment, infrastructure provision, and other attributes, a wide range of estimation methods account for the spatially autocorrelated nature of real estate prices. The effect of spatial autocorrelation on real estate prices has thus attracted much attention and been analyzed by various researchers and academic societies.Footnote 1

One notable example is the research carried out by Basu and Thibodeau (1998), who exhibit superior performance in predicting house prices, using an estimation model called the Kriged EGLS, which outperformed the OLS method in six out of eight submarkets. Case et al. (2004) held a competition to estimate real estate prices, using the suggested estimation models and comparing their performances. While the Case’s model has some advantages, in terms of the mean squared errors for predicted values, the performance of the other spatial econometric model (the spatial Durbin Model) does not seem to improve, in contrast to the OLS method and its variants. Thus, incorporating neighboring information does not necessarily improve prediction. It is more important to include other attributes of real estate as explanatory variables.Footnote 2

The present study employs a geostatistical model, which can extract spatial effects ignored in the OLS estimation. While the process would be asymptotically the same if this study focused on estimating the coefficients, here it shows that the captured spatial effect of the geostatistical model can be used to predict prices and improve accuracy. Geostatistics, as the name suggests, were originally used in the earth sciences; they have recently been applied to other natural sciences, including ecological and health sciences. In these fields, geostatistical models that capture spatiotemporal effects have begun to emerge in the literature. For example, Conn et al. (2015) have estimated animal abundance in certain geographical areas (mesh data in the Bering Sea), whereas Paul et al. (2020) have estimated the progression of COVID-19 via county-level data in the United States, using Bayesian Markov Chain Monte Carlo (MCMC) algorithms. Alegana et al. (2016) have applied a geostatistical method to map malaria for elimination, using mesh data from Namibia via a Bayesian maximum likelihood estimation. Although several earth science studies have applied point-level data (e.g., Babcock et al. (2018), Beloconi et al. (2018), Guhaniyogi et al. (2013), and Yang and Ng (2019)), such studies do not use a spatiotemporal specification of variance–covariance matrices for their estimations. In line with previous research on the application of geostatistics to socio-economic research, Muto et al. (2021) have shown that the geostatistical model, which explicitly captures the spatial error structure in their estimation model, substantially improves in-sample prediction and can also improve out-of-sample forecast performance in the context of a panel data regression, when used with the Monte Carlo experiment and real data. This can explain the regional vacant house ratio, with respect to regional age composition.

Unlike other geostatistics research with spatiotemporal effects, the present study is distinct in that it examines real estate data, and our model captures the effect from point data in terms of spatial and temporal continuous spaces. Such research is rare, due to data availability issues and analytical complexities. One feature of real estate price data is that they cannot be captured at one time, such as governmental statistics. Instead, transactions occur at random, both spatially and temporally, within a certain geographical area and time frame, with real estate price and observed characteristics, such as the transaction price, floor area, and building age, recorded separately for each transaction. The present study extends the existing method to include a hedonic real estate price analysis, based on a spatiotemporal weight matrix. This succeeds in explicitly modeling the variance–covariance relationship in real estate transactions that occur at various locations and points of time and applying them to other locations and periods in the data. As this study shows, the chosen geostatistical model not only provides a certain level of goodness-of-fit for predicted prices, but also derives useful parameters of interest with a proper statistical foundation.

Another issue in hedonic price analyses is the probabilistic distribution of predicted values. In other words, even if real estate prices can be estimated and explained using a certain explanatory variable or spatial effect, it is impossible to obtain a deterministic prediction. In other words, there is always a certain probability distribution when predictions are made, based on the estimated model. In fact, it is analytically and practically necessary to estimate such a probabilistic distribution appropriately. This study therefore uses a Bayesian MCMC estimation to estimate the geostatistical model, making it possible to obtain the posterior probabilistic densities for the parameters of interest.Footnote 3

After overcoming various issues associated with hedonic analyses in this way, the present analysis shows that a geostatistical hedonic real estate estimation model incorporates geographical and temporal information, has multiple benefits for researchers and practitioners alike. First, the geostatistical model captures spatial autocorrelation through its error structure, leading to a proper estimation of coefficients, including their estimates and standard errors. We find that an ordinary hedonic estimation of real estate prices with respect to explanatory variables affected by the surrounding environment, tends to underestimate the standard errors of such coefficients because it overlooks spatial autocorrelation. This may lead to an erroneous assertion of the statistical significance of some estimated coefficients in the OLS estimation or in any estimation model that does not control for spatial autocorrelation.

Second, a method of spatial complementation known as Bayesian kriging can predict the probability distribution of real estate prices in a certain out-of-sample location derived from the estimated model. Thus, it provides a useful perspective in terms of spatial correlation at specific points if we can assume geographical continuity among the points of interest and the points in the data. As this study shows, the model predicts the posterior density of real estate prices for a desired location both inside and outside the geographical boundaries of the estimated model. The estimated posterior densities provide point estimates, spatial effect surface plots, and out-of-sample estimations; these are used in real estate research and practical studies. Third, we have found that the geostatistical model can substantially improve in-sample prediction performance, enhancing the performance of the out-of-sample prediction method, which derives from the Bayesian Kriging technique, with moderately higher R2 and smaller Mean Squared Errors (MSEs). Finally, because we have estimated the scale parameter for a spatial distance in the model, the posterior probability density for estimated scale parameters translates directly into the spatial decay rate, indicating the correlation between real estate prices and various spatial distances in the dataset.

This paper is structured as follows: Sect. 2 formulates the spatiotemporal geostatistical model employed in this study and introduces a scale parameter, which enables the estimation of a real estate price analysis. Section 3 describes the data and the regional context needed to understand the nature of the data. Section 4 estimates the results. While certain characteristics of the estimated model are introduced and analyzed in relation to a specific dataset, the model can be applied to many settings in other real estate markets. Such extensions and limitations are discussed in the later and concluding sections.

2 The geostatistical estimation model

Geology and other earth science fields deal with the estimation of unobserved variables of interest under spatial autocorrelation, incorporating geographical information into the statistical model via spatial effects to represent potential spatial heterogeneity, rather than adjusting the correlation in error terms. Following Gelfand et al. (2003) and Banerjee et al. (2014), the present study has employed the following regression model with spatial effects, referred to here as the “geostatistical model:”

where \(y={\left({y}_{1},\dots ,{y}_{n}\right)}^{T}\) is the n-dimensional vector of real estate price; X denotes the \(n\times p\) matrix of the explanatory variables;, \({I}_{n}\) is the \(n\times n\) identity matrix; \(\varepsilon\) and \(\omega\) are mutually independent error terms and spatiotemporal effects, respectively; and \(H\left(\bullet \right)\) is the spatiotemporal correlation matrix in which the \(\left(i, j\right)\)-element includes a spatial correlation of \({\rho }_{S}({s}_{i}-{s}_{j};\phi )\) as well as temporal correlation\({\rho }_{T}({t}_{i}-{t}_{j};\delta )\). Here, \({\rho }_{S}\) is a valid isotropic correlation function indexed by an unknown range parameter\(\phi\), and \({s}_{1},\dots {s}_{n}\) are typically two-dimensional vectors of longitude and latitude. Typical correlation function options include Gaussian correlation \({\rho }_{SGij}\) and exponential correlation \({\rho }_{SEij}\) as follows:

To accommodate typical real estate data, which contain temporal information related to transaction registration times and spatial information on the transaction locations, we introduce an additional unknown or estimated time range parameter \(\delta\), which signifies a certain transaction \({t}_{i}\) and \({t}_{j}\), which also has the Gaussian correlation \({\rho }_{TGij}\) and exponential correlation \({\rho }_{TEij}\)

We assume the \(\left(i, j\right)\)-element of \(H\left(\bullet \right)\) as the product of \({\rho }_{SGij}\) or \({\rho }_{SEij}\) and \({\rho }_{TGij}\) or \({\rho }_{TEij}\), namely, the correlation between spatial effects at \(({s}_{i},{t}_{i})\) and \(({s}_{j},{t}_{j})\) is described as

The two range parameters \(\phi\) and \(\delta\) can be interpreted as weights for geographical and time difference, respectively. As the above form shows, the degree of correlation decreases when the temporal distance increases, even for transactions that take place in the same space. In addition, the degree of correlation decreases if the spatial distance increases, even for transactions that take place at the same time. This correlation structure is known as a “separable” correlation; more complicated nonseparable spatiotemporal models are also available (e.g., Cressie and Huang 1999). As results based on such advanced models are not always easy to interpret, here we use the simple separable form of spatiotemporal correlation, and four versions of the combination above can be used. They are: i) exponential \({\rho }_{SEij}\) and exponential \({\rho }_{TEij}\), ii) exponential \({\rho }_{SEij}\) and Gaussian \({\rho }_{TGij}\), iii) Gaussian \({\rho }_{SGij}\) and exponential \({\rho }_{TEij}\), and iv) Gaussian \({\rho }_{SGij}\) and Gaussian \({\rho }_{TGij}\) When we execute the MCMC and use our own datasets to estimate Eq. (1), the Gaussian correlation based specification \({\rho }_{SG}\) for geographical distances (specifications iii) and iv)) exhibits unstable performance because it is difficult to estimate and invert the near singular matrix \(H\left(\phi ,\delta \right)\). Among the two specifications that use the exponential correlation \({\rho }_{SE}\) for geographical distances, the one that uses the exponential time correlation \({\rho }_{TE}\) performs better than the other in terms of the MCMC chain convergence for parameter \(\delta\), based on the Geweke’s Chi-square test, as specified by LeSage (1999). We therefore report the estimation results using the exponential correlation \({\rho }_{SE}\) for exponential distance and the Gaussian correlation \({\rho }_{TG}\) for time difference (specification i)) to ensure the stability of the MCMC algorithm.

In model (1), \(\omega\) is a vector of spatial and time effects, and the marginal distribution of \(y\) is\(N(X\beta , {\tau }^{2}{I}_{n}+{\sigma }^{2}H\left(\phi ,\delta \right))\), a spatiotemporal correlation is introduced in \(y.\) The distinction between the spatial econometric literature and the geostatistical literature stems from the distance matrix,\(H\),\(\left(\phi ,\delta \right)\), which may be a counterpart of the spatial weight matrix, often referred to as the W matrix in the spatial econometric model. To estimate model (1), Bayesian techniques via MCMC have been widely adopted (e.g., Banerjee et al. 2014). After introducing prior distributions for the unknown model parameters\((\beta ,{\sigma }^{2},{\tau }^{2},\phi , \delta )\), the posterior distribution of the unknown parameters is given as:

where \(\pi\) \(\left(\beta ,{\sigma }^{2},{\tau }^{2},\phi , \delta \right)\) are the prior distributions; \(p(y;X\beta ,\Sigma )\) are the probability density functions of \(N(X\beta ,\Sigma )\), and \(\Sigma ={\sigma }^{2}H\left(\phi \right)+{\tau }^{2}{I}_{n}\). Throughout the MCMC estimation in this study, the prior distribution for \(\beta\) is set as N (\({\beta }_{0}\), \({V}_{\beta }\)), where \({\beta }_{0}=0, {V}_{\beta }\)= 1,000, and that for the error structures, which are \(\sigma ,\tau ,\phi\) and \(\delta\), employs the inverse gamma prior (IG(1,1)).Footnote 4

The MCMC algorithm that generates posterior samples of \(\left(\beta ,{\sigma }^{2},{\tau }^{2},\phi , \delta \right)\) consists of iteratively generating random samples from the complete conditional distributions of \(\beta\) and (\({\sigma }^{2},{\tau }^{2},\phi , \delta\)). The complete conditional of \(\beta\) is given by:

where \({D}_{\beta }={(X{\Sigma }^{-1}{X}^{\prime}+{V}_{\beta }^{-1})}^{-1}\),\({d}_{\beta }=X{\Sigma }^{-1}y+{V}_{\beta }^{-1}{\beta }_{0}\)

However, the logarithm of the complete conditional distribution of (\({\sigma }^{2},{\tau }^{2},\phi , \delta\)) is:

The log of the determinant in Eq. (7) is calculated using the Cholesky decomposition, adding the logarithm of the diagonal element of the matrix to speed up the calculation. We then execute the random walk Metropolis–Hastings (MH) algorithm to generate a random sample from the distribution above. Using posterior samples of the model parameters, we generate posterior samples of the spatial error term \(\omega\) from the following conditional distributionFootnote 5:

where \({D}_{\omega }=({{\sigma }^{-2}H\left(\phi ,\delta \right)}^{-1}+{\uptau }^{-2}{I}_{n}{)}^{-1}\),\({d}_{\omega }={\tau }^{-2}(y-X\beta )\)

In a later section, we show that spatiotemporal information from the posterior samples of \(\omega\) substantially improves in-sample predictions and moderately improves out-of-sample predictions.

While this use of the geostatistical model to estimate real estate prices is relatively straightforward, researchers may encounter a situation in which the MH algorithm above does not perform well because \(\left|\Sigma \right|\) in Eq. (7) takes an extremely small (close to zero) or large value when the sample size is large. When the determinant is evaluated as infinity or zero by the MH algorithm, using a computer, it is impossible to judge the acceptance or rejection of proposal densities. We have overcome this problem by including a scale tuning parameter in the MH algorithm when estimating the proposal and current density of Eq. (8), as shown in the Appendix.Footnote 6

3 Data

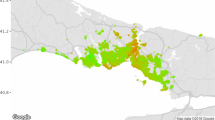

The present study uses real estate data obtained in Yokosuka City, Japan, 50 km south of central Tokyo. The city has various different housing areas within its compact boundary, which is diamond shaped and approximately 7.1 km from east to west and 6.5 km from north to south in our transaction data (Fig. 1a). In this suburban city, transaction samples are less dense than those taken in a major city center. To conduct a practical and useful analysis, we should consider a method of spatial complementation for out-of-sample predictions. As it is impossible to obtain sufficient samples that are spatially close, we must also refer to samples spanning several years from the transaction time.

The Tokyo metropolitan area has a monocentric city structure along commuter railways and a high homeownership rate (Kubo 2020). Many people commute to central Tokyo by train, traveling to the station on foot or taking buses that connect the station with suburban residential areas. The population of Yokosuka City is around 0.4 million; it has continued to decline from its peak in 1990, known as the “bubble period,” when real estate prices in Japan soared rapidly. At that time, this city faced acute urbanization, even on one difficult-to-access hillside, where direct car access to residential properties was limited or impossible. While the northeastern side of the city faces the coastline, Yokosuka is rather mountainous, with limited flat areas suitable for residential development. After the bubble period, the city experienced population loss and the number of vacant homes increased, particularly on the inaccessible hillside. As houses have become increasingly affordable, due to declining real estate prices, the demand for suburban housing has shifted to more convenient parts of the city. Furthermore, Yokosuka City has a military port and accumulated heavy industries. Factory closures have significantly accelerated the population decline. On the western edge of the city, there is a newly formed upscale residential complex, with some public facilities and a research institute. Some residential development has continued in neighborhoods that offer a sufficiently convenient commute to Tokyo or another larger city.

Thus, Yokosuka City has various residential areas, including distressed areas and a more upscale single-family housing complex within the geographically compact area; the city boundary and geographic characteristics are shown in Fig. 1a. In terms of the district information used in our estimation, the blue districts in Fig. 1b represent the hillside, which is surrounded by small mountains and contains significant numbers of long-term vacant houses and lots. The red districts in Fig. 1b represent the so-called “promotion area,” where the city financially supports the sale and purchase of existing houses to ensure an inflow of younger generation residents. Specifically, families with children can receive a maximum subsidy of 0.5 million JPY when they purchase an existing house, listed with the property bank. The promotion area was selected because it provides a suitable residential environment for raising a family: locations with low rise buildings, accessible by automobiles, and with easy access to train stations and/or bus stops. Compared to the hillside, a typical promotion area is composed of divided and orderly districts, with a low density of long-term vacant houses.

This study has employed property-level transaction data on detached houses, provided by the Real Estate Information Network System (REINS), a database for real estate agents, which shares property information. Registration is required by law for some forms of dedicated intermediary transactions, carried out by real estate agents. We use data registered by real estate agents or companies after the transaction through REINS is completed. While the registration of prices and other attributes is not necessarily mandated by laws after a transaction, the government and the REINS network encourage this; the data are thought to cover a sufficient proportion of transactions in this region.Footnote 7

The present analysis uses data on newly built and existing single-family houses, purchased and sold between 2016 and 2019, for a total sample size of 1,136 observations. Table 1 shows the summary statistics for the entire sample, which include prices and property-specific characteristics, such as the age of each transacted building and its building and floor areas. The data have been classified using access to the closest station, bus usage, and daily passenger numbers at the closest stations as property-level spatial variables. To reflect development history and each property location’s susceptibility to natural disasters, we include data detailing the construction period of developments in densely inhabited districts (DID) for each decade from the 1960s through the 2010s. The public data include risk areas for sediment related disasters and 3 m deep inundations, caused by tsunamis of a certain level, as property-level spatial dummy variables. The local characteristics discussed in this section, include both hillside and promotion areas. The ratio of residents who have lived in the development for twenty years or more is included as a district-level dummy variable to characterize the age of the development. To convert the longitude and latitude data to geographical distance, this study uses distances calculated via the GRS80 ellipsoid from the website of the Geospatial Information Authority of Japan. Distance related to longitude and latitude was measured by 0.1 points at the center of the data sample. We then converted 0.1 points of longitude to 9,100.741 m and 0.1 points of latitude to 11,094.52 m.Footnote 8

4 Estimation result

4.1 Estimation of coefficients for explanatory variables.

In comparing the OLS and geostatistical models, Table 2 shows the results of estimating the transaction price of single-family housing in Yokosuka City as an explanatory variable, using the data described in the previous section.

In terms of the estimates of coefficients for the explanatory variables, the posterior standard errors of the coefficients for the geostatistical model are greater than those of the OLS estimation for the property-level spatial variable, which includes district-level variables and the time it takes to walk to the railway station. This tendency toward larger standard errors using OLS for explanatory variables with spatial effects, thought to be spatially correlated with each other, reflects the likelihood of encountering underestimated standard errors for the hedonic estimated coefficients of such variables when spatial autocorrelation is not incorporated. In regard to property-specific explanatory variables, such as building age, floor size, and land area, such underestimations have not been observed. In addition, the standard errors associated with the geostatistical model tend to be smaller than those in OLS.

At the same time, we observe the largely robust nature of estimates, which are the posterior means in the geostatistical model, depending on the estimation model and the inclusion of various explanatory variables. As shown by Lee (2002), OLS estimates can be consistent even when spatial autocorrelation exists.Footnote 9 Thus, as standard errors for coefficients with spatial effects can be underestimated, researchers should be cautious in interpreting the statistical significance of such explanatory variables, taking steps to avoid causal judgment of the effect of explanatory variables by considering the existence of spatial autocorrelation. For example, while one might expect the presence of a tsunami hazard area to bring down house prices, this assumption contradicts the seemingly positive premium on prices in such areas, based on the OLS estimation result for specifications (2) and (4) in Table 2. These coefficients for the geostatistical model, although still positive, are less than their standard errors for the geostatistical model. We can see that these explanatory variables have a statistically insignificant effect on real estate price when estimations are made using the geostatistical model. Among various area specific explanatory variables, the presence of a sediment disaster risk has a consistently negative impact on real estate prices, even when spatial autocorrelation is controlled for using the geostatistical model. In addition, the data confirm the positive effect on real estate prices of mitigating hazards in such areas. From a regional policy perspective, there is a case for policy interventions to alleviate or mitigate landslides in this city. Such a policy could be introduced by increasing property tax revenue and regional revitalization.

We should note that we can employ spatial econometric models, such as the spatial lag of X (SLX) model and the spatial Durbin error model (SDEM), to correctly estimate the coefficients when considering spatial effects on real estate prices. In relation to our model, SLX and SDEM have been estimated, with the results compared in Table 4. They show the similarity between spatial econometric models and the geostatistical model for the coefficients of development age, disaster risk, and other district-level variables, which are captured by the specification, considering spatial effects. These variables tend to lose their explanatory power, which has a “significant” effect, according to OLS estimates. Moreover, the findings show a moderately improved fit to the observed data, in terms of the coefficient of determination (R2), when the spatial error specification in SLX and SDEM is included. The advantage of the SLX and SDEM models is evident for studies that aim to infer the direction and significance of estimated coefficients, in relation to the computational intensity of a geostatistical model. At the same time, there is a certain limitation in applying these models to our analysis, which explores the continuous spatiotemporal nature of the correlation.

4.2 Bayesian kriging and out-of-sample prediction, based on geostatistical models

The geostatistical model is effective in providing a statistically sound model by determining separately the effects of the explanatory variables and spatiotemporal effect. This model is particularly useful in situations where the predictive rationale has been questioned, including real estate appraisals. It is insufficient to simply question its price prediction performance. The geostatistical model estimated using Bayesian MCMC provides various forms of posterior densities, conditioned on the data and relatively non-informative prior distributions. One useful output of the estimation is the conditional distribution of the unobserved spatial effect (\({\omega }_{{k}_{0}}\)) at a certain out-of-sample point (\({k}_{0})\) on \(\omega\), which is defined by the following equation:

where Eq. (9) assumes multivariate normality between \({\omega }_{{k}_{0}}\) and \({\omega }_{{k}_{0}}\) and \({\sigma }^{2}{z}_{{k}_{0}}\) is its spatiotemporal covariance vector. Thus, the posterior mean value of \({\omega }_{{k}_{0}}\) is derived, as in Banerjee et al. (2014):

While we can retrieve the Kriged value of spatial effect (\({\omega }_{{k}_{0}}\)) at any spatial or temporal data point, we fix the temporal data toward the period, which is the end of 2019, and build an argument using the spatial correlation among geographical spaces. Using model specification (4) in Table 2, we obtain the posterior distribution of \({\omega }_{{k}_{0}}\) for specific locations using the point’s longitude and latitude information, which marks particular locations in (a) the hillside area, (b) the intermediate residential neighborhood, and (c) the upscale neighborhood at the southwest edge of our sample, shown in Fig. 2.

Posterior distribution of \({\omega }_{{k}_{0}}\) in different locations. (Specification of Table 2 (4))

This figure shows the effect of spatial information, which cannot be explained by explanatory variables. It not only shows the mean value of the predicted posterior densities in each location, but also the probabilistic distribution of posterior densities in a statistically consistent way. In other words, properties with the same characteristics (i.e., building age, building size, land area, transportation, and other attributes) are evaluated in each transaction, giving a house in the upscale residential complex a premium of around 17.8 million JPY and a house on the hillside a discount worth around 8.0 million JPY, according to the mode values of the posterior distribution shown in Fig. 2. These premiums and discounts derived from our data exhibit a fairly wide distribution. The shape of the distribution varies among data points. Seemingly, the narrower the posterior distribution of \({\omega }_{{k}_{0}}\) is, the more support is obtained from the correlation among surrounding observed data. We can derive such posterior densities in any location in or near the sample area. The distribution and its mean values can be useful for any individual or professional who wants to infer the real estate price for a particular property, using coherent information on real estate transaction data. These distributions can be easily combined with real estate prices; such combined probabilistic distributions are useful for mass evaluations, which are often conducted by financial institutions that manage multiple properties in a particular region.Footnote 10

The other metric that may help to identify the spatial effect is the surface plot derived from the Kriged values for grid points, using the posterior means of the error structure defined in Eq. (10). We can derive the posterior mean surface plot, as shown in Figs. 3a and b; these surface plots show a premium or discount that cannot be explained by property- or area-specific variables. Such variables include walking routes and bus access, as well as building age and floor and land area. We can therefore derive a numerical value from the premium or discount for a property at a certain location, which indicates positive or negative neighborhood quality, a characteristic that is sometimes referred to by real estate professionals in Japan as “land class.”

Using the posterior mean value of \({\omega }_{{k}_{0}}\) defined in Eq. (10), we can also conduct out-of-sample predictions, using the estimated coefficients and error structure variables, when we know certain characteristics about a property. Specifically, we estimate the model without data in the most recent year. We then make a counterfactual forecast or out-of-sample prediction for the real estate price in the latest year, assuming that we have correct information on the location and attributes of the transacted house.Footnote 11 As Table 3 shows, the benefit of the improved in-sample predictive performance of the geostatistical model is reflected in the out-of-sample predictions or forecasts. Under specifications (1) and (2), the geostatistical model provides moderately better predictions with higher R2 and smaller MSEs.

When OLS or another non-spatial estimation method is used, one strategy for avoiding erroneous assertions about the effect of explanatory variables on spatially correlated dependent variables is to include district-specific variables, such as specification (5) in Table 2 and specification (3) in Table 3. The present study employs district dummy variables, including one for the finest unit in the town segment, totaling 250 districts, following the spatial heterogeneity in detail. However, we would argue that this use of dummy variables should be limited to the analysis of coefficients and is not appropriate for a prediction analysis, while the prediction of the real estate price is often of interest to academic researchers or practitioners.Footnote 12

According to the results shown in Table 3, the out-of-sample prediction for the estimation model with district dummy variables is less accurate than the predictions of models without regional dummy variables in both the OLS and geostatistical models. This may reflect the over fitting of the estimation model with the district dummy variable, since there are few samples for each district and the biases associated with each transaction may lead to erroneous estimates of the district-specific effect. As there are large standard errors for the district dummy variable in the geostatistical model, researchers should avoid making predictions based on the estimated coefficients of those dummy variables. However, geostatistical models consistently perform better in estimating out-of-sample real estate prices. In other words, the bias between the posterior mean and the actual value of a real estate price has a larger R2 and smaller MSEs in the geostatistical model, even with fewer explanatory variables in the dataset. The improved MSEs in the out-of-sample prediction come to 0.049 out of the 0.375 from OLS, a smaller result than one might expect, given the drastic improvement in the in-sample prediction. This figure could be improved through the use of better property-specific data, such as the number of rooms or other specific property characteristics.

4.3 Spatial decay rate for correlation (variogram)

Having estimated the error structure variable that accounts for spatial autocorrelation, which is \(\phi\) in our specification, we can derive a spatial decay rate to measure how real estate prices are spatially and temporally correlated. Specifically, the spatial decay rate (\({D}_{S}\)) was derived from the following equation:

where \(d\) denotes the geographical distance (km).Footnote 13

Figure 4 shows the curve of the posterior mean values, which are shown as solid lines. The 10% and 90% tile values obtained from their posterior densities are shown as dashed lines for geographical distances and time differences. According to the results, the spatial correlation of real estate prices diminishes to 0.5 at around 200 m distant data points, according to the median value of the decay rate. When we infer the real estate price of a specific property with past surrounding data points, we need data within a radius of approximately 600 m, where the price correlation dissipates at a distance of approximately 0.1. This decay rate should be especially useful for appraisers, who regularly collect transaction data for “surrounding” areas for comparison purposes. While the results of our study have been obtained in a limited geographic space for a specific type of property—the transaction price for a single-family property in Yokosuka City, Japan between 2016 and 2019—we expect to obtain standardized figures with certain levels of variation by accumulating similar analyses with different datasets.

Spatial decay rate (Specification of Table 2 (4))

4.4 Limitations and possible extensions of future analyses

This study has analyzed the applicability and usefulness of the geostatistical model for real estate price analyses. The findings show that various numerical values can be obtained with statistical consistency in relation to coefficient estimation, prediction implementation, and the measurement of spatiotemporal correlations. Currently, the main limitation of this analytical method is its calculation intensity. The data used for this study include 1,136 data points, suggesting that the geographical matrix required for this analysis is 1,136 times 1,136 square matrices. As a Bayesian MCMC estimation requires a significant amount of time to implement an estimation with larger numbers, such analyses will be difficult or infeasible using an ordinary personal computer if the sample size becomes significantly larger than our datasets.

At present, the analysis described in this paper can be used to treat a relatively small amount of data, up to approximately 1,000 data points. The advantage of the present analysis lies in its ability to estimate the parameters of the error structure variable. We can estimate the necessary parameters with a certain precision, using a relatively limited amount of data. As computational capabilities progress rapidly, this issue should be overcome by technological advances in the future. In other words, researchers should implement “big data” analyses using millions of data points, and this sample size problem should be addressed as soon as possible. Although it is beyond the scope of the present study, an estimation can be carried out with relatively limited spatial correlation structures, using an approximated version of the large-scale Gaussian process, as in the predictive Gaussian process (Banerjee et al. 2008 and Latimer et al. 2009) and the nearest-neighbor Gaussian process (Datta et al. 2016). This will be possible when we can use a large dataset with spatial information to estimate real estate prices.

Although it is important to extend the analysis in this direction, it is also essential to conduct multiple analyses in different locations, using different types of properties. Since our analyses have uncovered some parameters that may have universal implications for real estate price analyses, such as the spatial decay rate, a comparison of different analyses can help researchers and practitioners ascertain the nature and formation of real estate prices, which hold a significant portion of our assets and affect individual lives, as well as the economy as a whole.

5 Conclusion

This study has developed a geostatistical model that uses explanatory variables and spatially autocorrelated error structures to explain real estate prices. The estimation has been carried out via the Bayesian MCMC method and MH within the Gibbs procedure. This type of estimation often suffers from computational difficulties, especially when calculating the determinant of the variance–covariance matrix, which often takes an extremely large or small value. We propose a scale tuning parameter to coordinate the determinant value within a computable value range and make it possible to estimate the spatiotemporal geostatistical model, using data from real estate transactions.

The results of this study demonstrate several findings of applying a model that considers a spatial autocorrelation that can be applied to real estate across a whole city, using transaction data from detached houses in Yokosuka City, Japan. First, the coefficients of explanatory variables with a spatial effect may underestimate the standard errors under OLS for some explanatory variables with spatial heterogeneities. Second, using the estimated geostatistical model, we have checked the predictive performance of the in-sample prediction and obtained a substantially improved margin of error for the predicted and actual values. The out-of-sample prediction performance has been examined and found to achieve moderately improved MSEs for the predicted values, in comparison to the actual values. Thus, the estimated model can improve the accuracy of real estate price estimates in the future and at points where there are no regional data by extracting the spatial effect on real estate prices. It can also derive statistically appropriate probability distributions. Third, from the spatial correlation perspective, our estimated model shows that the influence of real estate prices affects a relatively small range of properties, less than 600 m away. Such figures can be an important indicator for appraisers and real estate agents, who collect transaction cases in the surrounding area and judge their importance in the data. It is important in real estate analysis to generalize these boundaries through various studies based on different property types and geographical areas.

Although this analysis is limited in relation to geography and real estate types, the overall structure of the model should be universally applied to all hedonic real estate price analyses. Geographical space has a significant impact on real estate prices and this fact is unlikely to change, even with modern technology. Hedonic analyses carried out using a geostatistical model that allows for the structural analysis of autocorrelated space and time are expected to advance significantly in the near future.

Notes

Regarding the literature on the spatial nature of real estate prices, some researchers have used the Kriging technique developed in the field of geostatistics (see Kuntz and Helbich (2014)). Cheung et al. (2021) extend their analysis to include the development of the Automated Valuation Model (AVM) for the residential rental market, which considers spatial autocorrelation using weighted least squares. Both of these papers estimate the variogram structure directly and do not capture the whole error-term structure, as this paper does.

Reflecting advances in spatial econometrics analysis, subsequent strands of literature in the field of transportation economy, including Haider and Miller (2000) and Tsutsumi and Seya (2008), have aimed to capture the effect of transportation infrastructure on real estate prices. Another strand of the real estate and regional economics literature deals with the estimation of real estate prices under spatial autocorrelation. Brasington and Hite (2005) explore the effect of environmental quality on housing prices, using the spatial econometric method. They find a small but significantly negative effect of environmental hazards on prices. Small and Steimez (2012) review some articles about the so-called spatial hedonic housing-price model, examining the direct and spillover benefit effects of environmental attributes via the spatial multiplier derived from spatial-lag models. Regarding the problem of spatial heterogeneity, which emerges in general methods such as OLS, some researchers, including Farber and Yates (2009), employ GWR. Moreover, Páez et al. (2007) have used moving window kriging (MWK) to directly address spatial autocorrelation, a modification of the GWR. Also, among spatial studies in the statistical field, Matsuda and Yajima (2009) performed the parametric and nonparametric estimation on the Japanese house prices, which are observed as irregularly spaced data, using their frequency domain approach based on the asymptotic theories. Recently, Gupta and Hidalgo (2022) has developed the nonparametric prediction algorithm for spatial data, and applied to the prediction of housing prices in Los Angeles, where the data is collected on a lattice.

Several preceding papers deal with the estimation of real estate prices in Japan, including Inoue et al. (2007) and Tsutsumi et al. (2011). These authors use the hedonic model, with a spatiotemporal covariance function using OLS and a Weighted Least Squares estimation, to map or visualize of real estate prices. While their research intention coincides with the present analysis in some ways, their method uses a relatively restricted form for the spatiotemporal covariance. Moreover, their models derive the point estimates of real estate prices and parameters for spatiotemporal covariances, without retrieving the distribution of estimated parameters for spatiotemporal covariances.

The choice of normal and inverse-gamma distributions as the prior distributions in Eq. (5) comes from their conditional conjugacy. It is natural to use prior distributions that are not so informative, as used in the paper. The effect of the changes in prior distributions is limited under moderate sample sizes as in our application, and the results would not be sensitive to the choice of priors.

We restrict the bound of the proposed parameter values of the error structures in the MH algorithm within 50, and assume the positive definiteness of \(\Sigma\), the stability of the computation algorithm. The estimated result in this paper is obtained through 30,000 MCMC iterations with a burn-in period of 3,000 iterations using Matlab. For the algorithm convergence check, we examined the chain plot of the MCMC samples, as shown in Table 5. We then examined the numerical standard errors (NSEs) and the relative numerical efficiency (RNE) of the MCMC samples. As a formal test to determine the convergence of the algorithm, we performed Geweke’s chi-square probability test, described in LeSage (1999).

Even including the scale tuning parameters, we cannot completely eliminate scale sensitivity from the MCMC estimation, especially for the dependent variable and the values for space and time difference, which are longitude, latitude, and transaction date. Thus, compared to that shown in the descriptive statistics shown in Sect. 3, we use the dependent variable divided by a thousand, longitude and latitude are multiplied by 100, and the date of the transaction divided by 100 to achieve algorithmic smoothness.

While the coverage figures are not known or announced officially, experts have said in interviews that such transactions cover around 30–40% of all residential transactions made by individual owners in Tokyo and adjacent prefectures.

To obtain location data using the longitude and latitude of transacted real estate, we have used the address-matching services provided by the Center for Spatial Informational Science (CSIS) at the University of Tokyo. We note that 160 out of 1,136 samples have exactly the same longitude and latitude in the obtained data. Of these, many are newly built houses that lacked precise addresses at the time of transaction (while they were being built). Since a positive definite location matrix is needed to carry out the estimation adequately, properties have been differentiated using a 10-m distance in both the east–west and north–south directions. In these data, the average house is approximately 160 m2. If one assumes that the land is square, one side would be approximately 12.65 m. Because each data point exists as a separate detached house, we have estimated each data point by shifting it 10 m in the longitudinal direction and 10 m in the latitudinal direction. In calculations made when this distance was assumed to be 20 m and 30 m, for example, we retrieved a robust result.

Lee (2002) argues that the OLS estimator is consistent in some spatial scenarios, in cases where certain units may have small spatial impacts on other units, although each unit can be influenced aggregately. Lee also shows that the OLS method can be asymptotically efficient, relative to some other estimators, including estimations that use instrumental variables and MLEs.

Alongside the mass evaluation of real estate, many studies address the performance of the Automated Valuation Model (AVM). Bogin and Sui (2020) compare the performance of the OLS and other advanced methods, such as the “tree-based model,” which is a random forest and boosting model.

Out of 1,136 samples taken between 2016 and 2019, 298 samples were transacted in 2019. We estimate the model using 838 samples, making 298 out-of-sample forecasts for the models in Table 3.

Morali and Yilmaz (2020) note that the possibilities of spatial autocorrelation are significantly reduced when spatial-dependence factors and district-level data are controlled for in a standard hedonic regression. The result discussed in this paper suggests that we should acknowledge the benefits of capturing spatial autocorrelation. The simple inclusion of district-specific variables may end up missing information on the interdependence of geographically proximate data.

While we can readily derive the time decay rate using the estimate of \(\delta\), which is defined as the temporal decay rate (\({D}_{T}=\mathrm{exp}(-td/\delta )\)) as in Eq. (3), where td denotes a certain time difference, the estimated posterior distribution of \(\delta\) is relatively diffused; we thus avoid showing the estimated result in this paper. We should also explore this time-decay rate using various property types and regions.

References

Alegana VA, Atkinson PM, Lourenço C et al (2016) Advances in mapping malaria for elimination: fine resolution modelling of Plasmodium falciparum incidence. Sci Rep 6:29628

Anselin L (2010) Thirty years of spatial econometrics. Pap Reg Sci 89(1):3–25

Anselin L, Bera AK (1998) Spatial dependence in linear regression models with an introduction to spatial econometrics. Stat Textbooks Monogr 155:237–289

Babcock C, Finley AO, Andersen H-E, Pattison R, Cook BD, Morton DC, Alonzo M, Nelson R, Gregoire T, Ene L, Gobakken T, Næsset E (2018) Geostatistical estimation of forest biomass in interior Alaska combining Landsat-derived tree cover, sampled airborne lidar and field observations. Remote Sens Environ 212:212–230

Banerjee S, Gelfand AE, Finley AO, Sang H (2008) Gaussian predictive process models for large spatial data sets. J Royal Stat Soc Ser B Stat Methodol 70(4):825–848

Banerjee S, Bradley PC, Gelfand AE (2014) Hierarchical modeling and analysis for spatial data. Chapman & Hall, CRC. Monogr Stat Appl Prob 135

Basu S, Thibodeau TG (1998) Analysis of spatial autocorrelation in house prices. J Real Estate Finan Econ 17(1):61–85

Beloconi A, Chrysoulakis N, Lyapustin A, Utzinger J, Vounatsou P (2018) Bayesian geostatistical modelling of PM10 and PM2.5 surface level concentrations in Europe using high-resolution satellite-derived products. Environ Int 121(1):57–70

Bogin AN, Shui J (2020) Appraisal accuracy and automated valuation models in rural areas. J Real Estate Finan Econ 60(1–2):40–52

Brasington DM, Hite D (2005) Demand for environmental quality: a spatial hedonic analysis. Reg Sci Urban Econ 35(1):57–82

Case B, Clapp J, Dubin R, Rodriguez M (2004) Modeling spatial and temporal house price patterns: a comparison of four models. J Real Estate Finan Econ 29(2):167–191

Cheung W, Guo L, Kawaguchi Y (2021) Automated valuation model for residential rental markets: evidence from Japan. J Spatial Econ 2(1)

Conn PB, Johnson DS, Hoef JMV, Hooten MB, London JM, Boveng PL (2015) Using spatiotemporal statistical models to estimate animal abundance and infer ecological dynamics from survey counts. Ecol Monogr 85(2):235–252

Cressie N, Huang HC (1999) Classes of nonseparable, spatio-temporal stationary covariance functions. J Am Stat Assoc 94(448):1330–1339

Datta A, Banerjee S, Finley AO, Gelfand AE (2016) Hierarchical nearest-neighbor Gaussian process models for large geostatistical datasets. J Am Stat Assoc 111(514):800–812

Freeman AM (1974) On estimating air pollution control benefits from land value studies. J Environ Econ Manag 1(1):74–83

Gelfand AE, Kim H-J, Sirmans CF, Banerjee S (2003) Spatial modeling with spatially varying coefficient processes. J Am Stat Assoc 98(462):387–396

Guhaniyogi R, Finley AO, Banerjee S, Kobe RK (2013) Modeling complex spatial dependencies: low-rank spatially varying cross-covariances with application to soil nutrient data. J Agric Biol Environ Stat 18(3):274–298

Gupta A, Hidalgo J (2022) Nonparametric prediction with spatial data. Econ Theory. https://doi.org/10.1017/S0266466622000226

Haider M, Miller EJ (2000) Effects of transportation infrastructure and location on residential real estate values: application of spatial autoregressive techniques. Transp Res Rec J Transp Res Board 1722(1):0641

Inoue R, Kigoshi N, Shimizu E (2007) Visualization of spatial distribution and temporal change of land prices for residential use in Tokyo 23 wards using spatio-temporal kriging. In Proceedings of 10th International Conference on Computers in Urban Planning and Urban Management, Paper ID: 63

Kanemoto Y (1988) Hedonic prices and the benefits of public projects. Econometrica 56(4):981–989

Kubo T (2020) Divided Tokyo: disparities in living conditions in the city center and the shrinking suburbs. Springer, Singapore

Kuntz M, Helbich M (2014) Geostatistical mapping of real estate prices: an empirical comparison of kriging and cokriging. Int J Geogr Inf Sci 28(9):1904–1921

Latimer AM, Banerjee S, Sang H Jr, Mosher ES, Silander JA Jr (2009) Hierarchical models facilitate spatial analysis of large data sets: a case study on invasive plant species in the northeastern United States. Ecol Lett 12(2):144–154

Lee L (2002) Consistency and efficiency of least squares estimation for mixed regressive, spatial autoregressive models. Economet Theor 18(2):252–277

LeSage J, Pace RK (2009) Introduction to spatial econometrics. CRC Press, FL

LeSage J (1999) Applied econometrics using MATLAB. The. Web: https://www.spatial-econometrics.com/html/mbook.pdf

Matsuda Y, Yajima Y (2009) Fourier analysis of irregularly spaced data. J Royal Stat Soc Ser B (stat Methodol) 71(1):191–217

Morali O, Yilmaz N (2020) An analysis of spatial dependence in real estate prices. J Real Estate Financ Econ. https://doi.org/10.1007/s11146-020-09794-1

Muth RF (1969) Cities and housing: the spatial pattern of urban residential land use. The University of Chicago Press, Chicago

Muto S, Sugasawa S, Suzuki M (2021) Prediction and forecasting under spatial autocorrelation using a geostatistical panel model, CREI-Working Paper No. 1. University of Tokyo, Japan

Ord JK (1975) Estimation methods for models of spatial interactions. J Am Stat Assoc 70:120–126

Paelinck J (1978) Spatial econometrics. Econ Lett 1(1):59–63

Paelinck J, Klaassen L (1979) Spatial econometrics. Saxon House, Farnborough

Páez A, Fei Long F, Farber S (2008) Moving window approaches for hedonic price estimation: an empirical comparison of modelling techniques. Urban Stud 45(8):1565–1581

Paul R, Arif AA, Adeyemi O, Ghosh S, Han D (2020) Progression of COVID-19 from urban to rural areas in the United States: a spatiotemporal analysis of prevalence rates. J Rural Health off J Am Rural Health Assoc Nat Rural Health Care Assoc 36(4):591–601

Polinsky AM, Ellwood DT (1979) An empirical reconciliation of micro and grouped estimates of the demand for housing. Rev Econ Stat 61(2):199–205

Rosen S (1974) Hedonic prices and implicit markets: product differentiation in pure competition. J Polit Econ 82(1):34–55

Small KA, Steimetz SSC (2012) Spatial hedonics and the willingness to pay for residential amenities. J Reg Sci 52(4):635–647

Tsutsumi M, Seya H (2008) Measuring the impact of large-scale transportation projects on land price using spatial statistical models. Pap Reg Sci 87(3):385–401

Tsutsumi M, Shimada A, Murakami D (2011) Land price maps of Tokyo metropolitan area. Procedia Soc Behav Sci 21:193–202

Yang P, Ng TL (2019) Fast Bayesian regression kriging method for real-time merging of radar, rain gauge, and crowdsourced rainfall data. Water Resour Res 55(4):3194–3214

Acknowledgements

We would like to thank Yasushi Asami, Masayoshi Hayashi, Shinobu Minamikawa, Toshihiko Yamasaki, Noriyuki Yanagawa, and participants at the CREI workshop at the University of Tokyo for their insightful comments. We also thank Kimihiro Hino and Yokosuka City for providing data from Yokosuka City, and we thank the Real Estate Information Network System (REINS) for providing a parcel level real estate data. We would like to thank the reviewers for their comments on this paper regarding their suggestions for improving the position of the estimation model in academic research, its algorithms, and the robustness of estimation results.

This work gratefully acknowledges the support received from the Joint Research Program No.1075 at the Center for Spatial Information Science, the University of Tokyo. Sachio Muto is from the Ministry of Land, Infrastructure, Transport and Tourism (MLIT), Government of Japan, and the views expressed in this paper are those of the authors and do not necessarily reflect the official policy or position of any agency of the Japanese government.

Funding

Open access funding provided by The University of Tokyo.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare no conflicts of interest associated with this manuscript.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix. MCMC estimation and introducing a scale tuning parameter to the MH step

Appendix. MCMC estimation and introducing a scale tuning parameter to the MH step

See Tables

4,

To estimate with the MH step in the Bayesian MCMC estimation in this study, it is necessary to calculate the determinant values to obtain and compare the value of the proposal density and current density, as in Eq. (7).

Since the value of \(\left|\Sigma \right|\) often takes too large or too small a value to compute, especially for a large amount of data, the calculation is scale sensitive, and we use the following “scale tuning parameter” (\({s}_{tu}\)), which is a scalar within some reasonable bounds in Eq. (7). More specifically, we can rewrite the Eq. (7) as follows by introducing \({s}_{tu}\):

It is clear that a scaler \({s}_{tu}\) should be analytically dropped when comparing the log of the proposal and current posterior target densities if we use the same \({s}_{tu}\) for both the proposal and current densities. This analytically meaningless parameter is necessary for us to conduct the MH step by keeping the value of the determinant within the range of numerical values that can be calculated by ordinary calculation software, and we update \({s}_{tu}\) in each iteration so that \(|\Sigma \cdot {{s}_{tu}}^{2}|\) takes a value within a certain bound. In our analysis, we set the update procedure as follows.

-

i.

If \(|\Sigma \cdot {{s}_{tu}}^{2}|\) is larger than 100, \({s}_{tu}\) is tuned such that \(|\Sigma \cdot {{s}_{tu}}^{2}|\) equals 100.

-

ii.

If \(|\Sigma \cdot {{s}_{tu}}^{2}|\) is smaller than 0.01, \({s}_{tu}\) is tuned so that \(|\Sigma \cdot {{s}_{tu}}^{2}|\) equals to 0.01.

-

iii.

If (i) or (ii) are not applicable, \({s}_{tu}\) is kept at the same value as in the previous iteration.

The chain value of \({s}_{tu}\) for estimating specification (4) in Table 2 at each iteration is shown in Fig.

5 and the chain values of the coefficient and error structure parameters are shown in Fig.

The chain value for the coefficients and the error terms in estimating geostatistical model (Specification (4) of Table 2)

6.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Muto, S., Sugasawa, S. & Suzuki, M. Hedonic real estate price estimation with the spatiotemporal geostatistical model. J Spat Econometrics 4, 10 (2023). https://doi.org/10.1007/s43071-023-00039-w

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s43071-023-00039-w