Abstract

This paper derives an entrepreneur’s optimal switching between an idle and an active state under stochastic mean reverting output prices. The paper suggests a new categorisation of the effects of mean reversion. Mean reversion affects valuation and optimal entry and exit thresholds via the variance of output prices and expected future cashflows. High variance increases the value of optionality and enhances hysteresis effects. Changes to the expected cashflow path affect the attractiveness of the active relative to the idle state. In addition, changes to the moments affect the implicit risk discounting rate and thereby valuation and the optimal switching strategy.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

A classical challenge of the real options literature is the derivation of a firm’s optimal entry and exit strategy under uncertainty. Under what current condition and outlook should an entrepreneur invest in a market entry and when is it time to withdraw? In a seminal paper, Dixit [1] discusses the entry and exit problem of firms under output price uncertainty and shows how the value of flexibility creates hysteresis. Higher uncertainty increases the value to wait, which means that the spread between entry and exit price thresholds becomes wider. That is, the optimal entry threshold is higher than the variable cost plus the interest on the entry cost, and the optimal exit threshold is lower than the variable cost minus the interest on the exit cost.

Mossin [2] too studies market switching under uncertainty. He works in a discrete time setting. Dixit solves the entry and exit problem in a continuous time geometric Brownian motion output price setting. Dixit’s continuous time perspective has inspired a large theoretical and applied literature.

A geometric Brownian motion specification may be a good approximation in the case that the expected return of an underlying asset can be characterised by a geometric trend, e.g. in the Black and Scholes [3] stock market setting. However, as discussed by Lund [4], the geometric Brownian motion is probably not a good description of the dynamics of goods and services prices. Higher output prices will typically trigger higher production via better utilisation of existing production units, investment in new production capacity and due to the entry of new firms and vice versa for lower prices. Gradual adjustment of supply in response to changes in demand, i.e. inelastic short-term and elastic long-run supply, creates mean reverting goods and service prices.

Dixit recognises that mean reversion in prices may be a reasonable assumption in the case that production is responding to changes in output prices. This is precisely the case when firms enter or exit the market under price uncertainty. He therefore suggests extending the basis model by letting output prices follow a mean reverting process, i.e. he suggests that prices follow the geometric mean reverting process:

where \(\lambda\) governs the degree of mean reversion, \({P}^{*}\) is the fixed long-run equilibrium or mean level of output prices, and \(d{B}_{t}\) is the increment of a standard Brownian motion. However, Dixit does not derive a closed-form solution for the case that output prices following Eq. (1).

In Dixit’s basis model, the market agent is risk-neutral. Dixit suggests extending the model by introducing an output price process with a risk-adjusted trend. The risk adjustment of Dixit’s model is analytically fairly straightforward if modelled as a combination of the geometric random walk specification and classical capital asset pricing model (CAPM) assumptions.

Sarkar [5] discusses the impact of mean reversion on optimal entry. He follows Dixit and lets the mean reverting cashflow be described by process (1) above. Dixit and Pindyck [6] and Metcalf and Hassett [7] for similar optimal entry problems apply a slightly different geometric mean reversion output price process, i.e. the geometric Ornstein–Uhlenbeck differential equation.

Tsekrekos [8] derives a closed-form solution to a Dixit-type entry and exit problem in the case that the output prices are mean reverting. Tsekrekos follows Dixit and Sarkar and assumes that the output price follows (1) above and uses CAPM arguments to incorporate market pricing of risk. More precisely, he makes the assumption that the market price of risk is constant and that the correlation between the change in the output price and the return of the market portfolio is constant. That is, he follows Bhattacharya [9] both as regards the choice of stochastic price process and the pricing of risk.

In a consumption CAPM setting, only under restrictive assumptions are a constant market price of risk and a constant correlation between the output price and the market return mutually consistent. For example, the properties hold under time-additive constant relative risk aversion and normally distributed consumption growth rates and rate of asset returns. The extended Dixit and Tsekrekos models’ frameworks are therefore consistent with an implicit assumption that market agents have time-additive utility and constant relative risk aversion.

This article returns to the study of a risk-averse firm’s entry and exit decision under uncertainty and mean reverting output prices. The switching problem is solved for the geometric mean reversion process of Laughton and Jacoby [10] under log utility. See Schwartz [11] and Smith and McCardle [12] for early applications of the process. As will be evident below, the choice of utility function is favourable from a technical point of view and makes it easy to separate the different effects of mean reversion on valuation and optimal switching strategies. A more general specification of preferences would be preferable, but the choice is a sacrifice in order to obtain closed-form solutions that are a prerequisite for the economic analysis.

For an overview of alternative output price specifications in the literature, see Dias et al. [13]. A few articles study the effect of mean reversion in other types of underlying variables. For example, Dias and Shackleton [14] study hysteresis effects caused by mean reverting interest rates, i.e. they solve a switching problem for a Cox–Ingersoll–Ross stochastic process. Tsekrekos and Yannacopoulos [15] study optimal switching under mean reverting stochastic volatility. Kwon [16] studies the entry and exit problem under the assumption that prices deteriorate over time due to competition and new technologies. This approach may be a useful alternative to the mean reversion specifications.

The article is organised as follows: Sect. 2 introduces an entry and exit model for a geometric mean reverting output price. Section 3 adds a utility function to the Dixit model. Section 4 discusses the mean reverting switching model’s properties and suggests a new categorisation of the effects of mean reversion on optimal switching strategies. Section 5 discusses possible applications and extensions of the model. Section 6 concludes.

2 A Model of the Firm’s Entry and Exit Decision Under Risk Aversion and Mean Reverting Output Prices

Let an output price \({P}_{t}\) be given by a geometric mean reversion process, i.e. let

Here, \(\kappa >0\) governs the degree of mean reversion; \(\alpha\) represents the fixed long-run equilibrium or mean level of output prices on a logarithmic form, i.e. \(\alpha\) may take negative values; and \(\sigma >0\) is the standard deviation of the relative change of the output price. Let \({P}_{t}>0\) for any t. The moments of the output price process are easily calculated; see Tvedt [17]. The log of the output price follows an Ornstein–Uhlenbeck differential equation. For later use, note that the conditional expectation and variance of the log of the price process are

where \({\mathcal{F}}_{t}\) is a filtration of available information up to time t. The conditional expectation of the log of the price process converges towards a fixed number \(\alpha -\frac{{\sigma }^{2}}{2\kappa }\), and the conditional variance of the log of the price process converges towards a fixed number \(\frac{{\sigma }^{2}}{2\kappa }\) for high \(\tau\).

The entrepreneur has preferences for future consumption. Let the entrepreneur receive a nondurable endowment at any time t that can be turned into w units of consumption at the same period of time t. As an alternative to consuming w, the entrepreneur may use the endowment to produce one unit of output, which is sold in the market at the output price \({P}_{t}\). The entrepreneur will then, at any time t, use the cashflow from the sale to buy and consume \({P}_{t}\) units of the consumption good. The cashflow if the entrepreneur’s firm is actively producing is then uncertain and given by the dynamics of output price \({P}_{t}\). The endowment may be interpreted as an input factor, and the units of consumption, w, may alternatively be interpreted as the variable cost of production in the active case.

In this model setup, there is no direct inter-temporal substitutions. However, let there be a sunk investment cost or sunk cost of commencing production, \({k}_{entry}\), and a sunk cost of closing down production, \({k}_{exit}\). That is, these costs are necessary sacrifices for achieving an optimal consumption path, which is given by the optimal switching between the fixed level w in the idle state and the uncertain level \({P}_{t}\) in the active state.

Let the entrepreneur’s preferences be given by a von Neumann–Morgenstern utility function, which in the case that the entrepreneur optimally exercises the options to enter and exit the market under output price uncertainty can be characterised by the following value function:

where the entrepreneur’s instantaneous utility in the active state at time t is given by \(\varepsilon ln{P}_{t}\) and in the idle state by \(\varepsilon lnw\). \({I}_{a}\) is an indicator function, which takes the value 1 in the active state and 0 in the idle state. \(\rho\) is a constant discount factor that reflects time preferences. The controls \(\omega\) are given by \(\omega =\left({\theta }_{1},{\theta }_{2},\dots ,{\theta }_{N};{\xi }_{1},{\xi }_{2},\dots {,\xi }_{N}\right)\), where \({\theta }_{j}\) is the time of control j and \({\xi }_{j}\) is the direction of the move at control j, i.e. either an entry or an exit from the market.

The optimisation problem is similar to that of Dixit except for the output price process and the specification of risk preferences. The autonomous property of the problem suggests that the optimal output price thresholds for entry and exit, \({P}_{high}\) and \({P}_{low}\), respectively, are fixed for given parameter values.

Due to the time homogenous property of value function (5), it is natural to try a solution of the form \(\Phi \left({p}_{t}\right)={e}^{-\rho t}V\left({p}_{t}\right)\). For the controls to be optimal, the dynamics of value function (5) in the case that the firm is in an idle state and in an active state, respectively, should then satisfy the following partial differential equations:

Requirement (6) implies that the instantaneous return on the value of staying idle and at an optimal time exercising the real option to entering into the active state should be equal to the change in the value function from the change in the output price plus the instantaneous utility of the fixed consumption in the idle state. Requirement (7) implies that the instantaneous return on the value of being in the active state and optimally in the future switch between the active and the idle states should be equal to the change in the value function from the change in the output price plus the instantaneous utility of consumption in the active state.

Define a variable \(\mathrm{z}=\frac{\kappa }{{\sigma }^{2}}{\left(\propto -\frac{{\sigma }^{2}}{2\kappa }-lnp\right)}^{2}\). It then follows that the homogenous parts of Eqs. (6) and (7) reduce to.

That is, the equations reduce to Kummer’s equations with known solutions.

A solution to the inhomogenous part of Eq. (6) is simply the net present value of the log of future consumption in the idle state, i.e. \(\underset{0}{\overset{\infty }{\int }}{e}^{-\rho s}\varepsilon lnwds=\frac{\varepsilon lnw}{\rho }\). Adding together the solutions to the homogenous and inhomogenous parts gives the following solution to Eq. (6), i.e. the value function in the idle (zero) state:

where \(M\left(a,b,z\right)\) is Kummer’s function. See Abrawomitz and Stegun [18]. To make the expression somewhat more compact, a constant \(\frac{\sqrt{\kappa }}{\sigma }\), which is a factor of the solution’s \({z}^{1-b}=\frac{\sqrt{\kappa }}{\sigma }\left(\propto -\frac{{\sigma }^{2}}{2\kappa }-lnp\right)\), is included in the constant \({B}_{0}\). The same applies to the constant \({B}_{1}\) in Eq. (11).

The solution to the homogenous part of Eq. (7) has the same structure as the solution to Eq. (6), but with constants \({A}_{1}\) and \({B}_{1}\) instead of the constants \({A}_{0}\) and \({B}_{0}\). Note that \({\mathrm{V}}_{o}\left(p\right)\) represents the value of the flexibility to switch between the active and idle states plus the fixed utility of staying in the idle state forever. A reasonable assumption is therefore that the inhomogenous part of Eq. (7) represents the value of being active without any utilisation of switching options. That is, a solution to the inhomogenous part of Eq. (7) is simply the discounted value of the expected future instantaneous utility of always being active. Given that the first and second moments of the log of the output price is finite, it follows that

A solution to Eq. (7), i.e. the value function in the active (one) state, is then.

In the case that the output price approaches zero, the constants \({A}_{0}\) and \({B}_{0}\) of relation (9) should be related in such a way that it makes the value of the switching option in the idle state approaching zero. Note that when \(p\to 0\), then \(z\to \infty\). Using the asymptotic property of Kummer’s function, \(\underset{z\to \infty }{\mathrm{lim}} \ M\left(a,b,\mathrm{z}\right)=\frac{\Gamma \left(b\right)}{\Gamma \left(a\right)}{e}^{z}{z}^{a-b}\), the requirement that \({V}_{0}-\frac{\varepsilon lnw}{\rho }\to 0\) for \(p\to 0\) implies that.

In the case that the output price gets infinitely high, the value of the active state should approach the value of the future utility of the cashflows in the active state only as the value of the option to exit should approach zero. Note that if \(p\to \infty\), then \(\sqrt{-z}\to \infty\) and \(z\to \infty\). Due to the asymptotic property of Kummer’s function and letting \({V}_{1}-\frac{\varepsilon \kappa }{\rho \left(\rho +\kappa \right)}\left(\alpha -\frac{{\sigma }^{2}}{2\kappa }\right)-\frac{\varepsilon lnp}{\rho +\kappa }\to 0\) for \(p\to \infty\), the relation between the two constants \({A}_{1}\) and \({B}_{1}\) in (10) is given by.

The value functions in the idle (zero) or active (one) states can then be written in terms of the output price, the parameter values and two constants \({A}_{0}\) and \({A}_{1}\):

Let the high price that represents the optimal threshold for entry be \({p}_{high}^{MR}\) and let the low price that represents the optimal threshold for exit be \({p}_{low}^{MR}\) under the geometric mean reversion (MR) output price process. For these thresholds to be optimal, the value matching (16) and (17) and smooth pasting (18) and (19) conditions must be satisfied. See Dixit [19]:

Equations (16) to (19) determine the constants \({A}_{0}\) and \({A}_{1}\) and the optimal execution of the real options to switch between idle and active states in terms of the high entry price \({p}_{high}^{MR}\) and the low exit price \({p}_{low}^{MR}\).

3 A Dixit Model with Log Utility

In order to create a benchmark for comparing the mean reversion model to the Dixit specification, a few minor changes to the Dixit model are useful. It is straightforward to introduce log utility in the Dixit model. The differential equations for the idle and active states in the Dixit model are, respectively, as follows:

where \(\mu\) is the geometric trend and \(\sigma\) is the standard deviation of the relative change of a geometric Brownian motion and \(w\) is an operation cost. Mathematically, the optimal threshold levels of the Dixit model are not affected if the Dixit model’s operation cost, w, is redefined as a fixed cashflow in the case of idleness. That is, by removing w from Eq. (21) and adding it as a positive part in Eq. (20), the optimal switching strategy is not affected.

In order to introduce a risk-averse entrepreneur in the Dixit model, let the entrepreneur’s preferences be given by an instantaneous log utility, i.e. the same preferences as in the mean reversion model above. By moving the cost component w from Eqs. (20) to (21) and redefining w from a cost in the active state to a fixed income in the idle state, a closed-form solution is available in the case of instantaneous log utility.

In the idle and active states, respectively, the optimal switching strategies must satisfy the following differential equations:

The homogenous parts of Eqs. (22) and (23) are identical to the Dixit model, i.e. Euler equations with \(p>0\). Solutions to the inhomogenous parts of Eqs. (22) and (23) are given by a constant and a linear function of \(lnp\), respectively. Solutions to Eqs. (22) and (23), given the same endpoint conditions as in Dixit, are then

where

High contact and smooth pasting give four optimality conditions for determining the two threshold values for an optimal switching strategy under log utility (LU) and a geometric random walk, i.e. for determining the optimal high entry price \({p}_{high}^{LU}\) and the optimal low exit price \({p}_{low}^{LU}\), and the two constants A and B, given fixed entry and exit costs.

4 Optimal Switching Strategies Under Mean Reversion and Random Walk

The literature recognises three effects on optimal switching from a change in the degree of mean reversion: (a) the ‘variance effect’, (b) the ‘risk discounting effect’ and (c) the ‘realised price effect’:

-

a)

Increased mean reversion reduces the (long-run) variance, which typically reduces the value of the option to wait — i.e. the ‘variance effect’ reduces the spread between the thresholds and moves them closer to the Marshallian levels, i.e. the operation cost plus the interest on the cost of switching.

-

b)

Increased mean reversion reduces the systematic risk of future cashflows, which increases the certainty equivalent net present value. The risk discounting effect typically lowers both the entry and the exit thresholds as the active volatile state becomes relatively more attractive compared to the idle state.

-

c)

Mean reversion impacts the likelihood that a given level of the output price will be reached within a specified period of time. The direction of the realised price effect depends to a large degree on the present level of the cashflow relative to the long-run mean level.

The variance and realised price effects are discussed in Metcalf and Hassett. The risk discounting effect is recognised by Sarkar for the optimal entry case. Tsekrekos concludes that the findings of Sarkar also extend to entry and exit switching models. He finds that the variance and risk discounting effects affect the switching thresholds, whereas the realised price effect only affects the likelihood that the switching thresholds will be reached — not the level of the thresholds. As discussed above, in Tsekrekos, the market price of risk and the correlation between changes in \({P}_{t}\) and the market portfolio are assumed constant, which may affect the impact of changes to the output price mean reversion compared to a model where preferences are specified directly.

For completeness, in this section, the effect of volatility and risk aversion is discussed first, before turning to the question of mean reversion. To make the comparison with the existing literature easy, in most cases, parameter values from Dixit’s paper are applied.

Let the cashflow in the idle state \(w=1\). In the standard Dixit model, this represents a normalisation of prices. In the models with log utility, this implies that utility in the idle case is zero. Let the fix entry cost \({k}_{entry}=4\) and the fixed exit cost \({k}_{exit}=0\). Let the discount factor \(\rho =0.025\). Let the volatility parameter \(\sigma =0.1\). Let the utility parameter \(\varepsilon =1\). For the Dixit model and the Dixit model with log utility, let \(\mu =0\).

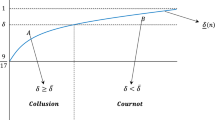

Figure 1 shows the effect on the entry and exit thresholds in the Dixit model and the Dixit model with log utility from changing the standard deviation parameter \(\sigma\). Given the base case parameters, the optimal thresholds in the Dixit model are \({p}_{low}=0.77\) and \({p}_{high}=1.47\) and in the model with log utility \({p}_{low}^{LU}=0.78\) and \({p}_{high}^{LU}=1.51\). In the Dixit model, the spread between the switching thresholds is 0.70 and in the Dixit model with log utility 0.73. A stronger preference for risk-free income implies that the entry and exit thresholds are higher in the model with log utility than in the standard Dixit model with risk neutrality.

For the Dixit model with log utility, the classical result of the Dixit model holds, i.e. higher \(\sigma\) increases the spread between the optimal switching thresholds, i.e. the classical hysteresis effect. If the volatility parameter \(\sigma\) is increased from 0.1 to 0.2, then the spreads between the switching thresholds increase to 1.13 and 1.22, respectively, for the Dixit model and model with log utility. That is, the spread difference between the models increases from 0.03 to 0.09. Risk aversion adds to the traditional hysteresis effect on the entry threshold as the higher volatility makes the cashflow in the active state less attractive than the stable income in the idle state. However, a less attractive cashflow in the active state makes the entrepreneur more inclined to exit to the idle state, which pushes the optimal exit threshold upwards. That is, the direct effect of higher volatility for a risk-neutral entrepreneur is a higher entry threshold and a lower exit threshold. In addition, for the risk-averse entrepreneur, the higher volatility increases the risk discounting of the volatile income in the active state, which pushes both the entry and exit thresholds upwards.

The conditional expectation of the geometric Brownian motion (GBM) can be defined by one parameter only and the variance by two parameters, i.e. \(\mu\) and \(\mu\) and \(\sigma\), respectively:

By setting \(\mu =0\), as in the base case, the value of \(\sigma\) defines the variance of the process (29) for any \(\tau\). Figure 1 is therefore a representative illustration of the effect of higher volatility, measured in terms of the standard deviation of the relative change in the output price, on the entry and exit thresholds — both for the Dixit model and the Dixit model with log utility.

For the geometric mean reversion process, the links between parameter values and the moments are more complex. The conditional expected value and the variance of the geometric mean reverting price process can be expressed in terms of the expectation and variance of the log of the process as given by Eqs. (3) and (4). That is, from the property of a lognormally distributed variable, the conditional expectation of the output price is

And the conditional variance of the process is

Both the expected value and the variance depend on the three parameter values \(\alpha\), \(\kappa\) and \(\sigma\). The long-run expected level of the output price is given by \(\underset{\tau \to \infty }{\mathrm{lim}}E\left[{P}_{\tau }|{\mathcal{F}}_{t}\right]=exp\left(\alpha -\frac{{\sigma }^{2}}{4\kappa }\right)\). For a given \(\alpha\), the log of the long-run average is lower for higher \(\sigma\) and for lower \(\kappa\). Therefore, a change in \(\sigma\) or \(\kappa\) does not only change the variance of the price process, but also the expectation. A change in the value of one parameter may have a rather complex impact on option values and the optimal switching strategies.

Figure 2 shows optimal entry thresholds for different levels of the long-run variance of the log of the price process and for the mean reversion parameter \(\kappa\) at 0.075, 0.25, 0.50 and 0.75. For all \(\kappa\) and \(\sigma\), the value of \(\alpha\) is adjusted in such a way that the long-run mean is stable at \(\underset{\tau \to \infty }{\mathrm{lim}}E\left[{P}_{\tau }|{\mathcal{F}}_{t}\right]=exp\left(\alpha -\frac{{\sigma }^{2}}{4\kappa }\right)\approx 1.9344\) in order to focus on the effect of changes to the variance — not the long-run mean. This stable mean (st. m.) is consistent with \(\alpha =ln\left(2\right)\), \(\sigma =0.1\) and \(\kappa =0.075\). That is, on the horizontal scale of Fig. 2, the long-run standard deviation of the log of the output price is given by different levels of \(\sigma\), whereas the threshold values are derived after adjusting the long-run mean to the stable mean, i.e. after compensating for the effect on the mean of changes to \(\sigma\).

Figure 3 shows optimal exit thresholds for different levels of the long-run variance of the log of the price process for different values of \(\kappa\).

Higher volatility, measured as the long-run variance of the log of the price process, increases the entry threshold and decreases the exit threshold. However, this relation does not hold for very low volatility and very strong mean reversion. In these cases, the option value of exit approaches zero. That is, \({A}_{1}\) in Eq. (15) approaches zero for low \(\sigma\) and high \(\kappa\). If the volatility is sufficiently low and the mean reversion force is sufficiently strong, there is hardly any case for a future exit from the market. The problem reduces to a question of optimal entry only. Besides this special case, the hysteresis effects of Dixit also hold for the mean reversion specification.

The easily derived moments and the direct specification of the risk preferences create a fairly simple framework for studying the effect of mean reversion on the valuation of flexibility and optimal switching strategies. The effect on the variance of the log of the output price from a change in the mean reversion parameter \(\kappa\) is given by

Higher mean reversion reduces the variance of the log of the output price process for high \(\tau\). The effect converges towards \(\frac{d\underset{\tau \to \infty }{\mathrm{lim}}Var\left[{lnP}_{\tau }|{\mathcal{F}}_{t}\right]}{d\kappa }=-\frac{{\sigma }^{2}}{{2\kappa }^{2}}\). This suggests that the mean reversion ‘variance effect’ on valuation is especially strong for low discount rates and for long investment horizons.

Define the ‘risk discounting effect’ as the effect on option valuation and optimal switching from changes in the stochastic discount factor caused by a change in the mean reversion parameter \(\kappa\). Define the stochastic discount factor, \({m}_{\tau ,t}\), as the inter-temporal marginal rate of substitution in the active state, i.e.

By definition, in this model, there is no opportunity for inter-temporal substitution — besides the switching between the idle and active states. That is, Eq. (33) is an implicit discount factor, which is only consistent with the entrepreneur’s preferences if the consumption path reflects an optimal inter-temporal substitution in a world where such substitution actually could take place.

From (33), it follows that the value of a bond, \({Q}_{\tau ,t}\), that pays unity with certainty at time \(\tau\) is given by

where \({r}_{\tau ,t}^{f}\) is the yield on a zero-coupon bond at time t with maturity \(\tau\). The risk-free yield is then

Let the forward price of one unit of output at time \(\tau\) be given by \({P}_{\tau ,t}^{FW}={e}^{-\rho \left(\tau -t\right)}E\left[{m}_{\tau ,t}|{\mathcal{F}}_{t}\right]={e}^{-\rho \left(\tau -t\right)}{P}_{\tau }\). The expected return at time t of holding the forward contract will then be

If storage of the output good was an option, contrary to model assumptions, the expected return on storing the output at time t and selling at time \(\tau\), \({r}_{\tau ,t}^{S}\), would be

From Eqs. (35) to (37), the spread between the expected return \({r}_{\tau ,t}\) and the risk-free interest rate \({r}_{\tau ,t}^{f}\) is given by

From Eqs. (36) to (37), it follows that \(\underset{\tau \to \infty }{\mathrm{lim}}{r}_{\tau ,t}=\rho >0\), whereas \(\underset{\tau \to \infty }{\mathrm{lim}}{r}_{\tau ,t}^{S}=0\). That is, in the long-run, the return on any hypothetical storage would be below the rate of time preference.

The risk discounting effect is related to changes in the expectation and variance of the output price. From the rate of return measures (35), (36) and (37), it follows that changes in the expected path of the output price from a change in \(\kappa\) change the demanded compensation for risk. As the expected path of the output price is altered, the expected future utility levels are changed and thereby the implied expected risk discounting factor.

From Eqs. (14) to (15), it follows that the parts of the value functions that are related to optionality are functions of the current output price via the functions \({z}_{t}=z\left({P}_{t}\right)\) and \(\sqrt{{z}_{t}}\). From Eqs. (4) to (37), it follows that

The effect on the option values from a change to the output price goes via the current output price’s effect on the expected price path, i.e. via the long-run expected return, and on the standard deviation, i.e. via the implicit compensation for risk. The effect of a change in the mean reversion parameter \(\kappa\) on \(\sqrt{{z}_{t}}\) is

The direction of the effect on \(\sqrt{{z}_{t}}\) from a change in the mean reversion parameter \(\kappa\) and thereby also the direction of the effect on the value of the entry and exit options depends on whether the log of the output price, \(ln{P}_{t}\), is high or low versus the long-run mean \(\propto -\frac{{\sigma }^{2}}{2\kappa }\). At \(ln{P}_{t}=\propto -\frac{{\sigma }^{2}}{2\kappa }\), the sign of the second part of the value functions (14) and (15) changes. This implies that if \(ln{P}_{t}\) is on the low side of the long-run mean, then an increase in the mean reversion parameter generally increases the option value. The expected near-term outlook of switching to the active state is improved. The value effect of this together with the positive effect of reduced implicit risk compensation may dominate the negative option value effect of reduced volatility.

If \(ln{P}_{t}\) is on the high side of the long-run mean, then an increase in the mean reversion parameter generally reduces the option value. The near-term outlook of switching to the active state is less bright. Volatility is reduced. Except for the positive effect on valuation of the reduced implicit risk compensation, the other factors contribute to reducing the option value.

Figures 4, 5 and 6 show the effect on the option value in the idle case for different levels of the output price and different levels of the mean reversion parameter \(\kappa\). The base case parameter values are here the same as in Tsekrekos. That is, the standard deviation of the relative change of the output price \(\sigma =0.15\), the discount rate \(\rho =0.04\), the fix entry cost \({k}_{entry}=3\), the fixed exit cost \({k}_{exit}=2\) and the income in the idle state \(w=1\).

The figures show the option value of the Dixit model with log utility together with the option values for the mean reversion model with \(\kappa =0.02\), \(\kappa =0.05\) and \(\kappa =0.1\). In Fig. 4, the long-run mean reversion parameter \(\propto =0\), i.e. at a low level. In Fig. 5, \(\propto =\mathrm{ln}(2.325)\), i.e. at a medium level. In Fig. 6, \(\propto =\mathrm{ln}(3)\), i.e. at a high level. In all the cases, the optimal entry thresholds are around 2 or lower. Given identical parameter values, Figs. 4, 5 and 6 are directly comparable to Tsekrekos Fig. 2.

In the low long-run mean case and for a given level of the output price, higher mean reversion implies that the option value is reduced. However, this is only true for output prices above a certain minimum level. In the high long-run mean case and for a given level of the output price, a higher mean reversion implies that the option value increases for prices below the entry threshold.

At certain levels of the output price, the direction of the mean reversion effect switches. Figure 5 illustrates this. Here, the long-run mean level is just right to create a switching of the direction at output price levels that are somewhat lower than the optimal entry threshold. For output prices below the switching threshold, increased mean reversion increases the option value. For output prices above the switching threshold, increased mean reversion reduces the option value.

Higher income in the idle state, w, makes it less attractive to move into the active state. The optimal entry threshold increases when w increases. Figure 7 shows the optimal entry threshold for different levels of w and for \(\kappa =0.02\), 0.05 and 0.075. Parameter values are as in the base case above.

The level of the income in the idle state, w, relative to the long-run average in the active state is important for the direction of the effect on the entry threshold from a change in the mean reversion parameter. If w is clearly below the long-run mean, then an increase in \(\kappa\) implies that the entry threshold declines. Increased mean reversion implies that the expected cashflow path for the active state will point more steeply upwards. The expectation effect makes the active state look more attractive versus the idle state. Both the expected cashflow and a lower implicit risk discount rate make the active state more attractive versus the idle state. The variance effect works in the same direction by reducing the value of waiting.

If w is clearly above the long-run mean, then an increase in \(\kappa\) implies that the entry threshold becomes higher. The main factor is the expectation effect. Higher mean reversion implies that the expected cashflow path points more steeply downwards. Both the expected cashflow and a lower implicit risk discount rate make the active state less attractive relative to the idle state. The variance effect works in the opposite direction by reducing the value of waiting. In Fig. 7, the variance effect is not dominating.

As illustrated above, the effects of mean reversion work through the expectation and variance of the output price process. The effects that are independent of an entrepreneur’s risk attitude may be characterised as the direct expectation and variance effects, whereas the effects that follow from an entrepreneur’s risk aversion may be characterised as the expectation and variance risk discounting effects. This suggests a somewhat alternative way of categorising the effects of mean reversion on valuation and optimal switching strategies:

-

a)

The variance effects

-

i)

The direct variance effect: reduced variance from higher mean reversion reduces the hysteresis effect on the optimal switching thresholds of a risk-neutral agent, which pushes the entry and exit thresholds closer together and closer to the Marshallian levels. That is, the entry level becomes lower and the exit level higher.

-

ii)

The risk discounting effect: reduced variance reduces the risk discount rate, i.e. it reduces the risk compensation demanded by a risk-averse entrepreneur. The relative attractiveness of the volatile cashflow in the active state increases versus the certain cashflow in the idle state. That is, the entry level becomes lower and the exit level higher.

-

i)

-

b)

The expectation effects

-

i)

The cashflow effect: a higher mean reversion makes the output price converge faster towards the long-run mean. If the output price is low relative to the long-run mean, higher mean reversion makes the outlook for the cashflow in the active state more favourable. The entry threshold will be lower (more favourable to leave the idle state) and the exit level lower as well (less favourable to enter the idle state). If the output price is high relative to the long-run mean, the effect of mean reversion will be the opposite given that the outlook for the cashflow in the active state will become less favourable.

-

ii)

Risk discounting effect: the change in the expected output price path changes the expected utility path as well, which affects the implicit risk discount rate. When the cashflow outlook is improved, the demanded risk compensation of a risk-averse entrepreneur is reduced. A steeper upward output price path makes the entry threshold lower and the exit threshold higher and vice versa for a steeper downward path. That is, the risk discounting effect from a change in the expected output price path works in the same direction as the cashflow effect.

-

i)

5 Potential Applications and Extensions

The mean reversion switching models are especially relevant for markets where supply only gradually adjusts to changes in demand, but there are no significant long-run supply restrictions. In other words, the models may be relevant when markets are characterised by inelastic short-term supply and elastic long-run supply. If long-run supply elasticity is restricted, e.g. the gold market, then the original Dixit model may be a better choice.

Schwartz [11] and Schwartz and Smith [20] criticise the use of the one-factor geometric mean reversion model for commodities and suggests two-factor models, i.e. combinations of the geometric mean reversion process and the geometric Brownian motion. Switching models inspired by the two-factor perspectives of Schwartz and Smith could be an area for future research.

In order to match industry-specific characteristic better, there is room for developing the mean reversion model further. For example, Brekke and Øksendal [21] extend the Dixit model by introducing resource extraction. A switching model with resource extraction and mean reversion may be a fairly good description of the optimal opening and closing problem of mining industries.

A number of stochastic processes have been suggested for approximating the notoriously volatile ocean freight rates. The papers of Mossin and Tvedt are discussed above. Dixit and Pindyck [6] apply the classical Dixit model on entry, exit and scrapping in the oil tanker industry. Bjerksund and Ekern [22] suggest that the freight rate follows an Ornstein–Uhlenbeck process. Sødal et al. [23] suggest that the freight rate spread between dry bulk and tanker markets follows an Ornstein–Uhlenbeck process and derives the optimal switching strategies between these markets. In a general setting, Suzuki [24] derives a solution to a somewhat similar switching problem and let the agent switch between three regimes.

In light of the shipping market literature, the framework of this paper may be useful for studying the classical ship layup problem. In the shipping context, initial entry, investment lags and scrapping may also be included. Methodically, the Dixit–Pindyck–Sødal discount factor approach may be a natural starting point in the case of mean reverting cashflows. See Dixit, Pindyck and Sødal [25] and Sødal [26].

In structure, the model of this paper is fairly close to a classical labour market switching problem. The entrepreneur’s endowment, at any time t, may be interpreted as hours available for work, which a worker can apply in two types of labour markets. That is, the idle state may be interpreted as a fixed salary job or leisure combined with social benefits. The active state may be interpreted as a variable pay job or self-employment.

A key result of the paper is the link between the moments of the mean reversion output price and the value of flexibility and the optimal switching strategy. The result partly hinges on the specification of preferences. A natural next step is to study the generality of this result. The large literature initiated by Kim and Omberg [27] and Campbell and Viceira [28] on optimal portfolio management under mean reverting stochastic risk premiums may give some guidelines to what utility specifications that may lead to closed-form solutions. The literature appears to suggest that to obtain closed-form solutions for general specifications of the representative agent’s preferences and relevant mean reverting price processes is challenging.

6 Concluding Remarks

An advantage of the mean reversion framework of this paper is the easily derived moments and a direct specification of the risk preferences of the entrepreneur. This makes it easier to derive analytical results.

The impact of the mean reversion on the value of flexibility and the optimal switching strategy goes via the expectation and variance of the underlying output price process. Both the expectation and variance work via two channels — the direct effect that is independent of the entrepreneurs’ risk attitude and the effect on the implicit risk discounting factor, which reflects the entrepreneurs’ risk aversion. Many commodity, consumer goods and services prices exhibit some degree of mean reversion. The paper’s categorisation of the effects of mean reversion may therefore be useful in a number of contexts that involve decision-making under uncertainty and optionality.

Data Availability

The datasets generated during and/or analysed during the current study are available from the corresponding author on reasonable request.

References

Dixit A (1989) Entry and exit decisions under uncertainty. J Polit Econ 97(3):620–638. https://doi.org/10.1086/261619

Mossin J (1968) “An optimal policy for lay-up decisions”. Swedish J Econ 170–177. https://doi.org/10.2307/3439310

Black F, Scholes M (1973) The pricing of options and corporate liabilities. J Polit Econ 81(3):637–654. https://doi.org/10.1086/260062

Lund D (1993) The lognormal diffusion is hardly an equilibrium price process for exhaustible resources. J Environ Econ Manag 25(3):235–241. https://doi.org/10.1006/jeem.1993.1045

Sarkar S (2003) The effect of mean reversion on investment under uncertainty. J Econ Dyn Control 28(2):377–396. https://doi.org/10.1016/S0165-1889(02)00181-1

Dixit A and Pindyck RS (1994) Investment under uncertainty, Princeton university press.

Metcalf GE, Hassett KA (1995) Investment under alternative return assumptions comparing random walks and mean reversion. J Econ Dyn Control 19(8):1471–1488. https://doi.org/10.1016/0165-1889(94)00838-9

Tsekrekos AE (2010) The effect of mean reversion on entry and exit decisions under uncertainty. J Econ Dyn Control 34(4):725–742. https://doi.org/10.1016/j.jedc.2009.10.015

Bhattacharya S (1978) Project valuation with mean-reverting cash flow streams. J Financ 33(5):1317–1331. https://doi.org/10.1111/j.1540-6261.1978.tb03422.x

Laughton DG and Jacoby HD (1993) Reversion, timing options, and long-term decision-making. Financ Manage 225–240

Schwartz ES (1997) The stochastic behavior of commodity prices: Implications for valuation and hedging. J Financ 52(3):923–973. https://doi.org/10.1111/j.1540-6261.1997.tb02721.x

Smith JE, McCardle KF (1999) Options in the real world: lessons learned in evaluating oil and gas investments. Oper Res 47(1):1–15

Dias JC, Larguinho M, Braumann CA (2015) “Entry and exit decisions under uncertainty for a generalized class of one-dimensional diffusions,” in Real Options Conference. Athens and Monemvasia.

Dias JC, Shackleton MB (2011) Hysteresis effects under CIR interest rates. Eur J Oper Res 211:594–600

Tsekrekos A, Yannacopoulos A (2016) Optimal switching decisions under stochastic volatility with fast mean reversion. Eur J Oper Res 251(1):148–157

Kwon HD (2010) Invest or exit? Optimal decisions in the face of a declining profit stream. Oper Res 58(3):638–649

Tvedt J (1997) Valuation of VLCCs under income uncertainty. Marit Policy Manag 24(2):159–174. https://doi.org/10.1080/03088839700000067

Abramowitz M and Stegun IA (1972) “Handbook of mathematical functions with formulas, graphs, and mathematical tables”. National Bureau of Standards Appl Math Series 55. Tenth Printing

Dixit A (1993) "The art of smooth pasting," in Fundamentals of Pure and Applied Economics 55 Harwood Academic Publishers.

Schwartz ES, Smith JE (2000) Short-term variations and long-term dynamics in commodity prices. Manage Sci 46(7):893–911

Brekke KA, Øksendal B (1994) Optimal switching in an economic activity under uncertainty. SIAM J Control Optim 32(4):1021–1036. https://doi.org/10.1137/S0363012992229835

Ekern S and Bjerksund P (1995) “Contingent claims evaluation of mean-reverting cash flows in shipping” in Real options in capital investment: Models, strategies, and applications 207–219

Sødal S, Koekebakker S, Aadland R (2008) Market switching in shipping – a real option model applied to the valuation of combination carriers. Review of Financial Economics 17(3):183–203. https://doi.org/10.1016/j.rfe.2007.04.001

Suzuki K (2016) Optimal switching strategy of a mean-reverting asset over multiple regimes. Automatica 67:33–45

Dixit A, Pindyck RS, Sødal S (1999) A markup interpretation of optimal investment rules. Econ J 109(455):179–189

Sødal S (2006) Entry and exit decisions based on a discount factor approach. J Econ Dyn Control 30(11):1963–1986. https://doi.org/10.1016/j.jedc.2005.06.011

Kim TS, Omberg E (1996) Dynamic nonmyopic portfolio behavior. The Review of Financial Studies 9(1):141–161. https://doi.org/10.1093/rfs/9.1.141

Campbell JY, Viceira LM (1999) Consumption and portfolio decisions when expected returns are time varying. Q J Econ 114(2):433–495. https://doi.org/10.1162/003355399556043

Acknowledgements

The article has benefitted from valuable comments by Steen Koekebakker, Sigbørn Sødal and Andrianos Tsekrekos.

Funding

Open Access funding provided by Institute Of Transport Economics.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of Interest

The author declares no competing interests.

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Tvedt, J. Optimal Entry and Exit Decisions Under Uncertainty and the Impact of Mean Reversion. Oper. Res. Forum 3, 54 (2022). https://doi.org/10.1007/s43069-022-00161-9

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s43069-022-00161-9