Abstract

Japan’s government is heavily indebted, and the current net debt tends to increase. This paper uses an extended life-cycle general equilibrium model with endogenous fertility to investigate an optimal size of government debt from two viewpoints: individual welfare and future demographic dynamics. A simulation analysis finds that the level of net government debt, which maximizes per-capita utility, is negative at − 220% of Japan’s gross domestic product (GDP). The results also indicate that the net debt-to-GDP ratio of − 220% produces a considerable per-capita welfare gain; however, compared to the baseline simulation with a debt-to-GDP ratio of 150%, it substantially decreases the total population in the long run.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

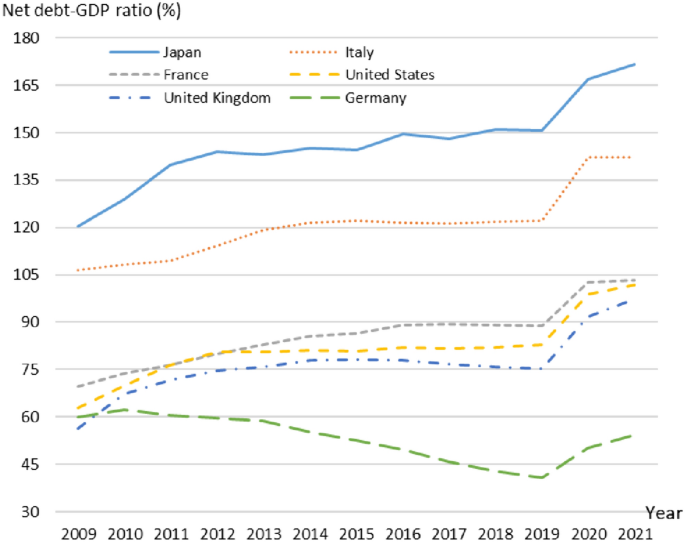

Many countries experienced sharp increases in outstanding government debt with the worldwide spread of the new coronavirus. While governments implemented lockdowns to prevent the spread of the disease, their budget deficits and outstanding debts rapidly increased to leverage the domestic economy. Figure 1, based on data from the International Monetary Fund (2021), illustrates the net government debt-to-GDP (gross domestic product) ratio transition for six developed countries. Various countries’ economic stimulus packages were expanded, and even Germany, which had been in relatively good fiscal condition, increased its budget deficits sharply. In addition, the President of the United States (U.S.), Biden, indicated that he would invest heavily in rebuilding the economy and expanding social welfare; thus, he expected spending to increase and the budget deficit to grow over the subsequent decade. As Fig. 1 shows, Japan’s net government debt tends to increase, and from 2016 to 2019, it was almost constant at approximately 150% of its GDP. Furthermore, the net debt-to-GDP ratio in Japan is estimated to balloon to 167.0% in 2020 and 171.5% in 2021, the highest among major developed countries.

Transition of net government debt-to-GDP ratio for six advanced countries. Source: International Monetary Fund (2021)

The net government debt has recently skyrocketed in many countries worldwide, including Japan. In light of this situation, exploring Japan’s desirable level of debt would be worthwhile. Few studies investigated the preferable level of government debt for Japan; however, there is extensive literature on the fiscal sustainability of Japan, including Sakuragawa and Hosono (2010), Doi et al. (2011), Hoshi and Ito (2014), Hansen and İmrohoroğlu (2016), and Sakuragawa and Sakuragawa (2020) (see the following literature review section for further details). Nakajima and Takahashi (2017) examined an optimal ratio of net government debt to GDP for Japan through a welfare analysis. Their analytical model is based on an Aiyagari (1994) style heterogeneous agent and incomplete market model with endogenous labor supply, following Aiyagari and McGrattan (1998) and Flodén (2001), who conducted a similar analysis using a model calibrated to match the U.S. economy. Nakajima and Takahashi (2017) introduced idiosyncratic earnings risk in a model to calculate an optimal government debt-to-GDP ratio for Japan, which can analyze the insurance effect of government debt. We examine an optimal level of net government debt for Japan using a different model than Nakajima and Takahashi (2017).

Next, we describe our research method. Our model can evaluate a desirable government debt-to-GDP ratio from two viewpoints: individual welfare and future demography. We use the life-cycle general equilibrium simulation model of overlapping generations, developed by Auerbach and Kotlikoff (1983a, 1983b) and similarly applied in Auerbach and Kotlikoff (1987), Auerbach et al. (1989), Altig et al. (2001), Homma et al. (1987), Ihori et al., (2006, 2011), and Okamoto (2013, 2021).Footnote 1 We investigate the quantitative effects of changes in the ratio of net government debt to GDP on per-capita welfare and future population using an extended Auerbach–Kotlikoff dynamic simulation model.

The simulation model in Okamoto (2020) introduced the number of children freely chosen by households into the utility function, thus incorporating endogenous fertility and future demographic dynamics. Furthermore, in the extended framework with endogenous fertility, Okamoto (2022) introduced the descendent link between a parent and children, providing the exogenous transition probabilities from the parent’s income class to the same (or the other) income class to which their children would belong. In other words, Okamoto (2022) introduced the descendent income inequality from parents to their children into the simulation model with endogenous fertility. They incorporated two representative households, the low-income class (high school graduates) and high-income classes (university graduates), into a cohort. Therefore, we can also evaluate the effect of different debt-to-GDP ratios on the population ratio between the low-income and high-income classes.

This paper’s analytical model is based on Okamoto (2022). In the framework of Okamoto (2022), we extended the model to freely change the government net debt-to-GDP ratio and analyze the impact of changes in the debt-to-GDP ratio on per-capita utility and future population dynamics.Footnote 2 The significant difference between Okamoto (2022) and our study is that our model extension investigates the impacts of changes in government net debt-to-GDP ratios. In contrast, an Okamoto (2022) model cannot analyze the effects of changes in the size of government debt. This model extension from Okamoto (2022) allows us to assess the impacts of alternative government net debt-to-GDP ratios. Based on data from IMF (2021), we assume that the net government debt for Japan is 150% of GDP in the 2020 initial steady state. Since a change in the net debt-GDP ratio would have a tremendous impact on the economy and severely disturb an individual utility-maximizing behavior, our simulation avoids abrupt changes by setting the net debt-to-GDP ratio to change smoothly over 10 years from 2021 to 2030.

From the above, it follows that we quantitatively analyze how the change in government debt for Japan impacts the future population levels and the welfare of all generations, including future generations and the current generation. Concretely, we examine the effect of different net debt-to-GDP ratios on the per-capita utility and the demographic dynamics for the transition process from 2020 to 2300. Thus, this paper analyzes a long-run impact on economic growth, welfare, and population levels, assuming alternative net debt-to-GDP ratios. This paper focuses primarily on the debt-to-GDP ratio that maximizes per-capita welfare in the long run and the debt-GDP ratio that provides the largest future population for each year.

As shown in Okamoto (2022), this study introduces an additional government institution, the Lump Sum Redistribution Authority (LSRA). Changes in the ratio of net government debt to GDP generally improve the welfare of some generations but reduce that of others. If combined with redistribution from winning to losing generations, such changes may offer the prospect of Pareto improvements; however, without implementing intergenerational redistribution, potential efficiency gains or losses cannot be estimated. Therefore, like Auerbach and Kotlikoff (1987) and Nishiyama and Smetters (2005), we introduce the LSRA as a hypothetical government institution that distinguishes potential efficiency gains/losses from possible offsetting changes in the welfare of different generations. To isolate pure efficiency gains or losses, we consider simulation cases via LSRA transfers where the ratio of net government debt to GDP is increased/decreased. The introduction of LSRA transfers enables us to examine policy proposals from a long-term perspective, considering the welfare of current and future generations. Because of its ability to quantify alternative policies from a long-term perspective, we can present concrete and valuable policy proposals.

Finally, we briefly mention the main results obtained by our simulation analysis. The level of net government debt, which maximizes per-capita utility, is negative at − 220% of Japan’s gross domestic product (GDP). The net debt-to-GDP ratio of − 220% produces a considerable per-capita welfare gain of 34.442 million Japanese yen (JPY), or approximately 314,000 US dollars (USD) in 2021; however, the optimal net government debt substantially decreases the total population in the long run compared to the baseline simulation with a debt-to-GDP ratio of 150%.

The remainder of this paper is organized as follows. Section 2 describes literature related to this study, Sect. 3 identifies the basic model applied in the simulation analysis, Sect. 4 explains the method and assumptions of simulation analysis, Sect. 5 evaluates the simulation findings, Sect. 6 conducts sensitivity analyses on different model settings and assumptions, and Sect. 7 summarizes, concludes, and discusses policy implications.

2 Related literature

This paper contributes to the literature related to the level of government debt, especially in Japan. The primary literature on the study is as follows.

First, we discuss three papers that analyzed an optimal level of net government debt— Aiyagari and McGrattan (1998), Flodén (2001), and Nakajima and Takahashi (2017)—which are the most important for our analysis.

Aiyagari and McGrattan (1998) were the first to analyze the optimal level of government debt using an Aiyagari (1994) type model. Their model has heterogeneous agents and incomplete markets with endogenous labor supply, incorporating many infinitely lived households whose saving behavior is influenced by precautionary saving motives and borrowing constraints. The authors analyzed the welfare implications of government debt for the United States, measuring welfare as utilitarian and weighting all households equally. They found that the welfare gains to being at the optimum quantity of debt rather than the current US level are small; therefore, any concerns regarding the high level of debt in the US economy may be misplaced.

Government debt and redistributive taxation can help people to smooth consumption when facing uninsurable individual-specific risks. Flodén (2001) examined the effects of variations in public debt and transfers on risk sharing, efficiency, and the distribution of resources, determining that risk sharing can be improved significantly by debt and transfers, but that debt has adverse effects on equity. Debt can enhance welfare if transfers are lower than optimal when used in isolation; however, the beneficial effects of public debt vanish if transfers are used optimally. Furthermore, the study also found that the optimal level of government debt for the U.S. is positive, with 150% of its GDP.

Nakajima and Takahashi (2017) analyzed the effect of the large government debt for Japan on welfare, using evidence based on macro-level and micro-level data. They used a heterogeneous agent, an incomplete market model with idiosyncratic wage risk, a borrowing constraint, and endogenous labor supply. They found that Japan’s optimal level of net government debt is − 50% of its GDP. They also showed that the welfare cost of keeping government debt to 130% of GDP, rather than the optimal level of − 50%, is 0.19% of consumption. Furthermore, according to their sensitivity analyses, if both government debt and public transfers can be set freely, then the optimal debt level is − 120% of GDP.

From the above, Flodén (2001) and Nakajima and Takahashi (2017) analyzed the optimal level of government debt for the U.S. and Japan, respectively, using a similar welfare analysis. Their studies obtained contrasting results. Flodén (2001) revealed that the optimal level of government debt for the U.S. is positive, at 150% of GDP; conversely, Nakajima and Takahashi (2017) suggested that it is negative, with − 50% of GDP for Japan.

The basic model is the main difference between our study and Flodén (2001) and Nakajima and Takahashi (2017); their studies are based on an Aiyagari (1994) style model, whereas our study is based on Auerbach–Kotlikoff-type simulation model. Because those two studies introduce idiosyncratic earnings risk in a model to calculate an optimal government debt-to-GDP ratio, they can analyze the insurance effect of government debt. Conversely, our study can analyze a desirable government debt-to-GDP ratio that produces the largest total population and a government debt-to-GDP ratio that maximizes per-capita welfare. This is because our study extends the life-cycle model and incorporates endogenous fertility, simulating variations in the future demographic dynamics induced by policy changes. Moreover, Flodén (2001) and Nakajima and Takahashi (2017) focused on a stationary equilibrium where the debt-to-GDP ratio is constant. In contrast, our paper analyzes the long-run impact of different debt-to-GDP ratios on per-capita utility and the demographic dynamics for the transition process from 2020 to 2300.

Next, we discuss several papers that analyzed the issue of government debt using an overlapping generations model, similar to our approach. The main differences between the model in previous papers and the model in this paper are as follows. Unlike previous studies, our model uses an overlapping generations model that incorporates endogenously determined populations and introduces the LSRA. This approach allows us to analyze the level of government debt that maximizes the welfare of households, including the current generation and future generations, and the impact of different government debt levels on future population levels.

Arai and Ueda (2013) investigated the size of a primary deficit-to-GDP ratio that Japan’s government can sustain. They used an overlapping generations model where multi-generational households live, and the government maintains a constant ratio of the primary deficit to GDP. Their results numerically showed that the primary deficit could not be sustained unless the economic growth rate is unrealistically high, which, according to their settings, is more than five percent. They concluded that Japan’s government needs to achieve a positive primary balance in the long run to avoid the divergence of the public debt-to-GDP ratio.

Braun and Joines (2015) found that Japan’s aging population is already burdening government finances and that the very high debt-GDP ratio constrains the country’s ability to confront the negative fiscal implications of future aging. They found that Japan faces a severe fiscal crisis without imminent remedial action, and they also analyzed alternative strategies for correcting Japan’s fiscal imbalances.

Kitao (2015) quantified the fiscal cost of Japan’s projected demographic transition over the next several decades. That study analyzed the issue using a life-cycle model with endogenous saving, consumption, and labor supply in both intensive and extensive margins. Kitao (2015) found that preserving the current level of public transfers would require a significant increase in taxation. Furthermore, using consumption taxes to balance the government budget, the tax rate was projected to reach the maximum value of 48% in the late 2070s. Finally, that study found that pension reform to reduce benefits by 20% could result in a peak tax rate of 37%, which could be reduced to 28% by gradually raising the retirement age by 5 years.

İmrohoroğlu et al. (2016) built a micro data-based, large-scale overlapping generations model for Japan, incorporating individuals’ ages, gender, employment type, income, asset holdings, and the Japanese pension rules. Using existing pension law, current fiscal policy, and medium variants of demographic projections, they produced future paths for government expenditures and tax revenues, with implications for government debt and the public pension fund. Their study found that Japan’s fiscal stability requires additional pension reform, a higher consumption tax, and higher female labor force participation.

Finally, we look at several previous studies that analyzed Japan’s government debt issue. Most literature addressing government debt in Japan analyzed fiscal sustainability and stability as follows. Unlike the previous studies, this paper focuses on the level of government debt that maximizes household welfare and analyzes the impact of different government debt levels on the future population level.

Sakuragawa and Hosono (2010) investigated the sustainability of government debt by applying a dynamic stochastic general equilibrium model of an exchange economy with infinitely lived agents to the Japanese economy. Introducing intermediation costs into the model helped successfully explain the observed relationship between the interest and GDP growth rates, which is crucial in testing sustainability. Their study found that under the projected real growth rate of 2.5%, the debt-to-GDP ratio gradually increases stochastically, resulting in unsustainable government debt. Furthermore, they found that the primary surplus must be 0.2% of GDP to recover sustainability.

Doi et al. (2011) constructed quarterly series of the revenues, expenditures, and outstanding debt for Japan from 1980 to 2010. They examined Japan’s fiscal sustainability, showing that the Japanese government debt poses serious challenges. To stabilize the debt-to-GDP ratio, Japan must implement a tax rate hike of an extraordinary magnitude. Such a dramatic tax increase for fiscal sustainability would represent a drastic departure from the last 30 years of Japanese fiscal policy. If the government fails to reduce the primary deficit by increasing taxes and reducing expenditures and transfer payments, Japan would be forced to reduce the value of government debt through either inflation or outright default.

Through simulations under various scenarios, Hoshi and Ito (2014) showed that even if the Japanese residents continue to invest their new savings into Japanese Government Bonds (JGB), Japan’s fiscal situation is not sustainable. They found that if the Japanese government’s fiscal policy stance does not change in the future, the amount of government debt will exceed the private sector financial assets available for government debt purchase in the next 10 years. They also suggested that sufficiently significant tax increases or expenditure cuts in the future would put the government debt on a sustainable path. Thus, if the market believes that Japan will embark on such fiscal consolidation in the next 10 years, at most, the low JGB yields are justifiable. Conversely, if the expectation changes, a fiscal crisis can be triggered even before the government debt hits the ceiling of the private sector financial assets.

Hansen and İmrohoroğlu (2016) used a standard growth model to measure the size of the Japanese fiscal burden in the form of additional taxes required to finance projected expenditures and stabilize government debt. They found that a massive fiscal adjustment is needed in 30–40% of total consumption expenditures, requiring a distorting tax such as the consumption or labor income tax to rise to unprecedented highs. Therefore, they suggested the importance of considering alternatives that attenuate the projected increases in public spending or enlarge the tax base.

Sakuragawa and Sakuragawa (2020) reconsidered Japan’s fiscal sustainability. They investigated whether the official projection is supported by a simulation conducted under the political constraint imposed by a fiscal reaction function. First, Sakuragawa and Sakuragawa (2020) obtained Japan’s fiscal reaction function by estimating the response of the primary surpluses to the past debt for a panel data set of 23 OECD (Organization for Economic Co-operation and Development) countries. Then, they evaluated the political feasibility of the official projection using their estimated reaction function. Thus, they found that the Cabinet Office criterion for the debt-to-GDP ratio could realize fiscal sustainability, attaining the government’s policy target of nonnegative fiscal surpluses. Notably, the negative growth-adjusted bond yield and the high growth rate contribute to this finding.

3 Theoretical framework

We calibrate the simulation of the Japanese economy by applying population data from 2023, estimated by the National Institute of Population and Social Security Research. The model includes 106 overlapping generations, corresponding to ages 0–105 years old. Three types of agents are incorporated: households, firms, and the government. The following subsections describe the basic structures of households, firms, and the government, as well as the market equilibrium conditions.

Our model incorporates intergenerational mobility across income classes based on Kikkawa (2009) who found that Japan’s income disparity stems fundamentally from different educational backgrounds between high school and university graduates. On the basis of his study, our model introduces two types of representative agents: the low-income class (i.e., (just) high school graduates) and the high-income class (i.e., university graduates) into a cohort. In this section, we describe the behavior of the low-income class household in the model (see Appendix A for the behavior of the high-income class).

3.1 Household behavior

The economy is populated by 106 overlapping generations that live with uncertainty, corresponding to ages 0–105. Each agent is assumed to consist of a neutral individual because our model does not distinguish by gender. Each agent enters the economy as a decision-making unit and starts to work at age 18 years, and lives to a maximum age of 105 years. Each household is assumed to consist of one adult and its children. The children aged 0–17 or 0–21 only consume, involving childrearing costs for their parent. Each household faces an age-dependent probability of death. Let \(q_{j + 1|j}^{t}\) be the conditional probability that a household born in year \(t\) lives from age \(j\) to \(j\) + 1. Then the probability of a household born in year \(t\), surviving until s can be expressed by

The probability \(q_{j + 1|j}^{t}\) is calculated from data estimated by the National Institute of Population and Social Security Research (2023). Since the survival probability is different among agents with different birth year, agents born in different years have the different utility function.

Each agent who begins its economic life at age 18 chooses perfect-foresight consumption paths (\(C_{s}^{t}\)), leisure paths (\(l_{s}^{t}\)), and the number of born children (\(n_{s}^{t\,(U)}\)) to maximize a time-separable utility function of the form:

This utility function represents the lifetime utility of the agent born in year \(t\). \(C_{s}^{t\,(H)}\), \(l_{s}^{t\,(H)}\) and \(n_{s}^{t\,(H)}\) are respectively consumption, leisure and the number of children to bear (only in the first 23 periods of the life) for an agent born in year \(t\), of age \(s\); \(\alpha^{(H)}\) is the utility weight of the number of children relative to the consumption–leisure composite, \(\gamma\) is the intertemporal elasticity of substitution, \(\delta\) is the adjustment coefficient for discounting the future, and \(\phi\) is the consumption share parameter to leisure.

Fertility choice in the model is only based on the direct utility that households obtain from their offspring, neglecting the investment element of children. The demand for children as investment goods played an important role in traditional economies (and still does in developing countries), where transfers from the young to the old arise within the family. In modern advanced countries, however, a pay-as-you-go (PAYG) social security scheme makes the investment aspect of children socialized, as Groezen et al. (2003) pointed out. This creates the possibility for households to free-ride on the scheme by rearing fewer or no children, still being entitled to a full pension benefit. Therefore, we treat children as “consumption goods” and a parent is assumed to obtain the utility from the number of children born at each age.

As shown in Okamoto (2022), letting \(A_{s}^{t(H)}\) be capital holdings for the agent born in year \(t\), of age \(s\), maximization of Eq. (2) is subject to a lifetime budget constraint defined by the sequence:

where \(r_{t}\) is the pretax return to savings, and \(w_{t}\) is the real wage at time \(t\); \(\tau^{w}\), \(\tau^{r}\) and \(\tau_{t}^{c}\) are the tax rates on labor income, capital income and consumption, respectively. \(\tau_{t}^{p}\) is the contribution rate to the public pension scheme at time \(t\). All taxes and contributions are collected at the household level. \(tc(n^{(H)} )\) is the time cost for childrearing. \(a^{(H)}\) is the bequest to be inherited, and \(or^{(H)}\) is the childrearing cost for orphans. There are no liquidity constraints, and thus the assets \(A_{s}^{(H)}\) can be negative. Terminal wealth must be zero. An individual’s earnings ability \(e_{s}^{(H)}\) is an exogenous function of age.

The public pension program is assumed to be a PAYG scheme similar to the current Japanese system. The program starts to collect contributions to the scheme from the age of 20, in accordance with the law. The pension benefit is assumed to comprise only an earnings-related pension:

where

The age at which a household born in year \(t\) starts to receive the public pension benefit is \(ST\), the average annual labor income for the calculation of pension benefit for each agent is \(H^{t\,(H)} \left( {\{ 1 - l_{u}^{t\,(H)} - tc_{u}^{t} (n_{u}^{t(H)} )\}_{u = 20}^{RE} } \right)\), and the weight coefficient of the part proportional to \(H^{t\,(H)}\) is \(\theta\). The symbol \(b_{s}^{t\,(H)} \left( {\{ 1 - l_{u}^{t\,(H)} - tc_{u}^{t} (n_{u}^{t(H)} )\}_{u = 20}^{RE} } \right)\) signifies that the amount of public pension benefit is a function of the age profile of labor supply, \(\{ 1 - l_{u}^{t\,(U)} - tc_{u}^{t} (n_{u}^{t(U)} )\}_{u = 20}^{RE}\).

A parent is assumed to bear children with the upper limit of 40 years old, and expend for them until they become independent of their parent, namely, during the period when children are from 0 to 17 or 21 years old. Regarding the childrearing costs, the model takes account of both monetary and time costs. Here note that the children aged below 18 or 22 years old do not conduct an economic activity independently, and childrearing costs for their parent arise until they become independent of their parent. The financial costs for rearing the children, for the parent born in year \(t\) and \(s\) years old, are represented by \(\Phi_{s}^{t\,(H)}\) and \(\Phi_{s}^{t\,(U)}\), which are the cost for the children who will become high school graduates and university graduates, respectively:

where \(\xi^{t\,(H)}\) is the childrearing cost for the parent born in year \(t\), \(\rho\) is the rate of government subsidy (including child allowances) to childrearing costs, and \(\beta\) is the ratio of childrearing costs to the net lifetime income, \(NW^{t\,(H)}\), for the parent born in year \(t\).

The children who will become university graduates needs more monetary cost than the children who will become high school graduates simply by the extra four-year (18–21) cost before the independence from their parents. The mobility \(m\) denotes the probability in which the children will belong to the high-income class (i.e., university graduates) different from their parent, and \(1 - m\) is the probability in which they will belong to the low-income class (i.e., high school graduates) same as their parent. The number of children affects the whole available time for a parent, because of the time required for childrearing. The time cost for rearing the children for the parent born in year \(t\), of age \(s\), is represented by

where \(\mu\) is the parameter that shows the relation between the number of children and the time required for childrearing, which is simply assumed to be proportional to the number of born children. The time cost is assumed to be same across the two types of children who will become high school graduates or university graduates.

The model contains accidental bequests that result from uncertainty over length of life. The bequests, which comprise assets previously held by deceased households, are distributed equally among all surviving low-income class households at time \(t\). When \(BQ_{t}^{(H)}\) is the sum of bequests inherited by the low-income class households at time \(t\), the bequest to be inherited by each low-income household is defined by

where

\(\tau^{h}\) is the tax rate on inheritances of bequests. The amount of inheritances received is linked to the age profile of assets for each household. \(E_{t}^{(H)}\) is the number of the low-income class households conducting an economic activity independently, aged 18 and older. The number of the generation with age \(s\) years born in year \(t\) is represented by

Total childrearing cost of the orphans, who are generated as a consequence of parents’ uncertainty over length of life, is distributed equally among all surviving low-income class households at time \(t\). When \(OR_{t}^{(H)}\) is the sum of childrearing costs incurred by the low-income class households at time \(t\), the childrearing cost for orphans for each low-income class household is defined by

where

Therefore, the net amount of bequests is represented as \(a^{(H)} - or^{(H)}\). When we consider the utility maximization problem over time for each agent, besides the flow budget constraint represented by Eq. (3), the following constraint is imposed:

This is a constraint that labor supply is nonnegative, and that each household inevitably retires after passing the compulsory retirement age, RE.

Let us consider the case where each agent maximizes expected lifetime utility under two constraints. Each individual maximizes Eq. (2) subject to Eqs. (3) and (17) (see Appendix B for further details). From the utility maximization problem, the equation expressing the evolution of the number of children over time for each individual is characterized by

where \(\Omega_{s,\,0}^{t}\) = 1 for \(g = 0\), \(\Omega_{s,\,g}^{t} = \left( {\prod\limits_{k = 1}^{g} {\{ 1 + r_{t + s - 1 + k} (1 - \tau^{r} )\} } } \right)^{ - 1} .\)

Similarly, that for the consumption–leisure composite is represented by

3.2 Firm behavior

As shown in Okamoto (2022), the model has a single production sector that is assumed to behave competitively using capital and labor, subject to a constant-returns-to-scale production function. Capital is homogeneous and depreciating, while labor differs only in efficiency. All forms of labor are perfectly substitutable. Households with different income classes or different ages, however, supply different amounts of some standard measure per unit of labor input.

The aggregate production technology is the standard Cobb–Douglas form:

where \(Y_{t}\) is aggregate output (national income), \(K_{t}\) is aggregate capital, \(L_{t}\) is aggregate labor supply measured by the efficiency units, and \(\varepsilon\) is capital’s share in production. Using the property subject to a constant-returns-to-scale production function, we can obtain the following equation:

where \(\delta^{k}\) is the depreciation rate.

3.3 Government behavior

As shown in Okamoto (2022), at each time \(t\), the government collects tax revenues and issues debt (\(D_{t + 1}\)) that it uses to finance government purchases of goods and services (\(G_{t}\)) and interest payments on the inherited stock of debt (\(D_{t}\)). The government sector consists of a narrow government sector and a pension sector, and a portion of revenues is transferred to the public pension sector. The public pension system is assumed to be a simple PAYG style and consists only of earnings-related pension. Pension account expenditure is financed by both contributions and a transfer from the general account.

The budget constraint of the narrower government sector at time \(t\) is given by

where \(G_{t}\) is total government spending on goods and services, \(T_{t}\) is total tax revenue from labor income, capital income, consumption and inheritances, and \(D_{t}\) is the net government debt at the beginning of year \(t\). \(D_{t}\) is gross public debt minus the accumulated pension fund because the model abstracts the public pension fund, which is represented as a ratio to national income:

where \(d\) is the ratio of net public debt to national income.

The public pension system is assumed to be a simple PAYG style. The budget constraint of pension sector at time \(t\) is represented by

where \(R_{t}\) is total revenue from contributions to the pension program, \(B_{t}\) is total spending on the pension benefit to generations of age \(ST\) and above, and \(\pi\) is the ratio of the part financed by the tax transfer from the general account.

The total government spending on goods and service is defined by

where \(G_{t}\) includes transfers to the public pension sector (\(\pi B_{t}\)) and the government subsidies to child rearing (\(GS_{t}\)). The government spending except for the transfers and the subsidies is \(gY_{t}\), which is assumed to be represented as a constant ratio (\(g\)) of national income. The spending is assumed to either generate no utility to households or enter household utility functions in a separable fashion.

The total amount of government subsidies (including child allowances) to the childrearing cost in year \(t\) is GSt:

where \(RC_{t}^{a\,(H)}\), \(RC_{t}^{b\,(H)}\) and \(RC_{t}^{c\,(H)}\) are monetary costs for childrearing when the children will belong to the low-income class same as their parent, namely, they will become high school graduates, and \(RC_{t}^{a\,(U)}\) and \(RC_{t}^{b\,(U)}\) are the costs when the children will belong to the high income class different from their parent, namely, they will become university graduates.

where \(RC_{t}^{a\,(U)}\), \(RC_{t}^{b\,(U)}\) and \(RC_{t}^{c\,(U)}\) are financial costs for childrearing when the parent is 22 to 61 years old. Once the parent becomes 62 years old, the cost does not exist because all children are independent from their parent.

The total spending on the pension benefit to generations of age ST and above is represented by

where \(B_{t}^{(H)}\) and \(B_{t}^{(U)}\) are the expenditure for the two income classes:

The total revenue from pension contributions and the total tax revenue are represented by

where aggregate assets supplied by households, \(AS_{t}\), and aggregate consumption, ACt, are given by

For the low-income class, aggregate assets supplied by households, \(AS_{t}^{(H)}\), and aggregate consumption, \(AC_{t}^{(H)}\), are given by

where aggregate consumption consists of adult’s consumption (at age 18–105 years old) and children’s consumption or cost (at age zero to 17 or 21 years old).

For the high-income class, aggregate assets supplied by households, \(AS_{t}^{(U)}\), and aggregate consumption, \(AC_{t}^{(U)}\), are given by

where aggregate consumption consists of adult’s consumption (at age 22–105 years old) and children’s consumption or cost (at age zero to 21 or 17 years old).

The total sum of bequests inherited by the households and the total childrearing cost of the orphans at time t are as follows:

Total population (i.e., the population aged zero to 105), the population aged 18 or 22 to 105 (i.e., independents financially), and the population aged 65 to 105 (i.e., retirees) in year t are respectively represented by

The aging rate (i.e., the old-age dependency ratio), the ratio of the population aged 65 and above to the total population, is given by \(O_{t} /Z_{t}\). For the low-income class, the total population, the population aged 18 to 105, and the population aged 65 to 105 in year t are respectively represented by

For the high-income class, the total population, the population aged 22 to 105, and the population aged 65 to 105 in year \(t\) are respectively represented by

3.4 Market equilibrium

Finally, equilibrium conditions for the capital, labor and goods markets are described.

-

(1)

Equilibrium condition for the capital market

Because aggregate assets supplied by households equal the sum of real capital and net government debt,

$$AS_{t} = K_{t} + D_{t} .$$(48)

-

(2)

Equilibrium condition for the labor market

Measured in efficiency units, because aggregate labor demand by firms equals aggregate labor supply by households,

$$L_{t} = L_{t}^{(H)} + L_{t}^{(U)} ,$$(49)where

$$L_{t}^{(H)} = \sum\limits_{s = 18}^{RE} {N_{s}^{t - s\,(H)} e_{s}^{(H)} \{ 1 - l_{s}^{t - s\,(H)} - tc_{s}^{t} (n_{s}^{t\,(H)} )\} } ,$$(50)$$L_{t}^{(U)} = \sum\limits_{s = 22}^{RE} {N_{s}^{t - s\,(U)} e_{s}^{(U)} \{ 1 - l_{s}^{t - s\,(U)} - tc_{s}^{t} (n_{s}^{t\,(U)} )\} } .$$(50’)

-

(3)

Equilibrium condition for the goods market

Because aggregate production equals the sum of private consumption, private investment and government expenditure,

$$Y_{t} = AC_{t} + \{ K_{t + 1} - (1 - \delta^{k} )K_{t} \} + G_{t} .$$(51)

An iterative program is performed to obtain the equilibrium values of the above equations.

4 Simulation analysis

4.1 Method

The simulation model presented in the previous section is solved fundamentally, given the assumption that households have perfect foresight and correctly anticipate interest, wages, the tax and contribution rates, and other factors such as the government net debt-to-GDP ratio. If the tax and social security systems and other elements are determined, then the model can be solved using the Gauss–Seidel method (see Auerbach and Kotlikoff (1987) and Heer and Maußner (2005) for the computation process).

Our study assumes the transitional economy of Japan from the initial steady state in 2020 to the final steady state in 2300. Alternative scenarios with the different debt-to-GDP ratio are assumed to be implemented at the end of 2020. For simplicity, 2020 is set as the starting year, and we simulate the demography and the economy in the following years. For the generations that were alive in 2020 and have survived in 2021, we need to pay attention to their formation of future expectations. In 2021, these generations realized that their previous expectations no longer apply and thus again maximize their remaining lifetime utility given perfect foresight. Based on the ex-post age profiles of the number of children to bear, consumption, and leisure for these generations, we calculated their lifetime utility at 18 and 22 years for the low- and high-income classes, respectively.

The LSRA first transfers to each household affected by the change in government net debt-to-GDP ratios just enough resources (possibly a negative amount) to return its expected remaining lifetime utility to its pre-change level in the benchmark simulation. For each household that is alive when a change occurs at the end of 2020, at its age in 2021, the LSRA makes a lump sum transfer, to return its expected remaining lifetime utility to its pre-change utility level. The LSRA also makes a lump-sum transfer to each future household that enters the economy after a change (from 2021 onward), at its age of 18 or 22 years, to return its expected entire lifetime utility back to its pre-change level.

Note that the net present value of these transfers in 2021 across living and future households will generally not sum to 0. Thus, the LSRA makes an additional lump sum transfer to each future household so that the net present value across all transfers is 0. To illustrate, let us assume that these additional transfers are uniform across all future generations, including the low- and high-income classes. If the transfer is positive, then the change has produced extra resources after the expected remaining lifetime utility of each household has been restored to its pre-change level. In this case, we can interpret that the change has created efficiency gains, i.e., Pareto improvements. Conversely, if the transfer is negative, then the change has generated an efficiency loss. Thus, the total net present value of all lump sum transfers to current and future generations sums to 0 in 2021, satisfying the LSRA budget constraint (see Nishiyama and Smetters (2005) for further details).

4.2 Simulation cases

This study investigates the quantitative effects of different levels of net government debt in Japan on individual welfare and future demographics, using an extended life-cycle general equilibrium model with endogenous fertility. The net debt-to-GDP ratio was constant at approximately 150% from 2016 to 2019, as illustrated in Fig. 1. Accordingly, we assume that Japan’s net government debt is 150% of its GDP (\(d\) = 1.5) in the 2020 initial steady state. The benchmark simulation assumes that the ratio remains 150% annually until 2300. We consider alternative scenarios with the different ratios of net government debt to Japan’s GDP from − 300 to 250% (\(d\) = − 3, − 2.9, …, 2.4, 2.5).Footnote 3 To avoid extra disturbance or confusion from sudden changes in the net government debt-to-GDP ratio, we assume that the ratio changes smoothly, interpolating over 10-year periods from 2021 to 2030.Footnote 4 In addition, we consider the case with LSRA transfers for each scenario with the different debt-to-GDP ratios. To distinguish potential efficiency gains/losses from possibly offsetting changes in the welfare of different generations, we introduce LSRA into the alternative simulation scenarios with different levels of net government debt. The LSRA transfers produce a leveled and common welfare gain/loss for each future household in both the low- and high-income classes.

4.3 Specification of the parameters

We chose realistic parameter values for the Japanese economy based on the literature (İmrohoroğlu et al., 2017; Kitao & Mikoshiba, 2020; Nishiyama & Smetters, 2005; Oguro et al., 2011). Table 1 displays the parameter values assigned in the baseline simulation, and the data source used in the calibration. Parameter values were chosen such that the calculated values of the model’s endogenous variables approached the actual data values. Table 2 presents the endogenous variables in the 2020 initial steady state. Because the simulation results depend on the model setting and the given parameters, we must be careful about the effects of any parameter changes. How well our model reproduces the actual Japanese economy is significant. Because the model includes a life-cycle feature, we show the profiles of individual consumption, assets, and leisure over the life-cycle in the model. Figures 2 and 3 illustrate age profiles of consumption, assets, and leisure in the model in the 2020 initial steady state, for the low- and high-income classes, respectively. Using empirical data, Ogawa et al. (2013) estimated age profiles of per capita consumption and labor income in Japan. A comparison with Fig. 27.1 in Ogawa et al. (2013) confirms that our model’s consumption and labor income age profiles are relatively close to the real Japanese economy. Figures 2 and 3 also reveal that the high-income class has more assets and leisure time than the low-income class, reflecting the Japanese reality.

4.3.1 Demography

Japan’s population is aging at an unprecedented speed for a developed nation; simultaneously, the population is decreasing, which has become one of Japan’s most important problems. Japan’s speed and magnitude of demographic aging are remarkable, even compared to other advanced countries facing similar challenges. Our extended life-cycle general equilibrium simulation model with endogenous fertility rigorously reflects such demographic dynamics in Japan.

The age-specific survival probability \(q_{j + 1|j}^{t}\) is calculated from data estimated by the National Institute of Population and Social Security Research (2023). We used the average values for males and females on future life tables by age from 2020 until the last year for which official projections are available, 2070; after 2070, we used the 2070 life table data. For simplicity, the survival rate for the low-income class (i.e., high school graduates) is unity at 18 years old, and that for the high-income class (i.e., university graduates) is unity at 22.

Table 3 indicates the population ratio of individuals with different educational backgrounds in 2020, estimated from the Basic Survey on Wage Structure (Chingin Sensasu) by The Ministry of Health, Labour and Welfare (2021). The population share of high school graduates (including junior high school graduates) and university graduates (including technical and junior college graduates) is 49.9% and 50.1%, respectively. Figure 4 illustrates the age–population distribution in 2020 based on data from the Ministry of Internal Affairs Communications (2021), denoting the population of high school and university graduates, respectively, for each age.Footnote 5 We estimated each population of high school graduates and university graduates aged 0–105 in 2020, similar to Okamoto (2022). For the elderly, especially those of advanced age, the number of high school graduates exceeds that of the university graduates, whereas for the young and the middle-aged, it is approximately fifty–fifty. For those who are under 18 or 22 years old and undecided to become high school or university graduates, we assume that their population is the same i.e., fifty–fifty on the basis of Kikkawa (2009).

Age–population distribution in the 2020 initial steady state. Notes: The vertical gap between the total population and the number of university graduates is the number of high school graduates for each age. For young people unsure if they will be (just) high school graduates or university graduates, we assume 50/50.

4.3.2 Preference parameter on the number of children

Regarding the preference parameter for children in the utility function of households, the parameter value in the benchmark simulation is the same between the low-income class (i.e., (just) high school graduates) and the high-income class (i.e., university graduates). In other words, the utility weight of the number of children relative to the consumption–leisure composite in Eqs. (2) and (2’) is the same between the two income classes (\(\alpha^{(H)}\) = \(\alpha^{(U)}\) = 0.03188). This parameter setting is implemented after comprehensively considering several empirical studies, such as Kikkawa (2018), Adsera (2017), and Doepke et al. (2022).

Initially, Kikkawa (2018) suggested that the low-income class tends to have more children than the high-income class. Kikkawa (2018) presents the scheduled number of children for young people aged 21–40, which is based on a large-scale questionnaire survey (SSM2015). Accordingly, on average, the scheduled number of children for young high school-graduate couples is 1.14, whereas it is 0.875 for young university-graduate couples. The data revealed that the low-income class has more children than the high-income class.

Conversely, some previous studies, such as Adsera (2017) and Doepke et al. (2022), revealed that such tendencies have weakened recently. Adsera (2017) investigated the effects of a possible increase in the employment and income gaps between highly educated and low-educated workers on their fertility. They suggested that educational attainment’s negative fertility gradient has recently weakened in developed countries, and the gap in the number of children born between more-educated and less-educated women has shrunk. Their study also suggested that rising inequality is one mechanism that could underlie this apparent fertility convergence. As some middle-income jobs seem to disappear, polarization in the labor market has increased. This change in the labor market could exert downward pressure on the fertility of medium- and less-educated couples and further flatten the educational gradient.

Doepke et al. (2022) analyzed the relationship between per capita GDP and total fertility rates in countries worldwide. They found that the relationship between income and fertility in rich countries has recently reversed and that higher per capita GDP may lead to higher total fertility rates. This relationship does not directly apply to the relationship between income and fertility for the low- and high-income classes divided by educational background in the specific country of Japan; however, we believe that the results of this analysis should be referenced.

The difference in fertility rates between the low- and high-income classes divided by educational background was set by data from a large-scale questionnaire survey (SSM2015); the survey used empirical data derived by Kikkawa (2018). The evidence shows that the fertility rate of the low-income class is higher than that of the high-income class, which is based on a reasonable rationale and has a certain validity; however, the findings of Adsera (2017) and Doepke et al. (2022) suggest that the fertility rate differences between the two income classes have recently decreased. Based on the above considerations, we assumed that the parameter (\(\alpha\)) related to the preference for the number of children in the households’ utility function was set to the same value between the two income classes (\(\alpha^{(H)}\) = \(\alpha^{(U)}\) = 0.03188). Consequently, the total fertility rate (TFR) is 1.38 for the low-income class and 1.26 for the high-income class in the 2020 steady state (the TFR for the whole society is 1.33). A possible reason is that the utility obtained from the number of children is relatively higher for the low-income class than the high-income class because of the lower wage income per unit of labor.

4.3.3 Childrearing costs

Next, we describe how we assign parameter values for childrearing since our simulation model incorporates endogenous fertility. Based on empirical data, such as Kikkawa (2009), in our model, 70% of children from the high-income class will become high-income class households, and 70% of children from the low-income class will become low-income. In Japan, the high-income class spends more on educating their children than the low-income class because private education has a higher weight. This fact justifies the model setting that childrearing costs are basically proportional to the parent’s lifetime income. Our model also introduced a constant portion of childrearing costs that is independent of the parent’s lifetime income, referring to the assumption for childcare costs, such as Attanasio et al. (2008) and Guner et al. (2020); see Equations (10) and (10’).Footnote 6

The Cabinet Office (2010) indicated the average annual childrearing costs for the first-born child to annual income for each age. Based on the survey in the Cabinet Office (2010), we assigned the parameter values of \(\beta\) (i.e., the ratio of childrearing costs to parental net lifetime income) and the constant part (\({\text{constant}}(\beta\))) such that the ratio of the annual net childrearing costs to annual labor income for the individual is, on average, close to 19.3%. Thus, \(\beta\) and \({\text{constant}}(\xi )\) are assigned 0.035 and 0.0654, respectively (the ratio is 19.1% for the low-income class and 17.3% for the high-income class).

The OECD (2022) presents public spending on family benefits in cash, services, and tax breaks for families as a percentage of GDP in 2017. For Japan, public spending ratios on family benefits in cash, services, and tax measures to GDP are 0.65%, 0.93%, and 0.20%, respectively.Footnote 7 We assigned the value of parameter \(\rho\) (government childcare subsidies divided by childrearing cost) to 0.1 in the model, as in Oguro et al. (2011). Consequently, the ratio of total government subsidies to national income was 1.14% in the 2020 initial steady state.

Addtionally, our model incorporated not only the monetary costs of childrearing but also the time costs. Increases in the number of children diminish the parent’s available time, because of the time required for childrearing; more children to bear, more time required for childrearing. The parameter determining this relation, \(\mu\), is assigned under the simple assumption that one child required 1 h per day for childrearing.Footnote 8

4.3.4 Age profile of labor efficiency

The age profiles of earning ability for the two income classes were estimated with data from the Basic Survey on Wage Structure (Chingin Sensasu) by the Ministry of Health, Labour and Welfare (2013–2022a) for the 2012–2021 period. The labor efficiency profiles are constructed from the Japanese data on employment, wages, and monthly work hours.

To estimate the age profiles of earnings ability, \(e_{s}^{(H)}\) and \(e_{s}^{(U)}\), respectively, the following equation is constructed:

where \(Q\) is the average monthly cash earnings for high school-graduate workers and university-graduate workers, respectively, and \(A\) is the average age for each of the workers, including both males and females. Because bonuses account for a large part of earnings in Japan, \(Q\) includes bonuses. Using the above data, we use the ordinary least squares (OLS) method to perform estimation. Figure 5 presents the results, illustrating age–earnings profiles by educational background. For the high school graduates, they start to work earlier (18 years old), but their age profile of earnings is flatter with a lower level than the university graduates. For the university graduates, they start to work later (22 years old), but their age profile of earnings is steeper with a higher level.

Age earnings profiles based on educational background. Source: The profiles are estimated from the Ministry of Health, Labour and Welfare (2013–2022a) for the 2012–2021 period

4.3.5 Taxes and expenditures

Tax rates on labor income, capital income, and inheritances are assumed to be fixed at the current levels (6.5%, 40%, and 10%, respectively) during the entire period until 2300. Tax rates on consumption are endogenously determined to satisfy Eqs. (24) and (35). General government expenditures, except for transfers to the public pension sector (\(\pi B_{t}\)) and government subsidies to childrearing (\(GS_{t}\)), are proportional to national income (\(Y_{t}\)), as indicated in Eq. (27). The ratio of general expenditure to national income, \(g\), is assigned 0.1 such that the endogenous tax rate on consumption is realistic and plausible in the 2020 initial steady state (i.e., 13.11%). The ratio is held constant at 0.1 throughout the entire period. The ratio of public expenditures to GDP as a source of social security funding is 6.9% lower in our model than the real ratio; therefore, we conduct a sensitivity analysis, where we set \(g\) = 0.169 (see Sect. 6.1 for further details).

4.3.6 The public pension system

The public pension program is assumed to be a simple PAYG system similar to the current Japanese system. The benefit is assumed to comprise an earnings-related pension, although Japan’s actual public pension system is two-tiered: a basic flat pension and an amount proportional to the average annual labor income for each household. General tax revenue finances half of the flat part, whereas contributions to the pension system fund both the remaining half and the entire proportional part. We assign the ratio (\(\pi\)) of the part financed by the tax transfer from the general account in Eq. (26) as 0.25, taken from Oguro and Takahata (2013). The replacement ratio (\(\theta\)) for public pension benefits in Eq. (4) is equal to 40%, following Braun et al. (2009).

The age at which households start to receive public pension benefits (\(ST\)) is constant during the entire period. The compulsory retirement age (\(RE\)) is the starting age of public pension benefits (\(ST\)) minus 1. Thus, after households retire at the end of the year in which they reach compulsory retirement, they immediately start to receive pension benefits from the beginning of the next year.

4.3.7 Government deficits

Net government debt (\(D_{t}\)) is assumed to be proportional to national income to make our simulation feasible. The value of parameter \(d\), which is the ratio of net public debt to national income as given in Eq. (25), is assigned as explained in the subsection simulation cases. After 2020, Japan’s national income is expected to decrease as the population declines. Therefore, the assumption that net government debt is proportional to national income during the entire period implicitly implies that the government will successfully reduce future government deficits.

4.3.8 Intertemporal elasticity of substitution

Following İmrohoroğlu et al. (2017), the intertemporal elasticity of substitution (\(\gamma\)) in the individual utility function is set to 0.5. Our model also set the same value between the number of children and the consumption-leisure composite parameter, as in previous studies, such as Oguro et al. (2011) and Oguro and Takahata (2013). This parameter is an important determinant of fertility and population size when income changes; therefore, we conduct a sensitivity analysis, where we set \(\gamma\) = 0.4 (see Sect. 6.2 for further details).

4.3.9 Share parameter on consumption in utility

The value of the consumption share parameter, \(\phi\), in the utility function is assigned based on Nishiyama and Smetters (2005). Referring to Nishiyama and Smetters (2005), where \(\phi\) = 0.47, we set \(\phi\) = 0.5 in this paper. Consequently, in the 2020 initial steady state, an individual devotes, on average, 59.0% for the low-income class and 60.1% for the high-income class, of the available time endowment (of 16 h per day) to labor during their working years (ages 18–64 or 22–64 years).

4.3.10 Adjustment coefficient for discounting the future

The adjustment coefficient for discounting the future, \(\delta\), is set such that the capital–income ratio (K/Y) in the model, that is 2.43, approaches its plausible value, 2.5 which is estimated by Hansen and İmrohoroğlu (2016).

4.3.11 Technological progress

The technological progress of private production is significant because it greatly influences economic growth. Thus, careful attention should be paid to our assumptions. Technological progress is assumed to be 0 in the simulation, reflecting Japan’s experience during the past two or three decades (see Ihori et al., 2006).

5 Simulation results

Based on the simulation results in Japan, we first address the net government debt-to-GDP ratio, which maximizes the per-capita utility and the level of per-capita welfare gain. We next address the net government debt-to-GDP ratio’s impact on future population levels and then discuss the mechanism behind the findings. The overall simulation analysis results reveal that the net debt-to-GDP ratio of − 220% maximizes the per-capita utility and produces a considerable per-capita welfare gain (34.442 million yen, approximately 314,000 USD in 2021); however, compared to the baseline simulation with a debt-to-GDP ratio of 150%, the optimal net government debt substantially decreases the total population in the long run. In general, one policy instrument cannot achieve two policy goals; therefore, it may be better to improve per-capita utility by reducing Japan’s net debt-to-GDP ratio and maintain the future population level through other policy instruments, such as childcare support measures or immigration policies.

5.1 Effect on individual welfare

First, we evaluate the effect of alternative cases with different net debt-to-GDP ratios on individual welfare. Figure 6 illustrates the leveled LSRA transfer value obtained by the simulation analysis for each net debt-GDP ratio, from − 300% to 250% (\(d\) = − 3, − 2.9, …, 2.4, 2.5). When the ratio is − 220% (\(d\) = − 2.2), each individual’s leveled welfare gain is maximized, equivalent to 34.442 million Japanese yen (approximately 314,000 U.S. dollars in 2021), a considerable amount for each individual.Footnote 9 Figure 6 shows that as the net debt-to-GDP ratio is lower or higher than − 220%, the per-capita welfare is lower. Therefore, these results show that the net debt-to-GDP ratio of − 220% (\(d\) = − 2.2) is desirable from the viewpoint of per-capita welfare. In terms of efficiency, it is preferable to realize the net debt ratio of − 220% of Japan’s GDP. This result means that the current high level of government debt (150% of GDP) is far from the optimal level of maximizing welfare, bringing about a considerable loss in economic welfare.

Although the net government debt-to-GDP ratio of − 220% maximizes per-capita utility, it seems to be difficult, in reality, to achieve this ratio because it is currently approximately 150% in Japan and is still increasing. As Fig. 6 illustrates, the debt-to-GDP ratios of 100%, 50%, and 0% bring about the leveled welfare gains of 5.328 million yen (approximately 49,000 U.S. dollars in 2021), 10.555 million yen (approximately 96,000 U.S. dollars in 2021), and 15.900 million yen (approximately 145,000 U.S. dollars in 2021), respectively. Because a decrease in the debt-to-GDP ratio from 150 to 100% generates such a considerable amount of per-capita welfare gain, the transition to the debt-to-GDP ratio of 100% would be an immediate and realistic goal to enhance the efficiency in present Japan.

5.2 Effect on future population

Next, we assess the impact of alternative cases with the different net debt-to-GDP ratios on the future population. Figure 7 illustrates the percent changes of the total population for each year from the benchmark case (\(d\) = 1.5), concerning five cases of different net debt-GDP ratios (\(d\) = − 3, − 2.2, − 1, 0, and 2.5), respectively. Different net government debt-to-GDP ratios bring about a different total population for each year. Although the net government debt-to-GDP ratio of − 220% maximizes per-capita utility, the ratio of − 220% (\(d\) = − 2.2) is not desirable from the viewpoint of the future total population. Figure 7 shows that just after the reform from 2021, the population for the ratio (\(d\) = − 2.2) slightly increased until 2028 compared to the baseline simulation (\(d\) = 1.5); it is higher by 0.09% in 2024. Yet, after 2028, this ratio’s population gradually decreases, standing apart from the baseline simulation’s level; it is lower by 1.69% in 2050, 3.73% in 2070, and 8.47% in 2100. Therefore, the net debt-to-GDP ratio of − 220% (\(d\) = − 2.2) maximizes the per-capita welfare with a considerable equivalent amount; however, it gradually decreases the total population, resulting in a substantial drop in the long run. This is mainly because an increase in the wage rate improves the individual utility but raises the opportunity cost of raising children (see the following subsection for further details).

5.3 Mechanism behind the findings

Here, we consider why the net debt-to-GDP ratio of − 220% (\(d\) = − 2.2) maximizes the per-capita welfare. Large changes in the net debt-to-GDP ratio greatly influence the level of capital stock through Eqs. (25) and (48). A substantial decrease in the debt ratio from 150% (\(d\) = 1.5) to − 220% (\(d\) = − 2.2) substantially increases the capital stock. For three scenarios with different net debt-to-GDP ratios (\(d\) = − 3, − 2.2, and 2.5), Figs. 8, 9, and 10 present the percent changes in national income, capital stock, and labor supply, respectively, from the benchmark case (\(d\) = 1.5). The capital stock for the net debt ratio of − 220% (\(d\) = − 2.2) sharply increases and peaks at a 117.47% increase in 2030; the increase then gradually shrinks over time. The labor supply for the net debt ratio of − 220% (\(d\) = − 2.2) first drops by 7.94% in 2021 and sharply rises by 7.67% until 2030. From 2030, the labor supply will increase slightly and gradually decrease over time. Consequently, the national income for the ratio of − 220% (\(d\) = − 2.2) also rapidly increases and peaks at a 40.58% increase in 2030; the increase will gradually shrink over time.

For the three scenarios, Figs. 11 and 12 illustrate the percent changes in interest rates and wage rates, respectively, from the benchmark case. Reflecting a large capital stock, the interest rate for the net debt ratio of − 220% (\(d\) = − 2.2) drops sharply at the bottom by 2.29% in 2030; the decline will then gradually decrease over time. Conversely, the wage rate for the ratio of − 220% (\(d\) = − 2.2) sharply increases and peaks at 30.54% in 2030 because the reduction in government debt increases real capital, resulting in a relative labor shortage; the increase will then gradually decrease over time. Higher wage rates for the ratio of − 220% (\(d\) = − 2.2) increase opportunity costs for childrearing, lowering fertility and decreasing the total population in the long run.

Figure 13 shows percentage-point changes in consumption tax rates from the benchmark case for three cases with different net debt-GDP ratios. The consumption tax rate for the net debt ratio of − 220% (\(d\) = − 2.2) sharply drops by 8.77% in 2027. After that, it slightly increases but, from 2030, again decreases gradually, and from around 2070, it settles at an approximately 13% decrease. Figure 13 reveals that under the net debt-to-GDP ratio of − 220% (\(d\) = − 2.2), the consumption tax rate is substantially lower throughout the entire period. This means a lower tax burden for individuals, which is one of the main reasons for attaining the highest utility for individuals in this simulation case (\(d\) = − 2.2).

Figure 14 illustrates percentage-point changes in contribution rates from the benchmark case for three cases of the different net debt-GDP ratios. The contribution rate for the net debt ratio of − 220% (\(d\) = − 2.2) sharply drops at the bottom by 4.56% in 2030 before beginning to increase. From 2061, the contribution rate for this case (\(d\) = − 2.2) becomes higher than that in the benchmark case. After that, it gradually increases and peaks at 4.22% in 2092, and, after 2092, again decreases gradually. A possible reason for this observation is the following. After the reform started, the transition to the ratio of − 220% increased the capital stock and promoted economic growth, reducing contribution rates; however, the reform (\(d\) = − 2.2) is not desirable from the viewpoint of the future total population. As Fig. 7 illustrates, although the reform slightly increases the total population until 2028, it decreases the total population at an accelerated pace over time. Consequently, reducing the young working population would increase contribution rates under a PAYG social security system.

The optimal debt amount is not a more negative debt, such as − 250% of GDP, because there are factors that worsen welfare as negative debt increases. Households in the transition process cannot adequately respond to a significant change in government debt and cannot sufficiently maximize their utility because such households would have to make extensive revisions to their advance future projections. This paper’s model assumes perfect foresight by households; however, changes will occur in their environment and circumstances when they enter the transition process in 2021 from the 2020 steady state. The foresight is recalculated at this time, exposing the households to significant changes in the economic environment if the amount of debt differs significantly. For example, because Japan’s net debt-to-GDP ratio is currently 150%, a shift to − 250% would mean a 400% change in net debt, significantly departing from their original future projections and potentially disturbing the individual utility-maximizing behavior. Therefore, households would be unable to improve their utility sufficiently, worsening utility. Since this paper deals with realistic reforms from the current situation, the transition costs associated with reforms are essential.

6 Sensitivity analysis

Because the simulation results described above depend on the model setting and the given parameters, we must be careful about the effects of any setting or parameter changes. This section first investigates how increases in government expenditures to finance social security affect the main findings. We then evaluate how different parameter values on the intertemporal elasticity of substitution impact the main findings.

6.1 Ratio of government expenditures to national income

Equation (27) shows that in our model, government expenditures are concentrated mainly on public pensions and childcare subsidies, and the medical care system is discarded. The government finances a large portion of medical care spending; therefore, this paper’s model incorporates only a portion of public spending to finance social security. The National Institute of Population and Social Security Research (2022) determined that the total amount of public expenditures to finance social security (including pensions, medical care, long-term care, and childcare support) was 58.95 trillion yen in 2020, representing 11.16% of the GDP. In this model’s 2020 initial steady state, the sum of public expenditures on public pensions (\(\pi B_{t}\)) and public expenditures as support for childcare (\(GS_{t}\)) comprise only 4.26% of GDP. The ratio of public expenditures to GDP as a source of social security funding is 6.9% lower than the real ratio in the baseline simulation; therefore, we considered an additional simulation case (Case A) with the real value of public expenditures as a percentage of GDP. We conducted a sensitivity analysis to determine how this setting difference impacts the optimal government net debt-to-GDP ratio.

In Case A, the difference (6.9% of GDP) was added to “other government expenditures (except for public expenditures on public pensions and public expenditures to support child care)” (\(gY_{t}\)) in the model. In other words, we replace \(g\) = 0.1 in this model’s baseline simulation with \(g\) = 0.169 in Case A; this substitution makes the ratio of public expenditures to GDP as a source of social security in the model consistent with reality. As shown in Table 4, we also adjusted the value of \(\alpha\) (the preference parameter for the number of children) in Case A to produce the total fertility rate of 1.33 (real value) in the 2020 initial steady state. This approach resulted in \(\alpha\)= 0.03754. The simulation results show that the optimal government net debt-to-GDP ratio is –220% in Case A, the same as the result in the baseline simulation in this paper. This outcome suggests that raising public expenditures to finance social security to the actual level does not affect the main findings.Footnote 10

6.2 Intertemporal elasticity of substitution

The baseline model assumes that the intertemporal elasticity of substitution (\(\gamma\)) in Eqs. (2) and (2’) is 0.5, referring to Nishiyama and Smetters (2005). We conduct a sensitivity analysis because this parameter setting may substantially change the simulation results. We consider an additional simulation case (Case B) with the intertemporal elasticity of substitution (\(\gamma\)) of 0.4 to quantify the effect of different values of the intertemporal elasticity of substitution on our main result. In Case B, we also adjusted the value of \(\alpha\) (the preference parameter for the number of children) to produce the total fertility rate of 1.33 in the 2020 initial steady state, as presented in Table 4. This approach resulted in \(\alpha\)= 0.007284. The simulation result reveals that the utility-maximizing government debt-to-GDP ratio is − 350% (− 220% in the benchmark case), indicating that changes in \(\gamma\) have a substantially significant impact on simulation results.

7 Conclusions

This paper evaluated a desirable quantity of government debt for a model parameterized to mimic certain features of the Japanese economy from two viewpoints: individual welfare and future demography. Concretely, it examined the quantitative effects of different levels of the net government debt on per-capita welfare and future population in an aging and depopulating Japan, using an extended life-cycle general equilibrium model with endogenous fertility. The effects of alternative ratios of the government net debt to GDP were quantitatively investigated during the transitional period, 2021–2300. An LSRA was introduced to calculate the per-capita welfare and evaluate the pure efficiency gains or losses of these policy reforms.

The three main findings of our analysis are as follows. First, we examined the net government debt-to-GDP ratio that maximizes the per-capita utility for all individuals, including future and current generations. From the viewpoint of economic efficiency, the optimal quantity of the net debt in Japan is − 220% of its GDP because it maximizes the per-capita welfare. This ratio is negative, showing that realizing Japan’s fiscal surplus is desirable from an efficiency viewpoint. Second, we also found that the net debt-to-GDP ratio of − 220% produces a considerable per-capita welfare gain (34.442 million JPY, approximately 314,000 USD in 2021). Third, from the viewpoint of the future total population, this ratio of − 220% is not desirable because, after 2028, the total population gradually decreases compared to the level of the baseline simulation, resulting in an 8.47% decrease in 2100.

Finally, we discuss policy implications based on the simulation results. The results reveal that from the efficiency viewpoint, Japan’s optimal net government debt-to-GDP ratio is negative, with a ratio of − 220%; however, the ratio of − 220% is not desirable from the future population viewpoint because it decreases the total population in the long run compared to the level of the baseline simulation. In general, one policy instrument cannot achieve two policy goals. Therefore, it may be better to improve per-capita welfare by reducing Japan’s net debt-to-GDP ratio. For example, since a decrease in the debt-to-GDP ratio from 150 to 100% generates considerable per-capita welfare gain (5.328 million yen, approximately 49,000 U.S. dollars in 2021), the transition to a debt ratio of 100% may be an immediate and realistic goal to enhance the efficiency in present Japan. From the viewpoint of maintaining the future population level, it may be preferable to implement another policy instrument, such as childcare support measures or immigration policies.

Notes

The life-cycle model is considerably applicable to the Japanese economy. According to Horioka (2021), almost all of the available evidence suggests that the selfish life-cycle model applies, to some extent, in all countries and that there is more consistent support for this model in Japan than in the United States and other countries.

It is crucial to use the framework with endogenous fertility. If the number of births is not determined endogenously in the model, then future births and demography are exogenously given, mostly by the government’s projected data. In this case, thus assumption is unrealistic because implementing various reform proposals can change the economic environment surrounding the people, such as interest rates and wage rates; however, the scale of change will have absolutely no effect on the number of children the people produce.

We consider a specific path for the government debt-to-GDP ratio. More generally, it would be better to consider the optimal path of government debt instead of the optimal level of long-run debt; however, because of the model’s basic structure, extending the current model to derive the optimal path of government debt is challenging. Therefore, deriving the optimal path of government debt can be considered a challenging task for future research.

For example, in the simulation case with net debt-to-GDP ratio of − 150% (\(d\) = − 1.5), the ratio (\(d\)) is assumed to be 1.5 in 2020, 1.2 in 2021, 0.9 in 2022, …, − 1.2 in 2029, and − 1.5 in 2030. After 2030, the debt-to-GDP ratio will remain constant at − 150%.

The relationship between the population endogenously determined in the model and the real age-population distribution in 2020 is as follows. In our model, individuals choose the number of children; thus, the number of children is endogenously determined; however, we apply the following special setting only for the 2020 initial steady state. Since the actual age-population distribution in 2020, illustrated in Fig. 4, is available from empirical data, it is applied in the model. In other words, for the initial steady state, the population of each age group is set to be predetermined. Under this external environment setting, each household maximizes its lifetime utility by choosing the number of children. The utility maximization of two types of households (low- and high-income classes) represented by a single representative household determines a stream of the number of children born at each age up to 40. The total number of new babies born is calculated by considering the real population weight at each age for each income class on the number of births. For example, for 2021, just out of the initial steady state, the number of newborns (age 0) in 2021 is determined endogenously, as explained above. For people aged 1–105, the age-specific probability rates of surviving from 2020 (initial steady state) to 2021 are applied. For 2022, the number of newborns (age 0) in 2022 is determined endogenously, and for people aged 1–105 we further apply the age-specific probability rates of surviving from 2021 to 2022. For 2022, newborns (age 0) and 1-year-old children are the population endogenously determined in the model. Thus, over time, the overall demographics gradually become more endogenous. Reflecting the real age-population distribution in 2020, this is a realistic picture, and this method is used to provide a more realistic and plausible simulation in our analysis.

The main findings remain almost the same even if all childrearing costs depend solely on the parent’s lifetime income (constant (ξ) = 0), as in Okamoto (2022).

In Japan, the ratio of total family benefits to GDP is only 1.79%, whereas it is, on average, 2.34% for the 37 OECD member countries. This shows that the level of governmental support for childrearing is considerably lower in Japan than that in other countries.

Calibrating the value of parameter, μ, that determines the time cost in the model is difficult. In the 2020 initial steady state, an average number of children to which a parent gives birth during the period from 18 or 22 to 40 is 0.0311 per year. We simply assume that a parent’s available time is 16 h per day and that the childrearing time cost for one child is 1 h per day.