Abstract

In addition to the standard risk factors suggested by asset pricing models, the extant literature shows mixed evidence of the impact of market structure on firm-level returns. Using data for 940 Indian firms listed on the Bombay Stock Exchange across 65 industries between FY 2010–11 to FY2018-19 and Lowess smoothing followed by a robust regression model with time fixed and industry effects, we find that firms in more concentrated industries earn lower returns, after controlling for the well-known determinants of asset prices. The relationship is stronger for firms that engage in non-price competition. Further, the explanatory power is better for industries with higher levels of concentration. Our study also provides an explanation on why firms operating in less concentrated environments are able to achieve high returns in the Indian context and provides important implications for both investors and the policymakers. Thus, the study is a novel attempt to examine the impact of not just the intensity of competition on firm level returns but also the type of competition in the case of a developing country, i.e. India.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Most firms face some form of competition in the product market. The competition that a firm faces depends on the market structure, and in turn affects the profitability of a business (Hou & Robinson, 2006). A widely accepted argument is that competition decreases profitability and increases uncertainty about future prospects (Gaspar & Massa, 2006). Due to competition, and the consequent uncertainty about future cash flows, firms also reduce leverage or avoid taking additional leverage to fund investments, thus increasing the cost of capital with an adverse impact on the value of the firm. The relationship between industry concentration and accounting profitability has been examined extensively in the extant literature, however, the impact of concentration on actual stock returns realized by investors has received little attention from researchers, particularly in the context of developing markets such as India.

In the present study, we aim to empirically examine this issue for India, using a panel data of 940 firms listed on the Bombay Stock Exchange. The time period under study is financial year 2010–11 to financial year 2018–19. Our results indicate that firms in more concentrated industries earn lower returns, after controlling for the well-known determinants of asset prices. The relationship is stronger for firms that engage in non-price competition. Further, the explanatory power is better for industries with higher levels of concentration.

The study is useful from a managerial perspective for the following reasons. Firstly, this study provides a risk-based explanation of high returns achieved by firms operating in competitive/concentrated environments. Secondly, the study offers important implications for investors as it offers better understanding of industry concentration as a driver of stock returns, and may be considered while designing their investment portfolios. For policymakers, this study highlights the importance of competition on innovation and in explaining trends in financial markets. The third and important contribution of this study lies in examining the impact of not just the intensity of competition on firm level returns, but also of the type of competition (i.e. price and non-price competition).

This study by investigating the influence of industry level competition on the stock market performance in the case of India, helps in understanding the conditions where there is potential for economic gain by limiting the number of companies in an Industry.

The remainder of the paper is organized as follows. “Impact of Market Structure on Firm Level Returns: Theoretical background Empirical Evidence” reviews the recent literature on this issue, and presents a theoretical background. “Data and Methodology” describes the data and methodology. “Results and Analysis” presents the analytical results. “Conclusion” concludes, with managerial and policy implications, and also provides future scope for research in this area.

Impact of Market Structure on Firm Level Returns: Theoretical Background Empirical Evidence

The risk factors suggested by standard asset pricing models for equities include the market risk premia [Capital Asset Pricing Model—CAPM), size of the firm, book to market value (the Fama French 3 Factor Model (Fama & French, 1992, 1993)], value to earnings ratio (Lakonishok et al., 1994), among other factors. The extant literature has also suggested market size and structure to be an important determinant in explaining stock price returns, with however mixed evidence.

There are two primary channels through which market structure affects stock prices (Hou & Robinson, 2006; Sharma, 2010). Firstly, product market structure affects managers’ equilibrium operating decisions that may have a bearing on cash flow risks, and in turn security prices. Secondly, market concentration affects innovation as proxied by a firm’s research and development (R&D) expenditure, and the latter has been empirically found to be an important factor in explaining abnormal equity returns in the extant literature (Chan et. al. 2001; Kothari et al, 2002; Needham, 1975). Innovation is likely to be present in more competitive industries, and thus higher stock returns can be expected in anticipation of higher future cash flows. Earlier empirical literature suggested negative impact of competition on innovation since the former discourages the latter by reducing the monopoly rents that reward new innovation (Schumpeter, 1942). More recent studies have confirmed a positive impact (Blundell et al. 1999), or an inverted U-shaped relationship. The latter implies that higher competition initially increases and then decreases the rate of innovation.

The study by Hou and Robinson (2006) on a sample of US companies suggests highly concentrated markets generating negative abnormal returns, after controlling for size, book-to-market, momentum and other return determinants. Lower distress risk due to high barriers to entry in concentrated industries, and lower innovation risk in such market structures compared to their competitive counterparts, may partly explain lower expected returns for investors. Barriers to entry protect industry from un-diversifiable demand shocks, so more firms in more concentrated industries are likely to generate lower stock returns. Hou and Robinson (2006) study is based on industry concentration as measured by the Herfindahl Hirschman index as a proxy of market structure or product market competition. Another study by Sharma (2010) builds on the earlier literature by using additional dimensions of product market competition, that is, product substitutability and market size. Their results based on an empirical analysis for UK companies show a statistically significant negative relationship between industry concentration and risk-adjusted returns, and a substantial predictive power of product substitutability and market size in explaining stock returns. Bustamante and Donangelo (2017) consider sample selection correction for publicly listed firms and empirically prove an overall negative relation between industry returns and product market competition. Hashem and Su (2015) examine this relationship using Fama-McBeth regressions for companies listed on the London Stock Exchange between 1985 and 2010. Their study confirms that industry concentration is negatively related to average stock returns and provide explanation regarding investor perception for larger premiums for bearing greater risk in more competitive industries. Mouselli and Jaafar (2019) use more recent data and confirm the findings by Sharma (2010) even after controlling for the well-known determinants of asset prices for a cross section of UK stock returns. Their findings also suggest that an asset pricing model that considers market structure explains the time-series variation in stock returns better than the well-known Fama–French model. Gaspar and Massa (2006) in their study show that more competitive firms have more volatile idiosyncratic returns. Their argument is that competition decreases profitability and increases uncertainty about future prospects. Due to competition, and the consequent uncertainty about future cash flows, firms also reduce leverage or avoid taking additional leverage to fund investments, thus increasing the cost of capital with an adverse impact on the value of the firm.

On the other hand, Dan et al (2007), in their study on investigating the relationship between industry concentration and stock returns for Chinese companies, find that the relationship is positive. Similarly, Gallagher et al. (2015) report that in case of Australia, highly concentrated industries generate higher abnormal returns vis-a-vis firms in industries with lower concentration ratios. Yet another study by Gu (2016) uses data of firms listed on the US stock market such as NYSE and confirms positive effect of competition and R&D investment on stock returns.A more recent study using data from annual reports of the A-share listed Chinese companies, Liu et al (2022) examine the effect of product market competition on firm performance amidst the Covid-19 pandemic. They employ a Generalised Method of Moment (GMM) technique to investigate the relationship between market competition and firm performance in the Chinese market. Their analysis concludes that market competition has a significant positive effect on firm performance.

Thus, the extant literature shows mixed evidence of the impact of market structure on firm level returns. While this has been a topic of interest among scholars mostly in the case of developed countries, very few studies examine the results for developing countries. Thus to fill the gap, the present study examines this issue in the case of India, and also adds the methodological refinement of testing not just the intensity, but also the type of competition. The size of the industry, or the market size is an important indicator, in the sense, that it explains the type of competition that exists in the Industry. Standard microeconomic theory suggests that fragmented market structures are unlikely to sustain high levels of profitability, and increasing market sizes and shares are characterized by rising levels of advertising expenditure. This is non-price competition (the opposite is price competition), i.e. competition for market share, which firms try to capture by building a higher brand value, and improving quality of products and services through investments in research and development and advertising. We interact the industry competition with expense ratios of firms to see how the impact changes with types of competition. The methodological refinements used in the present study are described in the next section.

Data and Methodology

For the purpose of this study, we use a sample of 940 firms listed on the Bombay Stock Exchange. The time period under study is financial year 2010–11 to financial year 2018–19. We have taken pre-Covid-19 time period to avoid the impact of the shock on financial marketscreated by the pandemic. The summary view of data and methodology is given as follows in Fig. 1:

The selection of the firms was done as follows. We listed all the firms with continuous trading history between 2011 and 2019. Then, we eliminated firms with net sales less than Rs. 1 billion, and market capitalization less than Rs. 1 billion. We also eliminated firms belonging to the financial services and banking sector. This is because of the legal constraints on their capital structure and its impact on cost of capital. The financial data including year-end stock prices are extracted from Capitaline database. This database provides fundamental and market data for more than 35,000 listed and unlisted companies classified under 313 industries in India. The database also provides extensive data and analysis on company profile and financials such as P&L, Balance Sheet, Cash flow statements, R&D investment data, ratios, etc. for more than ten years.

We use the first level industry classification given in Capitaline database. The 940 firms chosen in the sample are classified into 65 industry-sectors. The number of firms in each industry-sector varies considerably, capturing different intensity of competition. Of the 68 industry-sectors, 22 comprise five or less firms, 18 comprise 6–10 firms, 16 comprise between 10 and 30 firms, and 9 comprise more than 30 firms competing within the industry. For instance, the Textiles Industry comprises 92 firms that meet our selection criterion. Table 5 in the Appendix lists the various industry sectors to which the firms in our sample belong, and with the number of firms in each industry.

While the number of players gives a broad idea of the competitive environment, it ignores the relative size of the firms in relation to the total market size. A better measure industry competition is the Herfindahl Hirschman Index (HHI). The HHI is a statistical measure of concentration, commonly used to measure the size of firms in relation to the industry and the amount of competition amongst them (Herfindahl, 1950; Hirschman, 1945). It is calculated by squaring the market share of each firm competing within an industry and then summing the resulting numbers. Its value ranges from 0 to 1, 1 indicating a highly concentrated market (monopoly) and a result closer to zero indicating a highly fragmented market.

The HHI is calculated as follows:

where \({HHI}_{it}\) is the Herfindahl Hirschman Index for Industry i at time period t, \({S}_{jit}\) is the share of jth firm in the industry, and n is the number of firms in the particular industry. The shares of each firm in the industry are based on the total annual sales turnover.

To establish a statistical relationship between the variable of our interest, we first experiment with a Lowess and then run a robust regression model. In the Lowess smoothing, the dependent variable is the return on stock and the right side variable is the index of industry competition as measured by the Herfindahl–Hirschman Index (Sales). Briefly, Lowess is used for locally weighted scatterplot smoothing (Cleveland, 1979). The smoothed values are obtained by running a regression of yvar on xvar using only the data (xi, yi) and a small amount of the data near this point. The regression is weighted so that the central point (xi, yi) gets the highest weight and points that are farther away (based on the distance \(\left| {x_{j} - x_{i} } \right|\)) receive less weight. The estimated regression line is then used to predict the smoothed value of \(\hat{y}_{i}\) for \(y_{i}\) only. This procedure is repeated to obtain the remaining smoothed values. Thus, a separate weighted regression is performed for every point in the data. We split our sample year wise for a better exposition.

To estimate the impact of industry competition on firm level returns, we use a robust regression model with time fixed effects to remove the effect of common macroeconomic shocks. Robust regression is an alternative to least squares regression when data are contaminated with outliers or influential observations, and it can also be used for the purpose of detecting influential observations (Anderson, 2008). It is likely that industries may have observed returns which have no direct causal relationship with competition, but reflect other institutional features of the industry. Thus, we use industry fixed effects. The risk factors suggested by standard asset pricing models for equities—size of the firm, book to market value are used as controls in our model. We use the firm level expenses (selling, general and administrative expenses) to sales ratio as an indicator of the type of competition. As market size increases, firms engage into non price competition, i.e. competition for a higher market share. This is usually accompanied by rising levels of advertising expenses and R&D expenses. These act as signals of better quality. Because of unavailability of data on these two categories of expenses for all the firms in our sample, we use a proxy, i.e. total indirect expenses as ratio of sales. This term is interacted with the intensity of competition—HHI—to measure the differential impact of competition on returns for firms engaging in non-price competition vis-à-vis firms engaging in price competition.

The model specification is as follows:

where the dependent variable is the annual return on stock for ith firm in time t, \({HHI}_{it}\) is the index of competition for the industry in which firm i operates in time period t, \({\mathbf{X}}_{{{\text{it}}}}\) is a vector of firm characteristics (size of the firm as measured by the total assets, capital structure of the firm as measures by total debt and value of the firm relative to its book value as measure by the Price-Book Value Ratio), and \(\varepsilon_{{{\text{it}}}}\) is the error term. We also add time fixed and industry effects. A plot of correlation between explanatory variables suggests absence of multi-collinearity among them. The variables used in the analysis, their definitions and summary statistics are provided in Table 6 in the Appendix.

Results and Analysis

Table 1 shows the variation in the HHI—Sales across years for the sample used in the study. The average HHI-Sales has been stable across the years. The inter-quartile range, i.e. the difference between the 75th percentile observation (P75) and the 25th percentile observation (P25) suggest that majority of the firms in the sample belong to less concentrated industries.

The variation in HHI-Sales is stark in Fig. 2, which shows the average HHI-Sales for each decile of its distribution (for the year 2019). The number of firms that fall in each decile is also given. The spread in HHI-Sales is large. The most competitive decile has an HHI—Sales of 0.05, whereas the most concentrated decile has an HHI—Sales of 0.63.

Table 5 in Appendix list the industry sectors with the HHI-Sales for the most recent year, i.e. 2019. If we look at the Gas Distribution Industry Sector, it comprises two firms but, HHI—Sales of 0.86 vis-à-vis the Shipbuilding Sector with again two firms, but HHI—Sales of 0.56. Similarly, both the Sugar and Non Ferrous Metals Industry comprise 10 firms each in our sample. However, while the HHI-Sales for the Sugar Industry is 0.15 implying a highly competitive fragmented industry, the index for Non Ferrous Metals is much higher at 0.46. Figure 3 provides a graphical representation of the Industry characteristics for the firms in our sample. The most concentrated decile has the highest average assets. As the concentration increases, the size of the firm proxied by total assets also increases. As far as the market capitalisation is concerned, the upper deciles have higher market cap vis-a-vis the lower deciles, but one may also see a U shape as far as this variable is concerned. Finally, the average sales are also higher for the upper deciles.

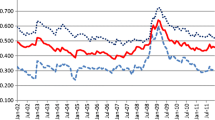

Figure 4 illustrates the Lowess results year wise. At lower levels of concentration, a clear negative relationship is observed between firm level returns and concentration for all years. This is consistent with the findings of Hou and Robinson (2006) suggesting highly concentrated markets generating negative abnormal returns.

The results of the robust regression are as follows.

Table 2 provides the robust regression results for the full sample of 940 firms based on the model specification (2). Column I presents the results with industry competition and firm specific characteristics as controls. In Column II, we add an additional explanatory variable, i.e. interaction of the HHI with expense ratio to assess the impact of the type of competition on stock returns. Columns III, IV and V presents the specification results when time fixed and industry fixed effects are added. The F-statistic is significant for all the specifications, providing sufficient evidence to conclude that the regression model fits the data better than the model with no independent variables.

It is found that the coefficient of HHI-Sales is consistently negative, implying that a higher concentration of firms lead to lower returns. In specification II–V, we use additional variable—indirect expenses to sales ratio—interacted with the index of concentration. The coefficient is negative implying that firms with higher expenses to sales ratio exhibit a stronger negative relationship between returns and concentration in relation to firms with a lower expenses to sales ratio. The economic meaning of this result is as follows. Firms in more fragmented competitive environments exhibit positive abnormal returns on the stock following the arguments of Hou and Robinson (2006) based on innovation and barriers to entry. This relationship is stronger for firms that engage in non-price competition than for firms selling a more homogenous product and engaging in price competition. The results remain the same when we add time fixed effects or industry-sector fixed effects or both. The coefficient of price/book value is positive implying a higher return for high value firms. This is consistent with Fama and French (1992). A more leveraged firm, implied by a higher debt ratio exhibits lower returns on the stock. The size effect captured by total assets does not give significant coefficients in our model. The size is also captured by the Debt Ratio (it is taken as the ratio of total debt to market capitalization). A higher market capitalization implies a lower ratio, and with negative coefficients, it confirms the positive relationship between size and returns.

Four industries in our sample comprise only 1 firm that meet our selection criterion. These are not monopolies in reality, and have competing firms which have been dropped out of our sample because of the selection criterion or missing data. Hence, we test our model by dropping these firms from our sample to avoid skewing of results. Table 3 provides the robust regression results for the truncated sample of 936 firms for various specifications. The coefficient of HHI-Sales is consistently negative as before, implying that a higher concentration of firms leads to lower returns, and so is the coefficient of expenses to sales ratio. The results remain the same when we add time fixed effects or industry-sector fixed effects or both. The coefficient of price/book value is positive implying a higher return for high value firms, and the coefficient of Debt Ratio is negative.

It may also be noted that as the number of firms in an Industry becomes very large, the variation in HHI reduces. Hence, we also test our results for a smaller subsample of 200 firms belonging to only those Industry Sectors where the number of firms is not more than ten. Table 4 shows the robust regression results when we experiment with our model by putting a restriction on the number of firms in an Industry. The results are given for the full specification using both time and industry sector fixed effects. Our results suggest that the coefficient of HHI-Sales is consistently negative, implying that a higher concentration of firms lead to lower returns. The coefficient is larger than in previous specifications implying a more stronger (negative relationship) at higher levels of concentration. It may also be noted that a drawback of using HHI as a measure of concentration is that as the number of firms become very large, the variation in the index reduces. Thus this index provides more valuable information about the intensity of competition when the number of firms is small. The coefficient of indirect expenses to sales ratio is negative implying that firms with higher expenses to sales ratio exhibit a stronger negative relationship between returns and concentration in relation to firms with lower expenses to sales ratio. This is true for higher levels of concentration. The coefficient of price/book value is positive and the coefficient of debt ratio is negative as in the previous specifications.

A summary of our results with managerial and policy implications are delineated in the next section.

Conclusion

In this paper, we investigate the impact of intensity of competition in the Industry on firm level returns using data on Indian listed firms for the period 2010–11 to 2018–19. Our hypothesis is that industry concentration affects stock returns through innovation, and capital structure. We find that firms in less concentrated environments earn a higher return vis-à-vis firms in more concentrated industries. The standard risk factors associated with capital asset pricing models, such as firm size, value of the firm and capital structure are used as controls. A refinement in this study is to see not just the intensity, but also the type of competition and its impact on firm level returns. The negative relationship between firm level returns and concentration, is found to be stronger for firms that engage in non-price competition than for firms selling a more homogenous product and engaging in price competition. We experiment with different specifications by putting restrictions on the maximum and minimum number of firms in the industry. Our results are consistent across specifications, confirming robustness of the results. Further, the explanatory power is better for industries with higher levels of concentration.

Lower returns in concentrated industries may be attributed to high barriers to entry in and lower innovation risk in such market structures. Our results are important for managers, investors and policymakers. A better understanding of industry concentration as a driver of stock returns, helps investors while designing their investment portfolios. For managers and policymakers, our results highlight the importance of competition on innovation and in explaining trends in financial markets, and firm valuation. Our study also helps managers and financial analysts to make better strategic financial decisions as well as provides a refined methodology for analysis.

While our study provides an explanation on why firms operating in less concentrated environments are able to achieve high returns in the Indian context and provides important implications for both investors and the policymakers, there is one limitation of focusing only on two main variables of interest, i.e. HHI and expense ratio. There is future scope for conducting robust tests using alternative measures other than the two chosen variables. Some of these alternate measures as suggested in the literature include level of historical innovations vis-à-vis the expected innovative activity in the future, permanent differences in the level of innovations across firms and across industries, dividend payout ratio, business cycle, etc. There is scope for further refinement in the methodology such as employing mixed methods or cross-section techniques to also incorporate factors such as Environmental, Social and Corporate Governance (ESG), using more datasets as well as include the joint-effects of the pandemic and product market competition on firm performance.

Key Questions Reflecting Applicability in Real Life

This study answers some of the following key questions:

-

1.

What is the relationship between the competition faced by a firm and the return on its stock prices?

-

2.

How does a market structure or the industry characteristics in which a firm operates affects the value generated for its shareholders?

-

3.

Why does Industry concentration matter, and what strategies should managers adopt to generate superior shareholder value?

Data Availability

The data that support the findings of this study are available from the corresponding author upon reasonable request.

Code Availability

Not applicable.

References

Andersen, R. (2008). Modern methods for robust regression (No. 152). Sage.

Blundell, R., Griffith, R., & van Reenen, J. (1999). Market share, market value and innovation in a panel of British manufacturing firms. Review of Economic Studies, 66(3), 529–554.

Bustamante, M. C., & Donangelo, A. (2017). Product market competition and industry returns. The Review of Financial Studies, 30(12), 4216–4266. https://doi.org/10.1093/rfs/hhx033

Chan, L., Lakonishok, J., & Sougiannis, T. (2001). The stock market valuation of research and development expenditures. Journal of Finance, 56, 2431–2457.

Cleveland, W. S. (1979). Robust locally weighted regression and smoothing scatterplots. Journal of the American Statistical Association, 74, 829–836.

Dan, M., Li-yan, H. & Dong-hui, L. (2007). Industry concentration and stock returns in China A-Share market. International Conference on Management Science &Engineering (14th) August, pp. 20–22

Fama, E., & French, K. (1992). The cross-section of expected stock returns. Journal of Finance, 47, 427–465.

Fama, F., & French, K. (1993). Common risk factors in thereturns of bonds and stocks. Journal of FinancialEconomics, 33, 3–56.

Gallagher, D., Ignatieva, K., & McCulloch, J. (2015). Industry concentration, excess returns and innovation in Australia. Accounting & Finance, 55(2), 443–466.

Gaspar, J., & Massa, M. (2006). Idiosyncratic volatility and product market competition. Journal of Business, 79, 3125–3152.

Gu, L. (2016). Product market competition, R&D investment, and stock returns. Journal of Financial Economics, 119(2), 441–455. https://doi.org/10.1016/j.jfineco.2015.09.008

Hashem, N., & Su, L. (2015). Industry concentration and the cross-section of stock returns: Evidence from the UK. Journal of Business Economics and Management, 16(4), 769–785.

Herfindahl, O. C. (1950). Concentration in the US Steel Industry. Columbia University.

Hirschman, A. O. (1945). National power and the structure of foreign trade. University of California Press.

Hou, K., & Robinson, D. T. (2006). Industry concentration and average stock returns. Journal of Finance, 61, 1927–1956. https://doi.org/10.1080/23322039.2019.1576350

Kothari, S., Laguerre, T., & Leone, A. (2002). Capitalization versus expensing: Evidence on the uncertainty offuture earnings from capital expenditures versus R&D outlays. Revenue Accounting Studies, 7, 355–382.

Lakonishok, J., Shleifer, A., & Vishny, R. (1994). Contrarianinvestment, extrapolation, and risk. Journal of Finance, 49, 1541–1578.

Liu, Q., Qu, X., Wang, D., Abbas, J., & Mubeen, R. (2022). Product market competition and firm performance: business survival through innovation and entrepreneurial orientation amid Covid-19 financial crisis. Frontiers in Psychology, 12, 790923. PMCID: PMC8993680.

Mouselli, S., & Jaffar, A. (2019). Industry concentration, stock returns and asset pricing: The UK evidence. Cogent Economics and Finance, 7, 1576350.

Needham, D. (1975). Market structure and firms’ R&D behaviour. The Journal of Industrial Economics, 23(4), 241–255. https://doi.org/10.2307/2098293

Schumpeter, J. (1942). Capitalism, socialism and democracy. Harper & Row.

Sharma, V. (2010). Stock returns and product market competition: Beyond industry concentration. Review of Quantitative Finance and Accounting, 37, 283–299.

Funding

This research received no specific grant from any funding agency in the public, commercial, or not-for-profit sectors. Both the authors declare that there are neither any financial nor non-financial interests associated with this research.

Author information

Authors and Affiliations

Contributions

Both the authors have contributed in the conceptualisation, design, material preparation, data analysis, manuscript writing, proof-reading and revision stages of this research paper.

Corresponding author

Ethics declarations

Conflict of interest

The authors declare no potential conflict of interest.

Ethical approval

All ethical approvals, consent for using data and material have been taken to conduct this research.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Kaicker, N., Aggarwal, R. Market Structure and Firm Level Returns: The Indian Evidence. JGBC 18, 59–69 (2023). https://doi.org/10.1007/s42943-023-00076-0

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s42943-023-00076-0