Abstract

We extend the application and test the performance of a recently introduced volatility prediction framework encompassing LSTM and rough volatility. Our asset class of interest is cryptocurrencies, at the beginning of the “crypto-winter” in 2022. We first show that to forecast volatility, a universal LSTM approach trained on a pool of assets outperforms traditional models. We then consider a parsimonious parametric model based on rough volatility and Zumbach effect. We obtain similar prediction performances with only five parameters whose values are non-asset-dependent. Our findings provide further evidence on the universality of the mechanisms underlying the volatility formation process.

Similar content being viewed by others

Data availability

All data used are publicly available on binance.com.

Notes

Mccrank, J. (2022, February 14). Wall St Week Ahead Crypto investors face more uncertainty after rocky start to 2022. Reuters. https://www.reuters.com/business/finance/wall-st-week-ahead-crypto-investors-face-more-uncertainty-after-rocky-start-2022-2022-02-11/.

Harrison, E. (2022, May 10). The crypto-winter is here. Bloomberg.com. https://www.bloomberg.com/news/newsletters/2022-05-10/the-crypto-winter-is-here.

Howcroft, E. (2022, June 13). Cryptocurrency market value slumps under $1 trillion. Reuters. https://www.reuters.com/business/finance/cryptocurrency-market-value-slumps-under-1-trillion-2022-06-13/.

Coingecko. (2023). 2022 Annual Crypto Industry Report. CoinGecko. https://www.coingecko.com/research/publications/2022-annual-crypto-report.

More about USDT can be found at https://tether.to/en/how-it-works.

References

Amirshahi, B., & Lahmiri, S. (2023). Hybrid deep learning and GARCH-family models for forecasting volatility of cryptocurrencies. Machine Learning with Applications, 12, 100465.

Arnosti, N., & Weinberg, S. M. (2022). Bitcoin: A natural oligopoly. Management Science, 68(7), 4755–4771.

Baur, D. G., & Dimpfl, T. (2018). Asymmetric volatility in cryptocurrencies. Economics Letters, 173, 148–151.

Bayer, C., Friz, P., & Gatheral, J. (2016). Pricing under rough volatility. Quantitative Finance, 16(6), 887–904.

Bennedsen, M., Lunde, A., & Pakkanen, M. S. (2022). Decoupling the short-and long-term behavior of stochastic volatility. Journal of Financial Econometrics, 20(5), 961–1006.

Bianchi, D., & Babiak, M. (2022). On the performance of cryptocurrency funds. Journal of Banking & Finance, 138, 106467.

Cheikh, N. B., Zaied, Y. B., & Chevallier, J. (2020). Asymmetric volatility in cryptocurrency markets: New evidence from smooth transition GARCH models. Finance Research Letters, 35, 101293.

Corsi, F. (2009). A simple approximate long-memory model of realized volatility. Journal of Financial Econometrics, 7(2), 174–196.

Delfabbro, P., King, D. L., & Williams, J. (2021). The psychology of cryptocurrency trading: Risk and protective factors. Journal of behavioral addictions, 10(2), 201–207.

Donier, J., & Bonart, J. (2015). A million metaorder analysis of market impact on the Bitcoin. Market Microstructure and Liquidity, 1(02), 1550008.

D’Amato, V., Levantesi, S., & Piscopo, G. (2022). Deep learning in predicting cryptocurrency volatility. Physica A: Statistical Mechanics and its Applications, 596, 127158.

El Euch, O., Gatheral, J., & Rosenbaum, M. (2019). Roughening Heston. Risk, pages 84–89.

El Euch, O., & Rosenbaum, M. (2018). Perfect hedging in rough Heston models. The Annals of Applied Probability, 28(6), 3813–3856.

El Euch, O., & Rosenbaum, M. (2019). The characteristic function of rough Heston models. Mathematical Finance, 29(1), 3–38.

Fang, F., Ventre, C., Basios, M., Kanthan, L., Martinez-Rego, D., Wu, F., & Li, L. (2022). Cryptocurrency trading: a comprehensive survey. Financial Innovation, 8(1), 1–59.

Gatheral, J., Jaisson, T., & Rosenbaum, M. (2018). Volatility is rough. Quantitative Finance, 18(6), 933–949.

Gatheral, J., Jusselin, P., & Rosenbaum, M. (2020). The quadratic rough Heston model and the joint S &P 500/VIX smile calibration problem. Risk, May 2020.

Goodfellow, I., Bengio, Y., & Courville, A. (2016). Deep learning. MIT press.

Griffin, J. M., & Shams, A. (2020). Is Bitcoin really untethered? The Journal of Finance, 75(4), 1913–1964.

Hendrycks, D., & Gimpel, K. (2020). Gaussian error linear units (gelus). arXiv preprint, arXiv:1606.08415v4.

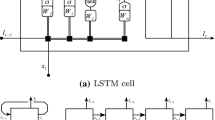

Hochreiter, S., & Schmidhuber, J. (1997). Long short-term memory. Neural Computation, 9(8), 1735–1780.

Kakinaka, S., & Umeno, K. (2022). Asymmetric volatility dynamics in cryptocurrency markets on multi-time scales. Research in International Business and Finance, 62, 101754.

Kingma, D. P., & Ba, J. (2015). Adam: a method for stochastic optimization. Proceedings of the International Conference on Learning Representations (ICLR).

Kristjanpoller, W., & Minutolo, M. C. (2018). A hybrid volatility forecasting framework integrating GARCH, artificial neural network, technical analysis and principal components analysis. Expert Systems with Applications, 109, 1–11.

Li, T., Shin, D., & Wang, B. (2021). Cryptocurrency pump-and-dump schemes. Available at SSRN 3267041.

Malik, N., Aseri, M., Singh, P. V., & Srinivasan, K. (2022). Why Bitcoin will fail to scale? Management Science, 68(10), 7323–7349.

Mita, M., Ito, K., Ohsawa, S., & Tanaka, H. (2019). What is stablecoin?: A survey on price stabilization mechanisms for decentralized payment systems. In 2019 8th International Congress on Advanced Applied Informatics (IIAI-AAI), pages 60–66. IEEE.

Nakamoto, S. (2008). Bitcoin: A peer-to-peer electronic cash system. Available online: http://bitcoin.org/bitcoin.pdf.

Patton, A. J. (2011). Volatility forecast comparison using imperfect volatility proxies. Journal of Econometrics, 160(1), 246–256.

Rosenbaum, M., & Zhang, J. (2022a). Deep calibration of the quadratic rough Heston model. Risk, Oct 2022.

Rosenbaum, M., & Zhang, J. (2022b). On the universality of the volatility formation process: when machine learning and rough volatility agree. To appear in Frontiers in Financial Mathematics.

Takaishi, T. (2020). Rough volatility of Bitcoin. Finance Research Letters, 32, 101379.

Wu, P., Muzy, J.-F., & Bacry, E. (2022). From rough to multifractal volatility: The log S-fBM model. Physica A: Statistical Mechanics and its Applications, 604, 127919.

Zumbach, G. (2010). Volatility conditional on price trends. Quantitative Finance, 10(4), 431–442.

Acknowledgements

Siu Hin Tang is supported by the SINGA award by A*Star Singapore. Mathieu Rosenbaum is supported by the École Polytechnique’s chairs Deep finance and statistics and Machine learning and systematic methods. Chao Zhou is supported by the Ministry of Education in Singapore under the MOE AcRF grants A-0004255-00-00, A-0004273-00-00, A-0004589-00-00 and by Iotex Foundation Ltd under the grant A-8001180-00-00.

Author information

Authors and Affiliations

Contributions

S.H.T. prepared the data and conducted the numerical experiments. All authors wrote and reviewed the manuscript.

Corresponding author

Ethics declarations

Conflict of interest

The authors declare no competing interests.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Tang, S.H., Rosenbaum, M. & Zhou, C. Forecasting volatility with machine learning and rough volatility: example from the crypto-winter. Digit Finance (2024). https://doi.org/10.1007/s42521-024-00108-1

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s42521-024-00108-1