Abstract

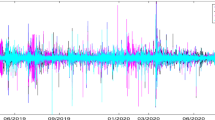

This paper investigates the volatility dynamics of Bitcoin, Ethereum, and Litecoin both before and after the COVID-19 pandemic. Employing an asymmetric two-state MS-MGARCH model, we identify a regime change in their volatility dynamics, providing a foundation for examining pre- and post-COVID volatility spillovers. Using the BEKK-GARCH model, we statistically confirm a spillover and quantify the correlation strength among the cryptocurrencies through the Windowed Scalogram Difference approach. Additionally, the cross-quantilogram approach is utilized to identify potential causal networks among the cryptocurrencies. The study unveils bidirectional shock transmission and volatility spillovers between Bitcoin and Ethereum, as well as Bitcoin and Litecoin, underscoring their interconnected nature. Furthermore, bidirectional volatility connections between Litecoin and Ethereum are uncovered. These findings enhance our comprehension of cryptocurrency volatility, emphasizing the influence of historical shocks and prior volatility on present dynamics. The study has practical implications for investors, traders, and policymakers, offering valuable insights for risk management in the cryptocurrency market, thus contributing to the advancement of knowledge in cryptocurrency dynamics and supporting more informed decision-making in this continually evolving financial landscape.

Similar content being viewed by others

Availability of data and materials

Our data will be available on request.

References

Alam, M., Chowdhury, M. A. F., Abdullah, M., & Masih, M. (2023). Volatility spillover and connectedness among REITs, NFTs, cryptocurrencies and other assets: Portfolio implications. Investment Analysts Journal. https://doi.org/10.1080/10293523.2023.2179161

Almeida, J., & Gonçalves, T. C. (2022). A systematic literature review of volatility and risk management on cryptocurrency investment: A methodological point of view. Risks, 10(5), 107.

Ampountolas, A. (2022). Cryptocurrencies intraday high-frequency volatility spillover effects using univariate and multivariate garch models. International Journal of Financial Studies, 10(3), 51.

Apergis, N. (2022). COVID-19 and cryptocurrency volatility: Evidence from asymmetric modelling. Finance Research Letters, 47, 102659.

Ardia, D. (2008). Financial risk management with Bayesian estimation of GARCH models (Vol. 612). Springer.

Arouri, M. E. H., Jouini, J., & Nguyen, D. K. (2011). Volatility spillovers between oil prices and stock sector returns: Implications for portfolio management. Journal of International Money and Finance, 30(7), 1387–1405.

Aste, T. (2019). Cryptocurrency market structure: Connecting emotions and economics. Digital Finance, 1(1–4), 5–21.

Baba, Y., Engle, R. F., Kraft, D. F., & Kroner, K. F. (1990). Multivariate simultaneous generalized ARCH. University of California, San Diego, Department of Economics.

Bollen, N. P. (1998). Valuing options in regime-switching models. Journal of Derivatives, 6, 38–50.

Bolós, V. J., Benítez, R., Ferrer, R., & Jammazi, R. (2017). The windowed scalogram difference: A novel wavelet tool for comparing time-series. Applied Mathematics and Computation, 312, 49–65.

Bouri, E., Christou, C., & Gupta, R. (2022). Forecasting returns of major cryptocurrencies: Evidence from regime-switching factor models. Finance Research Letters, 49, 103193.

Bouri, E., Kamal, E., & Kinateder, H. (2023). FTX Collapse and systemic risk Spillovers from FTX Token to major cryptocurrencies. Finance Research Letters, 56, 104099.

Bouteska, A., Sharif, T., & Abedin, M. Z. (2023). COVID-19 and stock returns: Evidence from the Markov switching dependence approach. Research in International Business and Finance, 64, 101882.

Catania, L., Grassi, S., & Ravazzolo, F. (2018). Predicting the volatility of cryptocurrency time-series. Mathematical and Statistical Methods for Actuarial Sciences and Finance: MAF, 2018, 203–207.

Chkili, W. (2021). Modeling Bitcoin price volatility: Long memory vs Markov switching. Eurasian Economic Review, 11, 433–448.

Choudhry, T., & Wu, H. (2008). Forecasting ability of GARCH vs Kalman filter method: Evidence from daily UK time-varying beta. Journal of Forecasting, 27(8), 670–689.

Corbet, S., Meegan, A., Larkin, C., Lucey, B., & Yarovaya, L. (2018). Exploring the dynamic relationships between cryptocurrencies and other financial assets. Economics Letters, 165, 28–34.

D’Amato, V., Levantesi, S., & Piscopo, G. (2022). Deep learning in predicting cryptocurrency volatility. Physica a: Statistical Mechanics and Its Applications, 596, 127158.

Das, D., Kayal, P., & Maiti, M. (2023). A K-means clustering model for analyzing the Bitcoin extreme value returns. Decision Analytics Journal, 6, 100152.

Delfabbro, P., King, D. L., & Williams, J. (2021). The psychology of cryptocurrency trading: Risk and protective factors. Journal of Behavioral Addictions, 10(2), 201–207.

Engle, R. F., & Kroner, K. F. (1995). Multivariate simultaneous generalized ARCH. Econometric Theory, 11(1), 122–150.

Fasanya, I. O., Oyewole, O. J., & Oliyide, J. A. (2022). Investors’ sentiments and the dynamic connectedness between cryptocurrency and precious metals markets. The Quarterly Review of Economics and Finance, 86, 347–364.

Fry, J., & Cheah, E. T. (2016). Negative bubbles and shocks in cryptocurrency markets. International Review of Financial Analysis, 47, 343–352.

Ftiti, Z., Louhichi, W., & Ben Ameur, H. (2023). Cryptocurrency volatility forecasting: What can we learn from the first wave of the COVID-19 outbreak?. Annals of Operations Research, 330(1):665–690.

Fung, K., Jeong, J., & Pereira, J. (2022). More to cryptos than bitcoin: A GARCH modelling of heterogeneous cryptocurrencies. Finance Research Letters, 47, 102544.

Ghorbel, A., & Jeribi, A. (2021). Contagion of COVID-19 pandemic between oil and financial assets: The evidence of multivariate Markov switching GARCH models. Journal of Investment Compliance, 22(2), 151–169.

Haas, M., Mittnik, S., & Paolella, M. S. (2004). A new approach to Markov-switching GARCH models. Journal of Financial Econometrics, 2(4), 493–530.

Hamilton, J. D. (2010). Regime switching models. Macroeconometrics and time-series analysis, 202–209.

Hilebrand, E. (2005). Neglecting parameter changes in GARCH models. Journal of Econometrics, 129, 121–138.

Hsu, S. H. (2022). Investigating the co-volatility spillover effects between cryptocurrencies and currencies at different natures of risk events. Journal of Risk and Financial Management, 15(9), 372.

Jiang, K., Zeng, L., Song, J., & Liu, Y. (2022). Forecasting value-at-risk of cryptocurrencies using the time-varying mixture-accelerating generalized autoregressive score model. Research in International Business and Finance, 61, 101634.

Katsiampa, P. (2019). Volatility co-movement between bitcoin and ether. Finance Research Letters, 30, 221–227.

Kayal, P., & Balasubramanian, G. (2021). Excess volatility in bitcoin: Extreme value volatility estimation. IIM Kozhikode Society & Management Review, 10(2), 222–231.

Kayal, P., & Rohilla, P. (2021). Bitcoin in the economics and finance literature: A survey. SN Business & Economics, 1(7), 88.

Klaassen, F. (2002). Improving GARCH volatility forecasts with regime-switching GARCH (pp. 223–254). Physica-Verlag HD.

Kyriazis, N. A. (2019). A survey on empirical findings about spillovers in cryptocurrency markets. Journal of Risk and Financial Management, 12(4), 170.

Labidi, C., Rahman, M. L., Hedström, A., Uddin, G. S., & Bekiros, S. (2018). Quantile dependence between developed and emerging stock markets aftermath of the global financial crisis. International Review of Financial Analysis, 59, 179–211.

Ma, F., Liang, C., Ma, Y., & Wahab, M. I. M. (2020). Cryptocurrency volatility forecasting: A Markov regime-switching MIDAS approach. Journal of Forecasting, 39(8), 1277–1290.

Madichie, C. V., Ngwu, F. N., Eze, E. A., & Maduka, O. D. (2023). Modelling the dynamics of cryptocurrency prices for risk hedging: The case of Bitcoin, Ethereum, and Litecoin. Cogent Economics & Finance, 11(1), 2196852.

Mensi, W., Gubareva, M., Ko, H. U., Vo, X. V., & Kang, S. H. (2023). Tail spillover effects between cryptocurrencies and uncertainty in the gold, oil, and stock markets. Financial Innovation, 9(1), 1–27.

Mgadmi, N., Béjaoui, A., & Moussa, W. (2023). Disentangling the nonlinearity effect in cryptocurrency markets during the covid-19 pandemic: Evidence from a regime-switching approach. Asia-Pacific Financial Markets, 30(3), 457–473.

Mikosch, T., & Starica, C. (2004). Nonstationarities in financial time-series, the long-range dependence, and the iGARCH effects. Review of Economics and Statistics, 86, 378–390.

Mullen, K., Ardia, D., Gil, D. L., Windover, D., & Cline, J. (2011). DEoptim: An R package for global optimization by differential evolution. Journal of Statistical Software, 40(6), 1–26.

Murty, S., Victor, V., & Fekete-Farkas, M. (2022). Is Bitcoin a Safe Haven for Indian Investors? A GARCH Volatility Analysis. Journal of Risk and Financial Management, 15(7), 317.

Nair, J. V., & Kayal, P. (2022). A study of tail-risk spillovers in cryptocurrency markets. Global Business Review. https://doi.org/10.1177/09721509221079969

Özdemir, O. (2022). Cue the volatility spillover in the cryptocurrency markets during the COVID-19 pandemic: Evidence from DCC-GARCH and wavelet analysis. Financial Innovation, 8(1), 1–38.

Ranjan, S., Kayal, P., & Saraf, M. (2023). Bitcoin price prediction: A machine learning sample dimension approach. Computational Economics, 61(4), 1617–1636.

Sajeev, K. C., & Afjal, M. (2022). Contagion effect of cryptocurrency on the securities market: A study of Bitcoin volatility using diagonal BEKK and DCC GARCH models. SN Business & Economics, 2(6), 57.

Shahzad, S. J. H., Bouri, E., Ahmad, T., & Naeem, M. A. (2022). Extreme tail network analysis of cryptocurrencies and trading strategies. Finance Research Letters, 44, 102106.

Sharma, G., Kayal, P., & Pandey, P. (2019). Information linkages among BRICS countries: Empirical evidence from implied volatility indices. Journal of Emerging Market Finance, 18(3), 263–289.

Smales, L. A. (2021). Volatility spillovers among cryptocurrencies. Journal of Risk and Financial Management, 14(10), 493.

Som, A., & Kayal, P. (2022). A multicountry comparison of cryptocurrency vs gold: Portfolio optimization through generalized simulated annealing. Blockchain: Research and Applications, 3(3), 100075.

Varma, Y., Venkataramani, R., Kayal, P., & Maiti, M. (2021). Short-term impact of COVID-19 on Indian stock market. Journal of Risk and Financial Management, 14(11), 558.

Verma, T., & Pearl, J. (1990). Causal networks: Semantics and expressiveness. In Machine intelligence and pattern recognition (Vol. 9, pp. 69–76). North-Holland.

Vo, X. V., & Ellis, C. (2018). International financial integration: Stock return linkages and volatility transmission between Vietnam and advanced countries. Emerging Markets Review, 36, 19–27.

Wan, Y., Song, Y., Zhang, X., & Yin, Z. (2023). Asymmetric volatility connectedness between cryptocurrencies and energy: Dynamics and determinants. Frontiers in Environmental Science, 11, 104.

Yousaf, I., & Ali, S. (2021). Linkages between stock and cryptocurrency markets during the COVID-19 outbreak: An intraday analysis. The Singapore Economic Review. https://doi.org/10.1142/S0217590821470019

Yu, L., Zha, R., Stafylas, D., He, K., & Liu, J. (2020). Dependences and volatility spillovers between the oil and stock markets: New evidence from the copula and VAR-BEKK-GARCH models. International Review of Financial Analysis, 68, 101280.

Zhang, L., Bouri, E., & Chen, Y. (2023). Co-jump dynamicity in the cryptocurrency market: A network modelling perspective. Finance Research Letters, 58, 104372.

Funding

This research received no specific grant from any funding agency in the public, commercial, or not-for-profit sectors.

Author information

Authors and Affiliations

Contributions

All authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Kayal, P., Dutta, S. Regime switching and causal network analysis of cryptocurrency volatility: evidence from pre-COVID and post-COVID analysis. Digit Finance (2024). https://doi.org/10.1007/s42521-023-00104-x

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s42521-023-00104-x