Abstract

In this paper, we attempt to understand and identify the cyclical fluctuations in cryptocurrency markets. To this end, we apply the Markov-Switching approach on daily prices of 17 selected digital currencies. This model allows us to capture the nonlinear structure in cryptocurrencies’ prices. The empirical results clearly show potential difference(s) among digital currencies when they react to the varying levels of the pandemic's severity. The existence of two distinguishable states and each state seems to be characterized by different features of market cycle’s phase for each cryptocurrency. So, the Covid19 pandemic affects asymmetrically the different market phases of digital currencies. Such findings can have insightful portfolios implications.

Similar content being viewed by others

1 Introduction

By and large, the literature on cryptocurrencies has widely analyzed many issues related to the dynamics of cryptocurrencies prices such as speculative bubbles in Bitcoin (Cheah & Fry, 2015), inefficiency of Bitcoin (Nadarajah & Chu, 2017), statistical proprieties of Bitcoin prices (Cheah & Fry, 2015), hedging ability of Bitcoin (Bouri et al., 2017a, 2017b) and multifractality (e.g. Mensi et al., 2020).They successfully identified salient features such as structural breaks, multifractality, persistence, large abrupt price swings and long memory in returns and volatility. For instance, Bariviera (2017) investigates long-range dependence in price returns during the period 30/06/2013–30/06/2017. The empirical results demonstrated the existence of asymmetric correlation according to increasing and decreasing trends. Lahmiri et al. (2018) revealed that the long-range dependence is well-documented in many cryptocurrency markets. Caporale et al. (2018) investigated the dynamic behavior of persistence in the cryptocurrency markets (Bitcoin, Litecoin, Ripple and Dash) over the period 2013–2017. They clearly stated that the cryptocurrency market displays time-varying persistence. Mensi et al. (2018) clearly identified dual long memory and structural changes on cryptocurrency markets. Chaim and Laurini (2018) explored the evolution of Bitoin returns and volatility during the period 05/2013–04/2018. They report the importance of incorporating permanent jumps to volatility and the relevance of transitory jumps in mean returns. Béjaoui et al. (2019) investigated the dynamic behavior of Bitcoin, Litecoin, Ethereum and Ripple daily returns and volatilities. They indicate the regime switching is well-pronounced in the return generating process. The market dynamics appears to be governed by two different states which differ from cryptocurrency market to another in terms of mean return, volatility and interstate dynamics. Caferra (2020) analyzed the linkages between news-driven sentiments and the behavior of cryptocurrency markets from 01/01/2018 to 01/01/2020. Thirteen cryptocurrencies are used, namely: Bitcoin, Lite-Coin, Ripple, Ethereum, Stellar, Nxt, Vertcoin, Cardano, Binance Coin, Thether, EOS, Zcash and IOTA. The empirical findings clearly demonstrated that the increases and decreases of optimism shape returns variability. They also display how a rise of news positivity is related to a lower return’s dispersion, implying the convergence of beliefs among investors.

With the outbreak of Covid-19 pandemic, some researchers have struggled to re-examine the behavior of cryptocurrency markets. Corbet et al. (2020) examine the dynamic behavior of some cryptocurrencies such as Bitcoin, Ethereum, XRP, Bitcoin Cash, Bitcoin, and Litecoin over the period 01/01/2019–31/03/2020. They revealed that the substantial increase in both returns and trading volumes. This clearly shows that large cryptocurrencies can act as a store of value during turbulent periods. Further, cryptocurrency returns seem to be significantly affected by negative sentiment related to Covid19. Umar and Gubareva (2020) investigated the effect of the Covid19 pandemic on the volatility of cryptocurrency (Bitcoin, Ethereum, Monero, Ripple and Zcash) and fiat markets during January–-May 2020. Some important differences in currency markets behavior are well-documented. Iqbal et al. (2020) analyzed the effect of the Covid19 pandemic on the behavior of cryptocurrencies (Bitcoin, Ethereum, Ether, XRP, Bitcoin Cash, Bitcoin SV, Litcoin, Binance Coin, EOS, Cardano and Tezos) over the period 01/01/2020–15/06/2020. They indicated that varying intensity levels of the Covid19 pandemic influence the bullish and bearish phases of cryptocurrency markets differently. Pietrych et al. (2021) examined the nonlinearity and chaos in some digital currencies (Bitcoin, Litecoin, Ripple and Ethereun) returns and volatility. They do not support for the efficiency of cryptocurrency market, implying that such time series come from an underlying unknown generating process. They therefore behave in nonlinear and chaotic fashion. Vidal-Tomás (2021) examined that the Covid19 pandemic influenced substantially the behavior of digital currencies over the period 12/03/2020–01/04/2020. This clearly implies a remarkable increase of market synchronization. Caferra and Vidal-Tomas (2021) investigated the dynamics of stock and cryptocurrency markets with the advent of the Covid19 pandemic. They clearly indicated that a financial contagion is well-pronounced during March 2020 given that both cryptocurrency and stock prices decreased steeply. As well, the price dynamics seem to depend on the type of the market during the health crisis.

This paper is related to the aforementioned literature and attempt to analyze the dynamic behavior of the cryptocurrency markets before and during the Covid19 pandemic. More particularly, we explore the nonlinear structure and cyclical behavior of 17 cryptocurrency prices. It is worth noting to investigate whether cryptocurrency prices display the same nonlinear structure and cyclical behavior during the health crisis. From methodological standpoint, we apply the Markov-Switching model on cryptocurrencies prices. This model enables to take into account the regime shifts behavior according to a latent state variable St, which takes on a finite number of values.

The paper is organized as follows. Section 2 reports the literature review and the model is presented in Sect. 3. Section 4 presents the data and descriptive statistics. The empirical results are reported in Sect. 5. Section 6 concludes.

2 Literature Review

Many researchers have increasingly examined the price dynamics of digital currencies such as statistical features of Bitcoin prices (Cheah & Fry, 2015), (in)efficiency of cryptocurrency market (Nadarajah & Chu, 2017), speculative bubbles in Bitcoin (Cheah & Fry, 2015), hedging proprieties of Bitcoin (Bouri et al., 2017a, 2017b), multifractility (Mensi et al., 2019) and nonlinearity effect (Béjaoui et al., 2019). In particular, they search for adequate specification in order to reproduce and understand the stock prices dynamics in cryptocurrency market. For instance, Conard et al. (2018) investigate the short- and long-term volatility components of digital currencies. They report that long-run Bitcoin volatility is negatively and significantly affected by S&P500 realized volatility. They also report the positive and significant impact of S&P500 volatility risk premium on long-term Bitcoin volatility. A highly positive relationship between the long-term Bitcoin volatility and Baltic dry index is well-documented. Yaya et al. (2019) examine the persistence and interdependence of Bitcoin with other coins. They show the presence of greater persistence in price shocks after the 2007/2008 cryptocurrency price crash. This is can be due to speculative transactions among cryptocurrency traders. As well, a phenomenon of non-reversion is well-documented, indicating that chances of further price fall in crptoccurrencies. There is also cointegration relationship between Bitcoin and other coins during both periods. Ardia et al. (2019) explore whether the presence of regime change in the volatility dynamics of Bitcoin. They clearly show regime changes in Bitcoin volatility dynamics. Béjaoui et al. (2019) examine the returns dynamics on the virtual market by exploring the nonlinearity structure in the returns of four crytocurrencies. They show the existence cryptocurrency market cycle which is marked by the existence of different states in terms of mean return and volatility. We also display distinguishable inert-dynamics between states. Gunay (2019) investigates between the effects of public information arrivals on cryptocurrency market using Twiter posts. The empirical results show that positive public information arrivals during bull markets positively and significantly affect Ripple’s value. Nonetheless, it does not influence Ripple during the bearish markets. Kyriazis (2020) analyze the herding behavior of 240 digital currencies during bear and bull markets. The empirical results show various behaviors during bullish and bearish periods. As well, the herding behavior is uniquely documented during bull markets. Joo et al. (2020) try to investigate the possible profitable trading opportunities even following an event announcement. They clearly show such evidence during such period.

With the outbreak of the Covid-19 pandemic, they re-examine the dynamic behavior of cryptocurrency market. For instance, Drozdz et al. (2020) examine the cryptocurrency market dynamics. They indicate the cryptocurrency returns seem to be multifractal with occasional signatures of bifractality which is related to the most volatile phases of the market dynamics such as the Covid-19 outburst in 03/2020 and a bull market onset in 04/2019. Nie et al. (2020) examine if the investor sentiment may influence the volatility and trading volume of major digital currencies. They display that the change rate of the trading volume of Ethereum and Bitcoin tends to be small when the investors seem to be optimistic about the U.S. stock market. Besides, the volatility of Bitcoin diminishes when the investors are optimistic about the stock market related to the greater U.S. economic policy uncertainty. Alqaralleh et al. (2020) analyze the potential stylized characteristics of digital currencies. They reveal the existence of nonlinear mean-reverting process. This implies the existence of asymmetry in return series. They also display the presence of high volatility dynamics. Maiti et al. (2020) explore the five cryptocurrency daily mean return time series linearity dynamics during the Covid-19 period. They report that returns of Ethereum, Bitcoin, Bitcoin Cash and XRP seem to be linear while those of Tether are greatly nonlinear and chaotic. Abakah et al. (2020) investigate the volatility persistence in cryptocurrency market by taking into consideration the potential structural breaks. They indicate that both squared and absolute returns show long memory features. Nonetheless, they display a decrease of the persistence level in the cryptocurrency market. Kakinaka and Umeno (2021) investigate the relationship between price and volatility of cryptocurrencies and analyze the existence of asymmetric volatility between bear and bull regimes. They show the high cross-correlations during bearish market phases for Bitcoin and Ethereum. Nonetheless, the strong cross-correlations are well-documented during bullish market phases for Litecoin and XRP. Banerjee et al. (2021) analyze the impact of Covid-19 news sentiment on the behavior of cryptocurrency returns. They report that Covid-19 news significantly affect cryptocurrency returns. James et al. (2021) analyze the effect of health crisis on cryptocurrency market dynamics. They report the behavior of cryptocurrency market tends to be more self-similar in variance than returns, before during and before the pandemic. The cryptocurrency market shows substantial homogeneity with respect to the structural breaks in variance. The effect of the health crisis on the return extremes, with unexpected shifts towards positive mean through the distribution extremities is well-documented. Sahoo (2021) investigates the impact of the health crisis on cryptocurrency market returns. The empirical findings display that the Covid-19 pandemic significantly affect the cryptocurrency returns. The results related to the post-break period show that the existence of unidirectional linear causality from Covid-19 confirmed cases to Ethereum and Bitcoin returns. So, information about the Covid-19 pandemic growth can help to predict cryptocurrency returns.

From the foregoing, one might argue that many researchers have interestingly revealed the existence of some stylized facts (e.g. long memory, volatility clustering and multifractality). They have also searched for congruent and suitable economertric framework to reproduce the cryptocurrency price dynamics, in particular during the unprecedented events. This study is related to the literature on cryptocurrency price dynamics and attempts to investigate the dynamic behavior of different digital currencies by examining if there is potential nonlinear structure in cryptocurrency prices with the outbreak of the health crisis.

3 Markov-Switching Model

The nonlinearity issue that we want to analyze in this paper includes asymmetric cycles and time variation in the conditional moments in the cryptocurrency returns. Ardia et al. (2019), among others, have focused on investigating the nonlinear structure in the conditional returns. Nonetheless, some researchers have explored such issue in the conditional returns, particularly with the outbreak of the health crisis. To analyze the dynamic behavior of different cryptocurrencies, one might use the Markov-Switching models. Such parametric method tends to investigate the nonlinear structure and cyclical behaviour of stock returns.

In this regard, the Markov-switching model of Hamilton (1989) is considered as a widely and frequently used model which permits the parameter values to change among market states and model the switching mechanism between different states based on a first-order Markov process. Such model allows to highlight some stylized facts in some economic and financial series. In particular, the underlying idea of Hamilton (1989) model is to model the non-stationarity using a state process. The time series can be modelled using an autoregressive process for which parameters vary over time. Besides, Hamilton (1989) assumed that the evolution of the model parameters is governed by an unobserved state variable that can be modelled using a k-regime Markov chain.

By and large, the unobserved variable is noted as st where t: is assumed to represent the current state of the cryptocurrency market. Such variable is modelled as a two-state Markov chain, which means that for all t, the variable st takes the value 1 for upturn periods and the value 2 for downturn periods. A downturn regime is a phase during which cryptocurrencies perform poorly. An upturn regime corresponds to a period of improving the performance of cryptocurrencies. The process Xt is defined as a two-state Markov-Switching (MS (2)) process if it satisfies the following conditions for a p-order AutoRegressive (AR (p)) process:

where εt is a white noise process of unknown finite variance and Xt is the cryptocurrency returns. One might specify the MS (2) -AR (p) processes as follows:

The complete representation of the process MS (2)-AR (p) requires the specification of the variable (st) as two states or two Markovian chains, i.e. for all t and st depend only on st-1 for i and j = 1.2.

The probabilities Pij denote the probabilities of transition between states. The following condition is satisfied as follows:

Interestingly enough, one might determine the unconditional probabilities of being in a specific regime. Following Hamilton and Susmel (1994), one might consider the following equations:

One might also estimate the average duration of a regime. Indeed, if Ui refers to the random variable which represents the duration of the MS process in regime 1, it is possible to assume that this random variable follows a geometric distribution with the parameters (1 − P11). For all n, one might consider the following equation:

Therefore, the mean and variance of the durationFootnote 1 for regime 1 are given as follows:

The application of the MS model for different cryptocurrencies pricesFootnote 2 is based on the following assumptions:

-

A1

The number of regimes is fixed: k = 2.

-

A2

The autoregressive order is equal to 1: p = 1.

-

A3

The transition probabilities are constant over time.

-

A4

The conditional distribution density is the normal distribution with the same variance for each regime.

-

A5

The optimal degree of smoothing is L = 1.

4 Data and Descriptive Statistics

In this paper, we attempt to the dynamic behavior of cryptocurrency markets following the outbreak of Covid-19 pandemic. For this end, we collect data from the website yahoofinance.fr site for seventeen cryptocurrency prices on daily frequency. The period spans from July 07, 2017 to March 01, 2021. These cryptocurrencies are: Bitcoin (BTC), Augur (REP), Bitshares (BTS), Digital cash (DASH), EOS.IO (EOS), Ethereum (ETH), Komodo (KMD), LISK (LSK), Monero (XMR), NEO (NEO), Quantum (QTUM), Ripple (XRP), Stellar (XLM), Stratis (STRAT), Waves (WAVES), Zcoin (XZC) and Dogecoin (DOGEUSD). The choice of 17 digital currencies is to examine if there is a potential difference in cryptocurrency market cycle.

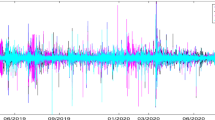

Figure 1 plots the evolution of cryptocurrency prices over time. From Fig. 1, time series plots evolve differently, although all plots exhibit cyclical swings. As well, one might show not only cyclical movements of all returns time series but also volatility clustering behavior of cryptocurrency prices.

Table 1 reports a set of descriptive statistics of daily prices for the selected 17 cryptocurrencies over the period 07/07/2017–01/03/2021. From Table 1, the mean price varies from 0 (Dogecoin) to 9903.65 (Bitcoin). Bitcoin has the highest standard deviation (7676.32) whereas Dogecoin has the lowest one (0.01). As well, the prices for all digital currencies are positively skewed during the sample period, implying that the right tail is particularly extreme (i.e. positive values or gains are much more likely). The leptokurtic feature of return distribution seems to be very salient in our sample. The Jarque–Bera statistics tend to be significant even at very low levels. Therefore, the daily prices are not normally distributed.

Afterwards, the Andrews-Zivot (1992) unit root test with trend break is used to examine the stationarity of time series. Under this test, the null hypothesis stipulates roots with the endogenous trend break. Table 2 reports the results of Andrews-Zivot (1992) test for different cryptocurrencies in level and first difference.

From Table 2, the results clearly show that all the digital currencies seem to be non-stationary in level given that the t-statistics are higher than the critical value of Andrews-Zivot (1992) at the 5% significance level, except for Quantum (QTUM). Overall, the unit root test developed by Zivot and Andrews (1992) is based on the existence of potential structural beak(s) in time series, without predetermining the break point dates. In this respect, the structural break point is endogenously found, by avoiding the subjective selection of such date. The results in Table 2 clearly show the break points by Zivot and Andrews are inconsistent among cryptocurrence price series. Some of them are occurred before the outbreak of the Covid-19 pandemic such as Ripple (07/12/2017), Augur (18/05/2018) and EOS.IO (24/11/2018) whereas others are recorded during the health crisis Bitcoin (11/12/2020), Ethereum (21/10/2021) and Waves (04/11/2021). This can be considered as a prima facie of the nonlinarity effect.

After a first difference, the prices of different cryptocurrencies are stationary given that the t-statistics are lower than the critical value of − 4.8 at the 5% significance level. Hence, the cryptocurrency prices are integrated of order one (I(1)). The trend break tends to be at the end of year 2020 (Bitcoin, Stellar) and during the year (Ethereum and Dogecoin). Nonetheless, other cryptocurrencies have experienced a trend break during the years 2017 and 2018.

5 Estimation Results and Interpretation

The estimation results of the MS-AR (1) model for each cryptocurrency are based on a new four-state Markov chain model are reported in Table 3.

From Table 3, asymmetric cyclical patterns seem to be well documented among different digital currencies in terms of mean return. Some cryptocurrencies display lowly and highly positive (resp. negative) mean returns such as XZC (resp. WAVES). Nonetheless, other digital currencies show two opposed regimes such as DOGEUSD. As well, high volatility seems to characterize the dynamic behavior of crycptocurrency market. Therefore, one might dichotomize the low (negative) return volatile state and high (positive) volatile state as regimes 1 and 2.

As well, the difference between digital currencies is marked in terms of probability of persistence in regime i. This implies that the duration of each regime differs from cryptocurrency to another. Figure 2 reports the evolution of cryptocurrencies’ returns over the period from July 07, 2017 to March 01, 2021.

From Fig. 2, the cryptocurrencies’ returns seem to display cyclical fluctuations, implying the existence of bearish and bullish market phases. Obviously, the migration from one episode to another is interestingly marked by the onset of turning points (peaks and troughs) with different amplitudes. Nonetheless, there is no synchronization between cryptocurrrency’s market cycles. Indeed, some of them the deterioration of market conditions whereas others show some improvements. This is seemingly attributed to the behavior of investors and the advent of different traumatic events such as Covid-19 pandemic during the period 2019–2021. Such event is mainly marked by the ongoing increase of number of confirmed cases and deaths around the world, but also the announcement of Covid-19 vaccine. This has led to pandemic-related cryptocurrency market volatility and anxieties in some digital currencies whereas other crytocurrency markets attract investors who search for safe-haven assets.

6 Conclusion

In this paper, we attempt to analyze the dynamic behavior of different cryptocurrency markets before and during the outbreak of Covid19 pandemic. Unlike many researchers who largely investigated the behavior of Bitcoin during such crisis, we use 17 selected cryptocurrencies, namely: Bitcoin (BTC), Augur (REP), Bitshares (BTS), Digital cash (DASH), EOS.IO (EOS), Ethereum (ETH), Komodo (KMD), LISK (LSK), Monero (XMR), NEO (NEO), Quantum (QTUM), Ripple (XRP), Stellar (XLM), Stratis (STRAT), Waves (WAVES), Zcoin (XZC) and Dogecoin (DOGEUSD). Such choice is interesting to identify potential difference(s) among digital currencies when they react to the varying levels of the pandemic's severity over the period from July 07, 2017 to March 01, 2021.

From a methodological standpoint, we use the Markov-switching method to better describe and figure out the return distribution of different cryptocurrencies. Overall, the underlying idea behind the Markov-switching model is the existence of states, which potentially govern the evolution of cryptocurrencies’ returns. We found clearly empirical evidence of regimes with different features. So, the Covid-19 pandemic influences the different market phases of digital currencies in asymmetric fashion. As well, there is no synchronization between digital currency market cycles in terms the duration of market phases and the amplitude of turning points. So, cryptocurrency market cycle is marked by the presence of different phases, like the stock market cycle. The alternance of market phases in the path of cryptocurrency returns can potentially highlight a difference in terms of amplitude and duration.

Overall, the empirical findings show that the cryptocurrency markets tend to behave in nonlinear fashion with the outbreak of the Covid-19 pandemic. Such results corrobore those of Iqbal et al. (2021) who clearly show that the relationship between cryptocurrency prices and the Covid-19 pandemic tends to be asymmetric and change in magnitude and direction. The results also show the impact of unprecedented and adverse event such as the health crisis. As well, such results might contrast the markey efficiency and random walk hypothesis. That is why the empirical results of this study can invite researchers to further introduce the duration dependence feature in Markov-switching model to more understand the cryptocurrency market cycle.

Our empirical findings have practical implications for policymakers and investors in apprehending cryptocurrency market dynamics during an unexpected and unprecedented event such as the outbreak of the Covid-19 pandemic. They can be particularly useful for investors to understand market behavior of the cryptocurrencies, dynamics and performance of the market timing strategy under stressful market conditions.

Notes

Obviously, the mean and variance of the duration for regime 2 is calculated using the same logic.

Needless to say, several economic and financial series are generally not stationary. Therefore, it is necessary to transform before using an MS model. That is why one might consider the series Yt = Log (Xt)—log (Xt-L) where Xt is the original series and L is the degree of smoothing of the series. Such transformation can stabilize the variance of the process. The choice of the smoothing degree is not without cost given that a high level of smoothing eliminates high frequency variations. The optimal degree of smoothing is an annual smoothing (L = 1), because it avoids the greatest number of false signals at the 5% significance level.

References

Abakah, E., Aikins, J., Gil-Alana, A., Madigu, G., & Romero-Rojo, F. (2020). Volatility persistence in cryptocurrency markets under structural breaks. International Review of Economics and Finance, 69, 680–91.

Alqaralleh, H., Abuhommous, A. A., Alsaraireh, A., et al. (2020). Modelling and forecasting the volatility of cryptocurrencies: A comparison of nonlinear garch-type models. International Journal of Financial Research, 11, 346–356.

Ardia, D., Bluteau, K., Rüede, M. (2019). Regime changes in Bitcoin GARCH volatility dynamics. Finance Research Letters, 266-271.

Banerjee A. K., Dionisio A., Pradhan H. K., Mahapatra B. Hunting the quicksilver: Using textual news and causality analysis to predict market volatility. International Review of Financial Analysis, 77.

Bariviera, A. F. (2017). The inefficiency of Bitcoin revisited: A dynamic approach. Economics Letters, 161, 1–4.

Béjaoui, A., Ben Sassi, S., & Majdoub, J. (2019). Market dynamics, cyclical patterns and market states: Is there a difference between digital currencies markets? Studies in Economics and Finance, 37, 585–604.

Bouri, E., Azzi, G., & Dyhrberg, A. H. (2017a). On the return–volatility relationship in the Bitcoin market around the price crash of 2013. Economic Journal. https://doi.org/10.5018/economics-ejournal.ja.2017-21-14

Bouri, E., Azzi, G., & Dyhrberg, A. H. (2017b). On the return-volatility relationship in the Bitcoin market around the price crash of 2013. Economic Journal. https://doi.org/10.5018/economics-ejournal.ja.2017-2

Caferra, D., & Vidal-Tomas, D. (2021). Who raised from the abyss? A comparison between cryptocurrency and stock market dynamics during the Covid-19 pandemic. Finance Research Letters, 1, 101954.

Caferra, R. (2020). Good vibes only: The crypto-optimistic behavior. Journal of Behavioral and Experimental Finance, 28, 100407.

Caporale, G. M., Gil-Alana, L., & Plastun, A. (2018). Persistence in the cryptocurrency market. Research in International Business and Finance, 46, 141–148.

Chaim, P., & Laurini, M. P. (2018). Volatility and return jumps in Bitcoin. Economics Letters, 173, 158–163.

Cheah, E. -T., & Fry, J. (2015). Speculative bubbles in Bitcoin markets? An empirical investigation into the fundamental value of Bitcoin. Economics Letters, 130, 32–36.

Conard, C., Custovic, A., Ghysels, E. (2018). Long- and short-term cryptocurrency volatility components: A GARCH-MIDAS analysis. Journal of Risk and Financial Management, 1–12.

Corbet, S., Hou, Y. G., Larkin, C., & Oxley, L. (2020). Any port in a storm: Cryptocurrency safe-havens during the Covid-19 pandemic. Economics Letters, 194, 109377.

Drozdz, S., Kwapie, J., Oswiecimka, P., Stanisz, T., & Watorek, M. (2020). Complexity in economic and social systems: Cryptocurrency market at around COVID-19. Entropy, 2020(22), 1043.

Gunay, S. (2019). Impact of public information arrivals on cryptocurrency market: A case of twitter posts on ripple. East Asian Economic Review, 23, 149–168.

Hamilton, J. D. (1989). A new approach to the economic analysis of nonstationary time series and the business cycle. Econometrica, 57, 357–384.

Hamilton, J. D., & Susmel, R. (1994). Autoregressive conditional heteroskedasticity and changes in regime. Journal of Econometrics, 64, 307–333.

Iqbal, N., Fareed, Z., Guangcai, W., & Shahzad, F. (2020). Asymmetric nexus between COVID-19 outbreak in the world and cryptocurrency market. International Review of Financial Analysis, 73, 101613.

James, N., Menzies, M., & Chan, J. S. K. (2021). Changes to the extreme and erratic behaviour of cryptocurrencies during COVID-19. Physica A: Statistical Mechanics and its Applications, 565(10228), 125581.

Joo, H., Nishikawa, Y., & Dandapani, K. (2020). Announcement effects in the cryptocurrency market. Applied Economics. https://doi.org/10.1080/00036846.2020.1745747

Kakinaka, S., Umeno, K. (2021). Exploring asymmetric multifractal cross-correlations of price–volatility and asymmetric volatility dynamics in cryptocurrency markets. Physica A: Statistical Mechanics and its Applications, 581.

Kyriazis, N. A. (2020). Is Bitcoin similar to Gold? An integrated overview of empirical findings. Journal of Risk Financial Management, 13, 88.

Lahmiri, S., Bekiros, S., & Salvi, A. (2018). Long-range memory, distributional variation and randomness of bitcoin volatility. Chaos, Solitons & Fractals, 107, 43–48.

Maiti, M., Zoran, G., & Darko, B. V. (2020). Dissecting Tether’s nonlinear dynamics during COVID-19. Journal of Open Innovation: Technology, Market, and Complexity, 6, 161.

Mensi, M., Lee, Y.-J., Al-Yahyaee, K. H., Sensoy, A., & Yoon, S. M. (2019). Intraday downward/upward multifractality and long memory in Bitcoin and Ethereum markets: an asymmetric multifractal detrended fluctuation analysis. Finance Research Letter., 31, 19–25.

Mensi, W., Rehman, M. U., Maitra, D., Al-Yahyaee, K. H., & Sensoy, A. (2020). Does Bitcoin co-move and share risk with Sukuk and world and regional Islamic stockmarkets? Evidence using a time-frequency approach. Research in International Business and Finance, 53, 101230.

Nadarajah, S., & Chu, J. (2017). On the inefficiency of Bitcoin. Economics Letters, 150, 6–9.

Nie, W. -Y., Hui-Pei, C., & Kuang-Chieh, Y. (2020). Investor Sentiment and the Cryptocurrency Market Investor Sentiment and the Cryptocurrency Market. Empirical Economics Letters, 19, 1254–62.

Pietrych, L., Sandubete, J. E., & Escot, L. (2021). Solving the chaos model-data paradox in the cryptocurrency market. Communications in Nonlinear Science and Numerical Simulation, 102, 105901.

Sahoo. (2021). COVID-19 pandemic and cryptocurrency markets: an empirical analysis from a linear and nonlinear causal relationship. Studies in Economics and Finance, 38(2), 454–468.

Umar, Z., & Gubareva, M. (2020). A time-frequency analysis of the impact of the Covid-19 induced panic on the volatility of currency and cryptocurrency markets. Journal of Behavioral and Experimental Finance, 28, 100404.

Vidal-Tomás, D. (2021). Transitions in the cryptocurrency market during the COVID-19 pandemic: A network analysis. Finance Research Letters, 7, 101981.

Yaya O. S., Ogbonna A. E., Olubusoye O. E. (2019). How persistent and dynamic inter-dependent are pricing of Bitcoin to other cryptocurrencies before and after 2017/18 crash? Physica A, 531.

Zivot, A., & Andrews, D. W. K. (1992). Further evidence on the great crash, the oil price shock and the unit root hypothesis. Journal of Business and Economic Statistics, 10, 251–270.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Mgadmi, N., Béjaoui, A. & Moussa, W. Disentangling the Nonlinearity Effect in Cryptocurrency Markets During the Covid-19 Pandemic: Evidence from a Regime-Switching Approach. Asia-Pac Financ Markets 30, 457–473 (2023). https://doi.org/10.1007/s10690-022-09384-6

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10690-022-09384-6