Abstract

MobilityCoins are a tradable mobility credit (TMC) scheme variant. TMC schemes are a cap-and-trade scheme for managing mobility that are designed to limit negative externalities, e.g., congestion, of traffic. Next to having link-specific or origin–destination-specific charges for cars as in the common TMC scheme, the MobilityCoin scheme’s distinctive elements are accommodating link-specific and origin-and-destination-specific charges and incentives for all modes of transport as well as being considered a mobility currency that can be earned, saved, and spent in multiple time periods. These distinctive features of the MobilityCoin scheme does not alter the core behavioral mechanism of TMC schemes of increasing car travel costs, but these features interfere with the credit market in terms of market volume and market price that ultimately affects traffic outcomes, e.g., an uncontrolled market volume increase can lower the market price that in turns increases the attractiveness of using the car. In this paper, we develop a mathematical model of multimodal macroscopic network flows and a MobilityCoin market to investigate the impacts of charges, incentives, and multi-period budgets. The model is implemented as a single-day model with an integration of sensitivity for multi-period budgets to study how the outcomes in the transportation system change with charges, incentives, and multi-period budgets. Further, we discuss implications for the policy design of MobilityCoins schemes.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

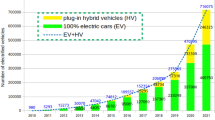

It has been argued that “economists have had limited success in promoting economically efficient transportation and environmental externality policies” (Lindsey and Santos 2020). Around the world, arguably, the primary policies are fuel excise taxes and road user charges for toll roads, where only a few examples are frequently cited for their (partial) successes, e.g., London and Singapore (Leape 2006; Prud’homme and Bocarejo 20058; Metz 2018). Considering the urgent need “for deep CO2 mitigation in road transport” (Axsen et al. 2020), as well as the thread to the treasury from a decline in fuel excise tax revenue due to vehicle electrification, one of the essential overarching research questions in transport policy is what kind of schemes to implement instead?

In economics, a long discussion on “price vs. quantities” exists for regulating an economic system in terms of externalities, i.e., setting standards or limits or charging taxes (Weitzman 1974). Here, Dales was one of the first to propose such a quantitative instrument to manage external costs using a cap-and-trade scheme (Dales 1968). In transport, such policy instrument based on tradable mobility credits (TMC) has been put forward by Verhoef et al. (1997) to regulate externalities, but so far have not seen any real-world implementation, except first promising field experiments (Geng et al. 2023). Nevertheless, such a policy instrument has already seen implementation in the energy sector to, e.g., manage carbon emissions (Perroni and Rutherford 1993) and promote green energy deployment (Bergek and Jacobsson 2010; Frei et al. 2018).

In transport, the cap-and-trade scheme usually works as follows: credits (or tokens, certificates, or permits) are required for traveling on a specific link, entering a specific area, or using certain infrastructures. The regulator defines an upper limit to the to-be-regulated quantity, e.g., emissions, congestion delays, or car travel, and issues credits to use parts of this overall quantity. Travelers obtain these credits from the regulator, e.g., free of charge or by auctioning, and redeem them for their mobility again at the regulator. Travelers can also sell their excess credits to travelers in shortage of credits, which generates additional monetary income for the seller. An overview of system designs is presented in Provoost et al. (2023), and aspects of the overall market design have been recently summarized comprehensively by Chen et al. (2023). As TMC market participants can negotiate and allocate the credits among themselves, a better performance compared to monetary fees can emerge in many circumstances (De Palma et al. 2018; De Palma and Lindsey 2020). Further, as credits can be initially distributed to market participants for free, participants not exceeding their initial allocation do not have to pay anything, which may support public acceptance of a TMC scheme (Krabbenborg et al. 2020).

Arguably, the seminal paper that re-initiated TMC research is Yang and Wang (2011), which provides the fundamental mathematical macroscopic model for a TMC scheme. Nevertheless, other modeling approaches have also been developed, e.g., an MFD-based approach in a multimodal context (Balzer and Leclercq 2022) or agent-based modeling approaches (Tian and Chiu 2015), where also the aspect of multi-period budgets has been included by (e.g., Miralinaghi and Peeta 2016). Further related to multi-period budgets are the within-day dynamics of a TMC scheme, which has been studied, e.g., by Seshadri et al. (2022), and the impact of day-to-day variability in demand and supply on the performance of a TMC scheme, which has been studied, e.g., by Lindsey et al. (2023). Research also studied user perceptions, the system’s acceptance, and feasibility (Krabbenborg et al. 2020, 2021; Kockelman and Kalmanje 2005). Further, Servatius et al. (2023b) discussed how the ability and willingness to participate in TMC trading can be ensured; the authors conclude that it is feasible but challenging considering the complexity of interactions of parameters and interests. The idea of credits also extends to incentives, which can be collected and then exchanged for, e.g., money or public transport tickets (Hu et al. 2023), where Singapore’s “Travel Smart Journeys”-scheme is presumably one of the most prominent schemes (Land Transport Authority 2023).

Recently, Bogenberger et al. (2021) proposed the TMC-scheme variant “MobilityCoins” that differs from a conventional TMC scheme in at least two aspects. First, it accommodates link-specific and origin-and-destination-specific charges and incentives for all modes of transport, not only cars, as in most variants present in the literature. Second, it is considered a currency in the mobility system that can be earned, saved, and spent. It has a natural validity spanning over multiple days or weeks, defined as multi-period budgets, compared to approaches in the literature that usually consider only one or a few days (Blum et al. 2022). These aspects interfere with the credit market and thus could affect the outcomes observed in the transportation system. For example, if too many credits are provided as incentives, the market price could drop, increasing the attractiveness of driving. Here, Schatzmann et al. (2023) recently showed using a stated-preference survey that the cost sensitivity for the credit price in the generalized travel cost depends on the time until the end of the validity period and the amount of budget left.

In this paper, we investigate how these multimodal incentives and multi-period budgets of a MobilityCoin scheme impact outcomes in the transportation system. We develop a mathematical model of static multimodal macroscopic network flows and of the MobilityCoin market that accommodates charges and incentives as well as considers the effects of multi-period budgets. We investigate the effects on transportation system outcomes of the interactions of charges, incentives, and multi-period budgets in a MobilityCoins scheme in a small transportation network and derive implications for policy design.

This paper is organized as follows. Section 2 presents the mathematical model, and Sect. 3 presents the case study network. Section 4 presents the results of the case study analysis before Sect. 5 ends with discussions and conclusions.

Mathematical model

Consider a transport network with \(\mathcal{N}\) nodes, \(\mathcal{A}\) arcs, and \(\mathcal{M}\) modes of transport. Nodes are referenced by \(i \in \mathcal{N}\) (with aliases j and k), arcs are a distinct pair of nodes and are referenced by the link start-end pair \(\left( i,j\right) \in \mathcal{A}\), modes are referenced by \(m \in \mathcal{M}\). In this model, three modes are considered: \(\mathcal{M} \in \{\text {car, public transport, bicycle}\}\). Travelers are distinguished by their origin–destination pair \(\left(o,d\right) \in \mathcal{OD}\). The set of origins and destinations is a subset of the set of nodes, i.e., \(\mathcal{OD} \subseteq \mathcal{N}\). The overall demand \(d_{od}\) between origin o and destination d is assumed fixed and exogenous. The MobilityCoin system is characterized an initial allocation of credits \(\gamma\) to travelers, link-specific charges for the car mode \(\kappa _{ij}\) as only car travelers make route choice and origin–destination-specific charges \(\lambda _{odm}\) for all modes of transport. In this model, \(\gamma\) is assumed to be uniform. In case \(\kappa _{ij} >0\) or \(\lambda _{odm} > 0\), the charge is subtracted from the available MobilityCoin budget; in case \(\kappa _{ij} < 0\) or \(\lambda _{odm} < 0\) the charge becomes a subsidy or incentive, i.e., it is added to the available budget. Here, the original MobilityCoin conceptualization argues that only sustainable modes of transport should be marginally subsidized as well as to limit the amount of MobilityCoins that can be earned to avoid induced travel only for such a purpose (Blum et al. 2022). Here, Xiao et al. (2019) argue that it should be ensured that “negative cycles”, i.e., loops in the network with overall negative path costs should be avoided. This is not only because of induced travel but also because the minimum-cost path problem cannot be solved anymore. Hence, in the MobilityCoin system design, providing incentives should focus on \(\lambda _{odm}\) rather than \(\kappa _{ij}\) to ensure the nonexistence of negative cycles while limiting the overall amount of incentives provided to avoid induced travel.

In this macroscopic model, travelers make two choices. First, they choose their mode m. Second, all users choosing the car also choose their route. Mode choice and route choice are made based on the travel costs that comprise travel time costs and costs resulting from the charges \(\kappa _{ij} >0\) and \(\lambda _{odm} > 0\). In this model, both choices are made simultaneously in such a way that the resulting travel costs across routes and modes lead to the stochastic user equilibrium (Daganzo and Sheffi 1977; Zhou et al. 2012), i.e., no traveler can improve her or his perceived travel costs by unilateral action. The stochastic user equilibrium relaxes the assumption of perfect knowledge of all travelers in the deterministic user equilibrium, i.e., Wardrop’s first principle (Wardrop 1952). In the following, the mathematical model is explained step by step.

The presented multimodal extension is a generalization of the seminal mathematical formulation presented by Yang and Wang (2011) and continuous the multimodal work of (Servatius et al. 2023a). The mathematical model describes a macroscopic traffic assignment and uses built-in parameters to simulate the impact of multi-period budgets. The model defined in the following is formulated as a mixed-complementarity problem (MCP) (Ferris et al. 1999) and is implemented in GAMS (GAMS Development Corporation 2018). The model’s variables and parameters are summarized in Table 1.

This demand is distributed across modes using a logit-based assignment. As shown in Eq. 1, the choice of modes depends on the minimum travel costs \(W_{odm}\) between o and d using mode m and a scale parameter \(\mu\).

In this mathematical model, the costs for MobilityCoins enter the travel costs of all modes through link-specific and origin-and-destination-specific charges and incentives, each multiplied by the MobilityCoin market price P. The MobilityCoin system is characterized by multi-period budgets which means that MobilityCoins can be earned, saved, and spent at and over various different days throughout a certain validity period. To describe such multi-period budget behavior, consider parameters b and t that describe the budget status and the time until the end of the validity period, respectively. In this mathematical model, we follow the findings as reported by Schatzmann et al. (2023). Cost sensitivity increases with fewer MobilityCoins available in the budget, but there is an interaction effect between the number of MobilityCoins left and the number of days until the end of the validity period: with the same number of MobilityCoins left, the cost sensitivity is higher with more days left until the end of the validity period. We integrate these findings as follows. Consider that both parameters have values between zero and one and that budget status b is equal to one if all MobilityCoins are available and zero if none are available anymore; t is equal to one at the start of the validity period and is zero at the end of the validity period. We approximate this for the cost sensitivity \(\eta\) as shown in Eq. 2.

By approximation, we mean using the relationships reported by Schatzmann et al. (2023) and integrating them into the simplest functional form with interaction effect as defined in Eq. 2 because no further information is currently available on the behavioral model. Note that a better behavioral model can replace this functional relationship once data for this is available. It is important to mention that Schatzmann et al. (2023) obtained these findings not at the interval boundaries but around the midpoint of each interval. Consequently, the relationship in Eq. 2 is only meaningful around the midpoint values

Figure 1 illustrates the cost sensitivity for different parameter values of b and t. If the MobilityCoin budget is almost fully available, i.e., b is large, \(\eta\) becomes small, while it gets smaller the shorter the time period until the end of the validity period given the same available MobilityCoin budget. Importantly, in this model, the feature of multi-period budgets are only considered in the cost sensitivity \(\eta\), but not in the market clearing condition.

In this mathematical model, the MobilityCoin charges with their respective cost sensitivity enter the resulting stochastic user equilibrium travel costs \(W_{odm}\) as given in Eq. 3. The origin-and-destination charges \(\lambda _{odm}\) weighted by the product of the MobilityCoin cost sensitivity \(\eta\) and the MobilityCoin market price P is added to the minimum travel costs \(M_{odm}\) for each mode. Parameter \(\lambda _{odm}\) can accommodate incentives, e.g., for cycling, but also charges for cars, e.g., for parking.

In this model, we consider that only cars experience congestion effects and have link-specific charges \(\kappa\), while public transport and bicycles have fixed travel times on their respective origin-and-destination pair. Thus, we conveniently set for public transport and bicycles \(M_{odm} \equiv \tau _{odm}\), where \(\tau _{odm}\) is the free-flow travel time between origin o and destination d. Thus, only \(M_{od,car}\) has to be computed from the stochastic user equilibrium flow pattern in the network.

The minimum travel costs \(M_{od,car}\) are obtained as follows. Consider that the car travel costs \(C_{ij}\) on link i-j comprises two elements. First, the travel time \(T_{ij}\). The link travel time is defined in Eq. 4 and follows the Bureau-of-Public-Roads (BPR) function (Bureau of Public Roads 1964) with the usual parameters and is a function of link flow \(Q_{ij}\).

The second element is the MobilityCoin link charge \(\kappa _{ij}\) valued at MobilityCoin market price P weighted by the cost sensitivity \(\beta\). As aforementioned, both elements, the travel time costs as well as the MobilityCoin link charges, constitute the perceived link travel costs for car travelers \(C_{ij}\) as defined in Eq. 5. Here, \(\zeta _{ij}\) is the corresponding random component (Zhou et al. 2012).

The arbitrage condition for car drivers to use link \(\left( i,j\right)\) follows a stochastic user equilibrium (Daganzo and Sheffi 1977) that relaxes the assumption of perfect knowledge of all travelers in the deterministic user equilibrium or Wardrop’s first principle (Wardrop 1952). It is formulated in this model as given in Eq. 6 based on Van Nieuwkoop et al. (2016), but modified using the perceived link travel costs \(C_{ij}\). \(Y_{ijk}\) are the partial flows on that link towards k. When the minimum perceived travel costs from node i to k over j equal the minimum perceived travel costs from node i to k, the link is used for car drivers towards k. In other words, Eq. 6 considers the perceived travel costs from i to k, i.e., origin and destination, while exploring route alternatives connected to node i over j. It is from this Equation from which \(M_{od,car}\) can be derived.

The partial link flows \(Y_{ijk}\) can then be aggregated to link flows \(Q_{ij}\) as the sum over all partial flows along those links as defined in Eq. 7.

In the model, it must be ensured that the inflows and outflows at each node in the network are balanced. This is ensured by Eq. 8.

Last, as the MobilityCoins scheme is a market-based system, Eq. 9 resembles the market clearing condition. Here \(\gamma\) is amount of credits initially issued per traveler. In other words, the left-hand side of Eq. 9 results into the total market volume of MobilityCoins. \(\kappa _{ij}\) is the MobilityCoins link charge for car travelers and \(\lambda _{odm}\) is a origin–destination mode-specific charge for all other travelers. The complementarity conditions ensure that the MobilityCoins market price P is only non-zero when supply and demand are balanced. If the market is over-supplied, the market price would be consequently zero.

In conclusion, the presented mathematical model is a single-day model with an integration of sensitivity for multi-period budgets. Hence, this model cannot be used to simulate and study the actual performance of a TMC or MobilityCoin system over time during a validity period, but rather to study how the average outcomes in the transportation system change when pivoting slightly the cost sensitivity as a consequence of changes in the available budget or time until the end of the validity period.

Case study definition

The objective of a MobilityCoin scheme is to reduce the external cost of car travel (Blum et al. 2022), which typically includes congestion externalities as well as pollution, noise, etc. It is the agency that defines \(\gamma\), \(\kappa _{ij}\), and \(\lambda _{odm}\) in such a way that the targets in terms of reduction in external costs are achieved. In doing so, the agency can weigh which external costs to prioritize over others. In this case study, the simple policy objective of reducing overall car travel is assumed because it is generally associated the most with external costs. This can lead to counter-intuitive outcomes that total travel time increases as the travel costs of faster modes, i.e., the car, are not competitive anymore. To illustrate the primary transport and economic mechanisms of a MobilityCoin scheme following the assumed policy objective, we apply the model developed in Sect. 2 to the simple network shown in Fig. 2. It is important to note that the presented model does not capture the effects of transaction costs of credits between parties (e.g., Nie 2012) and the effects of income (e.g., Krabbenborg et al. 2020), but both can be relevant in the performance and success of TMC schemes.

The network has 17 nodes of which 13 are origin and destination nodes and four are through nodes, i.e., the demand entering or exiting the network at these nodes is 0. The network has directed arcs as shown in Fig. 2. In the network, three modes of transport operate: cars, public transport, and bicycles, where only cars experience congestion effects. It is assumed that the same technology and infrastructure, i.e., level of service, for bicycles and public transport, is available in the entire network, irrespective of whether being in the CBD or not. For example, the same strategy of providing dedicated bus lanes or priority at signals.

This network is centered around node “9”, while having symmetry with the line from nodes “2”, “10”, “9”, “11”, “7”; hence we consider the area defined by all six mentioned nodes as the “CBD” (central business district) area of the network with all links between these six nodes belonging to the “CBD”. Table 3 shows the parameters for the volume-delay function of each link.

We generate a random origin–destination matrix that is provided in Table 4. There is sufficient travel demand in the network to lead to congestion effects considering the link parameters shown in Table 3. We define the origin–destination travel times \(\tau _{odm}\) for public transport and bicycles as follows. First, we calculate the car free-flow travel times in the network shown in Fig. 2. Second, we set the public transport travel times \(\tau _{od,\text {pt}}\) on each origin–destination pair and the bicycle travel times \(\tau _{od,\text {bicycle}}\) to a multiple of the car free-flow travel times, which is randomly sampled from a uniform distribution between 1.35 and 1.45 for public transport and between 1.40 and 1.50 for bicycles. Tables 6 and 5 provide the resulting travel times.

In this case study analysis, the status-quo scenario is defined by having no MobilityCoin system in place, i.e., the MobilityCoin market price is set to zero or \(P \equiv 0\). When implementing the MobilityCoin scheme, the following five policy design and system status parameters affect the transportation system outcomes and, thus, factor into the efficiency and success of the MobilityCoin system implementation.

-

The initial allocation of credits \(\gamma\): all else being equal, an increasing \(\gamma\) leads to an increase in market volume, decreasing the market price and thus decreasing the generalized travel costs for the car, making it more attractive.

-

The link-specific charges and incentives \(\kappa _{ij}\) for cars: all else being equal, increasing \(\kappa _{ij}\) increases the generalized travel costs for cars, making it less attractive. However, considering the limited market volume of MobilityCoins, \(\kappa _{ij}\) also determines the maximum car travel in the network. In case of \(\kappa _{ij} < 0\), i.e., it becomes an incentive; it increases the total supply of MobilityCoins and reduces the MobilityCoin market price, thus the general travel cost, making the car more attractive. If this incentive is unconditional and unrestricted, an upper limit to car travel is not given anymore.

-

The origin-and-destination charges and incentives \(\lambda _{odm}\): all else being equal, an increasing \(\lambda _{odm}\) increases the MobilityCoin market price and thus the generalized travel costs. In the case of \(\lambda _{odm} < 0\), it becomes an incentive; it increases the total MobilityCoin market volume and decreases the MobilityCoin market price, hence reducing the generalized travel costs, eventually making the car more attractive.

-

The multi-period budget indicators of budget status b and time until the end of the validity period t: all else being equal, the less budget is available, i.e., b decreases, and the longer the time period until the end of the MobilityCoin validity period, i.e., t increase, travelers become more cost sensitive for MobilityCoin charges, i.e., their perceived generalized travel costs increase for modes with \(\lambda _{odm} >0\) or \(\kappa _{ij} > 0\), or decreases for modes with \(\lambda _{odm} <0\) or \(\kappa _{ij} < 0\).

It can be seen that these five parameters of policy design and system status parameters strongly interact and affect the outcomes in the transportation system, eventually interfering with the intended policy targets of the MobilityCoin system. We measure the outcomes in the transportation system using

-

The number of trips per mode and their shares,

-

The total distance traveled by the car mode as it is the primary source of externalities, which are likely to be regulated by a tradable credit scheme,

-

The total travel time by mode and their shares

-

The MobilityCoin market price.

In the case study, we intentionally exaggerate the selected policy design and system status parameters or their ranges to highlight the effects of these on the transportation system outcomes: we set \(\gamma = 0.1\) MobilityCoins per traveler and \(\kappa _{ij,car} \in \{0.5;0.8;1;1.2;1.5\}\) MobilityCoins per link for all “CBD” links and to zero for all other links. When introducing, we set the origin–destination specific charges to \(\lambda _{od,bicycle} \in \{-0.1;-0.2\}\), where the minus sign indicates that it is a subsidy or incentive compared to a charge that has a positive sign. When considering the multi-period budgets, we set \(t \in \{0,0.3,0.8\}\) and \(t \in \{0.3,0.8,1\}\). Further, we set the scale parameter for the mode choice to \(\mu = 0.001\).

In the following section, we investigate the system outcomes with increasing complexity from the status quo with no tradable credit scheme (see Sect. 4.1), a MobilityCoin system only with link-specific charges for cars, i.e., a common tradable credit scheme, in Sect. 4.2, a MobilityCoin system with link-specific charges for cars and incentives for bicycles in Sect. 4.3, and a MobilityCoin system with link-specific charges for cars, incentives for bicycles, and considering multi-period budgets in Sect. 4.4.

Case Study Investigation

In this section, we use the mathematical model from Sect. 2 to investigate and discuss the system outcomes with the increasing complexity of adding policy design and system status parameters of that model. First, we present the status quo or the benchmark without any MobilityCoins of the case study presented in Sect. 3. Second, we introduce link-specific MobilityCoin charges for cars on the “CBD” links (see Fig. 2), which is similar to a common tradable credit scheme. Third, we additionally introduce incentives, i.e., negative charges, for cyclists. Fourth, we add to the previous car charges and bicycle incentives the aspect of multi-period budgets.

Status Quo

Table 2 summarizes the transportation system outcomes for the status quo scenario defined in Sect. 3. Overall, more than 300,000 travelers are navigating the multimodal network. These travelers distribute almost equally to all three modes. This is intuitive as it can be expected that the car is chosen by travelers until travel costs similar to public transport and bicycles result. Considering the modal share by travel time, it can be observed that those taking the car in the network have substantially larger travel times compared to public transport and bicycle users.

MobilityCoins only with Link-specific Charges for Cars

In Fig. 3 we show the outcomes in the case study transportation system when a MobilityCoin scheme with only link-specific charges on all links connecting to node “9” are introduced. Here, as already mentioned, we set the initially allocated budget to \(\gamma = 0.1\) MobilityCoins per traveler and the link-specific charge to \(\kappa _{ij,car} \in \{0.5;0.8;1;1.2;1.5\}\) MobilityCoins per link. Note by simulating different link charges \(\kappa _{ij,car}\) we investigate the sensitivity of the outcomes. Generally, we find in Fig. 3 that for \(\kappa _{ij,car}=0.5\) no impact compared to the status quo is observed. In other words, the number of initially allocated MobilityCoins exceeds the number of MobilityCoins required by all car travelers navigating the links in the center of the network. When we then increase the charge, we observe the expected pattern, namely that car travel declines and the MobilityCoin market price increases. Here, the market price is expressed in time units as in the case study model, all cost elements are expressed in time. For example, a MobilityCoin market price as seen in Fig. 3d of 5 min per MobilityCoin means that for link charge of one MobilityCoin per link, the travel costs increase by 5 min, which is a multiple of the free-flow speed (see also Table 3). Hence, travel on these links becomes highly unattractive. With car users following the equilibrium principle, drivers distribute to other routes until an equilibrium is reached. This explains the substantial increase in car travel distance seen in Fig. 3a and total travel time seen in Fig. 3b when increasing the charges from \(\kappa _{ij,car}=0.5\) to \(\kappa _{ij,car}=1.5\). Arguably, the desired effect of introducing a TMC-scheme seems fading, which is also emphasized by the fact that no further market price increase is seen in Fig. 3b, suggesting that the shifting potential has been almost fully exploited.

MobilityCoins with Charges and Incentives

The additional introduction of incentives for cyclists to the case study network with only link-specific charges means that the total market volume of MobilityCoins will increase. Consequently, it can be expected that the observed effects in Fig. 3 are attenuated. Investigating with \(\lambda _{od,bicycle} \in \{-0.1;-0.2\}\) per bicycle trip, i.e., an incentive of 0.1 and 0.2, respectively, we find exactly this attenuation as seen in Fig. 4. Here, we also see that with increasing incentives, the attenuation is stronger: we find that at \(\lambda _{od,bicycle} = -0.1\) the MobilityCoin market is inactive at \(\kappa _{ij,car}=0.5\), while it stays inactive until \(\kappa _{ij,car}=0.8\) when \(\lambda _{od,bicycle} = -0.2\). The MobilityCoin market price also does not reach the levels of the link-charges-only scenario from Fig. 3, leading to a less substantial shift to other modes and routes, in particular, is the rebound in car travel as seen in Fig. 3a not observed anymore.

MobilityCoins with Charges, Incentives, and Multi-period Budgets

In the analysis of the impact of multi-period budgets, we assume the market clearing with parameters \(\kappa _{ij,car}=1.5\) and \(\lambda _{od,bicycle} = -0.1\) from Fig. 4, leading to \(P=3.26\) min. In other words, for this investigation, the market is considered fixed to investigate the impact of budget status b (greater b means more MobilityCoins are available) and time until the end of the validity period t (greater t means more time until the end of the validity period is available).

In Fig. 5 we show the results of this investigation. First, it can be seen that different parameter combinations of b and t impact the transportation system outcomes compared to the status quo differently. Nevertheless, the changes in car kilometers, car share and total travel time are all in the same direction as observed before. Generally, the results are intuitive: we find that the strongest impact occurs when much time is left until the end of the validity period, but not much is left of the available budget (\(b=0.3,t=0.8\)); contrary, the smallest impact is found when much of the budget is available and the time until the end of the validity period is short (\(b=0.8,t=0.3\)).

Investigation of the multi-period aspect in transportation system outcomes compared to the status quo. The market clearing with parameters \(\kappa _{ij,car}=1.5\) and \(\lambda _{od,bicycle} = -0.1\) is assumed and fixed. MobilityCoin budget status b (greater means more MobilityCoins are available) and time until the end of the MobilityCoin period t (greater means more time until the end of the validity period)

Synthesis

The presented investigation emphasizes the complex interactions of charges, incentives, and multi-period budgets with respect to the outcomes of a multimodal transportation system. The presented case study is a simple network with exaggerated parameters to clearly point out what could happen and what should be considered in the policy design to avoid, e.g., the market is becoming inactive, or the market outcomes support substantial car detours, likely thwarting the objective of reducing overall car travel. As travel demand is distributed in the network according to the well-known Wardrop equilibrium principle, it is thus not trivial to optimize single policy parameters of a MobilityCoin or TMC scheme as the entire transportation system response in the equilibrium must be evaluated and considered for the decision making.

Discussion and Conclusions

In this paper, we introduced a mathematical model to study the impact of charges, incentives, and multi-period budgets in a MobilityCoin scheme, a variant of tradable mobility credits. The model was implemented as a single-day model with an integration of sensitivity for multi-period budgets to study how the outcomes in the transportation system change with charges, incentives, and multi-period budgets. We applied the introduced model to a simple multimodal case study network to illustrate transportation system outcomes under different design configurations. We have shown that the different aspects of the MobilityCoin scheme (charges, incentives, and multi-period budgets) interfere strongly with the outcomes compared to the status quo. Although all system implementations proved the capability of achieving the targeted reduction in car travel, it became apparent that it is likely not trivial to set policy parameters in such a way that the desired targets, e.g., emission or congestion levels, result. Here, using a mathematical program with equilibrium constraints (MPEC) could be a starting point (e.g., Ferris et al. 2005). Nevertheless, the aspect of heterogeneity in travelers’ preferences as well as the possibility for a more heterogenous initial allocation of MobilityCoins or credits must be considered too for the policy design of a MobilityCoin scheme.

In closing, tradable mobility credits or MobilityCoins are an alternative to price-based instruments like congestion charges or parking fees. With these instruments becoming more and more unpopular in public and politics, their implementation and thus ability to optimize the performance of the transportation system is likely to subside. Consequently, despite the complexity and challenges of a real-world implementation of a MobilityCoin scheme, investigating such a scheme further is promising, in particular as its feature of providing incentives and providing travelers the opportunity to trade in credits or travel time for additional monetary income, might support its introduction and ability to optimize the outcomes of the transportation system. Here, it should also be mentioned that such a tradable mobility credit scheme could also be seen as a novel opportunity to design and operate transportation systems that support agglomeration effects (Graham 2007; Loder et al. 2021).

References

Axsen J, Plötz P, Wolinetz M (2020) Crafting strong, integrated policy mixes for deep CO2 mitigation in road transport. Nat Clim Change 10:809–818. https://doi.org/10.1038/s41558-020-0877-y

Balzer L, Leclercq L (2022) Modal equilibrium of a tradable credit scheme with a trip-based MFD and logit-based decision-making. Transport Res Part C Emerg Technol 139:103642. https://doi.org/10.1016/j.trc.2022.103642. https://linkinghub.elsevier.com/retrieve/pii/S0968090X22000857

Bergek A, Jacobsson S (2010) Are tradable green certificates a cost-efficient policy driving technical change or a rent-generating machine? Lessons from Sweden 2003–2008. Energy Policy 38(3):1255–1271. https://doi.org/10.1016/j.enpol.2009.11.001. https://linkinghub.elsevier.com/retrieve/pii/S030142150900826X

Blum P, Hamm L, Loder A et al (2022) Conceptualizing an individual full-trip tradable credit scheme for multi-modal demand and supply management: the MobilityCoin System. Front Future Transport 3:914496. https://doi.org/10.3389/ffutr.2022.914496

Bogenberger K, Blum P, Dandl F, et al (2021) MobilityCoins—A new currency for the multimodal urban transportation system. arXiv:2107.13441 [econ, q-fin]

Bureau of Public Roads (1964) Traffic assignment manual. Tech. rep., US Department of Commerce, Urban Planning Division, Washington D.C

Chen S, Seshadri R, Azevedo CL et al (2023) Market design for tradable mobility credits. Transport Res Part C Emerg Technol 151:104121. https://doi.org/10.1016/j.trc.2023.104121. https://linkinghub.elsevier.com/retrieve/pii/S0968090X23001109

Daganzo CF, Sheffi Y (1977) On stochastic models of traffic assignment. Transport Sci 11(3):253–274. https://doi.org/10.1287/trsc.11.3.253. (iSBN: 0041-1655)

Dales JH (1968) Land, water, and ownership. Can J Econ 1(4):791–804. https://doi.org/10.2307/133706

De Palma A, Lindsey R (2020) Tradable permit schemes for congestible facilities with uncertain supply and demand. Econ Transport 21:100149. https://doi.org/10.1016/j.ecotra.2019.100149. https://linkinghub.elsevier.com/retrieve/pii/S221201221930070X

De Palma A, Proost S, Seshadri R et al (2018) Congestion tolling—dollars versus tokens: a comparative analysis. Transport Res Part B Methodol 108:261–280. https://doi.org/10.1016/j.trb.2017.12.005. https://linkinghub.elsevier.com/retrieve/pii/S0191261516308943

Ferris MC, Meeraus A, Rutherford TF (1999) Computing Wardropian equilibria in a complementarity framework. Optimiz Methods Softw 10(5):669–685. https://doi.org/10.1080/10556789908805733

Ferris MC, Dirkse SP, Meeraus A (2005) Mathematical programs with equilibrium constraints: automatic reformulation and solution via constrained optimization. In: Kehoe TJ, Srinivasan TN, Whalley J (eds) Frontiers in applied general equilibrium modeling, 1st edn. Cambridge University Press, pp 67–94, https://doi.org/10.1017/CBO9780511614330.005, https://www.cambridge.org/core/product/identifier/CBO9780511614330A013/type/book_part

Frei F, Loder A, Bening CR (2018) Liquidity in green power markets—an international review. Renew Sustain Energy Rev 93:674–690. https://doi.org/10.1016/J.RSER.2018.05.034. https://www.sciencedirect.com/science/article/pii/S1364032118303691

GAMS Development Corporation (2018) General Algebraic Modeling System (GAMS) Release 25.1. Place: Washington, DC, USA

Geng K, Brands DK, Verhoef ET et al (2023) The impact of tradable rush hour permits on peak demand: evidence from an on-campus field experiment. Transport Res Part D Transport Environ 120:103775. https://doi.org/10.1016/j.trd.2023.103775. https://linkinghub.elsevier.com/retrieve/pii/S1361920923001724

Graham DJ (2007) Agglomeration, Productivity and Transport Investment. JTEP 41(3):317–343

Hu X, Chen X, Lin X et al (2023) A path-based incentive scheme toward de-carbonized trips in a bi-modal traffic network. Transport Res Part D Transport Environ 122:103853. https://doi.org/10.1016/j.trd.2023.103853. https://linkinghub.elsevier.com/retrieve/pii/S136192092300250X

Kockelman KM, Kalmanje S (2005) Credit-based congestion pricing: a policy proposal and the public’s response. Transport Res Part A Policy Pract 39(7–9):671–690. https://doi.org/10.1016/j.tra.2005.02.014

Krabbenborg L, Mouter N, Molin E et al (2020) Exploring public perceptions of tradable credits for congestion management in urban areas. Cities 107:102877. https://doi.org/10.1016/j.cities.2020.102877. https://linkinghub.elsevier.com/retrieve/pii/S0264275120312257

Krabbenborg L, Molin E, Annema JA et al (2021) Exploring the feasibility of tradable credits for congestion management. Transp Plan Technol 44(3):246–261. https://doi.org/10.1080/03081060.2021.1883226

Land Transport Authority (2023) Travel smart journeys expanded to more bus services. https://www.lta.gov.sg/content/ltagov/en/newsroom/2023/3/news-releases/travel-smart-journeys-expanded-to-more-bus-services.html

Leape J (2006) The London Congestion Charge. J Econ Perspect 20:157–176. https://doi.org/10.1257/jep.20.4.157

Lindsey R, Santos G (2020) Addressing transportation and environmental externalities with economics: Are policy makers listening? Res Transp Econ 82:100872. https://doi.org/10.1016/j.retrec.2020.100872

Lindsey R, De Palma A, Rezaeinia P (2023) Tolls vs tradable permits for managing travel on a bimodal congested network with variable capacities and demands. Transport Res Part C Emerg Technol 148:104028. https://doi.org/10.1016/j.trc.2023.104028. https://linkinghub.elsevier.com/retrieve/pii/S0968090X23000177

Loder A, Schreiber A, Rutherford TF et al (2021) Design of a multi-modal transportation system to support the urban agglomeration process. Arbeitsberichte Verkehrs- und Raumplanung 1604. https://doi.org/10.3929/ETHZ-B-000474590. https://www.research-collection.ethz.ch:443/handle/20.500.11850/474590, publisher: IVT, ETH Zurich

Metz D (2018) Tackling urban traffic congestion: the experience of London, Stockholm and Singapore. Case Stud Transport Policy 6(4):494–498. https://doi.org/10.1016/j.cstp.2018.06.002

Miralinaghi M, Peeta S (2016) Multi-period equilibrium modeling planning framework for tradable credit schemes. Transport Res Part E Log Transport Rev 93:177–198. https://doi.org/10.1016/j.tre.2016.05.013. https://linkinghub.elsevier.com/retrieve/pii/S1366554516302125

Nie YM (2012) Transaction costs and tradable mobility credits. Transport Res Part B Methodol 46(1):189–203. https://doi.org/10.1016/j.trb.2011.10.002. https://linkinghub.elsevier.com/retrieve/pii/S0191261511001408

Perroni C, Rutherford TF (1993) International trade in carbon emission rights and basic materials: general equilibrium calculations for 2020. Scand J Econ 95(3):257. https://doi.org/10.2307/3440355. https://www.jstor.org/stable/3440355?origin=crossref

Provoost J, Cats O, Hoogendoorn S (2023) Design and classification of tradable mobility credit schemes. Transport Policy p S0967070X23000690. https://doi.org/10.1016/j.tranpol.2023.03.010, https://linkinghub.elsevier.com/retrieve/pii/S0967070X23000690

Prud’homme R, Bocarejo JP (2005) The London congestion charge: a tentative economic appraisal. Transport Policy 12(3):279–287. https://doi.org/10.1016/j.tranpol.2005.03.001, https://linkinghub.elsevier.com/retrieve/pii/S0967070X05000296

Schatzmann T, Álvarez Ossorio Martínez S, Loder A, et al (2023) Investigating mode choice preferences in a tradable mobility credit scheme. Arbeitsberichte Verkehrs- und Raumplanung 1837:21 p. https://doi.org/10.3929/ETHZ-B-000625516, http://hdl.handle.net/20.500.11850/625516

Servatius P, Loder A, Bogenberger K (2023a) MobilityCoins—tradable credit scheme in transport project appraisal. In: 103rd Annual Meeting of the Transportation Research Board (TRB 2023), Washington, D.C

Servatius P, Loder A, Provoost J et al (2023b) Trading activity and market liquidity in tradable mobility credit schemes. Transport Res Interdiscipl Perspect 22:100970. https://doi.org/10.1016/j.trip.2023.100970. https://linkinghub.elsevier.com/retrieve/pii/S2590198223002178

Seshadri R, De Palma A, Ben-Akiva M (2022) Congestion tolling—Dollars versus tokens: within-day dynamics. Transport Res Part C Emerg Technol 143:103836. https://doi.org/10.1016/j.trc.2022.103836. https://linkinghub.elsevier.com/retrieve/pii/S0968090X2200256X

Tian Y, Chiu YC (2015) Day-to-day market power and efficiency in tradable mobility credits. Int J Transport Sci Technol 4(3):209–227. https://doi.org/10.1260/2046-0430.4.3.209

Van Nieuwkoop R, Axhausen KW, Rutherford TF (2016) A traffic equilibrium model with paid-parking search. J Transport Econ Policy 50(3):262–286. https://doi.org/10.2139/ssrn.2748539. http://www.ssrn.com/abstract=2748539

Verhoef E, Nijkamp P, Rietveld P (1997) Tradeable permits: their potential in the regulation of road transport externalities. Environ Plann B Plann Des 24(4):527–548. https://doi.org/10.1068/b240527

Wardrop JG (1952) Some theoretical aspects of road traffic research. Proc Inst Civ Eng Part II:325–378

Weitzman ML (1974) Prices vs quantities. The review of economic studies 41(4):477–491

Xiao F, Long J, Li L et al (2019) Promoting social equity with cyclic tradable credits. Transport Res Part B Methodol 121:56–73. https://doi.org/10.1016/j.trb.2019.01.002. https://linkinghub.elsevier.com/retrieve/pii/S0191261517307270

Yang H, Wang X (2011) Managing network mobility with tradable credits. Transport Res Part B Methodol 45(3):580–594. https://doi.org/10.1016/j.trb.2010.10.002. https://linkinghub.elsevier.com/retrieve/pii/S0191261510001220

Zhou Z, Chen A, Bekhor S (2012) C-logit stochastic user equilibrium model: formulations and solution algorithm. Transportmetrica 8(1):17–41. https://doi.org/10.1080/18128600903489629. http://www.tandfonline.com/doi/abs/10.1080/18128600903489629

Funding

Open Access funding enabled and organized by Projekt DEAL. This project is partially funded by the Bavarian State Ministry of Science and the Arts in the framework of the bidt Graduate Center for Postdocs. The authors further acknowledge support by the Free State of Bavaria-funded research project ‘MobilityCoins – Anreiz statt Gebühr’ and by the Federal Ministry of Education and Research (BMBF) funded project MCube-SASIM (Grant-no. 03ZU1105GA).

Author information

Authors and Affiliations

Contributions

K.B. conceived the presented idea. A.L. developed the mathematical model, performed the formal analysis and computations. A.L. and K.B. interpreted the results. A.L. and K.B. wrote the manuscript.

Corresponding author

Ethics declarations

Conflict of Interest

The authors have no Conflict of interest to declare.

Ethical Approval

This declaration is not applicable.

Availability of data and materials

The code is available upon request from the corresponding author.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix A. Case study network parameters

Appendix A. Case study network parameters

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Loder, A., Bogenberger, K. Modeling MobilityCoins—Charges, Incentives and Multi-period Budgets in Multimodal Transportation Networks. Data Sci. Transp. 6, 10 (2024). https://doi.org/10.1007/s42421-024-00095-0

Received:

Revised:

Accepted:

Published:

DOI: https://doi.org/10.1007/s42421-024-00095-0