Abstract

Access to electricity is a crucial determinant of quality of life and productivity. The United States has a highly reliable electricity grid, but it faces new resilience challenges due to more intense disasters and ambitious green power requirements. Over the past decade, utilities have faced tradeoffs between achieving carbon mitigation goals, offering reliable power access, and keeping retail prices low. Using a generator panel dataset from 2013 to 2022, we document that electricity generation from renewables declines during extreme weather events. Based on an electric utility panel dataset over the same period, we find that disasters also disrupt electricity distribution. Although utilities have made some adaptation progress, investments in green and reliable green power are associated with higher electricity prices.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

In 2017, Hurricane Harvey in Texas left more than 13 million people without access to electricity for days. The hurricane had devastating effects on services that relied on electricity such as water treatment and home heating. The power outage was estimated to have caused $6.7 to $9.7 billion economic losses (Rafi et al. 2024). In February 2021, power supply in Texas was knocked out again by a severe winter freeze. In summer 2022, heat waves strained the electric grid in the American West and led to large-scale blackouts. As these extreme weather events become more frequent, the annual power outage time for an average American household has increased from 240 minutes in 2013 to 342 minutes in 2022.

Going forward, the United States electricity grid faces increasing risks posed by extreme weather and by the ramping up of state level renewable power generation requirements (Bushnell and Noval 2018; Stock 2020). Numerous recent disasters provide us with a set of natural experiments to test the resilience of our electric infrastructure. These events disrupt electricity generation, transmission, and distribution. In this paper, we study their impact on each of these three stages and test whether the negative impact has shrunk over time as American utilities adapt to these shocks.

In the generation stage, increased reliance on intermittent renewables poses challenges for electricity system operators tasked with achieving long-term resource adequacy for service delivery (Wolak 2022). The Renewable Portfolio Standard (RPS) is the percentage of sold electricity that each retailer is required to procure from renewable sources. This target is binding and is usually set by the state Public Utilities Commission (PUC).Footnote 1 The average standard across states has increased from 4.1% in 2013 to 11.4% in 2022.

The “green grid” features a lower carbon emissions factor, but an unintended consequence is that the short-term electricity generation becomes more volatile (Shaner et al. 2018). From data provided by the Energy Information Administration (EIA), we create a generator panel dataset by month from 2013 to 2022. We document that disasters triggered by natural hazards, especially storms, are negatively correlated with renewable generation and positively correlated with fossil fuel based power generation. This suggests that utilities turn on dispatchable generators to meet the reliability targets when renewables fail to deliver.

To benchmark the reliability of transmission and distribution networks, we use the two primary measures adopted by the EIA: the System Average Interruption Duration Index (SAIDI) and the System Average Interruption Frequency Index (SAIFI).Footnote 2 For a given utility, SAIDI is the average interruption time per customer, and SAIFI is the percentage of customers affected by any power outage.Footnote 3 We construct a panel dataset spanning 2013 to 2022, comprising annual reliability indices for over 500 US utilities and the corresponding count of weather shocks experienced by each utility in each year. Using this comprehensive dataset, we find that US transmission lines are overall resilient, and local distribution failures account for most of the power blackouts.Footnote 4 We show that each disaster is associated with a smaller increase in SAIDI over time, which we interpret as evidence of adaptation.

In addition to intertemporal dynamics, at any given time, we study how service reliability varies based on utility attributes and the spatial characteristics of the areas in which the utility operates. Our cross-sectional analysis indicates that SAIDI and SAIFI tend to be higher in states with a high RPS, where utilities are tasked to produce reliable and green power simultaneously. It is costly to comply with a high local RPS mandate. Utilities have to purchase green power at the wholesale market price or invest in capitals needed for renewable generation, both of which may lead to a higher cost per unit of electricity provision than in states with a less stringent RPS. If electric utilities do not raise rates, this expenditure reduces the budget resources available for resilience projects such as hardening the local distribution network.

This highlights a tradeoff between providing quality services and keeping electricity retail prices low. Investor-owned utilities report their expenditure to the FERC every year. Based on variations in each utility’s maintenance expenditure over time, we find that more ambitious RPS goals and more disasters are associated with higher costs of infrastructure maintenance. By instrumenting the lagged maintenance spending with lagged weather shocks, we find suggestive evidence that utilities pass down their capital upgrade expenditure to consumers through higher rates.

Our paper focuses on the supply of reliable power and complements recent works that estimate firms and households’ willingness to pay for stable power access. In China, in response to disruptions to electricity provision, firms outsource the production of energy-intensive intermediate goods (Fisher-Vanden et al. 2015). Allcott et al. (2016) find that electricity scarcity reduces producer surplus in India. In Africa, one fifth of firms own self-generators as backup power sources during outages, even though self-generation raises the production cost (Steinbuks and Foster 2010; Cole et al. 2018). We extend this literature by studying the resilience challenge in a developed country, emphasizing the new risks brought by intermittent renewables.

We also build on research that has used different measures to benchmark climate change adaptation progress. Using a global panel dataset, Kahn (2005) documents that the death toll from disasters has shrunk, especially in richer nations. Studies such as Barreca et al. (2016) and McRae (2023) document that the mortality risk as a function of heat waves has flattened over time due to increased access to air conditioning. Gandhi et al. (2022) document shrinking flood damages based on local lights at night dynamics.

This paper is organized as follows. We start by introducing our main datasets. Then we discuss how extreme weather affects each stage of the power supply chain and a utility’s incentives to supply reliable power. Building on the conceptual framework, we quantify the effects of disasters on generation, transmission, and distribution, respectively. We end by studying the tradeoff between reliable, renewable, and affordable power.

Data

The Electric Utility Panel

To study electricity transmission and distribution, we compile an electric utility by year panel from 2013 to 2022. We restrict our sample of utilities to investors-owned utilities (IOUs), publicly owned utilities (POUs), and cooperative distributors (i.e. no individual power retailers or Generation & Transmission cooperatives). Our core data is from the US Energy Information Administration (EIA).Footnote 5 The EIA data is reported at the utility/year level, where each utility supplies power to a single state.Footnote 6 The data includes each utility’s reliability in terms of SAIDI and SAIFI. The EIA provides these indices both when including and excluding transmission failures. This allows us to separately benchmark the resilience of transmission and distribution networks. The dataset also reports information such as sales, retail prices, and the count of customers enrolling in dynamic pricing.

We supplement the EIA data with utilities’ annual expenditure data from the FERC Form 1 that each IOU submits every year.Footnote 7 Each IOU reports its annual spending on operation and facility maintenance, and our variable of interest is the total spending on transmission and distribution lines maintenance. We are interested in how this expenditure changes in response to disasters and stricter renewable mandates.

We obtain the state RPS data from Berkeley Lab.Footnote 8 This state by year panel informs us about the minimum percentage of generation that a power retailer has to procure from renewable sources. We merge it into the utility by year panel based on the state that each utility delivers power to.

The Generator Panel

To study the electricity generation mix, we compile a dataset by generator/energy source/month. For each generator in the US, the EIA provides data on its capacity, energy source, county location, the power plant it belongs to, and monthly generation.Footnote 9 Using variation in monthly generation for a generator, we test whether fossil fuel generators contribute to a larger share of power production when disasters take place.

Disaster and Demographic Data

We obtain the disaster data from the Federal Emergency Management Agency (FEMA).Footnote 10 The FEMA data lists every disaster from 2013 to 2022. The dataset provides the date, type, and location of each disaster. We aggregate the thirteen disaster categories into four categories: hurricane, storm, fire, and other. For each category, we calculate its count by county/month and by county/year. We merge the monthly disaster data into the generator panel.

Each utility typically supplies power to multiple counties within the same state, and the EIA provides the list of counties within each utility’s service territory. We define a utility’s disaster exposure as the average disaster count across counties in its territory. For example, if a utility serves counties A and B in a given year, with two hurricanes reported in A and zero in B, then its hurricane exposure is one. We follow this approach to convert our county/year disaster data to the utility/year level. Table 1 presents summary statistics of utilities’ reliability, attributes, and disaster exposure.

We also merge county level cross-sectional data into our panel dataset. We use home prices data in 2013 from Zillow as a measure of each county’s income level.Footnote 11 Our climate belief data come from Yale Program on Climate Change Communication.Footnote 12 Specifically, our chosen measure is the percentage of residents believing climate change is real in each county in 2021. Lastly, we obtain data such as county population and educational attainment from the American Community Survey.Footnote 13

Disasters and Power Supply Reliability

Effects of Disasters on Generation, Transmission, and Distribution

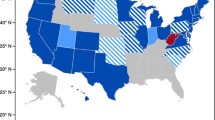

Extreme weather has caused more than half of the large-scale blackouts in the US (Hines et al. 2009). Figure 1 shows each county’s total count of disasters from 2013 to 2022. All disasters tend to be regional (i.e. hit a contiguous set of counties). While storms are more evenly distributed across the nation, hurricanes concentrate in the Southeast, and wildfires take place mostly in the West. In Fig. 2, we plot the average log(SAIDI) between 2013 and 2022 by county. These graphs indicate a positive correlation between SAIDI and disaster counts, especially hurricanes and storms. SAIDI has a correlation of 0.46 with the total hurricane count and a correlation of 0.28 with the storm count.

The electricity supply chain consists of three stages: generation, transmission, and distribution. Blackouts can occur when electricity generation falls short of real-time demand or when transmission and distribution networks are disrupted by extreme weather (e.g. trees falling onto overhead lines). Because of the NERC (North American Electric Reliability Council) reliability standards, there is redundancy in generation and transmission, yet typically not in distribution (Albert et al. 2004; Ward 2013). Redundancy refers to the presence of backup generators and alternative transmission routes, which ensure that a single failure does not lead to the collapse of the entire network. Compared with the other two phases, electricity distribution is more vulnerable to climate shocks in the absence of backup facilities. Electric utilities make costly investments to maintain the reliability of their distribution lines. For example, in California, Pacific Gas and Electricity (PG&E) is spending $6 billion burying 10,000 miles of overhead power lines to reduce the risk of wildfire ignition.Footnote 14

In the generation phase, conventional fossil fuel power plants can be ramped up quickly to meet the peak demand, while adverse environmental conditions reduce the productivity of renewable power plants. Wind speed of hurricanes is too high for turbines to safely operate. There is little solar power during hurricanes or storms, and solar panels’ efficiency declines under extreme heat. The increasing penetration of intermittent renewables thus poses new challenges to resource adequacy (Shaner et al. 2018; Wolak 2022). Regional transmission organizations (RTO) require electric utilities to maintain excess capacity. Such generation plannings minimize the likelihood that power outages occur due to an imbalance in electricity supply and demand. However, the "missing money" problem posits that utilities tend to underinvest in the backup capacity required for the peak demand (Cramton et al. 2013).

Incentives to Supply Reliable Power

The NERC establishes the set of reliability standards that electric utilities are mandated to follow. Such standards range from the planning of the bulk power system to the standards of power lines.Footnote 15 These regulations target the electricity wholesale market and interstate transmissions, ensuring that a few isolated failures could not bring down the whole system (Albert et al. 2004; Ward 2013; Veloza and Santamaria 2016). They do not extend to local distribution and the retail market, which are often regulated by state authorities. Disruptions to transmission capacity are costly as they can lead to regional blackouts, whereas local distribution failures usually affect only the local electricity customers. Utilities have an incentive to comply with these federal and state rules to avoid potentially enormous penalties (Watson 2017).Footnote 16

Utilities’ adaptation progress can differ by their ownership structure. Electric utilities in the US can be categorized into three major ownership types: investor-owned, publicly owned (e.g. municipal), and cooperative. IOUs are private companies that operate with the goal of maximizing shareholder value. They are typically regulated by state PUCs, which oversee their rates and service quality. Municipal utilities are established by cities, counties, or other governmental entities to provide electric services to the local community. They are non-profits and focus on meeting the needs of the community they serve. Electric cooperatives are owned and governed by their consumers. They predominantly operate in rural areas. There are two types of cooperative utilities: Generation & Transmission (G&T) co-ops and cooperative distributors. Distributors purchase electricity in the wholesale market (usually from their contracted G&T co-ops) instead of generating power by themselves.Footnote 17

IOUs are profit-maximizing agencies subject to rate-of-return regulations. The Averch and Johnson (1962) model implies that they have an incentive to invest in capital to improve grid resilience. However, because shareholders of IOUs are not their customers and IOUs face little threat of customer switching in regulated retail markets, they may have weak incentives to improve reliability beyond meeting the reliability standards (Joskow and Tirole 2007).

Municipal utilities are kept accountable by their customers (de-factor shareholders) through political elections. Cooperative utilities have a similar structure, except that they are run by an elected executive board instead of the local government. Local utilities including the municipal and cooperative ones face greater pressure from consumers as they could show up to the utilities and protest. IOUs are non-local and anonymous. Instead, local regulators bear the anger from customers.Footnote 18

Figure 3(a) shows the empirical distribution of SAIDI over time by utility ownership. Publicly owned utilities provide the most reliable services. Cooperative utilities seem to be the least reliable, as benchmarked by their 75th percentile and maximum SAIDI. Notably, the median SAIDI does not vary a lot from year to year, but the empirical distribution becomes more right-skewed. This suggests that extreme weather has increased the probability of tail events (Hines, Apy, and Talukdar 2009).

Although SAIDI at high percentiles has been increasing, this could simply be a result of the growing intensity and frequency of disasters. Figure 3(b) shows that the average annual count of disaster per county has increased by 50% from 2013 to 2022. Since the average SAIDI has increased less, this suggests adaptation progress as each shock is correlated with a shorter blackout over time.

The Performance of the Electricity Supply Chain Under Extreme Weather

Renewable Power Generators

In the past, the electricity generation phase has been overall resilient to weather shocks because fossil fuel generators can always be ramped up to full power quickly to fill in an existing power shortage. As an increasing share of electricity is generated from wind and solar resources, environmental disasters may give rise to new challenges in generation management. These intermittent renewables lead to long-term resource adequacy problems as their productivity decline under extreme weather events (Shaner et al. 2018; Wolak 2022). Regional electricity planning entities such as the RTOs determine the generation mix to meet the reliability targets. If renewable generators feature poor performance during critical times, a larger proportion of electricity needs to be generated from dispatchable but dirtier energy sources such as coal and natural gas.Footnote 19 To test this claim, we estimate the following regression on generator i in year/month t:

where disaster is a vector of disaster counts, and green is a dummy indicating whether the generator is powered by renewables (i.e. hydro, solar, wind, nuclear, or geothermal). \({\upbeta }_{1}\) represents how generation from brown generators changes when disasters take place, and \({\upbeta }_{2}\) represents the difference between the changes in brown and green generation. A positive \({\upbeta }_{1}\) implies more fossil fuel generators are used to produce power. If \({\upbeta }_{1}+{\upbeta }_{2}\) is negative, this would suggest that electricity production from renewables declines when a disaster takes place. We include different fixed effects. The standard errors are clustered by generator. Results are reported in Table 2. The omitted category in the table is fossil fuel.

In column (1), we include generator/year fixed effects and year/month fixed effects. Our estimation is thus based on each generator’s monthly variation in generation in a given year. For example, if a hurricane hits in August but in no other months during the year, our specification isolates the effects of the hurricane by testing whether green generators produce less power in August relative to their generation in other months. We find that storms and fires are respectively associated with an 8% and a 7% increase in generation from fossil fuels, while storms and other disasters are correlated with a 4% and a 5% decline in green generation, respectively. All are statistically significant at the 1% level. Electricity demand may surge when cooling or heating need increases during extreme weather events (McRae 2023). The rising demand along with the declining productivity of green generators imply that more fossil fuel generators have to be used, resulting in higher carbon emissions from electricity generation.

In column (2), instead of generator/year fixed effects, we include plant/year fixed effects and energy source fixed effects. Each power plant hosts multiple generators. We benchmark the productivity of green generators against brown generators within the same power plant. Renewable generators tend to feature lower marginal cost than fossil fuel ones. The merit order principle thus indicates that green generators are more likely to be called upon to produce power as long as they work (Cicala 2022). The statistical results are similar to those in column (1) where we report evidence of changes in generation mix during disasters.

Transmission and Distribution Networks

As discussed in Sect. "Disasters and Power Supply Reliability", failures in local distribution contribute to most of the power outages. To study the effects of disasters on the reliability of power delivery facilities, we use two different measures: SAIDI and SAIFI. These are commonly used in the engineering literature to benchmark power lines’ reliability. We estimate Eq. (2) for each utility i in year t:

where logged reliability can be log(SAIDI) or log(SAIFI), X is a vector including utility’s exposure to each disaster category, and trend refers to the annual time trend. We have also controlled for time-varying covariates such as utilities’ customer counts. The coefficient of interest is \({\upbeta }_{2}\). A negative coefficient would indicate that an additional disaster is associated with a smaller increase in SAIDI/SAIFI over time. We estimate this equation for distribution and transmission lines separately. Standard errors in this and later table are clustered at the utility level. The results are reported in Table 3.

In the first two columns, we find that disasters significantly reduce the reliability of the distribution network. Each storm is correlated with a 46% increase in outage duration (SAIDI) and a 9.2% increase in the proportion of customers affected by power blackouts (SAIFI). These large numerical values imply that extreme weather has been posing severe threats to the US power system. In column (1), we find that utilities are adapting to these shocks. The effect of each disaster on blackout duration has been shrinking by 1.12% per year. From 2013 to 2021, major US utilities’ spendings on distribution networks have increased from $40 billion to $60 billion.Footnote 20 The negative time trend we document may be explained by utilities’ investments in burying overhead power lines and increasing the redundancy of the network (e.g. building in backup lines). Although such investments have shrunk the duration of an average blackout, column (2) implies that they do not reduce the proportion of customers affected by power loss.

In the last two columns, we show that the transmission network is resilient to disasters. Each storm is correlated with a 19.6% increase in the blackout duration caused by transmission failures. This is less than half in magnitude when compared to the coefficient in column (1). Other disasters have statistically insignificant coefficients in both columns (3) and (4). The interaction between the time trend and the disaster count is negative but statistically insignificant, indicating no adaptation to storms. Currently, transmission lines are facing new resilience challenges. These high voltage power lines can spark wildfires when touching vegetation, especially on dry and windy days.

Cross-Sectional Comparison of Reliability

Each utility’s reliability can be benchmarked over time or across space at a given point in time. In Table 4, we study the cross-sectional determinants of the reliability of distribution and transmission lines. We estimate Eq. (3) for utility i in year t:

where X is a vector of variables of interest, including local demographics and utility ownership dummies, and Z is a vector of controls such as customer counts and total generating capacity. The omitted category of ownership is a public utility. We include NERC fixed effects and year fixed effects.

In columns (1) and (2), disaster counts are positively correlated with SAIDI and SAIFI as shown in Table 3. We find that electricity is more reliable in areas where home prices are higher and where people are more worried about climate change. Residential sorting could explain this correlation. If households are concerned about disasters, they would choose to live in neighborhoods with resilient infrastructure and are more likely to pay a premium for homes in such neighborhoods (Baldauf et al. 2020).

The RPS has a significantly positive coefficient in both column (1). A one percentage point increase is associated with a 0.86% increase in SAIDI. This estimated correlation is consistent with the environmental science literature documenting that renewable energy is unreliable when used for a large share of electricity generation (Shaner et al. 2018). We interpret this as electric utilities’ tradeoff presented in Table 2. Given a hard budget constraint, utilities have less money for resilience when they are mandated to comply with a higher RPS.Footnote 21

We also find that public utilities supply more reliable power than do electricity cooperatives and IOUs. POUs face more intense customer pressure and are thus more incentivized to respond to customers’ demand. Another explanation is based on the cost of upgrading infrastructure. IOUs often have transmission and distribution lines spanning across large areas, and cooperative utilities import electricity through long-distance transmission lines instead of generating their own power. In contrast, public utilities are locally run by municipal governments. The smaller scale of operation indicates lower infrastructure upgrade costs.

Energy Storage and Dynamic Pricing

In competitive wholesale electricity markets, storage developers make profits by engaging in energy arbitrage. They store electricity when the wholesale price is low, selling it during peak hours or electricity shortages. Energy storage complements green generation. While renewable generators are more productive in the early morning, electricity demand tends to be low at such time. This has led to negative wholesale prices and the curtailment of renewable generation. Energy storage can store power during this time and thus increase the usage efficiency of green generation.

Energy storage developers’ private incentives are aligned with the public interests of grid resiliency and cheaper power generation (Carson and Novan 2013). Additionally, energy storage systems can provide ancillary services such as frequency control. Frequency instability can damage components of the grid and reduce its resilience. Energy storage can inject power into the grid instantly to stabilize the frequency.

While energy storage is a supply-side solution to the reliability challenges, dynamic pricing is a demand-side solution. In the past decade, an increasing fraction of retail customers substituted mechanical metering (that had to be read manually) to smart metering, and this enabled them to opt into dynamic pricing of electricity. From 2013 to 2022, the proportion of dynamic pricing customers has doubled for IOUs and tripled for POUs.

Wolak (2011) has documented that dynamic pricing can reduce electricity demand at peak hours. This reduces the likelihood of power outages cost-efficiently. Without dynamic pricing, electricity demand does not respond to the scarcity of resources, so electricity supply has to catch up to avoid power outages. In capacity auctions, profit-maximizing generators bid to produce power and the optimal choice for them is to bid their marginal cost of generation. If peak demand does not shrink when supply drops, more backup capacity will be needed. This may increase the market clearing price in the capacity market, leading to a higher cost of keeping the lights on (Cramton et al. 2013).

The second effect is that dynamic pricing can reduce the marginal emissions from the grid. The average emissions intensity of the grid has dropped as more renewable generation is used to meet the base load. Yet, the marginal emissions have risen because fossil fuel power plants are now used to fulfil the marginal increase in demand (Holland et al. 2022). As dynamic pricing reduces this marginal demand, fewer brown power plants would be needed during peak hours, leading to lower marginal emission rates.

In columns (3) and (4) of Table 3, we test whether electricity is more reliable in states with more utility-scale energy storage capacity and for utilities that have signed more customers up for dynamic pricing. The storage capacity has a significantly negative coefficient in column (3). A 10% increase in storage is associated with a 0.7% drop in SAIDI. We find that each ten percentage points increase in the percentage of dynamic pricing customers is associated with a 2.5% drop in SAIDI. The results are statistically insignificant when we use SAIFI as the metric. We caution that these relationships are not causal because not a random subset of utilities install storage or implement dynamic pricing. Omitted variables may include a utility’s manager quality (Bloom et al. 2010).

The Trade-off Between Reliable, Green, and Affordable Power

Electric Utilities’ Resilience Investments

If utilities face a hard budget constraint, larger investments in adding renewable power plants would leave utilities with less money to spend on resilience, such as hardening the overhead distribution lines. Also, when local renewable generators are knocked down by disasters, utilities need to avoid blackouts by importing green electricity from non-affected regions through long-distance transmission (Davis et al. 2023). Hagspiel et al. (2018) have documented such cross-border balancing effects that increase power reliability in the European electricity markets. The increasing utilization of transmission lines incurs higher maintenance costs.

Using the maintenance expenditure from a sample of over 100 IOUs in the US, we estimate the following equation for utility i in year t:

where disaster is a vector of disaster counts, and we include utility fixed effects (\({\delta }_{i}\)) and year fixed effects (\({\gamma }_{t}\)). The results are reported in Table 5.

Column (1) shows that a higher RPS is associated with higher maintenance costs of power infrastructure. In columns (2) and (3), we estimate the same specification using the maintenance expenditure on transmission lines and distribution lines separately. Consistent with our expectation, RPS is significantly positive in column (2) but not in column (3). Renewable power is transported across regions through high-voltage transmission lines. The growing utilization accelerates the depreciation of such capitals and thus raises the maintenance expenditure. Based on the estimate in column (2), a one percentage point increase in state RPS is associated with a 1.7% increase in annual transmission maintenance costs. Although generation from renewables may feature lower marginal costs, the green facilities could be more expensive in operation and maintenance.

In all columns, we document that a utility’s maintenance expenditure is higher in years when more disasters take place, especially hurricanes and fires. It is costly for utilities to fix or upgrade their infrastructure after they are damaged by extreme weather. That said, these investments are crucial to supplying reliable power. In columns (4) and (5), we study whether higher lagged maintenance expenditure is correlated with a lower SAIDI in the coming year. Our results suggest that SAIDI drops by roughly 3% following a 10% increase in maintenance spending on transmission and distribution networks.

The Economic Incidence of Supplying Reliable Green Power

To recover the lump-sum expenditure on resilience, utilities need transfers from the government or have to raise retail rates. We test whether electricity prices are higher in states where the RPS is higher and where utilities invest more in infrastructure maintenance. Put simply, do electricity consumers pay more for reliable green power? When utilities seek to pass the capital costs on to consumers, such electricity price increases could disproportionately affect low-income households. To test our hypothesis, we estimate the following regressions for utility i in year t:

where the \(\beta\)s are the coefficients of interest. Positive coefficient estimates would support the claim that utilities pass down their capital expenditure to consumers. The vector of covariates (\({X}_{it}\)) includes disaster counts in the current year and utility attributes. We also control for NERC fixed effects and year fixed effects.

One concern is that the lagged maintenance expenditure may be endogenous. Thus, we also report the estimation of Eq. (5) with 2SLS where we instrument lagged maintenance costs with lagged disaster counts (hurricanes, storms, fire, and other). The key identification assumption is that the lagged disasters change electricity prices only through maintenance cost pass-through. This is plausible because lagged disasters tend not to affect the other factors that could determine the current prices, such as the demand and the operation cost in the current year. In the first stage, the counts of hurricanes and storms have significantly positive coefficients as expected, and the counts of fire and other disasters are positive but statistically insignificant. The OLS and the second-stage results are reported in the first two columns of Table 6. We restrict the sample to IOUs whose maintenance cost data is available.

In both columns, we find that retail electricity prices are higher in states with a higher RPS and for utilities that have invested more in infrastructure maintenance in the past year. A one percentage point increase in RPS is associated with a 0.77% to 0.87% increase in prices.Footnote 22 A 10% increase in maintenance spending is correlated with a 0.5% increase in prices based on OLS and a 1.98% increase based on 2SLS. PG&E in California provides an example of cost pass-through. It buries overhead powerlines to reduce wildfire risk and uses this to justify its rate hike request.Footnote 23

The downward bias of OLS implies that the lagged maintenance expenditure is positively correlated with unobserved shocks that reduce prices. For example, suppose a utility upgrades its generators and power lines so that the future cost of generating and transporting power declines. Then the lagged maintenance cost could be high, while the decreasing marginal cost of production can drive down future electricity prices.

We do not observe the maintenance expenditure of public and cooperative utilities. In column (3), we use OLS to estimate a reduced-form version of Eq. (5) where we replace the lagged maintenance cost by the lagged disaster count. This allows us to include all utilities in our sample. We test whether disasters in the previous year are associated with higher retail prices in the current year. We find that the lagged count of storms and fires are both correlated with an increase in electricity prices, consistent with evidence from the first two columns. While utilities have an incentive to invest in resilience, consumers bear the cost of such capital upgrades. Our findings sketch out a tradeoff between supplying reliable, renewable, and affordable electricity.

Conclusion

In the United States today, every sector of the economy seeks to decarbonize and to become more resilient in the face of rising physical climate risks. Given that both carbon mitigation and climate change adaptation require new investments, do fundamental tradeoffs arise between mitigation goals and adaptation goals? Using a decade’s panel datasets both at the generator and the electric utility level, we have quantified the effects of extreme weather on power generation, transmission, and distribution. Due to binding budget constraints, utilities must confront the opportunity cost of "over-investing" in either. Based on IOUs’ maintenance expenditure and retail price data, our analysis indicates that utilities petition the state regulators for a price hike to pass the capital costs on to electricity consumers.

In the electricity sector, expanding transmission access has the potential to reduce the risk of power loss while scaling up renewable generation (Davis et al.2023). However, multiple transmission projects have encountered political hurdles. Some alternatives include energy storage and dynamic pricing. We provide suggestive evidence that both of them can attenuate the tradeoff between adaptation and mitigation.

Compared with the electric utility industry, we know less about firms’ investment in carbon mitigation versus climate resilience in other sectors. For example, in the aviation sector, Brueckner et al. (2023) have shown that each airline's carbon footprint shrinks over time, but we know little about its climate resilience investments (e.g. how it protects its commercial buildings from extreme weather). Future research can collect better data on firms’ resilience investments and test whether the tradeoffs in mitigation versus adaptation are present in industries other than electricity provision.

Data Availability

Data is available upon request.

Notes

In California, for example, failing to comply with the RPS incurs a fine of $50 per MWh of green power. That is, if a utility sells 1000MWh of brown power and no green power, given a 30% RPS, it has to pay a fine of $15,000.

These indices only refer to sustained interruptions. As defined by the Institute of Electrical and Electronics Engineers (IEEE), sustained interruptions last at least five minutes.

Utilities’ customers include residential, commercial, and industrial ones. SAIDI gives each customer an equal weight, regardless of their electricity consumption. Because most customers are residential, SAIDI is a valid measure of residential electricity reliability. Previous electrical engineering has casted doubt on the accuracy of SAIDI when used to evaluate grid reliability for non-residential sectors (Schuerger, Arno, and Dowling 2016). We acknowledge that our results in this paper apply mostly to the residential sector.

This is consistent with what engineering studies have found. For example, see Veloza and Santamaria (2016).

If an electric company delivers power to multiple states, then it is listed as multiple utilities in the data. For example, Appalachian Power Company supplies power to both Virginia and West Virginia. In our data, Appalachian Virginia and Appalachian West Virginia are listed as two different electric utilities.

Based on the EIA data, 78% of the American electricity customers are served by IOUs, and municipal and cooperative utilities each serve half of the rest of the customers.

In California, instead of protesting against PG&E, consumers protested in front of the California PUC to express their concerns about rising energy bills and the frequent disruptions in services. In Puerto Rico, people marched along a main highway to pressure the state regulators to end the contract with the private electricity provider LUMA Energy.

https://www.nytimes.com/2021/10/19/us/puerto-rico-electricity-protest.html

Due to potential heat waves that could knock out power, Californian governors have proposed to extend the life of gas-powered plants as electricity reliability reserves during high-demand times.

https://www.latimes.com/opinion/story/2022-06-24/california-electricity-reliability-reserve

We acknowledge that the budget constraint may not be hard for regulated utilities. As predicted by Averch and Johnson (1962), utilities have an incentive to invest in green and reliable capitals if they can earn a rate of return on their investments.

Results are largely similar when we drop California. When we estimate the same specification with utility fixed effects and year fixed effects on the whole sample, RPS still has a significantly positive coefficient.

References

Albert R, Albert I, Nakarado GL (2004) Structural vulnerability of the North American power grid. Phys Rev E 69(2):025103

Allcott H, Collard-Wexler A, O’Connell SD (2016) How do electricity shortages affect industry? Evidence from India. Am Econ Rev 106(3):587–624

Averch H, Johnson LL (1962) Behavior of the firm under regulatory constraint. Am Econ Rev 52(5):1052–1069

Baldauf M, Garlappi L, Yannelis C (2020) Does climate change affect real estate prices? Only if you believe in it. The Review of Financial Studies 33(3):1256–1295

Barreca A, Clay K, Deschenes O, Greenstone M, Shapiro JS (2016) Adapting to climate change: the remarkable decline in the US temperature-mortality relationship over the twentieth century. J Polit Econ 124(1):105–159

Bloom N, Genakos C, Martin R, Sadun R (2010) Modern management: good for the environment or just hot air? Econ J 120(544):551–572

Brueckner JK, Kahn ME, Nickelsburg J (2023) How do airlines cut fuel usage, reducing their carbon emissions? CESifo Working Paper No. 10478, Available at SSRN: https://doi.org/10.2139/ssrn.4470398

Bushnell J, Novan K (2018) Setting with the sun: the impacts of renewable energy on wholesale power markets. No. w24980. National Bureau of Economic Research

Carson RT, Novan K (2013) The private and social economics of bulk electricity storage. J Environ Econ Manag 66(3):404–423

Cicala S (2022) Imperfect markets versus imperfect regulation in US electricity generation. American Economic Review 112(2):409–441

Cole MA, Elliott RJR, Occhiali G, Strobl E (2018) Power outages and firm performance in Sub-Saharan Africa. J Dev Econ 134:150–159

Cramton P, Ockenfels A, Stoft S (2013) Capacity market fundamentals. Econ Energy Environ Policy 2(2):27–46

Davis LW, Hausman C, Rose NL (2023) Transmission impossible? Prospects for decarbonizing the US grid. J Econ Perspect 37(4):155–180

Fisher-Vanden K, Mansur ET, Wang Q (Juliana) (2015) Electricity shortages and firm productivity: evidence from China's industrial firms. J Dev Econ 114:172–88

Gandhi, S, Kahn ME, Kochhar R, Lall S, Tandel V (2022) Adapting to flood risk: evidence from a panel of global cities. No. w30137. National Bureau of Economic Research

Hagspiel S, Knaut A, Peter J (2018) Reliability in multi-regional power systems: capacity adequacy and the role of interconnectors. Energy J 39(5):183–204

Hines P, Apt J, Talukdar S (2009) Large blackouts in North America: historical trends and policy implications. Energy Policy 37(12):5249–5259

Holland SP, Kotchen MJ, Mansur ET, Yates AJ (2022) Why marginal CO2 emissions are not decreasing for US electricity: estimates and implications for climate policy. Proc Natl Acad Sci 119(8):e2116632119

Joskow P, Tirole J (2007) Reliability and competitive electricity markets. Rand J Econ 38(1):60–84

Kahn ME (2005) The death toll from natural disasters: the role of income, geography, and institutions. Rev Econ Stat 87(2):271–284

McRae S (2023) Residential electricity consumption and adaptation to climate change by Colombian households. Econ Disasters Clim Chang 7(2):253–279

Rafi S, Meng S, Santos J et al (2024) Extreme weather events and the performance of critical utility infrastructures: a case study of Hurricane Harvey. Econ Disasters Clim Chang 8:33–60. https://doi.org/10.1007/s41885-023-00139-9

Schuerger R, Arno R, Dowling N (2016) Why existing utility metrics do not work for industrial reliability analysis. IEEE Trans Ind Appl 52(4):2801–2806

Shaner MR, Davis SJ, Lewis NS, Caldeira K (2018) Geophysical constraints on the reliability of solar and wind power in the United States. Energy Environ Sci 11(4):914–925

Steinbuks J, Foster V (2010) When do firms generate? Evidence on in-house electricity supply in Africa. Energy Economics 32(3):505–514

Stock JH (2020) Climate change, climate policy, and economic growth. NBER Macroecon Annu 34(1):399–419

Veloza OP, Santamaria F (2016) Analysis of major blackouts from 2003 to 2015: classification of incidents and review of main causes. Electr J 29(7):42–49

Ward DM (2013) The effect of weather on grid systems and the reliability of electricity supply. Clim Change 121(1):103–113

Watson WF (2017) NERC mandatory reliability standards: a 10-year assessment. Electr J 30(2):9–14

Wolak FA (2011) Do residential customers respond to hourly prices? Evidence from a dynamic pricing experiment. American Economic Review 101(3):83–87

Wolak FA (2022) Long-term resource adequacy in wholesale electricity markets with significant intermittent renewables. Environ Energy Policy Economy 3(1):155–220

Acknowledgements

We thank the editor and a reviewer for helpful comments. We thank Dora Costa and Bhaskar Krishnamachari for useful discussions.

Funding

Open access funding provided by SCELC, Statewide California Electronic Library Consortium The authors received no funding for this project.

Author information

Authors and Affiliations

Contributions

Each of the authors contributed equally to writing this paper.

Corresponding author

Ethics declarations

Competing Interest

The authors have no financial stakes in this research.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Huang, R., Kahn, M.E. United States Electric Utility Adaptation to Natural Hazards and Green Power Mandates. EconDisCliCha 8, 263–282 (2024). https://doi.org/10.1007/s41885-024-00146-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s41885-024-00146-4