Abstract

The relationship between trade flows and exchange rate uncertainty is still being debated in academic circles while examining the effects of exchange rate uncertainty on India's bilateral trade flows, prior research disregard the “third-county” effect. This study investigates the effect of third-country risk on the amount of India–US commodity trade using time series data for 79 Indian commodity export and 81 Indian commodity import businesses. The results show that the volume of trade in a select few industries is considerably impacted by third-country risk in terms of dollar/yen and rupee/yen. According to the findings, rupee–dollar volatility affects 15 exporting industries in the short run and 9 industries in the long run. Similarly, the third country effect demonstrates that Rupee–Yen volatility affects 9 Indian exporting industries both in the short and long run. The results show that rupee–dollar volatility tends to have a short-term impact on 25 importing industries and a long-term impact on 15 sectors. Similar to this, the third country effect demonstrates that Rupee–Yen volatility tends to have an impact on 9 Indian importing industries over the short and long term.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

As the international monetary system transitioned from fixed exchange rates to relatively more flexible rates, critics of floating exchange rates contended that the more volatile the exchange rates, the more it might hurt international trade. As a result, researchers were motivated to conduct theoretical and empirical analyses of how exchange rate volatility or uncertainty affects trade flows. Without citing a significant portion of the literature reviewed by Bahmani-Oskooee and Hegerty (2013, 2015), it is now well established that exchange rate uncertainty can have either positive or negative effects on the volume of trade; see Bahmani-Oskooee and Hegerty (2007). Future exchange rate uncertainty will undoubtedly cause risk-averse traders to trade less in order to avoid losses. Risk-taking traders, on the other hand, may trade more to boost their earnings right now so that they can offset their losses in the future.

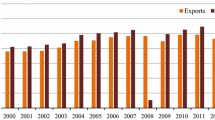

India's most significant export market and trading partner is the United States. In 2021–2022, the US overcame China to overtake it as India's biggest trading partner, a sign of the two nations' growing economic connections. A record $157 billion in goods and services were exchanged bilaterally between the United States and India in 2021. Data from the commerce ministry show that, in 2021–2022, US–India bilateral trade was $119.42 billion, up from $80.51 billion in 2020–2021. In the next fiscal year, 2021–2022, exports to the US soared to $76.11 billion from $51.62 billion, while imports jumped to $43.31 billion from roughly $29 billion. Of the $27.4 billion in U.S. exports to India in 2021, minerals accounted for 25.8% of those, followed by chemicals, plastics, leather products, stone, glass, and semi-precious metals, and then chemicals. The major commodity sectors for the $51.2 billion in Indian imports that the United States made in 2020 were chemicals, plastics, leather products (26.9%), stone, glass, and semiprecious metals (18.3%), textiles and footwear (14.8%), and chemicals.

Several US businesses see India as a crucial market and have increased their presence there. Towards the end of 2020, Indian investment in the United States reached $12.7 billion, supporting over 70,000 American employment. Indian businesses are also looking to expand their presence in American markets. India maintained a favourable trade balance with the United States, achieving a trade surplus of US$32.79 billion. According to data, the United States is the only country with whom India maintains a positive trade balance among its top ten trading partners. UAE (US$72.9 billion), Saudi Arabia (US$42.85 billion), Iraq (US$34.33 billion), Singapore (US$30.10 billion), Hong Kong (US$30.08 billion), and others are among the major trading partners.

On the other hand, Japan is a major player in the global economy and an important ally of India. One of India's most important allies in its economic development is Japan. In recent years, the connection between India and Japan has evolved into one of enormous depth and significance. India's growing importance to Japan is a result of a number of factors, including a sizable and expanding market, as well as its resources, particularly its human resources. In fiscal year 2018–19, Japan and India's bilateral trade reached a total of US$17.63 billion. During this time, Japan exported $12.77 billion to India while importing $4.86 billion. For the fiscal year 2019–20 (April–December), the two countries' bilateral commerce came to US$11.87 billion. India imported US$ 7.93 billion worth of goods from Japan while exporting US$ 3.94 billion worth of goods to Japan. During 2000 to September 2019, there have been around US$ 32.058 billion in investments made in India (Japan is now the third-largest investor). Investment from Japan has mostly gone into the automotive, electrical equipment, telecommunications, chemical, financial (insurance), and pharmaceutical industries in India. Thus, fluctuations in the exchange rate between Japan and India could have ramifications for trade flows between Pakistan and the US. In our study we investigate whether the volatility of the Rupee–Yen and yen-dollar rates could cause substitution effects in commodity trade flows between India and the United States. Decreased Rupee–Yen rate volatility may increase India’s trade with Japan, leading to a decline in trade with the U.S. Similarly, decreased Yen-dollar volatility may increase the U.S. trade with Japan, leading to a decline in trade with India. Again, changes in India’s trade with the U.S. could be in either direction, depending on the degree of risk aversion by traders in India and the U. S. and their sensitivity to three measures of volatility.

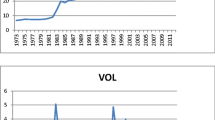

The trend in effective exchange rate volatility is shown in Fig. 1. The effective exchange rate pattern indicates that the period from 1985 to 1993 saw high exchange rate volatility, which peaked in 1990 at 30%.Yet thanks to frequent intervention by the Reserve Bank of India (RBI), the effective currency rate of India has been less volatile from 1994 to 2011.The RBI frequently intervenes in the spot and forward foreign exchange markets to regulate rupee value movement, even though India's currency is meant to be totally float. For a specific reason (either tacitly or explicitly), the RBI has always intervened in the spot and forward foreign exchange markets, sometimes continually for many days.

As a result, the RBI may engage in market activity in a passive or indirect manner, in which case it takes part in off-market transactions. Since the controlled float of the rupee was implemented in March 1993, the RBI's policy priorities have sporadically and subtly changed depending on the priorities. With the introduction of the managed float in March 1993, the following different periods of currency rate fluctuations are plainly seen in India. They are: March 1993 through August 1995, when the nominal exchange rate was remarkably stable on the forex market; September 1995 through February 1996, when severe pressure on the exchange market was mitigated by RBI exchange and money market operations. From March 1996 until July 1997, the foreign exchange market was stable. From August 1997 to January 1998, the foreign exchange market saw increased volatility, which was eventually reduced by a variety of exchange and money market initiatives (Patnaik & Shah, 2001). The period from February to April 1998 saw a return to tranquility. From May to June 1998, there was significant uncertainty in the Forex markets, both domestically and internationally (Sengupta & Mukherji, 2005); August 1998, once again a month of turbulence in the foreign exchange market, was overcome by a series of actions (Sahoo, 2002). The FX market was stable from September 1998 to April 2000, with a few hiccups in May and June 1999 (Mohapatra & Pattanaik, 2002). From May 2000 to July 2000, market volatility returned (Patnaik & Shah, 2001). The volatility of the Indian Rupee increased in 2013, but it decreased in 2014, but only modestly (Sengupta & Arora, 2014). According to Ila Patnaik and Rajeswari Sengupta (2015), the Reserve Bank of India's proactive action helped to reduce the volatility of the Indian Rupee's effective exchange rate. However, if left to the whims of the markets, it is more likely that the effective exchange rate will become increasingly unpredictable (Mukherjee & Chakraborty, 2017).

In the Indian context, several specific factors have contributed to an increase in exchange rate volatility from 1997 to 2022. These factors include political instability, such as the resignation of former Prime Minister Atal Bihari Vajpayee in 1999 and the Indian general elections in 2014 and 2019, which led to uncertainty in the markets, causing a depreciation of the rupee (Chowdhury, 2016). India's persistent current account deficit and fluctuations in global commodity prices, particularly oil, have also put pressure on the exchange rate (Jha, 2018; Rashid, 2018). Moreover, global events such as the financial crisis in 2008 and the COVID-19 pandemic in 2020 have resulted in a flight of foreign capital and a depreciation of the rupee (Dhawan & Singhal, 2014; Goyal, 2020). The inflow and outflow of foreign capital have also impacted the exchange rate, with the taper tantrum in 2013 leading to a significant depreciation of the rupee due to the outflow of foreign capital (Ghosh & Nagesh Kumar, 2014). Additionally, changes in economic policies, such as demonetization and Goods and Services Tax (GST) implementation, have disrupted the economy and contributed to increased exchange rate volatility (Acharya & Chakraborty, 2019).The primary goal of this article is to contribute to the body of knowledge on the effects of exchange rate uncertainty on commodity trade between India and the United States by taking into account the "Third-Country" effects, or the impact of real Rupee–Yen and real yen-dollar volatility in addition to real rupee–dollar volatility. Furthermore, the current study adds to the existing literature by investigating the third country effect while utilizing disaggregate level trade data for both exporting and importing industries involved in trade between India and the United States.

The results show that coffee, inorganic metals, pharmaceuticals, textile fabrics, and base metal appliances are among the products that India exports to the US and are sensitive to changes in the exchange rate between the two countries. Other industries that are prone to being affected by changes in the Rupee–Yen exchange rate include those that produce agricultural machinery, household electrical equipment, iron and steel bars, power generating equipment, and telecommunications equipment. While industries like chemical elements and compounds, electric power machinery and products, glassware, lime, cement, and manufactured building materials, metalworking equipment, mineral manufactures, n.e.s. paper, and motor vehicles are sensitive to changes in India–US exchange rate volatility in the case of Indian imports into the US. Yet, when it comes to the volatility of the third country's exchange rate, industries like those producing crude rubber, including synthetic and recycled rubber, electric power equipment, and metalworking machinery are susceptible to fluctuations and unpredictability in the Rupee–Yen instability.

The current research is structured as follows: Sect. 2 presents a review of some relevant literature. Section 3 discusses methodology. The results are presented in Sect. 4. The conclusion is reported in Sect. 5.

2 Literature review

As a result of the extant literature, every country now has its own literature, and our concerned country, India, is no exception. India, a major regional economic power in South Asia, has critical trade ties with the United States. The United States is India's second-largest trading partner, while India is the United States' ninth largest trading partner. The value of India–US trade in both goods and services is estimated to be $146.1 billion in 2019. (Source: IMF). India has attempted to manage its exchange rate in order to reduce the rupee's volatility in relation to the reserve currency, the US dollar. However, because prices in India and the United States fluctuate over time, there may be some volatility in the real rupee–dollar exchange rate as illustrated by Sahu (2012), Kamble and Honrao (2014).

How has such volatility affected India's trade flows? Studies related to India are classified into three types. Theoretical models developed by De Grauwe (1988) and Peree and Steinherr (1989) show that the effects of exchange rate uncertainty on imports and exports can be both positive and negative, depending on the level of risk that businesses and traders are willing to accept. Although reviews of the empirical literature by McKenzie (1999) and Bahmani-Oskooee and Hegerty (2007) support the theoretical claims, the empirical findings are mixed. From the two review articles, we gathered one cross-sectional study by Bahmani-Oskooee and Ltaifa (1992). His sample included 19 developed and 67 developing countries. Bahmani-Oskooee and Ltaifa (1992) included a mix of developed and developing countries in their sample. India was among the countries on the list. They found that exchange rate volatility has a negative impact on both the combined exports of the two groups as well as each group's individual exports. Using a panel procedure with 22 developed and 69 less developed nations, Sauer and Bohara (2001) arrived at a somewhat different conclusion after including a time dimension spanning the years 1973–1993. The notion of aggregation bias embodied in any panel model is clearly supported by the evidence. India's exports suffer from exchange rate volatility, according to the panel model developed by Sauer and Bohara (2001), which includes all 69 developing countries. None of them, however, could be relied on because what is true in aggregate may not be true in each panel country. The second group employs time-series models to account for aggregation bias embedded in cross-sectional or panel models.

The study by Doroodian (1999), which includes India in its scope, found that exchange rate volatility had a negative impact on Indian real exports to other countries. The same negative effects were confirmed by Mukhtar and Malik (2010), and Srinivasan and Kalaivani (2012). The three studies were biased in another way even though they only used time-series data because they also include information on India's exports to other countries. Exports may react to fluctuations in the exchange rate differently depending on the trading partner. Hooy and Choong (2010) examined bilateral trade flows between India and three of its Asian allies: Bangladesh, Pakistan, and Sri Lanka. Both studies found that the impact of exchange rate volatility on India's trade with all three countries was significantly positive. The three aforementioned countries, on the other hand, are India's three smallest trading partners. We question whether the same holds true for India's trade, which accounts for more than 11.5%Footnote 1 of all trade with a country like the United States. Many studies have examined the export supply equation using variables including production costs, relative pricing, and supply capacity and found a statistically significant effect of variable cost on export growth. The efficacy of border and transit systems, ICT, physical infrastructure, and the business and regulatory environments were four trade facilitation metrics that Portugal-Perez and Wilson (2012) looked at in relation to the export performance of developing countries. Physical infrastructure was determined to have the most influence on exports. Moreover, Hernandez and Taningco (2010) examined factors such as telecommunications services, port infrastructure quality, trade wait times, and credit information depth that affected bilateral trade flows in East Asia that took place across borders. They saw a variety in the industries or product categories where they were successful. The UNCTAD study used internal transportation infrastructure as a proxy for total infrastructure. It was shown that in many emerging economies, the efficiency of internal transportation plays a critical role in explaining export performance. The significance of it appears to be more apparent among exporters with strong export performance. According to the empirical evidence presented by Limo and Venables (2001), the low levels of trade flows seen in many countries are mostly the result of subpar transportation systems. Landlocked nations may experience greater severity of this due to their geographical disadvantages. Transport costs and infrastructure are used to explain trade and market access. Most of the historical literature has focused on trade cost reductions, especially those caused by endogenous changes in commercial policy and exogenous improvements in transportation technology (see O'Rourke and Williamson, 1999). The gravity model has also been used in other studies that have stressed the critical need of infrastructure for commerce. Shepherd and Wilson (2009) found that transport infrastructure, particularly ports and ICT, had an impact on bilateral trade flows in Southeast Asia. According to Hoekman and Nicita (2008), Bougheas et al. (1999), Limo and Venables (2001), Djankov et al. (2010) and Anderson and Van Wincoop (2003) substandard ports and roads, ineffective customs offices and processes, a lack of regulatory competence, and restricted access to financing and business services all had an impact on commerce. Wilson et al. (2003) proposed that port efficiency and the proxies for infrastructure quality for the services sector, such as the use, speed, and cost of the internet, had a significant impact on trade flows when they extended the gravity model to trade facilitation measures and to a larger sample of 75 economies.

3 Model and methods

The fundamental Mundell-Fleming paradigm (MFP) premise that exporters in each nation determine export prices in their own currency—and, more significantly, that these prices vary far less often than exchange rates—lies at the heart of this forecast. Because prices are "sticky" in the producer's currency, this is sometimes referred to as "producer currency pricing." To be specific, this supposition holds that Indian exporters set their pricing in rupees, and that rupee prices do not move as much as exchange rates. Therefore, it follows that when the rupee weakens in comparison to its trading partners, the price that American importers pay in dollars declines almost in line with the rate of exchange Gopinath & Zwaanstra (2017). In a similar vein, the price that Chinese importers of Indian goods pay in Chinese yuan declines by an equivalent amount. This decrease in the price of Indian goods on international markets ought to cause a shift in global demand in favour of Indian exporters, increasing export sales. India buys items from the U.S. and Japan that are priced in dollars and yen respectively, and their prices fluctuate less often than exchange rates. In this scenario, a depreciating rupee should increase the cost of American and Japanese goods in Indian marketplaces and decrease consumer demand for imported items. In general, then, from a trade standpoint, a nation with a weakening currency improves its trade balance relative to the rest of the world and enjoys a competitive edge in global markets Boz et al. (2017). It is crucial to refute the paradigm's presumptions with evidence given the MFP's dominance in policy and academic discourse. The exporters' use of their own currency to set prices is the first fundamental tenet of MFP. As I've said, this is a weak representation of reality. The majority of exporters' invoices are in US dollars is a more realistic definition. While just 5% of India's imports come from the United States, 86% of India's imports are invoiced in dollars. Similar to this, despite just 15% of India's exports go to the United States, 86% of its exports are invoiced in dollars. Although though 16% of India's imports come from China, these are mostly invoiced in dollars.In other words, most nations do not export in their own currency. This phenomenon is referred to in the literature as the "Dominant Currency Paradigm (DCP)" to express the notion that because dollars are used to conduct the great majority of trade, they are the "dominant currency" Somogyi (2021). In contrast to producer currency pricing, a significant portion of global exports are priced in dollars, and this is essential since dollar prices are less subject to exchange rate fluctuations Gopinath and Zwaanstra (2017).

According to a study by Liu and Niu (2019), in the context of the Dollar Currency Paradigm, the exchange rate volatility of a third country can have a significant impact on the competitiveness of the domestic economy. Specifically, if the domestic currency is pegged to the US dollar, a fluctuation in the exchange rate of the third country against the US dollar can result in a similar fluctuation in the domestic currency, which can lead to a decrease in the competitiveness of domestic exports. Furthermore, a study by Faria et al. (2018) suggests that the volatility of a third country's exchange rate can also impact the prices of imported goods in the domestic economy. If the exchange rate of the third country depreciates against the US dollar, the prices of imported goods from the third country can increase, leading to inflationary pressures in the domestic economy. This can ultimately affect the purchasing power of domestic consumers and reduce the demand for both domestic and imported goods. Finally, a study by Goyal and Sethi (2021) highlights that the volatility of the third country's exchange rate can also impact financial markets and capital flows in the domestic economy. If the exchange rate of the third country becomes too volatile, investors may become hesitant to invest in the domestic economy or to hold domestic assets. This can lead to a decrease in capital flows to the domestic economy and increased borrowing costs for domestic businesses and consumers. Overall, the volatility of a third country's exchange rate can have significant implications for the domestic economy within the context of the Dollar Currency Paradigm.

In light of the dollar Dominant Currency Paradigm (DCP), this research predicts that the value of the rupee relative to both the dollar and the yen may have a substantial impact on Indian trade flows As a result, we model the trade flows as follows. It is customary to use export and import demand models to analyze how exchange rate uncertainty affects a nation's trade flows. We must include a scale variable and a relative price term in each model. One or more measures of exchange rate volatility, some of which take into account "third-country" effects, are also included in addition to these two terms. We use the export and import demand models developed by “Cushman (1983, 1986), Bahmani-Oskooee and Xu (2012), Bahmani-Oskooee et al., (2013a, 2013b), Bahmani-Oskooee and Bolhassani (2014), and Bahmani-Oskooee et al. (2016), "all of which include "third-country" effects.

The flow of exports (Xt) from each Indian industry to the US is supposed to be positively determined by US real GDP (YUS) while negatively determined by the real exchange rate between the Indian rupee and US dollar (RER). An increase in US GDP means an increase in the purchasing power of US consumers for Indian goods. While a decrease in the real exchange rate between the Indian rupee and the US dollar means a depreciation of the Indian rupee that increases the demand for Indian products from the US. The other determinants of Indian exports are the volatility of the real exchange rate between the Indian rupee and the US dollar (VOLI−US) which is supposed to have either a negative or positive effect on the Indian export flow. Similarly, to capture the third country effect, equation-1 also includes the volatility of the real exchange rate between the Japanese yen and the US dollar (VOLUS−J) and the volatility of the real exchange rate between the Indian rupee and the Japanese yen (VOLI−J). Both of them are also supposed to have either positive or negative effects on the Indian export flows to the US, depending upon the exporter's behavior toward risk and the degree of substitution of different commodities traded among the three countries.

Equation 2 on the other hand shows the flow of imports by each Indian industry from the US (Mt) which is supposed to be determined positively by the Indian real GDP itself (YI) and the real exchange rate between the Indian rupee and US dollar (RER). An increase in Indian real GDP means an increase in purchasing power of Indian consumers and more demand for US imports. Similarly, a decline in the real exchange rate between the Indian rupee and the US dollar means a depreciation of the Indian rupee that will lead to the reduction of Indian imports from the US. The three volatilities of real exchange rates as mentioned earlier in equation-1 have the same positive or negative effect on the flow of imports from the US.

3.1 Estimation methodology

This study follows the cointegration analysis to estimate the augmented reduced form model that explains the determinants of Indian export flow to the US and also Indian imports flow from the US. The Auto-Regressive Distributive Lag (ARDL) estimation technique developed by Pesaran et al. (2001) is employed. This approach towards cointegration has various econometric advantages such as, it is considered most suitable for small sample data sets. Similarly, it allows for a different order of integration for the variables in the same specification where some variables are I (0) while some variables are I (1). Furthermore, by a simple linear transformation, the error correction model (ECM) can be derived from ARDL bound testing approach. The error correction model ECM integrates the short-run dynamics with long-run equilibrium without any loss of long-run information. Following Bahmani-Oskooee et al. (2015), we write Eqs. (1) and (2) in the format of error correction modeling (ECM) to assess short-run as well as long-run effects.

The coefficients attached with difference operator Δ are short-run coefficients and coefficients attached with lagged level terms indicate the long-run analysis. The optimal lag length of level 3 is selected through Akaike Information Criteria (AIC). The joint significance of lag level variables is tested with F-test suggested by Pesaran et al. (2001). For example, Eq. (3) can be tested for joint significance with the null hypothesis H0: αx = α1 = α2 = α3 = α4 = α5 = α6 = 0 indicates that there is no long-run relationship between the variables. While the alternative hypothesis H1: αx = α1 = α2 = α3 = α4 = α5 = α6 ≠ 0 indicates that there exists cointegration between variables in long run. For the given level of significance, this study uses upper and lower critical values developed by Pesaran et al. (2001). A lower critical value is applied to the variables integrated of order zero I (0) while an upper critical value is applied to the variables integrated of order one I (1). The F-statistic greater than the upper critical value rejects the null hypothesis of no long-run relationship between the variable and conclude that there exist cointegration between variables. On the other hand, the F-statistic less than lower critical value fails to reject the null hypothesis of no long-run relationship between variables and conclude that there does not exist a cointegration between the variables. Similarly, the F-statistic lies between lower and upper critical values which indicate that the inference is inconclusive. The robustness of the ARDL results has been tested with different kinds of diagnostic tests. These diagnostic tests are used to check serial correlation, normality of error terms, heteroskedasticity, and misspecification in the model. Moreover, there is an alternative method of testing cointegration i.e., the joint significance of the lagged level terms also indicates the existence of cointegration in long run. If the lagged level term is significantly negative it means the variables in the model are moving towards equilibrium.

4 Empirical results

This study has estimated equation-3 individually for 79 Indian export industries to the US. Similarly, it has also estimated equation-4 individually for 81 Indian imports industries from the US. For simplicity, we have summarized the short-run estimates for each industry. The availability of at least one significant coefficient is denoted by Yes while the non-availability of at least one significant coefficient is denoted by No. However, for long-run estimates, we provided the complete set of results for each industry in the case of both exports function as well as imports function.

Table 1 reports the coefficients estimates for Indian exports function with the US. In the short run, we found at least one significant coefficient for US real GDP in 21 industries and for the real exchange rate between the Indian rupee and US dollar in 35 industries. As for the three volatility terms are concerned, the volatility of real exchange rate between rupee and dollar, yen and dollar, and rupee and yen shows at least one significant coefficient in 18, 14, and 9 industries respectively. The short-run results indicate that in 41 industries, there is at least one significant coefficient associated with exchange rate volatility.

In long run, the US real GDP has a significant coefficient in 9 industries with a positive and negative signs. The real exchange rate between rupee and dollar has a significant coefficient in 18 industries most of them appeared with negative signs suggesting that an increase in the Indian exchange rate against the US dollar will reduce demand for its industrial goods from the US. Finally, the volatility of the real exchange rate between rupee and dollar could show a significantly positive effect only in 6 industries. As for the third country, effects are concerned, volatility of yen/dollar sowed significantly positive effect in 11 industries while the significantly negative effect in 5 industries. The volatility of the rupee/yen shows a significantly negative effect in 4 industries while a significantly positive effect in 5 industries. The results in long run show very few industries with a significant effect on these variables. Furthermore, the coefficients of different variables appeared with positive and negative signs for different industries.

Table 2 reports diagnostic tests for Indian exports function with the US. The F-test results suggest cointegration in 18 industries where the tabulated value of the F-test is greater than the critical value of 4.11. Following the alternative method of cointegration, it suggests cointegration in 54 industries where the lagged level term appeared with a significantly negative coefficient. The Lagrangian multiplier test suggests that all the models are serial correlation free as in most of the cases the LM test value is less than the critical value of 3.84. Similarly, the Ramsey Reset test suggests that most of the models are correctly specified as the tabulated value of the Ramsey Reset test is less than the critical value of 3.84. Finally, the CUSUM and CUSUMSQ indicate that all the models are stable and dented with S. Furthermore, the value of adjusted R2 approaching one shows the best fit of the model.

Table 3 contains the results for estimated coefficients of Indian imports from the US. In the short run, Indian real GDP shows at least one significant coefficient in 21 industries. While the real exchange rate between the Indian rupee and US dollar shows at least one significant coefficient in 29 industries. As for the three terms of volatility are concerned, the volatility of the rupee/dollar shows at least one significant coefficient in 25 industries. The volatility of yen /dollar shows at least one coefficient significant in 17 industries. Finally, the volatility rupee/yen has shown at least one coefficient significant in 13 industries.

In long run, we find that Indian real GDP is significant in 13 industries, and most of them show a significant negative effect. It suggests these commodities of US industries are inferior to India. The real exchange rate between the Indian rupee and US dollar shows a significantly negative effect in 6 industries while a significantly positive effect in 5 industries. The negative effect suggests that the appreciation of the Indian rupee against the dollar will reduce Indian imports from the US whereas, the positive effect suggests that appreciation of the Indian rupee will increase its imports of these industrial commodities from the US. The volatility rupee/dollar shows a significant effect in 15 industries most of them show a significantly positive effect. The third country effect was found significant for yen/dollar in 13 industries with positive and negative signs. Finally, for the volatility of the rupee/yen, we find a significantly negative effect in 9 industries. The results are in line with Bahmani-Oskooee et al., (2013a, 2013b) which suggest a negligible effect of these variables on the volume of trade.

The diagnostic test for the Indian imports function with the US is shown in Table 4. The cointegration is found in 19 industries while following F-test values and in 67 industries while following the lagged level significance criteria with a negative sign. The Lagrangian multiplier and Ramsey Reset test respectively suggest that most of the models are serial correlation free as well as specified with correct functional form, as in most cases the obtained value of each of these tests is less than the critical value i.e. 3.84. Again the CUSUM and CUSUMSQ have denoted the stable models by S. Finally, the adjusted R2 shows how well the model is.

Our research findings are consistent with previous studies that have investigated the relationship between exchange rate volatility and Indian trade flows. For instance, Rana and Bhanumurthy (2012) found that exchange rate volatility has a negative impact on Indian exports, especially in the short term. Similarly, Gupta et al. (2016) reported that exchange rate volatility has a significant effect on India's trade balance. The significant impact of exchange rate volatility on Indian trade flows indicates that not only the volatility of bilateral exchange rates but also that of third-country exchange rates is important for India.

Furthermore, the choice of the dominant currency for trade invoicing plays a crucial role in managing exchange rate risks and mitigating exposure to fluctuations in the dominant currency. For instance, historically, the US dollar has been the dominant currency for Indian trade invoicing, followed by the euro and other major currencies such as the Japanese yen and the British pound. India's vulnerability to fluctuations in the US dollar as the dominant currency arises from the fact that the country is heavily dependent on imports, particularly oil, which is usually invoiced in dollars. Therefore, fluctuations in the exchange rate between the rupee and the dollar can have a significant impact on the cost of imports and overall trade flows. Additionally, India's exposure to exchange rate volatility in third-country currencies is also significant. For example, if Indian trade is invoiced in Japanese yen, fluctuations in the exchange rate between the rupee and yen can also impact bilateral trade flows. Research conducted by the Reserve Bank of India suggests that the choice of the dominant currency in trade invoicing is crucial to manage exchange rate risks and to ensure the competitiveness of Indian exports (Singh and Patra, 2017). Another study by the Centre for WTO Studies found that a shift towards invoicing trade in the domestic currency can help reduce transaction costs and improve the stability of bilateral trade flows (Dhakal & Das, 2018). Therefore, it is essential for India to carefully consider the dominant currency paradigm for trade invoicing to mitigate exposure to fluctuations in dominant currencies and manage exchange rate risks effectively.

5 Conclusion and policy implications

Over the past decade, a large number of studies have examined the impact of exchange rate uncertainty on trade flows. Previous studies used aggregate level trade data for one country against the rest of the world; however, these studies were criticized as they were suspected to suffer from aggregation bias. To minimize the aggregation bias, many of the studies examined the exchange rate uncertainty nexus by relying on bilateral. In recent years, many studies have criticized the bilateral level studies suspecting that these studies too embody an aggregation bias. Hence many studies have analyzed the issue by using more disaggregated trade data at the commodity level between the two countries. However, more and more significant impacts of exchange rate uncertainty on trade flows are discovered at each level of disaggregation. All these studies have one thing in common all these studies use the volatility of exchange rate based on bilateral level exchange rate. However, the emergence of most recent literature on the subject has pointed out that a "Third Country" exchange rate matters significantly when dealing with the exchange rate and trade linkages.

This study contributes to the literature by investigating the impact of the India–US exchange rate on the India–US trade flows of 160 industries. Out of these industries, 79 industries are Indian export industries and 81 Indian import industries that are involved in trade with the US. These industries constitute a major share of total Indian exports and imports. Since India is a major player in trade not only with the US but with Japan which implies that if the volatility of exchange rate between the Rupee–Yen increases, it may likely convert India's trade more with the US by reducing it with Japan which is, in fact, a "Third County". Only a few studies have investigated the third country effect in the recent past. We also incorporate the Third country effect in our model by including the variable of dollar-yen volatility and Rupee–Yen volatility for investigating the impact of rupee–dollar exchange rate volatility on India–US trade flows.

Following the ARDL approach to cointegration and error correction modeling, we found evidence of a significant effect of rupee/dollar volatility on the volume of trade in very few industries. Although, the significant results provide evidence of positive and negative effects the evidence of positive effects is relatively stronger. Also, the third country's risk both in terms of yen/dollar and rupee/yen is found significant in very few industries i.e., far less than half of the total selected industries. The yen/dollar volatility has shown both significantly positive and negative effects on the volume of exports and imports. Similarly, the rupee/yen volatility has shown a significantly positive and negative effect on Indian exports but for Indian imports, it showed only a significantly negative effect. The short-run results indicate that out of 79 export industries, in 41 industries, there is at least one significant coefficient associated with exchange rate volatility. As far, as the third country exchange rate volatility is concerned, it shows that almost 25 percent of export and import industries have been affected significantly by third country exchange rate uncertainty. More specifically, Industries like flooring, tapestries, food preparation, iron and steel bars, rods, angles, leather products, mineral manufacturing, textile fabrics, other electrical machinery and apparatuses, sugar and honey, are particularly sensitive to changes in Rupee–Yen volatility in terms of Indian exports to the US. Agricultural machinery, home appliances, iron and steel, power generation, and telecommunications equipment are some of the sectors that are most vulnerable to fluctuations in the Rupee–Yen value over the long term.

Industries that produce pig iron, spiegeleisen, and sponge iron, articles of paper, pulp, and paperboard, articles of rubber, n.e.s., crude vegetable materials, n.e.s., made-up made of wool and garment products, and mineral manufactures are all impacted by short-term fluctuations in the India-Japan exchange rate. However, in the long run, industries like manufacturing of metal, n.e.s., metalworking machinery, organic chemicals, and the production of crude vegetable materials, n.e.s., lime, cement, and manufactured building materials are significant industries that frequently tend to be impacted by changes in the volatility of the rupee and the yen.

Empirical results have important policy implications. First, compared to bilateral exchange rate volatility, third country exchange rate volatility is equally important for India–US trade flows. Secondly, compared to exports, imports have more chances to be affected by the exchange rate uncertainty. Third, exchange rate volatility tends to have a clear prediction regarding the variability of imports as exchange rate volatility negatively affects the imports. However, in the case of exports, exchange rate volatility creates uncertainty in the case of exports as exports can be affected positively and both negatively. Hence for India to maintain the momentum of export growth, the stability of the rupee is important not only in terms of the dollar but in terms of other currencies also. Furthermore, in the case of exports, mostly textile and electrical goods have the tendencies to be affected by exchange rate volatility, while in imports, the machinery and steel industry tends to be affected by the volatility of both bilateral and third country exchange rates. India which is a major player in the iron and steel industry is supposed to pay the price of exchange rate volatility in terms of uncertainty in trade in the steel industry.

Data availability

The dataused and analyzed during the current study are not attached but may be available upon request.

References

Acharya, S., & Chakraborty, S. (2019). Impact of demonetization on Indian economy and exchange rate volatility. Journal of Emerging Market Finance, 18(1), 80–97.

Anderson, J. E., & Van Wincoop, E. (2003). Gravity with gravitas: A solution to the border puzzle. The American Economic Review, 93(1), 170–192.

Bahmani-Oskooee, M., Harvey, H., & Hegerty, S. W. (2013a). The effects of exchange rate volatility on commodity trade between the U.S. and Brazil. The North American Journal of Economics and Finance, 25, 70–93.

Bahmani-Oskooee, M., & Hegerty, S. W. (2007). Exchange rate volatility and trade flows: A review article. Journal of Economic Studies, 34, 211–255.

Bahmani-Oskooee, M., Hegerty, S. W., & Xi, D. (2015). Third-country exchange rate and Japanese–US trade: evidence from industry-level data. Applied Economics, 48(16), 1452–1462.

Bahmani-Oskooee, M., Hegerty, S., & Xu, J. (2013b). Exchange-rate volatility and S. Hong Kong industry trade: Is there evidence of a “third country” effect? Economics, 45, 2629–2651.

Bahmani-Oskooee, M., & Latifa, N. (1992). Effects of exchange rate risk on exports: Cross country analysis. World Development, 20(8), 1173–1181.

Bahmani-Oskooee, M., & Bolhassani, M. (2014). How sensitive are Iran's bilateral trade flows to the value of Euro? Economic Research-Ekonomska Istraživanja, 27(1), 438–450.

Bahmani-Oskooee, M., & Hegerty, S. W. (2013). Exchange rate volatility and industry trade between the U.S. and Korea. Journal of Economic Studies, 40(2), 161–177.

Bahmani-Oskooee, M., et al. (2016). Nonlinear ARDL Approach and the J-Curve Phenomenon. Economic Research-Ekonomska Istraživanja, 29(1), 527–540.

Bahmani-Oskooee, M., & Xu, J. (2012). Exchange rate volatility and trade flows: New evidence from 22 major trading partners. Applied Economics Letters, 19(1), 23–29.

Bougheas, S., Demetriades, P. O., & Morgenroth, E. L. (1999). Infrastructure, transport costs and trade. Journal of International Economics, 47(1), 169–189.

Boz, E., Gopinath, G., & Plagborg-Møller, M. (2017). Global trade and the dollar (No. w23988). National Bureau of Economic Research.

Chowdhury, R. R. (2016). Impact of political events on exchange rate volatility: Evidence from India. Theoretical and Applied Economics, 23(1), 15–30.

Cushman, D. O. (1983). The effects of real exchange rate risk on international trade. Journal of International Economics, 15(1–2), 45–63.

Cushman, D. O. (1986). Has exchange risk depressed international trade? The impact of country exchange risk. Journal of International Money and Finance, 5(3), 361–379.

De Grauwe, P. (1988). Exchange rate variability and the slowdown in growth of international trade. Staff Papers (international Monetary Fund), 35(1), 63–84.

Dhakal, D. R., & Das, P. (2018). Exchange rate volatility and Nepal-India trade flows. International Journal of Development Issues, 17(2), 194–208.

Dhawan, A., & Singhal, S. (2014). Impact of global financial crisis on Indian economy: Evidence from exchange rate volatility and stock price. Indian Journal of Finance, 8(6), 42–54.

Djankov, S., Freund, C., & Pham, C. S. (2010). Trading on time. Review of Economics and Statistics, 92(1), 166–173.

Doroodian, K. (1999). Does exchange rate volatility deter international trade in countries? Journal of Asian Economics, 10, 465–474.

Faria, A. C., Maia, S. F., & Pinheiro, M. D. (2018). The impact of exchange rate volatility on Brazilian firms’ imported inputs prices. Journal of Economics and Finance, 42(1), 39–53. https://doi.org/10.1007/s12197-017-9407-9

Ghosh, A., & Nagesh Kumar, M. (2014). Capital flows and the Indian economy. Oxford University Press.

Gopinath, G., & Zwaanstra, J. (2017). Dollar dominance in trade: Facts and implications. In 33rd commencement day lecture organised by EXIM Bank of India, December, 21.

Goyal, A. (2020). Impact of COVID-19 on Indian economy: An analysis. Journal of Public Affairs, 20(4), e2269.

Goyal, A., & Sethi, M. (2021). Exchange rate volatility and capital flows: Evidence from India. Economic Modelling, 98, 416–425. https://doi.org/10.1016/j.econmod.2020.09.018

Gupta, R., et al. (2016). Impact of exchange rate volatility on trade flows: Evidence from India. Economic Modelling, 54, 184–194.

Hernandez, J., & Taningco, A. B. (2010). Behind-the-border determinants of bilateral trade flows in East Asia (No. 80). ARTNeT Working Paper Series.

Hoekman, B., & Nicita, A. (2008). Trade policy, trade costs and developing country trade. World Bank Policy Research Working Paper Series. No. 4797. Washington, DC: World Bank.

Hooy, C. W., & Choong, C. K. (2010). The impact of exchange rate volatility on world and intra-trade flows of SAARC countries. Indian Economic Review, 45, 67–86.

Jha, R. (2018). Trade and current account deficits in India: An empirical analysis. Journal of Quantitative Economics, 16(1), 195–216.

Kamble, G., & Honrao, P. (2014). Time-series analysis of exchange rate volatility of Indian Rupee/US dollar-an empirical investigation. Journal of International Economics, 5(2), 17.

Limo, N., & Venables, A. J. (2001). Infrastructure, geographical disadvantage, transport costs and trade. World Bank Economic Review, 15, 451–479.

Liu, W., & Niu, G. (2019). Exchange rate volatility and international competitiveness: Evidence from China. The North American Journal of Economics and Finance, 47, 439–448. https://doi.org/10.1016/j.najef.2018.12.006

McKenzie, M. D. (1999). The impact of exchange rate volatility on international trade flows. Journal of Economic Surveys, 13(1), 71–106.

Mohapatra, S., & Pattanaik, S. (2002). Exchange rate management in India. Reserve Bank of India Occasional Papers, 23(2), 125–146.

Mukherjee, S., & Chakraborty, D. (2017). Effect of RBI intervention in foreign exchange market on volatility of rupee exchange rate. Journal of Advances in Management Research, 14(1), 1–14.

Mukhtar, T., & Malik, S. J. (2010). Exchange rate volatility and export growth: Evidence from selected South Asian countries. SPOUDAI-Journal of Economics and Business, 60(3–4), 58–68.

O'Rourke, K. H., & Williamson, J. G. (1999). Globalization and history: The evolution of a nineteenth-century Atlantic economy. MIT Press.

Patnaik, I., & Shah, A. (2001). Volatility in the foreign exchange market: A study in selected currencies. Economic and Political Weekly, 36(35), 3307–3311.

Patnaik, I., & Sengupta, R. (2015). Dynamics of exchange rate regimes: A panel VAR approach. Journal of Macroeconomics, 46, 331–346.

Peree, E., & Steinherr, A. (1989). Exchange rate variability, controls, and the theory of firm: Empirical tests using French firm-level data. The Review of Economics and Statistics, 71(2), 307–311.

Pesaran, M. H., Shin, Y., & Smith, R. J. (2001). Bounds testing approaches to the analysis of level relationships. Journal of Applied Econometrics, 16(3), 289–326.

Portugal-Perez, A., & Wilson, J. S. (2012). Export performance and trade facilitation reform: Hard and soft infrastructure. World Development, 40(7), 1295–1307.

Rana, P. B., & Bhanumurthy, N. R. (2012). Exchange rate and trade balance relationship: A bivariate EGARCH approach for India. Empirical Economics, 42(3), 819–836.

Rashid, S. (2018). Impact of oil prices on India’s trade balance and exchange rate. Indian Journal of Economics and Development, 14(4), 701–709.

Sahoo, B. K. (2002). Exchange rate policy and management in India in the reform period. Reserve Bank of India Occasional Papers, 23(2), 91–124.

Sahu, D. (2012). Dynamics of currency futures trading and underlying exchange rate volatility in India. Dynamics (pembroke, Ont.), 3(7), 15–24.

Sauer, J. B., & Bohara, A. K. (2001). Exchange rate volatility and exports: Regional differences between developing and industrialized countries. Journal of Economic Development, 26(2), 89–106.

Sengupta, R., & Arora, P. (2014). Exchange rate pass-through to domestic prices: The case of India. Economic and Political Weekly, 49(16), 86–94.

Sengupta, R., & Mukherji, N. (2005). The Indian foreign exchange market: Recent developments and the road ahead. Reserve Bank of India Bulletin, 59(3), 211–236.

Shepherd, B., & Wilson, J. S. (2009). Trade facilitation in ASEAN member countries: Measuring progress and assessing priorities. Journal of Asian Economics, 20(4), 367–383.

Singh, R., & Patra, S. (2017). Exchange rate volatility and bilateral trade flows: Evidence from India and its major trading partners. Journal of Economic Studies, 44(1), 148–166.

Somogyi, F. (2021). Dollar dominance in FX trading. University of St. Gallen, School of Finance Research Paper, (2021/15).

Srinivasan, P., & Kalaivani, M. (2012). Exchange rate volatility and export growth in India: An empirical investigation. MPRA Paper, 43828.

Wilson, J. S., Mann, C. L., & Otsuki, T. (2003). Trade facilitation and economic development: A new approach to measuring the impact. World Bank Economic Review, 17(3), 367–373.

Funding

The authors have not disclosed any funding.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors have not disclosed any competing interests.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix: Data source and variables description

Appendix: Data source and variables description

1.1 Data source

The time series data on different variables for the period 1980–2020 have been obtained from three sources. (a) International Financial Statistics of IMF (b) The World Bank’s WITS system that obtains data from COMTRADE and (c) World Bank Development Indicators (Table

5).

1.2 Variables description

X for each ith industry represents the volume of Indian exports to the US. The data for this variable is taken in US dollars, from source (b). In the absence of an annual price level for each commodity, the trade value for each industry is deflated by the export unit value of India obtained from source (a). This procedure was followed by Bahmani-Oskooee et al. (2015).

M for each ith industry represents the volume of Indian imports from the US. The data for this variable is taken in US dollars, from source (b). In the absence of an annual price level for each commodity, the trade value for each industry is deflated by the import unit value of India obtained from source (a).

YI and YUS represent the annual real GDP of India and the US respectively. These two variables have been used as a proxy for the size of economic activities in each of these two countries. And the data for this variable has been taken from source (c).

RER is the notation used for the real bilateral exchange rate between the Indian rupee and the US dollar. This variable is described with the formula (PI* NE)/PUS where PI is Indian CPI, PUS is US CPI and NE is a bilateral exchange rate between the Indian rupee and US dollar defined as US dollar per Indian rupee. The data for the variables used in the construction of RER has been obtained from source (a) (Table

6).

VOLI−U is the notation used for the variable that captures the fluctuations in the real bilateral exchange rate between the Indian rupee and US dollar (RER). The exchange rate volatility in each year is the standard deviation of 12 monthly real exchange rates during that year. The monthly data on CPI and monthly exchange rates have been taken from source (a).

VOLU−J is the notation used for the variable that captures the fluctuations in the real bilateral exchange rate between the Japanese yen and the US dollar. While VOLI−J is the notation used for the variable that captures the fluctuations in the real bilateral exchange rate between the Indian rupee and Japanese yen. These two variables have been constructed with the same procedure as VOLI−U.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Iqbal, J., Nosheen, M. & Wohar, M. Exchange rate volatility and India–US commodity trade: evidence of the third country effect. Ind. Econ. Rev. 58 (Suppl 2), 359–398 (2023). https://doi.org/10.1007/s41775-023-00182-z

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s41775-023-00182-z