Abstract

Literature on New Economic Geography (NEG) highlights the importance of spatial concentration and spillover effects in economic growth or decline. Northeast China, as an old industrial base, is experiencing a regional decline since its transition to the post-industrial stage. Therefore, what is the main sectoral composition in Northeast China and how does this influence regional decline? To what extent do spatial spillovers play a role before and during the regional decline of Northeast China? Based on these questions, we investigated the spatial connections between regional decline and structural changes in Northeast China over three development periods: Rust Belt (1995–2002), revival (2002–2015), and decline (2015–2019). The recent exploratory space–time data analysis was employed on prefecture-level income and its structural change components (sectoral output and employment ratio). We found that the possible reason for the regional decline in Northeast China is premature deindustrialisation. Spatial co-decline in the employment of industry and construction, the primary source of regional decline, facilitates most of the space–time patterns of the regional income. Agglomeration of the agricultural sector has shifted to the north, while industry and construction have gravitated towards the middle and south, with no clear spatial patterns in the service sector. Dependence on natural resources has a "lock-in effect" that inhibits the transition from industry to services, so industry and construction remain the most efficient in Northeast China. Strengthening spatial connections is essential for local governments to develop service sectors and overcome declining conditions.

Similar content being viewed by others

1 Introduction

The northeast region of China has historically served as the foundation of the country’s industrial sector, characterised by its prominent secondaryFootnote 1 and heavy industries. Comparable to other renowned industrial centres such as the Ruhr region in Germany and Detroit in the United States, the three provinces in Northeast China have undergone a transformative and adjustive phase, commonly known as the "Rust Belt" phenomenon, followed by efforts towards economic revitalisation. Nevertheless, Northeast China is experiencing a full-scale economic deterioration, commonly referred to as regional decline, arising from constraints in conventional growth mechanisms resulting from extensive industrial restructuring and resource exhaustion (Yu et al. 2022; Huang et al. 2018).

Since the establishment of the People’s Republic of China in 1949, Northeast China has developed a comprehensive industrial system with a focus on manufacturing, petroleum, chemicals and steel. Nevertheless, it has lost its leading role in the economic development of the entire country since China’s open and reform policies in 1978. Furthermore, the 1997 reform of the state-owned enterprise (SOE) changed the central planned economy in China into a market-orientated one. It has led to dramatic structural change, mainly in the transformation of industrial enterprises (secondary industry). However, the single and overweight economic structure in the Northeast region cannot adapt to the decreasing proportion of secondary industry caused by this reform. Furthermore, the substantial proportion of resource-dependent cities further impedes industrial upgrading in the Northeast region (Hou et al. 2019). A large number of bankrupted state-owned enterprises and declining industrial production caused massive unemployment and social problems.

The regional decline in Northeast China can be observed in Fig. 1, which shows a comparison of the economic evolution between Northeast China and the national level. The average income in the northeast began to fall behind the national average level after SOE reform in the 1990 s. Since 2003, the central government has implemented a revitalisation strategy for the economic revival of the northeast region. It aims to optimise the economic structure, develop modern service sectors, and promote the transformation of resource-based cities (Attrill 2021). Although the economy continued to grow for several years until 2015, the gap between Northeast China and national GDP has been increasing. Since 2015, full-scale deterioration has begun, with the GDP of three provinces dramatically falling.

Regional growth in Northeast China is closely correlated with structural change, as depicted in Fig. 2, which illustrates the transition of the production ratios among different industries. Notably, there has been a general shift from the secondary industry to the tertiary industry (Hong et al. 2019). In 2015, when the full-scale decline began in Northeast China, the tertiary industry started to take the most significant proportion of production and dominate the economy. In other words, the real downturn occurred when the tertiary industry began dominating the economy in 2015, although SOE reform disrupted the stable economic structure and led to sticky unemployment after 1997.

From Figs. 1 and 2, three important phases of economic development in Northeast China can be concluded. In the first phase (1995–2002), during the implementation of the SOE reform, the GDP in the northeast continued its growth trend and was slightly above the national average, with the secondary industry dominating. In the second phase (2002–2015), when the revitalisation strategy was implemented, GDP in the northeast continued to increase but was increasingly below the national average, dominated by the secondary sector. In the third phase (2015–2019), before the COVID pandemic, GDP in Northeast China continued to decline and is well below the national average, with the tertiary industry dominating instead. This research will be conducted based on regional growth and structural change during these three periods.

Regional income in Northeast China presents a clear spatial pattern of "south-north divide" (Du et al. 2015). The coastal region in the south exhibits a geographical agglomeration of high-income cities, whereas the northern inland cities present low-income clusters. Hence, it can be deduced that spatial factors and geographical connections play a significant role in shaping regional growth and decline in Northeast China. Moreover, the dependence on natural resources is another factor that influences the pattern of agglomeration between regions. The economic gap between Northeast China’s resource-based and non-resource-based cities has existed for a long time (Huang et al. 2018).

A growing literature has paid attention to the uneven development and spatial dependence of economies and industries, with the emergence of the "new economic geography" literature following Krugman (1991). The study of regional growth is experiencing a renaissance, particularly in exploring processes specific to regional decline, including the joint consideration of agglomeration and growth (Breinlich et al. 2014). Mohanty and Bhanumurthy (2018) emphasised the significance of looking into the spatial distribution of outcome variables, such as per capita income, along with its potential determinants.

However, prior studies in Northeast China have identified the value of structural transformation as a component of economic growth, but have not elaborated on the geographical connections that underlie the economy-industry relationship. Most studies tend to capture structural change by examining the shift of resources or labour across various sectors, often overlooking the spatial dimension.

Therefore, what is the main structural composition in Northeast China and how does it contribute to regional decline? To what extent do spatial spillover effects play a role before and during the regional decline of Northeast China? To address these two questions, this paper employs an exploratory space–time technique, which goes beyond traditional regression analysis and spatial econometrics, to investigate and compare the spatio-temporal patterns of regional growth and the determinants of structural change.

Our findings show that the regional income distribution does not necessarily move independently in the Rust Belt and decline periods. Instead, there are indications of a range of synchronised movements observed among adjacent cities. Regarding the industrial decomposition of regional income, our findings indicate that the space–time distribution of regional income is primarily influenced by employment in the secondary industry. Finally, regarding spatially joint changes of employment share across sectors, the city labour employed in the primary industry in the northern province shows spatially joint growth, while the labour in the secondary industry agglomerated and increased relatively in the middle and southern provinces.

The conceptual framework of this paper is illustrated in Fig. 3. In the traditional economic growth theory, structural change is often associated with economic development or decline (Lewis et al. 1954). The growth of production within and between sectors measured by sectoral output and employment share has been emphasised (McMillan and Rodrik 2011; Rodrik 2014). According to the New Economic Geography, agglomeration economies and industries yield increasing returns to scale, labour migration, and spillover effects of production factors among adjacent regions (Krugman 1991). This dynamic results in the growth within agglomerated economies and decline in depopulated or resource-depleted regions (Yoon 2013). Spatial spillover is also a central concept in spatial data science. Therefore, New Economic Geography serves as a link between neoclassical growth theory and new spatial data science by introducing spatial dependence into this study (more discussion in Sect. 2). Our aim is to propose policies that utilise geographical connections to ensure balance across all sectors.

The rest of this paper is organised as follows. The second section provides a concise overview of the relevant literature on regional growth and structural change. Section 3 outlines the empirical methodology and sources of data used in this study. The results and discussion are presented in Sect. 4. Lastly, Sect. 5 provides conclusions.

2 Related literature

2.1 The nature of regional growth and decline

What explains the characteristics of regional growth and decline? It is no longer valid to base most of the discussion on the neoclassical growth model of regional economics (Breinlich et al. 2014). The main theories that explain the nature of regional growth and decline are neoclassical growth theory, endogenous growth theory, post-Fordism, social capital theory, export base theory, innovative milieus theory, learning regions theory, and New Economic Geography (NEG) theory (Armstrong 2002). Neoclassical growth theory predicts that under diminishing returns and a perfectly competitive market, regional per capita income will converge over time. On the other hand, endogenous growth theory, export base theory, post-Fordism, innovative milieus, and learning regions theory posit the increasing regional disparities. In endogenous growth theory, the divergence is attributed to factors such as human capital, technology, and externalities, which generate increasing returns. Industrialisation and the formation of industrial clusters are emphasised in other theories, except social capital theory, leading to increasing returns to scale for the region. Furthermore, the inter-regional mobility of production factors, trade, and technology transfers is crucial to explaining regional growth. Complementing these theories, the New Economic Geography (NEG) framework provides further insights into understanding regional growth dynamics and the formulation of effective policy interventions.

All of these theories attribute the regional growth process to a set of factors and their mobility, such as labour, capital, technological progress, human capital, and industrial clusters (Capello 2009). Space is of vital importance when interpreting the regional growth and decline processes, particularly in the context of New Economic Geography (NEG) models (Krugman 1991; Baldwin and Forslid 2000). These models provide an explanation for regional growth and decline through spatial concentration (agglomeration) or dispersion of economic activities. Agglomeration is observed in regions with lower transport costs, input prices, and spatial spillovers, such as externalities in the technological or labour market (Ottaviano and Thisse 2002; Nocco 2005; Fischer 2011). These agglomerated regions provide increased demand, income, connections between firms, higher wages, and greater employment opportunities, leading to cumulative growth and attracting additional companies and workers (Gardiner et al. 2011). On the contrary, high trade costs disperse economic and industrial activities and can cause the decline of certain regions due to migration (Puga 1999). The nature of global or local spatial spillovers can result in distinct distribution patterns among developed and developing regions (Le Gallo et al. 2003). Local spillovers can lead to clusters of rich and poor regions, while global spillovers can lead to a group of affluent regions. Additionally, the starting conditions of the regions play a role in the continued existence of observed spatial patterns throughout time. To date, there has been limited literature involved on the specific processes of regional decline. Therefore, there is huge potential to consider agglomeration and growth jointly as the forces that drive regional decline (Breinlich et al. 2014).

In recent decades, empirical studies have increasingly incorporated spatial spillover effects as essential components in the regional growth process (Rey and Montouri 1999; Ertur et al. 2006; Silveira-Neto and Azzoni 2006; Celebioglu and Dall’Erba 2010). These studies have highlighted the significance of the spillover effect existing in growth-enhancing elements of one region that extend their influence to neighbouring regions through mechanisms such as trade links, demand links, and the mobility of production factors. These spillover effects exhibit spatial boundaries and tend to decrease as the distance between regions increases (Capello 2009). Both local and global spatial spillovers in New Economic Geography models play a crucial role in shaping the diverse spatial patterns observed in regions. The empirical literature has identified two key patterns: spatial heterogeneity and spatial dependence. Spatial heterogeneity captures the variations in economic behaviour across space (Ertur and Le Gallo 2009), specifically emphasising the polarisation between rich and less prosperous regions. On the other hand, spatial dependence occurs when the growth dynamics in one location is influenced by the growth patterns observed in close locations (Wei and Ye 2009; LeSage 2015). Positive spatial autocorrelation gives rise to clusters of regions with similar growth rates, either developed or developing, while negative spatial autocorrelation results in clusters of regions characterised by diverse growth rates, encompassing both prosperous and less prosperous regions. Nevertheless, the spillover effects in the regional growth process are a wider concept that extends beyond the spillovers of the technological and labour market (Mohanty and Bhanumurthy 2018). Therefore, it is crucial to examine the spatial patterns of outcome variables such as per capita income and their possible determinants.

2.2 Drivers of structural change and regional growth in China

In the case of China, structural transformation is an essential determinant that accompanies regional growth in the empirical literature (Cheong and Wu 2014; Zhang and Diao 2020; Bekkers et al. 2021; Zhou et al. 2021). Specifically, in the old industrial base of Northeast China, industrial restructuring is considered a primary element of economic decline (Yu et al. 2022).

On the one hand, smooth reallocation of resources and labour across sectors is a key driver in sustainable and effective structural change (McMillan and Headey 2014; Gollin 2014). The misallocation of resources or premature deindustrialisation would result in underdevelopment and efficiency losses for the overall economy (Vollrath 2009; Rodrik 2016; Restuccia and Rogerson 2017; Andreoni and Tregenna 2018). In Northeast China, there is a consensus that deindustrialisation is premature, as the SOE reform failed to radically upgrade the economic structure. The secondary industry continues to dominate urban and economic development (Li 2015; Hou et al. 2019; Xu et al. 2020). To address this issue, empirical studies provided suggestions for the future direction of structural upgrading in Northeast China. In addition to developing clean energy to optimise resource consumption structure (Li 2015), another fundamental method is to introduce high-tech industries for manufacturing modernisation (Hou et al. 2019), changing the comparative advantages of light and heavy manufacturing to electronic and mechanical equipment (Bekkers et al. 2021). Furthermore, after moving into the upper middle income stage, highly qualified labour is the key factor to help escape the "Middle Income Trap", despite the "talent dividend" phenomenon in Northeast China (Yu et al. 2022).

On the other hand, the geographical foundation and spatial spillover effects are also essential drivers in industrial policy to propel industrial and regional development (Scott and Storper 2005; Capello 2009; Mendez 2020). According to Ren et al. (2020), the limited policy effects of Revitalisation Strategy are due to ignoring the spatial connectivity and heterogeneity, resulting in disparities in policy effects across northeastern cities and a significant threat to regional employment in secondary industry. Wang et al. (2021) found spatial dependence in the industrial structure of Chinese cities. Zhang et al. (2021) emphasised the spatial agglomeration of factors and found significant spatial dependence and heterogeneity in the transformation efficiency of resource-based cities in China.

Previous literature has examined the spatial patterns of income and determinants of structural change, primarily from a static perspective (Fei and Zhou 2009; Qi et al. 2013; Li et al. 2022). However, a notable study by Chen et al. (2023) takes a step further by investigating the spatial-temporal dynamics of per capita income along with determinant variables such as investment and human capital. This study sheds light on the importance of space in understanding regional economic dynamics. Based on Chen et al. (2023), this paper also uses the exploratory space–time data analysis (ESTDA) approach to study the spatio-temporal connections between regional income and structural change indicators (more discussion in Sect. 3).

In addition, dependence on natural resources is another key issue that hinders the efficiency of structural change in Northeast China (Guo et al. 2014; Tan et al. 2017; Huang et al. 2018; Hou et al. 2019). Regarding the industrial structure, Huang et al. (2018) noted that the secondary industry dominates the economy in mature and declining models and the tertiary industry in regenerating models.Footnote 2 Furthermore, Zhu and Lin (2022) provided new insights into the industrialisation of resource-based regions, indicating that resource dependence is an important reason why secondary industry dominates the industrial structure and has a locking effect on industrial transformation. To some extent, the market-orientated system can alleviate such a lock-in effect. Similarly, Xu et al. (2020) also noted that marketisation in Northeast China is still low, so it is difficult to fundamentally change the industrial structure.

Using a dataset on 36 prefecture-level cities for four time points that divide three time periods (1995, 2002, 2015, 2019), the paper fills the gaps in the current literature and provides a more dynamic understanding of the nature of regional decline in Northeast China. This study examines how the space–time patterns of regional growth outcomes, such as per capita income, are influenced by various factors of sectoral composition. Based on the study of Mohanty and Bhanumurthy (2018), this study adds a temporal dimension to the analysis of spatial characters of both outcomes and factors, using a new technique, exploratory space–time data analysis (ESTDA). ESTDA provides insights into how regional growth and decline are influenced by spatial and temporal relationships and variations across different regions, which goes beyond the average spatial effects and differs from the traditional statistical method of spatial regression (Miranti 2021). From a policy point of view, this study aims to understand the reason for the regional decline and disparities despite the revitalisation policies implemented over a long period. It suggests that maintaining and balancing regional development requires considering the spatial aspects of the growth process and taking into account the spatial characteristics of both the outcomes and the factors that drive growth.

Furthermore, previous studies have focused primarily on examining structural changes between sectors rather than across regions, and have not adequately addressed the geographical connections among neighbouring regions in relation to the economy–industry co-evolution. In contrast, this paper offers a comprehensive analysis of the economic and industrial aspects of Northeast China, considering both resource dependence and spatial dependence. By doing so, it addresses the gap in the existing literature and provides a more holistic understanding of regional dynamics.

3 Methodology and data

3.1 Directional LISA

To investigate the role of space in the evolution of the distributions of regional income and structural components, we follow the geovisualisation approach introduced by Rey et al. (2011), based on static spatial dependence studies (Romão and Saito 2017; Miranti 2021; Sarwar 2021; Kataoka 2022). Rey et al. (2011) established movement vectors by linking two periods of cross-sectional local indicators of spatial association (LISA) proposed by Anselin (1995). This approach is crucial to monitoring the coordinated evolution of cities and neighbours in the distribution dynamics of regional income. To calculate the LISA statistic for location i at time t, the equation is as follows:

where \(z_{i,t}\) represents the per capita income of economy i at time t (expressed as standard deviations from the mean) and \(w_{i,j}\) is a spatial weight matrix that expresses whether i and j are neighbours. This paper adopts the queen contiguity weight matrixFootnote 3, which is most commonly used in the literature of Northeast China (Zhang et al. 2019; Li et al. 2022).

In our context, we use the coordinates (\(r_{i,t}\), \(\sum _j w_{i,j} r_{j,t}\)), where \(r_{i, t}=y_{i, t}*n / \sum _{i=1}^n y_{i, t}\), and \(y_{i,t}\) is the per capita income of the region i during the period t. The x-axis reflects the income of city i or focal unit relative to the average income across all cities. The y-axis represents the income of the focal unit’s neighbouring cities relative to their respective averages.

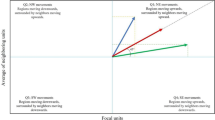

Each region has four different spatial associations, as shown in Fig. 4a. Observations in the first and third quadrants (Q-I and Q-III) have similar values within nearby regions. Specifically, regions with above-average income are surrounded by above-average income neighbours (High–High spatial clustering), or regions with below-average income are surrounded by comparably low-income neighbours (Low–Low spatial clustering). On the other hand, observations in the second and fourth quadrants (Q-II and Q-IV) are dissimilar to values within nearby regions, with Low–High or High-Low values, respectively. In other words, the first and third quadrants (Q-I and Q-III) describe positive spatial autocorrelation, while quadrants II and IV observe negative spatial autocorrelation.

Compared with the Static Moran Scatter Plot, the Dynamic Moran Scatter Plot in Fig. 4b provides a more comprehensive perspective of spatial dynamics. In the origin-standardised Dynamic Moran Scatter Plot setting, the observations in each quadrant are vectors reflecting movements from the origin to the final locations rather than points. From this novel and dynamic view, spatial associations entail the statistical relationship between a region and its neighbours regarding the movements within the income distribution over space and time. A Dynamic Moran Scatter Plot shows four different spatial association types, slightly different from the interpretation of Fig. 4a.

Quadrant I in Fig. 4b clusters spatially integrated moves within neighbourhoods, suggesting growing relative income in the distribution in both focal areas and neighbours, or positive co-movement. Quadrant II includes distinct observations shifting downward and neighbours moving upward. Quadrant III is a mirror of quadrant I, reflecting a deterioration of the relative income in each city and its neighbours in the distribution, or negative co-movement. Lastly, observations in the fourth quadrant (Q-IV) are distinct, representing regions shifting upward surrounded by neighbours moving downward.

According to Rey et al. (2011), statistical inference is based on this criterion:

where \(h_{i,t+k}\) represents the height of the actual movement vector (and direction) from the initial year t to the final year \(t+k\), and \(h_{ip,t+k}\) denotes the expected height (and direction) of the vectors under the null hypothesis of spatio-temporal independence based on random spatial permutations. In this context, the movements of focal regions and neighbours are due to spatial randomness under the null hypothesis.

3.2 Data and study area

To reflect regional and industrial development in China’s northeast, this paper studies seven main indicators from China City Statistical Year Book, which are annual real GDP (GDPpc), output ratio (GDPpri, GDPsec, GDPter) and employment share of different industries (EMPpri, EMPsec, EMPter) in 36 prefecture-level cities from 1995 to 2019.

The basic characteristics of these indicators in 1995, 2002, 2015, and 2019 are shown in Tables 4, 5 and 6 in Appendix B. Descriptive statistics from city-level data reflect a similar story to those at the provincial level in Figs. 1 and 2. We can see the full-scale recession from the decreasing mean value of GDP per capita since 2015 in Appendix B Table 4. Moreover, the mean values of the share of employment in the primary and secondary industries show a declining trend until 2019, while those of the tertiary industry continue to increase dramatically. Meanwhile, the median output ratio in the tertiary industry exceeded that of the secondary industry after 2015. The descriptive statistics in the table reflect a process in which the tertiary industry replaced the secondary industry and became the dominant industry in Northeast China.

According to the classification of The National Plan for the Sustainable Development of Resource-based Cities, 21 of 36 cities are resource dependent in Northeast China in total, including 1 growing model, 7 mature models, 9 declining models and 4 regenerating models, as reported in Table 3 of the appendix. We can also find the geographical locations of each resource-based city in a global context, as shown in Fig. 5. From the average income distribution from 2013 to 2019, disparities can be observed across different types of resource cities. There are red high-income outliers in mature and regenerating models like Daqing and Panjin, while most declining models have low-income levels in blue. Furthermore, the natural resource, to some extent, alters the clustering pattern of the south-north divide. For instance, the mature model of Daqing in the north stands out as a high-income outlier among low-income cities. This could be attributed to the challenges that resource-rich cities face in generating influence on their neighbouring regions. Thus, it becomes imperative to consider the factor of resource dependence when investigating spatial effects.

4 Results and discussion

4.1 Examination on regional income

In this section, we initially present and analyse the spatial and temporal changes in regional income dynamics during three periods: the Rust Belt, revival, and decline. Then we focus on industrial decomposition to find the industrial indicators that reflect the spatial co-movement observed in regional income.

To start with, Fig. 6 shows the static view of spatial dependence in four time points that divide the three episodes. Most cities are in the first and third quadrants in all four years. This distribution pattern indicates a positive spatial autocorrelation, implying that high-income cities tend to be surrounded by other high-income cities with positive effects, whereas low-income cities tend to cluster with other low-income cities with adverse effects. Take the example of Yingkou (city) in Fig. 6, a coastal city located in the south. In 1995, the relative income in Yingkou was lower than the national average. However, in the following three plots, it moved from the Low–High cluster to the High–High cluster with more substantial spatial autocorrelation because of the positive effects of neighbouring cities.

Besides, the degree of spatial autocorrelation increases as regional income increases. In 2015, we found a relatively strong spatial dependence as provincial average income peaked. Then, after stagnation, the spatial autocorrelation turned out to be relatively low in 2019, with more cities in the Low–Low cluster. The result partly matched the trend of global spatial autocorrelation during the revitalisation period in Northeast China observed in Fei and Zhou (2009). This phenomenon might indicate that significant economic growth could strengthen the correlations among nearby cities, this finding aligns with the conclusion drawn by Hu and Sun (2014), where the level of industrial development and the magnitude of economic volume are correlated to the extent of agglomeration. Finally, looking into the distribution of resource-dependent cities in 2015 and 2019,Footnote 4 3 of 4 regenerating models are in high-income clusters, while 6 of 9 declining models can be found in low-income clusters. One potential explanation for this phenomenon could be the significant role spatial dependence plays in driving development within both declining and regenerating models.

Although the static Moran Scatter plots provide general information on spatio-temporal dynamics, revealing the movements of specific regions with their neighbours may be challenging. In the dynamic Moran Scatter plot, these co-movements can be more comprehensively visualised. The transition of each city is depicted as a movement vector that illustrates the change from the initial to the final time, represented by an arrow pointing in a specific direction. In Fig. 7, the movement vectors are normalised at the origin to clearly show the magnitude and direction of movement. The vectors are origin standardised in this case, ensuring that the movement length and direction are preserved.

In the standardised plot, shifts to the first quadrant represent the upward co-movement of a city and its neighbours in the relative income distribution. On the other hand, movements towards the third quadrant represent joint movements of a city to a lower or downward position with its neighbours in a dynamic distribution. An inverse type of spatial heterogeneity is observed when movements occur towards the quadrants II and IV.

Before discussing the movements in the directional LISA plot, we now follow Rey et al. (2011) and perform inference by assessing whether the actual distributional patterns in each quadrant are not statistically different from the expected distributional values. The statistical significance of the actual directional LISA transitions is shown in Table 1. First, in the case of regional income, we can reject the null hypothesis of spatial randomness in the co-movements in the Rust Belt (1995–2002) and decline (2015–2019) episodes, which has been shown in Fig. 7.

In the Rust Belt period, only the movements in quadrant IV are statistically significant, which means that only space–time heterogeneity existed in the Rust Belt period. These negative spatial co-movements might imply a competition among neighbouring regions following the massive bankrupts of secondary industry enterprises in the SOE reform. In the decline period, we can observe the full-scale economic stagnation after 2015, from a spatio-temporal perspective. The dominant and significant movements in Q-III mean negative space–time integrated clusters, which indicates that most of the northeastern cities lost their income positions with their neighbours during the third period. In other words, the role of spatial dependence has contributed to the overall economic decline in Northeast China. There is no significant spatial movements in the revival period. This is consistent with the analysis in Ren et al. (2020), regarding the impact of the revitalisation strategy. The analysis indicated that the revitalisation policy overlooked spatial heterogeneity and hindered the achievement of synchronised growth across regions.

Finally, we observe the spatial evolution of regional income in resource-dependent cities from the second plot in Fig. 7. Similar to the conclusion from the static view of spatial autocorrelation, we can also see more apparent space–time patterns of the declining models in the directional LISA plot. From 2015 to 2019, 6 of 9 models experienced High–High movements with their neighbours, except Liaoyuan, Baishan, and Fushun. According to Tan et al. (2017), the pace of economic resilience varies among resource-based cities in different provinces. The space–time patterns of the same type of resource city are closely related to the province where they are located. For instance, all the declining models in Heilongjiang (North) province fell into the High-High movement clusters, whereas all cities in Jilin Province (Middle) moved to the Low-Low direction. Similar differences in provincial distribution can also be seen in the spatio-temporal patterns of mature models. All mature models in the Liaoning (southern) and Jilin (middle) provinces moved downward with their neighbours, whereas those in the northern province could not see the spatio-temporal regularity. These variations could imply the significance of movement in various spatial regimes, which we will discuss in the following section.

4.2 Disaggregated analysis and spatial mobility of structural determinants

In this section, we continue to investigate the industrial component that facilitates the space–time patterns of regional income and identify the spatial co-evolution across different regimes divided by provinces. From the statistical inference and distribution in Table 1, despite the lack of precise patterns of significance in certain quadrants, the movements in each quadrant and period that can be observed in the employment of secondary industry are mostly comparable to those found in the spatio-temporal dynamics of income.

The similarity of space–time patterns between GDP and secondary industry employment can be explained from three aspects. First, the dominant movements in Q-I and Q-III indicate the space–time integration for both indicators. Second, the absence of significant quadrants in the second period (2002–2015) for both GDP and secondary industry employment also confirmed the view of Ren et al. (2020). This viewpoint highlights the limitations of the revitalisation strategy, which neglected spatial connectivity and worsened the secondary industry employment. Third, similar and dominant Low-Low movement clusters during the decline period for GDP and secondary industry employment revealed that the secondary industry remains the principal industry that affects the trend of economy after taking into account the role of space (Li 2015; Hou et al. 2019; Xu et al. 2020). In other words, the deteriorating trend of secondary industry, as shown by the increasing and significant clusters of low-low mobility in labour share, may be the primary driver of the economic downturn after 2015, as Ren et al. (2020) mentioned.

Despite the similar distribution of movements for GDP and secondary industry employment, specific cities appear to move in relatively opposite directions in Figs. 7 and 8, especially for resource-based cities. Declining models with positive co-movements in regional income have now moved downwards with adjacent cities in the relative employment share of secondary industry, with significant spatial dependence. For instance, all the northern and middle declining models (located in Heilongjiang and Jilin provinces), including Yichun, Hegang, Shuangyashan, Qitaihe, Daxinganling, Liaoyuan, and Baishan, can be observed in quadrant III of Fig. 8b, with the significant result of spatial effects in Table 1. This implies the importance of geographical locations for the declining models in the northern and central regions. Consequently, the reduction in employment within the declining models of the secondary industry is interconnected across adjacent regions. Hence, it could be inferred that the spatial spillover effect plays a role in facilitating the transition of declining models away from the dependence on resources and the secondary industry (Zhang et al. 2021).

In comparison, regenerating models (3 of 4) tend to have increasing trends in the secondary industry labour force and are surrounded by neighbours with a higher share of secondary employment (Fig. 8), with non-significant spatial effects. However, the tertiary industry should generally dominate in regenerating models, which have removed the dependence on resources (Huang et al. 2018; Hou et al. 2019). One possible explanation is that the low marketisation of the tertiary industry and the lagging capacity have impeded the industrial transition in the regenerating cities of Northeast China, as confirmed by Xu et al. (2020) and Zhu and Lin (2022). Therefore, the smooth reallocation of labour from traditional to modern sectors is also a fundamental challenge for Northeast China in developing the tertiary industry, as Mendez (2020) proposed.

In the end, we present the spatio-temporal evolution of structural determinants across spatial regimes during the whole period 1995–2019. Figure 9 is the standardised dynamic LISA graph of three northeastern provincial spatial regimes, and Table 2 shows the results of statistical inference. For the primary industry, movements in all quadrants are statistically significant, with most movement vectors in Q-III, which means that Northeast China experienced a predominant joint reduction in the employment share of the primary industry. In the third quadrant of the Fig. 9 plot (a), movements in the south (blue) and middle (red) regimes take the most proportion of all observations in Q-III, whereas the movements in the north (green) region mainly accumulated in the first quadrant. For the secondary industry, both Fig. 9b and Table 2 display the opposite frequency distribution pattern with primary industry employment in Fig. 9 plot (a). The dominant and significant movements in Q1 suggests a relatively increasing co-evolution of secondary industry employment share. In the first quadrant of the Fig. 10 plot (b), movements in the south (blue) and middle (red) regimes are the majority of all observations in Q-I. Regarding the tertiary industry, statistical significance is solely observed in the space–time heterogeneous movements within Q4.

Above all, the results indicate the crucial role of space in driving the relative decline in primary industry employment and the relative increase in secondary industry employment in the Northeast. The advancement of the tertiary industry was not notably affected by spatial factors from 1995 to 2019. However, when examining the outcomes of tertiary industry employment in Table 1 with Table 2, there are only negative spatial co-movements for employment share with significant Q-II or Q-IV. This space–time heterogeneity could result from competitive relationships between focal regions and neighbouring areas. A likely explanation is the loss of high-quality labour to develop the tertiary industry, as Yu et al. (2022) mentioned.

The contrasting trends in employment co-movements within the primary and secondary industries from Fig. 9 could be attributed to two potential factors: shifts in employment distribution across sectors (McMillan and Headey 2014) and labour migration between regions (Capello 2009; Breinlich et al. 2014). In the first assumption, labour forces in the northern province tend to transition towards the agricultural sector. Conversely, there is an observable shift from the primary industry to the secondary industry in the southern and middle provinces. Alternatively, the second scenario proposes that labour engaged in the primary industry relocates from the south and middle provinces to the north. Conversely, labour within the secondary industry migrates from the north to the south and the middle regions. Both assumptions underscore the continued effectiveness and predominant role of the secondary industry within the northeast region (Li 2015; Hou et al. 2019; Xu et al. 2020). This pattern of industrial focus distribution aligns with the findings of the analysis on the stages of economic development in China, as discussed in Qi et al. (2013). Furthermore, this dynamic spatial labour transition pattern, whether across spatial boundaries or between sectors, has significant implications for balancing sectors. This pattern offers insights into the potential policy of fostering the development of the primary industry in the northern province, while simultaneously nurturing the agglomeration of the secondary industry in the southern and middle provincial regimes.

Collectively, these outcomes enable us to delve into the reasons underlying the regional decline in Northeast China. Our results can confirm that the secondary industry is still the most effective primary sector in Northeast China, as concluded in Li (2015), Hou et al. (2019), and Xu et al. (2020). First, combined the output ratio in Fig. 2 with the employment share shown in Fig. 10, it becomes evident that the secondary industry remains the most productive among the three sectors, which refers to the relatively higher production ratio with lower employment share. This observation persists even after 2015, when the tertiary industry’s output ratio started to dominate. Second, employment in the secondary industry mainly facilitates and reflects the space–time evolution of regional income, as shown in Table 1. Third, Table 2 displays the spatial co-decline in primary industry employment and the spatial co-increase in secondary industry employment, with no significant progress in the tertiary industry. The results of spatial regression between regional income and structural characteristics are shown as a robustness check in Table 7, Appendix D.

Therefore, our findings suggest that premature deindustrialisation from the secondary to tertiary industry might be the main structural reason for the regional decline in Northeast China. We can confirm that the SOE reform and revitalisation strategy improved the industrial structure in Northeast China in a limited way. They simply decreased secondary production and labour force manually (Yuen 2008; Ren et al. 2020). Possible factors for the unsmooth structural change include the regional lock-in effect due to dependence on natural resources (Tan et al. 2017; Huang et al. 2018; Hou et al. 2019; Xu et al. 2020), and the lack of spatial connectivity, especially for the tertiary industry. Strengthening geographical connections among regions could be essential to overcome the regional lock-in caused by resource dependence, and enhance the decline condition in the northeast region (Yoon 2013; Breinlich et al. 2014). The deindustrialisation process in China (excluding the northeast) and the northeast is shown in Fig. 12, Appendix F.

5 Concluding remarks

A wide range of economic-industry studies in Northeast China have focused on resource-dependent factors rather than spatially dependent factors. In an attempt to emphasise the geographical connections behind the relationship between regional growth and structural change before and during regional decline in Northeast China, this study utilised an advanced exploratory technique. We examined the evolution of regional income and industrial structure in 36 prefecture-level cities over 1995–2019, taking into account both resource and spatial dependence. Our results provide support for the correlation between regional decline and premature deindustrialisation based on the previous Northeast China literature. This unsuccessful transition could be attributed to regional lock-in due to resource dependence, coupled with limited spatial connectivity within the tertiary industry.

During the three periods of the Rust Belt (1995–2002), revival (2002–2015), and decline (2015–2019), our main results are threefold. First, for regional income, we observed significant spatial effects during the Rust Belt and decline periods. In all stages, the structural determinant of secondary industry employment shares the key features of spatio-temporal evolution with regional income in Northeast China. Specifically, we found space–time heterogeneity and spatial co-decline during the Rust Belt and the decline periods, respectively, with no significant spatial effects in the second period. Smooth reallocation of labour from the secondary to the tertiary industry could be the fundamental challenge confronted by Northeast China in the industrial transition.

Second, regarding resource-based cities, the spatial factor has particular significance for the central and northern declining models. It can potentially promote the transformation of these declining models, leading them away from resource dependence and the secondary industry. The regional lock-in caused by resource dependence inhibited the transition from industry to services, even in regenerating cities, due to low marketisation in Northeast China (Xu et al. 2020).

Finally, we explore the changes in employment share of different industries within three provincial regimes from 1995 to 2019. In general, the employment share of primary industry shows a joint decline across cities with their neighbours, whereas secondary industry increases significantly with neighbouring cities. The secondary industry is still effective and predominant within the northeast region. To some extent, our findings reflect the evolution of industrial focuses in different provincial regimes. The primary industry became relatively essential to the northern province, whereas the secondary industry has gravitated towards the centre and south. There is no clear trend for the tertiary industry employment. However, significant space–time heterogeneity during three periods (1995–2002, 2002–2015, 1995–2019) could suggest a competitive relationship among regions after the tertiary industry dominated the Northeast China economy.

Our findings also provide crucial implications for achieving sustainable economic and industrial development in Northeast China. The significantly increasing GDP during the revitalisation strategy indicates the importance of strengthening the vertical (scale) linkage with the central government. It is indispensable to get long-term policy support from the central government with effective vertical coordination of tasks. Moreover, horizontal (spatial spillover) linkage is an essential factor to break the lock-in effects of resource dependence so that promotes the industrial transition from the secondary to the tertiary industry. Local governments should play an indirect role in the further coordination of policy efforts to maximise the positive effect of spatial spillovers among regions (Mendez 2020). For a more comprehensive understanding of the solution to regional decline, it is imperative to involve further classified and detailed sector-specific data and critical factors such as technological progress and investment. However, such information is not accessible at the prefecture level in statistical data, which poses a significant limitation to this study. Therefore, we recommend further exploring satellite remote sensing data as a potential proxy for sectoral production or employment, enabling a more in-depth investigation.

Data availability

This study uses data from the Regional Economy database of China Stock Market & Accounting Research Database. The URL of the data source is: https://data.csmar.com/.

Notes

According to the classification made by the Chinese government: primary industry refers to the agriculture industry, including planting, forestry, animal husbandry and fishery; secondary industry refers to the industry and construction industry; tertiary industry refers to all other industries not included in primary or secondary industry.

The National Plan for Sustainable Development divides resource-based cities into four models according to different developing stages: (1) the growing cities where resource development is on the rise and the potential for resource security is high; (2) the mature cities: the core areas of China’s energy resource security, with a relatively stable stage of resource development; (3) the declining cities: key areas for accelerating the transformation of development in a context of depleted resources and lagging economic development; (4) the regenerating cities: largely freed from dependence on resources, are on the right track for economic and social development.

The construction of the queen contiguity spatial weight matrix is shown in Appendix E.

Because the classification of resource cities is based on the national plan document 2013–2020.

References

Andreoni A, Tregenna F (2018) Stuck in the middle: premature deindustrialisation and industrial policy, IDTT Working Paper 11/2018

Anselin L (1995) Local indicators of spatial association-LISA. Geogr Anal 27(2):93–115

Armstrong HW (2002) European union regional policy: reconciling the convergence and evaluation evidence. Regional convergence in the European Union: Facts, prospects and policies, pp 231–272

Attrill N (2021) Revitalising Northeast China: Rust Belt Politics and Policy Failures. PhD thesis, The Australian National University (Australia)

Baldwin RE, Forslid R (2000) The core-periphery model and endogenous growth: stabilizing and destabilizing integration. Economica 67(267):307–324

Bekkers E, Koopman RB, Rêgo CL (2021) Structural change in the Chinese economy and changing trade relations with the world. China Econ Rev 65:101573

Breinlich H, Ottaviano GI, Temple JR (2014) Regional growth and regional decline. Handbook of economic growth, vol 2. Elsevier, Amsterdam, pp 683–779

Capello R (2009) Space, growth and development. Handbook of regional growth and development theories. Edward Elgar Publishing, Cheltenham

Celebioglu F, Dall’Erba S (2010) Spatial disparities across the regions of Turkey: an exploratory spatial data analysis. Ann Reg Sci 45:379–400

Chen Y, Kpoviessi DO, Aginta H (2023) Investigating regional income convergence in China: an exploratory spatio-temporal perspective. Lett Spat Resour Sci 16(1):17

Cheong TS, Wu Y (2014) The impacts of structural transformation and industrial upgrading on regional inequality in China. China Econ Rev 31:339–350

Du H, Li W et al (2015) Spatial pattern evolution of economic growth in counties and districts of Northeastern China (东北地区县区经济增长空间格局演化). Geogr Res (地理研究) 12:2309–2319

Ertur C, Le Gallo J (2009) Regional growth and convergence: heterogeneous reaction versus interaction in spatial econometric approaches. Handbook of regional growth and development theories. Edward Elgar Publishing, Cheltenham

Ertur C, Le Gallo J, Baumont C (2006) The European regional convergence process, 1980–1995: do spatial regimes and spatial dependence matter? Int Reg Sci Rev 29(1):3–34

Fei L, Zhou C (2009) Spatial autocorrelation analysis on regional economic disparity of northeast economic region in China. Chin J Popul Resour Environ 7(2):27–31

Fischer MM (2011) A spatial Mankiw-Romer-Weil model: theory and evidence. Ann Reg Sci 47:419–436

Gardiner B, Martin R, Tyler P (2011) Does spatial agglomeration increase national growth? Some evidence from Europe. J Econ Geogr 11(6):979–1006

Gollin D (2014) The Lewis model: a 60-year retrospective. J Econ Perspect 28(3):71–88

Guo C, Luo L, Ye M (2014) Empirical analysis of factors influencing the sustainable development of resource-based cities (资源型城市可持续发展影响因素的实证分析). China Popul Resour Environ (中国人口·资源与环境) 24(8):81–89

Hong Y, Can P, Xiaona Y, Ruixue L (2019) Does change of industrial structure affect energy consumption structure: a study based on the perspective of energy grade calculation. Energy Explor Exploit 37(1):579–592

Hou G, Zou Z, Zhang T, Meng Y (2019) Analysis of the effect of industrial transformation of resource-based Cities in Northeast China. Economies 7(2):40

Hu A, Sun J (2014) Agglomeration economies and the match between manufacturing industries and cities in China. Reg Sci Policy Pract 6(4):315–327

Huang Y, Fang Y, Gu G, Liu J (2018) The evolution and differentiation of economic convergence of resource-based Cities in Northeast China. Chin Geogr Sci 28(3):495–504

Kataoka M (2022) Cyclical shocks and spatial association of Indonesia’s district-level per capita income. Asian Econ J 36(3):261–287

Krugman P (1991) Increasing returns and economic geography. J Polit Econ 99(3):483–499

Le Gallo J, Ertur C, Baumont C (2003) A spatial econometric analysis of convergence across European regions, 1980–1995. European regional growth, pp 99–129

LeSage J (2015) Spatial econometrics. Handbook of research methods and applications in economic geography. Edward Elgar Publishing, Cheltenham, pp 23–40

Lewis WA et al (1954) Economic development with unlimited supplies of labour. Manchester Sch 22(2):139–191

Li GZ (2015) The sustainable energy and economy development in Northeast China. Chem Eng Trans 46:883–888

Li W, Chen X, Wang Y (2022) Spatiotemporal patterns and influencing factors of industrial ecological efficiency in Northeast China. Sustainability 14(15):9691

McMillan M, Headey D (2014) Introduction–understanding structural transformation in Africa. World Dev 63:1–10

McMillan MS, Rodrik D (2011) Globalization, structural change and productivity growth. Technical report, National Bureau of Economic Research

Mendez C (2020) Promoting both industrial development and regional convergence: toward a regionally inclusive industrial policy. Designing integrated industrial policies, vol II. Routledge, Milton Park, p 21

Miranti RC (2021) Is regional poverty converging across Indonesian districts? A distribution dynamics and spatial econometric approach. Asia-Pacific J Reg Sci 5(3):851–883

Mohanty B, Bhanumurthy N (2018) Regional growth policy experience in India: the spatial dimension. Asia-Pacific J Reg Sci 2:479–505

Nocco A (2005) The rise and fall of regional inequalities with technological differences and knowledge spillovers. Reg Sci Urban Econ 35(5):542–569

Ottaviano GI, Thisse J-F (2002) Integration, agglomeration and the political economics of factor mobility. J Public Econ 83(3):429–456

Puga D (1999) The rise and fall of regional inequalities. Eur Econ Rev 43(2):303–334

Qi Y, Yang Y, Jin F (2013) China’s economic development stage and its spatio-temporal evolution: a prefectural-level analysis. J Geogr Sci 23(2):297–314

Ren W, Xue B, Yang J, Lu C (2020) Effects of the Northeast China revitalization strategy on regional economic growth and social development. Chi Geogr Sci 30(5):791–809

Restuccia D, Rogerson R (2017) The causes and costs of misallocation. J Econ Perspect 31(3):151–74

Rey SJ, Montouri BD (1999) US regional income convergence: a spatial econometric perspective. Reg Stud 33(2):143–156

Rey SJ, Murray AT, Anselin L (2011) Visualizing regional income distribution dynamics. Lett Spat Resour Sci 4(1):81–90

Rodrik D (2014) The past, present, and future of economic growth. Challenge 57(3):5–39

Rodrik D (2016) Premature deindustrialization. J Econ Growth 21:1–33

Romão J, Saito H (2017) A spatial analysis on the determinants of tourism performance in Japanese Prefectures. Asia-Pacific J Reg Sci 1:243–264

Sarwar A (2021) Mapping out regional disparities of reproductive health care services (RHCS) across Pakistan: an exploratory spatial approach. Asia-Pacific J Reg Sci 5(3):825–849

Scott AJ, Storper M (2005) Industrialization and regional development. Pathways to industrialization and regional development. Routledge, Milton Park, pp 15–28

Silveira-Neto R, Azzoni CR (2006) Location and regional income disparity dynamics: the Brazilian case. Papers Reg Sci 85(4):599–613

Tan J, Zhang P, Lo K, Li J, Liu S (2017) Conceptualizing and measuring economic resilience of resource-based cities: case study of Northeast China. Chin Geogr Sci 27(3):471–481

Vollrath D (2009) How important are dual economy effects for aggregate productivity? J Dev Econ 88(2):325–334

Wang D, Ren C, Zhou T (2021) Understanding the impact of land finance on industrial structure change in China: insights from a spatial econometric analysis. Land Use Policy 103:105323

Wei YD, Ye X (2009) Beyond convergence: space, scale, and regional inequality in China. Tijdschrift voor economische en sociale geografie 100(1):59–80

Xu J, Zhao J, Zhang H, Guo X (2020) Evolution of the process of urban spatial and temporal patterns and its influencing factors in northeast China. J Urban Plan Dev 146(4):05020017

Yoon C (2013) The decline of the Rust Belt: A dynamic spatial equilibrium. University of Pennsylvania

Yu T, Rong A, Hao F (2022) Avoiding the middle-income trap: the spatial-temporal effects of human capital on regional economic growth in Northeast China. Growth Change. 53:536

Yuen CYL (2008) Regional economies and potentials of Northeast China. J Int Trade Law Policy 7(1):27–45

Zhang Y, Diao X (2020) The changing role of agriculture with economic structural change-the case of China. China Econ Rev 62:101504

Zhang K, Xu D, Li S (2019) The impact of environmental regulation on environmental pollution in China: an empirical study based on the synergistic effect of industrial agglomeration. Environ Sci Pollut Res 26(25):25775–25788

Zhang Y, Zhao F, Zhang J, Wang Z (2021) Fluctuation in the transformation of economic development and the coupling mechanism with the environmental quality of resource-based cities-a case study of Northeast China. Resour Policy 72:102128

Zhou X, Cai Z, Tan KH, Zhang L, Du J, Song M (2021) Technological innovation and structural change for economic development in China as an emerging market. Technol Forecast Social Change 167:120671

Zhu J, Lin B (2022) Resource dependence, market-oriented reform, and industrial transformation: empirical evidence from Chinese cities. Resour Policy 78:102914

Acknowledgements

I owe special thanks to Prof. Carlos Mendez for the guidance on this project. Useful comments and suggestions on an earlier draft from anonymous referees and the editor are gratefully acknowledged. The author is a recipient of “Interdisciplinary Frontier Next-Generation Researcher Program of the Tokai Higher Education and Research System.”

Funding

Open Access funding provided by Nagoya University. This article is funded by JST SPRING (Japan Science and Technology Agency Support for Pioneering Research Initiated by the Next Generation), Grant Number JPMJSP2125.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The author has no competing interests to declare that are relevant to the content of this article. This study meets ethical standards.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix

Appendix A: The list of resource-based cities

See Table 3 here.

Appendix B: Descriptive statistics of regional income, output and employment share of each industry

Appendix C: The evolution of employment share of each industry

See Fig. 10 here.

Appendix D: Spatial regression between regional income and structural components

See Table 7 here.

Appendix E: Construction of the spatial weight matrix

See Fig. 11 here.

In spatial analysis, the spatial weight matrix is used to reflect the degree of interconnection among objects within a spatial dataset. Contiguity is one approach to defining the proximity between a target object and its spatial counterparts. In Northeast China, all cities are connected by land, with no islands separated by water bodies. In such a context, a contiguity weight matrix is typically employed. This matrix ensures that every object is linked to at least one neighbour. Queen contiguity is one of the contiguity conceptualisation methods. This method considers polygons that share borders or corners as neighbours to the target object. In the weight matrix, each row (and column) represents a geographic unit, and each cell represents the relationship between two units. If two units are neighbours according to the definition of queen contiguity, the value of the corresponding cell will be 1, otherwise it will be 0. In this study, we scale the spatial weights between 0 and 1 using row standardisation. Figure 11 is a visualisation of spatial connectivity across northeastern cities based on the queen contiguity weight matrix.

Appendix F: Deindustrialisation process in China (excluding the northeast) and the northeast

See Fig. 12 here.

Rights and permissions

This article is published under an open access license. Please check the 'Copyright Information' section either on this page or in the PDF for details of this license and what re-use is permitted. If your intended use exceeds what is permitted by the license or if you are unable to locate the licence and re-use information, please contact the Rights and Permissions team.

About this article

Cite this article

Chen, Y. Regional decline and structural changes in Northeast China: an exploratory space–time approach. Asia-Pac J Reg Sci (2024). https://doi.org/10.1007/s41685-023-00328-0

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s41685-023-00328-0

Keywords

- Regional decline

- Structural change

- ESTDA (exploratory space–time data analysis)

- Resource dependence

- Northeast China