Abstract

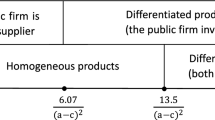

This paper examines the endogenous operational objectives of firms in a Cournot duopoly under the consideration of vertical product differentiation. We consider a three-stage game, where the owners of the duopoly simultaneously decide the operational objectives of their managers to be profit maximization or revenue maximization at the first stage, and then, based on the objectives, the managers simultaneously choose the quality of their products at the second stage, and compete in quantities at the final stage. The equilibrium results show that, for high heterogeneity of consumers’ quality tastes or restrictive quality improving technology, both firms choose to maximize revenues and produce goods with identical quality. For low heterogeneity of consumers’ quality tastes or superior quality improving technology, both firms choose to maximize profits and produce different quality. For the intermediate level of the heterogeneity of quality tastes and quality improving technology, both firms choose different objectives, and the firm maximizing revenues provides a high-quality product, while the firm maximizing profits provides a low-quality one.

Similar content being viewed by others

Notes

Tabeta and Wang (1996a, b) discovered that, in the international automobile market, American and Japanese automobile manufacturers adopt different operational strategies in competition: Japanese firms prefer “revenue maximization”, while American firms prefer the operational objective of “profit maximization”.

Tirole (1988) shows that a pioneer offers the higher-quality product and earns more profits. By contrast, in Jing (2006) and Amaldoss and Shin (2011), they show that a firm may produce a lower-quality product if its relative cost efficiency is higher, and if the size of the low-end market is moderately large, respectively.

The parameter range ensures the equilibrium demand and profits are nonnegative, which will be explained later.

This setting implies an assumption of an uncovered market. Under the condition that one consumer can only purchase at most one unit of product, the demand for gross products in an uncovered market will be less than the total population of consumers, hence, some consumers will choose not to consume.

From the perspective of management authorization, operational objectives are chosen as the contracts between firm owners and managers, which are connected with the managers’ salaries and their operational objectives. The objective function of an incentive contract between owners and managers is normally linear combination of profits and revenues \(w = \alpha \pi + \left( {1 - \alpha } \right)R\), where w is salary, \(\pi\) and \(R\) are firms’ profits and revenues, and \(\alpha\) is the decision-making parameter. \(\alpha = 0\) means owners require managers to pursue revenue maximization, and \(\alpha = 1\) means owners require managers to pursue profit maximization. Moreover, due to the complexity of endogenous product quality, following the settings of Fershtman (1985), Blinder (1993), Mavrommati (2012), Rtischev (2012) and Lin and Sun (2013), this paper only consider the binary choices of the objectives of “profit maximization” and “revenue maximization”.

Because \(\overline{s} \ge s_{1} \ge s_{2} > 0\) and \(1.5 \le \overline{\theta } /\overline{s} \le 2.2\), we obtain \(\left[ {2s_{1}^{2} - s_{2}^{2} + 2\left( {s_{2} - 2s_{1} } \right)\overline{\theta } } \right] < 0\) and \(\left[ {24s_{1}^{3} - 10s_{1}^{2} s_{2} + 4s_{1} s_{2}^{2} + s_{2}^{3} - 2\left( {8s_{1}^{2} - 2s_{1} s_{2} + s_{2}^{2} } \right)\overline{\theta } } \right] < 0\).

Note that Motta (1993) did not consider the possible impact of quality improving technology restrictions on product quality. Upon bringing in quality improving technology restrictions, we show that, the product quality of both high-quality and low-quality firms will be impacted by the upper limit of quality as shown in Table 1.

References

Amaldoss W, Shin W (2011) Competing for low-end markets. Marketing Sci 30:776–788

Blinder AS (1993) A simple note on the Japanese firm. J Japanese Int Econ 7:238–255

Chambers C, Kouvelis P, Semple J (2006) Quality-based competition, profitability, and variable costs’. Manage Sci 52:1884–1895

Fershtman C (1985) Internal organizations and managerial incentives as strategic variables in competitive environment. Int J Ind Organ 3:245–253

Fershtman C, Judd KL (1987) Equilibrium incentives in oligopoly. Am Econ Rev 77:927–940

Heifetz A, Shannon C, Spiegel Y (2007) What to maximize if you must. J Econ Theory 133:31–57

Jing B (2006) On the profitability of firms in a differentiated industry. Marketing Sci 25:248–259

Lin R-Y, Sun C-H (2013) Endogenous objective and quantity competition in an oligopoly model. Soochow J Econ Bus 80:1–25

Mavrommati A (2012) A Stackelberg duopoly with binary choices of objective. Econ Bull 32:843–853

Motta M (1993) Endogenous quality choice: price vs. quantity competition. J Ind Econ 41:113–131

Rtischev D (2012) Strategic commitment to pursue a goal other than profit in a Cournot duopoly. Gakushuin Econ Pap 49:133–142

Tabeta N, Wang R (1996a) Relative revenue-maximizing strategy under Cournot duopolistic competition: the case of US–Japan bilateral auto-trade. Working paper series (Nanyang Technological University, School of Accountancy and Business, SABRE Centre, Singapore), no 8–96. http://malcat.uum.edu.my/kip/Record/utm.u419471

Tabeta N, Wang R (1996b) Who will be the winner when a profit-maximizer meets a revenue-maximizer? The case of US–Japan auto trade. Working paper series (Nanyang Technological University, School of Accountancy and Business, SABRE Centre, Singapore), no. 19–96. http://malcat.uum.edu.my/kip/Record/utm.u450156

Tirole J (1988) The theory of industrial organization, Cambridge. MIT Press, Cambridge, pp 96–106

Vickers J (1985) Delegation and the theory of the firm. Econ J 95:138–147

Wauthy X (1996) Quality choice in models of vertical differentiation. J Ind Econ 44:345–353

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

We would like to express gratitude to Wen-jung Liang, Chia-hung Sun, Cheng-hau Peng, and Chin-sheng Chen for their helpful suggestions to the draft of the manuscript. Also, we appreciate the valuable comments from participants of the 2014 Joint Conference of the Taiwan Economic Association and the Taiwan Association of Efficiency and Productivity.

Appendix 1

Appendix 1

The profits of firms in each case can be written as:

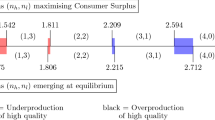

Assume \(k = \frac{{\overline{\theta } }}{{\overline{s} }}\), where \(1.5 < k < 2.2\). Then, substituting the above into (7)–(12), the equilibrium can be derived as follows.

The condition for Case (PP) to be the equilibrium:

where \(\varPi_{1}^{\text{PP}} - \varPi_{1}^{\text{RP}} > 0\) if \(1.5 < k < 1.529\):

where \(\varPi_{2}^{\text{PP}} - \varPi_{2}^{\text{PR}} > 0\) if \(1.5 < k < 1.531\).

Accordingly, Case (PP) is the equilibrium if \(1.5 < k < 1.529\).

The condition for Case (RP) to be the equilibrium.

Because \(\varPi_{1}^{\text{RP}} - \varPi_{1}^{\text{PP}} = - \left( {\varPi_{1}^{\text{PP}} - \varPi_{1}^{\text{RP}} } \right)\), we may obtain \(\varPi_{1}^{\text{RP}} - \varPi_{1}^{\text{PP}} > 0\) when \(1.529 < k < 2.2\). Besides, no deviation condition for Firm 2 is written as:

where \(\varPi_{2}^{\text{RP}} - \varPi_{2}^{\text{RR}} > 0\) if \(1.5 < k < 2.031\).

Accordingly, Case (RP) is the equilibrium, if \(1.529 < k < 2.031\).

The condition for Case (PR) to be the equilibrium.

Because of \(\varPi_{1}^{\text{PR}} - \varPi_{1}^{\text{RR}} = \varPi_{2}^{\text{RP}} - \varPi_{2}^{\text{RR}}\) and \(\varPi_{2}^{\text{PR}} - \varPi_{2}^{\text{PP}} = \varPi_{1}^{\text{RP}} - \varPi_{1}^{\text{PP}}\), the condition of Case (PR) to be the SPNE is the same with that of Case (RP): \(1.529 < k < 2.031\).

The condition for Case (RR) to be the equilibrium.

First, \(\varPi_{1}^{\text{RR}} - \varPi_{1}^{\text{PR}} = \frac{{\left( { - 2 + k} \right)\overline{s}^{2} }}{18k} > 0\), where \(\varPi_{1}^{\text{RR}} - \varPi_{1}^{\text{PR}} > 0\) if \(2 < k < 2.2\).

Besides, since \(\varPi_{2}^{\text{RR}} - \varPi_{2}^{\text{RP}} = - \left( {\varPi_{2}^{\text{RP}} - \varPi_{2}^{\text{RR}} } \right)\), we obtain \(\varPi_{2}^{\text{RR}} - \varPi_{2}^{\text{RP}} > 0\) if \(2.031 < k < 2.2\).

Accordingly, Case (RR) is the equilibrium if \(2.031 < k < 2.2\).

About this article

Cite this article

Cheng, YL., Kao, HH. Product quality and endogenous firm objectives. Asia-Pac J Reg Sci 3, 813–830 (2019). https://doi.org/10.1007/s41685-019-00122-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s41685-019-00122-x

Keywords

- Vertical product differentiation

- Quality

- Endogenous objectives

- Revenue maximization

- Quantity competition