Abstract

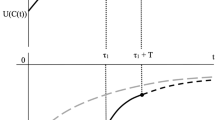

Restoration investment after an earthquake and tsunami can improve regional production, but effects of investment emerge differently in production, investment and consumption. Conventional economic models cannot reproduce such chronological nonconformity among economic indices. This study aims to analyze whether the dynamic stochastic general equilibrium (DSGE) model can duplicate the chronological restoration path and nonconformity, and quantifies the efficiency of the restoration measures, such as restoration investment with fund transfer and rebuilding subsidy, in the Iwate coastal region, where the east Japan earthquake hit. The analytical results are as follows: (1) consumption after the earthquake follows a hump-shaped path, where peak point of consumption was delayed from production peak, but then recovered; (2) private investment and labor demand decrease by more than self-restoration does when the restoration measures end; and (3) restoration investment with fund transfer and rebuilding subsidy improves the economy by accelerating the reconstruction of damaged capital stocks, and the benefits of these two measures outweigh their respective costs. These findings show that the influence of an unforeseen and disastrous earthquake can be explained well by the forward-looking decisions on consumption and savings (equal to investment) endogenizing in the DSGE model.

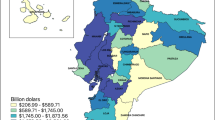

Source: Regional accounts on residents by city (Iwate Prefectural Government)

Similar content being viewed by others

Notes

Earthquake disasters occur with very low probability. Thus, it may be suitable to assume the occurrence probability of an earthquake disaster follows a Poisson distribution or a Power distribution. Numerical algorithm to treat Poisson uncertainty in DSGE model was proposed (Posch and Trimborn 2013), but transition process of the rare event itself is nothing to do with occurrence probability of the events. In our model, the post-simulation is conducted using the impulse response method, which inputs a one-time shock at the first period. Hence, the frequency of earthquake occurrence is not thought to be a matter in this simulation, even though this model assumes normal distribution for the earthquake.

To solve the model, Dynare ver. 4.4.3 (Juillard 1996) was used. Initial values are set as actual values to tell the effective starting points of iteration to this software, though the steady-state values of endogenous variables were calculated as letting the total factor productivity equal one.

When total damage of private capital stocks was supposed to be 1/3 of the total assets (lest of them was the private houses and public capital stocks) and was 5.6 trillion yen (= 16.9 trillion yen/3), such damage value accounts for about 5% of total private capital stocks in disaster prefectures (Aomori, Iwate, Miyagi, Fukushima and Ibaraki) (JIP database), which was 1.65 (= 0.05/0.03) times higher than the normal rate.

Based on JIP database, total factor productivity (TFP) decreased in whole country by about 2.5% (average of all industries). Since gross regional production (GRP) of disaster areas was about 7% of total Japanese GDP and half of such decrease might be caused by the damage of nuclear power plant, a decrease in TFP by the earthquake and tsunami of these disaster areas is supposed to be 20% (≒ 2.5/2/0.07).

References

Development Bank of Japan (2011) Influence of big earthquake on regional economies: case study on Hanshin–Awaji big earthquake. http://www.dbj.jp/pdf/investigate/area/kansai/pdf_all/kansai1112_01.pdf. Accessed 19 Oct 2016 (in Japanese)

Dixit A, Stiglitz J (1977) Monopolistic competition and optimum product diversity. Ame Econ Rev 67(3):297–308

Doi T (2010) Dynamic analysis on benefit incident of corporation tax. RIETI discussion paper series: 01-J-034 (in Japanese)

Eguchi M (2011) An analysis on fiscal policy by using dynamic general equilibrium model. The Mitsubishi Economic Research Institute, Tokyo (in Japanese)

Feehan J, Batina R (2007) Labor and capital taxation with public inputs as common property. Public Financ Rev 35:626–642

Government Office of Japan (2012) For development of creativity from reconstruction of Japanese economy. Annual report on the Japanese economy and public finance 2012. http://www5.cao.go.jp/j-j/wp/wp-je12/index_pdf.html. Accessed 19 Oct 2016 (in Japanese)

Hayashida M, Hamagata S, Nakano K, Hitomi K, Hoshino Y (2011) About macro economic influences of east Japan big earthquake: Trial calculation by macro-econometric model developed by CRIEPI. Discussion paper of the Central Research Institute of Electric Power Industry, SERC11024 (in Japanese)

Hayashida M, Ohno H, Yasuoka T (2014) An analysis on economic impacts of tax increase on Japanese economy by using DSGE model. The University of Kitakyushu working paper series, No. 2013–5 (in Japanese)

Iwata, Y. (2009) Fiscal Policy in an Estimated DSGE Model of the Japanese Economy: Do Non Ricardian Households Explain All?, ESRI Discussion Paper Series, 216

Juillard M (1996) Dynare: a program for the resolution and simulation of dynamic models with forward variables through the use of a relaxation algorithm. CEPREMAP working papers 9602, CEPREMAP

Keen DB, Pakko RM (2007) Monetary policy and natural disaster in a DSGE model. Federal Reserve Bank of St. Louis. Working paper series, 2007-025D

King RG, Plosser C, Rebelo S (1988) Production, growth and business cycles. J Monet Econ 21(2–3):195–232

Nakano S (2011) Trial calculation of macro-economic impacts of east Japan big earthquake on labor market. Special column of Japan Institute for Labor Policy and Training. http://www.jil.go.jp/tokusyu/sinsai/column/04_nakano.pdf. Accessed 19 Oct 2016 (in Japanese)

Okiyama M, Tokunaga S, Akune Y (2014) An analysis on influences of recovery fund and policy after earthquake on regional economy: application of two region CGE model. In: Tokunaga S and Okiyama M (eds) Model analysis on recovery and renewal of regional economy after big earthquake. Bunshin do, Tokyo (in Japanese)

Posch O, Trimborn T (2013) Numerical solution of dynamic equilibrium models under Poisson uncertainty. J Econ Dyn Control 37(12):2602–2622

Sakuragawa M, Hosono K (2011) Fiscal sustainability in Japan. J Jpn Int Econ 25(4):434–446

Shen WY (2015) News, disaster risk, and time-varying uncertainty. J Econ Dyn Control 51:459–479

Todo Y, Nakajima K, Matous P (2015) How do supply chain networks affect the resilience of firms to natural disasters? Evidence from the Great East Japan earthquake. J Reg Sci 55(2):209–229

Torres LJ (2013) Introduction to dynamic macroeconomic general equilibrium models. Vernon Press, Delaware

Wakasugi R, Tanaka A (2013) Causative factors on recovery periods from earthquake disaster: an empirical analysis of manufacturing sector in Tohoku region. RIETI discussion paper series 13-J-002 (in Japanese)

Xie TJ, Liu JT, Alba JD, Chia WM (2014) Does wage-inflation targeting complement foreign exchange intervention? An evaluation of a multi-target, two-instrument monetary policy framework. Econ Model 62:68–81

Acknowledgements

This study was supported by the Grant-in-Aid for Scientific Research 16H04991 and 16KT0036 (Ministry of Education, Science, Sports and Culture) and Council for Science, Technology and Innovation, Cross-ministerial Strategic Innovation Promotion Program (SIP), Infrastructure Maintenance, Renovation, and Management. The authors greatly appreciate their support.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

This section explains how to derive the equations relating to the production sector under monopolistic competition. These explanations are based on Torres (2013). Similar documents can be found in Eguchi (2011).

The final good is produced by a representative firm by aggregating the continuing of intermediate goods. This firm maximizes profits, Π, subject to the production function:

where Y t and Y j,t are the final good production and intermediate goods production, respectively, differentiated by j at time t; P t and P j,t are the price of the composite final good and the prices of intermediate goods, respectively; and ξ(> 1) is the elasticity of substitution across intermediate goods. This method used to aggregate the intermediate goods is the Dixit–Stiglitz aggregator.

The first-order condition derives the following equation:

Each intermediate good j is assumed to be produced by only one firm, and optimizes production costs, as:

where Φ are fixed costs and assumed to be constant. The first-order conditions of the above problems derive the following equations:

where λ t shows the Lagrange parameter and represents the shadow price of a change in the ratio of the use of capital and labor services.

The monopolistic firm determines the optimal price for the intermediate good they produce. The profit maximization problem to be solved is:

Using Eqs. (8), (10), and (11), the above maximization problem can be defined as

The conditions \( \frac{{\partial \pi_{j,t} }}{{\partial P_{j,t} }} = 0 \) derive the following relation as:

In the steady state, the price of final good, P t , corresponds to the prices of the intermediate goods, P j,t . If all intermediate firms are assumed identical, the following equation is obtained:

Hence, the wage rate and rental rate under the monopolistic situation in intermediate production is given as:

These equations are used for the model as Eqs. (M1) and (M2).

About this article

Cite this article

Kunimitsu, Y. Effects of restoration measures from the east Japan earthquake in the Iwate coastal area: application of a DSGE model. Asia-Pac J Reg Sci 2, 317–335 (2018). https://doi.org/10.1007/s41685-017-0055-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s41685-017-0055-z

Keywords

- Restoration investment

- Fund transfer

- Rebuilding subsidy

- Chronological nonconformity between production and consumption

- Cost–benefit ratio