Abstract

Background

Healthcare sustainability is a global challenge. Various value-driven healthcare strategies have been implemented by Singapore’s national health technology assessment (HTA) agency, the Agency for Care Effectiveness (ACE). Considering the high and growing expenditure on biologics, strategies have been implemented to drive the use of biosimilars. As Singapore has reached the 5-year mark since the subsidy listing of the first monoclonal antibody biosimilar infliximab, this review aimed to evaluate the impact of these strategies on the changes in adoption rates, utilisation, spending and cost savings for biosimilars in the public healthcare sector.

Methods

A retrospective cross-sectional study was conducted using aggregated drug utilisation data from all public healthcare institutions. Five monoclonal antibodies with biosimilars, namely infliximab, adalimumab, trastuzumab, rituximab and bevacizumab, were included in this study. The outcomes evaluated were the monthly trends for utilisation volume, proportion attributed to biosimilar use, and drug spending up to December 2022. The simulated cost savings associated with biosimilar adoption were also reported.

Results

After subsidy implementation, an upward trend in biosimilar use and proportion attributed to biosimilar adoption was observed, while spending reduced substantially. The adoption rate of most biosimilars reached more than 95% within 1 year of listing. Drugs with more than one approved biosimilar brand at the time of subsidy listing reported substantial price reductions of over 80%. Overall, spending for the five monoclonal antibodies have significantly reduced after biosimilar subsidy listing, with an estimated cumulative cost savings of $136 million over 5 years.

Conclusion

Value-driven healthcare strategies implemented in Singapore’s public healthcare institutions have contributed to high adoption rates of biosimilars and have improved affordable access through lower treatment costs. This in turn has led to significant cost savings to the healthcare system.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Following subsidy listing, the utilisation of biosimilars increased steeply, and spending on monoclonal antibodies significantly declined within 1 year in Singapore’s public healthcare institutions. Substantial cost savings of $136 million to the healthcare system have been achieved over 5 years. |

The high adoption rate of biosimilars hinges on disinvestment from non-cost-effective reference biological products (RBPs), i.e. delisting of RBPs from subsidy listing and encouraging the use of lower cost alternatives, and the listing of a second biosimilar brand (where feasible). |

Continued monitoring of utilisation of biosimilars post-subsidy listing and sharing early signals of suboptimal utilisation with relevant stakeholders could further enhance biosimilar uptake. |

1 Introduction

Globally, escalating healthcare expenditure is a concern and keeping the healthcare system sustainable remains a challenge. In the Asia-Pacific region, drug spending accounted for nearly one-third of the total healthcare expenditure on average [1]. In 2022, the national pharmaceutical market in Singapore reached an estimated value of US$1.2 billion and has a compound annual growth rate (CAGR) of 8% over a 5-year forecast period to 2026 [2]. Notably, the public sector, which accounts for 80% of all hospital beds in Singapore [3], observed a higher CAGR of 11% for drug spending between 2017 and 2020. The availability and increasing use of high-cost biologics are key growth drivers impacting the financial sustainability of Singapore’s public healthcare system. For example, drug spending for monoclonal antibody therapies in Singapore’s public healthcare institutions doubled from 2017 to 2020, with a soaring CAGR of 30% (aggregated drug utilisation data from public healthcare institutions, unpublished raw data from the Singapore Ministry of Health [MOH], 2021).

However, with the recent patent expiry for many reference biological products (RBPs), lower cost alternatives, such as biosimilars of monoclonal antibodies, have emerged. Biosimilars are biological therapeutic products with proven similarities in physicochemical characteristics, biological activity, safety and efficacy compared with their RBPs. Several types of biosimilars are currently available, including therapeutic proteins, monoclonal antibodies and vaccines [4]. Since 2005, the European Medicines Agency (EMA) has led the establishment of the regulatory approval pathway for biosimilars [5], and also recently endorsed the interchangeability and safe switching for all biosimilars approved in the European market [6].

Despite these advances, several challenges continue to limit biosimilar adoption on a global scale, such as clinician lack of knowledge regarding biosimilar efficacy and safety concerns with switching, particularly among specific patient populations such as paediatric patients [7]. The impact of this challenge is evident in the US, where biosimilar adoption is often delayed, and the US Food and Drug Administration (FDA) requires additional data to assess biosimilar interchangeability [8]. Other challenges include ongoing patent litigation among pharmaceutical companies and the involvement of rebate contracting in the healthcare payer system, which further delays biosimilar entry and use [9]. To avoid facing similar challenges in Singapore, value-driven healthcare strategies have since been implemented to drive biosimilar use.

In 2012, Singapore’s regulatory agency, the Health Sciences Authority (HSA), approved a biosimilar for therapeutic protein, filgrastim [10]. Utilisation of the filgrastim biosimilar in 2014 - the first year it was available, only accounted for 40% of the market share (aggregated drug utilisation data from public healthcare institutions, unpublished raw data from the Singapore MOH, 2015). Singapore’s national health technology assessment (HTA) agency, the Agency for Care Effectiveness (ACE), was established in 2015. ACE conducts HTA and implements value-driven strategies such as value-based pricing (VBP) negotiations for subsidy listings and recommended maximum selling price (MSP), aimed at improving patient affordability and access to clinically- and cost-effective treatments [11]. ACE conducts active horizon scanning and evaluates biosimilars that have entered the market in a timely manner for funding consideration by the MOH’s Drug Advisory Committee (DAC) [12]. The DAC may recommend de-listing of existing subsidised RBPs that are no longer considered cost effective and replace them with biosimilars, based on the evidence and pricing proposals presented. After subsidy listing, ACE also monitors utilisation and drives the use of lower-cost alternative health technologies through stakeholders’ engagements [11]. In 2016, the first monoclonal antibody biosimilar, infliximab, was approved by the HSA [10]. Infliximab biosimilars were subsequently evaluated by ACE and recommended by the DAC for inclusion on the MOH’s subsidy list in March 2018, while the infliximab RBP was delisted in December 2018. Within 1 year of listing, infliximab biosimilars achieved a utilisation rate of 70% (aggregated drug utilisation data from the public healthcare institutions, unpublished raw data from the Singapore MOH, 2019). Since then, several other monoclonal antibody biosimilars, such as adalimumab, rituximab, trastuzumab and bevacizumab, have been included on the MOH subsidy list.

As Singapore reached the 5-year mark since the inclusion of the first monoclonal antibody biosimilar on the subsidy list, it is timely to evaluate the changes in adoption rates, and utilisation and spending trends that have resulted from different value-driven healthcare strategies implemented to drive biosimilar uptake in the public healthcare system. The cost savings achieved from using biosimilars among Singapore’s public healthcare institutions were also quantified. Such insights provide valuable information about Singapore’s experience and contribute to the global understanding of effective strategies for driving biosimilar use.

2 Methodology

2.1 Study Design and Data Sources

Using a retrospective cross-sectional study design, this study evaluated the impact of value-driven healthcare strategies implemented to increase the uptake of biosimilars in Singapore. The focus will be on five monoclonal antibodies with biosimilars listed for MOH subsidy between 2018 and 2022, namely infliximab, adalimumab, trastuzumab, rituximab and bevacizumab. Detailed information about the products, including regulatory approval date, number of approved biosimilar brands and approved indications, were obtained from the HSA register of therapeutic products [10]. Subsidy implementation dates and additional background information were gathered from MOH circulars and ACE technology guidance documents [13].

In Singapore’s public healthcare sector, drugs are included in either the MOH’s Standard Drug List (SDL) or Medication Assistance Fund (MAF) to provide subsidies and financial assistance of up to 75% for eligible patients. Additional financial assistance schemes such as Pioneer Generation and Merdeka Generation packages are also in place to further improve affordability [14]. The SDL comprises essential therapies for the management of common diseases and subsidies apply to all registered indications. The MAF is a financial assistance scheme for selected high-cost drugs that have been assessed to be clinically efficacious and cost effective. To ensure appropriate use of these high-cost drugs, patients would need to fulfil specific clinical criteria to be considered for financial assistance. In 2018, infliximab was the first monoclonal antibody with biosimilar listed on the MOH’s MAF for the treatment of patients with autoimmune diseases. This was followed by a biosimilar for adalimumab that was registered for a wider range of autoimmune indications. Using a cost-minimisation approach, adalimumab biosimilar was evaluated against infliximab biosimilar and adalimumab RBP to achieve a cost-effective price, and was subsequently listed on the SDL in September 2020. To ensure the infliximab biosimilar’s price is commensurate with its value, further VBP negotiation was conducted that led to its reclassification from the MAF to SDL subsidy list in January 2021.

The introduction of biosimilars in the field of oncology in Singapore occurred in 2019. Since then, biosimilars for rituximab (used in lymphoma, leukaemia, and rheumatoid arthritis treatment), trastuzumab (used in breast and gastric cancers treatment), and bevacizumab (used in various cancer treatments) have also been listed on the SDL. For rituximab and trastuzumab, biosimilars are only available as intravenous formulations, while the RBPs have had additional subcutaneous formulations approved. Further details of the five monoclonal antibody biosimilar products listed on the MOH subsidy list between 2018 and 2022 are provided in Table 1.

All biosimilars evaluated in this study obtained subsidy listing within 2 years from their regulatory approval dates. Over the years, the gap between regulatory approval date and subsidy implementation date has narrowed. This is particularly evident for adalimumab, trastuzumab and bevacizumab, where subsidies for the biosimilars were implemented within 1 year of regulatory approval.

Aggregated (non-patient level) drug utilisation data for the five biosimilars and their RBPs were obtained from the pharmacy dispensing systems of all public healthcare institutions with biologics use. This comprised 10 government-restructured hospitals, five specialty centres and three primary care polyclinics. The dispensing systems captured all instances of the biosimilars being dispensed, regardless of the care setting (inpatient or outpatient). Data covering the period from at least 12 months prior to subsidy listing until December 2022 were used to analyse volume and spending. The unit cost price information was obtained from the public healthcare institutions’ pharmacy dispensing data and verified with procurement contracts from ALPS Healthcare, the public healthcare supply chain agency.

2.2 Outcome Measures Analyses

The outcomes evaluated were the monthly trends for utilisation volume, proportion attributed to biosimilar use and drug spending (from the healthcare system perspective), and estimated number of patients receiving treatment, from the earliest year in which data are available. The simulated cost savings associated with adoption of biosimilars was also reported.

Utilisation data in terms of monthly volume in prescribed daily dose (PDD) and drug spending in the public healthcare institutions are presented. PDD is defined as the average daily dose required for treatment of the main indication, with reference to the World Health Organization (WHO) defined daily dose (DDD) [15]. The DDD for rituximab, trastuzumab and bevacizumab were not available and hence the daily maintenance dose was calculated based on the main indication and a body weight of 60 kg or body surface area (BSA) of 1.6 m2. Drug spending was calculated by multiplying unit cost price by number of vials used, and excluding samples, free stocks and drugs used in clinical trials. The unit cost price used in the analyses do not take into account additional rebates, including those from patient assistance programmes for RBPs that may apply to a specific patient population, as most data are not captured within the pharmacy dispensing system.

Due to the limitation of the aggregated-level drug utilisation data, the annual number of patients receiving treatment was estimated using the volume in PDD divided by days in a year (365.25 days), or by dividing the total utilisation volume by number of doses required for total treatment cycles in a year (e.g. eight cycles for rituximab). Changes in the utilisation trends, spending, and number of patients receiving treatment were assessed before and after the subsidy listing.

Cost savings were computed by comparing the actual drug spending versus the simulated drug spending without biosimilar entry for the five drugs. Simulated drug spending was obtained by multiplication of the unit price of RBPs (assessed 1 year prior to subsidy listing of their first biosimilars) with the total volume of drugs used in vials. The cost-savings calculation accounted for savings from adoption of biosimilars and reduction in cost prices for RBPs due to biosimilar entry. Further analysis was conducted to investigate the relationship between the percentage price reduction and number of biosimilar brands available at the time of first subsidy listing. The reported drug spending, unit cost price and cost savings are given in Singapore dollars (SG$). Stata version 17 (StataCorp LLC, College Station, TX, USA) was used to analyse the utilisation data (volume and spending), while trend analysis and cost simulations were performed using Microsoft Excel (Microsoft Corporation, Redmond, WA, USA).

3 Results

3.1 Utilisation and Adoption of Biosimilars

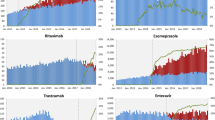

An upward trend in the use of biosimilar agents and proportion attributed to biosimilar adoption was observed that corresponded with the subsidy implementation date. Figure 1a–e depict the monthly utilisation trends (PDD), adoption in terms of biosimilar share for the five biosimilars (i.e. infliximab, adalimumab, trastuzumab, rituximab and bevacizumab) and the subsidy listing or delisting time points if applicable. Infliximab use has doubled since listing in 2018, however this use reached a steady state in 2022 (Fig. 1a). Seasonality was observed, with a drop in use typically seen during the first quarter of each year. Infliximab biosimilar reached 70% market share after 1-year post-subsidy implementation, and more than 80% after 2 years. Considering infliximab biosimilar was the first monoclonal antibody biosimilar to be subsidised, a slower adoption rate was expected compared with the other biosimilars.

a–e Monthly utilisation trend (volume in PDD and spending) of the five monoclonal antibodies up to year 2022 (RBPs vs. biosimilars). aFor bevacizumab, only an intravitreal injection of RBP was listed on the MAF before biosimilar entry, and there was no delisting of RBP. PDD prescribed daily dose, RBP reference biological products, MAF Medication Assistance Fund, SDL Standard Drug List

Rituximab, adalimumab and bevacizumab biosimilars each accounted for more than 95% of their respective market shares within 1 year of receiving subsidy implementation. Rapid adoption of the rituximab biosimilar saw it entirely replaced subcutaneous rituximab RBP, which had previously contributed to an approximately 10–15% share of the overall rituximab utilisation (Fig. 1b). The data showed that the utilisation volumes for both rituximab and bevacizumab have continued to grow, and further data points are needed to ascertain whether this trend is likely to persist. A steep increase in utilisation was observed for adalimumab, which surged fourfold within the 2-year post-subsidy period. This growth rate appeared to have stabilised towards the second half of 2022 (Fig. 1c).

However, the trastuzumab biosimilar demonstrated a different trend in utilisation and adoption compared with the other biosimilars evaluated in this study. Total trastuzumab utilisation increased post-subsidy listing but started to decline in 2022 (Fig. 1d). This could be related to the increasing use of new drugs such as trastuzumab deruxtecan in 2022, which resulted in a drop in total trastuzumab utilisation. In terms of overall trastuzumab share, a consistent reduction in intravenous trastuzumab (both RBPs and biosimilars) was also observed from April 2020, compared with earlier time periods, while the use of subcutaneous trastuzumab (available only as an RBP) has doubled. Moreover, the availability of new formulations such as subcutaneous trastuzumab in combination with pertuzumab since 2021 further contributed to the decreasing use of intravenous trastuzumab. As a result, adoption of the trastuzumab biosimilar (intravenous) was slower than others, achieving an approximately 40% share 1-year post-subsidy listing, and 72% 2 years after listing.

3.2 Price, Spending and Cost Savings Associated with Biosimilar Use

While utilisation of the five biosimilars, collectively, increased steeply post-subsidy listing, spending for these drugs dropped sharply. The sharp drop in spending resulted from the significantly lower price of biosimilars except for trastuzumab, where the lower utilisation in 2022 could have partially contributed to the drop in spending. Using infliximab as an example, a price reduction of approximately 57% was achieved for listing the first biosimilar brand following VBP negotiations in 2018. Notably, there was only one infliximab biosimilar brand at that time. A further price reduction of approximately 90% from the RBP price was achieved with the entry of a second biosimilar brand that in turn led to the expansion of subsidies for infliximab biosimilars in 2021. Despite this, the spending on infliximab post-2021 was lower compared with previous years (Fig. 1a).

Similar trends were observed for the other drugs, with the spending declining sharply following biosimilar listing (Fig. 1b, d, e). This was largely driven by the substantial price reduction and increased market competition (RBP and two or more biosimilar brands) at the time of listing. On average, an approximately 80% price reduction was achieved for biosimilars listed after infliximab, with a higher price reduction observed for biosimilars with more than one approved brand at the time of subsidy listing. In contrast, spending for adalimumab remained relatively stable following subsidy listing of the biosimilar due to the significant increase in utilisation volume in 2021. With its use stabilising in the subsequent year and further price reductions achieved after the entry of new biosimilar brands, spending for adalimumab started to decrease in 2022 (Fig. 1c). The number of patients who benefited from the subsidy listing of adalimumab biosimilar increased fourfold, from about 400 patients with an annual spending of $4.6 million in 2020 to 1600 patients with an annual spending below $4.1 million in 2022.

Prior to entry of biosimilars for infliximab, adalimumab, trastuzumab, rituximab and bevacizumab, the RBPs were only listed on the MAF for selected registered indications and in specific populations due to their high cost and budget impact to the Singapore healthcare system. Placing these biosimilars on the SDL and removing any coverage restriction led to improved patient access to treatment. This is demonstrated by an increase in the estimated number of patients using the five drugs, from about 1800 patients in 2018 to nearly 4100 patients in 2022.

Despite the significant increase in utilisation, overall spending for the five drugs reduced by more than half, from approximately $57 million in 2018 down to nearly $25 million in 2022 (Fig. 2). Based on the difference between simulated spending assuming no biosimilar entry and actual spending for the five drugs, the amount of cost savings to the Singapore public healthcare system was estimated to be $74 million in 2022. This further translates to cumulative cost savings of approximately $136 million over 5 years (Fig. 3). Of note, while having the delayed adoption rate among the five biosimilar drug classes, trastuzumab biosimilar contributed the greatest cost savings since being listed in 2020 due to the substantial absolute price differential between the RBP and biosimilar, additional price reduction from RBPs and the large market size of RBPs.

4 Discussion

This study reviewed the changes in utilisation, spending and adoption rate of the monoclonal antibody biosimilars associated with the various value-driven healthcare strategies implemented. It also analysed the price difference between five biosimilars (i.e. infliximab, adalimumab, trastuzumab, rituximab and bevacizumab) and their RBPs, and quantified the cost savings from uptake and use of these biosimilars in the public healthcare sector. Following subsidy listing, the utilisation of most biosimilars increased steeply, with the adoption rate reaching up to 95% within 1 year of listing. A significant decline in spending was also observed due to the substantially lower prices of biosimilars. To date, it is estimated that approximately $136 million in cumulative cost savings have been achieved over the past 5 years.

Singapore’s success in its high adoption rate of biosimilars hinges on a multi-pronged approach, similar to what is practiced in the United States (US) and several European countries [16,17,18,19]. In addition, Singapore’s efficient healthcare system, geographical advantage, and synergies in supply chain within public healthcare facilitated swift biosimilar adoption. One key strategy commonly reported in the published literature to encourage support for value-driven healthcare is improving stakeholder engagement, especially with the healthcare professionals. According to recently published reviews [4, 20, 21], despite a positive attitude towards prescribing biosimilars, most healthcare professionals still have reservations around interchangeability, switching and regulatory issues. Early clinician engagement during the ACE’s evaluation of the first monoclonal antibody biosimilar revealed that clinicians support starting biosimilars in new patients, but will only consider switching among stable patients if affordability is a concern. Noting this feedback, the ACE further engaged clinicians from gastroenterology, rheumatology and dermatology departments across Singapore’s public healthcare institutions to encourage changes in their prescribing practice for infliximab. This was achieved by providing more information on the clinical evidence for biosimilars, including switching, and highlighting the MOH DAC’s considerations in recommending biosimilars for subsidies. Besides partnering with healthcare professionals, the ACE also sought support from other stakeholders through meeting platforms with MOH senior management, Chairmen of medical boards from public healthcare institutions, and the HSA to share current evidence for biosimilars, their potential to improve patient access to treatment, and the associated cost savings to the healthcare system from their use. Although slower uptake was observed for infliximab, subsequent biosimilars listed between 2020 and 2022 generally experienced swift adoption in Singapore’s public healthcare institutions. In Denmark [16] and Sweden [17], where extensive stakeholder engagement was implemented, optimal biosimilar adoption was observed for trastuzumab, which achieved 80% share within 1 year for Sweden and more than 95% share within 6 months in Denmark [16, 22]. In contrast, published data from countries such as Korea [23], the US [24] and some European countries [22] demonstrated that biosimilar use remains to be optimised.

A second value-driven healthcare strategy involves disinvestment from non-cost-effective drugs and encouraging the use of lower cost alternatives. During the evaluation of infliximab, the ACE assessed the biosimilar brand to be clinically comparable with the RBP and more cost-effective [25]. In turn, the MOH DAC recommended delisting the infliximab RBP, with a 9-month transition period, post biosimilar listing. Relisting of the RBP will not be considered within a 3-year period to encourage companies to submit the best pricing proposal. In addition, public healthcare institutions are given early notifications about delisting of the infliximab RBP and biosimilar listing to allow sufficient time for downstream stock supply and inventory management. This also gave clinicians more time to assess patients for potential switching (to biosimilar or alternative subsidised treatments), and to offer financial counselling as needed. Resources including clinician and patient education materials were developed to facilitate discussions between doctors and patients and enable informed decision making by patients. To further nudge prescribing behaviours, prompts were also built into clinical prescribing systems to alert prescribers on the available lower cost biosimilar alternative and provide reference to the published drug guidances.

The ACE employs various pricing strategies in alignment with the 2020 WHO guideline on country pharmaceutical pricing policies [26]. VBP negotiations leveraging brand-specific subsidy listing encourages price competitions, and internal reference pricing applied helps to ensure that prices of comparable treatments are set at the same or a similar level. External reference pricing is also used informally as a tool to ensure biosimilars are fairly priced relative to overseas countries. To date, these strategies have worked well to achieve substantial price reductions for biosimilars upon first listing. Notably, mandatory price reduction of biosimilars or RBPs ranging from 15 to 80% upon biosimilar entry have been implemented in other countries such as Korea [23], Japan [27], Australia [28] and several European Union (EU) countries[29]. Despite being a small country with no mandatory price reduction measures, Singapore has achieved substantial price differences of up to 80% between RBPs and biosimilars. Lastly, to ensure that savings obtained through price negotiations translate to reduced patient expenses, public healthcare institutions are required to adhere to a recommended MSP for subsidised drugs.

After the implementation of subsidies for biosimilars, a critical next step for driving biosimilar adoption is to closely review utilisation trends, to identify early signals of low adoption and devise interventions to improve adoption in public healthcare institutions through the National Pharmacy and Therapeutics (NPT) Committee. The committee comprised representatives from the public healthcare institutions with an aim to encourage the use of cost-effective medicines, including generics and biosimilars. To further drive biosimilar uptake, the pay-for-performance (P4P) framework offers financial incentives to public healthcare institutions when a set target of biosimilar adoption is met, similar to the practice in the UK where biosimilar use is regularly tracked as part of the national indicators [30]. For example, trastuzumab was monitored under the P4P framework, starting in 2021. Despite the implementation of a multi-stakeholder approach and early notification of the subsidy listing for trastuzumab, there was suboptimal uptake of biosimilars and an increase in the use of subcutaneous trastuzumab RBPs during the coronavirus disease 2019 (COVID-19) pandemic. Subcutaneous trastuzumab was preferred due to the ease of administration and avoidance of hospital visits when hospital resources need to be optimised. After reviewing the first 3 months of utilisation data post-subsidy listing, the ACE shared the findings with key clinicians across public healthcare institutions to understand potential challenges faced and to offer support for higher adoption. Through continuous monitoring and stakeholder engagement, trastuzumab biosimilars saw an increase in further uptake, achieving 72% share after 2 years of listing. This demonstrated the importance of active utilisation review with stakeholder engagement to improve biosimilar adoption. In contrast, countries with suboptimal biosimilar adoption such as Korea reported a lack of policies such as monitoring prescription patterns and prescribing guidelines to enhance biosimilar uptake [30].

4.1 Limitations

There are a number of limitations for this study that may influence interpretation of the findings. First, we conducted the analysis from the public healthcare system perspective, where subsidies for the listed drugs were applicable and are expected to impact prescribing practice. In contrast, levers to nudge prescribing behaviours, including subsidies and VBP prices, are not extended to the private sector, thus the biosimilar adoption rates could be different from those observed in the public sector. Prescribing data in the private sector was also not available. Potential market implications to the private sector from post-subsidy listing of biosimilars could not be ascertained and is not within the scope of the study. Nonetheless, the private sector only serves a minority (approximately 20%) of the total population of Singapore in the acute care setting [3]. Second, the estimated numbers of patients who benefited from the biosimilar treatments were derived based on the doses used for the main indication, and unit prices used to compute cost savings do not account for additional rebates from manufacturers, which may potentially lead to over- or underestimation.

Third, the observation periods were relatively short for biosimilars listed between 2021 and 2022, whereas continued monitoring would be required to assess long-term trends. Next, comparison of drugs based on therapeutic areas and approved indications was not conducted due to factors such as the wide range of different indications used, different available formulations (intravenous vs. subcutaneous), and the emergence of new therapies in the therapeutic areas, all of which could affect their utilisation to varying extents. A descriptive approach was instead undertaken, which made it difficult to draw definitive conclusions without control groups or randomisation. Further investigation using longer-term and patient-level data would be required to conclude the relationship between healthcare strategies, utilisation, and cost savings attained from both healthcare system and patients’ perspectives.

5 Conclusion

This study demonstrated that value-driven healthcare strategies implemented in Singapore’s public healthcare institutions have contributed to high adoption rates of biosimilars and have improved affordable access through lower treatment costs. This in turn has led to significant cost savings to the healthcare system. Recognising that multi-stakeholders’ involvement, including patients, is the cornerstone in driving biosimilar adoption, the ACE has also embarked on engaging consumers and the public to improve health literacy and encourage behavioural changes. It is anticipated that with the emerging real-world data on the efficacy and safety of biosimilars, and as more patented monoclonal antibodies go off-patent, the adoption of biosimilars will continue to be one of the key initiatives to keep healthcare costs affordable and sustainable in Singapore. This study has contributed to the limited published data on adoption rates of biosimilars, and described various strategies that could be adopted to further improve the adoption of incoming biosimilars globally.

References

OECD and World Health Organization. Health at a Glance: Asia/Pacific 2016.

Fitch Solutions Group. Singapore Pharmaceuticals & Healthcare report Q3 2022. 2022

Singapore—Country Commercial Guide. Healthcare, Opportunities. 2022. 11 August 2022 to 18 October 2023. https://safe.menlosecurity.com/https://www.trade.gov/country-commercial-guides/singapore-healthcare. Accessed 2 June 2023.

Halimi V, et al. Clinical and regulatory concerns of biosimilars: a review of literature. Int J Environ Res Public Health. 2020;17(16):5800.

Gherghescu I, Delgado-Charro MB. The biosimilar landscape: an overview of regulatory approvals by the EMA and FDA. Pharmaceutics. 2020;13(1):48.

Statement on the scientific rationale supporting interchangeability of biosimilar medicines in the EU. European Medicines Agency; 2023. p. 1.

Barbier L, et al. European stakeholder learnings regarding biosimilars: part I-improving biosimilar understanding and adoption. BioDrugs. 2020;34(6):783–96.

US FDA. Interchangeable Biological Products. US FDA; 2023. p. 1.

Mehr SR, Brook RA. Biosimilars in the USA: will new efforts to spur approvals and access spur uptake and cost savings? Pharm Med. 2019;33(1):1–8.

HSA infosearch for health products and services. 2023. https://www.hsa.gov.sg/e-services/infosearch.

Agency for Care Effectiveness. "Who We Are". https://www.ace-hta.gov.sg/about-us. Accessed 12 February 2024.

Horizon Scanning Methods and Process Guide. Agency for Care Effectiveness; 2021.

ACE Technology Guidances. 2023. https://www.ace-hta.gov.sg/healthcare-professionals/ace-technology-guidances. Accessed 4 March 2023.

Pearce F, et al. Health technology assessment and its use in drug policies: Singapore. Value Health Reg Issues. 2019;18:176–83.

Guidelines for ATC classification and DDD assignment 2023. https://www.whocc.no/atc_ddd_index/. Accessed 14 November 2022.

Azuz S, et al. Uptake of biosimilar trastuzumab in Denmark compared with other European countries: a comparative study and discussion of factors influencing implementation and uptake of biosimilars. Eur J Clin Pharmacol. 2021;77(10):1495–501.

Moorkens E, et al. Different policy measures and practices between Swedish counties influence market dynamics: part 1-biosimilar and originator infliximab in the Hospital setting. BioDrugs. 2019;33(3):285–97.

Moorkens E, et al. Policies for biosimilar uptake in Europe: an overview. PLoS One. 2017;12(12): e0190147.

Kar I, et al. Biosimilar strategic implementation at a large health system. Am J Health Syst Pharm. 2022;79(4):268–75.

Leonard E, et al. Factors affecting health care provider knowledge and acceptance of biosimilar medicines: a systematic review. J Manag Care Spec Pharm. 2019;25(1):102–12.

Sarnola K, et al. Physicians’ perceptions of the uptake of biosimilars: a systematic review. BMJ Open. 2020;10(5): e034183.

IQVIA. The Impact of Biosimilar Competition in Europe December 2020 White paper. IQVIA; 2020.

Lee HJ, Han E, Kim H. Comparison of utilization trends between biosimilars and generics: lessons from the nationwide claims data in South Korea. Appl Health Econ Health Policy. 2020;18(4):557–66.

IQVIA, Biosimilars in the United States 2020–2024. IQVIA; 2020.

Infliximab biosimilar for treating inflammatory conditions. ACE Technology Guidances. ACE; 2021.

World Health Organization. WHO guideline on country pharmaceutical pricing policies. Geneva: World Health Organization; 2020.

Update of drug pricing in Japan. L.a.W. Ministry of Health.

Biosimilar uptake drivers questions and answers. Pharmaceutical Benefits Scheme (PBS).

Rovira J, et al. The impact of biosimilars’ entry in the EU market. Andal Sch Pub Health. 2011;30:1–83.

Kim Y, et al. Uptake of biosimilar infliximab in the UK, France, Japan, and Korea: budget savings or market expansion across countries? Front Pharmacol. 2020;11:970.

Singapore Statues Online. Healthcare Services Act 2020. https://sso.agc.gov.sg/Act/HSA2020. Accessed 5 February 2024.

Acknowledgements

The authors would like to thank Teresa Vaccaro, medical writer, for her review and constructive inputs to improve the information flow of this manuscript.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Authors’ contributions

All authors contributed to the study conception and design. Material preparation, data collection and analysis were performed by SHT, LGHG and BSKO. All authors read and approved the final manuscript.

Data availability

The datasets generated and/or analysed in the current study are not publicly available due to the confidentiality agreement in place to restrict data use. Data are available from the corresponding author on reasonable request and if legal implications are fulfilled.

Ethics approval

This was a retrospective, cross-sectional observational study. Ethics approval is not required for aggregated drug utilisation data obtained from the public healthcare institutions for use by the MOH to support the answering of health policy questions in the public interest. This is within the remit of the Healthcare Services Act 2020 [31].

Funding

No funding was received to assist with the preparation of this manuscript.

Conflict of interest

She Hui Tan, Louise Gek Huang Goh, Benjamin Shao Kiat Ong, Darren Sze Guan Ng, Liang Lin, Raymond Chee Hui Ng, Bernard Yu-Hor Thong, and Kwong Ng declare they have no competing interests in relation to this work.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License, which permits any non-commercial use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by-nc/4.0/.

About this article

Cite this article

Tan, S.H., Goh, L.G.H., Ong, B.S.K. et al. Impact of Value-Driven Healthcare Strategies for Biosimilar Adoption: The Singapore Story. PharmacoEconomics Open (2024). https://doi.org/10.1007/s41669-024-00491-w

Accepted:

Published:

DOI: https://doi.org/10.1007/s41669-024-00491-w