Abstract

Background

New pharmaceuticals are increasingly being developed for use across multiple indications. Countries across Europe and North America have adopted a range of different approaches to capture differences in the value of individual indications.

Objective

The three aims of this study were (i) to review the price-setting practice over the past 5 years for multi-indication products across England, France, Italy, Spain, Belgium, Switzerland, Turkey, Canada and the USA; (ii) to assess the impact of current practices on launch strategy; and (iii) to identify issues in the implementation of indication-based pricing.

Methods

Ten current and former members of health insurance organisations, healthcare payer organisations or health technology assessment agencies with expertise on pharmaceutical purchasing were invited to participate in semi-structured interviews. Interview transcripts were imported into NVivo 12 for thematic analysis.

Results

The majority of countries studied require full assessments upon launch of a new indication. Five different approaches to pricing were identified: weighted pricing, differential discounting, mandatory discount, price anchoring and free pricing. Manufacturers show a tendency to launch first in niche indications with high unmet need to achieve a high price. Stakeholders from England, France, Italy, Belgium and Switzerland consider their current system fit for purpose, while other countries expressed concern over the administrative burden of monitoring products at indication level.

Conclusions

Given the high administrative burden, it is questionable whether indication-based pricing would provide additional public benefit above and beyond current weighted dynamic single pricing and differential discounting practices for multi-indication products.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Most healthcare payers consider their current assessment and pricing practices fit for purpose for multi-indication products. |

Healthcare payers display a strong preference for administrative simplicity and a reluctance to engage in indication-specific pricing or financing. |

Current practices may restrict availability of indications, but typically only when there are suitable therapeutic alternatives. |

1 Introduction

Pharmaceuticals are increasingly being developed for use across multiple therapeutic indications [1,2,3,4]. This has been particularly prevalent in the field of oncology, where improvements in our understanding of tumour pathology and molecular genetics have spurred the development of tumour agnostic therapies and where an increasing number of older non-oncology medicines are being repurposed as anti-neoplastic medicines [1,2,3]. In 2018, over two thirds of cancer drugs were approved for use across multiple indications [4]. Developing a product across multiple therapeutic indications or repurposing an older product for use in different patient populations can be considerably cheaper than developing a product from scratch, given that many early R&D activities only need to be performed once [5].

As multi-indication products have become more prevalent, questions have emerged on whether current regulations for the assessment, pricing and reimbursement of pharmaceuticals are fit for purpose [6, 7]. It is generally accepted that the price of a pharmaceutical should be linked to the value it provides [8, 9]. In the case of multi-indication products, the value of each respective indication can be variable, given differences in therapeutic effect, patient population, disease pathway and standard of care. It follows that under single-pricing systems, where only a single price can be set per product, the incremental value that individual indications provide is disconnected from the price. Under single-pricing systems, firms may elect not to launch products with lower value to avoid price erosion in the higher value indication. Instead, economists argue that a system of price discrimination, or indication-based pricing, whereby a different price is assigned to each therapeutic indication, would maximise social welfare [10,11,12].

Countries across Europe and North America have adopted different value-based approaches to address the disconnect in value and price in multi-indication products, although no formal indication-based pricing systems have been implemented [13, 14]. France and Spain employ weighted pricing, whereby the price of a product is renegotiated upon the launch of an additional indication for a previously reimbursed product [7, 8]. The renegotiated price represents the average price of the various indications, weighted according to disease prevalence. Within the UK, current regulations do not enable different prices at list price level. Differential discounting is possible whereby the confidential discount rate, and by extension the net reimbursement price, can vary at indication level [7, 8]. However, the current Voluntary Scheme for Branded Medicine Pricing and Access (VPAS) is largely regulated on a per-product basis (a product-specific sales cap of £20 million applies) and the Department of Health expresses a preference against multiple net prices for a single medicine, due to the complexity it would create for the NHS [15]. The USA remains a single-price-per-product system, whereby manufacturers can freely set the price of a product and payers have limited capacity to push back on prices [14]. Barriers to implementation of indication-based pricing in the USA include regulation around Medicaid best-price law and anti-kickback statutes, along with insufficient data systems for monitoring product use at indication level [16, 17]. The Medicaid best-price law requires manufacturers to provide a product-specific rebate to state Medicaid programmes equivalent to either 23.1% of the average pharmacy retail price or to the ‘best price’ in the event a discount offered by manufacturers exceeds 23.1%. No provisions currently exist for multi-indication products, meaning that an indication-specific discount could trigger a new ‘best price’. Further, it is unclear if indication-based pricing may violate anti-kickback statutes, which prohibit the offering of renumeration to induce or reward prescription of medicines, due to concerns that manufacturers may ‘accept’ the risk of off-label use of lower price indications to obtain coverage [16].

Despite an increasing number of publications on the pricing of multi-indication products, overall evidence on the subject remains scarce, both in terms of peer-reviewed literature and public documents [18]. A key gap is that the hypothetical scenarios describing single-pricing systems evaluated in economic papers on indication-based pricing [1, 7, 10,11,12] do not accurately reflect current practices for pricing multi-indication products. While an indication-based pricing model maximises social welfare relative to a single pricing model that is anchored according to the price of a single indication, the social welfare implications of a dynamic weighted single pricing model or differential discounting model (indirect forms of indication-based pricing) have not been explored. Given widespread implementation of these measures for pricing multi-indication products [13, 18], it remains unclear if advocacy for formal systems of indication-based pricing, with different list prices for individual indications, is justified. On the other hand, recent analysis on a cohort of multi-indication oncology products has provided preliminary evidence that manufacturers show a tendency to sequence the development and launch of products according to clinical value and disease prevalence, highlighting the need to further explore the potential benefits of indication-based pricing over existing pricing practices for multi-indication products [19, 20]. This is an important finding given that the presence of previously launched indications has typically not been considered in empirical literature on pharmaceutical firm entry [21,22,23,24,25]. Overall, there is a lack of clarity on whether existing indirect indication-based pricing approaches adequately safeguard public and patient interest in the development and use of multi-indication oncology products and on the value and practicalities of implementing a more formal version of indication-based pricing.

This paper builds an analytical framework surrounding policy developments in multi-indication products and uses this framework to gather and present insights from current and former members of health insurance organisations and health technology assessment agencies with expertise in pharmaceutical purchasing across nine OECD countries. In doing so, the objective of this paper is threefold: first, to review current practices (over the period of the past 5 years) of price setting and paying for medicines with multiple distinct indications with emphasis on oncology; second, to assess the impact of said pricing practices on firm entry and the launch of multi-indication products; and third, to identify issues around the practicality of indication-based pricing implementation relating to political willingness, legal/regulatory structures, administration, and/or data infrastructure.

2 Methods

2.1 Analytical Framework

The evidence informing this study is based on primary sources. To address the study objectives, an analytical framework was created with associated endpoints which were separated into three groups: first, current practices for multi-indication products; second, impact of pricing regulation on manufacturer launch strategy; and third, future expectations on indication-based pricing. The analytical framework was jointly developed by study co-authors, based on identified gaps in existing literature on indication-based pricing. The identified endpoints are provided in Table 1, alongside brief definitions.

2.2 Semi-Structured Interviews

2.2.1 Development of a Semi-Structured Interview Guide

A semi-structured interview guide was developed to collect primary evidence on current assessment and pricing methods, monitoring challenges, industry launch strategy and expectations for future reform on multi-indication products. Interview respondents were asked to predominantly consider assessment and pricing of multi-indication oncology products; however, they were also invited to comment on pricing practices of multi-indication products in general. The interview guide consisted of 10 questions, as shown in Table 2.

2.2.2 Stakeholder Selection

Current and former members of health insurance organisations, healthcare payer organisations or health technology assessment agencies responsible for pharmaceutical purchasing in 13 countries (France, England, Switzerland, Italy, Spain, Belgium, Germany, Russia, Poland, Turkey, Australia, the USA and Canada) were invited to participate in semi-structured interviews. All experts identified had a minimum of 10 years of experience working on pharmaceutical policy and had extensive knowledge of pharmaceutical pricing and reimbursement practices in their respective settings. Specific candidates for participation were identified from our research group’s network of affiliated institutions and pharmaceutical policy experts, including, among others, members from the EU-funded ADVANCE HTA consortium, the IMPACT HTA consortium, and WHO Europe Collaborating Centres, along with contacts from health insurance/payer organisations and HTA agencies, stemming from several years of collaboration and work with these institutions (including a series of WHO Europe workshops on strategic procurement for innovative medicines, which were attended by representatives from health insurance organisations from over 21 EU members states). A total of two experts from each country were identified and invited to participate. Countries were selected to include (a) both high- and middle-income countries; (b) countries with large and small populations; and (c) countries with different health financing systems. Invitations for interviews were sent between April 2020 and June 2020.

2.2.3 Data Collection

Interviews were conducted between June 2020 and October 2020. All interviews took place virtually using Zoom software. Interview respondents were provided with a participant information sheet and were asked to sign a consent form in advance of the interviews. All interviews were anonymised to protect the identity of respondents. The evidence collected represent the views of the individual stakeholders participating, rather than official positions of healthcare organisations within included settings. The duration of interviews was 45–60 min. All interviews were recorded to facilitate transcription and analysis of the results. Prior to interviews, the research methodology was subject to standard institutional ethics review processes. No significant ethical issues were raised by the research.

2.2.4 Data Analysis

All interview recordings were transcribed using Rev transcription service (https://www.rev.com). Interview transcripts were imported into NVivo 12 for coding and thematic analysis. Interview text was coded according to the research endpoints outlined in the analytical framework and insights were analysed across three main themes.

The first theme related to current practices in the assessment, pricing and monitoring of multi-indication products. The assessment of multi-indication products was coded in terms of whether differences exist across original indications and indication extensions in the requirements for health technology assessment. Pricing was coded in terms of whether a setting employs indication-based pricing, weighted pricing, differential discounting, a single pricing model or an alternative pricing scheme for multi-indication products. Additional codes were assigned based on whether price increases can occur following the introduction of a new indication with higher effectiveness. Monitoring was coded in terms of how effectively a country can monitor a product’s use at indication level (low, medium, high or very high). A country with low monitoring capacity has no ability to differentiate the use of a product across different therapeutic indications. A country with very high monitoring capacity routinely and actively collects data on the use of a product at indication level.

The second theme related to perspectives on launch strategy and characteristics of first indications. Characteristics of first indications was coded in terms of the salient features of the first indication to launch, including disease prevalence, disease severity, price, unmet need, or disease stage. Additional codes were assigned for evidence of withholding the launch of subsequent indications.

Finally, the third thematic area focused on future expectations for pricing of multi-indication products. Performance of the current system was coded in terms of whether current pricing practices are fit for purpose for multi-indication products. Specifically, this relates to the extent to which current pricing practices: (a) adequately capture the incremental value of multi-indication products; (b) generate perverse incentives for manufacturers in terms of the development and launch of multi-indication products; and (c) adequately safeguard patient and public interests in the development and use of multi-indication products. Barriers to implementation of indication-based pricing were coded in terms of feasibility, technical/legal requirements and willingness to implement.

3 Results

3.1 Interview Results

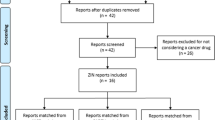

A total of ten experts across nine countries accepted invitations for semi-structured interviews. The countries included in the analysis are England, France, Spain, Italy, Belgium, Switzerland, Canada, the USA and Turkey. Two expert stakeholders from the USA were interviewed.

3.2 Assessment, Pricing and Monitoring of Multi-Indication Products

Most countries conduct full HTA assessments for indication extensions of a previously reimbursed molecule. England, France, Italy, Spain, Belgium, Switzerland and Canada all employ HTA as a key tool for informing pricing and reimbursement decisions and require separate evaluations for each approved therapeutic indication for a given molecule (See Table 3). Each assessment is conducted independently of previous submissions. Each indication is evaluated on the merits of the clinical and economic evidence submitted against the relevant standard of care within the defined therapeutic indication.

Five different approaches to the pricing of multi-indication medicines were identified across the included countries.

France, Spain, Belgium and Canada employ weighted pricing, whereby the price of a molecule is renegotiated upon launch of a new indication. Within France, the transparency committee of the Haute Autorité de Santé (HAS) conducts HTA on all newly approved therapeutic indications (both original indications and indication extensions). The transparency committee assigns a benefit rating (Medical Service Rendered—SMR), which determines the reimbursement rate for an indication and assigns an added benefit rating (Additional Medical Service Rendered—ASMR), which is used by the French medicine pricing committee (CEPS) to inform price negotiations. Within Spain, The Spanish Agency of Medicines and Medical Devices (AEMPS) conducts a clinical assessment of all new indications and produces a therapeutic position report (IPT). The Inter-Ministerial Pricing Commission negotiates both the official list price for a medicine and the discounted reimbursement price based on the IPT. Within Belgium, the reimbursement committee within the National Institute for Health and Disability (RIZIV-INAMI) assesses all new therapeutic indications and provides a reimbursement recommendation to the Minister of Social Affairs. The Minister of Social Affairs makes a final decision on the reimbursement and sets the reimbursement price. In Canada, the Canadian Agency for Drugs and Technologies in Health (CADTH) assesses newly approved therapeutic indications and issues reimbursement recommendations. Provincial reimbursement committees undertake pricing negotiations with manufacturers for each therapeutic indication.

England and Switzerland employ differential discounting models, whereby different discount rates can be negotiated for each individual indication. Within England, the National Institute of Health and Care Excellence (NICE) conducts HTA on newly approved therapeutic indications (both original indications and indication extensions) and makes reimbursement recommendations to NHS England. Reimbursement recommendations are frequently conditioned on indication-specific patient-access schemes negotiated between the manufacturer and NHS England, which may involve confidential discounts or other financial agreements. Deviations from uniform net pricing are typically reserved for cases where the level of clinical effectiveness is highly variable across indications. Differential discounts, when implemented, result in different net prices which can either be achieved through indication-specific procurement processes or through ex-post rebates based on tracking of product use at indication level. In Switzerland, the Federal Office of Public Health (BAG) assesses products approved by SwissMedic for inclusion on the positive reimbursement list. The assessment from the Federal Office of Public Health is subsequently appraised by the Federal Drug Commission (FDC), which provides a recommendation to the BAG on three criteria (‘WZW’ criteria: appropriateness, effectiveness and cost effectiveness). Effectiveness relates to the scientific evidence base of the product and includes assessment of both the clinical evidence considered in SwissMedic approval and real-world evidence. Both the total benefit of the product and the relative clinical benefit of the product are considered. Appropriateness relates to all pharmacological and formulation aspects of the product (e.g. packet size). Cost effectiveness or economic efficiency relates to the economic impact of funding a technology within the Swiss health insurance system in terms of opportunity cost, budget impact and efficiency). The BAG then makes a final determination on pricing and reimbursement based on these recommendations and negotiations with the manufacturer.

In Italy, the launch of a subsequent indication is now subject to a mandatory price discount, proportional to the increase in patient population. The specific level of discount is subject to a deliberative process which considers three criteria: (a) unmet need, (b) added clinical value and (c) quality of evidence. Indication extensions which address an unmet medical need, have high therapeutic value or launch in a niche indication may receive minimal or no discounts on the net product price. Conversely, competition (either currently available alternatives or competitors in development), marginal added clinical benefit, low quality of evidence and high disease prevalence will increase the level of discount required. The scientific committee (CTS) within the Italian Medicines Agency (AIFA) assesses the unmet need, added clinical value and quality of evidence for all newly approved therapeutic indications. The CTS provides recommendations to the price reimbursement committee (CPR), which has the mandate to conduct pricing negotiations. Italy has the capacity to implement unique risk-sharing schemes at indication level, however, it has begun to shift away from this practice in favour of simpler financial agreements.

In Turkey, prices are anchored by the first indication assessed and approved for reimbursement. The launch of a new indication does not trigger a price revision. The Social Security Agency (SGK) assesses newly approved drugs for reimbursement following regulatory approval by the Ministry of Health. There are two routes for reimbursement. Pricing under the general procedure requires a statutory discount of 40% on the retail price of the drug (determined through external reference pricing). Recently, an alternative reimbursement mechanism was implemented (predominantly for very expensive drugs) which allows companies to negotiate confidential discounts or risk-sharing schemes with the SGK.

The USA operates predominantly under a free pricing model as payers have limited capacity to push back on the prices of drugs. The USA healthcare market is highly fragmented with a range of public and private health insurers. HTA is not formally used within the USA to inform pricing and reimbursement of pharmaceuticals. Publicly funded plans include Medicare (for adults aged > 65 years), Medicaid (for low-income adults and families), and the Veterans Health Administration (VA). Nearly 70% of the population is covered through private insurance plans. Reimbursement and pricing criteria for pharmaceuticals vary across insurance plans. While list prices are set freely, pharmacy benefit managers (PBMs) can negotiate confidential discounts with manufacturers in private insurance markets and legislation ensures Medicaid and VA prices represent a price floor. These price floors are set at molecule level, according to the national drug code. In theory, PBM discounts may be renegotiated upon launch of a new indication through a weighted pricing approach, although this is not routinely done. It may also be possible for manufacturers to obtain separate drug codes, provided a product is launched under a different brand. This is likely only feasible for products with multiple indications across different therapeutic areas (e.g. older non-oncology medicines repurposed as anti-neoplastic agents with new brand names).

Countries vary significantly in their capacity to monitor product use at indication level. Italy, Belgium and Switzerland have very high capacity to monitor product use at indication level. Healthcare systems have extensive digital infrastructure which enables routine collection of prescribing data, including detail on the specific use of indications. Canada and Spain also have a high ability to monitor product use at indication level, however some disparities are present across provinces/regions. France, England and Turkey have established eprescribing infrastructure, but interview respondents indicated limitations in accessibility, extent of use, accuracy of information and/or granularity of information. Within the NHS England, central logging of sales only includes data on drug name and dosage, although separate datasets may facilitate tracking of product use at indication level for specific therapeutic areas. Within the USA, eprescribing infrastructure is in place (e.g. transactional databases for commercial plans and Medicare part D). However, data is not recorded and collected in a way that enables monitoring of products at indication level. Changes in legislation would be needed enabling drug codes to be assigned at indication level or enabling greater granularity in the collection of prescribing data.

No examples of prices increasing upon launch of an indication extension were identified across the included countries. In theory, weighted pricing systems (France, Spain, Belgium, and Canada) allow for an increase in price if a subsequent indication achieves a higher price than the first indication. An increase in price is also possible in Switzerland, although in practice separate prices are only given to indications if the subsequent indication has a lower therapeutic value. Within England, manufacturers can set prices freely as long as they meet NICE cost-effectiveness requirements and the VPAS requirements, but it is unlikely for the overall list price of a molecule to rise after commercial access agreements have been agreed for original indications. Within Italy, indication extensions trigger a mandatory discount. It is possible for the price to stay flat if the disease prevalence of the subsequent indication is very small or if high unmet need and therapeutic advantage is demonstrated. In Turkey, the price is set based on the first indication and is unlikely to change upon launch of a subsequent indication. In the USA, manufacturers may raise the list price of products freely and this process is independent of the launch of new indications. In theory, the net price of a product negotiated with PBMs could increase upon launch of a new indication, but no examples were identified.

3.3 Perspectives on Launch Strategy and Characteristics of First Indications

All countries identified highest price as the defining characteristic of first indications launched for multi-indication products (see Table 4). The majority of interviewees identified a tendency for first indications to be for smaller populations (England, France, Spain, Italy, Switzerland, USA, Canada). Additional characteristics of first indications identified include highest clinical effectiveness (France, USA), high unmet need (England, France, Switzerland, Turkey, USA), highest disease prevalence (Turkey) and late-stage disease (England).

Three interviewees (France, Italy, Belgium) identified instances where no agreement could be reached on the pricing and reimbursement of an indication extension, leading to a manufacturer electing not to launch a specific indication. However, each country expressed that the withholding of indications would typically only occur when there were concerns over the therapeutic benefit and the patient population had alternative treatment options. Interviewees from France, Italy and Belgium all expressed confidence that the current pricing and reimbursement system would facilitate access for indications that had significant therapeutic advantages over the current standard of care.

3.4 Future Expectations for Pricing of Multi-Indication Products

The majority of interviewees considered their current system fit for purpose for the pricing and reimbursement of multi-indication products (England, France, Italy, Belgium and Switzerland) (see Table 5). In France, Belgium and Italy, interviewees expressed confidence that weighted pricing models sufficiently capture the incremental value of indications and facilitate access to therapeutic indications that offer true therapeutic advantages. Interviewees from England and Switzerland expressed confidence that differential discounting methods adequately capture the incremental value of subsequent indications in cases where there are substantial differences across indications.

All interviewees indicated that a key barrier to implementation of indication-based pricing was administrative complexity. While many countries have high capacity to monitor product use at indication level, these countries still express a preference for administrative simplicity. In other countries (England, France, USA), improvements to monitoring capacity would be needed to facilitate indication-based pricing. Another common barrier to implementation identified was difficulty in payment and distribution (England, France, Spain, Italy, Belgium, USA, Canada). Currently, most payment and distribution systems for medicines do not differentiate according to indication use. Many countries use wholesalers to help distribute medicines. While it may be possible to have indication-specific prices if different formulations/brands were used across indications (e.g. for older non-oncology medicines repurposed as anti-neoplastic agents), current systems would not be able to accommodate different prices for different uses of the same formulation (which is frequently the case for tumour agnostic medicines). Parallel trade and off-label use would be difficult to prevent. Additional barriers to implementation included issues with regulatory/legal structure (England, Turkey, USA) and ethical issues for prescribers/patients (France, Spain, Belgium, USA, Canada).

4 Discussion

The current pricing and reimbursement environment for multi-indication products is highly dynamic. Most health systems considered (France, Belgium, Spain, Italy, England, Canada and Switzerland) routinely assess the incremental value of new indications and have methods of capturing this value in their pricing system, either through differential discounting or through weighted pricing, consistent with pricing approaches described in a recent systematic review [18]. Even within the USA, PBMs can engage in a ‘weighted pricing’-like model by renegotiating discounts upon launch of a new indication. This is despite broader issues in the public and private pricing system including the inability for the government to negotiate on Medicare prices, the inflexibility created for contracting due to the Medicaid best-price law, and the dynamic between PBMs and manufacturers which has led to consistent price increases to offset confidential discounts.

Two notable exceptions to currently published descriptions of pricing for multi-indication products are the UK and Italy. In Preckler et al., it was reported that patient access schemes (PAS) in the UK are negotiated at molecule level and do not support indication-based pricing mechanisms, while our expert reports that PAS are specific to indication and patient group [18]. This is consistent with the language in the current VPAS: “In cases where uniform pricing would lead to a reduction in total revenue for a medicine overall from the introduction of additional indications, other forms of commercial flexibility may be considered for medicines with a strong value proposition. In these cases, commercial flexibility would only be considered where the level of clinical effectiveness is highly differentiated, but substantial in all indications under consideration.” [15]. Further, while Italy is correctly described as having the legislative capacity and data infrastructure to support indication-specific managed-entry agreements, the finding that they are moving away from value-based indication-specific models towards simple financial models is extremely pertinent in the debate on indication-based pricing. Despite considerable capacity and experience in managing pharmaceutical purchasing at indication level, a shift towards administrative simplicity is consistent with the over-arching trend in preferences of payer stakeholders in the present study and may be interpreted to represent a shift away from value-based pricing (although unmet need, therapeutic advantage and quality of evidence still play a key role in the deliberative process in Italy).

A primary aim of pharmaceutical policy is to promote timely, equitable, affordable and sustainable access to effective medicines [9]. Policy makers must balance the short-term goal of promoting widespread access to currently available treatment with long-term global R&D priorities and the need to develop further treatments for diseases with unmet need [26]. Value-based pricing, or ensuring the price paid for a medicine reflects the value it provides, falls at the intersection of these two objectives. This is provided that sufficient mechanisms are in place to promote widespread access following expiration of intellectual property rights, whereby prices should converge towards marginal cost of production. In the short term, effective value-based pricing helps to ensure that value delivered to patients is maximised given a budget constraint. In the long-run, value-based pricing sends signals to manufacturers and helps align R&D incentives with value. A key policy question emerging from this research is whether a formal indication-based pricing model would achieve these objectives over and above current practices for price setting of multi-indication products including dynamic weighted single pricing models and differential discounting approaches.

Despite indications from several countries that current systems are fit for purpose, interview respondents also indicated that these systems generate incentives to sequence or withhold the launch of indications, a finding which is aligned with empirical research on the development and launch of multi-indication products [19, 20]. Proponents of indication-based pricing argue that single price systems may generate perverse incentives not to develop and launch medium or low value indications to avoid price erosion in high value indications [11, 12]. In theory, effective implementation of a dynamic weighted single pricing system or differential discounting addresses this issue by aggregating the incremental value of indications or by facilitating different net prices per indication through confidential discounts. In practice, current systems still incentivise prioritisation of the development and launch of niche indications with high unmet need to obtain a high price for the initial indication. There are several possible explanations for this discrepancy, with important implications in terms of the extent to which existing practices protect overall patient and public interests in oncology treatment development and use.

First, it is possible that current pricing and reimbursement methods are not accurately capturing the incremental value of indications. Weighted pricing relies on the ability to accurately forecast use of a product or the means to retrospectively adjust the price based on actual usage of a product across indications. Currently, weighted pricing models predominantly rely on the former method. Many factors influence ability to forecast usage correctly, including the presence of competitors, changes in patient demographics and poor data infrastructure [27]. Manufacturers may be reluctant to accept a reduction in price through launch of a new indication if there is uncertainty over usage.

Second, it is notable that no examples of price increases were identified, despite increases being theoretically possible. Perceptions of ‘price stickiness’, or the presence of price ceilings may contribute to launch prioritisation of indications that are most likely to achieve the highest price. Within Italy, indication extensions are subject to a mandatory price cut (depending on the level of unmet need, therapeutic advantage, and quality of evidence) that is proportional to the increase in patient volume, such that the payers capture a portion of the increase in revenue.

Third, it is possible that differences in the characteristics of first and subsequent indications are a product of standard R&D strategic decision making. The launch of an indication is not the result of a single decision, but rather a series of decisions throughout the various stages of clinical research and development. Given high costs and risks associated with drug development, firms are likely to prioritise development of indications with the highest perceived value and likelihood of success based on early clinical evidence and market projections. By extension, it is possible that the highest perceived value indication would be prioritised under both single-pricing and indication-based pricing models.

A separate issue relates to the withholding of indication extensions when no agreement can be reached on pricing and reimbursement. The withholding of indications signals an access failure and disconnect between payers and manufacturers on the value of a product within that indication. Interview respondents highlight that the non-launch of an indication typically only occurs when alternative treatment options are available to patients. While disagreements between payers and manufacturers on the value of a product is not unique to multi-indication products, concerns over price erosion of previously reimbursed indications may play a role in the process [8].

Although a formal indication-based pricing could help to address some of the challenges described above, R&D prioritisation of high-value indications and disconnects in the value between payers and manufacturers would likely still occur. Willingness to implement a formal indication-based pricing model was low across the studied countries. In some settings (USA, UK, France), data infrastructure and regulatory/legal hurdles represent significant barriers to implementing indication-based pricing, including but not limited to the Medicaid Best Price law (USA) and the VPAS (UK). In other settings (Italy, Belgium, Switzerland) where monitoring capacity was high and no significant legal or regulatory barriers were identified, implementation of indication-based pricing is still unlikely as payers have expressed a clear desire to avoid administrative burden. Overall, given the perception of only marginal potential benefits over existing practices and significant barriers to implementation, it is highly unlikely that a formal system of indication-based pricing will be implemented in the near future.

The reluctance to adopt indication-based pricing and, by extension, the low likelihood of seeing formalised indication-based pricing models in the near future, has important potential implications for patients. While healthcare payers may be convinced that current pricing practices adequately safeguard patients against the non-launch of a subsequent indication, given the perception that this typically only occurs if therapeutic alternatives are available, this finding should be validated in future empirical research exploring the conditions surrounding the withholding of indications or non-reimbursement of indications. Importantly, even in the absence of added clinical efficacy, there is value in having multiple treatment options with different tolerability profiles, particularly in oncology where treatments can have severe adverse event profiles [28]. Further, we cannot discount the possibility that the current environment for pricing multi-indication products may fail to generate optimal R&D incentives (although this may be less of a priority in smaller markets) and that some development programmes may not be initiated or may be terminated prematurely due to concerns over price erosion at molecule level. While recent literature has provided us with insights on how frequently multi-indication products are approved at the HTA level [19], future research on the conditions surrounding termination of development programmes prior to marketing authorisation would be of value.

4.1 Strengths and Weaknesses

This study relies on perceptual analysis of ten former and current senior members of health insurance organisations, health payor organisations, and health technology assessment agencies with expertise on pharmaceutical purchasing. Adopting a semi-structured interview approach with senior experts in pharmaceutical policy and purchasing enabled an in-depth exploration of the challenges presented by multi-indication products, approaches taken to mitigate these challenges, and the practicalities of implementing more formal indication-based pricing systems.

The present study is not without limitations. First, participation was limited to a single participant in all but one country. The results presented represent the subjective views of the individuals, rather than official positions of health insurance organisations, health payor organisations and health technology assessments. This reflects the required level of expertise (10 years of experience working in pharmaceutical policy) and the nature of the topic (while the proportion of products with multiple indications is increasing, pricing of products with multiple therapeutic indications remains a niche topic). Second, the study scope was restricted to health insurance and health technology assessment stakeholders. While these actors are potentially in the greatest position to comment on whether indication-based pricing would provide net additional value over and above existing pricing practices, it would be of interest to expand analysis to other stakeholder groups including patients, physicians, pharmacists, manufacturers, and regulators. Third, the characteristics of first versus subsequent indications reflect the subjective opinion of interviewees on the effects of current pricing practices, rather than an objective measure of the characteristics of first versus subsequent indications. Objective evaluations of these characteristics have been performed in other studies [19, 20]. Finally, the issue of combination pricing was not explored during interviews or throughout the study. Within oncology, the optimal therapeutic strategy may involve a combination therapy. Combination therapies are associated with a unique set of challenges from a pricing and assessment perspective. Most notably, (a) it may be difficult to attribute the individual contribution of each component of the combination to the overall therapeutic value; and (b) combination therapies involving multiple in-patent medicines often fail to reach cost-effectiveness requirements and may require substantial discounts. In this context, implementation of pricing systems that can support multiple prices by product use (either list or net) may be required to facilitate access [29]. As such, it is possible that there are additional benefits to indication-based pricing that may not have been fully considered by interview respondents in the context of multi-indication products.

5 Conclusion

Current price-setting practices for multi-indication products include weighted pricing, differential discounting, mandatory discounting, single pricing and free pricing. The majority of countries studied actively capture the incremental value of individual indications through assessment and pricing processes. Interview respondents, perhaps by nature of their direct experience in managing complex managed entry agreements, stressed the need for ‘practicality’ in managing the introduction of multi-indication products. Overall, respondents predominantly questioned whether an indication-based pricing system (if any) is likely to provide significant benefits above and beyond current practices for the pricing and reimbursement of multi-indication products. Even in settings capable of managing data infrastructure, supply chain issues, and legal/regulatory hurdles, there is poor willingness at the payer level to take on the administrative burden associated with monitoring products at indication level.

References

Bach PB. Indication-specific pricing for cancer drugs. JAMA. 2014;312(16):1629–30.

Saiyed M, Ong P, Chew L. Off-label drug use in oncology: a systematic review of literature. J Clin Pharm Ther. 2017;42(3):251–8. https://doi.org/10.1111/jcpt.12507.

Aitken M, Kleinrock M, Simorellis A, Nass D (2018) Global oncology trends 2018, innovation, expansion and disruption. [online] IQVIA Institute for Human Data Science. Available at: https://www.iqvia.com/- /media/iqvia/pdfs/institute-reports/global-oncology-trends-2018.pdf

Schein CH. Repurposing approved drugs for cancer therapy. Br Med Bull. 2021;137(1):13–27.

Hernandez JJ, Pryszlak M, Smith L, Yanchus C, Kurji N, Shahani VM, Molinski SV. Giving drugs a second chance: overcoming regulatory and financial hurdles in repurposing approved drugs as cancer therapeutics. Front Oncol. 2017;7:273.

Persson U, Norlin JM. Multi-indication and combination pricing and reimbursement of pharmaceuticals: opportunities for improved health care through faster uptake of new innovations. Appl Health Econ Health Policy. 2018;16(2):157–65.

Mestre-Ferrandiz J, Zozaya N, Alcalá B, Hidalgo-Vega Á. Multi-indication pricing: nice in theory but can it work in practice? Pharmacoeconomics. 2018;36(12):1407–20.

Flume M, Bardou M, Capri S, Sola-Morales O, Cunningham D, Levin LA. Feasibility and attractiveness of indication value-based pricing in key EU countries. J Market Access Health Policy. 2016;4(1):30970.

Kaltenboeck A, Bach PB. Value-based pricing for drugs: theme and variations. JAMA. 2018;319(21):2165–6.

Chandra A, Garthwaite C. The economics of indication-based drug pricing. N Engl J Med. 2017;377(2):103–6.

Cole A, Towse A, Lorgelly P, Sullivan R. Economics of innovative payment models compared with single pricing of pharmaceuticals. OHE Research Paper. 2018;18:4.

Garrison LP Jr, Veenstra DL. The economic value of innovative treatments over the product life cycle: the case of targeted trastuzumab therapy for breast cancer. Value Health. 2009;12(8):1118–23.

Campillo-Artero C, Puig-Junoy J, Segú-Tolsa JL, Trapero-Bertran M. Price models for multi-indication drugs: a systematic review. Appl Health Econ Health Policy. 2019;2:1–10.

Towse, A., Cole, A., and Zamora, B. (2018). The Debate on Indication-Based Pricing in the U.S. and Five Major European Countries. OHE Consulting Report, London: Office of Health Economics. Available at: https://www.ohe.org/publications/debate-indicationbased-pricing-us-and-five-major-european-countries

Department of Health. (2018). The 2019 Voluntary Scheme for Branded Medicines Pricing and Access. Available from: https://www.gov.uk/government/publications/voluntary-scheme-for-branded-medicines-pricing-and-access

Pearson SD, Dreitlein WB, Henshall C, Towse A. Indication-specific pricing of pharmaceuticals in the US healthcare system. J Compar Effectiv Res. 2017;6(5):397–404.

Sachs R, Bagley N, Lakdawalla DN. Innovative contracting for pharmaceuticals and Medicaid’s best-price rule. J Health Polit Policy Law. 2018;43(1):5–18.

Preckler V, Espín J. The Role of indication-based pricing in future pricing and reimbursement policies: a systematic review. Value Health. 2022;25(4):666–75. https://doi.org/10.1016/j.jval.2021.11.1376.

Michaeli DT, Mills M, Kanavos P. Value and price of multi-indication cancer drugs in the USA, Germany, France, England, Canada, Australia, and Scotland. Appl Health Econ Health Policy. 2022;20(5):757–68. https://doi.org/10.1007/s40258-022-00737-w.

Michaeli DT, Mills M, Michaeli T, Kanavos P. Initial and supplementary indication approval of new targeted cancer drugs by the FDA, EMA, Health Canada, and TGA. Invest New Drugs. 2022;40:798–809. https://doi.org/10.1007/s10637-022-01227-5.

Danzon PM, Wang YR, Wang L. The impact of price regulation on the launch delay of new drugs—evidence from twenty-five major markets in the 1990s. Health Econ. 2005;14(3):269–92.

Costa-Font J, McGuire A, Varol N. Regulation effects on the adoption of new medicines. Empir Econ. 2015;49(3):1101–21.

Ferrario A. Time to entry for new cancer medicines: from European union-wide marketing authorization to patient access in Belgium, Estonia, Scotland, and Sweden. Value Health. 2018;21(7):809–21.

Kyle MK. Pharmaceutical price controls and entry strategies. Rev Econ Stat. 2007;89(1):88–99.

Cockburn IM, Lanjouw JO, Schankerman M. Patents and the global diffusion of new drugs. Am Econ Rev. 2016;106(1):136–64.

Taylor DG (2020) The political economics of cancer drug discovery and pricing. Drug discovery today.

Zhang H, Zaric GS, Huang T. Optimal design of a pharmaceutical price–volume agreement under asymmetric information about expected market size. Prod Oper Manag. 2011;20(3):334–46.

Panje CM, Glatzer M, Sirén C, Plasswilm L, Putora PM. Treatment options in oncology. JCO Clin Cancer Inform. 2018;2:1–10. https://doi.org/10.1200/CCI.18.00017.

Latimer NR, Pollard D, Towse A, et al. Challenges in valuing and paying for combination regimens in oncology: reporting the perspectives of a multi-stakeholder, international workshop. BMC Health Serv Res. 2021;21:412. https://doi.org/10.1186/s12913-021-06425-0.

Acknowledgements

The authors would like to express their appreciation and gratitude to all stakeholders that agreed to participate in semi-structured interviews and share their insights on pricing of multi-indication products. The authors would also like to thank Aurelio Miracolo and Daniel Michaeli for their assistance in data collection. Finally, the authors would like to thank the editorial team and both reviewers for their insightful feedback.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Author Contributions

MM—conceptualisation, methodology, data collection, data analysis, writing—original draft. PK—conceptualisation, methodology, supervision, writing—reviewing and editing.

Funding

We acknowledge financial support from Novartis for the research leading to the paper.

Conflicts of interest

The authors have no additional conflict of interest or competing interests.

Availability of data, codes and material

The data generated during and/or analysed during the current study are not publicly available to maintain anonymity of the interview respondents. Data, codes and material may be made available from the corresponding author on reasonable request and with permission of study participants.

Ethics Approval

Approval was obtained from the research ethics committee of the London School of Economics and Political Science. The procedures used in this study adhere to the tenets of Declaration of Helsinki.

Consent

All interview participants were provided a detailed participant information form and gave written informed consent prior to participation in the study. All interview participants provided consent for interview data to be used in a peer-reviewed publication.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License, which permits any non-commercial use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by-nc/4.0/.

About this article

Cite this article

Mills, M., Kanavos, P. Healthcare Payer Perspectives on the Assessment and Pricing of Oncology Multi-Indication Products: Evidence from Nine OECD Countries. PharmacoEconomics Open 7, 553–565 (2023). https://doi.org/10.1007/s41669-023-00406-1

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s41669-023-00406-1