Abstract

The grand societal challenge of implementing the Sustainable Development Goals (SDG) puts pressure on firms to improve their sustainability practices. Environmental innovation can improve firms' sustainability practices, depending, in part, on the firm’s dynamic resource allocation capability. However, addressing whether to centralize or decentralize resource allocation has so far received scant attention in sustainability frameworks. This point-of-view article argues that the choice of whether to centralize or decentralize resource allocation will be increasingly more important as a structural lever for firms seeking to implement the SDGs. Linking this choice to the dynamic capability of resource allocation shows that this lever is intricately connected to the strategies of firms seeking to improve their sustainability practices. A practical framework is demonstrated that offers managerial decision support for this choice. Finally, avenues for future promising research are proposed.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Background

Can incorporating the choice of centralized vs. decentralized resource allocation into Sustainable Development Goals (SDGs) frameworks improve firms' sustainability practices? This is the main question this point-of-view article is meant to address. The intricate links between resource allocation and sustainability are complex; it is a multifaceted dynamic that demands consideration of several factors beyond mere supply and demand, encompassing environmental impacts, social implications, and long-term economic viability. This paper argues that the choice of centralized vs. decentralized resource allocation is intrinsically linked to the firm's sustainability practices and highlights the limited support for this choice in existing sustainability frameworks.

As a starting point, consider the scale and multifaceted nature of the grand societal challenge of implementing the SDGs. This challenge is a complex, large-scale problem with likely specific local implications (Etzion et al. 2017; George et al. 2016). In a modern economy, the role of firms is central in mediating the allocation of both financial and non-financial resources (Levinthal 2017; Simon 1991) such as assets, capabilities, and organizational processes controlled by a firm that enables it to improve its efficiency and effectiveness (Barney 1991). Indeed, the achievement of the greenhouse gas emission targets set in accordance with the Paris Agreement depends to a large extent on firms (Cenci et al. 2023; Krabbe et al. 2015; UNEP 2021). While a significant amount of resources have been allocated to reduce emissions, firms are still struggling to deliver on their emission targets (Dietz et al. 2021). This puts pressure on firms to improve their sustainability practices.

For some firms, the SDGs represent additional constraints; for others it could entail new opportunities. Firms can create both economic and social value by integrating sustainability considerations into their core business strategies (Porter and Kramer 2011). Furthermore, the nature of these circumstances can shift over time, potentially revealing emergent opportunities for resource redeployment (Helfat and Eisenhardt 2004; Levinthal and Wu Forthcoming; Sakhartov and Folta 2015, 2014). In other words, firms may face different opportunities in search and selection over time (Levinthal 2017). Either way, effective resource allocation can be essential to aligning business activities with sustainability targets and potentially unlocking new opportunities for growth and innovation. For instance, Cenci et al. (2023) attributed the misalignment between firms' emission goals and outcomes to a widespread over-investment in risk mitigation actions rather than opportunities for innovation and cooperation activities. Addressing the challenge of implementing the SDGs thus requires the effective allocation of scarce resources within and possibly between firms.

By resource allocation, this paper refers to the complex process of aligning fundamentally interrelated forces of technical, economic, financial, organizational, cultural, and interpersonal factors (Bower 2017). Knowledge of these forces can be spread across different layers within the firm, and the process of allocating resources can be decentralized among various business units and multiple levels of the hierarchical structures that govern firms (Bower 1970, 2017). Thus, as emphasized by Bower (2017), Chandler (1962) and Mintzberg (1978), resource allocation is an essential part of the strategy process. If individual firms are to contribute positively toward achieving the SDGs while remaining competitive, it implies embedding the SDGs into their strategy. This is particularly critical in sectors where environmental impacts are pronounced, as the allocation of resources not only influences organizational outcomes but also shapes the broader ecological footprint of the firm.

In addition to being an essential part of strategy, resource allocation can also be a dynamic capability. As pointed out by Helfat and Maritan (2023) firms may differ in how they structure and use various search and selection routines for resource allocation opportunities, constituting a firm's dynamic resource allocation capability. They argue that heterogeneity in how firms resolve trade-offs in the choice of resource allocation routines can be impacted by how they structure their resource allocation activities, thus impacting the firm's resource allocation capability. This implies that the choice of whether to centralize or decentralize resource allocation can enable this capability.

To illustrate, the underreporting of sustainability-related performance is used as an example. Routine flaring, the burning of excess gas released during oil production, continues to be massively underreported—for 2021 estimates were in the range of 20 Mt CO2 equivalents (Esme et al. 2022). In addition to being a source of waste of energy and unnecessary emissions, flaring releases toxic pollutants spreading hundreds of kilometers, endangering millions of people. There are indications that flaring increases the risk of cancer, leukemia, respiratory disease, and other blood disorders in local communities (CDC 2018; Pinnell and Ibrahim 2023). While several major oil companies claim commitment to eliminating all but emergency flaring (World Bank 2023); when confronted with the issue of underreporting, a majority express that the responsibility for reporting flaring emissions lies with the firm they have hired to manage daily operations. In terms of dynamic resource allocation capabilities, this example illustrates a failure of firms to adapt their strategies and operations toward sustainability by missing opportunities for environmental innovation and getting misaligned decentralized resource allocations.

Limited support in existing sustainability frameworks In recent years, scholarly and professional communities have developed a range of strategic frameworks and tools to assist firms in effectively implementing the SDGs. Examples include the "Ecosystem Pie Model" (Talmar et al. 2018) and the "Triple Layered Business Model Canvas" (Joyce and Paquin 2016). While existing frameworks and tools do consider resource allocation, they generally do not consider the choice of whether resource allocation should be centralized or decentralized. In an extensive review of such frameworks, Grainger-Brown and Malekpour (2019) show that the primary focus of these frameworks is on mapping existing programs or value chains against the SDGs (Baumgartner and Rauter 2017; Broman and Robèrt 2017; Compass 2015), reporting and benchmarking activities (Bebbington and Unerman 2018; De Villiers et al. 2014; Rosati and Faria 2019), or problem definition and goal setting (Littlewood and Holt 2018). Only a small subset of frameworks focuses on alignment (Morioka et al. 2018; Sullivan et al. 2018) i.e. to redefine the organizational practices to achieve the SDGs. The majority of existing frameworks focus on strategy implementation, with limited support for integrating the SDGs into strategic management processes (Grainger-Brown and Malekpour 2019). In addition, international standards like the ISO 14000 series (ISO 2015) advise on environmental impact reduction and compliance but do not offer specific support on choosing between centralized and decentralized resource allocation.

In sum, a practical framework addressing whether to centralize or decentralize resource allocation has so far received scant attention in sustainability frameworks. This is problematic, as managers responsible for implementing the SDGs will face this choice on multiple levels of the organization. This lack of framework support can pose SDG implementation risks, as existing research has documented that firms are struggling to deliver on their sustainability ambitions (Dietz et al. 2021; Goddard 2022). Firms must carefully balance the benefits of engaging in areas where they have established competence against exploring alternative, potentially more advantageous, courses of action—the next best and new best use of resources might reside internally or externally to the firm (Levinthal and Wu 2022). The allocation of firm-specific nonfinancial assets brings to the forefront the issue of opportunity cost (Levinthal 2017), especially for real-world managers, constrained by their finite capacity for time and attention (Levinthal and Wu 2022; Ocasio 1997). The distinct combination of resources and capabilities within a specific firm implies a unique set of strategic considerations when searching for and selecting opportunities. The choice of whether to centralize or decentralize resource allocation has implications for firms seeking to implement the SDGs, as the internal hierarchy within corporations is an important structure by which resource allocation is managed (Levinthal and Wu 2022; Meyer et al. 1992).

Linking resource allocation and sustainability practices

To establish vital links between the choice of centralized vs. decentralized resource allocation and firms' sustainability practices, this study adapts the model of resource allocation capability and the allocation of resources by Helfat and Maritan (2023). The adapted model includes four main concepts (firm sustainability practices, environmental innovation, resource allocation capability, and resource allocation routines) explained in more detail below.

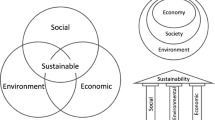

Firm sustainability practices assign firms the key role of integrating and pursuing economic, environmental, and social goals (Alinda et al. 2023; Annunziata et al. 2018). While the meaning of sustainability and sustainable development is changing over time (Mebratu 1998), contemporary connotations typically refer to sustainability as a way to describe the process of managing businesses in such a way that it contributes to the creation of an economy that is environmentally and socially conscious while also being efficient and viable (Kumar and Das 2018). Similarly, firm sustainability practices typically refer to corporate activities or operations that align with the triple-bottom-line principles of sustainability (Brundtland 1987)—social, economic, and environmental.

Environmental innovation is sometimes referred to as eco-innovation or green innovation. Kemp and Pearson (2008) offer a broad conceptual definition of environmental innovation as "the production, application or exploitation of a good, service, production process, organizational structure or management or business method that is novel to the firm or user and which results, throughout its life cycle, in a reduction of environmental risk, pollution and the negative impacts of resource use compared to relevant alternatives". This definition encompasses any changes, whether planned or unplanned, radical or incremental, in the product portfolio or production processes that aim to achieve sustainability goals like waste management, eco-efficiency, emissions reduction, recycling, and eco-design (Rennings 2000). Environmental innovation can improve a firm's sustainability practices (Silvestre and Neto 2014). Also, a firm's capacity for environmental innovation is affected by its capabilities (Salim et al. 2019).

Resource allocation capability A capability is the capacity to perform a set of tasks or activities on a repeated basis in a reliable manner (Amit and Schoemaker 1993; Helfat and Peteraf 2003). Research on organizational capabilities implies that companies oriented toward sustainability should identify and develop specific capabilities rooted in the organization to implement sustainability practices that are a source of competitive advantage (Annunziata et al. 2018). Due to path dependence, the firm's unique skills and knowledge, shaped by its past investments and learning experiences, form its distinct capabilities, which shape what the firm can do and the investment choices available to it at any given moment (Levinthal 2017). Helfat and Maritan (2023) argue that some firms have a resource allocation capability that can be a source of competitive advantage, as it can enable a more effective resource allocation, particularly through resource allocation search and selection activities.

Resource allocation routines From an evolutionary economics perspective, organizational routines—i.e., procedures or rules that specify steps for carrying out a task or activity—are the building blocks of a firm's dynamic resource allocation capability (Helfat and Maritan 2023; Winter 2003). Helfat and Maritan (2023) highlight two types of routines comprising a firm's resource allocation capability: (1) search routines and (2) selection routines. Search routines include the set of activities performed by a firm to identify opportunities and develop proposals for resource allocation. Selection routines comprise the set of activities a firm performs to evaluate and choose among the proposals for resource allocation. Such resource allocation routines can involve multiple levels in the firm, from the top management to lower levels (Bower 2017). This, in turn, can enable a firm's environmental innovation and sustainability practices. To synthesize, Fig. 1 shows how the choice of centralized vs. decentralized resource allocation is intrinsically linked to SDG implementation and firms' sustainability practices through the presented concepts of resource allocation capability, environmental innovation, and resource allocation routines. The arrows denote enabling links.

Enabling links between the choice of centralized vs. decentralized resource allocation and firms' sustainability practices. Developed by adapting the allocation of resources by Helfat and Maritan (2023). Adaptations in solid line

A practical framework

While centralized resource allocation can offer advantages such as economies of scale and scope and a consistent commitment to sustainability practices throughout the organization, decentralization can enhance sustainability in cases where local context, community engagement, and rapid adaptation to change are important factors. Some firms might achieve better sustainability outcomes by allowing regions or local entities more autonomy in resource allocation. However, as illustrated by the previous example of underreporting of gas flaring, this is not straightforward, and managers can face difficult trade-offs in such decisions.

To demonstrate what a practical framework might look like, this paper draws on a related study, which identify a set of decision criteria of relevance when faced with the choice of centralized vs. decentralized resource allocation (Solberg Forthcoming; Yassine et al. 2021). The criteria listed in Table 1 may help navigate the trade-offs faced by managers.

To illustrate, this framework is applied to the problem of underreporting of routine flaring in oil production presented earlier. In some regions, this reporting is both mature and standardized (criteria 2), supported by sufficient oversight, which effectively minimizes the issue of underreporting. The nature of the reporting-related tasks might differ across various operators (criteria 4). In cases with low reporting maturity (criteria 2), centralizing the resource allocation could mitigate the risk of underreporting by increasing control and providing necessary oversight, as well as ensuring a unified reporting practice. In scenarios where multiple operators involved in oil extraction are each responsible for reporting, this may result in duplicated skills and redundant efforts in the reporting process. A centralized resource allocation could not only reduce such redundancies but also foster shared expertise and learning (criteria 1), further increasing reporting performance. Depending on the variability of demand for flare-related reporting (criteria 3), redundancies could be removed, positively impacting sustainability outcomes. In contrast, over time, technological advancements in reliable measurement of air pollution from the flares on the ground—with official measurement data readily available and improved compliance with sustainability reporting standards and requirements—could favor a decentralized approach (criteria 2). For instance, the resources could be allocated to an external independent third party.

The criteria in Table 1 can serve as a useful starting point to incorporate the choice of centralized vs. decentralized resource allocation into sustainability frameworks. Guidelines can be developed that outline the steps managers should follow and the criteria to consider, adapted to the firm's specific goals. Further, in policy recommendations, such a framework can mitigate risks associated with "one-solution-fits-all" regarding firms' resource allocation.

Conclusion

The successful implementation of SDGs necessitates strategic resource allocation within firms. This paper has argued for the importance of choosing between centralized and decentralized resource allocation, a critical yet overlooked managerial choice in existing sustainability frameworks. A conceptual model is proposed, which builds upon existing literature to establish a link between this choice and a firm’s sustainability practices. As firms strive for greater sustainability, incorporating this choice into SDG frameworks can offer valuable guidance and mitigate implementation risks. This study has identified an important gap in existing sustainability frameworks: a lack of decision-making support for managers faced with the choice of centralized vs. decentralized resource allocation, and proposes that decision support for this choice should be an integral part of sustainability frameworks. Incorporating it into frameworks can offer managerial guidance and mitigate challenges in SDG-related search and selection. The proposed practical framework offers a more nuanced point of view beyond the sometimes polar stand of "one-solution-fits-all" in current centralization vs. decentralization-related debates.

Future research should empirically validate the identified theoretical insights aimed at further bridging the gap between managerial decision-making and sustainability practices. Also, it could focus on empirical validation of the proposed practical framework, investigating its applicability and the actual sustainability practices across different industries over time. Longitudinal studies could track the impact of shifts between centralized and decentralized resource allocation on SDG implementation. Comparative analyses can assess the efficacy of existing sustainability frameworks that incorporate such allocation structural shifts and explore the microfoundations that drive the managerial choices.

Data availability

Not applicable.

References

Alinda K, Tumwine S, Nalukenge I, Kaawaase TK, Sserwanga A, Navrud S (2023) Institutional pressures and sustainability practices of manufacturing firms in Uganda. Sustain Dev:1–18

Amit R, Schoemaker PJH (1993) Strategic assets and organizational rent. Strateg Manag J 14(1):33–46

Annunziata E, Pucci T, Frey M, Zanni L (2018) The role of organizational capabilities in attaining corporate sustainability practices and economic performance: evidence from Italian wine industry. J Clean Prod 171:1300–1311

Barney J (1991) Firm resources and sustained competitive advantage. J Manag 17(1):99–120

Baumgartner RJ, Rauter R (2017) Strategic perspectives of corporate sustainability management to develop a sustainable organization. J Clean Prod 140:81–92

Bebbington J, Unerman J (2018) Achieving the United Nations sustainable development goals: an enabling role for accounting research. Account Audit Account J 31(1):2–24

Bower JL (1970) Managing the resource allocation process. Harvard Business School, MA

Bower JL (2017) Managing resource allocation: personal reflections from a managerial perspective. J Manag 43(8):2421–2429

Broman GI, Robèrt K-H (2017) A framework for strategic sustainable development. J Clean Prod 140:17–31

Brundtland G (1987) Report of the world commission on environment and development: our common future. Oxford University Press, Oxford

CDC (2018) Facts about benzene. Bt.Cdc.Gov

Cenci S, Burato M, Rei M, Zollo M (2023) The alignment of companies’ sustainability behavior and emissions with global climate targets. Nat Commun 14(1):1–14

Chandler AD (1962) Strategy and structure: chapters in the history of the industrial enterprise. MIT Press, Cambridge

Compassdg S (2015) The guide for business action on the SDGs. World Business Council for Sustainable Development (WBCSD), Geneva

De Villiers C, Rinaldi L, Unerman J (2014) Integrated reporting: Insights, gaps and an agenda for future research. Account Audit Account J 27(7):1042–1067

Dietz BS, Gardiner D, Jahn V, Noels J (2021) How ambitious are oil and gas companies’ climate goals? Science 374(6566):405–408

Etzion D, Gehman J, Ferraro F, Avidan M (2017) Unleashing sustainability transformations through robust action. J Clean Prod 140:167–178

George G, Howard-Grenville J, Joshi A, Tihanyi L (2016) Understanding and tackling societal grand challenges through management research. Acad Manag J 59(6):1880–1895

Goddard, J (2022) Why Companies Aren’t Living Up to Their Climate Pledges. Harvard Bus Rev Digital Articles:1–5

Grainger-Brown J, Malekpour S (2019) Implementing the sustainable development goals: a review of strategic tools and frameworks available to organisations. Sustainability (switzerland) 11(5):1381

Helfat CE, Maritan CA (2023) Resource allocation capability and routines in multibusiness firms. Organ Sci. https://doi.org/10.1287/orsc.2022.16778

Helfat CE, Eisenhardt KM (2004) Inter-temporal economies of scope, organizational modularity, and the dynamics of diversification. Strateg Manag J 25(13):1217–1232

Helfat CE, Peteraf MA (2003) The dynamic resource-based view: capability lifecycles. Strateg Manag J 24(10 SPEC ISS):997–1010

ISO (2015) IS0 14001: environmental management systems—requirements with guidance for use. Iso.Org

Joyce A, Paquin RL (2016) The triple layered business model canvas: a tool to design more sustainable business models. J Clean Prod 135:1474–1486

Kemp R, Pearson P (2008) Final report MEI project about measuring eco-innovation. In: UM Merit, Maastricht, vol. 32, Issue 3. Retrieved from https://cordis.europa.eu/docs/results/44/44513/124548931-6_en.pdf

Krabbe O, Linthorst G, Blok K, Crijns-Graus W, Van Vuuren DP, Höhne N, Faria P, Aden N, Pineda AC (2015) Aligning corporate greenhouse-gas emissions targets with climate goals. Nat Clim Chang 5(12):1057–1060

Kumar A, Das N (2018) Sustainability Reporting Practices in Emerging Economies: A Cross-Country Study of BRICS Nations. Problemy Ekorozwoju Problems of Sustainable Development 13(2):17–25. Retrieved from https://ph.pollub.pl/index.php/preko/article/view/5009

Levinthal DA (2017) Resource allocation and firm boundaries. J Manag 43(8):2580–2587

Levinthal DA, Wu B (2022) Corporate strategy: an opportunity cost perspective. SSRN Electr J. https://doi.org/10.2139/ssrn.4262401

Levinthal DA, Wu B (Forthcoming) Corporate Strategy: Resource Reallocation and the Pursuit of the New Best Use. 1–27. Working Paper, submitted to Strategy Science

Littlewood D, Holt D (2018) How social enterprises can contribute to the sustainable development goals (SDGs)—a conceptual framework. In: Contemporary Issues in Entrepreneurship Research, vol. 8. Emerald Publishing Limited, pp 33–46

Mebratu D (1998) Sustainability and sustainable development: historical and conceptual review. Environ Impact Assess Rev 18(6):493–520

Meyer M, Milgrom P, Roberts J (1992) Organizational prospects, influence costs, and ownership changes. J Econ Manag Strateg 1(1):9–35

Mintzberg H (1978) Patterns in strategy formation. Manage Sci 24(9):934–948

Morioka SN, Bolis I, de Carvalho MM (2018) From an ideal dream towards reality analysis: proposing sustainable value exchange matrix (SVEM) from systematic literature review on sustainable business models and face validation. J Clean Prod 178:76–88

Ocasio W (1997) Towards an attention-based view of the firm. Strateg Manag J 18(SPEC. ISS.):187–206

Pinnell O, Ibrahim S (2023) Toxic gas putting millions at risk in Middle East, BBC finds—BBC News. Bbc.Com

Porter ME, Kramer MR (2011) Creating shared value: redefining capitalism and the role of the corporation in society. Harv Bus Rev 89(1/2):62–77

Rennings K (2000) Redefining innovation—eco-innovation research and the contribution from ecological economics. Ecol Econ 32(2):319–332

Rosati F, Faria LGD (2019) Business contribution to the sustainable development agenda: organizational factors related to early adoption of SDG reporting. Corp Soc Responsib Environ Manag 26(3):588–597

Sakhartov AV, Folta TB (2014) Resource relatedness, redeployability, and firm value. Strateg Manag J 35(12):1781–1797

Sakhartov AV, Folta TB (2015) Getting beyond relatedness as a driver of corporate value. Strateg Manag J 36(13):1939–1959

Salim N, Ab Rahman MN, Abd Wahab D (2019) A systematic literature review of internal capabilities for enhancing eco-innovation performance of manufacturing firms. J Clean Prod 209:1445–1460

Silvestre BS, Neto RES (2014) Capability accumulation, innovation, and technology diffusion: lessons from a base of the Pyramid cluster. Technovation 34(5–6):270–283

Simon HA (1991) Organizations and markets. J Econ Perspect 5(2):25–44

Solberg RJ (Forthcoming) Resource consolidation in organizations: unveiling a decision support tool. Working paper

Esme S, Owen P, Jess K (2022) Revealed: huge gas flaring emissions never reported. BBC News

Sullivan K, Thomas S, Rosano M (2018) Using industrial ecology and strategic management concepts to pursue the Sustainable Development Goals. J Clean Prod 174:237–246

Talmar M, Walrave B, Podoynitsyna KS, Holmström J, Romme AGL (2018) Mapping, analyzing and designing innovation ecosystems: The Ecosystem Pie Model. Long Range Plann. https://doi.org/10.1016/j.lrp.2018.09.002

UNEP (2021) Emissions gap report 2021. In unep.org

Winter SG (2003) Understanding dynamic capabilities. Strateg Manag J 24(10):991–995

World Bank (2023) Zero routine flaring by 2030 (ZRF) Initiative. The World Bank Group

Yassine A, Worren N, Christiansen T (2021) Dedicated vs shared resources in organizations: modifying the Design Structure Matrix (DSM) to support consolidation decisions. Proceedings of the 23rd International Dependency and Structure Modeling Conference, DSM 2021, 10–20

Acknowledgements

I extend my thanks to Professor Nicolay Worren for his valuable inputs, which have significantly enhanced the study, and Professor Ståle Navrud for his guidance on sustainability-related literature . I also wish to express gratitude to the peer reviewers for their constructive feedback, which has greatly improved the quality and rigor of this work. The contents reflect solely the opinion of the author and not of the funder or of another organization. The funders had no role in study design, data collection and analysis, decision to publish, or preparation of the manuscript.

Funding

Open access funding provided by Norwegian University of Life Sciences This study has received financial support from The Research Council of Norway and Statnett as part of Grant ES653494-310484.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Competing interests

The author declared no competing interests.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Solberg, R.J. Incorporating the choice of centralized vs. decentralized resource allocation into sustainability frameworks. J Org Design 12, 239–244 (2023). https://doi.org/10.1007/s41469-023-00161-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s41469-023-00161-x