Abstract

Various organizational factors reported in the hitherto literature affect individual (mis)behaviour within a company. In this paper, we conduct a literature review thereof, and propose a notion of the “Organizational Moral Structure” defined as a comprehensive framework of interrelated organizational factors that condition, incite or influence good or bad moral behaviour of individuals within the organization. Drawing from a wide bibliographical review and our own reflection on recent business scandals, we identify seven constituents of the “Organizational Moral Structure”: 1) leader’s values and character, 2) vision and exercise of power, 3) corporate control systems, 4) internal network of influence, 5) organizational culture, 6) internal and competitive pressures, and 7) external influences. The “Organizational Moral Structure” is proposed as a reflective framework for humanistic management and as an invitation to further research in this field. We provide recommendations on how a manager oriented towards humanistic management can use the OMS to secure and promote well-being and dignity of company’s employees.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

The influence of the internal and external organizational factors on individual ethical behaviour has been studied for a long time. The oldest contributions go back to Cressey who introduced the notion of “fraud triangle” (1953). Under his hypothesis, fraudulent behaviour is influenced by three factors: pressure, opportunity, and rationalization. Pressure or incentive motivates a fraud, which can be executed when it concurs with the opportunity to perform it. Rationalization of the fraudulent act, i.e. viewing it as justifiable in a given situation, is the third influential factor to committee a fraud. Albrecht et al. (1982) connect rationalization with personal integrity. They examine various academic and business sources and identify 82 fraud-related variables in the business context that encourage misbehaviour. They group these factors in three categories: 1) situational pressures, 2) opportunities to commit fraud, and 3) personal integrity (character). Building on these three groups and refining other seminal ideas, W.S. Albrecht advocates that “individuals are motivated to commit a fraud when three elements come together: 1) some kind of perceived pressure 2) some perceived opportunity and 3) some way to rationalize the fraud as not being inconsistent with one’s values” (Albrecht 2014). While many accept “The Fraud Triangle,” others perceive it too narrow. Among the latter, Lokanan (2015) argues that a fraud is a multifaceted phenomenon, the contextual factors of which may not fit into a particular framework like those of “The Fraud Triangle”.

Scholars investigating corporate misbehaviour point to a number of factors that contribute to corporate scandals and collapses. Soltani (2014) analyses six well-known corporate frauds (Enron, WorldCom, HealthSouth, Parmalat, Royal Ahold and Vivendi Universal) and finds several possible causes of wrongdoing: ineffective boards, inefficient corporate governance and control mechanisms, distorted incentive schemes, accounting irregularities, auditory failures, dominant CEOs, dysfunctional management behaviour, and the lack of a sound ethical tone at the top. Abid and Ahmed (2014) make a review of 55 corporate collapses from 16 countries during the period 1990–2014 along with analysing the role of their allegedly sound corporate leaders in each company’s failure. They attribute most collapses to either over ambition or greed of top executives, who indulged in high-risk ventures in order to expand.

Another source of knowledge of organizational factors and individual ethical behaviour is the literature on ethical decision-making. It suggests the co-existence of personal and organizational factors in ethical decision-making (Ford and Richardson 1994; Loe et al. 2000; O’Fallon and Butterfield 2005; Craft 2013). According to the findings, organizational factors include codes of conduct and the process of their implementation, rewards and sanctions, peers and management, ethical training and organizational culture, among others.

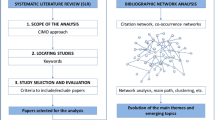

Notably, various factors proposed in the literature often overlap or paint a disperse picture. Against this backdrop, we conduct an analysis of organizational factors with an influence on individual behaviour, and we group them in seven categories. This provides a foundation for the main aim of this paper which is to propose a comprehensive framework of organizational factors that condition, incite or influence good or bad moral behaviour of individuals within an organization. We term it the “Organizational Moral Structure” (hereafter, ‘OMS’). The seven categories mentioned previously are highly interrelated and are considered as constituencies of the OMS. Importantly, our intention in developing the OMS framework is to deliver a practical tool for managers that helps them understand the OMS in order to deal with the elements of this structure to foster good individual behaviours in their companies. Therefore, our primary goal is not to provide yet another thorough literature review (see e.g., Moore and Gino 2015; Treviño et al. 2014; Treviño and Nelson 2017). Rather, we seek to contribute to the practical development of humanistic management in organisations.

Humanistic management replaces the dominant techno-economic paradigm of management with the one that is centred on people (Dierksmeier 2016; Melé 2003; Pirson et al. 2014). Humanistic management does not reject efficiency consideration as an organizational goal, but it goes beyond it by focussing on people, their dignity and on a continuous process of their development as human beings. The humanistic approach to management leads us to see a business organization primarily as a community of persons, with a goal of common good, particularly in terms of human flourishing. To this point, Melé suggests that recognizing a firm as a “community of persons” is a pillar of humanistic management (2012). He affirms that “being a ‘community of persons’ emphasizes both individuals and the whole and makes explicit the uniqueness, conscience, free will, dignity, and openness to self-realization and human flourishing of each one who form the community” (Melé 2012 p. 99). This requires favouring virtuous behaviours and establishing means to avoid misbehaviours. The achievement thereof posits the question of how corporate environment can promote or hinder good behaviour and what specific factors have influence on that.

In a certain sense, humanistic managers are continuously building up the community of persons by improving the sense of unity and cooperation and by trying to foster the development of moral virtues of people involved therein. Consequently, it makes sense for a sound humanistic management to reflect on how to improve ethical behaviour of employees. We hope that the “Organizational Moral Structure” framework contributes to the development of humanistic management by serving as a tool for analysing how to eliminate misbehaviours and how to foster good behaviours of others in the organizational context—a topic that has, so far, been scarcely considered in the modern approach to management.

This article is organized as follows. First, we review literature on organizational factors that condition, incite or influence moral behaviour of individuals within the organization. We complement it with insights drawn from well-known cases of corporate misbehaviour. Hereto, we group these factors in seven categories identified in an exploratory study. Second, we discuss the interconnection among these categories trying to show that a network of mutual dependences exists. Building thereupon, we propose the notion of the “Organizational Moral Structure” (OMS), inspired on the theological notion of “structures of sin”, which gives a comprehensive sense to all relevant organizational factors. Third, we discuss the relevance of managers in handling and shaping the OMS constituents in a way that they contribute to humanizing organizations. Specifically, we analyse the capacity of managers, and particularly top executives, for shaping the OMS that promotes good behaviour.

Organizational Factors Affecting Individual Ethical Behaviour

Findings mentioned in the introduction provide first evidence that some organizational factors affect individual behaviour, but not to the point of whatsoever denying individual moral conscience, freedom and corresponding responsibility. Conversely, acknowledging that individuals bear certain responsibility does not conflict the possibility that external factors affect individual decision-making and behaviour too.

If so, certain responsibility can also be attributed to the modern corporation as a whole; even though the latter is ultimately managed by personal moral agents. The reason for ascribing some moral responsibility also to the company is that there are “collective actions” done when individuals cooperate, which is a form of responsibility. Even the common language recognizes the existence of collective actions, for instance when people say that “a paper mill pollutes the air” or “a carmaker produces goods cars”. The results of a collective action, and even the collective action itself, can be evaluated in moral terms: one contemplates whether a collective action contributes to human good or whether it is right or wrong from the ethical principles perspective. However, when conducting a moral evaluation of a collective action and ascribing responsibility to a collective, we cannot forget that such actions consist of individual actions, and a respective individual responsibility. In other words, collective responsibility in an organization is shared by different agents, although the degree of responsibility might differ. In most collective actions, top managers will most likely bear greater responsibility than floor-shop employees.

Having said that, we acknowledge individual responsibility within the organizational context, but we also recognize it is being influenced by external factors. Upon an exploratory literature analysis and our own reflection on some recent business scandals, we identify seven groups of organizational factors that affect individual behaviour within an organization.

Factors Related to Leader’s Values and Character

First, Bandura (1977) suggests that through so-called modelling processes, leaders influence their followers as this is how values, attitudes, and behaviours are transmitted within an organization. In particular, modelling means that in the process of observing leaders’ behaviour and the subsequent consequences thereof, employees learn what is accepted and what is not, and are likely to imitate the behaviour of those with authority. Then, consecutive studies acknowledged that, through their behaviour, leaders serve as role models to employees (see e.g., Bass 1985; Kouzes and Posner 1987). Importantly, Kemper argues that leaders who engage in misbehaviour create circumstances that legitimate misbehaviour at lower levels: “if the boss (read the organization) can do it, so can I” (Kemper 1966 p. 295). As aggregated individual misbehaviour often leads to big corporate scandals, Soltani (2014) notices that the lack of a sound ethical tone at the top increases the propensity of scandals and misbehaviour.

Serving as a role model, managers can influence lower level employees to act ethically or unethically (Treviño and Brown 2005). Therefore, it is important what type of ethical tone is sent from the top. This, in turn, relates to leaders’ moral character and values. Character is generally understood as stable moral qualities of an individual, shaped by virtues (positive) or vices (negative) while values express preferences that drive actions. Both values and virtues are relevant to ethical behaviour, and consequently to misbehaviours of any individual. Hambrick and Mason (1984) argue that organizational outcomes are strongly determined by top executives’ cognitive frameworks and value commitments. When analysing cases of scandals and misconduct, value commitments play a pivotal role because it is the top management who have the formal status and practical capacity to influence organizational decisions and actions (Finkelstein and Hambrick 1990). We conclude that top managers, through their values and virtues, or lack thereof, become role models in an organization. In doing so, they set the tone for other peoples’ actions, which is a critical element in giving rise to corporate scandals.

Moreover, when individuals consecutively mimic the behaviour of managers, in time they are also likely to absorb values fostered by the top. Goodpaster (2007) argues that individuals within an organizational context tend to abandon personal values in favour of corporate-practiced values. Decision-makers at various levels need to act on corporate projects and operations in a manner that is expected of them by those at the top. Often, when there is no alignment of personal and corporate-practiced values people within organizations must give up something: either financial success or ethical values (Mostovicz et al. 2011). In the pursuit of corporate goals, they may sacrifice the latter. This happens in a situation when a choice or an action puts values and ethical principles, with which an individual closely identifies, at risk (Goodstein 2000). Hereto, one needs to explain that the corporate values mentioned are not those that organizations announce officially in their corporate websites; rather those that are truly practiced and fostered from the top. The former may be what is formally stated in the corporate statements of values, but the latter are what is often actually practiced in the course of everyday decisions, operations and interactions among specific individuals and that originate in those who execute power in the company. We observe that in the Enron scandal, in theory, the company’s management preached four corporate values (integrity, respect, communication, and excellence). In practice, personal behaviour was actually fuelled by informal values promoted by top executives: greed, arrogance, ruthlessness, corruption and chasing targets at any cost (the bottom line being the supreme value) (Windsor 2018). There were indirect personal aims involved—top executives sought to keep their positions and earn bonuses that depended on the bottom line. Therefore, in practice, management promoted values other than the official ones. In a bigger picture, Abid and Ahmed (2014), after reviewing 55 corporate collapses, conclude that greed and overambition of top executives are among the crucial causes of wrongdoing, followed by manager’s ambitions for an aggressive company’s growth and expansion and poor internal controls. Conversely, values that foster respect for human dignity, justice, truthfulness, sense of responsibility, care, benevolence and concern for the common good beyond individual interests can promote and develop integrity within the organization. Organizational leaders play a critical role in establishing a “values based climate” (Grojean et al. 2004).

Factors Related to Vision and Exercise of Power

Power can be seen as the responsibility of serving the community with justice or as means for personal interests or even as an end in itself. This latter view was theorized by Niccolo Machiavelli 500 years ago. In Renaissance Italy, Machiavelli was giving advice to the ruler (the Prince), arguing that a ruler, who wished to maintain power, should have prudence enough to avoid certain defects and vices, but he should not always be good. This orientation is still widely used by many managers today’s (Calhoon 1969). The Machiavelli’s approach can incentivise or even command fraudulent actions of employees and create dysfunctions in the organization that damage the common good of the firm because such a vision of power entails certain way of its execution.

There are various ways how managers can exercise power that are detrimental to individuals and to the company as a whole. For instance, negligent use of power can result in various inefficiencies. Hereto, incompetent or inefficient managers and boards can negatively influence individual ethical behaviour within the organization that later translates into the whole company’s financial and moral performance. Further, there is a misuse of power due to the lack of wisdom in orders given from the top, which encourages misbehaviours. This could be the case of a dominant and arrogant CEO, who neither listens to nor considers other people’s views, just like Jeffrey Skilling at Enron. The arrogant use of power is another way of misusing the power. Treviño et al. (2014) provide a complex literature review on the leader’s influence, and on just and unjust treatment of other employees by managers. Soltani (2014) claims causality between ineffective boards, dominant CEOs, dysfunctional management behaviour—which we term detrimental use of power by top leaders—and the occurrence of corporate scandals and misbehaviours.

At Enron, Skilling and Fastow (the senior executives) used power to execute their risky and semi-legal strategies in two ways. First, they induced lower-level employees to take certain actions (day-to-day operations). Second, both internal and external audit were subject to Skilling’s supervision, therefore any form of concern about the company’s accounting improprieties or violations was met with rejection. At Siemens, the use of power to induce employees to pay bribes was never proved to have taken place. However, Klaus Kleinfelt, the CEO, set ambitious targets for foreign units and expected others to deliver results. At the same time, he did not use power to prevent meeting the targets through bribes (Crawford and Esterl 2006).

Policies and practices of recruiting top executives are another consequence of the exercise of power, which ultimately affects the whole organization. Specifically, using power may refer to hiring and dismissing certain types of individuals. Albrecht et al. (2015) suggest that fraud perpetrators recruit individuals to participate in financial statement frauds. An illustrative example is the leadership of John Gutfreund, who was the CEO of Salomon Brothers—a company that was found guilty of serious frauds in the 1990s. Gutfreund used to select ambitious, aggressive young people, and tended to give them a chance to create new departments, new products and enjoy the success they could never achieve at other firms (Sims and Brinkman 2002). On the other hand, the criteria by which he dismissed employees were vague and led to ambiguous performance standards. Similar situation took place at Enron, Bear Stearns, and Lehman Brothers and in many other business cases, where already at the hiring stage power was (mis)used to secure execution of ambitious targets without too much hesitation on the employees’ end.

Factors Related to Corporate Control Systems

Management control systems include goal-setting, performance measurement and evaluation, and incentive scheme design. In addition to management control, we point to other two dimensions of oversight: internal audit and corporate governance. These three dimensions should operate independently, but at the same time, internal audit should exercise effective control over management, and the corporate governance should control the internal audit. Many scholars (Hegarty and Sims 1978, 1979; Jacobs et al. 2014; Selvaraj et al. 2016; Trevino 1986; Worrell et al. 1985 among others) agree that corporate control systems have a strong influence on individual behaviour, for good or for bad. These systems are aimed at aligning the interests of individuals with the interests of the organization. Goal congruence assumes that “the actions people are led to take in accordance with their perceived self-interest are also in the best interest of the organization” (Anthony and Govindarajan 2003).

Soltani (2014) points to three factors related to corporate control systems as the main causes of corporate wrongdoing: inefficient corporate governance and control mechanisms, distorted incentive schemes and ineffective boards. Treviño and Youngblood (1990) suggest that the locus of control and rewards, which results from certain control systems and incentives plans, tends to indirectly influence the individual’s decision making process. When the goal-setting is limited to economic objectives and there are strong incentives to meet these objectives without any concern for ethical values, the influence of control systems on individual behaviour is limited (Rosanas and Velilla 2005). The process of control is particularly imperfect when “the organizational goal is difficult to measure, possibly somewhat ambiguous, or even fuzzy” (Rosanas and Velilla 2005). In consequence, the complexity of goals depends on the type of organizational unit or job. Abid and Ahmed (2014) stress the importance of the control system, suggesting that poor internal controls are among the prominent causes of corporate collapses.

Lack of reasonable controls leads to the situations like the well-known Enron scandal: the freedom of Fastow (the CFO) to make independent decisions to engage in fraudulent accounting without any efficient control. At Enron, the management style, evaluation and remuneration system, and the direction of the operational decisions taken by top management created a certain informal Decalogue for all employees (Weiss 2014, 28–29). The company boasted a 64-page Code of Ethics underpinning a formal control system that laid out accepted behaviours. It was very generic however, with no clear instructions on activities after closing the deals, and there was no effective internal audit that would regulate individual employees’ actions (Healy and Palepu 2003).

Rewards and punishment should also be discussed in conjunction with control. The perceived opportunity—one of the three reasons for committing a fraud in the W.S. Albrecht’s (2014) “Fraud Triangle”—is related to the ‘carrot’ element of the control systems: rewards. Yet, it does not encompass the ‘stick’ element: compliance measures and the subsequent punishment. Abid and Ahmed (2014) address the latter component, pointing to poor controls as one of the empirically verified causes of corporate wrongdoing. An example of a clearly defective incentives and compliance system is the ‘carrot-and-stick’ approach used at Enron. On the carrot side, Enron’s employees were evaluated based on how much value they created for the company (with the risk of being made redundant for those ranked in the bottom 20%). Their remuneration was predominantly based on a bonus, which fostered internal pressures. The compensation plan consisted of the regular salary ($150–200 thousand on average), and bonuses as handsome as $1 million. They were awarded based on the trading profits generated by specific individuals. An incentive plan with strong emphasis on meeting the targets led to high personnel turnover. Employees pursued short term financial (personal) gains to get rich and after 2–3 years tended to leave the company (Sims and Brinkmann 2003).

Factors Related to Internal Network of Influences

In any corporate setting there are links, interdependences and interactions among individuals and groups. Some networks are formally established, some are rather informal. Within groups of people above a certain size, and when responsibility is not explicitly assigned, there is a tendency for diffusion of responsibility—a socio-psychological phenomenon whereby a person is less likely to take responsibility for action or inaction when others are present (Darley and Latane 1968). Diffusion rarely occurs in pairs, but drastically increases within groups of three and more (Leary and Forsyth 1987). Thus, even though individual moral agency is unquestionable, it is often difficult to blame specific persons when they remain in a complex network of interrelations. Additionally, the stronger the fragmentation of decision-making and action and the diffusion of knowledge are in a corporate setup, the more difficult it is to ascribe responsibility to particular individuals (Boatright 2004). And again, strong fragmentation and diffusion tend to occur in more intricate interrelations. Therefore, deliberation on moral responsibility requires consideration of interactive, mutually influential exchange between the organization (group) and individuals (its constituent elements) (Yates 1997).

Individuals tend to take specific decisions because they are in a complex network of interrelations. At the same time, individuals are the creators of the organizational links, interdependences and interactions, and so they initiate the formal and informal structures they later operate within. Interrelations within these structures condition personal behaviour for good or for bad. Painter-Morland (2007) describes such structures of relationships as “a complex adaptive system”, pointing to the fact that individuals tend to adapt to the expectations of others (internally and externally). The characteristics and intensity of links, interdependences and interactions among individuals and groups differ across organizations and specific situations—and probably, the degree of intensity of these elements—determines whether the influence of the network on personal behaviour is weaker or stronger.

Factors Related to Organizational Culture

Organizational culture can be understood as shared beliefs, values, and practices, and is built up by leadership and interactions among people within the organization. In other words, it is “a pattern of shared and stable beliefs and values that are developed within the company across time” (Gordon and DiTomaso 1992); or more simply, “the way we do things around here” (Deal and Kennedy 1982). Drawing from Goodpaster’s reasoning on the identifiability of a company’s culture (2007), Gibson (2011) describes organizational culture as “both action-guiding and thought-guiding environment” which consists of procedures, policies, goals, norms and corporate values. Moore and Gino argue that others, through their actions or inaction, help to establish a standard for ethical behaviour of a person (2013 p. 57). This is how the organizational culture—which later shapes the individual’s course of action within an organization—is built. At the same time, Gibson (2011) perceives the existence of two-way interrelation between individuals and organizations: “corporations actively participate in shaping a person’s moral agency, and hence moral outlook, and, reciprocally, the organization may be shaped by its members through a continuing negotiation of values” (Gibson 2011). Therefore, we suggest that corporate culture and individual behaviour are mutually causal in an organizational context. In the Barclays case, submitting untrue interest rates was a common, regular practice that was later qualified as ‘accepted culture’ in most of the banks that took part in the process (these were ‘the rules’ of the Libor submission ‘game’) (“Behind the Libor Scandal” 2012). On the other end, the very same culture was then shaping everyday decisions and actions of particular individuals involved in the submission process.

It is hardly surprising that culture is believed to be the most important factor that crafts ethical decision-making (Sims and Brinkman 2002; Sims and Brinkmann 2003). Pierce and Snyder (2008) find that employees switching job locations almost immediately conform to the local culture, in particular to organizational norms of unethical behaviour. Culture becomes, therefore, inherent to an organization. Numerous scholars who support this position compare culture to corporate identity (French 1984; Ladd 1984), and emphasize that identity is built over time and is not necessarily influenced by people leaving and newcomers entering the community.

Notably, organizational culture tends to evolve in time. It originates, in fact, from the decisions, actions or attitudes of particular individuals who acted in the past as agents of the corporation (Ashman and Winstanley 2007). Hence, psychological constructs that are attributed to corporations, such as values, personality, conscience, and identity, stem from particular individuals.

A good organizational culture promotes morally correct decisions (Chen et al. 1997) and vice-versa. Organizational culture played a paramount role in all of the financial scandals we analysed, such as Enron, Bear Stearns, Lehman Brothers, Barclays or Siemens.

Factors Related to Internal and Competitive Pressures

Individuals can be pushed to certain actions by internal motivation or external stimulus. The latter can in the form of pressure to produce results or certain outcomes either from the top or from the peers. In the W.S. Albrecht’s (2014) “Fraud Triangle” one of the dimensions relates to some kind of perceived pressure. We observe that this perceived pressure was evident in the cases of analysed corporate scandals, and most probably played an important role in individual behaviour.

Internal pressures towards employees to get results generally come primarily from the top. If adequate ethical guideline is not provided, such pressures can lead to pursuing company’s targets “at any cost”, what results in massive corporate scandals. At Enron, for instance, there was heavy internal competition and strong pressure on results, even at the expense of stretching the rules. The subprime crisis serves as an excellent example thereof too. In companies like Bear Stearns or Lehman Brothers there was strong pressure on results, along with a culture of risk-taking that grew from company’s trading operations (Maxey et al. 2008). Corporate policies, shaped by business practice, favoured target-oriented decision at all costs. Whereas the lower-level employees were ‘encouraged’ to take part in massive securitization by the specific incentive systems and by the example of company’s leaders, the higher-level executives faced the whole network of interrelated pressures: lenders wishing to sell more loans, speculative investors eager to suppress rational assessment of the situation for the sake of financial gains, shareholders striving for equity gains, and finally other financial institutions following the same path of profit making.

Quite often top management is also under heavy pressure to increase profits, and indirectly to boost company’s share price that comes from shareholders. Recent Libor manipulation scandal provides empirical evidence on numerous internal pressures at different levels. Barclays bank executives were pressed by shareholders to improve performance, particularly during the 2007–2008 credit crunch, when the best strategy for boosting the bottom line was to understate borrowing costs through manipulating Libor rate (Mollenkamp and Whitehouse 2008). Further internal pressures shaped everyday decisions and actions of individuals—Barclays’ employees (submitters) were again and again pushed by other employees (traders) to report untrue rates, something reported by several journalists (“Behind the Libor Scandal” 2012). Additionally, Barclays’ employees were pressured by the system of other submitting banks to take part in the unfair Libor forming process. On the one hand, they competed with other banks, and on the other hand it was a necessary cooperation to achieve a joint aim. A remark of one RBS trader in Singapore to a Deutsche Bank trader from August 19, 2007, illustrates how entangled the whole system was: “It’s just amazing how Libor fixing can make you that much money or lose if opposite. It’s a cartel now in London.” (Tan et al. 2012).

Additionally, in all of the cases we reflected upon, we see that internal pressures are dependent on the internal network of influences, and vice versa. Submitting untrue interest rates would not have been possible if not for the close informal links, interdependencies and interactions between top executives, traders, treasury managers and bank’s submitters, both within the bank and across all leading banks participating in the Libor formation process.

Factors Related to External Influences

The last factor encompasses influences upon the organization (and thus upon its managers and lower level employees) that arise from the legal, political, social and cultural context. External influences are diverse types of external pressures that affect those who run the organization. They originate from interrelations and interactions of the members of the company with people and institutions constituting a firm’s immediate environment. Those external agents, such as banks or auditors, are often necessary for company’s activity. The legal system and regulatory environment also have a material impact on internal agents (Ekici and Onsel 2013). Failure of the auditor, in addition to accounting irregularities, to appear to be among main causes of corporate frauds studied by Soltani (2014). Additionally, culture and social demands can be treated as external influences, for good or for bad.

Individuals and institutions who interact with a company have their own intentions and goals. In certain situations, these interests or goals can induce specific (also unethical) actions of the company. In each analysed scandal, the fraudulent company remained in a network of interrelations with a number of external entities (e.g., Enron and Arthur Andersen, investment banks and other financial institutions in the subprime crisis, Barclays bank, other banks manipulating Libor and financial supervision bodies). Importantly, we observe that the misbehaviour of individuals within the fraudulent organization is often affected, encouraged, or sanctioned by actions and pressures from external individuals, institutions and frameworks, which jointly comprise the broader business environment of the firm. For instance, in the Bear Stearns and Lehman Brothers case, the whole financial system demonstrated evident pressures and influences. Both investment banks’ collapses would not have happened if there was no bubble of subprime lending, which encompassed a number of institutions within the value chain of issuing the subprime mortgage-backed securities. The government and its policies pushed for home ownership. Careless mortgage clients took on obligations beyond their credit capability. Mortgage brokers, banks and insurers made massive lending possible and pushed for creating high-risk overleveraged financial products for investors, who pursued handsome returns. Last but not least, rating agencies contributed to the system by “rating laundering” (McLean and Nocera 2010 p. 122), and were “essential cogs in the wheel of financial destruction” and “key enablers of the financial meltdown” (Financial Crisis Inquiry Commission 2010). Together, all these institutions created an environment of interdependencies with mutual pressures exerted onto each other.

Some interrelations between an organization and external entities are particularly sensitive and can play a vital role in preparing the ground for scandals and misbehaviours. There are institutions which provide services that should be objective and serve the interests of the society, but in practice they are “aid and abet” institutions, i.e., they assist other companies in committing a crime by words or conduct. Boatright (2004) particularly emphasizes the key role of institutions with the gatekeeper function in preventing corporate wrongdoing. Due to the auditing and monitoring function, the gatekeepers have broader knowledge about company’s operations and performance than shareholders or an average employee (Boatright 2004). Gatekeepers are expected to monitor corporate actions, and hence should also be accountable and responsible for the scandals together with the fraudulent company (Coffee Jr. 2002; Ganuza and Gomez 2007). In Enron and Andersen case, unlike in the subprime crisis, external influences were not in form of external pressures but rather enablers of Enron managers’ misbehaviours. The parity of authority and responsibility that is discussed on corporate level (Stephen et al. 2010) is also problematic when one analyses cases that involve corporations and the government, when duties, deeds and responsibility tend not to go hand in hand.

Probably the biggest challenge regarding this constituent is insuring the independence of both company’s managers and external entities like auditors or rating agencies (Bazerman and Gino 2012). Often, there is a persistent conflict-of-interest situation (Sezer et al. 2015) because such entities have financial incentives to participate in or facilitate client’s misbehaviours. At the same time, they have great direct (bound to their function) and indirect (as an external observer) potential to prevent misconduct (Gino et al. 2009). Thus, although the role of the corporation in changing external factors that facilitate internal wrongdoing may be not too high, external influences should still be analysed in each case.

We conclude that the network of interrelations between the company and external parties can diminish individual responsibility; although in some cases it can be difficult to precisely determine the scope and strength of such influence.

The Notion of the “Organizational Moral Structure”

The identified seven groups of organizational factors that affect individual behaviour within organization comprehensively embrace the factors described by other scholars and are consistent with factors latent in the cited cases studies. Reflecting more thoroughly on these factors we discover certain connections among them.

Vision and exercise of power is closely related with values and character of the leader. A leader with a sense of justice and with a character in which justice is a significant trait, is likely to avoid a misuse of power. Other virtues shaping leader’s character can contribute to the use of power that strengthens common good. Practical wisdom and courage help lessen negligence in using the power, humility helps reduce the arrogant use of power by listening people and asking for an appropriate advice. Leader’s values along with vision and exercise of power affect the design and implementation of the corporate control systems which can foster misbehaviours. Internal network of influences and organizational culture are also related to values and character of leaders, and to the decisions taken by managers in the process of executing their power.

Boatright uses the Enron case to illustrate how top executives used their power to create work environment promoting wrongdoing. Additionally, he argues that Enron’s case involved serious injustice because some top executives, who had inflicted great financial and intangible losses on investors and employees, did not suffer adequate personal consequences (Boatright 2004 p. 9). Notably, these executives indeed had the means to change the course of action. There is empirical evidence that top executives committed to ethics tend to invest in ethics programs, policies, and structures (Weaver et al. 1999). Similarly, corporate leaders play a significant role in fostering values and shaping organizational culture (Schein 2010). Gibson argues that corporate culture influences individual ethical behaviour but, on the other hand, culture itself is shaped by the manager’s decisions and behaviour, and is further developed and fostered by regular employees: “corporations actively participate in shaping a person’s moral agency, and hence moral outlook, and, reciprocally, the organization may be shaped by its members through a continuing negotiation of values” (Gibson 2011).

Internal and competitive pressures are highly interdependent and empower each other. Power can be used to increase internal pressures without paying too much attention to the means used to obtain results. To this point, the well-known Milgram’s experiment on obedience to authority (Milgram 1974) can be mentioned. Milgram found that about 65% of subjects who performed the task required of them, and who followed immoral orders, did not see themselves as responsible. Milgram concluded that obeying a legitimate authority influences other people’s behaviour beyond their own moral conscience. In such circumstances, some individuals see themselves as merely an instrument for carrying out the orders of others—an “agentic shift” (Milgram 1974).

The impact of external influences on individual behaviour within an organization is also linked to the leaders’ values and character and to the incentives established within the internal control systems. Noteworthy, leaders’ values, vision and exercise of power and corporate culture determines to what extent external pressures are affecting individual ethical behaviours within an organization.

Corporate culture and individual behaviour seem mutually influential in organizational context. More specifically, leaders shape corporate culture by promoting certain behaviours in day-to-day practice. Then, the established corporate culture affects back the ethical behaviour of the new hires, new leaders’ values, the contemporaneous internal network of interrelations and control systems. To this point, organizational culture can affect leader’s values while strong external pressures can make leaders re-consider their values. Actually, the interdependence of factors is a complex phenomenon and a more thorough study thereof exceeds the scope of this paper. For our purpose, it is sufficient to acknowledge that a certain interrelation among the seven groups of factors exists and that they are not isolated in contributing to corporate misbehaviours.

Conditional on acknowledging the existence of the seven groups of organizational factors and their interrelation, one can talk about a certain “structure” that influences individual moral behaviour within an organization. We term this the “Organizational Moral Structure”.

Contrary to the fierce ongoing debate on ascribing moral responsibility to either individuals or corporations, the concept of the OMS shifts the centre of controversy. We focus on the individual responsibility, which is inherent to personal behaviour, although attenuated in certain degree due to the influence of the OMS. However, those who have an actual power to handle and shape the elements of the OMS, for good of for bad, bear moral responsibility for affecting the behaviour of others (see different types of responsibility in e.g., Melé 2019 pp. 67–70).

This claim is aligned with and partially inspired by the category of “structures of sin” taken from Catholic moral theology. A short explanation of this concept can help explain what we understand as the OMS.

As Pope John Paul II emphasizes, “[i]n not a few cases such external and internal factors may attenuate, to a greater or lesser degree, the person’s freedom and therefore his responsibility and guilt. But it is a truth of faith, also confirmed by our experience and reason, that the human person is free. This truth cannot be disregarded in order to place the blame for individuals’ sins on external factors such as structures, systems or other people. Above all, this would be to deny the person’s dignity and freedom, which are manifested—even though in a negative and disastrous way—also in this responsibility for sin committed.” (1984 n. 16) Accordingly, John Paul II holds that there is personal responsibility in wrongdoing—a “sin” in theological terms, and he discards the existence of collective responsibility or “social sin.” “A sin, in the proper sense, is always a personal act, since it is an act of freedom on the part of an individual person and not properly of a group or community” (John Paul II (Pope) 1984 n. 16). This is in line with the Aristotelian view that responsibility can be properly ascribed only to a moral agent, i.e. someone who possesses a capacity for decision—a certain kind of election resulting from deliberation: “The object of choice being one of the things in our own power which is desired after deliberation, choice will be deliberate desire of things in our own power; for when we have reached a judgment as a result of deliberation, we desire in accordance with our deliberation.” (Aristotle 1998 bk. III, ch.3) Thus, responsibility “cannot be disregarded in order to place the blame for individuals’ sins on external factors such as structures, systems or other people [...] this would be to deny the person’s dignity and freedom, which are manifested-even though in a negative and disastrous way-also in this responsibility for sin committed.” (John Paul II (Pope) 1984 n. 16) However, the late Pontiff recognizes that individuals may be conditioned, incited and influenced by numerous powerful external factors. Specifically, “[i]f the present situation can be attributed to difficulties of various kinds, it is not out of place to speak of “structures of sin,“ which […], are rooted in personal sin, and thus always linked to the concrete acts of individuals who introduce these structures, consolidate them and make them difficult to remove. Thus, they grow stronger, spread, and become the source of other sins, and so influence people’s behaviour.” (John Paul II (Pope) 1987 n. 36). The Pope points to two main causes of these structures: “[o]n the one hand, the all-consuming desire for profit, and on the other, the thirst for power, with the intention of imposing one’s will upon others. In order to characterize better each of these attitudes, one can add the expression: ‘at any price.’” (John Paul II (Pope) 1987 n. 37)Although all of the above quotations refer to a sin or to wrongdoing, mirroring arguments can be applied to good behaviour. Consequently, we extrapolate from the notion of the “structures of sin” to the “structures of virtue” and, in more generic terms, the concept of “moral structures” arises.

“Moral structures” include all kind of factors that excerpt certain influence or pressure on an individual. In the organizational context, it motivates our proposition of the “Organizational Moral Structure” that we define as the set of organizational factors that condition, incite or influence good or bad moral behaviour within the organization. We call these factors underlying constituents. Following previous findings, in Table 1. we explain the OMS through its seven constituencies, accompanied by a short explanation.

OMS and Humanistic Management: Managers in Shaping the OMS

Humanistic management—shortly introduced at the beginning of this paper—is a movement developed mainly after 2009 (Dierksmeier 2016; Melé 2016; Pirson 2017; Spitzeck et al. 2009; von Kimakowitz et al. 2011 among others), although one can track its antecedents back to the beginnings of management and to the thinkers like Mary Parker Follett, and others (Melé 2003, 2013). Humanistic management is generally presented as an alternative paradigm to the prevalent techno-economic or ‘economistic’ paradigm that has been guiding the twentieth-century management theory and practice, and even now is accepted by many. Humanistic management is based on a deeper knowledge of a human being. Some (Dierksmeier 2016; Pirson 2017) emphasised that humanistic management focuses on protecting human dignity and promoting well-being. Melé suggests that management can be called humanistic when its outlook emphasizes the human condition and is oriented to the development of human virtue, in all its forms, to its fullest extent (Melé 2003). Spitzeck et al. (2009) link humanism in business with the development of a responsible business.

Since humanistic management strives to protect and promote dignity and human flourishing, thereby it should contribute to eliminating misbehaviours and promoting good behaviours and to the responsible business. Managers who follow it, should be sensible to all factors that in positive or negative way can influence individual moral behaviour. For this purpose, the OMS offers a frame of reference. By no means, is the OMS a model of humanistic management nor a checklist of key elements to define a humanistic management, since this is more than this. Yet, hopefully the OMS becomes a valuable framework for reflecting on crucial organizational elements with an influence on good or bad behaviour.

Importantly, we argue that the seven OMS constituents with influence on individual behaviour remain within the managers’ sphere of influence. The natural question that follows is what managers, especially the top executives, can do to shape the elements of the OMS to promote good moral behaviour of employees and to prevent their misbehaviours. Managers’ capacity to, and the resulting responsibility for shaping some of the OMS constituents is clear and obvious. Regarding other constituents, further reflection is necessary. Given the insights for the cases and our theoretical proposition we learn more about the managerial capacity to change the OMS towards fostering good behaviours.

Leader’s Values and Character

This constituent of the OMS is anchored in the personality of those who are leading the company, and it directly depends on their will. In many recent scandals top executives demonstrated practicing rather egoistic ethics, which is rooted in the value maximization ideology. Once value maximization becomes primary objective and the driver of actions, there is no more room for the concern for others, their dignity and well-being, except for what is required by law. Stakeholders’ interests are only satisfied if it contributes to the bottom line. We also find the lack of virtues and direct unethical behaviour at the top.

Value commitments play a pivotal role in creating a positive OMS because it is the top management who have the formal status and practical capacity to influence organizational decisions and actions (Finkelstein and Hambrick 1990). Since the Enron scandal, especially after the successful prosecution of Enron executives in 2003, the link between ethical philosophy and management behaviour has been ever converging. Premeaux (2009) reports that ethical behaviour has been more in line with ethical rhetoric ever since, as the high-profile prosecutions, convictions, and jail sentences may have impressed on managers that was the time to incorporate ethics into business decisions. Noteworthy, a sound ethical philosophy with real concern for human dignity and well-being (of its followers) nourished by a leader’s moral character and coherent behaviour could be very effective for fostering good behaviour within the organization (Bormann 2017). In the same line, some findings show a positive relationship between ethical leadership and ethical pro-organizational behaviour. In such cases, employees are willing to work towards the benefit of their organization; yet this is conditioned by the degree to which the subordinates experience identification with their supervisor (Miao et al. 2013). Against this backdrop, we argue that managers need to recognize that their values and character can contribute to humanistic management provided they incorporate ethical philosophy into their decisions and actions that are directly affecting individuals within their organization.

Vision and Exercise of Power

Vision entails certain sense of power, but the bottom line is how this power is used. The Machiavellian orientation, which considers that power is an end in itself, is not a way to promote ethical behaviour. In many practical cases one can observe that such an approach leads to unethical decisions of those in power, but also has a detrimental effect on the individual behaviour of other employees. An alternative view entails that a firm is seen as a community of persons. As a result, the power is a mean used to provide the best service to the community, and is oriented towards acting with integrity (Melé 2012).

The vison and exercise of power have the responsibility to serve both the company and the society, and to be oriented towards doing good. Power within an organization defined this way fosters ethical behaviour, but the contrary is also probably true. First, Tepper (2000) provides evidence that abusive supervision is associated with lower job and life satisfaction, lower normative and affective commitment, higher continuance commitment, conflict between work and family, psychological distress, and often makes people resign from their jobs. We see this as a serious threat to employees’ dignity and well-being. Then, Hannah et al. (2013) develop and test a model that links abusive type of supervision to the subsequent ethical intentions and behaviour of followers. They find negative relation between abusive supervision and the followers’ moral courage and their identification with the organization’s core values. Thereupon, we are inclined to suggest that abusive use of power can have implications for individual moral behaviour. Importantly, managers are capable of directing the vision, but even more so they do have the physical capacity to exercise the power towards creating an OMS that protects and promotes of dignity and well-being of their subordinates. To do so, they foremost need to revise current power dynamics and then replace detrimental uses of power with the ones that enable employees to take ethical decisions and exercise ethical actions.

Corporate Control Systems

These systems can be an extremely powerful tool for reinforcing employees’ behaviour, one way or another. The main point here is to realize the importance of executive leaders’ role in developing corporate control systems—the criteria to perform employees’ evaluation, along with the system of rewards and punishment to reinforce normatively appropriate conduct—in organizations (Treviño et al. 2000). Specifically, top managers are the ones who practically decide about how such systems are designed, communicated and implemented.

Setting hyper-inflated targets and then using corporate control systems to guarantee that everyone works towards these common goals, seems a common practice. In 2014, Toshiba overstated its profits by more than 1.2 billion dollars, or about one-third of the total figure reported, in order to meet the (otherwise unrealistic) targets that the top management had established for the company and its subunits. According to the New York Times, there were problems in “virtually all corners of its business, which encompasses products stretching from refrigerators to nuclear power plants” (Soble 2015b). The same newspaper also reports that Hisao Tanaka, the serving chief executive, acknowledged that the company had engaged in ‘inappropriate accounting,’ but said that this had not been done intentionally. He also denied that he had ever told subordinates to exaggerate the profitability of their divisions. How then did it occur in “all corners of its business?” According to Melé et al. (2017) such situation is related to the performance measurement and reward systems. “Taking such measures triggered by the control system, they fostered unethical practices (lying to obtain an economic advantage) and damaged the whole company.” (Melé et al. 2017 p. 610) Similar story could be told about Siemens employees who were repeatedly referring to bribing to reach internal targets (Dietz and Gillespie 2012). Notably, it was at the top executives’ discretion to decide how those control systems have been designed and functioned for years. Therefore, managers should be constantly revising and improving this OMS constituent: company’s goals, incentive schemes, performance measurement and evaluation systems, if they want to foster good behaviour of individual employees. In doing so, they secure and promote employees’ well-being and dignity, as e.g., Lau and Martin-Sardesai (2012) report that the design of evaluation measures affects the degree to which employees feel treated with dignity. This way top executives can contribute to humanistic management.

Importantly, corporate governance has also its role in favouring a certain type of individual behaviour within an organization. Corporate governance is about establishing policies and controlling the management; yet it fails in cases of distorted incentive schemes or ineffective boards. Inefficient corporate governance leads to an improper control of the top executives which, historically resulted in serious corporate frauds and scandals.

Internal Network of Influences

Managers are inevitably a key element of many networks of influences within an organization. However, some links and interactions among individuals and groups are independent of the managers. In any of these cases, top executives still need to make sure that in both formal and informal networks, the responsibility is properly ascribed, and that individuals do not adapt to the group expectations at the expense of individual moral deliberation. This, we see as a particularly challenging task for top executives. An OMS that fosters good behaviour of individuals is the one where the influence of the network on personal behaviour is either strong and positive or none and allows for individual moral reasoning. Managers rarely can contribute thereto directly. They should foremost try to deeply understand network and group dynamics, and then promote individual responsibility and mutual support of individuals to do good.

Organizational Culture

Leadership is crucial in shaping organizational culture (Schein 2010) and ethical climate (Mulki et al. 2009). The experience of recent scandals such as Enron, Bear Stearns, Lehman Brothers, Barclays or Siemens shows that top executives played a paramount role in creating an unethical culture inside the organization. Diamond, the Barclays CEO, himself defined the bank’s culture as “how people behave when you think no one is watching” (Myners 2012). As noted, in the Toshiba case, ‘accounting irregularities’ seem to have become a part of the corporate culture that was either cultivated or, at least, accepted by top management. The same seems true for culture of bribery at Siemens. In all these cases, a number of top executives were dismissed or prosecuted (or left), even though they did not participated directly in wrongdoing (Dougherty 2007; Soble 2015a). Kenneth Lay, the Chairman of Enron, was not directly involved in accounting manoeuvres. He even testified in court that he had not been aware of the fraud. However, as an individual, he bears the moral responsibility that came with his position for the lack of proper supervision over other employees’ actions, and for allowing the culture of greed, arrogance, ruthlessness, corruption to spread throughout Enron (Sims and Brinkmann 2003). Therefore, managers, even though not directly pressing other individual’s to unethical decisions and actions, bear indirect responsibility for corporate misconduct related to the culture they promote internally. Conversely, their position enables them to promote a culture that actively incentivises individuals within the company to do good. Yet, we recognize that one ethical manager is most often not enough to change the corporate culture supported by other unethical managers (Treviño and Brown 2005).

Importantly, it’s not the officially declared culture that matters but the practiced one. Many official culture statements mention human dignity and well-being as its cornerstones. Yet, it is the managers who actually make the corporate culture alive by the way they run the organization. For instance, one could have read glamorous stories about Bear Stearns’s culture on its website, yet in practice, its managers developed and cultivated a culture of risk-taking that determined the employees’ approach towards doing business at all levels, a culture of pursuing financial gains without any single reflection on how they do it or how the employees feel about it. Managers who strive to create an ethical OMS need to reflect on what is declared and what is practiced on daily basis within their organization, and positively contribute to the latter. In doing so, they are capable of incentivising good behaviour: following Zwetsloot and Leka (2010), corporate culture is a variable to be manipulated for the promotion of health and well-being of employees because it has a significant, yet often unnoticed influence on the decisions and behaviour of individuals. At the same time, this reinforces humanistic management in an origination.

Internal and Competitive Pressures

Most of internal pressures that push individuals to certain (unethical) actions come from the top. But when employees continue to operate under pressure from the top, in time they also start to exert pressures on each other. In Enron, there was heavy internal competition and strong pressure on results among the employees, even at the expense of stretching the rules (Sims and Brinkmann 2003). In Barclays, mid-level employees (the submitters) were pushed by other mid-level employees (the traders) to submit the untrue rates (“Behind the Libor Scandal” 2012). Here, again, management has the greatest responsibility. Top executives, who care about promoting OMS that has a positive effect on individual behaviour, should not only refrain from exerting pressure towards misbehaviour of others, but also seek to identify and eliminate any other type of pressure that can effectively push individuals to unethical actions. The latter is not in the immediate set of management’s duties. It is, however, key in ascertaining that individuals can exercise their freedom and ethical judgement in decision-making, which is one of the conditions of humanistic management.

External Influences

External institutions can exert significant influence on individuals within an organization, but most often those individuals affected are managers themselves. In such cases, it is difficult for individual managers to oppose to the whole system.

Another example of a well-established way to exert pressures on top executives in public companies is the quarterly financial reporting system of communication with financial community. Investors press for immediate returns, while financial analysts are a threat to the managers because of a potentially negative recommendations (to investors), which, in turn, affect the share price and company’s cost of capital. However, this is not entirely a ‘catch 22’ situation. Managers with moral imagination can reverse the focus using, and committing to, a solid and convincing long-term philosophy. This is the case of Bill George, who was the CEO of Medtronic during 1991–2001. He stood for a mission-driven company, for a values-cantered organization and for an adaptable business strategy. He actively opposed to the short-termism and to maximizing shareholder value on quarterly basis. He believed that “sustained growth in shareholder value may be the end result, but it cannot be the sole purpose” (van de Ven 2001). This is an example of management that prioritises long term common good of the company and its employees over short-term material interests. This way, Medtronic employees neither needed to go beyond what they considered ethical for the sake of satisfying the interest of company’s investors, nor were internally conflicted regarding what ‘doing good’ meant. This type of leadership promotes human dignity and contributes to humanistic management. But it does take great courage to oppose to the whole ecosystem in order to do good.

Finally, sometimes external influences relate to non-executive employees. Barclays’ manipulation of Libor is a good illustration thereof. Additionally to internal pressures, banks’ mid-level employees (the submitters) were pressured by the system of other submitting banks to take part in the unfair Libor forming process (Tan et al. 2012). It was a paradox situation: on the one hand, they competed with other banks, on the other hand, the cooperation in wrongdoing was necessary to achieve a joint aim of all submitting banks. Hereto, a manager who recognizes that external entities can exert pressures on individual employees, and who wants to foster positive impact of the OMS on individual behaviour, needs to monitor any form of external pressure coming from business ecosystem. By eliminating external elements that prevent an individual form exercising the freedom of moral judgement and decision making, such a manager contributes to the well-being and dignity of its employees.

Conclusion

We propose the concept of the “Organizational Moral Structure” which we define as a comprehensive framework of organizational factors that condition, incite or influence good or bad individual moral behaviour within an organization. Our findings suggest that there are seven underlying constituents of the OMS which seem interconnected: 1) leader’s values and character, 2) vision and exercise of power, 3) corporate control systems, 4) internal network of influence, 5) organizational culture, 6) internal and competitive pressures, and 7) external influences. The OMS concept endorses individual rather than corporate responsibility, but it also takes into consideration structural elements that affect and may mitigate individual responsibility. At the same time, our approach emphasizes the responsibility of those who actually handle and shape the OMS constituents (especially when they promote and contribute to the detrimental type of the OMS), that is, the corporate leaders.

The “Organizational Moral Structure” with its seven constituents (factors) provide an analytical tool for analysing, and thus better understanding of, the root causes of wrongdoing within organizations. Consequently, the OMS can be used to as practical tool that helps design organizations by contributing to prevent misbehaviours. Hereto, we recognize the pivotal role of managers who have the capability of redesigning the OMS. Although further research is needed, the OMS has the potential to foster virtuous behaviours.

The OMS framework is also important for corporate leaders as individuals, who should strive to create for themselves “relational spaces that allow for critical reflection and conversation” (Wilcox 2012 p. 95). The seven OMS constituents can help leaders reflect about themselves. This is especially relevant if, as Pitesa and Thau (2013) argue, leaders (people who are higher in power) have a lower tendency to focus on others’ (un)ethical conduct.

OMS may also be useful for teaching purposes as a framework to analyse what contributes to fraud and other misbehaviours within the organization.

Current literature on humanistic management emphasizes respect for human dignity, promoting human flourishing and working for the common good, as well as partially addresses the aspects of ethical behaviour within organizations. However, in the space of humanistic management no systematic study about the organizational moral structures existed so far. The OMS and its constituents are particularly relevant for humanistic management. In humanistic management, the OMS provides a framework for analysing and reflecting on the how the described seven constituents work in a company in practice, how they affect good behaviour and, ultimately, how they can foster humanizing organizations. Thus, the proposition of the OMS opens the door to new studies on fostering good behaviours and preventing misconduct through enhancing and redefining leader’s values and character, vision and exercise of power, corporate control systems, fostering organizational culture, channelling internal network of influence, managing internal and competitive pressures and external influences from the humanistic management perspective.

We suggest further empirical research that could be aiming at verifying the validity of the OMS model in different organizational situations and at deepening the analysis of the interdependence among constituents beyond the seminal exploration suggested here.

The intersection of the OMS and the humanistic management yields proposals for further development. Hereto, a research question arises of what humanistic management could do to incentivise positive organizational structures. The research agenda could include a prescriptive theory based on humanistic management and descriptive analyses of companies that accept humanistic management, related to managing the seven constituents.

References

Abid, G., and A. Ahmed. 2014. Failing in corporate governance and warning signs of a corporate collapse. Pakistan Journal of Commerce & Social Sciences 8 (3): 846–866.

Albrecht, W.S. 2014. Iconic fraud triangle endures. Metaphor diagram helps everybody understand fraud. Fraud Magazine July/Augus: 1–7.

Albrecht, W.S., M.B. Romney, D.J. Cherrington, I.R. Payne, and A.J. Roe. 1982. How to detect and prevent business fraud. Englewood Cliffs: Prentice Hall.

Albrecht, C., D. Holland, R. Malagueño, S. Dolan, and S. Tzafrir. 2015. The role of power in financial statement fraud schemes. Journal of Business Ethics 131 (4): 803–813.

Anthony, R.N., and V. Govindarajan. 2003. Management control systems. 11th ed. New York: McGraw Hill Higher Education.

Aristotle. 1998. The Nicomachean ethics. Translated with an introduction of David Ross. Oxford: Oxford University Press.

Ashman, I., and D. Winstanley. 2007. For or against corporate identity? Personification and the problem of moral agency. Journal of Business Ethics 76 (1): 83–95.

Bandura, A. 1977. Social learning theory. Group & organization studies. Englewood Cliffs: Prentice-Hall.

Bass, B.M. 1985. Leadership and performance beyond expectations. New York: Free Press.

Bazerman, M.H., and F. Gino. 2012. Behavioral ethics: Toward a deeper understanding of moral judgment and dishonesty. Annual Review of Law and Social Science 8 (1): 85–104.

Behind the Libor Scandal. 2012. The New York Times. http://www.nytimes.com/interactive/2012/07/10/business/dealbook/behind-the-liborscandal.html. Accessed 14 Oct 2018.

Boatright, J.R. 2004. Individual responsibility in the American corporate system: Does Sarbanes-Oxley strike the right balance? Business & Professional Ethics Journal 23 (1/2): 9–42.

Bormann, K.C. 2017. Linking daily ethical leadership to followers’ daily behaviour: The roles of daily work engagement and previous abusive supervision. European Journal of Work and Organizational Psychology 26 (4): 590–600.

Calhoon, R.P. 1969. Niccolo Machiavelli and the twentieth century administrator. The Academy of Management Journal 12 (2): 205–212.

Chen, A.Y.S., R.B. Sawyers, and P.F. Williams. 1997. Reinforcing ethical decision making through corporate culture. Journal of Business Ethics 16 (8): 855–865.

Coffee, J.C., Jr. 2002. Understanding Enron: “It’s about the gatekeepers, stupid”. Business Lawyer 57 (4): 1403–1420.

Craft, J.L. 2013. A review of the empirical ethical decision-making literature: 2004–2011. Journal of Business Ethics 117 (2): 221–259.

Crawford, D., and M. Esterl. 2006. Suspect in Siemens case claims executives had a role in bribes. Wall Street Journal. http://www.wsj.com/articles/SB116536723538041789. Accessed 14 Sept 2018.

Cressey, D.R. 1953. Other people’s money: Study in the social psychology of embezzlement. Glencoe: Free Press.

Darley, J.M., and B. Latane. 1968. Bystander intervention in emergencies: Diffusion of responsibility. Journal of Personality and Social Psychology 8 (4, Pt.1): 377–383.

Deal, T., and A. Kennedy. 1982. Corporate cultures: The rites and rituals of corporate life. New York: Perseus Publishing.

Dierksmeier, C. 2016. Reframing economic ethics: The philosophical foundations of humanistic management. New York: Palgrave Macmillan.

Dietz, G., and N. Gillespie. 2012. Rebuilding trust: How Siemens atoned for its sins. The Guardian. https://www.theguardian.com/sustainablebusiness/recovering-business-trust-siemens. Accessed 14 Sept 2018.

Dougherty, C. 2007. Siemens revokes appointment after reviewing files in bribery case. The New York Times. http://www.nytimes.com/2007/12/14/business/worldbusiness/14iht-siemens.4.8752330.html. Accessed 14 Sept 2018.

Ekici, A., and S. Onsel. 2013. How ethical behavior of firms is influenced by the legal and political environments: A Bayesian causal map analysis based on stages of development. Journal of Business Ethics 115 (2): 271–290.

Financial Crisis Inquiry Commission. 2010. The financial crisis inquiry report: Final report of the National Commission on the causes of the financial and economic crisis in the United States. Washington, DC.

Finkelstein, S., and D.C. Hambrick. 1990. Top-management-team tenure and organizational outcomes: The moderating role of managerial discretion. Administrative Science Quarterly 35 (3): 484–503.

Ford, R.C., and W.D. Richardson. 1994. Ethical decision making: A review of the empirical literature. Journal of Business Ethics 13 (3): 205–221.

French, P.A. 1984. Collective and corporate responsibility. New York: Columbia University Press.

Ganuza, J.J., and F. Gomez. 2007. Should we trust the gatekeepers?: Auditors’ and lawyers’ liability for clients’ misconduct. International Review of Law & Economics 27 (1): 96–109.

Gibson, K. 2011. Toward an intermediate position on corporate moral personhood. Journal of Business Ethics 101: 71–81.

Gino, F., J. Gu, and C.-B. Zhong. 2009. Contagion or restitution? When bad apples can motivate ethical behavior. Journal of Experimental Social Psychology 45 (6): 1299–1302.

Goodpaster, K.E. 2007. Teleopathy. In Encyclopedia of business ethics and society, 2067. New York: SAGE Publications, Inc.

Goodstein, J.D. 2000. Moral compromise and personal integrity: Exploring the ethical issues of deciding together in organizations. Business Ethics Quarterly 10 (4): 805–819.

Gordon, G.G., and N. DiTomaso. 1992. Predicting corporate performance from organizational culture. Journal of Management Studies 29 (6): 783–798.

Grojean, M.W., C.J. Resick, M.W. Dickson, and D.B. Smith. 2004. Leaders, values, and organizational climate: Examining leadership strategies for establishing an organizational climate regarding ethics. Journal of Business Ethics 55 (3): 223–241.

Hambrick, D.C., and P.A. Mason. 1984. Upper echelons: The organization as a reflection of its top managers. The Academy of Management Review 9 (2): 193–206.

Hannah, S.T., J.M. Schaubroeck, A.C. Peng, R.G. Lord, L.K. Trevino, S.W.J. Kozlowski, B.J. Avolio, N. Dimotakis, and J. Doty. 2013. Joint influences of individual and work unit abusive supervision on ethical intentions and behaviors: A moderated mediation model. Journal of Applied Psychology 98 (4): 579–592.

Healy, P.M., and K.G. Palepu. 2003. The fall of Enron. Journal of Economic Perspectives 17 (2): 3–26.

Hegarty, W.H., and H.P. Sims. 1978. Some determinants of unethical decision behavior: An experiment. Journal of Applied Psychology 63 (4): 451–457.

Hegarty, W.H., and H.P. Sims. 1979. Organizational philosophy, policies, and objectives related to unethical decision behavior: A laboratory experiment. Journal of Applied Psychology 64 (3): 331–338.

Jacobs, G., F.D. Belschak, and D.N. Den Hartog. 2014. (un)ethical behavior and performance appraisal: The role of affect, support, and organizational justice. Journal of Business Ethics 121 (1): 63–76.

John Paul II (Pope). 1984. Apost. Exhort. “Reconciliatio et Paenitentia.”

John Paul II (Pope). 1987. Encyclical Letter “Sollicitudo Rei Socialis.”

Kemper, T.D. 1966. Representative roles and the legitimation of deviance. Social Problems 13 (3): 288–298.

Kouzes, J.M., and B.Z. Posner. 1987. The leadership challenge : How to get extraordinary things done in organizations. San Francisco: Jossey-Bass.

Ladd, J. 1984. Corporate mythology and individual responsibility. International Journal of Applied Philosophy 2 (1): 1–21.

Lau, C.M., and A.V. Martin-Sardesai. 2012. The role of organisational concern for workplace fairness in the choice of a performance measurement system. British Accounting Review 44 (3): 157–172.

Leary, M.R., and D.R. Forsyth. 1987. Attributions of responsibility for collective endeavors. In Review of personality and social psychology, Vol. 8. Group processes, ed. C. Hendrick, 167–188. Thousand Oaks: Sage Publications, Inc.

Loe, T.W., L. Ferrell, and P. Mansfield. 2000. A review of empirical studies assessing ethical decision making in business. Journal of Business Ethics 25 (3): 185–204.

Lokanan, M.E. 2015. Challenges to the fraud triangle: Questions on its usefulness. Accounting Forum 39 (3): 201–224.

Maxey, D., J. L. Pessin, and I. Salisbury. 2008. Wall street employee owners shudder as bear Stearns implodes. Dow Jones Newswires. https://www.marketwatch.com/story/wall-street-employee-owners-shudder-as-bear-stearns-implodes. Accessed 14 Oct 2018.

McLean, B., and J. Nocera. 2010. All the devils are Here: The hidden history of the financial crisis. London: Penguin.

Melé, D. 2003. The challenge of humanistic management. Journal of Business Ethics 44 (1): 77–88.

Melé, D. 2012. The firm as a “Community of Persons”: A pillar of humanistic business ethos. Journal of Business Ethics 106 (1): 89–101.

Melé, D. 2013. Antecedents and current situation of humanistic management. African Journal of Business Ethics 7 (2): 52–61.

Melé, D. 2016. Understanding humanistic management. Humanistic Management Journal 1 (1): 33–55.

Melé, D. 2019. Business ethics in action: Seeking human excellence in organizations. 2nd ed. London: Red Globe Press.

Melé, D., J.M. Rosanas, and J. Fontrodona. 2017. Ethics in finance and accounting: Editorial introduction. Journal of Business Ethics 140 (4): 609–613.

Miao, Q., A. Newman, J. Yu, and L. Xu. 2013. The relationship between ethical leadership and unethical pro-organizational behavior: Linear or curvilinear effects? Journal of Business Ethics 116 (3): 641–653.

Milgram, S. 1974. Obedience to authority: An experimental view. London: Tavistock Publications.

Mollenkamp, C., and M. Whitehouse. 2008. Study casts doubt on key rate. Wall Street Journal. http://online.wsj.com/article/SB121200703762027135.html. Accessed 14 Oct 2018.

Moore, C., and F. Gino. 2013. Ethically adrift: How others pull our moral compass from true north, and how we can fix it. Research in Organizational Behavior 33: 53–77.

Moore, C., and F. Gino. 2015. Approach, ability, aftermath: A psychological process framework of unethical behavior at work. The Academy of Management Annals 9 (1): 235–289.

Mostovicz, E.I., A. Kakabadse, and N.K. Kakabadse. 2011. The four pillars of corporate responsibility: Ethics, leadership, personal responsibility and trust. Corporate Governance 11 (4): 489–500.

Mulki, J.P., J.F. Jaramillo, and W.B. Locander. 2009. Critical role of leadership on ethical climate and salesperson behaviors. Journal of Business Ethics 86 (2): 125–141.