Abstract

The scandium production rate and price data for scandium oxide and scandium metal was extracted from various sources. Data for extractable resources of scandium were found and evaluated by application of estimated yields. The feasible extractable resource is about 6.1 million ton, and with present technology, about 676,000 ton scandium appear as potentially extractable. The potential for scandium extraction is about 1500 ton/year at present, but only about 45 ton per year was produced in 2022. With improved extraction and access yields, production could be increased to about 450 ton per year, and the scandium resource would increase to about 1.5 million ton. The investigation suggests that there will be an increased demand for scandium metal in the future, but that it is limited by the high price and the lack of a properly functioning market and by a lack of production infrastructure. The scandium market show signs of being disorganized and unstructured. Modelling of future scandium production was done using the WORLD7 integrated assessment model, after development of a scandium module. Simulations show that the price will remain relatively high, but lower than in the past. The most uncertain factor for predicting the price is the size of the demand. The main limitation for making scandium metal is high energy costs and low extraction yields.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Scandium is a rather unknown metal, not much spoken of outside the circles of specialists. It is a light metal, first found in association with Rare Earth Elements by the Swedish scientist Fredrik Nilsson in 1879 (Nilsson 1879a, b; Wilhelmsen 2020; Cleve 1879; Fischer et al. 1937).

Very little scandium is produced at present. Scandium has some very interesting metallurgical properties in alloys, and if scandium would be available in larger volume at significantly lower price than now, there would be a large hidden scandium demand that could become real (InvestorIntel Corp 2020; INN 2023). Scandium is used in aluminium alloys (Zakharov 2014, De Luca et al., 2016), in titanium alloys (Riva et al. 2016; Youssef et al. 2015), and in smaller amounts as a component of lasers, in metal halide flash lights, in some types of semiconductors and in new types of fuel cells (Duyvesteyn and Putnam 2014; Naumov 2008; Brown 1999; Dreissen 1990; Fernandez 2017; Laguna-Bercero et al. 2009). The main scandium uses, in specialty alloys, in aluminium alloys and in solid state fuel cells are the uses that are expected to increase in the future Kaiser Research Online 2021; Knipling et al. 2006). The scandium-aluminium alloys are used in advanced avionics (Djukanovic 2017). Scandium is very expensive and is used in high value applications, where high cost is less of a concern. New uses are in solid oxide fuel cells, 3D printing and in automotive parts (Djukanovic 2017). About 65% of scandium produced is used as metal for alloys.

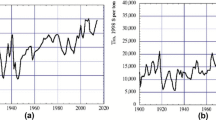

Figure 1a shows the reconstructed production rate for scandium in ton per year. The data shown in Fig. 1 was pieced together from the referenced literature and different websites. There is very little published material on scandium, and the data is not always internally consistent, nor complete. The squares represent estimates by the authors. The round circle in Fig. 1a is the anticipated rate in 2030 if different projects in the United States, Canada and Australia are realized. These new production projects are under way at present.

a Reconstructed total production rate for scandium in ton per year. The data was pieced together from the referenced literature and different websites. Squares represent estimates by the authors from corporate websites and articles in the reference list. b Approximate data corridor for the price for scandium oxide (Sc2O3). All curves based on approximate data gathered by the authors. c The metal price in $/kg as it appears in the United States Geological Survey, Minerals Commodities Summaries from the years 1996–2023

Figure 1b shows the approximate level of the price for scandium oxide (Sc2O3). The different sources vary a lot in price at the same time, thus we have defined a corridor where the price is most likely to be found for both metal and for oxide. Metal is the preferred product, but more expensive. Scandium oxide and scandium metal is not traded in any open market or any metal exchange where a market price can be set. Trades for scandium lots are made between individual produces and individual customers directly at prices not disclosed most of the time. A significant part has been military use. The data has been questioned and is very uncertain because of the lack of an open scandium market, and no real "free market price". Thus, the scandium oxide or metal price depend on which trader you ask, and the context just then, and a lot on who is buying and who is selling.

In 2011, there was a market panic for scandium (Botelho Jr. et al. 2020), leading to initiation of a process to find alternative civilian sources for scandium, to get out of dependence on Russia and China, and as an alternative to closed military deals. Figure 1c shows the metal price in $/kg as it appears in the United States Geological Survey's Minerals Commodities Summaries reports from the years 1996–2023, with data for 1996–2019 (Hedrick 1996; Brown 1999; Gambogi 2021; Cordier 2022; Riva et al. 2016). After 2019, the USGS do not regularly update the numbers. The price data in the diagrams was pieced together by the authors from the referenced literature and different websites (Fig. 2).

Objectives and Research Questions

We have a number of questions waiting to get an answer:

-

1.

How large are the resources of scandium, as primary resources if any and as secondary, hidden in mother metals?

-

2.

Who are the large producers of scandium now, and who will be the big ones in the future?

-

3.

What does historical production look like and what does the price history look like?

-

4.

Can the scandium supply and scandium use in society be modeled and what will future demand and supply look like? In 2050, 2100, 2200?

-

5.

How long will the scandium resources last, depending on what?

Questions 4 demands an integrated system dynamics model for simulations of the scandium supply system. Our goals were two: First to map the global scandium resources, their extractability and production potential. Secondly to predict future industrial supply of scandium. We will develop an integrated dynamic model for the global market for scandium, and a scandium module to be developed for the WORLD7 model. We will explore possible future scandium production and supply potentials and investigate future demands and price trajectories. This is based on estimates of scandium occurrence in mother metal residuals that can be used for scandium extraction. We include the whole global system in a generalized way; simulations cover the past and the future (1850–2200). We want to ensure that it can reconstruct the past with respect to extraction, recycling, supply and market price. The model was used to assess the long supply of scandium with respect to important new technologies. The big military powers withhold data on their scandium production (United States, Russia, India), or give misleading numbers to distract (Russia, China). Since there is little known and uncertain data on scandium production, supply and market price, the model may be a way to bridge knowledge holes.

Methods

The methods applied in this study are several methods that are used in combination to create a whole system. The most important are:

-

1.

The main simulation method used is system dynamics modeling (Sverdrup et al. 2022). We analyze the system using stock-and-flow charts and causal loop diagrams (Senge 1990; Sverdrup et al. 2022, 2023). The flow charts describe the mass balances used in the model. The causal loop diagrams show the causal links and feedbacks in the system. The flow charts and the causal loop diagrams are used for constructing the system dynamics model.

-

2.

Program the scandium system into a system dynamics tool. The simulation model for the mass flows and economics of extraction, production and cycling of scandium in society, as a part of the WORLD7 model. The mass balance differential equations are numerically solved using the STELLA® Architect software. The zirconium and hafnium module was integrated into the WORLD7 model system (For a full explanation of the WORLD7 model, see Sverdrup et al. 2017a, 2019a, b, 2022; Sverdrup and Olafsdottir 2019; Olafsdottir and Sverdrup 2020; Sverdrup and Sverdrup 2023).

-

3.

Parameterize the coefficients and constants of the model.

-

4.

The scandium demand was generated from a combination of potential future uses and general economic development. Identify the available sources of scandium and the estimate the available amounts that can be extracted, considering extraction technologies and the cut-off and costs of extraction as related to the market price. The reserves and resources estimates for the source metals are based on geological estimates, the interpretation of geological data, and the allocation of extractable amounts according to ore quality, considering yields and extraction costs (Sverdrup and Olafsdottir 2019; Sverdrup and Ragnarsdottir 2014, 2016; Sverdrup et al. 2018; Krautkraemer 1988). For the methodology of estimating the reserves and resources for metals, the works of Singer (2007) and Singer and Menzies (2010) was instructing. They use the geological characteristics of known and detected metal resources to predicts the amount of undiscovered resources, and estimating the amounts on a deposit-by-deposit basis.

-

5.

Validate the total model performance on historical data. The WORLD7 model is confined by mass balance and energy balances, and all parameterizations have a real world connection. The parameterization is based on measured or estimated parameters, leaving small room for free adjustments.

-

6.

Make model simulations for the system. Run the Business-as-usual scenario as a basis.

-

7.

Make sensitivity analysis for increased demand in the future. Finally, the model outputs are interpreted, the results studied and draw out consequences for the future.

About Scandium Production and Resources for Extraction

Scandium is found mainly in two minerals, there are no substantial occurrences of these in volume that would justify industrial mining, the minerals are called Thortveitite ScYSi2O7 and Kolbeckite ScPO4·2H2O (Nilsson 1879a, b; Neumann 1961; Kristiansen 2003; Steffenssen et al. 2020; Segalstad and Raade 2003). Madagascar and in the Iveland-Evje and Tørdal regions in Norway have the only deposits of Thortveitite and Kolbeckite minerals with high scandium content (Kristiansen 2003; Wilhelmsen 2020), but none these are being exploited at present. The typical scandium deposit is found as small isolated pockets in pegmatite formations and is not easy to exploit in an industrial way, even if they supply beautiful mineral samples. The dominating source of scandium is secondary extraction, from waste products after bauxite processing (Akcil et al. 2018; Altinsel et al. 2018). A smaller amount comes from scandium mining and from extraction from laterite soils (Altinsel et al. 2018; Botelho et al. 2020). Deposits with industrial potential are known from China, Kazakhstan, Australia, United States and Russia (Kristiansen 2003; Brown 1999). Chinese deposits are in tin ores, tungsten ores, and iron deposits and Rare Earth Element deposits The Russian deposits are associated with Rare Earth Element deposits and uranium mining. Some even speculate about deep ocean deposits, but if they ever can be extracted is still hypothetical (Hein et al., 2013). Other land resources are being researched (Huang et al., 2019, Kuzmin et al., 2019, Laqin et al., 2016, Liu et al., 2023, Wang et al., 2021). The Norwegian and Madagascan deposits are associated with gabbro and pegmatite formations, but are not used for production (Kristiansen 2003, Rosing-Schow 2020). Scandium is currently produced by calcio-thermic reduction of ScF3, which is obtained by fluorination of the oxide (Akcil et al., 2018). These are two reactions:

First scandium fluoride (ScF3) is produced from the scandium oxide (Sc2O3) and minerals by dissolution in hydrofluoric acid, then in a next step the metal is produced as a precipitate. The product is melted and distilled to produce either dendritic scandium or 99.9% pure cast scandium ingots. Use of scandium in aluminium alloys makes them harder, usual contents are 0.5–2%. With scandium, aluminium alloys can be given properties similar to titanium, but with only 25% of the specific weight. A probable market would be military aviation technologies.

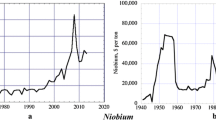

Scandium is not really a very rare element in terms of occurrence, the average crustal content is 22 ppm. Scandium does not really participate in the processes that normally concentrate metals in ores, and thus, it is very rare to find deposits with higher concentrations of scandium (DeCarlo and Goodman 2022). Thus, there are very few scandium mines, and none are significant. Data for scandium contents in bauxite used for scandium extraction in Russia (Boyarintsev et al. 2022) is shown in Fig. 2. Such data, as well as single data points found in the literature were used in constructing Tables 2 and 3.

The largest producers are as far as is known Russia, Ukraine, Kazakhstan and China. The United States have mined scandium in the past, but at present no running operations are known. The dominating use in 2022 was for solid state fuel cells and aluminium alloys. We estimate the annual production to be about 35 ton/year in 2022, in 2014, it was about 15 ton/year (Riva et al. 2016). Alloys based on scandium, titanium, zirconium and hafnium are also being developed. These would serves as hybrid superalloys, probably suitable for military hardware (Riva et al. 2016).

About 80 kg/year of scandium is used in metal-halide lamps/light bulbs globally per year. The alloy Al20Li20Mg10Sc20Ti30 is as strong as titanium, is as lightweight as aluminium, and as hard as some ceramics (Youssef et al. 2015). When bauxite is processed for making alumina (Al2O3), two types of waste are produced: red mud (a solid waste) and a Bayer liquid. From the red mud, scandium, iron ore, titanium oxide and yttrium can be extracted. From the Bayer liquid, gallium, indium and germanium can be extracted. One ton of bauxite normally yields 0.2 ton of aluminium. The scandium resources were estimated from the equation (Sverdrup and Olafsdottir 2023; Sverdrup et al. 2023):

where M is the available mother metal or ore amount, X is the amount of scandium in that material and Y is the extraction yield for obtaining it from the total resource. Y consists of the access yield, the utilization yield (it is reachable, but how much of the possibility is utilized), and the extraction yield.

Table 1 shows guess-assisted estimates of production volumes of scandium production in 2022. About 65% of the total volume is used as metal for alloys. The rate of scandium recycling is unknown, there are no numbers found in any of the references.

Figure 3 shows some of the available data for scandium contents in bauxite used for scandium extraction in Russia (Boyarintsev et al. 2022). For other mother materials, only anecdotical information is available (Duyvesteyn and Putnam 2014). The ranges found are for uranium 1–10 ppm in the ore, corresponding to 110–200 per uranium content. For tinstone, a scandium content of 125–200 ppm is given, for zirconium about 50–120 ppm, 12 ppm in ilmenite or about 22 ppm per titanium content (Akcil et al. 2018; Botelho et al. 2020, Borra et al. 2016). An estimated 12,000 ton of scandium is believed to be present in primary Australian deposits that would support scandium mining. What is shown in Table 1 is what will be explored and broadened with the model simulations. The total primary scandium resources may be of the order of 30,000–40,000 ton of scandium content.

Table 2 shows the resource estimates for scandium as done by the authors. For Rare Earth Element deposits there are some more data points and the contents vary a lot, from as low as 26 ppm to more than 110 ppm in India and China, other locations have averaged at 220–400 ppm, but some deposits may have as much as 2000 ppm (Phoung et al. 2023; Kalashnikov et al. 2016). Single deposits have significantly higher contents in smaller sections of the ore bodies (Ulrich et al. 2019; Wang et al. 2021). None of this is geostatistically representative for whole regions, and only represents single random samples. Thus, the data is tentative. The available data and information has been used to make educated guesses. The estimated yields are very variable.

Data on yields are only available for fly-ash and bauxite (Duyvesteyn and Putnam 2014; Naumov 2008, a low value of 15–20% is given). The other yields have been guessed looking at extraction yields for other secondary metals like indium (Sverdrup et al. 2023), germanium or tellurium from different mother metal refining wastes. Values given scandium contents in mother metals ore are approximate, and only mother metal ores in the high end of the scandium content range are used for scandium extraction at present (Williams-Jones and Vasyukova 2018). In Table 2, we estimate the total scandium extraction potential to be 6 million ton. The yields reported are very variable and come from a small number of studies. The raw scandium metal trades at 70% of the price of a 99.99% scandium metal ingot. The oxide trades at 1.6% of the metal price. The metal price for 99.99% (Electronics grade) has been systematically in the range of 185,000–210,000 $/kg, but occasionally higher. In April 2023 the price was 348,000 $/kg and 517,000 $/kg (Scrapmonster 2023). The price is comparable to the price of the platinum group metals such as rhodium or iridium. The high price effectively prevents any mass use or meaningless applications in mass produced consumer goods. Very little information on global scandium production is available. Information on the processes from taking scandium from different substrates is available (Ghosh et al. 2023; Salman et al. 2022). Examples are for bauxite waste extraction (Akcil et al. 2018; Botelho et al. 2020; Gu et al. 2018), Rare Earth Element mining (Borra et al. 2016; Ribagnac et al. 2017), from nickel–cobalt mining wastes (Altinsel et al. 2018; Chernoburova and Chagnes 2021; Kaya et al. 2017), from coal and coal ash (Arbuzov et al. 2014), from titanium substrates (Gao et al. 2019; Zhou et al. 2008, 2021).

Scandium comes mostly from secondary extraction from major metal primary extraction operations, and there are very few scandium mines being operated. Scandium is mined in the sense that some mines are multi-metal mines, where no single metal can alone cover the extraction and mining costs. The United States Geological Survey (Gambogi 2021; Cordier 2022; Hedrick 1996; Brown 1999) reports that they have no real numbers on total scandium production and resources. They guess that the world production of scandium is in the order of 15–20 ton per year, in the form of scandium oxide (Sc2O3). Numbers for production rates and resources are withheld in the United States, Russia and China. Scandium was apparently to 80% produced from TiO2 pigment processing residuals in China (Zhou et al. 2021). Many projects are under way (Rio Tinto 2023a, b are one example), but not very much is known about the projects in the USA, Russia and China. Apparently, it appears as the use of scandium is of military strategic importance. From different extractions, mainly the scandium oxide is extracted. Scandium metal is made from scandium oxide by reduction with either calcium metal, magnesium metal or lithium metal (Boyarintsev et al. 2022). The scandium demand is higher, and both the scandium production and demand keep increasing (Boyarintsev et al. 2022).

In 2003, three mines produced scandium as a by-product (Naumov 2008):

-

1.

Ukraine: uranium and iron mines in Zhovti Vody

-

2.

China: the rare earth mines in Bayan Obo

-

3.

Russia: the apatite mines in the Kola peninsula; yttrium extraction from the mineral loparite can yield scandium as a by-product

After 2003, scandium is mostly produced from red mud after bauxite processing, and from titanium and nickel processing residuals (Williams-Jones, and Vasyukova 2018; Rio Tinto 2023a, b). Every site only produce small amounts, measured in kg/yr rather than ton/yr. Since then, many other countries have built scandium-producing facilities (United States of America, Canada, Malaysia, Philippines). In each case, scandium is a by-product from the extraction of other elements and is sold as scandium oxide. The absence of reliable, secure, stable, and long-term production of scandium has limited commercial applications of scandium, beside the fact that the scandium metal is at present in the same price range as precious metals like gold and rhodium. Despite this low level of use, scandium offers significant benefits. Particularly promising is the strengthening of aluminium alloys with as little as 0.5% scandium. Scandium-stabilized zirconia enjoys a growing market demand for use as a high efficiency electrolyte in solid oxide fuel cells. The potential for extraction is about 7400 ton/year of scandium content. At present access and opportunity fraction, and at present chemical extraction yields, the maximum production would be about 1500 ton/year. Total scandium extraction yield from potentials are very low (About 11%, see Table 2), and it would probably be feasible to increase that to 40% on average, allowing a scandium production of about 3700 ton/year, where probably 3500 ton/year would be scandium metal. Increasing the yield to 65% would allow for a scandium production of 4810 ton/year. The approximate scandium production was estimated with (Sverdrup and Olafsdottir 2021; Sverdrup et al. 2023):

where ri is the rate of extraction of the mother material i, with yield Yi and mother metal scandium content fraction Xi. Table 3 shows the approximate scandium production potentials from the different possibilities. Production estimated from mother metal production rates and assumed average scandium content at present as estimated by the authors.

Scandium Simulation Model Description

The anthropogenic system for scandium is to be captured in the scandium module to be included in WORLD7. For that, a flow chart for scandium in the system is needed for the bookkeeping with scandium, and a causal loop diagram is needed to map the system interactions. Figure 3 shows the flow chart for the scandium system as it has been applied in the scandium module developed for WORLD7. There are two scandium markets, one for scandium oxide and one for scandium metal. Scandium metal is about 20 times more valuable than the scandium oxide, and it should be carefully recycled whenever possible. Red lines in the flow chart shows scandium flows that get irreversibly lost. A very significant fraction of all scandium in the system is lost, and there is large room for improvement. The main cause for scandium losses are low transaction yields from rock to pure oxide or pure metal, and that there are many process steps for producing metal, and a low general recyclability for scandium oxide uses. Scandium is sourced as a secondary metal in the model from 6 different sources. They are listed in order of importance (Table 3): Bauxite, coal fly-ash, rare earth elements refining, nickel refinery waste, titanium processing waste, yttrium refining, and from uranium refining waste. Primary mining is small at the moment, but may increase somewhat when prospecting for scandium has covered larger areas than at present.

Figure 4 shows the causal loop diagram for the flow of scandium. The causal loop diagram shows the causal interactions in the system, and displays the feedbacks in the system. Note that there is no feedback from scandium production to the mother metal system exemplified by bauxite mining to support aluminium production. The large R represent reinforcing feedback loops, the B are balancing loops (Sverdrup et al. 2022). In the causal loop diagram, there are three systems.

A causal loop diagram for the scandium system. Note that there is no feedback from scandium production to the mother metal system exemplified by bauxite mining to support aluminium production. The large R represent reinforcing feedback loops, the B are balancing loops. The large D and blue lines show the feedbacks around demand. This was applied to build the scandium submodel included in WORLD7

One system is the transfer of scandium from the mother ores, which here has been exemplified using aluminium production, to the refining waste and them how that is used for scandium extraction. The primary aluminium ore is bauxite. It is processed to alumina (Al2O3). It takes 4 ton of bauxite ore to make 1 ton alumina and 4 ton red mud. This red mud has the scandium that is extracted (as well as some other very interesting metals like indium, germanium or gallium). First scandium oxide is made, and then scandium metal is made from the scandium oxide. The metal production is driven by primary production from scandium oxide, and from recycling. Scandium oxide is made from secondary wastes from the substrates listed in Table 3. The metal and oxide production are closely linked. Figure 7 gives an example of a causal link used between market amount and scandium trade price. This is used to covert market amount to price in the model, and is behind a diagram like Figs. 9a and b.

Figure 5 shows the scandium module inside WORLD7 as it appears in the STELLA® Architect system dynamics software. The STELLA model is built from the flow chart and the causal loop diagram. The causal loop diagram explains the dynamics of the model. Thus, great care was taken in constructing the causal loop diagram.

Figure 6 shows an overview of the WORLD7 model. All modules are interconnected and run simultaneously. The model is not in any way fitted to any timeseries, it runs from physical system properties, and all model parameters are in principle measurable in the real system. The WORLD7 model addresses a number of metals, and they are all linked. Energy for metal extraction is taken from the energy module (Sverdrup et al. 2019b). For these metals, the price has an effect on demand, but not any significant impact on the supply, as this is dependent on the source metal extraction rate. The mining rate is driven by profit from operations. The price is determined by how much metal is available in the market in the same way as in our earlier models (Sverdrup and Ragnarsdottir 2014; Sverdrup et al. 2017b; Sverdrup and Olafsdottir 2019). A high metal price will increase profits and promote larger supply to the market, and limit demand. More supply to the market will increase the amount available and lower the price. The mining cost is modified with oil price and extra costs when the ore grade declines. For some of the specialty metals, there is not always a functioning market. The scrapping process for stock-in-use in society is not strongly driven by price. After the scandium metal has arrived at the waste pile, the high metal price will have a promotion effect in causing somebody to recover it and recycle it. Table 4 shows the parameterization of the scandium sub-model rate coefficients and used in the WORLD7 model simulations. The basic driving mechanism of basic mining comes from profits and availability of a mineable resource used in the model. It shows the estimation of contents of dependent metals used for the WORLD7 model simulations.

For scandium, the model runs on minimum a daily timestep (1/365 of a year). Different timesteps were tested (1/52, 1/256, 1/365, 1/512, 1/730), and the shortest timestep gives the most stable simulation results.

Estimating Future Scandium Demand

Demand for scandium is difficult to estimate accurately. The scandium demand is estimated partly from average affluence, expressed as disposable income per person and global population, using outputs of the WORLD7 model (Sverdrup et al. 2019b; Sverdrup 2019), and from specific technological demands generated internally in the WORLD7 model. There is a large potential demand for scandium metal, if it became available in larger volumes at price that would be below 20,000 $/kg. Many analysts make simple predictions based on just assuming a percent growth per year and simply rolling that forward. Those predictions are rather naive and are not based on any real understanding of neither scandium nor the market. This is further complicated with competing military interests. A demand estimate can be based on proportionality to GDP, but rather a understanding of technical uses and at what metal price those commodities would take off in markets (Phoung et al. 2023, Kaiser Research Online Scandium Center (2023). The Kaiser Research Online Scandium Center (2022) estimates that the production capacity may in 2028 be a bit ahead of demand, and, therefore, somewhat decreasing prices. Kaiser Research (2023) foresee a production in the range of 1100–1800 ton/year by 2028. Table 4 shows the estimation for future demand in ton scandium oxide per year. The table was made by assuming increasing metal amounts from 65% of the total production towards 90% of the total production. These estimates will be used as input to a sensitivity simulation using the integrated model.

Results

Resource Basis for Scandium Production

The estimates done earlier for reserves and resources, and how much is primary and how much is secondary and dependent on a mother metal is a part of the study results. These results have been shown earlier in Table 1 to Table 3.

Business-As-Usual

Figures 7, 8 and 9 show the WORLD7 outputs in the business-as-usual scenario for scandium. This is done to create a reference run, and to be able to evaluate the model performance on observed data for production and market price.

BAU. Simulation outputs for scandium dioxide demand, extraction, production, supply to market, and recycling. a Shows the scandium oxide production, b the secondary production, c and d show the origin of the produced scandium, e the change in hidden and known scandium ore bodies. f shows flows to different uses. g scandium oxide market price. h shows the simulated scandium metal market price and amount available for trade in the market. The simulations suggest that there will be market instabilities in 2060 and in 2100 just before the sources of scandium goes empty

BAU The model was validated on the available data. a Shows the simulated oxide production and the production data. b Shows the simulation of metal production and available data. c Shows the simulations and the observed price corridor observed. d Shows the simulation for scandium metal price and the reconstructed data. The simulated price for scandium oxide is excellent, but in the low end of the corridor for metal. e Shows cumulative amounts produced and supplied as compared to approximate cumulative actual production

Figure 8 shows the simulation outputs for scandium dioxide. Figure 8a shows the simulation outputs for scandium dioxide demand, extraction, production, supply to market, and recycling. Through the whole period, demand is reduced by the high price, and after 2050, scandium dioxide supply will not fulfill demand. It is in small physical scarcity. Take note that scandium oxide is not recycled throughout the whole period.

Figure 8b shows the scandium metal demand, modified demand by price, extraction, production, supply to market, and recycling. Figure 8c and d shows the origin of scandium from different sources. It can be seen that primary mining of scandium dioxide is small and that secondary extraction is the most important source. The most important source is from bauxite processing to alumina and from nickel refining residuals. Figure 8e shows the change in hidden and known scandium ore bodies. The decline in scandium resource follows that of the main mother metals. Figure 8f shows scandium flows to different uses in society. The simulation is based on an expansion of present uses into uses in advanced technology. Scandium goes to uses in laser technology, it goes to two types of alloys, and to different lighting technologies. Figure 8g shows the model simulation outputs for scandium oxide market price. Figure 8h shows the simulated scandium metal market price and amount available for trade in the market. The simulations suggest that there will be market instabilities in 2060 and in 2100 just before the sources of scandium goes empty.

Model Validation

The model was validated on the available data. The production rates for both scandium oxide and scandium metal are reconstructed excellently (Figs. 9a and 9b). When evaluating the model validation, we must keep in mind that the quality and accuracy of the observed data is very problematic. It appears that the simulation seems to recreate the available "data" quite well, production amounts and market prices. Simulated data might even be better than the real data available at the moment! Figs. 9c and 9d shows the scandium oxide and scandium metal price as compared to the observed price corridor. The simulations are inside the observed corridor throughout the whole period. Figure 9e shows cumulative amounts scandium oxide produced and supplied, and the observed cumulative amount 1980–20. It is no more than 500 ton according to the data, and 800 ton according to the simulation. The data should surely been seen as a minimum estimate, considering how producing countries withhold such numbers, and that the military has all interest in underreporting the real production. When evaluating the validation, we must keep in mind that the quality and accuracy of the data is very problematic.

Sensitivity Simulations, Using Different Demands

Sensitivity runs with WORLD7 were made, and the effect of several parameters on scandium supply and price were studied (Fig. 11):

-

1.

Demand

-

a.

Scandium metal demand (3 levels)

-

b.

Scandium oxide demand (3 levels)

-

a.

-

2.

From ore-to-metal yields

-

a.

Bauxite total yield as fraction of raw material used (3 levels, 0.02, 0.11, 0.23)

-

a.

This gives in all 27 model simulation runs. Access to the bauxite refining waste called red mud, is probably available as it is already subject to extraction for other metals like gallium, germanium (Sverdrup et al., 2023). No scandium is at present extracted from coal fly ash.

Figure 10 shows the inputs to the sensitivity analysis. The variations in scandium oxide demand and (Fig. 10a), the scandium metal demand (Fig. 10b). By studying Fig. 10 carefully, it can be seen which number corresponds to a certain combination of high and low demands and different extractions from red mud. We consider the development of yield improvements for scandium from nickel, rare earth element, yttrium refining to be well optimized and have little room for further significant improvements. The titanium refining process yields also a waste that can be used for scandium extraction. Here the yield is about 40%, which we think will be difficult to significantly improve.

The results of the sensitivity runs using the inputs shown in Fig. 10 and Table 4 have been presented in Fig. 11. Each line number corresponds to the same set-up of parameters, this is thorough-out the sensitivity analysis. Scandium oxide is found on the left side and metal on the right side in the figures. Figure 11a shows the price-modified demand for oxide and metal. It can be seen how this is far below the original demand.

Results from the sensitivity analysis simulations. Scandium oxide is found on the left side and metal on the right side in the figure. The first line shows total extraction, the next line shows oxide and metal supply. The third line show market price and the last line shows the market amounts. and (e) the scandium extracted from bauxite

Figure 11b and c shows the supply of oxide and metal, oxide supplied to the market is less than for metal, as the metal supply also have a significant amount produced from recycling. Most oxide is actually used for metal production, and only a small amount is used as oxide. The reason for this is the dependent extraction is dependent on the mother substance extraction rate, and scandium has no feedback to those systems. Take note that for most scenarios, the increase in modified demand cannot be supplied, and there is a significant degree of physical scarcity after 2030–2050, depending on scenario.

Figure 11e and f shows the scandium amounts in the trade market. The higher demand, the less scandium will be left in the markets, driving the price up. It can be seen that there is a shortage of scandium after 2030, driving up the price. Some scandium is available, but the demand cannot be met, thus there is shortage. This shortage is not of a one-cause origin, it is a systemic effect of the unresponsiveness of a strongly dependent extraction system. Note that the price is high when the amount in the market is low.

Figure 11g and h shows the scandium oxide and metal price, it can be seen how the shortage point moves earlier the higher the demand is. At the end of the scandium resources when scandium metal price-modified demand cannot be met, the both oxide and metal prices become very volatile for oxides. After 2030–2040, the scandium price spikes very high, neither demand nor price-modified demand can be met by supply and there is physical shortage. The total supply cannot go up very much above the present production in response to price, so the price is driven up by the uncovered demand.

Figure 12 shows further outputs from the sensitivity simulations. The first line shows the recycling degree for scandium oxide (a) and for scandium metal (b). Figure 12c shows the total extraction of scandium. There is not much variation, because the extraction is dependent and have not much room for variation. Figure 12f shows the scandium stocks-in-use in society.

Further outputs from the sensitivity simulations. The first line shows the recycling degree for scandium oxide (a) and for scandium metal (b). The next line shows the amounts of oxide (c) recycled and the total amount of scandium stocks in use. Waste stocks, stocks in refining and stocks in recovery have not been included in stocks-in-use

Discussion

Model Use and Robustness

The model provides a good support for understanding the scandium market, and helps when the available data is quite limited and very uncertain. The model is robust from the fact that it is mass and energy balance constrained, and do not require any timeseries for calibration. All model parameters have in principle physical reality and can be measured. At present, parts of such data are missing, and we had to make guesses and ball-parking estimates for parameters. The test shows that the price and production for scandium oxide and scandium metal is done to satisfaction, especially when considering the uncertainties in many of the parameterizations. So, can we say what is the real price of scandium? That would seem to depend on who you are, in which country you operate, and how good are your connections to the military and the high technology industries. All simulations give market volatility around 2060 and 2100. Each day, about 60 different commodities must be cleared through the metal exchange and the commodity exchange, and this requires deals to be settled minimum once per day, but results are when markets are cleared and prices set in the morning and in the afternoon on the same day, which is a common practice in reality.

Future Supply Security and Challenges

Scandium will always be a scarce metal, demanding a high price. The production will never be very large, for that there are very many difficult hurdles in the way. The contents are low in the substrates, the extraction process in demanding many steps and much energy. The overall yields are low or very low. Resource availability for extraction is low, extraction process yields are low, and much of the potential gets lost when materials with scandium is not used for extraction, but disappears into general waste disposal.

Since 2021, cheaper scandium has appeared on Chinese internet on sites like Ali Baba or with Indian traders that trade local Indian scandium or scandium sourced from China, in small lots at prices much closer to the scandium oxide price in the range from 20,000 $/kg to around 5000 $/kg. It is a bit unclear exactly where this scandium comes from and what is going on. Probably, the scandium originates from the Chinese Rare Earth Element works at Bayan Obo in Northern China.

On the average, scandium metal seems to be extracted in amounts comparable to platinum group metals and trades at a similar price. During 2010–2020 it was observed how Chinese Rare Earth Element producers sold Rare Earth Element metals at low prices, with the unspoken purpose to get rid of global, non-Chinese competition (Botelo et al. 2021; Han et al. 2015). In the past, this has also happened with magnesium, as some European companies did experience. That this was a non-defined real policy, there is not much doubt, and they learned that it works. For a while, that seems to have worked. If this is an aspect of the same is hard to tell, for scandium it is so far unprovable and mostly unknown.

Future scandium price level will be determined by the ability to improve scandium extraction methods and get better yields, and on further increased recycling. Today, only a fraction of the potential for scandium extraction is used, and in this lies also a large future opportunity. There are physical limits to how much scandium that can be produced, independently of the scandium demand. The mother metals extraction rate is independent of the scandium extraction rate. Thus, when the potential in the mother metal flow has been used, then the scandium extraction cannot increase further. Only a small part of the present potential is used and that fraction of the potential can be increased. Attempts may also be made to increase the extractive yields, which appear to be low at present. At present, scandium use appears to be dominated by military technology, causing production numbers to be kept secret. At the same time, it appears that China may be attempt to dominate the market, and that other nations may try to counter-react that for strategic reasons (Han et al. 2015; Hayes-Labruto et al. 2013).

There is a small, but real chance that somebody may find a significant scandium deposit that would allow for industrial scale production at some point in the future. There are still significant unexplored territories in Canada, Central Africa, Greenland and Siberia, where something may turn up by chance. But miracles to happen cannot be counted on to happen in future supply planning.

Market Dysfunction

The investigation suggests that there will be an increased demand for metal, limited by its high price and the lack of a properly functioning market. The military potential for use of scandium is good, and this suggests that the market may remain partly closed. The market show signs of being disorganized and unstructured.

Future Research Needs

There are very many research tasks waiting to be done for scandium. The metal has huge technical potential, but much research is needed into fully realizing what it really is. Relevant to our type of study, all general information about the size resources, scandium contents in different types of deposits, better data on production, with who and how much specified. There is no data for residence time in society and recycling rates are yet to be mapped and estimated. The data available from the system is at best faulty and has large holes. There is a need to map scandium occurrence in different types of deposits, evaluate assess and extractability. When all of this will be done, it would be time to do a full modeling again.

Conclusions

From the simulations, it was learned that scandium shows the typical behavior of a dependent secondarily extracted metal. When the scandium potential available from the mother substrates have been used, there will be very few options for increasing the scandium supply. Possible ways would be improving yields and recycling. Scandium is very valuable, but scandium recycling is still far too low. The potentially extractable scandium resource is about 6.1 million ton, and with present technology and access, about 676,000 ton of scandium appears as potentially extractable. The potential for extraction of scandium is about at present 1500 ton/year, but only about 45 ton of scandium per year is produced. If extraction yields and access yield could be improved, this may be increased to about 4800 ton per year, and the resource would increase to about 1.5 million ton.

The investigation suggests that there will be an increased demand for scandium metal, however limited by the high price and the lack of a properly functioning market. Simulations show that more scandium can be produced than now. The price will remain relatively high, but lower than in the past. It is suggested that the maximum feasible scandium production is about 250–300 ton/year. Depending on scandium recycling, supply may be 320–450 ton/year. The most uncertain factor for predicting the scandium price is the size of the scandium demand. The main limitation for making scandium metal is high energy costs and low extraction yields, as well as expensive raw materials.

Data availability

There are no data files needed outside the model. The authors are happy to share data used for the modelling upon request.

References

Akcil A, Akhmadiyeva N, Abdulvaliyev R, Meshram A, Meshram P (2018) Overview on extraction and separation of rare earth elements from red mud: focus on scandium. Miner Process Extr Metall Rev 39:145–151. https://doi.org/10.1080/08827508.2017.1288116

Altinsel Y, Topkaya Y, Kaya Ş, Şentürk B (2018) Extraction of scandium from lateritic nickel-cobalt ore leach solution by ion exchange: a special study and literature review on previous works. Springer, Cham, pp 1545–1553

Arbuzov SI, Volostnov AV, Mezhibor AM, Rybalko VI, Ilenok SS (2014) Scandium (Sc) geochemistry in coals (Siberia, Russian Far East, Mongolia, Kazakhstan, and Iran). Int J Coal Geol 125:22–35

Borra CR, Blanpain B, Pontikes Y, Binnemans K, Van Gerven T (2016) Recovery of rare earths and other valuable metals from bauxite residue (red mud): a review. J Sustain Metall 2:365–386. https://doi.org/10.1007/s40831-016-0068-2

Botelho AB Jr, Espinosa DCR, Tenório JAS (2020) Characterization of bauxite residue from a press filter system: comparative study and challenges for scandium extraction. Min Met Explor. https://doi.org/10.1007/s42461-020-00333-3

Botelo AB Jr, Espinosa DCR, Vaughan J, Tenorio JAS (2021) Recovery of scandium from various sources: a critical review of the state of the art and future prospects. Miner Eng 172:107148. https://doi.org/10.1016/j.mineng.2021.107148

Boyarintsev AV, Aung HY, Stepanov S, Shoustikov AA, Ivanov PI, Giganov G (2022) Evaluation of main factors for improvement of the scandium leaching process from Russian bauxite residue (Red mud) in carbonate media. Am Chem Soc Omega 7:259–273

Brown RJ (1999). Scandium. United States Geological Survey, Minerals Commodities Summaries 1999

de Carlo S, Goodman S (2022) Russia and Scandium's Scant Scale. U.S. International Trade Commission, Executive Briefings on Trade, June 2022. https://www.usitc.gov/publications/332/executive_briefings/ebot_russia_and_scandium_scant_scale.pdf

Chernoburova O, Chagnes A (2021) The future of scandium recovery from wastes. Mater Proc 5:55–63. https://doi.org/10.3390/materproc2021005055

Cleve PT (1879) Sur le scandium. Comptes Rendus 89:419–422

Cordier DJ (2022) Scandium. United States Geological Survey, Minerals Commodities Summaries 2022

De Luca A, Dunand DC, Seidman DN (2016) Mechanical properties and optimization of the aging of a dilute Al-Sc-Er-Zr-Si alloy with a high Zr/Sc ratio. Acta Mater 119:35–42

Djukanovic G (2017) Are aluminium-scandium alloys the future? July 28 Aluminium Insider 9:1–9. https://aluminiuminsider.com/aluminium-scandium-alloys-future/

Dreissen A (1990) Australia's resources of industrial minerals and an overview of its industrial minerals industry. In: Griffiths JB (ed) 9th Industrial Minerals International Congress, London, Metal Bulletin, pp 7–18

Duyvesteyn WPC, Putnam GF (2014) White paper: scandium. A review of the element, its characteristics, and current and emerging commercial applications EMC Metals Corporation (TSX: EMC.TO)

Fernandez V (2017) Rare-earth elements market: a historical and financial perspective. Resour Policy 53:26–45. https://doi.org/10.1016/j.resourpol.2017.05.010

Fischer W, Brünger K, Grieneisen H (1937) Über das metallische Scandium. Z Anorg Allg Chem 231:54–62. https://doi.org/10.1002/zaac.19372310107

Gambogi J (2021). Scandium. United States Geological Survey, Minerals Commodities Summaries 2021. https://pubs.usgs.gov/periodicals/mcs2021/mcs2021-scandium.pdf

Gao L-K, Rao B, Dai H-X, Hong Z, Xie H-Y (2019) Separation and extraction of scandium and titanium from a refractory anatase lixivium by solvent extraction with D2EHPA and primary amine N1923. J Chem Eng Jpn 52:822–828. https://doi.org/10.1252/jcej.18we347

Ghosh A, Dhiman S, Gupta A, Jain R (2023) Process evaluation of scandium production and its environmental impact. Environments 10:8. https://doi.org/10.3390/environments10010008

Gu H, Wang N, Hargreaves JSJ (2018) Sequential extraction of valuable trace elements from bayer process-derived waste red mud samples. J Sustain Metall 4:147–154. https://doi.org/10.1007/s40831-018-0164-6

Han A, Ge J, Lei Y (2015) An adjustment in regulation policies and its effects on market supply: game analysis for China’s rare earths. Resour Policy 46:30–42. https://doi.org/10.1016/j.resourpol.2015.07.007

Hayes-Labruto L, Schillebeeckx SJD, Workman M, Shah N (2013) Contrasting perspectives on China’s rare earths policies: Reframing the debate through a stakeholder lens. Energy Policy 63:55–68. https://doi.org/10.1016/j.enpol.2013.07.121

Hedrick JB (1996) Scandium. United States Geological Survey, Minerals Commodities Summaries 1996

Hein JR, Mizell K, Koschinsky A, Conrad TA (2013) Deep-ocean mineral deposits as a source of critical metals for high- and green-technology applications: comparison with land-based resources. Ore Geol Rev 51:1–14. https://doi.org/10.1016/j.oregeorev.2012.12.001

Huang Q, Talan D, Restrepo JH, Baena OJR, Kecojevic V, Noble A (2019) Characterization study of rare earths, yttrium, and scandium from various Colombian coal samples and non-coal lithologies. Int J Coal Geol 209:14–26. https://doi.org/10.1016/j.coal.2019.04.008

InvestorIntel Corp (2020) Making scandium mainstream in the very near future—InvestorIntel. 2018–2020. https://investorintel.com/markets/technology-metals/technology-metals-intel/light-weighting-of-vehicles-using-aluminium-scandium-alloys-can-reduce-costs-increasing-range-and-reduce-emissions/?print=print.

Kaiser Research Online (2021) Kaiser research online—education—KRO scandium Resource center. https://secure.kaiserresearch.com/s3/ Education.asp?ReportID=649798

Kalashnikov AO, Yakovenchuk VN, Pakhomovsky YA, Bazai AV, Sokharev VA, Konopleva NG, Makhailova JA, Ivanchuk GY (2016) Scandium of the Kovdor baddeleyite–apatite–magnetite deposit (Murmansk Region, Russia): Mineralogy, spatial distribution, and potential resource. Ore Geol Rev 72:532–537

Kaya S, Dittrich C, Stopic S, Friedrich B (2017) Concentration and separation of scandium from Ni laterite ore processing streams. Metals 7(12): article number 55. https://doi.org/10.3390/met7120557.

Knipling KE, Dunand DC, Seidman DN (2006) Criteria for developing castable, creep-resistant aluminum-based alloys—a review. Z Met 97:246–265

Krautkraemer JA (1988) The cut-off grade and the theory of extraction. Can J Econ 21:146–160

Kristiansen R (2003) Scandium-mineraler i Norge. Stein 30:14–23

Kuzmin VI, Flett DS, Zhizhaev AM, Gudkova NV, Kuzmin DV, Mulagaleeva MA, Tolstov AV, Logutenko OA (2019) The composition, chemical proper- ties, and processing of the unique niobium–rare earth ores of the Tomtor deposit. Chem Pap 73(6):1437–1446. https://doi.org/10.1007/s11696-019-00695-z

Laguna-Bercero MA, Skinner SJ, Kilner JA (2009) Performance of solid oxide electrolysis cells based on scandia stabilized zirconia. J Power Sources 192:126–131. https://doi.org/10.1016/J.JPOWSOUR.2008.12.139

Laqin AV, Tolstov AV, Kulikova IM (2016) Distribution of REE, Y, Sc, and Th in the unique complex rare-metal ores of the tomtor deposit. Geochem Int 54(12):1061–1078. https://doi.org/10.1134/S0016702916120065

Liu S, Fan HR, Santosh M, Liu X, Wang QW, Butcher AR (2023) Geological resources of scandium: a review from a Chinese perspective. Int Geol Rev. https://doi.org/10.1080/00206814.2023.2169842

Naumov AV (2008) Review of the world market of rare-earth metals. Russ J Non-Ferrous Met 49:18–27

Neumann H (1961) The scandium content of some Norwegian minerals and the formation of Thortveitite, a reconnaissance survey. Norsk Geologisk Tidskrift 41:197–211

Nilsson LF (1879a) Über Scandium, ein neues Erdmetall. Ber Dtsch Chem Ges 12:554–557. https://doi.org/10.1002/cber.187901201157

Nilsson LF (1879b) Sur l’ytterbine, terre nouvelle de M. Marignac. Comptes Rendus 88:642–647

NioCorp Superalloy Materials (2019) NI 43-101 technical report feasibility study, Elk Creek superalloy materials project, Nebraska report to. https://www.niocorp.com/wp-content/uploads/NioCorp_June-2022_NI_43-101_Technical_Report.pdf

Olafsdottir AH, Sverdrup H (2020) System dynamics modelling of mining, supply, recycling, stocks-in-use and market price for nickel. Min Metall Explor 38:819–840. https://doi.org/10.1007/s42461-020-00370-y

Phoung S, Williams E, Gaustad G, Gupta A (2023) Exploring global supply and demand of scandium oxide in 2030. J Clean Prod 401:136673

Ribagnac P, Deblonde GJP, Blancher SB, Lengagne L, Donati L, Malimba C, Courtaud B, Weigel V, Beltrami D (2017) Leaching of niobium- and REE-bearing iron ores: significant reduction of H2SO4 consumption using SO2 and activated carbon. Sep Purif Technol 189:1–10. https://doi.org/10.1016/j.seppur.2017.07.073

Rio Tinto (2023) Scandium. https://www.riotinto.com/en/products/scandium.

Rio Tinto (2023) Extracting scandium from waste. https://www.riotinto.com/en/news/stories/mineral-waste-to-fighter-jets

Riva S, Yusenko K, Lavery N, Jarvis D, Brown S (2016) The scandium effect in multicomponent alloys. Int Mater Rev 61:203–228. https://doi.org/10.1080/09506608.2015.1137692

Rosing-Schow N (2020) The Sveconorwegian pegmatite province: Identifying the parameters controlling the abundance and genesis of the pegmatites. Dissertation for the degree of Philosophiae Doctor, University of Oslo.

Salman AD, Juzsakova T, Mohsen S, Abdullah TA, Le P-C, Sebestyen V, Sluser B, Cretescu I (2022) Scandium recovery methods from mining, metallurgical extractive industries, and industrial wastes. Materials 15:2376. https://doi.org/10.3390/ma1507237629pages

Scrapmonster (2023) Scandium metal price. https://www.scrapmonster.com/metal-prices/rare-earth/scandium/957

Segalstad TV, Raade G (2003) Scandium mineralizations in southern Norway—geological background for the field trip. Norges Geologiske Forbund Abstracts Proc 2:57–86

Senge P (1990) The fifth discipline. The art and practice of the learning organisation. Century Business, New York

Singer DA (2007) Short course introduction to quantitative mineral resource assessments: U.S. geological survey open-file report 2007–1434. http://pubs.usgs.gov/of/2007/1434/

Singer DA, Menzie WD (2010) Quantitative mineral resource assessments—an integrated approach. Oxford University Press, New York, pp 219

Steffenssen G, Muller A, Munnik F, Friis H, Erambert M, Kristoffersen M, Rosing-Schow N (2020) Unusual scandium enrichments of the Tørdal pegmatites, south Norway. Part I: Garnet as Sc exploration pathfinder. Ore Geol Rev 126

Sverdrup HU (2019) The global sustainability challenges in the future: the energy and materials supply, pollution, climate change and inequality nexus. In: Holden E, Meadowcraft J, Langhelle O, Banister D, Linnerud K (eds) Our common future, what next for sustainable development? 30 years after the Brundtland report. Chapter 4:49–72. Springer, Frankfurt

Sverdrup H, Haraldsson H, Olafsdottir AH, Belyazid S, Svensson M, Nordby A (2022) System thinking, system analysis and system dynamics: find out how the world works and then simulate what would happen. 7th revised and rewritten edition. ISBN Oplandske Bokforlag, Hamar, Norway. ISBN 978-82-7518-280-5

Sverdrup H, Nordby A, Strandvik MCB (2023) Fra første ide til ferdig spill i bruk. Eksempel på innovasjonsatferd i spillutvikling og spillifisering. In: Hauge A, Rønbæk M, Myklebø S (Eds) Innføring i innovasjon. Chapter 17. Cappelen Damm Akademisk, Universitetsforlaget, Oslo, Norge, pp 254–266

Sverdrup H, Olafsdottir AH (2019) Conceptualization and parameterization of the market price mechanism in the WORLD7 model for metals, materials and fossil fuels. Miner Econ. https://doi.org/10.1007/s13563-019-00182-7

Sverdrup H, Olafsdottir AH (2023) Modelling aspects of the dynamics of the industrial vanadium cycle in a sustainability perspective using the WORLD7 Integrated Assessment Model. Resour Environ Sustain 13:100121

Sverdrup H, Olafsdottir AH, Ragnarsdottir KV (2019a) Assessing global copper, zinc and lead extraction rates, supply, price and resources using the WORLD6 integrated assessment model. Resour Conserv Recycl 1–26(X4):100007. https://doi.org/10.1016/j.rcrx.2019.100007.Openaccesspublication

Sverdrup H, Olofsdottir AH, Ragnarsdottir KV, Koca D (2018) A system dynamics assessment of the supply of molybdenum and rhenium used for superalloys and specialty steels, using the WORLD7 model. Biophys Econ Resour Qual 4:1–52. https://doi.org/10.1007/s41247-018-0040-9

Sverdrup H, Olafsdottir AH, Ragnarsdottir KV, Koca D, Lorenz U (2019b) The WORLD7 integrated system dynamics model: examples of results from simulations. In: Ludwig C, Valdivia S (eds) Progress towards the resource revolution, highlighting the importance of the sustainable development goals and the paris climate agreement as calls for action. World Resources Forum, Villigen PSI and St. Gallen, Switzerland, pp 68–76

Sverdrup HU, Ragnarsdottir KV (2014) Natural Resources in a planetary perspective. Geochem Perspect 2(October):1–156

Sverdrup H, Ragnarsdottir KV (2016) The future of platinum group metal supply; an integrated dynamic modelling for platinum group metal supply, reserves, stocks-in-use, market price and sustainability. Resour Conserv Recycl 114:130–152

Sverdrup HU, Ragnarsdottir KV, Koca D (2017a) An assessment of global metal supply sustainability: Global recoverable reserves, mining rates, stocks-in-use, recycling rates, reserve sizes and time to production peak leading to subsequent metal scarcity. J Clean Prod 140:359–372. https://doi.org/10.1016/j.jclepro.2015.06.085

Sverdrup H, Ragnarsdottir KV, Koca D (2017b) Modelling the copper, zinc and lead mining rates and co-extraction of dependent metals, supply, price and extractable amounts using the BRONZE model Proceedings of the 2015 World Resources Forum, 11–15 September. Davos, Switzerland. In: Ludwig C, Matasci C (eds) Boosting resource productivity by adopting the circular economy. pp 100–108. Paul Scherrer Institute, Villingen, Switzerland. ISBN 978-3-9521409-7-0

Sverdrup HU, Sverdrup AE (2023) An assessment of the global supply, recycling, stocks in use and market price for titanium using the WORLD7 Model. Sustain Horiz 7:100067

Ulrich M, Cathelineau M, Munoz M, Boiron MC, Teitler Y, Karpoff AM (2019) The relative distribution of critical (Sc, REE) and transition metals (Ni Co, Cr, Mn, V) in some Ni-laterite deposits of New Caledonia. J Geochem Explor 197:93–113. https://doi.org/10.1016/j.gexplo.2018.11.017

Wang W, Pranolo Y, Cheng CY (2011) Metallurgical processes for scandium recovery from various resources: a review. Hydrometallurgy 108:100–108. https://doi.org/10.1016/j.hydromet.2011.03.001

Wang Z, Li MYH, Liu ZRR, Zhou MF (2021) Scandium: ore deposits, the pivotal role of magmatic enrichment and future exploration. Ore Geol Rev 128:103906

Wilhelmsen MN (2020) The scandium content of beryllium-bearing minerals and micas from Tørdal pegmatites and its genetic and economic implications. Master Thesis in Geosciences. Department of Geosciences, Faculty of Mathematics and Natural Sciences and Natural History Museum. University of Oslo. http://www.duo.uio.no

Williams-Jones AE, Vasyukova OV (2018) The economic geology of scandium, the runt of the rare earth element litter. Econ Geol 113(4):973–988. https://doi.org/10.5382/econgeo.2018.4579

Youssef KM, Zaddach AJ, Niu C, Irving DL, Koch CC (2015) A novel low-density, high-hardness, high-entropy alloy with close-packed single-phase nanocrystalline structures. Mater Res Lett 3:95–99

Zakharov VV (2014) Combined alloying of aluminium alloys with scandium and zirconium. Met Sci Heat Treat 56:281–286. https://doi.org/10.1007/s11041-014-9746-5.ISSN1573-8973.S2CID135839152

Zhou H, Li D, Tian Y, Chen Y (2008) Extraction of scandium from red mud by modified activated carbon and kinetics study. Rare Met 27:223–227. https://doi.org/10.1016/S1001-0521(08)60119-9

Zhou J, Ning S, Meng J, Zhang S, Zhanf W, Chen Y, Wang X, Wei Y (2021) Purification of scandium from concentrate generated from titanium pigments production waste. J Rare Earths 39:194–200

Acknowledgements

This study contributed to the SIMRESS project (Models, potential and long-term scenarios for resource efficiency), funded by the German Federal Ministry for Environment and the German Environmental Protection Agency (FKZ 3712 93 102), the SIMRESSS Aufstockungsauftrag (FKZ 3712 93 102) and the SIMRESS Climate Impact Analysis project (FKZ 3716 32 100 0). This study contributed to EU H2020 LOCOMOTION project, funded by EU Horizon 2020 program under grant agreement 821105/H2020-LC-CLA-2018-2.

Funding

Open access funding provided by Inland Norway University Of Applied Sciences.

Author information

Authors and Affiliations

Contributions

HUS developed the scandium module for the WORLD7 model. HS wrote up the first draft, analyzed the scientific literature and did the initial simulation runs. AES cooperated in developing the simulation runs, the sensitivity set-up and participated in writing the manuscript. Both authors worked on the revision of the manuscript, and to correct the proofs.

Corresponding author

Ethics declarations

Conflict of interest

We declare that we have no conflict of interest with in the field of scandium, nor any vested interests. Both authors have no connections to any military use of these material and work from a fully academic perspective of system dynamics and aspects of sustainability.

Who Did What

Harald Ulrik Sverdrup developed the scandium module for the WORLD7 model. Harald Sverdrup wrote up the first draft, analyzed the scientific literature and did the initial simulation runs. Antoniy Elias Sverdrup cooperated in developing the sensitivity set-up, made model runs, and participated in writing the manuscript. Both authors worked on the revision of the manuscript, and to correct the proofs.

Dr. Anna Hulda Olafsdottir at the Icelandic Meteorological Institute, Reykjavik, Iceland, participated in developing earlier stages of the zirconium and hafnium model development for this work. She participated in earlier versions of the manuscript and is one of the main developers of the WORLD7 model and its principles during 2015–2021.

Dr. Deniz Koca and Harald Sverdrup were instrumental in developing WORLD6, starting from World3, with the intermediate models WORLD4, WORLD5 for use in the SIMRESS project for the German Government.

Original Work

The work presented is original research work by the authors. Every word of the text come straight from the authors hands, and no text was copied, and no Artificial Intelligence-driven Language models were used.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Sverdrup, H.U., Sverdrup, A.E. On the Supply Dynamics of Scandium, Global Resources, Production, Oxide and Metal Price, a Prospective Modelling Study Using WORLD7. Biophys Econ Sust 9, 2 (2024). https://doi.org/10.1007/s41247-024-00118-y

Received:

Revised:

Accepted:

Published:

DOI: https://doi.org/10.1007/s41247-024-00118-y