Abstract

A conceptual model of the electricity market is formulated. Demand can be either high or low, with given probabilities. Inflexible production units with high fixed cost supply the base load of low demand, while flexible units with lower fixed cost and rising marginal cost supply the rest. In a reference case, all production units cover exactly their fixed cost from inframarginal rents. Then a transition to renewable energy is analyzed. There is a certain probability that the renewable energy will not be available, but when it is, it supplies the previous base load. A back-up capacity to supply peak demand is assumed to be made available. The effect of availability of renewable energy on electricity price and fixed cost recovery is analyzed.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

The introduction of wind and solar energy has been going on in Europe and the United States for several years. In Germany, 40 (36)% of electricity generated in 2022 (2021) was from renewables other than hydro, that is, wind and solar energy (Energy Institute Statistical Review of World Energy). There is a lively debate on this development, especially about what it will do to the reliability of the electricity systems in individual countries, the cost of electricity for users, and the availability of back-up sources when demand is high and renewables not available. Over time, direct costs of wind and solar power have fallen markedly, but this is not a sufficient indicator that such energy has become cheaper, due to the costs of sources needed for back-up when renewable energy is not available.Footnote 1 Another and related concern is the one of the “missing money,” meaning that back-up units will not earn sufficient profits to pay their fixed costs despite occasionally high prices, due to infrequent need.Footnote 2 Such needs, even if infrequent, could nevertheless entail high costs if they are not satisfied, as this would mean black-outs and cut-offs.

This paper is an attempt to analyze these problems conceptually without getting lost in the thicket of intra-day and seasonal variability in demand and the details of “merit order” showing the order, according to marginal cost, of units called upon to produce as demand increases.Footnote 3 It offers a very simple model of demand variability where demand can be either high or low and varies randomly. It distinguishes between two types of producers. First, there are base load producers with low operating costs and high fixed costs and high costs of adjusting their production. Second, there are flexible producers with high and rising marginal costs, but lower fixed costs and greater ability to adjust their production quickly to changing demand. The model is used to analyze the transition from this reference case to another one where base load providers have been replaced by renewable energy providers with negligible operating costs but high fixed costs. The main questions are what the consequences will be for the cost of electricity for users and availability of back-up providers.

The base load energy that we have in mind as being replaced by solar and wind energy is coal and nuclear power. This is not a purely theoretical case; in Germany, this has already happened on a grand scale. In 2000, some 30% of electricity produced was nuclear with solar and wind accounting for less than 2%, while in 2022, some 36% was solar and wind power, with nuclear power accounting for 6% and on its way to be phased out. In April 2023, the last nuclear reactor in Germany was closed down. Coal power plants have not yet been phased out on a grand scale, but such phaseout is planned. There are other forms of base load energy where such considerations would be of little relevance, such as base load being provided by hydroelectric power which in fact could fit in well with intermittent solar and wind power, being easy to turn on and off according to the availability of solar and wind. Other types of base load energy such as nuclear and coal are much less easy to turn on and off, which is why they are used for base load in the first place. As the paper will make clear, a major part of the problem is that intermittent energy cannot be used reliably for base load; other types of more flexible energy will have to be called upon when the intermittent energy is not available. This paper does not address the question whether a competitive market will produce an optimal solution if left long enough to its own devices. In a recent paper, Korpås and Botterud (2020) have shown that this could indeed occur in markets with a significant share of wind and solar energy. Note, however that this solution would imply a degree of load shedding where occasionally a high demand would not be fully satisfied. Furthermore, their model does not take uncertainty into account, except as an average availability factor for renewable energy. As a recent paper by Papavasiliou et al. (2021) shows, there is clearly a need in some European electricity markets for a supplementary mechanism to ensure sufficient flexible generative capacity. The ongoing transition to renewable energy has not been driven by market forces but by government intervention through subsidies and regulation, and so the present situation is unlikely to represent a competitive market equilibrium.

The model is a conceptual one. Even if numbers are used for illustration, they do not pertain to actual costs anywhere; for such analysis, one would need a detailed applied model. The conceptual transition this paper considers is real enough; however; it is not unlike what has happened in Germany, as already mentioned.

A Simple Model

Assume that the demand for electricity can be either low, Qlow, or high, Qhigh, with probability π for high demand and 1 − π for low demand. This assumption, done to simplify the analysis, is not quite as bad as it may sound; demand is largely determined by what kind of equipment and dwelling households have acquired. Temporary needs for heating or cooling or food preparation, washing and drying, etc., will largely determine demand independently of price; it is limited what households can do to adjust demand to price except foregoing the services they have elected to have. In the long term, however, demand will presumably be determined by permanent price changes; this will influence what kind of insulation or dwellings or electrical equipment households decide to have.

Suppose there is a delivery system in place which provides a base load equal to the low demand at a constant marginal cost cb, but which has high start-up and shut-down costs. We shall not model this explicitly, but assume that the base load production will be kept online all the time. The high demand is supplied with a flexible technology with negligible start-up or shut-down costs. The marginal cost (cf) of this technology rises with production:

By assumption, production with the flexible technology will be equal to Qhigh − Qlow. For simplicity, it is assumed that the marginal cost of the flexible technology is always higher than for the base load technology, starting at the level of the marginal cost for the latter.Footnote 4 The rising marginal cost of the flexible technology reflects the so-called merit order, according to which production units are called into service, typically through auctioning, according to their position on the marginal cost curve. This point is, of course, moot when, as here, the demand is assumed to attain only two different levels, whereas in the real world, it will vary within a lower and an upper limit.

With marginal cost pricing, the price of electricity will be either low or high:

\(p_{{{\text{high}}}} = c_{{\text{b}}} + a\left( {Q_{{{\text{high}}}} - Q_{{{\text{low}}}} } \right).\)

The expected price (average cost of electricity for buyers) will be

What about total cost recovery? With marginal cost pricing, this will happen automatically if inframarginal rents are high enough to cover fixed costs. For the base load technology, this implies

where kb is the fixed cost per unit of production of the base load technology. The base load technology will only obtain rents if demand is high, but it only supplies Qlow, as it always does. The left-hand side of this expression is the expected value of the inframarginal rent.

For the flexible technology the corresponding expression is

where kf is the fixed cost per unit of production, assumed constant for simplicity. In the real world, different units of flexible capacity (gas turbines, coal fired plants) will have different unit costs.

Whether cost recovery will be obtained or not depends on the probability of high demand and the steepness of the marginal cost curve. A numerical example will illustrate. Set cb = 0.1, a = 1, Qlow = 1, and Qhigh = 2. This gives plow = 0.1 and phigh = 1.1. With π = 1/2, the expected inframarginal rent would be 0.5 for the base load technology and 0.25 for the flexible technology. It is not unreasonable to suppose that the fixed cost of the base load technology is higher than for the flexible technology, particularly if the base load technology is nuclear power. So, if kb = 0.5 and kf = 0.25, the fixed costs would be covered exactly. We set this as the reference case, against which introduction of renewable technology (wind and solar) will be discussed. There is indeed a presumption that a competitive electricity market would produce optimal generative capacity with inframarginal rents precisely covering all fixed costs (see Schweppe et al. 1988).

Renewable Technology

Now suppose that the base load technology has been replaced by a renewable technology such as wind and solar power (as mentioned in the Introduction, the base load we have in mind are nuclear and coal power, not other forms of base load such as hydroelectric power, for which solar and wind could be complementary). Suppose that this technology produces the same quantity as the previous base load technology, except that at certain times, the renewable technology is not available, either because there is no wind or no sunshine. Denote the probability of the renewable technology being available by ϕ. Suppose this probability is independent of whether demand is high or low.Footnote 5 The marginal cost of the renewable technology is low or negligible and we set it to zero.

We now get four different price regimes under marginal cost pricing:

This happens if demand is low and the renewable technology is available. The probability of this is (1 − π)ϕ.

This happens if demand is low and the renewable technology is not available. The probability of this is (1 − π)(1 − ϕ).

This happens if demand is high and the renewable technology is available. This is the same as the high price regime in the reference case. The probability of this is πϕ.

This happens if demand is high and the renewable technology is not available. The probability of this is π(1 − ϕ).

We note immediately that the highest price is now higher than in the reference case, because the renewable technology may not be available when the demand is high. The lowest price is lower than in the reference case, so variability of price increases. The average price, defined as expected average cost for users, will be discussed below.Footnote 6

What about recovery of fixed costs? The renewable technology only earns rents if p > 0 and the renewable technology is available. This happens only with p = p3. Hence, the expected inframarginal rent of the renewable technology is

This is to be compared with the expected inframarginal rent of the base load technology in the reference situation, which is \(\pi \left( {p_{{{\text{high}}}} - c_{{\text{b}}} } \right)Q_{{{\text{low}}}}\). As p3 = phigh, we cannot say unambiguously which is largest, but note that the less reliable the renewable energy is, the lower the expected inframarginal rent will be. Note that when the price is p3 demand is high, but the renewable technology only produces an amount equal to the low demand, by assumption.

The expected inframarginal rent of the flexible technology is

This is to be compared with the inframarginal rent in the reference case:

Since p3 = phigh, this corresponds to the middle term in the case with renewables, but the latter is smaller, because ϕ < 1. But there are two new terms in the renewables case, so there is reason to expect the inframarginal rents of the flexible units will be greater. On the other hand, more flexible units will be needed, because when the renewables do not produce, the entire high demand will have to be satisfied by the flexible units.

Let us compare the results we get for the case with renewables with what we got for the reference case, for different probabilities for renewables being available. Consider, first, the expected average price, that is, the expected value of what buyers pay for their electricity divided by the expected quantity purchased:

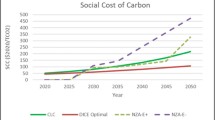

As shown in Fig. 1, this is higher in all cases with the renewable technology except when it is virtually certain to work at all times (compare Reference case with Renewables; the case new f(lexible) units will be explained later). This happens despite the fact that the price is zero when demand is low and the renewable technology is available (p1), but the need for the flexible technology when demand is high and the renewable one is not available raises the price to p4 = 2.1, almost twice the level it was in the reference case with a high demand (1.1). Low operating cost of the renewable technology together with marginal cost pricing is no guarantee for a low price; the need for high cost back-up sees to that.

Figure 2 shows the inframarginal rent of renewables versus base load in the reference case (again, the case new f-units will be explained later). The inframarginal rent of renewables is always below that of the base load in the reference case, except when renewables are virtually always available. If renewables have as high fixed costs as the alternative base load this is bad news. If the inframarginal rents were just sufficient to pay for the base load in the reference case, the renewables would not be able to cover their fixed costs and would have to be permanently subsidized. Higher network costs of renewables are a part of the picture, but sensitive to location of solar panels and wind turbines relative to central of demand (see Kendziorski et al. 2022).

Figure 3 shows the inframarginal rents of flexible production units with renewables versus in the reference case. The line shown for the reference case is twice the rent these units earn, because with renewables twice as large flexible capacity is needed; the flexible units will have to satisfy the entire demand when it is high (twice as large as when it is low), so twice as large rent needs to be earned in the renewables case. When the probability that renewables will be available is low, there will be enough rents to pay for the fixed costs of the flexible units because the flexible units are earning rents most of the time. When, however, the flexible units are seldom needed, they will not earn much rent and will not be able to recover their fixed costs. Hence, when the probability of renewables being available is relatively high, we are most likely to be confronted with the problem of “missing money”; that there will not be enough profit for the flexible units to pay for their fixed costs and hence they will not be available when they are needed. This may happen only infrequently, but the necessary back-up capacity may still be desirable because insufficient supply of electricity when it is needed is a nasty problem resulting in cut-offs and black-outs.

The transition to renewable energy will require a substantial increase in flexible production capacity. In this example, it will have to double, because renewable energy will at times be unavailable. It may be argued that this is an extreme case; even under the most difficult circumstances it is unlikely to be totally absent. That renewable energy could be substantially curtailed is not in dispute, however. At times, high-pressure areas form over the North Sea and adjacent areas and the winds die down. This is not unlikely to happen in winter, leading to unusually low temperatures and high demand for heating. It is, therefore, more than likely that an increase in flexible generating capacity will be required. Such new capacity is indeed likely to be explicitly installed or developed in order to balance an electricity market with a large share of solar and wind; batteries and gas turbines come to mind. These facilities, especially gas turbines, might well have lower marginal cost than older flexible units and would lead to marginal costs increasing less rapidly with output. In the numerical example we illustrate this with halving the coefficient a. The result is shown in Figs. 1, 2, and 3 as dashed lines labeled New f(lexible) units. We see in Fig. 1 that the expected price of electricity falls and is now lower than in the reference case, except for very low probabilities for the availability of renewable energy. But other cost-enhancing effects lurk. In Fig. 2, we see that the inframarginal rents of renewable energy are lower than for base load in the reference case, so if renewable energy has higher fixed costs than the base load in the reference case, it is likely to have difficulties to pay for these costs. And in Fig. 3, we see that the inframarginal rents for the flexible units are now below twice their value in the reference case (note that we need twice as much back-up capacity with renewables) for all, but the very low probabilities for availability of renewable energy. This “missing money” will somehow have to be found, in reality raising the cost of electricity to users.

Conclusion

Introduction of renewable energy sources amounts to substituting intermittent and uncontrollable sources for reliable and controllable ones. They may have lower costs than other sources, but they are not always available when we need them and necessitate more costly units as back-ups. Even if they have lower operating cost than the base load they replace, they are nevertheless likely to lead to higher electricity prices for users, because back-up units with higher operating costs will be needed more often. In addition, renewable energy may lead to higher prices of electricity due to high fixed costs that are not covered through rents under marginal cost pricing, partly because the renewable energy units may not earn enough rents to pay their own fixed cost, and partly because flexible units needed for back-up may not be needed often enough to earn rents to pay for their fixed cost. These uncovered fixed costs will have to be covered somehow, which ultimately will lead to higher prices for electricity even if they do not show up in the direct price for electricity used. The alternative would be cut-offs and black-outs, which also have their indirect costs.

Data availability

Not applicable.

Notes

The insufficiency of comparing so-called “levelized costs” is discussed in Joskow (2011).

The missing money problem can arise because of price regulation that reduces revenues for flexible generation units and blunts the incentive to invest in such equipment. The problem can also occur in markets with a high share of wind and solar energy leading to at times very low prices. On dealing with this by auctioning reserve capacity, see Papavasiliou, Smeers, and de Maere d’Aertrycke (2021). The missing money problem is extensively discussed in Holmberg and Ritz (2020) and de Maere d’Aertrycke et al. (2017).

For an interesting analysis of the implications of the merit order in the UK and Germany, see Gugler et al. (2021).

Qualitatively the same results would be produced if the lowest marginal cost of the flexible technology were higher than the marginal cost of the base load technology.

The availability of wind power depends critically on the size of the area from which wind power can be drawn. This, in turn, is affected by the availability of long-range transmission lines. Under certain circumstances, strong versus calm winds can affect large areas. Mauritzen and Sucarrat (2022) offer a thorough statistical analysis of this issue for Denmark and southern Sweden.

Kalghatgi (2021) offers an empirical analysis of electricity prices in 20 different countries in Europe, Asia and America and shows that they are higher in countries with higher installed capacity of wind and solar energy.

References

de Maere d’Aertrycke G, Ehrenmann A, Smeers Y (2017) Investment with incomplete markets for risk: the need for long-term contracts. Energy Policy 105:571–583

Gugler KA, Haxhimusa and M. Liebensteiner, (2021) Effectiveness of climate policies: carbon prizing vs subsidizing renewables. J Environ Econ Manag 106:102405

Holmberg P, Ritz RA (2020) Optimal capacity mechanisms for competitive electricity markets. Energy J 41:33–66

Joskow PL (2011) Comparing the costs of intermittent and dispatchable electricity generating technologies. Am Econ Rev Pap Proc 100(3):238–241

Kalghatgi G (2021) Are domestic electricity prices higher in countries with higher installed capacity of wind and solar? (2019 data). Automot Saf Energy 11(1):79–83

Kendziorski M, Goke L, von Hirschhausen C, Kemfert C, Zozmann E (2022) Centralized and decentral approaches to succeed the 100% energiewende in Germany in the European context—a model-based analysis of generation, network, and storage investments. Energy Policy 167:113039

Korpås M, Botterud A (2020) Optimality conditions and cost recovery in electricity markets with variable renewable energy and energy storage, Working paper 2020-005. MIT Center for Energy and Environmental Policy Research

Mauritzen J, Sucarrat G (2022) Increasing or diversifying risk? Tail correlations, transmission flows and prices across wind power areas. Energy J 43(3):105–131

Papavasiliou A, Smeers Y, de Maere d’Aertrycke G (2021) Market design considerations for scarcity pricing: a stochastic equilibrium framework. Energy J 42(5):195–220

Schweppe FC, Tabors RD, Caramanis MC, Bohn RE (1988) Spot pricing of electricity. Kluwer Academic Publishers, Boston

Funding

Open access funding provided by Norwegian School Of Economics.

Author information

Authors and Affiliations

Contributions

There is only one author

Corresponding author

Ethics declarations

Conflict of interest

The authors declare no competing interests.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Hannesson, R. A Simple Conceptual Model of Energy Transition. Biophys Econ Sust 8, 8 (2023). https://doi.org/10.1007/s41247-023-00116-6

Received:

Revised:

Accepted:

Published:

DOI: https://doi.org/10.1007/s41247-023-00116-6