Abstract

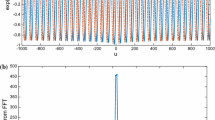

A generalization of the geometric stable law is introduced. We propose a procedure for estimating the parameters of the geometric stable distributions. The proposed estimation procedure is also applied to the generalized model. The estimation algorithm is less restrictive, computationally simple and necessary to make these models usable in practice. Asymptotic properties of the estimators are also established. We carry out a simulation study to show the performance of the estimators. The histogram of the simulated data from generalized geometric stable for various values of the parameter is presented. We fit the generalized geometric stable distribution to the daily exchange rates of Japanese Yen data (in relation to US dollar) during January 1, 1980–July 12, 1990 and show that the generalized geometric stable dominates all other models considered. For comparisons, we have used histogram, q–q plot and Kolmogorov Smirnov statistic.

Similar content being viewed by others

References

Bachelier (1900) Théorie de la Speculation. Annales de l' École Normale Superieure Series 3(17):21–86

Cahoy DO (2013) Estimation of Mittag-Leffler parameters. Commun Stat Simul Comput 42:303–315

Chambers JM, Mallows CL, Stuck BW (1976) A method for simulating stable random variables. J Am Stat Assoc 71:340–344

Fama E (1965) The behavior of stock market prices. J Bus 38:34–105

Ferguson TS (1996) A course in large sample theory. Chapman & Hall, New York

Jose KK, Uma P, Seetha Lekshmi V, Haubold HJ (2010) Generalized Mittag-Leffler distributions and processes for applications in astrophysics and time series modeling. In: Proceedings of the Third UN/ESA/NASA Workshop on the International Heliophysical Year 2007 and Basic Space Science, 79-92

Jayakumar K (1993) The first order autoregressive Mittag-Leffler process. J Appl Prob 30:462–466

Jayakumar K, Ristic MM, Mundassery DA (2010) A generalization to bivariate Mittag-Leffler and bivariate discrete Mittag-leffler autoregressive processes. Commun Stat Theory Methods 39:942–955

Kozubowski TJ (1994) The theory of geometric stable distributions and its use in modeling financial data. Eur J Oper Res 74:310–324

Kozubowski TJ (1999) Geometric stable laws: estimation and applications. Math Comput Model 29:241–253

Kozubowski TJ (2001) Fractional moment estimation of Linnik and Mittag-Leffler parameters. Math Comput Model 34:1023–1035

Kuruoğlu EE (2001) Density parameter estimation of skewed \(\alpha\)-stable distributions. IEEE Trans Signal Process 49:2192–2201

Mandelbrot B (1963a) New methods in statistical economics. J Polit Econ 71:421–440

Mandelbrot B (1963b) The variation of certain speculative prices. J Bus 26:394–419

Mittnik S, Rachev ST (1989) Stable distributions for asset returns. Appl Math Lett 2:301–304

Mittnik S, Rachev ST (1991) Alternative multivariate stable distributions and their applications to financial modeling. In: Stable Processes and Related Topics, Birkhäuser, Boston, MA 107-119

Mittnik S, Rachev ST (1993) Modeling asset returns with alternative stable distributions. Econ Rev 12:261–330

Pakes AG (1998) Mixture representation for symmetric generalized Linnik laws. Stat Prob Lett 37:213–221

Pillai RN (1990) On Mittag-Leffler functions and related distributions. Ann Inst Stat Math 42:157–161

Samorodnitski G, Taqqu M (1994) Stable non-Guassian random processes. Chapman & Hall, New York

Acknowledgements

The authors wish to thank the Editor-in-Chief and the referees for a careful reading of the original manuscript and for a number of suggestions that improved the presentation of the article.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

1.1 Simulation Results

See Table 3.

1.2 Interval Estimation for the \(GS(\alpha ,\beta ,\sigma ,\mu )\) Distribution

We study the limiting distribution of our estimator \(\hat{\alpha }\) and \(\hat{\sigma }\) from the GS distribution \(GS(\alpha ,0,\sigma ,0)\) for \(\alpha \ne 1\). If we let

then, the standard two dimensional central limit theorem implies, as \(n\rightarrow \infty\), the following convergence,

where \({L_1}^\prime ,{L_2}^\prime ,{L_3}^\prime ,{L_4}^\prime\) are the moments defined in section 2.

Now to show the asymptotic normality of the estimators, we use Cramer’s theorem [see Ferguson 1996]. Let

Then the gradient becomes \(\dot{g}({L_1}^\prime ,{L_2}^\prime )=\left( {\begin{array}{c} \exp ({L_1}^\prime +\mathbb {C})\\ 0 \end{array}}\right)\). This implies that \(\sqrt{n}(\hat{\sigma }-\sigma ) \overset{d}{\rightarrow }N(0,{\sigma _{\sigma }}^2)\) where

Similarly, \(\sqrt{n}(\hat{\alpha }-\alpha )\overset{d}{\rightarrow }N(0,{\sigma _{\alpha }}^2)\) where

The above expression for \({\sigma _{\alpha }}^2\) obtained by substituting

and

Therefore, we have shown that our estimates are normally distributed (asymptotically unbiased) as the sample size n goes large. Consequently, we can approximate the \((1-\epsilon )\%\) confidence interval for \(\alpha\) and \(\sigma\) as \(\hat{\alpha }\pm z_{\epsilon /2}\sqrt{{\frac{\hat{\sigma _{\alpha }}^2}{n}}}\) and \(\hat{\sigma }\pm z_{\epsilon /2}\sqrt{{\frac{\hat{\sigma _{\sigma }}^2}{n}}}\) respectively, where

and

\(z_{\epsilon /2}\) is the \((1-\epsilon /2)^{th}\) quantile of the standard normal distribution, and \(0<\epsilon <1.\)

1.3 Generalized Geometric Stable Distributions

Proof of Proposition (3.1).

Case 1 \(\alpha \ne 1\)

Case 2 \(\alpha =1\)

Rights and permissions

About this article

Cite this article

Jayakumar, K., Sajayan, T. On Estimation of Geometric Stable Distributions. J Indian Soc Probab Stat 21, 329–347 (2020). https://doi.org/10.1007/s41096-020-00085-9

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s41096-020-00085-9