Abstract

According to Kaldor and Verdoorn, the evolution of output is expected to structurally enhance labour productivity by generating economies of scale. At the same time, Okun’s law suggests a pro-cyclical association between output and productivity. These two aspects of the relationship often pose challenges in empirical studies when distinguishing between short-run (à la Okun) and long-run (à la Verdoorn) effects. In light of these complexities, our paper offers three contributions. First, we discuss the extant approaches to the estimation of long-run Verdoorn effects. Second, we investigate the presence of a short-run, Okun-like effect. Third, we propose a methodological advancement to separate the cyclical from the structural relationship between output and productivity. We employ panel cointegration-based techniques on data from a large set of OECD countries over the period 1970–2019. Our findings reveal a short-run coefficient of about 0.3 between growth rates and a long-run elasticity of about 0.5 between levels.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction and background

The recent deceleration in labour productivity experienced by OECD countries, particularly in Europe, is often considered the primary cause of the post-2008 economic slowdown, to the point that it has been included among the causes of a ‘secular stagnation’ (Gordon, 2015). Consequently, numerous studies have sought to pinpoint the drivers of labour productivity, a topic that is on the agenda of major international institutions and players (OECD, 2015; European Central Bank, 2021). The literature exploring the factors influencing productivity growth (and, conversely, its slowdown) is extensive. It takes into consideration an array of factors, depending on the level of aggregation of the analysis, and, more importantly, the analytical framework used in each empirical work.Footnote 1 Amidst the abundant research on this subject, especially intriguing are studies that have considered the possibility of a reverse – or at least bidirectional – causal link between the two variables under investigation. Indeed, these studies highlight the potential influence of output growth on the trajectory of labour productivity. This line of research draws inspiration from Kaldorian ideas, which suggest that productivity, in addition to the process of capital accumulation (Kaldor, 1957, 1961), is not independent of the evolution of output. This concept echoes the principles of the Verdoorn law (Kaldor, 1966; Verdoorn, 1949), which posits the existence of a positive, long-run relationship between output and labour productivity. In the words of Basu (1996), the law supports the idea that the “economy endogenously becomes more efficient by moving to higher levels of activity” (p. 720, emphasis added). In this context, output has the potential to boost productivity not only during the business cycle, but also by initiating economies of scale both within individual firms (leading to improved efficiency and specialisation processes) and at the sectoral level (through spillovers and positive externalities).

However, a methodological challenge arises when attempting to empirically estimate a long-run, Verdoorn-type effect. This is due to the common association between output changes and the pace of productivity within the business cycle, as indicated by the Okun law (1962). This connection is a result of productivity exhibiting a pro-cyclical behaviour, influenced by variations in the intensity of the use of factors (both labour and capital). According to Okun, about half of the output growth translates into productivity gains over the business cycle. Consequently, efforts to estimate the Verdoorn coefficient could potentially reflect (and be biased by) higher factors utilisation.Footnote 2 Hence, depurating the empirical analysis from such cyclical effect becomes central for the estimation of robust Verdoorn coefficients. At the same time, a statistical method capable of individuating the cyclical and the structural relation is desirable since it would help also in estimating an unbiased short-run effect.

To the best of our knowledge, this point has been recognised but not entirely addressed in previous research. Therefore, in this paper we deal with this specific problem and answer the following research question: how can we determine the extent to which changes in productivity growth are attributable to output growth beyond the pro-cyclical behaviour of productivity? Or, putting it differently, how can we differentiate between the short-run (à la Okun) and long-run (à la Verdoorn) effects of output on productivity? The paper explains why and how the cointegration framework is a suitable method for simultaneously estimating both effects. In particular, we employ cointegration methods for heterogeneous panel data (Pesaran & Smith, 1995; Pesaran et al., 1999), applied to 38 OECD countries (and subsets) for the period spanning from 1970 to 2019.

Our contribution adheres to the following logical chain. First, we engage in a methodological discussion about the challenges associated with extant approaches used to estimate a long-run association between output and productivity. Second, we subject Okun’s law to empirical scrutiny and document a positive association between output and productivity growth rates. By resorting to this law, we verify if this relation involves also other variables describing the situation of the labour market (hours worked per person employed, unemployment, and participation). Next, we introduce the most original aspect of the article, namely a procedure to differentiate between cyclical and structural effects. Our approach is capable of separately capturing both Okun-type and Verdoorn-type relationships between output and labour productivity. At the same time, the strategy we use can simultaneously consider both levels and growth rates, and in so doing it allows for the joint estimation of the short-run and long-run tie between variables. Finally, we implement methodological refinements to mitigate the thorny problem of endogeneity, which is typical in the Kaldor-inspired empirical literature.

While primarily a methodological study, our findings may provide valuable indications for policy makers seeking to introduce measures to stimulate productivity growth, especially in a context of economic stagnation. Indeed, disentangling the cyclical and structural effects is essential because the long-run effects can be thought to capture aspects that are more indicative of technical change and genuine productivity improvements, whereas the short-run effect might also reflect labour market dynamics. Consequently, the design of effective policies greatly depends on to what extent the output-productivity relationship is a cyclical or structural matter.

The paper proceeds as follows. Section 2 covers the fundamentals of Okun’s and Verdoorn’s laws. Section 3 delves into existing approaches and methods for estimating related coefficients. The paper then turns to the empirics. In Section, we test the original hypothesis by Okun. Section 5 presents our methodological procedure to disentangle short-run and long-run effects. Section 6 shows our results and some robustness tests. Section 7 provides a summary and outlines policy implications.

2 The Okun and the Verdoorn laws: an overview

2.1 Productivity and output in the short run: insights from Okun

Though it may not seem immediately obvious, the presence of a short-run connection between output growth and productivity growth is rooted in Okun’s law. Originally, this law established a link between changes in output and changes in unemployment. Okun’s law, originally based on observations of the US economy, predicts that a one percent rise in unemployment is usually associated with a higher-than-one percent drop in the gross domestic product (GDP).Footnote 3 While it might not be immediately apparent, Okun’s law does not directly address the relationship between output and productivity growth rates. However, it implies that factors other than employment, such as labor productivity, are linked to output.Footnote 4 Indeed, in Okun’s original statement, an increase in output is associated with: i) a decrease in the unemployment rate, ii) an increase in labour force participation, iii) an increase in hours worked per employee, and iv) an increase in labour productivity (output per hour worked).

There are different reasons why productivity shows a pro-cyclical pattern.Footnote 5 The primary reason for this pro-cyclical pattern is labour hoarding, a phenomenon that typically occurs during the downswing of the cycle, that is the possibility that a business chooses not to adjust immediately its employees when demand (and hence output) varies. In the words of Ball et al. (2013), who draw from Okun (1962) and Oi (1962), labour can be viewed as “a quasi-fixed factor”, since “it is costly to adjust employment, so firms accommodate short-run output fluctuations in other ways: they adjust the number of hours per worker and the intensity of workers’ effort” (p. 5). During a downturn, firms tend to retain employees rather than laying them off, and this behaviour can be attributed to different motivations. One is the difficulty of re-hiring workers with specific skills and/or competencies (most likely, workers who have been educated and trained for certain tasks at the expense of firms) when the economy will recover. Additionally, factors such as a tight labour market or strong employment protections can make sudden employment adjustment costly. The same may apply during positive phases of the cycle: in fact, labour productivity tends to rise during expansions since firms do not immediately adjust the installed capital, as they tend to operate in a context of ‘normal’ capacity utilisation which is below its potential.Footnote 6 This means that, during the first phase of the boom, the same amount of employees may use machinery and equipment “harder and longer” (Basu & Fernald, 2001, p. 225).

One way to alleviate the issue of pro-cyclicity is to measure productivity per hour worked, and not per person employed (as we will do in our empirics). This method can account for part-time and overtime work, which tend to be more prevalent during recessions (part-time) and expansions (overtime), all else being equal. Nonetheless, it can be argued that during a phase of economic contraction, an economy may reallocate – in case the mobility of labour is sufficiently robust – some workers towards sectors with lower productivity. Besides labour hoarding and reallocation, Basu and Fernald (2001) elucidate two additional channels that contribute to the pro-cyclicality of productivity, namely: i) pro-cyclical productivity may result from technology that also follows pro-cyclical patterns; and ii) the combined impact of imperfect competition and intra-firms increasing returns can lead productivity alongside inputs growth.

The empirical literature on the Okun law is mainly focused on the relationship between (changes in) output and (changes in) unemployment, and therefore it is not immediate to find a coefficient testifying to the relationship of our interest, i.e. the short-run connection between output and labour productivity growth rates. For the US economy, Baily et al. (2001) conducted a plant-level study and estimated a cyclical coefficient of 0.44 for productivity when measured per person employed; however, this coefficient decreased, as expected, to 0.24 when productivity per hour worked was considered. To provide an order of magnitude, we can refer to some contributions where we indirectly observe Okun coefficients related to the short-run link between output and productivity. For instance, Millemaci and Ofria (2014) show that in the short term (i.e., yearly changes), the elasticity of productivity growth to output growth ranges from 0.7 to 0.9, depending on the country. Deleidi et al. (2020) applied the same method to nine European countries but estimated lower values, ranging from 0.2 to 0.4. Both Tridico and Pariboni (2018) and Carnevali et al. (2020) estimate what they refer to as a ‘Smith effect’ (a coefficient linking productivity growth to output growth) of 0.36 and about 0.6, respectively; however, it is important to note that, due to the used estimation methods, this coefficient may condense short and long-run effects (we shall elaborate on this specific point in Section 4 and Section 6.1, when discussing our findings). Antenucci et al. (2020) report higher values of a short-run effect similar to an Okun effect; their estimated elasticities of productivity to output at the one-year horizon range from 0.5 to 0.7, with higher values in the manufacturing sector compared to the total economy. Analogously, Deleidi et al. (2023) estimated a productivity-enhancing impact coefficient associated with output growth of about 0.95 for developed countries and 1 for developing countries.

2.2 Productivity and output in the long run: insights from Verdoorn and Kaldor

In contrast, the Verdoorn law shifts the focus to the long run, positing the existence of a stable and structural association between output and productivity. Rooted in Adam Smith’s ideas on the division of labour and specialisation, this law embodies the positive, structural effects on productivity resulting from increased production scale. It finds empirical support in prominent works by Verdoorn (1949, 1956) and Kaldor (1957, 1966), to the point that some scholars use the term Kaldor-Verdoorn law (henceforth, KV law). Recently, this approach has been reappraised by post-Keynesian scholars who align with Kaldor’s concept of economic growth driven by aggregate demand (Kaldor, 1975). On this pillar, many contributions (see among others, McCombie, 2002; McCombie & Spreafico, 2015; Forges Davanzati et al., 2019; Antenucci et al., 2020; Deleidi et al., 2020, 2023) considered that the trend growth rate of output per unit of labour is influenced by the trend growth rate of output, an element which unambiguously “makes technical progress an endogenous variable” (Lavoie, 2014, p. 428).Footnote 7 In this framework, output growth, which serves as a suitable proxy for a larger extension of the market, can boost labour productivity beyond economic cycles through two distinct channels. First, it does so by activating various factors – like labour division, positive externalities among firms and industries (especially in manufacturing), specialisation processes both between and within firms, and learning-by-doing – capable of generating economies of scale (Kaldor, 1961, 1966, 1972; McCombie, 2002; McCombie & Roberts, 2007; Young, 1928). Second, output growth fuels investment through the accelerator principle, facilitating the introduction of more advanced technologies embodied in the newly installed capital goods (Cesaratto et al., 2003; Kaldor & Mirrlees, 1962; Kaldor, 1957, 1961).

Concerning the size of the estimated long-run scale coefficient, Verdoorn (1949) initially estimated it at about 0.45. Some years later, Kaldor (1966) indicated that each additional percentage point of output growth leads to a 0.5% increase in labour productivity. All-embracing reviews of the first empirical investigations for an array of manufacturing economies can be found in McCombie (1983), Thirlwall (1983), and McCombie et al. (2002). Yet, the empirical literature on the KV law has recently reached a positive momentum. By using the same method by Verdoorn and Kaldor (i.e. simple linear regressions), Knell (2004) estimated a Verdoorn coefficient of 0.53 for the manufacturing sectors of twelve industrial countries during the 1990s. Castiglione (2011) validated the Verdoorn law for the manufacturing sector through a cointegration analysis applied to US data. By using ARDL (autoregressive distributed lags)-based methods, Millemaci and Ofria (2014) estimated a long-run Verdoorn coefficient for several advanced economies, with values settling in the interval from 0.3 to 0.6. The same method is used by Deleidi et al. (2020), who validated the Verdoorn law for six (out of nine) selected European countries (the estimated coefficients range from 0.4 to 0.6). Magacho and McCombie (2017) found the existence of pervasive increasing returns to scale (that is, a Verdoorn coefficient of about 0.6) on a panel of manufacturing industries for 70 countries (1963–2009) by using a system GMM (generalized method of moments) estimator. Antenucci et al. (2020) employed SVAR (structural vector autoregressive) modelling to estimate a Verdoorn effect, with results ranging from 0.2 to 0.6 depending on the country under scrutiny; with the same method, Deleidi et al. (2023) found higher long-run Verdoorn coefficients (about 1 for both high- and low-income economies), even though they become significantly lower (about 0.3) when the autonomous demand is used as a proxy for output. Definitively, the extant literature presents high variability in the estimated long-run elasticity of productivity to output dynamics, with estimated coefficients ranging from 0.2 to 1. On one side, such variability may be related to the fact that the countries or regions covered by the studies are very different, which by itself would explain the range in estimates; in this regard, higher Verdoorn coefficients are generally associated with larger economies. On the other side, the variability may depend on the large array of estimation approaches used, an element that may suggest the presence of method-sensitive findings; in this regard, studies employing structural models seem to estimate Verdoorn coefficients that are slightly lower than those stemming from cointegration/ARDL approaches. In the next section, we will discuss in more depth the existing methods at both the analytical and the procedural levels.

3 The estimation of the Verdoorn coefficient: a discussion of the existing methods

In the previous section, we introduced the analytical foundations of the relationship between productivity and output, examining both short-term and long-run dynamics. We noted that this connection encompasses both cyclical and structural elements, potentially creating two effects that undermine the estimation of reliable Verdoorn coefficients. The related literature offers various methods to mitigate bias in estimating the Verdoorn coefficient due to the likely pro-cyclicality of productivity. In this section, we will discuss these methods, focusing on their key characteristics, advantages, and shortcomings. Methodologically, we proceed by clustering them into five logical groups, arranged in order of sophistication to serve our specific purposes.Footnote 8

3.1 Filtering methods

A very immediate way to distinguish between the cycle and trend components in productivity’s evolution may involve the use of detrended series generated through statistical filters. This approach has been applied in various contexts beyond Verdoorn’s law estimation (e.g., OECD, 2017; Galì & van Rens, 2021). However, if this approach were used to calculate long-run Verdoorn’s coefficient, it would assume that detrended series – using, for instance, moving averages or filters à la Hodrik and Prescott (1997) – are free from variations in capacity utilisation.Footnote 9 There are two concerns, partially connected, associated with this assumption. The first is methodological: the value of the smoothing parameter may theoretically vary from zero to infinity. However, the choice of the value is based solely on a priori grounds, lacking empirical economic basis. Setting it equal to zero implies that the trend coincides with the original series, assuming that there is no underutilisation of factors of production. Conversely, a significantly increased value of the smoothing parameter would result in a linear trend, with the implication that the Verdoorn coefficient would not be significantly different from zero. The second concern is empirical, as the assumption is questioned by the fact that indices of capacity utilisation show a substantial fall during recessions.Footnote 10 For these reasons, we do not opt for filtering methods in the estimation of short- and long-run coefficients linking output to productivity.

3.2 The specification with potential output

A second attempt to differentiate between cyclical and structural effects was made by Jeon and Vernengo (2008). The authors estimated a time series model for the US economy (1950–2005), employing a least-square partitioned regression. What we find problematic in their approach is not the estimation method, but the fact that they make use of an unusual specification of the Verdoorn law. Indeed, they formally connect the growth rate of productivity with potential growth, rather than with actual growth (as is the case in Verdoorn’s and Kaldor’s original works). The justification provided is that “Verdoorn’s Law is usually measured in a cross-section of countries, and averaging output growth over long periods eliminates the effects of cyclical variations” (p. 239). The approach is conceptually dubious since smoothing methods are traditionally applied to the series taken in levels, and at a later stage, growth rates are computed starting from the smoothed series (see Section 3.1). Instead, this specification seems to pave the way for the elimination of potential growth – an unobserved variable – from the empirical estimation. Indeed, the authors express the Okun law as a relationship between, on the one side, the difference between actual and potential growth, and, on the other side, the change in the unemployment rate. When terms are rearranged, the peculiar specification adopted assures the removal of the unobservable potential growth.Footnote 11

Finally, the formalisation by Jeon and Vernengo is not equipped to provide a short-run, cyclical association between output and productivity growth rates – an element that, on the contrary, represents one of the priorities for the present work.

3.3 From the short to the long run by reparametrizing coefficients

The third attempt can be ascribed to Millemaci and Ofria (2014), subsequently reappraised by Deleidi et al. (2020). This approach consists of a reparameterisation of an ARDL model (which is usually employed to estimate short-run coefficients) in an error correction model (ECM) to capture the long-run relationship between the considered variables (namely, output and productivity growth rates). Following this line of argument, Millemaci and Ofria (2014) perfectly catch the spirit of the present work, since they emphasize that techniques relying on first differences (i.e., growth rates) are not able “to distinguish the long-term influence of the demand on the productivity growth rate from that deriving from the short-term business cycle, which instead reflects the behavior of the so-called Okun law” (p. 143). The point is also acknowledged by Deleidi et al., (2020, p. 1444). With this consideration in mind, both papers opted for deriving a long-run relationship between growth rates starting from a short-run relationship between growth rates. Accordingly, the peculiarity of the estimated model is that it takes uniquely the dynamic side of the KV-type relation between variables taken in growth rates, while it is not capable of assessing the relationship between variables taken in levels. The point is not without controversy, as estimations of both the static (between levels) and dynamic (between growth rate) forms of the law have yielded mixed results (cf. McCombie, 1982; McCombie & Roberts, 2007; and refer to the discussion in Section 5.2.2).Footnote 12 Nevertheless, neglecting this relationship may result in overlooking the market size effect, where the concept of a larger scale of production stimulates productivity. This effect, as suggested by Basu (1996), makes the economy more efficient as it moves to higher levels. Therefore, model specifications that incorporate variables taken in levels and their structural comovement, if present, could provide more informative results.

3.4 Including capacity utilisation

One of the most sophisticated attempts to disentangle the long-run from the short-run effect has been presented by Antenucci et al. (2020). The authors draw from the work by Basu (1996), who suggested the inclusion of a term capable of representing cyclical conditions.Footnote 13 The employed specification offers the advantage of directly addressing the pro-cyclical behaviour of labour productivity growth. The authors are well aware that changes in productivity growth are likely to be (pro-)cyclical phenomena influenced by the flexibility of the degree of capacity utilisation and the intensity of labour use. Therefore, they incorporate an additional variable, namely the rate of capacity utilisation. While this modus operandi surely helps avoid potential biases in the estimates of the Verdoorn coefficient caused by changes in the capacity use, the specification does not allow for direct calculation and assessment of a short-term association between the evolution of output and that of productivity (short-run coefficients can only be extrapolated by considering the response on impact of productivity to output shocks). Moreover, while sophisticated, the empirical technique used – SVAR modelling for time series (Kilian & Lütkepohl, 2017) applied to G7 countries – does not permit the consideration of the relation between the level of output and that of labour productivity, that is (analogously to what stated in Section 3.3) the model estimated captures uniquely the relation between growth rates, while ignoring the one between levels.

3.5 The two-step procedure encompassing levels and growth rates

A recent study by Gabrisch (2021) lays the groundwork for the objective of this paper. The author estimates the KV law for Central and East European countries, uncovering compelling evidence of a significant Verdoorn’s effect. Methodologically, the author employs panel cointegration methods (a strategy that we will delve into in detail in the next section) to estimate short- and long-run coefficients. As highlighted in the previous sections, we share Gabrisch’s (2021, p. 112) concern that “the traditional KV models, relying on rates of change, might fail to provide a long-run perspective”. Accordingly, the proposed approach places substantial emphasis on the long-run relationship between variables taken in levels (specifically, labour productivity and output). Technically, the author follows a two-step procedure: first, an ECM is estimated, combining variables taken in levels and first differences; second, a cointegration term is assessed. However, in the second step, short-run variables are automatically set to zero. While this is formally correct and well-equipped from an econometric standpoint, it introduces a conceptual weakness in the context of the Okun/Verdoorn literature. This is because it does not allow for the simultaneous estimation of short-run and long-run coefficients, a crucial aspect of our work. Furthermore, the model proposed by Gabrisch (2021) assumes that short-run coefficients are constant across cross-sections (the only dimension that is flexible across panels is the constant term, thanks to the use of fixed effects for the country dimension). In contrast, one of the strengths of the procedure we propose is the ability to consider heterogeneity in both short- and long-run coefficients (as detailed in Section 5). Specifically, we will introduce a panel-cointegration method that, coupled with the use of different estimators for (dynamic) heterogeneous panels, may overcome the challenges encountered so far.

4 A preliminary test starting from Okun’s law

Now, we shift our focus to the empirical segment of the study. In our initial step, we aim to ascertain whether a positive association exists between the rate of growth of output and that of labour productivity, irrespective of whether it is a cyclical or a structural relationship. To explore this, we draw inspiration from Okun’s seminal intuition. Alongside scrutunizing the short-run connection between output and productivity growth rates, we also investigate how output growth correlates with other dimensions invoked by Okun. These include changes in hours worked per person employed, changes in unemployment, and changes in participation.

In our estimations, we target the whole set of OECD countries (38 high-income economies) from the period 1970–2019.Footnote 14 For variables that are not stationary, we use the logarithmic form: accordingly, \(Y\) identifies the log of real output (GDP at constant prices), \(P\) is the log of labour productivity (labour productivity is calculated as the ratio between gross value added at constant prices and the total amount of hours worked in the total economy), and \(HW\) is the log of the average hours worked per person employed. While stationary variables, namely the unemployment rate (\(UN\)) and the labour force participation rate (\(PR\)), are not expressed in logs.Footnote 15

In detail, we estimate the relation between the growth rate of output (\(\Delta Y)\), on one side, and one variable at a time (see below), on the other side of the equation.Footnote 16 Formally, the model we estimate is represented in Eq. (1):

where the operator \(\Delta\) indicates an annual change, \({X}_{i,t}\) represents our variable of interest (namely, \(P\), \(HW\), \(UN\), and \(PR\), alternatively), \(i\) stands for countries, \(t\) for years, and \(\varepsilon\) denotes the error term. Notably, we make use of both country (\({\alpha }_{i}\)) and time (\({\delta }_{t}\)) fixed effects, which enables us to i) control explicitly for spatial heterogeneity, specific time effects and/or coordinated business cycles, and ii) reduce the omitted variable bias.Footnote 17 We employ two estimators. First, we rely on the feasible generalized least squares (FGLS) estimator, which allows robust estimations in the presence of autocorrelation within panels, cross-sectional correlation, and heteroskedasticity across panels. However, we acknowledge that the FGLS implements the random effect estimator, assuming that the fixed effects are uncorrelated with the included regressors. To address this challenge, we permit the country fixed effects to be arbitrarily correlated with the regressors and employ the within-estimator (analogous to an LSVD estimator) as a supplementary tool. The results are reported in Tables 1 and 2. The two tables incorporate also some robustness checks that go in the following directions: regarding the time dimension, we exclude the post-Great Recession period; for the panel length, we confine the analysis to a lower set of 22 ‘mature’ economies that joined to OECD before 1973 (MA22),Footnote 18 and to the Euro area countries (EA12); finally, we make use of two different indicators of labour force participation, namely the participation rates 15 + years and 15–64 years, due to the possible existence of a different age of retirement in the set of considered countries.Footnote 19

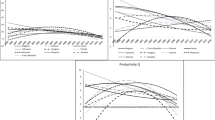

From the FGLS estimates (Table 1), we observe a positive link between output growth and productivity growth across all countries, with an estimated coefficient of approximately 0.5 (statistically significant at the 1% level in all specifications). The strength of this relationship, which is consistent with Okun’s hypothesis, experiences a marginal decrease only in specific subsamples, notably the European environment and the group of 22 mature economies before the Great Recession. It is important to note, however, that the methodology employed is not designed to detect long-run, structural relations (we shall return on this point at a later stage).

Simultaneously, we observe the anticipated relationship when extending the analysis to labour market variables. Our findings reveal a positive coefficient on the rate of change in hours worked per person employed, indicating a certain degree of workforce flexibility (averaging 30% across all estimations). As expected, we also observe a negative coefficient on the change in unemployment, which is statistically significant in all specifications. The magnitude of this relationship is lower in the EA12 cluster compared to the entire sample. This might reflect a tighter labor market in the European environment, where employment may not immediately adjust, or at least adjust less rapidly, to output variations. Lastly, the response of participation warrants specific attention, since the estimated coefficient is positive (and statistically significant) in two instances: when the analysis is restricted to the most recent years, and when the indicator focuses on the 15–64 cohort instead of the 15 + . The former finding may be indicative of the increased participation of females in the post-1980 period, while the latter suggests that the rise in participation generally does not involve individuals close to the retirement age.

These findings are qualitatively confirmed when making use of the within estimator (Table 2), even though some discrepancies emerge concerning the size of the effects. Indeed, the within estimator shows higher coefficients (in absolute terms) for all variables under consideration, thus confirming the likely significance of the relationship between changes in productivity, on the one side, and changes (in the expected direction) in output and labour market indicators, on the other side.

While this exercise affirms the relevance of Okun’s seminal work for OECD countries, we currently lack the capacity to evaluate whether our focal relationship, namely that between output and productivity, extends beyond the short run. Indeed, the empirical method we have employed thus far does not explicitly allow for the identification of structural relationships. On a speculative note, one might presume that the estimated cyclical association between output growth and productivity inadvertently incorporates a long-run component, such as a scale effect in the spirit of Verdoorn. Consequently, there is a tendency for it to be overestimated (a point to which we will return in Section 6.1).Footnote 20 More specifically, this would be the case if output and productivity levels are found to share a long-term trend, indicating a comovement between them. This is the rationale for our transition to an alternative methodology, which seeks to estimate the two facets of the relationship simultaneously.

5 Empirical approach

5.1 Model specification and employed estimators

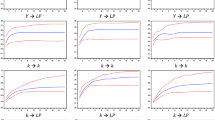

As highlighted in Section 3, certain reviewed methods pose critical issues and limitations in accurately estimating an unbiased long-run effect. In this section, we elaborate on why cointegration-based methods, along with their underlying properties and estimation techniques, offer the advantage of jointly capturing both effects, namely a short-run effect (comparable to an Okun effect) and a long-run effect (resembling a Verdoorn effect). Specifically, we rely on the procedure summarized in Blackburne III and Franck (2007). This method, grounded on the seminal contributions by Pesaran and Smith (1995) and Pesaran et al. (1999), is designed for non-stationary heterogeneous panels. Its main novelty lies in its ability to overcome the assumption of homogeneity in slope parameters. Indeed, this is quite an unrealistic assumption, especially when dealing with large cross-sectional datasets, as it is the case of our study since the model is applied to a panel of 38 OECD countries, as introduced in Section 4. Similar to Blackburne III and Franck (2007), the specification goes as in Eq. (2):

In this formulation, the coefficient \({\beta }_{1}\) captures the contemporaneous, cyclical relationship between the rate of growth of productivity (\(\Delta P\)) and the rate of growth of output (\(\Delta Y\)). For the short-run, our specification considers a two-lag order structure (namely, we include \({\Delta Y}_{i,t-1}\) and \({\Delta P}_{i,t-1}\)), as it is common with yearly data.Footnote 21 Simultaneously, the long-run, trend relationship between the variables taken in log levels (\(P\) and \(Y\)) is captured by the coefficient \(\theta\) within the co-integrating equation (in parentheses). In the spirit of cointegration-based methods, the \(\lambda\) coefficient is expected to be negative (and significant) if the variables exhibit a return to long-run equilibrium.

To calculate the size and significance of the coefficients, we employ three different estimators. The least complex is the traditional dynamic-fixed effect (DFE) estimator, assuming homogeneity in every dimension except in the constant term (and thus considering country heterogeneity only in \({c}_{i}\)).Footnote 22 Moreover, we allow for the existence of heterogeneous parameters across groups by using pooled mean group (PMG) and mean group (MG) estimators.Footnote 23 On the one hand, the MG estimator relies on estimating various time-series regressions and then averaging the coefficients (both in the short and the long run), allowing for heterogeneity in every dimension; however, it does not account for cross-country dependence, which may arise from spatial or spillover effects or could be due to unobserved common factors (Baltagi & Pesaran, 2007). On the other hand, the PMG estimator relies on a combination of pooling and averaging of coefficients: specifically, it considers the case of heterogeneity in the fixed effects and the short-term dynamics, but assumes a homogeneous long-term relationship (that is, imposing \({\theta }_{i}\)=\(\theta\) for all countries).Footnote 24 Especially, this represents an advancement of the work by Gabrisch (2021), as in this setting, we can account for heterogeneity in both the short- and the long-run coefficients.

5.2 Analytical advantages

From a conceptual standpoint, we find this procedure more suitable than existing ones for three reasons, which are discussed hereafter.

5.2.1 Methodological aspects

The econometric differentiation between short-run and long-run coefficients, nested in cointegration methods (the technical approach employed in our strategy), corresponds to the economic concepts of ‘cyclical’ and ‘structural’. The cointegration method is indeed designed to capture the long-run, structural relationship (if any) between integrated variables (i.e., variables with a time trend). Output and productivity (in levels), indeed, exhibit increasing trends overtime, and this approach enables us to determine if and to what extent they move together. At the same time, the method we employ allows us to also grasp the short-run connection between the growth rates of variables – a correlation representing the cyclical relationships between the ‘deviations’ of variables from their long-run trend.Footnote 25 Moreover, using an alternative model (such as, for example, a traditional VAR) would be inappropriate in the presence of a long-term association between the variables taken at levels (i.e., in the case of cointegration, a model without the variables at levels would be misspecified). Considering our research question, as long as the existence of a long-term relationships (as we will see in Section 5.3), cointegration-based methods appear preferable to other approaches, as already highlighted in Gabrisch (2021).

5.2.2 A static-dynamic approach

The second reason, partially related to the first one, is that this strategy allows us to consider levels and growth rates jointly and simultaneously. This point relates to the discussion over the two versions of the KV law, namely the static and the dynamic version, introduced in Secton 3.3. According to the literature, different results have emerged from estimates of a relationship at levels (yielding constant returns to scale) and growth rates (yielding increasing returns to scale), leading to the coining of the term ‘static-dynamic paradox’ (McCombie, 1982; McCombie & Roberts, 2007). Nevertheless, when estimating the static version, existing literature relies on cross-sectional data, concentrating on functional economic areas (FEA). As discussed in McCombie and Roberts (2007), this approach strives to achieve comparability, especially considering that the KV law has often been used to explore regional trends in an FEA. At this point, however, a clarification is in order: our method does not exclusively focus on levels using cross-sectional analysis. Instead, we employ a panel analysis, enabling us to retain the time dimension. Thus, the cointegrating equation (encompassing variables taken in levels) considers the trajectory of both output and productivity, accounting for the variables’ evolution over time. From this perspective, our work holds a distinct advantage as it effectively integrates the two mentioned aspects: firstly, it takes into account the evolution over time of variables, thus preserving the long-term trend (which implicitly provides insights into their growth path); secondly, it targets a group of countries (e.g., OECD economies) that share a similar level of development, as well as subsets that are potentially even more homogeneous.

5.2.3 Utilisation of factors

The third reason is that our method does not require the inclusion of a capacity utilisation index (as done in Antenucci et al., 2020), as it allows for the possibility of under- or over-utilisation without an immediate adjustment in the stock of capital (or the stock of capital per person employed). In simpler terms, the coefficient on the short-run term exclusively reflects the potential for more or less intense use of factors influenced by cyclical conditions (specifically, the Okun coefficient linking productivity and output). Indeed, it has been argued that the computation of indices of utilisation may be problematic for methodological reasons (see Shaikh, 2016, p. 823; while, for a counterargument, see Gahn, 2020, and Gahn & González, 2020). Furthermore, refraining from using proxies for capacity utilisation can be advantageous in a panel context, as the level of utilisation may significantly vary across countries due to the sectoral composition of the national product and/or different volatilities across economies.

5.3 Pre-estimation tests

Before proceeding with the estimations, we run some propaedeutic diagnostic tests. First, we check for the order of integration of the series employing tests that are feasible in the context of unbalanced panels (as it is our dataset), such as the Im-Pesaran-Shin test (2003) and the Fisher-type test grounded on the Dickey-Fueller approach (Choi, 2001). Both tests confirm that series are I(1) in levels, while they are I(0) in first differences (see Table 3). These two findings make suitable our econometric setting.

Second, we check for cointegration by employing a Westerlund test for panel data (Persyn & Westerlund, 2008). Intuitively, the test is aimed at assessing the presence of a structural comovement between variables. Cointegration between output and productivity is detected by three out of four statistics at the 1% level (see Table 4). That happens for the entire panel of 38 OECD countries and subsamples (namely 22 ‘mature’ economies and the 12 countries belonging to the Euro area). These results further assist us in our strategy of identifying a long-run association between output and productivity. Translated into economic terms, the detected cointegration confirms the likely existence of a Verdoorn-type relation between the two variables taken in levels.

6 Findings

We now apply the methodology presented in Section 5 to the panel of economies introduced in Section 4. We first focus on panel-level estimations; then we propose some robustness checks; and finally, we provide some introductory country-specific evidence.

6.1 Panel estimations

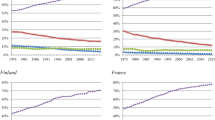

Once the presence of a long-run tie between output and productivity is verified (see Section 5.3), we estimate the reference model presented in Eq. 2. The results of our exploration are reported in Table 5, which provides the estimated coefficients for both the short run and the long run for three groups of countries, namely, the entire panel of 38 OECD economies, 22 ‘mature’ countries, and the 12 countries belonging to the Euro area. The long-term, structural relationship between productivity and output is positive and highly statistically significant in all estimations (at the 1% level), with coefficients ranging from 0.30 (DFE for the EA12 group) and 0.62 (PMG for the whole panel). In general, we see lower Verdoorn coefficients when subsamples are considered, probably due to a lower market size effect. Concerning the short-term effect, we find that the relationship between the current percent variation of output and that of productivity is always strongly significant and ranges from 0.18 (MG for the entire panel of 38 economies) and 0.38 (DFE for the EA12 group). Contrary to what happens in the long run, we see a higher short-run coefficient in the Euro area environment than in the rest of the sample: this can appear counterintuitive since the European context is characterized by relatively stronger labour market protection. Therefore, a less flexible labour market – or, in other words, a lower possibility to suddenly adjust the workforce – is likely to make labour productivity more pro-cyclical (hence, a larger, positive short-run coefficient). Nonetheless, it has to be noted that some asymmetries may hold since the EA12 group presents the lowest growth rates of output in the sample (2.4% compared to 3%), and this is particularly true in the post-1999 period (it decreased to 1.6%) – analogously, also the average yearly growth rate of productivity is significantly lower in this cluster (1.9% compared to 2.2%).

To some extent, these findings confirm our tentative explanation, given at the end of Section 4, concerning the ‘high’ coefficient associated with the Okun effect when it is estimated using standard methods that are capable of capturing the short-run relation uniquely. Here, indeed, the Okun effect assumes a lower size (0.3 approximately, instead of 0.5), confirming the intuition that short-run methods may accidentally incorporate a part of the long-run Verdoorn effect.

We also compare our panel estimators employing a Hausman test, whose results indicate that our findings are valid independently of the estimator used (see Appendix Table 10). Generally, the superior performance of the PMG and MG estimators compared to the less sophisticated DFE leads us to regard the results derived from the former as more plausible. Indeed, PMG and MG estimations take into account cross-country heterogeneity, a presumable characteristic of our exploration, due to a large number of considered economies (see Section 6.3 for further discussion on that).Footnote 26 However, a trade-off arises between PMG and MG in terms of suitability: on one hand, the MG is more reliable as it considers heterogeneity among countries both in the short-term and long-term relationships; on the other hand, the PMG accounts for heterogeneity only in the short term, but unlike the MG estimator, it incorporates cross-country dependence (as elucidated in Section 5.1). For this reason, the results obtained from the various estimates have to be read in conjuction.

Remarkably, the coefficient \(\lambda\) associated with the cointegrating equation is always negative and strongly significant. This testifies to the meaningfulness of the documented association between output and productivity taken in levels and the appropriateness of incorporating a long-term component in the specification of our model. However, this is not intended to conclusively establish a single and unambiguous direction of causality from output to productivity, as it might also operate the other way around (we shall return to this specific point in Section 6.2 below).

6.2 Robustness

For the sake of robustness, we expanded our model in two directions. Initially, we consider a shorter timespan by restricting the analysis to the period before 2008. This check was crucial due to findings in the literature on hysteresis, demonstrating that the Great Recession and the subsequent policies might have caused lasting effects on output (Fatás & Summers, 2018). As indicated in Table 6, confining the analysis exclusively to the pre-2008 period did not yield appreciable differences, as both the Okun coefficient and the Verdoorn coefficient are similar to those estimated for the entire timespan.

As a second robustness check, we employ autonomous demand (\(Z\)) as a proxy for output to mitigate endogeneity (output and gross value added are likely to be significantly correlated). To do that, we leverage two sources of non-capacity creating autonomous demand (Freitas & Serrano, 2015), namely current government spending (\(G\)) and export (\(X\)), both in real terms. In our framework, this aggregate is preferred over total autonomous demand because the latter encompasses also autonomous investment (both public and private, if any), a variable that concurrently influences the capital stock and therefore may have a direct impact on productivity (and not an indirect one, as occurs in the KV view).Footnote 27 Results are reported in Table 7. Qualitatively, they confirm the validity of the long-run Verdoorn law, even though some discrepancies emerge when we broke down our proxy for autonomous demand: indeed, the Verdoorn coefficient associated with export is in line with that of the aggregate, while it is lower (and less statistically significant) for public spending. In this circumstance, however, one point has to be made: exports can be viewed as autonomous to the extent that they are not influenced by a multiplier or accelerator effect; however, they are not entirely independent of productivity. Therefore, some endogeneity issues may take place. In this regard, the statistical significance of the cointegrating equation (namely, \(\lambda\) different from zero) indicates a reliable Verdoorn-type mechanism between export and productivity. At the same time, we verified that also the evolution of productivity proved to significantly promote export.Footnote 28 In this evidence, one can find shades of the Kaldor-Dixon-Thirlwall mechanism, according to which export growth can set up a virtuous circle via induced productivity growth (Kaldor, 1970; Dixon & Thirlwall, 1975; Boyer & Petit, 1981).Footnote 29

6.3 Country-specific analysis: preliminary findings

In this short section, our aim is to provide some suggestions to set the stage for country-specific studies on the subject, given the likely heterogeneity of the output-productivity relation. Although not the primary focus of this work, which aims to examine the two laws across high-income economies, we aim to investigate if the Verdoorn-type relationship varies in magnitude across different countries. To achieve this, we employ the MG estimator, which stands as the most pertinent estimator among the three (PMG, MG, and DFE) for conducting such an operation (as seen in Section 5.1, this estimator initially estimates distinct long-run slopes before averaging them).Footnote 30 Results are reported in Appendix Table 11. When the coefficients within and outside the cointegrating equation are significant, we see that the highest values of the Verdoorn coefficient stem from ‘large’ economies in terms of GDP (e.g., the United States and Canada). On the contrary, smaller countries in terms of national income present a lower Verdoorn coefficient, as they likely rely on a weaker scale effect. Nonetheless, a high Verdoorn coefficient is also found in the case of big countries that also present a strong manufacturing sector and that, in most cases, are featured by a large share of exports in GDP (e.g., Austria, Germany, Italy, Japan, and Korea). This partially confirm the potential occurrence of cumulative causation in certain exporting countries, as discussed in Section 6.2. However, the likely heterogeneity may somewhat contaminate the results in a panel environment, and therefore country-specific studies based on time-series analysis may provide a more robust picture of the productivity-output connection. In that case, a cointegration-based error-correction model à la Engle and Granger (1987) can be estimated by adding a long-run component to a standard VAR model. The method can account for both short-run and long-run relationships, as the method we introduced here is a derivation of that approach for panel data.

7 Concluding remarks and policy implications

This article offers a methodological discussion on distinguishing between short- and long-run impulses that output may impinge on labour productivity and, in so doing, estimate reliable Verdoorn coefficients. In our discussion, we see that the existing literature encounters some difficulties in achieving this distinction. As a solution, we propose a procedural advancement to separate the short-run Okun effect of output growth on productivity growth from the long-run Verdoorn relationship involving variables measured at levels.

From an empirical perspective, the paper starts by verifying the existence of a positive association between output and productivity growth rates, as well as between output growth and various variables representing the evolution of the labour market. Next, we assess whether the two variables (output and productivity) share a long-term trend by applying cointegration techniques. Once a comovement is verified, we introduce our procedure and we jointly estimate the short- and the long-run tie between output and productivity.

Our findings confirm the existence of a Verdoorn-type, long-run association between output and productivity, with an estimated elasticity of about 0.5. The approach is robust to the use of a shorter timespan and an alternative way to measure the scale of the market, namely recurring to the autonomous demand instead of the GDP (with a preeminent role played by export). While the coefficient is quite in line with the existing literature, our procedure presents some methodological refinements that may depurate the Verdoorn coefficient by the short-run effect stemming from higher/lower factors utilisation. At the same time, we estimate a robust and significant Okun effect (intended as a short-run connection between output growth and productivity growth), whose coefficient is about 0.3, testifying to a pro-cyclical behaviour of productivity.

A major limitation of the current work, however, is that we operate at the panel level, while some heterogeneity may exist. Despite mitigating potential issues through methodological adjustments, this approach could be expanded to conduct country-specific analyses based on time series (preferably at a frequency lower than annual). Such an extension could aid in conducting a more comprehensive examination of the output-productivity link and in addressing the variability of this relationship across countries.

Even though it is primarily conceived as a methodological contribution, some policy indications emerge from our work. Specifically, the twofold nature of the relationship between output and productivity, with both short-run and long-run effects being significant, leads to two key recommendations.

In the short run, a positive and statistically significant Okun coefficient testifies to the fact that productivity is (almost physiologically) likely to slow down when the general economic conditions deteriorate. This means that poor dynamics of labour productivity (even null or negative, as occurred in some European countries in recent times) may be also the result – and not only the cause – of stagnating output. In this case, policy proposals or prescriptions targeted at productivity (first and foremost, on the labour market) run the risk of being inadequate or at least myopic.

When the analysis is broadened to the long run, the existence of a significant Verdoorn effect highlights that strategies aimed at boosting the trend growth rate of productivity should not be thought of as independent of expansionary macroeconomic policies. Given its dual nature, investment emerges as the pivotal variable in promoting both productivity and output in the medium-to-long run. However, if investment is demand-driven (in line with the Kaldorian tradition), Keynesian policies that can stimulate aggregate demand become increasingly relevant, as they possess the potential for long-run effects by fostering technological advancement.Footnote 31 In addition to supporting the accumulation of capital, investment has indeed the potential to shape the supply side of the economy by transforming, modernising and making more efficient the exis productive capacity, and in so doing fostering productivity and countries’ long-run trajectories.

Notes

See Kim and Loayza (2019) for a systematic review of productivity’s drives.

As stated by McCombie (2002), “this will lead to a positive relationship between the growth of productivity and output, but one that is due merely to these short-term cyclical factors” (p. 97).

According to Palumbo et al. (2023), “a higher level of activity induces, in Okun’s view, not only a reduction in unemployment but also higher labour force participation and (short-run) positive effects on productivity through more intense utilization of given resources – which explains why a one percentage point change in unemployment is associated with a greater percentage change in output” (p. 312).

With respect to the specific case of the US, Fernald and Wang (2016) and Galì and van Rens (2021) have recently stated that the pro-cyclicality of productivity is vanishing in the last years. This might be attributed to a variety of factors, namely increased job flexibility, the process of structural change of the economy, a relevant technological shift and the occurrence of significant demand shocks (as the Great Recession).

For example, Corrado and Mattey (1997, p. 155) report a stable 82% long-run normal capacity utilisation in the US (survey data). Nikiforos (2013) argued in favour of the existence of a below-than-potential utilisation at the firm level. Gahn and González (2022) found that capacity utilisation is likely to be stationary (despite presenting cyclical fluctuations), but below the potential level.

This represents a clear distinction with the neoclassical theory, where labour productivity growth is regarded as the main driver of economic growth: despite endogenous technical progress is admitted in some ‘new growth’ models (Aghion et al., 2001; Preenen et al., 2017; Romer, 1990, 1994), the role of output growth in affecting productivity is not extended to the longer run. For a discussion, see Antenucci et al. (2020).

As our primary objective is to explore the output-productivity nexus, as originally presented in Verdoorn (1957), we concentrate on specifications of the KV law that do not incorporate investment. Besides adhering to the original formulation, there is a methodological reason behind this choice: introducing a variable representing capital accumulation may yield spurious results due to the likely endogeneity of the investment process (refer to the ‘augmented’ specification proposed by Kaldor in 1966, p. 128, where the investment-to-output ratio was found to be non-statistically significant in influencing productivity growth; also, see the discussion in Millemaci & Ofria, 2014, p. 153).

In addition to this conceptual shortcoming, the filter by Hodrik and Prescott has been criticized for methodological reasons (see Hamilton, 2018).

The case of the US, as exemplified by the Federal Reserve Board index (annual data since the 1970s), is emblematic. The index is constructed from surveys of firms regarding their utilisation of production factors (for a technical discussion, see Gahn, 2020).

Despite the method has been already discussed and criticized by Krohn (2019) due to its lack of producing robust results, Nabar-Bhaduri and Vernengo (2024) recently employed it for a study on the Chinese and Indian economies. Specifically, they estimate an SVAR model in which GDP growth initially affects productivity dynamics (without distinguishing between cyclical and structural effects), and subsequently influences changes in the unemployment rate.

While sharing the same terminology, the concept is different from the distinction between static (or reversible) and dynamic (or irreversible) returns to scale. The former mainly depend on organisational factors that operate internally to firms and are linked to the indivisibility of the production process. The latter are more pervasive and may occur on a larger scale (e.g., at the sectoral or industrial level) through learning-by-doing, positive externalities or induced technological change (cf. McCombie, 2002).

To consider the intensity of use of the factors of production, Basu (1996), in the context of a neoclassical production function, suggests the use of an index of the ratio of materials to the weighted capital stock and employment. Nevertheless, he finds constant returns to scale (i.e., a null Verdoorn effect). Nonetheless, Antenucci et al. (2020) make use of another proxy, such as the rate of capacity utilisation. Other works using capacity utilisation to correct for cyclical conditions are Harris and Lau (1998) and Harris and Liu (1999).

The panel is unbalanced. Moreover, we intentionally exclude the year 2020 from our analysis due to the potential bias introduced by the Covid-related economic collapse, given the heavy-tailed series problem. Further details regarding countries and the timespan are provided in Appendix Table 8.

For a more in-depth understanding of variable definitions and sources, refer to Appendix Table 9.

We refrain from presenting all variables simultaneously to prevent our specification from resembling an account identity. Indeed, the growth rate of GDP can be expressed as the sum of the growth rates of five components: labour productivity, hours worked per person employed, the employment rate (defined as the ratio between employment and the labour force), the participation rate, and the working-age population.

This second advantage is particularly important in our setting, since we estimate univariate regressions.

The same watershed is used in Girardi et al. (2020).

However, the participation rate 15–64 is available only for the post-1990 period.

Compared to Blackburne III and Franck (2007), where no lags are included, this is a minor departure. But in our case, the choice is supported by the Akaike information criterion (AIC). Note that the same criterion is adopted for stationarity and cointegration tests (for which the results are qualitatively confirmed up to four lags).

The DFE estimator is biased when applied to dynamic models, but the size of the bias tends to zero as the time dimension grows (Nickell, 1981). Moreover, DFE suffers from inconsistency if there is heterogeneity among countries. Pesaran and Smith (1995) proved the MG estimator to be consistent regardless of homogeneity or heterogeneity.

We leverage on the Stata command 'xtpmg' for nonstationary heterogenous panels. The procedure is illustrated in Blackburne III and Franck (2007).

Hence, the PMG calculates the short-term coefficients as averages across countries. Notably, Pesaran et al. (1999) have developed a maximum likelihood method to estimate the parameters, concluding that this estimator is inconsistent in case of homogeneity, but it is efficient if the long-term coefficient is homogeneous. On the open challenges of panel cointegration techniques, the interested reader can benefit from the discussion in Pedroni (2019).

That would not be possible by using more traditional cointegration-based methods for panel data (as, for instance, the Pedroni’s PDOLS) that can catch the long-run relation only. In any case, before proceeding with our strategy, we made use of the Stata command 'xtpedroni' (Neal, 2014) to verify that a statistically significant Verdoorn-type association between variables taken in levels exists (also for subsamples).

Since the Hausman test does not reject the null hypothesis of long-run slope homogeneity between MG and PMG estimations, the latter is recommended since more consistent and efficient than the former (Pesaran et al., 1999).

To do that, we estimated the model described in Eq. (2) by inverting the dependent with the independent variable, as it is standard in vector ECMs. The relationship carried significance, with large coefficients in both growth rates (0.78 using PMG, 0.61 using MG and 0.67 using DFE) and levels (2.71, 2.85 and 1.76, respectively).

Interestingly, Forges Davanzati et al. (2019) estimate a Kaldorian model of growth and find evidence of a bidirectional relation between export and productivity for the Italian economy.

Technically, we do that by adding the option 'full' to the 'xtpmg' command in Stata (see footnote 23 above).

Our conclusions are compatible with the ones drawn by Travaglini and Bellocchi (2018). Deleidi and Mazzucato (2019) and Fazzari et al. (2020) are two recent, alternative conceptualisations of the long-run connections between supply and demand. See Girardi et al. (2020) for some empirical support to the view that aggregate demand may have persistent, long-lasting effects on supply.

References

Aghion, P., Harris, C., Howitt, P., & Vickers, J. (2001). Competition, imitation and growth with step-by-step innovation. The Review of Economic Studies, 68(3), 467–492.

Antenucci, F., Deleidi, M., & Paternesi Meloni, W. (2020). Kaldor 3.0: An empirical investigation of the Verdoorn-augmented technical progress function. Review of Political Economy, 32(1), 49–76.

Baily, M. N., Bartelsman, E. J., & Haltiwanger, J. (2001). Labor productivity: Structural change and cyclical dynamics. Review of Economics and Statistics, 83(3), 420–433.

Ball, L., Leigh, D., & Loungani, P. (2013). Okun’s law: Fit at 50?. IMF working paper WP/13/10.

Baltagi, B. H., & Pesaran, M. (2007). Heterogeneity and cross section dependence in panel data models: Theory and applications introduction. Journal of Applied Econometrics, 22(2), 229–232.

Basu, S. (1996). Procyclical productivity: Increasing returns or cyclical utilization? The Quarterly Journal of Economics, 111(3), 719–751.

Basu, S., & Fernald, J. (2001). Why is productivity procyclical? Why do we care?. In New developments in productivity analysis (pp. 225–302). University of Chicago Press.

Blackburne, E. F., III., & Frank, M. W. (2007). Estimation of nonstationary heterogeneous panels. The Stata Journal, 7(2), 197–208.

Boyer, R., & Petit, P. (1981). Progrès technique croissance et emploi: un modèle d'inspiration kaldorienne pour six industries européennes. Revue économique, 1113–1153.

Carnevali, E., Godin, A., Lucarelli, S., & Veronese Passarella, M. (2020). Productivity growth, Smith effects and Ricardo effects in Euro Area’s manufacturing industries. Metroeconomica, 71(1), 129–155.

Castiglione, C. (2011). Verdoorn-Kaldor’s Law: An empirical analysis with time series data in the United States. Advances in Management and Applied Economics, 1(3), 135–151.

Cesaratto, S., Serrano, F., & Stirati, A. (2003). Technical change, effective demand and employment. Review of Political Economy, 15(1), 33–52.

Choi, I. (2001). Unit root tests for panel data. Journal of International Money and Finance, 20(2), 249–272.

Corrado, C., & Mattey, J. (1997). Capacity utilization. Journal of Economic Perspectives, 11(1), 151–167.

Deleidi, M., & Mazzucato, M. (2019). Putting austerity to bed: Technical progress, aggregate demand and the supermultiplier. Review of Political Economy, 31(3), 315–335.

Deleidi, M., Paternesi Meloni, W., & Stirati, A. (2020). Tertiarization, productivity and aggregate demand: Evidence-based policies for European countries. Journal of Evolutionary Economics, 30(5), 1429–1465.

Deleidi, M., Fontanari, C., & Gahn, S. (2023). Autonomous demand and technical change: Exploring the Kaldor-Verdoorn Law on a global level. Economia Politica, 40(1), 57–80.

Dixon, R., & Thirlwall, A. P. (1975). A model of regional growth-rate differences on Kaldorian Lines. Oxford Economic Papers, 27(2), 201–214.

Engle, R. F., & Granger, C. W. J. (1987). Co-integration and error correction: Representation, estimation and testing. Econometrica, 55(2), 251–276.

European Central Bank. (2021). Key factors behind productivity trends in EU countries. ECB Strategy Review, occasional paper series, n. 268.

Fatás, A., & Summers, L. H. (2018). The permanent effects of fiscal consolidations. Journal of International Economics, 112, 238–250.

Fazzari, S. M., Ferri, P., & Variato, A. M. (2020). Demand-led growth and accommodating supply. Cambridge Journal of Economics, 44(3), 583–605.

Fernald, J. G., & Wang, J. C. (2016). Why has the cyclicality of productivity changed? What does it mean? Annual Review of Economics, 8, 465–496.

Forges Davanzati, G., Patalano, R., & Traficante, G. (2019). The Italian economic stagnation in a Kaldorian theoretical perspective. Economia Politica, 36(3), 841–861.

Freitas, F., & Serrano, F. (2015). Growth rate and level effects, the stability of the adjustment of capacity to demand and the Sraffian supermultiplier. Review of Political Economy, 27(3), 258–281.

Gabrisch, H. (2021). The long-run properties of the Kaldor-Verdoorn law: A bounds test approach to a panel of Central and East European (CEE) countries. Empirica, 48(1), 101–121.

Gahn, S. J. (2020). Is there a declining trend in capacity utilization in the US economy? A technical note. Review of Political Economy, 32(2), 283–296.

Gahn, S. J., & González, A. (2020). On the ‘utilisation controversy’: A comment. Cambridge Journal of Economics, 44(3), 703–707.

Gahn, S. J., & González, A. (2022). On the empirical content of the convergence debate: Cross-country evidence on growth and capacity tilization. Metroeconomica, 73(7), 825–855.

Galí, J., & Van Rens, T. (2021). The vanishing procyclicality of labour productivity. The Economic Journal, 131(633), 302–326.

Girardi, D., Paternesi Meloni, W., & Stirati, A. (2020). Reverse hysteresis? Persistent effects of autonomous demand expansions. Cambridge Journal of Economics, 44(4), 835–869.

Gordon, R. J. (2015). Secular stagnation: A supply-side view. American Economic Review, 105(5), 54–59.

Hamilton, J. D. (2018). Why you should never use the Hodrick-Prescott filter. Review of Economics and Statistics, 100(5), 831–843.

Harris, R. I., & Lau, E. (1998). Verdoorn’s law and increasing returns to scale in the UK regions, 1968–91: Some new estimates based on the cointegration approach. Oxford Economic Papers, 50(2), 201–219.

Harris, R. I., & Liu, A. (1999). Verdoorn’s law and increasing returns to scale: Country estimates based on the cointegration approach. Applied Economics Letters, 6(1), 29–33.

Hodrick, R.J., & Prescott, E.C. (1997). Postwar US business cycles: an empirical investigation. Journal of Money, Credit, and Banking, 1–16.

Im, K. S., Pesaran, M. H., & Shin, Y. (2003). Testing for unit roots in heterogeneous panels. Journal of Econometrics, 115(1), 53–74.

Jeon, Y., & Vernengo, M. (2008). Puzzles, paradoxes, and regularities: Cyclical and structural productivity in the United States (1950–2005). Review of Radical Political Economics, 40(3), 237–243.

Kaldor, N. (1957). A model of economic growth. The Economic Journal, 67(268), 591–624.

Kaldor, N. (1970). The case for regional policies. Scottish Journal of Political Economy, 17, 337–348.

Kaldor, N. (1972). The irrelevance of equilibrium economics. The Economic Journal, 82(328), 1237–1255.

Kaldor, N. (1975). Economic growth and the Verdoorn Law – A comment on Mr Rowthorn’s article. The Economic Journal, 85(340), 891–896.

Kaldor, N., & Mirrlees, J. A. (1962). A new model of economic growth. The Review of Economic Studies, 29(3), 174–192.

Kaldor, N. (1961). Capital accumulation and economic growth. In: Lutz FA, Hague DC (eds.) The Theory of Capital (pp. 177–222). St. Martin’s Press.

Kaldor, N. (1966). Causes of the slow rate of economic growth of the United Kingdom. Cambridge University Press. In: Kaldor N (1978) Further Essays on Economic Theory, published by Holmes & Meier Publishers, Inc., New York.

Kilian, L., & Lütkepohl, H. (2017). Structural vector autoregressive analysis. Cambridge University Press.

Kim, Y. E., & Loayza, N. (2019). Productivity growth: Patterns and determinants across the world. World Bank Policy Research Working Paper, No. 8852.

Knell, M. (2004). Structure change and the Kaldor-Verdoorn law in the 1990s. Revue D’économie Industrielle, 105(1), 71–83.

Knotek, E. S., II. (2007). How useful is Okun’s law? Economic Review-Federal Reserve Bank of Kansas City, 92(4), 73.

Krohn, G. A. (2019). A note on “puzzles, paradoxes, and regularities: Cyclical and structural productivity in the United States (1950–2005).” Review of Radical Political Economics, 51(1), 158–163.

Lavoie, M. (2014). Post-Keynesian economics: new foundations. Edward Elgar Publishing.

Magacho, G. R., & McCombie, J. S. (2017). Verdoorn’s law and productivity dynamics: An empirical investigation into the demand and supply approaches. Journal of Post Keynesian Economics, 40(4), 600–621.

McCombie, J. S. (1982). Economic growth, Kaldor’s laws and the static-dynamic Verdoorn law paradox. Applied Economics, 14(3), 279–294.

McCombie, J. S., & Roberts, M. (2007). Returns to scale and regional growth: The static-dynamic Verdoorn Law paradox revisited. Journal of Regional Science, 47(2), 179–208.

McCombie, J. S., & Spreafico, M. R. (2015). Kaldor’s ‘technical progress function’ and Verdoorn’s law revisited. Cambridge Journal of Economics, 40(4), 1117–1136.

McCombie, J.S. (1983). Kaldor’s Laws in Retrospect. Journal of Post-Keynesian Economics, Spring 5(3), 414–429.

McCombie, J. S. (2002). Increasing returns and the Verdoorn Law from a Kaldorian perspective. In: J.S. McCombie, M. Pugno, B. Soro (Eds.), Productivity Growth and Economic Performance: Essays on Verdoorn’s Law (pp. 64–114). Palgrave Macmillan UK.

McCombie, J. S., Pugno, M., & Soro, B. (eds.) (2002). Productivity Growth and Economic Performance: Essays on Verdoorn’s Law (pp. 64–114). Palgrave Macmillan UK.

Millemaci, E., & Ofria, F. (2014). Kaldor-Verdoorn’s law and increasing returns to scale: A comparison across developed countries. Journal of Economic Studies, 41(1), 140–162.

Nabar-Bhaduri, S., & Vernengo, M. (2024). Economic growth and technological progress in developing economies: Okun and Kaldor-Verdoorn Effects in China and India (1991–2019). Review of Political Economy. https://doi.org/10.1080/09538259.2024.2319190

Neal, T. (2014). Panel cointegration analysis with xtpedroni. The Stata Journal, 14(3), 684–692.

Nickell, S. (1981). Biases in dynamic models with fixed effects. Econometrica: Journal of the Econometric Society, 1417–1426.

Nikiforos, M. (2013). The (normal) rate of capacity utilization at the firm level. Metroeconomica, 64(3), 513–538.

OECD. (2015). The Future of Productivity. OECD Publishing.

OECD (2017). Productivity trends in G7 countries. In: OECD Compendium of Productivity Indicators 2017. OECD Publishing, Paris. https://doi.org/10.1787/pdtvy-2017-en.

Oi, W. Y. (1962). Labor as a quasi-fixed factor. The Journal of Political Economy, 1962, 538–555.

Okun, A.M. (1962). Potential GNP & Its Measurement and Significance, American Statistical Association, Proceedings of the Business and Economics Statistics Section, 98–104.

Palumbo, A., Fontanari, C., & Salvatori, C. (2023). Okun’s law. In: Elgar Encyclopedia of Post-Keynesian Economics (pp. 312–313). Edward Elgar Publishing Limited.

Pedroni, P. (2019). Panel cointegration techniques and open challenges. In: Panel data econometrics (pp. 251–287). Academic Press.

Persyn, D., & Westerlund, J. (2008). Error-correction–based cointegration tests for panel data. The Stata Journal, 8(2), 232–241.

Pesaran, M. H., & Smith, R. P. (1995). Estimating long-run relationships from dynamic heterogeneous panels. Journal of Econometrics, 68(1), 79–113.

Pesaran, M. H., Shin, Y., & Smith, R. P. (1999). Pooled mean group estimation of dynamic heterogeneous panels. Journal of the American Statistical Association, 94(446), 621–634.

Prachowny, M.F. (1993). Okun's law: theoretical foundations and revised estimates. The review of Economics and Statistics, 331–336.

Preenen, P. T., Vergeer, R., Kraan, K., & Dhondt, S. (2017). Labour productivity and innovation performance: The importance of internal labour flexibility practices. Economic and Industrial Democracy, 38(2), 271–293.

Romer, P. M. (1994). The origins of endogenous growth. Journal of Economic Perspectives, 8(1), 3–22.

Romer, P.M. (1990). Human capital and growth: theory and evidence. In: Carnegie-Rochester conference series on public policy, 32(1), 251–286. North-Holland, March.

Shaikh, A. (2016). Capitalism: Competition, conflict, crises. Oxford University Press.

Sögner, L., & Stiassny, A. (2002). An analysis on the structural stability of Okun’s law–a cross-country study. Applied Economics, 34(14), 1775–1787.

Thirlwall, A. P. (1983). A Plain Man’s Guide to Kaldor’s Growth Laws. Journal of Post Keynesian Economics, Spring, 5(3), 345–358.

Travaglini, G., & Bellocchi, A. (2018). How supply and demand shocks affect productivity and unemployment growth: Evidence from OECD countries. Economia Politica, 35(3), 955–979.

Tridico, P., & Pariboni, R. (2018). Inequality, financialization, and economic decline. Journal of Post Keynesian Economics, 41(2), 236–259.

Verdoorn, P. J. (1949). On the factors determining the growth of labour productivity. L’Industria. In: J.S. McCombie, M. Pugno, B. Soro (Eds.) Productivity growth and economic performance: Essays on Verdoorn’s Law. Palgrave Macmillan UK.

Verdoorn, P. J. (1956). Complementarity and long-range projections. Econometrica, Journal of the Econometric Society, 429–450.

Young, A. A. (1928). Increasing returns and economic progress. The Economic Journal, 38(152), 527–542.

Funding

Open access funding provided by Università degli Studi di Roma La Sapienza within the CRUI-CARE Agreement.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors have no conflict of interest to declare.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Rights and permissions