Abstract

This paper aims to identify how and to what extent the Italian labour market structure, in terms of job composition and institutional changes, shaped the dynamics of wages and wage inequality in the decade between 2007 and 2017. We investigate the main determinants behind the rise in wage inequality in Italy by using Recentered Influence Function (RIF) regressions. This econometric approach allows—on the one hand—to directly assess the effects on the unconditional distribution and on “beyond the mean” statistics, like the Gini coefficient. On the other, it decomposes inequality into endowment and wage effects, following the standard Oaxaca-Blinder technique. We observe that working structures and institutional changes—contractual arrangements (permanent vs temporary contracts) and working hours (full-time vs part-time)—are the main factors in explaining the deterioration in wages at the bottom of the income distribution scale, and the consequent increase in wage inequality.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Until recently, mass unemployment, increased inequality among workers and surges in in-work poverty have been considered side effects of ongoing historical changes, mostly related to the Fourth Industrial Revolution and globalisation. The resulting hegemonic narrative disempowers policy makers since they exist outside their goodwill and beyond their powers. More specifically, this narrative, according to which the asymmetric gains from technological change are a deterministic outcome, spurs from two related theoretical arguments. According to the first one, known as Skill Bias Technological Change, introduced to explain the rise in wage inequality in the US [Katz and Murphy (1992)], the increase in inequality within a country is a direct consequence of technological development and of expansion of higher education when the supply of highly-skilled workers lags behind the increase in demand. However, the available empirical evidence shows differing and puzzling patterns for both the USA and some European countries. Indeed, in the US economy, employment expansion occurred not only at the top but also at the bottom of the wage distribution scale, leading to employment polarisation (Wright & Dwyer, 2003).

To adapt to this evidence, the SBTC was revised into the Routine-Biased Technological Change (RBTC) hypothesis, according to which employment changes (and wage inequality) can be better understood by shifting the focus of analysis from individual skills endowment to tasks. More specifically, tasks that are more routine are easier to codify, and therefore easier to substitute with machines (Acemoglu & Autor, 2011; Autor et al., 2003). Looking at Italy, the focus of the present article, Lilla and Staffolani (2009) observe that the rise in inequality starting from the 1990s is basically due to the slow growth in white-collar wages and the depression of blue-collar wages. Although this evidence points in favour of the RBTC hypothesis, the authors also claim that the main sources of inequality within groups are cohort differences and the higher volatility in younger workers’ wages, a result explained by Italian labour market reforms that started in the 1990s. Naticchioni et al., (2008, 2010) deepen the analysis of inequality determinants within and between groups by putting SBTC arguments to the test. The authors conclude that these arguments do not apply to the Italian case, which was characterised by a decrease in the Educational Wage Premium along the entire wage distribution between 1993 and 2004. According to the authors, lagging demand for high-skilled workers may explain the such pattern, at least at the top of the wage distribution.

Indeed, Rosolia and Torrini (2016) find a persistent wage penalty for the youngest cohorts compared to the older generations: those entering the new flexible labour market experience a relative wage loss that is not recovered by faster career paths. Also, Raitano and Fana (2019), studying the almost total liberalisation of fixed-term contracts in 2001, found a substantial and persistent wage penalty for highly educated workers entering the labour market just after the reform passed, compared to their peers who had entered it earlier. Naticchioni et al. (2016) consider the heterogeneity of this penalty across skill levels and observe that, compared to the older cohorts, younger higher-skilled workers are more heavily penalised than the younger unskilled workers.

This evidence suggests that other mechanisms—beyond SBTC and RBTC—are at play in influencing wage inequality, ones that are more grounded in the institutions of the labour market.

Coherently with this hypothesis, other theoretical arguments aim at explaining the relationship between wage inequality and labour structure. Called the “revisionists” by Autor et al. (2008), authors like Card and DiNardo (2002), Lemieux (2006), Di Nardo and Pischke (1997) criticise the SBTC argument, and claim that the real causal factors are not market-driven, but instead institutional. Specifically, the “revisionists” claim that the main factors driving the rise in inequality relate to the declining real value of the minimum wage and the de-unionisation process (Card, 1996; Visser & Checchi, 2011). This literature is more coherent with the sociological theory that highlights the importance of institutional design in terms of the welfare system and of the power relations and regulation of labour structure (Fernández-Macías, 2012; Esping-Andersen, 1990; Esping-Andersen and Regini, 2000).

The present article contributes to this last strand of literature on Italian wage inequality and its trends during the 2007–2017 period, by studying these phenomena along the entire income distribution and accounting for changes in labour market structure and the increase in the share of non-standard contractual and working time arrangements. More precisely, our study inspects—in a non-causal way—the determinants and trends of inequality at different points in the wage distribution, to capture if and to what extent individual characteristics, contractual arrangements and employment composition affect those changes in Italy. To do so, we use a sound and innovative empirical method that is the RIF approach developed by Firpo et al. (2009, 2018) to first estimate the cross-sectional associations and secondly we employ the revised RIF-Oaxaca decomposition method to establish the main determinants behind wage inequality dynamics. As already mentioned, the geographical scope of the present article differs from Firpo et al. (2018) as we focus on Italy, which represents a textbook case characterised by a continuous series of labour reforms, spanning from the Lira crisis in 1992 to the strong fiscal consolidation policies adopted to face the debt crisis in 2011.

In line with the existing literature (Naticchioni et al., 2016; Raitano & Fana, 2019; Rosolia & Torrini, 2016; etc.), our findings confirm that labour market institutions matter and are the main driver of changes in labour income, especially at the bottom of the distribution. Indeed, both part-time arrangements and temporary contracts have strong depressing effects on log wages, especially at the bottom of the distribution, thus determining a strong rise in inequality. These findings contribute to supporting the arguments advocated by the so-called ‘revisionists’ according to which to explain trends in wage inequality it is pivotal to look at institutional changes more than the degree of technical substitution between labour and capital. Although the paper only focuses on Italy, the results presented here can be potentially extended to countries, with a similar level of economic development and productive specialisation, which underwent similar processes of labour market deregulation and employment structural change.

The rest of the paper is organised as follows. Section 2 reviews some important facts about the Italian context. Section 3 introduces the methodology and data used for the analysis. Section 4 presents a summary of statistics on employment structure in Italy, as well as distributive statistics and inequality trends. In Sect. 5 we discuss RIF-OLS and decomposition results, and finally, Sect. 6 concludes the paper by synthesising our main findings.

2 The Italian case

From the annual report by the Italian National Social Security Institute (INPS, 2019) it emerges that, between 1993 and 2017, annual labour income remained on average almost flat, while the share of workers earning below 60% of the median increased from 26 to 31 per cent. Overall, during the last few decades, Italy has experienced increased inequality in income and wealth (Acciari et al., 2021; Hasell et al., 2019; Morelli et al., 2015), wage stagnation and increased profit share.

In Italy, wage inequality started to widen in the 1990s reversing the trend characterising earlier decades. Brandolini et al. (2001) show that all inequality measures decreased substantially between 1977 and 1989—a period when both mean and median net wages grew at 1.8 per cent per year. This effect is due to a particular indexation mechanism—the scala mobile, literally the escalator—which, beginning in 1975, granted a wage increase in real terms to all employees as prices rose, as shown by Manacorda (2004). From its abolition in 1993 inequality started to rise and kept rising.

It is therefore important to acknowledge that the country witnessed a long-lasting process of structural reforms towards a more flexible labour market starting in the Early ‘90s. The detrimental effect of labour market flexibilization has been widely documented in recent years (Kleinknecht, 2020). Recent work by Ricci and Cirillo (2019) shows that the increase in temporary employment led to a decline in labour productivity and wages, together with an increase in profits.

All these mechanisms build up patterns of structural change in terms of occupational composition. However, the dynamics of occupational change are puzzling, with some results indicating upgrading, while others indicate slight upgrading or even downgrading. Piccitto (2019) shows that between 1992 and 2015 the Italian labour market experienced a clear upgrade, irrespective of gender or territorial division, with the financial crisis of 2012 not reversing the process, but slowing it down. Conversely, Fernández-Macías (2012) observes only a slight upgrade for Italy between 1995 and 2007. Results from Hurley et al. (2019) are even more in contrast with those of Piccitto (2019), showing a clear downgrading pattern since 2007, a finding supported also by Basso (2019) and Aimone Gigio et al. (2021). Furthermore, Hurley et al. (2019) show a downgrading with respect to the EU average (of 9 countries), and this trend includes all the Italian regions, with only Lombardy having fewer lower-skilled workers compared to the other countries studied. Castellano et al. (2019) also observe a downgrading in the employment structure in Italy. In particular, they find growth in higher-skilled workers only at the median of the overall wage distribution. Finally, the Fernández-Macías et al. (2017) analyses the relationship between changes in occupational structure and wage inequality. According to the report, Italy is characterised by mid-level wage inequality (compared to other European member states) and low levels of occupational wage differentials. Overall, the authors find that occupational dynamics do not account for much of the variation in changes in wage inequality, which is mainly explained by within-occupation wage changes.

As for the potential relationship between occupational changes and wage inequality, we follow Firpo et al. (2009, 2018) to understand and quantify the impact of the structure of the Italian labour market on wage inequality.

3 Data and methodology

3.1 Data

Using the EU-SILC data (User Database, UDB), we estimate the main drivers of wage inequality over the decade between 2007 and 2017 and provide separate estimations for 2007, 2011, 2014 and 2017.

The UDB database covers information at the individual and household levels, both cross-sectionally and longitudinally, on a wide set of information about labour market conditions, income, and socio-demographic characteristics.

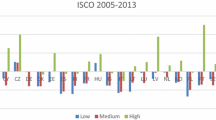

In this study, we use the cross-sectional part of the database and we concentrate on employees (excluding self-employed individuals) from both the private and public sectors, aged between 16 and 65, for a total sample of 14,367 workers in 2007 and 14,430 in 2017. Employees are classified into occupations, according to the ISCO 2-digit classification provided by the EU-SILC (variable PL050 and PL051) and into economic sectors, so that it is possible to characterise them according to their positions within both the vertical and horizontal division of labour. Using all occupation-sector pairs, we are able to build a job matrix for each year of interest. To deal with the change in both occupation and sector classifications, we convert the NACE Rev. 2 into the Rev 1.1 classification by using the double information in the 2008 UDB (PL110 and PL111). As for the occupations, we create 9 classes from the 2-digit ISCO-88 and ISCO-08. We acknowledge that there might be some potential bias due to changes in the occupational codes at the margins, which may lead to classifying an employee in different classes when using the two classifications. We end up having a 9 × 12 occupation-sector matrix.Footnote 1

The other two variables proxying labour market institutions are working hours (full-time vs part-time) and contractual arrangements, i.e., permanent vs temporary. We also include work experience as an additional covariate. Finally, we use educational attainment defined by the ISCED level, ranging from less than or equal to primary to tertiary education. Together with occupational codes, education is the key variable linked to the SBTC theory,

To account for geographical heterogeneity, we control for the macro-area in which the employee is living in Italy: North-East, North-West, South & Islands, and Central Italy.

The outcome variable of interest is the gross annual wage,Footnote 2 converted into a logarithmic scale and adjusted to deal with very extreme observations, which may skew the computation of inequality indexes like the Gini coefficient. For this purpose, we trim off both the top and bottom 1% of the distribution. Furthermore, to eliminate inconsistent data, such as when individuals classified as employees report null values for gross income,Footnote 3 we proceed to impute their annual gross wage by multiplying monthly values by twelve: original and imputed data generate identical distributions and distributional measures (like the Gini coefficient, see Fig. 8 in the Appendix). On this final gross annual wage, we apply the Eurostat HICP deflator (base year = 2015) to obtain nominal values at constant prices. Finally, all the analyses exclude armed forces employees.

The empirical analysis tests specifications of different models: standard OLS, conditional quantile regressions, RIF-OLS over percentiles, the Gini coefficient, and lastly the P90/P10 ratio.Footnote 4 In all these model specifications, individual workers are the unit of analysis, and all variables are defined at the corresponding level. Furthermore, all estimations are run separately by gender. The gendered segregation in the labour market both in terms of occupation and performed tasks (Fana et al., 2022) motivates this choice. These structural differences require a separate analysis to avoid any selection bias in pooled models.

3.2 RIF-OLS

To understand how the structure of the Italian labour market affects wage distribution and wage inequality, we rely on the contribution of Firpo et al. (2009, 2018), which allows us to go “beyond the mean”, both in our search of an explanatory association and in a decomposition using the standard Oaxaca-Blinder technique (Blinder, 1973; Oaxaca, 1973). Traditionally, the Oaxaca-Blinder method has been applied to the mean with standard linear regression models. Attempts to estimate the coefficient-endowments effects on different statistics, like quantiles, have been performed for example by Machado and Mata (2005).

The latter contribution is based on the conditional quantile regression (CQR) methods introduced by Koenker and Bassett (1978) that, in contrast to the standard OLS, do not permit unconditional interpretation i.e., the effect of a given explanatory variable X on the unconditional population outcome.

The main reason why CQR does not allow an unconditional interpretation is due to the impossibility of applying the law of iterated expectations. Applying that law to standard OLS leads to \(\left(y|x\right)=x\beta =E\left(y\right)=E\left(x\right)\beta\), a property that does not hold for CQR since \({Q}_{\tau }\left(y|x\right)\ne {Q}_{\tau }\left(y\right)\). In other words, using conditional quantile regressions, we can only interpret the effect of a unit change in a covariate X on the t-th quantile of the conditional outcome distribution. Conversely, the unconditional quantile regression (UQR) introduced by Firpo et al. (2009) allows researchers to identify the high-earning or low-earning worker in an “absolute” way on the log-wage distribution, which is not redefined conditionally on covariates and, hence, on different subgroups as in the standard conditional quantile regression. In our case, it enables us to understand to what extent the occupational structure, labour market characteristics and education affect the wage distribution at different points (wage percentiles), without conditioning the wage distribution.

The building block of the RIF-OLS is the influence function. Considering a given distributional statistic v(Fy)—for example, the Gini coefficient—computed on the distribution F, then the influence function of v(Fy) represents the effect of an infinitesimal change in the function F at a given point y (of our individual gross annual log-wage distribution). Hampel (1974) provides a formal definition of the influence function (IF):

Firpo et al. (2009) recentered the function, adding back the distributional statistic to the IF:

and demonstrated how the distributional statistic v(Fy) can be written in terms of expectations and, applying the law of iterated expectations, also in terms of expectations of the conditional RIF:

According to Eq. (3), when covariates are present and we are interested in understanding their association to a distributional statistic v(Fy), it is necessary to integrate \(\mathrm{over E}[RIF(y;v, Fy) | X]\).

To do so, Firpo et al. (2009) propose a simple OLS regression, obtaining the RIF-OLSFootnote 5:

where the coefficient \(\beta\) can be interpreted unconditionally, in Firpo et al. (2009) terms, as the unconditional partial effect (UPE). However, the interpretation of our coefficients is different from that of a standard OLS regression: \(\beta\) represents the expected change in our distributional statistic if the (unconditional) average of X increases by one unit. The unconditional (or marginal effects) interpretation implies that we can infer changes that affect everyone in the population, even if our covariates are measured at the individual level. For example, having individual level information for years of educational attainment, then the estimated coefficient refers to what happens to the outcome variable if the average number of years of education in the population increases by one year. In the case of dummies (or categorical variables in general), the interpretation of the coefficients consists in the expected change of the distributional statistic if the proportion of a given category (e.g., women) in the population increases by—for example—1%. Therefore, it is possible to estimate any distributional statistics referring to a population level, like the Gini coefficient.

Our final equation will be:

where \(\upsilon \left(Fy\right)\) will be the 10th, 50th, and 90th percentiles and the Gini coefficient; y is the (log) gross annual wage of individual workers; \({X}_{occ}\) and \({X}_{sector}\) are the matrix of covariates related to the occupation and sector of each worker. \({X}_{labour}\) includes the vectors of contractual arrangements, working times and work experience; \({X}_{edu }\) is the matrix of individual educational attainment; finally, \({\gamma }_{regions}\) represents the region fixed effects to control for the between variations at the regional levels.

This estimation procedure guarantees more informative results compared to the standard CQR. Indeed, the conditional quantile regression estimates associations, for example, between occupational structure and wages at different points of distribution, meaning comparing workers with different wages (high vs low), but with identical values in terms of covariates. This means that a high-wage worker in the standard CQR may not be a high-wage worker in an ‘absolute’ sense along the original wage distribution, but only conditional on the covariates. By contrast, with UQR we can identify the associations for ‘absolute’ high-wage and low-wage workers, which are identified on the original and unconditional wage distribution.

3.3 RIF-decomposition

Although RIF-OLS provides a powerful tool for estimating the unconditional effects of covariates of interest on a distributional statistic and important insights on the main contributors to wage inequality cross-sectionally, it is not sufficient for identifying gaps between groups when we want to compare two points in time. In other words, the first cross-sectional analysis is a necessary but not sufficient condition for identifying the real mechanisms behind wage inequality dynamics.

To narrow the analysis by decomposing such differences, it is necessary to combine RIF-OLS with the standard decomposition technique introduced by Oaxaca-Blinder (1973). As anticipated, this strategy has been implemented to identify the composition and the coefficient effects at the mean through standard OLS estimation. By combining it with RIF-OLS, the Oaxaca-Blinder technique can be also applied to measures beyond the mean, preserving the unconditional interpretation.

If we consider, for example, a distribution function v(Fy), a vector of covariates X and a variable T that identifies two different groups—0 and 1—, to estimate the gap between the two groups based on v(Fy) it is possible to perform the following operation:

Equation (6) suggests that two components explain the gap between the two groups. The first is due to differences in characteristics (the distribution of covariates differs among the groups); the second refers to the different relationship between the outcome and the covariates in the two groups.

At this stage, we require a counterfactual to determine the magnitude of each effect. For this purpose, following the standard Oaxaca-Blinder technique and specifying Eq. (4) for our two groups, we obtain the counterfactual by applying the coefficient of group 0 to the covariate’s distribution of group 1.

Firpo et al. (2009) suggest an alternative procedure for defining the counterfactual scenario. This approach relies on the identification of a reweighting factor that needs to be applied to \(d{F}_{X}^{0}(X)\) to mimic the distribution of group 1, \(d{F}_{X}^{1}(X)\). The most straightforward way of doing this is to perform a logistic (or probit) regression to estimate the reweighting factor, and then estimate the RIF-OLS for the counterfactual applying this factor.Footnote 6

We now have a full decomposition—by using the “normalisation” approach to avoid the omitted-reference bias which affects the Oaxaca-Blinder decomposition when using categorical variables—like the following:

The first term represents the (pure) coefficient effect, while the third addendum is the (pure) endowment effect. The coefficient effect refers to the differences in the relation between the covariates and the outcome across the groups. The endowment effect represents the differences in the covariates’ distributions across groups. The other two terms represent the reweighting and the specification errors, respectively. The reweighting error is a measure of the quality of the reweighting strategy and, as FFL report, it tends to zero when the sample size increases. The specification error, conversely, is a test on the model misspecification, since it measures the departure from linearity and, consequently, it is a way to check whether the RIF-OLS is an appropriate tool for the decomposition of endowment and coefficient effects. In brief, we ideally expect both errors to not be statistically different from zero.

Firpo et al. (2018) argue that under the ignorability assumptionFootnote 7 the endowment (composition) effect can be interpreted as the “policy effects of changing the distribution of one covariate from its T = 0 to T = 1 level, holding the distributions of other covariates unchanged”. The wage effect is then a “pure effect” of the covariates on wages.

In other words, even without a pure identification strategy and causal interpretation, it is possible to estimate what the effects—or ‘policy effects’ interpretation in FFL’s words—behind changes in wage distribution and inequality measures are over time.

4 Descriptive statistics

Before presenting the outcomes of the econometric exercise, in the present section, we summarise several descriptive statistics. The overall wage distributions are reported in Fig. 1, and the effect of the Great Recession emerges in 2011 and 2014: compared to the pre-2008 period and the recovery phase (2017), both years are characterised by a higher density at the bottom, with the emergence of two “bumps”.Footnote 8 Although GDP recovered in 2017 (Eurostat series), income levels remain lower compared to the pre-2008 period.Footnote 9

Looking at the distribution over time by gender and working hours, reported in Fig. 2, we observe that female workers suffer a pay gap in both years when employed full-time, while no major gender gaps emerge for part-time work in 2017 compared to 2007. The last piece of evidence may reflect the impoverishment of part-time male workers after the Great Recession, consistently with the increase in the share of men’s involuntary part-time work (Eurostat, 2020). Finally, Fig. 3 reports wage distributions according to other covariates. In particular, the left-hand panel contrasts the top and bottom professional groups (according to the ISCO one-digit classification), while the right-hand panel compares permanent and temporary contracts.

According to Fig. 3, changes in the wage distributions for occupational groups at the top and the bottom of the scale point in the same direction with a larger share at lower percentiles and a lower density at higher percentiles. In terms of magnitude, a stronger downgrading characterises elementary occupations compared to Professionals, with a consequent increase in wage inequality, due to the bottom 10th lagging behind. In line with expectations, temporary jobs are concentrated at the bottom of annual gross wages, with a distribution that is very similar to that of elementary occupations. An overall impoverishment also characterises permanent jobs: its distribution in 2017, compared to 2007, is characterised by higher density in the bottom percentiles.

The distribution of annual gross income, Table 1, highlights that inequality increased at the bottom of the scale (P50/P10) and decreased at the top (P90/P50), confirming our previous intuition about the Italian employment structure’s downward trend, rather than a polarising effect, as found in the US (Autor & Dorn, 2013). The increase in overall inequality, as resulting from the 90/10 wage ratio, is mainly driven by a surge in inequality at the bottom. More precisely, considering the log-distribution, it is possible to directly observe the percentage change of the wage distribution over time. In real terms, the bottom 10% lost 23%, while at the top, there was a decrease of about 6% (in nominal terms there was a decrease at the bottom of 7% and an increase at the top of around 10%). As a consequence, the Gini coefficient increases by around 2 points (from 0.28 in 2007 to 0.30 in 2017).

Finally, to display the dynamics of the employment structure, we use the Labour Force Survey data and replicate the jobs approach by Hurley et al. (2019), where jobs defined as occupation-sector pairs are ranked on median hourly wages from the Structure of Earning Survey database. The resulting ordinal distribution is then split into terciles, the low, mid and high-paid ones, weighted by the employment population of the corresponding year. This method enables us to trace each tercile employment change with respect to a base year, which in our case is 2002. Figure 4 plots the employment share in each terciles of jobs. It can be appreciated that while Italy was characterised by an upgrade of the employment composition in 2007, the situation reversed into a downgrade during the most recent periods. In fact, the share of bad jobs increases in 2011 and it outweighs the good ones in 2016.

5 Results

This section discusses the results from the RIF-OLS method and the detailed Oaxaca-Blinder decomposition. In the first step—the RIF OLS—the dependent variable, the log wage at three different points of the distribution in two different years (2007 vs 2017), is regressed against a set of both structural and individual characteristics summarised in Table 3.Footnote 10 Different estimations by gender are performed to account for gender bias and unobservable factors leading to gender differences in job composition and returns. To check the robustness of our estimates, we also implement a RIF-OLS for two different inequality measures, i.e., the Gini coefficient and the P90/P10 income ratio. Finally, the second and last step of the econometric analysis decomposes changes that occur along the wage distribution, using Firpo et al.’s detailed Oaxaca-Blinder decomposition (2018). These two steps—the static cross-sectional RIF-OLS and the Oaxaca decomposition—are complementary, as presented by Firpo et al. (2018). The first analysis helps to provide an initial intuition on how the main covariates are associated with wages and inequality measures, and how they evolved across periods. The changes in the estimates suggest what we should expect from a dynamic approach. The dynamic analysis will then clearly establish what are the determinants behind changes in wage inequality over time.

5.1 RIF-OLS at 10th, 50th and 90th percentiles

Figure 5 reports estimates from the RIF-regression at 10, 50 and 90th wage percentiles for women and men, respectively, at two points in time (2007 and 2017; Table 4 in the Appendix report the full estimates by gender and years, including 2011 and 2014). Overall, as expected, the analysis of changes in wages across the distribution highlights the strong heterogeneity in the effect of the covariates. Looking into the association of occupation with (log) wages, we observe that—irrespective of gender—the positive and significant coefficient of an expansion in the share of Legislator or Manager Occupation increases along the distribution and also over time for the 90th percentile. Conversely, working in a mid to low-level occupation (Service workers or Elementary occupations) has a strong negative correlation at the bottom, and to a lesser extent on median wages, where the coefficient is stronger in magnitude in 2017 compared to 2007.

Overall, the changes in monetary rewards and penalties to occupations do not seem to be fully consistent with the SBTC and RBTC theories. We observe increasing returns associated with the high-occupations, most notably at the top 90th, while mid-bottom occupations experience a stronger wage penalty, above all at the bottom 10th of the wage distribution. Coherently with Basso (2019), these findings are more in line with a downgrading occupational and wage structure rather than upgrading or polarizing structure, as predicted by the SBTC and RBTC. Moreover, the SBTC would predict increasing returns to higher education, reinforcing occupational upgrading and wage inequality due to skill-bias. However, we observe that returns to higher education are decreasing between 2007 and 2017—especially for men. This is a signal that education is now racing ahead of technology (Goldin & Katz, 2008) and, as a consequence of diminishing returns, it may not be the most relevant determinant in explaining wage inequalities, as suggested by the SBTC theory.

Finally, we observe that an increase in the share of individuals working part-time has a strong negative effect, although it is declining along the entire wage distribution: it holds for both genders, with greater magnitudes for men.

The gender difference is not surprising, and it is coherent with statistics on the gender distribution of involuntary part-time work: men lose out more than women since women already start from a lower baseline. Indeed, women’s employment is more concentrated in non-standard working arrangements compared to men, who are only now experiencing these new forms of employment that penalise their wages compared to the already low wages of women.

Moreover, permanent workers enjoy higher wages compared to temporary ones, especially at the bottom of the distribution, regardless of gender. However, while for women the positive effect weakens at the 50th and 90th percentiles, men with temporary contracts suffer from lower returns even at the bottom. This finding confirms the equalising effect of standard work arrangements, especially at the bottom of the distribution; in other words, more precarious contracts enhance inequality.

As expected, labour market institutions matter in line with some strands of economic literature discussed in the previous sections (Naticchioni et al., 2016; Raitano & Fana, 2019; Rosolia & Torrini, 2016; etc.). More precisely, the expansion of more precarious work arrangements—part-time, temporary contracts, involuntary part-time, on-call contracts, etc.—significantly decreases the workers’ bargaining power. The observed downgrading wage and occupational structure seems to be in line with the ideas of low-added value specialization and lower productivity as a consequence of the expansion of alternative work arrangements (Guarascio and Dosi, 2016; Guarascio and Simonazzi, 2016). In other words, the ongoing expansion of part-time and temporary contracts may constitute a more relevant theoretical explanation of the wage inequality level and its dynamics.

5.2 RIF-OLS for the Gini coefficient

After presenting the effects of a rich set of covariates at different points of the (log) wage distribution, we analyse how and to what extent those covariates directly affect wage inequality: here we discuss estimation outcomes for a RIF-OLS applied to the Gini coefficient (see Fig. 6, as a robustness check we also include the P90/P10 ratio. Full estimates and detailed years are reported in Tables 5 and 6 in the Appendix).

Compared to Clerks, an increase in both the share of higher and lower-skilled occupations significantly worsens inequality. As expected, as the share of Managers increases and strengthens over time, the effect is stronger for both men and women, while the effect associated with an increased share of Elementary occupations is quite stable.

Going back to theoretical explanations, the SBTC (Autor et al., 2003; Katz & Murphy, 1992) predicts an increase in wage inequality at the top and decreasing wage inequality at the bottom of the distribution driven by the complementarity/substitutability nexus between technologies (capital) and skills (mostly proxied by educational attainment). Thus, occupational upgrading and higher inequality at the top of the wage distribution—where more educated workers are more likely to be employed—should be expected. On the contrary, occupations at the bottom should decrease and not be significant in explaining wage inequality. In Goldin and Katz’s (2008) words, if the demand for skills is racing ahead of supply, then there will be an increase in wage inequality due to skill-bias. Our findings only partially coincide with the SBTC’s. Indeed, we observe that compared to Clerks, an increase in the share of highly skilled occupations—Managers and Professionals—significantly worsens inequality. For example, a 1% increase in the share of male (female) professionals contributes to a 0.46% (0.45%) increase in the Gini coefficient in 2007.Footnote 11

However, contrary to the SBTC’s main prediction, we also find that an expansion of bottom occupations leads to higher wage inequality. This latter evidence can be explained by a polarizing pattern—in accordance with the RBTC—or by a significant downgrading in both employment and wage structures. In the case of Italy, this last mechanism seems to better explain the occupational and inequality distributions as the expansion of bottom occupations is higher than the increase in the top ones (see Fig. 4). This downgrading trend is incompatible with both SBTC and RBTC predictions.

Furthermore, in terms of education, we observe higher Gini coefficients because of an increase in the share of highly educated workers (irrespective of gender), in line with SBTC theory. However, the magnitude is decreasing over time, suggesting that education may not be the unique and/or most important factor in shaping wage inequalities. Like Basso (2019), we fail to identify the SBTC as the main factor explaining the increase in wage inequality, which is mostly determined by changes at the bottom of the income distribution.

Such changes at the bottom are mostly driven by the labour market institutions embodied in the dynamics of non-standard work arrangements, with the persistent increase in both the use of part-time and temporary contracts over time. Such stronger concentration of precarious occupational forms at the bottom of the wage distribution is inequality enhancing. More in detail, in 2007 an increase of 1% in the share of women in part-time work led to a 0.40% increase in the Gini coefficient (0.60% for men). Similarly, an increase of 1% in the share of temporary contracts contributed to a 0.25% increase in wage inequality (0.37% for men).

Overall, our results cannot fully support the SBTC and RBTC predictions both in terms of occupational and educational estimates, while the role of proxies for labour market institutions suggests a potentially pivotal role in shaping wage distribution and its dynamics. As previously anticipated, the continuous expansion of alternative work arrangements and its impact on production structure and wage dynamics may be a more relevant theoretical explanation compared to the SBTC and RBTC predictions.

However, this evidence is not sufficient to truly understand the real mechanisms behind the wage inequality dynamics. The subsequent complementary and necessary step to test the relevance of SBTC/RBTC and institutional factors is the Oaxaca decomposition whose outcomes will be discussed in the next section.

5.3 RIF-Oaxaca decomposition

The last part of our analysis focuses on the main drivers of change in income inequality by means of the Gini decomposition, through which it is possible to distinguish between the endowment characteristics and unexplained (wage) coefficient effects. For this purpose, we follow Firpo et al.’s contribution (2009, 2018) to estimate Eq. (6), discussed in Sect. 3. Given that the Gini coefficient is a low-dynamic index, the most convenient approach is to evaluate the change over the extreme points of the selected decade, 2007–2017. To be concise, we present only aggregate results for the main variables, i.e., summing up all the coefficients of different categories (for example, the occupation effect is the sum of all occupation categories).Footnote 12

Lastly, we use the same variables specified in our model for the reweighting approach according to which the counterfactual consists of reweighting the characteristics in 2007 with the ones in 2017 (or equivalently, the 2007 characteristics with the 2017 returns).

The decomposition for log wage differences between 90 and 10p, 90p and 50p, 50p and 10p, as well as for the Gini coefficient is reported in Table 2, while Fig. 7 presents the log wage differences at each percentile.

We can confirm that both the 90–10 and 50–10 gaps increased over time, signalling that the bottom 10th clearly lags behind. On the contrary, the dynamic of the distance between the median and the top end is irrelevant. Because of the fall in the bottom end of the distribution, the Gini coefficient also increases by 2.3 points between 2007 and 2017. Furthermore, the total wage change, explained and unexplained components along percentiles are instead plotted in Fig. 9 in the Appendix.

The composition effect, i.e., the differences in log wage due to differences in characteristics, explains most of the change during the decade, specifically the 90–10 distance (76% for men and 193% for women), while it tends to be about the half in the 50–10 gap.

The decomposition analysis points to changes in the occupational structure and labour market institutions as the main factors in explaining changes across percentiles (Fig. 7), specifically the 90–10 and 50–10 gaps.

More in detail, for male workers in temporary jobs, changes in the occupational structure and working part-time explain around 22%, 18% and 20%, respectively, of the total log wage difference between the 90th and the 10th percentiles. However, differently from men, the difference among women is mostly explained by occupations, and to a less extent by part-time and temporary employment. This is coherent with the gendered structure of occupations, with women employed mostly at the extremes of the occupational distribution.

The 50–10 wage difference for men is mostly determined by contractual arrangements, and to a lesser extent by the occupation of employment. The results for women are similar to the 90–10 difference.

Figure 7 presents graphically the results in Table 2, but with detailed effects along all percentiles. Each point along a selected line represents the log-wage change at each percentile due to the selected covariate. Therefore, if we consider for example the 90–10 gap for men in temporary employment (0.045 in Table 2), we should take the difference between the point estimate at the 90th percentile (− 0.0047) and the point estimate at the bottom 10th (− 0.0499) on the ‘Contract curve. Overall, and regardless of gender, the composition effect linked to part-time and temporary contracts mostly penalizes the bottom percentiles, while its negative effects tend to flat-out above the median. Similarly, occupational differences lead to negative wage changes at the bottom percentiles, while favouring the top ones.

The analysis for the Gini coefficient confirms these results. Changes in the occupational structure account for the highest share in explaining the increase in wage inequality, with the effect for women being stronger. Although the role of education is marginal in explaining the 90–10 and 50–10 gap for men (and even non-significant for women), it turns out to be comparable with part-time effects in the case of Gini decomposition. However, the combined effects of part-time and temporary characteristics—i.e., our proxies for labour market institutions—outweighs the role of education for both men and women. Lastly, the coefficient effects are generally not significant and are reported in the bottom part of Table 2.

Overall, we confirm the hints provided by the static analysis in Sects. 5.1 and 5.2, with occupational structure and labour market institution proxies being the most important determinants in explaining wage inequality over time, contrary to the main predictions of the SBTC theory.

6 Conclusions

In this paper, we do not infer any causal effects, but we investigate the main structural contributions to wage inequality dynamics in Italy between 2007 and 2017. Starting from some stylised facts concerning the Italian labour market—a sharp increase in the share of temporary contracts, involuntary part-time work, working poor and the increase in low-added-value occupations—we first review the main reforms that directly affected the labour market. Following a discussion of these reforms, which are the key ingredients of the neoliberal and European recipes for the economy, we discuss the current literature on how Italy stands regarding occupational changes i.e., whether the Italian labour market has downgraded, upgraded, or polarised.

Although the existing literature is contradictory, we observe clear wage (and occupational) downgrading over the decade between 2007 and 2017, with the bottom 10% the most penalised, suffering a wage loss (in real terms) of about 20%, compared to 6% for the top 90%. This wage compression is coherent with the expansion of low-added-value occupations—elementary occupations and service workers—at the bottom of the wage distribution. Consequently, in the 2007–2017 decade, we observe an increase in wage inequality (+ 2 pp in the Gini coefficient).

To answer the research question about the determinants of the increase in wage inequality, we follow Firpo et al. (2009, 2018), and use RIF-OLS (unconditional quantile regressions) together with Oaxaca decomposition. In this way, we can first verify the effects of our main predictors on different percentiles and on the measure of overall inequality and then identify the main determinants behind inequality changes over time.

This exercise reveals that the top occupations (managers and professionals) experience positive monotonic returns on labour incomes for both male and female workers. Conversely, the expansion of middle to low occupations such as elementary workers and service workers has a strong negative association with the log wages at the bottom 10%. These results imply an inequality-enhancing effect that can be mostly explained by occupational downgrading, which is incompatible with both SBTC and RBTC predictions. Furthermore, in terms of education, we observe higher Gini coefficients as a consequence of an increase in the share of highly educated workers (irrespective of gender). However, these results are only partially coherent with SBTC, as the magnitude is decreasing over time, suggesting that education may not be the unique and/or most important factor in shaping wage inequalities.

Therefore, other theoretical mechanisms—mostly related to the labour market institutional changes—may better fit the Italian case. Indeed, the continuous expansion of non-standard work arrangements i.e., part-time and temporary contracts, reduce the workers’ bargaining power and leads the employers to focus on cost-compression, which may result in occupational and wage downgrading. Coherent with this strand of literature, our findings confirm that labour market institutions matter and are the main driver of changes in labour income, especially at the bottom of the distribution. Indeed, in line with the existing literature (Naticchioni et al., 2016; Raitano & Fana, 2019; Rosolia & Torrini, 2016; etc.), both part-time arrangements and temporary contracts have strong depressing effects on log wages, especially at the bottom of the distribution, thus determining a strong rise in inequality. The generalised negative effect on wages induced by non-standard contractual arrangements is not gender-neutral. For instance, men lose more compared to women, which also means that the associated reduction in the gender wage gap hides a generalised impoverishment of the labour force, not an improvement in living conditions for female workers.

The complementary results from the Oaxaca-Blinder decomposition reveal two important messages. First, looking at both the Gini coefficient and log wage differences at different points of the distribution, differences in characteristics explain most of the increases in wage inequality. Secondly, and more importantly, changes in the occupational structure are the main source of the widening log wage difference between the 90th and the 10th percentile (as well as for increasing the Gini coefficient), with a stronger effect for women. As noted by Firpo et al. (2018), this result confirms that increasing attention must be given to the role of occupational tasks and their impact on wage distribution. Moreover, contractual arrangements, i.e., temporary vs permanent contracts and part-time vs full-time play roles that are just as important as determinants of wage inequality, especially for men.

Education levels explain changes in the log wage differences only in a residual fashion, limited to men, while they account more for the increase in the Gini coefficient i.e., a higher share of workers with higher education significantly contributes to explaining the increase in the Gini coefficient. However, the combined effects of part-time and temporary characteristics outweigh the role of education for both men and women.

All in all, our results for the Italian case seem to confirm more the “heterodox” approach to labour market inequality, seen as the combined result of both occupational and institutional changes. These results may be generalized to countries that experienced similar dynamics in the labour market institutions.

Data availability

The analysed datasets are not publicly available due to access restrictions required by Eurostat. The corresponding author may provide elaborated non-original data and codes used for the analysis on reasonable request.

Notes

We consider the following occupations: legislators & managers, higher professionals, technical & associate professionals, clerks, service workers, skilled agricultural workers, craftspeople & related trade workers, machine operators and elementary occupations. The economic sectors are agricultural & fishing, industrial, wholesale & retail, hotels & restaurants, transport, store & communications, financial, real estate, PA, Education, Health & social care, private services.

“Employee cash or near cash income gross” (variable py010g). It must be noted that the variable py010g refers to the fiscal year preceding the year of the interview. This implies that the observable time-varying characteristics (e.g., contract type or occupation) and employee wages may be mismatched. Considering that such changes are more likely at the bottom end of the income distribution—where job discontinuity, precarious conditions and low-value occupations are concentrated—our estimates may underestimate the real effects of time-varying characteristics.

In the original database, there are between 1 and 5 percent of inconsistent cases depending on the year. In terms of occupational breakdown, the highest share of inconsistent cases is reported for “Technical & associate professionals” and “Service workers”.

All models will be estimated using EU-SILC individual cross-sectional weights. To take into account the survey structure, we use the rotational group as the stratum and the individual id as primary sampling unit.

This is a two-step procedure consisting in estimating the recentered influence function for each observation \({y}_{i}\) and then use these RIF as dependent variable against the covariates X.

The RIF-OLS for the counterfactual is the following: \(E[RIF(y;v, {F}_{y}^{C} )]=E({X}^{C}{\beta }_{C} )+E(\varepsilon )\)

The ignorability assumption—or unconfoundedness—in the identification studies replaces the standard strict exogeneity assumption and requires that the outcomes of the treated and control groups are independent from the treatment, once controlled for observable covariates. Symmetrically, it can be defined as the independence between the errors and the treatment T, once controlled for the covariates x. (Firpo et al. 2018).

Most likely, these bumps are the results of the “cassa integrazione”, the dominant protection provided by the lay-off scheme. Indeed, workers should receive the 80% of the global income they would obtain if they worked all their standard contract hours. Therefore, we observe a reduction in annual gross wages of under 20,000 euros, which disappears once the “cassa integrazione” scheme ended during the recovery.

The two-tailed Kolmogorov–Smirnov test of equality confirms that the distributions are statistically different by period, except for 2011 vs 2014.

For the sake of completeness, we perform standard OLS and Conditional Quantile Regression. Results are available upon request. Results using both OLS and CQR are consistent with RIF-OLS estimates presented and discussed in the text.

0.46% obtained as: (0.123/0.267)*0.01, where the numerator is the associated coefficient and the denominator the mean RIF for Men in 2007.

In this case we rely on the same reference base used for the RIF-OLS. This process does not affect our estimates of total differences, total explained effects and unexplained effects.

References

Acciari, P., Alvaredo, F., Morelli, S., (2021). The growing concentration of wealth in Italy: Evidence from a new source of data. VoxEU.org. URL https://voxeu.org/article/growing-concentration-wealth-italy (Accessed 29 Jun 21).

Acemoglu, D., & Autor, D. (2011). Skills, tasks and technologies: Implications for employment and earnings. Handbook of labor economics (pp. 1043–1171). Elsevier. https://doi.org/10.1016/S0169-7218(11)02410-5

Autor, D. H., & Dorn, D. (2013). The growth of low-skill service jobs and the polarization of the US labor market. The American Economic Review, 103, 1553–1597. https://doi.org/10.1257/aer.103.5.1553

Autor, D. H., Katz, L. F., & Kearney, M. S. (2008). Trends in U.S. wage inequality: Revising the revisionists. Review of Economics and Statistics, 90, 300–323.

Autor, D. H., Levy, F., & Murnane, R. J. (2003). The skill content of recent technological change: An empirical exploration. Quarterly Journal of Economics. https://doi.org/10.1162/003355303322552801

Basso, G. (2019). The evolution of the occupational structure in Italy in the last decade. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.3432515

Blinder, A. S. (1973). Wage discrimination: Reduced form and structural estimates. The Journal of Human Resources, 8, 436–455. https://doi.org/10.2307/144855

Brandolini, A., Cipollone, P., Sestito, P. (2001). Earnings Dispersion, Low Pay and Household Poverty in Italy, 1977–1998. Bank Italy Econ. Res. Dep. Temi Discuss. Econ. Work. Pap.

Card, D. (1996). The effect of unions on the structure of wages: A longitudinal analysis. Econometrica, 64, 957. https://doi.org/10.2307/2171852

Card, D., & DiNardo, J. E. (2002). Skill-biased technological change and rising wage inequality: Some problems and puzzles. Journal of Japan Water Works Association, 20, 733–783. https://doi.org/10.1086/342055

Castellano, R., Musella, G., & Punzo, G. (2019). Wage dynamics in light of the structural changes in the labour market across four more economically developed countries of Europe. Review of Social Economy. https://doi.org/10.1080/00346764.2019.1655163

DiNardo, J. E., & Pischke, J.-S. (1997). The returns to computer use revisited: Have pencils changed the wage structure too? The Quarterly Journal of Economics, 112, 291–303.

Esping-Andersen, G. (1990). The three worlds of welfare capitalism. Princeton University Press.

Esping-Andersen, G., & Regini, M. (2000). Why deregulate labour markets?, why deregulate labour markets? Oxford University Press.

Fana, M., Villani, D., & Bisello, M. (2022). Gender gaps in power and control within jobs. Socio-Economic Review. https://doi.org/10.1093/ser/mwac062

Fernández-Macías, E. (2012). Job polarization in Europe? Changes in the employment structure and job quality, 1995–2007. Work and Occupations, 39, 157–182. https://doi.org/10.1177/0730888411427078

Fernández-Macías, E., Hurley, J., & Arranz, J. M. (2017). Occupational change and wage inequality. Luxembourg: Publication Office of the European Union.

Firpo, S., Fortin, N. M., & Lemieux, T. (2009). Unconditional quantile regressions. Econometrica, 77, 953–973. https://doi.org/10.3982/ECTA6822

Firpo, S., Fortin, N., & Lemieux, T. (2018). Decomposing wage distributions using recentered influence function regressions. Econometrics, 6, 28. https://doi.org/10.3390/econometrics6020028

Gigio, L.A., Camussi, S., Maccarrone, V. (2021). Changes in the employment structure and in job quality in Italy: a national and regional analysis (No. 603), Questioni di Economia e Finanza (Occasional Papers), Questioni di Economia e Finanza (Occasional Papers). Bank of Italy, Economic Research and International Relations Area.

Goldin, C., & Katz, L. F. (2008). The race between education and technology. Harvard University Press.

Guarascio, D., & Dosi, G. (2016). Oltre la “magia del libero mercato”: il ritorno della politica industriale. Quaderni di rassegna sindacale 2016, 91–103.

Guarascio, D., & Simonazzi, A. (2016). A polarized country in a polarized Europe: an industrial policy for Italy’s renaissance. Economia e Politica Industriale: Journal of Industrial and Business Economics, 43, 315–322. https://doi.org/10.1007/s40812-016-0042-9

Hampel, F. R. (1974). The influence curve and its role in robust estimation. Journal of American Statistical Association, 69, 383–393. https://doi.org/10.1080/01621459.1974.10482962

Hasell, J., Morelli, S., Roser, M. (2019). Recent Trends in Income Inequality, in: Reducing Social Inequalities in Cancer: Evidence and Priorities for Research, IARC Scientific Publication.

Hurley, J., Fernández-Macías, E., Bisello, M., Vacas-Soriano, C., Fana, M. (2019). Europäische Kommission, Gemeinsame Forschungsstelle, European Foundation for the Improvement of Living and Working Conditions, 2019. Shifts in the employment structure at regional level labour market change.

INPS (2019). XVIII Rapporto annuale.

Katz, L. F., & Murphy, K. M. (1992). Changes in relative wages, 1963–1987: Supply and demand factors. The Quarterly Journal of Economics, 107, 35–78. https://doi.org/10.2307/2118323

Kleinknecht, A. (2020). The (negative) impact of supply-side labour market reforms on productivity: An overview of the evidence1. Cambridge Journal of Economics, 44, 445–464. https://doi.org/10.1093/cje/bez068

Koenker, R., & Bassett, G. (1978). Regression quantiles. Econometrica, 46, 33. https://doi.org/10.2307/1913643

Lemieux, T. (2006). Increasing residual wage inequality: Composition effects, noisy data, or rising demand for skill? The American Economic Review, 96, 461–498. https://doi.org/10.1257/aer.96.3.461

Lilla, M., & Staffolani, S. (2009). The evolution of wage inequality in Italy. Applied Economics, 41, 1873–1892. https://doi.org/10.1080/00036840601131771

Machado, J. A. F., & Mata, J. (2005). Counterfactual decomposition of changes in wage distributions using quantile regression. Journal of Applied Econometrics, 20, 445–465. https://doi.org/10.1002/jae.788

Manacorda, M. (2004). Can the Scala mobile explain the fall and rise of earnings inequality in Italy? A semiparametric analysis, 1977–1993. Journal of Japan Water Works Association, 22, 585–613. https://doi.org/10.1086/383108

Morelli, S., Smeeding, T., & Thompson, J. (2015). Chapter 8—post-1970 trends in within-country inequality and poverty: Rich and middle-income countries. In A. B. Atkinson & F. Bourguignon (Eds.), Handbook of income distribution, handbook of income distribution (pp. 593–696). Elsevier.

Naticchioni, P., Raitano, M., & Vittori, C. (2016). La Meglio Gioventù: Earnings gaps across generations and skills in Italy. Economics and Politics, 33, 233–264. https://doi.org/10.1007/s40888-016-0034-2

Naticchioni, P., Ricci, A., & Rustichelli, E. (2008). Wage inequality, employment structure and skill-biased change in Italy. Labour, 22, 27–51. https://doi.org/10.1111/j.1467-9914.2008.00416.x

Naticchioni, P., Ricci, A., & Rustichelli, E. (2010). Far away from a skill-biased change: Falling educational wage premia in Italy. Applied Economics, 42, 3383–3400. https://doi.org/10.1080/00036840802112455

Oaxaca, R. (1973). Male-female wage differentials in urban labor markets. International Economic Review, 14, 693–709. https://doi.org/10.2307/2525981

Piccitto, G. (2019). Qualificazione o polarizzazione? Il mutamento della struttura occupazionale in Italia, 1992–2015. Polis. https://doi.org/10.1424/92919

Raitano, M., & Fana, M. (2019). Labour market deregulation and workers’ outcomes at the beginning of the career: Evidence from Italy. Structural Change and Economic Dynamics, 51, 301–310. https://doi.org/10.1016/j.strueco.2019.03.003

Ricci, A., Cirillo, V., 2019. Produttività, salari e profitti: il ruolo dei contratti a tempo determinato.

Rosolia, A., Torrini, R. (2016). The Generation Gap: A Cohort Analysis of Earnings Levels, Dispersion and Initial Labor Market Conditions in Italy, 1974–2014 (SSRN Scholarly Paper No. ID 2917183). Social Science Research Network, Rochester, NY. https://doi.org/10.2139/ssrn.2917183

Visser, J., & Checchi, D. (2011). Inequality and the labour market: Unions, chapter 10. In B. Nolan, W. Salverda, & T. M. Smeeding (Eds.), The oxford handbook of economic inequality. Oxford University Press.

Wright, E. O., & Dwyer, R. E. (2003). The patterns of job expansions in the USA: A comparison of the 1960s and 1990s. Socio-Econ. Rev., 1, 289–325.

Funding

Open Access funding provided thanks to the CRUE-CSIC agreement with Springer Nature. The authors did not receive support from any organization for the submitted work.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

Furthermore, the authors have no relevant financial or non-financial interests to disclose.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

See Tables 3, 4, 5, 6 and Figs. 8, 9, 10.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Giangregorio, L., Fana, M. What’s behind increasing wage inequality? Explaining the Italian case using RIF-OLS. Econ Polit 41, 229–265 (2024). https://doi.org/10.1007/s40888-023-00303-0

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40888-023-00303-0