Abstract

The paper provides a novel, empirically grounded map of innovation ‘clubs’ in the EU, based on a unique analysis of micro-aggregated, country-level data. Using exploratory factor analysis we articulate innovation variables in a taxonomy of four ‘latent’ innovation theories: Network-Innovation-System, Kaldorian, New-Growth-Theory, and Schumpeterian. We then characterise clusters of countries (‘clubs’), based on their performance against this taxonomy, and design a new map of EU innovation clubs. We identify an articulated map of EU innovation hierarchy beyond the rather well-known ‘core-periphery’ structure, and interpret how some of the peripheries are functional to the ‘consolidated core’ of innovative countries, raising an issue of long-term sustainability of such hierarchies. We also find that even the most innovative clusters show concerning weaknesses. The strongest cluster in terms of its innovation system does not seem to exploit its full potential and lags behind with respect to radical product innovations. Instead, the leading cluster in terms of radical product innovations is strongly dependent on external innovative activity, is focused on scale-intensive sectors, and has a fairly weak innovation system. The periphery of small countries that show a healthy network structure, do so because they mainly include supplier-dominated firms, reliant on innovation inputs from the core. We offer some reflections on innovation policy within a broader view of EU cohesion.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The destructive (Schumpeter, 1911) and cumulative (Schumpeter, 1942) features of innovation tend to generate inequalities (Ciarli et al., 2020). Inequalities can emerge between workers in terms of earnings (Autor et al., 2008) or employment (Lazonick, 1979; Freeman et al., 1982), across firms (Song et al., 2019), countries (Cimoli & Porcile, 2011; Milanovic, 2016), as well as regions (Lee & Rodriguez-Pose, 2012). In recent decades, the growing concentration and accumulation of knowledge, technology and intangible assets in the hands of a few have exacerbated these inequalities (Autor et al., 2020).

There is growing consensus that such inequalities are engendering a new wave of social instability and political polarisation (Rodríguez-Pose, 2018; Naidu et al., 2020). Focusing on the European integration, Iammarino et al. (2019) argue that the growing inequality among EU regions pose a substantial threat to future cohesion and economic well-being in the Union. They suggest that such regional inequalities are due to the combined impact of technological progress and trade as well as to regional evolutionary features encroached in historical development paths, including capabilities, firms, skills, and institutions (see also Iammarino et al., 2020). Different EU countries and regions have followed different innovation trajectories, based on their historical developments and institutions (e.g. Mokyr, 2007; Ciarli et al., 2012).

Despite substantial and concerted policy effort to achieve a levelled-up ‘Innovation Union’ (EC, 2015), the EU is far from being a cohesive ensemble of countries in terms of innovation and socio-economic performance. There are imbalances, lack of convergence, innovation-driven clubs, which resonate with a classic core-periphery structure (Krugman, 1991), recently revisited at the regional level as the ‘places that do not matter’ (Rodríguez-Pose, 2018).

This evidence has often been (usefully) interpreted from an Innovation System (IS) perspective. In one of his seminal papers, Chris Freeman (Freeman, 2002) looked at ‘continental’, ’sub-continental’ and ‘sub-national’ differences in growth rates as related to technical and institutional capabilities. Based on contributions from historians of technical change (Landes, 1970), classical economists (List, 1841), and growth accountants (Abramovitz, 1986), he then attempted a first theoretical embedding of the notion of ‘Innovation System’. The very large literature that has emerged since has been mainly preoccupied with the empirical implementation of the IS approach, and less so with its embedding in a comparable theoretical framework, to the point that the IS approach has often been considered a-theoretical, with notable exceptions (Nelson, 1993; Lundvall, 1992, 2007).

In this paper we take a step back and offer a novel attempt to give the IS approach a theoretical dignity back. We do so by comparing it with established theoretical approaches to explain the disruptive and cumulative effects of innovation and the existence of EU innovation clubs. In addition, we provide ways to understand what are the technological and institutional fundamentals —as framed in the innovation systems literature (Freeman, 1987; Lundvall, 1992; Nelson, 1993)— that constitute the ‘diverse development trajectories’ characterising different European macro-regions, and which may drive inequalities and make them persistent.

In particular, we use micro-aggregated, country-level data on innovation inputs, institutions, and innovation performance, to identify latent innovation theories. Taking a data-driven approach, our main research question is: which innovation metrics across countries can be associated to different innovation theories? With our answer, we suggest plausible dominant sectoral and technological regimes (Pavitt, 1984).

We find that cross-country comparable innovation survey data can be structured in remarkably well-defined innovation theories. We distinguish four: (i) the ‘Network-Innovation-System’ approach characterised by interactions between public and private organisations, stronger in process innovations; (ii) a ‘Kaldorian’ theory, characterised by a local/regional cumulative, productivity-enhancing process driven by local effective demand; (iii) a ‘New Growth Theory’, where large firms with a concentration of factor accumulation and product innovations dominate; and (iv) a ‘Schumpeterian’ theory, driven by in-house R &D investments and high shares of patenting firms.

By means of a hierarchical clustering technique, we identify five clusters of countries’ innovation clubs, with strengths and weaknesses in relation to the four theories. Some of these are at odds not only with the established narrative of North–South and East–West divide, but also with the traditional prescriptions from the different innovation theories.

Besides confirming the well-known core-periphery structure in the EU innovation system, we observe that some of the peripheries are functional to the ‘consolidated core’ of innovative countries, raising an issue of long-term sustainability of EU innovation hierarchies.

We also find that even the most innovative clusters, according to all four innovation theories, show some unexpected weaknesses. For instance, the strongest cluster in terms of innovation system does not have a solid performance in terms of radical product innovations. Rather, the leading cluster in terms of turnover from product innovations new to the market is strongly dependent on external sourcing, mainly includes scale-intensive sectors (Pavitt, 1984), and is based on a fairly weak innovation system. In addition, the periphery of small countries that show a healthy network structure, do so because they they mainly include supplier-dominated firms, reliant on innovation inputs from the core.

By looking at the micro-level sources of the European country ‘clubs’, our findings ground the presence of a new European core-periphery, and add to the most recent literature to empirically ground IS approaches (Cirillo et al., 2019; Fagerberg & Srholec, 2008), taking into account the ‘goodness of fit’ of IS approaches amongst alternative innovation theories.

In sum, while EU peripheries persist, also the core innovation ‘clubs’ do not show textbook innovation performances across theoretical approaches, each of them having its own ‘dark side’. In this context, which risks to endanger traditional EU cohesion policies, our paper offers fine-grained empirical evidence to disentangle the underpinning components explaining the existence of EU clubs.

The rest of the paper is structured as follows. Section 2 highlights in detail our main contribution to the relevant literature. We then describe the dataset and data preparation procedures in Sect. 3. Section 4 provides an initial map of EU clusters. We then perform an exploratory factor analysis to identify latent innovation theories in Sect. 5, which are then used to characterise, in Sect. 6, the map of EU innovation clubs. Section 7 concludes.

2 Background and contribution

Amongst different perspectives on innovation and technological change, at least four approaches seem to stand out. From a Neoclassical perspective, New Growth Theory (NG, hereinafter) posits an equilibrium growth path in which the introduction of R &D-induced radical product innovations overcomes decreasing returns to factor accumulation (see, e.g. Aghion and Howitt, 2009).

Instead, whilst Schumpeterian theories predict that knowledge-augmenting investments — such as in-house R &D — would positively affect both innovation outputs (e.g. patents) and economic performance (e.g labour productivity), they contemplate the possibility of persistent out-of-equilibrium dynamics as the growth process unfolds (Nelson and Winter, 2002, p. 40).

Focusing on demand-induced mechanisms, Kaldorian theories emphasise the role of investment, effective demand and the size of destination markets in favouring a virtuous, cumulative process between (innovation) investments, labour productivity and further investments (Kaldor, 1966).

Finally, one of the most established approaches in innovation studies is based on the concept of (national) innovation system (IS). Albeit not a fully fledged theory (Edler & Fagerberg, 2017), innovation system approaches have helped pinning down the complexity of the innovation process by considering the institutional context; the variety of actors involved in the innovation process; the type of investments and cooperation that innovation entails; the potential barriers and bottlenecks, and the role of public policy to mitigate these.

The IS approach posits that a wide set of national characteristics — beyond the obvious size, population and per-capita GDP — are relevant to explain national differences in science, technology, innovation and, ultimately, their economic performance. More specifically, the core components of an IS are:

-

1.

the private organisations responsible for the applications of basic science and creation of knowledge and at firm and sectoral levels;

-

2.

the scientific and technological public infrastructures, such as research centres, universities and higher education institutions;

-

3.

the battery of instruments used by the government to fund and support both of the above, such as public procurement, grants, subsidies to firms and R &D tax credits;

-

4.

the nature and intensity of links between private and public actors aimed at increasing scientific and technological capabilities.

The IS approach lends itself to make sense of the complexity of innovation, precisely thanks to its all-encompassing nature. Yet, it is this very same nature that makes it quite difficult to be captured empirically, in the absence of a rigorous theoretical grounding. This is certainly so, when compared to alternative innovation theories, such as NG theory, whose empirical propositions may be more straightforwardly tested (based on a linear relation between inputs, e.g. capital, R &D investments, and outputs, in terms of certain economic performance indicators).

Despite difficulties to capture it empirically, the IS approach has long informed research and policy makers on the sources and nature of countries’ differences in science and innovation performance, public support to science and economic outcomes (Soete et al., 2010; Cirillo et al., 2019). It has proven useful to ‘appreciatively’ complement alternative theories, including the growth literature on technology clubs and countries’ divergences due to catching-up processes in science and technology performance (see Nelson, 2006; Lundvall, 2007; Castellacci, 2008; Castellacci and Archibugi, 2008; Fagerberg and Srholec, 2008, among others). Arguably, it would be advisable from a policy perspective, that innovation theories are able to explain the presence of peripheries, and suggest normative interventions to help them upgrade.

In this regard, our paper builds on the effort by Iammarino et al. (2019), to systematise and assess extant innovation theories in terms of whether and how well they are able to make sense of the (several) EU macro-regional divides. In particular, our empirical exercise complements the evidence shown in Shrolec and Verspagen (2008) and Cirillo et al. (2019) and offers a two-fold contribution.

First, we empirically unveil latent innovation theories, based on an Exploratory Factor Analysis performed on the Eurostat Community Innovation Survey 2014 (CIS2014) micro-aggregated data. We are able to identify, besides the established IS approach, denominated Network-Innovation System, the Kaldorian theory, the New-Growth Theory and the Schumpeterian theory, each synthesised by an emerging factor. Although it is outside the aims and scope of this work to test competing theories, we are still able to hint at whether different innovation theories may capture the large variety of innovation performances in the EU.

Second, we provide a novel, empirically grounded map of innovation clubs in Europe, associated to one or more of the latent innovation theories mentioned above. The aim is to comparatively advance our ‘appreciative theorising’ of innovation asymmetries across countries by empirically deriving the composite dimensions of the innovation system, including firms’ behaviour and performance, as well as the complex network of actors that firms interact with and respond to, such as public local and national government, public and private research.

To our knowledge, the analysis provided here is the first of its kind to intertwine the identification of EU innovation clubs — using hierarchical clustering — with the articulation of ‘latent’ innovation theories — using exploratory factor analysis. This allows us to appreciatively asses the explanatory power of alternative innovation theories, on the basis of the existing clubs.

We find that some of the theories can only make sense of the performance of a small sample of (hyper-performing) countries and are therefore not particularly fit to explain the presence of peripheries (and its persistence). Some theories, instead, would predict a high performance — based for instance on certain public interventions — which does not emerge from our analysis.

In sum, this evidence shows that a thorough reflection is needed on the extent to which the conditional, country-specific factors, might make even a ‘textbook’ innovation policy ineffective.

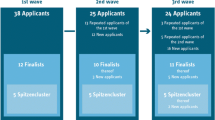

3 Dataset: Community Innovation Survey 2014 (CIS2014)

We use the publicly available micro-aggregated version of Eurostat Community Innovation Survey, 2014 edition (CIS, hereinafter).Footnote 1

The CIS is a firm-level survey executed at a national scale, which collects data on several dimensions of innovative activity and outcomes. The unit of analysis considered is the enterprise with 10 or more employees enrolled (in most cases) in the official statistical business register of each country. To ensure cross-country comparability, the survey is carried out by means of a standard questionnaire, based on the definitions and underlying methodology included in the well-known Oslo manual for collecting and interpreting innovation data (OECD & EUROSTAT, 2005).

The survey is performed every two years, covering the 28 EU member states and some additional countries.Footnote 2 Most statistics refer to the 3-year reference period 2012–2014, even though some indicators specifically correspond to 2012 and/or 2014.

Rather than using a firm-level dataset, we use micro-aggregated CIS results (i.e. data that have been aggregated across firms within each country, innovation type, economic activity and size class combination). This choice is dictated by a number of reasons.

First, European innovation statistics generally use aggregated national data.Footnote 3 By using micro-aggregated data we provide a novel, and more fine-grained picture than the use of traditional country-level indicators would allow.

Second, in the process of consolidating firm-level observations, national statistical institutes extrapolate collected data, by means of appropriate weighting schemes, in order to get population totals. As a consequence, official micro-aggregated data deal with the issue of sample size heterogeneity across countries.

Third, it should be borne in mind that individual firms cannot be followed from one CIS wave to another, which implies that micro-data cannot be treated as a panel across sequential CIS editions.

Fourth, focusing on micro-aggregated results allows us to obtain variables measuring both the proportion of firms that engage in innovation activity, cooperation, receive public funding or achieve a certain outcome,Footnote 4 as well as the intensity with which firms perform those tasks (e.g. the value of R &D expenditure). This is crucial as CIS firm-level studies mostly rely on binary or Likert-scale variables, as innovative expenditure data by type is aggregated (due to confidentiality issues), preventing its use in empirical studies (Shrolec & Verspagen, 2008).

Eurostat performs no imputation for missing firm-level data. In general, this implies a trade-off between country availability and the breadth of variables considered in empirical analyses (see, for example, the discussion in Shrolec and Verspagen, 2008, p. 12). Given that our aim is to have the widest possible country coverage, we have estimated missing values at the micro-aggregated level.Footnote 5

We considered 24 European countries for which data gaps made the missing-data imputation process parsimonious.Footnote 6 As a result, we obtained a working dataset consisting of 22 variables across 24 countries.

The 22 variables considered provide information on the expenditures, ownership structure, knowledge acquisition, sources of cooperation links, public funding/procurement, protection mechanisms (patents), average firm size and productivity in relation to innovation activities and outcomes.

We aim to articulate these variables into four dimensions that characterise an IS: (i) innovation inputs and demand sources, (ii) the type of cooperation links, (iii) government role and public sector policies, and (iv) innovation outputs. Table 1 reports a dictionary of the 22 variables we have used. Each row corresponds to a variable and includes a code label used throughout the paper, the firm type which it refers to, a short description and its unit of measurement.

The CIS covers both inputs/strategies (e.g. implementation, adoption) and outputs/effects (e.g. successful, ongoing or abandoned) of innovative activities. Moreover, the CIS organises data collection according to the type of innovation activity that firms declare to be engaged in (product, process, organisational and marketing innovation). The variables that feed into our data reduction procedures are (almost exclusively) limited to product and process innovation (i.e. technological innovation),Footnote 7 even though we consider some variables that correspond to the entire subset of innovative firms,Footnote 8 as well as some referring to the total universe of firms.Footnote 9 Note that we have chosen the indicator-per-firm-type which maximises the number of observations across countries, conditioned therefore to data availability.

4 Innovation ‘clubs’ in the EU through hierarchical clustering

Our starting point is a multivariate sample of observations for 22 variables across 24 countries covering a variety of aspects of the innovation process, as captured by the CIS. A first aim is, without imposing any a priori constraint, to identify a set of mutually exclusive homogeneous country groups, i.e. clusters, based on (relatively) similar within-group values when considering all variables jointly. To do so, we apply a data-driven, agglomerative hierarchical clustering technique (Everitt and Hothorn, 2011, p. 166) to obtain innovation ‘clubs’ in the EU.

Intuitively, if we had only two dimensions by which to compare countries, e.g. R &D expenditure and labour productivity, the problem would be relatively straightforward to visualise: groups would be identified by drawing lines across a two-dimensional scatter-plot separating different ‘clouds’ of dots, each dot representing a country along those two dimensions.

However, considering \(q=22\) dimensions simultaneously requires to refine both the assessment of the relative distance between q-dimensional (data) points, as well as the procedure to merge countries into groups.

To compute the distance between country i and j across the q variables, we use the Euclidean distance. And given that some of our variables in Table 1 differ in their unit of measurement, we standarise each of them before computing bilateral country distances:

where \({\bar{x}}_{r}\) and \(s_{r}\) are the cross-country sample average and standard deviation, respectively, for variable \(r=1,\dots ,q\).

As an outcome, the obtained symmetric bilateral country distance matrix \(\varvec{D}=[d_{ij}]\) is used to merge countries into groups. Starting from a set of \(n=24\) clusters (each representing a different country), the agglomerative algorithm merges the nearest pair of distinct clusters into a new group, iteratively repeating the process until only one group (containing all countries) is obtained.

While the bilateral distance between two countries is given by (1), the distance between any two country groups will be given by the distance between those two countries — one in each group — which are more dissimilar between them:

where A and B are country groups. The clustering rule given by (2) is known as complete linkage (or farthest neighbour) clustering (Everitt and Hothorn, 2011, p. 167). Intuitively, country groups will be merged in this case when the most distant pair of countries between two groups are still relatively closer than with respect to any other group.

Applying this iterative algorithm leads to a hierarchical structure known as dendrogram, in which countries have been successively merged into non-overlapping subsets. Figure 1 reports the resulting dendrogram in our case.

The dashed circle in Fig. 1 ‘cuts’ the dendrogram into five clusters (numbered 1–5). Cluster 1 includes three Nordic countries — Norway (NO), Sweden (SE) and Finland (FI) — as well as Austria (AT) and Belgium (BE). Cluster 2 includes the two largest countries of the EU, Germany (DE) and France (FR), as well as the Netherlands (NL) and Denmark (DK). Cluster 3 comprises Italy (IT) and Spain (ES), together with Czechia (CZ) and Hungary (HU). Cluster 4 is composed by a large set of relatively small EU countries: Greece (EL), Cyprus (CY), Croatia (HR), Lithuania (LT), Estonia (EE), as well as Portugal (PT) and Slovenia (SI). Finally, cluster 5 comprises four Central-Eastern European (CEE, hereinafter) countries: Romania (RO), Poland (PL), Bulgaria (BG) and Latvia (LV).

At this point, cluster numbers have been allocated without a specific criterion in mind. In fact, while the clustering procedure has allowed us to identify five country subsets, how should we compare cluster-average values for all 22 variables? By performing an exploratory factor analysis, in the next section we organise variables into conceptual subsets, allowing us to intertwine cluster-average values with variable groups, in order to understand differences in the innovation profiles across EU innovation clubs.

5 Latent innovation theories through exploratory factor analysis

5.1 Method

We use exploratory factor analysis (EFA, hereinafter) to identify (latent) common factors that best describe the differences across innovation clubs identified in Sect. 4. As will be seen below, each factor identified may be associated to an alternative theoretical perspective on innovation and technical change.

EFA is a statistical data reduction technique which allows us to combine and summarise groups of observed variables according to their covariances. Essentially, it uncovers the way in which these variables form coherent subsets. The underlying rationale behind the method is to formulate a linear probability model with specific moment constraints such that the observed covariances between the observed variables can be explained by the relationship of these variables with the (common) latent factors. Essentially, the k-factor model for q observed variables and k latent factors can be formulated as:

where, in our context, the variable \(x_i\), which measures an observable characteristic of innovative activity (e.g. share of in-house R &D expenditure), is linked to a linear combination of (unobserved) latent factors \(c_i\) and randomly disturbed by the term \(u_i\).

By assuming that:

-

(i)

Random disturbances \(u_i\) are uncorrelated with each other:

$$\text {Cov}(u_i, u_s)=0,\quad \forall i,s=1,\dots ,q;$$ -

(ii)

Random disturbances \(u_i\) are uncorrelated with latent factors \(f_j\):

$$\text {Cov}(u_i, f_j)=0,\quad \forall i=1,\dots ,q\text { and } \forall j=1,\dots ,k;$$ -

(iii)

Factors \(f_j\) are uncorrelated with each otherFootnote 10:

$$\text {Cov}(f_j, f_r)=0,\quad \forall j,r=1,\dots ,k;$$ -

(iv)

Factors are standardisedFootnote 11:

$$\text {E}(f_j)=0, \text {V}(f_j)=1,\quad \forall j=1,\dots ,k.$$

we obtain the essential result that:

i.e. the covariance amongst observed variables \(x_i\) and \(x_s\) depends exclusively on the connection between the variables and the k common factors (coefficients \(\lambda _{i1}, \dots , \lambda _{ik}\) for \(x_i\) and \(\lambda _{s1}, \dots , \lambda _{sk}\) for \(x_s\)).

The formulation of the problem (3)–(4) under assumptions (i)–(iv) implies that coefficients \(\lambda _{i1}, \dots , \lambda _{ik}\) are regression coefficients of \(x_i\) on the factors \(f_1,\dots ,f_k\). Such coefficients are labelled factor loadings and quantify the correlations between the observed variables and the factors, i.e. coefficient \(\lambda _{ij}\) quantifies the correlation between variable \(x_i\) and factor \(f_j\). When jointly considered, the k-factor model may be compactly expressed as:

where:

Crucially, the assumptions above imply that the population covariance matrix of the original variables is given by:

where \(\varvec{\sigma }_u=\text {diag}[\text {V}(u_i)]\) is a diagonal matrix with the variances of the variable-specific random disturbances \(u_i\).

Thus, the estimation problem of interest is to find point estimates \(\widehat{\varvec{\Lambda }}\) and \(\widehat{\varvec{\sigma }}_u\) such that the sample covariance matrix \(\varvec{S}\) of the (manifest) variables can be approximately written as:

i.e. to obtain a predicted covariance matrix that resembles the sample covariance matrix of the manifest variables.Footnote 12

But in order to estimate \(\widehat{\varvec{\Lambda }}\) we need to decide on its number of columns, i.e. the number of factors k. In fact, solutions with k and \(k+1\) factors will produce a different set of factor loadings altogether. A solution with not enough factors will have too many high factor loadings associated to each of them, whereas a solution with an excess of factors may render difficult the conceptual interpretation (i.e. finding a meaning through combining subsets of the original variables).

Alternative approaches to determine k involve, amongst others, the Kaiser (1960, p. 145) criterion to keep as many factors as there are eigenvalues of the sample correlation matrix greater than 1, as well as an inferential procedure based on iteratively incrementing k by one and performing a hypothesis test (Everitt & Hothorn, 2011, p. 143). However, something frequently overlooked by the literature is that these procedures generally provide an upper bound for k (Everitt and Hothorn, 2011, p. 155). In fact, the choice of k may be done by starting from \(k=1\) and iteratively increasing its value up until the upper bound is reached; in each step assessing which configuration provides a convincing interpretation and discrepancies between the actual sample correlation matrix — \(\varvec{S}\) in (7) — and the predicted one — \(\widehat{\varvec{\Lambda }}\widehat{\varvec{\Lambda }}^{\scriptscriptstyle {T}}+\widehat{\varvec{\sigma }}_u\) in (7) — are contained.

A further element to be considered is that factor analysis accounts only for the variation in the observed variables shared through the common factors. The focus is on the estimates \({\hat{\lambda }}_{ij}\) of regression coefficients \(\lambda _{ij}\).Footnote 13 We are not accounting for the entire variance of the observed variables.Footnote 14

We perform an EFA involving all variables in Table 1. In particular, we fit a k-factor model — as specified in (5) — to a sample of multivariate observations for the 24 countries.Footnote 15

To obtain the point estimates of the matrix of factor loadings \(\varvec{\Lambda }\) in (5) we apply maximum likelihood (ML), which is a scale-free estimation method (Timm, 2002, p. 504).Footnote 16 As a data preparation procedure, we standardise all data points by subtracting the sample mean and dividing by the standard deviation for each original variable.Footnote 17

After having obtained the point estimates, we adjust factor loadings applying the oblimin ‘rotation’, which is an oblique transformation that allows for correlation between factors (rather than imposing an orthogonal rotation).Footnote 18 Adopting this transformation implies that our solution now consists of three matrices:

where \(\widehat{\varvec{\Gamma }}\) is the structure matrix, \(\widehat{\varvec{\Lambda }}^{*}\) the pattern (loadings) matrix, and \(\widehat{\varvec{\Phi }}\) the factor intercorrelation matrix. Essentially, elements of \(\widehat{\varvec{\Gamma }}\) provide the correlation coefficients between the latent factors and the observed variables, elements of \(\widehat{\varvec{\Lambda }}^{*}\) are the regression coefficients that, multiplied by (transformed) factors, give us the observed variables, and elements of \(\widehat{\varvec{\Phi }}\) quantify the correlation between factors.Footnote 19

We interpret the fitted model results on the basis of matrix \(\widehat{\varvec{\Lambda }}^{*}=[{\hat{\lambda }}_{ij}^{*}]\). A high factor loading coefficient \({\hat{\lambda }}_{ij}^{*}\) indicates that, for a given correlation structure between factors, the observed variable \(x_i\) has a high (linear) association with factor \(f_j\), so we say that variable \(x_i\) ‘shapes’ factor \(f_j\). We group variables \(i=1,\dots ,q\) into subsets according to how their corresponding factor loading coefficients shape different factors. The oblimin transformation produces a simple pattern matrix that allows to unambiguously allocate each observed variable to one of the factors identified (in most cases). This way, factors are defined on the basis of their constituting elements. The label attributed to each factor mirrors our interpretation of the relative importance of the variables that shape it.

5.2 How factors fit different innovation theories

Table 2 reports the results of applying EFA to our dataset. Starting from \(k=1\) and iteratively increasing the number of factors by one, we found that \(k=4\) factors provide a parsimonious articulation of the 22 variables.Footnote 20 Panel (A) reports the point estimates \({\hat{\lambda }}_{ij}^{*}\), arranged as a 22 \(\times\) 4 matrix. Variables along rows are displayed in four blocks, each corresponding to a factor (i.e. column) to which they have been allocated, according to their factor loadings.

Interestingly, the variable subset allocated to each factor provides a quantitative description which may be associated to an alternative theoretical perspective on innovation and technical change.

The first factor in Panel (A) of Table 2 features variables that indicate relational aspects of innovation activities, thus it has been labelled ‘Network-Innovation-System’ (IS, hereinafter) factor. It comprises variables capturing cooperation links with suppliers and with other firms within the enterprise group, as well as with higher education institutions and governmental research institutes. It also includes procurement policies by domestic and foreign governments and the share of firms whose largest market is the EU (rather than local/regional/national markets). The output indicator with the highest positive loading for this factor is process innovation in production.

The ‘innovation systems’ approach particularly emphasises “the network of institutions in the public and private sectors whose activities and interactions initiate, import, and diffuse new technologies” (Freeman, 1987, p. 1). Thus, by loading particularly high onto cooperation links, this factor captures cross-country variation in this theoretical dimension of the innovation process. Moreover, by including the share of firms which are part of an enterprise group, foreign procurement and the EU as the largest market, the degree of internationalisation is also captured. Notably, the IS factor explains 28% of the total variance in the correlation structure between variables.

The second factor in Panel (A) of Table 2 has been labelled ‘Kaldorian’ (KA, hereinafter) factor. It suggests a local/regional cumulative process between funding and largest market source, with a labour productivity proxy (i.e. turnover per employee) as output indicator. The combination of: (i) the virtuous circle between local innovation funding and local demand absorbing the largest share of firms’ output and (ii) higher productivity levels, may be interpreted under the theoretical lens of the Keynesian principle of effective demand coupled with Verdoorn’s Law (Kaldor, 1966, p. 306): local/regional demand exerts a positive influence on labour productivity, and funding injections by local authorities trigger income creation that is channelled towards local/regional markets.

The local/regional emphasis of this factor is made clear when looking at the EU funding variable, which has a sharply negative factor loading, implying a negative correlation between the share of firms receiving EU funding and the other variables that characterise this factor. On the one hand, this suggests a substitutability between local/regional and EU funding whereas, on the other, it points to the fact that EU funds are addressed precisely to countries lagging behind in terms of labour productivity, which is in line with an EU funding policy aiming at cross-country convergence. Note that the KA factor explains 20% of the total variance in the correlation structure between variables.

The third factor in Panel (A) of Table 2 has been labelled ‘New-Growth-Theory’ factor (NG). It comprises total innovation expenditures per firm, the share of external R &D, average firm size (in terms of employees) and turnover per firm from product innovations that are new to the market. In particular, the endogenous growth paradigm developed by Aghion and Howitt (2009, p. 15) may aid in interpreting the variables composing this factor.

Within the baseline presentation (Aghion & Howitt, 2009, pp. 85–90), growth through ‘drastic’ (intermediate) product innovations is characterised by a higher rate of firm turnover associated to entry/exit with a monopolistic market structure. In this setup, “the more the entrepreneur spends on research, the more likely she is to innovate” (Aghion & Howitt, 2009, p. 88), motivating the connection between total innovation expenditures and turnover from product innovations. Instead, the share of external R &D captures the fact that research activities are excludable, so innovators are remunerated for pursuing them, and firms may outsource the R &D process in view of accumulating the factor input which leads to product innovations. The NG factor explains 11% of the total variance in the correlation structure between variables.

Finally, the fourth factor in Panel (A) of Table 2 has been labelled ‘Schumpeterian’ factor (SC, hereinafter). It includes the share of in-house R &D, the proportion of manufacturing-to-total R &D and the share of firms applying for a patent. As noted by Freeman (1979, p. 209), the dependence of technical change on scientific developments is particularly relevant in manufacturing industries such as chemicals and electronics, whilst “strong in-house R and D [...] will usually be needed to convert the first awareness of the new potential into a competitive advantage” (Freeman, 1979, p. 211), reflected in patenting activity. Hence, this fourth factor comprises variables highlighted by the evolutionary tradition inspired by Schumpeterian insights, and it explains 13% of the total variance in the correlation structure between variables.

It is important to note that while each variable has been allocated to only one factor, some of them load relatively high onto another factors, enriching their conceptual interpretation.

For example, the negative loading of employees per firm onto the Kaldorian factor — in contrast with its high and positive loading onto the New-Growth-Theory factor — suggests strong differences in the average firm size that characterises each factor: small and medium-sized firms in the former vis-à-vis relatively larger firms in the latter.

Interestingly, process innovation in production has a sharp negative loading onto the New-Growth-Theory factor, whose main output variable is turnover from product innovation, suggesting that process and product innovation do not share complementary mechanisms, rather quite the opposite: the network structure of cooperation links coupled with procurement and internationalisation — characterising the Network-Innovation-System factor — seems conducive to process innovation; whereas the accumulation (also through outsourcing) of innovation expenditures — characterising the New-Growth-Theory factor — seems instead conducive to product innovations.

Finally, cooperation links with universities has also a high positive loading onto the Schumpeterian factor, evincing the role of knowledge creation and diffusion through higher education institutions in science-based innovation, which characterises the evolutionary approach.

Before proceeding, it is important to be mindful of some of the limitations of exploratory factor analysis (EFA). First, the central role played by latent variables and second, the lack of uniqueness of factor loadings. As regards the former, while a factor is operationally defined by its loadings, the labels we allocate to factors reflect our interpretation of the partition of variables into subsets. But since factors cannot be directly measured, their existence is open to question. As regards the second point, it may be shown (Everitt & Hothorn, 2011, p. 143) that there is no unique solution for \(\varvec{\Lambda }\) in (5), i.e., the factor loading matrix. Depending on the factor rotation method, the description of the solution (though not its overall structure) will change.

The application of EFA led to the partition of the set of 22 original variables into 4 subsets associated to different factors. These subsets suggest alternative interpretations for each factor, according to a theory of innovation and technical change. Therefore, by combining the partition of countries into clusters — in Sect. 4 — with the articulation of variables into factors, the study of cluster-average values for each variable becomes a performance comparison of EU innovation clubs across different innovation theories, which we explore in the next section.

6 Innovation clubs seen through latent theories: The dark sides of innovation in Europe

Table 3 reports, for each innovation theory (i.e., each factor), the average value of variables in Table 1 for each of the five clusters identified in Sect. 4. Based on these values, we can compare how each of the five identified clusters fares with respect to each theory and, more in detail, in relation to each of the underlying variables.

For ease of comparison, Panel (B) in Table 3 reports — for each variable — the ratio between cluster-average values and the average across clusters (as well as the coefficient of variation in parenthesis). Values above (below) one identify variables/theories for which the cluster scores above (below) the average. The heat map helps distinguishing variables/theories in which clusters score close to the average (yellow) from those where they score above (green) or below (red).

The first thing to note is that the clusters identified in Fig. 1 of Sect. 4 have been labelled (1)–(5) in correspondence to their overall innovation performance, across all theories: starting from the best performing first cluster (Nordic model) to the most laggard country group, i.e. the fifth cluster (CEE factories).

The Nordic model cluster (comprising Austria, Belgium, Finland, Norway and Sweden), on average, scores highest across all theories, with the exception of the New-Growth-Theory factor. Its countries achieve the highest relative patenting ratio — with 6.38% of its firms applying for patents — and scores approximately twice the average on most variables that define the Network-Innovation-System factor. These are countries with a particularly cohesive innovation system, with strong cooperation with suppliers and research organisations, strong ties with enterprise groups (especially Belgium, Norway and Sweden), high shares of public procurement, both domestic and foreign, and high levels of funding from the central government (with the exception of Sweden).Footnote 21 Another theory on which they score on top of other clusters is the Kaldorian factor. These countries rely on substantial funding from local/regional government, as well as on local/regional demand sources, evincing a cumulative productivity-enhancing circuit between local expenditure and income.

The top performing cluster of small Nordic innovative countries has one “blind spot”, though. Although they have the highest patenting and incremental process innovation rates (hosting the most productive firms, in terms of average turnover per employee), their average firm turnover from radical product innovations tends to be below average, even in comparison to clusters that score below on all other variables and theories.

The New-Growth-Theory model, instead, fits the two next clusters – (2) and (3) in Table 3. Cluster (2) is the EU “consolidated core” of innovators (Denmark, France, Germany and the Netherlands), rating highest in total innovation expenditures (including intra and extra mural R &D), and with a patenting score similar to that of the Nordic model cluster discussed above. With respect to the first cluster, while it does not score as high across variables, it emerges as more ‘balanced’ across theories.

For the consolidated EU core, Network-Innovation-System indicators are (in almost all cases) above average, and the cluster experiences a virtuous Kaldorian circle between local/regional innovation funding, demand and labour productivity. Moreover, countries fit squarely with the Schumpeterian theory and, as previously mentioned, they excel in the New-Growth-Theory model, leading to a high turnover from radical product innovations – with the only exception of Germany, which is most competitive within the Schumpeterian model, having the highest patenting rate across all EU countries.

The results suggest that countries in this cluster host different types of firms, though science-based firms (Pavitt, 1984) seem to be prominent. These are firms of relative large size, whose main source of technology is internal and based on sourcing from external R &D labs, whose demand is particularly sensitive to innovative performance (e.g. electronics and pharmaceuticals), that focus on both product and process innovations and whose means of appropriation range from (R &D) know-how, process secrecy and patents. Overall, this second cluster is the highest scoring and the most balanced, and performing consistently high against the four innovation theories identified in the exploratory factor analysis of Sect. 5.

Cluster (3) in Table 3 (comprising Czechia, Hungary, Italy and Spain) may be considered as the innovative periphery within the EU. It excels in terms of average firm turnover from product innovations new to the market, for a similar average firm size but considerably lower innovation expenditures than average. If we were to focus on this output indicator of the New-Growth-Theory factor, we would consider EU’s innovative periphery as quite successful.

However, such innovative performance hides a substantially more dismal picture. First, contrary to the consolidated core, the New-Growth-Theory model behind such peripheral innovative performance is not as virtuous. Their radical product innovations are associated to factor accumulation and external acquisition of R &D. Low patenting activity make these countries’ performance quite weak in terms of the Schumpeterian approach, even if their sectoral R &D composition privileges manufacturing industries.

Second, and possibly more problematic, is the finding that the innovative dynamics characterising this cluster does not rely on a healthy innovation system. With the exception of Czechia, countries on this cluster score far below average on all networking and collaboration indicators (with the exception of the access to the EU market, which is another signal of a dominant traditional large manufacturing sector).

Third, the cluster seems to be split with regard to virtuous local Kaldorian dynamics. While Italy and Spain evince a clear above-average pattern of local/regional innovation funding-cum-largest demand source, a weak performance is observed for Czechia and Hungary. This asymmetry probably relates to these countries’ different institutional configuration and background: the former have experienced a process of accelerated growth within the Golden Age of Capitalism (1945–1970s) — albeit if at different times — whereas the latter had been centrally planned economies up until the 1990s.

Thus, the comparative innovative profile just described suggests that firms from countries in this third cluster are specialised in scale-intensive traditional manufacturing (continuous process, large-scale assembling) industries (Pavitt, 1984). With the exception of Italy, these countries exhibit firms of relatively large size, whose main source of technology is external R &D, whose demand is particular sensitive to price and changes in the product design (e.g. automotive and consumer durables), and whose means of appropriating innovation benefits is process secrecy, technical lags, firm-specific skills and dynamic learning economies in continuous production processes (Pavitt, 1984, p. 362).

The fourth cluster of peripheral suppliers in Table 3 (including Cyprus, Croatia, Estonia, Greece, Lithuania, Portugal and Slovenia) turns the third cluster upside down. Contrary to the latter, it scores lowest in terms of turnover from product innovations new to the market, and in general does not fit within the logic of a New-Growth-Theory model. However, it does not score substantially below average in terms of the Network-Innovation-System theory, especially for some of its constituent countries, such as Lithuania, Slovenia and Portugal. These latter two countries score close to average also for those variables composing the Schumpeterian factor.

Overall, though, in terms of innovation outputs, countries in the fourth cluster tend to score below average across all indicators except for the share of firms introducing process innovations in production. Thus, despite its relatively good performance in relation to the Network-Innovation-System factor, the position of these countries is not at the core of innovation, but within the periphery. The fact that most countries of the cluster score above average in variables such as cooperation with suppliers, procurement and access to the EU market suggests that they perform a role of peripheral suppliers for core economies and (some of the) innovative peripheries in clusters (1)–(3) of Table 3.

Firms in countries of cluster (4) seem to pertain mainly to the supplier dominated type within the Pavitt (1984) taxonomy. These are relatively small firms, whose main source of technology is (mostly foreign) providers of material and equipment, whose demand is particularly sensitive to price (e.g. traditional manufacturing sectors, agriculture and construction), focus on (cost-cutting) process innovations and whose means to appropriate innovation benefits are non-technical (e.g. trademarks and design).

The last (fifth) cluster in Table 3 is composed of low-wage large factories in Eastern European Countries (Bulgaria, Latvia, Poland and Romania). These countries host the largest firms (in terms of employees) of the whole sample, and score markedly below average across all innovation output indicators, and across all innovation theories, with the exception of Poland and Romania who have a close to average labour productivity. Most firms in these countries may be included in the supplier-dominated and scale-intensive classes of the Pavitt (1984) taxonomy.

The emerging picture of EU innovation clubs (that is, innovation performance across clusters) uncovers a number of problems, that are the measure of the several shades of darkness in terms of uneven development resulting from innovation.

First, cohesion. Although this problem is well known, our analysis illustrates the implications of the core-periphery structure of international production in the EU, in which “CEE countries are usually located further downstream in global value chains than their euro area partners. They typically import industrial equipment and higher value-added components from euro area countries, which they then use to produce additional components and assemble intermediate goods or final products” (ECB, 2013, pp. 17–8).Footnote 22 Thus, while the EU consolidated core — cluster (2) — is the most balanced, it still relies on the CEE (low-wage) factories — cluster (5) — and, in part, on the innovative periphery (Czechia and Hungary) — cluster (3). Neither of these two latter clusters seem to greatly benefit from this core-periphery relationship in terms of innovative performance.

Second, the peripheral small countries in cluster (4), with an above average score in selected variables of the Network-Innovation-System model and second-highest rate of process innovation is, mainly, dominated by suppliers. While a more detailed panel of micro-data would help us assess the extent to which these countries benefit from these supplier-dominated type of core-periphery relationships, the fact remains that their country-level innovative performance is well below the EU average. Hence, an innovation system reliant on cooperation links with (technology) suppliers, intensive in public procurement and having the EU as largest market may indeed be conducive to (cost-cutting) process innovations, but may, at the same time, hinder the possibility of a proper catch-up in terms of wider (and necessary) dimensions of innovative performance (such as patent applications, labour productivity and turnover from radical product innovations).

Third, possibly the most controversial, the innovative periphery cluster (3) performs in terms of radical (new to the market) product innovations better than any other cluster, but such innovative performance is not based on a solid innovation system. The performance of the Schumpeterian innovation process is below average (Czechia, Hungary, Spain) or close to average (Italy). Knowledge flows through cooperation links by means of the Network-Innovation-System factor are comparatively lacking (Hungary, Spain, Italy) or close to average (Czechia). A virtuous income-expenditure Kaldorian circle is only present in Italy and Spain. Even the New-Growth-Theory model is based mainly on external, outsourced R &D efforts and on scale-intensive activities. It is difficult to imagine how these countries may sustain their above-average innovative output indicators, if it were not for the reliance on the other clusters to support the innovative effort (external R &D).

Fourth, the Nordic innovative cluster (1), which excels in terms of the Network-Innovation-System, Schumpeterian and Kaldorian factors, does not seem to be able to exploit those investments, collaborations, and strong flows to generate high average firm turnover from radical product innovations, possibly relying for that on other firms within the enterprise group which are located in the EU consolidated core.

Finally, the EU consolidated core — cluster (2) — is balanced and stable, but relies on several peripheries, and on the cohesion of the EU. As noted above, the weakness of some of the other clusters may not guarantee the sustainability of such cohesion in the long run.

7 Conclusion

The aim of this paper was to unpack the theoretical and empirical fundamentals behind EU innovation asymmetries. We provided a map of EU innovation ‘clubs’, and associated their idiosyncratic characteristics to the extent to which they fit different innovation theories.

First, we unveiled the several shades of darkness that innovation leads to, in terms of uneven performance, and the implicit dependency relations amongst different clubs, which makes these asymmetries particularly difficult to level up. Second, we offered an empirically grounded way to ‘appreciatively’ assess the explanatory power of different innovation theories to make sense of the uneven innovation performance and the presence of peripheries. The intended contribution of this paper is directly relevant to policy, as it shows that deriving innovation policy implications based on a single innovation theory might risk overlooking a variety of (other) weaknesses.

Based on the micro-aggregated Eurostat CIS2014 data, we proceeded in a two-step fashion.

First, we applied a hierarchical clustering algorithm to organise distances between countries across 22 innovation variables. Five country groups emerged. The ‘Nordic model’ cluster, which includes Finland, Norway, Sweden alongside Austria and Belgium. The ‘Consolidated core’ including not only Germany, France and the Netherlands, but also Denmark. The ‘Innovative periphery’ comprising Hungary, Czechia, Spain and Italy. The ‘Peripheral suppliers’, including geographically scattered small EU countries as diverse as Slovenia, Croatia, Estonia, Lithuania, Cyprus, Greece and Portugal. Finally, the ‘Central-Eastern European (CEE) Factories’, comprising Bulgaria, Latvia, Poland and Romania.

Second, we applied exploratory factor analysis (EFA) to articulate correlations between variables across the 24 European countries in our sample. We identified four ‘latent’ factors, each related to an alternative theoretical approach to innovation and technical change: the Network-Innovation-System factor (IS), the Kaldorian (KA) factor, the New-Growth-Theory (NG) factor and the Schumpeterian (SC) factor.

In the best of innovation systems tradition, the IS factor shows the dominance of firms cooperating with public research institutes and private actors, but also firms relying on domestic and foreign procurement and highly internationalised.

In line with the Kaldorian tradition, the KA factor fits with a profile of firms supported by regional/local public funds, that trigger a virtuous circle between local effective demand and labour productivity, which in turn makes innovation efforts and economic performance mutually reinforcing.

Based on endogenous growth theory, the NG factor is associated to high R &D expenditures, large firm size and product innovation, whereas the SC factor synthesises an innovation profile based on intramural R &D, intensity of patent applications and dominance of manufacturing firms.

Combining the first and second steps of our empirical strategy, we then characterised cluster profiles according to their performance across theory-based variable subsets. In this way, we analysed EU innovation clubs on the basis of their idiosyncratic score against innovation theories.

A very rich picture emerges, that substantially nuances the North–South and East–West divides, as illustrated at length in the previous section.

Our results speak of the ‘goodness of fit’ of different theoretical approaches to innovation. From a normative perspective, they also tell us whether these theories are able to allow for the presence of peripheries and qualify them. In addition, these results might be revealing as to which theoretical grounding policy should rely upon. For instance, NG fits a small sample of very virtuous countries (the ‘consolidated core’), which also consistently score high across all other theories. They are a benchmark of innovation performance, though they most likely rely on the presence of the peripheral suppliers, as shown also in previous work (Bontadini et al., 2022). Rendering these core-periphery interdependencies explicit and analysing them is an important avenue for further research.

At the same time, NG is fairly misleading for other clusters. For example, despite the relatively high firm turnover from product innovation (flagship of NG), the countries from the ‘innovative periphery’ cluster conceal a less virtuous picture: they rely to a greater extent on R &D acquired externally and have a low incidence of patenting activities. This means that these countries are specialised in scale-intensive manufacturing and are likely to fall (or have fallen) into the ‘middle-income trap’ described for the EU regions in Iammarino et al. (2020), with low prospects (nor potential) for upgrading.

Arguably, it is this ‘under the radar’ under-performance (Iammarino et al., 2020) that is interesting from the policy perspective, particularly when a more cohesive and less polarised EU is at stake. It is not the ‘consolidated core’, which continues to enjoy a stable and consistent leading position in Europe, nor some of the peripheral suppliers or CEE factories, which enjoy EU funding support to catch up and shift from a low to middle ground innovation performance, that might represent a threat to the cohesion policies and the long-term sustainability of EU asymmetries. Rather, it is the (several) different peripheries that, despite a decent innovative performance, struggle to upgrade from a range of supplier-dominated, production-intensive activities to the science-based core. Thus, a ‘handbook-type’ innovative behaviour, even with substantial innovation policy support, might not be enough to get out of this trap.

On this regard, a key policy implication is the need to finetune the articulation between EU research and technological development, innovation and industrial policies to develop a framework which overcomes the dual focus on providing financial aid to a catching-up periphery, on the one hand, and propelling a self-reinforcing core, on the other (Diemer et al., 2022).

Our new taxonomy of EU innovation clubs only confirms the extent of the challenges that the EU cohesion faces. Notwithstanding the substantial and well-directed interventions designed and implemented towards achieving EU cohesion, the presence of uncertain, or unanticipated innovation outcomes might just make them ineffective, when not detrimental in terms of furthering inequality. We hope to spark some much needed reflections on the ‘dark side’ of innovation policy.

Notes

A detailed meta-data description can be found in:http://ec.europa.eu/eurostat/cache/metadata/en/inn_cis9_esms.htm.

The CIS 2014 has been conducted in the following additional countries: Norway, Iceland, Switzerland, Serbia, Macedonia and Turkey.

See Sect. 3.1. Data description’ in Eurostat CIS 2014 meta-data documentation:http://ec.europa.eu/eurostat/cache/metadata/en/inn_cis9_esms.htm.

Variables of this sort are a “ratio between the selected combination of indicator, type of innovators and — in most cases — the total category of the selected type of innovators”, as reported in:http://ec.europa.eu/eurostat/cache/metadata/en/inn_cis9_esms.htm.

Please see Appendix A for details.

The countries considered (with the corresponding ISO2 code) are: Austria (AT), Belgium (BE), Bulgaria (BG), Cyprus (CY), Czechia (CZ), Germany (DE), Denmark (DK), Estonia (EE), Greece (EL), Spain (ES), Finland (FI), France (FR), Croatia (HR), Hungary (HU), Italy (IT), Lithuania (LT), Latvia (LV), Netherlands (NL), Norway (NO), Poland (PL), Portugal (PT), Romania (RO), Sweden (SE) and Slovenia (SI).

In the CIS these firms are labelled ‘INNOACT’: product and process innovative enterprises regardless of organisational and marketing innovation.

In the CIS these firms are labelled ‘INNO’: innovative enterprises.

In the CIS the label used is ‘TOTAL’: total enterprises.

This latter constraint on the cross-moments between factors will be relaxed in our implementation of the setting.

Due to their being unobserved, the scales and locations of factors can be fixed arbitrarily (Everitt and Hothorn, 2011, p. 137).

Note that “factor analysis is essentially unaffected by the rescaling of the variables” (Everitt and Hothorn, 2011, p. 139), so it is essentially equivalent to work with the covariance or correlation matrix.

In fact, the estimate for the variance of the variable-specific disturbance term \({\hat{V}}(u_i)\) is obtained as a residual. This may give rise to Heywood cases: the point estimate of the diagonal terms in \(\widehat{\varvec{\Lambda }}\widehat{\varvec{\Lambda }}^{\scriptscriptstyle {T}}\) may exceed the sample variance of the manifest variable resulting in a negative estimate for \({\hat{V}}(u_i)\) (for details, see 2011).

These two latter features, i.e. number of factors and share of variance accounted for, should be taken into consideration when interpreting results, especially when comparing EFA with other data reduction techniques, such as Principal Component Analysis (PCA).

It has to be borne in mind that including variables that are implicitly contained in other variables should be avoided in factor analysis. For example, consider including a set of variables measuring the percentage of firms engaged in alternative types of innovation cooperation, as well as a variable quantifying firms engaged in any type of cooperation. The latter variable should be excluded, otherwise factors that load highly on cooperation measures will be artificially higher (see e.g. Shrolec & Verspagen, 2008).

Usually, studies using firm-level CIS data avoid the recourse to maximum likelihood factor analysis, due to the fact that binary and Likert-type variables do not conform to the hypothesis of multivariate normality of the underlying data (e.g. Shrolec and Verspagen, 2008). However, unlike in most of the extant literature applying EFA to CIS-like data, we consider continuous variables, making this estimation method particularly fit for our purposes.

Recall that factor analysis is unaffected by the rescaling of the original variables.

The oblimin transformation is particularly apt for solutions obtained with ML. ML imposes a restriction on the diagonal character of \(\varvec{\Lambda }^{\scriptscriptstyle {T}}\varvec{\sigma }_u^{-1}\varvec{\Lambda }\), so an oblique transformation improves the description of the results (Raykov & Marcoulides, 2008, p. 268). Moreover, it has been noted that orthogonal rotations may often lead to biased results (Shrolec & Verspagen, 2008).

The oblimin ‘rotation’ procedure consists in applying a nonsingular transformation matrix \(\varvec{T}\) such that \(\varvec{f}^{*}=\varvec{T}\varvec{f}\) and \(\varvec{\Lambda }^{*}=\varvec{\Lambda }\varvec{T}^{-1}\) in (5). Moreover, the population covariance matrix implied by the model in (6) becomes: \(\varvec{\Sigma }=\varvec{\Lambda }\varvec{\Phi }\varvec{\Lambda }^{\scriptscriptstyle {T}} + \varvec{\sigma }_u\), where \(\varvec{\Phi }\) is the population factor inter-correlation matrix. For details see Timm (2002).

Incidentally, \(k=4\) corresponds to the number of eigenvalues of the sample correlation matrix \(\varvec{S}\) in (7) which are greater than one.

In fact, “At least one-third of CEE countries’ top 15 trade partners in global value chains are from the euro area. Among the euro area countries, Germany is the most important trading partner of CEE countries in global value chains, followed by Italy, France and Austria” (ECB, 2013, pp. 15–6).

References

Abramovitz, M. A. (1986). Catching up, forging ahead and falling behind. Journal of Economic History, 46(2), 385–406.

Aghion, P., & Howitt, P. (2009). The economics of growth. MIT press.

Autor, D., Dorn, D., Katz, L. F., Patterson, C., & Van Reenen, J. (2020). The fall of the labor share and the rise of superstar firms. The Quarterly Journal of Economics, 135(2), 645–709.

Autor, D. H., Katz, L. F., & Kearney, M. S. (2008). Trends in U.S. Wage inequality: Revising the revisionists. Review of Economics and Statistics, 90(2), 300–323.

Bontadini, F., Evangelista, R., Meliciani, V., & Savona, M. (2022). Patterns of integration in global value chains and the changing structure of employment in Europe. Industrial and Corporate Change, 31(3), 811–837.

Castellacci, F. (2008). Technology clubs, technology gaps and growth trajectories. Structural Change and Economic Dynamics, 19(4), 301–314.

Castellacci, F., & Archibugi, D. (2008). The technology clubs: The distribution of knowledge across nations. Research Policy, 37(10), 1659–1673.

Ciarli, T., Meliciani, V., & Savona, M. (2012). Knowledge dynamics, structural change and the geography of business services. Journal of Economic Surveys, 26(3), 445–467.

Ciarli, T., Savona, M., & Thorpe, J. (2020). Innovation for inclusive structural change. In J.-D. Lee, K. Lee, S. Radosevic, D. Meissner, & N. S. Vonortas (Eds.), The challenges of technology and economic catch-up in emerging economies. Oxford University Press.

Cimoli, M., & Porcile, G. (2011). Learning, technological capabilities, and structural dynamics. In J. A. Ocampo & J. Ros (Eds.), The Oxford handbook of Latin American economics. Oxford University Press.

Cirillo, V., Martinelli, A., Nuvolari, A., & Tranchero, M. (2019). Only one way to skin a cat? Heterogeneity and equifinality in European national innovation systems. Research Policy, 48(4), 905–922.

Diemer, A., Iammarino, S., Rodríguez-Pose, A., & Storper, M. (2022). The regional development trap in Europe. Economic Geography.

EC (2015). State of the Innovation Union 2015. European Commission (EC), Luxembourg: Directorate-General for Research and Innovation.

ECB (2013). The role of central and eastern Europe in pan-European and global value chains. European Central Bank (ECB) Monthly Bulletin, June 2013:15–19.

Edler, J., & Fagerberg, J. (2017). Innovation policy: What, why, and how. Oxford Review of Economic Policy, 33(1), 2–23.

Everitt, B., & Hothorn, T. (2011). An introduction to applied multivariate analysis with R. Springer.

Fagerberg, J., & Srholec, M. (2008). National innovation systems, capabilities and economic development. Research Policy, 37(9), 1417–1435.

Freeman, C. (1979). The determinants of innovation: Market demand, technology, and the response to social problems. Futures, 11(3), 206–215.

Freeman, C. (1987). Technology policy and economic performance: Lessons from Japan. Pinter.

Freeman, C. (2002). Continental, national and sub-national innovation systems-complementarity and economic growth. Research Policy, 31(2), 191–211.

Freeman, C., Clark, J., & Soete, L. (1982). Unemployment and technical innovation: A study of long waves and economic development. Pinter.

Iammarino, S., Rodriguez-Pose, A., Storper, M., & Diemer, A. (2020). Falling into the Middle-Income Trap? A Study on the Risk for EU Regions to be Caught in a Middle-Income Trap. Final report, Directorate-General Regional and Urban Policy, European Commission.

Iammarino, S., Rodriguez-Pose, A., & Storper, M. (2019). Regional inequality in Europe: Evidence, theory and policy implications. Journal of Economic Geography, 19(2), 273–298.

Kaiser, H. F. (1960). The application of electronic computers to factor analysis. Educational and Psychological Measurement, 20(1), 141–151.

Kaldor, N. (1966). Causes of the slow rate of economic growth of the United Kingdom. Cambridge University Press.

Krugman, P. (1991). Increasing returns and economic geography. Journal of Polictical Economy, 99(3), 483–499.

Landes, M. (1970). The unbound prometheus: Technological and industrial development in western Europe from 1750 to the present. Cambridge: Cambridge University Press.

Lazonick, W. (1979). Industrial relations and technical change: The case of the self-acting mule. Cambridge Journal of Economics, 3(3), 231–262.

Lee, N., & Rodriguez-Pose, A. (2012). Innovation and spatial inequality in Europe and USA. Journal of Economic Geography, 13(1), 1–22.

List, F. (1841). The National System of Political Economy (1904th ed.). London: Longman.

Lundvall, B. A. (Ed.). (1992). National systems of innovation: Toward a theory of innovation and interactive learning. Pinter.

Lundvall, B. A. (2007). National innovation systems – analytical concept and development tool. Industry and Innovation, 14(1), 95–119.

Milanovic, B. (2016). Global inequality: A new approach for the age of globalization. Harvard University Press.

Mokyr, J. (2007). Knowledge, enlightenment, and the industrial revolution: Reflections on the gifts of Athena. History of Science, 45, 185–196.

Naidu, S., Rodrik, D., & Zucman, G. (2020). Economics after neoliberalism: Introducing the EfIP project. AEA Papers and Proceedings, 110, 366–371.

Nelson, R. (Ed.). (1993). National innovation systems: A comparative analysis. Oxford University Press.

Nelson, R. R. (2006). Reflections on “the simple economics of basic scientific research’’: Looking back and looking forward. Industrial and Corporate Change, 15(6), 903–917.

Nelson, R. R., & Winter, S. G. (2002). Evolutionary theorizing in economics. Journal of Economic Perspectives, 16(2), 23–46.

OECD & EUROSTAT (2005). Oslo Manual: Guidelines for collecting and interpreting innovation data, 3Ed. OECD Publishing.

Pavitt, K. (1984). Sectoral patterns of technical change: Towards a taxonomy and a theory. Research Policy, 13(6), 343–373.

Raykov, T., & Marcoulides, G. A. (2008). An introduction to applied multivariate analysis. Routledge.

Rodríguez-Pose, A. (2018). The revenge of the places that don’t matter (and what to do about it). Cambridge Journal of Regions, Economy and Society, 11(1), 189–209.

Schumpeter, J. A. (1911). Theory of economic development: An inquiry into profits, capital, credit, interest, and the business cycle. Harvard University Press.

Schumpeter, J. A. (1942). Capitalism, socialism and democracy. Allan and Unwin.

Shrolec, M., & Verspagen, B. (2008). The Voyage of the Beagle in innovation systems land. Explorations on sectors, innovation, heterogeneity and selection. UNU-MERIT, Working Paper Series, 2008-008.

Soete, L., Verspagen, B., & Ter Weel, B. (2010). Systems of innovation. In B. Hall & N. Rosenberg (Eds.), Handbook of the economics of innovation (Vol. 2, pp. 1159–1180). Elsevier.

Song, J., Price, D. J., Guvenen, F., Bloom, N., & von Wachter, T. (2019). Firming up inequality. The Quarterly Journal of Economics, 134(1), 1–50.

Timm, N. H. (2002). Applied multivariate analysis. Springer.

Wirkierman, A. L., Ciarli, T., & Savona, M. (2021). A taxonomy of European innovation clubs. UNU-MERIT, Working Paper Series, 2021-020.

Acknowledgements

The present paper is a revised version of the working paper Wirkierman et al. (2021). The authors gratefully acknowledge the support by the European Union’s Horizon 2020 research and innovation programme under Grant Agreement No. 649186/ECRN 194562— ISIGrowth (Innovation-led, Sustainable and Inclusive Growth).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendixes

A Consolidation of dataset and imputation of missing values

Eurostat’s publicly available micro-aggregated CIS 2014 database is presented as a series of data files covering different aspects of the CIS questionnaire. In particular we considered the following Eurostat CIS-2014 files:

File | Label | Description |

|---|---|---|

1 | bas | Basic economic information on the enterprises |

2 | gen | General information on the enterprises |

3 | type | Enterprises by main types of innovation |

4 | spec | Enterprises by specific types of innovation |

5 | prod | Product and process innovative enterprises |

6 | exp | Innovation activities and expenditures in the enterprises |

7 | pub | Public funding in the enterprises |

8 | coop | Types of co-operation of the enterprises |

9 | proc | Public sector procurement and innovation in the enterprises |

10 | ipr | Intellectual property rights and licensing in the enterprises |

As reported in Panel (A) of Table 4, 13 out of the 22 variables considered had missing values for, at least, one of the 24 countries included in the analysis. Thus, an estimation procedure to obtain within-sample predictions for the missing values had to be devised.

We proceeded as follows. First, we identified the subset of variables for which all countries have full data coverage (i.e. Panel (B) of Table 4). Second, with the subset of variables in panel (B), as well as average turnover per firm and average employees per firm, we created a 24 \(\times\) 11 matrix with countries in rows and standarised variables in columns and applied a combinatorial optimisation algorithm, in order to find a partition of the 24 countries into 5 groups which minimises the within-group sum of squares over all variables (Everitt and Hothorn, 2011, p. 175). Third, we computed within-group average values for all variables in Panel (A) of Table 4, using those countries in each group for which observations were available. Finally, we allocated the within-group average to each country in the group whose original variable value was missing.

B Additional country-level tables

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Wirkierman, A.L., Ciarli, T. & Savona, M. A taxonomy of European innovation clubs. Econ Polit 40, 1–34 (2023). https://doi.org/10.1007/s40888-022-00289-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40888-022-00289-1