Abstract

This paper develops a Nash bargaining model of price formation in the art market. Agents can be naïve, if they are overconfident and either overestimate artistic quality or underestimate their uncertainty of artistic quality, or sophisticated, if they correctly use all the available information. Overconfidence turns out to have a positive impact on both the price and the average quality of the artworks traded in the market. The impact of overconfidence on expected quality is weaker than the corresponding price increase, so sellers overcharge buyers. In addition, the buyer’s (seller’s) overconfidence has a positive (negative) impact on the likelihood of trade. If many pairs of agents may bargain simultaneously, we find that seller’s market power is negatively affected by the number of sellers and positively affected by the number of buyers. If sophisticated and naïve buyers coexist, naïve buyers exert a negative externality on the sophisticated ones, increasing the price the latter pay.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Bargaining is a widespread practice in many areas of economic life within the market and non-market relations. In market relations, parties are often characterized by imperfect information on important elements of the transaction, such as the quality of the traded good, on which consequently they hold beliefs. As shown in the last decades by cognitive psychology and behavioral economics, beliefs are often distorted, and as source of belief distortion, a bias with important economic implications is overconfidence (Moore & Healy, 2008; Malmendier & Taylor, 2015). Overconfidence can take two main forms (Grubb, 2015): overoptimism and overprecision. Overoptimistic individuals overestimate their prospects or their abilities, while overprecise individuals underestimate uncertainty, thus placing overly narrow confidence intervals around forecasts. These biases can cause upward-biased estimates of the quality of a good (or downward-biased estimates of prices) thus leading to imperfect choices (Camerer & Lovallo, 1999; DellaVigna & Malmendier, 2006; Iossa & Palumbo, 2010; Grubb & Osborne, 2015). A market where bargaining, imperfect information, and overconfidence are jointly important aspects is the art market. As a matter of fact, “haggling for art” is a common practice, where sellers and buyers often engage in a bargaining process to establish the artwork’s prices, regardless of the selling method (posted or auction price) used by the art dealers (Velthuis, 2011). Dealing with goods that embody both cultural and economic values, agents in the art market usually operate in a context of “asymmetric disinformation” (Candela et al., 2012). Agents can be characterized by incomplete sets of information about artworks quality, and, to a large extent, heterogeneity arises because traders differ in their knowledge of how the art market works. On one hand, galleries, experienced collectors and artists are typically sophisticated traders, who have the expertise to correctly elaborate all the available signs and signals about the artwork and the artist, relying on a highly specific type of cultural knowledge or educational capital. On the other hand, less experienced collectors, who are particularly sensitive to trendy brands, may behave naively, suffering from “investment mania”, or be driven by “art passion” and not by the principle of risk minimization (De Vecchi, 2008; Candela et al., 2013; Kräussl et al., 2016).Footnote 1

This paper aims to develop a model of the art trade in which bargaining is the selling method, and the bilateral relationships between sellers and buyers depend on their possibly divergent and biased beliefs on the quality of the artworks, considered as goods with exogenous quality (Candela & Cellini, 1998). In our model, artwork quality is a stochastic variable whose distribution is exogenously given, in that it is not influenced by sellers’ or buyers’ choices. Artwork quality is affected by an artist’s talent and fame, and agents in the art market can use signs and signals to proxy them. However, not all have the same ability to interpret these signs and signals (Candela et al., 2012). In particular, we assume that two types of agents exist: sophisticated and naïve agents. The former can interpret signs and signals properly, and hence they know the actual distribution of quality, that hereafter we will call objective distribution. Their reservation price, hence, hinges upon such a distribution. Naïve agents, instead, form their reservation price based on a subjective distribution of quality, which, due to overconfidence, has a higher mean and/or lower variance than the objective one. It follows that overconfidence does not affect quality, but only the perception of the stochastic process behind it.

Our results can be summarized as follows. In the first part of the paper, we consider the interaction within a single buyer-seller pair, which models a situation in which the two agents do not consider the possibility to negotiate with other parties in case of disagreement. For the seller, the reservation price, i.e. the minimum price that she is willing to accept to sell the artwork, is determined by valuing the quality of the artwork based on a probability distribution, which is the objective one for sophisticated agents. The same is for the buyer’s reservation price, i.e. the maximum price that she is willing to pay for the artwork. By using a biased distribution, overconfident agents overestimate expected quality (in the case of overoptimism) or underestimate risk (in case of overprecision). In both cases, and irrespective of the side of the market that is biased (sellers or buyers), overconfidence has a positive impact on agents’ reservation prices. In turn, seller’s and buyer’s reservation prices determine if the trade occurs (whenever the buyer’s reservation price is higher than the seller’s one) and, if that is the case, the transaction price, which is the outcome of the bargaining process. The side of the market that is overconfident matters, when one looks at the likelihood of trading. While buyer’s overconfidence has a positive impact on the likelihood of trading, because sellers are more willing to exchange, profiting from their information advantage, the seller’s overconfidence has a negative impact, since her excessive reservation price makes buyers more reluctant to exchange. Conditional on trade occurring, overconfidence has always a positive impact on the transaction price, since it positively affects the lower bound and/or the higher bound of the feasible prices range. Focusing on the case of overoptimism, the expected quality of the artworks that are traded is higher, compared to the case in which no bias exists. If the buyer is overconfident, the high price she is willing to pay can convince a reluctant seller to trade the artwork with high expected quality. If the seller is overconfident, trade is less likely, but it can nevertheless occur when the expected quality is indeed high.

In the second part of the paper, we move to a market setting, in which many pairs of agents may simultaneously bargain and negotiation is affected by the existence of alternative partners. For that purpose, we introduce a notion of market equilibrium, in which the disagreement outcome becomes endogenous. In a first model in which each side of the market is homogeneous, we find that seller’s market power is affected by the number of sellers and buyers. In particular, a large number of buyers and a small number of sellers increases the seller’s market power, since these conditions imply that buyers have a high probability to wait for a long time before having a new opportunity for a transaction, in case the negotiation breaks down. All the results concerning overconfidence derived for the single encounter extend to the market setting. In addition, we find that the impact of buyer’s (seller’s) overconfidence on prices is low when the number of buyers (sellers) is high, through their effect on seller’s market power. Secondly, we consider a market where a single seller operates, while the buyer side is composed of a heterogeneous population where sophisticated and naïve agents coexist. As expected, we find that the seller can exploit naïve consumers by overcharging them, and the difference in the prices paid by naïve and sophisticated buyers is increasing in the degree of distortion. More interestingly, we find that naïve buyers exert a negative externality on sophisticated ones. The price paid by sophisticated buyers is increasing in the level of distortion and the share of naïve buyers, as they both increase the seller’s expected utility from disagreement in the interaction with a sophisticated buyer, and consequently his market power. Similarly, an increase in the share of sophisticated buyers protects naïve buyers reducing the price they pay.

Our paper contributes to several streams of literature. Firstly, we add to the extensive literature on the role of overconfidence in markets. Some of our results can be considered unsurprising given our assumptions. This is the case of the positive impact of overconfidence on prices, leading to misallocation, inefficiencies, and regret. However, the bargaining setting produces also novel insights. In particular, overconfidence can lead to a higher or lower likelihood of trade, depending on the side of the market that has biased beliefs. It also has a positive impact on expected quality, for the goods that are traded, although weaker than the corresponding price increase. We also observe that ours is not the first model including a role for overconfidence in bargaining. In particular, there is a burgeoning literature, including Yildiz (2003, 2004) and Galasso (2010), and surveyed by Yildiz (2011), that considers non-cooperative bargaining models, in which overconfidence refers to aspects of the bargaining process. However, to the best of our knowledge, this is the first paper that considers overconfidence and bargaining in a market equilibrium and the first application to the art market. This allows identifying a specific mechanism for the emergence of positive or negative externalities across buyers characterized by different degrees of sophistication, a recurrent theme in the literature on behavioral industrial organization (Armstrong, 2015).

Secondly, our paper contributes to the literature on artworks’ price formation mechanisms. Velthuis (2003) focuses on the price formation mechanism of art galleries and identifies the existence of a set of rules (“pricing scripts” or “pricing norms”) dealers follow where the price is never decreased but it can be discounted. Gallery owners are willing to negotiate the amount of discount on the posted price, and each gallery will handle it differently. When galleries post a price, a bargaining process on discounts of posted prices occurs between the dealer and the buyer (Angelini & Castellani, 2018), even though the actual discounted amount is private information. A model of competition among galleries in line with Velthuis’s pricing scripts has been developed by Schönfeld & Reinstaller (2007), while Cellini & Cuccia (2014) analyze price formation considering the artist and the art dealer as part of the same market channel. Despite the anecdotal evidence on selling methods (Grant, 2013) and cognitive biases in agents’ behavior (Ragai, 2018), cultural economics studies lack a comprehensive theory that analyzes the role of beliefs over the artistic quality of an artwork in its price formation process, as the “behavioral economics of culture” is still in its infancy (Coate & Hoffmann, 2022). Within this literature, we bring insights on how cognitive biases can affect bargaining, as developed by recent studies from the behavioral industrial organization (Spiegler, 2011). In addition, our framework allows us to take into account the differences between the tiers of the art market.Footnote 2 The high-end art market hosts more sophisticated agents and concerns trades of higher-quality pieces, for which information is more likely to be available and when it is not, agents are more willing to spend money or time to collect it given the higher value of the traded objects. Low-tier market hosts pieces with less available information, more brief known history, and less well-defined quality, such as emerging artists’ works, pieces with unknown or dubious provenance, and artworks with a higher likelihood of misattribution than those in the high tier. Therefore, in contrast with many papers of the current literature on this topic, our analysis develops results that mostly apply to the low-tier art market. The scope of our paper depends also on the factors that our model does not consider, such as seller’s reputation, the role of experts, who can help increase the information available to the agents, or that of auction houses as agents that both trade and share information through their catalogs. The latter, in particular, are key players in the high-tier market. For them, reputation is a fundamental asset to preserve. The low-end market is instead mostly hosted by galleries and dealers, bargaining is more likely to be observed, and reputation tends to have a less prominent role.

Finally, we contribute to the debate on the role of information in cultural economics (McCain, 1980). Over the last decades, the literature has posited several definitions of artworks based on the level of information the agents possess, referring to cultural goods as experience goods (Blaug, 2001; Krueger, 2005), indeterminate goods (Lupton, 2005), meta-credence goods (Ekelund et al., 2020), or trust goods (Zorloni, 2013). In this paper, we apply the more general notion of “exogenous quality good” to artworks, as introduced by Candela & Cellini (1998). Within this strand of literature, our contribution is one of the first models which consider how information interacts with biased beliefs using an analytical approach, a fact that possibly adds new tools for the comprehension of the complex role of information in this particular market.

The remainder of the paper is organized as follows. In Sect. 2 we present our conceptual framework on the role of (dis)information in the art market, with a specific focus on the notion of overconfidence. In Sect. 3, we set up our model of art pricing, considering first the impact of overconfidence on trading and price in the bilateral buyer-seller relationship, when agents are risk neutral and risk averse, to move then to a market setting. Sect. 4 concludes, by also pointing out a few empirical implications and possible extensions of our model.

2 (Dis)information and overconfidence in the art market: a conceptual framework

In economic transactions, sellers and buyers can operate with different information sets about the quality of goods (Candela et al., 2012):Footnote 3

-

symmetric information, if all agents have equal and complete information;

-

asymmetric information, if only one agent – usually the seller – has complete information;

-

symmetric disinformation, if all agents have equal but incomplete information.

-

asymmetric disinformation, if all agents have an incomplete set of information but one agent, the seller or the buyer, has an information advantage.

Quality

Though situations of symmetric information and disinformation generally apply to several markets where the good quality is uncertain or indeterminate, the debate around the role of information over cultural goods is still ongoing. Blaug (2001) states that cultural goods are “typically experience goods for which tastes have to be acquired by a temporal process of consumption”, while Krueger (2005), using music as an example, states that “a concert is an «experience good», as consumers do not know the utility they will derive from a concert unless they go to it”. Lupton (2005) introduces the concept of “indeterminate good”, a good whose quality is uncertain for every agent; the author points out that a cultural good is an indeterminate good, and the only agent who knows the quality is the artist.Footnote 4 Zorloni (2013) defines the artworks sold in the contemporary art market as a “trust good, whose quality is assessable by the buyer neither before nor after purchase due to lack of technical and cultural knowledge”. Caves (2003) claims that “in creative industries nobody knows, and the core problem is one of symmetrical ignorance”. Bonus & Ronte (1997) state that cultural goods are neither experience goods, nor credence goods. They also introduce the concept of “cultural quality” as a new type of quality, that can only be evaluated by agents who possess a very specific set of cultural knowledge through “a process of generating credibility, a process in which experts from the art scene have a key role”. Similar to a market for professional services, these experts are the most informed agents operating in the art market and have access to information about the artwork’s quality.

For cultural goods, then, uncertainty is pervasive and quality typically varies over time even among artworks by the same artist. For this reason, we interpret artworks as exogenous quality goods. The quality is exogenous when it is determined by a stochastic process and is not chosen by the seller (Candela & Cellini, 1998). The definition and measurement of an artwork quality are still open issues.Footnote 5 Extending the conceptualization raised by Throsby (1990) for performing arts to visual arts, quality can be decomposed into a series of the artwork characteristics that, considered together, make up the whole experience conveyed by art consumption. In words, the judgment of artwork quality can be decomposed in the evaluation of a series of criteria, some of which are objective, while others are subjective with either a consensus among the agents or not. By considering only the objective criteria and, by analogy, the subjective criteria for which a consensus exists, an ordering of artworks quality becomes possible. It is on the dimensions of quality that can be ordered, which this paper focuses on.

Signs and signals

In the art market, asymmetries in uncertainty often arise because agents differ in their degree of sophistication, defined as their ability to correctly interpret signs and signals to evaluate the good quality (Locher et al., 2015). According to Candela et al. (2009) and Candela et al. (2012), signs and signals can be described as observable characteristics of the artwork that can be related to its quality. Signs are “unalterable” characteristics that belong to the artwork itself while signals are “interpretable” characteristics of the artwork that agents observe on the market.Footnote 6 Candela et al. (2012) report “technique, iconography, materials, style, and concept in conceptual art” as examples of signs in the art world, and “authenticity certification (issued by artists themselves, dealers, experts, or seller associations), exhibitions, documents issued by archives and foundations, and annotated catalogs” as examples of signals. Signs include the variables mainly related to the artist’s talent, which influences the cultural value through a series of stylistic choices. Signals are primarily correlated to the artist’s fame, which directly affects the economic value through an artist brand effect (Angelini & Castellani, 2019). Both of these artists’ characteristics exert a positive influence on the quality of an artwork. Artist’s talent is her innate creative ability, influenced by the context in which the artist operated and operates. It is a latent variable, meaning that agents can usually observe only some of the artist’s features which are correlated with talent, such as an art degree, but do not perfectly know the magnitude of this correlation; thus talent is private information for most agents, even though the selection of artists made by the galleries who know the artist’s talent is mainly based on this characteristic (Di Gaetano et al., 2019). An artist’s fame is her reputation and it is linked to the public information on the artist’s identity that the market shares (Adler, 2006). Recent works (e.g., Candela et al.,2012;Candela, Castellani, Pattitoni, & Di Lascio,2016;Hofmann & Opitz, 2019) suggest that an artist’s talent and fame are the main factors underlying artwork’s quality.Footnote 7

Information from signs and signals must be elaborated for agents to assess a probability distribution over quality. This may occur if the information is at least partially ambiguous, as it may occur for attribution; or because understanding the link between signs and signals and quality requires certain expertise, as it is the case for stylistic features or provenance in the tribal art market or the market of antiques, carpets, tapestries, and draperies. Agents differ in their ability to extract all the relevant information from signs and signals. Typically, galleries are agents who can correctly interpret all signs and signals associated with an artist’s talent and fame, so that they extract all the relevant information and derive the objective probability distribution over quality. We define such agents as sophisticated. On the other hand, expertise may differ widely among collectors. Baumol (1986) states that in the art market there are two kinds of collectors: those who are “people who understand art” (insider collectors), and those who behave like an “amateur who does not know what he is doing” (outsider collectors). Becoming an insider collector requires an educational capital that can be accumulated through general education or targeted training, which increases the agents’ capacity to understand the quality of the goods they are considering (Seaman, 2006). While insider collectors may exhibit a level of sophistication similar to galleries’ one, outsider collectors are naïve agents who cannot interpret signs and fully process the information conveyed by signals, so they make their decisions relying on biased beliefs and expectations that are subjective. Hence, their choices are based on a subjective distribution of quality.Footnote 8

Overconfidence

Within the “heuristics and bias” paradigm in cognitive psychology, the overconfidence bias plays a predominant role among the systematic errors involving individual judgment (Malmendier & Taylor, 2015). In a critical assessment of the previous works in the literature, Moore & Healy (2008) identify three phenomena that scholars investigated under the label of overconfidence: overoptimism (or overestimation), overplacement, and overprecision. Overoptimism refers to an upward bias in the absolute evaluation of one’s actual ability, performance, level of control, or chance of success. The related notion of overplacement refers instead to a relative evaluation of abilities and performance when a majority of individuals believe themselves better than the median. Overprecision refers to the excessive certainty regarding the accuracy of one’s beliefs, which in statistical terms leads to confidence intervals around the mean that are too narrow.

Overconfidence has been proposed as the explanation for a variety of economic phenomena. Camerer & Lovallo (1999), for instance, showed through experiments how optimistic biases can plausibly and predictably influence entry into the competitive market, thus accounting for the observed high rate of business failure. Glaser & Weber (2007) find that investors who think that they are above average in terms of investment skills or past performance (but who did not have above-average performance in the past) trade more. Daniel & Hirshleifer (2015) theoretically show how overprecision can lead to excessive trading in financial markets, and Bregu (2020) provides experimental evidence that the accuracy of information mediates such an effect. On the consumer side, studies have shown that overconfidence can lead to misforecast usage due to overoptimism about self-control (DellaVigna & Malmendier, 2006) or overprecision (Grubb & Osborne, 2015). In a few instances, overconfidence may have a “bright side”, as in the case of contributions in public good games (Yin et al., 2019).

In the case of the art market, overoptimism and overprecision can emerge for a variety of reasons. For instance, inexperienced collectors may overestimate their ability to discover unknown artists who are destined to become famous, a distortion that can be seen as a form of self-attribution bias (Moore & Cain, 2007). In this case, overoptimism over quality takes the form of overestimating the probability that the artist is going to become a blue-chip artist soon and the artwork’s resale potential. In other cases, upward biased beliefs may result if the buyer is wrongly convinced that the work is by another more profitable artist. On the other extreme, collectors may be victims of social influence when evaluating renowned artists and particularly impressionable by artists’ brands and speculative bubbles such as those that often rise in actual “investments mania” phases (Kräussl et al., 2016). In these cases, too little importance is assigned to signs and signals, leading once again to overoptimism.Footnote 9 Although less likely, overconfidence may occur also on the seller side. For instance, non-professional sellers can be characterized by overoptimism when an agent assigns an additional value to the artwork simply from its possession, as for the behavior bias associated with the endowment effect (Ericson & Fuster, 2014). Overprecision may be observed in the art market as well. Due to the psychic return in art investments, the idiosyncratic risk may be partially overlooked as long as art investors are driven by “art passion” and not by the principle of risk minimization (Candela et al., 2013). In addition, inexperienced collectors may attribute too much importance to an artist’s fame, underestimating the variance in artistic quality that characterizes artworks by the same artist.Footnote 10

High- and low-tier art market

As we anticipated in the introduction, an important distinction to make our model applicable is that between high-end (or high-tier) and low-end (or low-tier) art markets. So far, the analysis of low- and high-tier markets has been mostly developed within the industrial organization and marketing literature, focusing on consumers’ heterogeneity across tiers and the role of branded and unbranded firms (Pan, 2020).Footnote 11 The high-end market is characterized by artworks of generally high cultural and economic value which fetch high prices. For these artworks, information is generally abundant and easier to obtain than for artworks traded in the low-tier, and the agents operating in this part of the market tend to be more sophisticated. This does not mean that the high end of the market has no naïve agents operating in it, but that the share is presumably lower and that the incentive to obtain information is higher. The high-tier market is also characterized by a higher presence of experts, who reduce information failure and quality uncertainty. Conversely, low-end market features are scarcity of information, which is also sometimes unreliable, a higher proportion of private sales, and a lower presence of signs and signals, which remain however crucial in the evaluation process. The scarcity of signs and signals does not imply that they are less important, since each piece of information could contribute to the evaluation of an artwork. For example, having a short provenance history record is still better than having no provenance. As discussed above, information obtained from signs and signals needs to be correctly processed to infer an objective distribution over quality. This is easier to do in the high-tier of the market, where experts can evaluate artworks and help the buyer in interpreting signs and signals. High-end market agents are also motivated by the presence of reputation mechanisms that discourage them from taking advantage of their information advantage, which is an opportunistic behavior more likely to be at work in the low-tier art market. All this suggests that biased beliefs can emerge in both the high- and the low-end art market, but they are more likely to be observed in the latter. In the low-tier of the market, an agent could form biased beliefs about the artwork quality, for example valuing as authentic a misattributed piece of “dubious provenance” (Shortland & Shortland, 2020). In addition, there is evidence that home bias has a stronger impact in the low-tier market than in the high-tier one (Renneboog & Spaenjers, 2015; Vosilov, 2015). The agents with biased beliefs are more likely to be the buyers, but the non-negligible role of non-professional sellers in the low-tier market may lead this side of the market to be characterized by overconfidence as well.Footnote 12 Misattributed and fake artworks are more likely to be observed in the low-tier art market (Radermecker, 2021), but this issue also concerned the high-tier market, such in the famous case of John Drewe and John Myatt, where forged artworks were accompanied by forged provenance records. Agents in the low-tier market are also less likely to perform due diligence, namely the process to ensure that an artwork provenance is legitimate, due to the generally lower value of the pieces. However, negligence on due diligence is observed also in the high-tier art market (e.g., Runhovde, 2021).

In order to formally represent our conceptual framework, we assume an artwork j is characterized by an exogenous quality \(q_{j}\), which is a random variable with mean \(\mu _{j}\) and variance \(\sigma _{j}^{2}\). The quality for an agent i, \(q_{ij}\), depends to the vector of signs \(\nu _{j}\) and of signals \(\eta _{j}\), so that \(q_{ij}\) is a random variable with mean \(\mu _{ij}(\nu _{j},\eta _{j})\), and variance \(\sigma _{ij}^{2}(\nu _{j},\eta _{j})\). For sophisticated agents (\(i=s\)), who correctly and fully process all the available signs and signals, \(\mu_{sj}(\nu _{j},\eta _{j})=\mu _{j}\) and \(\sigma _{sj}^{2}(\nu _{j},\eta _{j})=\sigma _{j}^{2}\). For naïve agents (\(i=n\)), overoptimism implies \(\mu _{nj}(\nu _{j},\eta _{j})>\mu _{j}\) and \(\sigma _{nj}^{2}(\nu _{j},\eta _{j})=\) \(\sigma _{j}^{2}\). Overprecision, instead, occurs when \(\mu _{nj}(\nu _{j},\eta _{j})=\mu _{j}\) and \(\sigma _{nj}^{2}(\nu _{j},\eta _{j})<\) \(\sigma _{j}^{2}\).

3 The model

In this section, starting from our conceptual framework, we set up the basic model of the bilateral buyer-seller relationship (Sect. 3.1), to analyze the impact of overconfidence on trading and price when agents are risk neutral (Sect. 3.1.1), and then we explore the case when agents are risk averse (Sect. 3.1.2). Then, we extend the analysis to a market setting (Sect. 3.2), considering two scenarios. In the first case (Sect. 3.2.1), we consider a market with several sellers and buyers, and each side of the market is composed of a (possibly overconfident) homogeneous population. In the second case (Sect. 3.2.2), we consider a market where a single seller operates, while the buyer side is composed of a heterogeneous population where sophisticated and naïve agents coexist.

3.1 The basic set-up of the bilateral relationship

In this model, a seller (vendor) \(\textit{v}\) and a buyer \(\textit{b}\) bargain over an artwork’s price. Both agents are risk neutral, and they are characterized by a utility function \(u_{ij}(q_{j},m_{i})=\alpha _{ij}q_{j}+m_{i}\), where \(\alpha _{ij}\) is the hedonic valuation of an artwork’s quality \(q_{j}\) and \(m_{i}\) is money (numeraire good). In other words, \(\alpha _{ij}\) measures the relative importance attached to an artwork’s quality with respect to money. Notice that this specification accounts for both the case where the purchase of the artwork is motivated by consumption and investment reasons since in both cases the utility the buyer obtains from the consumption or the investment in an artwork is monotonically increasing in its quality.Footnote 13Based on the discussion in Sect. 2, each agent is characterized by expectations over quality identified by the mean \(\mu _{ij}(\nu _{j},\eta _{j})\) and the variance \(\sigma _{ij}^{2}(\nu _{j},\eta _{j})\). For the seller, the reservation price \(R_{vj}\) is given by the minimum price that she is willing to accept to sell the artwork j. Given the utility function and the risk neutrality assumption, we obtain \(R_{vj}=\alpha _{vj}\mu _{vj}\). Similarly, for the buyer, the reservation price \(R_{bj}\) represents the maximum price that she is willing to pay for the artwork j, and we have \(R_{bj}=\alpha _{bj}\mu _{bj}\).Footnote 14 Given \(R_{vj}\) and \(R_{bj},\) trade will occur if and only if \(R_{vj}\le R_{bj}\), i.e. if and only if:

The bargaining price will lay in the interval \(\left[ R_{vj};R_{bj}\right]\). We assume that Nash bargaining problem underlying the price-formation mechanism is the following (Binmore et al., 1986):

where \(\rho _{v}\in (0,1)\) is the seller’s bargaining power in the trade between \(\textit{v}\) and b, while the buyer’s bargaining power is its complement to 1. The solution of (2) exists if \(R_{vj}\le R_{bj}\) and it is given by:

which boils down to:

In what follows we show the main results as comparative statics in our Nash bargaining model.

3.1.1 The impact of overconfidence on trading and price

To assess the impact of overconfidence, we start by considering the most salient case in which the seller has correct beliefs on the artwork’s quality, while the buyer may suffer from overoptimism. Formally, we assume \(\mu _{vj}=\mu _{j}\) and \(\mu _{bj}=\mu _{j}+\Delta _{bj}\), where \(\Delta _{bj}>0\) measures the degree of buyer’s distortion. This is the case of \(v=s\) and \(b=n\). Condition (1) becomes:

If \(\alpha _{vj}\le \alpha _{bj}\), trade always occurs. If \(\alpha _{vj}>\alpha _{bj}\), an increase in the buyer’s overoptimism increases the likelihood of trading, e.g. condition (5) is satisfied for a larger set of the other parameters. In particular, for given \(\alpha _{vj}\) and \(\alpha _{bj},\) overoptimism allows a trade for higher values of \(\mu _{j}\) (compared to the case of non-biased beliefs), i.e. of artworks with ex-ante higher quality. In other words, through its effect on the reservation price, overconfidence eases the conditions for trade to occur, and the average expected quality of artworks that are traded is higher, compared to the case where there is no overconfidence. The intuition is that a seller is reluctant to sell artworks with high expected quality (according to correct beliefs) unless she can obtain a high price: this is what overoptimism can guarantee. We obtain:

from which we see that overoptimism has a positive impact on prices. This impact increases with the bargaining power of the seller and with the importance attributed by the buyer to quality.

Since both price and quality increase, it is interesting to look at the ratio between the price and the (expected) quality, or hedonic price, which is given by:

It is clear that \(\frac{p_{j}^{*}(\Delta _{bj})}{\mu _{j}}\) is increasing in \(\Delta _{bj}\). In other words, overoptimism generates overcharging, since the bargaining process allows the seller to appropriate a part of the (unjustified) extra surplus that overconfidence generates in the perception of the buyer.

Consider now the case where the seller has biased beliefs. Formally, we assume \(\mu _{vj}=\mu _{j}+\Delta _{vj}\) and \(\mu _{bj}=\mu _{j}\), where \(\Delta _{vj}> 0\) measures the degree of the seller’s distortion. This is the case of \(b=s\) and \(v=n\). The trade condition becomes:

If \(\alpha _{vj}\ge \alpha _{bj}\), trade never occurs. If \(\alpha _{vj}<\alpha _{bj}\), seller’s overoptimism reduces the likelihood of trade (i.e. the larger is \(\Delta _{vj}\), the smaller is the set of the other parameters for which the condition (8) is satisfied), but trade occurs only for the higher expected quality. A seller is reluctant to sell an artwork that she (wrongly) perceives to be high-quality, but the trade can nevertheless occur when the actual expected quality (as captured by buyer’s belief) is indeed high. For the price, we obtain:

It is straightforward to derive \(\frac{dp_{j}^{*}(\mu _{bj})}{d\Delta _{vj}}=\alpha _{vj}(1-\rho _{vj})>0\). When the seller is overconfident, the equilibrium price increases because the increased reservation price makes the seller a tougher negotiator. As before, we can consider the ratio between the price and the average quality, given by:

\(\frac{p_{j}^{*}(\Delta _{vj})}{\mu _{j}}\) is always increasing in \(\Delta _{vj}\) since \(\rho _{v}<1\) by definition. Overoptimism generates overcharging also when it occurs on the seller’s side, since expectations, though unjustified, of high quality influence the bargaining process by increasing the seller’s request.

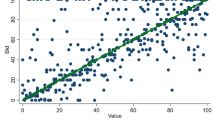

Figures 1 and 2 graphically represent the condition for trade and the bargained price in the case of a biased buyer’s and seller’s beliefs, respectively. In Fig. 1 we assume \(\alpha _{bj}=1,\) and \(\alpha _{vj}>1.\) In Fig. 2, we assume \(\alpha _{vj}=1\) and \(\alpha _{bj}>1\).

Finally, we consider the case of symmetric disinformation, assuming that \(\mu _{vj}=\mu _{bj}=\mu _{j}+\Delta _{j}\). From (1), we observe how the condition for trading is independent of \(\mu _{j}\) and \(\Delta _{j},\) since the condition for trading to occur becomes \(\alpha _{vj}\le \alpha _{bj}.\) As for price, we now obtain \(\frac{dp_{j}^{*}(\mu _{bj})}{ d\Delta _{j}}>0\): overconfidence has a positive impact on reservation prices for both the seller and buyer so that the two effects sum upon equilibrium price.

3.1.2 The risk aversion case

The basic set-up can be easily extended to the case of risk averse agents, by assuming a utility function \(u_{ij}(q_{j},m_{i})=\) \(\alpha _{ij}u(q_{j})+m_{i}\), with \(u^{\prime }(\dots )\equiv \frac{\partial u}{ \partial q_{j}}>0\) and \(u^{\prime \prime }(\dots )\equiv \frac{\partial ^{2}u }{\partial q_{j}^{2}}<0\). Let us now define as \(f_{j}(\dots )\) the actual distribution of \(q_{j}\) over a support \(\left[ \underline{q};\overline{q} \right]\) and as \(f_{ij}(\dots )\) the perceived distribution by agent i, for simplicity assumed over the same support. In this case, the reservation prices are given by \(R_{vj}=\alpha _{vj}\int f_{vj}(q_{j})u(q_{j})dq_{j}\) and \(R_{bj}=\alpha _{bj}\int f_{bj}(q_{j})u(q_{j})dq_{j}\). Furthermore, we define as \(CE_{ij}\) the certainty equivalent of the quality “lottery”, i.e. \(CE_{ij}=u^{-1}\left[ \int f_{ij}(q_{j})u(q_{j})dq_{j}\right]\) (Mas-Colell et al., 1995). It follows that \(R_{vj}=\alpha _{vj}u(CE_{vj})\) and \(R_{bj}=\alpha _{bj}u(CE_{bj})\). The conditions for trade and the equilibrium price become:

First of all, we consider the role of the degree of risk aversion, when information is incomplete but symmetric. In this case, \(CE_{ij}\) will be lower the higher is the degree of agent’s risk aversion (Mas-Colell et al., 1995). From (11), it follows that a trade is less (more) likely to occur the more the buyer (the seller) is risk averse. Risk aversion has a negative impact on price since \(\frac{dp_{j}^{*}}{dCE_{ij} }>0\). As intuition tells us, risk averse agents are more reluctant to trade and to pay a high price in presence of uncertainty.

Second, we can analyze the role of the agents’ overprecision when \(v=s\) and \(b=n\). Let us assume that the two perceived quality distributions have the same mean, \(\mu _{vj}=\mu _{bj}\), but their variances differ, \(\sigma _{vj}^{2}\ne \sigma _{bj}^{2}\). Buyer’s overprecision can be analyzed by assuming that \(f_{vj}(\dots )=f_{j}(\dots )\) and \(f_{bj}(\dots )\ne f_{j}(\dots )\), such that \(\sigma _{bj}^{2}<\sigma _{vj}^{2}\), that is, the variance implied by \(f_{bj}(\dots )\) is lower than the one associated to \(f_{j}(\dots )\). It follows that \(CE_{bj}>CE_{vj}\). Therefore, the trade condition is more likely to be satisfied, compared to the case where both agents have a correct perception of risk. As for price, (12) shows that overprecision has a positive impact on equilibrium price.

Similarly, seller’s overprecision, when \(b=s\) and \(v=n\), can be analyzed by assuming \(f_{bj}(\dots )=f_{j}(\dots )\) and \(f_{vj}(\dots )\ne f_{j}(\dots )\) such that \(\sigma _{bj}^{2}>\sigma _{vj}^{2}\), that is, the variance implied by \(f_{vj}(\dots )\) is lower than the one associated to \(f_{j}(\dots )\). It follows that \(CE_{vj}>CE_{bj}\). Therefore, the trade condition is less likely to be satisfied, compared to the case where both agents have a correct perception of risk. The seller’s overconfidence also has a positive impact on equilibrium price.

In conclusion, in this setting, the specific form of overconfidence (overoptimism vs overprecision) does not influence the results. The intuition is that both forms of overconfidence positively influence the reservation prices, and overprecision matters only when agents are risk averse.

3.2 Art trade in a decentralized market

So far, we analyzed isolated encounters between a pair of agents who bargain over the price of an artwork. In this section, we move to the analysis of decentralized markets, in which many pairs of agents may simultaneously bargain, or, at least, negotiation can depend upon the existence of alternative partners. In this context, the solution of one specific bargaining situation is part of equilibrium in the entire market, as the disagreement outcome becomes endogenous and is affected by the outcomes of other negotiations which can take place at the same time or in the future.

Below, we fully characterize two specific models which share several elements, following Osborne & Rubinstein (1990). In both cases, the market opens at time \(t=0\) with \(V_{0}\ge 1\) sellers (each endowed with artworks) and \(B_{0}\ge V_{0}\) buyers operating.Footnote 15 In each period \(t>0\), each seller is matched with a single buyer. If an agreement is reached in a match, the bargaining outcome is determined by the Nash solution, for which the disagreement utility of an agent is given by his expected utility if he remains in the market until period \(t+1\). Each agent concludes at most one transaction and leaves the market after an agreement is reached. It follows that \(B_{0}\ge V_{0}\) implies \(B_{t}\ge V_{t}\) for any \(t>0\). For each t, a seller has a probability of 1 to be matched with a buyer, while the buyer has a probability \(\frac{V_{t}}{B_{t}}\) to be matched with a seller.

For simplicity, the time index is omitted from now on. In the analysis, we focus on the case of risk neutrality for all agents, which we know is not restrictive from the previous section. When \(V_{0}>1\), we will assume that the agents’ information about artworks qualities is fully symmetric, i.e. their objective quality \(q_{j}\) is given by a random variable with mean \(\mu _{j}=\) \(\mu\) (variance is, in fact, irrelevant due to the risk neutrality assumption), and the subjective quality for an agent i is given by a random variable \(q_{ij}\) with mean \(\mu _{ij}(\nu _{j},\eta _{j})=\mu _{i}(\nu _{j},\eta _{j})=\mu _{i}\). As a consequence, the characteristics of a transaction that are relevant are only the transaction price and the number of periods \(\tau\) in which agents stayed in the market so that each utility at \(\tau\) are discounted by a factor \(\delta ^{\tau }\), with \(\delta \le 1\). It follows that the subscript j is also omitted from now on.

3.2.1 The homogeneous population case

The first model we study considers a homogeneous population of sellers and buyers, with the mean of perceived quality distribution being \(\mu _{v}\) for sellers and \(\mu _{b}\) for buyers. We shall assume \(\alpha _{v}\mu _{v}\ge \alpha _{b}\mu _{b}\), i.e. the reservation price for sellers is higher than the reservation price for buyers. As a consequence, any match between a seller and buyer creates a positive (perceived) surplus. As we will see, this will imply all transactions to occur at \(t=0\). Since sellers and buyers are homogeneous, \(\alpha _{v}\mu _{v}<\alpha _{b}\mu _{b}\) would have implied no transactions.

A candidate for a market equilibrium is a function P that assigns a price in \(\left[ \alpha _{v}\mu _{v}, \alpha _{b}\mu _{b}\right]\) or a disagreement outcome D to each pair (V, B), where V and B are the number of sellers and buyers active in the market in a given period, respectively. Given a function P and the matching technology described above, we can calculate the expected utility of being a seller or a buyer containing V sellers and B buyers. We denote such expected utilities with \(E[U_{v}(V,B)]\) and \(E[U_{b}(V,B)]\) respectively. When \(P(V,B)=D\), all sellers and buyers remain in the market until period \(t+1\). Therefore, the (discounted) expected utility pair at \({t+1}\) is given by \(\left( \delta E[U_{v}(V,S)];\delta E[U_{b}(V,S)]\right)\). Whenever (V, B) implies an agreement in equilibrium, failing to reach an agreement for a specific pair implies that there will be one seller and \(B-V+1\) buyers at time \(t+1\). Therefore, in this case, the disagreement point is in \(\left( \delta E[U_{v}(1,B-V+1)], \delta E[U_{b}(1,B-V+1)]\right)\). From the discussion so far the following definition of market equilibrium applies.

Definition 1

A function \(P^{*}\) that assigns an outcome to each pair (V, B), with \(V\le V_{0}\) and \(V-B=V_{0}-B_{0}\) is a market equilibrium if there exist functions \(E[U_{s}(V,B)]\) and \(E[U_{b}(V,B)]\), with \(E[U_{v}(V,B)]\ge 0\) and \(E[U_{b}(V,B)]\ge 0\), satisfying the following three conditions:

-

1.

if \(P^{*}(V,B)\in \left[ \alpha _{v}\mu _{v}, \alpha _{b}\mu _{b}\right]\) then

$$\begin{aligned} \delta E[U_{v}(1,B-V+1)]+\delta E[U_{b}(1,B-V+1)]\le \alpha _{b}\mu _{b}-\alpha _{v}\mu _{v} \end{aligned}$$(13)and

$$\begin{aligned} P^{*}(V,B)-\alpha _{v}\mu _{v}-\delta E[U_{v}(1,B-V+1)]=\alpha _{b}\mu _{b}-P^{*}(V,B)-\delta E[U_{b}(1,B-V+1)] \end{aligned}$$(14) -

2.

if \(P^{*}(V,B)=D\) then

$$\begin{aligned} \delta E[U_{v}(V,B)]+\delta E[U_{b}(V,B)]>\alpha _{b}\mu _{b}-\alpha _{v}\mu _{v} \end{aligned}$$(15) -

3.

\(E[U_{v}]\) and \(E[U_{b}]\) are defined as follows:

$$\begin{aligned} E[U_{v}(V,B)] ={\left\{ \begin{array}{ll} P^{*}(V,B)-\alpha _{v}\mu _{v} &{} \text {if } P^{*}(V,B)\in \left[ \alpha _{v}\mu _{v}, \alpha _{b}\mu _{b}\right] \\ \delta E[U_{s}(V,S)] &{} \text {if } P^{*}(V,B)=D \end{array}\right. } \end{aligned}$$(16)$$\begin{aligned} E[U_{b}(V,B)]={\left\{ \begin{array}{ll} \alpha _{v}\mu _{v}-p^{*}(V,B) &{} \text {if } P^{*}(V,B)\in \left[ \alpha _{v}\mu _{v}, \alpha _{b}\mu _{b}\right] \\ \delta E[U_{b}(V,S)] &{} \text {if } P^{*}(V,B)=D \end{array}\right. } \end{aligned}$$(17)

Condition 1 implies that a transaction occurs when the surplus created by the bargaining is larger than the sum of the expected utility for the seller and the buyer at time \(t+1\) when the transaction does not occur. In this case, the negotiated price results from the Nash solution. Otherwise, condition 2 applies and we have a disagreement between agents in equilibrium. Finally, condition 3 defines the expected utility from being a seller or a buyer in equilibrium.

Next Proposition characterizes the (unique) market equilibrium in this model (the Proof is in the Appendix A).

Proposition 1

The equilibrium price \(P^{*}(V,B)\) is given by

where \(\rho _{v}^{M}=\frac{B-V+1-\delta }{(B-S+1)(2-\delta )-\delta }\).

Proposition 1 shows that, in the market equilibrium, equilibrium price can be written as a linear combination of seller’s and buyer’s reservation prices, as in Sect. 3.1, where we analyzed the interaction within a single pair and buyer. It follows that results concerning the impact of overconfidence on prices, such as buyer overcharging, extend to a market setting as well since they occur through the impact on reservation prices. The same happens for the impact of overconfidence on trading, through the impact on the condition \(\alpha _{b}\mu _{b}\ge \alpha _{v}\mu _{v}\). Since all sellers are equal, then they all trade in equilibrium, or nobody does, and the first case is more (less) likely if buyers (sellers) are overconfident. The additional result of the market equilibrium analysis is to endogenize the seller’s market power (\(\rho _{v}^{M}\)) and to make it dependent on the number of sellers and buyers and the discount factor. Straightforward derivations lead to the following Corollary.

Corollary 1

The impacts of B, V, and \(\delta\) on \(\rho _{v}^{M}\) are given by:

The Corollary 1 shows that the seller’s market power (and consequently the transaction price) is positively affected by the number of buyers, negatively affected by the number of sellers, and non-increasing in the discount factor. The intuition is as follows. First, we observe that the relative market power depends on the disagreement points. While the probability of a new match after a disagreement is 1 for sellers, it is \(\frac{ V}{B}\) for buyers. The lower is this probability (i.e. for high B and low V), the higher is the seller’s market power, since the buyer has a high probability to wait for a long time before having a new opportunity for a transaction. Finally, we observe that an increase in the discount factor increases the disagreement utility for both the sellers and the buyers, but if favors the side of the market with less competition (as long as \(B-V<0\)).

From Eqs. (6) and (9) we also observe that the seller’s market power has a moderating effect on the impact of belief distortion on prices, in that high seller’s market power increases the impact of seller’s distortion on prices and reduces the impact of buyer’s distortion. It follows that the impact of buyer’s (seller’s) overconfidence on prices is low when the number of buyers (sellers) is high.

3.2.2 The heterogeneous buyer population case

The second model we study focuses on the impact of agents’ heterogeneity in the sophistication dimension and does it with respect to the buyer’s side. In particular, we consider a market where, at time \(t=0\), one seller and B buyers are present. The seller is sophisticated, while the set of buyers is divided in \(B_{s}\ge 0\) sophisticated buyers and \(B_{n}\ge 0\) naïve buyers, where at least one inequality is strict. We shall assume that the seller can observe the buyer type and that \(\alpha _{bn}\mu _{bn}\ge \alpha _{bs}\mu _{bs}\ge \alpha _{v}\mu _{v}\), i.e. any transaction between the seller and a buyer generates a positive surplus.Footnote 16 We shall also assume that the belief distortion of naïve consumers is not too high, i.e. \(\Delta \le \frac{1-\delta }{\alpha _{b}B_{n}\delta }\left[ 2(B_{s}+B_{n})-\delta \right] (\alpha _{bs}\mu _{bs}-\alpha _{v}\mu _{v})\), which guarantees the existence of an equilibrium in which all buyers have a positive probability to obtain the artwork.Footnote 17

With a single seller (and at most one transaction per seller) we only need to consider what happens when the seller and all the buyers are present in the market, since the market closes after the transaction. For each t, the seller has a probability \(\frac{B_{s}}{B_{s}+B_{n}}\) (\(\frac{B_{n}}{ B_{s}+B_{n}})\) to be matched with a sophisticated (naïve) buyer, while the buyer has a probability \(\frac{1}{B_{s}+B_{n}}\) to be matched with the seller.

A candidate for a market equilibrium is now a pair of outcomes, one for a negotiation involving a sophisticated buyer (in \(\left[ \alpha _{v}\mu _{v}, \alpha _{b}\mu _{b}\right]\)) and one for a negotiation involving a naïve buyer (in \(\left[ \alpha _{v}\mu _{v}, \alpha _{bn}\mu _{bn}\right]\)). Given the outcome of the negotiation and the matching technology described above, we can calculate the expected utility of being the seller or a sophisticated (naïve) buyer, when there are \(B_{s}\) sophisticated buyers and \(B_{n}\) naïve buyers in the market. We denote such expected utility with \(E[U_{v}(B_{s},B_{n})]\), \(E[U_{bs}(B_{s},B_{n})]\), and \(E[U_{bn}(B_{s},B_{n})]\) respectively. In case of disagreement, the seller and buyers remain in the market until period \(t+1\). Therefore, the (discounted) expected utility triple at \(t+1\) is given by \(\left( \delta E[U_{v}(B_{s},B_{n})],\delta E[U_{bs}(B_{s},B_{n})],\delta E[U_{bn}(B_{s},B_{n})]\right)\). From the discussion so far the following definition of market equilibrium applies.

Definition 2

A pair (\(p_{s}^{*}(B_{s},B_{n})\), \(p_{n}^{*}(B_{s},B_{n}))\) is a market equilibrium if there exist functions \(E[U_{v}]\), \(E[U_{ns}]\), and \(E[U_{bs}]\), with \(E[U_{v}]>0\), \(E[U_{bs}]>0\), and \(E[U_{bn}]>0\), satisfying the following three conditions:

-

1.

for \(P_{s}^{*}(B_{s},B_{n})\in \left[ \alpha _{v}\mu _{v}, \alpha _{bs}\mu _{bs}\right]\) then:

$$\begin{aligned} \delta E[U_{v}(B_{s},B_{n})]+\delta E[U_{bs}(B_{s},B_{n})] \le \alpha _{bs}\mu _{bs}-\alpha _{v}\mu _{v} \end{aligned}$$(18)and

$$\begin{aligned} P_{s}^{*}(B_{s},B_{n})-\alpha _{v}\mu _{v}-\delta E[U_{v}(B_{s},B_{n})]=\alpha _{b}\mu _{b}-p_{s}^{*}(B_{s},B_{n})-\delta E[U_{bs}(B_{s},B_{n})] \end{aligned}$$(19)Otherwise, if \(P_{s}^{*}(B_{s},B_{n})=D\), then:

$$\begin{aligned} \delta E[U_{v}(B_{s},B_{n})]+\delta E[U_{bs}(B_{s},B_{n})]>\alpha _{bs}\mu _{bs}-\alpha _{v}\mu _{v} \end{aligned}$$ -

2.

for \(P_{n}^{*}(B_{s},B_{n})\in \left[ \alpha _{v}\mu _{v}, \alpha _{bn}\mu _{bn}\right]\) then:

$$\begin{aligned} \delta E[U_{v}(B_{s},B_{n})]+\delta E[U_{bn}(B_{s},B_{n})]\le \alpha _{bs}\mu _{bs}-\alpha _{v}\mu _{v} \end{aligned}$$(20)and

$$\begin{aligned} P_{n}^{*}(B_{s},B_{n})-\alpha _{v}\mu _{v}-\delta E[U_{v}(B_{s},B_{n})]=\alpha _{bn}\mu _{bn}-P_{n}^{*}(B_{s},B_{n})-\delta E[U_{bn}(B_{s},B_{n})] \end{aligned}$$(21)Otherwise, if \(P_{s}^{*}(B_{s},B_{n})=D\), then

$$\begin{aligned} \delta E[U_{v}(B_{s},B_{n})]+\delta E[U_{bs}(B_{s},B_{n})]>\alpha _{bs}\mu _{bs}-\alpha _{v}\mu _{v} \end{aligned}$$ -

3.

for \(P_{s}^{*}(B_{s},B_{n})\in \left[ \alpha _{v}\mu _{v}, \alpha _{bs}\mu _{bs}\right]\) and \(P_{n}^{*}(B_{s},B_{n})\in \left[ \alpha _{v}\mu _{v}, \alpha _{bn}\mu _{bn}\right]\), \(E[U_{v}]\), \(E[U_{bs}]\), and \(E[U_{bn}]\) are defined as follows:

$$\begin{aligned} E[U_{v}(B_{s},B_{n})]= & {} \frac{B_{s}}{B_{s}+B_{n}}P_{s}^{*}(B_{s},B_{n})+ \frac{B_{n}}{B_{s}+B_{n}}P_{s}^{*}(B_{s},B_{n})-\alpha _{v}\mu _{v} \end{aligned}$$(22)$$\begin{aligned} E[U_{bs}(B_{s},B_{n})]= & {} \alpha _{bs}\mu _{bn}-P_{s}^{*}(B_{s},B_{n}) \end{aligned}$$(23)$$\begin{aligned} E[U_{bn}(B_{s},B_{n})]= & {} \alpha _{bn}\mu _{bn}-P_{n}^{*}(B_{s},B_{n}) \end{aligned}$$(24)while if \(P_{s}^{*}(B_{s},B_{n})=D\) then

$$\begin{aligned} E[U_{v}(B_{s},B_{n})]= & {} \delta E[U_{v}(B_{s},B_{n})] \end{aligned}$$(25)$$\begin{aligned} E[U_{bs}(B_{s},B_{n})]= & {} \delta E[U_{bs}(B_{s},B_{n})] \end{aligned}$$(26)$$\begin{aligned} E[U_{bn}(B_{s},B_{n})]= & {} \delta E[U_{bs}(B_{s},B_{n})] \end{aligned}$$(27)

Condition 1 implies that, when the seller and a sophisticated buyer meet, a transaction occurs when the surplus created by bargaining is larger than the sum of the expected utility for the seller and the buyer at time \(t+1\) when the transaction does not occur. In this case, the negotiated price results from the Nash solution. Condition 2 similarly applies for the case in which when the seller and a naïve buyer meet. Finally, condition 3 defines the expected utility from being a seller or a buyer.

The next Proposition characterizes the (unique) market equilibrium in this model (the proof is in the Appendix B).

Proposition 2

Under the assumption \(\Delta \le \frac{1-\delta }{\alpha _{b}B_{n}\delta }\left[ 2(B_{s}+B_{n})-\delta \right] (\alpha _{bs}\mu _{bs}-\alpha _{v}\mu _{v})\), the equilibrium pair of prices \((P_{s}^{*}(B_{s},B_{n});P_{n}^{*}(B_{s},B_{n}))\) is given by:

The equilibrium described in Proposition 2 has several notable properties. First, as expected, \(P_{n}^{*}(B_{s},B_{n})\ge P_{s}^{*}(B_{s},B_{n})\), where the inequality is strict if \(\Delta >0\). That is, the seller can exploit naïve consumers by overcharging them, by applying what is known as naïvete-based discrimination (Heidhues & Koszegi, 2017). In addition, the difference in prices is increasing in the distortion degree. Second, the price paid by sophisticated buyers is increasing in the amount of distortion \(\Delta\) and in the share of naïve buyers \(\frac{B_{n} }{B_{s}+B_{n}}\). In other words, naïve buyers exert a negative externality on sophisticated ones. The intuition is that the higher is the distortion (or the share of naïve buyers) the higher is the seller expected utility from disagreement in the interaction with a sophisticated buyer. As a consequence, the seller obtains a higher market power and consequently a higher price. Similarly, an increase in the share of sophisticated buyers (i.e. a lower \(\frac{B_{n}}{B_{s}+B_{n}}\)), keeping constant the total number of buyers \(B_{s}+B_{n}\) benefit naïve buyers reducing the price they pay (since \(P_{s}^{*}(B_{s},B_{n})\) and \(P_{n}^{*}(B_{s},B_{n})\) reduce by the same amount). This result suggests some policy implications. The process through which naïve agents can turn into sophisticated ones requires effort and time, as individuals have to accumulate cultural and educational capital. Cultural institutions such as museums and other exhibitions hosts can carry on this process since they allow the attendants to enrich their knowledge on artists and art in general (Throsby, 2010; Frey, 2013). The dissemination of information on artworks quality and on how to evaluate it can be also fostered by cultural and educational policies. In other words, every institution or policy that may lead to an increase of the cultural capital naïve collectors are endowed with would imply a reduction of their negative impact on the market due to biased beliefs. However, in implementing this type of policy suggestion one should also consider how it could impact other market agents’ welfare such as artists’ utility. For example, considering only a short-term impact of a higher price on the artist’s utility, this would be positive since it would increase it. However, if we analyze the long-term impact, we should also consider if the price increase could be perceived as price inflation for the artist’s pieces, which could be deceitful for his/her career.Footnote 18 The role of gatekeepers in choosing the type of buyers can mitigate this price impact in the long term, but, as suggested by Coslor et al. (2020), the gatekeeping action is more likely to be observed in high-value art galleries. What could happen in the low-tier market is something that would need further investigation.

4 Conclusions

In this paper, we developed a model of price formation through bargaining between (possibly) overconfident agents and we applied it to the art market. We have shown that overconfidence, both in the form of overoptimism and overprecision, has an impact on all the dimensions of market outcomes: price, quality, and the likelihood of trading. Considering the impact of overconfidence on the likelihood of trading, the side of the market that is overconfident matters, so the effect of overconfidence on the likelihood of trading is ambiguous. On one hand, buyers’ overconfidence has a positive impact on the likelihood of trading, because sellers are more willing to exchange since they can exploit their information advantage. On the other hand, the seller’s overconfidence has a negative effect, since the seller’s reservation price is excessively high given the available information, and leads buyers to be less willing to trade. In dynamic models of financial markets with overconfidence (Scheinkman & Xiong, 2003), buyers who know that an asset is overpriced may buy it anyway, if they expect to resell it at an even higher price to other overconfident buyers. While this is also a possibility in the art market, liquidity in this market is surely lower than in the financial markets, so this effect is expected to be weaker. As for the average quality of artwork sold, it is notable that when overconfidence reduces the likelihood to trade (i.e. when sellers are overconfident), the market tends to select artwork with higher expected quality. Differently from the usual models of markets with asymmetric (hidden) information, where we observe adverse selection (Akerlof, 1970), here we obtain an advantageous selection. This is because sophisticated buyers are willing to pay the higher price induced by overconfidence only if they expect higher quality. Finally, for the impact of overconfidence on the hedonic price, we find that buyers are overcharged irrespective of the side of the market that is biased. Overcharging is one of the specific issues that can arise in the presence of credence goods when a consumer requires and receives an inexpensive and simple treatment but is charged for an expensive and complex one (Dulleck & Kerschbamer, 2006). In our setting, this result is extended to exogenous quality goods. However, overcharging is not necessarily due to the exploitation of superior information, since the buyer may end up paying an excessive price even when it is the party possessing a correct estimation of the artwork’s quality. Indeed, it depends on the fact that the equilibrium price obtained with Nash bargaining depends on the reservation prices of both parties.

All the results so far hold both when a single interaction between a seller and a buyer is considered, and in a market setting where each side of the market is composed of homogeneous agents. However, the analysis of the market equilibrium has also provided several additional insights. First, relative market power for sellers and buyers depends on their number, as a more “crowded” market side reduces the ability to appropriate surplus. Second, in a model with buyers who are heterogeneous in terms of sophistication, we identify an externality effect, in that the fraction of naïve consumers has a positive impact on the price paid both by sophisticated and naïve consumers.

From our model it is possible to derive some testable hypotheses and implications. Within a specific art market, for instance, the larger is the fraction of naïve buyers, the higher we expect the (bargained) prices. Conditional on trade to occur, this should in principle benefit the seller since it would gain more. However, the implications in the long term are not that straightforward, in particular for the case of artists. These agents could indeed see their artworks’ price increase, but this market recognition could not be coupled by an actual institutional acknowledgment. In other words, the evaluation would be made through popularity, but this does not mean that the traded pieces are actually of high quality. If so, we can reasonably expect that outsiders will be more frequent than insiders when sellers provide one artwork of an artist of this type. The role of private and public institutions in shaping the way information is processed is indeed important, such as in the case of private investment banks organizing educational events where investment in art is discussed and explained or in the case of public museums or even ministries that start processes of education for the citizens. Studying the role of this type of public and private choice, though, would need a wider modeling framework containing also these institutions and, possibly, the artists, so to see how the latter is impacted by educational processes.

An additional point that could be taken into account is the role of digitalization and the spread use of social media and other information platforms (Arora & Vermeylen, 2013). Higher accessibility to information, however, does not directly imply a better use of it, since the information has to be processed to become usable knowledge, and the higher quantity of information is not necessarily related to higher ability in processing it. Moreover and above all, information has to be reliable, which might not always be the case when it comes from digital sources, particularly for less reputed institutions that share their data (Van Miegroet et al., 2019). Future research could study how quality (or reliability) and quantity of information can interact with price formation, also considering the processing ability of agents as well as the reasons that motivate their buying choices, being these investment or collection reasons. This would ask for a dynamic model, better suited to take into account the complexity of such an analysis.

Notes

Candela & Castellani (2000) noted that many economists such as Baumol claimed to be passionate connoisseurs but not experienced collectors. Concerning risk, inexperienced collectors are more prone to speculation or gambling when the prices of the artworks are volatile and the artists are not famous so it is difficult to predict the value of their artworks over time.

We are indebted to an anonymous reviewer for suggesting this point.

In cases of asymmetric information or disinformation, “intentional misinformation” may also occur. Deceitful behavior is not considered explicitly in our model. A recent strand in cultural economics analyzed the case where an art market agent voluntarily chooses to share fake or limited information to take advantage of his/her information advantage (Radermecker et al., 2021; Angelini & Castellani, 2022).

Cellini & Cuccia (2003) assumed that two types of an artist can exist: the innovative artist with a high propensity to experiment, and the conservative artist with a low (or nil) propensity to experiment. If the propensity to experimentation is not directly observable, incomplete and asymmetric information arises in the relationship between private agents and artists.

An alternative interpretation of signals sees them as observable features of an agent that are displayed intentionally by that agent while signs are perceivable features of an agent that unintentionally convey information about qualities of that agent (Gambetta, 2009; Gambetta & Székely, 2014) This paradigm can be applied to the art market case too, where one can interpret signs and signals related to art market agents. In the case of auction houses, for example, guarantee policies can be seen as a signal and reputation as a sign. However, since we are considering how the buyer/seller evaluates the good rather than how the buyer (seller) evaluates the seller (buyer), using the approach outlined by Candela et al. (2012) is better suited for our model.

The listed reasons for biased beliefs in the art market are shared with other markets as well. In financial markets, for instance, agents may overestimate their investment skills and their ability to identify high-return investment opportunities. Using data from sports memorabilia and collector pins markets, List (2003) finds that sellers are affected by the endowment effect, but market experience mitigates it.

Starting from the seminal paper by Ishibashi & Matsushima (2009), several scholars have studied how firms compete which each other given the willingness to pay of the consumers located in either the high- or the low-end market. The impact of the size of the low-end market (Amaldoss & Shin, 2011) and of the possible choice of managerial delegation (Pan et al., 2020) have been investigated as well. However, to the best of our knowledge, the rationale lying behind the consumers’ choices in the low-end market have not been studied yet.

The presence of pieces with dubious provenance can be due to their owner preferring to avoid public sales in important auction houses when he/she is not sure about the provenance (Bocart & Oosterlinck, 2011) to not incur in possible reputation loss, knowing that this can also possibly impact the artist who made it, through attribution stigma (Coslor & Fry, 2021). Availability of provenance information is positively related with price (Radermecker, 2021; Li et al., 2021).

As for the investment motive, a high probability of resale the artwork in the future at a higher price impacts positively the value an agent attaches to that piece. However, even absent such an expected price increase, high-quality artworks can preserve their value over time and generate a positive effect on the reservation price for a purely hedonic evaluation of quality.

As it is common in models with overconfidence, bargaining parties “agree to disagree” on expected quality.

All sellers are considered identical and their artworks have the same quality. In the low-tier market, this can happen in the case of graphics, where the artworks are identical copies; in some segments of the tribal art market, where the artist is anonymous and very similar artworks can be found in the market, or if we consider the quality of a certain artist’s artworks as equivalent.

As in trust-based, relationship, and loyalty marketing, sellers focus on repeat customers or existing buyers through trustworthy dialogue, unbiased information, and incentives to build consumer relationships. So, sophisticated buyers are well-known collectors, while naïve are often occasional or new buyers in the art market. In the low-tier of the art market, the model can represent a situation where the seller is a gallery offering a specific artwork, and interacting with many possible buyers.

If the condition on \(\Delta\) is not satisfied, the seller would not prefer to conclude the transaction with a sophisticated buyer, to wait for the higher price guaranteed by a naïve one. If market participation has a positive (negligible) cost for buyers, sophisticated buyers will not participate and the analysis would boil down to the homogeneous population case.

We thank an anonymous reviewer for suggesting this discussion.

References

Abbé-Decarroux, F. (1994). The perception of quality and the demand for services. Empirical application to the performing arts The perception of quality and the demand for services. Empirical application to the performing arts. Journal of Economic Behavior & Organization, 23, 99–107.

Adler, M. (1985). Stardom and talent Stardom and talent. American Economic Review, 75(1), 208–212.

Adler, M. (2006). Stardom and talent. In V. A. Ginsburgh & D. Throsby (Eds.), Handbook of the economics of art and culture (Vol. 1, pp. 895–906). Elsevier.

Akerlof, G. A. (1970). The Market for “Lemons”: Quality Uncertainty and the Market Mechanism The market for “Lemons”: Quality uncertainty and the market mechanism. The Quarterly Journal of Economics, 84(3), 488–500.

Amaldoss, W., & Shin, W. (2011). Competing for low-end markets. Marketing Science, 30(5), 776–788.

Angelini, F., Castellani, M., & Pattitoni, P. (2022). Artist names as human brands: Brand determinants, creation and co-creation mechanisms. Empirical Studies of the Arts: Retrieved from. https://doi.org/10.1177/02762374211072964.

Angelini, F., & Castellani, M. (2018). Private pricing in the art market. Economics Bulletin, 38(4), 2371–2378.

Angelini, F., & Castellani, M. (2019). Cultural and economic value: a critical review. Journal of Cultural Economics, 43(2), 173–188.

Angelini, F., & Castellani, M. (2022). Price and information disclosure in the private art market: a signalling game. Research in Economics, 76(1), 14–20.

Armstrong, M. (2015). Search and ripoff externalities. Review of Industrial Organization, 47(3), 273–302.

Armstrong, M., & Chen, Y. (2020). Discount pricing. Economic Inquiry, 58(4), 1614–1627.

Arora, P., & Vermeylen, F. (2013). The end of the art connoisseur? Experts and knowledge production in the visual arts in the digital age. Information, Communication & Society, 16(2), 194–214.

Baumol, W. J. (1986). Unnatural value: or art investment as floating crap game. American Economic Review, 76(2), 10–14.

Binmore, K., Rubinstein, A., & Wolinsky, A. (1986). The Nash bargaining solution in economic modelling. The Rand Journal of Economics, 17(2), 176–188.

Blaug, M. (2001). Where are we now on cultural economics? Journal of Economic Surveys, 15(2), 123–143.

Bocart, F., & Oosterlinck, K. (2011). Discoveries of fakes: Their impact on the art market. Economics Letters, 113(2), 124–126.

Bonus, H., & Ronte, D. (1997). Credibility and economic value in the arts. Journal of Cultural Economics, 21(2), 103–118.

Bregu, K. (2020). Overconfidence and (over) trading: The effect of feedback on trading behavior. Journal of Behavioral and Experimental Economics, 88, 101598.

Camerer, C., & Lovallo, D. (1999). Overconfidence and excess entry: An experimental approach. American Economic Review, 89(1), 306–318.

Candela, G., & Castellani, M. (2000). L’economia e l’arte. Economia Politica, 17(3), 375–392.

Candela, G., Castellani, M., & Pattitoni, P. (2012). Tribal art market: Signs and signals. Journal of Cultural Economics, 36(4), 289–308.

Candela, G., Castellani, M., & Pattitoni, P. (2013). Reconsidering psychic return in art investments. Economics Letters, 118(2), 351–354.

Candela, G., Castellani, M., Pattitoni, P., & Di Lascio, F. M. (2016). On Rosen’s and Adler’s hypotheses in the modern and contemporary visual art market. Empirical Economics, 451(1), 415–437.

Candela, G., & Cellini, R. (1998). I mercati dei beni di qualità esogena. Politica Economica, 14(2), 217–244.

Candela, G., Lorusso, S., & Matteucci, C. (2009). Information, documentation and certification in Western and ethnic art. Conservation Science in Cultural Heritage, 9(1), 47–78.

Caves, R. E. (2003). Contracts between art and commerce. The Journal of Economic Perspectives, 17(2), 73–84.

Cellini, R., & Cuccia, T. (2003). Incomplete information and experimentation in the arts: A game theory approach. Economia Politica, XX(1), 21–34.

Cellini, R., & Cuccia, T. (2014). The artist-art dealer relationship as a marketing channel. Research in Economics, 68(1), 57–69.

Coate, B., & Hoffmann, R. (2022). The behavioural economics of culture. Journal of Cultural Economics, 46, 3–26.

Coslor, E., & Fry, T.R. (2021). Attribution stigma and contagion: How did the art auction market react to Australian “Black art scandals”? (Available at SSRN: https://ssrn.com/abstract=3934138)

Coslor, E., Crawford, B., & Leyshon, A. (2020). Collectors, investors and speculators: Gatekeeper use of audience categories in the art market. Organization Studies, 41(7), 945–967.

Daniel, K., & Hirshleifer, D. (2015). Overconfident investors, predictable returns, and excessive trading. Journal of Economic Perspectives, 29(4), 61–88.

De Vecchi, N. (2008). The fine arts market: The methodological limitations of art economics taking a Smithian approach. Economia Politica, XXV(1), 33–57.

DellaVigna, S., & Malmendier, U. (2006). Paying not to go to the gym. American Economic Review, 96(3), 694–719.

Di Gaetano, L., Mazza, I., & Mignosa, A. (2019). On the allocation of talents in the contemporary art market. Journal of Cultural Economics, 43(1), 121–143.

Dietrich, M., & Tscheulin, D. K. (2013). It’s the funding, not the art(ist)—How public spending affects the acceptance of public art. Zeitschrift für öffentliche und gemeinwirtschaftliche Unternehmen, Beiheft, 42, 105–116.

Dulleck, U., & Kerschbamer, R. (2006). On doctors, mechanics, and computer specialists: The economics of credence goods. Journal of Economic Literature, 44(1), 5–42.

Ekelund, R. B., Higgins, R., & Jackson, J. D. (2020). ART as meta-credence: Authentication and the role of experts. Journal of Cultural Economics, 44(2), 155–171.

Ericson, K., & Fuster, A. (2014). The endowment effect. Annual Review of Economics, 6(1), 555–579.

Frey, B. S. (2013). Arts & economics: Analysis & cultural policy. Springer.

Galasso, A. (2010). Over-confidence may reduce negotiation delay. Journal of Economic Behavior & Organization, 76(3), 716–733.

Gambetta, D. (2009). Signaling. In P. Hedström & P. Bearman (Eds.), The Oxford handbook of analytical sociology (pp. 168–194). Oxford University Press.

Gambetta, D., & Székely, Á. (2014). Signs and (counter) signals of trustworthiness. Journal of Economic Behavior & Organization, 106, 281–297.

Ginsburgh, V. A., & Weyers, S. (1999). On the perceived quality of movies. Journal of Cultural Economics, 23(1), 269–283.

Glaser, M., & Weber, M. (2007). Overconfidence and trading volume. The Geneva Risk and Insurance Review, 32(1), 1–36.

Grant, D. (2013). How to haggle for art. Wall Street Journal. (Retrieved at: https://www.wsj.com/articles/how-to-haggle-for-art -1379539675, June 21, 2018)

Grubb, M. D. (2015). Overconfident consumers in the marketplace. Journal of Economic Perspectives, 29(4), 9–36.

Grubb, M. D., & Osborne, M. (2015). Cellular service demand: Biased beliefs, learning, and bill shock. American Economic Review, 105(1), 234–71.

Heidhues, P., & Koszegi, B. (2017). Naivete-based discrimination. The Quarterly Journal of Economics, 132(2), 1019–1054.

Hofmann, K. H., & Opitz, C. (2019). Talent and publicity as determinants of superstar incomes: Empirical evidence from the motion picture industry. Applied Economics, 51(13), 1383–1395.

Iossa, E., & Palumbo, G. (2010). Over-optimism and lender liability in the consumer credit market. Oxford Economic Papers, 62(2), 374–394.

Ishibashi, I., & Matsushima, N. (2009). The existence of low-end firms may help high-end firms. Marketing Science, 28(1), 136–147.

Karpik, L. (2010). Valuing the unique: The economics of singularities. Princeton University Press.

Kozbelt, A. (2004). Originality and technical skill as components of artistic quality. Empirical Studies of the Arts, 22, 157–170.

Kräussl, R., Lehnert, T., & Martelin, N. (2016). Is there a bubble in the art market? Journal of Empirical Finance, 35, 99–109.

Krueger, A. B. (2005). The economics of real superstars: The market for rock concerts in the material world. Journal of Labor Economics, 23(1), 1–30.

Lazzaro, E. (2006). Assessing quality in cultural goods: The hedonic value of originality in Rembrandt’s prints. Journal of Cultural Economics, 30(1), 15–40.

Li, Y., Ma, X., Renneboog, L. (2021). In art we trust. (CentER Discussion Paper Series No. 2021-016, Available at SSRN: https://ssrn.com/ abstract=3871007)

List, J. A. (2003). Does market experience eliminate market anomalies? The Quarterly Journal of Economics, 118(1), 41–71.

Locher, P., Krupinski, E., & Schaefer, A. (2015). Art and authenticity: Behavioral and eye-movement analyses. Psychology of Aesthetics, Creativity, and the Arts, 9(4), 356–367.

Lupton, S. (2005). Shared quality uncertainty and the introduction of indeterminate goods. Cambridge Journal of Economics, 29(3), 399–421.

Malmendier, U., & Taylor, T. (2015). On the verges of overconfidence. Journal of Economic Perspectives, 29(4), 3–8.