Abstract

Using a sample of firms over the 2002–2010 period relative to the US, Europe, and Japan, this paper investigates the effects of control of corruption on firms’ efficiency. Our econometric analysis is developed into two main steps. In the first step, we rely on the application of the Stochastic Frontier Analysis (SFA) to estimate firm-level efficiency. We then regress the derived efficiency scores against the International Country Risk Guide (ICRG) control of corruption indicator, through an Instrumental Variable approach, where the ICRG index is instrumented using a measure of ethnolinguistic fractionalization. The evidence reported in the paper indicates that improved control of corruption systematically enhances firms’ efficiency. We also rely on a direct approach, in which we assess the impact of corruption on R&D expenditures and the number of registered patents and show that improved control of corruption stimulates both of these dimensions of innovation, though the impact is higher, in magnitude and significance, for patents. The evidence reported in this paper, which is robust to alternative specifications of the production technology, to an alternative instrumentation strategy and to the aggregation of firm-level information, brings relevant implications in terms of policy.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction and literature review

Over time, a large amount of economic literature has been devoted to assessing the impact of corruption on both economic growth and innovation, with mixed results both theoretically and empirically.

Indeed, while one strand of the theoretical literature predicts that corruption hinders economic growth (Aghion et al., 2016; Aidt et al., 2008; Kunieda et al., 2014; Shleifer & Vishny, 1993), a second strand of theoretical research has instead emphasized that corruption may facilitate it (Dzhumashev, 2014; Leff, 1964; Liu, 1985).

According to these papers, several mechanisms might operate in the corruption-growth nexus and such to justify these mixed theoretical predictions.

Specifically, the contributions supporting the “sand the wheels” hypothesis argue that corruption has a detrimental impact on trade (Wanchek, 2009), reduces income mobility and entrepreneurship (Boudreaux, 2014), hinders the development of the financial system (Emenalo et al., 2018), and diverts resources from productive to unproductive activities, where bribery is more profitable (Shleifer & Vishny, 1993). Others, for instance Kunieda et al. (2014), show that corruption increases tax rates or reduces tax revenues and, through that, reduces the amount of available resources for the financing of infrastructures that facilitate innovation (Aghion et al., 2016). Additional mechanisms, however, might operate and such to explain the detrimental effect of corruption and growth. These channels have been notably identified in the contribution of Pellegrini and Gerlagh (2004), who show that beside a direct effect, corruption adversely affects economic growth via its indirect effect on investments and, to a lesser extent, on trade openness and political stability. In his comprehensive review of the role of corruption, Svenson (2005) emphasizes that while at the micro-level corruption adversely affects economic outcomes, as it distorts entrepreneurial incentives and the distribution of entrepreneurial skills, props up inefficient firms, and misallocates the allocation of talents, technology, and capital, evidence of an insignificant effect of corruption on growth is instead detected at the macro-level.Footnote 1 On the other hand, papers supporting the “grease the wheels” hypothesis suggest that corruption positively affects growth as it speeds up bureaucratic procedures and overcomes inefficient regulations (Leff, 1964; Liu, 1985), though Dzhumaschev (2014) warns that this positive effect only occurs if the government’s size is above its optimal level. These ambiguous theoretical predictions are reflected in a large body of empirical research which supports these two contrasting views.

While the detrimental effect of corruption on growth is documented in the papers of Mauro (1995), Méon and Sakkat (2005), and Johnson et al. (2011), the contributions of Méndez and Sepúlveda (2006) and Méon and Weill (2010) instead provide favorable evidence for the “grease the wheels” hypothesis and find evidence of a positive relationship between corruption and growth.

Others, for instance Saha and Sen (2021), have instead proven that the corruption–growth nexus crucially depends on the type of political regime. Using data for a set of 100 countries over the 1984–2016 period, they show that corruption is growth-enhancing in autocracies but detrimental to growth in democracies. In particular, they argue that the positive effect of corruption on growth in autocracies is driven by the commitment of the political elites to economic freedom, which, in turn, stimulates firms’ investments, and, through that, has a positive effect on long-run growth.

Similar results are obtained by Zergawu et al. (2020), who rely on a panel of 99 countries over the 1980–2015 period to evaluate the relationship between infrastructures, institutional quality, and economic growth. By relying on alternative measures of institutional quality,Footnote 2 such as control of corruption, bureaucratic quality, rule of law, and government stability, their evidence indicates that the joint effect of infrastructure and institutional quality is growth-enhancing, with a major role played by control of corruption.

More recently, however, the economic literature has also been concerned with the impact of corruption on different dimensions of innovation.

Most of this literature suggests that increased corruption discourages entrepreneurship and innovation (Anokhin & Schulze, 2009), reduces the likelihood of introducing new products onto the market (De Waldemar, 2012), depresses the issuance of quality certificates and of innovation inputs and machineries (Paunov, 2016), and slows down both investments in R&D and the number of registered patents (Xu & Yano, 2017; Dincer, 2019; Ellis et al., 2020; Lee et al., 2020), further emphasizing that innovative firms represent the main target of corrupt officials (Ayyagari et al., 2014).

On the other hand, Goedhuys et al. (2016) show that corruption facilitates innovation, provided that firms face several administrative and bureaucratic obstacles, while Pluskota (2020) documents a non-linear relationship between corruption and growth and innovation, with low levels of corruption found to be growth-enhancing.

Another strand of the literature, for instance De Rosa et al. (2010), Hanousek and Kochanova (2016), and Giordano and Lopez Garcia (2018), has instead proposed a complementary approach based on evaluation of the effect of corruption and bribery on firms’ performance. In particular, De Rosa et al. (2010) rely on a sample of over 11,000 firms from 28 transition and developed countries of Central and Eastern Europe (CEE) drawn from the 2009 Business Environment and Enterprise Performance Survey (BEEPS) to empirically assess the impact of two alternative forms of corruption on firm-level productivity. Accordingly, while bribe taxes, defined as informal payments to government officials to speed up the daily operations of the firms, are found to reduce productivity, time taxes, defined as red tape, are instead proven to be insignificant. Their analysis further reveals that that the detrimental effects of corruption are larger for non-EU countries and crucially depend on the overall level of institutional quality, as the lower the level of institutional quality, the stronger will be the adverse effects of corruption. Finally, according to their findings, in the presence of a weak institutional environment most productive firms do not pay bribes. Using data from CEE countries, Hanousek and Kochanova (2016) study the effects of corruption on both firm-level sales and productivity. Their findings suggest that while the performance of firms shrinks as the mean of firm-level bribes increases, the former is instead enhanced when firm-level bribes become more dispersed. Moreover, their findings indicate that the adverse consequences of the local bribery environment are larger for firms with more than 10 employees and that the impact of both mean bribes and dispersion becomes higher in countries with weaker institutional environments. Giordano and Lopez-Garcia (2018), using data for nine CEE countries over the 2003–2012 period, investigate the relationship between firm-level bribes and the efficiency of within-sector production factor allocation. Accordingly, higher corruption is associated with lower efficiency and higher misallocation of both labor and capital. Moreover, the adverse effects of increased corruption are higher for smaller countries and in the presence of poor quality of institutions.

Martins et al. (2020), using a sample of 21,250 firms in both developed and developing countries, appraise the impact of corruption on different dimensions of firms’ performance, such as sales’ growth, employment growth, productivity growth and investment, showing that corruption systematically hampers the performance of firms.

While a pervasive literature has been devoted to assessing the impact of corruption on growth and innovation, only a limited amount of theoretical and empirical research has instead investigated the relationship between corruption and firms’ efficiency. From a theoretical perspective, the main economic literature suggests that increased corruption hampers the efficiency of firms as it changes the incentives of the managements towards factor coordination (Dal Bó & Rossi, 2007), while according to Lien (1990), corruption is detrimental to allocative efficiency if there exists some degree of discrimination. Others, see for instance Murphy et al., (1991, 1993), emphasize that corruption, acting like an extortionary tax on innovators, depresses both innovation and innovation efficiency. Although some contributions, Castiglione et al. (2018), Sun et al. (2019), Zalle (2019), Aldieri, Makkonen, et al. (2020), and Aldieri, Barra, et al. (2020), by relying on alternative measures of governance quality, have proven that the higher the quality of institutions, the higher the efficiency of firms,Footnote 3 little is known on the impact of corruption, as stand-alone dimension of institutional quality, on the efficiency of firms. Contributions of this type are limited, to the best of our knowledge, to the papers of Dal Bó and Rossi (2007) and Sharma and Mitra (2015), who have shown that increased corruption is detrimental to the technical efficiency of firms.

Departing from this literature, in this paper, using data on firms’ innovation from the US, Europe, and Japan over the period 2002–2010, we investigate the impact of control of corruption on firms’ efficiency and test the following hypothesis: H1) increased control of corruption enhances firms’ efficiency.

A priori, we therefore expect this hypothesis to be empirically accepted. Indeed, following Méon and Weill (2005), corruption distorts individual incentives and affects not only the accumulation of productive resources but also the intensity with which they are employed, hence suggesting that control of corruption and firms’ efficiency should be directly correlated.

To assess the effects of corruption on firms’ efficiency, the empirical analysis proposed in this paper is developed in two main steps.

In the first step, we rely on the application of the Stochastic Frontier Analysis (SFA) proposed by Kumbhakar et al. (2014) to obtain a measure of firms’ efficiency. We then regress the estimated efficiency scores against the ICRG control of corruption indicator through the application of an Instrumental Variable (IV) approach, where our preferred measure of control of corruption is instrumented, in line with Mauro (1995), with an index of ethnolinguistic fractionalization. The application of this two-stage procedure is justified by the fact that the previous literature, most notably Méon and Weill (2005), Dal Bó and Rossi (2007), Sharma and Mitra (2015), Castiglione et al. (2018), and Aldieri, Makkonen, et al. (2020), Aldieri, Barra, et al. (2020)), has directly embodied the quality of institutions within the SFA framework, hence making these estimates vulnerable to the likely endogeneity between measures of government quality and efficiency. The approach followed in this paper, on the other hand, allows us to obtain consistent estimates of the efficiency scores in the first stage and, in the second, to control for the endogeneity in the corruption-efficiency nexus.

Our results indicate that increased control of corruption systematically enhances firms’ efficiency.

Moreover, as it might be argued that firms’ efficiency is not directly observable, we also examine the impact of control of corruption on the number of patents issued and R&D expenditures. Evidence obtained through this econometric exercise reveals that a higher capacity of government to control corruption is positively and significantly correlated with these two dimensions of innovation, hence suggesting that control of corruption plays a key role in explaining the innovative performances of firms. The evidence reported in this paper, which is robust to alternative specifications of the underlying technology, to an alternative instrumentation strategy, based on a measure of freedom of press, and to the aggregation of firm-level innovation, brings, in our opinion, some relevant policy implications. The paper is organized as follows: Sect. 2 provides a theoretical underpinning, while Sect. 3 introduces the methodology employed to empirically assess the efficiency and investigate the corruption-efficiency nexus. Section 4 describes the main variables employed, while Sect. 5 reports the results obtained from our benchmark specifications. Section 6 provides a battery of robustness checks, while Sect. 7 concludes and discusses the main policy implications.

2 Theoretical background and hypothesis development

Departing from Rodríguez-Pose and Di Cataldo (2015), we consider a knowledge production function (KPF) which depends not only on the standard inputs of a canonical KPF but also on a measure which captures the ability of the government to control corruption to evaluate, within the US, Europe, and Japan, how control of corruption interacts with the innovative performances of firms. Following Rodríguez-Pose and Di Cataldo (2015), we therefore propose the following knowledge production function:

where \(\dot{{A}_{t}}\) is the rate of change of technological progress at time t, \({A}_{t}\) is the stock of knowledge, \({x}_{it}\) is a vector of standard inputs, like the capital stock in country i at time t \({Z}_{it}\) is a vector of firms’ characteristics, which include factors like total revenues, number of employees, physical capital, and the Hirshman-Herfindhal index, while \({CORR}_{t}\) is an index which captures the extent to which government is able to limit corruption. From inspection of Eq. (1), we may easily derive:

where \({g}_{{A}_{t }}\) is the growth rate of \({A}_{t}\). From the previous theoretical framework, we can test for the following hypothesis:

H1: Increased control of corruption increases firms’ efficiency.

3 Empirical framework

3.1 Assessing firm efficiency using the stochastic frontier analysis

To assess the efficiency of the capacity of firms to innovate, we employ the Stochastic Frontier Analysis (SFA). With respect to the output side, our analysis relies on the amount of R&D expenditure reported by the firms available in our sample over the 2002–2010 periodFootnote 4 As suggested by Fischer and Varga (2003) and Fritsch and Slavtchev (2011), a certain amount of time is required before R&D activities will be realized, since several months (usually from 12 to 18) are needed for patent applications to be published,Footnote 5 implying that a time lag between innovation inputs and output of at least one or two years should be assumed.Footnote 6 It is true, however, that the time lag between R&D inputs and patent applications also depends on the reliability of the data and alternative solutions have been exploited in the literature. Acs et al. (2002) report that innovation records result from inventions made four years previously, while Fritsch and Slavtchev (2007) use a time lag of three years between patent applications and innovation input. Fischer and Varga (2003) instead propose a two-year lag, while Ronde and Hussler (2005) estimate regional innovation performances linking the R&D efforts to the number of patents registered one, two, and three years later. Fritsch and Slavtchev (2011) reduce the time lag to a period of one year. Given the data constraints and the main literature, and to take into account the time required to transform competences into concrete innovation as well as innovation into patents, we assume, following Fischer and Varga (2003), a time lag of two years between innovation inputs and outputs.

Following Fritsch and Slavtchev (2011) and Barra and Zotti (2018), we measure Country Innovation System (CIS) efficiency through the concept of technical efficiency introduced by Farrell (1957), which states that a given unit is technically efficient if it can produce the possible maximum output from a given amount of input. A KPF,Footnote 7 based on a Translog with two time lags in inputs (see Griliches, 1979, and Jaffe, 1989) is estimated, in order to analyze the relationship between inputs and outputs of the innovation process, which is essential for assessing CIS technical efficiency.Footnote 8

Formally, to empirically analyze the effects of corruption on firms’ inefficiency, we rely on the methodology developed by Kumbhakar et al. (2014), which, differently from others, allows us to assess the way in which firms employ their inputs and to evaluate to what extent corruption influences their inefficiency component. The model is specified through the following set of equations:

where yit denotes the output of firm \(i\) at time \(\mathrm{t}\), xit represents a (1 × k) vector of input quantities of firm \(i\) at time \(\mathrm{t}\), \({\varvec{\upbeta}}\) is a (k × 1) vector of unknown parameters to be estimated, \({\upeta }_{\mathrm{i}}\) represents persistent inefficiency, \({\mathrm{u}}_{\mathrm{it}}\) denotes the short-run inefficiency, assumed to be distributed as a half normal, \({\upsigma }_{\mathrm{u}}^{2}={\mathrm{z}}_{\mathrm{it}}\updelta\), where zit is a (1 × m) vector of exogenous variables associated with the technical inefficiency of firm \(i\) at time \(\mathrm{t}\), and \(\updelta\) is an (m × 1) vector of unknown coefficients, \({\upmu }_{\mathrm{i}}\) captures firm fixed effects, and \({\mathrm{v}}_{\mathrm{it}}\) is a stochastic component, while the same determinants are included in the variance as in the variance of the short-run inefficiency component. The model is estimated in three steps. First, Eq. (3a) is estimated using standard Fixed Effects estimation. Second, the time-varying inefficiency \({\mathrm{u}}_{\mathrm{it}}\) is obtained. Finally, persistent inefficiency \({\upeta }_{\mathrm{i}}\) is estimated (Kumbhakar et al., 2014).

3.2 Control of corruption and firms’ efficiency: an IV approach

The main threat to the correct estimation of the association between control of corruption and firms’ efficiency stems from the likely endogeneity of the relationship, driven by reverse causality. As notably emphasized by Mauro (1995), reverse causality issues are determined by the co-evolution between the quality of institutions and growth. Specifically, while an improvement in the quality of institutions enhances economic growth, at the same time improved economic conditions might be the drivers of institutional change. In the specific context of this paper, it is reasonable to assume that increased control of corruption influences firms’ efficiency but that, at the same time, variations in the efficiency of firms might have an impact on the ability of the government to limit corruption, hence justifying the application of an econometric approach which makes it possible to control for endogeneity.

To address this issue, we therefore rely on an instrumental variable regression (IV) estimation strategy. For the IV approach to be valid, we need to find a variable that is related to control of corruption (the variable to be instrumented) but not to firms’ efficiency (the outcome of interest). In line with Mauro (1995), we propose to instrument corruption with an index of ethnolinguistic fractionalization (EFR) (QoG database— https://qog.pol.gu.se/), which measures the probability that two individuals randomly selected from a population of a given country do not belong to the same ethnolinguistic group. According to Mauro (1995), ethnolinguistic fractionalization represents a valid instrument as it is highly correlated with the quality of institutions and with control of corruption but does not directly affect economic outcomes. Indeed, bureaucracies in highly fractionalized countries might have an incentive to favor one ethnic group over another, with a detrimental effect on the control of corruption but with no direct impact on firms’ economic performances. Given these considerations, it seems reasonable to assume that higher ethnolinguistic fractionalization is inversely correlated with control of corruption but has no direct impact on the efficiency of firms. Formally, we estimate the following equations:

where EFF is the efficiency (see Sect. 3.1 for more details about the method employed for calculation) calculated in the first stage for firm j, in country i at time t, CORR is the control of corruption for country i and time t, SECT represents a vector of sectoral dummies, and COUNTRY represents a set of country fixed effects in the US, Europe, and Japan. The subscripts i, t, k, and j denote country, time (2002–2010), sector, and firm, respectively.

The coefficient \({\gamma }_{1}\) in Eq. (4) is the main parameter of interest in our analysis and we expect it to be > 0, with the implication that the higher the ability of the government to limit corruption, the higher the efficiency of firms. In Eq. (5), we formalize the effect of firm efficiency on control of corruption, assuming that \({\delta }_{2}\) is positive (e.g., firm efficiency tends to increase control of corruption). From Eqs. (4) and (5), it is easy to verify that the control of corruption of country i in period t might be correlated with the error term \({\varepsilon }_{i1}\), hence necessitating the application of an estimator that makes it possible to control for the endogeneity of our control of corruption indicator. To assess whether the instruments employed are weak or not, an F-test has been reported, jointly with the Durbin-Wu-Hausman statistics, which allows to test for the exogeneity of our measure of control of corruption and, in turn, to determine whether an IV approach is valid for our empirical purposes or whether the OLS provides consistent estimates of the parameter of interest.

4 Data, production set, and model specification

4.1 The production set

The empirical analysis is developed on the basis of a dataset that combines firm-level data and the patents registered by each firm (Aldieri & Vinci, 2016; Aldieri, Barra, et al., 2020; Aldieri, Makkonen, et al., 2020) in three economic areas (the USA, Japan, and 12 European countries: Austria, Belgium, Denmark, Finland, France, Germany, Italy, Spain, Sweden, Switzerland, the Netherlands, and the UK). In particular, firm-level data have been sourced from the JRC-IPTS EU R&D investment scoreboards (European Commission, 2011, 2012). Data relative to net sales—output—and the annual R&D expenditure, number of employees, and annual capital expenditure—inputs—are reported. Moreover, firms are grouped according to the two-digit level Industrial Classification Benchmark (ICB). Monetary values in the scoreboards are expressed in euros using the exchange rate from 2007 (our reference year). The measure of R&D stock is derived using the perpetual inventory method: a depreciation rate of 0.15 has been applied, in line with previous literature (Aldieri, 2011; Hall & Mairesse, 1995). Finally, once the same cleaning procedure as in Aldieri et al. (2018) has been introduced, the removal of firms leads to an unbalanced panel of 823 firms observed over the period 2002–2010.

Moreover, data on patents registered by firms from the scoreboards have been sourced from the OECD REGPAT (January 2012,Footnote 9Footnote 10). REGPAT collects data on patents registered with PATSTAT (the EU patent office) and the address of the applicant (a firm) may differ from the inventor’s address (reported in REGPAT as well). If the inventor’s address is different from the address of the applicant, we will label the inventor as a foreign inventor. For each firm, we have computed the share of patents owned by the firm with foreign inventors.

Knowledge spillovers are typically measured as the stock of R&D conducted outside the focal firm and weighted by some measure of closeness between the source and the recipient of the spillovers (Griliches, 1992). Empirical literature distinguishes between knowledge and rent spillovers and, in line with this, we will use the measure of spillovers as a proxy for “knowledge” spillovers. The Jaffe measure (1986) computes the uncentered correlation coefficient between the corresponding technology vectors based on the distribution of patents:

where Ti is the technological vector of the firm i and Pij is the technological proximity between firms i and j. The spillovers’ weighted stock is the following:

with Kj being the R&D capital stock relative to company j (as in Aldieri & Cincera, 2009; Aldieri et al., 2018). The potential capital stock of spillovers is partitioned into four components: the intra-industry national capital stock, the intra-industry international capital stock, the inter-industry national capital stock and, finally, the inter-industry international capital stock.

The production (innovation) technology is specified with four inputs (the intra-industry national capital stock, IINS; the intra-industry international capital stock, IIIS; the inter-industry national capital stock, ININS; and finally the inter-industry international capital stock, III) and one output (we use the R&D expenditures, RD_EXP, and the number of patents registered, PAT, over the 2002–2010 period, respectively).

To control for firms’ balance sheets, we include variables like total revenue of firms (REV), total number of employees of firms (EMPL), physical capital of firms (PH_CAP), and index of market concentration (HH) (in our case, the Hirshman-Herfindhal index, the indicator widely used in the empirical literature, as in Aldieri (2011), is a measure of the size of firms in relation to the industry they are in and an indicator of the amount of competition among them), while time dummies and macro-area dummies are included in the regression in order to control for exogenous effects and to capture the effects of relevant macroeconomic variables or territorial differences on firms’ inefficiency. Information about control of corruption is instead taken from the International Country Risk Guide (ICRG) dataset (see Table 1 for information about the production set). Accordingly, the ICRG control of corruption indicator provides a measure which summarizes the degree of corruption within the political system, assumed to create distortions in the economic and financial environments, to reduce the effectiveness of government, to favor patronage, and to reduce the stability of the political process. The ICRG control of corruption index lies in the interval [0,6], with higher values representing lower levels of corruption.

Table 2 provides the summary statistics for the main variables employed in the empirical analysis proposed in the in paper, further partitioned by geographical area, in order to capture differences or similarities in terms of both innovative performances and control of corruption among the countries under scrutiny.

According to Table 2, the amount of R&D expenditure is higher in the US and Europe and lower in Japan. On the other hand, Japan and Europe exhibit, on average, a larger number of registered patents compared to the US. A similar picture emerges once we consider the intra-industry national capital stock, which is, on average, much lower in Japan, where the value of the variable is almost half that of the two other countries composing the sample. Nevertheless, Japan outperforms the US and Europe in terms of both intra-industry international capital stock and inter-industry international capital stock, while descriptive statistics concerning the amount inter-industry national capital stock reveal that while the US exhibits the highest average, the European economic area and Japan perform quite similarly, as the statistics reported for these two countries are quite similar.

With respect to the levels of employment registered within the sample, according to Table 2, Europe employs, on average, 11 and 13 million more workers compared to the US and Japan respectively. Once we consider the degree of competition of the countries composing the sample, summarized here by the Hirshman-Herfindhal Index, our statistics indicate that the European economic area is largely less competitive than the US and Japan, as it exhibits the higher concentration index.

When the focus is on the ICRG control of corruption indicator, descriptive statistics reported in Table 2 reveal that all countries are characterized by a significant ability to limit corruption. Nevertheless, inspection of the descriptive statistics for this indicator suggests that Europe and the US perform better than Japan.

Table 3 reports the estimated pairwise correlations between the main variables employed in the econometric analysis proposed in the paper. Accordingly, the whole set of inputs (IINS, IIS, ININS, and III) and most of the relevant determinants of the efficiency component (REV, EMPL, PH_CA) exhibit a positive, as expected, and significant linear relationship with both the amount of R&D expenditures and the amount of patents, while an inverse relationship characterizes market concentration and the two output variables under scrutiny. With respect to the estimated correlations between our preferred measure of control of corruption and the two output variables considered in the econometric analysis, we find that increased control of corruption positively and significantly correlates with R&D expenditures but not with patents.

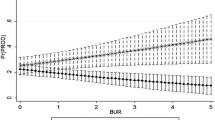

4.2 Time series behavior of firm efficiency, control of corruption, and ethnolinguistic fractionalization

Figure 1 reports the time series behavior of the mean values of the main variables employed in our econometric analysis, namely efficiency, control of corruption, the index of ethnolinguistic fractionalization, and the index of press freedom. With respect to mean efficiency, the dynamics of these indicators are quite similar regardless of the output variable employed.Footnote 11 Specifically, firms’ efficiency shrinks over the period 2002–2006 and then rises from 2007 to 2009, when it reaches its peak. The contraction between 2009 and 2010 can probably be ascribed to the advent of the financial crisis in many developed countries.

When we consider the time-series behavior of the ICRG index of control of corruption, our evidence signals a clear downward trend from 2002 to 2008, when the variable reaches its minimum, while from 2008 to 2010 we document a higher ability of the countries under scrutiny to control corruption.

Relative to the dynamics of our index of ethnolinguistic fractionalization, the reported time series provides evidence of a marked contraction of the mean ethnolinguistic fractionalization from 2002 to 2008, while from 2008 onwards we instead find evidence of a moderate increase in this variable. Finally, when we consider the time-series behavior of the press freedom index employed in this paper, we detect an increase over the 2002–2005 period and a contraction from 2005 to 2007. From 2008 onwards, evidence of a marked increase is found.Footnote 12

5 The empirical evidence

5.1 Firm efficiency: a stochastic frontier approach

Table 4 reports the estimated efficiency scores for the full sample and for the three countries composing the sample. Evidence reported in Table 4 indicates that, regardless of the chosen environment used to estimate the efficiency scores, Japan and Europe are more efficient than the US. Specifically, while the estimated efficiency scores for Japan and Europe lie in the ranges 0.58–0.61 and 0.56–0.59 respectively, for the US they lie between 0.54 and 0.55.

5.2 The relationship between control of corruption and firms’ efficiency: an IV approach

In Table 5 we report the benchmark regression in which we assess the impact of control of corruption on firms’ efficiency, assuming a Translog specification and imposing a two-year lag in inputs. Our results indicate that increased control of corruption has a positive and significant effect on firms’ efficiency, regardless of the output variable employed. The evidence reported here seems therefore to confirm the previous findings of Méon and Weill (2005), Dal Bó and Rossi (2007) and Sharma and Mitra (2015), the studies closest to our contribution, which show that increased control of corruption significantly reduces both aggregate and firm-level efficiency. Nevertheless, a comparison between the estimated parameters reveals that the control of corruption coefficient is 2.49 times larger when patents are used as the output variable. In terms of policy implications, the evidence reported in Table 5 suggests that measures that make control of corruption more effective are beneficial as they allow firms to use their resources efficiently.

Moreover, an assessment of the first-stage estimates indicates that the index of ethnic fractionalization employed to instrument the ICRG control of corruption indicator is negative, as expected, and highly significant, providing evidence for the validity of the instrument. Moreover, as the F-test, in both the specification, is statistically significant at the 1% level and well above the threshold value of 10 identified by Staiger and Stock (1997), our results seem to suggest that the instrument employed in our empirical analysis is not weak. Relatively to the potential exogeneity of the control of corruption indicator, the Durbin-Wu-Hausman statistics are below the conventional 10% threshold, hence suggesting that the control of corruption indicator must be treated as endogenous and providing credits to the application of an IV approach.

In Table 6, we assess the impact of increased control of corruption on firms’ efficiency, by assuming a Translog technology and imposing a one-year lag in inputs.

Our results indicate that a different lag structure between R&D inputs and outputs does not significantly alter the main findings, as increased control of corruption exerts a positive and significant impact on firms’ efficiency. In line with the evidence reported in Table 5, the estimated coefficient is larger in size when patents are taken as the output variable. Again, the statistics of the F-tests and those of the Durbin-Wu-Hausman suggest that the instrument employed is not weak and that the control of corruption indicator must be treated as endogenous, hence providing additional support to the application of the IV estimator.

6 Sensitivity analysis

To assess the robustness of our estimates, we propose various alternative strategies, respectively represented by (i) the application of an alternative functional form for the production function, based on a Cobb–Douglas formulation; (ii) the application of alternative dependent variables, that is, the number of patents issued and R&D expenditures (direct approach); (iii) the application of an alternative instrumentation strategy, where the control of corruption indicator is instrumented using an index of freedom of press; and (iv) the use of aggregated data instead of firm-level information. We discuss each robustness test separately.Footnote 13

6.1 Does a different specification of production function affect the estimates?

Table 7 deals with the impact of control of corruption on firms’ efficiency by assuming a Cobb–Douglas production function and a two-year lag between the time in which innovation is performed and the time in which a new patent is issued. The main results are not particularly affected by the application of an alternative functional form of the technology, as increased control of corruption enhances firms’ efficiency. Nevertheless, under the assumption of a Cobb–Douglas technology, we document a weaker impact of control of corruption on efficiency when R&D expenditures are the relevant output variable, as the coefficient of interest is significant only at the 10% level. In line with the estimates obtained so far, the size of coefficient differs significantly depending on the output variable employed, as the estimated control of corruption coefficient is almost three times larger when patents are the output variable. With respect to the diagnostic statistics reported, in both the specifications the F-tests indicate that the instrument is not weak. Nevertheless, while the Durbin-Wu-Hausman statistics provides favorable evidence for the IV in the specification with patents, the value of the test in the specification with R&D expenditures seems to provide some credit to the consistency of the OLS.

In Table 8 we provide estimates of our IV strategy, assuming a Cobb–Douglas technology and a one-year lag between the time in which innovative activities take place and a new patent is issued. Even in this environment, the benchmark results are confirmed, as improved control of corruption is always found to affect firms’ efficiency positively and significantly. Again, the estimated coefficient of the ICRG indicator is significantly larger when patents are the relevant output variable. The diagnostics statistics reported again suggest that the instrument employed is not weak and that the control of corruption indicator must be treated as endogenous, providing additional favorable evidence for the application of the IV.

6.2 Do different dependent variables affect the estimates?

To further investigate how control of corruption interacts with innovation, we propose additional estimates in which we rely on a direct approach (Tables 9 and 10). Specifically, we investigate whether increased control of corruption directly affects both R&D expenditures and number of registered patents, respectively. Table 9 reports the evidence obtained under the assumption of a two-year lag between inputs and outputs. We find evidence of a positive and significant impact of control of corruption on these two dimensions of innovation, though the impact is weaker when the left-hand-side variable represents R&D expenditures. Moreover, the evidence reported in Table 9 seems to suggest that increased control of corruption is more likely to influence patenting activities than the amount of R&D expenditures. Even once we rely on a direct approach, the statistics of the F-test indicate that the instrument employed is valid. At the same time, however, there is some evidence against the assumption of endogeneity of the control of corruption indicator, although this evidence is limited to the specification in which R&D expenditures are the relevant left-hand-side variable.

Table 10 provides estimates of the proposed direct approach, in which we assume a one-year lag between the time when innovation takes place and the time when innovation is translated into a new patent. Accordingly, increased control of corruption stimulates innovative activities, as the estimated control of corruption coefficients are positive and highly significant. Nevertheless, the evidence reported in Table 9 is confirmed as increased control of corruption is shown to have a preeminent impact on patenting activities rather than R&D expenditures. The main diagnostic statistics again confirm the validity of the instrument and the endogeneity of the control of corruption indicator employed in this paper.

Notes: estimates using stochastic frontier approach; Standard errors in brackets; *p < 0.10, **p < 0.05, ***p < 0.01

6.3 Does a different instrument of control of corruption affect the estimates? The role of freedom of the press

To further assess the robustness of our findings, we propose a set of econometric estimates in which, instead of the index of fractionalization adopted so far, we propose to instrument our measure of control of corruption through the application of an index of freedom of the press. In particular, as noted in the literature, such as Ahrend (2002) and Brunetti and Weder (2003), among others, the higher the degree of press freedom, the lower and less pervasive corruption will be. Other contributions, for instance Giordano and Lopez-Garcia (2018), have instead emphasized that press freedom is a valid instrument of corruption. Accordingly, higher freedom of the press is assumed to be a valid instrument for corruption as it discourages corrupt behaviors by increasing the cost of corruption and the threat of exposure, being instead uncorrelated with the allocation of inputs. For our purposes, we therefore assess the robustness of our benchmark findings by instrumenting control of corruption through the application of the Press Freedom Index developed by Reporters Without Borders (RSF).Footnote 14 Based on various criteria, such as pluralism, media independence, media environment and self-censorship, legislative framework, transparency, and the quality of the infrastructure that supports the production of news and information, the RSF produces, at yearly frequency, a press freedom index which ranges in the [0,100] interval, with higher scores indicating lower levels of press freedom. Table 11 reports the results of our specifications in which our measure of control of corruption is instrumented using the RSF press freedom index. In line with the estimates reported so far, the evidence indicates that increased control of corruption increases firm-level efficiency (assuming a Translog specification and imposing a two-year lag in inputs), hence suggesting that our results are robust to the application of an alternative instrument. With respect to the first-stage estimates, we detect, in line with the expectations, an inverse and highly significant relationship between the RSF press freedom index and our measure of control of corruption, a result that suggests that the lower the freedom of the press, the lower the control of corruption. The F-statistics reported indicate that the freedom of press indicator is not a weak instrument for corruption, while the Durbin-Wu-Hausman statistics suggest that the control of corruption indicator must be treated as endogenous.

Table 12 reports the regression in which we assess the impact of control of corruption on firms’ efficiency, assuming a Translog specification and imposing a one-year lag in inputs. As in Table 11, the RSF press freedom index has been used to instrument the control of corruption indicator. The evidence indicates that higher control of corruption has a positive and highly significant impact on efficiency, regardless of the output variable employed in the specifications. Again, lower press freedom significantly reduces the ability to control corruption.Footnote 15 In line with the estimates reported in Table 11, even in this case the diagnostic statistics seem to suggest that the instrument employed is not weak and that the control of corruption indicator is endogenous.

6.4 Does aggregation affect the estimates?

As a last robustness check, we propose to replicate the specifications reported so far using aggregated instead of firm-level information.Footnote 16 Specifically, we reported a set of econometric estimates for our Translog specifications under the assumption of a two-year lag between inputs and output, where the latter respectively consists of R&D expenditures, while the index of control of corruption has been instrumented alternatively relying on ethnic fractionalization and freedom of the press.

The evidence reported in Table 13 indicates that our benchmark results are only slightly affected when we consider aggregated instead of firm-level data, as the positive and significant relationship between control of corruption and efficiency holds for all the specifications except the one where R&D expenditures represent the output variable, and our measure of institutional quality is instrumented relying on the index of ethnic fractionalization.

With respect to the instruments employed, the results of the first-stage estimates, in line with expectations, seem to suggest that both higher ethnic fractionalization and lower freedom of the press significantly reduce the control of corruption indicator, hence providing favorable evidence concerning the validity of the proposed instruments. While the p-values of the F-statistics again indicate that the instrument employed is valid, those of the Durbin-Wu-Hausman test mostly indicate that, in this context, the OLS is consistent.

7 Conclusions and policy discussion

The effects of corruption on economic growth and innovation have been widely debated in economic analysis, with no unanimous consensus either theoretically or empirically.

While papers supporting the “sanding the wheels” hypothesis show that increased corruption is detrimental to economic growth as it diverts resources from productive to unproductive activities, other contributions indicate that corruption can facilitate economic growth as it avoids bureaucratic inefficiency and speeds up administrative procedures. This mixed evidence is reflected in a large body of empirical literature which has been devoted to assessing how corruption interacts with different dimensions of innovation.

Recent economic literature, however, has instead been concerned with the impact of the quality of institutions on the efficiency of countries and firms, with the general consensus being that countries with good governance exhibit more efficient firms.

In this paper, using information for a set of 823 firms from the US, Europe, and Japan over the 2002–2010 period, we investigate the effects of control of corruption on firms’ efficiency. The empirical analysis proposed in this paper is essentially divided into two main steps. Specifically, in the first step we obtain technical efficiency scores by relying on the parametric approach of the Stochastic Frontier Analysis (SFA) developed by Kumbhakar et al. (2014), while in the second stage these scores are regressed against the ICRG control of corruption indicator through the application of an Instrumental Variable regression, where the control of corruption has been instrumented with an index of ethnolinguistic fractionalization. Differently from the main literature, which has directly embodied the quality of institutions in the SFA framework, we believe that our analysis is relatively more accurate as it deals with the endogeneity between our control of corruption indicator and the efficiency of firms, hence reducing the likelihood of biased estimates that can be obtained when the quality of institutions is directly introduced in the SFA specification. The evidence reported in this paper indicates that increased control of corruption systematically enhances firms’ efficiency and that the results are robust when an alternative instrumentation strategy, based on the application of a press freedom index, is employed. Moreover, the evidence reported in the paper is confirmed when we rely on aggregated data instead of firm-level information.

Moreover, as it might be argued that firms’ efficiency is not directly observable, we also examine the impact of control of corruption on the amount of patents issued and R&D expenditures. Evidence obtained through this econometric exercise reveals that higher capacity of government in controlling corruption is positively and significantly correlated with these two dimensions of innovation, though the significance and size of the estimated coefficients are found to be larger when the number of patents registered by firms is the relevant dependent variable. All in all, our findings seem to suggest that improved control of corruption positively contributes to firms’ innovation decisions and allows them to use their resources more effectively.

Although our contribution provides compelling evidence of a positive and robust impact of control of corruption on the efficiency with which firms employ their inputs, the analysis presented in this paper is not immune from limitations.

Indeed, the major concern arising from the empirical strategy pursued in this paper relates to the combination of a country-level index of control of corruption with firm-level information. Although an approach based on the combination of country-level information on corruption or, more generally, on the quality of institutions, with firm-level data is now quite common in the literature (see, among others, Dal Bó & Rossi, 2007; Hakkala et al., 2008; Enikopolov et al., 2014 and Castelnovo et al., 2019), the mixing of macro and micro information may be problematic and may affect the estimates. For this reason, we advocate future research to appraise the nexus between control of corruption and the efficiency of firms either from a purely macro or fully micro-perspective.

Nevertheless, the empirical evidence presented in this paper is relevant in terms of policy implications. Though we agree, in line with Méon and Weill (2005, p. 87), with the view that “improving governance can arguably be deemed too evasive an objective to be really achievable”, our evidence indicates that improved control of corruption is positively correlated with both unobservable (i.e. the efficiency) and observable variables (i.e. the amount of registered patents and R&D expenditures), hence calling for the implementation of policy measures which allow for a tighter and more effective control of corruption. These policies, in our opinion, are highly beneficial for firms, as they increase their efficiency and stimulate both patenting activities and, to a lesser extent, R&D expenditures.

Notes

According to Svensson (2005), the insignificant impact of corruption on growth in a cross-country setting may depend on a host of factors. Likely causes can be found in the difficulties of measuring corruption, omitted variables, reverse causality, or the possibility that corruption does not necessarily depress economic growth as it may take several forms.

For a comprehensive discussion concerning the relevance of institutions, please refer to Boettke and Fink (2011). For a comprehensive overview of institutional quality indices and available datasets of institutional quality, please refer to Kunčič (2014).

At the aggregate level, the findings reported in Méon and Weill (2005) confirm the positive effect of the quality of institutions on efficiency.

As notably emphasized by the main innovation literature, see, among others Fritsch and Slavtchev (2011) and Van Roy et al. (2018), there are some limitations regarding the number of patents. For this reason, our analysis relies on the use of R&D expenditures. Nevertheless, the number of registered patents has been used as robustness.

This corresponds to the amount of time the patent office needs to verify whether an application fulfills the basic preconditions for being granted a patent and to complete the patent documents (Greif and Schmiedl, 2002).

Assuming such a time lag also helps to avoid potential problems of endogeneity between R&D inputs and outputs.

This is based on the assumption that R&D activities are the main source of inventions and innovation.

In order to allow the production technology to be linearly homogeneous, we normalize for one input (inter-industry international capital stock), while robustness checks are performed under different assumptions about the technology, employing an alternative dependent variable and assuming a different lag structure in innovative activities. Specifically, we model the technology by assuming a Cobb–Douglas formulation, while as an alternative dependent variable the number of patents, rather than R&D expenditures, is considered. Finally, while in our benchmark specification a two-year lag between innovative inputs and outputs is assumed, in the robustness check exercise a one-year period is instead hypothesized.

See Maraut, Dernis, Webb, Spieazia, and Guellec (2008) for a description of REGPAT.

https://www.oecd.org/ to access REGPAT database.

Note that the press index score employed in the paper ranges between 0 and 100, with higher scores indicating lower press freedom. This, in turn, implies that as the score exhibits an increasing trend, this must be interpreted as lower press freedom, and vice versa. For additional details concerning the computation of the index and its interpretation, please refer to Sect. 6.3.

Additional robustness tests include the median analysis, in which we appraise whether the impact of control of corruption on the efficiency of firms varies once the index is taken below and above its median level, and a set of specifications in which we consider different sub-samples, to deal with the heterogeneity exiting in our dataset. These estimates, for the sake of the convenience, have not been reported in the paper but are available in a supplementary material.

Data have been retrieved from https://govdata360.worldbank.org/sources.

Unfortunately, due to lack of available information concerning the inputs employed in the paper, it was not possible to perform a proper aggregate analysis. At the same time, given the lack of available data for some of the countries included in our sample, we could not assess the robustness of our findings using alternative firm-level surveys, such as those of the World Bank. Given these considerations, we proceeded with the aggregation of the available firm-level information.

References

Acs, Z. J., Anselin, L., & Varga, A. (2002). Patents and innovation counts as measures of regional production of knowledge. Research Policy, 31(7), 1069–1083.

Aghion, P., Akcigit, U., Cagé, J., & Kerr, W. R. (2016). Taxation, corruption, and growth. European Economic Review, 86, 24–51.

Ahrend R. (2002). Press Freedom, Human Capital and Corruption. DELTA Working Paper No. 2002–11, 1–25.

Aidt, T., Dutta, J., & Senia, V. (2008). Governance regimes, corruption and growth: Theory and evidence. Journal of Comparative Economics, 36(2), 195–220.

Aldieri, L. (2011). Technological and geographical proximity effects on knowledge spillovers: Evidence from the US patent citations. Economics of Innovation and New Technology, 20(6), 597–607.

Aldieri, L., Barra, C., Ruggiero, N., & Vinci, C. P. (2020). Innovative performance effects of institutional quality: An empirical investigation from the Triad. Applied Economics, 52(50), 5464–5476.

Aldieri, L., & Cincera, M. (2009). Geographic and Technological R&D Spillover within the Triad: Micro evidence from US patents. Journal of Technology Transfer, 34, 196–211.

Aldieri, L., Makkonen, T., & Vinci, C. P. (2020). Environmental knowledge spillovers and productivity: A patent analysis for large international firms in the energy, water and land resources fields. Resources Policy, 69, 101877.

Aldieri, L., Sena, V., & Vinci, C. P. (2018). Domestic R&D spillovers and absorptive capacity: Some evidence for US, Europe and Japan. International Journal of Production Economics, 198, 38–49.

Aldieri, L., & Vinci, C. P. (2016). Knowledge Spillover effects: A patent inventor approach. Comparative Economic Studies, 58(1), 1–16.

Anokhin, S., & Schulze, W. S. (2009). Entrepreneurship, innovation, and corruption. Journal of Business Venturing, 24, 465–476.

Ayyagari, M., Demirgüç-Kunt, A., & Maksimovic, V. (2014). Bribe payments and innovation in developing countries: Are innovating firms disproportionately affected? Journal of Financial and Quantitative Analysis, 49(1), 51–75.

Barra, C., & Zotti, R. (2018). The contribution of university, private and public sector resources to Italian regional innovation system (in)efficiency. Journal of Technology Transfer, 43, 432–457.

Boettke, P., & Fink, A. (2011). Institutions first. Journal of Institutional Economics, 7(4), 499–504.

Boudreaux, C. (2014). Jumping off of the Great Gatsby curve: How institutions facilitate entrepreneurship and intergenerational mobility. Journal of Institutional Economics, 10(2), 231–255.

Brunetti, A., & Weder, B. (2003). A free press is bad news for corruption. Journal of Public Economics, 87(7–8), 1801–1824.

Castelanovo, P., Del Bo, C. F., & Florio, M. (2019). Quality of institutions and productivity of State-Invested Enterprises: International evidence from major telecom companies. European Journal of Political Economy, 58, 102–117.

Castiglione, C., Infante, D., & Zieba, M. (2018). Technical efficiency in the Italian performing arts companies. Small Business Economics, 51(3), 609–638.

Dal Bó, E., & Rossi, M. A. (2007). Corruption and inefficiency: Theory and evidence from electric utilities. Journal of Public Economics, 91(5–6), 939–962.

De Rosa D., Gooroochurn N. and Görg H. (2010). Corruption and productivity: firm-level evidence from the BEEPS survey. World Bank Policy Research Working Paper 5348, 1–46.

de Waldemar, F. S. (2012). New products and corruption: evidence from Indian firms. Developing Economies, 50(3), 268–384.

Dincer, O. (2019). Does corruption slow down innovation? Evidence from a cointegrated panel of U.S. states. European Journal of Political Economy, 56, 1–10.

Dzhumashev, R. (2014). Corruption and growth: The role of governance, public spending, and economic development. Economic Modelling, 37, 202–215.

Ellis, J., Smith, J., & White, R. (2020). Corruption and corporate innovation. Journal of Financial and Quantitative Analysis, 55(7), 2124–2149.

Emenalo, C. O., Gagliardi, F., & Hodgson, G. M. (2018). Historical institutional determinants of financial system development in Africa. Journal of Institutional Economics, 14(2), 345–372.

Enikopolov, R., Petrova, M., & Stepanov, S. (2014). Firm value in crisis: Effects of firm-level transparency and country-level Institutions. Journal of Banking and Finance, 46, 72–84.

European Commission (2011). The 2011 EU Industrial R&D Investment Scoreboard. JRC Scientific and Technical Research series. http://iri.jrc.ec.europa.eu/scoreboard.html.

European Commission, (2012). Regional innovation monitor: governance, policies, and perspectives in European regions. Enterprise and Industry Directorate-General. Project No. 0932, Brussels.

Farrell, M. J. (1957). The measurement of productive efficiency. Journal of the Royal Statistical Society, 120(3), 253–290.

Fischer, M. M., & Varga, A. (2003). Spatial knowledge spillovers and university research: Evidence from Austria. Annals of Regional Science, 37, 303–322.

Fritsch, M., & Slavtchev, V. (2007). Universities and innovation in space. Industry and Innovation, 14(2), 201–218.

Fritsch, M., & Slavtchev, V. (2011). Determinants of the efficiency of regional innovation systems. Regional Studies, 45(7), 905–918.

Giordano, C., & Lopez-Garcia, P. (2018). Is corruption efficiency-enhancing? A Case Study of the Central and Eastern European Region. European Journal of Comparative Economics, 15(1), 119–164.

Goedhuys, M., Mohnen, P., & Taha, T. (2016). Corruption, innovation and firm growth: Firm-level evidence from Egypt and Tunisia. Eurasian Business Review, 6, 299–322.

Greif, S., & Schmiedl, D. (2002). Patentatlas deutschland. Deutsches Patent- und Markenamt.

Griliches, Z. (1979). Issues in assessing the contribution of research and development to productivity growth. Bell Journal of Economics, 10, 92–116.

Griliches, Z. (1992). The search for R&D Spillovers. Scandinavian Journal of Economics, 94, 29–48.

Hakkala, K. N., Norbäck, P. J., & Svaleryd, H. (2008). Asymmetric effects of corruption on FDI: Evidence from Swedish multinational firms. Review of Economics and Statistics, 90(4), 627–642.

Hall, B. H., & Mairesse, J. (1995). Exploring the relationship between R&D and productivity in french manufacturing firms. Journal of Econometrics, 65, 263–269.

Hanousek, J., & Kochanova, A. (2016). Bribery environments and firm performance: Evidence from CEE countries. European Journal of Political Economy, 43, 14–28.

Jaffe, A. B. (1986). Technological opportunity and spillovers of R&D: Evidence from firms’ patents, profits and market value. American Economic Review, 7, 984–1001.

Jaffe, A. B. (1989). Real effects of academic research. American Economic Review, 79, 957–970.

Johnson, N. D., LaFountain, C. L., & Yamarik, S. (2011). Corruption is bad for growth (even in the United States). Public Choice, 147(3), 377–393.

Kumbhakar, S. C., Lien, G., & Hardaker, J. B. (2014). Technical efficiency in competing panel data models: A study of Norwegian grain farming. Journal of Productivity Analysis, 41(2), 321–337.

Kunčič, A. (2014). Institutional quality dataset. Journal of Institutional Economics, 10(1), 135–161.

Kunieda, T., Okada, K., & Shibata, A. (2014). Corruption, capital account liberalization and economic growth: Theory and evidence. International Economics, 139, 80–108.

Lee, C. C., Wang, C. W., & Ho, S. J. (2020). Country governance, corruption, and the likelihood of firms’ innovation. Economic Modelling, 92, 326–338.

Leff, N. H. (1964). Economic development through bureaucratic corruption. American Behavioral Scientist, 8(3), 8–14.

Lien, D. H. D. (1990). Corruption and allocation efficiency. Journal of Development Economics, 33(1), 153–164.

Liu, F. T. (1985). An equilibrium queuing model of bribery. Journal of Political Economy, 93(4), 760–781.

Maraut, S., H. Dernis, C. Webb, V. Spiezia, and D. Guellec. 2008. “The OECD REGPAT Database: A Presentation.” STI Working Paper 2008/2, OECD, Paris.

Martins, L., Cerdeira, J., & Teixeira, A. A. C. (2020). Does corruption boost or harm firms’ performance in developing and emerging economies? A firm-level study. World Economy, 43(8), 2119–2152.

Mauro, P. (1995). Corruption and growth. Quarterly Journal of Economics, 110(3), 681–712.

Méndez, F., & Sepúlveda, F. (2006). Corruption, growth and political regimes: Cross country evidence. European Journal of Political Economy, 22(1), 82–98.

Méon, P. G., & Sekkat, K. (2005). Does corruption grease or sand the wheels of growth? Public Choice, 122(1), 69–97.

Méon, P. G., & Weill, L. (2005). Does better governance foster efficiency? An aggregate frontier analysis. Economics of Governance, 6(1), 75–90.

Murphy, K. M., Shleifer, A., & Vishny, R. W. (1991). The allocation of talent: implications for growth. Quarterly Journal of Economics, 106(2), 503–530.

Murphy, K. M., Shleifer, A., & Vishny, R. W. (1993). Why is rent-seeking so costly to growth? American Economic Review, 83(2), 409–414.

OECD, REGPAT database (accessed January 1, 2012). ftp://prese:Patents@ftp.oecd.org/REGPAT_201301/.

Paunov, C. (2016). Corruption’s asymmetric impacts on firm innovation. Journal of Development Economics, 118, 216–231.

Pellegrini, L., & Gerlagh, R. (2004). Corruption’s effect on growth and its transmission channels. Kyklos, 57(3), 429–456.

Pluskota, A. (2020). The Impact of Corruption on Economic Growth and Innovation in an Economy in Developed European Countries. Annales Universitatis Mariae Curie-Skło-Dowska, Sectio H – Oeconomia, 54(2), 77–87.

Rodríguez-Pose, A., & Di Cataldo, M. (2015). Quality of government and innovative performance in the regions of Europe. Journal of Economic Geography, 15, 673–706.

Ronde, P., & Hussler, C. (2005). Innovation in regions: What does really matter. Research Policy, 34, 1150–1172.

Saha, S., & Sen, K. (2021). The corruption–growth relationship: Does the political regime matter? Journal of Institutional Economics, 17(2), 243–266.

Sharma, C., & Mitra, A. (2015). Corruption, governance and firm performance: Evidence from Indian enterprises. Journal of Policy Modelling, 37(5), 835–851.

Shleifer, A., & Vishny, R. W. (1993). Corruption. Quarterly Journal of Economics, 108(3), 599–617.

Staiger, D., & Stock, J. (1997). Instrumental variables regression with weak instruments. Econometrica, 55(3), 557–586.

Sun, H., Edziah, B. K., Sun, C., & Kporsu, A. K. (2019). Institutional quality, green innovation and energy efficiency. Energy Policy, 135, 111002.

Svenson, J. (2005). Eight questions about corruption. Journal of Economic Perspectives, 19(3), 19–42.

Van Roy, V., Vértesy, D., & Vivarelli, M. (2018). Technology and employment: Mass unemployment or job creation? Empirical evidence from European patenting firms. Research Policy, 47(9), 1762–1776.

Wanchek, T. (2009). Exports and legal institutions: Exploring the connection in transition economies. Journal of Institutional Economics, 5(1), 89–115.

Xu, G., & Yano, G. (2017). How does anti-corruption affect corporate innovation? Evidence from recent anti-corruption effort s in China. Journal of Comparative Economics, 45(3), 498–519.

Zalle, O. (2019). Natural resources and economic growth in Africa: The role of institutional quality and human capital. Resources Policy, 62, 616–624.

Zergawu, Y. Z., Walle, Y. M., & Giménez-Gómez, J. M. (2020). The joint impact of infrastructure and institutions on economic growth. Journal of Institutional Economics, 16(4), 481–502.

Funding

Open access funding provided by Università degli Studi di Salerno within the CRUI-CARE Agreement.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

Below is the link to the electronic supplementary material.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Aldieri, L., Barra, C., Ruggiero, N. et al. Corruption and firms’ efficiency: international evidence using an instrumental variable approach. Econ Polit 40, 731–759 (2023). https://doi.org/10.1007/s40888-022-00267-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40888-022-00267-7