Abstract

The orthodox theory of wage negotiations considers that the trade union monopoly causes a rigidity of real wages which is, itself, the cause of unemployment. The model of this negotiation ("Nash bargaining") only considers situations where negotiations between union and firm succeed. In this article, we attempt to read the WS-PS model from a Keynesian point of view. Our model reflects the fact that successful negotiation is only one case among other situations, including failure where the union expresses a claim that is not necessarily satisfied. Although, in situations close to full employment, there is a bargaining mechanism by which unions and firms reach an agreement, this is not the case in times of massive unemployment. In the latter situation, employment is unilaterally determined by firms, on the basis of previous demand.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The WS-PS model (Layard et al., 1991) is the macroeconomic expression of a set of microeconomic models accounting for an endogenous rigidity of real wage rates and the appearance of what is known as “involuntary” unemployment. It can be regarded as the New Keynesian response to the natural rate of unemployment (NRU) devised by Friedman and the monetarists (which, in turn, was a criticism of the neo-Keynesian interpretation of the Phillips curve). While the NRU is based on the assumption of perfect competition, the non-accelerating inflation rate of unemployment (NAIRU) is based on the assumption of imperfect markets, in the same wat as the (equivalent) concept of Imperfect Competition Equilibrium (ICE) rate of unemployment identified by the WS-PS model. However, several criticisms have been evoked against this model (Blanchard & Summers, 1988; Sterdyniack, 1998, Laurent & Zajdela, 1999; Piluso, 2010; Lavoie, 2014).

In our opinion, it is necessary to reformulate the model by reintroducing some of Keynes’ most fundamental teachings on the theory of unemployment. First of all, we need to reaffirm the hypothesis of an asymmetry between employers and employees (Cartelier, 1996; Glustoff, 1968; Piluso, 2011), thus restoring the role of the principle of effective demand in determining the level of employment. We aim to show that the equilibrium unemployment rate as determined in the traditional WS-PS model is only one case among many others, including the more general model presented here which incorporates the possibility of equilibria in Keynesian involuntary unemployment. The originality of our article is that it gives an account of Classic unemployment and Keynesian unemployment without making the assumption of fixed prices as in the literature of the 1960s and 1970s (Barro & Grossman, 1971; Clower, 1965). Layard’s WS-PS model is certainly a flexible price model, but, as discussed here, it cannot account for truly Keynesian unemployment.

Therefore, the theoretical challenge here is to account for Keynesian and classical unemployment in the same model (which is impossible with the traditional WS-PS model) in the absence of a fixed price assumption (unlike the Barro and Grossman model).

First, we justify our approach to the reformulation of the WS-PS model by highlighting some of the criticisms that have been made against this model. Secondly, we explain our methodology for introducing involuntary unemployment following the teachings of Keynes in General Theory. In a third step, we outline the structure of the model. Finally, in a fourth section, we highlight the properties of the model.

2 Justification of our approach: some criticisms of the traditional WS-PS model

In the WS-PS model of Blanchard and Kyotaki (1987), Keynesian economic policies have no effect on employment levels. This is highlighted by Laurent and Zajdela (1999). Let is suppose an expansionary Keynesian monetary policy aimed at increasing the level of employment. What happens when there is an increase in the exogenous money supply M? The increase in the money supply is associated with a proportional increase in wages and prices. As a result of this increase in the money supply, firms encounter a rise in demand for goods, as shown by (15). All firms want to increase their relative price (as shown in Eq. (12′)) and the way to do this is to increase their own price. Since all firms behave in the same way, the real money supply gradually decreases until it is equivalent to its starting value. Once this process is complete, the supply and demand for goods return to their original levels. Employment remains at the same level. It depends only on the parameters of the firm’s technology, consumer preferences, and imperfect competition in the goods market.

Kyotaki and Blanchard show that it is only by introducing nominal price rigidities that money becomes active. If prices do not adjust in the short run because the cost of changing them is too high, then the exogenous increase in the money supply leads to a change in the real cash position that increases the demand for goods and the level of employment. However, this effect can only be transitory. Once the price of goods adjusts, real cash flow and aggregate income return to their initial levels.

However, the “menu costs” hypothesis is not based on explicit microeconomic foundations and can be considered as ad hoc. In this perspective, Laurent and Zajdela (1999) assert that the New Keynesians have reached a threefold impasse with this model:

-

technical, because the ad hoc nature of the “menu costs” hypothesis appears indisputable;

-

methodological, because the New Keynesians have finally shown that real wage rigidity is necessary to obtain unemployment;

-

empirical, because these models are not validated by the facts.

In view of this impasse, Blanchard and Summers (1988) contest the merits of the “new labour market theories” and the WS-PS model which is their macroeconomic expression. To defend their point of view, these authors consider the case of the United Kingdom. They argue that the new labour market theories are invalid since they are incorrectly based on the belief that economies would return to their “natural” unemployment rates after disinflation (Blanchard & Summers, 1988). Indeed, 9 years after the start of this economic policy in the UK, accompanied moreover by a liberalization of the labour market, the unemployment rate had risen very sharply: from 5% in 1979 to 11.6% in 1988.

The WS-PS model suggests that factors of a structural nature affecting free competition in the labour market are at the origin of “equilibrium” unemployment. However, the policy of the Thatcher government was to liberalize the labour market in depth through attacks on trade union power, limitations on the actions of the welfare state and changes in labour legislation. Yet the UK experienced more unemployment between 1979 and 1987 than in the forty years preceding the 1980s. Marc Lavoie (1998) makes the same observation with regard to the empirical tests of the WS-PS model applied to the case of France. Theoretical models attribute responsibility for increases in the long-term equilibrium unemployment rate to the generosity of the unemployment benefit programmes, even though empirical tests do not validate this result. Blanchard and Summers, as well as Marc Lavoie (2014), conclude that the standard framework generally used to make unemployment understandable cannot be accepted because of its lack of explanatory power. Thus, according to Sterdyniack (1998), “For these theories to explain the existence in Europe of growing mass unemployment, it would be necessary to admit that competitive imperfections in the labour market increased sharply between the 1960s and the 1990s, which is not easy to establish, given the increased flexibility of wages and jobs in Europe during the 1980s; or it must be concluded that past imperfections and rigidities have led, particularly during oil shocks, to a rise in unemployment which has gradually fossilized into equilibrium unemployment. These theories might have seemed relevant in the period 74–84, when rising unemployment in Europe was accompanied by a high level of the wage share in value added. Since then, however, the unemployment rate rose from 8.4 to 10.4% in Europe between 1990 and 1994, while the wage share declined from 70.7 to 68.8%. The level of wages is still difficult to incriminate" (Sterdyniack, 1998, p. 940).

Finally, the literature has challenged the involuntary nature of unemployment in the WS-PS model. For the New Keynesians, equilibrium unemployment is Keynesian unemployment in the sense that it is involuntary: “If wages are flexible, those who want to work at prevailing wages will be in work, and the remainder will be ‘voluntarily unemployed’; if wages are set above market clearing levels, some of those wanting work will not get for it and they will be ‘involuntarily unemployed’” (Layard et al., 1991, p. 145). In other words, once workers wish to work for the prevailing real wage, but this is not directly applicable [at the place of work], there is involuntary unemployment. According to these authors, unemployment thus results from a combination of imperfect competition and markup behaviour in both the labour and goods markets (Layard et al. 1991, p. 146).

Piluso (2006) challenges this analysis. The involuntary nature of unemployment is debatable. Certainly, some workers would like to work at the prevailing real wage rate but remain unemployed. However, it should be borne in mind that the unemployment suffered by these agents is the result of an excessivlely high real wage level; the basis of wage rigidity is linked to the active behaviour of workers claiming excessively high wages, either through trade unions or their labour productivity. The New Keynesians thus enriched the classical theory of unemployment rather than the thinking of Keynes. This is far removed from Keynes’ conjecture that the possibility of equilibrium of involuntary unemployment is due to the rejection of the second classical postulate, or, in other words, to the asymmetry between entrepreneurs and employees. Here, there is no asymmetry arising from the nature of the capital-labour relationship; on the contrary, it is asserted that workers have too much weight in the wage relationship. The asymmetry is inherent in the WS-PS-type models of an informational nature. Involuntary unemployment can disappear as soon as entrepreneurs can solve the principal/agent problem other than by raising wages.

All these criticisms lead us to consider that we need to reformulate this model in a way that is more in line with Keynes’ teachings.

3 Methodology for reformulating the model: how to introduce the hypothesis of asymmetry into the wage relation? What are the consequences for the model?

Starting from the second chapter of the General Theory, Keynes rejects the second classical postulate according to which employees are able to adjust the marginal disutility of the volume of employment to the real wage rate. According to Keynes, wage earners are unable to equalize the marginal disutility of labour with the real wage: they are not on their labour curve when there is unemployment in the economy (Cartelier, 1995). Entrepreneurs have the initiative of spending to initiate production activity and they impose their employment decision unilaterally (Piluso, 2011). While entrepreneurs have the opportunity to maximize their profit, employees do not always have the opportunity to maximize their utility, as the level of employment decided by entrepreneurs alone may be lower than the level of employment desired by workers.

In order to model such a change of assumption in the neoclassical labour market model, Glustoff and Cartelier replace the budget constraint of employees by the demand of firms for the labour supply. Firms are thus taking control of the employee’s budget constraint.

In doing so, entrepreneurs who decide on the level of employment can implement a level of production below that needed to ensure full employment. Keynes then discusses in Chapter 3 what can make this simple possibility effective. He then shows that it is the inadequacy of anticipated demand that is the cause of unemployment made possible by the asymmetry of status between entrepreneurs and employees.

Therefore, in Keynesian labour market modelling, the level of output corresponds to the aggregate demand anticipated by entrepreneurs.

Keynes’ logic is therefore as follows: the anticipated global demand being known, entrepreneurs set their production level. The latter being known, employment is determined. However, as the first classical postulate is accepted by Keynes, the equality between marginal labour productivity and real wages must be verified. Therefore, since the level of employment is known, marginal labour productivity is also known.

The real wage for this volume of employment is therefore determined by marginal productivity.

Keynesian logic therefore requires that any increase in the volume of employment should be considered as a decrease in the real wage. Thus, a decrease in unemployment leads to a decrease in the real wage (Piluso, 2011).

As Glustoff (1968) and Cartelier (1995) have shown, it is quite possible to obtain Keynes’ result of involuntary unemployment in a perfect competition framework. Certainly, the WS-PS model is a model of imperfect competition (both for the labour market and the goods market). In principle, the NAIRU can be reduced by reforms not only of the labour market but also the goods market. Nevertheless, as Piluso (2010) points out, “with regard to the cause of unemployment, it seems obvious that imperfect competition in the goods market is not responsible for unemployment in the WS-PS model, even if it modulates the level of unemployment. Without imperfect competition in the labour market, imperfect competition in the goods market would produce no unemployment outcome since the real wage would not suffer from any rigidity or fixity. It only reduces the level of employment” (Piluso, p.47). Moreover, it is quite possible to construct a PS curve in a context of perfect competition, while maintaining the existence of an equilibrium unemployment rate (Piluso & Colletis, 2012). This is why, in order to simplify the modelling and to remain faithful to the spirit of Keynes, we make the hypothesis that the goods market is in perfect competition (which authorizes the equalization of real wages and marginal labour productivity).

Finally, the use of utility functions in our model may appear not to follow Keynes’ purely macroeconomic approach. Nevertheless, we consider it is not contrary to removing the minimum number of hypotheses of standard theory so the causes of the results can be put back back into perspective. Our approach is not to produce a model which is totally faithful to Keynes’ General Theory, but rather to enrich the WS-PS model with Keynesian teachings.

4 Construction of the model: reformulation of the PS curve and construction of the WS curve

Our model comprises two types of economic agents: the representative firm and the trade union monopoly. In the traditional WS-PS model, the firm and the union enter into a Nash bargaining game that always results in success, i.e. an agreement where a real wage is set in such a way that the product of the net gains of each stakeholder is maximized. In our model, the negotiation is not formalized by a Nash bargaining process (which maximizes the product of the participants’ net gains). Our article does not claim to provide a new microeconomic model of bargaining; we simply represent the negotiations in terms of a confrontation between the reformulated WS and PS curves. Equilibrium, i.e., the point of intersection between WS and PS, is not necessarily reached. This is the originality of our approach, which contrasts with the standard WS-PS model where an equilibrium is always achieved in the negotiations.

4.1 The firm and the reformulated PS curve

The firm is assumed to have a Cobb–Douglas production function \(Y = AL^{\alpha }\), with Y representing the total production, L the quantity of labour units, A product per unit of labour, and \(\alpha\) the output elasticity of labour. We consider that the production function includes only one factor because the quantity of capital used in the short run is considered fixed and does not play a determining role in the causal relations.

The effective demand principle adopted here indicates that the level of production, and thus employment, is determined by the anticipated aggregate demand for goods denoted \(D_{g}\). The level of production depends on the entrepreneurs’ expectations and is assumed to be exogenous. The type of anticipation (rational, adaptive or other) is irrelevant for our purpose. However, the expectations can be considered rational.

We thus have:

From which we obtain:

Nevertheless, Keynes adopts the first classical postulate: we should therefore check for equality between the marginal productivity of labour and real wages. However, in contrast to the traditional neoclassical approach, it is not the real wage that determines the level of employment but the opposite: since the anticipated aggregate demand is fixed, and thus also the level of employment, it follows that there is a real wage denoted here as w.

We thus obtain a standard decreasing relationship between the level of employment and the real wage, the only change being that it is the level of employment that determines wages:

To obtain the labour demand curve linking real wages, w, with the unemployment rate u, we simply writeFootnote 1:

From this, given (3), we can deduce that:

After rearranging the terms, we obtain:

This yields the PS curve for the goods market, which reflects/?points to a positive correlation between unemployment rate and real wages.

According to Keynes (1936), the wage is the explained variable and the unemployment rate is the explanatory variable. This results from the anticipated demand for goods and so from the aggregate equilibrium product determined on the goods market as indicated by Eq. (2′).

We find an identical logic in the models of Piluso (2011) and Cartelier (1995), who highlight the following sequence:

In classical economics, the equation of the PS curve is interpreted traditionaly as follows: the real wage level explains the level of unemployment.

4.2 The trade union and the WS curve

The union utility function contains the arguments of employment level L and the real wage supplement (w-wr), where wr denotes the reservation wage.

This utility function is derived from the WS-PS model of Piluso and Colletis (2012), itself taken from labour economics textbooks (Cahuc & Zylberberg, 1996).

The parameter \(\gamma\) represents the weight given to employment in the union’s objective. This maximizes its utility with respect to the wage claim. The problem can be written:

We obtain:

whence

To plot the WS curve, let us make the standard assumption that the reserve wage of the worker (the rate below which he or she does not accept work) is equal to a weighted mean of the wage that could obtained in another firm and the unemployment benefit. Let us write:

where u is the unemployment rate, B is the unemployment benefit, and w is the average wage rate in the economy. If the worker looks for another job in the economy, the probability of finding one is (1 − u), and that of being unemployed is u. At equilibrium, the negotiations in each employment area lead to the same real wage if \(w_{i}\) = w, so, from Eqs. (4) and (5), it can be stated that:

This gives a WS curve for wage demand showing that unemployment rate falls as a function of real wages.

5 Classical and Keynesian disequilibria of the reformulated WS-PS model

The confrontation between the firm’s objective (to maximize its profit) and the union’s objective (to maximize its utility, which itself depends on the real wage obtained for the employees) is expressed by the different shapes of the PS and WS curves. The specific logic of each participant differs from and may prove impossible to reconcile with that of the others. If the effective demand is insufficient (downturn in the economic situation), firms are in a strong position to impose wage and employment levels (Keynesian logic). The unions are unable to situate themselves on their WS curve. On the contrary, if the effective demand is high and firms cannot hire all the workforce they are looking for (buoyant activity), the unions have the upper hand and are able to impose the corresponding wage and employment rate (classical logic). In the end, the equilibrium defined by the point at which WS and PS intersect is unforeseeable and may be either classical or Keynesian in nature.

Three types of unemployment can thus be distinguished.

5.1 Equilibrium corresponding to the point of intersection between the WS and PS curves: firms and trade unions negotiate successfully…

Equilibrium exists when the level of production, Y, is such that the unemployment rate and real wages correspond to the point where the WS and PS curves intersect. The equilibrium unemployment rate can then be expressed by following the equation:

and is given by the expression

The determinants of the equilibrium unemployment rate are in line with classical analysis, including the reserve wage, the product per unit of labour and the output elasticity of labour (see Fig. 1).

5.2 Keynesian disequilibrium: failure of trade union action

Keynesian disequilibrium exists when anticipated aggregate demand is such that actual unemployment is higher than the equilibrium unemployment rate and that, correspondingly, actual wages in force are higher than the real “equilibrium” wage (higher than the level claimed by the union).

We then have, for the wage rate:

and for the unemployment rate:

Effective demand is such that the unemployment rate is higher than the level sought by the union. Since the marginal product of labour is decreasing, this level of employment determines a real wage that is higher than that sought by the union. The disequilibrium may last for some time because completely different factors determine the employment level set by the firms and that desired by the unions: for the firm, the determining factor is the effective demand, while, for the union, it is the weight attached to employment together with the level of unemployment benefit. The only way to get back to equilibrium would be for the union to accept the employer’s wishes and reduce the weight of employment in the union’s objectives. Alternatively, the state can intervene in the economy to increase demand on firms.

In the case of a failure in trade union action, it is indeed the firm which unilaterally fixes the level of employment and thus the level of real wages (asymmetry hypothesis). The firm has no reason to give in to the union’s demands since the firm maximises its profit. In this configuration, the firms reach their objective (they are on their PS curve), which is not the case for the unions and employees (who are unable to be on their WS curve). It is therefore a disequilibrium (and not a sub-optimal equilibrium) that can become long-lasting if the state does not intervene.

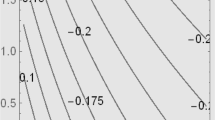

We can illustrate the situation with Fig. 2. In a context of a deteriorated economic situation, the demand encountered by firms is depressed. Firms unilaterally set levels of production and employment that are low. The unemployment rate is set at the Ups level (fixed via the demand for goods by firms, according to the Keynesian principle). Since employment is known, the marginal productivity of the volume of employment determines the real wage Wps. Trade unions are unable to position themselves on their WS curve: for the actual employment volume they want a real wage Wws (lower than the actual wage Wps), and for the wage level Wps determined on the goods market by marginal labour productivity they want the unemployment rate Uws (lower than the actual unemployment Ups),Footnote 2. But firms have no interest in deviating from their strategy because they maximize their profit. The State must necessarily intervene to increase the demand for goods and thus the levels of production and employment.

5.3 Success of union action: classical macroeconomic disequilibrium

Classical macroeconomic disequilibrium is symmetrical with Keynesian disequilibrium. In this case, we can write the following expression for the wage rate:

and, for the unemployment rate:

The effective demand is such that the employment level desired by the firm is higher than that sought by the union, and the wage offered by the firm is lower than that hoped for by the union. In this case, it is the firm that is under a constraint; union members can refuse to work for the current salary offer, the firm is rationed on the labour market in the sense that it cannot hire all the labour force it wants. Hence, the firm is obliged to lower its production and raise real wages. The unemployment rate and real wages rise until equilibrium is again achieved between firms and unions (point of intersection between the WS and PS curves).

The equilibrium unemployment rate returns to its standard level: it is indeed the union that, through its action, helps to set a higher actual wage.

In this classical unemployment situation, the firm reduces production under the pressure of the “classical forces” of unemployment. In the classical system, it is the amount of union pressure and unemployment benefit that determine the real wage as well as the level of employment. Here, the disequilibrium is characterized by the fact that the union is on its WS curve, unlike the firm, which cannot reach its WS curve.

We can illustrate the situation with Fig. 3.

In this configuration, the weight/influence of the trade union is such that it manages to impose a real wage equal to Wps. For this real wage, firms are rationed on the labour market: they want the unemployment rate to be at Ups but the actual unemployment rate is higher, at the Uws level. The classical logic that prevails here is that the real wage determines the level of employment and therefore the unemployment rate. For the firm to reach the desired employment level and unemployment rate in Ups, the wage would have to be Wws. But this salary is too high because the firm would not maximise its profits.

This classical disequilibrium is transitory, contrary to the Keynesian disequilibrium. Indeed, the union can perfectly well agree to increase the real wage gradually so that the point of intersection between the PS and WS curves is reached. The failure of the negotiations would therefore only be temporary and would not require state intervention. The classic type of disequilibrium is therefore only temporary and leads to a situation of equilibrium unemployment.

6 Conclusion

In contrast to the traditional WS-PS model which only accounts for one type of unemployment with essentially classical properties, our WS-PS model has two original features: it accounts for situations where negotiations between firms and trade unions have failed and highlights two types of unemployment: Keynesian unemployment, whose level depends on the demand encountered by firms; classic unemployment, whose level depends mainly on the level of real wages. In the WS-PS model, unemployment is only caused by a downward rigidity of real wages, while our model is able to highlight unemployment linked to the asymmetry between entrepreneurs and employees (firms unilaterally set the level of employment) and insufficient demand.

Although our study presents a kind of disequilibrium model, it also differs from the Barro and Grossman model because we do not need to assume price fixity.

It is worth bearing in mind that this reformulated model could provide a basis for econometric estimates to identify the nature of unemployment in the contemporary economies of the different countries studied.

Notes

The labour force size is denoted N.

The model leads to an apparently paradoxical result, where employers pay a high actual wage Wps to employees who would have accepted a lower wage wws (see Fig. 1). What is to prevent employers from reducing actual wages? In reality, the problem cannot be posed in these terms. In the model, the actual wage determined at the macroeconomic scale corresponds to the wage that maximizes profit given the effective demand. Lowering actual wages supposes that, upstream, the effective demand is higher (given the diminishing performance of the labour factor). However, in the model, such a rise in demand cannot be imposed at will.

References

Barro, R. J., & Grossman, H. I. (1971). A general disequilibrium model of income and employment. American Economic Review, 61(1), 82–93.

Blanchard, O., & Kiyotaki, N. (1987). Monopolistic competition and the effects of aggregate demand. American Economic Review, 77(4), 647–666.

Blanchard, O., & Summers, L. (1988). Why is Unemployment so high in Europe? Beyond the natural rate hypothesis. American Economic Review, 78(2), 182–187.

Cahuc, P., & Zylberberg, A. (1996). Economie du travail. Economica.

Cartelier, J. (1995). L’économie de Keynes. De Boek Université, Collection Ouvertures économiques, Ballise series.

Cartelier, J. (1996). Chômage involontaire d’équilibre: Asymétrie entre salariés et non-salariés, la loi de Walras restreinte. Revue Economique 655–666.

Clower, R. W. (1965). The Keynesian counter-revolution: A theoretical appraisal. In F. H. Hahn & F. P. R. Brechling (Eds.), The theory of interest rates. Macmillan.

Glustoff, E. (1968). On the existence of a Keynesian equilibrium. Review of Economic Studies, 35, 327–334.

Keynes, J. M. (1936). Théorie générale de l’emploi, de l’intérêt et de la monnaie. Payot. 1969.

Laurent, T., & Zajdela, H. (1999). Emploi, salaire et coordination des activités. Cahiers d’économie politique, 34, 67–100.

Lavoie, M. (2014). Postkeynesian economics: new foundations. Edwar Edgar Publishing.

Layard, R., Nickell, S., & Jackman, R. (1991). Unemployment, macroeconomic performance and the labour market. Oxford University Press.

Piluso, N. (2010). Chômage et marché financier. Editions Universitaires Européennes.

Piluso, N. (2011). Chômage involontaire et rationnement du crédit: une relecture de la relation salaire-emploi. Economie appliquée, LXIV(4), 69–86.

Piluso, N., & Colletis, G. (2012). Shareholder value and equilibrium rate of unemployment. Economics Bulletin, 32(4), 3233–3242.

Sterdyniack, H. (1998). Le taux de chômage d’équilibre: discussion théorique et évaluation empirique. Revue de l’OFCE, 81, 205–244.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Piluso, N., Colletis, G. A Keynesian reformulation of the WS-PS model: Keynesian unemployment and Classical unemployment. Econ Polit 38, 447–460 (2021). https://doi.org/10.1007/s40888-021-00222-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40888-021-00222-y