Abstract

This paper investigates the relationship between livelihood diversification strategies and risk preferences, including risk aversion, loss aversion, and higher-order risk preferences of farmers from West Bengal, India, using multivariate regression (mvreg) and multivariate probit (mvp) models. We use data from lottery choice experiments and household surveys to estimate higher-order risk preferences and analyse the relationship between risk preferences and livelihood diversification (N = 191). We found that many sampled households take up other supplementary income-generating activities besides agriculture and allied activities to spread their risk. Farmers who are risk averse are more likely to receive income from remittances and entrepreneurial activities. Higher prudence is linked with higher income contribution from agricultural activities, but a lower income contribution from migration-related activities and non-migratory casual labour. Temperate individuals are more likely to generate a higher share of income from agriculture-related activities and non-migratory casual labour, but a lower share from remittances. Higher-order risk preferences—prudence and temperance—affect livelihood diversification significantly.

Similar content being viewed by others

Notes

Kimball (1990) coined the term prudence to explain precautionary savings by individuals when faced in a risky situation. That is, prudent individuals tend to save more and consume less when there is more background risk or uncertainty about future income, and these individuals save more at higher income levels than when their income is low. In the expected utility framework, prudence is a positive third-order derivative of the utility function. The expected marginal utility of saving rises with a rise in background risks (Noussair et al. 2014), whereas Kimball (1992) referred to ‘temperance’ as the negative fourth-order derivative (or equivalently concave second derivatives) of the utility function. A temperate individual would prefer two independent risks to be spread across various periods than have both occurring at the same time. Temperate individuals prefer a less risky investment in the presence of background risk as they tend to be more risk averse in the presence of higher background risk.

Landholders with less than 2.5 acres are categorized as marginal landholders. Small landholders are those with more than 2.5 acres and less than 5 acres. Landholders with more than five acres are categorized as large landholders.

Minimum drought survival capability is calculated as the number of months that a household could survive in a drought-like situation with only their existing income.

References

Adnan KMM, Ying L, Sarker SA, Hafeez M, Razzaq A, Raza MH (2019) Adoption of contract farming and precautionary savings to manage the catastrophic risk of maize farming: evidence from Bangladesh. Sustainability 11(1):29. https://doi.org/10.3390/su11010029

Akhtar S, Li G-C, Ullah R, Nazir A, Iqbal MA, Raza MH, Iqbal N, Faisal M (2018) Factors influencing hybrid maize farmers’ risk attitudes and their perceptions in Punjab Province. Pakistan Journal of Integrative Agriculture 17(6):1454–1462. https://doi.org/10.1016/s2095-3119(17)61796-9

Alemayehu M, Beuving J, Ruben R (2018) Risk preferences and farmers’ livelihood strategies: a case study from Eastern Ethiopia. J Int Dev 30(8):1369–1391. https://doi.org/10.1002/jid.3341

Ayenew H, Sauer J, Abate-Kassa G (2014) On smallholder farmers’ exposure to risk and adaptation mechanisms: panel data evidence from Ethiopia, Paper prepared for presentation at the 89th Annual Conference of the Agricultural Economics Society, University of Warwick, England

Barrett CB, Reardon T, Webb P (2001) Nonfarm income diversification and household livelihood strategies in rural Africa: concepts, dynamics, and policy implications. Food Policy 26(4):315–331. https://doi.org/10.1016/S0306-9192(01)00014-8

Batista C, Umblijs J (2015) Do migrants send remittances as a way of self-insurance? Oxf Econ Pap 68(1):108–130. https://doi.org/10.1093/oep/gpv049

Binswanger HP, Sillers DA (1983) Risk aversion and credit constraints in farmers’ decision-making: a reinterpretation. J Dev Stud 20(1):5–21. https://doi.org/10.1080/00220388308421885

Binswanger HP (1980) Attitudes toward risk: experimental measurement in rural India. Am J Agr Econ 62(3):395–407. https://doi.org/10.2307/1240194

Binswanger HP (1981) Attitudes toward risk: theoretical implications of an experiment in rural India. Econ J 91(364):867–890. https://doi.org/10.2307/2232497

Birbhum District Administration. (2021). Agriculture. Birbhum District Administration, Government of West Bengal. Retrieved from https://cdn.s3waas.gov.in/s3fc3cf452d3da8402bebb765225ce8c0e/uploads/2021/07/2021070933.pdf

Brons JE (2005) Activity diversification in rural livelihoods: The role of farm supplementary income in Burkina Faso. PhD Thesis. Tropical Resource Management Papers, No.66. Wageningen University and Research Centre, Department of Social Sciences, Development Economics Group, The Netherlands

Bryan G, Chowdhury S, Mobarak AM (2014) Underinvestment in a profitable technology: the case of seasonal migration in Bangladesh. Econometrica 82(5):1671–1748

Carroll CD, Kimball MS (2008) Precautionary saving and precautionary wealth. In: Durlauf NS, Blume LE (eds) The New Palgrave Dictionary of Economics, 2nd edn. MacMillan, London

Chand R, Singh J (2022) Workforce changes and employment: Some findings from PLFS data series, NITI Aayog Discussion Paper 1/2022. NITI Aayog, Government of India, New Delhi, pp 20

Davies S, Hossain N (1997) Livelihood adaptation, public action and civil society: A review of the literature, IDS Working Paper 57, Brighton: IDS

Deck C, Schlesinger H (2014) Consistency of higher order risk preferences. Econometrica 82(5):1913–1943. https://doi.org/10.3982/ECTA11396

Deck C, Schlesinger H (2010) Exploring higher order risk effects. Rev Econ Stud 77(4):1403–1420

Dercon S (2002) Income risk, coping strategies, and safety nets. World Bank Res Observ 17(2):141–166. https://doi.org/10.1093/wbro/17.2.141

Dutta A (2017) Modified poverty index of West Bengal: a human development approach. Int J Multidiscip Res Dev 4(10):43–50

Ebert S, Weisen D (2009) An experimental methodology testing for prudence and third-order preferences (Discussion paper 21, 2009). Retrieved from http://www.wiwi.uni-bonn.de/bgsepapers/bonedp/bgse21_2009.pdf

Ebert S, Wiesen D (2011) Testing for prudence and skewness seeking. Manage Sci 57(7):1334–1349. https://doi.org/10.1287/mnsc.1110.1354

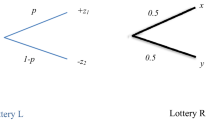

Eeckhoudt L, Schlesinger H (2006) Putting risk in its proper place. Am Econ Rev 96(1):280–289

Ender P (2007) Multivariate analysis: Multivariate multiple regression. Retrieved from http://www.philender.com/courses/multivariate/notes2/mvreg.html

Ellis F (1998) Household strategies and rural livelihood diversification. J Dev Stud 35(1):1–38. https://doi.org/10.1080/00220389808422553

Ellis F (2000) The determinants of rural livelihood diversification in developing countries. J Agric Econ 51(2):289–302. https://doi.org/10.1111/j.1477-9552.2000.tb01229.x

Fissha S, Brehanu M (2017) Decentralization as a commitment to rise public services and improve quality of rural life in Ethiopia: a Case Study. J Public Admin Gov. https://doi.org/10.5296/jpag.v7i4.12276

Government of West Bengal. (2004). West Bengal Human Development Report 2004. Published by Development & Planning Department, Government of West Bengal. Retrieved from http://www.in.undp.org/content/india/en/home/library/hdr/human-development-reports/State_Human_Development_Reports/west-bengal.html

Greene WH (2008) Econometric analysis, 6th edn. Pearson/Prentice Hall, Upper Saddle River, N. J.

Haering A, Heinrich T, Mayrhofer T (2017) Exploring the consistency of higher-order risk preferences. Retrieved from https://ideas.repec.org/p/zbw/rwirep/688.html

Heinrich T, Mayrhofer T (2014) High order risk preferences in social settings: An experimental analysis (Ruhr Economic Papers no. 508). Retrieved from http://www.rwi-essen.de/media/content/pages/publikationen/ruhr-economic-papers/REP_14_508.pdf

Hill T, Kusev P, Van Schaik P (2019) Choice under risk: How occupation influences preferences. Front Psychol 10:428505. https://doi.org/10.3389/fpsyg.2019.02003

Jianjun J, Yiwei G, Xiaomin W, Nam PK (2015) Farmers’ risk preferences and their climate change adaptation strategies in the Yongqiao District, China. Land Use Policy 47:365–372. https://doi.org/10.1016/j.landusepol.2015.04.028

Jiao X, Pouliot M, Walelign SZ (2017) Livelihood strategies and dynamics in rural Cambodia. World Dev 97:266–278. https://doi.org/10.1016/j.worlddev.2017.04.019

Joshi K, Ranganathan T, Ranjan R (2021) Exploring higher order risk preferences of farmers in a water-scarce region: evidence from a field experiment in West Bengal, India. J Quant Econ 19:317–344. https://doi.org/10.1007/s40953-021-00232-4

Kahneman D, Tversky A (1979) Prospect theory: an analysis of decision under risk. Econometrics 47(2):263–292

Karmakar KG, Sahoo BB (2015) “Green revolution in Eastern India,” India Studies in Business and Economics. In: Ghosh M, Sarkar D, Roy BC (eds) Diversification of agriculture in Eastern India, chapter 2, 127 edn. Springer, pp 15-26. https://doi.org/10.1007/978-81-322-1997-2_2

Kassie GW, Kim S, Fellizar FP, Ho B (2017) Determinant factors of livelihood diversification: evidence from Ethiopia. Cogent Soc Sci 3:1. https://doi.org/10.1080/23311886.2017.1369490

Khatiwada SP, Deng W, Paudel B, Khatiwada JR, Zhang J, Su Y (2017) Household livelihood strategies and implication for poverty reduction in rural areas of Central Nepal. Sustainability 9(4):612. https://doi.org/10.3390/su9040612

Kimball MS (1990). Precautionary Saving and the Marginal Propensity to Consume. National Bureau of Economic Research Working Paper Series, No. 3403, 46. doi: https://doi.org/10.3386/w3403

Kimball MS (1992) Precautionary motives for holding assets. In: Newman P, Milgate M, Falwell J (eds) The New Palgrave Dictionary of Money and Finance. MacMillan, London

Leland HE (1968) Saving and uncertainty: the precautionary demand for saving. Q J Econ 82(3):465–473. https://doi.org/10.2307/1879518

Maddala GS (1983) Limited-dependent and quantitative variables in economics. Cambridge University Press, New York

Maertens A, Chari AV, Just DR (2014) Why farmers sometimes love risks: evidence from India. Econ Dev Cult Change 62(2):239–274. https://doi.org/10.1086/674028

Mezgebo TG, Porter C (2020) From rural to urban, but not through migration: Household livelihood responses to urban reclassification in Northern Ethiopia. J Afr Econ 29(2):173–191. https://doi.org/10.1093/jae/ejz020

Mintiwab B, Gebreegiabher Z, GebreMedhin L, Köhlin G (2010). Participation in off-farm employment, risk preferences, and weather variability: the case of Ethiopia. In: A Paper presented at the Joint 3rd African Association of Agricultural Economists (AAAE) and 48th Agricultural Economists Association of South Africa (AEASA) Conference, Cape Town, South Africa

Mintiwab B, Sarr M (2013) Risk preferences and environmental uncertainty: implications for crop diversification decisions in Ethiopia. Discussion Paper, ERSA working paper: Pretoria, South Africa

Mondal P (2014) Relief and human intervention are major reason for flood and drought: a case study of Birbhum. Online Int Interdiscip Res J 4:8

Nath SK, Roy D, Thingbaijam KKS (2008) Disaster mitigation and management for West Bengal India - an Appraisal. Curr Sci 94(7):7

National Informatics Centre (NIC). (2017). Geography of Birbhum district. Retrieved from http://birbhum.gov.in/geog1.htm

Noussair CN, Trautmann ST, van de Kuilen G (2014) Higher order risk attitudes, demographics, and financial decisions. Rev Econ Stud 81(1):325–355. https://doi.org/10.1093/restud/rdt032

Press Information Bureau (PIB). (2023a). Ministry of Finance, Press Release ID: 1894913. Delhi, PIB, Government of India. Retrieved from https://pib.gov.in/PressReleseDetail.aspx?PRID=1894913#:~:text=As%20per%20the%20Economic%20Survey,from%2011.6%20per%20cent%20to

PIB. (2023b). Contribution of Agricultural Sector in GDP. SNC/PK/3373. Delhi, PIB, Government of India. https://www.pib.gov.in/PressReleasePage.aspx?PRID=1909213

Prakash L (2003) Scheduled castes and tribes: the reservation debate. Econ Pol Wkly 38(25):2475–2478

Quizon JB, Binswanger HP, Machina MJ (1984) Attitudes toward risk: further remarks. Econ J 94:144–148

Ranganathan T, Ranjan R, Pradhan D (2018) Water scarcity and livelihoods in Bihar and West Bengal. India Oxford Dev Stud 46(4):497–518

Reardon T (1997) Using evidence of household income diversification to inform study of the rural nonfarm labor market in Africa. World Dev 25(5):735–747. https://doi.org/10.1016/S0305-750X(96)00137-4

Reardon T, Berdegue J, Barrett CB, Stamoulis K (2006) Household income diversification into rural nonfarm activities. In transforming the rural nonfarm economy. John Hopkins University Press, Baltimore

Reardon T, Delgado C, Matlon P (1992) Determinants and effects of income diversification amongst farm households in Burkina Faso. J Dev Stud 28(2):264–296. https://doi.org/10.1080/00220389208422232

Rigg J (2006) Land, farming, livelihoods, and poverty: rethinking the links in the rural south. World Dev 34(1):180–202. https://doi.org/10.1016/j.worlddev.2005.07.015

Rothschild M, Stiglitz JE (1970) Increasing risk: I A Definition. J Econ Theory 2(3):225–243. https://doi.org/10.1016/0022-0531(70)90038-4

Roumasset JA, Boussard JM, Singh I (Eds.) (1979). Risk, uncertainty, and agricultural development. Southeast Asian Regional Center for Graduate Study and Research in Agriculture

Saha B, Bahal R (2012) Constraints impeding livelihood diversification of farmers in West Bengal. Indian Res J Ext Educ 12:59–63

Start D, Johnson C (2004) Livelihood options? The political economy of access, opportunity and diversification. Working paper 233. Overseas Development Institute, UK: London

Stata Manual 13. (n.d.). mvreg – Multivariate regression. Retrieved from https://www.stata.com/manuals13/mvmvreg.pdf

Teshager Abeje, M, Tsunekawa A, Adgo E, Haregeweyn N, Nigussie Z, Ayalew Z, Elias A, Molla D, Berihun D (2019) Exploring drivers of livelihood diversification and its effect on adoption of sustainable land management practices in the Upper Blue Nile Basin, Ethiopia. Sustainability 11(10):2991. https://doi.org/10.3390/su11102991

Trautmann ST, van de Kuilen G (2018) Higher order risk attitudes: a review of experimental evidence. Eur Econ Rev 103:108–124. https://doi.org/10.1016/j.euroecorev.2018.01.007

Tversky A, Kahneman D (1986) Rational choice and the framing of decisions. J Bus 59(4):S251–S278

Wang Y, Xu Y, Chen W (2023) Study on the Relationship between agricultural credit, fiscal support, and farmers’ income—empirical analysis based on the PVAR model. Sustainability 15(4):3173. https://doi.org/10.3390/su15043173

Acknowledgements

Kanchan Joshi would like to thank the Australian Government for providing her with the “Australian Government Research Training Program Scholarship”. Kanchan Joshi would also like to thank the Institute of Economic Growth (IEG), New Delhi, for all the support she got during her stay to design the experiment. The authors are grateful for the generous financial support from the Department of Environmental Sciences, Macquarie University, and partial funding from the Australian Centre for International Agricultural Research. We thank Dr Ram Ranjan for his initial support and engagement. We thank the Bolpur Manab Jamin team for their logistical support during the fieldwork. We thank all the farmers who voluntarily consented to participate in the experiments and surveys. This research would not have been possible without their generous time and engagement.

Funding

We are grateful for the generous financial support for PhD research from the Department of Environmental Sciences, Macquarie University, and partial funding from the Australian Centre for International Agricultural Research.

Author information

Authors and Affiliations

Contributions

KJ performed conceptualization, designed methodology, created models, conducted data analysis, and wrote the original draft. TR provided guidance in conceptualization, methodology design and implementation, reviewed statistical analysis, and edited the manuscript.

Corresponding author

Ethics declarations

Conflict of interest

The manuscript has not been previously published, is not currently submitted for review to any other journal, and shall not be submitted elsewhere before this journal makes a decision.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Joshi, K., Ranganathan, T. Higher-order risk preferences and livelihood choices of farmers from West Bengal, India. J. Soc. Econ. Dev. (2023). https://doi.org/10.1007/s40847-023-00292-7

Accepted:

Published:

DOI: https://doi.org/10.1007/s40847-023-00292-7