Abstract

This study investigates the characteristics that contribute to elderly poverty, mainly focusing on individuals’ lifetime work experience. It adopts the heterogeneous relative poverty line. It calculates the work experience and obtains demographic variables using the Korean Labor and Income Panel Study’s survey data for 2006, 2009, 2012 and 2015. The objective is to estimate poverty among elderly and explain its variations in relation to individual characteristics and lifetime work experience. Poverty is measured in terms of the head count, poverty gap and the poverty severity indices based on monetary dimensions, namely income and consumption. The methodology used in this study is a logit model to explain the incidence of poverty and a sample selection model to analyze the depth and severity of poverty. The results show that an increase in the total work years and a decrease in the gap years between jobs reduce incidence and depth of poverty.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

As South Korea has rapidly developed in a short period, it faces many issues of increased inequalities and concentration of wealth. The gap between the rich and the poor is growing, and many policies to find a solution to poverty have been implemented by different administrations. Among all the age groups, the elderly are especially vulnerable to poverty because they are physically weakened and are at an age of retirement. The labor market is reluctant to employ physically inferior job candidates and the elderly can face the worst economic conditions of their whole life.

In particular, Korean parents in the working age group are not prepared to welcome their advanced aged parents after their children grow up. They spend most of their money on educating their children and save little, so they have very limited resources that they can use for living in old age. Adult children also face an unemployment crisis and cannot afford to take responsibility for themselves, so they leave aside supporting their old parents. The traditional household system in which old parents are supported by their adult children has collapsed in modern Korean society, and the elderly are experiencing an unprecedentedly high poverty rate.

Lee (2020) describes the labor market in South Korea, during 2000–2016, and reports that the economy is one of the most successful emerging economies which recovered quickly from the Asian Financial crisis of 1998 and the global economic crisis of 2008. Real income increased continuously 2.0–5.0% annually. High earnings inequality, an aging labor force, increased part-time work and rising youth unemployment are challenges. The long-term unemployment varies in the range of 2.5–4.0% in 1990–2016 but was above 7.0% in 1998–1999. Males’ unemployment is slightly higher than that of females, but they converged to 4.0% around 2014. Youth unemployment for males was higher than that for females, and for both is increasing post-2008. In 2021, people aged 65 and older made up 16.5% of South Korea's population. The fast-aging demographic transition can pose a drag on the country's economy. Heshmati and Yoon (2019) discuss the economics of South Korean demographics.

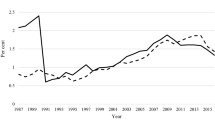

OECD statistics give the rate of poverty incidence and the poverty gap ratio across age cohorts. According to Fig. 1 which gives the head count ratio, as of 2014 about 48.8% of the elderly above 65 years were living in poverty; this is the latest year for which data have been released.Footnote 1 The mean poverty gap ratio was 42.9% (Fig. 2), which is income gap expressed as percent of the poverty line. The figures for the elderly are much higher than those for the working age group of 18 to 65 years. Only 9.3% of the working age group was living in poverty, and the mean poverty gap of this group was 36.4% in 2014. The head count ratio for the total population was 14.4%, and the mean poverty gap ratio was 38.7%.

Figure 1 shows that the poverty rate became higher as the age of the group increased; poverty rate was the highest in the age group above 65 of age. Also, the poverty rate of the elderly group was on an increase, while that of the other age groups was declining. OECD data list the reasons for the significantly higher poverty rate among the elderly in Korea. The higher poverty among the elderly is attributable to public social spending and a dualistic labor market. According to OECD statistics in 2016, the government’s social spending as percent of GDP was about 10.4, which is the lowest among OECD countries. The figure for OECD members’ public social spending was 20% of GDP. In addition, in the Korean labor market, a significant number of workers are employed in temporary positions, which leads to less work years and more gap years between jobs.

Policies that encourage the elderly to have new jobs after retirement have been proposed, and the extension of the retirement age to 60 years was introduced in 2016 in public institutions and in firms with more than 300 employees; this was extended to small companies in 2017. The revised bill is based on the hypothesis that the current work status is important for determining elderly poverty. Life expectancy is increasing, and to earn a living for themselves and lead healthy lives, the elderly should remain in the labor market. Looking at the poverty among the elderly from the perspective of working is very essential in an aging society. However, this amendment is only for the working elderly, so the effect is expected to act as mitigating poverty among the elderly who were working at the time when the revised law came into effect. Hence, what is also needed is a preventive policy to stop the vicious cycle of poverty.

The literature on poverty is referring to the share of the population in countries and is measured relative to the developing countries and relative to the mean or median of income in the developed countries. The increased life expectancy in recent decades and low fertility have resulted in an increased number of aged people and a higher dependency rate. The high cost of health care, expensive urban housing, long retirement period and no economies of scale in a growing number of single elderly households have resulted in financial difficulties in managing elderly care in both rich and poor societies. These are the main reasons for elderly poverty to be unique from a theoretical/analytical perspective. Longevity, improved health conditions, independence from children’s care and financial support, combined with desires to remain physically and socially active and have a higher living standard, motivate the elderly to remain in the labor market beyond the retirement age of 65. Thus, work experience in a lifetime and the ability to continue part- or full-time working are crucial factors in determining the incidence and severity of poverty in the advanced age groups regardless of the level of development in the country of residence. In Korea with a less developed welfare and pension systems, many elderly people find it necessary to continue working to secure a minimum living standard in the urban areas and the megacity of Seoul.

This research aims at verifying the hypothesis that work experience in a lifetime is a crucial factor in determining the incidence and severity of poverty in the advanced age groups. It uses the total number of work years, gap years between jobs, current employment, last occupation and the number of jobs in a lifetime as work experience variables. In contrast to earlier research, this study finds both work years and occupation to be of significance and suggests how the policy for preventing elderly poverty should be implemented in the labor market. For example, it suggests a policy that reduces career disruptions and gap years between jobs. It also suggests remedies for the current situation like providing the retired elderly with decent workplaces. Without a detailed and precise analysis of the factors that lead to poverty, policy measures cannot have the effects that the government intended in the initial period. Based on thorough analysis of the labor market, this study suggests there should be appropriate action to mitigate poverty in Korea among the elderly population.

While earlier research used the single poverty line based on the whole sample, this research uses the heterogeneous relative poverty line based on a combination of gender, province of residence and time of survey to measure poverty among the elderly. Poverty line across provinces may be more important since it takes care of the cross-regional price differences. Gender also representing the head of household can play an important role for the dimensional heterogeneity of poverty line. It also calculates three types of poverty measures—poverty incidence, poverty gap and poverty severity—by not only income but also consumption level which are used as dependent variables in this analysis.

The rest of the study is organized as follows. The section “Literature review” reviews related literature. The section “Data and variable definitions” presents the data used in the empirical part, and the section “Methodology and model specifications” discusses the methodology and model specifications. Analysis of the results is presented and discussed in the section “An analysis of the results”, and the final section gives a conclusion and suggests policy implications of the results.

Literature review

The literature on poverty and its measurement is vast (Sen 1976; Clark et al. 1981; Atkinson 1987; Shorrocks 1995; Ravallion 1996; Zheng 1997; and Celidoni 2015). The literature on elderly and women poverty and their determinants are discussed in Boaz (1987), Ginn and Arber (1991), Coulter et al. (1992), Dodge (1995), Rank and Hirschl (1999), Bastos et al. (2009), Quadagno (2013), Kim and Shin (2014) and others.

Research on elderly poverty in Korea has been conducted in two ways: the first is by verifying the effectiveness of the policy, and the second is by decomposing the components of poverty in terms of the demographic characteristics of the elderly, while there are many such studies that rarely use the perspective of work experience as one of the main factors of poverty.

As a first attempt to incorporate the work history variable in an analysis of elderly poverty, Hong (2005) investigated whether previous experiences in the labor market influenced the economic status defined as the income-to-needs ratio and the poverty incidence of the elderly in Korea using the relative poverty line. The relative poverty line was set at 40% of median income of the whole sample. He used cross-sectional data from KLIPS for 2002 and adopted the number of jobs, work years during the lifetime and the last occupation as work relevant variables. When the work experience variables were included, demographic characteristics like age, marital status and gender no longer significantly affected the economic status of the elderly, while age was the only factor that significantly affected the incidence of poverty.

Choi (2007) and Kim and Kim (2011) point to the appropriateness of using the last occupation as the proxy variable for work experience because the income in the last occupation tends to decrease. They introduce occupation and years worked in the main job and current employment as work experience variables. One of their contributions is considering the heterogeneity of elderly groups by confining the sample to elderly households not living with their children. However, the limitation of these studies is that they use elderly households without children as their samples, so they cannot be generalized to the whole population.

Choi (2007) uses the balanced panel data from KLIPS. The sample includes age above 55 years as of 1998, using only elderly households not living with their children, like elderly couples or elderly singles. The results show that age, education, marital status, wealth, residence and occupation or the main job were significant predictors of poverty incidence of the elderly. The research also found that age and marital status were the only significant factors that explained elderly women’s poverty and wealth and health status were the only significant predictors of poverty incidence of the single elderly. These results show that in Korea women resort to their husbands’ incomes and the singles maintain their living through accumulated assets and good health.

Kim and Kim (2011) used cross-sectional data from the Survey of Living Conditions and Welfare Needs of Korean Older Persons for 2008 and adopted the absolute poverty line and poverty incidence as the poverty measures. Their sample was elderly couples above 65 years of age not living with their children. Their results showed that work years significantly decreased wives’ poverty risk but not that of husbands. Occupation was the only significant factor explaining husbands’ poverty. The study also demonstrated the wives’ role as a buffer against poverty among elderly households in Korea which has implications for a gender-sensitive policy which is needed to solve the problem of poverty among married elderly couples.

Seok and Kim (2012) analyzed the impact of demographic features and work history on incidence of poverty using a sample from the Korean Retirement and Income Study (KRIS). They approached the problem of elderly poverty in a perspective different from that used in earlier research by considering status in the labor market when the elderly retired from their jobs. The main results of this research using the bivariate probit estimation were that there was a simultaneous decision of labor participation and incidence of poverty. The elderly who had retired unintentionally and got a new job were less likely to be impoverished. The study suggests that the government should provide retirees with appropriate jobs as an antipoverty measure.

Unlike research on Korea, research in other countries is much more developed. McLaughlin and Jensen (2000) analyze the effect of the demographic and work history variables on the first transition into poverty using 3,438 sample individuals above 55 years of age from the panel study of income dynamics (PSID) between 1968 and 1998. This study uses the absolute poverty line based on the official US Bureau of the Census definition. The main work history variables used in the research are occupation, years of work experience since age 18, union coverage and pre-retirement wages. The study categorizes the elderly into four groups: male heads of households, female heads of households who have experienced no change in marital status, women who have experienced changes in marital status and wives who remained wives throughout the study. The authors find that poverty transitions are strongly correlated with the marital status of the elderly. Their results demonstrate that the hours worked significantly lowered the probability of being poor in all the groups, but the years that the head of the household worked full time were not significant in all the models. Among the occupation categories, professional or managerial occupation acted in lowering the poverty incidence in male heads and women with changes in marital status. After controlling demographic and work history, the elderly living in the non-metropolitan areas had a higher probability of being impoverished.

Much research has focused on the feminization of poverty, especially relating poverty to later life events and work history. Vartanian and McNamara (2002) consider mid-life work history as a factor leading to poverty among older women in the USA. They found that both factors were significant in explaining female elderly poverty. Choudhurry and Leonesio (1997) also focused on mid-life factors like the number of children, labor market experience and marital status as the reasons for poverty in the female elderly. Many studies have found that widowhood and divorce significantly increased the incidence of poverty both among younger and older women. Duncan and Hoffman (1985) verify that divorce endangered the women substantially. However, Smith and Zick (1986) found that work years prior to widowhood significantly reduced the risk of being impoverished among both men and women.

According to O’Rand (1996), women tended to get cumulative disadvantages of the labor market through their whole lifetime like discrimination in the employment and exclusion from the labor market. For this reason, the gender effect on poverty can disappear when other work relevant variables are included as independent variables. Hong (2005) and Choi (2007) also found that the gender effect in the incidence of poverty became insignificant when demographic characteristics and work experience were included as independent variables.

All these studies emphasize that poverty among the elderly should be analyzed in the context of life course aspects to reflect the real reasons, especially work experience in the labor market. This study is consistent with their predictions.

Data and variable definitions

Sample data

The data used in this study are from the Korean Labor and Income Panel Study (KLIPS), which is a longitudinal survey of individuals aged 15 years or older from a nationally representative sample of 5,000 urban households. The full data for 15 + population are used in this study. Since the full data collected are used, sampling bias may not be an issue. Employment corresponds to full-time equivalent employment. The survey offers information about an individual’s labor market and income activities from the past to the present and the demographic and household characteristics. The dataset used in this research is unbalanced panel data from four years—2006, 2009, 2012 and 2015. It encompasses individuals above 60 years of age, the age at which people start retiring from their main jobs.

Poverty measures

The poverty measures used in this study are monetary—income and consumption based. Poverty can be multidimensional accounting for income, consumption, health, housing, education, etc. (see Maasoumi and Xu, 2015; Wang and Wang 2016). The number of observations is higher in the consumption model. Different aspects of poverty can be analyzed using either income or consumption. Poverty measured using the consumption level can provide information on liquidity constraints that individuals face. The income level can vary from time to time because of transient income or seasonal variations, but consumption is not sensitive and is smoother than income. So, consumption may be a better indicator of individuals’ actual abilities to meet their basic needs. But poverty measured by income is also a good indicator when comparing the results of this study with those of other studies. The monetarily measured variables of income and consumption are in 2015 constant prices. The summary statistics for income and consumption models are given in Table 1.

As can be seen in Table 1, about 17% of the 10,586 observations were in poverty in terms of consumption, while about 32% of the 10,567 observations were poor in terms of income. A correlation matrix of the dataset is reported in Table 2. The frequency distribution of income and consumption is presented in Table 3. Also, columns of Table 3 show that the mean annual poverty gap defined as poverty line minus consumption per capita, for the consumption model, was 1.35 million Won.This is about 40% of the mean poverty gap for the income model, defined as poverty line minus per capita income, at 3.31 million Won. This demonstrates the lower sensitivity of consumption to financial conditions. For this reason, poverty rate in consumption is much lower than that in income because of transfers and precautionary saving.

Three types of poverty measures are used in this study: poverty incidence, poverty gap and poverty severity. The poverty incidence equals one if the individual’s real annual income is less than the group−specific poverty line.Footnote 2 This is also called the head count index and is the most often used measure of poverty. However, it does not tell us the level of poverty. Poverty gap is defined as the distance between a poor person’s income and the group-specific poverty line. It provides information on how much income is needed to lift a poor person out of the poverty. The use of squared terms is to allow for capturing nonlinearity in the effects. The total effects (elasticities) are also calculated. The square of the gap is important considering the groups of individuals with common characteristics. As ‘distribution-sensitive’ measures, Foster et al. (1984) suggested the squared poverty gap index, which is also called poverty severity. The more severe the poverty that a person has, the higher the weight that is placed on the poor person when measuring the poverty level. The non-poor have a value of zero in all three cases. Poverty measures in terms of consumption are similarly defined, using the group-specific poverty line calculated using consumption.

The heterogeneous relative poverty line is set at 50% of each group’s mean per capita income or consumption. The individuals in the sample are assigned to 24 distinct groups in which the individuals have the same gender, province of residence and time of survey.Footnote 3 The approach allows to measure the direct effect of the work history in the poverty of the elderly, excluding the differences caused by demographic characteristics. The inclusion of gender in determining poverty is justified by the relative differences in males and females’ income and consumption behaviors. The differences in development and employment opportunities and wages across the location of residence are in favor of using the heterogeneous poverty line by location. The males' and females' labor force participation differs. The women in the earlier days concentrated more on family than work. The work participation gap has reduced over time. A combination of education, demographic and work-related variables is used for explaining the level and variations in poverty. The poverty line set by year of observation also incorporates the effect of price and income developments over time. These together imply the gains in using the relative poverty line that differs by individuals and local characteristics. To reflect price differences by regions and at different points in time, the income and consumption levels are adjusted by the consumer price indices with base year 2015 so that all the monetary values are real per capita annual values in 10,000 Korean Won.

KLIPS has information on income in two ways: the previous year’s annual household income and the previous month’s household income. The former was adopted in this study because of some advantages of this variable. First, the income level will be very volatile along with changes in transient income if monthly income is used. Second, the latter has many more missing values than the former. In addition, the annual income variable contains much more detailed information about the sources of income. The income sources include earned income, financial income, real estate income, social insurance, transfer income and the other incomes. Transfer income incorporates subsidies from the government, social community and adult children or relatives living separately. Other income includes private insurance, severance pay and donated or inherited property.

The proxy variable for consumption level is the previous year’s average total monthly living expenses, which is per household.Footnote 4 Because the observation unit in this study is the individual, income and consumption per capita were calculated by dividing household income and consumption by the square root of family size to control for economies of scale. This method is generally used in comparisons across the OECD countries. Adjusting the economies of scale is important because a household with more family members can buy commodities in bulk, leading to a reduction of consumption per capita. This equivalence scale incorporates the economies of scale, so income per capita in case of 4 million Won a month for a family of four is different from income per capita of a million Won a month in a single-person household.

Because of outliers, the upper bound of annual income exceeding 170 million Won per capita was censored. Also, the annual income per capita under 100,000 Won was censored. Consumption was also adjusted for the outliers, so the censored annual consumption level per capita ranges from 600,000 to 40 million Won.

Work experience measures and demographic variables

The independent variables in this study can be divided into two sets related to work experience and demographic variables. The work experience variables used are the total number of work years in the lifetime, gap years between jobs, whether currently working or not, the last occupation and the total number of jobs; these are based on ‘work history’ data and ‘individual’ data. The ‘work history’ data have individuals’ work history from the first job to the last job. The job start years and the job end years are used to calculate the work period of each job, adding up to the total number of years for which individuals have worked in their lifetimes. Also, observations about individuals were dropped if the jobs’ start year and end year were missing. The job start month and the job end month were not included in calculating the work and gap years to minimize the exclusion from the sample due to frequent missing values.

Calculating the total years for which individuals had worked in their lifetimes was complex because the data ‘work history’ have both the main job and the sideline. Calculating the true work years by just dropping the sidelines was not appropriate. Hence, the true work years were calculated by dividing the cases into three cases: working without gap years between jobs, two jobs with overlapped periods, and gap years between jobs. The cases are defined by subtracting the minimum value of the job start year and the total gap years from the maximum value of job end year, using the job start year and job end year values for each job.

The variables gap years between jobs and the number of jobs in the lifetime are included as independent variables to estimate the impact of career discontinuity and turnover rate on poverty, respectively. The independent variable ‘last occupation’ is an indicator of job quality. Although the work years are long, poverty can increase if one has a low-income occupation. According to McLaughlin and Jensen (2000), an occupation that demands more intellectual thinking and determination may prepare people well for post-retirement life. The impact of current employment on poverty was also considered.

Gender, age, marital status, family size, education level and the province of residence were included as demographic characteristics. Several previous studies point out that age is correlated with the culture of elderly care, household type, education and gender, so the pure effect of age cannot be easily separated; this offers grounds for including various demographic characteristics in models for explaining poverty. For example, Lee et al. (2011) pointed out that elderly people who lived in an era of less education may incorporate the effect of education in the estimated effect of age when the education level is not controlled for. The region where the elderly live in is also important, and it incorporates the differences in the labor market structure across regions. Tienda (1986) explains the different occupational and industrial structures in less urbanized cities.

The data are unbalanced, and households are observed at most for four periods. We estimate the models both using pooled OLS and panel models. The year dummy variables were also included to control for the time effect. To capture the nonlinear effects of the important independent variables, the squared terms of work years, gap years, age and family size were included as independent variables and their total effects calculated which are influenced by the interaction of the squared variables’ coefficients with the first-order level that varies by households and over time. The square of the gap is important considering the individual households and groups of individuals with common characteristics. As ‘distribution-sensitive’ measures, Foster et al. (1984) suggest the squared poverty gap index, which is also called poverty severity.

The elderly living with their children are less likely to be in poverty because the adult children can economically support their old parents. Hence, controlling the effect of household members is critical when analyzing poverty of the elderly. The effect of other household members can be controlled by including household size as one of the independent variables or by just confining the sample as elderly couples or singles not living with their adult children. The former is adopted in this research. By not excluding the elderly living with their adult children, the results of this study can be generalized to all types of households.

It is worth mentioning that a composite index of living arrangements can be useful in explaining variations in poverty and its severity. The disadvantage is that the index will confound the highly correlated variable effects and as such it helps to avoid multicollinearity, but it neglects the separation of the individual indicators’ poverty effects.

Methodology and model specifications

Poverty incidence

For the model examining the factors influencing the incidence of poverty, the conditional fixed-effects logistic regression estimation with maximum likelihood estimation is used (McDonald and Moffitt 1980; Amemiya 1981; and Greene 2018). The result of Hausman test required us to adopt the fixed-effects instead of the random-effects model. The former is consistent, but it does not deliver the estimated fixed effects. The latter is neither consistent nor efficient, but the fixed-effects model which always has consistent estimators is adopted. The probit model is the first stage of the two-stage sample selection model, while the conditional fixed-effects logit model is used for sensitivity analysis of poverty incidence result and calculation of the odds ratio. The unobserved heterogeneity of individuals can be controlled by estimating the fixed-effects model. The independent variable vector \(z_{{{\text{it}}}}\) in Eq. (1) contains all the demographic and work history variables listed in the summary statistics. The squared terms of the work years, gap years, age and family size were included in the vector to reflect the different marginal effects of these variables at various levels. The same specification was applied to both the income and consumption models. In the logit model, the dependent variables, poverty incidence (pi) had dichotomous values, one and zero. If the latent variable \(pi_{{{\text{it}}}}^{*}\) was greater than zero, the outcome variable \(pi_{{{\text{it}}}}\) has a value of one. In this study, the outcome has a value of one if the annual real income or consumption is less than the relative poverty line. The estimated coefficient vector of the independent variables, \(\hat{\gamma }\), represents the sign and significance of the effect. The odds ratio was computed to understand the exact size of the effect presented in Tables 4 and 6.

Poverty gap and severity

The value of poverty gap (pg) and poverty severity (ps) for the non-poor equaled zero, which makes the data censored at a value of zero. The Heckman sample selection model was used to estimate the effect of individual work and non-work factors on poverty gap and poverty severity using pooled data of poor individuals. The sample selection bias can be eased by using the Heckman two-stage model because it controls for unobservable characteristics that determine both the incidence and depth of poverty. If there is a systematic selection of a sub-sample whose income or consumption is below the poverty line, the estimators of poverty gap and severity which do not incorporate sample selection will have distorted empirical results about the population.

Equations (3) and (4) represent the first stage, the poverty incidence estimation, using the probit model. Equations (5) and (6) represent the second stage, the poverty gap and severity models, using pooled ordinary least squares estimation, respectively. As the unique variable that only determines the discrete choice, the ‘current employment’ variable was included in the first-stage estimation. In the second estimation, the number of jobs was used as the identifying variable in estimating poverty gap and severity with pooled OLS estimation with robust standard errors. The estimated coefficient vectors of the independent variables, \(\widehat{{\beta }_{g}}\) and \(\widehat{{\beta }_{s}}\), represent marginal effects on poverty gap and severity which are in logarithmic form.

The inverse Mills ratio was derived at the first-step estimation. The inverse Mills ratio \(\Lambda \left({z}_{\mathrm{it}}\widehat{\gamma }\right)\) in Eqs. (5) and (6) is defined as the ratio of the probability density function to the cumulative distribution function of a standard normal distribution function, \(\phi \left({z}_{\mathrm{it}}\widehat{\gamma }\right)\) and \(\Phi ({z}_{\mathrm{it}}\widehat{\gamma })\), evaluated at the predicted outcome \({z}_{\mathrm{it}}\widehat{\gamma }\), which was estimated at the first-stage probit model. When incorporated in the second-stage estimation of poverty gap and severity, this ratio serves as a control for potential biases arising from selectivity into poverty. If the estimated coefficient of the inverse Mills ratio, \(\widehat{{\lambda }_{g}}\) and \(\widehat{{\lambda }_{s}}\), is statistically significant, the sub-sample that was used in the estimation of poverty gap and severity is non-random. In this case, without attempting to mitigate for the non-random sampling the estimators will be biased in the whole sample or can be applied only to the selected sub-sample.

An analysis of the results

Income-based measures of poverty

The models of poverty gap and severity measured by income level both have the selection bias problem, so the inverse Mills ratio calculated at the first-stage probit model was imputed in the second-stage OLS regression model. Work years and gap years are statistically significant in models of poverty incidence, poverty gap and poverty severity. The longer the periods that the elderly have worked, the lower the poverty incidence, gap, and severity. The gap years between two jobs which represent an interrupted work career increase the probability of being in poverty while decreasing the poverty gap and severity at the mean value of 4 years. However, when calculating total effects including the squared effects at different points of gap years, the gap years start having a positive effect on poverty gap and severity above 18 years. Elderly who are currently working, as expected, are less likely to be in poverty. The last occupation that the elderly had is only statistically significant in the poverty incidence model. Laborers are most likely to be impoverished.

Among the demographic characteristics, marital status, family size and education level significantly affect poverty incidence, gap and severity. Single elderly have a lower probability of being in poverty while having a larger poverty gap and severity. As family size and education level increase, the risk of being poor decreases, but poverty gap and severity increase. Other demographic factors like age and gender have a significant effect only on poverty incidence. Age significantly increases the probability of being impoverished but not poverty gap and severity. Females have a lower probability of being in poverty, not having significant effects on poverty gap and severity. Living in the less urbanized regions decreases the incidence of elderly poverty, and living in highly urbanized regions increases elderly poverty gap and severity.

The direction of the effects of the demographic variables in poverty gap and severity is different from the direction of the effects in the poverty incidence model. This result demonstrates the reasons for poverty should be studied using a variety of measures; in this research, poverty incidence, gap and severity were used. An analysis using only poverty incidence cannot offer a deep understanding of poverty among the elderly in Korea.

Poverty incidence

Table 4.A gives the results of the conditional fixed-effect logistic regression in the income model. Column (1) has the estimated coefficients, and Column (2) has the odds ratio. Longer work periods and shorter interrupted work careers in a lifetime decrease the risk of being impoverished in old age. As the total work years increase by one year, the odds of being in poverty decrease by about 3%. An increase in the gap year between two jobs by one year increases the odds of poverty by 3% as well. The last occupation coefficients are compared with professional or managerial occupations and are positive and significant except for the clerical occupation. On an all-other things equal basis, the elderly with low incomes in the last occupation are more likely to be in poverty. In the case of laborers in particular, the odds of being in poverty are multiplied by about 2.8, which means that the elderly whose last occupation was as a laborer have the greatest risk of being impoverished. The currently not working elderly are more likely to be in poverty having their odds of being in poverty multiplied by 2. Although the coefficient on the number of jobs is not statistically significant, the sign of the estimator is positive which means a high turnover may increase poverty incidence among the elderly.

Among the demographic characteristics, age, marital status, family size and education level are all significant in explaining the poverty incidence among the elderly. As age increases, the probability of being in poverty also increases. The elderly who live with many family members are less likely to be in poverty. Each additional year of education that the elderly received reduces the odds of being in poverty by about 9%. These results are all expected and consistent with earlier research. The odds of being in poverty among the single elderly are 29% less than the odds of the elderly with spouses being in poverty. Compared with previous findings, this unexpected result suggests that elderly couples have a deprived status in Korea; this has also been pointed out by Kim and Kim (2011).

In the probit model using pooled data (Table 5, column 1), the effect of gender in poverty incidence shows that female elderly had a significantly lower probability of being poor. Although the coefficient is biased downward because this study uses the heterogeneous poverty line by gender, the direction of the effect on poverty incidence is the same in the model using the single poverty line based on the whole sample (see Appendix Table 8).Footnote 5 This finding contrasts with earlier research practice. McLaughlin and Jensen (2000) found that females had a higher poverty rate than males. Hong (2005) and Choi’s (2007) studies using different periods of KLIPS suggest that the gender effect in poverty incidence among elderly was not significant, demonstrating that gender incorporates the effects of work history and other demographic characteristics through the lifetime.

The result that females have a lower poverty rate may come from the sample used in this study. The female elderly are more likely to live with their children than with their elderly male counterpart. The elderly women living with their children contribute to lowering their probability of being in poverty when compared with the male elderly. Choi (2007) also used the same data but confined the sample to those elderly not living with their children. This means that single elderly women living alone in Choi’s (2007) sample contribute to lowering the significance of the negative effect of females on poverty incidence.

The elderly living in less urbanized areas is less likely to be in poverty; this is also contrary to the results of much earlier research. McLaughlin and Jensen (1993) concluded that non-metropolitan elders were more likely to move into the poverty group and that they spent more time of their elderly lives in poverty. Choi and Ryu (2003) found that the poverty rate among the elderly was higher in small- and medium-sized cities than in metro cities. Choi’s (2007) study which used the same data as this study but from a different period concluded that the elderly residing in the capital or metropolitan cities were less likely to become impoverished. According to Appendix Table 8, the model using a single poverty line based on the whole sample has a different result from the model using the heterogeneous poverty line. The estimation based on the single poverty line does not suggest results consistent with earlier research.

Poverty gap and severity

Table 5 shows the results of the poverty gap and severity estimation using the second part of the two-step sample selection model. The coefficients of the inverse Mills ratio of income-based poverty gap and severity models are significant, which means there would have been a selection bias if the sample selection model were not used. The total work years and gap years between two jobs are significant in explaining the poverty gap among the poor elderly. Table 3 shows the elasticities calculated at the initial point of each range of a given demographic distribution.Footnote 6

The total effect of work years incorporating the coefficient of the squared term of work years is in the direction of decreasing the poverty gap. If the elderly in poverty have worked at least for 29 years, the poverty gap decreases 0.03% as work years increase from 29 to 30 years. The decreasing effect of work years becomes larger, 0.63%, as the work years increase.

The elasticity calculated at the mean of gap years, about 4 years, indicates that gap years between jobs downsize the poverty gap.Footnote 7 However, the effect on poverty gap becomes positive if the gap years exceed 18. According to Table 3, as gap years between jobs increase from 18 to 19 years, the poverty gap widens by 0.08%. The effect on the poverty gap becomes larger as the gap years become longer; for instance, the poverty gap increases 0.61% if gap years increase from 24 to 25 years.

Work years have an inflection point at 29 years where the sign of the coefficient changes from a positive value to a negative value. The direction of the elasticity of gap years turns into a positive value at 18 years. That is, work years lead to decreasing the poverty gap if the elderly have worked for at least 29 years. Also, the gap years above 18 years increase the poverty gap. The effect becomes larger as the years increase. Poverty gap in terms of work years has a symmetric concave function with the maximum value at about 29 years. Poverty gap in terms of gap years has a convex relationship with the minimum value at about 18 years.

Among the demographic variables, marital status, family size, education level and the dummy variable for the highly urbanized region are statistically significant. While having a lower risk of being impoverished when compared with the elderly with spouse, elderly who are single have a 34.3% larger poverty gap. As the number of family members increases, the needed income to reach the poverty line also increases. The role of diminishing poverty gap in big families takes an effect above a family size of 7, which is a very rare household size.

However, as shown in the mean value of poverty gap in Table 3, the highest mean of poverty gap appears in the single elderly household, which means that the elderly living alone are the most likely to experience a severe poverty level among the various household types. On average, the single elderly living alone are short of about 3.4 million Won for a year to meet the minimum income level (the poverty line) for a living.

The effect of education on poverty also reverses in the case of the poverty gap when compared with the poverty incidence model, which means that a higher education level increases the poverty gap among the poor elderly. This finding is verified in Table 3, where the poverty gap is ascending as the education level increases.

The elderly living in highly urbanized region have a larger poverty gap when compared to the elderly living in the capital city. The mean annual poverty gap for the elderly residing in the less urbanized provinces is about 1 million Won less than for the elderly living in the capital city. When measuring the poverty gap for a single poverty line (Appendix Table 8), the dummy variables for both the highly and less urbanized regions do not have statistically significant coefficients. This explanation also corresponds to the result of the poverty severity model.

Consumption-based measure of poverty

When estimating the poverty gap and severity models in terms of consumption, the model did not have a selection bias problem. This means that there is no systematic heterogeneity that differentiates the deprived elderly from the full sample above 60 years old in the consumption model.

The poverty incidence measured by the consumption level was significantly affected by all the variables excluding gap years between jobs, which significantly increased the poverty incidence in the probit model using pooled data. The direction and size of the effects are similar to those of the income model. The difference in the consumption model is that the number of jobs significantly increased the probability of being in poverty.

In the poverty gap and severity estimations, among the work history variables, work years significantly decreased the poverty gap and severity measured by consumption level. This finding illustrates that poverty level based on the consumption level is not sensitive to the work history of the elderly. In other words, the poverty level is not influenced much by work history after the poverty status is identified. That is, whether the elderly have interrupted work careers or not does not determine the poverty level measured by consumption.

In contrast to the income model, gender explains poverty gap and severity in the consumption model. Females have lower poverty gap and poverty severity than males. While significantly increasing the poverty gap and severity in the income model, family size is not significant in the consumption model. A higher education level decreases the poverty gap and severity in the consumption model, while it increases the poverty gap and severity in the income model. Like the income model, single elderly and elderly living in the highly urbanized regions have widened poverty gaps and severity in the consumption model. In the case of the impact of age on poverty, being older significantly increases poverty incidence, but it does not significantly affect poverty gap and severity in both income and consumption models.

Education is positively correlated with income, although heterogeneously depending on the level of education. Consumption is also positively correlated with income, meaning the higher educated have higher income and consumption levels compared with lower educated counterparts. Thus, a higher education level by generating income reduces not only the poverty rate but also the poverty gap and its severity. Consumption is need-based, and at a lower income level, the largest portion of income is used for basic consumption.

Poverty incidence

Table 6 gives the results of the conditional fixed-effect logistic regression in the consumption model. The work years significantly decreased poverty incidence, while gap years were not statistically significant although the sign of coefficient is positive.Footnote 8 Additional work years decreased the odds of poverty by about 3%. The elderly not in working status were more likely to be impoverished, having twice higher odds of being in poverty. The number of jobs, which is the proxy for the turnover rate, was also a significant factor having a positive impact on the probability of being in poverty unlike poverty incidence measured by income level. Additional jobs increased the odds of consumption poverty by about 5%. The last occupation dummy except for the clerical occupation significantly increased the poverty incidence, which is the same result as in the income model. Being older increased the odds of being in poverty by about 50%. The elderly singles were less likely to be in poverty when compared with the elderly with spouses among whom the odds of being poor decreased by 25%. Family size and education level also lowered poverty incidence among the elderly. An additional increase in education by one year reduced the odds of being in poverty by 10%.

In the probit model using pooled data, females (Table 7, column 1) had lower probability of being impoverished. However, Appendix Table 8 shows that the female coefficient is not statistically significant if poverty incidence is measured by the single poverty line. The results suggesting that females are less likely to be in poverty in terms of consumption are influenced by the use of the heterogeneous poverty line by gender. The insignificance of the dummy variable for province of residence is also a result of using the heterogeneous poverty line.

The squared terms of work years, age and family size indicate that the effect of these variables becomes less as their numbers increase. The only different result from the income model is the significance of the number of jobs and the insignificance of gap years in the consumption model. Consumption is a measure sensitive to individual characteristics; for example, a temperamental person is more likely to change consumption patterns according to economic conditions. This can be the reason for the significance of the number of jobs in the consumption model but not in the income model.

In the new job market, dominated by the private sector, there is an upcoming trend that high-level professionals only do work up to the early or mid-50 s, save and invest enough for their and family's future. In such cases, despite the low frequency of early retirement by educated high-income earners, the work years cannot explain the elderly poverty in consumption, but it can influence poverty in the income model.

Poverty gap and severity

Table 7 shows the estimation results of the poverty gap and severity models. In the poverty gap measured by consumption level, there was no significant impact of work experience on the poverty gap except for work years. Because the squared term of work years is not statistically significant, the nonlinear effect of work years on the poverty gap does not exist. However, the squared term of work years is included to suggest similar model specifications. When the total work years of the elderly increase by one year, the poverty gap decreases about 1% according to the coefficient of work years in column (2) of Table 7. Among the demographic variables, gender, marital status, education level and the dummy variable for the highly urbanized region are significant. Other things being equal, females have a 27.5% lower poverty level than males. However, this result is because of using heterogeneous poverty lines across gender.Footnote 9 The elderly who are single have about a 31% higher poverty level than the elderly with spouses. The higher the education levels, the smaller the poverty gap for consumption (decreasing at about 1.4% per year).

The elderly living in the highly urbanized region have about a 23% larger poverty gap than the elderly living in the capital city, while the coefficient of the dummy variable for the less urbanized region is not statistically significant. Using a single poverty line, Appendix Table 8 shows that the elderly living in both the highly urbanized regions and the less urbanized regions had a larger poverty gap when compared to the elderly living in the capital city, to the extent of about 17 and 27%, respectively. Like the poverty gap model, work years, gender, marital status, education level and the dummy variable for the highly urbanized region are the only significant variables in the poverty severity model as shown in column (3) of Table 7. The signs of the coefficients are the same, and the size of coefficient is bigger than in the poverty gap model.

We do control for individuals and their living/working characteristics. This controls in part for the heterogeneous and two-way causality between the socioeconomic status (SES) of the elderly and their well-being which gradually lead to declining SES and higher incidence of poverty and its severity. A high SES has a positive effect on survival, and well-being of the elderly and higher survival captured by age have a negative effect on SES. This paper aims to understand the relationship between lifetime work experience and poverty from a Korean perspective. The Korean empirical results can differ from those of other old industrial nations with well-developed welfare systems with guaranteed minimum living standards, health care, elderly care services and independence of the elderly’s income from that of their family members. The results can be useful for other aging societies like the Japanese and Swedish ones with comparable economic and demographic conditions.

Conclusion and policy implications of the results

Previous poverty studies on South Korea mainly analyze demographic characteristics to explain poverty. They conclude that poverty rate is the highest in elderly households with the head aged above 60 years. Elderly households without adult children are found to have the highest risk of being impoverished. However, aging cannot be a cause of poverty, else there would be no solution to aging and poverty. Most of the research on other countries points out the need to analyze elderly poverty in the process of the lifetime, especially in terms of work experience in the labor market. The existing literature on Korea does not focus on the role of work experience in poverty; hence, this study contributes to filling this gap in literature.

Attempt to incorporate work experience in a study of poverty led to a surge of research that considered work history variables in their analyses of elderly poverty. However, most of the research in Korea did not find any evidence on the effect of work years on poverty incidence. In this study, total work years in the lifetime are reflecting the whole lifetime work experience. In addition, gap years between two jobs and the number of jobs in the lifetime are also included as the main work experience variables to find out the effects of an interrupted career and turnover rate on poverty in the elderly. This study found that work years, gap years between jobs, last occupation and current working status all significantly affected poverty incidence among the elderly; this was measured by both income and consumption. Poverty gap and severity in terms of income significantly decreased if the work years exceeded 29 years, and it increased if the gap years exceeded 18 years. In the consumption model, work years significantly increased the poverty gap and severity. Consumption is need-based and more relevant for elderly than retirement income. The income and consumption of elderly are highly correlated. Finding significant coefficients of work history in the poverty model while controlling for the demographic characteristics indicates other factors that were relevant to work experience which affected poverty among the elderly.

The poverty incidence model in this study used a panel data approach to control for the individual’s unobserved heterogeneity. Poverty among the elderly in Korea was captured by adopting a variety of poverty measures—poverty incidence, poverty gap and poverty severity. The findings that the same factors have different effects on poverty incidence, poverty gap and severity support the need to analyze elderly poverty using these three measures. These poverty measures were calculated using the heterogeneous poverty line being differently set by gender, province of residence and time of survey. This is the first attempt in a study on poverty. In addition, this study analyzed the factors influencing poverty measured by consumption level, which is a more need-based measurement.

Based on the results of this study, policies are suggested in two directions. The first is a preventive policy, and the second is remedies for the current circumstances. Economic status in old age is an accumulation of the positions in the labor market through the lifetime. A work period during the lifetime offers decent opportunities to save and prepare for post-retirement life. Gap years between two jobs that are significantly increasing poverty risk among the elderly are the proxy for an interrupted career. The significance of these work relevant variables indicates that policy should be aimed at reducing career discontinuity and allowing the elderly to work longer. This is in line with Lee's (2020) recommendations that “Policymakers should consider steps to strengthen the social safety net, develop labor market programs to promote fertility and female labor force participation and encourage long-term investment in education.”

Life expectancy is increasing, and the low birth rates are leading to a reduction of the working age population. Utilizing the work efforts of the elderly in suitable workplaces will benefit both the employers and employees. This argument is reinforced by the result that the currently working elderly have less poverty risk in both the income and consumption models. Demographic factors are also important in explaining poverty among the elderly. Investigating elderly poverty only in terms of the demographic characteristics cannot offer any viable solutions to the problem after poverty has been identified. More studies on the cause of elderly poverty in the labor market need to be conducted, and appropriate policies should be enforced to prevent elderly poverty in the future and serve as a cure for immediate circumstances.

One important shortcoming of this analysis is that it cannot be applied in most of the developing countries with weak healthcare systems for the elderly. Ample research evidence has proven that health expenditure is one of the main reasons pushing the elderly into poverty. Hence, this manuscript has not considered the morbidity state of elderly individuals in the last few years of their life. The story in Korea with generous medical care for the elderly, significant production of low-price generic medicine and family support for the elderly may differ from that of most developing countries. This is one of the limitations of this study to be considered in future research.

Data availability

The data are available upon request.

Code availability

The code is available upon request.

Notes

Real disposable income after taxes and transfer was used to measure the poverty rate. The relative poverty line is set at 50% of the median equalized disposable income of the entire population.

Group-specific poverty line refers to the relative poverty line that differs based on gender, province of residence and year of survey. The choice of source of variations is made due to differences in needs and developments of prices, labor productivity and incomes.

The number of groups, 24, was calculated by multiplying two gender (male and female), three provinces of residence (capital city, highly urbanized and less urbanized regions) and four surveys (2006, 2009, 2012 and 2015).

Average monthly living expenses include the costs for food, clothing, education, housing, transportation, leisure, durables, health, and medical and other costs.

This study uses the heterogeneous relative poverty line based on gender, regions of residence and time of survey. The model using the single poverty line based on the whole sample is estimated in Appendix Table 8 for income and consumption. The null hypothesis using the Chi-squared test that the female coefficients of these two models are not systematically different was rejected at the 1% significance level.

Only the variables work years, gap years, age and family size have the semi-elasticity columns because these variables have squared terms to allow for nonlinear and variable effects.

The elasticity calculated at the point of 4 gap years is not presented in Table 3 to save space. If requested, the table could be provided by the authors.

The coefficient for gap years becomes significant in the probit model using pooled data.

The null hypothesis using the Chi-squared test that the female coefficients of these two models are not systematically different was rejected at the 1% significance level.

References

Amemiya T (1981) Qualitative response models: a survey. J Econ Literat 19(4):1483–1536

Atkinson AB (1987) On the measurement of poverty. Econometrica 55(4):749–764

Bastos A, Casaca SF, Nunes F, Pereirinha J (2009) Women and poverty: a gender-sensitive approach. J Socio-Econ 38(5):764–778

Boaz RF (1987) Work as a response to low and decreasing real income during retirement. Res Aging 9(3):428–440

Celidoni M (2015) Decomposing vulnerability to poverty. Rev Income Wealth 61(1):59–74

Choi O-G (2007) Factors influencing poverty of the elderly: utilizing the panel data model. Korean J Soc Welf (in Korean) 59(1):5–25

Choi HS, Ryu YK (2003) A study on the levels, trends, and composition of the old-age poverty in Korea. J Korea Gerontol Soc (in Korean) 23(3):143–160

Choudhury S, Leonesio MV (1997) Life-cycle aspects of poverty among older women. Soc Sci Bull 60(2):17–36

Clark S, Hemming R, Ulph D (1981) On indices for the measurement of poverty. Econ J 91(362):515–526

Coulter FA, Cowell FA, Jenkins SP (1992) Equivalence scale relativities and the extent of inequality and poverty. Econ J 102(414):1067–1082

Dodge HH (1995) Movements out of poverty among elderly widows. J Gerontol B Psychol Sci Soc Sci 50(4):S240–S249

Duncan GJ and Hoffman SD (1985) Economic consequences of marital instability. In: Horizontal equity, uncertainty, and economic well-being (pp 427–470). University of Chicago Press

Foster J, Greer J, Thorbecke E (1984) A class of decomposable poverty measures. Econometrica 52(3):761–766

Ginn J, Arber S (1991) Gender, class and income inequalities in later life. Br J Sociol 42(3):369–396

Greene WH (2018) Econometric analysis, 8th Edition. Pearson

Heshmati A and Yoon H (2019) The economics of South Korean demographics. Georgetown J Int Affairs pp 1–5

Hong B-E (2005) Factors influencing the economic status of the elderly in Korea. Korean J Soc Welf (in Korean) 57(4):275–290

Kim SJ, Kim CS (2011) Poverty of the married couple households in old age: the effects of gender and work history. Fam Cult (in Korean) 23(3):63–91

Kim DH, Shin DM (2014) Identifying and explaining different poverty trajectories using a group-based trajectory analysis–a case study of South Korea. Soc Pol Administr 48(7):826–847

Lee J (2020) The labor market in South Korea, 2000–2018. IZA World Labor 2020:405v2

Lee YG, Jeong GH, Yeom JH, Oh YH, Yoo HY and Lee EJ (2011). Analysis and Projection of Changes in the Lives of Elderly Koreans. Korea Institute for Health and Social Affairs, Research Report pp 2010–2025

Maasoumi E, T. Xu T, (2015) Weights and substitution degree in multidimensional well-being in China. J Econ Stud 42(1):4–19

McDonald JF, Moffitt RA (1980) The uses of Tobit analysis. Rev Econ Stat 62(2):318–321

McLaughlin DK, Jensen L (1993) Poverty among older Americans: the plight of nonmetropolitan elders. J Gerontol 48(2):S44–S54

McLaughlin DK, Jensen L (2000) Work history and US elders’ transitions into poverty. Gerontologist 40(4):469–479

O’Rand AM (1996) The precious and the precocious: Understanding cumulative disadvantage and cumulative advantage over the life course. Gerontologist 36(2):230–238

Quadagno J (2013) Aging and the life course: an introduction to social gerontology. McGraw-Hill Higher Education

Rank MR, Hirschl TA (1999) Estimating the proportion of Americans ever experiencing poverty during their elderly years. J Gerontol B Psychol Sci Soc Sci 54(4):S184–S193

Ravallion M (1996) Issues in measuring and modeling poverty. Econ J 106(438):1328–1343

Sen A (1976) Poverty: an ordinal approach to measurement. Econometrica 44(2):219–231

Seok SH, Kim HS (2012) Determinants of poverty in elderly-headed households in Korea. Korean J Public Finance (in Korean) 5(3):99–124

Shorrocks AF (1995) Revisiting the Sen poverty index. Econometrica 63(5):1225–1230

Smith KR, Zick CD (1986) The incidence of poverty among the recently widowed: mediating factors in the life course. J Marriage Fam 48(3):619–630

Tienda M (1986) Industrial restructuring in metropolitan and nonmetropolitan labor markets: Implications for equity and efficiency. In: Symposium on rural labor markets research issues, pp 33–70

Vartanian TP, McNamara JM (2002) Older women in poverty: the impact of midlife factors. J Marriage Fam 64(2):532–548

Wang Y, Wang B (2016) Multidimensional poverty measures and analysis: a case study from Hechi City. China Springerplus 5:642

Zheng B (1997) Aggregate poverty measures. J Econ Surv 11(2):123–162

Funding

Open access funding provided by Jönköping University.

Author information

Authors and Affiliations

Contributions

The authors individual contributions to the paper is as follows: SC was involved in the conceptualization, data curation, software, writing—original draft, writing—reviewing and editing and validation. AH contributed to the conceptualization, methodology, supervision, writing—reviewing and editing, validation and project administration.

Corresponding author

Ethics declarations

Conflicts of interest

The authors declare no conflict of interest.

Human and animals rights statement

Not applicable.

Ethics approval

Not applicable.

Consent to participate

Not applicable.

Consent for publication

Not applicable.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

The authors are grateful to two anonymous referees and the handling editor of the manuscript at the journal for their comments and suggestions on an earlier version of this manuscript.

Appendix

Appendix

See Table 8.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Chae, S., Heshmati, A. The effects of lifetime work experience on incidence and severity of elderly poverty in Korea. J. Soc. Econ. Dev. (2023). https://doi.org/10.1007/s40847-023-00278-5

Accepted:

Published:

DOI: https://doi.org/10.1007/s40847-023-00278-5