Abstract

The notorious ‘dual stability’ paradox is stated as follows: in a closed dynamic Leontief model, when the quantity system is relatively stable, its corresponding price system will be unstable, and vice versa. This paradox arises from the neoclassical assumptions of full utilization of capacity and perfect foresight, which have caused serious complications in the dynamic Leontief model. In this study, we aim to construct a dynamic input–output model within an evolutionary framework, departing from neoclassical assumptions. Two new assumptions are introduced: incomplete utilization of capital stocks and bounded rationality in decision-making. Our findings reveal that the ‘dual stability’ paradox of the quantity and price systems can be addressed by including these two assumptions, and some special conditions are proposed for the stability properties in both the systems. Furthermore, we prove that the distance between the time paths and equilibrium position converges to a constant, which is related to the initial position.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The problem of the stability of quantity and price systems has been a continuing concern for economists working on multi-sectoral models. In accordance with this problem in economic analysis, Jorgenson and Solow summarized the well-known ‘dual stability’ theorem as follow: if the output system is globally relatively stable, the price system is globally relatively unstable, and vice versa (Solow 1959; Jorgenson 1960). Recently, an evolutionary economic method to investigate the quantity system adjustment process without considering price changes, which is regarded as an extension of the Leontief model, was proposed by Shiozawa, Morioka, and Taniguchi (Shiozawa et al. 2019). This method studies the decision-making behaviour of economic agents and the dynamics of economic system from the perspective of evolutionary economics. It provides a heuristic evolutionary approach for this paper to reexamine the ‘dual stability’ theorem. In this study, we introduce the bounded rationality assumption and adaptive learning approach to expectations formation in the hope of providing a alternative solution to the ‘dual stability’ issue.

The stability of dynamic input–output systems in alternative frameworks has been investigated in a large amount of studies since Wassily Leontief proposed a dynamic multi-sectoral model in Studies in the Structure of the American Economy. The standard form of this model and its corresponding price system are given without considering technological change (that is, technical coefficients are fixed) as follows:

where \(X\left(t\right):=({x}_{i}(t))\in {R}^{n\times 1}\) is the output level vector; \(P\left(t\right):=({p}_{j}(t))\in {R}^{1\times n}\) is the price vector; \(A:=({a}_{ij})\in {R}_{+}^{n\times n}\) is the input matrix; \(B:=({b}_{ij})\in {R}_{+}^{n\times n}\) is the capital stock matrix. If the time subscripts are removed, then the static systems are given by:

where \(g\) and \(r\) are the rate of growth and rate of profit, respectively.

The main difference between this dynamic input–output model and the static input–output model is that it considers capital stocks (the \(B\) matrix). Therefore, this dynamic model also suffers from the ‘dual stability’ problem that the static model does not have, which is elaborated in the following three points.

Firstly, it is observed that the quantity system is unstable, that is, if there is a slight disturbance, the time paths of the output level will rapidly diverge from the movement that corresponds to the dominant characteristic root (Sargan 1958). Second, if the initial capital stocks do not identify with the balanced growth path, then the evolution of outputs and capital stocks might become negative, which is the ‘causal indeterminacy’ problem (Uzawa 1961; Dorfman et al. 1987). Third, after the establishment of the price system, the notorious ‘dual stability’ issue appears.

To address the first two problems, two assumptions are made within the neoclassical framework: full utilization of capacity and perfect foresight (Solow and Samuelson 1953; Solow 1959). These assumptions derived from the Walrasian thought that economic agents can perfectly foresee the demand and future price of the market during the tâtonnement process until supply and demand are in balance. These two assumptions ensure the stability of the quantity system and that the non-negativity of capital stocks. However, the neoclassical price mechanism established by Solow and Samuelson based on the one-sided determination of the supply–demand balance seems to be flawed. Further, these two restrict assumptions cannot adequately identify and solve the ‘dual stability’ problem, or even be consider as the cause of it (Solow 1959; Jorgenson 1960; Zaghini 1971, 1991; Aoki 1977; Filippini 1983; Flaschel and Semmler 1986; Duménil and Lévy 1987; Flaschel 2010).

On the one hand, some Keynesian economists pointed out that the ‘dual stability’ issue could be due to full-utilization of capacity and perfect foresight (Jorgenson 1960; Aoki 1977; Filippini 1983; Zaghini 1991). They argued that in reality, economic agents have limited information about future demand and price changes, leading to the possibility of excess capital stock and capital loss or gains in the production process, and the path of the quantity and price system will diverge from the equilibrium path. In order to relax the restrict assumptions mentioned above, these economists proposed some Keynesian sequential models as an alternative to avoid the ‘dual stability’ problem. At the same time, the quantity system and the price system should be determined independently of each other. On the other hand, other modern classical economists argued that the ‘dual instability’ theorem may arise from the price-determination mechanism that is the unilaterally determined by supply–demand system (Flaschel and Semmler 1986; Duménil and Lévy 1987; Flaschel 2010). Therefore, they proposed the cross-dual model in which price changes affect the level of output, while output changes impact prices.

Nevertheless, these approaches have certain limitations. Firstly, the Keynesian-type models only consider circulating capital and inventories, while ignores capital stocks. Secondly, although the expectation functions are introduced in these models, they do not provide a logical justification of the decision-making process of economic agents. Thirdly, the range of limits to which the time path converges is not determined.

This paper aims to relax the assumptions that full-utilization of capacity and perfect foresight and then construct a multi-sectoral model with mico-dynamics of quantity and price systems independent of each other, which helps to overcome the ‘dual stability’ problem. The model contributes to the following points:

Firstly, the model considers the existence of redundant capital stocks. Secondly, the model introduces the expectation functions of heterogeneous producers who have limited information of future demand and returns. Thirdly, both quantity system and price system converge to a constant and the range of limits is given.

The remainder of this paper is organized as follows. Section 2 surveys and re-evaluates alternative methodologies for dealing with the ‘dual stability’ paradox. Section 3 formalizes the generalized dynamic Leontief model with evolutionary hypothesis and examines the stability of the model. Finally, Sect. 4 presents our conclusions.

2 Comparisons with previous studies

This section posits the following assertions: Firstly, the full utilization of capacity and short-run perfect foresight are mathematically convenient assumptions basing on rationality expectations. In the empirical studies of macroeconomics, the rational expectations approach presumes that producers have a large amount of information (Evans and Honkapohja 2001). Consequently, producers can accurately predict the future demand for capital stocks and price change. In the real world, however, producers are not omniscient, which may lead to ‘dual stability’ problem for a long time. Secondly, the bounded rationality assumption would be a good alternative to the rationality hypothesis. This is the basis for modelling the behaviours of producers using adaptive learning methods to construct expectations in economic studies. Our literature review is divided into two parts: quantity system and price system.

2.1 The quantity system

Initially, much attention has been paid to whether the quantity system (1.1) will produce a time path such that output and capital stocks are non-negative in each period. Only when the initial position of the output path starts from a very limited range can the output and capital stocks be guaranteed to be non-negative in each period. This is because the dynamic paths of the output levels are easily perturbed by the slightest disturbance of the initial positions such that these paths depart from the razor edge of the balanced growth path. This is so-called ‘causal indeterminacy’ problem (Dorfman et al. 1987). Thus, Solow and Samuelson proposed the concept of ‘relative stability’, which is expressed as Eq. (2.2). If the balanced growth path turns out to be relatively stable, then the ‘causal indeterminacy’ problem also disappears (Solow and Samuelson 1953; Takayama 1985).

Definition 2.1

Let \({X}^{*}(t)=\left({x}_{i}^{*}(t)\right)\in {R}^{n\times 1}\) be balanced growth path and \(X(t)=\left({x}_{i}(t)\right)\in {R}^{n\times 1}\) be any path beginning from arbitrary non-negative initial position. A balanced growth path is relatively stable ifFootnote 1:

In the models under different frameworks, there are different conditions that guarantee relative stability. Neoclassical economists insisted that ‘causal indeterminacy’ stems from the restriction of fixed technical coefficients and the non-substitution theorem (Solow and Samuelson 1953; Morishima 1958; Solow 1959; Takayama 1985). They attempted to solve this issue with a nonlinear model, using the following neoclassical substitution theorem as follows:

This nonlinear quantity system is relatively stable if all neoclassical production functions \({H}_{i}\)’s are monotonically increasing functions of all \({x}_{i}(t)\)’s. Evidently, this assumption is restrictive—it requires that each good must be produced by all other goods and each good can produce all other goods.

Morishima relaxes this condition (2.2) by adopting a nonlinear model of the neoclassical production function (Morishima 1958). The optimal input and capital coefficients \({a}_{ij}^{*}\)’s and \({b}_{ij}^{*}\)’s, are determined by non-linear functions of prices:

where \({p}_{i}\) is the price of commodity \(i\) and \({p}_{n+1}\) is the wage rate. However, the neo-classical substitution theorem does not help to overcome the ‘causal indeterminacy’ issue. When the optimal technical coefficients \({a}_{ij}^{*}\)’s and \({b}_{ij}^{*}\)’s, are fixed, the system transforms from a nonlinear model to a linear one. Morishima was interested in building a harmonious relationship between the quantity and price system, similar to von Neumann’s model where the rate of profit is equal to the rate of growth. Thus, even though he succeeded in proving the uniqueness of the balanced growth path according to the Frobenius theorem, he failed to prove ‘relative stability’ of his model.

Apparently, neoclassical economists have come to acknowledge that the substitution theorem is not a remedy for the ‘dual stability’ or ‘causal indeterminacy’ issues. Solow provided a sufficient geometric condition for guaranteeing the ‘relative stability’ in a linear model (Solow 1959). This condition is expressed as follows: Let \({\lambda }_{1}\) be the dominant characteristic roots of \({B}^{-1}\left(I-A\right)\), such that \({1+\lambda }_{1}>\left|1+{\lambda }_{i}\right|\) where \({\lambda }_{i}\)’s are the other characteristic roots of \({B}^{-1}\left(I-A\right)\). Under the assumption of full utilization of capacity, the balanced growth path \({X}^{*}\left(t\right)={(1+{\lambda }_{1})}^{t}{X}_{1}^{*}\) is relatively stable, where \({X}_{1}^{*}\) is the characteristic column vector corresponding to \({\lambda }_{1}\).

Nevertheless, due to the full utilization of capacity, Solow’s geometric methodology does not perform well in practical application (Tokoyama and Murakami 1972). When Tokoyama and Murakami attempted to fit Solow’s model with empirical data on the Japanese economy, the calculated fitting path was unstable. Hence, for empirical purposes, quantity system (1.1) should be modified as follows:

And Solow’s geometric condition of ‘relative stability’ is revised as: the balanced growth path to (2.5) is relatively stable if the dominant characteristic root is located in the zone which is outside of the circles of \(1-{\lambda }_{1}\) satisfying \(\left|1-{\lambda }_{i}\right|>1-{\lambda }_{1}\forall i\). Tokoyama and Murakami’s modification should be considered as a rebuttal to the neo-classical assumption of perfect foresight.

Neoclassical methodologies cannot reject the rationality and perfect foresight assumptions whereas Keynesian-type models advocate solving the ‘dual stability’ issue without adopting these assumptions. In these Keynesian-type models, economic expansion is based on the expected levels of future demand. After dropping perfect foresight assumption, Aoki proved that if markup rates exceed the rate of increase in the wage rate, the quantity system is relatively stable (Aoki 1977). In Aoki’s system, excess capacity is assumed to be decomposable without cost. Compared to the neoclassical full utilization of capacity, Aoki’s model is reasonable because there only exist capacities for current goods but not for fixed capital goods. In our model discussed in Sect. 3, however, we relax this assumption—capacities for fixed capital goods cannot be decomposable.

Alternative models consider the expectation hypothesis to address ‘instability’ problem (Filippini 1983; Zaghini 1991; Shiozawa et al. 2019). The Filippini model is expressed as follows:

where \({I}^{e}\left(t\right)\) represents the expected investment; \(I\left(t\right)\) represents the actual investment; \(\lambda\) is the desired rate of growth of capital stocks, which is assumed to be equal to the rate of profit; and \(r\), \(\gamma\) denote the diagonal matrix expected parameters.

Let \(E\) be the unity matrix and \(U\left(t\right)=(E-A)X(t)\), system (2.6) and (2.7) can be simplified as

Filippini’s proposition is stated as following: if there exists \(X\left(t\right)>0\forall t\), such that arbitrary \(U\left(t\right)\geqq 0\forall t\), then the system (2.9) is relatively stable which is independent of the expectation coefficients. Filippini’s model may be the first step in introducing expectations into the dynamic Leontief model. Nevertheless, the expectation mechanism is defective: (i) It should be noted that this system (2.9) is not ‘globally’ relatively stable because the stability is established under the special condition \(U\left(t\right)\geqq 0\forall t\). (ii) Furthermore, the parameters in parenthesis, \(\gamma\) and \(\lambda\), complicate the calculation of the dominant characteristic roots. We need to assume \(\gamma =0\) and \(\lambda =1\). Otherwise, we have no idea what the time paths are going to be. (iii) there exist no constraints on expansion of capital stocks. (iv) Filippini artificially assumed that the rate of the expansion of capital stocks exactly equals to the rate of profit. We show that the growth rates of output and capital stocks are endogenously determined and equal to the rate of profit.

Zaghini proposed a complementary model of Filippini’s model where \(\lambda (t)\) is the desired growth rate of capital stocks, which is determined endogenously in the system (Zaghini 1991). He argued that when the time paths converge to the balanced growth path, the \(\lambda \left(t\right)\) will also converge to a limit related to it. However, in Sect. 3, we will show that the stability property of the quantity system separates from the expected parameter \(\lambda \left(t\right)\). Except when a mechanism for the expected parameter \(\lambda \left(t\right)\) exists, it should be provided externally and not from a converging sequence.

More recently, a new approach in evolutionary economics provides a glimmer of hope to address ‘dual stability’ issue. The most interesting feature of this new evolutionary approach is the quantity adjustment adapting process (Shiozawa et al. 2019). This method, so-called the simple moving average approach, assumes that economic agents have bounded rationality such that they must produce according to the estimated demand and constantly adjust their production strategies, which is expressed as followsFootnote 2:

where \(u(t+1)\) is the vectors of outputs, inputs, and inventories; \(\Theta\) is an augmented matrix including input matrix A, the buffer stock ratio K, and the average period M; Ψ is a certain matrix, defined by the input matrix A, the buffer stock ratio K, and the average period M. According to the Taniguchi–Morioka theorem, system (2.10) is asymptotically stable if the Frobenius root of \(A\) satisfies:

where \(K\) denotes the buffer stock ratio and \(M\) is the average period. This evolutionary model that introduces expectations offers an alternative way to replace the neoclassical framework and solve the ‘dual stability’ problem. Similar to Aoki’s Keynesian model, the quantity adjustment process focuses on the demand for products and their inventories rather than fixed capital. The quantity adjustment process considers the situation that the order cannot be satisfied due to stockout. Therefore, it does not suffer from ‘causal indeterminacy’ that plagues the dynamic Leontief model. When a stockout of product inventory occurs, unfulfilled orders may be carried over to the next period as ‘negative inventory’. Under the assumption that unfulfilled orders are simply cancelled, these negative inventories do not affect production in the next period. However, the capital stocks considered in the dynamic Leontief model (such as plant, machinery, and lathes) are difficult to remove once they are installed. Therefore, we set the non-negative restrictions for our model in Sect. 3. Moreover, while the evolutionary model is asymptotically stable, the dynamic Leontief model is not necessarily asymptotically stable. That is, the time path might converge to the balanced growth path only from one side (Takayama 1985).

2.2 The price system

In constructing a price system corresponding to the quantity system, a major problem ‘dual stability’ arises. Next, the methods of different frameworks for dealing with this problem are introduced.

Morishima was the first to propose a price system in a neoclassical framework (Morishima 1958). The fixed technical coefficients, \({A}^{*}=\left({a}_{ij}^{*}\right)\) and \({B}^{*}=\left({b}_{ij}^{*}\right)\), are optimally determined by the neoclassical production functions (2.13) and (2.14). His ‘pseudo’ neoclassical price theory is denoted by

where \(r\) is the rate of profit and \(w\) is the wage rate. Morishima proved the existence of a unique long-run equilibrium price of Eq. (2.12). At the same time, there exists a unique balanced growth solution for the corresponding quantity system. In his study, both price system and quantity system are static and stable, so there is no need to solve ‘dual stability’ issue. Moreover, it is worth noting that even if the technical coefficients are determined by a typical tâtonnement process, Morishima aimed to construct to a price system where prices converge to the equilibrium natural price in the long-run. His input–output matrix also contains the daily means of subsistence of workers. Morishima’s intention to revive the classical paradigm, in particular the Marxian paradigm, through modern economics has been revealed in this study.

Since the first price system was pointed out by Solow as a de facto static system, Morishima proposed another dynamic linear price system consisting of Eqs. (2.13) and (2.14) (Solow 1959):

where \(\sigma\) represents a chosen technology belonging to technological set \(S\). The price vector \({P}_{(\sigma )}\) satisfying (2.13) is called the static long-run equilibrium price vector if \({P}_{(\sigma )}\leqq {P}_{(\alpha )}\forall \alpha \in S\). By introducing the time variable, the dynamic long-run equilibrium price vector is determined by the following equation:

If the capital losses and gains are neglected, the system (2.14) is globally stable, i.e., \(\mathop{\mathit{lim}}\nolimits_{t\to \infty }P\left(t\right)={P}_{(\epsilon )}\), where \({P}_{(\epsilon )}\) is the dynamic long-run equilibrium price vector satisfying (2.14). An important question is whether the static long-run equilibrium price vector \({P}_{(\sigma )}\) is equivalent to the dynamic long-run equilibrium price vector \({P}_{(\epsilon )}\). However, Morishima did not prove this point, and we provide the complementary proof as follows:

Proposition 1

The static long-run equilibrium price vector is equivalent to the dynamic long-run equilibrium price vector.

Proof

Let \({P}_{(\epsilon )}\) be the dynamic long-run equilibrium price vector satisfying (2.14) such that,

Then we have

According to Morishima’s assumption that at least one non-negative price vector belongs to \(S\), which ‘properly’ corresponds to the technology matrix, then there must be at least one technology matrix satisfying the Hawkins–Simon conditions. This implies that \(\left(I-\left({A}_{(\alpha )}+r{B}_{(\alpha )}\right)\right)\) is invertible. It follows:

Then we obtain \({P}_{(\epsilon )}\leqq {P}_{(\alpha )}\forall \alpha \in S\). Therefore, the dynamic long-run equilibrium price vector is equivalent to the static long-run equilibrium price vector, i.e., \({P}_{(\epsilon )}\leqq {P}_{(\sigma )}\).□

In his paper, Morishima seemed to realise that the restrictive assumption of perfect foresight is a barrier to achieving dual-system stability. But he simply ignored the capital losses and gains induced by price changes and did not propose an alternative method. This was criticized by Solow and Jorgenson (Solow 1959; Jorgenson 1968). In Sect. 3, we would construct an expectation mechanism with capital losses and gains as well as capacity production to guarantee the dual stability property of the two systems.

To refute Morishima’s static price expectation hypothesis, Solow proposed a dynamic price theory in the neo-classical framework that takes into account capital losses and gains (Solow 1959):

Simplifying the above equation can be obtained:

where \(r(t)\) is the interest rate, \({v}_{j}\left(t+1\right)-{v}_{j}(t)\) denotes capital loss and gain, and \({n}_{j}(t+1)\) is current profit. System (2.19) is equivalent to system (1.2). Solow proved that if \(\left(1+r\right){\left(1+{\lambda }_{1}\right)}^{-1}<1\), where \({\lambda }_{1}\) is the Frobenius root of \({B}^{-1}\left(I-A\right)\), then the time path of prices to (2.19) will be globally asymptotically stable, i.e., \(P(t)\) converges to the stationary solution \({P}^{*}\) satisfying (1.4). However, there is also the ‘dual stability’ problem in Solow’s theory since the global stability of (2.19) requires perfect foresight about the future price of capital stocks \(P\left(t+1\right)B\).

The trouble induced by perfect foresight has been recognized by many heterodox economists. It makes no logical sense that information about what will happen in the future can determine what will happen today (Zaghini 1971). To get rid of the ‘dual stability’ puzzle, some heterodox economic literature attempted to find an expectation mechanism that can allow idle capital stock to exist when the actual situation does not match the expectation. In his model, Zaghini (1971) adopted the Walras-Hicks flexible expectations hypothesis that economic agents invest in the capital stocks for future returns at an expected stock rent \({\widehat{v}}_{i}(t+1)\). That is, the rate of profit \(r(t)\) and future price \({p}_{i}(t+1)\) in (1.2) are replaced by the expected rate of profit \(\widehat{r}(t)\) and expected \({\widehat{p}}_{i}\left(t+1\right)=\frac{{\widehat{v}}_{i}(t)}{\widehat{r}(t)}\), respectively. Zaghini showed that there exists at least one economically meaningful solution to his dual systems. But the model suffers from a controversial point: economic agents are assumed to know the long-run equilibrium rate of profit \(r(t)\). If economic agents already know the long-run equilibrium rate of profit \(r(t)\), then they will set current price according to the long-run equilibrium rate of profit rather than the expected rate of profit.

In addition, Zaghini argued that Solow’s price equation was based on neoclassical scarcity hypotheses and the tâtonnement process, which creates the ‘dual stability’ issue of quantity system and price system. According to Zaghini’s reconstruction of Solow’s model in his Eq. (2.12), the prices of low-scarcity stocks with lower rents increase relative to the prices of high-scarcity stocks with higher rents. This argument is contrary to the theory of Jorgenson (1960). From this, he concluded that in Solow’s model, economic agents tend to increase investment in low-scarcity stocks and decrease investment in high-scarcity stocks. As a result, the redundant capital stocks in the model keeps increasing, which leads to the instability of the model. Thus, in addition to perfect foresight, the strong association between the quantity and price systems assumed by the neoclassicism is also considered to be the cause of the ‘dual stability’ problem. In order to avoid these two hypothesis (Zaghini 1971), Filippini and Zaghini proposed models with expectations functions in which the quantity system and price system is independent of each other (Zaghini 1971, 1991; Filippini 1983). Unfortunately, Filippini and Zaghini’s models are relatively stable only to a limited range.

In some Keyneisan sequential models, the ‘dual stability’ paradox is claimed to have been overcome. For example, Aoki proposed a fixed mark-up price mechanism and a quantity system in which production is based on expectations (Aoki 1977). Shiozawa et al. developed a similar theory of prices, where prices are determined by the minimum price theorem (Shiozawa et al. 2019). In both models, producers tend to sell their products as much as possible at a constant mark-up prices. However, the models of Aoki and Shiozawa et al. consider the current prices and production of goods and their inventories. In Aoki’s model, excess inventories can be decomposable without cost. In the model of Shiozawa et al., excess inventories can be freely delivered to the next period. In Sect. 3, our linear multi-sectoral model provides a complementary explanation to the indecomposability of the capital stocks. That is, the producers must estimate the demand for capital stocks at the same time as the demand for the production in order to reduce the excess capital stocks.

In conclusion, the existence of the ‘dual stability’ paradox stems from the idea that the producers adjust their short-run output and capital stocks through temporary strategies each period in order to approximate a long-run stable position. At the same time, producers adjust their prices basing on the returns on the capital stocks so as to converge to the nature price. In such short-term production, it is difficult for producers to accurately predict future demand and price changes of products and capital stocks. Therefore, in some contemporary macroeconomic empirical studies, attentions have been focused on incomplete information and uncertainty. They introduced the adaptive learning approach—under the bounded rationality hypothesis, producers act like econometricians, that is, they estimate the parameters of the real model based on limited data and econometric methods (Evans and Honkapohja 2001; Frydman and Phelps 2013). All these provide clues for us to develop a dynamic model of the separation of quantity and price systems, while introducing the adaptive learning expectations hypothesis in place of perfect foresight.

3 A dynamic Leontief model with bounded rationality

In this section, we propose a closed dynamic Leontief model with bounded rationality assumption in an evolutionary framework. Several of the limitations of previous studies discussed in Sect. 2 are effectively addressed in this model. Firstly, in the price system, we introduce an expected variable of price changes instead of perfect foresight of capital losses and gains. Under perfect competition and free capital mobility, the time paths of prices will gradually approach to the ‘pseudo’ long-run equilibrium price vector until the distance between them approximates to a constant. If prices are assumed to be constant (i.e., static price expectation), this ‘pseudo’ long-run equilibrium price vector is equivalent to the long-run equilibrium price vector. Second, in the quantity system, we introduce an expected variable of future capital stocks requirements in place of full-utilization assumption. In the presence of redundant capital stocks, the time paths of outputs, driven by the expected expansion of the capital stocks, will gradually approach to the ‘pseudo’ balanced growth path until the distance between them approximate to a constant. If the capital stocks requirements are assumed to be constant, this ‘pseudo’ balanced growth path is equivalent to the balanced growth path. Finally, we compare our results with previous studies.

This paper proposed the following basic assumptions: there exist \(n\) industries and \(n\) goods. Each industry uses one technique to produce one good. This technique is characterized by constant returns to scale. We define the following technical notations:

-

\({a}_{ij}\in {R}_{+}:\) the current input coefficient of good \(i\) required by industry \(j\), \(i,j=\mathrm{1,2},\ldots ,n.\)

-

\(A:=({a}_{ij})\in {R}_{+}^{n\times n}\): the current input matrix.

-

\({b}_{ij}\in {R}_{+}:\) the capital stock coefficient of good \(i\) required by industry \(j\), \(i,j=\mathrm{1,2},\ldots ,n.\)

-

\(B:=({b}_{ij})\in {R}^{n\times n}\): the capital stock coefficient matrix.

-

\({s}_{i}^{e}\left(t\right)\in R\): the expected capital stocks of good \(i\) available at the beginning of period \(t\), \(i=\mathrm{1,2},\ldots ,n\).

-

\({S}^{e}\left(t\right):=({s}_{i}^{e}(t))\in {R}^{n\times 1}\): the vector of expected capital stocks.

-

\({v}_{ij}^{e}(t)\in R\): the expected capital losses and gains of capital stocks of good \(i\) in industry \(j\) at the beginning of period \(t\), \(j=\mathrm{1,2},\ldots ,n\).

-

\({r}_{j}^{e}(t)\in {R}_{+}\): the expected profit rate in industry \(j\) in period \(t\).

-

\({p}_{j}(t)\): the price of good \(j\) in period \(t\), \(j=\mathrm{1,2},\ldots ,n\).

-

\(P\left(t\right):=({p}_{j}(t))\in {R}^{1\times n}\), the price vector in period \(t\).

-

\({x}_{i}(t)\): the output level of good \(i\) in period \(t\), \(i=\mathrm{1,2},\ldots ,n\).

-

\(X\left(t\right):=({x}_{i}(t))\in {R}^{n\times 1}\), the output level vector in period \(t\).

Assumption 1

\(A\) is indecomposable and productive, i.e., \({\lambda }^{F}\left(A\right)<1\), where \({\lambda }^{F}\left(\cdot \right)\) is the Frobenius root; \(B\) is non-zero, i.e., there exists at least one industry using capital stocks.

3.1 The price system

As mentioned above, heterodox economists criticize the fact that perfect foresight and full utilization of capacity have become an obsession in the dynamic Leontief model. However, from an evolutionary perspective, given fixed coefficients, free mobility of capital, and perfect competition, producers’ investment decision-making has an evolutionary process to adapt to the uncertainty of profitability and capital losses and gains (van Wegberg 1990). At the beginning of each production period, the limited information possessed by bounded rational producers in industry \(j\) is the capital investment and profits received in the previous period. Producers in industry \(j\) faces uncertainty risk when planning the subsequent investment process. Thus, this study assumes that producers have expectations of capital losses and gains. To make profits and capital gains (or reduce losses) from capital stocks, producers adjust the expected rate of returns on capital stocks based on experience and estimated parameters. Because producers do not have perfect foresight, there is a deviation between the expected returns on capital stocks and the actual returns, and then the expected price vector are not necessarily equivalent to the long-run equilibrium price vector.

The following assumptions are adopted:

Assumption 2

(Bounded rationality of capital losses and gains) Producers do not have perfect foresight regarding received profits, capital losses and gains. Thus, they estimate returns and price changes based on limited information and experience.

Assumption 2 is formulated based on the consideration that when doing empirical research, economists do not know the parameters of the economic system and must estimate them econometrically. It is more reasonable to assume that the producers experience similar limitations in their understanding of the economy. Consequently, the producers model expectations formation by employing adaptive learning approach, just as econometricians do (Evans and Honkapohja 2001).

Assumption 3

Production of capital stocks requires time.

Assumption 3 indicates that (i) the goods used as current inputs take one period to complete the production process and may not be delivered on time. These goods are settled ex post at prices of the next period. (ii) Capital stocks require to be built (e.g., factories) or installed (e.g., machines) at least one period in advance. Thus, these capital stocks (or ‘advanced capital’ in Marx terminology) should be paid at the prices of the previous period. To some extent, lagged variables of past events may affect expectations of future events (Christ 1966). Since capital stocks generally require more than one period to install, the calculation of the current values and output levels of capital stocks depend on the lagged values.

Assumption 4

The price system and quantity systems are independent of each other.

Assumption 4 states that price formation does not depend on the balance between demand and supply but on the unit cost of production. We assume that the current inputs are fully consumed in each period. While the capital stocks may be over-utilized or under-utilized. If the capital stocks are over-utilized, producers will increase investment to construct sufficient capacity in the next period. If the capital stocks are under-utilized, then producers will reduce investment in the next period.

Denote \({\rho }_{j}^{e}(t)\) as the expected rate of price change in industry \(j\), then we can obtain the expectation on capital losses and gains in industry \(j\) as below:

where \({\rho }_{j}^{e}(t)\in [-\mathrm{1,1}]\). Equation (3.1) reflects that under the Assumption 2, producers estimate the unknown parameters of capital losses and gains incorporating adaptive learning approach. Let \({\rho }_{j}\left(t\right)\) be the rate of price change that producers in industry \(j\) need to forecast and \({\rho }_{j}^{e}(t)\) is the expectations estimated by producers based on available data. That is, the forecast \({\rho }_{j}^{e}(t)\) is a time-varied function of the observables of capital losses and gains, which are varied among industries. In a stochastic dynamics system with adaptive learning approach, economic variables depend on producers’ estimations of parameters and those parameters evolve over time in response to the changing variables themselves (Evans and Honkapohja 2001).Footnote 3 Therefore, producers can adjust \({\rho }_{j}^{e}(t)\) over time through past experience. For example, if the level of holding stocks is high, the expectations on rate of price change will be negative, that is \({\rho }_{j}^{e}\left(t\right)<0\) and consequently the change in value is added to cost (capital losses). If the level of holding stocks is low, the expectations on rate of price change will be positive, that is \({\rho }_{j}^{e}\left(t\right)>0\) and consequently the change in value is added to revenue (capital gains).

Now we can give the general price system with the different expectations. Under the assumption of bounded rationality and adaptive learning behaviour, producers in industry \(j\) expect that the value of the net output in period \(t+1\) (the term on the left side) should equal to the value of the profits and capital losses and gains in period \(t\) (the term on the right side):

or in matrix form,

where \({\Gamma }^{e}\left(t\right)=({\gamma }_{ij}^{e}\left(t\right))\in {R}^{n\times n}\) (\({\gamma }_{ij}^{e}\left(t\right)={r}_{j}^{e}\left(t\right)+{\rho }_{j}^{e}\left(t\right)\) for \(i=j\) and \({\gamma }_{ij}^{e}\left(t\right)=0\) for others). Since producers do not know the uniform long-run equilibrium rate of profit, they have different expected rate of profit due to heterogeneity of industries.

Next, we begin to investigate the stability properties of the price system (3.3).

Assumption 5

\(M={B(I-A)}^{-1}\) is non-negative and indecomposable.

Definition 1

A semi-positive price vector \(\bar{P }\) is called the long-run equilibrium price vector if it satisfies system \(\bar{P }=\bar{r }\bar{P }M\) and the corresponding rate of profit \(\bar{r }\) is called the equilibrium rate of profit.

Definition 2

Assume that in the price system (3.3), both the expected rate of price change and the expected rate of profit are uniform across industries, i.e., \({\rho }_{j}^{e}\left(t\right)={\rho }^{e}(t)\), \({r}_{j}^{e}\left(t\right)={r}^{e}(t)\), and \({\gamma }_{jj}^{e}\left(t\right)={\gamma }^{e}(t)\). A semi-positive price vector \({P}^{*}(t)\) is called the ‘pseudo’ long-run equilibrium price vector if it satisfies system (3.3) and takes the following form:

where \({\xi }_{1}\) is the Frobenius root of \(M\) and \({P}_{1}^{*}\) is the corresponding characteristic row vector.

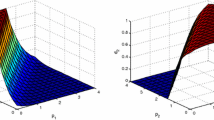

Proposition 2

Let the expected rate of price change and rate of profit be uniform across industries, i.e., \({\rho }_{j}^{e}\left(t\right)={\rho }^{e}(t)\), \({r}_{j}^{e}\left(t\right)={r}^{e}(t)\), and \({\gamma }_{jj}^{e}\left(t\right)={\gamma }^{e}(t)\), so that there exists a pseudo long-run equilibrium price vector satisfying system (3.3). Let \(P(t)\) be any solution to system (3.3) starting from an arbitrary initial position \(P\left(0\right)>0\), then we have:

-

(a)

The ‘pseudo’ long-run equilibrium price vector is globally relatively stable, i.e., \(\mathop{\mathit{lim}}\limits_{t\to \infty }\frac{{p}_{j}(t)}{{p}_{j}^{*}(t)}=\nu \forall j\), where \(\nu >0\) is a constant.

-

(b)

\(\nu =\frac{\Vert P(0){X}_{1}^{*}\Vert }{\Vert {P}_{1}^{*}{X}_{1}^{*}\Vert }\forall j\), where \(\Vert \cdot \Vert\) represents the norm of a vector.

-

(c)

The ‘pseudo’ long-run equilibrium price vector is equivalent to the long-run equilibrium price vector, i.e., \({P}^{*}\left(t\right)=\overline{P }\), if and only if \({\prod }_{\tau =0}^{t-1}{\upgamma }^{e}\left(\tau \right)=\frac{1}{{\xi }_{1}^{t}}\).

Proof

We begin by proving (a).Footnote 4

Let us define \({m}_{ij}\) as the element of \(M\) and \(\frac{{p}_{j}(t)}{{p}_{j}^{*}(t)}={w}_{j}(t)\), then we have \(n\) sequences \(\left\{{w}_{j}(t)\right\}\), \(j=\mathrm{1,2},\ldots ,n\). Assume \(w^{\prime}(t-1)\) and \(w^{\prime\prime}(t-1)\) to be the minimum and maximum values of \({w}_{j}(t-1)\), respectively. It is required to prove \(\mathop{\mathit{lim}}\limits_{t\to \infty }{w}^{\prime}\left(t-1\right)=\mathop{\mathit{lim}}\limits_{t\to \infty }w^{\prime\prime}\left(t-1\right)=\nu\). Then we have \(\mathop{\mathit{lim}}\limits_{t\to \infty }{w}_{j}\left(t-1\right)=\nu\) by the Squeeze theorem.

Let \({w}_{1}\left(t-1\right)=w^{\prime}(t-1)\). According to \({p}_{j}^{*}\left(t\right)={\xi }_{1}{p}_{j}^{*}(t-1)\), we have.

Substituting \({w}_{j}(t)\) with \(w^{\prime\prime}(t)\), then we find that \(\left\{w^{\prime\prime}(t)\right\}\) is a decreasing sequence according to the following property:

Let \({w}_{1}\left(t-1\right)=w^{\prime\prime}(t-1)\); we have,

Substituting \({w}_{j}(t)\) with \(w^{\prime}(t)\), we find that \(\left\{w^{\prime}(t)\right\}\) is an increasing sequence according to the following property:

For \(P(t)\) starting from an arbitrary non-negative position, there exists,

Thus, the limits of \(\left\{w^{\prime}(t)\right\}\) and \(\left\{w^{\prime\prime}(t)\right\}\) must exist and be non-negative.

From Inequalities (3.5) and (3.7), we obtain the following properties of the limits:

and

Since \(M\) is an indecomposable matrix, there exists a unique, simple, and positive eigenvalue \({\xi }_{1}\) such that,

and

Since \(\mathop{\mathit{lim}}\limits_{t\to \infty }{w}^{\prime}\left(t\right)=\mathop{\mathit{lim}}\limits_{t\to \infty }{w}^{\prime\prime}\left(t-1\right)=\nu\), the left sides of (3.12) and (3.13) converge to zero. Then we obtain,

Hence, we have proved \(\mathop{\mathit{lim}}\limits_{t\to \infty }{w}^{\prime}\left(t-1\right)=\mathop{\mathit{lim}}\limits_{t\to \infty }w^{\prime\prime}(t-1)=\mathop{\mathit{lim}}\limits_{t\to \infty }{w}_{i}(t)=\nu >0\).

Next, we prove (b).Footnote 5

As \(M\) is indecomposable, according to the Perron-Frobenius theorem, the Frobenius root \({\xi }_{1}\) of \(M\) is unique, simple, and positive, and there exists a corresponding characteristic row vector \({P}_{1}^{*}>0\) and a corresponding characteristic column vector \({X}_{1}^{*}>0\).

Let us define a matrix \(\bar{M }=\frac{1}{{\xi }_{1}}M\). Mori (2011, Sect. 2.2) has shown that,

where \({\bar{M} }^{*}=\frac{1}{{P}_{1}^{*}{X}_{1}^{*}}{X}_{1}^{*}{P}_{1}^{*}\) is a semi-positive matrix of rank one.

According to Mori (2016, Appendix 1), for an arbitrary semi-positive solution \(P(t)\) to system (3.3), we have,

It implies that,

Consequently, we obtain the following equation for each \(j,\)

And then,

Finally, we prove (c). The result is obvious.

(Necessity) If \({\prod }_{\tau =0}^{t-1}{\upgamma }^{e}\left(\tau \right)=\frac{1}{{\xi }_{1}^{t}}\) is satisfied, then we obtain,

(Sufficiency) If \({P}^{*}\left(t+1\right)={P}^{*}\left(t\right)=\bar{P }\), it immediately implies that \({\prod }_{\tau =0}^{t-1}{\gamma }_{jj}^{e}\left(\tau \right)=\frac{1}{{\xi }_{1}^{t}}\) for each \(j\).

Since \({\gamma }_{jj}^{e}\left(t\right)={r}_{j}^{e}\left(t\right)+{\rho }_{j}^{e}(t)\), it can be considered as a continuous function of time and there must exist a sequence such that \({\prod }_{\tau =0}^{t-1}{\gamma }_{jj}^{e}\left(\tau \right)=\frac{1}{{\xi }_{1}^{t}}\) for each \(j\).□.

Remark 1

Proposition 2 (a) shows that the relative stability of the price system is independent of the expectation mechanism. It is not necessary to add any constraints on the expected rate of profit or capital losses and gains except their uniformity to guarantee relative stability. This is consistent with Filippini’s conclusion, but contrary to Solow’s claim that the rate of profit should not exceed a special constraint—the rate of balanced growth. Otherwise, the price system is unstable. Aoki and Zaghini argued that the expected rates of profit and capital losses and gains gradually converge. Nevertheless, there is no behavioural mechanism for producers to guarantee the convergence of expectations. Furthermore, based on Mori’s approach, Proposition 2 (b) determines the constant to which the prices converge (Mori 2011, 2016). The constant depends on the initial position at which the arbitrary time path of prices starts. In Proposition 2 (c), \({\prod }_{\tau =0}^{t-1}{\gamma }^{e}(\tau )=\frac{1}{{\xi }_{1}^{t}}\) for each \(j\) means, in particular, that under the static price expectation hypothesis, the prices are expected not to change, i.e., \({\rho }^{e}\left(t\right)=0\) for all \(t\), and the rate of profit is expected to equal the equilibrium rate of profit, i.e., \({r}^{e}\left(t\right)=\bar{r }=\frac{1}{{\xi }_{1}}\). Consequently, the expectations on price vector exactly equal to the long-run equilibrium price vector.

3.2 The quantity system

The following discussion focuses on the quantity system with capital stock adjustment. In general, the current inputs produced in the present period can be sold in the next period (i.e., the quantity of inventories can decrease). However, once installed, capital stocks are difficult to decompose (i.e., capital stocks cannot depreciate in a short time). Introuducing both inventories of the current inputs and capital stocks into the same model might complicate matters. Thus, in this study, we assume that the current inputs are fully consumed in each period.Footnote 6

Producers must be able to produce by holding capital stock. There are three motivations for holding capital stocks: for production or transactions, for speculation, and for precautionary purposes (Jorgenson 1960). The first motivation implies that capital stocks held for production or transactions depends on the social technological level of production or on the previous capital stock requirements. The second motivation states that producers hold capital stocks to adjust the price level (Jorgenson 1960), or that price changes might affect the level of capital stock holdings (Aoki 1977). The third motivation suggests that producers prefer to produce excess output at the buffer ratio in respond to unexpected demand (Shiozawa et al. 2019), or to follow a partial adjustment mechanism for precautionary reasons (Zaghini 1991). In this study, we assume that holding capital stocks are held for the first and second purposes.

It is also necessary to make assumptions regarding the expectation mechanism of the quantity system. Assumptions 2 and 3 can also be applied to the quantity system with minor modifications.

Assumption 2*

(Bounded rationality of capital stocks demand) Producers do not have perfect foresight of utilization of capital stocks. Thus, they estimate the capital stock requirement based on limited information and experience.

Assumption 3*

Production of capital stocks requires time.

Assumptions 2* and 3* indicate that at the beginning of each period, there exists a certain amount of capital stock available for utilization, which must be produced one period in advance. If at the beginning of period \(t\), producers not only produce the current inputs of the current period \(t\), but also the capital stocks of the next period \(t+1\).

Denote \({\theta }_{i}^{e}(t)\) as the expected rate of change of capital stocks of good \(i\) in period \(t+1\), then we can obtain the expectations on capital stocks requirements of good \(i\) as below:

where \({\theta }_{i}^{e}(t)\in \left(0,{\theta }_{max}\right)\). The lower limit indicates that capital stocks cannot decumulate, and the upper limit \({\theta }_{max}\) means that producers will prevent the output of sectors from growing immoderately. Similar to Eqs. (3.1), (3.21) reflects that under Assumption 2, producers combine the adaptive learning approach to estimate the unknown parameters of capital stocks requirement. Let \({\theta }_{i}(t)\) be the rate of change in demand of holding capital stocks of good \(i\), which needs to forecast. And \({\theta }_{i}^{e}(t)\) is the producers’ expectation estimated from the available data. That is, the estimated \({\theta }_{i}^{e}(t)\) is a time-varied function of observable capital stocks requirement. The producers can adjust \({\theta }_{i}^{e}(t)\) through past experience over time.

After dropping the assumption of the full utilizing of capacity, a feasible constraint on the demand for capital stocks is required. Otherwise, the growth of capital stocks will be out of controlled:

where equality holds if the available capital stocks of good \(i\) is fully utilized. Thus, if the actual demand of capital stocks in period \(t+1\), \({\sum }_{i=1}^{n}{b}_{ij}{x}_{j}(t+1)\), exactly equals to the estimated demand of capital stocks in period \(t+1\), \((1+{\theta }_{i}^{e}\left(t\right)){\sum }_{i=1}^{n}{b}_{ij}{x}_{j}(t-1)\), we can find the maximum value of \({\theta }_{i}^{e}(t)\):

It should be noted that inequalities (3.22) and (3.23) are different from the capital stocks constraints assumed by Aoki (1977, inequality 9) and Zaghini (1991, inequality 26). Aoki and Zaghini both argued that at least one equality must be satisfied. This is because competitive growth between industries leads to an expansion of the whole economy until part of the output capacities become a bottleneck for further expansion. However, there is no reason to assume that the available capital stock of at least one good is fully utilized. Under perfect competition and free capital mobility, if producers have earned the expected profits, the expansion might stop before reaching the capacity bottleneck at which producers maintain constant profits.

Now we can give the general quantity system with different expectations. Under the assumption of bounded rationality and adaptive learning behaviour, the output level of good \(i\) in period \(t\) (the term on the left side) should be equal to the current input of good \(i\) and the expected capital stocks of good \(i\) in period \(t+1\) (the term on the right side):

or in matrix form

where \({\Theta }^{e}\left(t\right)=\left({\theta }_{ij}^{e}(t)\right)\in {R}^{n\times n}\) (\({\theta }_{ij}^{e}\left(t\right)={\theta }_{i}^{e}\left(t\right)\) for \(i=j\) and \({\theta }_{ij}^{e}\left(t\right)=0\) for others).

Now we investigate the stability properties of the quantity system (3.25).

Assumption 5*

\({M}^{\prime}={(I-A)}^{-1}B\) is non-negative and indecomposable.

Definition 3

A semi-positive output vector \(\bar{X }\left(t\right)\) is called the balanced growth path if it satisfies system \(\bar{X }\left(t\right)=\bar{g}{M }^{\prime}\bar{X }(t-1)\) and the corresponding rate of growth \(\bar{g }\) is called the balanced growth rate. And the balanced growth path takes the following form:

where \({\mu }_{1}:=\frac{1}{\overline{g} }\) is the dominant characteristic root of \({M}^{\prime}\) and \({X}_{1}^{*}\) is the corresponding characteristic column vector.

Definition 4

Assume that in the quantity system (3.25), the expected rates of capital stocks change are uniform across fixed capital goods, i.e., \({\theta }_{i}^{e}\left(t\right)={\theta }^{e}(t)\). A semi-positive output vector \({X}^{*}(t)\) is called ‘pseudo’ balanced growth path if it satisfies system (3.25) and takes following form:

where \({\mu }_{1}\) is the dominant characteristic root of \({M}^{\prime}\) and \({X}_{1}^{*}\) is the corresponding characteristic column vector.

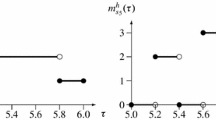

Proposition 3

Let the expected rate of capital stocks change be uniform across fixed capital goods, i.e., \({\theta }_{i}^{e}\left(t\right)={\theta }^{e}(t)\), there exists a pseudo-balanced growth path that satisfies system (3.25). Let \(X(t)\) be any solution to system (3.25) starting from an arbitrary initial position \(X\left(0\right)>0\), then we have:

-

(a)

The ‘pseudo’ balanced growth path is globally relatively stable, i.e., \(\mathop{\mathit{lim}}\limits_{t\to \infty }\frac{{x}_{i}(t)}{{x}_{i}^{*}(t)}=\varphi \forall i\), where \(\varphi >0\) is constant.

-

(b)

\(\varphi =\frac{\Vert {P}_{1}^{*}X(0)\Vert }{\Vert {P}_{1}^{*}{X}_{1}^{*}\Vert }\forall i\), where \(\Vert \cdot \Vert\) represents the norm of a vector.

-

(c)

The ‘pseudo’ balanced growth path is equivalent to the balanced growth path, i.e., \({X}^{*}\left(t\right)=\bar{X }(t)\), if and only if \({\prod }_{\tau =1}^{t}{\theta }^{e}\left(\tau \right)={\mu }_{1}^{-t}\).

Proof

The characteristic roots of \({(I-A)}^{-1}BM\) are identical to those of \({B(I-A)}^{-1}\). Thus, the proofs of Propositions 3 (a) and (b) are analogous to Propositions 2 (a) and (b), respectively. The result in (c) is also evident.□

Remark 2

Proposition 3 (a) shows that the relative stability of the output system is independent of the expectation mechanism of capital stocks. Proposition 3 (b) states that the ratio of arbitrary solution and ‘pseudo’ balanced growth path depends on the initial position where the arbitrary solution starts from. The interpretation of Proposition 3 (c) is similar to that of Proposition 2 (c). \({\prod }_{\tau =1}^{t}{\theta }^{e}\left(\tau \right)={\mu }_{1}^{-t}\) means that when the expected rate of change of capital stocks requirement remains constant, i.e., \({\theta }^{e}\left(t\right)={\mu }_{1}^{-1}\) for all \(t\), the ‘pseudo’ balanced growth path is equivalent to the balanced growth path.

Remark 3

Since we do not assume full utilization of capital, the expected expansion of capital stocks must deviate from the demand of capital stocks, which is defined as the ‘stock errors’ (Hahn 1963). In Zaghini’s model, an excess supply of capital stocks remains constant over time. In this study, when there are redundant capital stocks in initial position, if \({\prod }_{\tau =1}^{t}{\theta }^{e}\left(\tau \right)>{\mu }_{1}^{-t}\), it is Zaghini’s case; if \({\prod }_{\tau =1}^{t}{\theta }^{e}\left(\tau \right)\leqq {\mu }_{1}^{-t}\), it means that these over-produced capital stocks will gradually disappear. Because the expected expansion of capital stocks is always less than the previous demand, the redundant capital stocks will be eventually brought into production. The output levels will eventually approach the balanced growth path where capital stocks are fully utilized. This implies that our model is efficient in the short run for overproduced capital stocks. Moreover, we refute Zaghini’s argument that excess capital stock remains constant. The ‘stock errors’ can be eliminated by the expectation mechanism and quantity adjustment process.

4 Conclusions

In this study, we firstly revisit the characteristics of dynamic Leontief model in different frameworks. The restrictive assumption of neoclassical models, namely full utilization of capacity and perfect foresight, have been recognized as the underlying cause of the ‘dual stability’ puzzle. To address this problem, heterodox economists have focused on integrating the expectations mechanism and decision-making processes. However, these models have certain deficiencies and limitations as discussed in Sects. 2.

Subsequently, based on the bounded rationality assumptions, we develop a linear multisectoral model that can overcome the ‘dual stability’ problem by incorporating expectations function. Even in the presence of capital gains and losses and non-full utilization of capacity, the price system and quantity system are proved to be relatively stable. Meanwhile, the static expectations case is a special case of this model. Further, this paper also provides a potential approach to treatment of redundant capital stocks from an evolutionary economics perspective.

Finally, future research needs to be advanced in the following three directions: (i) this model is limited to fixed technical coefficient. If the choice of technique and technological change is introduced, the impact of expectations mechanisms on the process of economic evolution will be of potential interest to explore. (ii) modern classical economists have pointed to the existence of ‘idiosyncratic’ factors that lead to differential rate of profit (Flaschel 2010; D’Agata and Mori 2017; Bloch 2022). Although our generalized model assumes that the expectation function varies across industries, Propositions 2 and 3 are restricted to the uniform expectations functions. Therefore, it is worthwhile to discuss capital stocks investment based on differential rate of profit across industries. (iii) the treatment of fixed capital in this study is still in its infancy and more work is needed to establish microfoundations for evolutionary economics.

Data availability

We do not analyse or generate any datasets, because our work proceeds within a theoretical and mathematical approach.

Notes

The signs are defined as follow: Let there be two vectors \(x\) and \(y\), we have: (i) \(x>y\) represents \({x}_{i}>{y}_{i}\) for all \(i\); (ii) \(x\ge y\) represents \({x}_{i}\ge {y}_{i}\) for all \(i\) but \(x\ne y\); (iii) \(x\geqq y\) represents \({x}_{i}\geqq {y}_{i}\) for all \(i\).

The simple moving average method in (2.10) and (2.11) refers to Mori’s comments and Shiozawa et al.’s corrected version (Aspromourgos et al. 2022). In the original version, the condition of the Taniguchi-Morioka theorem is \(\lambda <M/(M+2K+4)\). Mori pointed out that in a one-good economic system, the system will diverge even if this condition is satisfied. After this condition is corrected to Eq. (2.11) by Shiozawa et al., the one-good economic system is shown to converge.

Evans and Honkapohja presented a generalized framework for adaptive learning approach as follows:

$${y}_{t}^{e}=\Psi \left({X}_{t},{\theta }_{t-1}\right),$$where \({y}_{t}^{e}\) is the vector of expectations of unknown variable \({y}_{t}\) and \({\theta }_{t-1}\) is the vector of unknown parameters which must be estimated statistically in order to implement the forecast rule.

The proof of Proposition 2 (a) refers to Nikaido’s proof (Nikaido 1970, pp 149–154). If System (3.3) is an open form, then we have a \(n+1\) unknown time profiles and \(n\) equations. Let the wage rate be the numéraire and rate of profit given exogenously, then the System (3.3) can uniquely determine all \({p}_{i}(t)\)’s. Woods provided a proof that the open formed of dynamic Leontief system can be relatively stable, which is an extension of Nikaido’s work (Woods 1978). Thus, we can employ the closed form here without loss of generality.

References

Aoki M (1977) Dual stability in a Cambridge-type model. Rev Econ Stud 44:143–151. https://doi.org/10.2307/2296978

Aspromourgos T, Mori K, Morioka M et al (2022) Symposium on Yoshinori Shiozawa, Masashi Morioka and Kazuhisa Taniguchi (2019), microfoundations of evolutionary economics, Tokyo: Springer Japan. Metroeconomica 73:2–48. https://doi.org/10.1111/meca.12345

Bloch H (2022) The language of pluralism from the history of the theory of price determination: natural price, equilibrium price and administered price. Metroeconomica 73:1094–1111. https://doi.org/10.1111/meca.12393

Christ CF (1966) Econometric models and methods. Cambridge University Press, Cambridge

D’Agata A, Mori K (2017) An analytical foundation of the classical view of long-period prices with differential profit rates. Metroeconomica 68:22–46. https://doi.org/10.1111/meca.12121

Dorfman R, Samuelson PA, Solow RM, Robert M (1987) Linear programming and economic analysis. Dover Publications, London

Duménil G, Lévy D (1987) The dynamics of competition: a restoration of the classical analysis. Camb J Econ 11:133–164. https://doi.org/10.1093/oxfordjournals.cje.a035020

Evans GW, Honkapohja S (2001) Learning and expectations in macroeconomics. Princeton University Press, Princeton

Filippini L (1983) Price and quantity adjustment in a dynamic closed model: the dual stability theorem. J Macroecon 5:185–196. https://doi.org/10.1016/0164-0704(83)90091-5

Flaschel P (2010) Classical and neoclassical competitive adjustment processes. In: Flaschel P (ed) Topics in classical micro- and macroeconomics: elements of a critique of Neoricardian theory. Springer, Berlin, pp 329–350

Flaschel P, Semmler W (1986) The dynamic equalization of profit rates for input–output models with fixed capital. In: Semmler W (ed) Competition, instability, and nonlinear cycles. Springer, Berlin, pp 1–34

Frydman R, Phelps ES (eds) (2013) The way forward for macroeconomics. Princeton University Press, Princeton

Hahn FH (1963) On the disequilibrium behaviour of a multi-sectoral growth model. Econ J 73:442–457. https://doi.org/10.2307/2228579

Jorgenson DW (1960) A dual stability theorem. Econometrica 28:892–899. https://doi.org/10.2307/1907571

Jorgenson DW (1968) Linear models of economic growth. Int Econ Rev (philadelphia) 9:1–13. https://doi.org/10.2307/2525611

Mori K (2011) Charasoff and Dmitriev: an analytical characterisation of origins of linear economics. Int Crit Thought 1:76–91. https://doi.org/10.1080/21598282.2011.566043

Mori K (2016) Georg von Charasoff and anticipation of von Mises iteration in economic analysis. Cahiers D’écon Polit 2016:65–89

Morishima M (1958) Prices, interest and profits in a dynamic Leontief system. Econometrica 26:358–380. https://doi.org/10.2307/1907617

Nikaido H (1970) Introduction to sets and mappings in modern economics. North-Holland Pub. Co., London, pp 149–154

Sargan JD (1958) The instability of the Leontief dynamic model. Econometrica 26:381–392. https://doi.org/10.2307/1907618

Shiozawa Y, Morioka M, Taniguchi K (2019) Microfoundations of evolutionary economics. In: Shiozawa Y, Morioka M, Taniguchi K (eds) Microfoundations of evolutionary economics. Springer, Tokyo, pp 1–52

Solow RM (1959) Competitive valuation in a dynamic input–output system. Econometrica 27:30–53. https://doi.org/10.2307/1907776

Solow RM, Samuelson PA (1953) Balanced growth under constant returns to scale. Econometrica 21:412–424. https://doi.org/10.2307/1905447

Takayama A (1985) Mathematical economics. Cambridge University Press, Cambridge

Tokoyama K, Murakami Y (1972) Relative stability in two types of dynamic Leontief models. Int Econ Rev (philadelphia) 13:408–415. https://doi.org/10.2307/2526034

Uzawa H (1961) Causal indeterminacy of the Leontief dynamic input–output system. Polit Econ Quart 12:49–59. https://doi.org/10.11398/economics1950.12.1_49

van Wegberg M (1990) Capital mobility and unequal profit rates: a classical theory of competition by boundedly rational firms. Rev Rad Polit Econ 22:1–16. https://doi.org/10.1177/048661349002200201

Woods JE (1978) An input–output model with a lagged consumption function and proportional growth in autonomous expenditures. Metroeconomica 30:223–232. https://doi.org/10.1111/j.1467-999X.1978.tb00600.x

Zaghini E (1991) Prices and production levels in the closed dynamic input–output system. Manch Sch 59:274–294. https://doi.org/10.1111/j.1467-9957.1991.tb00451.x

Zaghini E (1971) Solow prices and the dual stability paradox in the Leontief dynamic system. Econometrica 39:625–632. https://doi.org/10.2307/1913270

Acknowledgements

This work was supported by the Support for Pioneering Research Initiated by the Next Generation (JST SPRING) program, Grant No. JPMJSP2114.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The author declares that there is no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

This article is published under an open access license. Please check the 'Copyright Information' section either on this page or in the PDF for details of this license and what re-use is permitted. If your intended use exceeds what is permitted by the license or if you are unable to locate the licence and re-use information, please contact the Rights and Permissions team.

About this article

Cite this article

Wang, Y. Stability of price and quantity to a long-run equilibrium: a dynamic Leontief model with bounded rationality. Evolut Inst Econ Rev (2024). https://doi.org/10.1007/s40844-024-00282-2

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s40844-024-00282-2