Abstract

We study the continuous time limit of a self-exciting negative binomial process and discuss the critical properties of its intensity distribution. In this limit, the process transforms into a marked Hawkes process. The probability mass function of the marks has a parameter \(\omega\), and the process reduces to a “pure” Hawkes process in the limit \(\omega \rightarrow 0\). We investigate the Lagrange–Charpit equations for the master equations of the marked Hawkes process in the Laplace representation close to its critical point and extend the previous findings on the power-law scaling of the probability density function (PDF) of intensities in the intermediate asymptotic regime to the case where the memory kernel is the superposition of an arbitrary finite number of exponentials. We develop an efficient sampling method for the marked Hawkes process based on the time-rescaling theorem and verify the power-law exponents.

Similar content being viewed by others

References

Bacry E, Mastromatteo I, Muzy J (2015) Hawkes processes in finance. Market Microstruct Liq. 1:1550005

Blanc P, Donier J, Bouchaud JP (2017) Quadratic hawkes processes for financial prices. Quant Finance 17(2):171–188

Bowsher CG (2007) Modelling security market events in continuous time: Intensity based, multivariate point process models. J Econom 141(2):876–912

Brown EN, Barbieri R, Ventura V, Kass RE, Frank LM (2002) The time-rescaling theorem and its application to neural spike train data analysis. Neural Comput 14(2):325–346

Engle RF, Russell JR (1998) Autoregressive conditional duration: a new model for irregularly spaced transaction data. Econometrica 66(5):1127–1162

Errais E, Giesecke K, Goldberg LR (2010) Affine point processes and portfolio credit risk. SIAM J Financ Math 1(1):642–665

Filimonov V, Sornette D (2012) Quantifying reflexivity in financial markets: toward a prediction of flash crashes. Phys Rev E 85(5):056108

Filimonov V, Sornette D (2015) Apparent criticality and calibration issues in the hawkes self-excited point process model: application to high-frequency financial data. Quant Financ 15(8):1293–1314

Gardiner C (2009) Stochastic methods a handbook for the natural and social sciences. Springer, Berlin

Hasbrouck J (1991) Measuring the information content of stock trades. J Financ 46(1):179–207

Hawkes A (1971) Point spectra of some mutually exciting point processes. J R Statist Soc Ser B. https://doi.org/10.1111/j.2517-6161.1971.tb01530.x

Hawkes AG (1971) Spectra of some self-exciting and mutually exciting point processes. Biometrika 58(1):83–90

Hawkes AG (2018) Hawkes processes and their applications to finance: a review. Quant Financ 18(2):193–198

Hawkes AG, Oakes D (1974) A cluster process representation of a self-exciting process. J Appl Probab 11(3):493–503

Hisakado M, Mori S (2020) Phase transition in the bayesian estimation of the default portfolio. Physica A Stat Mech Appl 544:123480

Hisakado M, Kitsukawa K, Mori S (2006) Correlated binomial models and correlation structures. J Phys A Math General 39(50):15365

Hisakado M, Hattori K, Mori S (2022) From the multiterm urn model to the self-exciting negative binomial distribution and hawkes processes. Phys Rev E 106(3):034106

Hisakado M, Hattori K, Mori S (2022) Multi-dimensional self-exciting nbd process and default portfolios. Rev Socionetwork Strateg 16(2):493–512

Kanazawa K, Sornette D (2020) Field master equation theory of the self-excited hawkes process. Phys Rev Res 2(3):033442

Kanazawa K, Sornette D (2020) Nonuniversal power law distribution of intensities of the self-excited hawkes process: a field-theoretical approach. Phys Rev Lett 125(13):138301

Kanazawa K, Sornette D (2023) Asymptotic solutions to nonlinear hawkes processes: a systematic classification of the steady-state solutions. Phys Rev Res 5(1):013067

Kirchner M (2017) An estimation procedure for the hawkes process. Quant Financ 17(4):571–595

Sakuraba K (2023) Self-exciting negative binomial distribution process and critical properties of intensity distribution. https://github.com/Kotaro-Sakuraba/SE-NBD_Process.git

Wheatley S, Wehrli A, Sornette D (2019) The endo-exo problem in high frequency financial price fluctuations and rejecting criticality. Quant Financ 19(7):1165–1178

Acknowledgements

This work was supported by JPSJ KAKENHI [Grant No. 22K03445]. We would like to thank Editage (www.editage.com) for English language editing.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

A Method of Characteristics

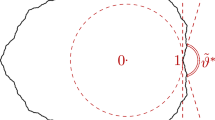

The method of characteristics is a standard method to solve first-order partial differential equations (Gardiner 2009; Kanazawa and Sornette 2020b, a). The equation for the characteristic function

is

We consider the corresponding Lagrange–Charpit equations

with the parameter l encoding the position along the characteristic curves. These equations are equivalent to an invariant form in terms of l

The method of characteristics can be used to solve this equation. Namely, if

are two integrals of the subsidiary equation (with a and b arbitrary constants), then a general solution of (A.1) is given by

with an arbitrary function f(a, b), which is determined by the initial or boundary condition of the PDE (A.1). This method can be readily generalized to systems with many variables.

B Addendum

In a recent publication by K.Kanazawa and D.Sornette (Kanazawa and Sornette 2023), the power-law exponent of the intensity distribution of general marked Hawkes process was given. We explain the correspondence for the reader’s convenience.

In (Kanazawa and Sornette 2023), the power-law exponent is given using the second moment of the mark’s PDF E\([m^2]\) as

The normalization of \(\rho (m)\) with E\([m]=1\) is adopted. In our model, a is given as

We use \(\rho (m)\) in Eq.(6) to estimate the power-law exponent. As E\([m]=\omega /\ln (\omega +1)\), E\([m^2]=\omega (\omega +1)/\ln (\omega +1)\), we obtain

The result is consistent with ours in (Hisakado et al. 2022a).

About this article

Cite this article

Sakuraba, K., Kurebayashi, W., Hisakado, M. et al. Self-exciting negative binomial distribution process and critical properties of intensity distribution. Evolut Inst Econ Rev (2023). https://doi.org/10.1007/s40844-023-00261-z

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s40844-023-00261-z