Abstract

This paper extends a Minsky model by incorporating net worth ratio, which Steindl stressed the importance of in reference to financial markets. We construct a dynamic macroeconomic model comprising discrete equations of both the net worth ratio and interest rate. We investigate what factors bring the instability of the steady state. We show that the effect of asset income on consumption can contribute to economic stability following Lavoie (1995) and Hein (2007). On the other hand, the economy becomes unstable when a bank’s lending reaction is elastic with respect to the net worth ratio of the firm. When the steady state is a saddle point, the monetary policy is likely to shift the economy from an unstable path to a convergence path. It can be said that monetary policy may have a stabilizing effect in the long run, however, in practice, there would be considerable difficulties in accomplishing this.

Similar content being viewed by others

Notes

From the standpoint of the new Keynesians, Greenwald and Stiglitz (1993) pointed out that the investment and output of firms depend on the firms’ balance sheet factors under an imperfect capital market. On the other hand, the post-Keynesians extended stock-flow consistent (SFC) approach. The SFC models are based on accounting frameworks that consistently integrate financial flows of funds with a full set of balance sheets. These include Dos Santos (2005, 2006).

Our model downplays some issues highlighted in Minsky’s work and some other Minskian models, such as changes in asset prices and financial innovation.

The interest rate in the IS–LM model is determined by the money market. In our model, it is determined by the bank lending market.

We describe the interest of the central bank advances as the discount rate.

This formulation follows Adachi and Miyake (2015).

We assume that τ, \(\omega\) and \(n\) are constant throughout this paper.

This follows Kalecki (1971). The markup rate τ is taken to be constant, representing Kalecki’s degree of monopoly.

We suppose that the interest rate \(i_{t}\) is a risk-free interest rate. It is the theoretical rate, in practice, the interest rate of a bond which is issued by a government or agency whose risks of default are so low as to be negligible. With respect to the risk premium \(\sigma\), the importance of the role is emphasized by Kalecki (1937).

We assume expected returns \(Q\) to be a linearly homogeneous function with respect to \(pI_{t}\) and \(pK_{t - 1}\). Then, the ratio of expected returns to capital depends on the accumulation rate.

See Steindl (1952).

This means the inequality, \(i_{t - 1} \le a\). If this condition is not satisfied, the firm will raise new equity. This situation contradicts the assumption in this model.

We suppose that investment exceeds retained earnings. In other words, \(l_{t}^{d} > 0\).

Keynes (1936) stressed the importance of the lender’s risk. We note the following remarks made by Keynes: “But where a system of borrowing and lending exists, by which I mean the granting of loans with a margin of real or personal security, a second type of risk is relevant which we may call the lender's risk. This may be due either to moral hazard, i.e., voluntary default or other means of escape, possibly lawful, from the fulfilment of the obligation, or to the possible insufficiency of the margin of security, i.e., involuntary default due to the disappointment of expectation” (Keynes 1936, p. 144). In our model, the lender’s risk has an indirect influence on the interest rate through the cost functions of banks. It is in contrast to borrower’s risk \(\sigma\) which is formulated in the Sect. 3-1.

For the sake of simplicity, we assume that the bank does not hold excess reserves. When the bank wants to lend more, it borrows more from the central bank.

Appendix 2 shows the mathematical results of comparative statics.

We suppose that the retained earnings \(F\), the net worth ratio \(z\), and capital accumulation rate \(k\) are positive at the steady state.

For more information, see Gandolfo (1997).

Appendix 3 outlines the process to derive the conditions to stabilize the steady state.

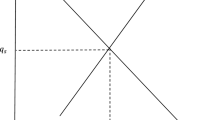

If the economy starts below the separatrix, investment will eventually keep rising in that zone as net worth keeps rising and the interest rate falling. The economy continues to rise.

Asada (2014) formulates a series of mathematical macrodynamic models that contribute to the theoretical analysis of financial instability and macroeconomic stabilization policies.

References

Adachi H, Miyake A (2015) A macrodynamic analysis of financial instability. In: Adachi H, Nakamura T, Osumi Y (eds) Studies in medium-run macroeconomics. World Scientific Publishing, Singapore, pp 117–148

Asada T (2014) Mathematical modeling of financial instability and macroeconomic stabilization policies. In: Dieci R, He XZ, Hommes C (eds) Nonlinear economic dynamics and financial modelling: essays in honour of Carl Chiarella. Springer, Switzerland, pp 41–63

Dos Santos C (2005) A stock-flow consistent general framework for formal Minskyan analyses of closed economics. J Post Keynes Econ 27:711–735

Dos Santos C (2006) Keynesian theorizing during hard times: stock-flow consistent model as an unexplored ‘frontier’ of Keynesian macroeconomics. Camb J Econ 30:541–565

Dutt AK (1995) Internal finance and monopoly power in capitalist economies: a reformation of Steindl’s growth model. Metroeconomica 46:16–34

Dutt AK (2006) Maturity, stagnation and consumer debt: a Steindlian approach. Metroeconomica 57:339–364

Gandolfo G (1997) Economic dynamics. Springer, Berlin

Greenwald B, Stiglitz JE (1993) Financial market imperfections and business cycles. Quart J Econ 108:77–114

Hein E (2007) Interest rate, debt, distribution and capital accumulation in a post-Kaleckian model. Metroeconomica 58(2):310–339

Kalecki M (1937) The principle of increasing risk. Economica 4:440–447

Kalecki M (1971) Selected essays on dynamics of capitalist economy. Cambridge University Press, Cambridge

Keynes JM (1936) The General theory of employment, interest, and money. Macmillan, London

Lavoie M (1995) Interest rate in post Keynesian models of growth and distribution. Metroeconomica 46:146–177

Minsky HP (1975) John Maynard Keynes. Columbia University Press, New York

Minsky HP (1986) Stabilizing an unstable economy. Yale University Press, New Haven

Ryoo S (2010) Long Waves and short cycles in a model of endogenous financial fragility. J Econ Behav Organ 74(3):163–186

Ryoo S (2013) Bank profitability, leverage and financial instability: a Minsky-Harrod model. Camb J Econ 37:1127–1160

Semmler W (1987) A macroeconomic limit cycle with financial perturbations. J Econ Behav Organ 8:469–495

Steindl J (1952) Maturity and stagnation in American capitalism. Blackwell, Oxford

Taylor L, O’Connell SA (1985) A Minsky crisis. Quart J Econ 100:871–885

Tobin J (1969) A general equilibrium approach to monetary theory. J Money Credit Bank 1:15–29

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1: The outlines of the process to derive Eq. (25)

The household earns wages ωN t and dividends from the firm. We assume that the costs of the bank G t−1 and the profit Π b t−1 are distributed to the household via the bank’s labor cost and other factors. The household can earn the interest from deposit. Finally, we suppose that the revenue of the central bank also belongs to the household.

Then, taking into account equation of dividends (14), the revenue of the household involved financial assets can be expressed as

Substituting Eqs. (16) and (17) into equation (43), we have

Taking into account the economy as a whole, the assets which one has are the liabilities which another has. The following equation is satisfied:

From equations (44) and (45), we have

On the other hand, the expenses of the household involved financial assets can be expressed as

We have the Eq. (25) from equations (46) and (47)

Appendix 2: The comparative statics analysis in short-run model and the outlines of the process to derive Eqs. (39a) and (b)

The mathematical results of comparative statics in short-run model expressed as

Linearizing this dynamic model near the steady state to analyze stability, we have

The values of each element are appreciated at the steady state. Taking into account the results of comparative statics, we can rewrite equations (53) and (54) as Eqs. (39a) and (b) and determine the signs.

Appendix 3: The stability of the steady state

The following equation is satisfied at the steady state from Eqs. (32), (38a), (38b),

Assuming that the accumulation rate and the interest rate are positive at the steady state, we have the Eq. (40).

Substituting the results of comparative statics and equation (55) into the factors of coefficient matrix M D , we have

For convenience, we omit the asterisks which express the values of the steady state. Substituting these equations (56) and (57) into the Eqs. (41), we can derive the factors which bring about the stable steady state.

About this article

Cite this article

Watanabe, T. Net worth ratio, bank lending and financial instability. Evolut Inst Econ Rev 13, 37–56 (2016). https://doi.org/10.1007/s40844-016-0038-1

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40844-016-0038-1