Abstract

This paper estimates macroeconomic connectedness in the CIS (the Commonwealth of Independent States) through risk spillovers via the exchange rates. We collect high frequency daily data on exchange rates from January 2006 to July 2020 and use the Diebold-Yilmaz method of variance decomposition, as well as the Barunik-Krehlik method of frequency variance decomposition, for the analysis. We find that macroeconomic risk in the region increases significantly during macroeconomic shocks and that it has maintained a higher average level since 2015, a difficult year full of regional and global challenges. Our findings also show that currencies managed by more flexible exchange rate regimes on average transmit macroeconomic risk in the region. Frequency variance decomposition demonstrates that while the majority of risk transmission is smaller-scale and short-lived, spillovers from main regional and global crises are bigger and more persistent. Although short-term connectedness dominates the overall variance of the system, more severe macroeconomic shocks resonate greatly on all time horizons, i.e. they impact the system for a longer period of time and more deeply.

(Data adapted from Investing.com)

Similar content being viewed by others

Data availability

Data is available upon request.

Notes

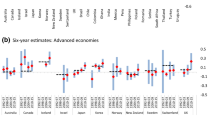

A notable example of application of this method is the April 2016 IMF Global Financial Stability Report, which uses it to apprehend financial spillovers across advanced and emerging market economies. A big advantage of this methodology is its ability to appraise directional specifics of the spillovers, a property explored by the April 2018 IMF Global Financial Stability Report in their evaluation of term premium spillovers among G4 countries. We turn to this advantage to perceive which countries on average drive the spillovers, or lead the contagion, in the region.

The Group of Seven, or G7, is an informal grouping of the advanced economies: Canada, France, Germany, Italy, Japan, the UK, and the US.

OE is the author-defined informal grouping of low- and middle-income emerging economies: Malaysia, Phillipins, South Africa, Thailand, Turkey.

The standard BIC criterion gave the 1 lag specification.

We are employing VAR(1) specification in our analysis.

Note that we drop (H) going forward for convenience but it is always implied that measures are attributed to a given forecast horizon H.

These values are normalized for easier interpretation as described in 3.2.

BK call these measures within spectral band measures.

Additionally, Kiani (2010) argues that given the SOE (small open economy) status of the CIS countries, interest rates may not be the most viable monetary policy tool available to them whilst exchange rates may be playing a more poignant role in their economies and policy toolkits.

Please see the table in the Appendix for detailed information.

Azerbaijan has mostly pegged against the USD, and Belarus - USD and euro. Other two countries who have leaned on pegging is Kazakhstan (peg to USD and the rouble) and Kyrgyzstan (mostly unofficial peg to USD).

Countries often switch around the arrangements during a year, IMF captures the most accurate information to the date.

Data on these three variables was taken from the Fred website.

It increases largerly by the virtue of having more variables and variance being non-negative.

We measure volatility by 20-day rolling standard deviations.

Values are as of 2016.

Data is taken from the oec.world website.

Abbreviations

- BK:

-

Barunik-Krehlik

- CEE:

-

Central and Eastern Europe

- CIS:

-

Commonwealth of Independent States

- DE:

-

Developed economies

- DY:

-

Diebold-Yilmaz

- ECU:

-

Eurasian Customs Union

- EEC:

-

European economic community

- EEU:

-

Eurasian Economic Union

- EU:

-

European Union

- FEVD:

-

Forecast error variance decomposition

- GVD:

-

General variance decomposition

- IMF:

-

Internaitonal Monetary Fund

- LA:

-

Latin America

- RGDP:

-

Real Gross Domestic Output

- USSR:

-

Union of Soviet Socialist Republics

- VAR:

-

Vector Autoregression

- WTI:

-

West Texas Intermediate

References

Albulescu, C., Demirer, R., Raheem, I., & Tiwari, A. (2019). Does the U.S. economic policy uncertainty connect financial markets? Evidence from oil and commodity currencies. Energy Economics, 83, 375–388.

Al-Sadiq, A., Bejar, P. & Otker, I. (2021). Commodity Shocks and Exchange Rate Regimes: Implications for the Caribbean Commodity Exporters. IMF Working Paper No. WP/21/104.

Andries, A., & Sprincean, N. (2021). Cyclical behaviour of systemic risk in the banking sector. Applied Economics, 53(13), 1463–1497.

Barisitz, S. (2009). Macrofinancial Developments and Systemic Change in CIS Central Asia. Focus on European economic integration. Oesterreichische Nationalbank (Austrian Central Bank), 3, 38–61.

Barisitz, S. (2014). Macrofinancial Developments and Systemic Change in CIS Central Asia from 2009 to 2014. Focus on European economic integration. Oesterreichische Nationalbank (Austrian Central Bank), 3, 48–73.

Barunik, J., Kocenda, E., & Vacha, L. (2017). Asymmetric volatility connectedness on the forex market. Journal of International Money and Finance, 77, 39–56.

Barunik, J., & Krehlik, T. (2017). Cyclical properties of supply-side and demand-side shocks in oil-based commodity markets. Energy Economics, 65, 208–218.

Barunik, J., & Krehlik, T. (2018). Measuring the frequency dynamics of financial connectedness and systemic risk. Journal of Financial Econometrics, 16(2), 271–296.

Beckmann, E., & Fidrmuc, J. (2013). Exchange rate pass-through in CIS countries. Comparative Economic Studies, 55, 705–720.

Benczur, P., Muradov, E., & Attila Rátfai, A. (2007). Cyclical fluctuations in CIS economies. Journal of Business Cycle Measurement and Analysis, 3(1), 121–135.

Benczur, P., & Ratfai, A. (2014). Business cycle around the globe: Some key facts. Emerging Markets Finance and Trade, 50(2), 102–109.

Blockmans, S., Kostanyan, H. & Vorobiov, I. (2012). Towards a Eurasian economic union: The challenge of integration and unity, CEPS Special Report No. 75, Available at SSRN: https://ssrn.com/abstract=2190294

Brunnermeier, M., Rother, S., & Schnabel, I. (2020). Asset Price Bubbles and Systemic Risk. The Review of Financial Studies, 33, 4272–4317.

Caetano, J., & Caleiro, A. (2018). On business cycle synchronization: Some directions for the Eurasia. Eurasian Journal of Economics and Finance, 6(3), 13–33.

Chinn, M. D., & Hiro, I. (2006). What Matters for Financial Development? Capital Controls, Institutions, and Interactions. Journal of Development Economics, 81(1), 163–192.

Cojocaru, L., Falaris, E., Hoffman, S., & Miller, J. (2016). Financial System Development and Economic Growth in Transition Economies: New Empirical Evidence from the CEE and CIS Countries. Emerging Markets Finance & Trade, 52, 223–236.

Comunale, M., & Simola, H. (2018). The pass-through to consumer prices in CIS economies: The role of exchange rates, commodities and other common factors. Research in International Business and Finance, 44, 186–217.

Deev, O., & Lyosca, S. (2020). Connectedness of financial institutions in Europe: A network approach across quantiles. Physica A, 550, 124035.

Diebold, F., & Yilmaz, K. (2012). Better to give than to receive: Predictive directional measurement of volatility spillovers. International Journal of Forecasting, 28, 57–66.

Diebold, F., & Yilmaz, K. (2014). On the network topology of variance decomposition: Measuring the connectedness of financial firms. Journal of Econometrics, 182, 119–134.

Diebold, F., & Yilmaz, K. (2015). Financial and Macroeconomic Connectedness. Oxford University Press.

Eichengreen, B., Rose, A., & Wyplosz, C. (1996). Contagious Currency Crises: First Tests. The Scandinavian Journal of Economics, 98(4), 463–484.

Engel, C. (2014). Exchange Rates and Interest Parity. In: Gopinath, G., Helpman, E. & K. Rogoff, (Eds). Handbook of International Economics, North-Holland, 4, 453-522.

Fedorova, A., & Lukasevich, I. (2012). Forecasting Financial Crises with the Help of Economic Indicators in the CIS Countries. Studies on Russian Economic Development, 23(2), 188–194.

Frankel, J. A., & Wei, S. J. (1994). Yen bloc or dollar bloc? Exchange rate policies of the East Asian economies. In Macroeconomic Linkage: Savings, Exchange Rates, and Capital Flows, edited by Ito, T. and A.O.Krueger. NBER-EASE, Chicago: University of Chicago Press, 3, 295–333.

Haas, E., & Schmitter, P. (1964). Economics and Differential Patterns of Political Integration: Projections about Unity in Latin America. International Organization, 18(4), 705–737.

International Monetary Fund. (2012). Regional Economic Outlook: Middle East and Central Asia. Washington: DC, November.

International Monetary Fund. (2013). World Economic Outlook: Transitions and Tensions. Washington: DC, October.

Kiani, K. (2010). Fluctuations in Economic and Activity and Stabilization Policies in the CIS. Computational Economics, 37, 193–220.

Kishor, K., & Giorgadze, S. (2022). Business Cycle Synchronization in the CIS. Economics of Transition and Institutional Change, 30, 135–158.

Kittleman, K., Tirpak, M., Schweickert, R., & Vinhas de Souza, L. (2006). From Transition Crises to Macroeconomic Stability? Lessons from a Crises Early Warning System for Eastern European and CIS Countries. Comparative Economic Studies, 48, 410–434.

Kocenda, E., & Moravcova, M. (2019). The pass-through to consumer prices in CIS economies: The role of exchange rates, commodities and other common factors. Journal of International Financial Markets, Institutions & Money, 28, 42–64.

Koop, G., Pesaran, M., & Potter, S. (1996). Impulse response analysis in nonlinear multivariate models. Journal of Econometrics, 74, 119–147.

Korhonen, I., & Wachtel, P. (2006). A note on exchange rate pass-through in CIS countries. Research in International Business and Finance, 20, 215–226.

Korotin, V., Dolgonosov, M., Popov, V., & Korotina, O. (2019). The Ukrainian crisis, economic sanctions, oil shock and commodity currency: Analysis based on EMD approach. Research in International Business and Finance, 48, 156–168.

Leung, H., Schierek, D., & Schroeder, F. (2017). Volatility spillovers and determinants of contagion: Exchange rate and equity markets during crises. Economic Modelling, 61, 169–180.

Lovcha, Y., & Perez-Laborda, A. (2020). Dynamic frequency connectedness between oil and gas volatilities. Economic Modelling, 84, 181–189.

Park, B., & An, J. (2020). What Drives Growing Currency Co-movements with the Renminbi? East Asian Economic Review, 24(1), 31–59.

Pesaran, M., & Shin, Y. (1998). Generalized impulse response analysis in linear multivariate models. Economics Letters, 58, 17–29.

Smaga, P. (2014). The concept of systemic risk. The London School of Economics and Political Science, Systemic Risk Centre Special Paper No 5.

Tomuleasa, I. (2015). Macroprudential policy and systemic risk: An overview. Procedia Economics and Finance, 20, 645–653.

Vymyatnina, Y., & Antonova, D. (2014). Creating a Eurasian union. Palgrave Macmillan.

Funding

The author has no relevant financial or non-financial interests to disclose.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The author declares that no funds, grants, or other support were received during the preparation of this manuscript. On behalf of all authors, the corresponding author states that there is no Conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

The paper is based on the author’s dissertation.

Appendix

Appendix

See Table 9.

KAOPEN is a popular index invented by Chinn and Hiro (2006) used to quantify a country’s capital account openness; the larger the value, the more financially open a country is.Footnote 16 As a reference point, the US has a KAOPEN value of 2.33. Income group indicates which of the four income group classifications (low, lower middle, upper middle, high) as per the World Bank Atlast method the countries belonged to in 2016. Top Exports column designates the products our countries exported the most in 2019.Footnote 17

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Giorgadze, S. Exchange rate spillovers in the CIS. Eurasian Econ Rev (2024). https://doi.org/10.1007/s40822-024-00268-w

Received:

Revised:

Accepted:

Published:

DOI: https://doi.org/10.1007/s40822-024-00268-w