Abstract

This study examines hourly realized volatility and high-order moments (realized kurtosis, realized skewness, and Jumps) spillovers among leading cryptocurrency markets (Bitcoin [BTC], Ethreum [ETH], Litecoin [LTC], Ripple [XRP], Bitcoin Cash [BCH]) using the time-varying parameter vector autoregression (TVP-VAR)-based connectedness method of (Antonakakis, N., & Gabauer, D., (2017). Refined Measures of Dynamic Connectedness Based On TVP-VAR. Technical Report. Munich: University Library of Munich.). Further, we investigate the impacts of uncertainty indices of stocks, gold, and oil on spillover size by employing a quantile regression framework. The results show that cryptocurrency connectedness increased during COVID-19 and returned to pre-pandemic levels once the stock markets recovered. BTC and XRP are net receivers of realized spillovers, whereas the remaining markets are net transmitters in the system. Under high-order moments, BTC is a net receiver of spillovers in Kurtosis and Jumps and shifts to a net contributor in kurtosis. ETH (XRP) is a net transmitter (receiver) of spillovers at high moments, except for jumps. LTC (BCH) is a net transmitter (receiver) of spillovers in the system, irrespective of high-order moments. From the hedging analysis, we document the hedging ability of the XRP against price fluctuations in BTC and ETH assets. Furthermore, quantile regression analysis reveals that cryptocurrency markets react asymmetrically to uncertainties during bullish and bearish regimes and exhibit potential hedge and safe haven properties.

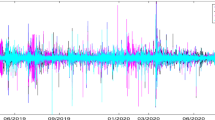

Source: Authors’ calculation

Similar content being viewed by others

Data availability

Data available on request from the authors.

Notes

We present the net spillover of realized kurtosis, skewness and jumps in Appendix A1 to A3.

References

Abdul-Rahim, R., Khalid, A., Karim, Z. A., & Rashid, M. (2022). Exploring the driving forces of stock-cryptocurrency comovements during COVID-19 Pandemic: An analysis using wavelet coherence and seemingly unrelated regression. Mathematics, 10(12), 2116.

Ahelegbey, D., Giudici, P., & Mojtahedi, F. (2022). Tail risk measurement in crypto-asset markets. International Review of Financial Analysis, 73, 101604.

Al-Yahyaee, K. H., Mensi, W., Ko, H.-U., Caporin, M., & Kang, S. H. (2021). Is the Korean housing market following Gannam style? Empirical Economics, 61(4), 2014–2072.

Amaya, D., Christoffersen, P., Jacobs, K., & Vasquez, A. (2015). Does realized skewness predict the cross-section of equity returns? Journal of Financial Economics, 118, 135–167.

Andersen, T. G., & Bollerslev, T. (1998). Answering the skeptics: Yes, standard volatility models do provide accurate forecasts. International Economic Review, 39(4), 885–905.

Andersen, T. G., Bollerslev, T., Diebold, F. X., & Labys, P. (2003). Modeling and forecasting realized volatility. Econometrica, 71(2), 579–625.

Antonakakis, N., Chatziantoniou, I., & Gabauer, D. (2019). Cryptocurrency market contagion: Market uncertainty, market complexity, and dynamic portfolios. Journal of International Financial Markets, Institutions and Money, 61, 37–51.

Antonakakis, N., & Gabauer, D., (2017). Refined Measures of Dynamic Connectedness Based On TVP-VAR. Technical Report. Munich: University Library of Munich.

Apergis, N. (2023). Realized higher-order moments spillovers across cryptocurrencies. Journal of International Financial Markets, Institutions and Money, 85, 101763.

Aslanidis, N., Bariviera, A. F., & Martínez-Ibañez, O. (2019). An analysis of cryptocurrencies conditional cross correlations. Finance Research Letters, 31, 130–137.

Babaei, G., Giudici, P., & Raffinetti, E. (2022). Explainable Artificial Intelligence for crypto asset allocation. Finance Research Letters, 47, 102941.

Balcilar, M., Ozdemir, H., & Agan, B. (2022). Effects of COVID-19 on cryptocurrency and emerging market connectedness: Empirical evidence from quantile, frequency, and lasso networks. Physica a: Statistical Mechanics and Its Applications, 604, 127885.

Balli, F., de Bruin, A., Chowdhury, M. I. H., & Naeem, M. A. (2020). Connectedness of cryptocurrencies and prevailing uncertainties. Applied Economics Letters, 27(16), 1316–1322.

Balli, F., Hasan, M., Ozer-Balli, H., & Gregory-Allen, R. (2021). Why do US uncertainties drive stock market spillovers? International evidence. International Review of Economics & Finance, 76, 288–301.

Barndorff-Nielsen, O., Kinnebrock, S., & Shephard, N. (2010). Measuring downside risk: realised semivariance. In T. Bollerslev, J. Russell, & M. Watson (Eds.), Volatility and Time Series Econometrics Essays in Honor of Robert F. Engle (pp. 117–136). Oxford University Press.

Barndorff-Nielsen, O., & Shephard, N. (2004). Power and bipower variation with stochastic volatility and jumps. Journal of Financial Econometrics, 2, 1–37.

Barndorff-Nielsen, O. E., & Shephard, N. (2002). Estimating quadratic variation using realized variance. Journal of Applied Econometrics, 17(5), 457–477.

Barunik, J., Kocenda, E., & Vacha, L. (2015). Volatility spillovers across petroleum markets. The Energy Journal, 36, 309–329.

Barunik, J., Kočenda, E., & Vácha, L. (2017). Asymmetric volatility connectedness on the Forex market. Journal of International Money and Finance, 77, 39–56.

Bhattacherjee, P., Mishra, S., & Kang, S. H. (2023). Does market sentiment and global uncertainties influence ESG-oil nexus? A time-frequency analysis. Resources Policy, 86, 104130.

Borri, N. (2019). Conditional tail-risk in cryptocurrency markets. Journal of Empirical Finance, 50, 1–19.

Bouri, E., Gupta, R., Lahiani, A., & Shahbaz, M. (2018). Testing for asymmetric nonlinear short-and long-run relationships between Bitcoin, aggregate commodity and gold prices. Resources Policy, 57, 224–235.

Bouri, E., & Jalkh, N. (2023). Spillovers of joint volatility-skewness-kurtosis of major cryptocurrencies and their determinants. International Review of Financial Analysis, 90, 102915.

Bouri, E., Jalkh, N., Molnár, P., & Roubaud, D. (2017a). Bitcoin for energy commodities before and after the December 2013 crash: Diversifier, hedge or safe haven? Applied Economics, 49(50), 5063–5073.

Bouri, E., Molnár, P., Azzi, G., Roubaud, D., & Hagfors, L. I. (2017b). On the hedge and safe haven properties of Bitcoin: Is it really more than a diversifier? Finance Research Letters, 20, 192–198.

Briere, M., Oosterlinck, K., & Szafarz, A. (2015). Virtual currency, tangible return: Portfolio diversification with Bitcoin. Journal of Asset Management, 16(6), 365–373.

Cagli, E., & Mandaci, P. (2023). Time and frequency connectedness of uncertainties in cryptocurrency, stock, currency, energy, and precious metals markets. Emerging Markets Review, 55, 101019.

Canh, N. P., Binh, N. Q., & Thanh, S. D. (2019). Cryptocurrencies and investment diversification: Empirical evidence from seven largest cryptocurrencies. Theoretical Economics Letters, 9(03), 431.

Charfeddine, L., Benlagha, N., & Maouchi, Y. (2020). Investigating the dynamic relationship between cryptocurrencies and conventional assets: Implications for financial investors. Economic Modelling, 85, 198–217.

Chen, B., & Sun, Y. (2024). Risk characteristics and connectedness in cryptocurrency markets: New evidence from a non-linear framework. The North American Journal of Economics and Finance, 69, 102036.

Choi, K.-H., Mclver, R. P., Ferraro, S., Xu, L., & Kang, S. H. (2021). Dynamic volatility spillover and network connectedness across ASX sector markets. Journal of Economics and Finance, 45(4), 677–691.

Ciaian, P., & Rajcaniova, M. (2018). Virtual relationships: Short-and long-run evidence from Bitcoin and altcoin markets. Journal of International Financial Markets, Institutions and Money, 52, 173–195.

Conlon, T., & McGee, R. (2020). Safe haven or risky hazard? Bitcoin during the COVID-19 bear market. Finance Research Letters, 35, 101607.

Corbet, S., Hou, Y. G., Hu, Y., Larkin, C., & Oxley, L. (2020a). Any port in a storm: Cryptocurrency safe-havens during the COVID-19 pandemic. Economics Letters, 194, 109377.

Corbet, S., Larkin, C., & Lucey, B. (2020b). The contagion effects of the COVID-19 pandemic: Evidence from gold and cryptocurrencies. Finance Research Letters, 35, 101554.

Corbet, S., Meegan, A., Larkin, C., Lucey, B., & Yarovaya, L. (2018). Exploring the dynamic relationships between cryptocurrencies and other financial assets. Economics Letters, 165, 28–34.

Corsi, F., Pirino, D., & Renò, R. (2010). Threshold bipower variation and the impact of jumps on volatility forecasting. Journal of Econometrics, 159, 276–288.

Díaz, A., Esparcia, C., & Huélamo, D. (2023). Stablecoins as a tool to mitigate the downside risk of cryptocurrency portfolios. The North American Journal of Economics and Finance, 64, 101838.

Diebold, F. X., & Yilmaz, K. (2012). Better to give than to receive: Predictive directional measurement of volatility spillovers. International Journal of Forecasting, 28(1), 57–66.

Diebold, F. X., & Yılmaz, K. (2014). On the network topology of variance decompositions: Measuring the connectedness of financial firms. Journal of Econometrics, 182(1), 119–134.

Dyhrberg, A. H. (2016). Hedging capabilities of bitcoin. Is it the virtual gold? Finance Research Letters, 16, 139–144.

Elsayed, A., Gozgor, G., & Yarovaya, L. (2022). Volatility and return connectedness of cryptocurrency, gold, and uncertainty: Evidence from the cryptocurrency uncertainty indices. Finance Research Letters, 47, 102732.

Fakhfekh, M., & Jeribi, A. (2020). Volatility dynamics of crypto-currencies returns: Evidence from asymmetric and long memory GARCH models. Research in International Business and Finance, 51, 101075.

Giudici, P., & Polinesi, G. (2021). Crypto price discovery through correlation networks. Annals of Operations Research, 299(1–2), 443–457.

Gkillas, K., Bouri, E., Gupta, R., & Roubaud, D. (2022). Spillovers in higher-order moments of crude oil, gold, and bitcoin. Quarterly Review of Economics and Finance, 84, 398–406.

Gonzalez, M. D. L. O., Jareño, F., & Skinner, F. S. (2020). Nonlinear autoregressive distributed lag approach: An application on the connectedness between bitcoin returns and the other ten most relevant cryptocurrency returns. Mathematics, 8(5), 810.

Guesmi, K., Saadi, S., Abid, I., & Ftiti, Z. (2019). Portfolio diversification with virtual currency: Evidence from bitcoin. International Review of Financial Analysis, 63, 431–437.

Hasan, M., Naeem, M. A., Arif, M., & Yarovaya, L. (2021). Higher moment connectedness in cryptocurrency market. Journal of Behavioral and Experimental Finance, 32, 100562.

Hung, N. T. (2020). Time-frequency nexus between bitcoin and developed stock markets in the Asia-Pacific. The Singapore Economic Review. https://doi.org/10.1142/S0217590820500691

Ji, Q., Bouri, E., Kristoufek, L., & Lucey, B. (2021). Realised volatility connectedness among Bitcoin exchange markets. Finance Research Letters, 38, 101391.

Ji, Q., Bouri, E., Lau, C. K. M., & Roubaud, D. (2019). Dynamic connectedness and integration in cryptocurrency markets. International Review of Financial Analysis, 63, 257–272.

Jlassi, N., Jeribi, A., Lahiani, A., & Mefteh-Wali, S. (2023). Subsample analysis of stock market – cryptocurrency returns tail dependence: A copula approach for the tails. Finance Research Letters, 58, 104056.

Joo, Y., & Park, S. (2023). Quantile connectedness between cryptocurrency and commodity futures. Finance Research Letters, 58, 104472.

Just, M., & Echaust, K. (2024). Cryptocurrencies against stock market risk: New insights into hedging effectiveness. Research in International Business and Finance, 67, 102134.

Katsiampa, P. (2019). Volatility co-movement between Bitcoin and Ether. Finance Research Letters, 30, 221–227.

Katsiampa, P., Corbet, S., & Lucey, B. (2019). Volatility spillover effects in leading cryptocurrencies: A BEKK-MGARCH analysis. Finance Research Letters, 29, 68–74.

Klein, T., Thu, H. P., & Walther, T. (2018). Bitcoin is not the New Gold–A comparison of volatility, correlation, and portfolio performance. International Review of Financial Analysis, 59, 105–116.

Koop, G., Pesaran, M. H., & Potter, S. M. (1996). Impulse response analysis in nonlinear multivariate models. Journal of Econometrics, 74, 119–147.

Koutmos, D. (2018). Return and volatility spillovers among cryptocurrencies. Economics Letters, 173, 122–127.

Kumar, S., Jain, R., Narain, N., Balli, F., & Billah, M. (2023). Interconnectivity and investment strategies among commodity prices, cryptocurrencies, and G-20 capital markets: A comparative analysis during COVID-19 and Russian-Ukraine war. International Review of Economics & Finance, 88, 547–593.

Lamine, A., Jeribi, A., & Fakhfakh, T. (2023). Spillovers between cryptocurrencies, gold and stock markets: Implication for hedging strategies and portfolio diversification under the COVID-19 pandemic. Journal of Economics, Finance and Administrative Science,. https://doi.org/10.1108/JEFAS-09-2021-0173

Le, T. L., Abakah, E. J. A., & Tiwari, A. K. (2021). Time and frequency domain connectedness and spill-over among fintech, green bonds and cryptocurrencies in the age of the fourth industrial revolution. Technological Forecasting and Social Change, 162, 120382.

Marco, T., Mighri, Z., Tiwari, A. K., & Sarwar, S. (2023). A quantile-time-frequency connectedness investigation through the dirty and clean cryptocurrencies spillover. Journal of Cleaner Production, 425, 138889.

Mensi, W., Al-Yahyaee, K. H., Vo, V. X., & Kang, S. H. (2021a). Dynamic spillover and connectedness between oil futures and European bonds. North American Journal of Economics and Finance, 56, 101342.

Mensi, W., ElKhouri, R., Ali, S., Vo, X., & Kang, S. H. (2023a). Quantile dependencies and connectedness between the gold and cryptocurrency markets: Effects of the COVID-19 crisis. Research in International Business and Finance, 65, 101929.

Mensi, W., Hammoudeh, S., Vo, V. X., & Kang, S. H. (2021b). Volatility spillovers between oil and equity markets and portfolio risk implications in the US and vulnerable EU countries. Journal of International Financial Markets, Institutions and Money, 75, 101457.

Mensi, W., Kamal, R., Vo, X. V., & Kang, S. H. (2023b). Extreme dependence and spillovers between uncertainty indices and stock markets: Does the US market play a major role? The North American Journal of Economics and Finance, 68, 101970.

Mensi, W., Maitra, D., Vo, X. V., & Kang, S. H. (2021c). Asymmetric volatility connectedness among main international stock markets: A high frequency analysis. Borsa Istanbul Review, 21(3), 291–306.

Mensi, W., Rehman, M. U., Al-Yahyaee, K. H., Al-Jarrah, I. M. W., & Kang, S. H. (2019). Time frequency analysis of the commonalities between Bitcoin and major Cryptocurrencies: Portfolio risk management implications. The North American Journal of Economics and Finance, 48, 283–294.

Mensi, W., Vo, X. V., & Kang, S. H. (2021d). Multiscale spillovers, connectedness, and portfolio management among precious and industrial metals, energy, agriculture, and livestock futures. Resources Policy, 74, 102375.

Mensi, W., Vo, X. V., & Kang, S. H. (2021e). Precious metals, oil, and ASEAN stock markets: From global financial crisis to global health crisis. Resources Policy, 73, 102221.

Mensi, W., Vo, X. V., & Kang, S. H. (2021f). Time and frequency connectedness and network across the precious metal and stock markets: Evidence from top precious metal importers and exporters. Resources Policy, 72, 101054.

Moser, M., Bohme, R., & Breuker, D. (2013). An inquiry into money laundering tools in the Bitcoin ecosystem. In eCrime Researchers Summit (eCRS), 2013 (pp. 1–14). IEEE.

Naeem, M. A., Qureshi, S., Rehman, M. U., & Balli, F. (2022). COVID-19 and cryptocurrency market: Evidence from quantile connectedness. Applied Economics, 54(3), 280–306.

Neto, D. (2022). Revisiting spillovers between investor attention and cryptocurrency markets using noisy independent component analysis and transfer entropy. The Journal of Economic Asymmetries, 26, e00269.

Nguyen, T. V. H., Nguyen, B. T., Nguyen, T. C., & Nguyen, Q. Q. (2019). Bitcoin return: Impacts from the introduction of new altcoins. Research in International Business and Finance, 48, 420–425.

Olofsson, P., Råholm, A., Uddin, G. S., Troster, V., & Kang, S. H. (2021). Ethical and unethical investments under extreme market condtions. International Review of Financial Analysis, 78, 101951.

Pesaran, H. H., & Shin, Y. (1998). Generalized impulse response analysis in linear multivariate models. Economics Letters, 58, 17–29.

Raham, M. L., Hedström, A., Uddin, G. S., & Kang, S. H. (2021). Qunatile relationship beween Islamic and non-lslamic equity markets. Pacifci Basin Finance Journal, 68, 101586.

Rehman, M. U., & Vo, X. V. (2020). Cryptocurrencies and precious metals: A closer look from diversification perspective. Resources Policy, 66, 101652.

Shahzad, S. J. H., Bouri, E., Roubaud, D., Kristoufek, L., & Lucey, B. (2019). Is Bitcoin a better safe-haven investment than gold and commodities? International Review of Financial Analysis, 63, 322–330.

Sharif, A., Aloui, C., & Yarovaya, L. (2020). COVID-19 pandemic, oil prices, stock market, geopolitical risk and policy uncertainty nexus in the US economy: Fresh evidence from the wavelet-based approach. International Review of Financial Analysis, 70, 101496.

Shi, Y., Tiwari, A. K., Gozgor, G., & Lu, Z. (2020). Correlations among cryptocurrencies: Evidence from multivariate factor stochastic volatility model. Research in International Business and Finance, 53, 101231.

Symitsi, E., & Chalvatzis, K. J. (2019). The economic value of Bitcoin: A portfolio analysis of currencies, gold, oil and stocks. Research in International Business and Finance, 48, 97–110.

Tiwari, A. K., Adewuyi, A. O., Albulescu, C. T., & Wohar, M. E. (2020). Empirical evidence of extreme dependence and contagion risk between main cryptocurrencies. The North American Journal of Economics and Finance, 51, 101083.

Tiwari, A. K., Raheem, I. D., & Kang, S. H. (2019). Time-varying dynamic conditional correlation between stock and cryptocurrency markets using the copula-ADCC-EGARCH model. Physica a: Statistical Mechanics and Its Applications, 535, 122295.

Trabelsi, N. (2018). Are there any volatility spill-over effects among cryptocurrencies and widely traded asset classes? Journal of Risk and Financial Management, 11(4), 66.

Tu, Z., & Xue, C. (2019). Effect of bifurcation on the interaction between bitcoin and litecoin. Finance Research Letters. https://doi.org/10.1016/j.frl.2018.12.010

Vidal-Tomás, D. (2021). Transitions in the cryptocurrency market during the COVID-19 pandemic: A network analysis. Finance Research Letters, 43, 101981.

Walther, T., Klein, T., & Bouri, E. (2019). Exogenous drivers of Bitcoin and Cryptocurrency volatility–A mixed data sampling approach to forecasting. Journal of International Financial Markets, Institutions and Money, 63, 101133.

Xu, Q., Zhang, Y., & Zhang, Z. (2021). Tail-risk spillovers in cryptocurrency markets. Finance Research Letters, 38, 101453.

Yi, S., Xu, Z., & Wang, G. J. (2018). Volatility connectedness in the cryptocurrency market: Is Bitcoin a dominant cryptocurrency? International Review of Financial Analysis, 60, 98–114.

Zeng, T., Yang, M., & Shen, Y. (2020). Fancy Bitcoin and conventional financial assets: Measuring market integration based on connectedness networks. Economic Modelling, 90, 209–220.

Zhang, H., Jin, C., Bouri, E., Gao, W., & Xu, Y. (2023). Realized higher-order moments spillovers between commodity and stock markets: Evidence from China. Journal of Commodity Markets, 30, 100275.

Zięba, D., Kokoszczyński, R., & Śledziewska, K. (2019). Shock transmission in the cryptocurrency market. Is Bitcoin the most influential? International Review of Financial Analysis, 64, 102–125.

Funding

This work was supported by a 2-Year Research Grant of Pusan National University.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

There are no conflicts of interest to declare.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Mensi, W., Kumar, A.S., Ko, HU. et al. Intraday spillovers in high-order moments among main cryptocurrency markets: the role of uncertainty indexes. Eurasian Econ Rev (2024). https://doi.org/10.1007/s40822-024-00263-1

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s40822-024-00263-1