Abstract

We investigate the contribution of network exposure to both shock transmission and absorption. Our data sample comprises 45 economies for the period 1998–2018 to which we apply spatial econometric estimation technique. Our empirical findings show that both network intensity and interconnectedness in the financial system have impact on increasing network exposure. We also demonstrate how to estimate network intensity in the financial system. Our results indicate that an increased network intensity parameter is associated to period when the financial system is under stress. The results show high exposure of the financial system to vulnerabilities. The results suggest the changing market conditions increase the exposures to the financial system. Thus, effective ways to monitor the financial system should be implemented by the policy makers to reduce the chances of financial instabilities.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The occurrence of the 2007–2009 global financial crisis still raises concerns to policy makers, regulators and academic researchers. The focus has been to find ways and mechanisms to develop measures to predict distress in financial institution so as to limit further destabilization of the global economy. Until recently, there has been growing research focusing on how to predict systemic risks to minimize the recurrence of financial crises, while the importance of understanding how network exposure contributes to the spread of financial distress in the financial system has been largely underestimated. Motivated with increasing uncertainty of the stability of the financial markets, this paper aims at investigating the effect of network exposure to common factors.

With the advances in both technology and globalization in recent years, there has been an increase in size, complexity, interconnectedness and concentration of the financial system. These factors combined make the financial system more vulnerable to a collapse. To ensure stability in the entire financial system, it is important to study how the global financial system is interconnected. In a nutshell, interconnectedness (the key source of systemic risk) helps to assess systemic risk and financial stability (Billio et al., 2010; Cai et al., 2014). To enable effective monitoring conditions, there is need to quantify and measure these financial linkages.

This paper focuses on identifying the effect of interconnectedness in the financial system. This is achieved through examining the cross-border financial linkages using real data. The paper aims to identify the impact of interconnectedness in either absorbing or spreading risks in the financial system. It focuses on the cross-border exposure, aiming at identifying the role played by interconnectedness in propagating shocks across countries, in the period of 1999–2018. The sample period covers different crisis periods which include the global financial crisis of 2007–2009, the European sovereign debt crisis of 2010 and the Chinese stock market crash of 2015.

Different approaches have been used to measure financial networks, systemic risks and interconnectedness. Recent studies on measuring systemic risk show that it was not only the size of the institution that led to the distress in the financial system but also the interconnectedness between institutions (Billio et al., 2012; Dungey et al., 2012).Footnote 1 Contagion rapidly spread the crisis through financial linkages, leading to severe disruption of financial stability in both the United States and globally. The recent financial crisis emphasized the importance of using interconnectedness (defined as a set of relationships and interactions among the financial markets participants) as a proxy in measuring systemic risk. Hautsch et al. (2014) note that both size and interconnectedness of financial institutions determine its systemic relevance.

Although currently there is ongoing research focusing on the interconnectedness of institutions (Diebold & Yilmaz, 2009, 2012, 2013; Glasserman and Young, 2015; Tonzer, 2015), there is still need to understand whether an increase of financial linkages affect the stability (either weakening or strengthening) of the financial system and the impact of financial interconnectedness to both common factors and contagion. It is also important to assess the resilient nature of financial networks to shocks (both exogenous and endogenous).

Different studies have extended the variance decomposition model proposed by Diebold and Yilmaz (2012) to measure connectedness in across different markets. For example, Giudici et al. (2021) provide a methodology to build a minimum variance currency basket aimed at assessing contagion spillovers among foreign exchange markets using the variance decomposition model. Giudici and Pagnottoni (2019) extent variance decomposition model to examine the relationships of five major Bitcoin exchange platforms. Giudici and Pagnottoni (2020) also extent the variance decomposition model to a generalized vector error correction framework to investigate return connectedness across eight of the major exchanges of Bitcoin.

Other emerging research have proposed different approaches to predicting systemic risks across different markets. For example, Resta et al. (2020) apply technical analysis on bitcoin market and find trading on daily data is more profitable than going intraday. Peralta and Zareei (2016) use Markowitz framework to construct a network-based investment strategy. Spelta et al. (2021) develop a novel methodology to detect the emergence of crisis and provide early-warning market signals to policy makers. Spelta (2017) introduces a tensor decomposition technique to empirically extract complex relationships from prices’ time series. Spelta et al. (2022) propose a dynamical systems theory for non-linear time series forecasting and investment strategy development which correctly make predictions at long time horizons.

Our paper differs from these approaches in measuring dynamic exposures in the financial system. To estimate the network exposure in the financial system, this paper uses spatial economic approach proposed by Anselin (1988). This is innovative way of estimating the intensity of the exposures to vulnerabilities. The network intensity parameter measures the network exposure in the financial system. We use data on equity because of its ability to accurately reflect market conditions and sentiments.

Our work focusing on the dynamic effects of the network exposure on the financial market has the following contributions. First our paper contributes to the existing literature on interconnectedness by using the spatial econometric approach. Previous research has mainly focused on the advance economies however, little attention has focused on emerging economies. This paper aims at identifying network exposure on both advanced and emerging economies. To the best of our knowledge, this is a major piece of work, that utilizes spatial econometric techniques to estimate the network exposure in the financial system.

The key findings of this paper highlight the role of network exposure in increasing vulnerability, with both interconnectedness and network intensity playing key roles in monitoring these exposures. We find high network intensity coefficient to be associated with extreme events. This suggests that high network intensity parameter relates to crisis period. We also find that both interconnectedness and network intensity increase exposures in the financial system. Cautions must be taken by policy makers in regulating and monitoring financial system to avoid re-occurrences of crises.

The remainder of this paper is organized as follows. Section 2 reviews related literature and develops key hypotheses which form the basis for empirical testing. It also introduces the spatial econometric concept. Section 3 discusses the mechanism underlying network exposure to common factors. Section 4 presents the results and the effect of network exposures. Section 5 discusses various methods of estimating the network intensity parameter. Section 6 presents empirical evidence of the network intensity parameter. Section 7 outlines the implications of our results, and Section 8 concludes.

2 Literature review

Recent studies have shown that a major contributor to the transmission of shocks during crisis such as the GFC (2007–2009) was not only the institution size, but also the institution interconnectedness. Different interpretations of interconnectedness have resulted in the development of various measurement methods. All these measures aim to assess the role and impact of interconnectedness during financial distress.

Recent findings indicate that interconnectedness acts as a channel through which shocks and losses spread to other financial institutions (Glasserman & Young, 2015, 2016). Other findings show that interconnectedness acts as a ‘double edge’ by being able to absorb shocks up to certain point and also transmitting them to the financial system after a given threshold is reached (Acemoglu et al., 2015; Cohen-Cole et al., 2012; Gai & Kapadia, 2010; Tonzer, 2015). Gai and Kapadia (2010) suggested that an increase in connectivity may lower the chance of contagion, but conditional on a default by a given node, an increase in interconnectedness may trigger defaults to other nodes, making the financial system more sensitive to defaults.

With increasing growth in the cross-border financial activities, interconnectedness poses threats to the financial system via increased vulnerability to shocks spreading globally. Minoiu and Sharma (2014) supported the fact that a high degree of interconnectedness triggered the breakdown of financial system during the 2007–2009 GFC. This implies that the more interconnected an institution, the higher the likelihood of risk amplification to the entire system threatening the stability of the economy.

Markose et al. (2012) referred to institutions that are ‘too interconnected’ as ‘super-spreaders’ of shocks in the financial system. This means that interconnectedness of financial institutions tends to spread shocks extensively across links, causing instability in the financial system. Gai and Kapadia (2010) showed that degree of interconnectedness has an impact on contagion by acting as a channel through which contagion spreads and shocks amplify. Greater interconnectedness aids in lowering the likelihood of contagion but increases shocks transmission when the financial system experiences difficulties.Footnote 2 Using spatial modeling, Tonzer (2015) assessed whether cross-border linkages have any impact on the stability of interconnected institutions. Though interconnectedness is beneficial in stable conditions, Tonzer (2015) showed that interconnection of financial institution to foreign entities provided a channel for propagating shocks when the system experienced difficulties.

Assessing interconnectedness in financial institutions could serve as an early warning indicator for distress in financial systems. Econometric measures based on Granger causality and principal components analysis proposed by Billio et al. (2012) measure interconnectedness. These measures show that an increase in links in a financial institution before a crisis signal an early warning. In addition, Minoiu et al. (2015) focused on determining whether interconnectedness in financial institution is a possible source of systemic risk that could serve as an early warning of crisis. Their findings suggested that interconnectedness has early warning indicator properties for a crisis. Diebold and Yilmaz (2009, 2012) proposed new measures of interconnectedness by measuring risk and management in financial institutions based on variance decomposition. Their results showed that global financial interconnectedness is time-varying, implying that network exposure within financial institutions varies over time.

Minoiu et al. (2015) showed that an increase in linkages within a country and a decrease in cross-border linkages are associated with a high chance of financial crisis. This is consistent with the results of Peltonen et al. (2019) which indicated that more interbank linkages increase the chance of banking crises. The increase in cross-border transactions led to more interactions and relationships between different markets, leading to the formation of international ‘robust-yet-fragile’ financial networks. A financial network is ‘robust-yet-fragile’ when it serves as a shock absorber (promoting financial stability) up to a certain point, beyond which it amplifies shocks (leading to financial instability) in the whole financial system. While financial markets benefit through the formation of more robust and stronger interconnections beyond a certain point, they also create potential channels of shock transmission.

Several studies have explored roles that financial networks play in good and bad periods. The first strand of literature relates interconnectedness to risk diversification, cross-border investment opportunities and availability of different financial products in the market. A financial network is robust when it absorbs shocks, enhancing the stability and health of a financial system (Allen & Gale, 2000). Having more interconnections implies more risk-sharing and diversification, so shocks hitting the network will be shared among the various interconnected institutions building a resilient financial system (Glasserman & Young, 2016). This mechanism is supported by Vitali et al. (2016), who found that an increase in interconnections makes the financial system more resilient and increases shock diversification. Other studies show that formation of these interlinkages helps absorb shocks to a certain point before contributing to their spread (Acemoglu et al., 2015; Cohen-Cole et al., 2012; Gai & Kapadia, 2010; Tonzer, 2015). Kubelec and Sá (2012) argued that financial interconnectedness increases due to countries becoming more open, therefore causing the entire network to collapse. While Gai and Kapadia (2010) determined that stronger connectivity in the financial sector would improve absorption of shocks, they also suggested that conditional on the default of an institution, an increase in network connectivity propagates shocks from one institution to others.

The second strand of literature focuses on how interconnectedness enhances the channels through which shocks spread and intensify to the broader financial system (Battiston & Caldarelli, 2013; Glasserman & Young, 2015, 2016). That is, financial networks tend to be fragile when they amplify shocks rather than contain them. This may destabilize the entire financial system by increasing systemic risk, leading to financial instability. Many studies show the extent to which interconnectedness could have a negative effect on financial stability. For instance, Battiston and Caldarelli (2013) demonstrated that although individual institutions benefit from increased interlinkages, this could be a channel through which contagion and distress spread to the entire financial system. Battiston et al. (2012) found that an increase in financial interconnections increased credit exposure which increases systemic risk. Amini et al. (2016) argued that institutions with more interconnections contribute more to financial instability. Further, Acemoglu et al. (2015) stated that more interconnections can make the financial system more fragile due to increased shock propagation when shocks are either large or coincidental. These findings are supported by Markose et al. (2012), who referred to institutions that are ‘too interconnected’ as ‘super-spreaders’ of shocks. Minoiu and Reyes (2013) analyzed the global banking network using 184 countries and reported that connectivity in the banking network tends to increase particularly when the market is under stress. This aligns with the findings of Glasserman and Young (2015), which asserted that interconnectedness among different markets were key contributors to the GFC of 2007–2009. Yellen (2013) regarded interconnectedness as a financial stability concern after the occurrence of the global crisis while Sun and Chan-Lau (2017) argued that interconnectedness was the source of systemic risk.

The third strand of literature shows that specific institutions or markets play a key role in spreading shocks in the network. For instance, by investigating the patterns of international trade and financial integration, Schiavo et al. (2010) demonstrated a cause of the global crisis was shocks spreading from advanced economies to other markets, leading to network-wide distress. Kubelec and Sá (2012) found the US and UK to be the key players in the global financial network, with high interconnections compared to the rest of the world.

2.1 Spatial econometric concept

Introduction of spatial econometric techniques into financial application can be useful in modeling spillovers. The spatial econometric technique has been used recently in finance. For example, Eder and Keiler (2015) used it to model contagion risk among financial institutions; Fernandez (2011) employed it to measure risk premium propagation among firms; Asgharian et al. (2013) used it to investigate stock market co-movements while Catania and Billé (2017) applied it to advancements in score-driven models typically used in time series econometrics.

Spatial dependence parameter (network intensity parameter) captures the strength of the spatial dependent units; thus, it is a key component in investigating the structure of the spatial autoregressive process. Network intensity parameter falls within the range of 0 and 1, where 0 (1) is the minimum (maximum) estimate. A robust-yet-fragile financial system is associated with high (greater than 0 and approaching 1) network intensity. Financial systems benefit from high network intensity through risk-sharing and diversification. Conversely, increasing intensity beyond certain limits will increase the rate at which shocks propagate, leading to financial instability (Eder & Keiler, 2015). As a consequence, the financial system benefits from relative high network intensity (especially when there is no shock hitting the system), which allows for effective absorption of shocks rather than their amplification them to the entire system (Affinito & Pozzolo, 2017). Restricting network intensity parameters may improve stability leading to a more robust financial system (Gofman, 2017).

In addition, since estimation of network intensity depends on the connection matrix, the structure of the connection matrix will have an impact on the estimation of network intensity. Let \(d \in [{\underline{d}}, {\overline{d}}]\) be the degree of network connectivity, where \({\underline{d}}\) and \({\overline{d}}\) are the minimum and maximum degree of connectivity respectively; then, a robust-yet-fragile network is associated with degree of connectivity close to \({\overline{d}}\). The network is robust in the sense that the risk-sharing and diversification are higher in the absence of large shocks and fragile when large shocks hit the network. High connectivity with shocks hitting the financial system imply more shocks being propagated in the network causing a fragile financial system (Glasserman & Young, 2015).

Consider a full or complete network with equivalent row-normalized weighted connection matrix, an example represented as:

A shock hitting the above network will be proportionally shared among the nodes in the network depending on the weights of the edges. The shock will either be equally shared or proportionally shared across the entire system depending on the size of the shock. Thus, a robust network exists when shocks are equally distributed to all institutions since the network is more resilient to small shocks (Hüser, 2015). Conversely, when weights are beyond a certain threshold, the risk-sharing effect is endangered by larger shocks being amplified in the financial system rather than being contained. This implies that shocks will affect nodes that are strongly interconnected.

Generally, financial institutions benefit from high connectivity in the absence of shocks, while high connectivity can lead to financial instability when large shocks hit the system. This argument is supported by various studies. For example, Haldane (2009) asserted that high connectivity in the financial system leads to greater risk-sharing and diversification; above certain connectivity thresholds, it will propagate shocks to the entire system. In addition, Vitali et al. (2016) argued that high connectivity beyond certain threshold leads not only to large systemic events, but also to more frequent occurrence of distress events. Acemoglu et al. (2015) also found that highly connected institutions are more resilient to small shocks that pose a high chance of contagion in the presence of large shocks. This is also supported by Silva et al. (2016), who identified a high potential for a default to be triggered, especially in a dense interconnected network since risk-sharing effects vanish when large shocks hit this network. Schiavo et al. (2010) suggested that the structure of the connection determines how the financial system responds to shocks.

Estimates of network intensity are dependent on the interaction of the endogenous spatial lag (Wy); thus, increasing interactions (a denser weighting matrix) leads to greater amplification of shocks rather than sharing shocks across these networks. This is supported by various studies. For example, using European CDS spread data, Blasques et al. (2016) showed that high time-varying spatial coefficients are associated with credit riskiness, which leads to fragility and potential collapse of financial system. Battiston et al. (2012) found that financial systems can be more resilient when the financial accelerator is low; when it is at a maximum, adverse effects are inflicted via spreading shocks. This suggests that when shocks hit the financial system, a high network intensity estimate signifies a higher probability that the financial system will be fragile (Vitali et al., 2016).

2.2 Motivation and hypotheses development

Financial integration is a process through which either financial markets, countries or regions become interconnected in different ways. This process includes cross-border lending and borrowing and is an important phenomenon in financial markets. Increasing integration is often associated with a more complex financial sector. Financial integration is beneficial to markets in terms of efficient capital allocation, higher investment and growth opportunities and risk-sharing. Risk-sharing improves the resilience of the global financial system (González-Páramo, 2010).Footnote 3

Financial integration also serves to spread shocks to the entire financial system. According to Schiavo et al. (2010), it is through integration that advanced economies become more interconnected with other markets, thereby spreading shocks to these markets. This leads to global distress and increased cross-border exposure threatening financial system stability. Hüser (2015) showed that an increase in the integration of the interbank network poses an increased risk of contagion, and as a consequence increases systemic risk. Asgharian et al. (2013) argued that cause of the Asian crisis was trade integration (measured by cross-border flows of imports and exports) between Asian countries, especially those emanating from Thailand and spreading rapidly to its neighbors (Indonesia, Malaysia and even Korea). In this context, we consider financial integration a contributory factor to increased network intensity. As countries engage in cross-border activities, financial integration expands potentially making financial markets more volatile.

Based on these motivation and related literature, we outline four hypotheses:

Hypothesis 1: Network intensity increases during periods of stress. This hypothesis tests whether network intensity estimate changes over time. It will determine whether it tends to increase or decrease when the market is under stress. We would expect network intensity to increase when shocks hit the network.

Hypothesis 2: Degree of connectivity affects estimation of network intensity. This aims to investigate whether greater interconnectedness among different markets influences estimation of network intensity parameter. This will provide an insight into how the connection matrix makes the financial network robust-yet-fragile.

Hypothesis 3: Financial integration affects the estimation of network intensity. This tests whether financial integration can explain why network intensity increases or decreases during different periods. With increasing cross-border activities, markets have become more integrated forming a possible channel through which shocks can spread in financial systems.

Hypothesis 4: Advanced economies have a greater impact in spreading shocks. This tests whether developed economies have a greater impact in the estimation of network intensity. This test is in line with Schiavo et al. (2010), who found that advanced economies were the key spreaders of shocks during the GFC.

3 Financial network and exposure to common factors

We now consider the impact of exposure to common factors in financial networks. This involves examination of how the structural model (which incorporates both systematic and idiosyncratic shocks) behaves in the presence of network exposure.

The starting point focus on the structural model, capturing exposures to common factors as considered in Billio et al. (2015). According to Sharpe (1964) and Lintner (1965), the traditional capital asset pricing model (CAPM) is given by:

where \(r_{it}\) is the return on stock i at time t, \(r_{mt}\) is the market return at time t, \(r_{ft}\) is the risk-free rate and \(\varepsilon _{it}\) is a vector capturing the idiosyncratic shocks of stock i at time t. \(\alpha _{it}\) and \(\beta _{it}\) are the parameters of the model.

The traditional CAPM model can be extended to the Fama–French three-factor linear model. Considering the pricing perspective, the Fama–French three-factor for a set of risk asset returns, \(r_{it}\) at time t is given by:

where HML is the book-to-market factor of stock i at time t, \(SMB_{it}\) is the size factor of stock i at time t. \(h_{it}\) and \(s_{it}\) are additional parameters of the model; \(\varepsilon _{it}\) is a vector capturing the idiosyncratic shocks of stock i at time t.

The main focus of this approach is on both network exposures (endogenous) and exposures to common factors (structural exposure, which is exogenous). Equation (2) can be rewritten in a structural form as:

The spatial matrix S in Eq. (4) captures the contemporaneous relations associated with interconnections between different assets, while \(\eta _{t}\) is the structural idiosyncratic risk at time t.

Our aim is to construct a structural model that contains contemporaneous relationships driven by links across assets, and systematic and idiosyncratic shocks. Thus, the spatial matrix S can be parametrized as \(S = I_{n} - \rho W\), where \(I_{n}\) is \(n\times n\) identity matrix, \(\left| \rho \right| < 1\) is the spatial dependence parameter (network intensity parameter) indicating the strength of the network exposure. It monitors the network impact while W represents relationships across assets.Footnote 4

Equation (4) into a spatial autoregressive framework (SAR) as:

If we let \(\beta _{M}r_{it}^{M} + \beta _{HML}r_{it}^{HML} +\beta _{SMB}r_{it}^{SMB} = Z\), using a geometric series expansion to the first degree,Footnote 5 the above model can be represented as:

where

-

i.

structural exposure to common factors

-

ii.

structural impact to idiosyncratic component

-

iii.

network exposure to common factors

-

iv.

network impact to idiosyncratic component

Equation (7) captures the impact of exposures (both structural and network exposures) of both systematic and idiosyncratic shocks. Therefore, we conclude that both idiosyncratic and systematic components are influenced by the presence of interconnections across assets/institutions.

4 Dataset and effect of network exposure

The empirical analysis of this paper uses different datasets. We use daily return constructed from daily equity market indices obtained from Thompson Reuter’s Datastream. We also used the liability, market value and 90 days treasury bill (T-Bill) rates data. Other datasets that include foreign exchange (FX), interest rate (IR), S&P 500 volatility index—US (VIX), Euro STOXX 50 volatility index—Europe (VSTOXX) and trade were also considered in the second part of the analysis.

We chose our sample of markets based on the availability of: (i) closing values, (ii) closing hours, and (iii) changes in closing prices, listed by region in Table 1. Our analysis of equity return spillovers is based on local currencies to avoid blurring the extent of market co-movements with fluctuations in the foreign exchange market (Mink, 2015).

The daily return (\(r_{t}\)) for all markets are calculated as the log differences of the total daily equity market indices of a given economy at time t. This can be expressed as:

where \(r_{t}\) is the return at time t, \(P_{t}\) is the closing stock price of a given financial institution at time t, \(P_{t-1}\) is the lagged price and \(\ln\) is the natural logarithm.

We study 42 stock markets in three categories: developed, emerging, and frontier. We extended the previous research that primarily focused on a few developed or emerging markets (e.g. the G7 [Canada, France, Germany, Italy, Japan, the UK and the US] stock markets investigated by Apostolakis and Papadopoulos (2014), the 10 developed and 11 emerging markets in Asia studied by Yarovaya et al. (2016), and Asian markets examined by Narayan et al. (2014) and did not consider all possible interconnectedness across different stock markets).

Table 2 presents the descriptive statistic of the daily returns for each market. The mean returns are positive for all economies with standard deviation ranging from 0.0096 to 0.0237. The kurtosis results suggest that the daily return would be ‘peaked’ and have ‘fat-tailed’ distribution. Unit root tests revealed the usual characteristics of stationary returns in each series. The analysis was conducted using de-meaned returns (as the mean is usually extremely close to 0 and, as we are focused on variance decompositions, this assumption is innocuous). Analysis of the complete network, consisting of 42 nodes, formed the initial benchmark for the study.

To construct our network, we used the data with its recorded local closing time date. The choice of time-zone treatment can have dramatic effects; no single choice is dominant due to the complications of wanting to test for two-way causality. Other researchers have used the dates as provided with the data (Wang et al., 2018), averaged data over consecutive days (Forbes & Rigobon, 2002) or used time-matched data series (Kleimeier et al., 2008). Although the last of these is arguably the most appropriate, it is difficult to obtain these data for the markets examined here and to control for problems associated with out-of-local trading time liquidity effects (most markets have different price-impact effects during local and non-local trading). The averaging procedure used by Forbes and Rigobon (2002) introduced a moving average bias into the problem, and, with Granger-causality testing, created additional problems with the performance of the statistic. Further, it is debated whether the use of lagged or non-lagged samples introduces or reduces noise in the process. Sensitivity analysis to different choices of date-lagging produced important differences; the most pronounced of these is that when the US data are lagged, there is virtually no evidence of transmission from the US to Asia, which seems at odds with our understanding of international financial markets and the transmission of shocks. Consequently, this chapter uses the convention of actual day dating in its analysis.

We first examine the evolution of the unweighted and weighted networks over the sample period and augmented this analysis with scenarios based on alternative clustering of markets, as per the Asian Development Bank member countries and the role of regional groupings, including the Association of Southeast Asian Nations (ASEAN) with other regions across the globe.

The sample period considered is January 1999–December 2017 because our focus is to observe the dynamics of the network exposure in the twenty-first century. By taking advantage of the long horizon with a large number of observations (4956), we subdivided the sample into four phases, as represented in Table 3: Phase 1 is the pre-crisis (1 January 1999–14 September 2008) period, Phase 2 is the GFC (15 September 2008–31 March 2010) period, Phase 3 is the European debt crisis (EDC) (1 October 2010–21 November 2013) and phase three is the most recent period (22 November 2014–29 December 2017). We followed Dungey et al. (2015) and Dungey and Renault (2018) when choosing these dates.

We use the BIS database to obtain liabilities data to construct the weighting matrix. The BIS bilateral locational banking statistics provided a comprehensive cross-border data set of international banking transactions. This included aggregate international cross-border claims and liabilities of a set of both reporting and non-reporting countries. We use cross-border liabilities of reporting countries, measured on a quarterly basis from 1999Q1–2017Q4 to construct the connection matrix. The weighting matrix is obtained using the combined Granger causality and DY approach (see Chowdhury et al., 2019). Each country is represented by direct liability towards all the other countries in all financial sectors (central banks, banks, non-bank financial institutions and non-financial sectors). We consider 42 (mature and emerging markets) countries in our sample (see Table 4), for which the data were complete and reliable. We also use different specifications of the connection matrix in our empirical analysis. Particularly, we randomly generated sparse (fewer interconnections) and denser (more interconnections) matrices for the markets in our sample.Footnote 6

Figure 1 displays the average cross-border liability flow, measured in US billion dollars, for the countries in our sample. Liability defined as what a country or company owes to others (including loans, bonds and other debts), plays a significant role in propagating shocks in the financial system. Having unsecured lending and borrowing could increase cross-border liability within the financial system. There was a change in the average liability between the entire period of our sample. As shown in Fig. 1, the average liability drastically changed during crises, implying that on average, countries in our sample paid more than required by a liability. This may be a contributory factor to the collapse of the financial system, because the failure of these countries to pay liabilities could lead to defaults for their counter-parties. Therefore, liability within countries serves as a major contributory factor to crises. The higher the liability, the greater the chance of system exposure to distress. These findings concur with those of Gai and Kapadia (2010), who found that liability from defaulting banks led to the spread of contagion, which in turn increased the vulnerability of interconnected institutions.

4.1 Effect of financial network to common factor model

This subsection investigates whether network exposure affects common factors. This enables greater understanding of the importance of financial networks in both spreading and absorbing financial shocks in the system. Our investigation focuses on the individual countries in our sample. Following Billio et al. (2015), we estimated both systematic and idiosyncratic components in the structural model. Our analysis relied on estimating these parameters because the Fama–French factors available in Kenneth French’s data library were limited to few countries. Since the idiosyncratic component is unobservable and model-dependent, we used indirect estimation proposed by Campbell et al. (2001) to estimate it.

4.1.1 Estimating beta and idiosyncratic volatilities

To estimate idiosyncratic volatility for an individual stock in our sample, we assumed the return of each country i to be driven by a common factor and country-specific shock \(\varepsilon _{it}\). To be precise, we followed Sharpe (1964) and Lintner (1965), who assumed a single factor return generating process and estimated the market model using Eq. (1).

In this analysis, we computed the excess returns of individual countries as the log return on the global market index (\(r_{mt}\)) minus absolute change of 90 days’ T-Bill rates (\(r_{ft}\)), which we considered the risk-free rate. The 90 days’ T-Bill rates and market value data were obtained from Thompson Reuter’s Datastream for January 1999–December 2017.

The return on the global market index (\(r_{mt}\)) was computed as the value of weighted excess return of each country over the 90 days T-Bill rates \(r_{ft}\) of each country:

where \(\omega _{it}\) is the ratio of country’s i market value to the total market value of the entire market m in time t and n is the total number of countries.

The beta and residual estimates for each market were obtained by running the regression for each market index in the sample using Eq. (1).

Following Bali and Cakici (2008), we estimated country-specific idiosyncratic volatility as the standard deviation of the residuals of each individual country given by:

4.1.2 Effect of financial network on betas

The beta estimate for each country was estimated by running separate regressions. Table 4 displays the structural betas for individual countries in our sample. We estimated betas using Eq. (1) for all phases categorized in Table 3. Our results clearly show that beta coefficients are different in all phases. In most countries, the structural betas were lower in the pre-crisis period, while increased in the GFC with the exception of some emerging markets (Indonesia, Malaysia, Philippines, Singapore, Sri Lanka and Egypt) in which estimates decreased during the global financial crisis period. The structural betas remain high in Phase 3, associated with the European debt crisis. Country-specific betas changed with the introduction of many factors. For instance, using Fama–French three-factor model might result in different estimates. Since our focus was the effect of network exposure on structural betas, we did not focus on discussing each country’s specific betas.

Using beta coefficients obtained from the regression model, we investigated how they changed with the increase in network exposure. First, we examined the effect of the connection matrix (W) on the structural beta. Figure 2a displays how the structural beta (\(\bar{\beta _{i}}\)) changed with the interaction of the connection matrix, given by:

where \(\beta ^{*}_{i}\) is the new (augmented) beta obtained from the interaction with the connection matrix while \(\bar{\beta _{i}}\) is the country-specific structural beta. The results show that the structural beta changes with the interaction with the connection matrix. The connection matrix is based on liability linkages obtained using the combined Granger causality and DY measure (Chowdhury et al., 2019). This suggests that the increased interconnection between various market participants leads to change in the structural beta of a given country. The results also revealed the role of the weighting matrix in spreading shocks in a financial system. For example, the connection matrix increased the values of structural betas by more than 50% for countries whose beta values were small. Countries with low betas included Greece, Philippines and Poland. The size of the augmented betas varied depending on the strength of the connections a country has with others. In Fig. 2a, we noted that beta values of countries (including Denmark, Greece, Sri Lanka, Malaysia and the Philippines) tend to be 0 but are greatly influenced by the weighting matrix. The beta values increased depending on the level of shock one country receives from others. These results depict the role of interconnections in spreading risk. This observation is consistent with Glasserman and Young (2016), who showed that countries with high connectivity tend to suffer more when shocks hit the financial system.

Structural betas for all the phases under different scenarios. The figures exhibit how the structural beta for all phases changed under different scenarios. We used country’ abbreviations from BIS. a Displays changes in betas with and without the presence of the connection matrix. This was obtained by multiplying the betas with the corresponding liability weighted matrix. b Shows how betas changed using sparse weighting matrix. c Shows how betas changed across different network intensity parameters. d Shows the effect of network exposure on betas. The period covered in the sample is 1 January 1999–31 December 2017

For countries (including Greece, Sri Lanka and the Philippines) with lower beta estimates due to stronger links with other countries, we observed that the structural beta was amplified. This implies that these countries are strongly affected by other countries, leading to amplification of shocks.

It is important to understand whether using a different weighting matrix has a different impact on structural betas. Figure 2b shows how betas changed using a sparse matrix.Footnote 7 We randomly generated a sparse matrix. From the results, we noted that the contribution of the weighting matrix changed depending on the strength of connections between countries. This is depicted using orange bars in Figures 2a and b. For example, the Philippines had stronger links in Fig. 2a, leading to greater change in exposure, while in Fig. 2b, it had weak links, leading to a smaller change in structural betas.

The impact of the different network intensity parameters on the structural betas can be estimated as:

where \(\beta ^{**}_{i}\) is the new beta obtained from the interaction with the different network intensity parameters.

Figure 2c shows how structural betas changed across the different network intensity parameters (we assumed network intensity parameters to take quartiles values [i.e. 0.25, 0.5 and 0.75]). It is clear from these that structural betas tend to increase across different network intensity parameters. This is an indicator that as the network intensity increases, the level of risk in the financial system also tends to increase. Unlike the connection matrix, whose effect is severe to all countries with stronger connections including countries whose beta values are small, the network intensity parameters have more influence on the countries whose beta values are large. Countries with small values of beta (Greece, Sri Lanka and the Philippines) are less affected by network intensity parameters. Conversely, countries with high beta estimates (e.g. South Korea) are more affected by larger network intensity parameters. This explains the role of network intensity parameters in spreading and reducing shocks. Our finding indicates that network intensity parameters have a greater impact in spreading risk than absorbing it.

Next, we investigated the effects of network exposure on structural betas. This involved combining the connection matrix and network intensity parameters. This is because both coefficients have a great impact on betas. We used the following equation to gauge the role of network exposure on structural betas:

where \(\beta ^{***}_{i}\) is the new beta obtained from the interaction with the changing network exposure.

Figure 2d shows how the structural betas change across the changing network exposure. These results show that both the weighting matrix and the network intensity parameters have effects on the structural beta.

Change in structural betas due to network exposures. The figure reports contribution of connection matrix, network intensity parameters and network exposures on structural betas. Blue represents % change of betas due to the connection matrix, orange due to network intensity coefficient and yellow due to the network exposures. The period covered in the sample is 1 January 1999–31 December 2017

To obtain a clear insight into how structural beta changed, we calculated the percentage change in betas in \(\beta ^{*}_{i}\), \(\beta ^{**}_{i}\) and \(\beta ^{***}_{i}\). Figure 3 summarizes the contribution of connection matrix, network intensity parameters and network exposure to structural betas. The height of the bar represents the percentage change of betas. These results revealed stronger connections between markets increase network exposure. This is consistent with Silva et al. (2016) who found that high connectivity triggers a greater probability of default in the financial system. It also shows that network intensity parameter has an amplifying effect on shocks. It is clear from the bar size that both the weighing matrix and the network intensity parameters have different effects. Although the contribution of the connection matrix is similar, it varies depending on the strength and number of the connections. Thus, our main finding from Fig. 3 is that both network intensity parameters and connection matrix are key ingredients in either increasing or decreasing network exposure.

4.1.3 Network exposure to common factors

To investigate the effect of network exposure on common factors, we used slope coefficient betas as the systematic risk of specific country’s market portfolios. This is useful to examine the effect of network exposure on both systematic and idiosyncratic volatility. Bali and Cakici (2010) used beta coefficients as the systematic risk of a country’s market portfolio to determine whether country-specific risks are priced into the intertemporal capital asset pricing model (ICAPM). They found that country-specific risks are significantly priced into the ICAPM framework.

Table 5 reports country-specific idiosyncratic volatility in all sample periods, estimated in Eq. (10). As noted by Hueng and Yau (2013), these estimates may vary depending on the data used because they are model-dependent. Notably, the country-specific idiosyncratic volatility of emerging markets as greater than those of developed economies is consistent with the findings of Bali and Cakici (2008, 2010) and Hueng and Yau (2013). We also observed, on average, that Turkey had high idiosyncratic volatility in the full sample period and also in Phase 1. These results are consistent with Bali and Cakici (2010) and Hueng and Yau (2013), who determined that Turkey had a higher estimate than other countries in their sample. Interestingly, most countries had greater idiosyncratic estimates in the crisis period. This could be explained by higher uncertainty in the market during the GFC.

Therefore, we will not discuss country-specific idiosyncratic volatilities because our aim is to determine the role of network exposure on both systematic and idiosyncratic components. By assuming the first order neighborhood in Eq. (7), we investigated the effect of network exposure on the structural model. We used the network intensity parameter to capture the strength of the network exposure (network intensity). This coefficient lies between 0 and 1, where close to 0 implies lower network intensity and close to 1 signifies higher network intensity. The existence of network exposure is captured by the weighting matrix which was row-normalized. The weighting matrix takes the values between 0 and 1 as representing exposure from other markets, where values close to 0 imply less exposure, while close to 1 implies high exposure. We used the weighting matrix constructed from combined Granger causality and DY approach by using the cross-border liabilities. Based on simple continuity, we assumed that the network intensity parameters exert a similar effect on each country. To be precise, we assume this network intensity parameter to be 0.5, which is related to the mean estimate obtained in Sect. 6. Other studies, including Blasques et al. (2016), found the estimate to be higher (approximately 0.7). Figure 4 shows how the structural model responds to network exposure across the entire sample period. The blue bar represents the structural systematic component, and the yellow bar is the idiosyncratic component. The orange bar is the absolute contribution of network exposure to change in the systematic component while the purple bar is the absolute contribution of network exposure to change in the idiosyncratic component.

Turkey, Romania and Argentina had greater values of idiosyncratic volatility than other economies with smaller estimates. We observed that the systematic component was predominant in most economies compared to the idiosyncratic volatility. The effect of network exposure on systematic component was higher (represented by the size of the orange bars in Fig. 4) than on idiosyncratic component, with the exception of Turkey, Argentina and Romania.

Figure 5 shows the contribution of network exposure on the structural model in different periods. On average, the idiosyncratic volatility of Turkey was still dominant in Phase 1 but reduced in all other phases. We can relate Turkey’s high idiosyncratic volatility to the banking crisis that led to capital flight and recession in the economy at the end of 2000. This demonstrates that Turkey’s banking crisis was largely idiosyncratic even though it could have been triggered by other external factors. Higher idiosyncratic volatility also explains the ability of Turkey’s investors (who are mostly foreign) to diversify their portfolios. Turkey’s idiosyncratic volatility seemed to diminish in Phase 2. Surprisingly, we expected it to increase due to the GFC. This may have happened due to Turkey’s restructure of its financial system after the banking crisis in 2001.

The results in Phase 1 for all other countries shows that the network contribution to the idiosyncratic component is almost irrelevant. A possible suggestion is that the network exposure has a diversifying effect on the idiosyncratic component. The network contribution to the systematic component was large; thus, it has an amplifying effect on the systematic component. The results in all other phases indicate that network exposure has a greater impact on the systematic component and less impact on idiosyncratic volatility. These results support the notion that network exposure contributes to spreading and diversifying risks.

Effect of network exposures with decreased interconnectedness. The figures show how the contribution of network exposure to both systematic and idiosyncratic volatility changed with reduced interconnections between markets. This involved using a sparse weighting matrix. The period covered in the sample is 1 January 1999–31 December 2017

In general, our contribution highlights the distinction between the spreading and sharing of sharing. From Fig. 5, it can be observed that the presence of network exposure increases systematic risk and reduces idiosyncratic risk. Institutions with increased unsecured borrowing and lending have a higher chance of receiving and spreading shocks to other institutions. Figure 5 also reveals the changing nature of interconnections in the different phases. This is because we used a constant network intensity parameter while changing the connection matrix. Billio et al. (2015) reported similar results in which the presence of network effect increased the systematic component and decreased the idiosyncratic component. With the increase in network intensity parameters (from 0.5 to 0.75), the financial system became more vulnerable to shocks and benefited more from diversification. If the network intensity parameter is decreased from 0.5 to 0.25, there will be a decrease in shock spreading and a reduced diversification effect. These results are consistent with recent studies that showed that the presence of interconnection increases vulnerability in the financial system while also helping to diversify risks.Footnote 8 The results also indicate that network exposure had greater impact in Phases 2, 3 and 4 than Phase 1. This is attributable to the GFC in Phase 2, EDC in Phase 3 and Chinese market crash in Phase 4.

Effect of network exposures with increased interconnectedness. The figure shows how the contribution of network exposure to both systematic and idiosyncratic volatility changed with increased interconnections between markets. This involved using a denser connection matrix. The period covered in the sample is 1 January 1999–31 December 2017

We also investigated the effect of network connectivity on the structural model. For our case, we used a sparse matrix to determine whether a decrease in network connectivity increased or decreased network exposure. We randomly generated the sparse matrix. As shown in Fig. 6, fewer interconnections in the financial system led to a reduction in the size of the bars. This suggests that having fewer interconnections reduces the magnitude of the spread of absorption of shocks .

We also used dense matrix to determine its effect on the structural model. Figure 7 shows the contribution of using denser weighting matrix in all sample periods. This weighting matrix was based on trade linkages. Trade linkages are denser because countries are more interlinked through bilateral trade. This figure shows that more interconnection in the financial system increases the systematic risk and reduces the idiosyncratic component. This implies that using a denser weighting matrix increases the network exposure and amplify shocks as well as diversify some shocks. Overall, our approach shows that an increase in network exposure significantly increases systematic shocks through risk spreading, and reduces idiosyncratic risk through diversification. Further, these results signify that a large degree of connectivity does not necessarily dampen risk exposure, but amplifies shocks in the financial system. This is consistent with Amini et al. (2016), who affirmed that an increase in network connection may lead to systemic instability.

5 Optimal value of the network intensity parameter

The next question to address is the estimation of the network intensity parameter (\(\rho\)), which captures the strength of the network exposure. This coefficient is also important, as it plays a key role in monitoring network exposure (Sect. 4). Different estimation methods have been proposed to estimate network intensity parameter, including ordinary least squares (OLS), maximum likelihood estimation (MLE), method of moments (MoM), two-stage least squares (2SLS) and the generalized method of moments (GMM).

5.1 Static network intensity parameter

We introduce the spatial autoregressive (SAR) model to measure network intensity parameter. We begin by considering a simple first-order (pure) SAR model, where ‘pure’ refers to the absence of exogenous regressors \((X_{n})\) as proposed by Anselin (1988) and is defined as:

where n is the number of observations, \(y = (y_{1},y_{2},\ldots,y_{n})'\) is a vector of observations on the dependent variable, W is \(n\times n\) exogenous connection matrices, \(\rho\) is a scalar representing the network intensity coefficient and \(\varepsilon = (\varepsilon _{1},\varepsilon _{2},\ldots,\varepsilon _{n})'\) as a vector of residuals assumed to be independent and identically distributed.

By rearranging Eq. (14), the error term yields:

LeSage and Pace (2009) describe the vector Wy as spatial lag representing a linear combination of the neighboring values to each observation. This is supported by Lee (2007), who shows that the influence in the neighboring asset is due to spatial effects.

Our first estimate of \(\rho\) is based on OLS. However, the OLS estimate of \(\rho\) is considered biased and inconsistent. Following Anselin (1988), the OLS estimate of \(\rho\) is denoted by \({\hat{p}}\) and given by,

An estimate of \(\rho\) is unbiased if \(E({\hat{p}})=p\). We prove below that \(E({\hat{p}})=p\).

Therefore, the OLS estimate is biased since the second term in Eq. (17) does not equal 0, \(E({\hat{p}})\ne p\). To show that the OLS estimate is inconsistent, Anselin (1988) demonstrated that the probability limit (plim) for the term \(y'W'\varepsilon\) is not 0 except in trivial cases when \(\varepsilon = 0\).Footnote 9 Since the OLS estimate is biased and inconsistent, we had to consider alternatives to estimate the network intensity parameter.

We first consider the MLE method because of its simplicity. According to LeSage and Pace (2009), the MLE for \(\rho\) requires identification of the value of the SAR coefficient that maximizes the likelihood function, given by:

The Jacobian function can be obtained through the differentiation of Eq. (15) with respect to the dependent variable y yielding:

where \(I_{n}\) is \(n\times n\) identity matrix. Substituting Eq. (19) for Eq. (18) gives:

Lee (2002) asserts that deriving the eigenvalue (\(\lambda\)) of the connection matrix W simplifies the computation problem. The natural logarithm of Eq. (20) is:

The natural logarithm can be further restructured by eliminating the residual parameter, \(\sigma ^{2}\). This is achieved by substituting with the error term, given by:

This yields to:

The parameter space of \(\rho\) requires that the determinants of \(I_{n} - \rho W\) to be strictly positive. A univariate optimization problem can be used to maximize the above expression with respect to \(\rho\). This implies that the optimal search of \(\rho\) estimates take feasible values within the range:

where \(\lambda _{min}\) is the minimum eigenvalue of the standardized matrix W while \(\lambda _{max}\) is the largest eigenvalue of the same matrix.

Equation (14) can be extended to investigate how network intensity changes with the presence of exogenous variables. The mixed-SAR model (see LeSage & Pace, 2009) can be written as:

where \(X = (X_{1},X_{2},\ldots,X_{n})\) a vector (\(n\times k\), and where k is the number of variables) of observations on the exogenous variables having \(\beta = (\beta _{1},\beta _{2},\ldots,\beta _{k})\) coefficients.

Rewriting Eq. (25) repeatedly yields:

Equation (26) clearly shows the effect of the weighting matrix in spreading shocks from one entity to the other until it diminishes leading to a steady-state.

Equation (25) can also be written in a more compact way as:

which provides a structure to the contemporaneous relationship based on the spatial proximity in association with the SAR model. Thus, the model includes contemporaneous relationships, driven by interconnections across different assets (markets), exogenous regressors and asset (market) specific shocks. Equation (27) is conveniently expressed in compact because our focus is to estimate the network intensity parameter, \(\rho\) which captures the endogenous effect of network exposure.

The general idea is to first construct a univariate optimization problem for the parameter \(\rho\). Following Anselin (1988) and LeSage and Pace (2009), this is done by maximizing the full likelihood function of the dependent variable with respect to the unknown parameters. This is given by:

The natural logarithm function in Eq. (28) can be specified as:

where

where \(\omega\) is the eigenvalue constructed from matrix W. The value of \(\rho\) is assumed to be bounded between 0 and 1. Next, we estimate each parameter in Eq. (29). This is done by solving the first-order derivatives of Eq. (29) with respect to the individual parameters.

-

Estimate of \(\beta\) by differentiating Eq. (29) with respect to \(\beta\). We obtain:

$$\begin{aligned} \begin{aligned} \frac{\partial ln(L)}{\partial \beta }&= 0\\ \frac{\partial ln(L)}{\partial \beta }&= \frac{\partial \Big (\frac{1}{2\sigma ^{2}}(y - \rho Wy - X\beta )'(y - \rho Wy - X\beta )\Big )}{\partial \beta }\\ 0&= \frac{\partial \Big (\frac{1}{2\sigma ^{2}}(y - \rho Wy - X\beta )'(y - \rho Wy - X\beta )\Big )}{\partial \beta }\\ 0&= \frac{1}{2\sigma ^{2}}(X'(y - \rho Wy) - X'X\beta )\\ \beta&= (X'X)^{-1}X'(I_{n} -\rho W)y \end{aligned} \end{aligned}$$(30)From Eq. (30), the estimate of \(\beta\) is:

$$\begin{aligned} {\hat{\beta }}&= (X'X)^{-1}X'(I_{n} -\rho W)y \end{aligned}$$(31)For simplicity, this can be written as:

$$\begin{aligned} {\hat{\beta }} = (X'X)^{-1}X'y - \rho (X'X)^{-1}X'Wy \end{aligned}$$(32) -

Estimate of \(\sigma ^{2}\) we differentiate Eq. (29) with respect to \(\sigma ^{2}\) to yield:

$$\begin{aligned} \begin{aligned} \frac{\partial ln(L)}{\partial \sigma ^{2}}&= 0\\ \frac{\partial ln(L)}{\partial \sigma ^{2}}&= \frac{\partial \Big ( -\frac{n}{2}\ln (\sigma ^{2}) + \frac{1}{2\sigma ^{2}}(y - \rho Wy - X\beta )'(y - \rho Wy - X\beta )\Big )}{\partial \sigma ^{2}} \\ 0&= -\frac{n}{2\sigma ^{2}} + \frac{1}{2(\sigma ^{2})^{2}}(y - \rho Wy - X\beta )'(y - \rho Wy - X\beta ) \\ 0&= -n + \frac{1}{\sigma ^{2}}(y - \rho Wy - X\beta )'(y - \rho Wy - X\beta ) \\ \sigma ^{2}&= \frac{(y - \rho Wy - X\beta )'(y - \rho Wy - X\beta )}{n}\\ \end{aligned} \end{aligned}$$(33)Thus, the estimate of \(\sigma ^{2}\) is given by:

$$\begin{aligned} \hat{\sigma ^{2}} = \frac{(y - \rho Wy - X\beta )'(y - \rho Wy - X\beta )}{n} \end{aligned}$$(34) -

Estimate of \(\rho\) unlike \(\beta\) and \(\sigma ^{2}\), which have closed form solutions, \(\rho\) needs to be estimated using optimization problem that maximizes Eq. (29) with respect to \(\rho\). By replacing estimates of \(\beta\) and \(\sigma ^{2}\) in Equation (29) and letting \({\hat{\delta }}_{0} = (X'X)^{-1}X'y\), \({\hat{\delta }}_{d} = (X'X)^{-1}X'Wy\) in Eq. (32), we have:

$$\begin{aligned} y = X{\hat{\delta }}_{0} + {\hat{e}}_{0} \quad \text {and} \quad Wy = X{\hat{\delta }}_{d} + {\hat{e}}_{d} \end{aligned}$$(35)which can be estimated by OLS. Thus, Eq. (32) can be rewritten as:

$$\begin{aligned} \begin{aligned} {\hat{\beta }}&= (X'X)^{-1}X'y - \rho (X'X)^{-1}X'Wy\\&= {\hat{\delta }}_{0} - \rho {\hat{\delta }}_{d} \end{aligned} \end{aligned}$$(36)The error term from Eq. (35) can be given by: \({\hat{e}}_{0} = y - X{\hat{\delta }}_{0}\) and \({\hat{e}}_{d} = Wy - X{\hat{\delta }}_{d}\). Substituting to \(\sigma ^{2}\) yields

$$\begin{aligned} \sigma ^{2} = \frac{(e_{0} - \rho e_{d})'(e_{0} - \rho e_{d})}{n} \end{aligned}$$(37)Using the results of \(\beta\) and \(\sigma ^{2}\), Eq. (29) becomes:

$$\begin{aligned} \begin{aligned} \ln L&= -\frac{n}{2}\ln (2\Pi ) - \frac{n}{2}\ln \Big (\frac{(e_{0} - \rho e_{d})'(e_{0} - \rho e_{d})}{n}\Big ) \\&\quad + \ln |I_{n} - \rho W| - \frac{1}{2}\\&= -\frac{n}{2}\ln (2\Pi ) - \frac{n}{2}\ln \Big ((e_{0} - \rho e_{d})'(e_{0} - \rho e_{d})\Big ) - \frac{n}{2}\ln (n)\\&\quad + \ln |I_{n} - \rho W| - \frac{1}{2} \end{aligned} \end{aligned}$$which can be written as:

$$\begin{aligned} \begin{aligned}&= c - \frac{n}{2}\ln \Big ((e_{0} - \rho e_{d})'(e_{0} - \rho e_{d})\Big ) + \ln |I_{n} - \rho W|\\ c&= -\frac{n}{2}\ln (2\Pi ) - \frac{n}{2}\ln (n) - \frac{1}{2} \end{aligned} \end{aligned}$$(38)Thus, to obtain the estimates of \(\rho\), we need to simplify the log-likelihood with respect to the scalar \(\rho\) and optimize the following equation:

$$\begin{aligned} \begin{pmatrix} f(\rho _{1})\\ f(\rho _{n})\\ \vdots \\ f(\rho _{r}) \end{pmatrix} = \begin{pmatrix} c - \frac{n}{2}\ln \Big ((e_{0} - \rho _{1} e_{d})'(e_{0} - \rho _{1} e_{d})\Big ) + \ln |I_{n} - \rho _{1}W| \\ c - \frac{n}{2}\ln \Big ((e_{0} - \rho _{2} e_{d})'(e_{0} - \rho _{2} e_{d})\Big ) + \ln |I_{n} - \rho _{2}W| \\ \vdots \\ c - \frac{n}{2}\ln \Big ((e_{0} - \rho _{r} e_{d})'(e_{0} - \rho _{r} e_{d})\Big ) + \ln |I_{n} - \rho _{r}W| \end{pmatrix} \end{aligned}$$(39)

5.2 Dynamic network intensity parameter

The static SAR model specified in Eq. (25) can be further extended to a dynamic SAR. This allows estimation of a time-varying network intensity parameter (\(\rho _{t}\)). This is useful in understanding how the spatial parameter changes over time. As pointed out by Blasques et al. (2016), time-varying network intensity parameters indicate how the spillover changes over time. We considered the case when we have constant volatility.

A time-varying SAR model with constant disturbances is defined as:

where \(\Sigma\) is constant over time.

Assuming constant disturbances allows us to investigate how the spatial parameter changes over a specific point in time. This is an important aspect of examining financial systems in which the volatility of returns is known to vary considerably between non-crisis and crisis periods (Blasques et al., 2016; Catania & Billé, 2017). The diagonal elements represent the time-conditional variances of the cross-sectional independent innovation at any given point in time. We impose diagonality assumption as the standard constant conditional correlation (CCC) and dynamic conditional correlation (DCC) model proposed by Engle (2002).

The generalized log-likelihood function of the constant (\(Lc_{t}\)) variance models becomes:

where

Allowing for time-varying variance in the shocks led to the following:

where

The generalized log-likelihood function of the time-varying (\(Lv_{t}\)) variance models becomes:

where

6 Empirical analysis

We use the MLE method to estimate the values of \(\rho\). MLE is preferred over OLS because of the limitations of OLS as discussed in Sect. 5.1. Despite the known limitations of OLS in estimating \(\rho\), Elhorst (2010) stated that the OLS estimate of \(\rho\) could serve as a guide of the expected true value. The initial OLS estimate of \(\rho\) for our data was 0.5327. Therefore, it is expected that the optimal value of the estimate of \(\rho\) will be within this range. Next, we estimate \(\rho\) using the MLE and allow the search to be within the range \(1/\lambda _{min}\)– \(1/\lambda _{max}\). The y vector is the average return of each country in our sample over the entire sample period, while we constrained W to lie within the interval {0,1} through the process of row standardization; using the row-normalized contiguity matrix of weights ensures that each row of the matrix sums to unity. The row-normalized matrix represents the portion of total liability that the source country/institution shares among its target nodes.

By estimating static network intensity parameter using a pure SAR model (Eq. 21), we ensure consistency with the extant spatial literature (Asgharian et al., 2013; Fernandez, 2011). The static network intensity parameter (which captures the endogenous effect of network exposure) is estimated at each phase. We begin the estimation by excluding additional explanatory variables. Table 6 contains the static network intensity estimates with their corresponding standard errors in parentheses. The estimate for the whole sample was 0.5072 with a small standard error of 0.0043. This is close enough to the estimate obtained using OLS (0.5327) and represents the potential impact of the parameter on the entire network. Comparing estimates in the different phases, the network intensity parameter was higher in Phase 2 (0.6134). From Fig. 8, we observed a more than 30% increase in the estimate from Phase 1 to 2. It only increased by 16% in Phase 3 which is approximately half the increase reported for Phase 2.

From the static network intensity results in Table 6 and Fig. 8, it is evident that network intensity increased drastically in Phase 2 (corresponding to the GFC), followed by in phase 3 (associated with the EDC) compared to the other two phases. This is consistent with the finding of Blasques et al. (2016), who used the CDS data of big players in Europe to show that network intensity is higher when the financial system is under stress, suggesting higher spillover in the financial system. Our results also reveal that the GFC, which is associated with large network intensity, had a severe impact on the entire financial system compared to the EDC. The GFC spread throughout the entire network while the EDC severely affected only European countries.

Overall, we can conclude that increases in network intensity estimate could be associated with periods when the financial system is under stress. This is in line with Hypothesis 1, which states that higher network intensity could be associated with crises. For instance, higher estimates in Phase 2 corresponded to GFC; in Phase 3, they could be associated with the EDC. Finally, in Phase 4, they could correspond to the Chinese market crash of 2015 (Alter & Beyer, 2014; Black et al., 2016; Yu et al., 2017).

The increase in the estimate during times of stress could have an economic effect. Large network intensity estimates are assumed to signify higher propagation strength of a shock to the entire system. This is because of high interconnectedness, which increases network exposure, and thus, may increase fragility in the financial system (Minoiu & Reyes, 2013). We can relate this to the findings of Tonzer (2015) and argue that high network intensity is associated with increased cross-border exposures.Footnote 10 Our findings are also similar to those of Cao et al. (2017), who found that cross-border linkages tend to increase during crises. This could be a signal of greater propagation of shock when institutions are under distress.

To capture the dynamics of the network intensity parameter, we conduct an estimation using a 251-day (one-year horizon) rolling window. We investigate how network intensity changed over time. A one-year period is assumed to be adequate to capture any significant change in economies. Before estimating the parameter, it would be interesting to determine if the estimates differed using a constant initial value of \(\rho\) and a changing initial value of \(\rho\) at each point in time (the initial value will be used as the starting values in search of the real values in our optimization problem). To proxy the initial changing values of \(\rho\), we assume the pattern of the network intensity parameter to be same as those used by Blasques et al. (2016).Footnote 11 Specifically, we assumed the following: constant (\(\rho _{t} = 0.5\)), sine (\(\rho _{t} = 0.5 + 0.4*cos(2\pi t/200\)), fast sine (\(\rho _{t} = 0.5 + 0.4*cos(2\pi t/20\)) and step (\(\rho _{t} = 0.9 - 0.5*(k > 500)\)). We estimate the network intensity parameters by both excluding and including the additional explanatory regressors.

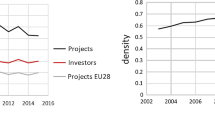

Network intensity estimates for the entire period. The figures display the network effect for the whole sample period without regressors. The light areas are the 95% confident intervals with the horizontal line representing average estimate in the whole period. Figure 9a presents the dynamic estimates obtained with an assumption of constant (\(\rho = 0.5\)) initial value while Fig. 9b displays the estimates obtained using changing initial value (it follows \(\rho _{t} = 0.5 + 0.4*cos(2\pi t/200)\)). Figure 9c presents network intensity estimates using sparse matrix. The period covered in the sample is 1 January 1999–31 December 2017

The evolution of the network intensity parameter for the whole sample with the 95% confidence intervals are presented in Fig. 9a–c. In terms of whether using the different initialization of \(\rho\) within the range of 0 and 1 leads to different estimates, our results indicate that dynamic network intensity estimates are identical when using any specification of \(\rho\) within (0,1). Next, we investigate whether using varying initial values of \(\rho\) would result in different estimates of the network intensity coefficient. The results in Fig. 9a and b show that both initializations of \(\rho\) produce similar plots. The implication here is that dynamic network intensity estimates does not necessarily depend on the initial value of \(\rho\).

Figure 9a and b clearly show that the network intensity parameter changes over time. This is consistent with other studies, such as Forbes and Rigobon (2002), who stated that spillover is time variant. We also observed that estimates oscillated between 0.2 and 0.8, which signifies a higher variation of propagation chance of shock hitting specific nodes in the network. There is a notable repetition of similar trends of network intensity estimates in that estimates were lower before a crisis and increased during the crisis. This is an indicator of higher propagation of shocks to the system. This finding supports Hypothesis 1, which associates high network intensity to periods of stress, which could be due to increased interconnectedness resulting in fragility of the entire financial system.

In general, higher network intensity estimates in Fig. 9a and b coincide with past major events in the financial sector that include:

-

the dot-com bubble in 2002

-

the second war in Iraq in 2003

-

the GFC between 2007 and 2009

-

the EDC in May 2010

-

the rapid fall of prices of gold in early 2013

-

Chinese stock market turbulence in 2015.

These results imply that network intensity tends to increase during times of stress, which could be associated with an increase in interconnectedness in the financial system (Geraci & Gnabo, 2018). Additionally, the results indicate financial contagion inthe financial system (Hung, 2021). These findings are supported by Blasques et al. (2016), who related high network intensity to increased spillover in the financial system. These findings are similar to Cao et al. (2017), who reported that cross-border linkages tend to increase during crisis periods. Conversely, larger network intensity—especially during times of stress—are associated with increased cross-border lending, which results in transmission of stronger shocks between markets. Previous research by Tonzer (2015) and Sun and Chan-Lau (2017) supports this reasoning. They found that foreign exposures play a significant role in spreading risk. This implies that countries are exposed more to more risks due to large exposure from trading partners. The high network intensity across markets signifies the strong exposure of a shock to the entire financial system (Forbes & Rigobon, 2002).

Network intensity estimates in different phases. The plots display the network effect for the whole sample period in each phase. The light areas are the 95% confident intervals while the horizontal line is the is the average estimate in the entire period. The period covered in the sample is 1 January 1999–31 December 2017

To check Hypothesis 2, we use an alternative sparse matrix to estimate network intensity parameter. The sparse matrix provides us with an idea of how the degree of interconnection in a financial system affects estimation of network intensity parameter. We use a randomly generated sparse network matrix with the exception of main diagonal taking zeros. Figure 9c shows the dynamic estimates of the network intensity parameter obtained using sparse matrix with 95% confidence intervals. From this figure, we observe that network intensity estimates shift downwards when sparse weighting matrix is used. The dynamics of network intensity in Fig. 9c differ from those in Fig. 9a. The results also indicate that interconnectedness among financial markets changes the patterns of network intensity over time. A more stable economy with higher network connectivity would be beneficial in shock absorption, leading to a more resilient financial system. The converse is also true. Further, these results imply that as the degree of connectivity increases (decreases), then network intensity parameter shifts upwards (downwards). As a result, the degree of interconnection plays a key role in the estimation of network intensity parameters. These findings are consistent with previous studies. For instance, Silva et al. (2016) found that shocks spread from highly interconnected networks, leading to financial distress in the entire financial system. This is also supported by Amini et al. (2016), who showed that financial market with larger connections is associated with spreading shocks in the network, leading to financial instability. As Minoiu and Reyes (2013) described the financial network as volatile, we expect this to have an impact on the estimation of network intensity parameters.

To obtain a clearer picture of the evolution of network intensity, we obtain the values of the estimates at each phase. Figure 10 displays the dynamic network intensity coefficients at each phase. From these, we draw a similar conclusion those drawn from the static estimates. On average, these estimates are lower in Phase 1 than in other phases, and increase in Phase 2. The network intensity parameter remains higher in Phase 3 (after the crisis and during the EDC). This suggests that network intensity tends to be higher when the market is under stress. Blasques et al. (2016), who used European CDS data, arrived at a similar conclusion.

6.1 Impact of exogenous factors on the estimation

Next, we investigate the marginal effects of the explanatory variables on the estimation of network intensity (Eq. 28). The beta coefficient of the model represents the exogenous exposure to the common factors, while the network intensity parameter captures the endogenous effect of the network exposure in the model. All these external regressors are country-specific. They include volatility index, FX and IR. Volatility index captures the change in risk appetite, which gauges the overall market sentiment. It is measured using the implied volatility of the world index. We considered implied volatilities of two major stock indices, VIX and VSTOXX, because of the unavailability of individual country data.

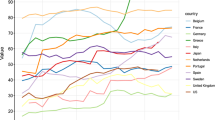

Figure 11 shows the trend of the implied volatility of these stock indices. We use these two major implied volatility indices to investigate the impact on network intensity estimation. It can be observed in Fig. 11 that the implied volatility depicts similar patterns. For example, during the GFC of 2007–2009, the two indices reached their peak over the whole period. We also observe a comparable shift in the magnitude of volatility at different points in time. High spikes in the implied volatility were associated with periods when financial markets were under stress. For instance, the spikes in 2002 are associated with the dot-com bubble, those in 2003 are associated with war in Iraq (Degiannakis et al., 2018), 2007–2009 spikes were associated with the GFC, 2010 spikes with the EDC, 2013 with the rapid fall of prices of gold and 2015 with turbulence in the Chinese stock market.