Abstract

This paper investigates the relationship between profit efficiency, finance and innovation. By adopting stochastic frontiers, we pioneer the use of a novel dataset merging firm level survey data with balance sheet information for a large sample of European companies. We find that firms having difficulties in access to finance as well as firms introducing product innovation display an incentive to improve their efficiency. While innovation produces benefit for firms’ profitability, financial constraints impose a discipline to the firms forcing them to cut unproductive costs that reduce the profitability. We document nuanced differences between firms in industry and services, while they are more pronounced when we look at disaggregation across High-Tech and Low-Tech companies. From a policy perspective, our results enrich the understanding on the link between innovation, financial constraints and efficiency, which goes beyond the idea that easier access to finance is the panacea to get higher performance.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

This study assesses how firms’ performances can stem from innovation efforts and financial friction in credit access by using the perspective of the economic efficiency approach.

From a broader perspective, the relation between performance, innovation growth and their links with finance has been well documented in the literature (Acemoglu et al., 2006; Aghion et al., 2010; Bartelsman et al., 2013; Love & Roper, 2015). Technological innovation is indeed a critical element in enhancing and fostering firm performance and therefore is considered a conductor of economic development (Acemoglu et al., 2006; Aghion & Howitt, 1998; Archibugi & Coco, 2004; Goedhuys & Veugelers, 2012; Grossman & Helpman, 1991; Romer, 1990). Through research and development (R&D) activities, firms are able to launch new products and services for the market, which allow them to attain a strategic advantage over competitors (see among others, Dosi et al., 2015; Love & Roper, 2015; Ferreira & Dionísio, 2016).

The literature has also underlined that the growth ambitions of firms are often compromised or weakened by the presence of financial constraints, which are particularly binding for small- and medium- sized enterprises (SMEs) that often suffer from lack of transparencies on their credit records, lack of own capital and ability to provide collateral (Acharya & Xu, 2017; Becker, 2015; Cowan et al., 2015; Pigini et al., 2016).When financial frictions are strong, such as during the recent great financial crisis (Agénor & Pereira da Silva, 2017; Carbo-Valverde et al., 2015), enterprises tend to counteract their adverse impact on profitability by reducing investment activities and, in particular, by abandoning innovation projects (García-Quevedo et al. 2018).

However, looking closely at the complex links of firm efficiency with innovation and financial constraints, we discover that they remained largely unexplored in the literature and they deserve additional scrutiny. More specifically, while few studies—closely related with our research target—have investigated the interplay between efficiency and financial constraints (Bhaumik et al., 2012; Maietta & Sena, 2010; Sena, 2006; Wang, 2003), the academic research directly focusing on the relation between innovation and firm profit efficiency is relatively scant. In fact, the literature has rather concentrated on the link between innovation and firm profitability or firm performance from one side (i.e., Koellinger, 2008; Lööf & Heshmati, 2006; Shao & Lin, 2016), and on the effect of R&D activities on innovation efficiency, from the other side (i.e., Yang et al., 2020; Zhang et al., 2018). Furthermore, by focusing on productivity, several studies have explored the effects that financial constraints will exert on firm productivity—without tackling the perspective of economic efficiency (Butler & Cornaggia, 2011; Ferrando & Ruggieri, 2018; Jin et al., 2019; Midrigan & Xu, 2014). Others have focused on the link between innovation efforts and firm productivity (Calza et al., 2018; Dabla-Norris et al., 2012; Dai & Sun, 2021; Kumbhakar et al., 2012), showing that enterprises, particularly European ones, display a low ability to translate R&D activities into productivity gains (Castellani et al., 2019; Ortega-Argilés et al., 2015).

Building on these research inputs, our paper aims at filling the gap in the literature by providing, in a unified framework, novel evidence on whether innovations efforts and obstacles in access to finance affect firms’ profit efficiency. The empirical analysis relies on a unique firm-level dataset comprising a large sample of European SMEs and large enterprises over the period 2012–2017. The investigation compares firm profit performance across sectors taking into account also the technological and knowledge-intensive content of their activities.

Our main contributions to the literature move along the following three dimensions.

First, to the best of our knowledge, there are no other studies that test in a unified framework whether innovation efforts and financial constraints exert a significant effect on firms’ performance. In particular, we enrich our understanding on firms’ performance by adopting the stochastic frontier approach (SFA) to estimate profits functions and to obtain efficiency scores for a sample of European firms.

As well known in the literature, profit efficiency measures the distance between the current profit of a firm and the efficient profit frontier (Berger & Mester, 1997). Compared to cost/revenue efficiency and other measures based on financial ratios, profit efficiency is able to account for the overall firm performance (Arbelo et al., 2021; Chen et al., 2015; Pilar et al., 2018).

To estimate profit frontiers, we prefer to use the SFA, proposed by Battese and Coelli (1995), which offers several theoretical and empirical advantages. First, it allows to formulate a model for inefficiency in terms of observable variables (Coelli et al., 2005; Kumbhakar & Lovell, 2000) and second, by exploiting the panel dimension of the data, it allows to overcome the shortcomings of time-invariant firm-level inefficiency, while benefitting from easier identification and smaller bias (Cornwell & Smith, 2008; Greene, 2005, among others).

Second, we pioneer the use of a novel dataset that merges firms’ survey-based replies derived from the European Central Bank Survey on access to finance for enterprises (ECB SAFE) with their financial statements—taken from AMADEUS by Bureau van Dijk (BvD). From the survey data, we retrieve harmonized and homogeneous information on several aspects of financial constraints and innovation for a large set of European countries. From the financial statements, we make use of output and input variables to be included in the production frontier as well as of other financial information useful to define firms’ characteristics. In fact, this unique dataset allows us to rely on various indicators of financial constraints and innovation activities. The literature has underlined the difficulties in directly measuring the financial constraints and have relied on indirect proxies (Farre-Mensa & Ljungqvist, 2016). By contrast, we use both perceived and objective indicators of financial constraints based on the qualitative responses of surveyed firms and we complement them with a quantitative measure based on the cash flow available to firms (Fazzari et al., 1988).

Third, to consider the different technologies and production functions across sectors, we complement our dataset with the Eurostat classification on high-technology/knowledge-intensive sectors. We then estimate different frontiers for two main productive sectors—Industry and Services—and for two main technological sectors—High-technology and Low-technology sectors- as well as for their subsectors, up to 5 distinct macro sectors.

This approach allows us to exploit an alternative sectoral heterogeneity—in a similar fashion to Baum et al. (2017) and to Pellegrino and Piva (2020)—which might bring novel evidence on the topic. In fact, high-technology/knowledge-intensive companies in industry and services turn to be more like to each other than high technology/knowledge-intensive and low technology/knowledge intensive within the two sectors.

Based on a variety of model specifications, we document that innovation has an important impact on firms’ profit efficiency. Additionally, bearing in mind that policymakers and economists generally agree that well-functioning financial institutions and markets contribute to economic growth (Urbano & Alvarez, 2014), we provide evidence that, in the presence of market failure, financial constraints induce firms to improve efficiency. We also contribute to the literature by providing novel evidence on the effects of debt maturity and the cost of debt for the efficiency decisions of firms. We find that firms with long-term debt tend to increase efficiency. As for the cost of debt, the impact is different depending on the sector in which a firm operates. More precisely, firms operating in Services seem to have more stringent cost burden on the debt side impacting negatively on profit efficiency. An opposite picture emerges for firms in the manufacturing sector. This supposedly occurs because of a better bank-firm relation that seems to favor firms operating in the traditional manufacturing sector. Finally, we document the presence of heterogeneity across technology and knowledge-based sectors. Specifically, for high-technology and high-knowledge-intensive companies product innovation has a strong positive impact on profit efficiency, while for low-technology and low-knowledge-intensive companies product innovations negatively affect firms’ efficiency.

The rest of the paper is organized as follows. The next section highlights the theoretical background and the research hypotheses. In Sect. 3 we present the methodological issues, and we describe the firm-level database as well as the empirical models. The estimated results are presented in Sect. 4, while the last section concludes.

2 Theoretical background and research hypotheses

Efficiency in production function focuses on the relationship between inputs and outputs, and a production plan is called efficient if it is not possible to produce more using the same inputs, or to reduce these inputs leaving the output unchanged (Farrell, 1957). The presence of frictions either in terms of agency problems, lags between the choice of the plan and its implementation or inertia in human behavior and bad management, can drive observable data away from the optimum production plan (Leibenstein, 1978) and create instances of technical inefficiency.

Focusing on the economic efficiency perspective to assess firms’ performance, in this section we shortly refer to the theoretical and empirical evidence related to our research. From one side we consider the link between performance, profit efficiency and financial constraints; on the other side the link between performance, profit efficiency and innovation. Building on those links we develop our research hypotheses that provide the backbone of our empirical model.

2.1 Performance, technical efficiency and financial constraints

It is well known that financial frictions influence firm performance (Farre-Mensa & Ljungqvist, 2016) and the issue of financial constraints has been investigated in literature using different theoretical perspectives, such as monetary policy (Bernanke et al., 1996), corporate finance (Hanousek et al., 2015) and entrepreneurship (Kerr & Nanda, 2009, Kerr & Nanda, 2015).

Looking at the link between finance and productivity, some studies argue that lower financial constraints exert a positive effect on productivity and growth (Aghion et al., 2010, and Aghion et al., 2012, for France, and Manaresi & Pierri, 2017, for Italy) as firms exposed to higher financial constraints lower their investment, in particular on assets that have a strong impact on productivity. By contrast, the strand of the literature focusing on the cleansing “Schumpeterian” effect of financial constraints points to the fact that the highest productive firms crowd out the least efficient ones. In the environment of low real interest rates and low financial constraints which characterized the period just before the financial crisis, the cleansing mechanism has been weakened with a detrimental impact on average productive growth (Cette et al., 2016; Gopinath et al., 2017). Interestingly, Jin et al. (2019) show that financial constraints might have two opposite effects on the firm productivity: from one side financial constraints increase productivity because they force to clean-out “sub-optimal investment”; on the other side they harm productivity, because the scarcity of financial resources reduce the “productivity-enhancing investment”.

If we look at the effect that financial constraints exert on firm efficiency, it is indisputable that the increase in the cost of borrowing has a negative impact on firms’ performance in terms of investment activity. Due to the presence of information asymmetries, borrowing external funds for firms turn to be more expensive than using internal finance (Nickell & Nicolitsas, 1999). In presence of binding financial frictions, enterprises tend to counteract their adverse impact on profitability by reducing investment activities and improving their efficiency in order to reduce the risk of failure (Bhaumik et al., 2012; Maietta & Sena, 2010; Sena, 2006).

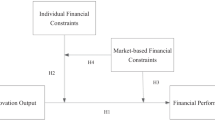

The preceding arguments lead us to test whether being financially constrained has an impact on firms profit efficiency, by formulating the following hypothesis:

H1

Binding finance constraints exert a positive effect on firms’ efficiency, as debt constrained firms try to reduce their risk of failure.

While this hypothesis has already been researched in the literature, our empirical testing based on survey and balance sheet data is quite novel and could contribute to the actual debate.

2.2 Performance, technical efficiency and innovation

Our second working hypothesis relates to the innovative activity of companies. While it is easily recognized the central role of innovation as engine of economic growth (Grossman & Helpman, 1991; Romer, 1990; Solow, 1957), the relationship between innovation and efficiency in production is more complex and contingent to several factors.

Starting from the seminal work of Griliches (1979), the literature has investigated the impact of R&D activities on productivity. Innovation can cause shifts outwards in the production frontier and this in turn might reduce the inefficiency of firms that do not lie on the technical efficient frontier (Aghion et al., 2005; Nickell, 1996). More recently, a stream of the literature has documented that R&D activities contribute—with different nuances—in improving firm productivity (Heshmati & Kim, 2011; Janz et al., 2004; Klette & Kortum, 2004; Lööf & Heshmati, 2006; Ugur et al., 2016), especially for high-tech sector (Castellani et al., 2019; Kumbhakar et al., 2012; Ortega-Argilés et al., 2015).

However, if innovation efforts are just inputs and do not generate innovation outputs they shall be considered as sunk costs that do not necessarily increase firm performance (Koellinger, 2008). Additionally, some scholars have also underlined the limited ability of firms, particularly European ones, in translating R&D efforts into productivity gains (Castellani et al., 2019; Ortega-Argilés et al., 2015).

Looking more closely at the stream of literature on the impact of innovation on profitability, many papers provide support to a positive relationship (Cefis & Ciccarelli, 2005; Geroski et al., 1993; Leiponen, 2000; Lööf & Heshmati, 2006), which may arise because either innovative firms are able to shield their new products from competition, or they display higher internal capabilities, compared to non-innovators (Love et al., 2009).

By contrast, other studies do not find a clear relationship between technological innovation and firm performance (Díaz-Díaz et al., 2008), when analyzing either short term effects (Deeds, 2001; George et al., 2002; Le et al., 2006) or long term indirect effects (Schroeder et al., 2002). Furthermore, the empirical evidence on the linkages between innovation and efficiency is mixed and, in some cases, it even documents a trade-off between them (Zorzo et al., 2017).

The link between innovation and performance is crucial also for the productivity literature that recognizes the strategic role of profit-seeking entrepreneurs investing on R&D activities for higher productivity, and, consequently, for higher economic growth (Bravo-Ortega & García-Marín, 2011; Castellani et al., 2019; Foster et al., 2008; Kumbhakar et al., 2012; O’Mahony & Vecchi, 2009; Ortega-Argilés et al., 2015).

We bring new evidence to the extant contributions by employing the economic efficiency approach to measure firm performance. As we focus on the output of innovation efforts (product innovation introduced by firms) rather than the inputs of innovations efforts (R&D investments), in our investigation we look at the subsequent efficiency gains stemming from increasing revenues.

Consequently, we would like to investigate whether undertaking innovation exerts an effect on firms’ profit efficiency by formulating our second working hypothesis as follows:

H2

Innovation output improves profit efficiency, as the developments of new products or services are aimed at attaining a strategic advantage over competitors and leveraging revenues.

3 Empirical setting

3.1 Stochastic frontier approach

In the previous section we introduced the theoretical reasoning of why the presence of financing constraints and the innovation efforts of firms may have a positive impact on profit efficiency. To test these hypotheses, we estimate the profit functions by employing the SFA, which is a stochastic method that allows companies to be distant from the frontier also for randomness (Aigner et al., 1977; Meeusen & van den Broeck, 1977).Footnote 1 The SFA is a parametric method, which means that it assigns a distribution function to the stochastic component of the model and, thus, allows making inference. In our analysis we make use of the specification introduced by Battese and Coelli (1995), which permits the simultaneous estimation of the stochastic frontier and the inefficiency model, given appropriate distributional assumptions associated with panel data. This approach improves, in terms of consistency, previous modeling based on two-step approaches.Footnote 2

We estimate a two-inputs-one-output model described by the following Translog profit frontier.Footnote 3

where the dependent variable is the natural logarithm of value added over the cost of fixed asset calculated for each firm i at time t.Footnote 4 Additionally, y represents the output and is equal to the operating revenues; wl is the cost of labor (measured as the ratio between the personnel expenses and the number of employees), wk is the cost of fixed assets (measured as the ratio between the depreciation and total amount of fixed assets); α, β, δ and \(\gamma\) are the parameters to be estimated; v is the random error; u is the inefficiency. In the profit frontier, the inefficiency tends to reduce the profit, thus the composite error is equal to (v-u).

Equation (1) is an alternative profit function since it depends on inputs and output, whereas actual profits depend on the prices of outputs. It uses the same variables as for a cost function, implying that output-prices are free to vary (Huizinga et al., 2001).Footnote 5,Footnote 6

The specification includes also a set of control dummies (controls) to guarantee that the efficiency scores are net of additional heterogeneity: at country level, c, to exclude any geographical and institutional fixed effect; at firm size level s, to take care of the possibility of different shifts in the frontier for different group of firms (Micro, Small and Medium)Footnote 7 and at each survey round t to control for the dynamics over time.

We also take into account the different technologies and production functions across sectors by estimating different frontiers for several productive sectors: Industry and Services and also two technological sectors—High-tech and Low-tech sectors- using the Eurostat classification.Footnote 8

From the Eq. (1), profit efficiency (PE) is the ratio between the observed firms’ profit and the maximum level of profit achievable in case of full efficiency:

where Fp(.) indicates a generic profit function in which the profit is obtainable from producing y at input price w.

Finally, we assume that vit is normally distributed with mean zero and uit is distributed as a truncated Normal, as proposed by Battese and Coelli (1995), we estimate the following inefficiency equation:

where i indicates the ith firm, j the country, t is time and eit the random component.

Efficiency is time-varying, ensuring a change in the relative ranking among enterprises, which accommodates the case where an initially inefficient firm becomes more efficient over time and vice versa.

To test the effect of the determinants of firms’ efficiency, we simultaneously estimate Eqs. (1) and (3), by employing the following covariates for the Eq. (3):

(i) Finance constraintsit includes a set of variables able to capture firms’ experience in their access to finance. We consider three different alternative proxies of financial constraints. First, we use the ratio between cash flow and total assets (Cash flow/Total assetsit), as the dependence to internal finance represents a particularly binding constraint for firms to finance investment (Fazzari et al., 1988; Guariglia & Liu, 2014; Sasidharan et al., 2015). We are aware of the criticism of the subsequent literature on the use of this indicator (starting by Kaplan & Zingales, 1995, and recently summarized in Farre-Mensa & Ljungqvist, 2016). For this reason, we turn to the information derived from the survey to define financial constrained firms.

Our second proxy of financial constraint is derived directly from the survey information. Problem of Financeit captures firms’ perception of potential financing constraints. It is a dummy equal to one if firms reported that access to finance represents the most relevant problem among a set of other problems (competition, finding customers, costs of production or labor, availability of skilled staffs and business regulation), and 0 otherwise.

Our third financial friction indicator—Finance obstaclesit—is an “objective” measure of credit constraints, also derived from the survey. This dummy variable indicates firms as financially constrained if they report that: (1) their loan applications were rejected; (2) only a limited amount of credit was granted; (3) they themselves rejected the loan offer because the borrowing costs were too high, or (4) they did not apply for a loan for fear of rejection (i.e. discouraged borrowers). The indicator is equal to one if at least one of the above conditions (1–4) is verified, and 0 otherwise.

As shown in Ferrando and Mulier (2015), firms that self-report finance as the largest obstacle for their business activity display often different characteristics compared with financially constrained firms. For instance, the authors find that more profitable firms are less likely to face actual financing constraints, while firms are more likely to perceive access to finance problematic when they have more debt with short term maturity. For this reason, we consider both indicators in our analysis.

(ii) Product innovationit: is a dummy equal to one if a firm declares in the survey to have undertaken product innovation, and 0 otherwise.Footnote 9 It is worth noting that this variable has the advantage of providing direct information on the innovation undertaken by the firms, rather than the information on R&D investments, which do not necessarily turn into product innovation outcome. This is for us relevant as we need to assess how the innovation output will impact on revenues and therefore on profit efficiency.

(iii) In addition, we use some firm-varying covariates describing firms’ market and debt conditions, Firm controlsit. To capture the change in profitability—in a similar fashion to Srairi (2010) and to Luo et al. (2016)—we rely on two alternative measures. The first is Profit marginit, defined as net income divided by sales and the second Profit upit which is a dummy equal to one if the firm has experienced an increase in profit in the past six months, and 0 otherwise.Footnote 10 We proxy firms’ debt conditions using the dummy Leverage upit which is equal to one if the firm has experienced an increase in the ratio debt/assets in the past six months, and 0 otherwise. In some specifications, we consider also the maturity structure of indebtedness and the debt burden in terms of interest expenses paid on total debt. Both variables are derived from the financial statements as explained in detail in the next section.

Finally, we use the real GDP growth rate as an additional time-country varying control for the business cycle, named macroeconomic controls (Ferrando et al., 2017).

3.2 Data

In order to test our hypotheses, we rely on a novel dataset that merges survey-based data derived from the ECB SAFE with detailed balance sheet and profit and loss information gathered from BvD AMADEUS. We also augmented firm level data with the firms´ technological intensity provided by the Eurostat classification on high-tech industry and knowledge-intensive services.

SAFE gathers information about access to finance for non-financial enterprises in the European Union. It is an on-going survey conducted on behalf of the European Commission and the European Central Bank every 6 months since 2009. The sample of interviewed firms is randomly selected from the Dun and Bradstreet database and it is stratified by firm-size class, economic activity and country. The firms´ selection guarantees satisfactory representation at the country level.

The combined dataset has several advantages. First, we retrieve harmonized and homogeneous information on several aspects of financial constraints and innovation from the survey dimension of the dataset. Second, we can use output and input variables to be included in the production frontier as well as other firm-level information useful to pursue our research trajectory (e.g. leverage compositions and profitability measures). Third, we are also able to disentangle the different technological characteristics of the firms, high-, medium-, low-technology industries, and knowledge-intensive and less knowledge-intensive services.

Our investigation is based on firms belonging to the following eight European countries (Austria, Belgium, France, Finland, Germany, Italy, Portugal and Spain)Footnote 11 observed from wave 8th (second part of 2012)Footnote 12 until wave 17th (first part of 2017).

Moreover, we focus our analysis only on firms belonging to Industry and Services.Footnote 13 Our choice is driven by the following considerations. (i) they are the largest sectors (Industry accounts for about 19% of European GDP, and Services account for about two thirds of European value added (Eurostat Data, 2016). (ii) they have displayed divergent trends in recent years in terms of shares of value added to GDP with a declining trend for Industry and an increasing one for Services (Stehrer et al., 2015). (iii) the two sectors differ also for their efficient allocation of resources as shown by the allocative efficiency index, which is particularly low for the Services (European Commission, 2013).

Our starting sample includes almost 30,000 observations, of which 53% are from the Industry sector and 47% from the Services sector. Once we take into consideration the variable Product innovation, the sample reduces more than half to 7279 observations for Industry and 5864 for Services. Table 1 displays some descriptive statistics of the variables used in defining the frontiers (Panel A) and the determinants of efficiency (Panel B) for both sectors of activities. All balance sheet data are deflated using HICP index.

Regarding the production factors in Panel A, firms in Industry report on average higher operating revenues with lower labor and capital costs than firms in Services. Moreover, they are also on average bigger than firms in Services in terms of numbers of employees. From Panel B, our sample is mostly composed by SMEs by construction of the survey.Footnote 14 13.6% of firms in Industry and 14.3% in Services perceived access to finance as a major problem. A slightly lower percentage of firms (around 11%) are financially constrained according to the objective indicator Finance obstacles. Regarding the innovative activity, around 46% and 31% of firms have indicated that they introduced product innovation in the previous six months in Industry and Services, respectively.

Turning to firms’ financial position, the average firm in our sample is profitable with a profit margin of 1.7% in both sectors, although looking at the distribution we see that at least 10% of all firms in our sample are reporting losses. On average, firms in our sample can generate internal funds (6.6% and 7.5% of total assets for Industry and Services, respectively). At the same time, at least 19% of companies are reporting increasing debt to total assets in the previous six months (Leverage up). In the table we report also some additional financial ratios to quantify better the financial conditions of firms in the sample: financial leverage and return on equity (ROE).Footnote 15 On average, firms have a financial debt which is around 22% of total assets, while the return on equity ratios are just above 3%. This latter ratio, although relatively low, shows some efficiency by firms in using their equity. It also emerges from the survey that the use of bank loans and credit lines are more relevant for firms operating in Industry (37% and 47%) than in Services (28% and 38%).Footnote 16 Looking at the debt maturity structure, firms in the manufacturing sector tend to use on average the same amount of short- and long-term debt (50%), while those in the service sector report a slightly higher percentage of long-term debt (60%).Footnote 17 As for the interest burden, this is slightly higher for firms in the service sector (7.9%) than for those in the manufacturing sector (7.5%).

Looking at size classes, our sample has a total of 2876 (3626) wave-firm observations of micro/small companies (up to 49 employees) in the Industry (Services) sector. The remaining observations belong to medium and large companies (from 50 employees) for industry (4420) and for Services (2238). Common to other studies based on matched databases like ours, the sample composition in terms of size classes might not reflect the general distribution of the population of firms within the different countries. This is a caveat for our empirical results and, for this reason, we perform some additional robustness checks based on firm size classes in Sect. 4.4.

Finally, in the Supplementary material, Figure S1 reports the sample composition by country and by industries. Most firms are from Italy, France and Spain, covering almost three quarters of all observations, which reflects mostly the fact that the country information on financial statements from BvD Amadeus is much higher for those countries.

4 Econometric results

4.1 The impact of innovation and finance constraints in industry and services sectors

In this section, we discuss the results of the maximum likelihood estimations of the profit functions for both Industry and Services. Following the approach proposed by Battese and Coelli (1995), the coefficients are obtained by simultaneous estimates of the profit efficiency frontier (Eq. 1) and the inefficiency term, expressed as a function of a set of explanatory variables (Eq. 3). We point out that in the framework of Battese and Coelli (1995), we can interpret only the sign and the significance of the estimated coefficients.

Before presenting the estimated results, we report some information on model diagnostics. All estimations in Table 2 show the appropriateness of the Translog specification used in the analysis. In fact, it turns out that most of the second-order terms parameter estimates (σ2) of the profit function are significant. In addition, the high value of the estimation of the γ parameter, reflecting the importance of the inefficiency effects, strongly advocates the use of the stochastic frontier production function rather than the standard OLS method.Footnote 18 Finally, the Akaike Information Criterion (AIC) and the Bayesian Information Criterion (BIC) are used to provide some models diagnostics (Burnham & Anderson, 2004).Footnote 19

Table 2 displays several model specifications (columns 1–3 for Industry, and 4–6 for Services), which differ for the alternative inclusion of financial constraints as z-variables of the inefficiency equation.Footnote 20

In the various specifications we take care of the likely high correlation between the cash flow ratio and the profit margin. Hence when we employ the continuous variable Cash flow ratio we use the dummy Profit up as our preferred profitability measure. When the financial constraints indicators are those derived from the survey (Problem of finance and Finance obstacles), we use the Profit margin, retrieved from balance sheet data.

Starting with Industry, all three measures of firms’ external financial constraints display a negative and significant coefficient, signaling, in the context of the Battese and Coelli (1995) model, lower inefficiency scores. Most likely, when the availability of external finance decreases, financially constrained firms are forced to be more efficient in order to counter the potential adverse impact of financial frictions on their profitability. These findings provide support to our prediction (H1) and are in line with previous studies based on different countries and sample periods (Bhaumik et al., 2012; Maietta & Sena, 2010; Nickell & Nicolitsas, 1999; Sena, 2006).

Interestingly, we also find a negative and significant coefficient for the variable Product innovation. This indicates that the efforts of firms to develop new products or services—in order to attain a strategic advantage over competitors—produce some leverage on revenues. This evidence corroborates the prediction of our hypothesis (H2).Footnote 21 Our analysis also shows the relevance of the performance indicators. In all specifications, the two alternative measures of profit (Profit up and Profit margins) and leverage (Leverage up) display a negative and significant coefficient, suggesting that the increase in profitability and leverage have a positive effect on efficiency.

Turning to the Services sector results are displayed in columns 4–6 (Table 2). Remarkably, some similarities emerge with the analysis performed for the Industry firms: the financial obstacles and the firm performance indicators show a negative sign indicating a positive effect exerted by those variables on efficiency. By contrast, and differently from the Industry case, the variable Product innovation is not statistically significant in most specifications, except for the last one (Column 6). A tentative interpretation of this outcome could be that firms operating in the Services sector, which is traditionally considered non-tradeable, are less exposed to the international competition. For this reason, the pressure for these firms to develop and launch new product and services for the market might be less cogent. However, our results also show that for firms that report access to finance as an acute obstacle for their activity, innovation positively affects their profit efficiency, as indicated by the negative sign displayed in Column 6.

To address potential endogeneity issues related to the link between efficiency and innovation, we implemented the instrumental variable approach proposed by Karakaplan and Kutlu (2017).Footnote 22 By using R&D expenses as percentage of GDP by sector of activity as instrument for innovation, this approach allows us to test the endogeneity bias in the stochastic frontier estimation in both the frontier and efficiency determinants equations. The results rule out any evidence of endogeneity referred to Product innovation.Footnote 23

4.2 Sectoral heterogeneity: high- and low-tech sectors

In this section we exploit further the sectoral heterogeneity by aggregating firms according to the technological and knowledge-intensive content of their activities, in a similar fashion to Baum et al. (2017) and Pellegrino and Piva (2020).

Starting from the Eurostat classification on technological and knowledge intensity, we collapse the sectors into two main groups: High-Tech and Low-Tech sectors. In the first group we include high-technology industries and knowledge-intensive services (HT and KIS, respectively) and in the second one medium–low and low-technology industries and less knowledge intensive (MT, LT and less-KIS, respectively).

Our assumption is that HT companies in Industry and KIS companies in Services are more like to each other than high knowledge-intensive and low technology/knowledge-intensive within the two sectors.

The results of the simultaneous estimations of Eq. (1) and several specifications of Eq. (3) for High-Tech and Low-Tech sectors are displayed in Table 3, in columns 1–3, and columns 4–6, respectively.

Results are noteworthy. First, the variables accounting for the financial constrains turn to be significant with the negative sign in all specifications for LT firms. Conversely, this effect disappears for HT firms. The only exception is the negative coefficient for the cash flow ratio, which confirms that firms using internal sources are forced to be more efficient. In other words, when financial constraints are binding, LT firms are induced to be more efficient to enhance their profitability than HT firms. Second, our evidence shows that for the HT sector Product innovation displays a negative sign, indicating that it produces positive effect on profit efficiency. By contrast, for LT firms we get a positive sign signaling a reduction in profit efficiency. This evidence might indicate that investments in product innovation for HT companies imply complementing different tasks such as information technologies, which in turns produce efficiency gains. In the case of Low-Tech companies, instead, it seems that the business activities needed to introduce new products might divert funds and efforts that could be otherwise used in a more efficient way. Noticeably, the signs of all the other inefficiency determinants are stable across the High-Tech and Low-Tech disaggregation.

In a second step, we estimate our model by disaggregating the sectors into five sectors: HT, MT and LT for Industry and for KIS and less-KIS for Services. For the sake of brevity, Table S1 in Supplementary material reports only the results of the specification including the Cash flow ratio, as financial constraints indicator.Footnote 24 Noticeably, the variable product innovation displays the expected negative sign for HT industry and KIS Services—indicating that innovation output reduces profit inefficiency. By contrast, in the case of less-KIS companies, innovation efforts seem to enhance profit inefficiency. For MT and LT results are not conclusive (the coefficients are not significant). Overall, this evidence reinforces once more our assumption that the two sectors (HT industry and KIS Services) share more common characteristics in terms of the impact of innovation on efficiency than the other subgroups.

4.3 Further analysis: the impact of firm indebtedness

So far in our analysis we have not considered in an explicit way the role of firms’ indebtedness on their performance (Maietta & Sena, 2004, 2010; Sena, 2006; Vermoesen et al., 2013). It is known that companies choose between short-term and long-term debt depending on their productive needs. While they typically utilize short-term financing for working capital, they turn on long-term debt to better align their capital structure with long-term strategic goals, including innovation plans. Hence, long-term financing affords companies more time to realize a return on investment and innovation activities and reduces refinancing risks that come with shorter-term debt maturities. In this respect, we should expect a positive impact of long-term debt on profit efficiency.

To address the issue, we re-estimate our model including two additional variables in the inefficiency equation: (i) Long-term debt and (ii) Interest ratio.Footnote 25 If our predictions are corroborated, we should find, ceteris paribus, a negative coefficient for the variable Long-term debt. For similar reasons, we shall expect a positive sign for the variable Interest ratio, as an increase of the debt burden will affect the firm cost structure and, in turns, will deteriorate profit efficiency. Panel A of Table 4 displays the results of the new specifications for both Industry (columns 1–3) and Services (columns 4–6), while Panel B reports the same specifications for HT (columns 1–3) and LT sectors (columns 4–6).

Starting with panel A (Table 4), results can be summarized as follows. First, the inclusion of the two new variables in our specifications does not affect the baseline results for the key variables of the inefficiency equation (displayed in Table 3), thus providing support to the robustness of our analysis in terms of innovation and financial constraints.

Second, the estimated coefficients of the variable Long-term debt are always negative and statistically significant in both sectors, confirming the positive effect of the debt maturity structure on profit efficiency, as shown also by Sena (2006) and Maietta and Sena (2010). Interestingly, some differences between sectors arise for the estimated coefficients of the Interest ratio variable. Specifically, they turn out to be positive and significant across the three specifications (columns 4–6) for Services, while they are never statistically significant for Industry. This evidence may suggest that firms operating in the Industry sector might be less affected by their debt burden as a consequence of a better bargaining power with banks.Footnote 26

The main takeaway from this additional analysis is that while the maturity of the debt structure is not unpaired between sectors, the effect of the debt burden appears to damage firms in Services, regardless of the macroeconomic context. However, we are cautious when interpreting such a result as we acknowledge that further investigation might be required to check out its consistency.

Turning to Panel B, where we present the new specifications (including firm indebtedness indicators) for HT and LT sectors, results show that the impact of innovation and financial constraints on efficiency is consistent with the estimates displayed in Table 3. The coefficients of Long-term debt are always negative and significant indicating a positive impact on the profit efficiency independently from the sectoral disaggregation. This evidence turns to be consistent with the results presented in Panel A. As an additional check, we estimate models (1)–(6) of Table 4 (for both Panels A and B) with lagged innovation and finance constraints. Although this leads to a notable reduction in the number of observations by roughly two/thirds, the results corroborate the main findings reported in Table 4.Footnote 27

A different picture emerges when we look at the estimated coefficients of the Interest ratio. The coefficient is statistically significant only in the subgroup of HT firms and when firms face objective difficulties in their access to finance. The sign is positive indicating that increases of the interest ratio reduce profit efficiency for firms in that group (Column 3).

4.4 Robustness analysis: a focus on micro-small firms

By looking at our sample composition, the summary statistics show that close to 40% of the industrial companies and almost 60% of the service companies are classified as micro and small (see Table 1). Previous studies have shown that firm size matters on the decision to innovate (see among others, Leal-Rodríguez et al., 2015). Two opposite perspectives are recalled here. According to the Schumpeterian point of view (Karlsson & Olsson, 1998; Schumpeter, 1942), large firms have an advantage to innovate vis à vis smaller companies as innovation requires effort, long-time investment, know–how and resources that small firms cannot often afford. By contrast, it is also argued that smaller-sized firms tend to display more innovative and efficient efforts than large firms in order to survive (Baumann & Kritikos, 2016; Cohen & Klepper, 1996; De Jong & Marsili, 2006; Laforet, 2008, 2013).

To address the issue, we re-estimate our model specifications for the sub-sample of micro and small firms (up to 49 employees). Results are displayed in Table S2 of Supplementary Material where we report only the z-variables of the several inefficiency term specifications. As far as Industry is concerned, while the sign and the significance of the financial constraints covariates are consistent with the previous analysis, the variable product innovation turns to be not significant. We read these inconclusive results as a signal that we should investigate the impact of innovation on small-sized firms by focusing more on their innovative characteristics. By contrast, no relevant differences emerge for the micro-small firms compared to the full sample in the Services sector.

Indeed, the sector disaggregation based on the technology and knowledge intensity brings more clear-cut findings (see Table S3 of the Supplementary Material). In detail, we observe that for the micro-small HT enterprises product innovation matters in reducing firm inefficiency, while for LT firms the innovation efforts are negligible or they could be even counter-productive as they induce an increase of inefficiency. Once again, these results are largely consistent with the findings on the full sample on the similarity between technological and knowledge-intensive companies independently from firm size.

5 Discussion and conclusions

This paper contributes to the literature that investigates the interplay between firms’ efficiency, innovation and access to finance. Despite the policy relevance of this topic, the fundamental assumptions underlying it have remained largely unexplored. Indeed, the related literature has mainly focused on the role of financial constraints and innovation on productivity separately, yet these studies do not address the direct link between innovation and profit efficiency and the effect that a limited access to credit may exert on profit efficiency.

We fill this gap through the lens of the economic efficiency perspective. To the best of our knowledge, no previous work considered the effects that both innovation and credit access limitations may have on profit efficiency. To accomplish such a task, we pioneer the use of a novel dataset that merges survey-based data with balance sheet information. This allows us to exploit the heterogeneity across firms’ financial and financing positions.

Furthermore, we consider heterogeneous production functions across sectors by estimating different frontiers: first for two main productive sectors (Industry and Services) and second for an alternative sectoral distribution based on the technological and knowledge intensity. The empirical analysis confirms the hypothesis that technological and knowledge-intensive companies in the manufacturing and service sectors are more like to each other than high knowledge-intensive and low technology/knowledge-intensive firms within Industry and Services.

Our main findings support the prediction (H1) according to which firms that perceived difficulties in accessing external finance, or that are objectively financially constrained, tend to improve efficiency to reduce their risk of failure and to maintain profits, independently from the macro sector disaggregation. This outcome seems to be consistent with previous literature (Sena, 2006). Our analysis also documents that when financial constraints are binding, LT firms are induced to be more efficient to enhance their profitability than HT firms. Moreover, we find that debt maturity matters as well. Firms making more use of long-term debt are more efficient as they have more time to realize a return on their business activities to cover their debt independently from the sectoral disaggregation employed in our investigation. As for the cost of debt, the impact is different depending on the sector in which a firm operates. Enterprises operating in Services seem to have a more stringent cost burden on the debt side determining an increase in inefficiency. In the case of HT firms, an increase of the interest ratio is reducing their efficiency but only when they perceive difficulties in the access to finance.

Consistently with our second hypothesis (H2), we show that firms which stated in the survey to have introduced product innovation, have a higher likelihood to improve efficiency. This evidence is robust for firms in the manufacturing sector, and only weakly present for firms belonging to Services. We also find that product innovation is important for the profit efficiency of high-technology and knowledge-intensive companies, while it tends to diminish it for LT and less-KIS firms.

Finally, we consider also the role of firm size within sectors. Specifically, we show that micro and small HT firms are able to turn innovation into revenue gains, while it is not the case for LT and less-KIS companies, broadly confirming the findings of the full sample on the relevance of the sectoral composition. This supports the idea that the different sectoral aggregations provided in our analysis are indeed relevant for detecting additional firm heterogeneity and this does not depend on the firm’s size.

The implications of our results are not negligible. Fostering innovation and growth opportunities for enterprises is particularly relevant in times of economic slowdown and financial distress. Recommendations for public policy to encourage long-term investment in innovation and to reduce conducts which particularly penalize enterprises when investing in R&D would be another outcome of our investigation. Hence, our results give support to the line of firm-level policy interventions directly aimed at mitigating the underinvestment in R&D in Europe while considering firm heterogeneity across technology and knowledge intensity sectors. Though not explicitly analyzed in this paper, the line of reasoning goes beyond the idea that easier access to finance is the panacea to get higher profit efficiency. What seems more important is the support provided to businesses to be competitive by encouraging them to adopt new business models and innovative practices.

Despite its numerous contributions to the literature, we acknowledge some limitations of our study which can provide input for further research. First, while the results of our analysis seem to be robust to different econometric approaches and turn to be robust to endogeneity issues, we could argue that the introduction of additional variables controlling, for instance, the different degrees of entrepreneurship could be an advantage to better understand firms’ different efficient scores. Beyond size and innovation, several studies have focused on age, ownership structure, skill and competencies (Binnui & Cowling, 2016; Falk & Hagsten, 2021).

Second, while the instrument-based approach proposed by Karakaplan and Kutlu (2017) could remove some potential sources for reverse causality, it does not eliminate other possible sources of endogeneity. In fact, identifying valid instruments has been proved a difficult task for our financial constraints indicators, also because the majority of observable firm characteristics are already included in the inefficiency equation.

Third, one of the main advantages of our investigation is the use of a unique dataset that allows us to employ not only the qualitative survey-based information to measure financial constraints, but also balance sheet data to estimate production functions at firm level. However, it could be argued that, by merging two different data sources, firms in our sample might not reflect the composition of the population of firms by size and sector of activity within the different countries. We are aware of this limitation and one step further in our analysis would be to set appropriate weights to be used to have representative results. This is of particular importance for the novel results related to HT and LT companies. Fourth, we also recognise that differences in institutional settings might play a role in innovation policy at the national level, so we control for the country macroeconomic context in our estimates. However, we leave a more in-depth country-level analysis on this issue to future research tasks.

Finally, though our analysis starts just after the great financial crisis due to the availability of our survey database, we would expect that our results are not specific to the period that we study. Once more data will become available, further research should be devoted to substantiating our assessment over the business cycle, in particular considering the long-term impact of the Covid19 pandemic on firms’ efficiency.

Notes

Econometric methods used to estimate the economic efficiency are largely employed in several strands of literature (among others, Aiello and Bonanno, 2018, and Zhang et al., 2021, for the banking sector; Le et al., 2018, Hanousek et al., 2015, and Bonanno, 2016, for manufacturing and non-manufacturing firms).

In the two-step approach, first inefficiency is estimated using a frontier and, in the second step, the estimated efficiency-scores are the dependent variable in a subsequent regression (Greene, 1993). As shown by Lensink and Meesters (2014) and Wang and Schmidt (2002), the two-step approach suffers from the fact that the inefficiency is assumed to be identically and independently distributed in the main frontier equation, while it depends on other variables in the inefficiency equation.

We use the Translog function to model the form of frontiers (expressed in log-linear form), which satisfies the assumptions of non-negativity, concavity and linear homogeneity (Kumbhakar and Lovell, 2000). We take into account the constraint of homogeneity in relation to input-prices (which requires the sum to one of the input price elasticities).

We choose the value added to proxy profit as it includes both revenues and costs information. Moreover, by choosing this variable we overcome the practical problem of having too many negative values for the profit variable. Empirically, the correlation between value added and profit is very high.

Micro and Small firms register a turnover less than 2 and between 2 and 10 million (euros), respectively; Medium firms have a turnover between 10 and 50 million (euros); Large enterprises have a turnover more than 50 million (euros). In our analysis Micro firms are the controlling group.

See Eurostat: https://ec.europa.eu/eurostat/cache/metadata/Annexes/htec_esms_an3.pdf. Based on NACE Rev. 2 at 2-digit level Eurostat has compiled a classification of 12 sectors and subsectors according to their degree of technology and knowledge intensity. In the paper, we use the main 5 sectors. The supplementary material section will report the estimations also for those 5 sectors.

The information on this variable (question Q1 in the survey) is provided by SAFE every second wave, and refers to the previous 12 months, i.e. two waves. As the SAFE survey is conducted every six months, in order to restore this information at the wave round, we replicate this data for firms present on consecutive waves.

In the empirical analysis we use this proxy when the measure of finance constraints is the Cash flow/Total assets ratio because of the high correlation with the profit margin ratio.

The selection of those countries is driven by the availability of the data after the merge of surveyed firms in SAFE with the financial statements in the dataset from BvD AMADEUS.

This is due to the availability of the variable Product innovation from the 8th wave onwards in SAFE.

We use the 2-digit NACE classification used in the survey to define the two sectors. Industry includes manufacturing, mining, electricity, gas and water supply, while Services include construction, wholesale and retail trade, transport, accommodation, food services and other services to business or persons. We exclude public administration, financial and insurance services.

Albeit the focus of SAFE is on SMEs, the survey also provides information on large firms. As for Services 12% of our sample are large enterprises. In the case of Industry, they are 16%.

The financial leverage is defined as the ratio of short- and long-term debt, excluding trade credit and provisions, to total assets while the return on equity (ROE) is the amount of net profit earned as a percentage of shareholders’ equity.

The variables Use bank loans, Use credit lines and Use bank credit capture firms’ use of banking products as reported by firms in the survey. They are dummy variables equal to 1 if one financing source is used by the firm and 0 otherwise.

Long-term debt is defined as the ratio between long term debt and total financial debt. Interest ratio is the ratio between the interest payable on short and long-term debt, accrued during the period covered by the financial statements, and total financial debt.

The variance σ2 is equal to the sum of the variances of the two error components: \({\sigma }_{u}^{2}\) and \({\sigma }_{v}^{2}\). γ is equal to \(\frac{{\sigma }_{u}^{2}}{{\sigma }^{2}}\) where the zero value of this parameter indicates that deviations from the frontier are only due to random error, while values close to one indicate that the distance from the frontier is due to inefficiency.

AIC is equal to [2 k-2Log-likelihood], where k is the number of estimated parameters; BIC is equal to [ln(N. obs) k-2 Log-likelihood].

In order to exclude the possibility that our findings are driven by the contemporaneous presence of financial constraints and innovation, we run different specifications for Industry and Services, in which we introduce one by one the three proxies for financial constraints (without Product innovation)—Cash flow ratio, Problem of Finance, Finance obstacles—and the variable Product innovation (without the variables accounting for financial constraints). The main results on the impact of the different variables on efficiency are confirmed and are available upon request.

In order to disentangle possible combined effects of financial frictions and innovation efforts, we also estimated model specifications where we included interaction terms between Product innovation and each indicator of financial constraints. Estimates (available upon request) on the interactions did not provide conclusive results.

We are aware that our approach is far from being conclusive in eliminating other possible sources of endogeneity which might affect the relationship under scrutiny. Other approaches have been used for addressing the endogeneity of inputs and output in the SFA (Lien et al., 2018). We acknowledge this potential limitation of our study in the conclusion section of this paper.

Untabulated results are available upon request.

Similar results are obtained when we use the other two indicators of financial frictions. The results are available upon request.

The variable Long-term debt is the ratio between long term debt and total financial debt. Interest ratio is measured as the ratio between the interest payable on short and long-term debt, accrued during the period covered by the financial statements, and total financial debt.

We find analogous results, available on request, when we use alternative variables for measuring the interest burden such as the interest coverage ratio which is defined as the ratio between earnings before interest and taxes and interest payments due within the same period.

Untabulated regressions are available upon request.

References

Acemoglu, D., Aghion, P., & Zilibotti, F. (2006). Distance to frontier, selection, and economic growth. Journal of the European Economic Association, 4(1), 37–74.

Acharya, V., & Xu, Z. (2017). Financial dependence and innovation: The case of public versus private firms. Journal of Financial Economics, 124(2), 223–243.

Agénor, P.-R., & Pereira da Silva, L. (2017). Cyclically adjusted provisions and financial stability. Journal of Financial Stability, 28, 143–162.

Aghion, P., Angeletos, G.-M., Banerjee, A., & Manova, K. (2010). Volatility and growth: Credit constraints and the composition of investment. Journal of Monetary Economics, 57, 246–265.

Aghion, P., Askenazy, P., Berman, N., Cette, G., & Eymard, L. (2012). Credit constraints and the cyclicality of R&D investment: Evidence from France. Journal of the European Economic Association, 10, 1001–1024.

Aghion, P., Bloom, N., Blundell, R., Griffith, R., & Howitt, P. (2005). Competition and innovation: An inverted-U relationship. Quarterly Journal of Economics, 120, 701–728.

Aghion, P., & Howitt, P. (1998). Endogenous Growth Theory Cambridge. MIT Press.

Aiello, F., & Bonanno, G. (2018). On the sources of heterogeneity in banking efficiency literature. Journal of Economic Surveys, 32(1), 194–225.

Aigner, D., Lovell, C. K., & Schmidt, P. (1977). Formulation and estimation of stochastic frontier production function models. Journal of Econometrics, 6(1), 21–37.

Arbelo, A., Arbelo-Pérez, M., & Pérez-Gómez, P. (2021). Profit efficiency as a measure of performance and frontier models: A resource-based view. BRQ Business Research Quarterly, 24(2), 143–159.

Archibugi, D., & Coco, A. (2004). A new indicator of technological capabilities for developed and developing countries (ArCr). World Development, 32(4), 629–654.

Bartelsman, E., Haltiwanger, J., & Scarpetta, S. (2013). Cross-country differences in productivity: The role of allocation and selection. American Economic Review, 103(1), 305–334.

Battese, G. E., & Coelli, T. J. (1995). A model for technical inefficiency effects in a stochastic frontier production function for panel data. Empirical Economics, 20(2), 325–332.

Baum, C. F., Lööf, H., Nabavi, P., & Stephan, A. (2017). A new approach to estimation of the R&D–innovation–productivity relationship. Economics of Innovation and New Technology, 26(1–2), 121–133.

Baumann, J., & Kritikos, A. S. (2016). The link between R&D, innovation and productivity: Are micro firms different? Research Policy, 45(6), 1263–1274.

Becker, B. (2015). Public R&D policies and private R&D investment: A survey of the empirical evidence. Journal of Economic Surveys, 29(5), 917–942.

Berger, A. N., & Mester, L. J. (1997). Inside the black box: What explains differences in the efficiencies of financial institutions? Journal of Banking & Finance, 21(7), 895–947.

Bernanke, B., Gertler, M., & Gilchrist, S. (1996). The financial accelerator and flight to quality. Review of Economics and Statistics, 78, 1–15.

Bhaumik, S. K., Das, P. K., & Kumbhakar, S. C. (2012). A stochastic frontier approach to modelling financial constraints in firms: An application to India. Journal of Banking & Finance, 36(5), 1311–1319.

Binnui, A., & Cowling, M. (2016). A conceptual framework for measuring entrepreneurship and innovation of young hi-technology firms. GSTF Journal on Business Review, 4(3), 32–47.

Bonanno, G. (2016). ICT and R&D as inputs or efficiency determinants? Analysing Italian manufacturing firms (2007–2009). Eurasian Business Review, 6(3), 383–404.

Bravo-Ortega, C., & García-Marín, A. (2011). R&D and productivity: A two way avenue? World Development, 39(7), 1090–1107.

Burnham, K. P., & Anderson, D. R. (2004). Multimodel inference: Understanding AIC and BIC in model selection. Sociological Methods & Research, 33(2), 261–304.

Butler, A. W., & Cornaggia, J. (2011). Does access to external finance improve productivity? Evidence from a natural experiment. Journal of Financial Economics, 99(1), 184–203.

Calza, E., Goedhuys, M., & Trifković, N. (2018). Drivers of productivity in Vietnamese SMEs: The role of management standards and innovation. Economics of Innovation and New Technology, 28(1), 1–22.

Carbo-Valverde, S., Degryse, H., & Rodríguez-Fernández, F. (2015). The impact of securitization on credit rationing: Empirical evidence. Journal of Financial Stability, 20, 36–50.

Castellani, D., Piva, M., Schubert, T., & Vivarelli, M. (2019). R&D and productivity in the US and the EU: Sectoral specificities and differences in the crisis. Technological Forecasting and Social Change, 138, 279–291.

Cefis, E., & Ciccarelli, M. (2005). Profit differentials and innovation. Economics of Innovation and New Technology, 14(1–2), 43–61.

Cette, G., Fernald, J., & Mojon, B. (2016). The pre-Great Recession slowdown in productivity. European Economic Review, 88, 3–20.

Chen, C. M., Delmas, M. A., & Lieberman, M. B. (2015). Production frontier methodologies and efficiency as a performance measure in strategic management research. Strategic Management Journal, 36(1), 19–36.

Coelli, T. J., Rao, D. S. P., O’Donnell, C. J., & Battese, G. E. (2005). An introduction to efficiency and productivity analysis. Springer Science & Business Media.

Cohen, W. M., & Klepper, S. (1996). A reprise of size and R & D. The Economic Journal, 106, 925–951.

Cornwell, C. M., & Smith, P. C. (2008). Stochastic frontier analysis and efficiency estimation. In P. Sevestre & L. Mátyás (Eds.), The econometrics of panel data (pp. 697–726). Springer Verlag.

Cowan, K., Drexler, A., & Yanez, Á. (2015). The effect of credit guarantees on credit availability and delinquency rates. Journal of Banking & Finance, 59, 98–110.

Dabla-Norris, E., Kersting, E. K., & Verdier, G. (2012). Firm productivity, innovation, and financial development. Southern Economic Journal, 79(2), 422–449.

Dai, X., & Sun, Z. (2021). Does firm innovation improve aggregate industry productivity? Evidence from Chinese manufacturing firms. Structural Change and Economic Dynamics, 56, 1–9.

European Commission. (2013). Product market review 2013: Financing the real economy. European Economy 8, 2013. ISBN 978-92-79-33667-6. https://doi.org/10.2765/58867.

de Jong, J. P., & Marsili, O. (2006). The fruit flies of innovations: A taxonomy of innovative small firms. Research Policy, 35(2), 213–229.

Deeds, D. L. (2001). The role of R&D intensity, technical development and absorptive capacity in creating entrepreneurial wealth in high technology start-ups. Journal of Engineering and Technology Management, 18(1), 29–47.

Díaz-Díaz, N. L., Aguiar-Díaz, I., & De Saá-Pérez, P. (2008). The effect of technological knowledge assets on performance: The innovative choice in Spanish firms. Research Policy, 37(9), 1515–1529.

Dosi, G., Grazzi, M., & Moschella, D. (2015). Technology and costs in international competitiveness: From countries and sectors to firms. Research Policy, 44(10), 1795–1814.

Falk, M., & Hagsten, E. (2021). Innovation intensity and skills in firms across five European countries. Eurasian Business Review, 11(3), 371–394.

Farrell, M. J. (1957). The measurement of productive efficiency. Journal of the Royal Statistical Society Series A (General), 120(3), 253–290.

Farre-Mensa, J., & Ljungqvist, A. (2016). Do measures of financial constraints measure financial constraints? The Review of Financial Studies, 29(2), 271–308.

Fazzari, S. M., Hubbard, R. G., Petersen, B. C., Blinder, A. S., & Poterba, J. M. (1988). Financing constraints and corporate investment. Brookings Papers on Economic Activity, 1988(1), 141–206.

Ferrando, A., & Mulier, K. (2015). Financial obstacles and financial conditions of firms: Do perceptions match the actual conditions? The Economic and Social Review, 46(1), 87–118.

Ferrando, A., Popov, A., & Udell, G. F. (2017). Sovereign stress and SMEs’ access to finance: Evidence from the ECB’s SAFE survey. Journal of Banking & Finance, 81, 65–80.

Ferrando, A., & Ruggieri, A. (2018). Financial constraints and productivity: Evidence from euro area companies. International Journal of Finance & Economics, 23(3), 257–282.

Ferreira, P. J. S., & Dionísio, A. T. M. (2016). What are the conditions for good innovation results? A fuzzy-set approach for European Union. Journal of Business Research, 69(11), 5396–5400.

Fitzpatrick, T., & McQuinn, K. (2008). Measuring bank profit efficiency. Applied Financial Economics, 18(1), 1–8.

Foster, L., Haltiwanger, J., & Syverson, C. (2008). Reallocation, firm turnover, and efficiency: Selection on productivity or profitability? American Economic Review, 98(1), 394–425.

García-Quevedo, J., Segarra-Blasco, A., & Teruel, M. (2018). Financial constraints and the failure of innovation projects. Technological Forecasting and Social Change, 127, 127–140.

George, G., Zahra, S. A., & Wood, D. R., Jr. (2002). The effects of business–university alliances on innovative output and financial performance: A study of publicly traded biotechnology companies. Journal of Business Venturing, 17(6), 577–609.

Geroski, P., Machin, S., & Van Reenen, J. (1993). The profitability of innovating firms. The RAND Journal of Economics, 24, 198–211.

Goedhuys, M., & Veugelers, R. (2012). Innovation strategies, process and product innovations and growth: Firm-level evidence from Brazil. Structural Change and Economic Dynamics, 23(4), 516–529.

Gopinath, G., Kalemli-Özcan, Ş, Karabarbounis, L., & Villegas-Sanchez, C. (2017). Capital allocation and productivity in South Europe. The Quarterly Journal of Economics, 132(4), 1915–1967.

Greene, W. H. (1993). The econometric approach to efficiency analysis. The measurement of productivity efficiency: Techniques and applications (pp. 92–250). Oxford University Press.

Greene, W. (2005). Fixed and random effects in stochastic frontier models. Journal of Productivity Analysis, 23(1), 7–32.

Griliches, Z. (1979). Issues in assessing the contribution of research and development to productivity growth. The Bell Journal of Economics, 10, 92–116.

Grossman, G., & Helpman, E. (1991). Innovation and growth in the global economy. MIT Press.

Guariglia, A., & Liu, P. (2014). To what extent do financing constraints affect Chinese firms’ innovation activities? International Review of Financial Analysis, 36, 223–240.

Hanousek, J., Kočenda, E., & Shamshur, A. (2015). Corporate efficiency in Europe. Journal of Corporate Finance, 32, 24–40.

Heshmati, A., & Kim, H. (2011). The R&D and productivity relationship of Korean listed firms. Journal of Productivity Analysis, 36(2), 125–142.

Huizinga, H. P., Nelissen, J. H. M., & Vander Vennet, R. (2001). Efficiency effects of bank mergers and acquisitions in Europe. Working paper no. 088/3. Tinbergen Institute.

Janz, N., Lööf, H., & Peters, B. (2004). Firm level innovation and productivity-is there a common story across countries? Problems and Perspectives in Management, 2, 184–204.

Jin, M., Zhao, S., & Kumbhakar, S. C. (2019). Financial constraints and firm productivity: Evidence from Chinese manufacturing. European Journal of Operational Research, 275(3), 1139–1156.

Kaplan, S. N., & Zingales, L. (1995). Do financing constraints explain why investment is correlated with cash flow? (No. w5267). National Bureau of Economic Research.

Karakaplan, M. U., & Kutlu, L. (2017). Endogeneity in panel stochastic frontier models: An application to the Japanese cotton spinning industry. Applied Economics, 49(59), 5935–5939.

Karlsson, C., & Olsson, O. (1998). Product innovation in small and large enterprises. Small Business Economics, 10(1), 31–46.

Kerr, W. R., & Nanda, R. (2009). Democratizing entry: Banking deregulations, financing constraints, and entrepreneurship. Journal of Financial Economics, 94(1), 124–149.

Kerr, W. R., & Nanda, R. (2015). Financing innovation. Annual Review of Financial Economics, 7, 445–462.

Klette, T. J., & Kortum, S. (2004). Innovating firms and aggregate innovation. Journal of Political Economy, 112(5), 986–1018.

Koellinger, P. (2008). The relationship between technology, innovation, and firm performance—Empirical evidence from e-business in Europe. Research Policy, 37(6), 1317–1328.

Kumbhakar, S. C., & Lovell, C. A. K. (2000). Stochastic frontier analysis. Cambridge University Press.

Kumbhakar, S. C., Ortega-Argilés, R., Potters, L., Vivarelli, M., & Voigt, P. (2012). Corporate R&D and firm efficiency: Evidence from Europe’s top R&D investors. Journal of Productivity Analysis, 37(2), 125–140.

Laforet, S. (2008). Size, strategic, and market orientation affects on innovation. Journal of Business Research, 61(7), 753–764.

Laforet, S. (2013). Organizational innovation outcomes in SMEs: Effects of age, size, and sector. Journal of World Business, 48(4), 490–502.

Le, S. A., Walters, B., & Kroll, M. (2006). The moderating effects of external monitors on the relationship between R&D spending and firm performance. Journal of Business Research, 59(2), 278–287.

Le, V., Vu, X. B. B., & Nghiem, S. (2018). Technical efficiency of small and medium manufacturing firms in Vietnam: A stochastic meta-frontier analysis. Economic Analysis and Policy, 59, 84–91.

Leal-Rodríguez, A. L., Eldridge, S., Roldán, J. L., Leal-Millán, A. G., & Ortega-Gutiérrez, J. (2015). Organizational unlearning, innovation outcomes, and performance: The moderating effect of firm size. Journal of Business Research, 68(4), 803–809.

Leibenstein, H. (1978). General X-efficiency theory and economic development. Oxford University Press.

Leiponen, A. (2000). Competencies, innovation and profitability of firms. Economics of Innovation and New Technology, 9(1), 1–24.

Lensink, R., & Meesters, A. (2014). Institutions and bank performance: A stochastic frontier analysis. Oxford Bulletin of Economics and Statistics, 76(1), 67–92.

Lien, G., Kumbhakar, S. C., & Alem, H. (2018). Endogeneity, heterogeneity, and determinants of inefficiency in Norwegian crop-producing farms. International Journal of Production Economics, 201, 53–61.

Lööf, H., & Heshmati, A. (2006). On the relationship between innovation and performance: A sensitivity analysis. Economics of Innovation and New Technology, 15(4–5), 317–344.

Love, J. H., & Roper, S. (2015). SME innovation, exporting and growth: A review of existing evidence. International Small Business Journal, 33(1), 28–48.

Love, J. H., Roper, S., & Du, J. (2009). Innovation, ownership and profitability. International Journal of Industrial Organization, 27(3), 424–434.

Luo, Y., Tanna, S., & De Vita, G. (2016). Financial openness, risk and bank efficiency: Cross-country evidence. Journal of Financial Stability, 24, 132–148.

Maietta O. W., & Sena V. (2004), Profit sharing, technical efficiency change and finance constraints. In Employee participation, firm performance and survival (pp. 149–167). Emerald Group Publishing Limited.

Maietta, O. W., & Sena, V. (2010). Financial constraints and technical efficiency: Some empirical evidence for Italian producers’ cooperatives. Annals of Public and Cooperative Economics, 81(1), 21–38.

Manaresi, F., & Pierri, N. (2017). Credit constraints and firm productivity: Evidence from Italy. Mo. Fi. R. Working Papers, 137.

Meeusen, W., & van Den Broeck, J. (1977). Efficiency estimation from Cobb–Douglas production functions with composed error. International Economic Review, 18(2), 435–444.

Midrigan, V., & Xu, D. Y. (2014). Finance and misallocation: Evidence from plant-level data. American Economic Review, 104(2), 422–458.

Nickell, S. (1996). Competition and corporate performance. Journal of Political Economy, 104, 724–746.

Nickell, S., & Nicolitsas, D. (1999). How does financial pressure affect firms? European Economic Review, 43(8), 1435–1456.

O’Mahony, M., & Vecchi, M. (2009). R&D, knowledge spillovers and company productivity performance. Research Policy, 38(1), 35–44.

Ortega-Argilés, R., Piva, M., & Vivarelli, M. (2015). The productivity impact of R&D investment: Are high-tech sectors still ahead? Economics of Innovation and New Technology, 24(3), 204–222.

Pellegrino, G., & Piva, M. (2020). Innovation, industry and firm age: Are there new knowledge production functions? Eurasian Business Review, 10(1), 65–95.

Pigini, C., Presbitero, A. F., & Zazzaro, A. (2016). State dependence in access to credit. Journal of Financial Stability, 27, 17–34.

Pilar, P. G., Marta, A. P., & Antonio, A. (2018). Profit efficiency and its determinants in small and medium-sized enterprises in Spain. BRQ Business Research Quarterly, 21(4), 238–250.

Romer, P. (1990). Endogenous technological change. Journal of Political Economy, 98, 72–102.

Sasidharan, S., Lukose, P. J., & Komera, S. (2015). Financing constraints and investments in R&D: Evidence from Indian manufacturing firms. The Quarterly Review of Economics and Finance, 55, 28–39.

Schroeder, R. G., Bates, K. A., & Junttila, M. A. (2002). A resource-based view of manufacturing strategy and the relationship to manufacturing performance. Strategic Management Journal, 23(2), 105–117.

Schumpeter, J. A. (1942). Socialism, capitalism and democracy. Harper and Brothers.

Sena, V. (2006). The determinants of firms’ performance: Can finance constraints improve technical efficiency? European Journal of Operational Research, 172(1), 311–325.

Shao, B. B., & Lin, W. T. (2016). Assessing output performance of information technology service industries: Productivity, innovation and catch-up. International Journal of Production Economics, 172, 43–53.

Solow, R. (1957). A contribution to the theory of economic growth. Quarterly Journal of Economics, 70, 65–94.

Srairi, S. A. (2010). Cost and profit efficiency of conventional and Islamic banks in GCC countries. Journal of Productivity Analysis, 34(1), 45–62.

Stehrer, R., Baker, P., Foster, N., McGregor, N., Koenen, J., Leitner, S., Schricker, J., Strobel, T., Vieweg, H. G., Vermeulen, J., & Yagafarova, A. (2015). The relation between industry and services in terms of productivity and value creation. Wiiw Research Report 404.