Abstract

We investigate the pro-environmental behavior of green firms in a context where consumers value the goods’ eco-quality features. We present a two-sector monopolistic competition model with green and brown goods displaying both horizontal and vertical differentiation. Using analytical and quantitative techniques, we derive the optimal eco-quality level selected by green firms and the industry structure both in the short- and long-run equilibrium. We then study the effectiveness of three policy tools (green incentives, the imposition of a minimum quality standard, and green awareness campaigns) with respect to the policymaker’s objective of increasing the overall level of greenness, which we measure through a specific indicator. We find that each policy alone is apt to stimulate an increase in the greenness intensity compared to the unregulated equilibrium. Yet, their side effects in terms of market structure and the possibility that the intensity of application of a single tool may hit budgetary, political, or social limits call for a combination of two or more policies to overcome the above limits and get a higher overall level of greenness than that resulting from just one of them.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The growing diffusion of pro-environmental awareness among citizens is a topic catching increasing attention in media and public discussions, as well as in academic papers. Worldwide campaigns in favor of emission abatements, wild world preservation, and responsible behavior concerning waste treatment, or recycling, are only a few examples of the aforesaid awareness. Green consumerism is often revealed through an increased willingness to pay for products viewed as clean, i.e., produced with environmentally friendly production or abatement technologies, or for products whose consumption has a lower impact on the environment.

Our paper follows the strand of literature focusing on green consumerism, with the purpose of examining the pro-environmental behavior of greener firms, in a context where consumers value the eco-quality features of the goods as well as their intrinsic attributes. In our approach, the term ‘eco-quality’ refers to all the pro-environmental features of a product that are valued by eco-responsible consumers. Since there are several dimensions of environment-friendliness, the term signals the product’s lower impact than the standard on the environment stemming from the production process, and/or its use and disposal. ‘Eco-quality’ refers for instance to energy efficiency, a reduction in pollution generated from the production and/or use of the product, the degree to which the product or parts of it can be recycled, reducing waste, the presence of recyclable or refillable packaging, the lack of pesticide content reducing harm to biodiversity and possibly others.

In the paper, we set out a model based on a two-sector monopolistic competition setting, the two sectors (called ‘brown’ and ‘green’) differing as to the products’ environmental attributes; in the unregulated framework, brown goods have no environmental characteristics, while the eco-quality level of green goods derives endogenously from a profit-maximizing process. The model is then modified to study the impact of policy interventions by a regulator aiming at increasing the overall level of greenness in the industry, namely a subsidy on green costs, pro-environment government campaigns, and the imposition of a minimum quality standard. We use both analytical and quantitative techniques since the former do not yield a closed expression for the optimal eco-quality level of green goods.

Analytically, we get the long-run equilibrium for the green sector from the interplay of two relationships, each between the environmental quality of green goods and the number of active firms. The first relationship derives from the long-run zero-profit condition and the second from the maximizing behavior of green firms with respect to their products’ greenness intensity. Since we are not able to get an analytical result for green firms' optimal eco-quality, we make use of a numerical simulation that allows quantifying the long-run industry equilibrium, as well as the effects of the exogenous and policy-induced factors influencing the above relationships and the industry structure. It is worth noting that, albeit not in closed form, all the qualitative policy results (that is, the signs of the interventions’ effects on green firms' optimal eco-quality) can be derived analytically, so that only the quantitative results depend on the parameter values.

We find that the granting of a subsidy on ecological-related costs and an intensification in consumers’ environmental awareness have a positive impact on green firms’ profits, the former thanks to a reduction in their environmental costs, and the latter thanks to a surge in green goods’ demand. The increase in green firms’ profit leads to a higher optimal level of greenness and, at the same time, to more green firms entering the market. It follows that the long-run equilibrium is characterised by a higher optimal eco-quality level chosen by green firms, a higher green firms' market share, and thus a higher industry’s total eco-quality. The imposition of a minimum quality standard (MQS) binding for brown products has the same positive impact on the industry’s total eco-quality, as green firms react to brown firms’ greater quality competition by incrementing the eco-quality content of their products. However, the resulting industry structure sees a reduction in green firms’ market share, a side effect that we show can be addressed by complementing the MQS policy with one or more of the other instruments.

Indeed, the policies under consideration appear to be complementary since they mutually reinforce one another. Thus, the policymaker can combine two or more policies to get a higher overall level of greenness, when the intensity of application of a single policy cannot be further expanded due to budgetary, political, or social limits. For instance, the budget constraint may limit the granting of the eco-subsidy, environmental campaigns may take too long to produce sizeable effects on consumers' behaviour, or the imposition of a high minimum standard may compel too many green firms to exit the market.

There is an established body of literature on the economic impact of green consumerism, investigating both firms’ responses in terms of the environmental aspects of their production process, and the type and extent of policy makers’ interventions in this field. Most environmental literature papers consider consumers' green-oriented preferences to act as an incentive inducing firms to produce with environmental-friendly technologies. Some of the contributions show that consumers' eco-friendly behavior may bring about the same results as some environmental policies or may strengthen their effects. For instance, Sartzetakis et al. (2012) find that information provided to consumers about the environmental damage of products may lead to a reduction in the level of environmental taxation. In Arora and Gangopadhyay (1995) duopoly model, a minimum standard binding on the dirty firm has the effect of improving the performance of the cleaner firm as well, due to the latter’s effort to lessen the price competition through increased product differentiation. In the same vein, in the context of a spatial duopoly with vertically differentiated products, Conrad (2005) finds that, when consumers’ environmental concern is strong, the market equilibrium is characterized by both firms differentiating their products towards a higher environmental attribute.

The paper is innovating over other similar studies of green consumerism in several respects. First, we analyse a monopolistically competitive market, whereas most models (differing as to assumptions on firms’ cost and green investment functions, to consumers’ heterogeneity, and others) consider duopoly markets. Few other papers investigate a generic imperfect competition setting, the equilibrium ranging from monopoly to duopoly or oligopoly depending on the parameters' values (for instance, Cremer and Thisse 1999). To the best of our knowledge, ours is the only paper that assumes a monopolistic competition framework with both dimensions of differentiation, as another paper by Requate (2005), based on the Dixit-Stiglitz model of monopolistic competition, only considers horizontal differentiation among commodities. In the economy, there are several examples of monopolistically competitive industries with differentiation both in intrinsic characteristics and eco-qualities, such as for instance processed food, electric and electronic appliances, house cleaning products, cosmetics, and others. Our model is meant to be a stylized representation of their features. In this way, we are able to account for several intrinsic attributes, that is, design, style, brand, and so on, that differentiate goods in the same branch of industry and that are not easily represented in a duopolistic market framework.

As to the horizontal product differentiation within the same quality group, our theoretical model assumes a monopolistic competition setting à la Blanchard and Kiyotaki (1987), where consumers' desirability for variety is expressed by a CES utility function. Following the literature on quality product differentiation, in our model, each variant is also characterized by a vertical attribute defining its eco-quality, so that the two dimensions (horizontal and vertical attributes) together describe each good, with the bi-dimensional attributes jointly valued by eco-concerned consumers. Other contributions (such as Conrad 2005; Deltas et al 2013; Garella 2021) consider both types of differentiation among goods in duopolistic markets. However, apart from the market form, their framework differs from ours, as in their approach consumers value separately the intrinsic and the environmental characteristics of each product. In our model, the concurrent horizontal and vertical differentiation of the goods and the monopolistic competition structure of the market consent to fully exploit the competitive implications stemming from the simultaneous working of both types of differentiation. In fact, we are able to consider at the same time two competitive forces at work: competition within sectors, based on the horizontal differentiation, that triggers the entry/exit of firms in each sector, and competition between sectors, based on the vertical differentiation. Both competitive forces contribute to determining the level of eco-quality that green firms optimally select and define the equilibrium market structure. This enriches the analysis of policy interventions since it allows us to complement their results in terms of the regulator objective of the industrial greenness level with an understanding of their effects on the industry structure (number of firms in each sector and each sector’s market share). As the industry composition changes unevenly in response to different policies, it is possible to complement policy analyses with respect to this outcome.

Second, we depart from the large body of literature (among the others, Arora and Gangopadhyay 1995; Moraga-Gonzáles and Padrón-Fumero 2002; Amacher et al 2004; Fujiwara 2009) that considers firms’ products to be differentiated only as to the intensity of pollution linked to their production. According to our approach, instead, goods are characterized by environmental qualities referring to all the ecological features linked to pro-environmental impacts occurring during production, consumption, and/or disposal. Eco-quality differentiation results in product variants, some of which are more environment-friendly than the standard (‘brown’) ones (or the less eco-friendly ones).

Third, we consider that the weight of each good in consumers’ preferences is endogenously determined by its relative eco-quality with respect to the overall eco-content of final goods. Since consumers’ demand for any good responds positively to an increase in its relative eco-quality content, each firm’s market share depends on the quality gap between its product and all the products in the industry. On the contrary, other papers assume exogenous weights for clean and dirty goods (see, for instance, Chang et al 2018). In our model, the endogeneity of such weights lets policy interventions, which are able to influence the optimal eco-quality level selected by green firms, modify the relative consumption of green to brown goods, that is, the industry composition. Changes in relative consumption of goods with different eco-quality features represent an important effect of the environmental policies under consideration, along with the growth in products’ eco-quality.

Fourth, our model assumes that consumers have homogeneous ecological preferences; still, they are willing to buy all eco-types of goods thanks to the CES utility function consistent with the monopolistic competition structure of the market. On the contrary, most contributions analysing green consumerism explain the simultaneous presence of market demand for both brown and green products via consumers' diverse willingness to pay due to dissimilar income (Arora and Gangopadhyay 1995; Elhadij and Tarola 2015), to different environmental attitudes (Garcia-Gallego and Georgantzis 2009), or differing responsiveness to social norms and community approval (Doni and Ricchiuti 2013).

The rest of the paper is structured as follows. Section 2 presents the theoretical model. Section 3 solves, both analytically and through a numerical example, for the short- and long-run equilibria in each sector of the industry. Section 4 considers the effects of regulatory interventions on the long-run market equilibrium, the industry’s structure, and the overall level of greenness. Section 5 analyses the same effects deriving from a combination of all policy tools together. Section 6 discusses the results and concludes.

2 A Two-Sector Model

We put forward a partial-equilibrium model of a closed economy. We analyse an industry where firms manufacture final goods in a framework of monopolistic competition, with each firm producing a variety that substitutes imperfectly for the other products of the industry. Besides, we assume a vertical differentiation among goods with respect to the product’s environmental attributes. In this respect, the industry is composed of two sectors: sector \(G\), which collects firms manufacturing goods with high environmental qualities (green goods), and sector \(B\), which gathers firms producing goods with no (or low) environmental qualities (brown goods). This determines an asymmetry between firms belonging to the two different sectors, leading to a market segmentation based on the eco-qualities of the horizontally differentiated goods.

Demand comes from households concerned about the environmental quality of goods, who are willing to pay more for goods with higher environmental features, and the more so the higher the greenness intensity. Therefore, albeit firms incur variable and fixed costs specific to the production of eco-friendly goods, they can sell at higher prices, thus covering their higher costs.Footnote 1 Hence, there is an interaction between consumers’ eco-preferences and firms’ advantage in meeting ‘green consumerism’, that is, in producing goods that incorporate pro-environmental features.

2.1 Consumers’ Behaviour

The set of green final goods is composed of \(N\) intrinsically differentiated varieties, so that each \(G\) good is specified as a bundle of a physical quantity \({C}_{j}\), with \(j=1,\dots , N\), and a matching green quality, \(g>1\). For the sake of simplicity, we assume that all green products embody the same level of environmental quality.Footnote 2 Correspondingly, set \(B\) of final goods is composed of \(M\) differentiated varieties, \({C}_{i}\), with \(i=1,\dots , M\), and a matching brown quality, \(b\ge 1\), with \(b<g\). We assume that all goods’ eco-quality is perfectly observable to consumers.Footnote 3

Preferences of the representative consumer are characterized by a CES utility function defined over the consumption of each good j included in sector \(G\) and each good i belonging to sector \(B\)

where \({C}_{j}\) and \({C}_{i}\) are the physical quantities consumed of good \(j\) and \(i\), which enter the utility function with a constant elasticity of substitutionFootnote 4\(\theta >1\). The assumption that consumers value the environmental attributes of each good, so that their utility increases beyond that arising from the physical features of products, is captured by the specification that each differentiated variety in sector \(G\) and sector \(B\) is a bundle of the physical quantity and the corresponding environmental quality (or ‘quality-adjusted’ variety). The utility deriving from the products’ greenness is enhanced by the parameter \(\lambda \), the consumer’s intensity of preference for the environmental quality content, taken to be \(\lambda >1\). It represents consumers’ concern for the environment, which results in an extra value attached to eco-friendly products. Thus, for any physical quantity, the consumer's utility is greater the higher the eco-content of goods and the higher the consumer's eco-sensitivity.Footnote 5 In addition, consumers’ utility depends on the quality differentiation between sectors, with the weight of each sector in consumers’ preferences endogenously given by its relative eco-quality with respect to the overall eco-content of final goods, so that the weight of sector \(G\) is defined as \(\frac{g}{g+b}\) and that of sector \(B\) as \(\frac{b}{g+b}\).

The above is a general formulation of consumers’ preferences, which permits to analyse both the market equilibrium under no regulation (the benchmark case) and the effects of different regulation tools. We first solve the model for the benchmark case, where we assume that brown goods have no environmental content, so that the brown eco-quality, \(b\), is set equal to 1. This assumption will be removed in Sect. 4, where we study the effectiveness of policy tools with respect to the policymaker’s objective of increasing the overall level of greenness.

For the benchmark case, Eq. (1) reduces to

Given the consumer’s budget constraint, utility maximization leads to the following aggregate demand functions for the green good j and the brown good i:

where \(E\) denotes the exogenously given aggregate consumption expenditure in the industry, \(E=\sum_{j=1}^{N}{C}_{j}{p}_{j}+\sum_{i=1}^{M}{C}_{i}{p}_{i}\), whereas \({p}_{j}\) and \({p}_{i}\) represent the prices of good \(j\) and \(i\), respectively, and

is the ‘ideal’ price index consistent with the utility function specification.

The demand equations display the standard result that aggregate demand for any variety of each sector is a negative function of its relative price, with elasticity \(\theta \), while the positive income elasticity of demand is unity. In Eqs. (3) and (4), the first three terms on the right side denote each firm's quota of the share of consumers' expenditure devoted to its sector. In our model, such a share is given by the sectors' relative eco-quality \(\left(\frac{g}{g+1}\right)\) for sector \(G\), and \(\left(\frac{1}{g+1}\right)\) for sector \(B\). It follows that each sector's demand is increasing in the quality of its products and decreasing in the quality of the other sector goods. Besides, for green products, a positive role is played by the consumer's intensity of preference for greenness, which operates as a further positive demand shifter.

2.2 Firms’ Behaviour

In each of the two final sectors, every firm manufactures a differentiated product. We assume that firms belonging to the same sector share the same constant-return-to-scale Cobb–Douglas production technology: \({Y}_{j}=A{L}_{j}^{\beta }{Z}_{j}^{\left(1-\beta \right)}\) in sector \(G\) and \({Y}_{i}=A{L}_{i}^{\beta }{Z}_{i}^{\left(1-\beta \right)}\) in sector \(B\), where \(A\) is a measure of technology, for the sake of simplicity assumed to be equal in both sectors.

Production requires the use of labour, \(L\), and an intermediate input, \(Z\), that are differentiated as to their 'green productivity', that is, \({L}_{j}\) and \({Z}_{j}\) are more qualified inputs for the production of eco-friendly final goods in sector \(G\), while \({L}_{i}\) and \({Z}_{i}\) are unskilled workers and no eco-qualified intermediate inputs employed in the production of brown goods in sector \(B\). To relate the production of eco-quality to its cost, we follow Hallak and Sivadasan (2013), who consider that price gaps across types of inputs reflect differences in their ‘quality productivity’. We thus assume that firms in sector \(G\) need to pay more qualified workers (the so-called green-collar workers) \({w}_{g}={w}_{0}{g}^{\eta }\) and more qualified intermediates \({z}_{g}={z}_{0}{g}^{\eta }\), where \({w}_{0}\) and \({z}_{0}\) are costs of no eco-qualified workers and intermediates, respectively, and \(\eta \) is the price elasticity of inputs to their green content. We assume \(0<\eta <1\) on the hypothesis that an intensification in eco-quality benefits from scale economies, as usually put forward in the literature on vertical quality differentiation (see Crinò and Epifani 2012; Hallak and Sivadasan 2013). Accordingly, given the production function, we get that the minimum unit cost of producing a variety j in sector G is \({\left(AC\right)}_{j}=\frac{c}{A}{g}^{\eta }\), where c is a constant that depends on the parameters of the production function and the (exogenously given) prices of unskilled workers and non-eco-qualified intermediate inputs, \({w}_{0}\) and \({z}_{0}\) respectively.Footnote 6 Unitary costs are increasing with the environmental features of the goods produced, \(\frac{d{\left(AC\right)}_{j}}{dg}\)>0. On the contrary, a brown firm pays workers and intermediates at the basic rate, so that the minimum unit cost of producing a variety i in sector \(B\) is \({\left(AC\right)}_{i}=\frac{c}{A}\).

Along with unitary costs, we assume green firms to incur two types of fixed costs: totally exogenous fixed costs, \(f\), and fixed costs necessary to achieve the products’ eco-quality. Investment costs in eco-quality, such as research and development resources to reformulate products, investments to redesign production processes, acquire new eco-friendly equipment, or retool old one, are assumed to be a convex function of the greenness intensity, \({\left(FC\right)}_{j}=k{g}^{\phi }\), where \(\phi \ge 2\) is the elasticity of fixed costs with respect to the eco-quality level.Footnote 7 Thus, also environmental fixed costs are increasing in the eco-quality of products: \(\frac{{d\left(FC\right)}_{j}}{dg}\)>0. Summing up, total fixed costs are \({\left(FC\right)}_{j}=k{g}^{\phi }+f\) for green firms and \({\left(FC\right)}_{i}=f\) for brown firms, so that total costs are \({\left(TC\right)}_{j}=\left(\frac{c}{A}{g}^{\eta }\right){Y}_{j}+k{g}^{\phi }+f\) for sector G goods and \({\left(TC\right)}_{i}=\left(\frac{c}{A}\right){Y}_{i}+f\) for sector B products.

As standard with CES preferences, the behavior of imperfectly competitive firms yields the result that profit-maximizing prices are a constant markup over unitary costs, with the size of the markup depending on the elasticity of substitution between goods. Thus, each firm in sector \(G\) sets its price according to:

while each firm in sector \(B\) sets its price equal to

3 Short- and Long-Term Equilibria in the Unregulated Market

With this formulation of the model, we are able to analyse both the short- and long-term market equilibria when brown goods have no environmental content and there are no policy interventions. This will serve as a benchmark for policy comparisons.

3.1 Short-Term Market Equilibrium

In the short term, there is a given number of firms active in each sector, \({M}_{0}\) for sector \(B\) and \({N}_{0}\) for sector \(G\), that earn positive profits.

Our model implies that any green firm’s profit depends on the eco-quality content of the goods it produces. When there is market equilibrium, i.e., \({Y}_{j}={C}_{j}\), green firms’ profit is defined as \({\pi }_{j}={p}_{j}{Y}_{j}-\frac{c}{A}{g}^{\eta }{Y}_{j}-k{g}^{\phi }-f\). We substitute in it Eqs. (3) and (5)—now specified for a given number of firms \({M}_{0}\) and \({N}_{0}\)—and Eq. (6). Considering that in market equilibrium there is symmetry among green firms, since they face the same demand and set the same price, we substitute the subscript \(j\) referring to the \({j}^{th}\) firm with the subscript \(G\) to represent sector \(G\), when necessary. The following equations define the short-term maximum profit of any green firm

and the maximum profit first order conditionFootnote 8

The symmetry among all \(G\) sector firms implies that they optimally choose the same level of greenness intensity. However, we are not able to get an analytical result for the optimal short-term value of \(g\), as Eq. (9) is not a closed expression for it.Footnote 9 We thus make use of a numerical simulation by assigning parameter values in harmony with the assumptions deriving from the theoretical model, as indicated in Table 1.

Values in Table 1 satisfy the restrictions imposed by the model, in particular:\(\theta >1\);\(\lambda >1\);\(\lambda >\eta \); so that\(\left(\lambda -\eta \right)\left(\theta -1\right)>0\).

We then compute the short-term market equilibrium for sector \(G\) on the basis of an exogenously given number of firms \({N}_{0}=1000\), getting \({g}^{*}=1.766\) as the optimal short-term value of \(g\).Footnote 10

Analogously, the short-term market equilibrium for sector \(B\) yields for any brown firm the following profit \({\pi }_{B}={p}_{B}{Y}_{B}-\frac{c}{A}{Y}_{B}-f\), which is the maximum one due to the price-setting rule. Again, in equilibrium, there is symmetry among all firms within the sector. Thus, we replace the subscript \(i\) referring to the ith firm with the subscript \(B\). By substitution of Eqs. (4) and (5)—specified for \({M}_{0}\) and \({N}_{0}\)—and Eq. (7), any brown firm maximum profit becomes

showing that brown firms' short-term profit depends only on the number of active firms \({M}_{0}\), assumed to be \({M}_{0}=600\), on other parameters of the model, as well as on the optimal eco-quality of the green goods. Actually, we have \(\frac{\partial {\pi }_{B}}{\partial g}<0\), as an increase in \(g\) reduces the market share of brown goods.

3.2 Long-Term Market Equilibrium

As all \(N\) and \(M\) firms earn short-term positive profits, new firms enter both segments of the market, until the next potential entrant would incur in a loss. The long-run equilibrium number of firms in each sector is endogenously defined by the null-profit condition.

For the green sector, from Eq. (8) solved for a null profit,Footnote 11 we get:

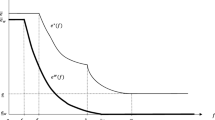

where \({N}^{L}\) is the long-run equilibrium number of green firms. We have \(\frac{\partial {N}^{L}}{\partial g}>0\), as an increase in \(g\) augments the share of green goods in total consumption (see Eq. (3)): with a higher demand for the green segment of the market, the null-profit condition is satisfied with a greater number of firms. This relationship is described by the growing curve in Fig. 1, obtained on the basis of the values of Table 1 parameters.

At the same time, the entry of new firms in the green segment of the market modifies the value \(g\) that maximizes green firms’ profit. To analyze the resulting relationship between \(N\) and \(g\), we restate the first-order condition for profit maximization—Eq. (9)—as

It is easily verifiedFootnote 12 that \(\frac{\partial {N}^{L}}{\partial g}<0\), that is, the optimal greenness intensity chosen by maximizing firms is decreasing as new competitors enter. Indeed, the entry of new firms in the green segment of the market, ceteris paribus, leads to a reduction in each incumbent firm’s profit. Thus, the maximizing behavior of incumbent firms involves a modification of their choice variable \(g\). As firms’ revenues and total costs are positively linked to the greenness intensity, the negative relationship between \(N\) and the optimum \(g\) entails the elasticity to product eco-quality of total costs to be higher than that of revenues. This is usually the case when firms incur investment costs for improving the eco-quality of their products so that a lower \(g\) reduces total costs more than revenuesFootnote 13 and restores the firm maximum profit. Based on the values of the parameters in Table 1, the above relationship is described by the decreasing curve in Fig. 1.

The intersection between the two curves yields the long-run equilibrium in the green segment of the market, characterised by the number of firms \({N}^{L}\) satisfying the zero profit condition and the corresponding optimal greenness intensity \({g}^{L}\) assuring profit maximization. The simulation identifies \({N}^{L}=\mathrm{1,112}\) and \({g}^{L}=1.692\) as the long-run equilibrium values, as indicated in the first row of Table 2.Footnote 14 The figure also shows that the short-period equilibrium for \({N}_{0}=\mathrm{1,000}\) is on the maximum profit curve, but well above the zero-profit one.

As to the brown sector, from Eq. (10) solved for a null profit, we get:

that depends negatively on the optimal long-run value of \(g\), \(\frac{\partial {M}^{L}}{\partial g}<0\), since a rise in \(g\) has an adverse effect on brown firms’ demand and profit.

4 Policy Interventions and Long-Run Equilibrium

The above result is open to policy interventions by a regulator aiming at increasing the level of greenness of the goods produced in the industry. To this end, we now study three environmental policy instruments: the granting of a subsidy on eco-friendly production costs and investments for the development of the ecological upgrading of products, campaigns to increase consumers’ ecological awareness, and the imposition of a minimum eco-quality standard.Footnote 15

In what follows, we are going to study the long-run effects of the above policies, in the first place by considering each policy tool ‘alone’. For the first two policies considered, we thus maintain the assumption that the brown sector's goods present no ecological content, so that \(b=1\), as in the benchmark case. In the MQS policy analysis we assume that the standard exogenously fixed by the policymaker, \(\underline{b}>1\), only binds sector \(B\) firms. Indeed, the working of our model implies that an MQS policy cannot impose the same or even a higher value than that voluntarily selected by green firms when regulations are absent (benchmark case).

In Table 2, in the ‘single policies’ rows, we summarise the numerical results obtained from two values of each tool referring to the long-term equilibrium values for the following variables: the number of green and brown firms \({N}^{L}\) and \({M}^{L}\), the optimal eco-quality intensity for green goods \({g}^{L}\), sector \(G\) market share \({\left(MS\right)}_{G}\), the industrial greenness index (IGI), and the degree of quality differentiation (eco-quality ratio, EQR). The IGI index is defined as the sum of the eco-intensity of green and brown goods, weighted for their respective market shares, while the EQR is expressed as the ratio of the eco-quality intensity of the two sectors.

4.1 Subsidy on Green Costs

To support a higher ecological content of the goods produced, the policy maker may grant a subsidy to green firms to lessen the cost of their environmental efforts. This type of subsidy, which may consist of low-interest or guaranteed loans, equity infusions, and tax credits given directly to green firms, modifies their behaviour in the desired direction. We assume the subsidy to take the form of a proportional cost-sharing, with the government paying a fraction \(\rho \) of all costs linked to the level of greenness firms choose to undertake. With reference to our benchmark model, the subsidy \(0<\rho <1\) lowers unitary and fixed environmental costs incurred by green firms, so that their total costs become \({\left(TC\right)}_{G}=\left(1-\rho \right)\left[\left(\frac{c}{A}{g}^{\eta }\right){Y}_{G}+k{g}^{\phi }\right]+f\), bringing about an increase in their profit. It follows that the zero-profit condition is satisfied by a higher number of green firms, while the new profit-maximizing green level is higher as now green costs respond to a lesser extent to changes in \(g\). Indeed, with this policy in effect, the long-run zero-profit condition is:

whereas the optimal ecological intensity results from the solution of the profit maximization problem:

Comparing the above equations with the corresponding ones absent the subsidy (Eqs. (11) and (9)), we get that the subsidy has a positive effect on both the long-run equilibrium number of green firms \({N}^{L}\) and their optimal level of greenness \({g}^{L}\); both variables are higher, the greater the subsidy granted. This analytical result is confirmed by a numerical simulation carried on by assuming the following values for the subsidy: \(\rho =0.10\) and \(\rho =0.15\). Figure 2 shows sector \(G\) ‘old’ and ‘new’ equilibria, where the solid lines refer to the no-regulation case, the dashed ones to \(\rho =0.10\), and the dotted ones to \(\rho =0.15\).

Since \(b=1\), brown firms do not benefit from the subsidy. Yet, as the subsidy makes the optimal level of \(g\) to increase, it alters the two sectors’ market shares in favour of sector \(G\), bringing down sector \(B\) profit, so that its null profit condition is satisfied by a smaller number of firms. These results are confirmed by our numerical simulation, as well, as presented in the 'Subsidy’ rows of Table 2. In sum, by granting a 'green subsidy', the policymaker can increase the overall level of greenness (the IGI index), as well as modify the market structure in favour of green firms.

4.2 Ecological Awareness Campaigns

In our model consumers’ demand supports the production of goods differentiated as to their eco-friendly characteristics and at the same time plays a pivotal role in determining the optimal eco-quality level of green firms and thus the overall level of greenness in the industry. This is an important issue, as people are increasingly conscious of the impact of their consumption choices on the quality of the environment, in particular, thanks to targeted awareness campaigns by opinion movements and reports by national and international institutionsFootnote 16 that are able to provide better information and modify consumers' ecological attitudes as well as social norms.

Policy interventions may support the growth of ‘green consumerism’. Examples of government interventions aimed at increasing consumers’ ecological consciousness are informative and educational campaigns designed to strengthen both private and altruistic motives that cause consumers to attach a specific value to eco-friendly products (see Sartzetakis et al 2012; Kaufman 2014).

In our analysis, starting from the benchmark case, a government campaign succeeding in enhancing consumers' sensitivity to eco-quality goods and increasing their willingness to pay a premium for the ecological features of goods—other things equal—has a positive impact only on green goods demand and therefore on green firms’ profit. It follows that for any eco-quality content \(g\), when \({\lambda }^{^{\prime}}>\lambda \) the zero-profit condition is satisfied by a higher number of green firms, while, for any number of firms, there is an increase in the profit-maximizing green level, as now firms’ revenues respond to a greater extent to changes in \(g\). In comparison to Eqs. (11) and (12) of the benchmark case, the corresponding long-run zero-profit condition

and the first order condition

confirm that a greater consumers’ eco-awareness impacts positively on both the long-run equilibrium number of green firms \({N}^{L}\) and their optimal level of greenness \({g}^{L}\).

‘Green campaigns’ rows in Table 2 report the numerical outcome of our simulation, assuming an increase in consumers’ intensity of eco-preference from \(\lambda =1.2\) to \(\lambda {^{\prime}}=1.5\) and to \(\lambda {^{\prime}}=1.7\). With respect to the benchmark case, our results indicate a growth in sector \(G\) level of greenness and market share, as well as in the overall level of greenness in the industry.

This result is depicted in Fig. 3, where the solid line curves refer to \(\lambda =1.2\) (same curves as the benchmark case in Fig. 1), the dotted ones to \(\lambda {^{\prime}}=1.5\), and the dashed ones to \(\lambda {^{\prime}}=1.7\). With the increase in \(\lambda \), there is a rightward shift of the zero-profit condition curve and an upward shift of the profit-maximization one, leading to two new equilibria with higher values for both \({N}^{L}\) and \({g}^{L}\).

The rise in consumers’ ecological consciousness does not directly affect sector \(B\) firms, whose products have no eco-quality content; nevertheless, the demand shift in favour of green goods and the increase in their optimal green intensity lead to a reduction in brown firms' profit and consequently in the long-run equilibrium number of brown firms:

The numerical outcome is shown in column (3), ‘Green campaigns’ rows, of Table 2.

4.3 Minimum Quality Standard

With the imposition of a minimum quality standard (MQS), brown firms are compelled to manufacture goods with a required eco-quality content, \(\underline{b}>1\). To analyse the working of this policy we refer to the more general formulation of our model, starting from consumers’ preferences (Eq. (1)), which leads to the following aggregate demand functions for green and brown goods, respectively

with the price index \(P={\left[\frac{g}{g+\underline{b}}{g}^{\lambda \left(\theta -1\right)}\frac{1}{N}\sum_{j=1}^{N}{p}_{j}^{1-\theta }+\frac{\underline{b}}{g+\underline{b}}{\underline{b}}^{\lambda \left(\theta -1\right)}\frac{1}{M}\sum_{i=1}^{M}{p}_{i}^{1-\theta }\right]}^{\frac{1}{1-\theta }}\).

As to firms’ productive process, also brown firms are now compelled to use eco-qualified workers and intermediates, albeit with a lower 'green productivity' compared to green firms. Following the same reasoning put forward for green firms (Sect. 2.2 above), brown firms need to pay their workers and intermediate inputs \({w}_{b}={w}_{0}{\underline{b}}^{\sigma }\) and \({z}_{b}={z}_{0}{\underline{b}}^{\sigma }\), respectively, where \(0<\sigma <1\) and \(\sigma >\eta \) as they benefit from lower scale economies from a lower intensification in eco-quality, with respect to green firms.Footnote 17 Accordingly, the minimum unit cost of producing a variety i in sector \(B\) is \({\left(AC\right)}_{i}=\frac{c}{A}{\underline{b}}^{\sigma }\), with \(\frac{d{\left(AC\right)}_{i}}{d\underline{b}}>0\). Sector B firms’ investment costs in eco-quality are assumed to be \({\left(FC\right)}_{i}=h{\underline{b}}^{\gamma }\), with \(\frac{{d\left(FC\right)}_{i}}{d\underline{b}}>0\), \(h>1\), and \(\gamma \ge 2\). The latter is the elasticity of fixed costs with respect to the eco-quality level in sector B. To represent the asymmetry in eco investment costs between sectors, we posit \(\gamma >\phi \) and \(h>k\), on the assumption that greener firms are more efficient in improving their environmental characteristics. Summing up, the total costs for sector B products are \({\left(TC\right)}_{i}=\left(\frac{c}{A}{\underline{b}}^{\sigma }\right){Y}_{i}+k{\underline{b}}^{\gamma }+f\). Profit maximization behaviour leads brown firms to set the following price for their products: \({p}_{i}=\frac{\theta }{\theta -1}\frac{c}{A}{\underline{b}}^{\sigma }\).

With the above specifications, starting from a situation of \(b=1\), the imposition of an MQS modifies both brown firms’ demand—as consumers value the eco-quality content of their products—and their costs—as they incur additional unitary and fixed costs related to the eco-quality of their production, costs which are absent in the benchmark case. The surge in brown firms’ environmental costs is likely to outweigh the demand expansion linked to \(\underline{b}>1\), owing to the weight of environmental costs and the partially offsetting effect on brown goods’ demand of the concomitant increase in \(g\), explained below. Thus, in the presence of an MQS, brown firms’ profit

is lower than that previously stated in Eq. (13),Footnote 18 implying that the zero-profit condition is met with a lower \({M}^{L}\).

Besides modifying the market equilibrium of sector \(B\) firms, the imposition of an MQS modifies the behavior of green firms as well. The intuition goes as follows. The MQS causes an increase in sector \(B\) weight in consumers’ utility, which translates into an increase in brown goods’ share of expenditure and, correspondingly, a reduction in the share of green goods in total consumption. The importance of relative eco-quality in the demand structure appears clearly by taking the ratio between Eqs. (18) and (19)

which shows that the demand for any \(j\) variety with respect to the demand of any \(i\) variety is increasing in its relative eco-quality. Following the imposition of an MQS, the reduction in the relative demand for green goods has a negative effect on green firms’ profit

which is lower compared to Eq. (8), since it depends negatively on the standard imposed on brown firms (\(\frac{\partial {\pi }_{G}}{\partial \underline{b}}<0\)). It follows that, for any eco-quality \(g\), the zero-profit condition is satisfied by a lower number of green firms

as emerges clearly from a comparison with Eq. (11). At the same time, the imposition of an MQS modifies the optimal ecological intensity resulting from the solution of the new profit maximization problem

Green firms react to the adverse profit effect of growing values of the standard by increasing the greenness of their goods to regain the eco-differentiation of their products and compensate for the worsening in their relative demand. Thus, the imposition of an MQS is able to increase the level of greenness in both sectors, as brown goods now incorporate a positive eco-quality, while the optimal ecological content of green goods increases. However, green firms are not able to fully recover their market shares, as a rise in \(g\) brings about a surge in firms' environmental costs as well. Albeit the elasticity of revenues is higher than the elasticity of variable costs with respect to the green content of the goods, as \(\lambda >\eta \),Footnote 19 the convexity of the fixed eco-quality cost function makes their growth to more than offset the positive effect on profit of a rising demand. Thus, the growth of the optimal \({g}^{L}\) is not able to catch up with the increase of the standard \(\underline{b}\) and the product eco-quality differentiation declines.

Our numerical simulation, where we assume the following valuesFootnote 20 for the additional parameters of the model \(\sigma =0.7\), \(h=2\), and \(\gamma =3\), confirms the above results. The imposition of an MQS is binding for brown firms since \({\pi }_{B}\) is decreasing in \(\underline{b},\) resulting in a persistent reduction in the long-run equilibrium number of brown firms for growing values of \(\underline{b}\). As to green firms, for higher values of the standard, there is an increase in the optimal long-term value of the eco-quality \({g}^{L}\). The latter is coupled with a decrease in sector \(G\) market share, as the increase in \({g}^{L}\) is lower than that of the MQS so that the eco-quality ratio decreases (see the ‘MQS’ rows of Table 2). In Fig. 4, the profit maximization lines shift upward and the zero condition curves move leftwards, with the solid lines referring to the benchmark case \(b=1\), the dotted ones to \(\underline{b}=1.2\), and the dashed ones to \(\underline{b}=1.3\).

Comparing the results for the three policies, based on the parameters' values, our numerical simulation stresses that the greater increase in the IGI index comes from the MQS policy. This outcome is not surprising since this policy compels brown goods to embody the required eco-characteristics and in reaction also green goods become more eco-friendly, so that the IGI index augments, notwithstanding the reduction in sector \(G\) market share.

5 Combined Policies

So far, we have investigated the effectiveness of three policy tools with respect to the policymaker’s objective of increasing the overall level of greenness in the industry, that is, the granting of an incentive on eco-quality related costs, interventions fostering consumers' environmental awareness, and the imposition of an MQS. Our results show that each policy alone is apt to stimulate an increase in the industrial greenness intensity vis-a-vis the unregulated equilibrium. Yet, regarding the assessment of the single policies, additional considerations are useful, for instance regarding their side effects in terms of the market composition and the possibility that the intensity of application of a single tool may hit budgetary, political, or social limits. Indeed, the setting of an MQS has the side effect of engendering a reduction in the share of greener goods in consumers’ real expenditure, pointing to a trade-off between the growth in the level of greenness and the market weight of sector \(G\) products. Besides, the budget constraint may limit the granting of the eco-subsidy, environmental campaigns may take too long to produce sizeable effects on consumers' behaviour, or the imposition of a high minimum standard may compel too many brown and green firms to exit the market.

Since the policies under consideration appear to be complementary as they mutually reinforce one another, the regulator can combine two or more policies to overcome the above limits to get a higher overall level of greenness.

In what follows, we are going to briefly investigate the joint effect of the policies analysed, first considering the concurrent adoption of only two policies at a time, and then the simultaneous implementation of all policies.

5.1 Combined Policies: Pro-environmental Campaigns and Green Subsidy

Given the uncertainty about the extent and the timing of the efficacy of a policy aiming at a greater ecological awareness (i.e., an increase in \(\lambda )\), it may be better considered as a tool supplementing other policies.Footnote 21

We start considering the simultaneous working of an increase in consumers’ ecological awareness and a subsidy on environmental costs. Their joint effect on the industry’s level of greenness is higher than that of each single policy, as both policies affect positively green firms' profits, the pro-environmental campaign working through the demand side and the granting of incentives on green costs through the supply side. Since each policy has the same (qualitative) impact on the long-run equilibrium number of green firms, the optimal long-run green content of goods, and the market weight of sector \(G\) products, we expect the long-run equilibrium values for both \({N}^{L}\) and \({g}^{L}\) to further increase, along with sector \(G\) market shares. Our numerical simulation (for simplicity, carried on for only one value for each policy) confirms this conclusion: in Table 2, the values of \({N}^{L}\), \({g}^{L}\), and \({\left(MS\right)}_{G}\) in the (\({\lambda }^{^{\prime}}+\rho \)) row are higher than the respective values in each single policy row ‘Subsidy \(\rho =1.5\)’ and ‘Green campaigns \({\lambda }^{^{\prime}}=1.7\)’. Figure 5 illustrates our findings, comparing the long-period equilibrium of the benchmark case (solid lines) to the case of the increased consumers’ awareness alone (dotted lines), the case of the green subsidy alone (dashed lines), and the simultaneous implementation of both policies (dot-dashed lines).

In the literature, several papers stress that ‘green consumerism’ can replace environmental policies in enhancing firms’ pro-environmental behaviour (Conrad 2005; Brennan 2006), whereas other contributions (Eriksson 2004; Doni and Ricchiuti 2013) give little support to this idea. Our results endorse the former conclusion, as the two policies are substitutes with respect to the regulator’s aim: the policymaker may attain the same industry’s level of greenness, either by granting a green subsidy or by a campaign fostering consumers’ ecological awareness.Footnote 22

Since the positive impact of each policy on green firms’ optimal \({g}^{L}\) is enhanced when the two policies are carried on simultaneously, the negative effect on brown firms’ profit is stronger than that of each policy alone, leading to a corresponding lower long-run equilibrium number of sector \(B\) firms. In terms of our numerical simulation, this result is shown in Table 2, by comparing the \({M}^{L}\) \(\mathrm{value}\) in the (\({\lambda }^{^{\prime}}+\rho \)) row with the corresponding values in the rows referring to every single policy.

5.2 Combined Policies: MQS, Green Subsidy, and Pro-environmental Campaigns

We have seen that the setting of a quality standard has the side effect of engendering a reduction in the share of greener goods in consumers’ real expenditure, pointing to a trade-off between the growth in the level of greenness and the market weight of sector \(G\) products. The policy maker may match the imposition of an MQS with the other policies, to support the share of green goods consumed, thus favouring a higher ecological composition of the industry.Footnote 23

Adding a subsidy on environmental unitary and investment costs to the MQS leads—compared to the MQS policy alone—to a lesser decrease both in the long-run equilibrium number of green firms and in the green sector’s market share, and to an even higher increase in the optimal \({g}^{L}\). Indeed, even when \(\underline{b}>1\) and brown firms benefit from the subsidy as well, this policy is more valuable to green than to brown firms as the former incur higher eco-related costs; hence, the MQS negative effect on green firms’ profit is partly compensated by the subsidy.

These results are confirmed by our numerical simulation, (for simplicity, carried on only for \(\lambda =1.5\)) where in Table 2 the values of \({N}^{L}\), \({g}^{L}\), and \({\left(MS\right)}_{G}\) of the (\(MQS+\rho \)) row are higher than the respective values in the row ‘MQS’ of the single policy. Figure 6 reports the above findings, comparing the equilibrium points of an MQS policy alone (solid lines) to the equilibrium points of the two joint policies (dotted lines).

The joint utilisation of both policy tools changes brown firms' long-term equilibrium, as well. As stated above, an MQS leads to a reduction in their profit and in the number of active firms; on the other hand, the granting of the subsidy on the environmental costs brown firms must sustain when adhering to an MQS helps limit the reduction in their profit, as emerges from a comparison between the profit in Eq. (20) and the one following the granting of the green subsidy which is

In sum, the net effect on \({\pi }_{B}\) (and on \({M}^{L}\)) of the two combined policies depends on the interplay of different factors with a contrasting outcome: starting from the benchmark case, the imposition of an MQS and the increase in green firms’ optimal \({g}^{L}\) (following both policies) harm \({\pi }_{B}\), whereas the subsidy on eco-quality costs influences favourably the profit. The positive effect of the subsidy on brown firms’ costs may counterweight the negative influence of the MQS if the latter is sufficiently high to make the eco-linked subsidy large enough to bring about an increase in their profit.

Our numerical simulation confirms this result: for lower values of the MQS, the final effect of an MQS coupled with a green subsidy is a decline in brown firms' profit, leading to a contraction in the long-term equilibrium number of sector \(B\) firms. On the contrary, in our example, when \(\underline{b}=1.3\), the two combined policies lead to an increase in \({M}^{L}\) with respect to the MQS policy alone (in Table 2, compare the values for \({M}^{L}\) in rows (\(MQS+\rho \)) and \(MQS\)).

Coupling the MQS policy with consumers’ education campaigns results in similar outcomes, as a greater ecological awareness favors to a larger extent green firms compared to brown ones. Likewise, the reasoning is akin to the one developed above: for any MQS, a rise in ecological awareness causes the demand and profit expansions to be larger for the green sector than for the brown one. Indeed, a higher ecological feeling makes consumers’ valuation of goods increase more the greater the eco-quality content of products (see Eq. (21) for the role of relative eco-quality in the demand structure). The numerical results, which are consistent with our analytical findings, are in the (\(MQS + {\lambda }^{^{\prime}}\)) row of Table 2. Figure 7 reports the above findings, comparing the long-run equilibrium points of an MQS policy alone to the equilibrium points of the two joint policies, with \(\underline{b}=1.2\) and \(\underline{b}=1.3\) (dotted lines).

We now turn to consider the simultaneous adoption of all policies, adding both a green subsidy and an increase in consumers’ ecological attitude to the setting of an MQS. Since the policies considered are complementary, the simultaneous use of all the policy tools triggers an increase in the eco-quality content of all the goods produced in the industry so that it is possible to attain a higher level of greenness than with any policy alone.

As to our numerical simulation, the last row (\(MQS + {\lambda }^{^{\prime}}+\rho \)) in Table 2 shows that by putting together all interventions, the policymaker can achieve a higher eco-quality content of green products than that resulting from any single policy alone. At the same time, for every minimum quality standard, the simultaneous use of all policy tools displays a greater positive impact on the long-run equilibrium number of green firms \({N}^{L}\), the market share of green products, and the IGI index than the one deriving from each ‘single’ policy instrument.

Figure 8 illustrates our findings, comparing the long-period equilibrium in the case of the joint implementation of only the ecological awareness and the subsidy policies (dashed lines) to the simultaneous execution of all policies, with the dotted lines referring to the addition of an MQS policy, with the standard set to \(\underline{b}=1.2\), and the dot-dashed lines to an MQS set at \(\underline{b}=1.3\).

The positive impulse on sector \(G\) of the three joint policies is tallied by the negative effect on sector \(B\) firms, with a reduction in their profit. Indeed, our previous analysis pointed to every single policy bringing about a fall in brown firms' profit, so that their cumulative effect leads to a further contraction in their long-run equilibrium number.

6 Further Discussion and Conclusions

We have developed a two-sector monopolistic competition model in which consumers appreciate the eco-quality features of the goods, which differ between the brown and green sectors. The model has been used to explore the implications of green consumerism, that is, a market demand for eco-friendly goods, as well as the role of product differentiation in the choice of the optimal eco-quality level of green firms and the long-run equilibrium in both sectors. We have then investigated the effectiveness of three policy tools with respect to the regulator’s objective of increasing the overall level of the greenness of the industry, that is, the granting of an incentive on eco-quality related costs, the imposition of an MQS, and interventions fostering consumers' environmental awareness.

To this end, we have computed an indicator of the greenness intensity in the industry, the IGI index, whose values help to shed light on the diverse degree of efficacy of the policies under examination. We have taken the increase in the IGI index to be the aim of the regulator, as we deem that a complete welfare analysis is not feasible given the complexity of our modelFootnote 24 within the Dixit-Stiglitz approach. Even if the IGI index does not substitute for a welfare analysis, we believe that it can be seen as akin to the average environmental quality, which in a number of works (among others, Cremer and Thisse 1999; Deltas et al 2013; Wada 2019; Garella 2021) is a positive externality additively entering consumers’ utility functions and the policy maker welfare function. This externality stems from the economy-wide consumption of environment-friendly products and is defined as the sum of the different environmental qualities weighted by the share of heterogeneous consumers choosing each quality. Since our IGI index is obtained as the sum of the two sectors’ environmental qualities weighted by their market shares, its increase would correspond, in the approach of the cited papers, to an increase in the externality, positively influencing social welfare.Footnote 25

Our results show that each policy is apt to stimulate an increase in the industrial greenness intensity vis-a-vis the unregulated equilibrium and that, since the three policy tools are not substitute instruments, their joint use helps to attain a greater level of greenness than that resulting from any single policy alone, should the latter meet with limits in their implementation.

Our first result is in line with other papers analysing a duopolistic market, such as Ronnen (1991), Arora and Gangopadhyay (1995), Conrad (2005). In our two-sector monopolistically competitive setting, it may be explained by considering that there are two competitive forces at work, based on product differentiation. On the one hand, the competition within each sector, linked to the horizontal differentiation among goods, triggers the entry of new firms and leads to a long-run equilibrium where all maximizing firms earn zero profit. On the other hand, the competition between sectors operates through the eco-quality vertical differentiation of products that influences the share of each sector in consumers' real expenditure: the greater the eco-quality differentiation, the greater the competitive advantage of the greener sector. Policy interventions can modify consumers' and/or firms' behaviour, altering the unregulated long-run equilibrium in the industry in the direction sought after by the policymaker. We find however that there is not a unique mechanism linking the policies examined to an increase in the industrial greenness intensity, depending on the eco-quality differentiation effect of each policy. Interventions reducing firms’ eco-quality costs or stimulating consumers' sensitivity to the ecological features of the goods create an incentive for attaining a higher eco-quality differentiation vis-à-vis brown goods, as green firms optimally respond by increasing the eco-quality level of their goods. Differently, the imposition of an MQS that compels brown firms to attain a minimum environmental content for their products brings about a reduction in the eco-quality differentiation between sectors. In reaction, profit-maximizing green firms try to limit the fall in their relative competitiveness by increasing the eco-quality level of their goods, with the overall result of an additional increase in the level of industry greenness. It is worth noting that most duopoly models share our result of a positive relationship between the imposition of an MQS and the eco-quality level of green products. On the contrary, the duopoly model by Deltas et al (2013) obtains that an MQS policy decreases the environmental features of the high-quality firm since it reduces the latter's market share, which in their approach lessens the incentive for investing in product greenness.

We also get that each policy tool leads to a decline in brown firms' profit and the number of active firms in that sector. However, the different transmission mechanisms make the policy instruments not neutral for the equilibrium structure of the industry that emerges after the regulatory interventions.Footnote 26 In our model, the industry structure resulting after the imposition of an MQS is different from that stemming from the two other policy interventions. In the latter cases, there is an increase in the weight of the green sector in the industry, as well as in the number of active green firms. In the former case, the industry composition alters in favour of the brown sector and the number of firms shrinks in both sectors, notwithstanding a higher growth in the industrial greenness intensity index in comparison to the other two policies. The policy maker can however tackle the trade-off between the increase in the greenness intensity and the market weight of the green sector, as well as the number of horizontally differentiated products, through the simultaneous utilisation of other policy tools.

Since the three policy tools are complementary, this is a general result: the joint use of all policy tools helps to attain a higher level of greenness intensity in the industry, a greater weight of the green sector, and a greater number of active green firms. Along with the above remarks, it suggests that an environmental policy must take into consideration not only its effects on the eco-quality features of the products but also its implications on consumers’ expenditure allocation between sectors and on the market structure. We think that our model represents the first step in this direction, as a change in our industrial greenness index reflects a change in the level of eco-quality of both green and brown products (if the latter occurs) as well as a change in the share of consumers’ expenditure devoted to each sector.

Data availability

Data sharing not applicable to this article as no datasets were generated or analysed during the current study.

Notes

In so doing, we follow the literature on quality product differentiation.

This simplifying assumption does not affect the working of the model, as in equilibrium there is symmetry among all firms of the same sector so that they optimally choose the same greenness intensity.

See Arora and Gangopadhyay (1995) for a similar hypothesis. Models with imperfect information about products' eco-friendliness analyse the role of firms' strategies aimed at capturing the market demand from environmentally oriented consumers. To expand their market share, firms try to gain a pro-environmental reputation by spreading information on their green performance. The focus is on over-compliance with environmental regulations, the imposition of higher prices, since green efforts are associated with higher costs (Mahenc 2008; Sengupta 2012) or the differentiation of products from those produced by firms that make lower green investments through advertising activities, the use of eco-certification (Hamilton and Zilberman 2006) or labels (Amacher et al 2004).

As standard with CES utility functions, for \(\theta >1\), utility rises with varieties, so that the representative consumer demands all differentiated varieties within both sets of available products. To save on notation, we assume the same value of the elasticity of substitution among all goods.

The rationale for considering that the environmental quality of products influences consumers’ utility rests on the approach followed in models of quality product differentiation (see Grossman and Helpman 1991). According to this strand of literature, optimizing firms invest in R&D to obtain an increase in the qualitative characteristics of goods and thus conquer market shares, given consumers' demand for higher-quality products. The latter depends no more on pure relative prices but on quality-weighted relative prices. Another approach, leading to the same result of goods’ environmental features entering the utility function, refers instead to social drivers of consumers’ behaviour. Among the large volume of literature discussing the social dimension of green consumerism, are Andreoni (1990), Frey and Stutzer (2006), Nyborg et al (2006).

The constant is defined as \(\equiv \frac{{w}_{0}^{\beta }{z}_{0}^{1-\beta }}{{\beta }^{\beta }{\left(1-\beta \right)}^{1-\beta }}\).

Fixed costs are a convex function of eco-quality as $${\left(FC\right)}_{j}^{\text{'}\text{'}}>0$$ and $${\left(FC\right)}_{j}^{\text{'}\text{'}\text{'}}\ge 0$$ (Zhou et al 2002). As common in the vertical product differentiation literature, several contributions consider that eco-quality only affects fixed costs and assume a quadratic function to represent them (Lutz et al 2000; Moraga-González and Padrón-Fumero 2002; Garcia-Gallego and Georgantzís 2009; Deltas et al 2013). To have investment costs strictly increasing in quality, in the following numerical simulations we assume \(\phi \ge 2\).

The second-order derivative is: \(\frac{{\partial }^{2}{\pi }_{G}}{\partial {g}^{2}}=\frac{E\left[\left(\lambda -\eta \right)\left(\theta -1\right)+1\right]\left[{g}^{\left(\lambda -\eta \right)\left(\theta -1\right)-1}\right]}{\theta {N}_{0}}\break \left\{\frac{\left(\lambda -\eta \right)\left(\theta -1\right)\left[1-{g}^{\left(\lambda -\eta \right)\left(\theta -1\right)+1}\right]-2{g}^{\left(\lambda -\eta \right)\left(\theta -1\right)+1}}{{\left[{g}^{\left(\lambda -\eta \right)\left(\theta -1\right)+1}+1\right]}^{3}}\right\}-\phi \left(\phi -1\right)k{g}^{\phi -2}\). Its sign is negative, i.e. we have a maximum profit when both terms are negative. Looking at the first term, the term in curly brackets is negative if \(\left(\lambda -\eta \right)\left(\theta -1\right)>0\), that is if \(\lambda >\eta \), implying that “going green pays,” i.e. consumers’ marginal valuation of the eco-qualities of goods exceeds the marginal cost to produce more eco-friendly goods.

We cannot analytically derive the optimal level of greenness as the variable \(g\) appears in the first-order condition with different exponents.

All numerical calculations are available upon request.

Assuming no entry costs.

The derivative \(\frac{\partial {N}^{L}}{\partial g}=\frac{E\left[\left(\lambda -\eta \right)\left(\theta -1\right)+1\right]\left[{g}^{\left(\lambda -\eta \right)\left(\theta -1\right)}\right]}{\phi k\theta }\break \left\{\frac{\left[\left(\lambda -\eta \right)\left(\theta -1\right)+1\right]{g}^{-\phi }\left[1-{g}^{\left(\lambda -\eta \right)\left(\theta -1\right)+1}\right]-\phi {g}^{-\phi }\left[{g}^{\left(\lambda -\eta \right)\left(\theta -1\right)+1}+1\right]}{{\left[{g}^{\left(\lambda -\eta \right)\left(\theta -1\right)+1}+1\right]}^{3}}\right\}<0\) is negative, as the term in curly brackets is negative.

As stated in footnote 7, in the literature it is usual to assume a quadratic function to represent eco-quality fixed costs. In our model, the key role is played by \(\phi \), the elasticity of fixed costs with respect to the eco-quality level, whose value is not less than 2.

To check the robustness of the model, we have assigned different values to the demand and supply parameters θ, η, and ϕ. The simulation results are consistent with those implied by the working of the model. In particular, we obtain a higher optimal \({g}^{L}\) associated with a higher θ, as the latter signals a competition intensification, prompting green firms to further diversify their products by increasing the greenness intensity of their goods. Instead, we get a lower optimal \({g}^{L}\) associated with higher values for η and ϕ, since they imply that green costs respond to a higher extent to a given eco-quality so that profit-maximizing firms choose a lower optimal\({g}^{L}\).

Several papers show that a subsidy lessening green firms’ eco-related costs is analogous to an emissions tax increasing brown firms’ costs and prices. However, this is not why we do not analyse the imposition of such a tax on brown firms. The reason is that, in our model, taxing brown firms does not yield the expected outcome of a decrease in the brown sector’s market share and an increase in the overall industry’s level of greenness. On the contrary, it results in a worsening in the industry’s greenness. The reasoning goes as follows. By augmenting brown goods’ cost of production and prices, an emissions tax reduces brown goods’ consumption, thus lowering brown firms' profit and the long-run number of active firms. As to green firms, there is a growth in their demand and profit. However, the loosening in price competition allows a slackening in quality competition. As the elasticity of total costs to eco-quality is higher than that of revenues, green firms maximize their profit by a lower differentiation of their products' eco-quality. The result is a reduction in the IGI index. Analytical, numerical, and graphical solutions (available from the authors) confirm the above outcome.

Since the working of our model implies $$\underset{\_}{b}<g$$.

Our result differs from that of Crampes and Hollander (1995), who, in an oligopoly model with quality differentiation, show that when setting a minimum quality standard, the firm producing the lower quality will gain.

Recall that \(\lambda >\eta \) is needed for the profit Eq. (9) to have a maximum.

Such values satisfy the additional restrictions imposed by the model, in particular \(\left(\lambda -\sigma \right)\left(\theta -1\right)>0\).

For instance, according to our numerical simulation, with the granting of a subsidy equal to \(\rho =0.158\) we get the same level of the greenness of a policy increasing consumers' awareness to \(\lambda =1.7.\)

See Birg and Voßwinkel (2018) for an analysis of the usefulness of combined policy instruments in achieving the policymaker's goal of an improvement in products' environmental quality.

Indeed, in our analysis, we do not include an emissions tax since taxing brown firms would worsen the industry’s overall level of greenness, following the reasoning specified in footnote 15. Since in the paper we maintain that the aim of the policymaker is the growth in the overall environmental quality, an emissions tax policy should be ruled out as a suitable policy tool.

As stated by Garella (2021, p. 205) “A Government may only aim at increasing the externality, or it may consider a more complete welfare function.”

Cremer and Thisse (1999) stress that, in a differentiated oligopoly, both a subsidy and different types of taxes may have a significant impact on the market structure, so that, when considering all the effects, the welfare conclusions about the most appropriate policy tool may change.

References

Amacher GS, Koskela E, Ollikainen M (2004) Environmental quality competition and eco-labeling. J Environ Econ Manag 47(2):284–306. https://doi.org/10.1016/S0095-0696(03)00078-0

Andreoni J (1990) Impure altruism and donations to public goods: a theory of warm-glow giving. Econ J 100(401):464–477. https://doi.org/10.2307/2234133

Arora S, Gangopadhyay S (1995) Toward a theoretical model of voluntary overcompliance. J Econ Behav Organ 28(3):289–309. https://doi.org/10.1016/0167-2681(95)00037-2

Birg L, Voßwinkel JS (2018) Minimum quality standards and compulsory labelling when environmental quality is not observable. Resour Energy Econ 53:62–78. https://doi.org/10.1016/j.reseneeco.2018.01.003

Blanchard OJ, Kiyotaki N (1987) Monopolistic competition and the effects of aggregate demand. Am Econ Rev 77(4):647–666

Brennan J (2006) Green preferences as regulatory policy instrument. Ecol Econ 56(1):144–154. https://doi.org/10.1016/j.ecolecon.2005.01.012

Chang J-J, Wang W-N, Shieh J-Y (2018) Environmental rebounds/backfires: Macroeconomic implications for the promotion of environmentally-friendly products. J Environ Econ Manag 88:35–68. https://doi.org/10.1016/j.jeem.2017.09.004

Conrad K (2005) Price competition and product differentiation when consumers care for the environment. Environ Resour Econ 31(1):1–19. https://doi.org/10.1007/s10640-004-6977-8

Crampes C, Hollander A (1995) Duopoly and quality standards. Eur Econ Rev 39(1):71–82. https://doi.org/10.1016/0014-2921(94)00041-W

Cremer H, Thisse J-F (1999) On the taxation of polluting products in a differentiated industry. Eur Econ Rev 43(3):575–594. https://doi.org/10.1016/S0014-2921(98)00021-X

Crinò R, Epifani P (2012) Productivity, quality and export behaviour. Econ J 122(565):1206–1243. https://doi.org/10.1111/j.1468-0297.2012.02529.x

Deltas G, Harrington DR, Khanna M (2013) Oligopolies with (somewhat) environmentally conscious consumers: market equilibrium and regulatory intervention. J Econ Manag Strategy 22(3):640–667. https://doi.org/10.1111/jems.12019

Doni N, Ricchiuti G (2013) Market equilibrium in the presence of green consumers and responsible firms: a comparative statics analysis. Resour Energy Econ 35(3):380–395. https://doi.org/10.1016/j.reseneeco.2013.04.003

Elhadij NB, Tarola O (2015) Relative quality related (dis)utility in a vertically differentiated oligopoly with an environmental externality. Environ Dev Econ 20(3):354–379. https://doi.org/10.1017/S1355770X14000576

Eriksson C (2004) Can green consumerism replace environmental regulation? A differentiated-products example. Resour Energy Econ 26:281–293. https://doi.org/10.1016/j.reseneeco.2003.10.001

Frey BS, Stutzer A (2006) Environmental morale and motivation. Institute for Empirical Research in Economics, Working papers No.288, University of Zurich. https://doi.org/10.2139/ssrn.900370

Fujiwara K (2009) Environmental policies in a differentiated oligopoly revisited. Resour Energy Econ 31(3):239–247. https://doi.org/10.1016/j.reseneeco.2009.03.002

Garcia-Gallego A, Georgantzís N (2009) Market effects of changes in consumers’ social responsibility. J Econ Manag Strategy 18(1):235–262. https://doi.org/10.1111/j.1530-9134.2009.00213.x

Garella PG (2021) The effects of taxes and subsidies on environmental qualities in a differentiated duopoly. Lett Spatial Resour Sci 14:197–209. https://doi.org/10.1007/s12076-021-00272-7

Grossman G, Helpman E (1991) Innovation and growth in the global economy. MIT Press, Cambridge

Hallak JC, Sivadasan J (2013) Product and process productivity: implications for quality choice and conditional exporter premia. J Int Econ 91(1):53–67. https://doi.org/10.1016/j.jinteco.2013.05.001

Hamilton SF, Zilberman D (2006) Green markets, eco-certification, and equilibrium fraud. J Environ Econ Manag 52:627–644. https://doi.org/10.1016/j.jeem.2006.05.002

Intergovernmental Panel on Climate Change (IPCC) (2021) AR6 Climate change 2022: mitigation of climate change. https://www.ipcc.ch/report/sixth-assessment-report-working-group-3/. Accessed 17 Jan 2022

Kaufman N (2014) Overcoming the barriers to the market performance of green consumer goods. Resour Energy Econ 36(2):487–507. https://doi.org/10.1016/j.reseneeco.2013.05.007

Lutz S, Lyon TP, Maxwell JW (2000) Quality leadership when regulatory standards are forthcoming. J Ind Econ 48(3):331–348. https://doi.org/10.1111/1467-6451.00126

Mahenc P (2008) Signaling the environmental performance of polluting products to green consumers. Int J Ind Organ 26(1):59–68. https://doi.org/10.1016/j.ijindorg.2006.10.005

Moraga-Gonzáles JL, Padrón-Fumero N (2002) Environmental policy in a green market. Environ Resour Econ 22(3):419–447. https://doi.org/10.1023/A:1016060928997

Nyborg K, Horwarth RB, Brekke KA (2006) Green consumers and public policy: on socially contingent moral motivation. Resour Energy Econ 28(4):351–366. https://doi.org/10.1016/j.reseneeco.2006.03.001

Requate T (2005) Environmental policy under imperfect competition: a survey. Department of Economics, Economics working paper No. 12, Christian-Albrechts-Universität Kiel. http://hdl.handle.net/10419/22000

Ronnen U (1991) Minimum quality standards, fixed costs, and competition. Rand J Econ 22(4):490–504. https://doi.org/10.2307/2600984

Sartzetakis ES, Xepapadeas A, Petrakis E (2012) The role of information provision as a policy instrument to supplement environmental taxes. Environ Resour Econ 52(3):347–368. https://doi.org/10.1007/s10640-011-9532-4

Sengupta A (2012) Investment in cleaner technology and signaling distortions in a market with green consumers. J Environ Econ Manag 64(3):468–480. https://doi.org/10.1016/j.jeem.2012.04.001

United Nations Development Programme (UNDP) (2020) The 2020 human development report. http://hdr.undp.org/en/2020-report/download. Accessed 24 Sept 2021

Wada Y (2019) (2019) Discriminatory tax and subsidy on environmental behaviors. Environ Econ Policy Stud 21:25–36. https://doi.org/10.1007/s10018-018-0220-2

Zhou D, Spencer B, Vertinsky I (2002) Strategic trade policy with endogenous choice of quality and asymmetric costs. J Int Econ 56(1):205–232. https://doi.org/10.1016/S0022-1996(01)00118-0

Acknowledgements

The authors would thank all participants to the 61st SIE Conference (2020, October 22th), the 14th ESEE Conference (2022, June 15th, Pisa), the XX SIEPI Workshop (2022, June 16th, L’Aquila), the X Conference of the Spanish-Portuguese AERNA (2022, September 3rd, Barcelona) and the XXXIV SIEP Conference (2022, Semptember15th, L’Aquila) for helpful comments and suggestions. Discussions with Roberto Basile, Nicolò Barbieri, and Luìs M. Graneroas on previous versions of the paper helped improve it. The authors would also like to thank the two anonymous referees for providing constructive comments and suggestions. The usual disclaimer applies.

Funding

Open access funding provided by Università degli Studi dell’Aquila within the CRUI-CARE Agreement. This paper has not been published previously and it is not under consideration for publication elsewhere, nor it will be published elsewhere in the same form, in English or in any other language, including electronically without the written consent of the copyright-holder. This work was supported by the University of L’Aquila—Department of Industrial and Information Engineering and Economics. The authors have no relevant financial or non-financial interests to disclose.

Author information

Authors and Affiliations

Contributions

All authors contributed to the study conception and design. Numerical simulations and policy analysis were performed by Luisa Giallonardo. All authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Conflict of interest