Abstract

The Italian wine supply chain has performed well in recent decades both in terms of profitability and success on the domestic and international markets. This is despite the fact that it is fragmented in terms of products, prices and consumption context, and, in particular, despite the fact that it is characterised by an organisation that hinders the full exploitation of economies of scale. This paradox has not been investigated in literature. We propose several elements in support of the hypothesis that the Italian wine sector’s success is linked to favourable elements of the Porter Diamond Model (5 out of 6) but also to the “district” nature of a large part of the sector. The presence of numerous networks, some of which are formal and others informal, gives most Italian local production systems specialising in grapes and wine the characteristics of industrial districts, due to the local social capital that is stratified there. These networks include operators such as Cooperatives and Consorzi di Tutela, upstream and downstream industries and services, tourism, research and educational bodies. Such networks can overcome the weakness represented by the low concentration and small average size of the operators. To support this hypothesis, we analyse the historical evolution of the sector and its drivers, the structural features of the different phases of the wine chain (grape growing, winemaking, bottling and distribution), the market relationships within the chain and the national and European policies favouring the sector. This analysis also underlines the differences between the Italian sector and its competitors from the Old and New World.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The authors are grateful to the anonymous referees and to the Editor for their comments on an earlier draft, which substantially improved the paper. The authors would also like to thank Tiziana Sarnari of ISMEA for providing crucial information. The usual disclaimer applies.

Wine is one of Italian agriculture’s most traditional products and one of the most characterising and constant elements of the diet of the Italian population. Throughout time, wine has been a cheap source of energy, an essential beverage when water was unsafe to drink, and a symbolic element of social celebrations. After the Golden Age of Falerno in Roman times, viticulture and wine production returned to the fore in the tenth-century and continued to remain so over later centuries, with most of the cultivation devoted to poor wines for popular consumption and only a small part to the production of fine wines, intended mainly for local aristocracy and ecclesiastical hierarchies. It was from this position that the Italian wine sector encountered the globalisation wave, which began after World War II but has accelerated since 1990, with an unprecedented expansion of international wine trade, “which it then did so spectacularly, albeit unevenly, and which led to the democratisation of wine consumption in many more countries” (Anderson and Pinilla 2018, p. 6). This expansion was fuelled by increasing demand for wine in countries with no—or very little—wine production, also stimulated by intriguing wine guides. This represented a window of opportunity that New World (NW) wine producers were more ready to exploit, implementing a catch-up process that allowed them spectacularly to increase their hold over the international wine market (Giuliani et al. 2011; Mariani et al. 2012).

As globalisation is typically a disruptive process, it is no surprise that these newcomers on the wine market, able to apply effective catch-up strategies, were successful and even overtook the incumbents, the traditional Old World (OW) producers (Alonso Ugaglia et al. 2019a). Nevertheless, the evolution of this market over the last 20 years reveals that the old leaders in the wine market are still at the forefront and that Italy, in reacting to the challenge of these newcomers, has, in particular, improved its competitive potential, overtaking France as the top supplier in some key markets (Morrison and Rabellotti 2017). Therefore, Italy now stands as a leader in the wine market, carefully responding to the qualitative and quantitative evolution of wine consumption and distribution.

Its remarkable available production capacity allows the Italian wine sector to cover all price segments but, due to France’s enduring leadership in the high end of the market, the majority of Italian supply is aimed at the low and medium market segments. The case of Italian wine cannot be completely included in the general label of “Made in Italy”, which defines a set of products characterised by high positioning that are not in competition with old or new cost-effective competitors (De Nardis and Traù 1999; Becattini 2007), and its success in terms of international competition is thus intriguing.

Despite the profound structural change after World War II (WWII), the Italian wine sector is still very fragmented and the industry structure appears weak in comparison with competitors on the international market, with limited possibilities to enjoy economies of scale and to implement brand strategies typical of fast-moving consumer goods (FMCG; Aaker 2000), in a context where “achieving economies of scale seems to be a crucial matter in the food sector [….. and] large firms tend to be more adept at counteracting the superiority of a highly concentrated retail sector” (Hirsch et al. 2014, p. 715).

The success of the Italian wine sector appears to be a kind of paradox, which can be described with the metaphor of the hornet, the insect that should not be able to fly, but actually does, first proposed by Galimberti and Paolazzi (1998) and used by Becattini (2007) to interpret the more general case of industrial development in Italy. Reasonably, the bulk of Italian wine supply takes advantage of the fascination with Italian origin which is fuelled by the iconic “Made in Italy” goods, such as cars or clothes, but the structural weaknesses necessarily require the balancing of other elements that are still not comprehensively analysed in literature.

The goal of this paper is, therefore, after presenting its evolution, to illustrate how the Italian wine sector is currently structured and performs, also in comparison with competitors, and to offer a proposed interpretation of the complex set of drivers of its success. The analysis is based on the literature as well as on an interpretation of statistical data from various sources.

The paper is organised as follows: Sect. 1 presents the evolution of the Italian wine sector over the seven decades after WWII, identifying four distinct periods resulting from its continuous change in terms of industry structure and characteristics of supply, demand and institutional framework. Moving on from the last period described in Sect. 1, Sect. 2 analyses in detail the current features of the sector, illustrating the main structural differences with competitors, while Sect. 3 qualifies the competitiveness of the industry, considering its performance in the domestic and international market and in relation to the profitability of firms. Section 4 offers an explanation of the competitiveness of the Italian wine sector that goes beyond the catch-up model and applies the Porter Diamond approach integrated by the industrial district approach. Finally, the last section summarises the most important elements proposed and highlights the major challenges that the sector must face due to endogenous and exogenous changes, which could, in future, weaken the overall competitive performance and profitability of Italian wine production.

2 Evolution of the Italian Wine Sector

In Italy, winegrowing and winemaking have a long history, dating back to the Greek settlers in southern Italy and possibly to pre-Roman populations, continuing over the centuries. At the time of Unification, vineyards were spread over the whole country, albeit with a geographical concentration in southern Piedmont, Tuscany and Sicily. Notwithstanding alternating trends in production (Federico and Martinelli 2018; ISTAT, Istituto Nazionale di Statistica 1976), up until WWII Italian winegrowing did not change a great deal, with production being largely based on non-specialised intercropped vineyards and mostly intended for self-consumption, with a small share of “quality wine”.

The great transformation of the Italian wine sector took place in the post-WWII period. Thanks to market and production trends and to strong national and European policies, the sector changed radically: from unspecialised to specialised winegrowing; from a fragmented to an integrated agro-industrial supply chain based on efficient farm wineries; from a production almost totally destined for the domestic market to largely export-oriented production; from an almost undifferentiated low value production to a production characterised by quality at different levels; from a large, but low level, domestic consumption to much lower but more articulated consumption. According to Corsi et al. (2018), this evolution can be divided into four periods, based on the main drivers of the evolution itself.

2.1 From 1950 to 1970: Structural Change and Growth

This period was characterised by a strong increase in production which grew by 55.3% (data from Anderson and Pinilla 2017), thanks to the increase in the vine area (+ 10.6%), but particularly to the increase in yields. This first phase evolution was mainly driven on the supply side by the dramatic structural change in grape growing, supported by agricultural policy, which also began to favour the development of appellation wines, and, on the demand side, by increased domestic consumption.

The increase in yields was the result of a radical decrease in the area of non-specialised intercropped vineyards (− 75% between 1950 and 1960), while the specialised grape area rose by 20% (Corsi et al. 2004). As a result, yields increased, while the number of farms growing grapes dramatically decreased (Table 1). Wine, traditionally made directly by farmers for self-consumption, was increasingly produced in rationally organised wineries, in which cooperatives began to play an important role. There were 148 cooperatives in 1950, producing 3% of total production (Casalini 1953), a share that had increased to 18% by 1970, produced by 690 cooperatives.

The increase in supply saw a corresponding rise in consumption. This growth was driven, rather than by population growth, by an increase in per capita consumption of about 24% in the 1950s and + 3.1% in the 1960s. In the first decade, this was the result of the rising income of the agricultural population moving to the manufacturing industry which maintained its traditional consumption habits. In the following decade, wine consumption began to change from a source of energy to a hedonic good. Nevertheless, most wine was purchased in bulk in small shops, although some signs of modern marketing began to appear (Folonari launched bottled branded wine; Cantine Riunite exported massive quantities of branded Lambrusco to the USA; the first Super Tuscan appeared). The role of exports, though increasing, was minor, mainly represented by shipping in bulk at low prices, despite the growing role of some traditional Italian bottled wines. Imports, mainly French champagne, were tiny in volume, though greater in value.

The structural change was supported by the national agricultural policy through subsidies to investments (First and Second “Piano Verde”) and through the European (1962) and national (1963) legislation on appellations.

2.2 From 1970 to 1985: Export-Orientation and Over-Production

In this period, the Italian wine sector increasingly shifted from production mainly aimed at the domestic market to one directed towards exports. The drivers for the production growth in this second period were the increase in exports, on one side, and the subsidies for distillation provided by the European Economic Community (EEC), on the other. Wine production increased up until 1980, and then began to decrease, with an 8% overall decline throughout the whole 1970–1985 period. Wines with certified origin—according to Italian laws, DOC (denominazione di origine controllata) wines and the highest-level DOCG (denominazione di origine controllata e garantita) winesFootnote 2—became more and more important: the number of certified wines reached 225 in 1985, covering 10% of Italian wine production. Their expansion was a sign of the changes that were occurring in domestic demand. Per capita consumption began to stagnate and later to decrease as the result of changing lifestyles and work styles that led to lower consumption of basic wines and a shift to higher quality wines. The decline in domestic demand was partially offset by an increase in exports and by EEC interventions to control market imbalances (distillation of low quality wines). Exports were encouraged by the implementation of the Common Market within the EEC, and were boosted by devaluations of the Italian currency. Exports reached a peak in 1985, before the 1986 methanol scandal which led to a sharp decline. They consisted mainly of bulk high-alcohol wine destined to reinforce French wines, substituting Algerian wines (Chevet et al. 2018; Meloni and Swinnen 2018). More generally, they were predominantly low-end wines, although an increasing part was made up of bottled wines (42% of Italy’s export volume but 73% of its value in 1985). Exports were nevertheless not sufficient to offset the decline in domestic consumption, and significant EEC interventions were applied, in the form of subsidies for wine distillation and of prohibitions on new vineyards. Nevertheless, the minimum retirement price granted by the EEC allowed some production “for distillation” of high-yield, high-alcohol, low-cost wines, especially in the South, which resulted in the persistence of strong market imbalances. Wine imports remained low.

2.3 From 1985 to 2000: Crisis and Success on the International Markets

During this time, production fell dramatically, but, at the same time, it changed, with a much stronger focus on quality and an export boom. The main drivers of this evolution were changes in the characteristics of domestic demand, growth in international demand, and, above all, the quest for a new reputation by producers. This led to a reorganisation of the sector with the development of top-end wines, the adoption of new techniques (e.g. the use of barriques), and the modernisation of basic wines.

The symbolic turning point was the methanol scandal shock, when some cases of wine adulteration caused casualties, leading to a large drop in domestic and foreign market demand. Food safety controls were substantially improved and production shifted progressively to a higher quality, thus taking advantage of the increasing international demand for premium wines.

Production decreased by 23% between 1985 and 2000, mainly due to the fall in vine area following some changes to European policy which strengthened the prohibition on new plantings, encouraged a programme of permanent abandonment of production (grubbing up) and decreased the profitability of distillation. The upgrading of wine quality was propelled by regulatory changes adopted by Italy within the Common Agricultural Policy (CAP) (Pomarici and Sardone 2001). The number of grape-growers halved, but several grape-growers started processing and bottling their wine, particularly in the segment of premium wines. The cooperative sector consolidated, through mergers and acquisitions (the establishment of GIV in 1986, a future top Italian group), and by producing both premium and basic wines: Tavernello, a boxed wine produced by Caviro (a cooperative group), was launched with great success (Giacomini 2010; Williams 2014).

Domestic consumption, though shifting from basic to premium wine, quantitatively dropped by 19%, also due to the growing competition of beer among alcoholic drinks. By contrast, exports, after the initial fall due to the methanol scandal, rose rapidly (+ 84% in volume between 1986 and 2000, reaching 34% of production in that latter year). More importantly, the composition of exports changed, both in terms of their destination (drop in the French share and increase in the German share, with a rise in highly-priced exports to the USA) and in terms of their value. Unlike the previous period, when they were pushed by the devaluation of the Lira, exports were now being driven by the improving quality of Italian wines, as shown by the increasing share of appellation and geographical indication wines and by the dynamics of the international market. In a period characterised by the rapid emergence of NW producers, Italy’s share of the world volume of exports slightly decreased but retained the same share in value terms (32.1–30.3% from 1985 to 2000, and 18.7–18.6%, respectively) (Anderson and Pinilla 2017).

2.4 From 2000 to the Present: Consolidation of Success on the International Markets

During these years, the Italian wine industry competed successfully both on the international and domestic markets, thanks to the reorganisation of both the agricultural and the industrial phases. The main driver of this evolution was the capacity to adapt to (declining) domestic demand and to (increasing) international demand. Wine production still decreased, but the shift from low to high quality wines continued, with the share of PDOs and PGIs on total output reaching 42.2% and 24.9%, respectively, by 2018. This trend was accompanied by strong qualitative and geographical changes in production. Thanks to the flexibility in European production control mechanisms, the decrease in vine areas mainly concerned vineyards without appellations and the southern and north-western regions, instead favouring the north-eastern regions, which were better equipped to exploit the shift in demand towards better quality. In particular, the growth of the north-eastern area was linked to the success of Pinot Grigio and Prosecco, both domestically and internationally. The wine industry moved to the higher-quality segment, but some companies (particularly cooperatives) targeted the less expensive commercial premium segment. Cooperatives underwent a further consolidation process but the economic size of wine companies more generally increased.

Domestic consumption continued to decline until 2009, only to stabilise and even grow in recent years. This decline was nevertheless offset by the growth in exports, from 17.8 in 2000 to 19.8 million hectolitres (hl) in 2018 (+ 11.3%) and from 2.4 to 7.3 billion US$ (+ 187%). The increase in export value reveals a remarkable performance, and demonstrates the strong positioning of Italian exports among higher quality and higher price wines. Italy, in addition to its traditional destination countries, gained particularly success in Eastern Europe, though much less so in China (Mariani et al. 2012). Conversely, imports grew by 218.5% in volume and by 98% in value, thus suggesting increasing imports of low-price bulk wine to compensate for the domestic demand for basic wine which was not fully satisfied by local production.

3 Current Features of the Italian Wine Sector

3.1 Production System

3.1.1 Grape-Growing

Italy represents 9% of the world’s vineyard area, positioned third in the world ranking, after Spain and France. Despite its undisputed international standing, the share of Utilised Agricultural Area (UAA) devoted to vines on the total national UAA is not particularly high, around 5% in 2018. In spite of this low specialisation, vines truly characterise the agriculture of all Italian regions as they spread across practically all regions in the different altimetry bands, mountains included. This aspect represents a peculiar feature of Italian viticulture compared to other traditional producing countries, particularly the new producing countries, where viticulture develops across limited areas.

According to the Agenzia per le Erogazioni in Agricoltura (AGEA) (Personal Communication), in 2018, wine-producing vineyards covered 658,000 hectares (Table 2), with almost 46% in the South and the Islands, 38% in the North and 16% in Central Italy. The production system is complex in terms of differentiated supply and forms of production organisation. Officially, 408 wines receive a PDO designation and 118 wines a PGI indication, many more than in Spain or in France. The different historical phases mentioned above meant that wine quality certifications are strongly linked to the production origin area, which is given significant weight in terms of the reputation of wine quality. This designation system based on territorial origin is common to all traditional European producing countries (see note 1), but in Italy it is amplified by the ubiquitous diffusion of grape-growing in the country and by the high number of varieties. Over time, it has led to the proliferation of tiny designations, which sometimes makes them unsuitable as a marketing tool, especially abroad.

In 2019, 7.6 million tonnes of grapes were collected (ISTAT 2019), of which 2/3 destined for PDO wines (42.2%) and PGI wines (24.9%).

In structural terms, the agricultural phase presents a very low level of concentration, as demonstrated by the small average vineyard size (2.34 ha in 2016). Nevertheless, the situation differs quite significantly across Italy. The average size decreases from the North (3.24 ha) to the South of Italy (1.98 ha) and is higher in areas with vineyards producing PDO wines. There is also a large variation in distribution by classes of vineyard size: according to the 2010 Census, farms with vineyards covering over 20 hectares constituted less than 1% but represented 19% of the Italian area with vines, nearly 130,000 hectares. According to the AGEA, the number of grape-growers engaged in production intended for the market was much lower, about 175,000 in 2015 and decreasing with respect to 2010, cropping 85% of the area with vines. About half of the grape-growers are associated with cooperatives while the remainder are definitely market-oriented.

3.1.2 Winemaking

Wine production in Italy currently stands at around 45 million hectolitres. Year by year, Italy and France alternate as the top wine producer in the world ranking, both accounting for about 18% of total production.

According to ISTAT, the area with the largest share of wine production is the North (over 51%), followed by the South and the Islands (39%), and the Centre (10%) (Table 3). The North and the Centre areas are definitely oriented towards quality wine production (PDO and PGI wines cover, respectively, 80% and 82% of their production) while in the South and Islands the predominant orientation is towards wines without a geographical indication (generic wines, 54%).

Winemaking is carried out by several operators, namely farms processing self-produced grapes, cooperative wineries, and winemaking industries processing purchased grapes. The winemaking phase is undoubtedly very heterogeneous, both with reference to the nature of the operators and to their economic size.

Winemaking is performed by nearly 46,000 wineries (ISMEA 2019), mostly belonging to the agricultural phase. The presence of such a large number of grape-growers, individually making wine, is certainly a typical and distinctive feature of the wine supply chain in Italy compared to other countries, particularly NW producers. The dispersion of overall production is high among small farms, while the few larger farms and companies (with capacity > 10,000 hl, nearly 1000) concentrate around 80% of Italian wines. This segment includes industrial operators, producing large quantities of wine, and cooperative wineries which, in spite of their limited number (518 in 2019, according to ISMEA) play a very important role, as they produce about half of Italian wines. Therefore, in terms of turnover, the Italian wine industry is polarised between many very small units that represent a small share of production, and the few large companies that cover most of it. According to the Mediobanca annual survey (2020), in Italy, 215 major companies operate—with 2018 turnover exceeding 20 million Euros—accounting for 78% of Italy’s total turnover from wine. The top 40 of these companies (turnover > €60 million) account for about one half of it. All phases of the chain are represented among these top producers: fourteen are cooperatives (22% of the overall turnover), eight are bottlers, three have a mainly industrial nature, and nine are agricultural. The limited companies are almost entirely under national control, usually family control. Only five corporations are under foreign control and only two are considered small and medium-sized enterprises. On the other hand, less than one-third of Italy’s wine turnover is generated by a very large number of producers (about 8000) with a turnover varying from 20 million Euros to a few tens of thousands of Euros.

3.1.3 Intermediate Grape Markets

It is crucial, in the chain analysis, to assess the flows of materials (grapes, wine) between the chain operators. The relevant intermediate grape market currently consists of: (1) “external” markets (with respect to the agricultural phase), represented by grape sales from grape-growers to winemaking industries or to cooperative wineries of which they are not members; (2) “internal” markets, represented by grapes self-processed inside the producing farms and by deliveries to cooperative wineries by their members. The difference is substantial as, in the former case, grape sales take place according to prices defined by private supply contracts or inter-professional agreements or by spot sales on the grape market. The latter, on the other hand, achieve a return in terms of a processing price, strongly linked to the wine price and to the efficiency of the winemaking operator (Mazzarino and Corsi 2015).

With reference to the 2012 harvest,Footnote 3 the “internal” markets represent almost 70% of grapes transferred to winemaking, while the “external” markets represent less than one-third of the total (Fig. 1 ). It should be noted that the two market shares differ according to the production areas, the winemaking agents and the types of wine. In particular, the highest incidence of the internal markets is reached in Central Italy (80% of processed grapes) due to the weight of farmers’ enterprises in winemaking, and in the North-East (almost 74%), due to the considerable weight of cooperation. The incidence of external markets is substantially higher in the North–West (around 39%) and in the South (close to 41%) due to a prevalent presence in both areas of industrial winemakers, linked to the type of wines produced locally and the different types of grapes.Footnote 4 The agricultural incidence in winemaking increases in relation to PGI wines and, even more so, to PDO wines. This pattern is roughly the same in all districts, giving greater importance to cooperatives in some areas (particularly in Emilia Romagna and Veneto) or to individual grape-growers in others (especially in Tuscany).

3.1.4 Bottling and Distribution

Sales methods strongly characterise producers’ marketing strategies and help to understand the complex intertwining between bulk wine flows, starting from winemaking and going so far as the bottling phase. Investigating these flows is complicated, due to the lack of reliable statistical data. We can, therefore, only provide some estimates, obtained from the small amount of literature and from some informal talks with experts.

Considering the output flow of the winemaking phase directed outside the sector, it can be estimated that, on average, 25% of the wine is sold in bulk, both on the domestic market (to off-trade consumption,Footnote 5 to HoReCa and for industrial use) and abroad (our estimates on ISMEA 2019 and Global Trade Atlas-GTA data). The rest (75%) is processed by a relatively small number of bottling/packing plants, which are estimated to number about 9000 (wine bottlers are not all recorded among official statistics). A large part of them is integrated in winemaking plants but about 1000 are managed by pure bottlers, which bottle purchased bulk wine, performing storage/blending/aging/labelling, and, in the case of sparkling wines, even the second fermentation.

Wineries equipped with bottling facilities and pure bottlers also frequently work for third parties (unequipped farmers that opt to use this method simply to reduce their packing costs); moreover, in some cases, on-farm wineries use the mobile plants (bottling trucks) managed by service supply agencies.

The bottling plants differ greatly in size; it can be estimated that 80% of bottled wine is processed by just 6% of large-sized bottling plants (more than 10,000 hl/year) (Malorgio et al. 2011; Corsi et al. 2019).

The category of pure bottler is becoming increasingly important in supply to distribution chains, particularly for less valuable/medium value wines destined for domestic and foreign markets. Their dual function—connection between winemaking and final distribution, but also handling, storage and finishing/blending of the batches—is crucial for the smooth functioning of the wine sector.

Typically, wine produced on-farm is either almost entirely bottled or sold entirely in bulk. Wine tourism, which has developed rapidly over the last two decades in all Italian regions, through wine roads and the attractiveness of typical regional gastronomy, has increased direct sales of bottled wines for many farms and cooperatives (Boatto and Gennari 2011; Cinelli Colombini 2015).

As highlighted by the XVI report on Wine Tourism in Italy (Scolari 2020), in recent years, the interest in wine tourism has grown considerably. In 2019, as many as 15 million visitors spent from one to a few days holiday in wine regions, each family allocating an average spend of 80 to 155 Euros for direct purchases and tastings, depending on the length of stay. In response to this greater interest, the supply of diversified and integrated activities and services has also grown, including, in addition to winery visits and tastings, particularly attractive tours of vineyards, on foot or by bike, outdoor tastings of wines and local food specialties, associated cultural activities and so on, organised by farms, cooperatives and companies in conjunction with local administrations. It should, however, be underlined that not all farms have successfully exploited this opportunity, due to internal organisation issues or due to their personal inability to develop this strategic segment.

Most cooperatives only bottle part of their production and sell the rest in bulk to industrial wineries, bottlers or wholesaler exporters. Industrial wineries buy bulk wine on the intermediate market, bottling it together with the wine they produce directly. Of course, pure bottlers buy all of the wine that they bottle on this market.

Currently, about half of Italian wine production, in volume, is destined for the foreign markets. About 2/3 of the part destined for the domestic market goes to off-trade commercial channels and direct sales, while the remaining 1/3 goes to the on-trade catering channel.

3.1.5 Supply Chain Patterns and Supply Concentration

The analysis of the chain highlights the presence of two intermediate markets—grapes and bulk wine—in the Italian wine industry, smaller in volume than 30–40 years ago but still important in economic and functional terms (Fig. 1).

The degree of concentration increases along the supply chain, as the entities operating at the different stages gradually reduce. The different entities involved (farmers, cooperatives, industrial wineries, pure bottlers) combine together in different specific supply chain patterns, vertically integrated and de-integrated supply chains, characterising the markets of different types of wine, different type of packing and different areas.

In vertically integrated supply chains, all activities (grape-growing, winemaking, bottling/packing) are carried out by a single unit, which may refer to the farms phase (agricultural chain), or to a cooperative (cooperative chain). De-integrated supply chains are characterised by a focal company operating on intermediate and final distribution with bottled/packed wine obtained mostly by purchased inputs; these supply chains are led by industrial wineries (industrial chain) and pure bottlers (bottler chain).

All these supply chain models are important, in volume and value, in the Italian wine industry. According to available figures, the shares in volumes of bottled wine of these four supply chains can be estimated as follows: agricultural chain 20%; cooperative chain 17%; industrial chain 30%; and bottler chain 33%. The shares in value are probably different. In particular, the share of the agricultural chain is higher as it includes the production of the most prestigious Italian wines. Therefore, entities of different economic size operate in the final stage of each supply chain, in connection with distribution. Many are small or very small, a few are medium-sized and very few are very large. This is because bottling plants have different operating capacity, and some companies own several plants (and even vineyards and winemaking plants). Hence, the latter collect large quantities of wine to supply the distribution, achieving remarkable turnover.

3.2 Structure of the Italian Wine Industry Vis-à-Vis Competitors

It is worth highlighting some peculiarities of the Italian supply chain concerning its competitors. The first peculiarity is the diversification of Italian wine supply based on the specific features of the local area, be they traditional or native varieties, physical and climatic characteristics, or cultural ones, all encompassed in the term terroir. This peculiarity, shared with other Mediterranean countries (in particular, Spain and France) is based on the wide use of native varieties and is institutionally sustained by a well-structured system of designations of origin and geographical indications (PDO/PGI). This is opposed to the tendency, typical of NW producers, to rely mainly on producers’ brands and on international varieties. While NW producers are moving towards homogenisation around international varieties, as in Chile (Mora 2019) and in the USA (Lapsley et al. 2019), even at the expense of traditional ones, as in Argentina (Merino 2019), Italian viticulture is still based on valuable traditional varieties (about 500), which differ by region, with international varieties playing a minor role (D’Agata 2014).Footnote 6 This was a relative weakness during the phase of expansion of consumption in countries that did not traditionally drink wine, such as the UK, when the easier-to-understand varietal wines and brands gave NW producers an advantage. However, with consumers’ increasing sophistication and curiosity, the diversity of Italian wines now appears to be an “Old World style” strategic asset,Footnote 7 for some aspects more developed in Italy than elsewhere. While it is undisputable that France still has the monopoly on mythical terroir-based wines, it is also true that the presence of original (in terms of sensory profile and grape variety) and reputed wines in all Italian regions, over such a wide area, is something unique.

A second feature of the Italian wine industry is its low degree of concentration. While the largest four Italian wine firms account for 18% of domestic wine sales, the corresponding share in all NW countries (except South Africa) is well above 50%, with peaks of 56%, 60% and 91% in the USA, Argentina and Chile, respectively (Anderson 2019).Footnote 8 The higher concentration in NW countries explains the greater reliance on brands and their capacity to organise aggressive marketing campaigns. It should be noted that the concentration level of the Italian wine industry is low due to the size of the sector but also due to the small economic magnitude of the most important firms. The biggest Italian players are not comparable in size to the NW’s biggest players.Footnote 9 Hence, they have fewer opportunities to exploit economies of scale in production and marketing than their competitors, and they do not have particularly strong oligopolistic market power. In addition, there are few foreign multinational firms operating in Italy and those that do exist are of medium-small size, with few national firms (and not the most important ones)—unlike in OW and NW countries—being listed on the stock exchange.

On the other hand, it is difficult to make comparisons regarding the structural situation of the grape-growing phase. As already stated, Italian winegrowing farms are small (2.34 ha), a feature shared with Spain (1.8 ha, though with great regional variation, see MAPA 2016) and, to a lesser extent, with France (9 ha, see Alonso Ugaglia et al. 2019b). By contrast, the average area is much larger in Australia (20–30 ha), South Africa (30 ha), and the USA (25–30 ha) (CNIV-Agro-Meter 2016b). This is undoubtedly a structural weakness of the Italian industry.

A third structural peculiarity is the role of cooperatives and procurement arrangements in terms of grapes for winemaking. As mentioned before, about half of the total Italian grape production is crushed by cooperatives. This is intermediate between 37% in France (Alonso Ugaglia et al. 2019b) and 60% in Spain (Albisu et al. 2019), although in Italy, unlike in these countries, cooperative groups are a large part of the most important wine firms operating on the final market.Footnote 10 The cooperative sector does not play such an important role in any NW country. It is not that they never existed, but, when they did, they were often subsequently absorbed by private businesses, as in Australia (Anderson 2019). In other cases, the share of cooperatives is small, as in Chile (5%), or the actions of the latter are limited to marketing grapes and not to crushing, as in the USA (CNIV-Agro-Meter 2016b. The small presence of cooperatives in the NW is arguably due to the strong export orientation of their wine sectors, which makes them more subject to the vagaries of the international markets and of exchange rates. By contrast, the presence of a large, albeit declining in volume, domestic market, made cooperatives more resilient and successful in Italy (as well as in France and in Spain). As a result, grape-growers have much greater bargaining power, also considering that independent wine-makers processing their own grapes claim an additional 28% of the total grape production. Hence, sales of grapes by grape-growers to wineries are a minor share of total production, and a part of this share is supplied on a contractual basis, possibly multiannual. Nevertheless, independent wineries obtain a large part of the wine produced by cooperatives, reducing the bargaining power gained by grape-growers in relation to wineries. However, overall, grape-growers that are cooperative members are in a better position than non-members; in any case, wineries cannot pass on any downturns of the wine market entirely to the grape-growers, through price reductions, making the whole sector more cohesive.

Another difference concerns the organisation of intermediate distribution, i.e. the link between wine production and retail channels. In the competitor countries (traditional and non-traditional), the distribution systems are characterised by leading operators not directly involved in production but able to orient supply (as in the case of the French négociants) or they are influenced by the action of the distribution networks of multinational wine and beverages companies (Markham 1997; Bardaji and Del Rey 2006; Baritaux et al. 2006; Green et al. 2006; Simpson 2011). In Italy, by contrast, the intermediate distribution system is highly fragmented and largely controlled by wine producers, which make their production decisions autonomously in each area (Pomarici and Boccia 2006). Hence, the development of the wine sector in Italy has essentially been a bottom-up process.

A further characteristic element is the projection on international markets. For some NW countries, the share of exports on national production is very high, as for Chile (73%), New Zealand (71%) and Australia (57%) (CNIV-Agro-Meter 2016a). In the OW, Italy’s share is at a lower level (45%), more than France (35%) but much less than Spain (67%). Exposure to the international market is not a weakness per se, but it leads to strong competition, while the domestic market, at least in traditional drinking countries, provides an advantage due to consumers’ general preference for domestic wines.

4 Competitiveness of the Italian Wine Sector

Competitiveness is a relative concept, as it is evaluated by benchmarking against comparable entities, and it is multi-dimensional, as it considers several aspects of a firm/sector performance (Wijnands and Verhoog 2016).

In this paper, the evaluation of the competitiveness of the Italian wine industry follows the approach of COGEA (2014, p. 12) “Competitiveness is defined as the ability of a system to sustainably produce and sell goods and services on a given market, in such a way that buyers prefer these goods to those offered by competitors. The goal of competitiveness in a specific market is the consolidation or increase of market share while maintaining an adequate return”. According to this approach, a system is in a condition of competitiveness when it demonstrates an adequate competitive performance with respect to the relevant competitors and profitability, which makes the business sustainable.

To evaluate the competitive performance, it is appropriate to analyse separately the evolution of wine consumption in the domestic market, where competition is with alternative beverages, with the pressure of imported wine being negligible, and the performance in foreign markets, where competition is with other exporters and, possibly, with local producers (such as in the USA and in Germany). The following analysis focuses on more recent years. As the development of the Italian wine sector over recent decades implicitly demonstrates the competitiveness of the Italian wine sector over time, it is interesting to evaluate if the conditions of competitiveness are still present.

Section 1 highlighted how wine ceased to be a structural component of the diet of Italian people slowly but progressively and how, after becoming a more hedonistic consumption, it underwent major changes in quantitative and qualitative terms. As in other traditional wine-drinking countries, Italian wine consumption decreased substantially over 30 years while the value of consumed wine increased.

Focusing on recent years, in 2010 wine consumption in Italy was slightly under 20 million hectolitres (Table 4) but it went on to increase and in 2018 was estimated to be slightly over 22.4 million hectolitres (yearly per capita consumption of about 44 litres). Italy is now ranked as the third leading wine consuming market, after the USA and France.

The recovery of consumption is associated with a change to the consumption model whereby a continuous decrease in individual drinking intensity is overcompensated by a new increase in the share of wine consumers of the adult population (59.9% in 2003; 51.6% in 2013; 54.1% in 2018), driven by the growth of occasional drinkers (Table 10 in the Appendix). The increase in the share of drinkers relates to almost all age classes but, interestingly, in 2018, the share of younger drinkers was higher even in comparison with 2003, while for older consumers it was higher than in 2013 but not in comparison with 2003. In other words, generational turnover is fuelling wine consumption.

In terms of volume, the cheapest wines are those most consumed, consistently with the still significant, but no longer predominant, daily consumption; currently non-premium winesFootnote 11 represent, in volume, only just over half of consumption,Footnote 12 and fine wines almost one-fifth (Table 5). However, the hierarchy of shares, in terms of value, is the opposite.

Considering the domestic market, the data thus reveal that the Italian wine sector was successful in defending the position of wine in the consumption pattern of Italian society, correctly interpreting consumers’ changing needs and, in particular, the attitude of new generations toward wine. This is the result of supply improvements and the effective interaction of entities from the off-trade and on-trade distribution channels.Footnote 13

The Italian wine sector is one of the key players in the international wine market. In 2019, Italian exports accounted for 6.3 billion Euros and 21.3 million hectolitres to almost all importing countries, with the USA, Germany and the United Kingdom being the biggest clients (50% of Italian exports, Table 11 in the Appendix). Italian wine exports are made up of a wide range of products (Anderson and Pinilla 2018). The largest share of Italian exports is represented by commercial premium, making Italy the world’s top supplier of this type of wine. The share of Italian exports of fine wines, mainly coming from Tuscany, Piedmont or Veneto, is also substantial (one-fourth in terms of volume and one-fifth in value) with Italy being the second leading supplier after France, while exports of non-premium are relatively small, just below 15% (Table 6). Bottled wine represents the largest share (more than half) of exports in volume and value; sparkling and bulk wines both represent about one-fifth in volume, while the share in terms of value is about one-quarter for sparkling and just 7% for bulk wine (Table 7). These shares were very different at the beginning of the century: smaller for bottled and sparkling wines, which then experienced a dramatic increase, fuelled by Prosecco; larger for bulk wines.

The evolution in the composition of Italian exports is the result of Italy’s progressive specialisation as a supplier of mid-price bottled wines, with large cooperatives and pure bottlers driving this process. Large cooperatives increased their production of PGI and PDO wines but also the share of wine directly bottled in-house, reducing their supply of wine to the intermediate market, where at the same time pure bottlers were experiencing increased demand and purchases of PGI and PDO bulk wine. As a consequence, Italian exports of bulk wine decreased, and basic wine producers in Italy began to suffer a shortage of available supply, leading to a remarkable increase of bulk wine imports into Italy, mainly from Spain (Table 12 in the Appendix).

The data show that the Italian wine sector has been able to sustain the challenge of competitors and has improved its positioning over the years, stabilising its leadership role in medium-range wines and gaining a hold in the higher end of the market. The unit value of Italian wine exports between 2000 and 2019 more than doubled (+ 112%), whereas the unit value of world exports increased by just 30%. In comparative terms and from a dynamic perspective, Italy’s current share of world exports is 20.1% in value (second after France) and increasing over time, and 20.3% in volume (second after Spain) as result of a progressive decrease (Table 7). However, the position of Italian supply compared to competitors varies in the individual markets. Italy ranks first in terms of shares of wine imports in the larger and smaller traditional importing countries, but plays a secondary role in supplying new emerging markets, such as China and Hong Kong (Table 13).

The evaluation of the second dimension of sustainability, the profitability of production, must consider the specific structure of the wine industry, which is characterised by the coexistence of small and large players, having different degrees of integration (Sect. 2.1). Unfortunately, data for each type of entity are not available, but it is possible at least to perform a separate evaluation of small producers of grapes and wines, mostly supplying the intermediate markets, and larger wine companies. Small producer profitability is mainly evaluated through the Italian Farm Accountancy Data Network (FADN),Footnote 14 while the profits of leading wine companies are analysed from the balance sheet databases processed by Mediobanca and analysed in the Wine Industry Survey (Mediobanca 2019).

FADN allows us to focus on the economic performance of wine growers that are mainly small players, often not directly connected to the end market, selling grapes or wines on intermediate markets. Nevertheless, in some circumstances—and more frequently in the case of grapes eligible for wines with geographical origin—they are also involved in wine production. The more suitable indicators available from FADN are represented by the net income per hectare of area (NI/HA) and per unit of family work employed (NI/FWU) (Pomarici and Sardone 2020). In both cases, the indicators show a positive evolution in the recent period (2011–2016), above the national average for overall agriculture (Fig. 2).

These trends, jointly with the consistently high relevance of the Italian wine sector on the overall value of agricultural production (EUROSTAT), prove the relatively good economic vitality of winegrowers’ holdings. However, significant differences may be seen between wine grape suppliers and wine processors, and between geographical areas. Not surprisingly, growers processing their own production were found to have significantly higher revenues, although they were generally less stable. In addition, the NI/FWU values are significantly higher in the North and, more specifically, approximately double in the North-East area compared to the South. In general, the differences in wine production profitability seem to reflect the different degree of development of the production process inside the farm and are strictly linked to the relevance of wines with a geographical indication (PGI) and particularly with a denomination of origin (PDO). These results are consistent with the previous description of the features of the Italian chain and are supported by other studies based on a set of even more complex FADN indicators (EU Commission 2019a; Scardera and Tosco 2014).

Data from Mediobanca (2020) reveal that the growth of sales and the profitability indicators of the largest Italian wine companies are positive in recent years and are comparable to those of manufacturing industry as a whole (Table 8). Moreover, the analysis of the capital structure of these companies shows a positive situation: the net debt/equity ratio for 2018 still suggests overall solidity (64.2%), which, for non-cooperatives, reduces to 47.7%, improving on previous years. The positive credit standing of the companies for 2018 is also confirmed by the Mediobanca scoring model (Z-score): in 2018, it qualified 76.7% of the wine companies as investment grade, 21.9% as intermediate, and only the other 1.2% as fragile. An indirect indicator of the profitability of this part of the Italian wine industry is also the positive trend of employment.

In conclusion, the Italian wine sector is enjoying fair profitability, comparable to the overall manufacturing sector, greater, on average, among large companies than smaller ones with agricultural features. In fact, almost all large companies, despite different individual performances, are experiencing positive results. Conversely, the performance of small agricultural farms appears to be more varied. Their profitability is influenced by their geographical location and production specialisation and, for the majority, by the balances of the intermediate markets which change, year by year, according to harvest size. However, as already stated, grape and wine production is constantly one of the most profitable agricultural activities due to the substantial balance between supply and demand in the intermediate markets.

The above analysis reveals that even in the recent period the Italian wine sector has sustained the pressure of competitors in the domestic market and on the international playing field, obtaining in all production phases revenues able adequately to remunerate inputs. Hence, the sector can, overall, be evaluated as competitive according to the chosen definition.

5 Success Drivers of the Italian Wine Sector

According to the analytical framework of the evolution of the global wine market proposed by Giuliani et al. (2011), the global wine sector was subject to a peculiar catch-up process (Abramovitz 1986) driven by wine producers in the NW. In this process, the competitive advantage of newcomers was based, rather than on any cost advantage, on product and process innovations and on the establishment of a favourable institutional set-up. However, as recognised by Morrison and Rabellotti (2017), “the performance of the Italian wine industry exemplifies a successful response […] to the challenges posed by NW latecomers”. How was this possible?

Considering the two drivers of newcomers’ success in catch-up processes, the analysis of the Italian case highlights that despite Italy being a “traditional” producer, since the 1960s, remarkable innovation processes have been developed in the wine sector, sustained by close cooperation between producers, research institutions, and input supply companies. Over the same timeframe, wine policy stimulated and drove the sector’s profound transformation.

Research and technical innovation were and are carried out by specialised research centres belonging to the network of the Ministry of Agriculture (now CREA-VE), by many university departments and by local networks supported by regional administrations (Morrison and Rabellotti 2007). These institutional activities in research and technical improvement were accompanied and fertilised by the R&D carried out by supporting industries, particularly developed in Italy, allowing wineries to adopt cost-saving or quality-improving innovations, according to the target market (Pomarici et al. 1997). Over 70% of wine technologies in wineries all over the world are Italian (UIV 2019). A large number of nurseries are located in Italy, including Vivai Cooperativi di Rauscedo, the largest firm in the world and leader in the diffusion of new rootstocks resistant to abiotic stress and of new hybrids resistant to powdery mildew and downy mildew. The industry producing processing aids is also significant. The main foreign producers of microbiological inputs (yeast and bacteria) established commercial branches in Italy, promoting experimentation with research institutions and wine companies. In fact, a rich network of different entities has been operating for decades inside the Italian wine industry, cooperating in order to grasp the opportunities offered by technological development. This situation favoured Italian participation in the European Innovation Partnership for Agriculture (EIP-Agri)Footnote 15 through 47 Operative Groups specialising in viticulture and oenology, where wine and grape producers, professionals, input supply companies and representatives of other sector bodies operate together to target specific innovation objectives.

The perimeter of innovation in Italy, as in the EU, was delimited by the rules in force on oenological practices. However, over time, the Ministry of Agriculture has authorised tests and experimentations also on oenological practices not allowed by the EU, when a change of regulation was expected, as was the case for the use of pieces of wood, dealcoholisation, or the experimentation of carton containers. However, the impact on competitiveness of the prohibition of some oenological practices has not actually been significant over time, particularly for super-premium wines (Mariani et al. 2005). By contrast, the prohibition on adding inputs as aromas has probably prevented a loss of identity of Italian wines in times when temptation was strong.

With regard to the institutional set-up, as already briefly mentioned in Sect. 1, the Italian wine industry has been deeply influenced by a system of public support, mainly originating from the European Union (EU), which represented one of the most significant drivers of structural changes and consequently of sector competitiveness. Over its fifty-plus years of functioning, the wine policy, as part of the overall CAP, has progressively reshaped both its goals and its instruments, always combining direct expenditures (structured into two financing lines or pillars) in favour of wine supply chains, and an extended regulatory framework for wine production, resulting in an “unconventional” sector policy (Meloni and Swinnen 2013; Gaeta and Corsinovi 2014; Corsi et al. 2018; Corsinovi and Gaeta 2019; Pomarici and Sardone 2020). Since the end of the twentieth-century, the goal of quality improvement crept into the foreground and EU wine policy targets were mainly oriented towards improving competitiveness, with a radical shift of policy action in favour of adjusting the supply of European wines to market demand.

Since 2008, two main types of interventions have been financed in the framework of the CAP first pillar: direct payments, for supporting farmers’ income and a set of market measures, financed through a five-year National Support Programme (NSP), based on a financial envelope in which Member States can select from a given menu of 8 measures; the eligible measures can support a large array of beneficiaries (farmers or operators involved in wine production or marketing) and are of two different types: five are structural measures, while three are aimed at managing specific circumstances and crisis events.

The amount of direct payments granted to Italian grape growers has been rather smallFootnote 16 and in the implementation of its NSP Italy has mainly focused on the measures having more significant potential impact on improving competitiveness. A 42% share was allocated to the measure intended to restructure and convert vineyards for wines with protected indication of origin, thereby allowing for the renovation of a large part of Italian vineyards; a further 23% share was used for the wine promotion measure, which played a strategic role in improving the performance of Italian certified wines on the international markets; finally, an additional share of 14% was allocated to the measure for investments in wine enterprises, achieving improvements in quality and adjusting wine production to the changing market demand (EU Commission 2019b).

Before the introduction of the NSP 2009, in the framework of the CAP second pillar, Italian wineries were already receiving financial resources for tangible and intangible investments, generational renewal and technical assistance but undoubtedly with the introduction of the NSP the available amount of resources and the pursuable objectives related to structural enhancement expanded significantly after 2008 (ISMEA 2019).

The regulatory framework defined by the EU wine policy covers many areas: wine-growing, winemaking, definition of different types of wines, labelling and so on. The wine sector thus represents one of the most regulated of all CAP areas. However, considering the situation of the sector in Italy after WWII, the application of this policy in Italy appears to be a key driver of the modernisation of the different phases of the wine supply chain with a view to guaranteeing the quality, in broad terms, of Italian wines, contributing to the positioning of Italy as a major global producer, favouring the reputation and recognition of the national production, almost all over the world. The pervasive regulation established by the CAP was criticised by some scholars, on the one hand, as it was rent generating and, on the other hand, as it limited the free initiative and innovative spirit of the sector players, hampering the competitive potential of most producers, including Italian producers (Meloni and Swinnen 2013; Gaeta and Corsinovi 2014). From this perspective, it is worth highlighting that in applying the peculiar EU wine regulation concerning wines with certified geographical origin (currently PDO and PGI, see note 1), Italy has followed an almost liberal approach. From the few designations oriented to the super-premium segments, producers adopted product specifications characterised by rather high vineyard yields and by the possibility of harvesting different varieties: they thereby guaranteed relatively low costs and flexibility in supply and have been in a position actually to compete with NW producers even in the field of varietals.

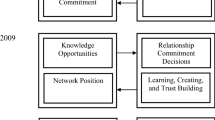

The positive effect of innovative activities and of the institutional setup in sustaining the development of the Italian wine sector is not, however, sufficient to explain Italy’s resilience on the international wine market, given the importance of low/medium priced wines in Italian supply. Indeed, in the international market of low/medium price, cost matters and the fragmentation of the Italian wine industry, in comparison to its competitors, really ought to be a concern. Therefore, additional elements are necessary to explain the competitiveness of the Italian wine sector and these can be identified, according to Fanfani and Lagnevick (1995) and Pitts and Lagnevick (1998), by applying the Porter Diamond approach (Porter 1990), supplemented by the industrial district approach (Becattini 1987). The Porter Diamond considers six competitiveness drivers, namely chance, factor conditions, related supporting industries, demand conditions, firm strategy, structure and rivalry, government. Its strength lies in investigating competitive processes in the agri-food sector, also in terms of their historical development; however, in the view of those authors, it does not adequately identify the support to competitiveness deriving from the territorial organisation of production, in contexts where small and medium enterprises are significant, as they are in Italy. This support could be identified by the industrial district approach, which applies the categories of socioeconomic networks of relations and the division of work and specialisation.

The result of this exercise is summarised in Table 9, where the descriptive elements presented in previous sections, supplemented by additional information, are classified according to the six factors considered by the Porter Diamond and the two broad factors encompassing the peculiar elements of the industrial districts. Considering the Porter Diamond, Table 9 shows how the weakness represented by the absence of significant economies of scale in production, distribution and marketing (industry structure) is offset by the favourable condition of the other five factors. Moreover, the analysis of district conditions highlights how the single Porter elements are empowered in the different production areas by intense and diverse socioeconomic and network relations. These relations give peculiar economic strength to the division of work and specialisation in the local supply chain, thus allowing favourable operating conditions and the enhancement of factor productivity.

In fact, most production areas are characterised by numerous networks, some formal and others informal. Most of the Italian local production systems specialising in grapes and wines differ from the clusters operating in other wine producing countries (Migone and Howlett 2010; Montaigne and Coelho 2012; Dana et al. 2013). The difference lies in the importance of the local social capital stratified there, which typically characterises industrial districts (Trigilia 2005). Among the formal networks, cooperatives and Consorzi di Tutela are at least worthy of mention. Cooperatives give economic viability to thousands of small farms, in a framework where the entrepreneurial skills and experience of single farmers contribute to the sustainability of the cooperative business; Consorzi di Tutela, inter-branch organisations formed by producers of each PDO and PGI wine, contribute to the functioning of the widespread system of designations of origin. Cooperatives and Consorzi facilitate the exchange of experiences and knowledge strictly related to the single areas, contributing to the accomplishment of a priority objective of EU policy, strongly supported by national choices for its implementation. Strong networks of bodies exist around them, particularly vocational schools and universities, producing related research, along with upstream and downstream industries and services, all contributing to obtaining positive feedback on production and creating a district “atmosphere”.

Nevertheless, it is also important to mention the significance taken on over time, at national scale, by other elements, such as the numerous fairs (some of international scope), which encouraged the global reputation of Italian wines, and the development of territorial specificities deriving from the positive evolution of oenological tourism services, increasingly structured and organised (i.e. wine routes). Some informal networks developed more recently, namely agreements between wineries belonging to different areas to cooperate in promotion and distribution, which gave a significant and sudden contribution to the competitiveness of the Italian wine sector. Together with national networks coordinating local ones and the expansion in the operations of larger companies across more regions, they generate an integrated network of local systems. Certainly, the policy action supported by EU funds could not have had the same success without the reinforcement of skilled professionals, properly trained to act alongside grape growers and winemakers, the widespread presence of adequate inputs and suitably equipped external services, and the ability to build an increasing interest among consumers in tasting different wines animated by many guides, professional or for beginners.

In summary, considering all the numerous specific elements sustaining the competitiveness of the Italian wine sector, a picture emerges of that sector being largely organised on localised production systems characterised by a very high endowment of local social capital which allows individual producers to interact between them and with the local context and, in particular, with the knowledge and production experience established therein. As highlighted by the analysis of other Italian products originating from industrial districts, in the case of wine, the high number of production units, together with the action of competition and collaboration mechanisms, actually stimulate continuous product, process and market innovations based upon a common knowledge base. Furthermore, the presence of a defined and socially cohesive territorial context makes it possible to carry out significant cumulative processes on the knowledge developed, largely incorporated, precisely, in the local human capital, and to preserve the most suitable conditions for such processes to take place (Conti and Menghinello 1997).

6 Final Remarks

Over the last seven decades, the Italian wine industry has changed dramatically, from a dispersed production system of mainly low-value wines for self-consumption and the local market, to a modern industry able to satisfy increasingly demanding domestic supply and very competitive international markets with a wide range of wines. The sector reacted to stimuli coming from the changing domestic and international demand and from the activism of NW newcomers, and in this context, different types of firms were able to thrive. The Italian wine sector, with its roots in a vast population of farms, is today characterised by a complete array of firms (upstream integrated private wineries, cooperatives, industrial wineries, bottlers). Italian wine companies are different sized and have different orientations in terms of product characteristics, with the central and northern regions more oriented towards PDO and PGI wines, so that they are able to connect their supply with several different markets and distribution networks.

The combination of such different players results in a complex organisation of the sector. Within it, the intermediate markets (grapes and bulk wine) are necessary for the functioning of the de-integrated supply chains. Moreover, they allow for temporary shortages or surpluses of grapes or wines of the integrated supply chains to be offset, thus giving flexibility to its functioning.

The Italian wine sector has taken advantage of the windows of opportunity that opened up in the market and sustained the challenge of newcomers, not remaining locked into existing technologies or existing managerial and institutional routines. However, as Italy’s wine industry structure cannot enjoy greater economies of scale than its competitors and does not include companies that, due to their size, can be considered world leaders, the competitiveness of the Italian wine sector appears to be a paradox that literature has never investigated.

In this paper, we have presented several elements in support of our hypothesis that the drivers behind the competitiveness of Italian wine sector lie in the favourable conditions of the elements considered by the Porter Diamond. Nevertheless, we have argued that what is peculiar to the Italian wine sector when compared to other traditional producing countries is its territorial organisation of production, characterised by the typical condition of industrial districts. The Italian wine industry was not traditionally made up of large firms, but it was nationally familiar with grape-growing and winemaking, hence in a condition to rely on a wine production potential rich with local and international varieties and in contact with wide and increasingly exigent domestic demand. This created the conditions for establishing strong local networks having the nature of industrial districts. With regard to the geography of supply, it is therefore interesting to note that the most vibrant wine producing districts are located close to, or in the same areas as, the more dynamic manufacturing districts, sharing the same entrepreneurial atmosphere and social capital and, as a consequence, located mainly in the Centre and the North of Italy. In addition, with regard to technologies, the sector was accompanied in its evolution by an input supply industry that is now a world leader in many fields.

Looking to the future, in order to maintain its competitiveness, the Italian wine industry will certainly have to be successful in addressing some important challenges related to supply and to the market.

On the production side, a risk of a shortage of grapes may stem from the absence of generational renewal, resulting in a massive reduction of small and medium farms that represented, over time, a significant share of supply, very resilient to price volatility. Climate changes could reduce yields and worsen the grape content in the warmer areas (Galletto et al. 2014; Santos et al. 2020), although it could also improve the quality of some wines produced in cooler areas (Anderson 2017). Finally, the sector will have to meet the increasing social and institutional demand for environmental sustainability which will require a new substantial evolution of production processes (Pomarici and Vecchio 2019) and this will be difficult to achieve, as the use of pesticides in viticulture, in Italy, as well as elsewhere, is quite high (ISTAT 2011). Substantial progress will require not only new equipment to reduce the use of variable inputs but also a particularly careful day-by-day control of processes or, alternatively, the use of new resistant hybrids, with serious consequences on the organisation of supply. Many initiatives are already being implemented to improve substantially the sustainability of production processes and to certify performance but these, as yet, involve a relatively small number of companies (Corbo et al. 2014; Aivazidou and Tsolakis 2020).

On the market side, the sector, in a context of increasing competition in the international market exacerbated by the consequences of the COVID pandemic, must first consolidate the positive evolution of domestic demand. It must defend the social legitimacy of moderate consumption against anti-alcohol pressures and, through improved synergies with the distribution entities, it may be able to deliver greater value to domestic consumers, particularly in HoReCa, where the consumption habits of young generations are developed through shared experiences (Mariani and Pomarici 2010). Moreover, Italy must defend its competitive advantage in traditional import markets and increase that advantage in new markets, particularly in China. It must take advantage of the changes in distribution networks and channels and implement up to date promotion strategies as well as improved institutional support. In fact, “the wine story is not necessarily one of aborted catch up” (Morrison and Rabellotti 2017, p. 13): newcomers are reshaping their strategies; their competitive pressure may increase and China may become a major player, at least in import substitution, although the physical and environmental constraints on cultivation do not indicate a dramatic increase in supply (Anderson and Pinilla 2018).

In this paper, we present a comprehensive overview of the Italian wine sector, also highlighting the main structural differences with respect to competitors. It fills a gap in the academic literature by offering an interpretation of the drivers of Italian competitiveness, apparently inconsistent with the sector’s dimensional structure. Further interesting and challenging research avenues may be suggested. The intensity of the district conditions of the various wine areas in Italy could be measured, adopting up to date methods (Giordano et al. 2016), and this intensity could be regressed on their performances. Moreover, the importance for the success of wine areas of the proximity to successful manufacture districts could be evaluated, to identify the influence of their business and entrepreneurial culture.

Notes

Wines with certified origin are identified with a geographical name, officially recognised and protected, as they come from a specific area and are produced following a particular traditional process. According to a more recent European regulation, established in 2012, these are currently represented by wines with protected designation of origin (PDO) and wines with protected geographical indication (PGI). Wines belonging to the latter category follow a procedure similar to PDO, but the link between sensory characteristics and production area is not required. The request for recognition is made at the initiative of the producers who are committed to respecting self-established rules (production area boundaries, admitted varieties, maximum yield, aspects of grape production, analytical parameters of wine, processing and wine finishing) which guarantee wine characteristics strictly dependent on the characteristics of the production area (terroir). Italian DOC/DOCG and IGT (indicazione geografica tipica) wines comply with EU rules concerning, respectively, PDO and PGI.

The quantitative study of the intermediate grape market requires data collected annually by AGEA not published and not available to the public.

Sparkling wines, in the North-West, are produced in their entirety by winemaking industries. The same happens for generic wines in the South.

From direct selling by farms and cooperatives or purchase in retail outlets.

However, Italian wines from international varieties exhibit good sensory profiles and are appreciated by experts (Cacchiarelli et al. 2016).

To be fair, this difference between NW and OW appears to be fading slowly. NW producers increasingly establish officially recognised geographical indications to provide evidence of wines originating from particularly reputable areas (although there are vast normative differences compared to the EU) and European producers catching up in the production of varietal wines, despite mainly being characterised by an appellation of origin or a geographical indication.

In France and Spain, the figures are similar those of Italy, 16% and 20%.

The wine company recording the highest turnover in the world, Gallo (USA), achieves 5 billion Euros, while the tenth (FECOVITA, Argentina) achieves 1.2 billion Euros. The leading Italian wine company (Gruppo Italiano Vini—CIV) achieves just 0.6 billion Euros in turnover.

From the top 15 Italian firms in terms of turnover, 8 are cooperatives (Mediobanca 2020).

The text uses the quality categories proposed by the University of Adelaide (Anderson and Pinilla 2018). These are defined according to price (in US$ per litre, pretax) at a country’s wholesale level or national border: non-premium, under 2.50; commercial premium, between 2.50 and 7.50; fine wines, above 7.50 (super-premium and sparkling).

Boxed wine consumption is quite significant (about 1.5 million hectolitres), mainly sold under a few leading brands (Cembalo et al. 2014). Bag-in-box wine consumption, on the other hand, is rather limited.

Off-trade consumption, at home or in other places, accounts for 60% of the total and is mainly supplied by supermarket chains (ISMEA 2018). Specialised wine shops play an important role in premium wine sales (Mediobanca 2019).

FADN (known in Italy as RICA) surveys the economic performances of a representative random sample of European farms. It collects information on production, structural characteristics, financial situation and income of farms, organised by technical specialisation including grape-growing and winemaking when part of the farm activities. It is an EU instrument, launched in 1965, for evaluating the income of agricultural holdings and the impacts of the CAP. In Italy, FADN includes about 11,000 farms.

The EIP for agriculture productivity and sustainability is an EU programme, launched in 2012, to foster competitive and sustainable farming and to contribute to the “Europe 2020” EU strategy.

With regard to direct payments, there are no official data, and the information reported here was obtained from privileged witnesses and professional organisations.

References

Aaker DA (2000) Managing brand equity: capitalizing on the value of a brand name. DIANE Publishing Company, Darby

Abramovitz M (1986) Catching up forging ahead, and falling behind. J Econ Hist 46(2):385–406

Aivazidou E, Tsolakis N (2020) A water footprint review of italian wine: drivers, barriers, and practices for sustainable stewardship. Water 12:369–374. https://doi.org/10.3390/w12020369

Albisu LM, Escobar C, del Rey R, Gil Roiget JM (2019) The Spanish wine industry. In: Alonso Ugaglia et al., pp 77–103

Alonso Ugaglia A, Cardebat JM, Corsi A (eds) (2019a) The Palgrave handbook of the wine industry economics. Palgrave MacMillan, Cham

Alonso Ugaglia A, Cardebat JM, Jiao L (2019b) The French wine industry. In: Alonso Ugaglia et al., pp 17–46