Abstract

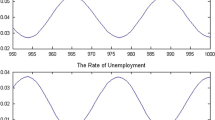

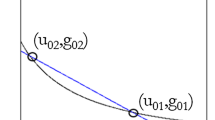

This paper introduces a macromodel with oligopoly and entry/exit in a framework where individuals are heterogeneous in their budget constraints, since they can be workers, new entrant entrepreneurs, incumbent entrepreneurs or unemployed and may change their status due to a stochastic process, associated to entry and exit. Agents’ heterogeneity is explicitly modelled in the aggregate demand, that also accounts for the income distribution. Heterogeneity also plays a relevant role in the process of entry/exit in the goods market, which interacts with the labour market and generates macroeconomic fluctuations. As shown in the agent-based numerical simulation, the model provides a new interpretation of the business cycle and an explanation for the empirical phenomenon of countercyclical mark up.

Similar content being viewed by others

Notes

One could have equivalently assumed that the firms go bankrupt after more than one period of losses, but this would have introduced some element of arbitrariness. On the other hand, since this is a dynamic general equilibrium model with stochastic elements (although it is not a DSGE and, on the contrary, is meant to introduce an alternative framework to the DSGE), introducing the shares would have required the formalization of the stock market which would have considerably complicated the algebra of the model without qualitatively changing the focus and the results. In addition, formalizing elements such as the expectations impact on share pricing and the impact of share pricing on aggregate wealth and, again, the impact of share pricing on entry/exit would have required a number of arbitray conditions and would have considerably dragged away the attention from the main focus of the paper.

At the initial time \(t_{0}\) the existence of entrepreneurs and firms, i.e. different social groups, can be thought of as being determined by a random initial distribution of wealth.

We can imagine that no incumbent firm has incentive to deviate from this “publicly announced” incentive compatible wage by making the following assumption: since there is rivalry among the oligopolistic firms, the publicly announced wage is a form of coordination. If there were no coordination, each firm would have incentive to “steal” the workers from the rivals by offering them a marginally higher wage. We assume that this firm coordination is supported by a retaliation strategy, against a firm that would deviate from the announced wage, performed by all the other firms.

Using a different notation, we may write 11 as follows:

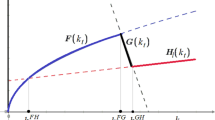

$$\begin{aligned} n_{t}h_{t}= & {} n_{t-1}h_{t-1}\left[ \Pr (\pi ^{in}\ge 0)+\frac{1-h_{t-1}}{ h_{t-1}}\psi (var(\Psi _{t}))\right] \\&-\,(1+r_{t-1})\xi Fn_{t-2}(1-h_{t-2})\psi (var(\Psi _{t-1})) \end{aligned}$$where \(H_{t}=n_{t}h_{t}\). However, we do not use this notation because it might be misleading, since the number of workers employed by each firm is stochastic, implied by the specific output of the firm, determined by information shocks and this other notation is only true ex post.

Please look at the Reference of SLAPP, Section 2.1, to run the simulation shell and to link it to a specific project, as the oligopoly one.

The fraction is equal for all the firms, being i here not relevant

The method is applied with \(t>1\), so the use of the lagged price starts at time 2, at that time \(P_{t-2}\) would be the undefined \(P_{0}\) value; as a simplification we use \(P_{t-1}\) in this case.

If at least one method is linked to a probability, SLAPP displays—in its text output—a dictionary with the method probabilities.

schedule.xls is one of the files of the simulation project, as described at https://github.com/terna/oligopoly/ and particularly into the Oligopoly.pdf reference; it is useful to quote schedule.xls to allow the replicability of the simulation. the sensitivity analysis shows that the model is responsive to this probability, as higher values increase the presence of countercyclical mark ups—see about this effect at the end of the paper—but anyway the key determinant of that effect is the entry/exit phenomenon, as in Sect. 10.

Activated if the parameter cut also the wages is set to yes

References

Aoki M, Yoshikawa H (2007) Reconstructing macroeconomics—a perspective from statistical physics and combinatorial stochastic processes. Cambridge University Press, Cambridge

Bagliano FC, Bertola G (2004) Models for dynamic macroeconomics. Oxford University Press, Oxford, pp 296, ISBN:0199266824

Boero R, Morini M, Sonnessa M, Terna P (2015) Agent-based models of the economy agent-based models of the economy—from theories to applications. Palgrave Macmillan, Basingstoke, pp 228, ISBN:9781137339805

Borril PL, Tesfatsion L (2010) Agent-based modeling: the right mathematics for the social sciences?”. Staff general research papers, Iowa State University, Department of Economics. http://econpapers.repec.org/RePEc:isu:genres:31674

Bragin J (2012) An Outline of Complex Systems Science: Goals, Scope and Methods. mimeo UCLA. http://ucla.academia.edu/JohnBragin

Etro F, Colciago A (2010) Endogenous market structure and the business cycle. Econ J 120:1201–33

Fagiolo G, Roventini A (2012) Macroeconomic policy in DSGE and agent-based models. Revue de l’OFCE (5):67–116. http://www.cairn.info/revue-de-l-ofce-2012-5-page-67.htm

Gertner R (1985) Simultaneous move price-quantity games and non-market clearing equilibrium. In: Essays in theoretical industrial organization. Ph.D. thesis, Massachusetts Institute of Technology, Dept. of Economics. http://dspace.mit.edu/handle/1721.1/14892

Gilbert N, Terna P (2000) How to build and use agent-based models in social science. Mind Soc 1(1):57–72

Harsanyi JC (1973) Games with randomly distributed payoffs: a new rationale for mixed-strategy equilibrium points. Int J Game Theory 2:1–23

Holt C (1994) Oligopoly price competition with incomplete information: convergence to mixed-strategy equilibria. Working Paper, University of Virginia, https://goo.gl/MZjVqm

LeBaron B, Tesfatsion L (2008) Modeling macroeconomies as open-ended dynamic systems of interacting agents. Am Econ Rev 98(2):246–250

Maskin E (1986) Oligopolistic markets with price-setting firms—the existence of equilibrium with price-setting firms. Am Econ Rev 76(2):382–386

Merlone U, Szidarovszky F (2015) Dynamic oligopolies with contingent workforce and investment costs. Math Comput Simul 08:144–154 (2015). ISSN:0378-4754, https://goo.gl/iVp7vW

Osborne MJ, Rubinstein A (1994) A Course in Game Theory. MIT Press, Cambridge, MA

Author information

Authors and Affiliations

Corresponding author

Electronic supplementary material

Below is the link to the electronic supplementary material.

Rights and permissions

About this article

Cite this article

Mazzoli, M., Morini, M. & Terna, P. Business Cycle in a Macromodel with Oligopoly and Agents’ Heterogeneity: An Agent-Based Approach. Ital Econ J 3, 389–417 (2017). https://doi.org/10.1007/s40797-017-0058-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40797-017-0058-y