Abstract

To investigate the long-term effects of the Port Authority’s supervision strategies on the container terminal’s collusion strategies, this study constructs a two-sided evolutionary game model consists of the Port Authority and a container terminal based on evolutionary game theory which usually examine a game’s long-term trends. Under the premise that the container terminal’s net profits from collusion strategy are greater than those from non-collusion strategy, the stability analysis demonstrates that the container terminal tend to choose collusion strategy, and the Port Authority tends to choose lax supervision strategy when the fine received by the container terminal is less than the Port Authority’s cost; the container terminal tends to choose collusion strategy, and the Port Authority tends to choose strict supervision strategy when the fine received by the container terminal is greater than the Port Authority’s cost and the sum of the fine and subsidy is less than the difference in the container terminal’s profits from collusion strategies. Finally, the numerical simulation results confirm the robustness of the stability analysis. These results can guide and benefit relevant stakeholders in the sustainable development of the container shipping supply chain.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Container ports have a prominent role in the container shipping supply chain (CSSC) [31]. The 2022 World’s Top 100 Container Ports Ranking (Lloyd’s [22], reported by Lloyd’s List which is the oldest shipping newspaper in the world, indicated that all current container ports are in a tough struggle for long-term development, including 28 ports in China. In 2021, the Shanghai port had a 47.03 million TEU container throughput, representing an 8.1% increase from the previous year, leading the world’s ports for 12 consecutive years; the second-ranking Singapore port completed a 37.47 million TEU container throughput, an increase of 1.6% from the previous year; the third-ranking Ningbo Zhoushan port completed 31.07 million TEU of containers, which was up 8.2% from the previous year. The container port throughput of the top 10 global container ports worldwide increased from 253.63 million TEUs in 2020 to 268.31 million TEUs in 2021, representing an annual growth rate of 5.8%.

Most container ports have entered a post COVID-19 pandemic recovery phase but are still facing rural tests [41]. In the short term, port shutdowns caused by the pandemic continued to occur [23]. In the long term, the labor shortages and industrial shifts generated by China’s vanishing demographic dividend will make its ports face increasingly difficult circumstances in the future [45]. According to Deloitte’s forecast, container traffic in global ports will grow 2.3% in 2022, indicating further slowdown. Amid the ongoing effect of the COVID-19 pandemic, tense multilateral relations, and uncertain trade relations, the future of container ports remains unknown.

With the advancing development of the CSSC, container terminals have motivations for collusion to guarantee their own interests and keep up with the pace of development. Xin et al. [36] solved the multiplayer non-zero-sum games with online mode-free integral reinforcement learning algorithm. Zhuang et al. [44] introduced an optimal iterative learning control algorithm for linear time-invariant multiple-input–multiple-output problems with nonuniform trial lengths under input constraints. Unlike the previous research [6], in this study, we explore the optimal dynamic strategies between the Port Authority and container terminals applying the evolutionary game (EG) model, under the premise that the container terminal’s net profits from collusion strategy are greater than those from non-collusion strategy.

Several research issues requiring investigation are examined in this study. (1) What are the optimal evolutionary stable strategies (ESS) in the long term of a container terminal and the Port Authority under different scenarios? (2) How can a long-term optimal strategy be adopted for the container terminal and the Port Authority? (3) Will social welfares improve if the optimal strategy is implemented? To answer these three questions, this study introduces an EG model, verifies the robustness of the analysis with numerical simulation, and provides proposed conclusions for advancing the CSSC.

The reminder of this paper is devised as follows. Sect. "Literature review" presents a literature review regarding the CSSC, EG theory, and government regulation of collusion. In Sect. "Model", we formulate the EG models in different scenarios. In Sect. "Evolutionary stability analysis", we conduct the ESS in an evolutionary stable analysis. In Sect. "Numerical simulation", we apply the model to a number of simulations. Finally, in Sect. "Conclusions", we summarize the conclusions of this study, and elaborate the shortcomings of this paper and our next research directions in the future.

Literature review

Container shipping supply chain

Some research has focused on and expanded the breadth and depth of knowledge regarding tacit collusion among the container terminals, upstream ports, downstream liner companies, and even shippers. For example, Tan et al. [30] introduced the strategic integration of inland ports and shipping services for ocean carriers in a vertical CSSC. Dong et al. [5] examined the effects of regional port collusion in a multiport region using a three-stage non-cooperative game model. Zhang et al. [40] examined regional transshipment ports using the structural hole theory.

Other scholars have explored collusion practices between carriers and pertinent enterprises such as inland freight forwarders and shipping lines [32, 33]. Paridaens and Notteboom [27] analyzed recent developments in the strategic routes of three shipping companies amid logistics integration and presented empirical findings. Zhou et al. [43] designed a hub-and-spoke network for the convenience of container ships’ movement in the CSSC. Jeong and Kim [15] also designed a robust network to model for ensuring the reliability of container operations. Dong et al. [6] determined the optimum strategies among container terminals and related liner companies using a game model. Nguyen et al. [26] explored the unknown risk situation for the CSSC. Fan et al. [8] focused on decisions related to investment in vessel trading and demolition in different CSSC submarkets.

Studies have also been conducted regarding the future directions of CSSC. For instance, Yang [38] argued that the CSSC can expect to adopt green transportation processes and supply chains,Cariou et al. [2] found that the CSSC can lower greenhouse gas emissions from international shipping as announced by the International Maritime Organization in 2018,Finally, Huang et al. [14] investigated the locating of hub ports and allocating of non-hub ports to hubs, to ensure high-level reliability of CSSC, which was facing increased exposures of unreliability in the post-COVID-19 pandemic era.

Evolutionary game theory

EG theory has been described in the context of a Hawk–Dove game [29] and is usually applied by scholars to analyze the relationships between different stakeholders or to forecast the long-term development of different industries using a two-sided or tripartite EG model, particularly in examining CSSC, as shown in Table 1.

Among the most useful analysis tools, EG theory has been widely applied by many scholars in investigating a variety of industries. For example, in the ride sourcing industry, Lei et al. [19] used a tripartite EG model to demonstrate the regulatory strategies for the sharing industry. For the energy industry, Wang et al. [34] introduced an EG model introducing the engagement of energy customers and government regulators and analyzed the ESS of each participant. In the business management industry, Hafezalkotob et al. [12] introduced a policymaking EG model between small and medium-sized enterprises during a pandemic recession to examine their remaining in the economic market at the end of the pandemic.

Particularly in the CSSC and related research areas concerning the maritime industry, a body of research has conducted a series of meaningful explorations. For instance, in the CSSC area, scholars examined the ESS of each participant, ensuring the sustainable development of the entire system. Jiang et al. [16] explored the different benefits among the government and liner companies in implementing China’s Emission Control Areas regulation. Lin et al. [21] introduced a perspective for shipping lines concerned with green maritime shipping using ESS. Zhang et al. [42] introduced a system EG model to examine the responses of tripartite participants to governance policies in different scenarios. Xu et al. [37] designed a tripartite EG model to investigate the effects of ESS on the growth of the electrical ship industry. Hu and Dong [13] used EG theory to describe the interaction between different container carriers in peak and off seasons. Regarding marine pollution, other studies have explored the ESS among different stakeholders. Meng et al. [24] introduced a tripartite EG model to analyze the evolution of each participant’s emissions reduction. Ye et al. [39] studied the ESS regarding the control of ballast water discharge from ships between flag and port states, determining that the results can be influenced by different participants’ decision sequences. Li and Jiang [20] established a tripartite EG model and analyzed participants’ interests to show how central governments affect the strategies of local governments and sea-using enterprises by developing maritime pollution control regulations. Xiao and Cui [35] showed that the shipping market demand can influence government’s carbon quota regulation.

Supervision of collusion

We next review the literature on government supervision of corporate collusion. Government supervision could advance the healthy functioning of the entire industry. Faure-Grimaud et al. [10] assessed the efficiency of supervision in centralized and decentralized organizations. Fang et al. [9] examined the impact of social relationships between senior managers on the quality of financial reporting. Lee et al. [17] explored various themes and identified the pivotal issues emerging in the sustainability of the maritime industry. Meng et al. [24] studied the probability of active government regulation to reduce carbon emissions. Xu et al. [37] showed the influence of ESS in the electric shipping industry.

Efficient supervision may also improve the effectiveness of the entire industry. Che et al. [3] showed a hierarchy with inadequate supervision, demonstrating that supervisors may collect incorrect signals about agent effort, identifying a new tradeoff between inefficient supervision and supervisor-agent collusion. Du et al. [7] researched the effect of a carbon tax policy implementation on altering the choices of low-carbon buildings. Mookherjee and Tsumagari [25] found that principals will not benefit from hiring supervisors.

Summary

This study aims to fill the gap in understanding the relationship between the Port Authority and container terminals under the premise that the container terminal’s net profits from collusion strategy are greater than those from non-collusion strategy. We examine the long-term development of container terminals in the CSSC under Port Authority supervision in different particular scenarios. Hence, we construct an EG model with two stakeholders based on EG theory, determine the optimal strategies through the evolutionary stability analysis, and confirm the robustness of the stability analysis using the numerical simulation, and finally summarize the conclusions and research directions.

The primary contributions of this study are threefold. (1) We explore the long-term effects of the Port Authority’s strict or lax supervision strategy on the container terminal’s collusion or non-collusion strategy; (2) we develop an EG model with two stakeholders based on the EG theory under the premise that the container terminal’s net profits from collusion strategy are greater than those from non-collusion strategy; and (3) We verify the stability of the collusion strategy and the robustness of the stability analysis using numerical simulation.

Model

Problem description

In this section, we consider a CSSC involving two stakeholders—a container terminal and the Port Authority. To maximize its profits in the long term, the container terminal will choose a collusion or non-collusion strategy with the liner companies or with other container terminals.

Meanwhile, the Port Authority will implement strict or lax supervision on the collusion strategy of the container terminal. According to the EG, the interactive behavior between the two participants is illustrated in Fig. 1.

Basic hypotheses

Hypothesis 1

Both the container terminal and the Port Authority have bounded rationality, choosing their strategy according to maximizing profits [13, 37].

Hypothesis 2

This EG model includes a container terminal and the Port Authority. If the proportion of the collusion strategy of a container terminal is \(x\), then, the proportion of the non-collusion strategy of a container terminal is \(1 - x\). In addition, the proportion of the strict supervision strategy of the Port Authority is \(y\), and the proportion of the lax supervision strategy of the Port Authority is \(1 - y\) [16, 42].

Hypothesis 3

When choosing the collusion strategy, the container terminal’s profit is \(I_{c}\), and its cost is \(C_{c}\); when choosing the non-collusion strategy, the container terminal’s profit is \(I_{n}\), and its cost is \(C_{n}\). Meanwhile, the difference between \(I_{c}\) and \(C_{c}\) is greater than that between \(I_{n}\) and \(C_{n}\) (i.e., \(I_{c} - C_{c} > I_{n} - C_{n}\)) [4].

Hypothesis 4

When choosing the strict supervision strategy, the Port Authority will fine the container terminal, receiving \(F\) as the profit. If the container terminal chooses the non-collusion strategy, it will bring an increase in social welfare \(W\), and the Port Authority will give the container terminal a discount in tax or subsidy (\(S\)), and the Port Authority will spend workforce, material, and financial resources to maintain strict supervision at a cost of \(C_{g}\). If the Port Authority chooses lax supervision when the container terminal chooses a collusion strategy, the cost is 0; otherwise, the benefit is \(W\). All notions and their descriptions are presented in Table 2 [19, 28].

Replicated dynamic equation

Considering the limited rationality of the container terminal and the Port Authority, we formulate the payoff matrix between the two participants based on EG theory, as presented in Table 3.

When the container terminal chooses the collusion strategy, its expected profit is \(U_{T}^{C}\), when the container terminal chooses the non-collusion strategy, its expected profit is \(U_{T}^{N}\), then, its average expected profit is \(U_{T}\). The container terminal’s average expected profit is the expected profit regardless of the collusion strategy.

Likewise, when the Port Authority chooses the strict supervision strategy, its expected profit is \(U_{P}^{S}\), when the Port Authority chooses the lax supervision strategy, its expected profit is \(U_{P}^{L}\), then, its average expected profit is \(U_{P}\). The Port Authority’s average expected profit is the expected profit regardless of the supervision strategy.

Above all, the replicated dynamic equation (RDE) of collusion strategy chosen by the container terminal and the RDE of strict supervision strategy chosen by the Port Authority are {F(x), F(y)} as follows [1]:

Evolutionary stability analysis

To solve the partial derivative of \(F(x)\) and \(F(y)\) with respect to \(x\) and \(y\), we obtain the Jacobian matrix (\(J\)) of the above RDEs as follows [18]:

The EPs of the RDEs are \(E_{1} = (0,0)\), \(E_{2} = (0,1)\), \(E_{3} = (1,0)\), \(E_{4} = (1,1)\), and \(E_{5} = (x_{0} ,y_{0} )\), in which \(x_{0} = \tfrac{{S + C_{g} }}{F + S}\),\(y_{0} = \tfrac{{I_{c} - C_{c} - I_{n} + C_{n} }}{F + S}\).

Substituting the five EPs into the Jacobian Matrices, we obtain the following:

The eigenvalue (Eig) and determinant (Det) of the Jacobian Matrix \(J\) are obtained in different scenarios. Referencing Friedman [11], the EP is an ESS while the EP of the RDE satisfies the condition that det J = ad − bc > 0, tr J = a + d < 0; otherwise, the EP is a saddle point while det J < 0.

Proposition 1

When the fine is less than the Port Authority’s cost, the ESS will be collusion and lax supervision, regardless of the magnitude between the sum of the fine and subsidy and the welfare difference from the container terminal’s collusion strategy.

Proof

A. When \(F - C_{g} < 0\), we can obtain \(\tfrac{{S + C_{g} }}{F + S} > 1\); thus \((\tfrac{{S + C_{g} }}{F + S},\tfrac{{I_{c} - C_{c} - I_{n} + C_{n} }}{F + S})\) is not the internal EP, then, (0,0), (0,1), (1,0), and (1,1) are the local EPs of the system. Moreover, from Hypothesis 3, it is clear that \(I_{c} - C_{c} - I_{n} + C_{n} > 0\); thus, there are two scenarios for a container terminal:

Scenario 1: When \(F + S > I_{c} - C_{c} - I_{n} + C_{n} > 0\) and \(F < C_{g}\), at \(E_{1} = (0,0)\), we can obtain \(\lambda_{1} = I_{c} - C_{c} - I_{n} + C_{n} > 0\) and \(\lambda_{2} = - S - C_{g} < 0\); thus, det \(J < 0\) and tr \(J < 0\), and \(E_{1}\) is a saddle point. Similarly, at \(E_{2} = (0,1)\), we can obtain \(\lambda_{1} < 0\) and \(\lambda_{2} > 0\); thus, det \(J < 0\) and tr \(J > 0\), and \(E_{2}\) is a saddle point. At \(E_{3} = (1,0)\), we can obtain \(\lambda_{1} < 0\) and \(\lambda_{2} < 0\); thus, det \(J > 0\) and tr \(J < 0\), and \(E_{3}\) is an ESS point. At \(E_{4} = (1,1)\), we can obtain \(\lambda_{1} > 0\) and \(\lambda_{2} > 0\); thus, det \(J > 0\) and tr \(J > 0\), and \(E_{4}\) is a saddle point. These conditions are presented in Table 4.

Scenario 2: When \(0 < F + S < I_{c} - C_{c} - I_{n} + C_{n}\) and \(F < C_{g}\), at \(E_{1} = (0,0)\), we can obtain \(\lambda_{1} = I_{c} - C_{c} - I_{n} + C_{n} > 0\) and \(\lambda_{2} = - S - C_{g} < 0\); thus, det \(J < 0\) and tr \(J > 0\), and \(E_{1}\) is a saddle point. Similarly, at \(E_{2} = (0,1)\), we can obtain \(\lambda_{1} > 0\) and \(\lambda_{2} > 0\); thus, det \(J > 0\) and tr \(J > 0\), and \(E_{2}\) is an instability point. At \(E_{3} = (1,0)\), we can obtain \(\lambda_{1} < 0\) and \(\lambda_{2} < 0\); thus, det \(J > 0\) and tr \(J < 0\), and \(E_{3}\) is an ESS point. At \(E_{4} = (1,1)\), we can obtain \(\lambda_{1} < 0\) and \(\lambda_{2} > 0\); thus, det \(J < 0\) and tr \(J < 0\), and \(E_{4}\) is a saddle point. These conditions are presented in Table 4.

Proposition 2.

When the fine is greater than the Port Authority’s cost, the ESS will be collusion and strict supervision as the sum of the fine and subsidy is less than the welfare difference from the container terminal’s collusion strategy. There is no ESS as the sum of fine and subsidy is greater than the welfare difference from the container terminal’s collusion strategy.

Proof

The welfare of the collusion strategy provides the container terminal with motivation to choose a collusion strategy, and the Port Authority will choose a strict supervision strategy to improve social welfare, but the high cost will hinder the Port Authority’s positivity of supervision, and the Port Authority will select lax supervision strategy, then the container terminal will have the motivation to select the collusion strategy, and this cycle will continue over and over again. Therefore, there is no ESS as the sum of the fine and subsidy is greater than the welfare difference from the container terminal’s collusion strategy.

When \(F - C_{g} > 0\), we can obtain (0,0), (0,1), (1,0), (1,1), and \((x_{0} ,y_{0} )\), which are the local EPs of this system. Moreover, from Hypothesis 3, it is clear that \(I_{c} - C_{c} - I_{n} + C_{n} > 0\); thus, for the container terminal, there are two scenarios as follows:

Scenario 3: When \(F + S > I_{c} - C_{c} - I_{n} + C_{n}\) and \(F > C_{g}\), at \(E_{1} = (0,0)\), we can obtain \(\lambda_{1} = I_{c} - C_{c} - I_{n} + C_{n} > 0\) and \(\lambda_{2} = - S - C_{g} < 0\); thus, det \(J < 0\) and tr \(J\) is not available, then, \(E_{1}\) is a saddle point. Similarly, at \(E_{2} = (0,1)\), we can obtain \(\lambda_{1} < 0\) and \(\lambda_{2} > 0\); thus, det \(J < 0\) and tr \(J\) is not available, and \(E_{2}\) is a saddle point. At \(E_{3} = (1,0)\), we can obtain \(\lambda_{1} < 0\) and \(\lambda_{2} > 0\); thus, det \(J < 0\) and tr \(J\) is not available, and \(E_{3}\) is a saddle point. At \(E_{4} = (1,1)\), we can obtain \(\lambda_{1} > 0\) and \(\lambda_{2} < 0\); thus, det \(J < 0\) and tr \(J > 0\), and \(E_{4}\) is a saddle point. At \(E_{5} = (x_{0} ,y_{0} )\), we can obtain \(\lambda_{1} > 0\) and \(\lambda_{2} < 0\); thus, det \(J < 0\) and tr \(J\) is uncertain, and \(E_{5}\) is a saddle point. These conditions are presented in Table 5.

Scenario 4: When \(F + S < I_{c} - C_{c} - I_{n} + C_{n}\) and \(F > C_{g}\), at \(E_{1} = (0,0)\), we can obtain \(\lambda_{1} = I_{c} - C_{c} - I_{n} + C_{n} > 0\) and \(\lambda_{2} = - S - C_{g} < 0\); thus, det \(J < 0\) and tr \(J\) is uncertain, then, \(E_{1}\) is a saddle point. Similarly, at \(E_{2} = (0,1)\), we can obtain \(\lambda_{1} > 0\) and \(\lambda_{2} > 0\); thus, det \(J > 0\) and tr \(J > 0\), and \(E_{2}\) is an instability point. At \(E_{3} = (1,0)\), we can obtain \(\lambda_{1} < 0\) and \(\lambda_{2} > 0\); thus, det \(J < 0\) and tr \(J < 0\), and \(E_{3}\) is a saddle point. At \(E_{4} = (1,1)\), we can obtain \(\lambda_{1} < 0\) and \(\lambda_{2} < 0\); thus, det \(J > 0\) and tr \(J < 0\), and \(E_{4}\) is an ESS point. At \(E_{5} = (x_{0} ,y_{0} )\), we can obtain \(\lambda_{1} > 0\) and \(\lambda_{2} < 0\); thus, det \(J > 0\) and tr \(J = 0\) is uncertain, and \(E_{5}\) is a central point. These conditions are presented in Table 5.

Numerical simulation

The results are calculated using the simulation platform MATLAB R2012a in four simulations with a computer with 8G RAM, 6G discrete NVIDIA GTX2050 graphics card, an Intel i5-12540 processor, and a 64-bit WIN11 operating system. These simulation experiments replicate the behavior of the model when collusion strategies are considered, with insufficient attention to the illegal behavior of container terminals in different initial scenarios. The results of these simulation experiments are described below.

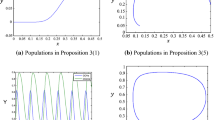

Simulation 1: When \(F + S > I_{c} - C_{c} - I_{n} + C_{n} > 0\) and \(F < C_{g}\), the initial condition is set as follows: \(F = 1\), \(C_{g} = 2\), \(S = 2\), \(I_{c} = 5\),\(C_{c} = 2\), \(I_{n} = 4\), and \(C_{n} = 2\). Considering the different probabilities of the collusion and supervision strategies under the initial conditions, the dynamic route of the EG between the two participants is illustrated in Fig. 2. The simulation results indicate that the only ESS point is (1, 0), that is, the container terminal tends to select collusion strategy, and the Port Authority tends to choose lax supervision strategy.

In the early stage of the new policy implementation regarding collusion in CSSC, the government supervision over container terminals is in the mapping stage, and not effectively put into practice. Excessive supervision costs cause the Port Authority to ignore collusion in container terminals, leading to its prevalence. This situation is exceptionally unconducive and unhealthy to the sustainable development of the CSSC.

Simulation 2: When \(0 < F + S < I_{c} - C_{c} - I_{n} + C_{n}\) and \(F < C_{g}\), we set \(F = 0.5\), \(C_{g} = 2\), \(S = 0.4\), \(I_{c} = 5\),\(C_{c} = 2\), \(I_{n} = 4\) and \(C_{n} = 2\). The dynamic route of the EG between the two participants is presented in Fig. 2b, which considers different probabilities of collusion and strict supervision strategies under the initial conditions. The simulation results indicate the same as in Fig. 2a that the only ESS point is (1, 0), that is, the container terminal tends to select collusion strategy, and the Port Authority tends to choose lax supervision strategy.

Simulations 1 and 2 have also proved the truth of Proposition 1.

Simulation 3: When \(F + S > I_{c} - C_{c} - I_{n} + C_{n}\) and \(F > C_{g}\), we set \(F = 3\), \(C_{g} = 2\), \(S = 2\), \(I_{c} = 5\), \(C_{c} = 2\), \(I_{n} = 4\), and \(C_{n} = 2\). The dynamic route of the EG under the initial conditions between the two participants is presented in Fig. 3a, which considers different probabilities of the collusion strategy and strict supervision strategy. The simulation results show that there is no ESS point.

Due to a lack of experience, and the Port Authority may have no more human, material and financial resources to select the strict supervision, the Port Authority can only occasionally maintain a strict supervision strategy, which contributes to the prevalence of collusion. The container terminals restrain intensive collusion when the strict supervision strategy is in place and the Port Authority dynamically adjusts its stringency according to the ratio of container terminals’ collusion strategy. Subsequently, the strategies of the container terminals and the Port Authority are dynamic along with changes in related market conditions.

Simulation 4: When \(F + S < I_{c} - C_{c} - I_{n} + C_{n} > 0\) and \(F > C_{g}\), we set the initial condition as follows, \(F = 0.5\), \(C_{g} = 0.2\), \(S = 0.4\), \(I_{c} = 5\), \(C_{c} = 2\), \(I_{n} = 4\) and \(C_{n} = 2\). Considering the different probabilities of collusion and supervision strategies under the initial conditions, the dynamic route of the EG between the two participants is shown in Fig. 3b. The simulation result indicates that the only ESS point is (1, 1), that is, the container terminal tends to select collusion strategy, and the Port Authority tends to choose strict supervision strategy.

Simulations 3 and 4 have also verified the conclusion of Proposition 2.

Conclusions

When the fine is less than the Port Authority’s cost, regardless of the magnitude between the sum of the fine and subsidy and the welfare difference from the container terminal’s collusion strategy, the ESS will be collusion and lax supervision. When the fine is greater than the Port Authority’s cost, the ESS will be collusion and strict supervision, as the sum of the fine and subsidy is less than the welfare difference from the container terminal’s collusion strategy. There is no ESS as the sum of fine and subsidy is greater than the welfare difference from the container terminal’s collusion strategy, as the welfare of collusion strategy provides the container terminal with the motivation to choose the collusion strategy, and the Port Authority will choose strict supervision to improve social welfare. Still, the high cost will harm the Port Authority’s positivity of supervision, and the Port Authority will choose the lax supervision strategy. The container terminal will have the motivation to select the collusion strategy, and this cycle will continue over and over again. These theoretical and simulation conclusions can guide and benefit relevant stakeholders in advancing the sustainable development of the CSSC. Finally, it should be noted that, future empirical research will be conducted in expanded directions.

The action of the two participants is not synchronized, either the container terminal’s action lags behind the Port Authority, or the Port Authority’s action lags behind the container terminal. The uncertainties are not only internal, but also external. The choosing of strategy not only depends on market environment, but also on participants themselves. Also, as the complex environment, this paper only takes into account the Port Authority and the container terminal, next, the future research will take into account more participants, for example, the liner enterprise, the freight forwarder, even the shipper.

Data availability

All relevant data are within the manuscript and its Additional files.

References

Bomze IM (1983) Lotka-Volterra equation and replicator dynamics: a two-dimensional classification. Biol Cybern 48(3):201–211

Cariou P, Parola F, Notteboom T (2019) Towards low carbon global supply chains: a multi-trade analysis of CO2 emission reductions in container shipping. Int J Prod Econ 208:17–28

Che X, Huang Y, Zhang L (2021) Supervisory efficiency and collusion in a multiple-agent hierarchy. Games Econom Behav 130:425–442

Dong G, Huang R, Ng P (2016) Tacit collusion between two terminals of a port. Transp Res Part E: Log Trans Rev 93:199–211

Dong G, Zheng S, Lee PTW (2018) The effects of regional port integration: The case of Ningbo-Zhoushan Port. Transportation Research Part E: Logistics and Transportation Review 120:1–15

Dong G, Liu Z, Lee PTW, Chi X, Ye J (2023) Port governance in the post COVID-19 pandemic era: Heterogeneous service and collusive incentive. Ocean Coast Manag 232:106427

Du Q, Yan Y, Huang Y, Hao C, Wu J (2021) Evolutionary games of low-carbon behaviors of construction stakeholders under carbon taxes. Int J Environ Res Public Health 18(2):508

Fan L, Wang R, Xu K (2023) Analysis of fleet deployment in the international container shipping market using simultaneous equations modelling. Marit Pol Manag:1–18.

Fang X, He K, Meng Y, Ye J (2022) Supervision or collusion? CEO–CFO social ties and financial reporting quality. J Account Lit (ahead-of-print)

Faure-Grimaud A, Laffont JJ, Martimort D (2003) Collusion, delegation and supervision with soft information. Rev Econ Stud 70(2):253–279

Friedman D (1991) Evolutionary games in economics. Econom J Econo Soc:637–666

Hafezalkotob A, Nersesian L, Fardi K (2023) A policy-making model for evolutionary SME Behavior during a pandemic recession supported on Game Theory Approach. Comput Ind Eng:108975

Hu ZH, Dong YJ (2022) Evolutionary Game Models of Cooperative Strategies in Blockchain-Enabled Container Transport Chains. Asia-Pacific J Oper Res 39(01):2140029

Huang L, Tan Y, Guan X (2022) Hub-and-spoke network design for container shipping considering disruption and congestion in the post COVID-19 era. Ocean Coast Manag 225:106230

Jeong Y, Kim G (2023) Reliable design of container shipping network with foldable container facility disruption. Transp Res Part E Log Transp Rev 169:102964

Jiang B, Wang X, Xue H, Li J, Gong Y (2020) An evolutionary game model analysis on emission control areas in China. Mar Policy 118:104010

Lee PTW, Kwon OK, Ruan X (2019) Sustainability challenges in maritime transport and logistics industry and its way ahead. Sustainability 11(5):1331

Gao L, Yan A, Yin Q (2022) An evolutionary game study of environmental regulation strategies for marine ecological governance in China. Front Mar Sci 9:2428

Lei LC, Gao S, Zeng EY (2020) Regulation strategies of ride-hailing market in China: An evolutionary game theoretic perspective. Electron Commer Res 20(3):535–563

Li JM, Jiang SS (2023) How can governance strategies be developed for marine ecological environment pollution caused by sea-using enterprises? A study based on evolutionary game theory. Ocean Coast Manag 232:106447

Lin DY, Juan CJ, Ng M (2021) Evaluation of green strategies in maritime liner shipping using evolutionary game theory. J Clean Prod 279:123268

Lloyd's List (2022) One Hundred Ports 2022. https://lloydslist.maritimeintelligence.informa.com/one-hundred-container-ports-2022.

Marschke M, Vandergeest P, Havice E, Kadfak A, Duker P, Isopescu I, MacDonnell M (2021) COVID-19, instability and migrant fish workers in Asia. Maritime Studies 20(1):87–99

Meng L, Liu K, He J, Han C, Liu P (2022) Carbon emission reduction behavior strategies in the shipping industry under government regulation: a tripartite evolutionary game analysis. J Clean Prod 378:134556

Mookherjee D, Tsumagari M (2023) Regulatory mechanism design with extortionary collusion. J Econ Theory 208:105614

Nguyen S, Chen PSL, Du Y (2022) Risk assessment of maritime container shipping blockchain-integrated systems: an analysis of multi-event scenarios. Transp Res Part E Log Transp Rev 163:102764

Paridaens H, Notteboom T (2022) Logistics integration strategies in container shipping: A multiple case-study on Maersk Line, MSC and CMA CGM. Res Transp Bus Manag 45:100868

Pu D, Xie F, Yuan G (2020) Active supervision strategies of online ride-hailing based on the tripartite evolutionary game model. IEEE Access 8:149052–149064

Smith JM (1986) Evolutionary game theory. Physica D 22(1–3):43–49

Tan Z, Meng Q, Wang F, Kuang HB (2018) Strategic integration of the inland port and shipping service for the ocean carrier. Transp Res Part E Log Transp Rev 110:90–109

Wan C, Zhao Y, Zhang D, Yip TL (2021) Identifying important ports in maritime container shipping networks along the Maritime Silk Road. Ocean Coast Manag 211:105738

Wang F, Zhuo X, Niu B, He J (2017) Who canvasses for cargos? Incentive analysis and channel structure in a shipping supply chain. Transp Res Part B Methodol 97:78–101

Wang J, Liu J, Zhang X (2020) Service purchasing and market-entry problems in a shipping supply chain. Transp Res Part E Log Transp Rev 136:101895

Wang XP, Zhang ZM, Guo ZH, Chang S, Sun LH (2023) Energy structure transformation in the context of carbon neutralization: evolutionary game analysis based on inclusive development of coal and clean energy. J Clean Prod:136626

Xiao G, Cui W (2023) Evolutionary game between government and shipping companies based on shipping cycle and carbon quota. Front Mar Sci 10:241

Xin X, Tu Y, Stojanovic V, Wang H, Shi K, He S, Pan T (2022) Online reinforcement learning multiplayer non-zero sum games of continuous-time Markov jump linear systems. Appl Math Comput 412:126537

Xu L, Di Z, Chen J (2021) Evolutionary game of inland shipping pollution control under government co-supervision. Mar Pollut Bull 171:112730

Yang CS (2018) An analysis of institutional pressures, green supply chain management, and green performance in the container shipping context. Transp Res Part D: Transp Environ 61:246–260

Ye J, Chen J, Shi J, Jie Z, Hu D (2022) Game analysis of ship ballast water discharge management—triggered by radioactive water release from Japan. Ocean Coast Manag 228:106303

Zhang Q, Pu S, Luo L, Liu Z, Xu J (2022) Revisiting important ports in container shipping networks: a structural hole-based approach. Transp Policy 126:239–248

Zhang Y, Sun Z (2021) The coevolutionary process of maritime management of shipping industry in the context of the COVID-19 pandemic. J Marine Sci Eng 9(11):1293

Zhang Y, Xiang C, Li L, Jiang H (2021) Evolutionary game analysis and simulation with system dynamics for behavioral strategies of participants in crowd logistics. Transp Lett 13(7):540–554

Zhou S, Ji B, Song Y, Samson SY, Zhang D, Van Woensel T (2023) Hub-and-spoke network design for container shipping in inland waterways. Expert Syst Appl:119850

Zhuang Z, Tao H, Chen Y, Stojanovic V, Paszke W (2023) An optimal iterative learning control approach for linear systems with nonuniform trial lengths under input constraints. IEEE Trans Syst Man Cybern Syst 53(6):3461–3473

Zwanka RJ, Buff C (2021) COVID-19 generation: a conceptual framework of the consumer behavioral shifts to be caused by the COVID-19 pandemic. J Int Consum Mark 33(1):58–67

Funding

This work was supported by the Humanities and Social Sciences of the Chinese Ministry of Education Planning Fund [Grant Number: 22YJA630013].

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Liu, Z., Dong, G. & Shang, S. Evolutionary stability strategies of tacit collusion in supervised container terminals. Complex Intell. Syst. 10, 3319–3328 (2024). https://doi.org/10.1007/s40747-023-01334-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40747-023-01334-7