Abstract

In this paper, a novel framework for the estimation of optimal investment strategies for combined wind-thermal companies is proposed. The medium-term restructured power market was simulated by considering the stochastic and rational uncertainties, the wind uncertainty was evaluated based on a data mining technique, and the electricity demand and fuel price were simulated using the Monte Carlo method. The Cournot game concept was used to determine the Nash equilibrium for each state and stage of the stochastic dynamic programming (DP). Furthermore, the long-term stochastic uncertainties were modeled based on the Markov chain process. The long-term optimal investment strategies were then solved for combined wind-thermal investors based on the semi-definite programming (SDP) technique. Finally, the proposed framework was implemented in the hypothetical restructured power market using the IEEE reliability test system (RTS). The conducted case study confirmed that this framework provides robust decisions and precise information about the restructured power market for combined wind-thermal investors.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The concept of “sustainable development” was proposed to international diplomats at the United Nations Framework Convention on Climate Change. It was established that the contribution of the energy sector to the greenhouse effect should play a major role in the policy for sustainable environmental development. Thus, several countries ratified an agreement to address this crisis by reducing greenhouse gas emissions. They offered to expand the existing renewable energy infrastructures to solve this problem. Moreover, countries in the European Union (EU) prepared a supportive policy to develop renewable technologies, and are committed to generate 20% of their total electrical power from renewable energies by 2020 [1]. Among the sustainable and renewable energies, the maturity rate of wind sources is the highest. This expansion occurred due to the economic, social, and environmental advantages of wind [2]. Besides wind deployment, the structure of the electricity power market underwent a shift from the vertical integrated utility or centralized structure to the decentralized power market. Private companies and investors are the main participants in the restructured power markets, and the governments function as supervisors [3]. In traditional systems, the generation expansion planning (GEP) is modeled in the centralized environments, and there is a standard and reliable pattern for the GEP [4]. Moreover, the restructured power market of the GEP model is dependent on the decisions of private investors. These decisions have an influence on the undetermined parameters in the restructured power market. Hence, the companies encounter several risks in their investments. Furthermore, the aims of the participants in the restructured power markets are different from the objectives described in the centralized power markets. In the traditional power market, the aims of the GEP are to determine the ideal technology, capacity, time, and the location of the construction of power plants by considering the acceptable reliability, to effectively respond to the demand, and by considering the social welfare [5,6,7]. On the other hand, the aim of the investor in the restructured power market is to maximize profits [8,9,10]. Therefore, the investors should provide long-term optimal investment strategies to maximize their profits by considering the uncertainties and regulatory policies in the restructured power market.

Although thermal companies should consider uncertainties such as the demand and fuel price in their long-term planning, wind companies are subject to a greater number of uncertainties. This is due to the volatile and intermittent nature of the wind. Moreover, the capital costs of wind sources are higher than that of thermal power plants. Thus, it is difficult for wind investors to participate in a competitive power market. Consequently, the investors in the restructured power market prefer to invest in stable and reliable power plants. This could reduce the investments in renewable energy; thus preventing governments from realizing renewable energy sources [11].

The long-term revenue of wind-power companies in the restructured power market are therefore subject to more uncertainties than thermal companies. These uncertainties include the forecasted load, fuel price, and output power of the wind farm, which are referred to as stochastic uncertainties. Furthermore, in medium-term planning, wind-power companies are subject to fluctuations in the market clearing price (MCP). The MCP is affected by uncertain parameters, which include the demand, fuel price, wind fluctuations, and the strategic behavior of other investors. In addition to the previously mentioned uncertainties, several factors influence the MCP, such as the regulatory interventions and realities in the restructured power market. These factors increase the investment risks for wind investors. Thus, the private wind investors require decision-making tools to determine their investment strategies in the long-term planning, by considering the medium-term effects of uncertainties, regulatory policies, and realities on the MCP in the restructured power market.

Until the end of the 1990s, a significant number of published researches were conducted on the GEP process in regulated electricity markets. During the last two decades, the GEP problem was solved in several studies by considering the stochastic or rational uncertainties individually; and in fewer studies, both types of uncertainties were evaluated to solve the GEP problem [6, 12,13,14,15,16]. Moreover, a major drawback of these approaches is that the wind sources and regulatory interventions with respect to wind sources were not considered. Until now, there has been little discussion on the economic issues of the GEP with respect to the hybrid wind-thermal investors, when considering the abovementioned risks and realities in the restructured power market.

Until the end of 1990s, a significant number of public studies were conducted on the GEP process in the regulation of electricity markets, and several key contributions are presented in [17,18,19]. In a significant review paper [10], mathematical programming-based and heuristic-based techniques used to solve GEP problems in regulated settings were discussed. In recent times, several researches have addressed GEP in restructured power markets using game theory (GT) [20]. As a field of applied mathematics, GT involves the investigation of mathematical models of conflict between rational private investors [21]. Moreover, it has been used to model the systematic behavior [22]. The expansion planning of wind power plants in the regulated power market was discussed in [23]. The authors suggested the Monte Carlo simulation for the calculation of the wind speed, to estimate the output power of wind power plants.

Reference [6] developed one of the initial GEP models in a restructured power market. The GEP was modeled as a Cournot game by assuming that the generators compete only in quantities, new entries do not occur in the middle of the game, and all the generators make investment decisions simultaneously. However, the GEP problem was solved despite the stochastic uncertainties. Reference [24] presented three different GEP models. Moreover, for the models in [6] and [24], the transmission constraints were not considered. Reference [14] considered the transmission constraints and extended the Hobbs linear complementarity problem (LCP) formulation [25] for power markets by incorporating GEP-related decision variables into the objective function. In [26], reliability criteria were assumed for the GEP model based on GT, to solve the generation investment problem, where the forecasted average market prices were assumed as a known parameter. A model based on the Nash Cournot equilibrium was proposed in [27] to solve the GEP problem that considers the power production in the energy market where the uncertainties have not been considered. An agent-based model was proposed to solve the generation investment problem, where interactions among agents were represented by a conjectured variation approach in [28]. In [12], a novel hybrid dynamic programming (DP)/GT framework was proposed to evaluate the impact of regulatory interventions on the dynamic behavior of investments in the new generation capacity in electricity markets. In [29], [12] was expanded by considering wind uncertainty. A framework for simulating the medium-term restructured power market was proposed. Moreover, the scenario-based method was used to model a wind-power plant in the restructured power market. In [30], a Monte Carlo simulation was used to model the uncertainties. In addition, the risk of a power system overload was evaluated for various penetration levels of wind plants. This assessment was conducted based on the measurement of the wind speed and the correlation between the wind resources. In this study, the minimization of the overload risk for each penetration level of wind resources was the basis of the expansion planning. In [31], the impact of climate policy and machine learning on future investments in the Swedish power sector was analyzed, in addition to the influence of carbon pricing policies on future investments in the Swedish power sector. In [32], a method to determine the optimum location of wind resources based on geographic information systems (GIS) was proposed. In [33], a novel method based on the load duration curve (LDC) for the GEP of large-scale wind plants was proposed. In [34], investment strategies were developed for wind power generation under the assumption that the generation capacity and investment resources are flexible. The investment problem was formulated as a mixed-integer programming (MIP) problem with the constraints specified as intervals, and the net present value (NPV) of generation profits specified as the objective. The general algebraic modeling system (GAMS) was used to solve the optimization problems. In [35], an integrated power generation expansion (PGE) planning model toward a low-carbon economy was proposed. Moreover, wind power plants should be considered, to complete the model.

A simple mathematic model was proposed in [36] to evaluate the impact of fixed feed-in-tariffs (FITs). Accordingly, the stochastic uncertainties and realities of the power market were not considered in [36]. In another article, the system dynamics model was reviewed to assess the power market policy. It was revealed that policy assessment and GEP are the most critical factors [37]. Moreover, a dynamic system model was proposed in [38]. Although the proposed model presented more useful information about the impact of incentive policies in the deregulated power market, the realities of the power market such as the CO2 tax were not considered.

Based on the literature review, it was concluded that the wind investor met more risks for their expansions. The private wind investors therefore require decision-making tools to evaluate investment strategies in long-term planning by considering the uncertainties, regulatory policies, and realities in the restructured power market. However, only a limited overview of the GEP of the combined wind-thermal investor by considering the abovementioned risks in the restructured power market is available.

In this paper, a novel framework is proposed to calculate the long-term optimal investment strategies for the combined wind-thermal investor by considering the medium-term and long-term uncertainties. Moreover, a mathematical model is proposed to simulate the medium-term restructured power market by considering the medium-term stochastic and rational uncertainties. The wind uncertainty was modelled using a data-mining technique. The method was previously validated in [29]. The electricity demand and fuel prices were simulated based on the Monte Carlo method. The Cournot concept was applied to model the strategic behavior of other investors in the restructured power market. Furthermore, the fixed FIT and bilateral contract were considered in the proposed model. The growths of the electricity demand and fuel prices, as two important long-term stochastic uncertainties, were modelled for several years using a binomial Markov chain process. The long-term optimal investment strategies were then estimated for the combined wind-thermal investor based on the stochastic dynamic programming (SDP) method and real options theory.

2 Description of proposed framework

The primary aim of this study was the development of an algorithm to model the restructured power market by considering the wind sources. Moreover, a method is proposed to solve the GEP for wind investors based on the SDP. The proposed framework is illustrated in Fig. 1. It consists of three main blocks, which are discussed below.

According to the literature review, the intermittent nature of wind resources increases the investor risks. Therefore, the features of wind power plants are different from that of the traditional power plants. In particular, the output power of thermal power plants is considered almost equal to the nominal power; whereas in electrical power systems that are integrated with wind sources, a fraction of the installed capacity of the wind farm is considered as an output power of the wind power plant. This concept is referred to as the capacity factor [39,40,41]. The capacity factor is commonly used to evaluate intermittent power sources. In this study, the wind scenarios were generated based on a method proposed in [29] by the authors of this paper. Moreover, in this study, the wind scenarios and their corresponding probabilities were generated based on a data mining algorithm. The proposed method in [29] was implemented on a real system, to illustrate the efficiency of the approach, as presented in block 1.

In block 2, a model was developed to evaluate and analyze the medium-term restructured power market while considering combined wind-thermal companies. The short-term uncertainties include the demand and fuel price, which have an effect on the MCP, simulated for a period of one year using the Monte Carlo method. Moreover, the wind generation scenarios and their probabilities were calculated using the output of block 1. These are the stochastic uncertainties that are considered in the proposed model for the simulation of the medium-term power market. Besides the stochastic uncertainties, as a critical parameter of the MCP, the strategic behavior of the investors is considered in the model based on the Cournot GT concept. Moreover, in this model, the regulatory interventions such as the CO2 tax, fixed FIT, and bilateral contracts are considered as the exogenous parameters. The sensitivity analysis of the investment, average annual MCP, and maximum profit of each company are the outputs of the developed model.

In block 3, an algorithm was proposed based on the SDP algorithm, to solve the GEP problem of wind-power companies. In this method, the demand and fuel price, which are considered as long-term uncertainties, were modelled using a binomial Markov chain. The Markov chains prepare the long-term uncertainties for the application of the SDP, to determine the optimal investment strategy of the wind investor. The maximum expected profit of the wind investor is calculated for each state and stage of SDP. The expansion planning problem of the wind investor was solved using backward recursion DP.

2.1 Mathematical formulation for simulation of medium-term restructured power market

As mentioned in the previous section, a comprehensive model requires the determination of the MCP. In particular, the model should consider the realities and uncertainties in the restructured power market. The realities include the bilateral contracts and regulatory interventions such as the FIT incentive policy and carbon tax for thermal power plants. Moreover, the uncertainties in the restructured power market include the stochastic and rational uncertainties.

The objective of this model is to maximize the profit for each company, which is determined in the medium-term based on the difference between the revenue of the private companies from the energy sales in the spot price power market and the operating and CO2 tax rate costs. The mathematical formulation of the proposed model is as follows:

s.t.

where e represents traditional generation company; s represents the season; e′ represents the combined traditional and renewable generation company; l represents the load level; u represents the thermal unit of traditional company; u′ represents the thermal unit of combined traditional and renewable generation company; uw represents the wind unit of combined traditional and renewable generation company; dsl is the duration of time; Ne,u and Ne′,u′ are the numbers of thermal units in e and e′; Pe,u,sl and Pe′,u′,sl are the power generation by thermal unit u and u′ of company e and e′ in sl; Qe,sl and Qe′,sl are the total generation contracted by company e and e′ in sl; SPsl is the average electricity price of power market in sl; inc is the fixed FIT incentive; Ne′,uw is the number of wind units in e′; BPsl is the contracted electricity price in sl; FPu is the fuel price of unit u; au, bu, cu and au′, bu′, cu′ are the constant coefficients of heat rate function for unit u and u′; Tax is the CO2 tax rate; EMu is the CO2 produced by unit u; GP is the percentage of electricity price; Dsl is the average demand in sl; Pe,u,min and Pe,u,max are the minimum and maximum generation of thermal unit u of company e; Pe′,u′,min and Pe′,u′,max are the minimum and maximum generation of thermal unit u′ of company e′; PWe′,uw,n,min and PWe′,uw,n,max are the minimum and maximum generation of wind unit uw of company e′ for scenario n; ge,e′,sl is the total power generation of companies e and e′.

The objective function proposed in (1) estimates the maximum benefits of private investors in the electricity power market, and it is composed of two main parts. The first part includes the revenue from the either energy sales in the spot power market, from traditional or wind sources, in addition to the revenue of the company in contractual markets. Moreover, the revenue from the incentive policy for wind units estimates in (1). The first and second components of (1) indicate the revenue of the thermal units of the traditional and combined traditional-renewable private companies in the spot market, respectively. The third and fourth components indicate the revenue in the contractual market. The fifth component of (1) represents the revenue of the wind units of the combined wind-thermal company in the spot market, by considering the incentive for wind generation units. The second part of (1) includes the operating and CO2 tax rate costs for the thermal units of the traditional and combined wind-thermal companies. Thus, the sixth and seventh components represent the fuel cost and carbon taxes of the thermal units of the traditional investor, respectively. Furthermore, the eighth and ninth components represent the fuel cost and carbon taxes of the thermal units of the combined wind-thermal company, respectively. The wind unit costs are neglected in this study.

The generation amounts of the traditional and combined wind-thermal private companies are represented in (2) and (3), respectively. The price of the electricity in the contractual market is given by (4). The constraint in (5) is related to the demand constraint, given that the generation companies are not responsible for the total demand of the market. The boundary limitations of the decision variables in the thermal units of the traditional and combined wind-thermal companies are given by (6) and (7), respectively. The boundary limitation of the decision variable in the renewable units of the combined wind-thermal company is represented by (8).

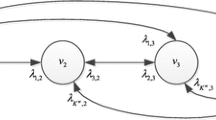

The optimization problem, as discussed in the previous section, was solved based on the initial electricity price. The results of this model include the total electricity produced in the power market, the electricity generated by each company, the total market profit, and the profit of each company. In this case, participants in the competitive power market with lower operating costs than the other companies maximize their profits by increasing their production. On the other hand, other participants with high operating costs prefer not to participate in the power market, or they do so with minimum production. The equilibrium price and equilibrium quantity are therefore provided. In the equilibrium condition, the quantity demanded is equal to the quantity supplied, which is the most critical parameter for decision-making in the competitive power market. Moreover, the players in the competitive power market have less information about the operating decisions of other investors, and they require a logical model and approach for decision-making. GT is defined as the study of mathematical models of conflict and cooperation between intelligent rational decision-makers [42]. Various games are considered in a competitive environment. Cournot, Bertrand, and van Stackelberg are the foremost GT models. In the Cournot model, each company chooses an output quantity to maximize profit. Companies are assumed to produce homogeneous goods that are non-storable. Thus, all quantities produced are immediately sold. The market price in the model is determined through an auction process that equates the industry supply with the aggregate demand. The model also assumes that all the companies in the industry can be identified at the start of the game, and the decision-making of all the companies occurs simultaneously [6, 43, 44]. Therefore, due to the similarities between the Cournot model and the competitive power markets, the concept of the Cournot game was applied in this study, to determine the MCP. This algorithm is explained by the following steps, and it is shown in Fig. 2.

Step 1: Each private company calculates its generation by solving the optimization problem discussed in Section 2.1.

Step 2: After the optimization problem has been solved for each company, the demand function of the power market is used to update the electricity price. To simplify the model performance, a linear demand function is used as follows [12, 45]:

Due to the importance of the balance between the demand and supply in the power market, the total generation of all the companies is substituted by the demand (Dsl) at each season and load level. Constants A and B are calculated for each season and load level, according to (10) and (11), respectively [12]:

where dc is the demand coefficient introducing demand intercept; pc is the price coefficient introducing price intercept; \(\pi_{base ,sl}\) is the competitive electricity price in sl. The forecast demand Dbase,sl at each season and load level can be determined based on the predicted average load at each season and load level, and the reference electricity price is calculated from the traditional unit commitment [46].

Step 3: The calculated price is then compared with the initial price. If the initial price is equal to the calculated price, the program stores the consequences. Otherwise, the first and second steps are repeated until this condition is fulfilled. Under these circumstances, the Nash equilibrium of the Cournot game is obtained, and none of the companies receive profits from changing their generation amounts. For the determination of the MCP for each of the wind scenario, these three steps are represented by the internal loop of Fig. 2

Step 4: Steps 1–3 are repeated for all the wind scenarios in a season. The external loop of Fig. 2 displays this process.

Step 5: The demand and fuel price uncertainties are considered using a Monte Carlo simulation. The Monte Carlo simulation produces distributions of possible outcome values. Using probability distributions, the variables can assume different probabilities. Probability distributions are significantly more realistic descriptions of the uncertainty in variables of a risk analysis. The probability distribution function of the demand and fuel price was estimated based on historical data. In this study, the normal distribution function was selected to generate random data for these uncertainties. The algorithm is depicted in Fig. 3.

Step 6: The outputs of the proposed algorithm, which are indicated in Fig. 2 and Fig. 3, include the average MCP for each scenario in a season, in addition to the investor profit for each scenario in a season. In this study, each year was divided into four seasons. Specific wind scenarios were then generated for each season based on the proposed framework in [29]. Thereafter, the approach discussed in this section was implemented for all the seasons, to calculate the average MCP and investor profit for each scenario in each season.

Step 7: The expected profit and MCP for each season and load level is determined using (12) and (13).

where Bn is the benefit for each season; Probn is the probability for each season; MCP is the market clearing price for each season.

2.2 Long-term optimal investment strategies for wind investor

In the field of economics, an investment is defined as the act of incurring an immediate cost in the expectation of future rewards. The financial estimations of the expansion project consist of three main aspects. First, the project type includes the capacity size and choice of technology for new power plants. Second, the timing for the investment; and third, the location of the investment. The first two aspects were investigated in this study.

In this section, a novel technique is proposed to solve the long-term optimal investment decision based on the SDP and real options theory. The NPV is typically used to evaluate a new investment project. The static form of the NPV rule states that a project should be undertaken given that the sum of discounted cash flows from the project (i.e., the NPV) is positive, whereas projects with a negative NPV should be rejected. However, this method has drawbacks, i.e., the uncertainties in an investment project are not considered. Moreover, the NPV method only compares two alternatives: ① making an investment today; ② making no investment [47, 48]. In several cases, the private investors can choose to defer the investment. The most common options for investment projects are presented in [49], i.e., the option to defer an investment, the option to alter the operating scale, the option to abandon a project, the option to switch inputs or outputs from a process, and different types of growth options.

Dynamic programming is an optimization method that is suitable for solving decision-making problems in accordance with the real options theory. Moreover, DP is a general optimization technique with applications within a range of different fields, including power system planning. In addition, DP is based on Bellman principle of optimality, as follows [47]: “an optimal path has the property that whatever the initial conditions and control variables over some initial period, decision variables chosen over the remaining period must be optimal for the remaining problem, with the state resulting from the early decisions taken to be the initial condition”. Hence, a DP optimization problem is typically solved stepwise, starting from either the beginning or the end of the considered period.

Therefore, to solve the decision-making problem using the DP optimization method, the components of the problem should be initially determined. The components include the stages and states of the DP. In the long-term expansion planning, the sequential years build the stages. Moreover, the demand, fuel price and the new capacity of wind generation construct the states of the DP. The long-term uncertainties of the demand and fuel price were modelled based on the binomial discrete Markov tree that was proposed in [19].

As mentioned in previous sections, the objective of the investor in generation expansion in the restructured power market is the maximization of profit. Therefore, the investment optimization problem for an investor is defined by (14)–(17). The backward recursion DP was used to solve this problem.

s.t.

where E is the expected profit of each stage and each state of the planning period; r is the discount rate; \(X_{e}\) is the electricity generation of company e (thermal-power company); \(X_{{e^{\prime}}}\) is the electricity generation of company \(e^{\prime}\) (hybrid wind-thermal company); \(U_{{e^{\prime}}}\) is the new candidate capacity of company \(e^{\prime}\) for the wind unit; Dt is the demand for year t; FPt is the fuel price for year t; lt is the construction delay of new wind units.

The total expected profit of a planning period establishes in (14) that the expected profit for each year contains three main components. These components are indicated in (18). The first and second terms represent the revenue of the hybrid wind-thermal company from the energy sales market and FIT incentive policy, respectively. The capital investment cost is represented by the third term. The capital cost of wind sources for each stage of the DP was calculated according to (19).

where \(C_{{e^{\prime},t}}\) is the investment cost of the wind technology in year t; nt is the total lifespan of the wind technology; Ccap is the capital cost.

3 Case study

The proposed framework was tested using the IEEE reliability test system (RTS) [50]. The total installed capacity and peak demand of the studied system were 2595 MW and 2072 MW, respectively. The duration of the study was one year. Each year was divided into four windy seasons, and three load levels were considered, which include the off-peak, medium, and peak levels. The historical wind-speed data were obtained from a wind farm near the town of Swift Current in the southern part of the Saskatchewan province in Canada, as presented in [51]. Moreover, the wind scenarios for each season are presented in Table 1 and Table 2. The forecasted demands and durations for each season and load level were collated from [12], and they are presented in Table 3. Specifications with respect to the units of companies in the system considered are presented in Table 4. The system contains five price-maker companies. The fuel prices and data associated with the generating units of the companies were obtained from [28, 52], and they are presented in Table 5. Other input parameters such as the CO2 tax rate and the bilateral contract price were obtained from [12]. The CO2 emissions for the different types of generating units are presented in Table 6.

4 Sensitivity analysis

In this section, the verification of the proposed mathematical model to simulate the medium-term restructured power market is presented. In general, sensitivity analysis is a technique used to determine the influence of different values of an independent variable on a given dependent variable, with specified constraints. This technique is used within specific boundaries that depend on one or more input variables, such as the effect of fuel-price changes in on the total profit of the electricity market. In addition, this technique can be used to test the robustness of the model or system in the presence of uncertainties. To complete this discussion, the expected effect of the increase in the fuel price was investigated, as presented in this section. Based on economic principles, the costs of the electric generating units are increased by an increase in the fuel price. Consequently, the total profit of the power market decreases, and the equilibrium price of the power market increases. Furthermore, due to the nonlinear features of the proposed model; by considering the increase in the fuel price, the outputs of the proposed model indicate a nonlinear behavior. If the previously mentioned results are obtained by solving the proposed model, the validity and the robustness of the model can be confirmed. Thus, the proposed mathematical model was solved under an additive set of fuel prices. The analysis results are presented in Table 7. Furthermore, the incremental effect of the increase in the fuel price on the MCP and the subtractive effect of the increase in the fuel price on the total profit of the power market are presented in Figs. 4 and 5, respectively. In summary, the results confirmed the robustness of the proposed mathematical model for the simulation of the medium-term restructured power market.

To complete the discussion, the proposed framework was solved without any incentives for the wind power plants. The contributions of each company in the power market were then compared with the scenarios wherein the fixed FIT was considered. The results are presented in Fig. 6. In the figure, it can be seen that the generation share of company 5 as a hybrid wind-thermal company increased by considering the fixed FIT as an effective incentive policy for the wind power plants. This evaluation was used to analyze the effect of the incentive policy on the proposed framework, to simulate the restructured power market.

5 Simulation results for long-term optimal investment for a wind-power company

Given the dynamic and multistage nature of the GEP problem, the DP technique was used to solve the optimization problem. Moreover, by considering the long-term stochastic uncertainties, the DP algorithm was converted to SDP. Each stage of the SDP was over a period of one year, and the increase in the demand and fuel price was considered in each state of the SDP. The medium-term proposed model was solved for each stage and state of the SDP. In this study, the demand and fuel price were considered as two long-term uncertainties. The expected upper and lower bounds of the increase in demand related to the binomial Markov chain were 7% and 4%, respectively. Moreover, the annual increase in the fuel price was considered as 2%. The planning period was assumed to be five years, due to the five-year outlook of regulators. Company 5 was considered as an investor in wind resources, and the maximum capacity for the candidate wind plant was assumed to be 300 MW. Given that the effect of regulator interventions is considered in the proposed model, it is given as investment sensitivity to solve the GEP problem. The SDP algorithm was solved for three scenarios. These scenarios include the cases wherein FIT is not considered, the fixed FIT is equal to 92 $/MWh, and the fixed FIT is equal to 110 $/MWh. The expected annual market prices (EAMC) and the average of the expected annual market prices (AEAMC) are presented in Table 8. The variations of these prices are compared in Fig 7. As can be seen from the figure, the market equilibrium price decreases by increasing the incentive policy for wind resources. The expansion strategies for the investor and the expected profit due to the wind investment during the planning period are presented in Table 9 for the different scenarios.

6 Conclusion

In summary, the investment in wind resources is a high-risk investment in the restructured power market. A comprehensive and sophisticated framework is therefore required to evaluate and analyze the impact of wind resources in the restructured power market. In this paper, a novel comprehensive framework was proposed to simulate the medium-term restructured power market, and to determine the long-term optimal investment strategies for the wind investor. Thus, the stochastic and rational uncertainties were considered to simulate the medium-term restructured power market. A novel method was proposed for the evaluation of the output power of wind farms based on the data mining method. Sensitivity analysis was then conducted to verify the proposed framework, for the simulation of the medium-term restructured power market. The effects of regulatory intervention, CO2 tax, and the bilateral contract were also investigated using the mathematical model. The long-term optimal investment strategies were then estimated based on the SDP and real options theory. The results confirm that the generation share of a hybrid wind-thermal company is increased when the fixed FIT is considered as an effective incentive policy for wind power plants. Furthermore, the market equilibrium price decreases in accordance with an increase in the incentive policy for wind resources. Finally, a new option was proposed for real options theory. With this approach, the investor could invest in his properties in consecutive years during the planning period. Although a comprehensive model was developed in this study, which may be useful to investors, future work should consider more uncertainties using this model. These uncertainties include the policies of regulators, the CO2 tax rate, hydro-power plants, etc. The simulation of a restructured power market can be used for long-term planning, and it can also be applied to other issues in the restructured power market such as efficient carbon taxation, which will be evaluated in future work.

References

Brown P (2013) European Union wind and solar electricity policies: overview and considerations. https://fas.org/sgp/crs/row/R43176.pdf. Accessed 3 July 2017

Ji H, Niu D, Wu M et al (2017) Comprehensive benefit evaluation of the wind-PV-ES and transmission hybrid power system consideration of system functionality and proportionality. Sustainability 9(1):65–82

Wang N, Mogi G (2017) Deregulation, market competition, and innovation of utilities: evidence from Japanese electric sector. Energy Policy 111:403–413

Weber C (2004) Uncertainty in the electric power industry: methods and models for decision support. Springer, New York

Kothari DP, Nagrath IJ (2011) Modern power system analysis. McGraw-Hill Education, New York

Chuang AS, Wu F, Varaiya P (2001) A game-theoretic model for generation expansion planning: problem formulation and numerical comparisons. IEEE Trans Power Syst 16(4):885–891

Hemmati R, Hooshmand RA, Khodabakhshian A (2013) Reliability constrained generation expansion planning with consideration of wind farms uncertainties in deregulated electricity market. Energy Convers Manag 76:517–526

Park JB, Kim JH, Lee KY (2002) Generation expansion planning in a competitive environment using a genetic algorithm. In: Proceedings of IEEE PES summer meeting, Chicago, USA, 21–25 July 2002, 4 pp

Lin WM, Zhan TS, Tsay MT et al (2004) The generation expansion planning of the utility in a deregulated environment. In: Proceedings of IEEE international conference on electric utility deregulation, restructuring and power technologies, Hong Kong, China, 5–8 April 2004, 6 pp

Zhu J, Chow MY (1997) A review of emerging techniques on generation expansion planning. IEEE Trans Power Syst 12(4):1722–1728

Oree V, Hassen SZS, Fleming PJ (2017) Generation expansion planning optimisation with renewable energy integration: a review. Renew Sustain Energy Rev 69:790–803

Barforoushi T, Moghaddam MP, Javidi MH et al (2010) Evaluation of regulatory impacts on dynamic behavior of investments in electricity markets: a new hybrid DP/GAME framework. IEEE Trans Power Syst 25(4):1978–1986

Barforoushi T, Moghaddam MP, Javidi MH et al (2006) A new model considering uncertainties for power market. Iran J Electr Electron Eng 2(2):71–81

Kaymaz P, Valenzuela J, Park CS (2007) Transmission congestion and competition on power generation expansion. IEEE Trans Power Syst 22(1):156–163

Botterud A, Ilic MD, Wangensteen I (2005) Optimal investments in power generation under centralized and decentralized decision making. IEEE Trans Power Syst 20(1):254–263

Nanduri V, Das TK, Rocha P (2009) Generation capacity expansion in energy markets using a two-level game-theoretic model. IEEE Trans Power Syst 24(3):1165–1172

Masse P, Gibrat R (1957) Application of linear programming to investments in the electric power industry. Manag Sci 3(2):149–166

Bloom JA (1982) Long-range generation planning using decomposition and probabilistic simulation. IEEE Trans Power Apparatus and Syst 4:797–802

Mo B, Hegge J, Wangensteen I (1991) Stochastic generation expansion planning by means of stochastic dynamic programming. IEEE Trans Power Syst 6(2):662–668

Motalleb M, Ghorbani R (2017) Non-cooperative game-theoretic model of demand response aggregator competition for selling stored energy in storage devices. Appl Energy 202:581–596

Neshat N, Amin-Naseri MR, Ganjavi HS (2017) A game theoretic approach for sustainable power systems planning in transition. Int J Eng Trans 30(3):393–402

Li R, Ma H, Wang F et al (2013) Game optimization theory and application in distribution system expansion planning, including distributed generation. Energies 6(2):1101–1124

Ivanova EY, Voropai NI, Handschin E (2005) A multi-criteria approach to expansion planning of wind power plants in electric power systems. In: Proceedings of IEEE Russia power tech, St. Petersburg, Russia, 27–30 June 2005, 4 pp

Murphy FH, Smeers Y (2005) Generation capacity expansion in imperfectly competitive restructured electricity markets. Oper Res 53(4):646–661

Hobbs BF (2001) Linear complementarity models of Nash–Cournot competition in bilateral and POOLCO power markets. IEEE Power Eng Rev 21(5):63–63

Kim JH, Park JB, Park JK et al (2005) A market-based analysis on the generation expansion planning strategies. In: Proceedings of 13th international conference on intelligent systems application to power systems, Arlington, USA, 6–10 November 2005, 6 pp

Centeno E, Reneses J, García R et al (2003) Long-term market equilibrium modeling for generation expansion planning. In: Proceedings of IEEE Bologna power tech conference, Bologna, Italy, 23–26 June 2003, 7 pp

Gnansounou E, Dong J, Pierre S et al (2004) Market oriented planning of power generation expansion using agent-based model. In: Proceedings of IEEE PES power systems conference and exposition, New York, USA, 10–13 October 2004, 6 pp

Askari MT, Kadir MZA, Hizam H et al (2014) A new comprehensive model to simulate the restructured power market for seasonal price signals by considering on the wind resources. J Renew Sustain Energy 6(2):023104

Papaefthymiou G, Verboomen J, Sluis LVD (2007) Estimation of power system variability due to wind power. In: Proceedings of IEEE Lausanne power tech, Lausanne, Switzerland, 1–5 July 2007, 6 pp

Pettersson F, Söderholm P (2009) The diffusion of renewable electricity in the presence of climate policy and technology learning: the case of Sweden. Renew Sustain Energy Rev 13(8):2031–2040

Ramírez-Rosado IJ, García-Garrido E, Fernández-Jiménez LA et al (2008) Promotion of new wind farms based on a decision support system. Renew Energy 33(4):558–566

George M, Banerjee R (2009) Analysis of impacts of wind integration in the Tamil Nadu grid. Energy Policy 37(9):3693–3700

Kongnam C, Nuchprayoon S (2007) Development of investment strategies for wind power generation. In: Proceedings of IEEE Canada electrical power conference, Montreal, Canada, 25–26 October 2007, 6 pp

Chen Q, Kang C, Xia Q et al (2010) Power generation expansion planning model towards low-carbon economy and its application in China. IEEE Trans Power Syst 25(2):1117–1125

Askari MT, Ab Kadir MZA, Bolandifar E (2015) Evaluation of FIT impacts on market clearing price in the restructured power market. In: Proceedings of IEEE student conference on research and development, Kuala Lumpur, Malaysia, 13–14 December 2015, 4 pp

Ahmad S, Tahar RM, Muhammad-Sukki F et al (2016) Application of system dynamics approach in electricity sector modelling: a review. Renew Sustain Energy Rev 56:29–37

Ibanez-Lopez AS, Martinez-Val JM, Moratilla-Soria BY (2017) A dynamic simulation model for assessing the overall impact of incentive policies on power system reliability, costs and environment. Energy Policy 102:170–188

Askari M, Ab Kadir M, Hizam H et al (2013) A new approach to simulate the wind power energy based on the probability density function. Int J Electr Compon Sustain Energy 1:8–13

Billinton R, Gao Y (2008) Multistate wind energy conversion system models for adequacy assessment of generating systems incorporating wind energy. IEEE Trans Energy Convers 23(1):163–170

Patil S, Ramakumar R (2010) A study of the parameters influencing the capacity credit of WECS-a simplified approach. In: Proceedings of IEEE PES general meeting, Providence, USA, 25–29 July 2010, 7 pp

Osborne MJ (2004) An introduction to game theory. Oxford University Press, New York

Sabolić D (2017) On economic inefficiency of European Inter-TSO compensation mechanism. Energy Policy 110:548–558

Singh H (1999) Introduction to game theory and its application in electric power markets. IEEE Comput Appl Power 12(4):18–20

Villar J, Rudnick H (2003) Hydrothermal market simulator using game theory: assessment of market power. IEEE Trans Power Syst 18(1):91–98

Wood AJ, Wollenberg BF (2012) Power generation, operation, and control. Wiley, New York

Dixit AK, Dixit RK, Pindyck RS et al (1994) Investment under uncertainty. Princeton University Press, Princeton

Brennan MJ, Trigeorgis L (2000) Real options: development and new contributions. Proj Flex Agency Compet New Dev Theory Appl Real Options 11:1–10

Schwartz ES, Trigeorgis L (2004) Real options and investment under uncertainty: classical readings and recent contributions. MIT Press, Cambridge

Grigg C, Wong P, Albrecht P et al (1999) The IEEE reliability test system-1996. A report prepared by the reliability test system task force of the application of probability methods subcommittee. IEEE Trans power systems 14(3):1010–1020

Canada’s national climate archive. http://climate.weather.gc.ca. Accessed 21 September 1840

Shahidehpour M, Yamin H, Li Z (2002) Market operations in electric power systems. Wiley, New York

Author information

Authors and Affiliations

Corresponding author

Additional information

CrossCheck date: 28 October 2018

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

About this article

Cite this article

ASKARI, M.T., KADIR, M.Z.A.A., TAHMASEBI, M. et al. Modeling optimal long-term investment strategies of hybrid wind-thermal companies in restructured power market. J. Mod. Power Syst. Clean Energy 7, 1267–1279 (2019). https://doi.org/10.1007/s40565-019-0505-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40565-019-0505-x