Abstract

This paper presents a security constrained unit commitment (SCUC) suitable for power systems with a large share of wind energy. The deterministic spinning reserve requirement is supplemented by an adjustable fraction of the expected shortfall from the supply of wind electric generators (WEGs), computed using the stochastic feature of wind and loosely represented in the security constraint with scenarios. The optimization tool commits and dispatches generating units while simultaneously determining the geographical procurement of the required spinning reserve as well as load-following ramping reserve, by mixed integer quadratic programming (MIQP). Case studies are used to investigate various effects of grid integration on reducing the overall operation costs associated with more wind power in the system.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

For the last decade, significant actions that drastically curb air pollution have been heightened in the electricity generation sector, particularly the use of wind electric generators (WEGs). According to the Global Wind Energy Council [1], by the end of 2017, of the 539.6 GW wind power spinning around the globe, 52.6 GW had been recently brought in; being a 10.66% increase in cumulative capacity. The harnessing of these resources poses many technical issues as a result of their intrinsic intermittent and fluctuant output characteristics. In particular, due to their poor predictability, operational reliability of the power system cannot be guaranteed with the conventional deterministic spinning reserve method [2]. Moreover, WEGs with inertia less resources do not maintain system balance. Hence, reductions in the system net load resulting from declining WEGs output will force conventional plants to ramp up their output, otherwise if sufficient ramping capability is not available, fast-starting units will need to come online. These units are thus left stressed with temporal operating restrictions, which limits the rate of altering their output or of bringing them online. And it makes the grid costly to operate, insecure and vulnerable.

An optimal schedule that takes into account extra spinning reserve generation in order to accommodate WEGs integration can save considerable fuel input and cost. Equally, some inherent level of flexibility—design can relieve the jerkings around these units and prevent them from breaking down. Although this physical flexibility can be gained from those units, large penetrations of WEGs on a power plant portfolio may lead to a decrease in energy prices [3], resulting in revenue reduction to enable flexible plants to recover their variable and capital costs since their output may decrease. If incentives are not provided to encourage the needed ramping capability, the system is unlikely to get the efficient balance of generation resources because potential reliability degradation or costly out-of-market actions can occur. To gain the system requirements necessary to support the security and reliability of the power grids, adequate market policies must be crafted that address the required financial implications.

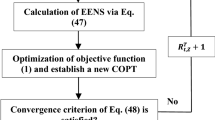

In this paper, an improved deterministic security constrained unit commitment (SCUC) has been devised. It optimally commits and dispatches generating units while simultaneously determining the geographical procurement of the required spinning reserve as well as load-following ramping reserve. To quantify the overall possible risks of generation shortfall, spinning reserve generation is considered as an exogenous parameter comprising a fraction of the hourly demand due to equipment unreliability, and a fraction of the expected energy not served (EENS) due to the uncertainty of supply from WEGs computed using the stochastic feature of WEGs. The optimization tool is used to investigate how: ➀to expand access to diverse resources and geographic footprint of operations; ➁valuation of ramping related costs on fossil-fuelled facilities coalesce to mitigate the jerkings around these units and lessen costs that are imposed on the power systems for accommodating WEGs. The main aim is to ease larger amounts of WEGs penetration into the grid.

The remainder of the paper is structured as follows. Section 2 briefly summarizes the literature relevant to this work and states its contributions. Section 3 provides the modeling of WEGs and the risks involved. The model formulation and solution methodology are addressed in Section 4. Section 5 reports on the results from the studies on a 6-bus two-area systems and the modified IEEE 118-bus three-area systems. Conclusions are drawn in Section 6.

2 Literature review and paper contributions

2.1 Literature review

Stochastic approaches have been particularly recommended to face the variable output of WEGs. In the available literature, wind power uncertainty has been mostly modeled in terms of scenarios [4,5,6]. In [4] where wind power is modeled with the normal distribution and possible wind power scenarios generated by applying the Monte-Carlo simulation based on the Latin hypercube sampling technique, the authors show that the iterations between the master unit commitment (UC) and wind power scenarios could identify a robust UC and dispatch solution for accommodating the volatility of wind power. Two strategies that minimize costs and handle risks due to WEGs are implemented in [5] through the Weibull distribution. The formulations are posed as fuzzy optimization models and are solved using the mixed integer linear programming technique. Reference [6] improves the two-stage stochastic UC of [4], by introducing a dynamic decision making approach similar to a multi-stage formulation in the presence of wind power scenarios which are not well represented by a scenario tree. Based on stochastic UC, chance-constrained model [7, 8] provides a probabilistic guarantee on the performance of solutions. Yet, those models heavily depend on the accuracy of scenarios and their realization probabilities. In contrast to stochastic models, robust UC [9,10,11] utilizes uncertainty sets to capture randomness and minimize the scheduling cost of the worst-case scenario, which may produce conservative solutions, but computationally it can avoid incorporating a large number of scenarios. Some hybrid models have been proposed under the premises of both the stochastic and the robust approaches in which some of the uncertain parameters are assumed to follow certain probability distributions, while others are known solely to belong to some uncertainty sets [12, 13].

In addition to the optimization algorithms, a number of physical measures have been proposed to improve grid operation and planning with WEGs, including demand-side management, use of storage devices, the interconnection of neighbouring power systems and increasing flexibility in the resource portfolio. Among existing prior work related to interconnected power systems are [14,15,16,17]. In [14], a risk-based reserve allocation method that accounts for multiple control sub-area coordination is presented, and a particle swarm optimization method is employed to provide a numerical solution to the problem. Reference [15] developed a decentralized UC algorithm for multi-area power systems using an augmented Lagrangian relaxation and auxiliary problem principle. Reference [16] proposed a coordination framework for tie-line scheduling and power dispatch of multi-area systems in which a two-stage adaptive robust optimization model was applied to account for uncertainties in the available wind power. In [17], an adjustable interval robust scheduling of wind power for day-ahead multi-area energy and reserve market clearing is proposed.

2.2 Paper contributions

It emerges from the literature review that the variable output and imperfect predictability of WEGs face stochastic approaches to plan and operate the power grids in the short-term. While being good, they are not suitable for production grade programs. Indeed, stochastic programming and/or robust optimization are still not being used in practical systems yet [18]. System operators (SOs) are concerned with the high computational requirements of these methods. For these reasons, all the market clearing tools are based on deterministic methods which assume a fixed knowledge of system conditions for the next day [18]. However, with large amounts of WEGs in power systems, the sole use of the deterministic criteria may not be economical or reliable in limiting the risk of uncertainty: an extra spinning generation reserve is needed to accommodate WEGs integration. Besides, except [15] that addresses the market clearing problem with the commitment decision of generators, the majority of these references focus on the economic dispatch or optimal power flow (OPF) problem and none of them rewards conventional units for their positive environmental attributes. The contributions of this paper can be summarized as follows:

-

1)

A scheduling algorithm in which the stochastic feature of WEGs is related to an adjustable extra spinning reserve constraint loosely represented by only three scenarios. This makes our model more applicable, more acceptable and computationally efficient. Compared to robust optimization that tackles uncertainties through immunizing against the worst-case scenario, our model delivers the feasible solution through providing sufficient ramp capability to ensure feasible transition from lower to upper bound.

-

2)

The valuation of ramping related costs on fossil-fuelled facilities. Indeed, by receiving compensation for costs they incur based on the decisions of others, these generators will have greater incentives to make their units available with higher ramp rates and to follow dispatch signals.

-

3)

The translation of the optimization framework into a mixed integer quadratic program (MIQP) problem. An MIQP solver returns a feasible solution with a known optimality level.

3 WEG model and risk management

Wind turbines are devices that convert the kinetic energy of the wind into mechanical energy, which in turn generates electricity with the help of an electric generator. The theoretical power available in the wind can be given by [19]:

where v is the wind speed (m/s); \(A_{r}\) is the rotor swept area exposed to the wind (\({\mathrm{m}}^{2}\)); \(\rho _{air}\) is the air density (\({\mathrm{kg/m}}^{3}\)); \(\eta _{g}\) the generator efficiency; \(\eta _{b}\) the gearbox/bearings efficiency; \(C_{p}\) the performance coefficient of the wind turbine; and \(P\left( v\right)\) is the power (W).

Since the overall efficiency of the turbine, \(C_{p}\eta _{g}\eta _{b}\), is practically not constant [20], the output of a certain turbine is obtained from the power performance curve as follows:

where \(C_{v}\) is a combined coefficient; \(v_{cut,in}\), \(v_{cut,out}\), \(v_{rated}\) are the cut-in, cut-out and rated wind speeds; and \(P_{rated}\) is the rated power of the wind turbine.

In order to calculate the average power over the different range of the power curve, a generalized expression is needed for the probability density distribution of the wind speed. Accordingly, the 2-parameter Weibull functions shown in the following formula \(f\left( v\right) =\frac{k}{c}\left( \frac{v}{c}\right) ^{k-1} \,{\mathrm{e}}^{-\left( \frac{v}{c}\right) ^{k}}\) and \(F\left( v\right) =1- {\mathrm{e}}^{-\left( \frac{v}{c}\right) ^{k}}\) have been most commonly recommended and used to model uncertainty in the day-ahead wind speed forecast [5, 21, 22], \(k>0\) being the dimensionless shape parameter and \(c>0\) the scale parameter in units of wind speed. The average power produced by such a WEG can then be calculated by integrating the power curve multiplied by the probability density function f(v). However, The hourly power output is obtained by Monte Carlo simulation [21, 23]. In this work, three samples of wind availability serve as the base scenarios, representing low, average and high wind realizations with associated probability as shown in Table 1 [5]. A WEG is dispatched around its forecasted power output, meaning that there may be a shortfall between observed and scheduled power. Let \(F_{m}^{gt}\) be the cumulative probability associated with a WEG output. The probability that power output of \(P^{gt}\) may not appear is equal to \(1-F_{m}^{gt}\). Considering a block of one hour, the EENS in this case is equal to \((1-F_{m}^{gt}) P^{gt}\). Summing this term for all generators and segments for an hour, one gets the total EENS for the solution X as follows:

where \(m=3\) is the number of segments on each probability distribution function curve of the Weibull distribution, each segment corresponding to a scenario; t(h) is the index over time periods, from 1 to \(N_{T}\); R is the index over regions; g is the index over generators of region R, from 1 to \(N_{g}^{R}\); \({RG^{R}}\) is the set of renewable generators of region R; \(F_{\max }^{gt}=\max (F_{m}^{gt}),\)\(\forall m\); and \(P^{gt}\) the output power of the WEG g in time t. Equation (3) is an average risk due to WEGs inclusion and represents the amount of shortfall energy from WEGs. It is scaled by a factor \(\beta\) and used to supplement the fixed amount of spinning reserve in the security constraint.

4 Problem formulation and solution methodology

Considering the following optimization variables \(P^{gt}\), \(u^{gt}\), \(v^{gt}\), \(q^{gt}\), \(r^{gt}\), \(\delta _{+}^{gt}\), \(\delta _{-}^{gt}\), \(L_{lns,n}^{Rt}\), \(\theta _{n}^{Rt}\), \(F_{flow,nk}\), \(F_{flow,nl}\), \(r_{tie}^{t}\), for \(\forall t\), \(\forall R\), \(\forall n\), \(\forall g\), our objective as stated below is to minimize the net costs TC(X) to purchase adequate energy and reserve to meet the demands of supply and security:

subject to

The objective function (4) includes the no load, startup and shutdown costs, \(a_{g}\), \(S_{on}^{g}\) and \(S_{off}^{g}\), respectively; \(u^{gt}\), \(v^{gt}\) and \(q^{gt}\) are the commitment, startup and shutdown states, in the same order; \(\sum \nolimits _{g=1}^{N_{g}^{R}}\left[ c_{g}\cdot \left( P^{gt}\right) ^{2}+b_{g}\cdot P^{gt}\right]\) is the expected cost of active power dispatch, with \(c_{g}\), \(b_{g}\) the cost coefficients and \(p^{gt}\) the power output of unit g in time t; \(d_{g}\), \(e_{g_{+}}\) and \(e_{g_{-}}\) are respectively the costs for unit g to provide spinning reserve \(r^{gt}\), upward load-following reserve \(\delta _{+}^{gt}\) and downward load-following reserve \(\delta _{-}^{gt}\) in time t; \(V_{voll}\) in row five is the cost incurred in shedding load \(L_{lns,n}^{Rt}\) at bus n of region R in period t.

In the power balance equations (5) \(k, l=1\) to \({N_{b}^{R}}\) are indices of buses/loads of region R; \(D_{n}^{Rt}\) is the demand at bus n of region R in time t; \({C_{CG,n}^{R}}\) and \({C_{RG,n}^{R}}\) are respectively the sets of conventional and renewable generators located at bus n of region R; \({\varPhi _{nk}^{R}}\) is the set of buses adjacent to bus n, all in region R; \({\varGamma _{nl}^{R}}\) is the set of buses of adjacent regions to region R, all connected to bus n of region R. Equations (6) and (7) compute the power flow on internal lines \(F_{flow,nk}\) and tie-lines \(F_{flow,nl}\) as a function of the reactance \(x_{nk}\) of line between buses n and k, and \(\left( \theta _{n}^{Rt}-\theta _{l}^{Rt}\right)\), the phase angle difference between the two end buses of the line. Equation (8) enforce \(n=1\) to be the reference node. Equation (9) sets bound on the amount of load involuntarily shed. Equations (10) and (11) enforce the transmission capacity limits \(f_{nk}^{\mathrm{max}}\)\(\in L^{R}\) and \(f_{nl}^{\mathrm{max}}\)\(\in L_{tie}^{R}\) of the internal lines and the tie-lines of each area, respectively. Equations (12) and (13) are the variable limits and load-following ramp reserve definition. \(\delta _{\max ^{+}}^{g}\) and \(\delta _{\max ^{-}}^{g}\) are respectively the upward and downward load-following ramping reserve limits for unit g. Equation (14) defines the amount of spinning reserve carried by each conventional generator, with \(R_{{\mathrm{max}}^{+}}^{g}\), the upward spinning reserve capacity limit for unit g, \(\varDelta _{+}^{g}\), the upward physical ramping limit on unit g and \({C_{CG}^{R}}\), the set of conventional generators of region R. Equation (15) enforce that the power plus the spinning reserve scheduled must be below the capacity \(P_{\mathrm{max}}^{g}\) of the unit. In the spinning reserve constraints (17), \(\alpha\) is the scaling factor of region R hourly demand. Equation (16) guarantee the sharing of reserve between regions. In these constraints, RR is the index over adjacent regions to region R; \({C_{CG}^{RR}}\) is the set of conventional generators of region RR; and \(r_{tie}^{t}\) is the contribution of region RR to the reserve requirement of region R in time t.

Equaitons (18)–(23) constitute the UC constraints and represent respectively, the injection limits and commitments, startup and shutdown events, minimum up and down times and integrality constraints. Note that a WEG is always turned on (23) and its power output limits (19) is controlled by the choice made by the optimal algorithm to operate it in any one of the segments. In these constraints, \({C_{RG}^{R}}\) is the set of renewable generators of region R; \(P_{\mathrm{min}}^{g}\) is the limit on the output power of unit g, \(\tau _{+}^{g}\) and \(\tau _{-}^{g}\) are in this order, the minimum up and minimum down times for unit g in number of periods.

The above formulation has a quadratic objective function and the majority of constraints except (16) are linear constraints of both equality and inequality types as well as variables of mixed nature, i.e. real and integer. Equation (16) is a nonlinear constraint due to the non-smooth min function which argument are state variables. This constraint has been transformed into linear constraints as:

Hence, MIQP technique is used to obtain the solutions. The model has been implemented on an Intel(R) Core(TM) i7-3770 cpu @ 3.40 GHz with 32.0 GB of RAM, and programs were developed using MATLAB R2016a. Relevant MIQP problems were solved by Gurobi 7.5.1 [24] under MOST [25] for Matpower [26] optimal scheduling tool.

5 Illustrative example and case study results

5.1 6-bus interconnected test system

In Fig. 1, two identical systems are interconnected through a 150 MW capacity of tie, those of internal lines being all set to 300 MW. The reactances of internals and tie-line are all 0.01 p.u. on a 100 MVA base. Two demands with the hourly load profile detailed in Table 2 are located at buses 3 and 6. The generation mix comprises a WEG located at bus 2 with a bidding price of $0/MWh and an available generation capacity of 200 MW.

The forecasted power outputs as stated in Section 3 is approximated by a set of probability-weighted scenarios for low, average and high wind realizations. However, transitions between these scenarios are not allowed from period to period. That is, if the system is in the high wind state in the first period, it will stay in the high wind state in the subsequent periods as shown in Fig. 2 where the EENS profile is also drawn. Conventional generating unit data are given in Table 3 where region 2 generator costs for energy, spinning reserve and load-following ramping reserve are twice those of region 1. In doing so, we force imports on this region. The hourly model over a time period of 4 hours duration allows shedding load at the value of $1000/MWh if it is economically efficient to do so. Furthermore, all generators are on service at the beginning of the horizon of study and their ramping capabilities are at the largest possible level. The data provided so far for this illustrative example defines the base case.

The first part of our analysis is devoted to the optimal outcomes of the base case, but before this, we earlier assessed the impact of wind uncertainty on the system reliability and on the cost of operation when \(\alpha =20\%\). For the purpose hereof, the program chooses to commit more power from the WEG. An increasing trend of both decision variables above are presented in Fig. 3 with wind power uncertainty increasing from \(0\%\) to \(100\%\) at \(10\%\) increments. Indeed, an increased WEG output comes with lower cumulative probability values. This increases the EENS defined in (6). From (20), system spinning reserve requirement equals the largest \(N-1\) contingency and an additional amount that equals a parameterized value of EENS. Hence, as hourly EENS increases the need for system spinning reserve in (20) increases, necessitating the use of quick start units, or short-term market purchases that lead to higher variable costs through increased fuel consumption thus, increased operation costs. This is particularly thriving for the values of \(\beta\) above 50% as the rate of change in the total operation cost is faster than the one of the total spinning reserve. If the metric of EENS in risk-averse UC models is easy to calculate and can be included in the bounding constraint, it is based on expected values and hence, cannot tell how risky the scheduled spinning reserve decision may be. To overcome this limitation, EENS has been factored so that the operator can maintain adequate defensive system posture likely for wind events, while dialing in system reliability. However, in the UC time frame, EENS as defined in our study is a proxy to real time market, then there is no need to consider its full percentage. For this reason, \(\beta\) has been set at \(90\%\) for the rest of this paper, accordingly with the standards [27].

The outcomes related to units scheduling, positive load-following ramping reserve (PLFR), negative load-following ramping reserve (NLFR), spinning reserve allocation and branch power flow of the base case are reported in Tables 4 and 5. It is meaningful to point out the effectiveness of our explicit representation and quantification of wind forecast errors into the optimal scheduling program as the model can withstand any unforeseen events by deploying spinning reserve and assistance from the other region as defined in (19) and (20). Indeed, during the entire scheduling horizon and under any scenario, no load shedding or line congestion occurred. However, the system’s need for load-following has been found to increase with wind generation. The net load that must be served after accounting for wind has more variability than the load alone. Notice how the output level of conventional generators changes more quickly and turns to a lower level with wind energy in the system. At \(t=2\) when wind generation is typically ramping down, load is picking up, increasing the need for generating resources to ramp up to meet the increasing electric demand. Conversely, wind production is high at \(t=3\) of minimum load, increasing the need for generating resources that can ramp down. This is due mainly to the wind’s diurnal output, which in many cases may be the opposite of the peak demand period for electricity. Unfortunately, these changes in system net load requirements is expected to significantly increase with WEGs penetration to grid and, if incentives are not provided to encourage the needed ramping capabilities, the system is unlikely to get the efficient balance of generation resources as potential reliability degradation or costly out-of-market actions may occur. Therefore, adopting a cycling payment mechanism will not only mitigate the revenue reductions for conventional generating units (as their output levels must be turned to a lower level with WEG in the system), but also compensate the wear and tear costs on the generating equipments resulting from load-following.

The benefits of the interconnection are illustrated in Table 6, where we compare the market-clearing results including total generation, total PLFR, total NLFR, total spinning reserve, all in (MW), and total cost of each area in ($), for the isolated (tie-line capacity set to 0 MW) and interconnected (tie-line capacity set to 150 MW) operation cases. The following remarks can be drawn from this table: ➀ the system’s total cost of operation decreases with interconnection; ➁ the power and spinning reserve requirement of the costly area 2 are partly covered by the green energy and inexpensive generating units in area 1; ➂ area 2 contribution to system load-following is more significant; ➃ both areas benefit from inter-regional trading: area 2 by buying cheap and area 1 by selling more. Though the total operation cost of area 1 has significantly increased between both modes of operation, it is important to underline its contribution in tackling climate change through decarbonization.

We analyze the impact of tie-line capacity on the problem outcomes. For this purpose, the base case is next solved for different tie-line capacities ranging from 0 MW to 375 MW in steps of 75 MW. In Table 7 where the black dots indicate the units that are committed, one can notice that, increasing the tie-line capacity can have a significant effect on the unit scheduling, as several expensive units will not be scheduled at some time periods.

The evolution of the share of load and spinning reserve, PLFR and NLFR, allocated when tie-line capacity varies are depicted in Figs. 4 and 5. By increasing the tie-line capacity, cross border trade of power and spinning reserve rises to more desirable values. Indeed, the portions of imported power and the spinning reserve by area 2 increase monotonically as the tie-line capacity increases, making such transactions profitable as reported in Table 6. At the same time, the contribution of area 1 to load-following is higher for smaller tie-line capacity values. However, for a value of 100 MW and above, area 2 contribution to system frequency restoration is more significant. Quantitatively, it can be inferred from Figs. 4 and 5 that as tie-line capacity evolves, most of the load-following ramping reserve is allocated to area 2 while area 1 covers most of the interconnected system load and spinning reserve. Nonetheless, for a tie-line capacity of 300 MW and above, cross-border exchanges of power and reserves do not change any more.

If the interconnection of electricity grids appears in the above analysis as a promising solution to help both cost-efficiency and system reliability, it definitely emerges as a good means to spur the widespread deployment of WEGs into power systems. Indeed, in Fig. 6, we have drawn the system operating cost in dash-dot lines and the system saving, defined as the change in the system total operating cost compared to its reference value, i.e., when there is no WEG in the system, in solid lines. The comparison of these two quantities with respect to wind power realizations for both isolated and interconnected operations represented by the cross and the downward-pointing triangle markers respectively, reveal that adding wind power to the system has not only considerably lowered the operating cost and increased the saving, but also, the system starts to accumulate profit at a lower level of wind penetration when interconnected, while the break-even point for the isolated operation is reached at medium wind realization.

5.2 IEEE 118-bus test system

A modified IEEE 118-bus test system is considered to illustrate the effectiveness of the proposed model for practical systems. The system data and topology are in [28]. The peak load of the interconnected system is 6000 MW and occurs at hour 21. WEGs #1, #2 and #3 whose capacities in the same order are 300 MW, 300 MW and 200 MW, are added to the system, all in area 2 at buses 80, 69 and 59, respectively. Wind power and EENS profiles can be seen in Fig. 7. Each conventional unit offers spinning reserve and load-following ramping reserve at a price level equal to 10% of the coefficient b of its cost function. To force cross-border trading, the cost of units in areas 1 and 3 for both energy and reserves are assumed to be twice those of units in area 2. The value of lost load for all demands is assumed to be 1000 $/MWh and \(\alpha =5\%\). Below are our findings when the program chooses to operate WEGs at lower cumulative probability segments with higher outputs.

Firstly, the solution in the case of isolated operation with a system total cost of $2335694.00 is obtained. The solving time is 280.30 s. Economic units of each area are used as base units, some other units are committed accordingly to satisfy hourly load demands while the remaining units are not committed at all as reported in Table 8. Interconnecting the 3 power grids has significant effects on the unit scheduling of the whole system. Indeed, from Table 9, one can notice that several expensive units of areas 1 and 3 are shutdown throughout the day, while more cheaper units from area 2 are brought online. As a result, the total system cost is driven down to $1937926.08, saving the solving time by 196.37 s. Compared to the adjustable interval robust scheduling model of [17] and the centralized model of [15], our approach is less time-consuming.

From Table 10 where the benefits of interconnection are illustrated, it is observed that areas 1 and 3 being incrementally the expensive ones, keep less share of their power production, 59.03% and 46.24% of their own load, for the 24 hours respectively. Accordingly, area 2 serves part of the loads of these areas. On the other hand, 3.43% of area 1 spinning reserve requirement is allocated to areas 2 and 3. This can be attributed to the facts that ➀ area 3 keeps the lowest share of power production. Therefore, it has more available resources for spinning reserve provision than others, reason why it has kept 9.48% of its load for system reliability, that is 9.48% above its area requirement; ➁ area 2 being the cheapest area, has more available resources to supply spinning reserve at a lower cost even if its requirement is the highest. The effect of load-following on base load units in the presence of wind uncertainty is illustrated in Fig. 8, where a change in the output of unit 27 from period to period can initially be observed in isolated operations thereafter when expansion access to the resources of areas 1 and 3 is achieved. In the first case, the generating unit ramps frequently in order to coordinate the additional load-following due to wind power variability. Fortunately, by spreading variability across more units, this ramping duty on unit 27 decreases substantially with corresponding price implications. So, a large pool of generation is advantageous. While it is true that generators have to ramp to provide energy, that does not mean that the cost of ramping must be recovered from energy sales. In the present study, the solution regardless ramping charge with the total operation costs of $2318530.12 and $1922466.19 for both operation modes, does not reflect the marginal cost of producing electricity. So, ignoring ramping costs in the price-setting mechanism inevitably results in pecuniary damage for those generating units suited in supplying the needed function of maintaining the system balance.

6 Conclusion

This paper presents a methodology to investigate various effects of grid integration on the reduction of the overall operation costs associated with more wind power in interconnected multi-area power systems. The numerical simulations conducted have led to the following conclusions:

1) Although extra spinning reserve needs to be borne by a system proportionate to the output power from WEGs, it is always profitable in terms of total operation costs to maximize output from WEGs.

2) Spreading variability across more units is advantageous as large pools of generation substantially decrease the jerkings around these units and, lessen costs imposed on the power system for accommodating WEGs.

3) Adopting ramping charge can improve the performance of electricity markets from both the point of views of the plant owner and SOs. This compensation can be used to reverse the ageing effect on a plant over time, therefore help to maintain profitable operations in the long term.

References

Global Wind Energy Council (GWEC) (2018) Global wind statistics 2017. http://gwec.net/publications/global-wind-report-2/. Accessed 14 May 2018

Ummels BC, Gibescu M, Pelgrum E et al (2007) Impacts of wind power on thermal generation unit commitment and dispatch. IEEE Trans Energy Convers 22(1):44–51

Maggio DJ (2012) Impacts of wind-powered generation resource integration on prices in the ERCOT nodal market. In: Proceedings of 2012 IEEE PES general meeting, San Diego-California, USA, 22–26 July 2012, 4 pp

Wang J, Shahidehpour M, Li Z (2008) Security-constrained unit commitment with volatile wind power generation. IEEE Trans Power Syst 23(3):1319–1327

Venkatesh B, Yu P, Gooi HB et al (2008) Fuzzy MILP unit commitment incorporating wind generators. IEEE Trans Power Syst 23(4):1738–1746

Uçkun C, Botterud A, Birge JR (2016) An improved stochastic unit commitment formulation to accommodate wind uncertainty. IEEE Trans Power Syst 31(4):2507–2517

Wang Q, Guan Y, Wang J (2012) A chance-constrained two-stage stochastic program for unit commitment with uncertain wind power output. IEEE Trans Power Syst 27(1):206–215

Wu H, Shahidehpour M, Li Z et al (2014) Chance-constrained day-ahead scheduling in stochastic power system operation. IEEE Trans Power Syst 29(4):1583–1591

Hu B, Wu L, Marwali M (2014) On the robust solution to SCUC with load and wind uncertainty correlations. IEEE Trans Power Syst 29(6):2952–2964

Amjady N, Dehghan S, Attarha A et al (2017) Adaptive robust network-constrained AC unit commitment. IEEE Trans Power Syst 32(1):672–683

Bertsimas D, Litvinov E, Sun XA et al (2013) Adaptive robust optimization for the security constrained unit commitment problem. IEEE Trans Power Syst 28(1):52–63

Liu G, Xu Y, Tomsovic K (2016) Bidding strategy for microgrid in day-ahead market based on hybrid stochastic/robust optimization. IEEE Trans Smart Grid 7(1):227–237

Fanzeres B, Street A, Barroso LA (2015) Contracting strategies for renewable generators: a hybrid stochastic and robust optimization approach. IEEE Trans Power Syst 30(4):1825–1837

Chen J, Wu W, Zhang B et al (2013) A spinning reserve allocation method for power generation dispatch accommodating large-scale wind power integration. Energies 6(10):5357–5381

Ahmadi-Khatir A, Conejo AJ, Cherkaoui R (2014) Multi-area unit scheduling and reserve allocation under wind power uncertainty. IEEE Trans Power Syst 29(4):1701–1710

Li Z, Wu W, Shahidehpour M et al (2016) Adaptive robust tie-line scheduling considering wind power uncertainty for interconnected power systems. IEEE Trans Power Syst 31(4):2701–2713

Doostizadeh M, Aminifar F, Lesani H et al (2016) Multi-area market clearing in wind-integrated interconnected power systems: a fast parallel decentralized method. Energy Convers Manag 113:131–142

Chen H (2016) Power grid operation in market environment: economic efficiency and risk mitigation. IEEE Press series on power egineering. Wiley, New York

Heier S (2014) Grid integration of wind energy, 3rd edn. Wiley, New York

Pallabazzer (1995) Evaluation of wind-generator potentiality. Solar Energy 55(1):49–59

Vallée F, Lobry J, Deblecker O (2007) Impact of the wind geographical correlation level for reliability studies. IEEE Trans Power Syst 22(4):2232–2239

Costa PA, Coelho de Sousa R, Freitas de Andrade C et al (2012) Comparison of seven numerical methods for determining Weibull parameters for wind energy generation in the northeast region of Brazil. Appl Energy 89(1):395–400

Billinton R, Wangdee W (2007) Reliability-based transmission reinforcement planning associated with large-scale wind farms. IEEE Trans Power Syst 22(1):34–41

Gurobi (2017) Gurobi Homepage. http://www.gurobi.com/. Accessed August 2017

Murillo-Sánchez CE, Zimmerman RD, Anderson CL et al (2013) Secure planning and operations of systems with stochastic sources, energy storage and active demand. IEEE Trans Smart Grid 4(4):2220–2229

Zimmerman RD, Murillo-Sánchez CE, Thomas RJ (2011) Matpower: steady-state operations, planning and analysis tools for power systems research and education. IEEE Trans Power Syst 26(1):12–19

Robitaille A, Kamwa I, Oussedik AH et al (2012) Preliminary impacts of wind power integration in the hydro-quebec system. Wind Eng 36(1):35–52

Courtesy of Robert W. Galvin Center for Electricity Innovation at Illinois Institute of Technology (2018) 118-bus system data. http://motor.ece.iit.edu/data/SCUC_118test.xls. Accessed 14 May 2018

Author information

Authors and Affiliations

Corresponding author

Additional information

CrossCheck date: 13 December 2018

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

About this article

Cite this article

MOGO, J.B., KAMWA, I. Improved deterministic reserve allocation method for multi-area unit scheduling and dispatch under wind uncertainty. J. Mod. Power Syst. Clean Energy 7, 1142–1154 (2019). https://doi.org/10.1007/s40565-019-0499-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40565-019-0499-4