Abstract

Collaborative standardization, an efficient and inclusive form of organized innovation under the auspices of standard-setting organisations (SSOs), has demonstrated significant technological achievements in the field of wireless telecommunications. At the core of collaborative standardization is a working balance of interests and incentives of all stakeholders involved, i.e. contributors of technology and users of standards, epitomized by licensing on FRAND terms. Standardization contributes to significant gains in consumer welfare, in the form of lower prices, more innovation and more consumer choice and convenience. At the same time, standardization fosters competitive markets, upstream and downstream. Public policy has not always been successful in accommodating collaborative standardization. The enforcement of Art. 102 TFEU by the EU Commission, for instance, reveals an underlying mistrust of the operation of markets in the context of collaborative standardization and a strong preference for court-determined FRAND terms. However, the recent CJEU ruling in Huawei v. ZTE provides strong incentives for private stakeholders to determine FRAND through bilateral commercial negotiations and as such it is a welcome shift in EU competition policy in collaborative standardization.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In the past few decades information and communication technologies have transformed every aspect of human endeavour; mobile technologies, being the most rapidly adopted technologies in human history, have fundamentally changed the way we work, learn, travel, consume and communicate with each other.Footnote 1 Connected devices bundle multiple functionalities, which were hitherto performed by various independent gadgets, in integrated, multi-component devices. However, for such devices to operate and communicate seamlessly with each other, common interfaces and technical specifications are required. These common interfaces and specifications, allowing interoperability between individual components, devices and networks, are known as industry standards.Footnote 2

There are, in general, three paths to standardization: the first one is the emergence, through fierce competition “for the market”, of a technical solution as dominant in the market, that is as a de facto standardFootnote 3; the second one is standardization by government intervention and the regulation of technical aspects of products, also known as legal standardsFootnote 4; the third one, which is the subject of the present paper, is standardization through industry collaboration under the aegis of standard-setting organizations (SSOs).Footnote 5 SSOs engaged in the standardization of wireless communications have produced some of the most innovative and commercially successful standards, adopted by millions of consumer electronic devices around the world.Footnote 6 Such standards provide long- and short-range connectivity (cellular standards, Wi-Fi, Bluetooth and USB), and audio, picture and video functionalities (MP3, ACC, GSM voice codecs, JPEG, PNG and MPEG).Footnote 7

Collaborative standardization under the auspices of SSOs has, thus far, a remarkable record of breakthrough technological achievements, high-quality, cutting-edge standards, vibrant follow-on innovation in the implementation of standards and open, competitive upstream and downstream markets. Interoperability standards produce massive efficiency gains and result in tangible benefits for consumer welfare. Interoperability implies economies of scale, cost savings, and gains in productivity and efficiency. However, standardization efforts in recent years aim not only at seamless interoperability, but also at the highest possible level of performance, i.e. in capacity, data rates, latency, reliability and security.Footnote 8 Providing for high performance, cutting-edge standards form the infrastructure upon which a whole ecosystem of innovating products and services has flourished.

Navigating through the complexities of collaborative standard-setting has proved a challenge for EU competition policy. The European Commission, in particular, has demonstrated an ambivalent stance towards collaborative standardization, recognizing its pro-competitive potential in theory, but revealing mistrust on the efficient performance of standard-setting in its actual enforcement of EU competition law. The Court of Justice of the EU in its recent landmark Huawei ruling marked a shift of EU competition policy towards a more balanced and market-oriented approach.Footnote 9

The structure of the present article is the following: in Sect. 2, the historical course of standardization in wireless telecommunications will be briefly outlined; in Sect. 3, the efficient and inclusive nature of the standard-setting process and its tangible benefits to consumer welfare will be discussed; in Sect. 4, the standard-setting process will be analyzed as a fundamentally disruptive process; Sect. 5 discusses EU competition policy on collaborative standardization; and finally Sect. 6 presents the conclusions of this paper.

2 Standardization in the Mobile Telecommunications Sector: From Analogue to the Internet of Things

Collaborative standardization takes place under the auspices of SSOs, industry bodies governed by rules and regulations agreed upon by their members, which include technology contributors and implementers of standards.Footnote 10 SSOs are of varying size, membership and formal recognition: some SSOs are formally recognized standardization bodies by governments and international organizations (ITU, ETSI, ISO, IEC)Footnote 11; others are semi-formal institutions, not officially recognized but enjoying a status similar to formal SSOs (IEEE, IETF); many SSOs are informal industry consortia, established for specific purposes, which provide for flexibility in standardization efforts but are not bound by principles such as transparency, consensus and openness.Footnote 12

Collaborative standardization is a long-term, resource-draining and intensive endeavour; even after a standard is formally adopted by an SSO it takes several years before it is finally commercialized on the market.Footnote 13 For instance, the 2G-GSM standard took 15 years to develop and the development of the 4G-LTE standard consumed no less than one million working hours by engineers employed in 43 companies worldwide.Footnote 14 The standard-setting process normally begins with setting out a clear and bold goal for a future level of desired technological performance.Footnote 15 Once such a goal is set, working groups of technical experts, representing all interested stakeholders, decide upon submitted proposals and choose the most meritorious technical solutions to be included in the specifications of the standard.Footnote 16

The first wireless cellular telecommunication networks were commercially rolled out in the early 1980s. The first generation of mobile telecommunication networks (1G) was built on analogue frequency modulations to transmit voice signals.Footnote 17 In its very early days, the development of wireless telecommunication standards was a predominantly national process characterized by a strong national focus; telecommunication markets at the time were highly concentrated, on the basis of a rigid, thoroughly regulated structure of one country, one network operator and one service vendor.Footnote 18

Moreover, the narrow national orientation of 1G precluded interoperability among the various national telecommunication networks. Limited interoperability, in turn, curbed the massive uptake of mobile telecommunications by impeding economies of scale and keeping prices for network equipment and handsets very high.Footnote 19 As a response, in the mid-1980s, in several major markets, including the U.S. and the EU, a far-reaching process of liberalization of the telecommunications sector began to unfold.Footnote 20

In the early 1990s, standardization for the second generation of wireless telecommunications departed radically from 1G in two crucial respects: firstly, the narrow national focus was replaced by a more international approach, especially in Europe with the emergence of ETSI and the GSM Working Party. Secondly, 2G involved a drastic leap forward in technology, with the development of standards based on the digital transmission of voice and SMS messages.Footnote 21 With 2G, mobile telecommunications for the first time reached a massive consumer market, benefiting from better and cheaper networks, services and handsets. That said, competing 2G standards precluded the emergence of global interoperability and slow mobile internet connectivity (download speed of less than 128 kbits/s) allowed the performance of only rudimentary online tasks, such as e-mail and limited web-surfing.Footnote 22

The third generation of mobile telecommunications (3G), in the early 2000s, represented a radical leap forward, introducing the era of high-speed, ubiquitous mobile internet and the emergence of vibrant mobile applications (“apps”) ecosystems.Footnote 23 3G dramatically improved mobile data speeds (download speed up to 63 Mbps/s) and enabled connectivity through Wi-Fi and Bluetooth.Footnote 24 In drastically improving interoperability, 3G generated massive economies of scale in the manufacturing of network equipment and smartphone devices, robust follow-on innovation and product differentiation, lower prices and more intense competition in the downstream markets for standard-compliant products. However, ever-increasing consumer demand for online services at the same time created the need for faster, more efficient and innovative networks, leading to the development of the fourth generation of mobile telecommunications and the emergence of the first, truly global wireless standard, with high throughput and low latency characteristics, the LTE.

Spurred by steep growth in demand for mobile data, the fourth generation of wireless standards initially evolved around two competing technologies, LTE and WiMax; however, after a decade of commercial deployment, LTE has gained a decisively higher adoption rate, being essentially the first global wireless standard.Footnote 25 The fourth generation of wireless standards delivered impressive gains in cost-efficiency, spectral efficiency, capacity, data rates and quality of service. More importantly, though, for the first time LTE enabled the widespread use of sensors and the ubiquitous connectivity of all kinds of everyday consumer devices, laying the ground for the Internet of Things (IoT).

The IoT could be defined as a system of “sensors and actuators, connected by networks to a computing system”.Footnote 26 Other important technological developments notwithstanding,Footnote 27 standardization and the new mobile telecommunication networks are the key enablers behind the emergence of the IoT.Footnote 28 Cutting-edge wireless standards, and in particular 4G-LTE, provided not only interoperability between myriad devices and sensors on the basis of long-range wireless networks, but also dramatic improvements in performance, reliability and in energy and cost efficiency.

Conclusively, once the process of open, collaborative standardization was set in motion in the early 1990s, the following pattern could be discerned: investment and innovation in telecommunication standards grow markets and consumer demand, which in turn increases demand for investment in innovation and standardization. At the end of every major standardization effort, better-performing standards also bring about larger, integrated markets and more consumer demand for innovative services and better performing standards.Footnote 29

3 The Standard-Setting Process and Its Impact on Competition and Consumer Welfare

3.1 Collaborative Standardization as an Efficient, Open and Inclusive Process

Collaborative standardization in wireless telecommunications has a remarkable record of technological achievement and innovation. However, this in itself does not automatically imply that collaborative standardization is the only path to standardization or that it brings welfare gains such that they outweigh the negative implications of collaboration between competitors. After all, interoperability is also plausible through the emergence of an independently developed de facto standard. That said, there are good reasons to believe that collaborative standardization is indeed the most efficient path to standardization and that its overall impact is strongly pro-competitive.

Collaborative standardization owes its success to its character as an efficient, open and inclusive process of organized innovation. Standard-setting organizations have an active interest, as well as regulations and policies in place, to promote open and unrestricted membership of all interested parties and to foster consensus-based decision-making processes.Footnote 30 SSOs compete with each other in the development of the most innovative and commercially successful standards.Footnote 31 Thus, SSOs have powerful incentives to attract, on the one hand, contributors of the best technologies, and, on the other hand, numerous implementers that will successfully commercialize developed standards.

Of course, diverse membership necessarily implies that participants have diverging and often conflicting interests and business models.Footnote 32 In general, vertically integrated firms adopt a more balanced attitude with regard to licensing of standard-essential patents (SEPs), having important stakes in both the upstream and the downstream markets and an interest in broad cross-licensing agreements with other SEP-holders which provide valuable “freedom to operate”.Footnote 33 Pure upstream firms depend on royalty revenue to make a profit, lacking any downstream business and interest in cross-licensing. Conversely, pure downstream implementers, having no patents to offer for cross-licensing and viewing royalties as an additional input cost, have an interest in keeping the royalty rates low.Footnote 34

SSOs face the difficult task of accommodating such conflicting interests: they need to attract cutting-edge technology and enable efficient and rapid commercialization of standards.Footnote 35 The meeting point of the interests of contributors and users of the standard is FRAND licensing, based on a commitment to make a standardized technology available on fair, reasonable and non-discriminatory terms.Footnote 36 FRAND is an apparently abstract and ambiguous term. However, the purpose of the FRAND commitment is to ensure that access to the standard will remain unrestricted, the precise terms of the licence being left to the parties to agree upon in good faith and in the context of commercial negotiations.Footnote 37

Unrestricted access and licensing on FRAND terms are at the core of the success of collaborative standardization. FRAND licensing is vital for maintaining a predictable and rewarding structure of returns that provides incentives for contribution of cutting-edge technology and implementation of standards. On the one hand, licensing revenue from FRAND royalties, by ensuring that patent holders reap a fair reward for their contributions, provides strong incentives for leading innovators to contribute the best available technologies to the standard-setting process.Footnote 38 Over-restrictive IPR policies might provide strong disincentives to participation.Footnote 39 On the other hand, the FRAND commitment ensures that standards will remain accessible and implementation unrestricted. The FRAND commitment ensures implementers that they will not fall victim to opportunistic conduct by SEP-holders; that they will have access to third-party technologies on reasonable terms that allow profitable implementation of the standard; and that they will not be discriminated against vis-à-vis their downstream competitors.

This working balance of interests and incentives distinguishes collaborative standardization as a process of superior efficiency, in particular compared to de facto standardization. De facto standards that emerge as the outcome of fierce standardization races between competitors competing “for the market” are associated with serious inefficiencies in investment in innovation; the reward, complete dominance over an entire market, would induce over-investment and wasteful duplication of R&D efforts, raising the cost of implementation and putting a brake on adoption.Footnote 40 Even such over-investment offers little assurance that the market will eventually pick the most meritorious technical solution. Of course, this balance of interests and incentives is an uneasy one, and commercial disputes on the appropriate level of royalties have become more frequent.Footnote 41 However, the overall success of collaborative standard-setting in spurring innovation and competition is hard to deny.

3.2 Interoperability, Economies of Scale and Efficiencies

Successful collaborative standardization brings significant benefits to consumer welfare. Interoperability allows companies to benefit from network externalities,Footnote 42 economies of scale, specialization and integration of international markets. Consumers, in turn, reap significant gains in prices, product choice and innovation. Interoperability is vital to wireless telecommunications in that it allows networks, network equipment (such as base stations), devices and components within devices (such as antennas and baseband chips) to work seamlessly with each other.Footnote 43 Network equipment, devices and components are typically manufactured by a wide range of firms worldwide and for this vast number of individual devices to work together, common interfaces and product specifications are vital.Footnote 44 Compatibility between individual components within a network allows firms to specialize in what they do best.Footnote 45 Moreover, interoperability between networks and devices results in significant economies of scale, since equipment and device manufacturers serve an integrated, international market.Footnote 46 Successful international standards also boost consumer confidence that components will work well together, they increase consumer adoption and allow positive network externalities to materialize faster.

Interoperability further enhances efficiency by bringing down technical, non-tariff barriers to international trade, integrating international markets and enabling competition between firms worldwide.Footnote 47 Consumers have access to a wider range of standard-compliant products at competitive prices. This aspect of market integration is particularly relevant in the context of the EU and EU competition law with its strong focus on the integration of the internal market and in particular on the emergence of an internal digital market: common, European wireless standards bring down barriers to cross-border tradeFootnote 48 and allow the interpenetration of national markets by telecom service providers.

3.3 Performance-Driven Standardization and Innovation

Although interoperability is a key driver of collaborative standardization, recent standardization efforts have moved beyond this point. Standardization in wireless telecommunications is performance-driven, aiming not merely to integrate networks and devices, but also to achieve the highest possible level of performance and capabilities.Footnote 49 This high level of performance owes much to the meritocratic nature of collaborative standardization: SSOs have strong incentives to guarantee that the best available technologies are included in standards. Performance-driven standards also reduce technological risks for implementers, thus facilitating the rapid and smooth industrial transition from inferior to superior technologies.

The evolution of collaborative standardization, from interoperability to performance-driven, results from the internal dynamic of the process and from strong competitive pressures that SSOs find hard to resist. The development of standards takes place within working groups of technical experts presented with various alternatives as solutions to specific technical problems. Although non-technical matters, such as the accessibility of a particular technology and licensing terms, might occasionally be taken into account, engineers at working groups decide on inclusion primarily on the basis of technical merit. SSOs in their regulations make efforts to ensure that the development of standards is open, transparent and consensus-based at all stages of the process.Footnote 50

Strong competitive pressure also comes into play. SSOs that fail to include the best technologies presented to them might find out that someone else – be it another SSO or a new standardization consortium, or even a firm unilaterally – did. Failure to include the best available technologies might have important implications for an SSO and its standardization efforts. A second-best technology might not gain acceptance by industry and consumers.Footnote 51 Moreover, the superior technology might be independently commercialized and compete head-on with the chosen inferior solution.Footnote 52 The market would be divided between competing standards negating the very purpose of standardization itself.

There is substantial evidence that SSOs in wireless telecommunications have performed well. The performance of telecommunication networks has increased dramatically in all important respects: in capacity, data rates, reliability, latency and security. Added to that, empirical evidence suggests that patents declared as standard-essential at SSOs are of higher quality and receive roughly three times more citations than their non-SEP counterparts.Footnote 53 Transfers of SEP portfolios also indicate that SEPs are highly valued by the market.Footnote 54

Collaborative standardization is successful not only at handpicking the best technologies, but also at organizing transition from inferior to superior technologies in a smooth and rapid manner. In general, markets with strong network effects exhibit excess inertia in moving to new technologies, due to imperfect information; without complete and reliable information on the real value of a technology, market actors fail to coordinate their transition to a superior technology.Footnote 55 SSOs, by including a technology into a standard, send a strong signal to the market that the particular technology is valuable and that their hefty investments in capital expenditure will not go to waste. Thus, SSOs reduce the risks of implementation of standards, encouraging rapid and widespread adoption of cutting-edge technologies.Footnote 56

3.4 Robust Competition in All Relevant Markets

Collaborative standardization, at first sight, represents a paradox: although it provides a forum where competitors coordinate the technical specifications of their products, at the same time it spurs competition in all relevant upstream and downstream markets. In the upstream market for technologies, standardization creates fierce rivalry for inclusion in a standard, pressing firms to invest more, to innovate and become more efficient. In the downstream markets for standard-compliant products, standardization brings about integrated, open markets and access to cutting-edge technologies at reasonable rates, providing strong incentives for firms to outperform their rivals in prices, follow-on innovation and product differentiation.

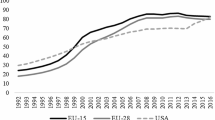

Innovators have strong incentives to invest, participate and contribute to the process. Barriers to entry are low: SSOs develop standards on the basis of merit and participation is open. Although firms with no previous engagement in the standard-setting process might need to invest more than others in developing strong R&D capabilities, entry is frequent and meaningful. Entry is also reasonable and attractive from a business perspective; companies that are successful in their contributions can expect a licensing revenue stream for many years.Footnote 57 Low barriers to entry and the expectation of licensing revenue result in vibrant competition for inclusion and more investment in innovation. The rapid increase in patented inventions in the field of wireless telecommunications indicates that standardization has had a profound impact on innovation: according to WIPO, wireless telecommunication patents have increased in the past 30 years from virtually non-existing to 400,000 today, representing 6% of all patent activity.Footnote 58

Competition is also fierce in downstream markets for network equipment, components, devices and services. Implementation is open and downstream firms can expect access to some of the best technologies available on reasonable terms that allow for profitable implementation. Moreover, non-discriminatory licensing terms ensure a level playing field for all downstream competitors. Investment in follow-on innovation and product differentiation is strong; dramatic improvements have been achieved in smartphone battery life, processing power, cameras and design. Every year consumers enjoy a vast array of compliant devices to choose from, assured that interoperability and high performance are guaranteed.

Strong – actual and potential – competition and economies of scale bring prices down. Holding performance constant, real prices have fallen dramaticallyFootnote 59: a fully functional smartphone with LTE connectivity might cost less than $100. Prices for networks and network equipment have also fallen drastically: the deployment of 3G networks brought the cost of network equipment down by 95% and the deployment of 4G-LTE networks brought this cost down even further by 67%.Footnote 60

4 The Standard-Setting Process and Disruptive Innovation

Collaborative standardization has contributed decisively to massive gains for consumer welfare, productivity and innovation. However, standardization is also a profoundly disruptive process. It involves radical leaps in technology, in business and in everyday life. It is an important accelerator of the Schumpeterian process of creative destruction.Footnote 61 Yet the representation and structure of the process might conceal the magnitude of technological leaps.

Standardization efforts in wireless telecommunications are expressed in consecutive generations of standards (2G–3G–4G). Such representation tends to create a misleading impression of continuity and incrementalism. It understates the drastic technological advances between each consecutive standard. The structure of the process contributes to this misrepresentation. Standards are developed over many years, in thousands of meetings of technical experts, resulting in several consecutive “releases”. This incremental process with its apparently gradual improvements conceals the drastic character of the core technologies included in a standard.Footnote 62

More importantly, though, collaborative standardization, in providing telecommunication networks with ever more capabilities at lower costs, accelerates the process of creative destruction in such remote sectors as manufacturing, banking and entertainment. In particular, high-speed mobile broadband has been the basis upon which a vibrant ecosystem of software apps has emergedFootnote 63; with each step forward in standardization, new digital services come online and transform fields with massive impact, such as healthcare, finance and education.Footnote 64

High-performance standards have also lowered the cost of follow-on innovation and thus barriers to entry for disruptive new firms and entrepreneurs that challenge incumbents.Footnote 65 The low cost of access to high-speed broadband, as well as the emergence of global markets of billions of consumers, allows start-ups with even a modest initial investment to offer new, groundbreaking services and introduce new and disruptive business models.Footnote 66 This disruptive effect spills over into a vast range of markets and sectors.Footnote 67 Evidence of disruptive innovation abounds. Online mobile banking, for instance, has effectively challenged the centuries-old basis of banking, the bricks-and-mortar retail banking, providing consumers online access to a full range of banking services. Billions of previously disenfranchised citizens in the developing world, for the first time, have access to banking services, integrating millions of people in financial markets.

Entertainment and content are also under drastic transformation. On demand, HD video streaming capabilities have resulted in an explosion in the amount of online content consumed by users. At the same time, it has a profoundly disrupting effect on the business models in entertainment. Much of the consumed content is generated by users on social media platforms, outside the formal entertainment sector. Moreover, content is increasingly consumed through mobile devices, shifting viewers from cable and broadcast channels.Footnote 68 Disruption of established business and consumption patterns will reach new levels with 5G and, in particular, with the IoT.

5 Implications for EU Competition Policy

5.1 Anticompetitive Risks and Private Ordering in Collaborative Standardization

Although collaborative standardization has demonstrated strong pro-competitive potential, the process is not without risks, for it is, after all, a form of coordination involving discussions among competitors. Formal standardization could, under certain circumstances, raise barriers to entry and enable stakeholders to exercise control over the standard, thereby excluding actual or potential competitors.Footnote 69 The European Commission in its “Horizontal Guidelines” identified collusion between competitors to raise prices, reduce output and restrict the inclusion of innovative technologies as a particular concern when assessing standardization agreements under Art. 101 TFEU.Footnote 70 It further stressed the exclusionary effects of standardization for technologies that fail to be included in a standard and which subsequently face insurmountable barriers to entry.Footnote 71

However, the most serious frictions in the context of collaborative standardization concern the licensing and enforcement of standard-essential patents and the allocation of rents along the standardization value chain. Opportunism in the standard-setting context arises, as much as in every other context, from asset-specific investments and incomplete contracting.Footnote 72

Indeed, in collaborative standardization, stakeholders normally undertake asset-specific investments well before the negotiations for licensing of SEPs. On the one hand, technology contributors commit resources to research and development years before a standard is adopted. Such investments in contribution to the standard-setting process are not recoverable since, once a standard is adopted, patent holders cannot switch and offer their patented technologies independently on the market for there would be no market demand. Technology contributors are thus locked into their relationship with SSOs and standard users.Footnote 73

On the other hand, standard implementers also sink investments in building their manufacturing capabilities to produce standard-compliant products. Such investment is typically undertaken once a release of a standard is published and before any licences of essential IPRs are negotiated. Switching to competing technologies at a later point is costly and market demand for non-standard-compliant products might be extremely weak. This lock-in of technology contributors and standard users fundamentally transforms their relations with each other and creates the ground for opportunism with a view to extracting hold-up value.

Added to that, under certain circumstances, hold-up might seem an attractive strategy from a business perspective. Collaborative standardization, in fostering open markets, has exposed all participants to fierce competitive pressures. On the one hand, vertically integrated firms facing strong pressures in downstream markets might be tempted to enforce their essential IP aggressively with a view to obtaining supra-FRAND royalties (patent hold-up) and thus to restrict accessibility to a standard.Footnote 74 Pure upstream stakeholders, in need of cash to fund costly R&D endeavours, might also be tempted to extract hold-up value. On the other hand, downstream firms with no contributions – and SEPs – upstream might be tempted to gain a competitive advantage vis-à-vis their downstream competitors by lowering SEP licensing fees or free-riding on others’ IP and innovations (reverse hold-up and hold-out).Footnote 75

However, the economics of contractual opportunism and hold-up have long established that market participants routinely overcome hold-up situations by means of private ordering, including reputation and credible commitments; standardization is a repeat game and opportunistic stakeholders suffer harm to their reputations that decisively impacts their future dealings.Footnote 76 Moreover, technology contributors commit to SSOs to offer access to their standard-essential IP on FRAND terms.

From a contractual point of view, the FRAND commitment is incomplete.Footnote 77 SSOs rarely define what FRAND terms might actually mean or provide any guidance on issues of royalty determination.Footnote 78 Instead, the FRAND commitment is meant as a general assurance to standard users that the price they will be called upon to pay for using the technologies incorporated in a standard will not be prohibitive, that they will not be discriminated against vis-à-vis their downstream rivals and, more importantly, that licences will not be altogether withheld.Footnote 79

This contractual incompleteness, though a source of dispute on several occasions, represents a sensible choice given the significant costs of a more precise definition of FRAND. To begin with, a more precise definition of FRAND by SSOs would deprive the commitment of much-needed flexibility to accommodate the various complexities of commercial bargaining.Footnote 80 Additionally, a more precise definition of FRAND would significantly raise transaction costs for all participants in collaborative standardization. Businesses have widely diverging views on which contractual terms qualify as FRAND, and negotiations within SSOs to establish a common ground would be costly, protracted and would also distract SSOs and their membership from their main duty, i.e. to decide on the technical specifications of standards. Moreover, discussions on issues such as royalty calculation would expose SSOs and their members to considerable risks of antitrust liability. It is not yet clear where the boundary actually lies between a “more precise definition of FRAND” and anticompetitive collusion to fix prices.Footnote 81

Contractual incompleteness and opportunism are not normally issues of concern from a competition law perspective. Indeed, in jurisdictions where contract law remedies are readily available, competition law is confined to a minor role in the standard-setting context. In the U.S., for instance, courts have repeatedly recognized the contractual nature of FRAND commitments, and claims for breach of contract are routinely put forward by standard users faced with demands they view as non-FRAND.Footnote 82 Moreover, requests for injunctive relief are subject to close scrutiny under the U.S. Supreme Court’s four-factor eBay test.Footnote 83 Claims for antitrust remedies are rarely raised in SEP-related litigation and no U.S. court has ever found that a request for injunctive relief violates antitrust law.Footnote 84

However, in contradistinction to the U.S., competition law has figured prominently in SEP-related disputes in Europe, particularly in Germany. Germany is the biggest market for mobile telecommunication devices in the EU and at the same time an especially attractive forum for patent owners in view of its strong pro-patentee legal tradition and its civil procedure for patent infringement cases.Footnote 85

Crucially, German patent infringement courts have interpreted FRAND commitments as mere declarations of an obligation to conclude a contract that already exists under German competition law.Footnote 86 Denying the contractual enforceability of the FRAND commitment has the important implication that defendants in SEP infringement disputes cannot rely on contractual remedies when faced with unreasonable licensing demands. Moreover, German patent law and civil procedure rules are considerably less flexible when it comes to injunctive relief for patent infringement compared to their equivalent in the U.S. Consequently, competition law is practically the only legal framework in Germany that can be relied upon in cases of SEP-related disputes to rein in opportunistic patent assertions.

Moreover, in adjudicating SEP disputes, German courts relied on the “FRAND defence” introduced by the German Federal Supreme Court (Bundesgerichtshof) in its Orange Book Standard ruling.Footnote 87 It is important to note that Orange Book concerned a de facto standard on DVDs. The standard was not developed through the familiar cooperative process under an SSO, and the SEPs reading on the standard were not FRAND-committed. German lower courts, however, controversially extended the application of the Supreme Court ruling to the different factual setting of collaborative standardization. Expectedly, defendants in SEP-related disputes have so far universally failed to fulfil the stringent conditions of Orange Book and injunctions have been granted on several occasions.Footnote 88

5.2 EU Competition Policy and the European Commission’s Enforcement of Art. 102 TFEU

The European Commission has twice enforced EU competition law, specifically Art. 102 TFEU, against SEP-holders requesting injunctive relief in several EU Member States, issuing an infringement decision in Motorola Footnote 89 and an Art. 9 Regulation 1/2003 commitments decision in Samsung.Footnote 90 Both actions intervened in the so-called smartphone warsFootnote 91 between major handset device manufacturers.

In its Motorola ruling, the Commission found a breach of Art. 102 TFEU at Motorola’s request and enforcement of injunctive relief against Apple before the District Court of Mannheim on the basis of some of its SEPs reading on the ETSI 3G wireless standard. The Commission established Motorola’s dominance, within the meaning of Art. 102 TFEU, in the upstream market for technologies contributed to the ETSI 3G standard.Footnote 92 In the Commission’s view, the fact that there were no substitutes for Motorola’s contributed technologies in dispute, as well as no viable substitute to the ETSI 3G standard, gave rise to industry lock-in and placed Motorola in a position of market dominance vis-à-vis downstream manufacturers implementing the standard.Footnote 93

The Commission further formulated its test of abuse of a dominant position in the context of collaborative standardization and enforcement of SEPs. In line with the CJEU case law on refusal to license IPRs,Footnote 94 the Commission identified the “exceptional circumstances” that warranted a competition law interference with the exercise of IPRs: the standard-setting process and the FRAND commitment.Footnote 95 However, the Commission distinguished its decision in Motorola from previous CJEU cases on the interface between competition and intellectual property. Although the factual differences between the enforcement of SEPs encumbered with FRAND commitments and contributing to the collaborative standard-setting process and the CJEU line of cases on the refusal to license non-essential IPRs are quite obvious, what mostly motivated the Commission’s divergence from previous CJEU case law on “exceptional circumstances” was the difficulty of fitting Motorola’s behaviour at hand within the CJEU’s stringent three-factor test.

Specifically, the CJEU in its previous IP-related competition rulings, particularly in its latest IMS Health ruling, held that refusal to license an IPR might constitute an abuse of a dominant position provided that: (a) the IPR in question is indispensable for the production of a new product for which there would be consumer demand, (b) the refusal to license is likely to eliminate competition in a secondary market, and (c) there was no objective justification for such a refusal.Footnote 96 Had the Commission applied the IMS Health test, it would have faced two important barriers. Firstly, contrary to the behaviour of IPR-holders in previous IP-related cases, who completely denied access to their IPRs, Motorola’s behaviour did not follow the same pattern: its pursuit of injunctive relief aimed at higher royalty rates, rather than actual exclusion of its rival from the market. Enforcement of its SEPs were a means to “discipline” the potential licensee into accepting better licensing terms, a conduct that can questionably be characterized as a refusal to license in the first place. Secondly, Motorola did not seek to prevent the emergence of a new product and eliminate competition in a secondary market. Both Motorola and Apple manufactured smartphones. Thus, Motorola’s injunction would not restrict follow-on innovation and the emergence of a new product in a secondary market, but would rather restrict competition by substitution.

Having identified the aforementioned exceptional circumstances, the Commission developed its theory of harm: threatening to seek, seeking and enforcing injunctions against a “willing licensee” might result in exclusion of competitors from the market or in granting access on “disadvantageous terms”.Footnote 97 Moreover, such conduct is, according to the Commission, likely to undermine confidence in the standard-setting process and ultimately to deprive consumers of its benefits.Footnote 98 It appears that the Commission’s theory of harm and legal test of abuse constitutes a new, sui generis form of abuse of dominance, a “refusal to license on FRAND terms”. This new form of abuse seems to entail both an exclusionary – the exclusion of competitors from the downstream market – and an exploitative element – imposing disadvantageous licensing terms.Footnote 99

However, the Commission’s notion of “willing licensee” never developed beyond an abstract, vague and open-ended concept. The Commission failed to establish objective criteria and requirements to substantiate “willingness” on the part of a potential licensee, under which seeking and enforcing injunctions would be liable to bring about the above anticompetitive effects.Footnote 100 On the contrary, it created an over-broad “safe harbour” for potential licensees who agreed to FRAND royalty determination by an arbitration tribunal or a national court.Footnote 101 It is hard to conceive of any real circumstances, under the Commission’s test of a “willing licensee”, whereby a standard user would ever actually agree to a licensing offer in the context of bilateral commercial negotiations. Having the option of free and unlicensed use of proprietary technology for an undefined period of time; being free from the threat of IP enforcement and injunctive relief; and being liable to pay a court-determined royalty rate after years of “negotiations” and litigation, it would hardly qualify as sensible for any potential licensee to be actually willing to conclude a licence through good-faith bilateral negotiations.

In diminishing incentives to conclude a licence through commercial bargaining, the Commission based its antitrust analysis on erroneous policy assumptions while revealing a disturbing institutional choice against market-determined prices and in favour of court price-setting. The salient policy concern underpinning the Commission’s enforcement in Motorola and Samsung is patent hold-up. Judging from the far-reaching protection afforded by the Commission to potential licensees, one might assume that the risk of patent hold-up is exaggerated in the Commission’s understanding of standard-setting. It seems that the Commission tends to disregard the efficient operation of standard-setting, including the licensing of SEPs, in the overwhelming majority of cases. Added to that, standard users can avail themselves of a variety of legal remedies, under contract law, civil law and patent law, in most EU Member States; hence the number of injunctions granted for SEPs in all EU jurisdictions bar Germany is close to zero.Footnote 102

Moreover, the Commission failed to pay appropriate attention to a stream of theoretical contributions pointing out the perils of a heavy-handed antitrust approach to enforcement of SEPs, such as reverse hold-up and hold-out.Footnote 103 Although preventing hold-up in cases where contractual remedies are unavailable, as was the case in Motorola, is a legitimate policy aim, competition law enforcement that fails to maintain a fair balance between competing interests might distort the efficient operation of the standard-setting process and skew incentives to innovate and contribute, therefore depriving consumers of significant welfare gains.

Crucially though, the Commission’s preference for price-setting by means of arbitration or litigation instead of good-faith bilateral bargaining is a sign of the Commission’s distrust of the operation of markets in the context of collaborative standardization. Such distrust is unwarranted given the significant achievements of collaborative standardization. Moreover, encouraging litigation or arbitration as the most appropriate means of achieving FRAND outcomes entails significant risks. The Commission’s over-protection of potential licensees would only increase recalcitrance in negotiations, thus resulting in rising litigation costs and uncertainty. Furthermore, it is hard to see why courts, having inferior information on the actual market value of technologies than the private parties involved in negotiations, should be, from a public policy perspective, a preferable forum for determining FRAND compared to private stakeholders doing so themselves. Courts or any other public price regulator for that matter offer only an imperfect simulation of actual market bargaining outcomes. Making court-determined FRAND terms the rule rather than the exception would only interfere with the market price system, distorting the supply and demand of technologies incorporated in standards, and ultimately resulting in various allocative and dynamic inefficiencies to the detriment of consumers.

Had the Commission’s approach in Motorola been reaffirmed by the CJEU, a negative impact on competitive conditions and licensing negotiations within the framework of collaborative standardization would be the most likely outcome. However, the Commission’s analysis, in particular its formulation of the “willing licensee”, conflicted with the legal standard applied by German courts, prompting the District Court of Dusseldorf to refer the question of abuse of a dominant position in SEP-related disputes to the CJEU in the Huawei v. ZTE case.Footnote 104 The Court’s ruling represents an important shift in EU competition policy in collaborative standardization.

5.3 Huawei v. ZTE: Policy Underpinnings

The case concerns an alleged infringement by ZTE’s base stations of Huawei’s LTE SEPs. Huawei brought an action for infringement and injunctive relief before the District Court of Dusseldorf. In its request for preliminary reference, the Dusseldorf court essentially asked the CJEU which standard applies for finding a breach of Art. 102 TFEU in cases of requests for injunctive relief on the basis of a SEP subject to a FRAND commitment: the one introduced by the German Federal Supreme Court in Orange Book or the one proposed by the Commission in its Statement of Objection to Samsung.Footnote 105

In its ruling the CJEU, following in large part the approach of Advocate General Wathelet, outlined a framework of bilateral negotiations outside which parties to a SEP-related dispute risk either antitrust liability for breach of Art. 102 TFEU or an injunction on the basis of national patent law. Specifically, according to the CJEU, the SEP-holder must, as a first step, notify in writing the standard user of his alleged infringement and must further identify the specific SEPs that have been infringed and the way they have been infringed.Footnote 106 As a second step,

it is for the proprietor of the SEP to present to that alleged infringer a specific, written offer for a licence on FRAND terms, in accordance with the undertaking given to the standardisation body, specifying, in particular, the amount of the royalty and the way in which that royalty is to be calculated.Footnote 107

According to the CJEU, it is then for the licensee “diligently to respond to that offer, in accordance with recognised commercial practices in the field and in good faith, a point which must be established on the basis of objective factors and which implies, in particular, that there are no delaying tactics”.Footnote 108 In the event that the licensee finds the terms proposed by the SEP-owner as too onerous, he should submit a formal, written counter-offer on terms he views as FRAND.Footnote 109

It is immediately obvious that the CJEU formulates a notion of “willing licensee” that departs drastically from the one developed by the Commission in Motorola and Samsung.Footnote 110 Indeed, the negotiation framework envisaged by the CJEU places substantial obligations upon potential licensees in stark contrast with the Commission’s nebulous view on willingness.Footnote 111 This change of course by the EU’s highest court was grounded on two overarching policy goals: the first was the need to strike a fair balance between the interested parties and the second to place licensing negotiations and market determination of FRAND terms back at the epicentre of EU competition policy.

References to the need to strike a fair balance are repeated throughout the Court’s decision, as well as in the Opinion of AG Wathelet.Footnote 112 Combined with the AG’s particularly interesting remark that the Commission’s approach in Motorola resulted in the under-protection of SEP-holders,Footnote 113 such emphasis on the need to strike a fair balance might be interpreted as an implication that such a balance was not struck in the past. In particular, the Court emphasized the need to balance, on the one hand, the right to (intellectual) property and effective judicial protection and, on the other hand, the need to maintain undistorted competition.Footnote 114 Moreover, the AG stressed the fundamental nature of the rights to property and access to courts and that limitations on such rights can be permitted “only in exceptional and clearly defined circumstances”.Footnote 115

The Huawei ruling also reveals a strong preference for FRAND determination in the context of licensing negotiations between patent holders and users. The negotiation pattern outlined by the CJEU provides strong incentives to all stakeholders to come to an agreeable FRAND outcome through serious, good-faith bargaining and to do so as early as possible.Footnote 116 The Court essentially uses antitrust liability and exposure to IP enforcement as levers to deter opportunism by both patent holders and standard users.Footnote 117

This strong pro-market orientation of the judgment is best exhibited in its rejection of the Commission’s safe harbour of third-party FRAND determination.Footnote 118 In one of its very few departures from the AG’s analysis,Footnote 119 the CJEU clarified that recourse to third-party determination of FRAND terms is voluntary, subject to agreement of the parties, and on the condition that the standard user provides “appropriate security”.Footnote 120 By removing the safe harbour to licensees merely pretending to be willing to conclude a licence agreement following third-party adjudication,Footnote 121 the CJEU essentially seeks to actively discourage hold-out practices, tolerated by the Commission’s forgiving approach in Motorola.

Moreover, the CJEU seeks to strengthen confidence in bilateral licensing negotiations by imposing antitrust liability to some of the worst practices by SEP-holders. In particular, the requirement for SEP-holders to submit a formal written offer, mentioning the IPRs infringed, the proposed royalty rate and the way it was calculated prior to requests for injunctive relief, provides strong incentives to patentees to organize their essential-patent assets, develop licensing programmes on a FRAND basis and refrain from aggressive practices, such as pursuing injunctions following vague and imprecise warning letters, or making exorbitant licensing offers to potential licensees.

5.4 Huawei v. ZTE: Antitrust Analysis and Theory of Harm

Although the Huawei ruling is firmly based on correct assumptions and makes a prudent policy choice in favour of market bargaining, the Court’s legal analysis and its proposed theory of harm create uncertainty and leave ample scope for interpretation by private parties and national courts. The CJEU, following the IMS dictum that interference with intellectual property is warranted only in exceptional circumstances, moved on and distinguished the case at issue from previous refusal-to-license cases, and identified the exceptional circumstances of Huawei. In the Court’s view, a limitation of the patent holder’s exercise of its IPRs is justified in view of the fact that the IPRs in question are indispensable for the implementation of the standard by downstream manufacturers and that its patent(s) achieved such a status of indispensability and essentiality only in return for an irrevocable commitment to offer access on FRAND terms.Footnote 122 This distinct set of exceptional circumstances is again used to bypass the IMS new-product requirement: in Huawei, the competition law limitation concerns the very subject matter of the patent, not a new product resulting from follow-on innovation in a secondary market. The Court seems to protect competition between competitors offering more or less the same product.

According to the CJEU, the FRAND commitment on the part of the patent holder creates legitimate expectations by third parties and a refusal to license under such circumstances might constitute an abuse of a dominant position.Footnote 123 The Court, in outlining the negotiation pattern discussed above, essentially drew the boundary between conditions governing normal competition and behaviour that departs from such conditions, which thus cannot be characterized as competition on the merits and as such falls foul of Art. 102 TFEU.Footnote 124

An important question that national courts interpreting Huawei will have to deal with is whether compliance with the requirements set out by the CJEU is to be determined on a step-by-step basis or whether the Court actually laid out the elements of anticompetitive abuse which have to be established cumulatively by the party alleging the abuse. Under a step-by-step approach in case of a patent holder’s failure to comply with the Huawei requirements, for instance by not submitting a FRAND first offer, injunctive relief should be considered abusive regardless of the potential licensee’s behaviour. On the other hand, if a cumulative approach is adopted, even in the case of a patent holder’s failure to comply with its own obligations, a potential licensee would still have to meet all the requirements on its part (submit a FRAND counter-offer; no delaying tactics; and appropriate security in case of third party determination of FRAND) in order to establish a breach of Art. 102 TFEU.

Having in mind the Court’s focus on the willingness of the potential licensee, a cumulative approach seems more appropriate; a step-by-step approach might extend Huawei to cases of actually unwilling licensees. However, it is important that national courts demanding a cumulative application of Huawei requirements adopt a flexible approach, focusing more on the good-faith behaviour of the potential licensee which is to be determined on a case-by-case basis and not using the FRAND counter-offer requirement in a way that would render Huawei ineffective. In particular, attention should be placed on the fact that FRAND terms refer to a range of outcomesFootnote 125 and that the patent holder, due to information asymmetries, is in principle in a better position to assess compliance with FRAND.Footnote 126

The Court further identified the exclusionary nature of the abuse, without mentioning hold-up as a potential risk,Footnote 127 contrary to the Commission’s analysis which alluded to the “disadvantageous licensing terms” as a possible anticompetitive effect. The CJEU essentially based its ruling on a monopoly leverage theory of harm, according to which the enforcement of SEPs might result in the actual exclusion of a competitor and the elimination of competition in the downstream market.Footnote 128

The choice of the particular leveraging theory of harm by the CJEU could be interpreted in three ways: the first would be that the Court identified the exclusion of competitors and the elimination of downstream competition as the only practice with antitrust relevance; a second reading would be that the Court gave a case-specific answer and left open the issue of anticompetitive abuse in other factual settings; and a third approach would be that reference to legitimate expectations might imply that Huawei also applies to scenarios other than anticompetitive leveraging.

The first, rather narrow, interpretation of Huawei seems plausible given that the Court indeed repeatedly refers to “competitors”, implying a horizontal relationship between the patent holder and the potential licensee in the downstream market, and also refers to the risk that the patentee would “reserve to itself the manufacturing of the products in question”.Footnote 129 In conjunction with the AG’s statement that much of the problem in the licensing of SEPs stems from lack of clarity on FRAND and that SSOs or other branches of law could address such issues “adequately – if not better” than competition law,Footnote 130 one might assume that the CJEU identified leveraging as the only scenario meriting an antitrust remedy and that other cases of opportunism could be dealt with by SSOs or under contract and civil law. That said, it should also be taken into account that if such a narrow reading of Huawei is accepted, one might doubt the practical relevance of the decision.Footnote 131 Many disputes in the standard-setting context concern companies active at different levels of the value chain, such as non-practising entities. Anticompetitive leveraging in such situations seems impossible.

The second interpretation might be more appropriate. The Court was well aware of the factual background of the case – Huawei and ZTE compete on both the market for network equipment and smartphones – and tailored its response to the specific facts of the case, remaining silent on other scenarios. Indeed, the exceptional circumstances identified by CJEU apply to all classes of patent holders, and the legitimate expectations flowing from the FRAND commitment do not depend on the particular business model of the SEP-holder. Moreover, the negotiation pattern envisaged by the Court might well be applicable to other cases as well.

The third interpretation, that Huawei as it is applies to all cases of requests for injunctive relief seems the most weak. Reference to exceptional circumstances and legitimate expectations notwithstanding, the Court’s choice of anticompetitive harm is not without consequence. The CJEU had the option of formulating its theory of harm in broader terms, but nonetheless did not. Moreover, the ruling explicitly refers to the fundamental nature of the right to property and effective judicial protection. Limitations on such rights should not be presumed lightheartedly. Extending antitrust liability without a convincing theory of harm would only stretch EU competition law beyond its limits, ultimately deterring pro-competitive behaviour (false positives).

5.5 Implications of Huawei

The CJEU’s ruling in Huawei has important implications for national courts, SSOs and their members, and the European Commission and its policy on injunctions for SEPs. National courts, to begin with, face the difficult task of applying the Court’s guidance in practice. German courts, in particular, have to discard a legal standard they have been applying for years in SEP-related cases, and replace it with the test of anticompetitive abuse in Huawei. The first few SEP cases in Germany post-Huawei Footnote 132 have so far demonstrated the courts’ willingness to extend the application of Huawei in SEP disputes between NPEs and manufacturers, despite the monopoly leveraging theory of harm expounded by the CJEU and without offering any other alternative theory of harm that would justify a finding of a breach of Art. 102 TFEU. This approach carries the risk of the CJEU rejecting the application of Huawei in non-leveraging cases, just as Huawei essentially disapproved the application for years of the Orange Book Standard in FRAND-encumbered SEPs.Footnote 133 A more sensible route would be for courts facing licensing disputes between firms that are not competitors to refer back to the CJEU the question of the applicability of Huawei in cases where anticompetitive leveraging is impossible.

Moreover, the Huawei ruling sends messages to SSOs as well. The AG’s remarks that SSOs could contribute to mitigating several problems arising from lack of clarity of FRAND should be taken into account in current policy reform discussions within SSOs. In particular, the establishment of a framework of rules of good conduct proposed by the AG is a reasonable proposal that could contribute to streamlining bilateral negotiations. The Huawei negotiation framework could well serve as a starting point in discussions for SSO policy reform. Compared to other – far-reaching – reform proposals, such as disclosure of maximum royalties or joint-licensing negotiations that might distort the market price mechanism,Footnote 134 the introduction of rules of good conduct seems a realistic, pragmatic and market-oriented approach.

Finally, the CJEU’s decision in Huawei could serve as a good opportunity for the European Commission to rethink its policy in the standard-setting context and critically reflect upon its enforcement of Art. 102 TFEU in SEP-related disputes. The Commission’s reaction following the ruling shows otherwise. Competition Commissioner Vestager welcomed the decision as a confirmation of the Commission’s approach in Motorola and Samsung. Footnote 135 However, the Commission should take note of the AG’s criticism that its decisions resulted in under-protection of IP owners and strike a better balance in the future. Moreover, little – if anything – of the Commission’s test of abuse survives in the Huawei ruling. The Court followed a different approach that fosters bilateral commercial negotiations, essentially rejecting the Commission’s broad safe harbour for potential licensees which would diminish incentives to negotiate in good faith and increase litigation costs and uncertainty.

6 Conclusion

Collaborative standardization in wireless telecommunications has a remarkable record of technological achievement. It has contributed decisively to the development of cutting-edge, high-performance wireless standards. Standardization in wireless telecommunications is driven by a self-reinforcing dynamic: investment and innovation in wireless standards make markets and consumer demand grow; in turn, increasing consumer demand triggers more investment and innovation in wireless standards. This remarkable record of innovation is tangible evidence that markets in collaborative standardization are competitive, open and efficient.

Public policy has not always been successful in accommodating the development of the standard-setting process. European competition policy provides a good case in point. The enforcement of Art. 102 TFEU by the EU Commission reveals an underlying mistrust of the operation of the market in the context of collaborative standardization. The Commission tends to overplay the risks of patent hold-up, ignoring at the same time the risks of reverse hold-up and hold-out. Moreover, its approach in Motorola and Samsung exhibits a preference for FRAND determination by courts or arbitration, rather than through bilateral negotiations.

The CJEU’s ruling in Huawei marks a turning point in the application of EU competition law in the standard-setting context. The Court premised its ruling on correct policy assumptions, namely that private parties are in a better position to determine FRAND in the context of licensing negotiations and that court-determined FRAND terms should only be the last resort in case of failure to come to a mutually agreeable outcome. Being a balanced and realistic approach, the negotiation pattern outlined in Huawei could also inform the debate on policy reform within SSOs and thus contribute to the better performance of collaborative standardization.

Notes

The Boston Consulting Group (2015), pp. 3 and 7.

Geradin and Rato (2007), pp. 103, 104.

A typical example of a de facto standard would be the QWERTY typewriting layout which emerged at the end of the 19th century. See Cabral (2000), pp. 316–318.

Legal standards are mandatory for all parties engaged in the relevant commercial activity, such as, for instance, fuel emission standards. See Gilbert (2012), pp. 2–3.

See Geradin and Rato, supra note 2, at p. 104; see also Rysman and Simcoe (2008), p. 1920.

The most relevant SSOs in the field of wireless communications standards are the European Telecommunication Standards Institute (ETSI), the Institute of Electrical and Electronics Engineers (IEEE), the 3G Partnership Project (3GPP), the International Telecommunications Union (ITU) and the Internet Engineering Task Force (IETF). See ECORYS and Eindhoven University of Technology (2014), pp. 31–33.

Ibid., at p. 64.

Net!Works (2012), p. 3.

Case C-170/13, Huawei v. ZTE (2015) (not yet published).

Epstein et al. (2012), p. 10.

In the EU, three SSOs are recognized by the EU Commission as official European standardization bodies: CEN, CENELEC and ETSI.

Gilbert, supra note 4, at p. 4; ECORYS and Eindhoven University of Technology, supra note 6, at p. 33; see also Bekkers and Updegrove (2012), p. 5.

Teece et al. (2014), p. 87.

The Boston Consulting Group, supra note 1, at p. 30.

For instance, the goal of the development of 3G cellular standards was to increase network capacity ten-fold. See ibid.

ECORYS and Eindhoven University of Technology, supra note 6, at pp. 29–30; The Boston Consulting Group, supra note 1, at pp. 29–30.

Goodman and Myers (2005), p. 1.

ECORYS and Eindhoven University of Technology, supra note 6, at p. 59.

ECORYS and Eindhoven University of Technology, supra note 6, at p. 59.

Ibid.

Goodman and Myers, supra note 17, at p. 1.

The Boston Consulting Group, supra note 1, at p. 9.

3G was developed around two interoperable core network technologies, with the decisive involvement of informal standardization consortia, the W-CDMA-UMTS (3GPP), later evolving into HSPA and HSPA+, and CDMA-2000 (3GPP2), which in turn evolved into EV-DO. See Qualcomm (2014), p. 19.

The Boston Consulting Group, supra note 1, at p. 9.

ECORYS and Eindhoven University of Technology, supra note 6, at p. 60; The Boston Consulting Group, supra note 1, at p. 27.

McKinsey Global Institute (2015), p. 17.

In particular, improvements in cost-efficiency and the battery life of sensors, and advances in big data and cloud storage. See The Economist Intelligence Unit (2013), p. 10.

Ibid., at p. 18 (“IoT will not fly if we do not have standards”).

This self-reinforcing dynamic is noted by several industry experts. See The Boston Consulting Group, supra note 1, at p. 34 (“The digital services ecosystem is thriving, which drives stronger investment in core technologies and infrastructure. This in turn, drives additional investment in digital services.”); see also McKinsey Global Institute (2013), p. 32 (“As consumers spend more time online, the number and quality of Internet-based services are increasing, further driving demand.”).

Geradin and Rato, supra note 2, at p. 104; Gilbert, supra note 4, at p. 3.

Harkrider (2013), p. 23.

Layne-Farrar (2010), p. 1; see also European Commission, “Guidelines on the applicability of Article 101 TFEU to Horizontal Cooperation Agreements”, [2001] OJ C3/2.

Layne-Farrar, supra note 32, at p. 6.

Ibid.

Harkrider, supra note 31, at p. 23.

Geradin and Rato, supra note 2, at p. 110.

Ibid., at p. 113; see also Geradin (2010), p. 4; Epstein, Kieff and Spulber, supra note 9, at p. 14.

Bekkers and Updegrove, supra note 12, at p. 9.

In particular, a royalty-free licensing commitment might be perceived as a “contamination” threat to a valuable patent portfolio. See DeVellis (2003), p. 343.

Drexl (2015), p. 31, para. 13; see also The Boston Consulting Group, supra note 1, at p. 32.

See, among others, IPCom v. Nokia, [2012] EWHC 1446 (Ch) (UK); IPCom v. Deutsche Telekom & Vodafone, Dusseldorf District Court (Landgericht), 24 April 2012, Case 4b O 274/10 (Germany); Apple Inc. v. Motorola, Inc., 757 F.3d pp. 1286, 1331 (Fed. Cir. 2014); Microsoft Corp. v. Motorola, Inc., 696 F.3d pp. 872, 878 (9th Cir. 2012); Microsoft Corp. v. Motorola Inc., 864 F. Supp.2d pp. 1023, 1038 (W.D. Wash. 2012); Realtek Semiconductor Corp. v. LSI Corp., 946 F. Supp.2d pp. 998, 1005 (N.D. Cal. 2013).

Layne-Farrar et al. (2011), p. 2.

Layne-Farrar, supra note 32, at p. 1; Geradin and Rato, supra note 2, at p. 103.

Layne-Farrar, supra note 32, at p. 2.

DeLacey et al. (2006), p. 2.

The Boston Consulting Group, supra note 1, at pp. 32–33.

ECORYS and Eindhoven University of Technology, supra note 6, at p. 34.

Ibid., at p. 25 (“Standard setting has evolved from the definition of interface specifications enabling interoperability to joint development of large technology platforms including critical technologies.”).

Geradin and Rato, supra note 2, at p. 104.

DeVellis, supra note 39, at p. 343.

Ibid.

Rysman and Simcoe, supra note 5, at p. 1932.

For instance, in 2011, Apple, RIM, Ericsson, Sony and Microsoft, all members of the Rockstar consortium, spent $4.5 billion in an auction to acquire Nortel’s thousands of SEPs in wireless telecommunication standards. See Teece, Sherry and Grindley, supra note 13, at p. 89. However, it is not yet quite clear whether the high market valuation of a portfolio of SEPs stems solely from technological merit, or could rather be associated with the strong bargaining position of a SEP-holder.

Simcoe et al. (2007), p. 4; Layne-Farrar, Llobet and Padilla, supra note 43, at p. 2.

The Boston Consulting Group, supra note 1, at pp. 9 and 30.

DeLacey et al., supra note 46, at p. 2.

The Boston Consulting Group, supra note 1, at p. 29.

Teece, Sherry and Grindley, supra note 13, at p. 96.

The Boston Consulting Group, supra note 1, at p. 9.

Joseph Schumpeter, “Capitalism, socialism and democracy” (first published 1942; Routledge, 2013).

Of course, even a particular release of a standard can represent a drastic innovation. Yet the structure of the process leaves a different impression.

The Boston Consulting Group, supra note 1, at p. 28 (“The core technologies are the oxygen within the mobile ecosystem: fundamental to life, invisible to the user and necessary for all other functions to continue.”).

Ibid., at p. 7.

McKinsey, supra note 29, at p. 38.

In 2013, 100 billion mobile apps were downloaded by consumers. This number is forecast to grow in 2017 to reach an astounding 270 billion. See Qualcomm, supra note 23, at p. 2.

McKinsey, supra note 29, at p. 38.

Ibid., at p. 32.

Horizontal Guidelines, supra note 32, at para. 262.

Ibid., at para. 266.

Ibid., at para. 275.

Ginsburg, Wong-Ervin and Wright, supra note 72, at p. 4.

This type of strategic behaviour is known in the relevant literature as patent hold-up. See Lemley and Shapiro (1991), p. 1991.

This second type of strategic behaviour is known as hold-out or reverse hold-up. See Epstein, Kieff and Spulber, supra note 10, at p. 22.

Wright (2013), p. 791.

Mair, supra note 72, at p. 73.

Contreras (2015), pp. 39, 42.

Wright, supra note 77, at pp. 2, 3.

Realtek Semiconductor Corp. v. LSI Corp., 946 F. Supp.2d pp. 998, 1005 (N.D. Cal. 2013); see also Microsoft Corp. v. Motorola, Inc., 696 F.3d pp. 872, 878 (9th Cir. 2012).

Under Sec. 283 of the U.S. Patent Act, courts adjudicating on patent infringement cases may issue injunctions prohibiting infringers from making, selling or offering for sale infringing products “in accordance with the principles of equity”. The U.S. Supreme Court ruled in eBay that the traditional four-factor test for awarding injunctive relief in equity should equally be applied to patent infringement cases. According to the Supreme Court, for an injunction to be granted, the patentee must establish: “1) that it has suffered an irreparable injury; (2) that remedies available at law, such as monetary damages, are inadequate to compensate for that injury; (3) that, considering the balance of hardships between the plaintiff and defendant, a remedy in equity is warranted; and (4) that the public interest would not be disserved by a permanent injunction.”; see eBay Inc. v. MercExchange, L.L.C., 126 S.Ct. p. 1837 (2006).

Ginsburg, Wong-Ervin and Wright, supra note 72, at p. 6; however, the FTC has enforced antitrust rules in merger control cases involving acquisition of SEPs. See FTC Consent Order, In the Matter of Robert Bosch GmbH (23 April 2013), https://www.ftc.gov/sites/default/files/documents/cases/2013/04/130424robertboschdo.pdf (accessed 30 September 2016); FTC Consent Decree, In the Matter of Motorola Mobility and Google (23 July 2013), https://www.ftc.gov/sites/default/files/documents/cases/2013/07/130724googlemotorolado.pdf (accessed 30 September).

Jones (2014), pp. 1, 10.

IPCom v. Deutsche Telekom & Vodafone, supra note 41.

According to the Orange Book Standard decision, the defendant in a patent infringement action involving a de facto SEP must meet two conditions to escape an injunction. The first condition is that the defendant must make an unconditional offer to conclude a licence agreement that the patent owner cannot refuse without breaching competition law. The second requirement is that the defendant must have behaved like a licensee, that is, paid a “reasonable” licence fee to the SEP-holder or otherwise put a sufficient amount in escrow. See Orange Book Standard (2009), p. 694. See also Orange Book Standard (2010), 41 IIC p. 369 (English translation).

IPCom v. Deutsche Telekom & Vodafone, supra note 41; General Instrument Corp v. Microsoft Deutschland GmbH, Mannheim District Court (Landgericht), 2 May 2012, Case 2 O 240/11; Motorola Mobility Inc v. Apple Sales International, Mannheim District Court, 9 December 2011, Case 7 O 122/11 and Karlsruhe Court of Appeals (Oberlandesgericht), 30 January 2013, Case 6 U 136/11.

Motorola (Case Number AT.39985), Commission Decision, [2014] OJ C344/6.

Samsung (Case Number AT.39939), Commission Decision, [2014] OJ C350/8.

Jones, supra note 85, at p. 9.

Motorola, supra note 89, at paras. 190–213.

Ibid., at para. 212.

See Cases C-241-242/91, RTE and ITP v. Commission, [1995] ECR I-743; Case C-7/97, Oscar Bronner GmbH & Co KG v. Mediaprint, [1998] ECR I-7791; Case C-418/01, IMS Health GmbH & Co OHG v. NDC Health GmbH & Co KG, [2004] ECR I-5039.

Motorola, supra note 89, at para. 281.

IMS Health, supra note 94, at para. 28.

Motorola, supra note 89, at paras. 322–414.

Ibid., at paras. 415–420.

Lundqvist (2016), pp. 367, 378.

Batista and Mazutti (2016), pp. 244, 247.

Motorola, supra note 89, at para. 495.

Epstein, Kieff and Spulber, supra note 10, at p. 22.; Geradin and Rato, supra note 2, at p. 101; Langus et al. (2013), p. 253.

Huawei, supra note 9.

Ibid., at para. 39.

Ibid., at para. 61.

Ibid., at para. 63.

Ibid., at para. 65.

Ibid., at para. 66.

Rato and English, supra note 102, at pp. 103, 104.

Ibid., at p. 111; see also Subiotto et al. (2016), pp. 1, 6; Rato and English, supra note 102, at p. 104.

Case C-170/13, Huawei v. ZTE [2014], Opinion of AG Wathelet, para. 50.

Ibid., at para. 51.

Huawei, supra note 9, at para. 42; Wathelet, supra note 112, at paras. 62, 66; Lundqvist, supra note 99, at pp. 386–87; Heinemann (2015), pp. 947, 950.

Wathelet, supra note112, at para. 62.

Lawrance et al. (2016), pp. 227, 228; Lundqvist, supra note 99, at p. 391.

Petit (2015), p. 6.

Huawei, supra note 9, at para. 68 (“where no agreement is reached on the details of the FRAND terms following the counter-offer by the alleged infringer, the parties may, by common agreement, request that the amount of the royalty be determined by an independent third party, by decision without delay”).

Wathelet, supra note 112, at para. 93.

Huawei, supra note 9, at para. 67.

Heinemann, supra note 114, at p. 951.

Huawei, supra note 9, at paras. 49–51.

Ibid., at para. 53.

See also Wathelet, supra note 112, at para. 74.

Sidak (2013), p. 931.

Heinemann, supra note 114, at p. 951.

Rato and English, supra note 102, at p. 110.

Huawei, supra note 9, at para. 52 (“Although the proprietor of the essential patent at issue has the right to bring an action for a prohibitory injunction or for the recall of products, the fact that that patent has obtained SEP status means that its proprietor can prevent products manufactured by competitors from appearing or remaining on the market and, thereby, reserve to itself the manufacture of the products in question.”); see also Petit, supra note 117, at p. 3.

Huawei, supra note 9, at para. 52.

Wathelet, supra note 112, at para. 9 (“That does not mean, however, that the matters at issue in the dispute before the referring court, which, in my view, stem largely from a lack of clarity as to what is meant by ‘FRAND terms’ and as to the requisite content of such terms, could not be adequately – if not better – resolved in the context of other branches of law or by mechanisms other than the rules of competition law.”).

Lundqvist, supra note 99, at pp. 388–89.