Abstract

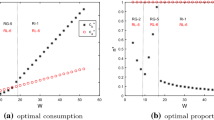

In the real-world environments, different individuals have different risk preferences. This paper investigates the optimal portfolio and consumption rule with a Cox–Ingersoll–Ross (CIR) model in a more general utility framework. After consumption, an individual invests his wealth into the financial market with one risk-free asset and multiple risky assets, where the short-term rate is driven by the CIR model and stock price dynamics are simultaneously influenced by random sources from both stochastic interest rate and stock market itself. The individual hopes to optimize their portfolios and consumption rules to maximize expected utility of terminal wealth and intermediate consumption. Risk preference of individual is assumed to satisfy hyperbolic absolute risk aversion (HARA) utility, which contains power utility, logarithm utility, and exponential utility as special cases. By using the principle of stochastic optimality and Legendre transform-dual theory, the explicit expressions of the optimal portfolio and consumption rule are obtained. The sensitivity of the optimal strategies to main parameters is analysed by a numerical example. In addition, economic implications are also presented. Our research results show that Legendre transform-dual theory is an effective methodology in dealing with the portfolio selection problems with HARA utility and interest rate risk can be completely hedged by constructing specific portfolios.

Similar content being viewed by others

References

Merton, R.C.: Lifetime portfolio selection under uncertainty: the continuous-time case. Rev. Econ. Stat. 51(3), 247–257 (1969)

Merton, R.C.: Optimum consumption and portfolio rules in a continuous-time model. J. Econ. Theory 3(4), 373–413 (1971)

Xu, G.L., Shreve, S.E.: A duality method for optimal consumption and investment under short-selling prohibition. I. General market coefficients. Ann. Appl. Probab. 2(1), 87–112 (1992)

Fleming, W.H., Pang, T.: An application of stochastic control theory to financial economics. SIAM J. Control Optim. 43(2), 502–531 (2004)

Munk, C., Sørensen, C.: Optimal consumption and investment strategies with stochastic interest rates. J. Bank. Financ. 28(8), 1987–2013 (2004)

Fleming, W.H., Hernandez-Hernandez, D.: An optimal consumption model with stochastic volatility. Financ. Stoch. 7(2), 245–262 (2003)

Chacko, G., Viceira, L.M.: Dynamic consumption and portfolio choice with stochastic volatility in incomplete markets. Rev. Financ. Stud. 18(4), 1369–1402 (2005)

Sotomayor, L.R., Cadenillas, A.: Explicit solutions of consumption-investment problems in financial markets with regime switching. Math. Financ. 19(2), 251–279 (2009)

Chang, H., Rong, X.M., Zhao, H., Zhang, C.B.: Optimal investment and consumption decisions under the constant elasticity of variance model. Math. Probl. Eng. (2013). https://doi.org/10.1155/2013/974098

Zeng, Y., Wu, H.L., Lai, Y.Z.: Optimal investment and consumption strategies with state-dependent utility functions and uncertain time-horizon. Econ. Model. 33, 462–470 (2013)

Liu, J.: Portfolio selection in stochastic environments. Rev. Financ. Stud. 20(1), 1–39 (2007)

Noh, E.J., Kim, J.H.: An optimal portfolio model with stochastic volatility and stochastic interest rate. J. Math. Anal. Appl. 375(2), 510–522 (2011)

Ekeland, I., Pirvu, T.A.: Investment and consumption without commitment. Math. Financ. Econ. 2(1), 57–86 (2008)

Pirvu, T.A., Zhang, H.: Investment-consumption with regime-switching discount rates. Math. Soc. Sci. 71(5), 142–150 (2014)

Zhao, Q., Shen, Y., Wei, J.Q.: Consumption-investment strategies with non-exponential discounting and logarithmic utility. Eur. J. Oper. Res. 238, 824–835 (2014)

Zou, Z.R., Chen, S., Wedge, L.: Finite horizon consumption and portfolio decisions with stochastic hyperbolic discounting. J. Math. Econ. 52(1), 70–80 (2014)

Grasselli, M.: A stability result for the HARA class with stochastic interest rates. Insur. Math. Econ. 33(3), 611–627 (2003)

Jung, E.J., Kim, J.H.: Optimal investment strategies for the HARA utility under the constant elasticity of variance model. Insur. Math. Econ. 51(1), 667–673 (2012)

Chang, H., Chang, K., Lu, J.M.: Portfolio selection with liability and affine interest rate in the HARA utility framework. Abstr. Appl. Anal. (2014). https://doi.org/10.1155/2014/312640

Jonsson, M., Sircar, R.: Optimal investment problems and volatility homogenization approximations. In: Modern Methods in Scientific Computing and Applications NATO Science Series II, vol. 75, pp. 255–281. Springer, Germany (2002)

Xiao, J.W., Zhai, H., Qin, C.L.: The constant elasticity of variance (CEV) model and the Legendre transform-dual solution for annuity contracts. Insur. Math. Econ. 40(2), 302–310 (2007)

Gao, J.W.: Optimal investment strategy for annuity contracts under the constant elasticity of variance (CEV) model. Insur. Math. Econ. 45(1), 9–18 (2009)

Gao, J.W.: An extended CEV model and the Legendre transform-dual-asymptotic solutions for annuity contracts. Insur. Math. Econ. 46(3), 511–530 (2010)

Karatzas, I., Lehoczky, J.P., Shreve, S.E., et al.: Martingale and duality methods for utility maximization in a incomplete market. SIAM J. Control Optim. 29(3), 702–730 (1991)

Stanton, R.: A nonparametric model of term structure dynamics and the market price of interest rate risk. J. Financ. 52(5), 1973–2002 (1997)

Grzelak, L., Oosterlee, K.: On the Heston model with stochastic interest rates. SIAM J. Financ. Math. 2(1), 255–286 (2010)

Hainaut, D.: A fractal version of the Hull–White interest rate model. Econ. Model. 31(2), 323–334 (2013)

Boulier, J.F., Huang, S.J., Taillard, G.: Optimal management under stochastic interest rates: the case of a protected defined contribution pension fund. Insur. Math. Econ. 28(1), 173–189 (2001)

Deelstra, G., Grasselli, M., Koehl, P.F.: Optimal investment strategies in the presence of a minimum guarantee. Insur. Math. Econ. 33(1), 189–207 (2003)

Ferland, R., Watier, F.: Mean-variance efficiency with extended CIR interest rates. Appl. Stoch. Models Bus. Ind. 26(1), 71–84 (2010)

Shen, Y., Siu, T.K.: Asset allocation under stochastic interest rate with regime switching. Econ. Model. 29(4), 1126–1136 (2012)

Li, D.P., Rong, X.M., Zhao, H.: Time-consistent reinsurance-investment strategy for a mean-variance insurer under stochastic interest rate model and inflation risk. Insur. Math. Econ. 64(1), 28–44 (2015)

Yao, H.X., Li, Z.F., Li, D.: Multi-period mean-variance portfolio selection with stochastic interest rate and uncontrollable liability. Eur. J. Oper. Res. 252(3), 837–851 (2016)

Hunter, J., Wu, F.: Multifactor consumption based asset pricing models using the US stock market as a reference: evidence from a panel of developed economies. Econ. Model. 36, 557–565 (2014)

Chen, G.J., Hong, Z.W., Ren, Y.: Durable consumption and asset returns: cointegration analysis. Econ. Model. 53, 231–244 (2016)

Cox, J.C., Ingersoll, J.E., Ross, S.A.: A theory of the term structure of interest rates. Econometrica 53(2), 385–408 (1985)

Yong, J., Zhou, X.Y.: Stochastic Control: Hamiltonian Systems and HJB Equations. Springer, Berlin (1999)

Cox, J.C., Huang, C.F.: Optimal consumption and portfolio policies when asset prices follow a diffusion process. J. Econ. Theory 49(1), 33–83 (1989)

Acknowledgements

The authors are very grateful to reviewers for their comments and suggestions.

Author information

Authors and Affiliations

Corresponding author

Additional information

This paper is dedicated to Professor Duan Li in celebration of his 65th birthday.

This research is supported by National Natural Science Foundation of China (No. 71671122), China Postdoctoral Science Foundation Funded Project (Nos. 2014M560185 and 2016T90203), Humanities and Social Science Research Fund of Ministry of Education of China (Nos. 11YJC790006 and 16YJA790004) and Tianjin Natural Science Foundation of China (No. 15JCQNJC04000).

Appendix

Appendix

(A1) Proof of Lemma 4.1 Introducing the following variational operator on any function f(t, r):

we can rewrite Eq. (4.5) as

In fact, according to \(f(t,r)=\left( {\frac{\alpha }{1-\alpha }} \right) ^{-\frac{1}{p-1}}\int _t^{T} {{\hat{f}}(s,r)\hbox {d}s} +{\hat{f}}(t,r)\), we have

Putting (a2) and (a3) into (a1), we obtain

Comparing the coefficients on both sides of (a4), we get

Therefore, Eq. (4.7) holds.

(A2) Proof of Lemma 4.2 Substituting \({\hat{f}}(t,r)=\hbox {e}^{D_1 (t)+D_2 (t)r}\) back into (4.7) and separating the variables, we arrive at the following two ODEs:

By investigating the following quadratic equation:

we get its discriminant:

-

(i)

If \(0<p<1\) and \(p<\frac{b^2}{(k\lambda _r -b)^2+2k^2}\), i.e. \(0<p<\min \left\{ {\frac{b^2}{(k\lambda _r -b)^2+2k^2},\;1} \right\} \), we have \(\Delta _1 >0\); if \(p<0\), we have \(\Delta _1 >0\). To sum up, we obtain \(p<\min \left\{ {\frac{b^2}{(k\lambda _r -b)^2+2k^2},\;1} \right\} \) and \(p\ne 0\), we thus have \(\Delta _1 >0\).

The two different roots of Eq. (a8) are given by

$$\begin{aligned} m_{1,2} =\frac{\frac{p}{p-1}k\lambda _r -b}{-k^2}\pm \frac{\sqrt{\Delta _1 } }{-k^2}. \end{aligned}$$(a10)The solution to Eq. (a6) is derived as follows.

$$\begin{aligned} \begin{aligned}&{\dot{D}}_2 (t)=-\frac{1}{2}k^2D_2^2 (t)-\left( {\frac{p}{p-1}k\lambda _r -b} \right) D_2 (t)-\left( {\frac{p}{2(p-1)^2}\lambda _r^2 -\frac{p}{p-1}} \right) \\&\quad \Rightarrow {\dot{D}}_2 (t)=-\frac{1}{2}k^2(D_2 (t)-m_1 )(D_2 (t)-m_2 )\\&\quad \Rightarrow \frac{1}{m_1 -m_2 }\int _t^{T} {\left( {\frac{1}{D_2 (t)-m_1 }-\frac{1}{D_2 (t)-m_2 }} \right) } \hbox {d}D_2 (t)=-\frac{1}{2}k^2(T-t). \end{aligned} \end{aligned}$$Solving the above integration, we obtain (4.8). Further, plugging (4.8) into Eq. (a7), we have (4.9).

-

(ii)

If \(p=\frac{b^2}{(k\lambda _r -b)^2+2k^2}\) and \(p<1\), we have \(\Delta _1 =0\). Then, the unique root of (a8) is given by

$$\begin{aligned} m_3 =\frac{\frac{p}{p-1}k\lambda _r -b}{-k^2}. \end{aligned}$$(a11)We derive the following process to solve Eq. (a6):

$$\begin{aligned} \begin{aligned}&{\dot{D}}_2 (t)=-\frac{1}{2}k^2(D_2 (t)-m_3 )^2\\&\quad \Rightarrow \int _t^{T} {\frac{1}{(D_2 (t)-m_3 )^2}\mathrm{d}D_2 (t)} =-\frac{1}{2}k^2(T-t). \end{aligned} \end{aligned}$$Solving the above integration yields (4.10). Putting (4.10) in Eq. (a7), we get (4.11).

-

(iii)

If \(\frac{b^2}{(k\lambda _r -b)^2+2k^2}<p<1\), we have \(\Delta _1 <0\). Then, for Eq. (a6), we adopt the following solving technique:

$$\begin{aligned} \begin{aligned}&{\dot{D}}_2 (t)=-\frac{1}{2}k^2D_2^2 (t)-\left( {\frac{p}{p-1}k\lambda _r -b} \right) D_2 (t)-\left( {\frac{p}{2(p-1)^2}\lambda _r^2 -\frac{p}{p-1}} \right) \\&\quad \Rightarrow {\dot{D}}_2 (t)=-\frac{1}{2}k^2\left( {\left( {D_2 (t)-m_3 } \right) ^2+\frac{-\Delta _1 }{k^4}} \right) \\&\quad \Rightarrow \int _t^{T} {\frac{1}{\frac{\sqrt{-\Delta _1 } }{k^2}\left( {\left( {\frac{k^2}{\sqrt{-\Delta _1 } }\left( {D_2 (t)-m_3 } \right) } \right) ^2+1} \right) }\mathrm{d}\left( {\frac{k^2}{\sqrt{-\Delta _1 } }\left( {D_2 (t)-m_3 } \right) } \right) }\\&\quad =-\frac{1}{2}k^2\left( {T-t} \right) . \end{aligned} \end{aligned}$$Therefore, we obtain (4.12). Further, we have (4.13). Thus, the proof is completed.

(A3) Proof of Lemma 4.4 Plugging \({\hat{h}}(t,r)=\hbox {e}^{D_3 (t)+D_4 (t)r}\) into Eq. (4.14) and separating the variables, we get

The discriminant for the quadratic equation \(-\frac{1}{2}k^2D_4^2 (t)-(k\lambda _r -b)D_4 (t)+1=0\) is given by \(\Delta _2 =(k\lambda _r -b)^2+2k^2>0\). So, the two different roots are represented as

By using the same technique as Lemma 4.2, we derive (4.15) and (4.16).

Therefore, we easily complete the proof.

Rights and permissions

About this article

Cite this article

Wang, CF., Chang, H. & Fang, ZM. Optimal Portfolio and Consumption Rule with a CIR Model Under HARA Utility. J. Oper. Res. Soc. China 6, 107–137 (2018). https://doi.org/10.1007/s40305-017-0189-8

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40305-017-0189-8

Keywords

- CIR model

- Optimal portfolios and consumption rules

- HARA utility

- Legendre transform-dual theory

- Stochastic optimal control

- Economic implication