Abstract

Objective

High upfront costs and long-term benefit uncertainties of gene therapies challenge Medicaid budgets, making value-based contracts a potential solution. However, value-based contract design is hindered by cost-offset uncertainty. The aim of this study is to determine actual cost-offsets for valoctocogene roxaparvovec (hemophilia A) and etranacogene dezaparvovec (hemophilia B) from Colorado Medicaid’s perspective, defining payback periods and its uncertainty from the perspective of Colorado Medicaid.

Methods

This cost analysis used 2018–2022 data from the Colorado Department of Health Care Policy & Financing to determine standard-of-care costs and employed cost simulation models to estimate the cost of Medicaid if patients switched to gene therapy versus if they did not. Data encompassed medical and pharmacy expenses of Colorado Medicaid enrollees. Identified cohorts were patients aged 18+ with ICD-10-CM codes D66 (hemophilia A) and D67 (hemophilia B). Severe hemophilia A required ≥ 6 claims per year for factor therapies or emicizumab, while moderate/severe hemophilia B necessitated ≥ 4 claims per year for factor therapies. Patients were included in the cohort in the year they first met the criteria and were subsequently retained in the cohort for the duration of the observation period. Standard-of-care included factor VIII replacement therapy/emicizumab for hemophilia A and factor IX replacement therapies for hemophilia B. Simulated patients received valoctocogene roxaparvovec or etranacogene dezaparvovec. Main measures were annual standard-of-care costs, cost offset, and breakeven time when using gene therapies.

Results

Colorado Medicaid’s standard-of-care costs for hemophilia A and B were $426,000 [standard deviation (SD) $353,000] and $546,000 (SD $542,000) annually, respectively. Substituting standard-of-care with gene therapy for eligible patients yielded 8-year and 6-year average breakeven times, using real-world costs, compared with 5 years with published economic evaluation costs. Substantial variability in real-world standard-of-care costs resulted in a 48% and 59% probability of breakeven within 10 years for hemophilia A and B, respectively. Altering eligibility criteria significantly influenced breakeven time.

Conclusions

Real-world data indicates substantial uncertainty and extended payback periods for gene therapy costs. Utilizing real-world data, Medicaid can negotiate value-based contracts to manage budget fluctuations, share risk with manufacturers, and enhance patient access to innovative treatments.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Using real-world data, our study generates markedly different break-even time estimates compared with those obtained from published literature based on clinical trials and cost-effectiveness analyses. |

We highlight the impact of varying eligibility criteria on cost offsets and breakeven time, emphasizing the importance of carefully defining treatment and coverage criteria in the context of value-based contracts. |

Our study underscores the considerable cost variation in alternative treatments to cell and gene therapies, adding to the uncertainty surrounding breakeven time estimation and highlighting the importance of addressing them in value-based contracts. |

1 Background

The Food and Drug Administration (FDA) has approved over twenty cell and gene therapies (CGT) [1, 2], with expectations of over fifty product indication approvals by 2030 [3, 4]. For state Medicaid programs to qualify for Centers for Medicare and Medicaid Services (CMS) mandated drug rebates, states must cover all nonexcluded FDA-approved therapies from manufacturers that have a mandatory rebate agreement in place with CMS [5]. Many patients affected by diseases targeted by CGTs, such as rare genetic disorders, will depend on Medicaid to access treatment, as Medicaid covers 28% [6] of the US population. As a result, the substantial costs associated with CGTs [3] pose a significant burden on Medicaid’s budget.

In most cases, CGT requires a single course of treatment for long-term improvement rather than a lifetime of continuous treatment. Therefore, instead of many smaller payments spread over time for chronic therapy, Medicaid programs face a large one-time payment for a CGT. As CGTs are relatively new and evolving treatments, long-term implications for patients are still being evaluated [7,8,9,10]. Additionally, since many CGTs receive expedited regulatory approval, evidence often stems from limited clinical trial populations and restricted time frames [8, 10]. High upfront payments, coupled with uncertainties in the durability of the benefit, shift the financial risk of paying for a potentially failing therapy to the payer. CGTs have the potential to generate considerable cost offsets for Medicaid by eliminating the necessity for costly standard care. Nevertheless, this outcome can only be attained over an extended duration, during which the savings gradually accrue, offsetting the initial high expense of the CGT (breakeven time). Variations in cost offsets, especially with time lag involved, create uncertainty for Medicaid and state decision-makers when projecting budgets. These challenges faced by Medicaid decision-makers necessitate a different payment approach to accommodate the pipeline of CGTs.

Value-based contracts (VBCs) are innovative payment models to link reimbursement to a treatment’s real-world performance. VBCs between Medicaid and the manufacturer are a way to spread costs over time based on the therapy’s performance, thus alleviating potential budget shocks and ensuring financial risk is shared between Medicaid and the manufacturer [11, 12]. However, key uncertainties may impact negotiations between payers and manufacturers to establish VBCs. A crucial area of uncertainty, extensively discussed in the literature [8,9,10,11], relates to long-term durability of the beneficial treatment effect (durability of effect) of CGTs, which influences overall cost of disease management, as higher costs may be incurred when patients fail on a CGT and are forced to switch back to standard of care.

An under-discussed source of uncertainty for developing VBCs include: (1) the heterogeneity in the real-world costs of standard of care (i.e., what was spent by Medicaid in actual costs versus cost estimation in economic evaluations driven by medication usage recommended in clinical guidelines) and (2) how the definition of eligibility criteria for covering gene therapy utilization may influence real-world cost estimates, which then impacts magnitude of cost offsets and breakeven time. While this relationship is not clear from economic evaluations, it can have a large impact on the extent of cost offset achieved by replacing standard of care with a new CGT. To address this uncertainty, incorporating real-world data becomes essential. Such data provides retrospective insights into the real costs paid by Medicaid, the distribution of costs, and the relationship between eligibility and cost offsets. This information serves as the foundation for accurately assessing the financial risk associated with choosing CGT over standard of care so that Medicaid agencies can negotiate risk-neutral or financially beneficial VBCs.

For our study, we selected two CGTs for in-depth investigation to demonstrate how real-world cost data can be used to inform the design of VBCs for CGTs. Etranacogene dezaparvovec received FDA approval in the second half of 2022 [13, 14]. It has a list price of $3.5 million and targets moderate and severe hemophilia B in adults. Valoctocogene roxaparvovec has a list price of $2.9 million and is designed to treat severe hemophilia A in adults; it received FDA approval in July 2023 [15, 16].

This study aims to demonstrate how real-world data (RWD)-based cost estimates can inform the design of VBCs, using a case study of hemophilia A and B CGTs, estimating the true expected cost savings, and appropriately defining the payback period and its uncertainty from the perspective of Colorado Medicaid.

2 Methods

To employ RWD-based cost estimates to inform the design of VBCs for CGTs, we first compared the real-world cost of hemophilia A and B treatment for Colorado Medicaid enrollees with literature-based cost estimates commonly used in economic evaluations. This comparison aimed to identify any substantial differences in the magnitude and variation of costs. Next, we assessed how the utilization of RWD influenced the results of cost simulations, specifically comparing the cost of standard care with the cost of gene therapy. Additionally, we examined the relationship between eligibility criteria, the proportion of patients eligible for gene therapy, and the breakeven time associated with utilizing gene therapy instead of standard care.

2.1 Identifying Literature-Based Cost Estimates

Cost estimates used in economic evaluations were identified by a targeted review of the literature. We retrieved economic evaluations related to hemophilia A and B from the Tufts Cost-Effective Analysis (CEA) registry [17] and excluded studies published over 10 years ago because the treatment landscape and spending on these disease areas have changed considerably since. Additionally, we searched the Institute for Clinical and Economic Review [18] website to find economic evaluations that specifically compared the CGTs of interest against standard of care. From economic evaluations we reviewed, we extracted key cost inputs, including resource utilization and unit costs, that had a substantial impact on the overall expenses of the standard of care. The health benefits (including quality-adjusted life years) were not extracted from the economic evaluations reviewed and have not been used in any way in this study. For hemophilia A and B, the primary cost is factor replacement therapy, which involves regular infusion of clotting factor concentrates or use of bispecific monoclonal antibody (emicizumab). These account for more than 90% of total cost of prophylaxis in patients without factor inhibitors [19,20,21].

2.2 Real-World Cost Estimation

We accessed the Colorado Department of Health Care Policy & Financing (HCPF) database to extract cost data for Medicaid-enrolled patients diagnosed with paid claims for hemophilia A and B using ICD-10-CM codes. The data spanned from 2018 to 2022. The analysis focused on actual care, determined based on disease-related prescriptions and medical procedure codes (Online Resource 1). Extracted data included age, sex, treatment, number of claims, and the total amount paid by Medicaid.

To estimate average cost of standard of care as a reference point in our analysis, we identified cohorts of patients aged 18+ who were potentially eligible for CGTs. The use of specific ICD-10-CM codes (D66 for hemophilia A and D67 for hemophilia B) was not sufficient for precise identification of patients with severe hemophilia A and B (who would be eligible for the new CGTs) as the codes encompass all cases of the disease, including various severity levels. To address this, we used criteria from recent studies [19, 22]. Croteau et al. [19] suggest that the criterion of four or more claims per year captures patients regularly filling prescriptions for factor concentrate on 90-day supply. Shorter schedules (e.g., 60-day or 30-day supply) would require more frequent claims. The algorithm suggested by Buckner et al. [22] recommends four to five factor claims for moderate-to-severe profile and six or more claims for severe profile patients. We adopted these criteria for our base case analysis. Severe hemophilia A was defined as having a minimum of six claims of factor replacement therapies or emicizumab per year, while moderate and severe hemophilia B required at least four claims of factor replacement therapies to reflect regular prophylaxis. Patients were included in the cohort in the year they first met the criteria and were subsequently retained in the cohort for the duration of the observation period. We conducted sensitivity analyses around the definition of the eligible population to identify how the frequency of factor (and emicizumab) utilization influences annual costs. By pooling individual patient-level costs within identified cohorts, we derived estimates of average costs of care for these specific groups. All costs were reported in 2022 US dollars and adjusted for healthcare cost inflation [23].

2.3 Cost Simulation Model

In Microsoft Excel, we constructed two-state partitioned survival models (alive, dead) for conducting cost simulations in the context of hemophilia A and B. We compared the costs of standard care and CGT over a lifetime horizon. We accounted for durability of effect of CGT and assumed that patients would revert to standard of care if CGT was ineffective. We validated the models by using the inputs from the literature and comparing the results to the cost estimates generated by models in the literature [24, 25]. One of the authors (R.B.M), who was not directly involved in the model’s development, conducted a thorough review of the model. We used assumptions from the literature regarding the durability of the effect and assigned an increasing probability of switching to standard care per year, such that 50% of patients with hemophilia A switched after 11 years [24] and 20% of patients with hemophilia B switched 25.5 years after infusion [26]. The inputs used in the model are listed in Table 1. The model considered two scenarios incorporating treatment costs from different sources: (1) findings from a literature review and (2) results from a cost analysis using RWD from the HCPF database. A probabilistic sensitivity analysis was conducted by varying the cost of standard care using the standard deviation of actual costs. To determine probability of breakeven at 5 years and 10 years, a Monte Carlo simulation with 1000 trials was run, employing probabilistic value of the standard-of-care cost as input. Further information on the cost simulation model, including model structure and key assumptions can be found in Online Resources 2 and 3.

3 Results

3.1 Annual Costs of Standard Care in Economic Evaluations

Table 2 presents the annual costs of factor VIII, emicizumab, and factor IX therapies in economic evaluations for hemophilia A and B. All studies were published in the last 5 years. Cost variations can be attributed to differences in the specific drug considered as standard care, assumptions made about dosage, frequency of use, the average weight of patients, and unit costs (refer to Online Resources 4 and 5).

3.2 Results of the Cost Analysis from Real-World Data

The study analyzed a cohort of 238 Colorado Medicaid patients with hemophilia A (ICD-10-CM code D66) between 2018–2022. Fifty-nine (25%) of them had at least one factor VIII or emicizumab claim in the study period (Table 3). The mean age of this cohort was 34.3 (SD 14.8) years. Patients with at least six claims for factor VIII or emicizumab (N = 36, 15%) had an annual mean cost of $426,000 (SD $353,000). The mean annual drug cost suggested by the literature ($633,000) was only representative of about the top 5% of all patients with the highest costs. For further information regarding the distribution of patients and costs across different subgroups defined by resource utilization criteria, refer to Online Resources 6 and 7.

Between 2018–2022, a cohort of 54 patients with hemophilia B (ICD-10-CM code D67) was analyzed in the study (Table 3). The mean age of the cohort having at least one factor IX claim during that period was 33.5 (SD 12.9) years. Among patients with at least four claims for factor IX, the average annual cost was $546,000 (SD $542,000). The mean annual drug cost reported in the literature ($689,000) was representative of approximately the top 13% of all patients with the highest costs. For more detailed information on the distribution of patients and costs across various subgroups based on resource utilization criteria, refer to Online Resources 8 and 9.

3.3 Results of the Cost-Simulations

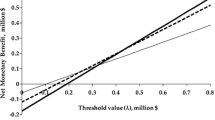

The analysis reveals that based on the point estimate of real-world costs, the upfront cost of valoctocogene roxaparvovec to treat hemophilia A can be recouped in approximately 8 years, with a balance of − $880,000 at 5 years and $481,000 at 10 years. When accounting for uncertainty in these estimates through probabilistic sensitivity analysis, simulation results indicate a 23% probability of reaching breakeven within 5 years and a 48% probability within 10 years. In contrast, when employing literature-based cost inputs in the simulation, results indicate a projected return of $191,000 over a 5-year period and $2,246,000 over a 10-year period, with breakeven achieved in 5 years (Fig. 1).

Cumulative cost difference: gene therapy versus standard care estimated using real-world Medicaid data compared to estimates from the literature. These panels provide an overview of the long-term financial risk associated with upfront gene therapy payments. They illustrate the cumulative difference in treatment costs between gene therapy options and standard care. Moreover, they demonstrate how the estimated financial risk varies based on assumptions about the cost of standard care treatments. a Presents the cumulative difference in treatment costs between Valoctocogene roxaparvovec and standard care. This calculation is based on a literature-based estimate of $633,000 per year, compared to the actual Medicaid costs of $426,000 per year for standard care of patients with ≥ 6 factor utilization. b Displays the cumulative difference in treatment costs between Etranacogene dezaparvovec and standard care. The estimation for Etranacogene dezaparvovec is based on a literature-based estimate of $689,000 per year, while the actual Medicaid cost for standard care is $546,000 per year of patients with ≥ 4 factor utilization.

Similarly, for etranacogene dezaparvovec, based on the point estimate of real-world costs, the upfront cost to treat hemophilia B was estimated to be recovered in approximately 6 years, with a balance of − $429,000 at 5 years and $2,490,000 at 10 years. When accounting for uncertainty in these estimates, simulation results show a 32% probability of reaching break-even within 5 years and a 59% probability within 10 years. In contrast, utilization of literature-based cost inputs in the simulation leads to projected returns of $266,000 over a 5-year period and $3,841,000 over a 10-year period. These findings also demonstrate a break-even point achieved in less than 5 years (Fig. 1).

By varying eligibility criteria for the CGT based on the number of claims of factor replacement therapy or emicizumab per year, the proportion of patients who would be eligible for the CGT and paid for through a VBC would vary, influencing the financial balance and probability of payback over 5 and 10 years (Table 4)

4 Discussion

Payers, such as state Medicaid programs and commercial insurers, face significant financial challenges in covering CGTs due to high upfront costs for these treatments and uncertain long-term effectiveness [3, 27]. Using a case study of paying for CGTs for hemophilia A and B for a state Medicaid program (Colorado), our study has three main findings that can inform how insurers determine coverage and negotiate payment rates for CGTs. First, using real-world data generates very different estimates of breakeven times relative to published literature on clinical trials and cost-effectiveness analyses. Second, estimated costs, cost offsets, and breakeven times depend upon the eligibility criteria for treatment, such as disease severity. Third, as CGTs are often used to treat relatively rare conditions, there is substantial variation in the cost of treatment prior to gene therapy, which increases uncertainty about breakeven time. To address the challenges of paying for CGTs, state Medicaid agencies, as well as some commercial payers, are considering alternative payment models such as VBCs to spread payment over time and tie payment to longer-term treatment performance. However, setting appropriate contract terms requires accurate estimates of the actual costs of the standard of care.

By comparing the impact of using actual or literature-based cost inputs in the simulation, for hemophilia A and B, we find literature-based cost inputs for current treatments are higher. Medicaid real-world data indicate that only 5% of patients with hemophilia A and 13% of patients with hemophilia B are associated with the costs of standard care suggested by the economic evaluations (around $633,000 for hemophilia A and $689,000 for hemophilia B). This leads to an overly optimistic expectation regarding breakeven time and thus an underestimation of financial risks for the payer of covering CGT. This is likely because economic evaluations rely on cost estimates assuming protocol-based use of the drug and prices that do not reflect Medicaid payments. The reviewed economic evaluations (Online Resources 4 and 5) rely on medication protocols for dosage and frequency, patient weights based on US averages, and unit costs from sources such as Redbook and Medi-Span Price Rx Basic. The lower RWD costs might be attributed to several factors. Prices tend to fluctuate over time, whereas economic evaluations typically rely on constant prices. Additionally, existing literature often assumes complete adherence to prophylaxis, whereas our observations reveal variations in patient-level utilization. Furthermore, the types and share of factor therapies utilized in this study differ from the assumptions made in the literature.

Varying assumptions about eligibility for a CGT change estimated breakeven time and budget impact of paying for these therapies. While clinical expertise should inform the determination of eligibility criteria, VBCs should be designed with consideration for the associated breakeven point, driven by the eligibility criteria. We used the requirement of at least six claims for factor therapies or emicizumab for individuals with hemophilia A and a minimum of four claims for factor therapies for hemophilia B to identify potentially eligible patients. For this population, the base case results suggest a longer payback period than what is indicated by cost estimates derived from the current body of literature. However, altering this criterion has significant implications for spending and the budget, leading to substantial impacts on estimated breakeven time and how Medicaid should structure VBCs.

State Medicaid agencies should also design VBCs to account for substantial variations in the costs of treatment that serve as alternatives to CGT. The magnitude of standard deviation we observed (83–99% of the mean cost) in hemophilia A and B aligns with the findings of previous studies utilizing claims data [30, 31]. This underscores the importance of accounting for cost variations in cost simulations, as point estimates in economic evaluations often fail to capture these variations adequately. Although our estimation suggests an average breakeven period of 8 and 6 years when providing gene therapy to patients with hemophilia A or B, respectively, taking into account uncertainty reveals that the likelihood of reaching breakeven within 10 years is approximately 48% for hemophilia A and 59% for hemophilia B. One option to address uncertainty is to pool risk with other state Medicaid programs by developing VBCs that encompass several states. The CMS Centers for Medicare & Medicaid Innovation (CMMI) will test a model to achieve this type of risk pooling, or states may independently choose to pool together [28]. A second option is to construct a more financially conservative VBC where reimbursement to the drug manufacturer is lower or a warranty for refund is set over a longer time period.

Our findings have direct implications for designing VBCs. In the examples provided for CGTs in hemophilia A or B, since the payment is made up front, Medicaid does not have the opportunity to link the payment to expected outcomes over time. A VBC ensures patient access to the gene therapy offering a payback or refund mechanism if the therapy does not deliver the expected results. To enter into a VBC, Medicaid must first understand the cost-offset potential of the CGT, which is a function of the uncertainty around eligibility for the CGT, and the heterogeneity in costs spent on usual care. A deep understanding of how these sources of uncertainty and heterogeneity can provide Medicaid with trade-offs when evaluating the terms of a VBC. For a generic example applicable to CGTs that have large cost offsets, these trade-offs may include higher (lower) refund amounts with shorter (longer) contract durations evaluated at varying levels of eligibility.

4.1 Limitations

Our analysis has certain limitations. The data we used was specific to Colorado, and therefore may not be representative of the experience of other state Medicaid plans. However, we believe the methodology is transferable to other states and can be used by other Medicaid organizations to design VBCs. The analysis did not account for loss to follow-up. Therefore, it should be acknowledged that savings projected in our simulations may not be fully realized by Medicaid only, as patients have the potential to switch to another payer, such as Colorado’s state healthcare exchange or employer-sponsored insurance. These savings will then be realized at a broader health system level. We recognize that the number of factor claims does not necessarily correspond to the utilization of prophylactic therapy. If available for analysis, the total international units of factor replacement products administered during a specific timeframe may offer a more precise metric for use in value-based agreements. Nevertheless, based on the literature we have reviewed, the number of claims appears to serve as a reliable proxy for indicating the requirement for regular treatment (prophylaxis) and may be indicative of a more severe disease.

5 Conclusion

The rising number of approved CGTs and their high up-front costs pose significant challenges for Medicaid budgets. To address these challenges, VBCs have been proposed as a way to share financial risk between Medicaid and manufacturers. However, uncertainties regarding the durability of the effects of CGTs and the real-world costs of standard care create obstacles for establishing VBCs. Our study revealed three key findings that can assist states in constructing VBCs for CGTs. These findings were derived by comparing real-world cost data to literature-based estimates, analyzing cost variations, and evaluating the influence of eligibility criteria on cost offsets and breakeven time. First, real-world data yields substantially different breakeven time estimates compared with those derived from published clinical trials and cost-effectiveness analyses. Second, estimated costs, cost offsets, and breakeven times are contingent upon treatment eligibility criteria, including factor utilization, which is a proxy for prophylaxis and disease severity. Third, given CGTs are commonly employed for treating rare conditions, there is considerable variation in cost of treatment prior to CGT, which adds to uncertainty surrounding break-even time. In conclusion, incorporating real-world data into the design of VBCs for CGTs can provide Medicaid agencies with a more accurate understanding of costs and cost offsets associated with these therapies. By leveraging RWD, Medicaid can negotiate VBCs that mitigate budget shocks, share financial risk with manufacturers, and ensure patients have access to these innovative treatments.

References

Ma C-C, Wang Z-L, Xu T, He Z-Y, Wei Y-Q. The approved gene therapy drugs worldwide: from 1998 to 2019. Biotechnol Adv. 2020;40: 107502. https://doi.org/10.1016/j.biotechadv.2019.107502.

FDA. Approved cellular and gene therapy products. [Online]. https://www.fda.gov/vaccines-blood-biologics/cellular-gene-therapy-products/approved-cellular-and-gene-therapy-products. Accessed 1 Jun 2023.

Young CM, Quinn C, Trusheim MR. Durable cell and gene therapy potential patient and financial impact: US projections of product approvals, patients treated, and product revenues. Drug Discov Today. 2022;27(1):17–30. https://doi.org/10.1016/j.drudis.2021.09.001.

CVS Health. Latest look at projected gene therapies and approval timelines. 2022. [Online]. https://payorsolutions.cvshealth.com/sites/default/files/q2-2022-look-projected-gene-therapies-approval-timelines.pdf. Accessed 18 May 2023.

Baghdadi R. Medicaid best price. 2017. https://doi.org/10.1377/hpb20171008.000173.

Centers for Medicare & Medicaid Services. February 2023 Medicaid & CHIP enrollment data highlights. [Online]. https://www.medicaid.gov/medicaid/program-information/medicaid-and-chip-enrollment-data/report-highlights/index.html#:~:text=93%2C373%2C794%20individuals%20were%20enrolled%20in,individuals%20were%20enrolled%20in%20Medicaid. Accessed 12 Jun 2023.

Pearson SD, Ollendorf DA, Chapman RH. New cost-effectiveness methods to determine value-based prices for potential cures: what are the options? Value Health. 2019;22(6):656–60. https://doi.org/10.1016/j.jval.2019.01.012.

ten Ham RMT, Klungel OH, Leufkens HGM, Frederix GWJ. A review of methodological considerations for economic evaluations of gene therapies and their application in literature. Value Health. 2020;23(9):1268–80. https://doi.org/10.1016/j.jval.2020.04.1833.

Garrison LP, Lo AW, Finkel RS, Deverka PA. A review of economic issues for <scp>gene-targeted</scp> therapies: Value, affordability, and access. Am J Med Genet C Semin Med Genet. 2023;193(1):64–76. https://doi.org/10.1002/ajmg.c.32037.

Drummond M, et al. How are health technology assessment bodies responding to the assessment challenges posed by cell and gene therapy? BMC Health Serv Res. 2023;23(1):484. https://doi.org/10.1186/s12913-023-09494-5.

IPG Health. Evolving outcomes-based agreements with cell & gene therapies. [Online]. https://ipghealth.com/news/evolving-outcomes-based-agreements-with-cell-gene-therapies. Accessed 18 May 2023.

NEWDIGS. Designing financial solutions to ensure affordable access to cures An overview of the MIT FoCUS project. 2018. [Online]. https://newdigs.tuftsmedicalcenter.org/wp-content/uploads/2018/11/NEWDIGS-FoCUS-Frameworks-20180823.pdf. Accessed 18 May 2023.

U.S Food & Drug Administration. Zynteglo. [Online]. https://www.fda.gov/vaccines-blood-biologics/zynteglo. Accessed 18 May 2023.

U.S. Food & Drug Administration. Hemgenix. [Online]. https://www.fda.gov/vaccines-blood-biologics/vaccines/hemgenix. Accessed 18 May 2023.

Biomarin. BioMarin’s gene therapy for adults with severe hemophilia A, ROCTAVIANTM (valoctocogene roxaparvovec), assessed to provide substantial cost savings per patient in a preliminary independent report. [Online]. https://investors.biomarin.com/2022-09-15-BioMarins-Gene-Therapy-for-Adults-with-Severe-Hemophilia-A,-ROCTAVIAN-TM-valoctocogene-roxaparvovec-,-Assessed-to-Provide-Substantial-Cost-Savings-Per-Patient-in-a-Preliminary-Independent-Report. Accessed 18 May 2023.

Biomarin. BioMarin provides update on FDA review of ROCTAVIANTM (Valoctocogene Roxaparvovec) gene therapy for adults with severe hemophilia A. [Online]. https://investors.biomarin.com/2023-03-06-BioMarin-Provides-Update-on-FDA-Review-of-ROCTAVIAN-TM-Valoctocogene-Roxaparvovec-Gene-Therapy-for-Adults-with-Severe-Hemophilia-A/. Accessed 18 May 2023.

Tufts Medical Center. CEA registry. 2023. [Online]. https://cear.tuftsmedicalcenter.org/. Accessed 18 May 2023.

Institute of Clinical and Economic Review. Institute of Clinical and Economic Review Assessments. [Online]. https://icer.org/explore-our-research/assessments/. Accessed 18 May 2023.

Croteau SE, et al. Health care resource utilization and costs among adult patients with hemophilia A on factor VIII prophylaxis: an administrative claims analysis. J Manag Care Spec Pharm. 2021;27(3):316–26. https://doi.org/10.18553/jmcp.2021.27.3.316.

Li N, et al. Adult lifetime cost of hemophilia B management in the US: payer and societal perspectives from a decision analytic model. J Med Econ. 2021;24(1):363–72. https://doi.org/10.1080/13696998.2021.1891088.

Rodriguez-Merchan EC. The cost of hemophilia treatment: the importance of minimizing it without detriment to its quality. Expert Rev Hematol. 2020;13(3):269–74. https://doi.org/10.1080/17474086.2020.1716726.

Buckner TW, et al. Health care resource utilization and cost burden of hemophilia B in the United States. Blood Adv. 2021;5(7):1954–62. https://doi.org/10.1182/bloodadvances.2020003424.

U.S. Bureau of Labor Statistics. Consumer Price Index, Calendar Year Historical, 2018-2022. [Online]. https://www.bls.gov/regions/southwest/data/consumerpriceindexcyhistorical_southwest_table.htm. Accessed 18 May 2023.

Rind D et al. Valoctocogene roxaparvovec and emicizumab for hemophilia a: effectiveness and value; final report. 2020. [Online]. https://icer-review.org/material/hemophilia-a-update-final-evidence-report/. Accessed 15 Nov 2022.

Tice J et al. Gene therapy for hemophilia b and an update on gene therapy for hemophilia A: effectiveness and value evidence report prepared for. 2022. [Online]. https://icer.org/assessment/hemophilia-a-and-b-2022/. Accessed 12 Dec 2022.

Shah J, Kim H, Sivamurthy K, Monahan PE, Fries M. Comprehensive analysis and prediction of long-term durability of factor IX activity following etranacogene dezaparvovec gene therapy in the treatment of hemophilia B. Curr Med Res Opin. 2023;39(2):227–37. https://doi.org/10.1080/03007995.2022.2133492.

Gavan SP, Wright SJ, Thistlethwaite F, Payne K. Capturing the impact of constraints on the cost-effectiveness of cell and gene therapies: a systematic review. Pharmacoeconomics. 2023;41(6):675–92. https://doi.org/10.1007/s40273-022-01234-7.

Department of Health and Human Services. HHS secretary responds to the president’s executive order on drug prices. Press Release. [Online]. https://www.hhs.gov/about/news/2023/02/14/hhs-secretary-responds-to-the-presidents-executive-order-on-drug-prices.html. Accessed 25 Jun 2023.

Optum Rx. RoctavianTM (valoctocogene roxaparvovec-rvox)—New orphan drug approval. 2023. [Online]. https://professionals.optumrx.com/content/dam/optum3/professional-optumrx/news/rxnews/drug-approvals/drugapproval_roctavian_2023-0629.pdf. Accessed 29 Oct 2023.

Biomarin. BioMarin announces stable and durable annualized bleed control for ROCTAVIANTM in largest phase 3 gene therapy study in adults with severe hemophilia a; 134-participant study met all primary and secondary efficacy endpoints at 3-year analysis. 2023. [Online]. https://investors.biomarin.com/2023-01-08-BioMarin-Announces-Stable-and-Durable-Annualized-Bleed-Control-for-ROCTAVIAN-TM-in-Largest-Phase-3-Gene-Therapy-Study-in-Adults-with-Severe-Hemophilia-A-134-Participant-Study-Met-All-Primary-and-Secondary-Efficacy-Endpoints-at-3-Year-Analysis. Accessed 29 Oct 2023.

Reuters. Australia’s CSL prices hemophilia gene therapy at $3.5 million. [Online]. https://www.reuters.com/business/healthcare-pharmaceuticals/fda-approves-csls-gene-therapy-hemophilia-2022-11-22/. Accessed 12 Dec 2022.

MDsave Incorporated. IV therapy infusion (1-3 hours). [Online]. https://www.mdsave.com/procedures/iv-therapy-infusion-1-3-hours/d581ffcf. Accessed 15 Nov 2022.

Machin N, Ragni MV, Smith KJ. Gene therapy in hemophilia A: a cost-effectiveness analysis. Blood Adv. 2018;2(14):1792–8. https://doi.org/10.1182/bloodadvances.2018021345.

Hassan S, et al. Mortality, life expectancy, and causes of death of persons with hemophilia in the Netherlands 2001–2018. J Thromb Haemost. 2021;19(3):645–53. https://doi.org/10.1111/jth.15182.

Centers for Disease Control and Prevention. Underlying cause of death, 1999-2020 request. [Online]. https://wonder.cdc.gov/controller/datarequest/D76. Accessed 14 Nov 2022.

Cook K, Forbes SP, Adamski K, Ma JJ, Chawla A, Garrison LP. Assessing the potential cost-effectiveness of a gene therapy for the treatment of hemophilia A. J Med Econ. 2020;23(5):501–12. https://doi.org/10.1080/13696998.2020.1721508.

Bolous NS, et al. The cost-effectiveness of gene therapy for severe hemophilia B: a microsimulation study from the United States perspective. Blood. 2021;138(18):1677–90. https://doi.org/10.1182/blood.2021010864.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Funding

The University of Colorado is funded by the Department of Health Care Policy & Financing for the assessment of value-based contracts. Dr. Zemplenyi authored this manuscript during his Fulbright Visiting Scholarship at the University of Colorado Anschutz Medical Campus.

Competing Interests

Dr. Leonard is affiliated with the Colorado Department of Health Care Policy & Financing. The authors have disclosed no conflicts of interest concerning the research, authorship, or publication of this article. None of the authors are affiliated with or hold financial interests in the manufacturers of the gene therapies investigated in this study. The views expressed in this article represent the opinions of the authors and do not necessarily reflect those of their respective employers.

Data Availability

All data analyzed during this work are from the Colorado Department of Health Care Policy & Financing. The data are not publicly available. The model used during this work was developed by the University of Colorado under a contract with the Colorado Department of Health Care Policy & Financing.

Ethics Approval

The study was declared exempt by the Colorado Multiple Institutional Review Board (no. 23-1401).

Author Contributions

AZ, BM, MD, KA, and KN contributed to the study conception and design. Material preparation, data collection and analysis were performed by Garth Wright, NM, and AZ. The first draft of the manuscript was written by AZ and BM and all authors commented on previous versions of the manuscript. All authors read and approved the final manuscript.

Supplementary Information

Below is the link to the electronic supplementary material.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License, which permits any non-commercial use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by-nc/4.0/.

About this article

Cite this article

Zemplenyi, A., Leonard, J., DiStefano, M.J. et al. Using Real-World Data to Inform Value-Based Contracts for Cell and Gene Therapies in Medicaid. PharmacoEconomics 42, 319–328 (2024). https://doi.org/10.1007/s40273-023-01335-x

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40273-023-01335-x