Abstract

Objective

To provide up-to-date and comprehensive US data tables to estimate future net resource use, including nonlabor market production, and examine distributional impacts of including nonhealth and future costs in cost-effectiveness results.

Methods

Using a published US cancer prevention simulation model, the paper evaluated the lifetime cost effectiveness of implementing a 10% excise tax on processed meats across age- and sex-specific population subgroups. The model examined multiple scenarios accounting for cancer-related healthcare expenditure (HCE) only, cancer-related and unrelated background HCE, adding productivity benefits (i.e., patient time, cancer-related productivity loss, and background labor and nonlabor market production), and with nonhealth consumption costs, adjusted for household economies of scale. Additional analyses include using population-average versus age–sex-specific estimates for quantifying production and consumption value, as well as comparing direct model estimation versus postcorrections with Meltzer’s approximation for incorporating future resource use.

Results

Accounting for nonhealth and future costs impacted cost-effectiveness results across population subgroups, often leading to changes in “cost-saving” determination. Including nonlabor market production had a noticeable impact on estimating future resource use and reduced the bias toward undervaluing productivity among females and older populations. The use of age–sex-specific estimates resulted in less favorable cost-effectiveness results compared with population-average estimates. Meltzer’s approximation provided reasonable corrections among the middle-aged population for re-engineering cost-effectiveness ratios from a healthcare sector to a societal perspective.

Conclusion

With updated US data tables, this paper can help researchers conduct a comprehensive value assessment to reflect net resource use (health and nonhealth resource use minus production value) from a societal perspective.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Despite their importance, nonhealth consequences (e.g., patient time costs and productivity benefits) and future costs are rarely captured in cost-effectiveness analysis. |

In modeling the impact of implementing a 10% tax on processed meats as a population-based cancer prevention strategy, accounting for nonhealth and future costs had a substantial impact on cost-effectiveness results across population subgroups, often leading to changes in “cost-saving” determination. |

The updated US data tables—including production value in the formal labor market, valuation of time spent in household production and caregiving, and nonhealth consumption after adjusting for the household economies of scale—can help researchers conduct comprehensive value assessment to reflect net resource use from a societal perspective. |

1 Background

Health interventions offer a range of health benefits, such as reducing the risk of harm, improving quality of life (for both patients and caregivers), and extending life. However, they also often provide nonhealth benefits, such as allowing individuals to return to work, reducing caregiver time, improving educational attainment, and reducing health disparity. For example, COVID-19 treatments and vaccinations not only confer reductions in COVID-19-related mortality and morbidity, but also help our society restore daily routines, such as returning to the workforce or school [1]. A recent distributional cost-effectiveness analysis (CEA) found that funding COVID-19 inpatient treatment could improve population health and reduce health inequalities in the USA [2]. Still, it is well documented that most CEAs do not account for relevant nonhealth impacts in their assessment [3, 4]. In particular, measuring and valuing nonlabor market production has been largely excluded in CEAs. Leaving out these societal value elements could lead to suboptimal resource allocation decisions by not optimizing overall welfare.

Another important consideration is whether CEA should account for medical and nonmedical consumption during added life years, often referred to as mortality costs or future costs. This has long been the subject of debate, with extensive reviews of the issue [5, 6]. In short, Garber and Phelps developed a theoretical framework for CEA based on expected utility theory, concluding that the inclusion of unrelated future medical and nonmedical costs is irrelevant because the optimal choice for cost-effective interventions remains unchanged as long as future costs are consistently estimated [7]. The proposition assumes that unrelated future costs are independent of prior expenditures and that net future resource use is zero (i.e., lifetime earnings are equal to lifetime medical and nonmedical consumption). However, in his 1997 paper, Meltzer challenged such an assumption, arguing that the probability of survival (hence, future costs associated with extended life) depends on prior expenditures on medical care and that net future resource use is nonnegligible [8]. A more general framework proposed by Meltzer suggested that cost-effectiveness criteria become consistent with utility maximization only when incorporating all of the future medical and nonmedical costs. Later, Nyman argued that future costs should be excluded due to the inconsistency [9]. Because quality-adjusted life-year (QALY), a standard measure of health benefits in CEA, is assumed to measure “health”-related quality of life, resource costs should be excluded from cost-effectiveness ratio estimation when consumption-related utility is not captured in the denominator. Although, theoretically, QALY optimization could be consistent with welfare maximization with restrictive assumptions (constant utility of consumption over lifetime, positive utility of consumption, being multiplicative between the utility of consumption and the utility of health status) [10], practical operationalization of CEA in welfare economics has been questioned [11, 12].

In practice, the Second Panel on Cost-Effectiveness in Health and Medicine [13], along with a few international health technology assessment bodies, notably Sweden and the Netherlands [14], recommended including nonhealth consequences and future costs in CEA to capture full lifetime consequences of the interventions. However, both nonhealth consequences (e.g., patient time costs and productivity benefits) and future costs are rarely captured in a consistent manner. For example, Tufts Medical Center CEA Registry found that only 0.3% (7 of 2197) of published cost-per-QALY studies included patient time costs, productivity benefits, and consumption costs [15]. Several empirical studies have also documented the substantial impact of including future costs on cost-effectiveness ratios, with implications for funding decisions [16,17,18,19,20,21]. However, most of the relevant data inputs (e.g., data on earnings and nonhealth consumption) needed to be updated, including nonlabor market production. In the US setting, relevant data and the investigation of nonhealth impacts and future costs have been largely lacking, except for the worked example included in the Second Panel’s report (using 2014 data) [22] and the estimation of labor productivity (using 2016 data) [23]. This paper aims to (1) provide up-to-date and comprehensive US data tables to estimate future net resource use, including nonlabor market production, and (2) examine distributional impacts of including nonhealth and future costs in cost-effectiveness results using a US policy simulation model for cancer prevention strategies.

2 Methods

2.1 Overview

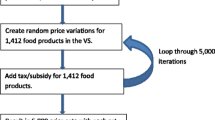

Using a published US population cancer prevention simulation model [24], this paper examined the impact of including nonhealth impacts and future costs in cost-effectiveness results. The US Dietary and Cancer Outcome (DiCOM) Model—a probabilistic cohort-state transition model developed in 2018—projected population effects of food and nutrition policies on cancer outcomes among the US population. In this simulation study, we evaluated the lifetime cost-effectiveness of implementing a 10% excise tax on processed meats, which are associated with an increased risk of colorectal and stomach cancers across age- and sex-specific population subgroups. Probabilistic sensitivity analysis was performed using probability distributions for all input parameters to account for input parameter uncertainty. The model reported means of 1000 simulations with a lifetime analytic horizon and an annual discount rate of 3% for both costs and health outcomes. The previous publication provided a detailed model structure, data inputs, and validation analyses [24] (Online Supplementary Text 1).

We considered the following nonhealth impacts and future costs: (a) unrelated future healthcare cost (i.e., background medical spending, including end-of-life healthcare spending), (b) patient time cost (i.e., patient time spent to access and undergo interventions), (c) productivity benefits through formal labor market participation, (d) productivity benefits through household production and caregiving, and (e) nonhealth consumption cost with adjusting for the household economies of scale. Thus, the overall net resource use is estimated by the following simple formula:

where HCE denotes healthcare expenditures.

2.2 Data Inputs for Nonhealth and Future Costs in the USA

We extracted annual cancer-related medical care costs (i.e., related healthcare costs) from costs attributable to cancer care services and oral prescription drugs, across initial (with treatment), continuous, and end-of-life phases [25]. The cancer-attributable costs represent the difference in costs among individuals without versus with cancer diagnoses, including Medicare payments and patient responsibility (copayments, coinsurance, deductibles, and payments from other insurers) (Table 1). To capture age-, sex-, and race/ethnicity-specific background medical spending (i.e., unrelated healthcare costs), we empirically estimated mean annual healthcare expenditures per person without cancer diagnosis from the nationally representative 2019 and 2020 Medical Expenditure Panel Survey (MEPS) data, a major data source on healthcare utilization and associated costs among the noninstitutionalized US population [26] (Online Supplementary Table A1). In addition, we extracted the mean end-of-life healthcare spending among the general population [27]. We inflated cost estimates to 2021 USD for cancer-specific and background medical expenditures using the personal healthcare and personal consumption expenditure price indices and accounted for MEPS survey design and sampling weights [28, 29].

A previous study provided annual patient time costs associated with roundtrip travel to care, waiting for care, and receiving care were estimated separately for cancer survivors and those without cancer history and by age under and over 65 years [30]. Because the original study quantified patient time costs using the outdated hourly wage (2011 data), we back-calculated time spent on selected services and re-estimated the time costs using an updated hourly wage ($24.95) (Table 1). For cancer-related productivity losses relative to those without a history of cancer diagnosis, we extracted data on the probability of employment disability (i.e., those who were not employed with no job to return to and reported “unable to work because ill/disabled”), the number of missed work days, and the number of days stayed in bed [31]. Following the original study’s valuation, we applied the 2021 median annual ($51,896) and weekly earnings ($998) to estimate productivity loss due to employment disability and missed workdays (assuming 5 workdays per week), respectively. The number of days stayed in bed was valued using the daily value ($44.2) of household production and caregiving (Table 1).

To estimate the production value of time spent on the formal labor market, we first calculated age–sex-specific expected annual earnings per person (i.e., background productivity benefits through formal labor market participation) by multiplying the percentage of full-time employment in each age and sex stratum with the percentage by medial annual earnings among the full-time workers (Online Supplementary Tables B and C). The age–sex-specific numbers of full-time employed workers and the overall population were estimated from the US Census Data and the Current Population Survey [32, 33]. The earning data represent earnings before taxes and other deductions and include any overtime pay, commissions, or tips usually received among full-time employed, wage, and salary workers. Then, we quantified the value of total benefit costs using 23.4% of the total wages and salaries based on a previous estimation [23]. The total benefit costs include insurance (e.g., life, health, short-term and long-term disability), retirement and savings (e.g., defined benefit and defined contribution), and legally required benefits (e.g., social security, Medicare, federal and state unemployment insurance, and workers’ compensation). The total production value in the formal labor market was the sum of expected annual earnings and the monetary value of benefit costs [23] (Online Supplementary Table D).

We also measured and valued time spent in household production and caregiving, which has yet to be formally quantified and incorporated into CEA. Based on the American Time Use Survey (ATUS) data, which measures the amount of time people spend doing various activities, such as paid work, childcare, volunteering, and socializing, we extracted mean hours per day spent in the following activities: household activities, caring for and helping household and nonhousehold members [34, 35]. We then multiplied the sum of mean hours in each category by age–sex-specific median hourly earnings to estimate the daily value of household production and caregiving. The annual value is estimated by multiplying daily value with 365 (Online Supplementary Table E).

Finally, we estimated the mean annual nonhealthcare consumption costs—which each person is expected to spend on food, housing, utilities, apparel, transportation, entertainment, personal care products, education, etc.—using the US Consumer Expenditure Survey (CES) data [36] (Online Supplementary Table F). One thing to note is that healthcare expenditures reported in the CES data only capture consumer expenditures (i.e., out-of-pocket spending), a subset of overall healthcare expenditures. We only used the reported healthcare expenditures to estimate nonhealthcare expenditures (i.e., nonhealth consumption costs) by calculating the difference between the total expenditures and healthcare expenditures. Because the original data were captured at the “consumer-unit” level, we initially divided the “consumer-unit” estimates by the average number of people reported in the consumer unit to derive “per-person” estimates (Online Supplementary Table G). However, a recent study highlighted that accurate estimation of nonhealth consumption requires the consideration of household economies of scale [37]. Following Kellerborg’s approach based on the Organisation for Economic Co-operation and Development (OECD)-modified equivalence scale [38], weights smaller than 1 are used to divide total consumption among household members. The scale assigns a weight of 1 to the first adult household member, 0.5 to each additional adult, and 0.3 to each person under 14 years old. In the subsequent analyses, we applied mean nonhealth expenditures per person, adjusting for household economies of scale. Online Supplementary Table H provides additional details.

2.3 Analysis

Using the described DiCOM policy simulation model, we evaluated the lifetime cost effectiveness of implementing a 10% excise tax on processed meat across 32 subgroups. The 32 subgroups represent four age groups (20−44, 45−54, 55−64, and > 65 years), both sexes (male and female), and four race/ethnicity groups (non-Hispanic white, non-Hispanic black, Hispanic, and others), with varying input parameters, such as baseline process meat consumption, cancer incidence, cancer, and noncancer-related mortality, healthcare expenditures, labor and nonlabor market productivity, and nonhealth consumption. Health-related quality of life weights were applied to each health state [39, 40] (Online Supplementary Text A).

This paper examined the distributional impacts of including nonhealth and future costs in cost-effectiveness results across four age groups. First, we examined the following scenarios of accounting for (A) cancer-related healthcare expenditure only; (B) cancer-related and unrelated background HCE; (C) related and unrelated HCE plus patient time, cancer-related productivity loss, and background labor-market production; (D) related and unrelated HCE plus patient time, cancer-related productivity loss, and background labor and nonlabor market production; and (E) related and unrelated HCE plus all productivity effects (patient time, cancer-related productivity loss, and background labor and nonlabor market production) and nonhealth consumption costs.

We measured incremental cost-effectiveness ratios (ICER) of implementing a 10% excise tax on processed meats, compared with the status quo (no policy). Since the original evaluation of a 10% excise tax on processed meats was considered cost saving from a societal perspective [24], we also applied a net monetary benefit (NMB) framework using the valuation of $50,000-per-QALY to calculate the net of monetized additional QALY gained and overall costs (healthcare costs and nonhealth costs) and estimated the magnitude of changes in NMBs by incrementally adding nonhealth and future cost components. Although we acknowledge that a $100,000–$150,000/QALY would be more reasonable health opportunity costs in the USA [41, 42], we chose a more conservative threshold to examine whether the different scenarios would result in changing the “cost-saving” determination.

In an NMB framework, the cost-saving benchmark was estimated based on the monetized value of average QALY gained per person (e.g., 0.0024 QALY for all ages, 0.0036 QALY for those aged 20–44 years, 0.0020 QALY for aged 45–54 years, 0.0013 QALY for aged 45–54 years, 0.0007 QALY for aged 65+ years). When the net monetary benefit (NMB) is greater than the cost-saving benchmark (e.g., $119 for all ages, $179 for aged 20–44 years, $100 for aged 45–54 years, $63 for aged 45–54 years, $35 for age 65+ years), the 10% excise tax on processed meats is a health-improving and cost-saving (i.e., dominant) strategy. When the NMB is positive (i.e., NMB > 0), but smaller than the cost-saving benchmark, the 10% excise tax on processed meats is considered cost effective at the $50,000-per-QALY benchmark but no longer a dominant strategy.

2.4 Secondary Analyses

In the base case analysis, we applied population-average estimates for valuing labor, nonlabor market production, and nonhealth consumption. In secondary analyses, we examined the impact of age–sex-specific estimates for valuing these outcomes. In addition, we investigated the predictive power of Meltzer’s formula, which can approximate the effect of future costs on the cost-effectiveness ratios [8]. To approximate the bias of excluding future costs, Meltzer suggested a simple formula using the net present value of future annual resource use at the age of the population multiplied by a ratio of changes in life-years gained to changes in QALY, given as follows:

where CResource Use represents the net present value of annual future resource use from the age of the target patient or population. Based on our data on expected earnings, nonlabor market production, and nonhealth consumption (see the earlier section), we estimated annualized net present value of resource use per year of life saved. We assume that, once the death is averted at the specified age, individuals live up to age 85 years with the current estimates of the age-specific net resource use with a 3% annual discounting. Using the estimated CResource Use, we compared how well Meltzer’s approximations matched the direct model estimations of future costs. Because of the age-dependent annualized net present value of future resource use used in Meltzer’s formula, we compared the model estimated ICER from a societal with applying age–sex-specific estimates for quantifying productivity and nonhealth consumption, instead of population-average estimates used in our base case analysis. Online Supplementary Table I provides estimation detail with the data table.

3 Results

3.1 Estimating Net Future Resource Use

We found strong age effects in annual net resource use (i.e., U-shape) with negative net resource use (i.e., the production value was greater than resource consumption) among the middle-aged groups (age between 25 and 64 years) (Fig. 1, Online Supplementary Fig. A). The production value in the nonlabor and formal labor markets peaked at ages 35 and 44 years ($22,539 and $44,872 per year, respectively), while nonhealth consumption reached the highest at ages 45 and 54 years ($43,203 per year). Compared with males, females reported lower expected production value in the formal labor market ($22,254 versus $33,935), but higher household production and caregiving value ($18,571 versus $13,147). The same pattern was observed across all age groups (Online Supplementary Tables B and C). Table 2 summarizes key data inputs to estimate age–sex-specific annual net resource use, which can be incorporated into CEAs.

Annual net resource use by age groups. Net resource use = (nonhealth consumption + overall healthcare expenditure − (labor market production + nonlabor market production). Online Supplementary Fig. A provides sex–age-specific annual net resource use, but the age-dependent net resource use trends were similar between males and females.

3.2 Cost Effectiveness of 10% Excise Tax on Processed Meat

Our model found that a 10% excise tax on processed meat would generate substantial health benefits by preventing future cancer cases, reducing cancer-related healthcare costs, and providing nonhealth benefits, such as increased productivity. After accounting for policy implementation costs, a 10% excise tax on processed meat would be considered health improving and cost saving (i.e., dominant) across all subgroups from a societal perspective (Fig. 2). The model suggested greater health and economic benefits among individuals aged 20–44 years with longer life expectancy for accruing the health benefits than individuals aged over 45 years.

Lifetime cost effectiveness of implementing a 10% excise tax (versus no policy) on processed meats in the US population across baseline age groups. HCE healthcare expenditure, TC patient time cost, Prod productivity effect, Consmp population-average nonhealth consumption estimates, NMB net monetary benefit. We applied a valuation of $50,000 per quality-adjusted life-year (QALY) to calculate the net of monetized additional QALY gained and overall costs (healthcare costs and nonhealth costs), such that NMB = (QALY gained × 50,000) − [(HCE + nonhealth consumption + time cost + policy cost) − (productivity benefits)

3.3 Impact of Nonhealth and Future Costs

Our analysis also highlighted that including nonhealth and future costs impacted cost-effectiveness results, often differential impacts across population subgroups and changes in “health-improving and cost-saving” determination (Table 3). First, excluding unrelated healthcare costs (Scenario A) would bias toward favoring a cancer prevention policy (i.e., leading to greater NMB estimates than those incorporating unrelated healthcare costs). Second, accounting for productivity benefits would generate more favorable cost-effectiveness results than those without productivity benefits, often leading to changes in the “health-improving and cost-saving” determination. For example, a 10% tax on processed meat was deemed highly cost effective from a healthcare sector perspective (Scenario B) among the population aged 55–64 and aged over 65 years (ICER: $1380/QALY and $6570/QALY, respectively). After accounting for patient time costs and productivity benefits (Scenario D), the tax policy became a “dominant” strategy for both subpopulations. Third, adding nonhealth consumption costs (Scenario E) would offset the production value (i.e., reducing overall iNMB, compared with Scenario C and D), often leading to a change in the “dominant ” determination. For example, a 10% processed meat tax policy was a “dominant” strategy, including the production value (Scenario D), among the population aged over 65 years. After accounting for nonhealth consumption costs, however, the tax policy became highly cost effective ($1740/QALY), instead of “health improving and cost saving.” The absolute magnitude of the change in iNMB from accounting for nonhealth consumption was the largest among younger populations, whose group had the largest life-year gained.

3.4 Secondary Analyses

Using age–sex-specific production value and nonhealth consumption would lower the incremental production value and nonhealth consumption resulting from a 10% tax policy (versus no policy). As a result, applying age–sex-specific estimates led to less favorable cost-effectiveness results (i.e., decreases in iNMB), leading to changes in the “cost-saving” determination for all populations and population subgroups (Table 4).

When applying Meltzer’s approximation to correct the bias of excluding future costs, the corrected ICER using Meltzer’s approximation ($3090/QALY) was close to model estimated ICER using age-sex-specific estimates ($4090/QALY) from a societal perspective (Difference: − $1000/QALY). Meltzer’s approximation was less accurate for younger (age 20–44 years) [−$5330/QALY (i.e., dominant) versus $3270/QALY (difference: $8600/QALY)], and older (age 65+ years) populations [$19,725/QALY versus $11,700/QALY (difference: $8025/QALY)] (Table 5).

4 Discussion

This paper provided up-to-date US data tables to estimate future net resource use and examined distributional impacts of including nonhealth and future costs in cost-effectiveness results using a US policy simulation model for cancer prevention strategies. The updated US data tables—including production value in the formal labor market, valuation of time spent in household production and caregiving, and nonhealth consumption after adjusting for the household economies of scale—can help researchers conduct comprehensive value assessment to reflect net resource use (health and nonhealth resource use minus production value) from a societal perspective. In modeling the impact of implementing a 10% tax on processed meats as a population-based cancer prevention strategy, accounting for nonhealth and future costs had a substantial impact on cost-effectiveness results across population subgroups, often leading to changes in “health-improving and cost-saving” determination.

Specifically, including nonlabor market production had a noticeable impact on estimating future resource use, lowering the net resource use. In particular, the practice reduced the bias toward undervaluing productivity among females and older populations whose nonlabor market production accounted for a greater proportion of their productivity benefits. Also, accounting for nonhealth consumption costs offsets the production value, often leading to a change in the “health-improving and cost-saving” determination. Finally, excluding unrelated future healthcare costs would bias toward favoring a cancer prevention policy. The bias was the greatest among the older population, who are more likely to have higher noncancer-related healthcare costs in the immediate future.

However, these findings should be interpreted with caution and cannot be generalized to other interventions or settings. The interplay between multiple factors (e.g., target populations, intervention and comparators, disease profiles, magnitude and uncertainty of clinical effectiveness, the timing of benefits and costs, intervention’s nonhealth impact, and discounting rates) could determine how much cost-effectiveness results would be differed by accounting for nonhealth and future costs. For example, the intervention in this study (i.e., population-based cancer prevention strategy) provided infinitesimal life-extending benefits (particularly after discounting), diminishing the impacts of future costs. However, for certain interventions with substantial and immediate life-extending benefits, such as bypass surgery and certain chemotherapy, including nonhealth consumption would have consequential implications for cost-effectiveness decisions.

Although future costs should be directly included in the decision-analytic model to estimate their precise impact on the overall cost effectiveness, it is often challenging to re-engineer existing models or published cost-effectiveness results. This paper highlighted how to apply Meltzer’s approximation to correct the bias of excluding future costs and compared the corrected ICERs with the model-estimated ICERs. Meltzer’s approximation provided reasonable corrections for re-engineering ICERs from a healthcare sector perspective to a societal perspective. However, the correction approach mostly worked well for the middle-aged population (ages 45–64 years), where annualized NPV of future resource use estimates were more reliable. More empirical applications of his approach would be needed to further validate the predictive power of Meltzer’s approximation.

Finally, this paper examined the impact of applying population-average (base case) versus age–sex-specific estimates in estimating the lifetime cost-effectiveness of implementing a 10% processed meat tax. The use of age-sex-specific estimates resulted in less favorable cost-effectiveness results, compared with population-average estimates. This is because population-average values (i.e., net positive values: $1791) underestimated net resource use for older populations (i.e., net positive values: $24,526 for ages 65 and 74 years and $20,839 for ages 75+ years). Younger cohorts at the baseline had similar effects as they eventually aged over time in the model, consequently underestimating their future net resource use.

The pertinent question of whether we should apply targeted versus population-average estimates reveals the intricacies of this issue. Although an important role in economic evaluation is to capture the actual resource use in the society (as is often the case in benefit–cost analyses), the use of age- (and sex-) specific estimates to value individual’s production value would lead to undervaluing productivity of some members of our society, including children, individuals not participating in the formal labor market, and the older population. As highlighted in this paper, including nonlabor market production may mitigate the potential discrimination against females and older populations. To be consistent with a practice guideline to avoid unnecessary discrimination [43], this paper recommends using mean estimates among the largest possible subgroups (e.g., the population mean). When specific subgroups are the only relevant samples in the analysis (e.g., evaluating cost effectiveness of prostate cancer screening for men older than 70 years or cervical cancer screening for women older than 65 years), the use of age–sex-specific estimates would be a reasonable alternative.

This study also has limitations. First, although we estimated nonhealth consumption accounting for the household economies of scale costs (Table 2 and Online Supplementary Table H), accurate estimation of nonhealth consumption further requires the consideration of period and cohort effects (in addition to age effects, which we addressed) [37]. More precise estimation accounting for these factors remains in future work. Second, although our empirical analyses included end-of-life costs among patients who died of cancer and end-of-life among noncancer patients, such one-time estimates were excluded from estimating age–sex-specific annual net resource use (Table 2). For precise future healthcare cost estimation, researchers should consider much higher costs attributable to end-of-life care. A recent paper provides the US-based catalog of age- and medical condition-specific healthcare costs among survivors and decedents [44]. Also, despite incorporating individuals’ nonlabor market production, our analysis did not capture broader spillover effects on family members and informal caregivers. Methodological advances have provided valuable resources for measuring and valuing the spillover effects [45]. Analysts should consider capturing relevant spillover effects when possible. Finally, this study illustrates how to account for nonhealth and future costs in CEA and presents the distributional impacts of their inclusion in cost-effectiveness results. Despite different arguments summarized in the earlier section, this paper does not intend to guide whether international health technology assessment agencies should include these costs in their guidelines. Such normative judgment depends on the decision-making context for each country and agency.

5 Conclusions

This paper highlights that accounting for nonhealth and future costs impacted cost-effectiveness results across population subgroups, often leading to changes in “health-improving and cost-saving” determination. Also, including nonlabor market production had a noticeable impact on estimating future resource use and reduced the bias toward undervaluing productivity among females and older populations. Along with up-to-date US data tables to estimate future net resource use, this paper can help researchers conduct a comprehensive value assessment to reflect net resource use (health and nonhealth resource use minus production value) from a societal perspective.

References

Kim DD, Neumann PJ. Analyzing the cost effectiveness of policy responses for COVID-19: the importance of capturing social consequences. Med Decis Mak. 2020;40(3):251–3. https://doi.org/10.1177/0272989X20922987.

Kowal S, Ng CD, Schuldt R, Sheinson D, Cookson R. The impact of funding inpatient treatments for COVID-19 on health equity in the United States: a distributional cost-effectiveness analysis. Value Health. 2022. https://doi.org/10.1016/j.jval.2022.08.010.

Kim DD, Silver MC, Kunst N, Cohen JT, Ollendorf DA, Neumann PJ. Perspective and costing in cost-effectiveness analysis, 1974–2018. Pharmacoeconomics. 2020;38(10):1135–45. https://doi.org/10.1007/s40273-020-00942-2.

Podolsky MI, Present I, Neumann PJ, Kim DD. A systematic review of economic evaluations of COVID-19 interventions: considerations of non-health impacts and distributional issues. Value Health. 2022;25(8):1298–306. https://doi.org/10.1016/j.jval.2022.02.003.

de Vries LM, van Baal PHM, Brouwer WBF. Future costs in cost-effectiveness analyses: past, present, future. Pharmacoeconomics. 2019;37(2):119–30. https://doi.org/10.1007/s40273-018-0749-8.

Rappange DR, van Baal PH, van Exel NJ, Feenstra TL, Rutten FF, Brouwer WB. Unrelated medical costs in life-years gained: should they be included in economic evaluations of healthcare interventions? Pharmacoeconomics. 2008;26(10):815–30. https://doi.org/10.2165/00019053-200826100-00003.

Garber AM, Phelps CE. Economic foundations of cost-effectiveness analysis. J Health Econ. 1997;16(1):1–31. https://doi.org/10.1016/s0167-6296(96)00506-1.

Meltzer D. Accounting for future costs in medical cost-effectiveness analysis. J Health Econ. 1997;16(1):33–64. https://doi.org/10.1016/s0167-6296(96)00507-3.

Nyman JA. Should the consumption of survivors be included as a cost in cost-utility analysis? Health Econ. 2004;13(5):417–27. https://doi.org/10.1002/hec.850.

Bleichrodt H, Quiggin J. Life-cycle preferences over consumption and health: when is cost-effectiveness analysis equivalent to cost-benefit analysis? J Health Econ. 1999;18(6):681–708. https://doi.org/10.1016/s0167-6296(99)00014-4.

Klose T. Life-cycle preferences over consumption and health: a comment on Bleichrodt and Quiggin. J Health Econ. 2002;21(1):161–6. https://doi.org/10.1016/s0167-6296(01)00120-5. (discussion 167–168).

Brouwer WB, Koopmanschap MA. On the economic foundations of CEA. Ladies and gentlemen, take your positions! J Health Econ. 2000;19(4):439–59. https://doi.org/10.1016/s0167-6296(99)00038-7.

Sanders GD, et al. Recommendations for conduct, methodological practices, and reporting of cost-effectiveness analyses: second panel on cost-effectiveness in health and medicine. JAMA. 2016;316(10):1093–103. https://doi.org/10.1001/jama.2016.12195.

Hakkaart-van Roijen L, Van der Linden N, Bouwmans C, Kanters T, Tan S. Costing manual: methodology of costing research and reference prices for economic evaluations in healthcare. Diemen: Zorginstituut Nederland; 2015.

Center for the Evaluation of Value and Risk in Health, Tufts Medical Center. The cost-effectiveness analysis registry. www.cearegistry.org. Accessed 7 Apr 2022.

Tew M, Clarke P, Thursky K, Dalziel K. Incorporating future medical costs: impact on cost-effectiveness analysis in cancer patients. Pharmacoeconomics. 2019;37(7):931–41. https://doi.org/10.1007/s40273-019-00790-9.

de Vries LM, Kellerborg KM, Brouwer WBF, van Baal PHM. Don’t forget about the future: the impact of including future costs on the cost-effectiveness of adult pneumococcal conjugate vaccination with PCV13 in the Netherlands. Vaccine. 2021;39(29):3834–43. https://doi.org/10.1016/j.vaccine.2021.05.091.

Kruse M, Sorensen J, Gyrd-Hansen D. Future costs in cost-effectiveness analysis: an empirical assessment. Eur J Health Econ. 2012;13(1):63–70. https://doi.org/10.1007/s10198-010-0280-0.

van Baal P, Morton A, Meltzer D, Brouwer W. Future unrelated medical costs need to be considered in cost effectiveness analysis. Eur J Health Econ. 2019;20(1):1–5. https://doi.org/10.1007/s10198-018-0976-0.

Manns B, Meltzer D, Taub K, Donaldson C. Illustrating the impact of including future costs in economic evaluations: an application to end-stage renal disease care. Health Econ. 2003;12(11):949–58. https://doi.org/10.1002/hec.790.

Mokri H, Kvamme I, de Vries L, Versteegh M, van Baal P. Future medical and non-medical costs and their impact on the cost-effectiveness of life-prolonging interventions: a comparison of five European countries. Eur J Health Econ. 2022. https://doi.org/10.1007/s10198-022-01501-6.

Kim DD, Basu A, Duffy SQ, Zarkin GA. Worked Example 1: the cost-effectiveness of treatment for individuals with alcohol use disorders: a reference case analysis. Cost-Eff Health Med. 2017;2:385–430.

Grosse SD, Krueger KV, Pike J. Estimated annual and lifetime labor productivity in the United States, 2016: implications for economic evaluations. J Med Econ. 2019;22(6):501–8. https://doi.org/10.1080/13696998.2018.1542520.

Kim DD, et al. Cost effectiveness of nutrition policies on processed meat: implications for cancer burden in the U.S. Am J Prev Med. 2019;57(5):e143–52. https://doi.org/10.1016/j.amepre.2019.02.023.

Mariotto AB, Enewold L, Zhao J, Zeruto CA, Yabroff KR. Medical care costs associated with cancer survivorship in the United States. Cancer Epidemiol Biomark Prev. 2020;29(7):1304–12. https://doi.org/10.1158/1055-9965.EPI-19-1534.

The Medical Expenditure Panel Survey (MEPS) [Online]. https://www.meps.ahrq.gov/mepsweb/.

Hogan C, Lunney J, Gabel J, Lynn J. Medicare beneficiaries’ costs of care in the last year of life. Health Aff (Millwood). 2001;20(4):188–95. https://doi.org/10.1377/hlthaff.20.4.188.

Dunn A, Grosse SD, Zuvekas SH. Adjusting health expenditures for inflation: a review of measures for health services research in the United States. Health Serv Res. 2018;53(1):175–96. https://doi.org/10.1111/1475-6773.12612.

Agency for Healthcare Research and Quality. Using appropriate price indices for analyses of health care expenditures or income across multiple years. https://meps.ahrq.gov/about_meps/Price_Index.shtml. Accessed 3 Oct 2022.

Yabroff KR, et al. Annual patient time costs associated with medical care among cancer survivors in the United States. Med Care. 2014;52(7):594–601. https://doi.org/10.1097/MLR.0000000000000151.

Zheng Z, et al. Annual medical expenditure and productivity loss among colorectal, female breast, and prostate cancer survivors in the United States. J Natl Cancer Inst. 2016. https://doi.org/10.1093/jnci/djv382.

US Bureau of Labor Statistics. Weekly and hourly earnings data from the Current Population Survey. https://data.bls.gov/PDQWeb/le. Accessed 4 Oct 2022.

United States Census Bureau. National Population by Characteristics: 2020–2021. https://www.census.gov/data/datasets/time-series/demo/popest/2020s-national-detail.html. Accessed 15 Oct 2022.

US Bureau of Labor Statistics. Time spent in primary activities for the civilian population by age, sex, race, Hispanic or Latino ethnicity, marital status, and educational attainment, 2021 annual averages. https://www.bls.gov/news.release/atus.t03.htm. Accessed Oct 2022.

US Bureau of Labor Statistics. American Time Use Survey. https://www.bls.gov/tus/. Accessed 12 Oct 2022.

US Bureau of Labor Statistics. Table 1300. Age of reference person: Annual expenditure means, shares, standard errors, and coefficients of variation, Consumer Expenditure Surveys, 2021. https://www.bls.gov/cex/tables/calendar-year/mean-item-share-average-standard-error/reference-person-age-ranges-2021.pdf. Accessed 2 Oct 2022.

Kellerborg K, Wouterse B, Brouwer W, van Baal P. Estimating the costs of non-medical consumption in life-years gained for economic evaluations. Soc Sci Med. 2021;289: 114414. https://doi.org/10.1016/j.socscimed.2021.114414.

Hagenaars AJ, De Vos K, Asghar Zaidi M. Poverty statistics in the late 1980s: research based on micro-data. 1994.

Farkkila N, et al. Health-related quality of life in colorectal cancer. Colorectal Dis. 2013;15(5):e215–22. https://doi.org/10.1111/codi.12143.

Zhou HJ, et al. Validation of the functional assessment of cancer therapy-gastric module for the Chinese population. Health Qual Life Outcomes. 2012;10:145. https://doi.org/10.1186/1477-7525-10-145.

Vanness DJ, Lomas J, Ahn H. A health opportunity cost threshold for cost-effectiveness analysis in the United States. Ann Intern Med. 2021;174(1):25–32. https://doi.org/10.7326/M20-1392.

Neumann PJ, Cohen JT, Weinstein MC. Updating cost-effectiveness–the curious resilience of the $50,000-per-QALY threshold. N Engl J Med. 2014;371(9):796–7. https://doi.org/10.1056/NEJMp1405158.

Basu A. Estimating costs and valuations of non-health benefits in cost-effectiveness analysis. In: Neumann PJ, Ganiats TG, Russell LB, Sanders GD, Siegel JE, editors. Cost-effectiveness in health and medicine. Oxford: Oxford University Press; 2016. p. 201–236.

Jiao B, Basu A. Catalog of age- and medical condition-specific healthcare costs in the United States to inform future costs calculations in cost-effectiveness analysis. Value Health. 2021;24(7):957–65. https://doi.org/10.1016/j.jval.2021.03.006.

Prosser LA, Wittenberg E. Advances in methods and novel applications for measuring family spillover effects of illness. Pharmacoeconomics. 2019;37(4):447–50. https://doi.org/10.1007/s40273-019-00794-5.

US Bureau of Labor Statistics. Employer Costs for Employee Compensation—JUNE 2022. https://www.bls.gov/news.release/pdf/ecec.pdf. Accessed 1 Nov 2022.

Acknowledgments

This paper was presented at the Society for Medical Decision Making 44th Annual North American Meeting. The author appreciated valuable feedback from the participants, two anonymous reviewers, and guest Editors.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Author contributions

David Kim is the sole author and is responsible for the overall content and analyses of this manuscript.

Funding

No funds were received for the current work.

Ethics approval

Not Applicable.

Conflict of interest

David Kim had no conflicts of interest to disclose.

Consent to participate

Not applicable.

Consent for publication

Not applicable.

Data availability

Tables in the Main Manuscript and Online Supplement provide all of the data used in the analysis.

Code availability

The source code for the DiCOM model is available in the previously published study (https://pubmed.ncbi.nlm.nih.gov/31564600/).

Supplementary Information

Below is the link to the electronic supplementary material.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Kim, D.D. Accounting for Nonhealth and Future Costs in Cost-Effectiveness Analysis: Distributional Impacts of a US Cancer Prevention Strategy. PharmacoEconomics 41, 1151–1164 (2023). https://doi.org/10.1007/s40273-023-01275-6

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40273-023-01275-6